Abstract

Background and Objective

Immune checkpoint inhibitors (ICIs) have become a cornerstone in cancer treatment. With high treatment costs and an increasing number of young and low-income patients with cancer, there is a need to determine the current spending and utilization of ICIs in a real-world population. The objective of this study was to outline the drug spending, utilization, and price trends of ICIs for US Medicaid programs from 2011 to 2021.

Methods

A retrospective descriptive analysis was conducted using the Medicaid State Drug Utilization pharmacy summary files managed by the Centers for Medicare and Medicaid Services. Six ICIs for this study include ipilimumab, pembrolizumab, nivolumab, atezolizumab, avelumab, and cemiplimab. Yearly reimbursement and prescription numbers were calculated for six ICIs billed through Medicaid between 2011 and 2021. The average spending per prescription was calculated as a proxy for drug prices.

Results

Overall spending and utilization on ICIs have risen exponentially over the past decade. Between 2011 and 2021, expenditures increased from $2.8 million to $4.1 billion. Utilization increased from 94 prescriptions to 462,049 prescriptions in 2021 with six ICIs. The average spending per prescription, or average drug price, decreased 70%, from $29,795.88 in 2011 to $8914.69 in 2021.

Conclusions

Spending on and utilization of ICIs have increased dramatically over the past decade. These findings shed new light on the impact of ICIs on state Medicaid programs and may provide insight into potential cost drivers that need to be addressed through policy.

Similar content being viewed by others

Spending on ICIs increased from $2.8 million to $4.1 billion and utilization increased from 94 to 462,049 prescriptions between 2011 and 2021. |

Average drug prices, represented by average spending per prescription, decreased 70% between 2011 and 2021. |

These findings may provide insight into potential cost drivers that need to be addressed through policy. |

1 Introduction

Cancer is a major global health issue, affecting millions. It has risen to become the second leading cause of death in the USA, second to heart disease [1]. Incident cancer cases have increased in the past decade, jumping 26.3% from an estimated 18.7 million in 2010 to 23.6 million in 2019 [2]. Cancer mortality rates have decreased because of advances in treatment, early detection, and a reduction in smoking since their peak in 1991, but approximately 600,000 people in the USA are expected to die from cancer in 2022 [3]. In addition to morbidity and mortality, the heavy economic burden of cancer is growing for patients and the healthcare system. Healthcare expenditures related to cancer treatments in the USA have increased from $57 billion in 2001 [4] to $208.9 billion in 2020 [5]. Of cancer-related treatment costs, anticancer drugs make up a large part with costs of cancer drugs in the USA being two to six times higher than in the rest of the world [6].

In the past decade, a type of immunotherapy called immune checkpoint inhibitors (ICIs) has improved the treatment for a broad range of cancers, including non-small cell lung cancer (NSCLC), renal cell carcinoma, and melanoma [7]. However, novel drugs, especially cancer drugs, come at a high price. In recent years, financial toxicity has emerged as an important and highly prevalent issue amongst patients with cancer across cancer types [8], having the greatest impact on younger patients, those from low-income households, and those without health coverage. In the USA, Medicaid is one of the largest sources of healthcare coverage, providing coverage to low-income populations under 65 years of age [9]. With the coverage expansion that came along with The Affordable Care Act, over 17 million previously uninsured individuals became eligible for Medicaid, including low-income adults younger than 65 years of age, an increasingly important population because cancer incidence is growing in this age group [10, 11].

With the inflated costs of cancer treatment and an increasing number of young low-income patients diagnosed with cancers, there is a need to determine the current use of ICIs in a real-world population to evaluate and understand the spending and utilization trends of ICIs. No previous studies have analyzed changes in drug utilization, reimbursement, and price for ICIs in the Medicaid setting, thus the current extent of utilization and reimbursement of ICIs in US Medicaid programs is unclear. This study aims to describe the drug spending, utilization, and price trends of ICIs in US Medicaid programs between 2011 and 2021.

2 Methods

A retrospective, descriptive drug utilization study was conducted using outpatient pharmacy reimbursement and prescription data for the ICIs from 2011 to 2021. The data were extracted from the publicly available Medicaid State Drug Utilization Data managed by the Centers for Medicare and Medicaid Services [12]. The database contains outpatient prescription data for Medicaid beneficiaries reported by all 50 states and the District of Columbia. The national summary files for each state and the District of Columbia were combined.

Each record included an 11-digit national drug code (NDC), drug name (brand and generic), quarter and year of Medicaid expenditure, number of outpatient prescription claims, number of units (unit dose), and pharmacy reimbursement amount, including drug cost and dispensing fees. The database was searched for all currently approved and available ICIs using brand names and NDCs. The first five digits of the NDC identify the drug manufacturer, and the remaining digits identify specific drug products by strength, dose formulation, and packaging. The six ICIs included in this study are ipilimumab, pembrolizumab, nivolumab, atezolizumab, avelumab, and cemiplimab. Using the brand name and NDCs, the database was searched for all ICIs included in Table 1. Although durvalumab (Imfinzi) is available in the USA, this study did not include this product because reimbursement coding errors were present in the State Drug Utilization Database.

The total amount of pharmacy reimbursement in US dollars and the number of prescription claims were found by summing data for each drug based on quarter. We considered the total reimbursement by Medicaid and the number of prescription claims as representative of spending and utilization, respectively. Days’ supply for each prescription was not specified in the collected data. Because the amount of rebates Medicaid receives from pharmaceutical companies is unknown, the exact acquisition cost for each drug is approximated by per-per prescription reimbursements. Drug price was calculated by dividing the total reimbursement by the number of prescriptions for each quarter and year as performed in a similar study with anti-ulcer gastric medications [13]. Because spending is indicative of the amount that Medicaid reimbursed the ICIs that are only available as brand-name medications in the USA, the data were computed only for the branded ICIs. Reimbursement values were inflated from the year the data were obtained to June 2022 US dollars using the Consumer Price Index for all urban consumers’ medical care [14]. Data extraction was performed using the SAS software package for Windows, version 9.4 (SAS Institute Inc., Cary, NC, USA). Microsoft Excel was used to analyze trends and create figures.

3 Results

Table 2 shows an overview of the annual totals of Medicaid expenditure and prescriptions claimed through Medicaid and the average annual spending per prescription for ICIs from 2011 to 2021. The total spending on ICIs grew dramatically from $2.8 million in 2011 to $4.1 billion. The greatest annual spending change occurred between 2015 and 2016 with expenditures jumping from $47 million to $332.7 million. The total number of prescriptions also increased from 94 prescriptions in 2011 with one ICI on the market to 462,049 prescriptions in 2021with six ICIs, excluding durvalumab. Utilization had the greatest annual change between 2015 and 2016 from 4828 to 56,678 prescriptions. The average spending per prescription, or average drug price, decreased 70% from $29,795.88 in 2011 to $8914.69.46 in 2021. The average drug price experienced the greatest change in 2014 with an average price decrease of 69.4%, dropping from $31,800.61 in 2014 to $9740.71 in 2015.

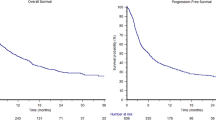

Spending and utilization of ICIs followed similar patterns, seen in Figs. 1 and 2. Spending on ipilimumab (Yervoy) grew from $2.8 million in 2011 to $26 million at the end of 2014 while utilization grew from 94 to 808 prescriptions in 2014. After their approvals in 2014, pembrolizumab (Keytruda) and nivolumab (Opdivo) became the ICIs with the highest spending and utilization by a large margin. Nivolumab had the greatest expenditure and utilization until early 2019 when pembrolizumab surpassed it. Pembrolizumab had the most dramatic change out of all the ICIs with its spending increasing from $184,211.73 to $2.5 billion and its utilization increasing from 18 to 263,385 prescriptions between 2014 and 2021.

In Table 3, the market shares in spending and utilization of pembrolizumab and nivolumab are greater than those of other ICIs. In 2016, nivolumab claimed an 83.9% market share in spending and 94.4% in utilization, the largest market share since 2014 when ipilimumab had the largest market share at 99.3% for spending and 97.8% for utilization compared to the newly approved pembrolizumab and nivolumab.

Out of the three ICIs approved after nivolumab and pembrolizumab, atezolizumab (Tecentriq®) had the largest growth in spending and utilization, increasing from $897,163.90 and 115 prescriptions in 2016 to $451 million and 51,761 prescriptions in 2021, as seen in Figs. 1 and 2. Cemiplimab (Libtayo), the most recently approved ICI, has had the slowest growth in spending out of all ICIs increasing from $1.2 million to $30.6 million, and utilization increased from 180 to 4226 prescriptions between 2019 and 2021. Spending on avelumab (Bavencio®) grew from $543,319.44 to $18.4 million and utilization has grown from 141 to 3080 prescriptions between 2018 and 2021. All the ICIs experienced a brief decrease in spending and utilization at the end of 2019 or the beginning of 2020.

The trends of average drug price per prescription differed from the spending and utilization trends. Table 4 and Fig. 3 show the changes in average drug prices of each ICI between 2011 and 2021. The average drug price decreased markedly with the addition of new and lower cost ICIs. Ipilimumab has maintained the highest average price per prescription of all the ICIs since its approval in 2011. The price ranged between $29,000 and $32,000 per prescription while it was the only ICI available on the market. The price of ipilimumab continued to increase, peaking at $46,553.38 per prescription in 2017. After 2017, the price began to drop rapidly, falling to $14,368.96 in 2021. The price has remained above $14,000 per prescription between 2011 and 2021, costing at least $4000 more per prescription than the other ICIs. The prices of the other five ICIs have remained relatively stable since their approvals, remaining at around or under $11,000 per prescription. After ipilimumab, pembrolizumab and atezolizumab have maintained the highest prices since their approvals in 2014 and 2016, respectively, with a range between $8000 and $11,000. The price of cemiplimab started greater than that of avelumab when it was first approved in 2019 and has maintained a similar price to nivolumab since 2019, with a range between $6000 and $8000 per prescription. The price of nivolumab has grown slowly, increasing from $7801.43 at approval in 2014 to $7176.41 in 2021. Though avelumab has the lowest price amongst the ICIs, it remained steady between 2018 and 2021 at a range of $3000–$6000.

4 Discussion

This study is the first study to report the spending, utilization, and price trends of ICIs over time in Medicaid patients, who reflect a large proportion of the medically insured population in the USA. The findings of this study show that Medicaid expenditures on ICIs have increased since 2011. Both spending and utilization of ICIs have grown dramatically over the past decade, primarily owing to the huge successes of pembrolizumab and nivolumab, which have consistently made the top ten drugs with the highest revenue globally since 2018 [15,16,17,18].

According to the National Cancer Institute, the most common cancers are breast cancer, lung and bronchus cancer, prostate cancer, colorectal cancer, and melanoma [19]. Immune checkpoint inhibitors have indications approved by the US Food and Drug Administration (FDA) for these cancers and have been proven to be effective for them, which explains the exponential increase in utilization. However, most patients with cancer do not respond to immunotherapy. A study that assessed tumor response to ICIs found that only about one in five patients diagnosed with common cancers responded to ICI therapy [20]. A retrospective study that evaluated patients who are eligible for and respond to ICI therapy found that 43.63% of US patients with cancer were eligible for ICI treatment and only 12.46% of patients with cancer were estimated to respond to ICI treatment in 2018 [21]. The low response rate for ICIs may be the reason that the relative number of prescriptions for ICIs is low.

The spending and utilization of all ICIs dipped from late 2019 to early 2020, corresponding with the emergence of the COVID-19 pandemic in the USA. Immune checkpoint inhibitors are given as intravenous infusions, which patients can only receive in an oncology clinic. With lock-down measures in place across the country at the beginning of 2020 because of COVID-19, many patients with cancer who were prescribed ICI treatment would not have been able to receive their medications, which is most likely the justification for the temporary decrease in spending and utilization.

Generally, increases and decreases in spending and utilization for the ICIs may be partly explained by the addition of FDA-approved indications or withdrawal of indications, as shown in Table S1 of the Electronic Supplementary Material. Pembrolizumab and nivolumab have the highest reimbursement amounts and utilization, which may be owing to both drugs having the greatest number of indications currently among the ICIs. The upward trends of nivolumab and pembrolizumab between 2015 and 2016 may be because nivolumab was the first PD-1 inhibitor to gain FDA approval for the treatment of metastatic NSCLC and small cell lung cancer [22] and pembrolizumab received FDA approval for metastatic NSCLC [23]. These may also explain the substantial surge in total ICI spending and utilization between 2015 and 2016. Nivolumab and pembrolizumab experienced drops in spending and utilization between late 2020 and early 2021 because both Bristol Myers Squibb and Merck voluntarily withdrew their ICIs for the treatment of metastatic small cell lung cancer because of a failure to establish the superiority of treatment based on overall survival in their post-marketing requirements [24, 25].

In line with the study’s results, intra-class competition among ICIs did not appear to be a factor in determining prices as the ICIs included in this study have maintained roughly the same prices over time. A study that examined price changes and within-class competition among cancer drugs found that the addition of new drugs within the same class generally did not hinder rising prices in the USA [26]. However, it seems that manufacturers may be pricing newer ICIs lower than previous ICIs, driving down the total average price over time.

One unanticipated finding was the price of ipilimumab. Relative to its utilization, the reimbursement amount for ipilimumab was considerable as reflected by its average drug price of $18,799.66 compared with the average prices of newer ICIs, which are less than $9300, as shown in Table 4. Ipilimumab is primarily used in combination with nivolumab because of its inferiority as monotherapy to pembrolizumab [27] and nivolumab [28] and evidence that the combination improves overall survival and response to therapy [29,30,31]. Previous research has also established that ipilimumab monotherapy costs more and is less effective than pembrolizumab and nivolumab individually from US and European healthcare system perspectives for melanoma [32], the only indication it is approved for as monotherapy. Given the lack of a unique indication and inferiority to nivolumab and pembrolizumab of ipilimumab, the maintenance of its price and significant price difference compared with the newer ICIs are unexpected. The reason for this is not clear but might be related to the fact that pharmaceutical companies are able to determine drug prices without negotiation according to the “best price’ provision of the Medicaid Drug Rebate Program [33].

There is a need for policy changes to address rising drug costs. Spending on specialty drugs such as cancer drugs places immense fiscal pressure on Medicaid programs. Medicaid programs reported in 2019 that the cost of specialty drugs is one of the key factors that will drive up Medicaid spending in 2020 [34]. Several policy proposals that have been suggested recently are eliminating the Medicaid drug rebate cap, limiting or prohibiting pharmacy benefit manager spread pricing in Medicaid, eliminating or modifying the Medicaid “best price” requirement, increasing the minimum rebate amount for high-cost drugs, and allowing the importation of prescription drugs from other countries [35]. The proposals individually have been estimated to reduce federal spending by up to $228 million over 5 years and between $900 million and $17 billion over 10 years [36]. An additional recommendation is to conduct health technology assessment on drugs prior to approval. Many countries, such as the UK, Canada, and Australia, utilize health technology assessments as a tool to support decision making in drug approvals [37]. Evaluating drugs through a comprehensive and multidisciplinary process to assess the efficacy, safety, and economic impact could encourage health policies that push for the best value in drug pricing for cancer therapies.

Further work is needed to fully understand the impact of ICIs on the US healthcare system. Spending on ICIs results in less spending on other widely used, costly [38, 39], and less efficacious [40] treatment options for cancer, such as tyrosine kinase inhibitors and chemotherapy. Economic evaluations comparing ICIs to existing treatment options are necessary to fully understand the value of ICIs. A natural progression of this work is to analyze the utilization, effectiveness, and safety of ICIs in the Medicaid population with patient- and prescription-specific data. A similar study looking at trends related to reimbursement and utilization conducted using Medicare or commercial insurance data should be conducted for a more detailed look at the impact of ICIs on overall spending and utilization in the USA. Similar studies in individual cancers or across all cancer types could provide valuable insights into the effectiveness and safety of ICIs in a real-world population.

4.1 Limitations

The scope of this study is subject to certain limitations. For instance, the data used to evaluate trends consisted of Medicaid-covered outpatient prescription drug data, limiting the generalizability of the results. The state utilization data also lack patient-specific information, thus the demographics of the patients receiving the ICIs and whether the patient received it that may be related to using the treatment cannot be determined. The data also lack patient-specific prescription information, thus prescribed indications and the number of cycles prescribed or that patients received is unknown. Because of the database consisting of self-reported data by states, there may be coding and reporting errors in the database. The codes are subject to error owing to potentially incorrect reporting from states. Durvalumab, an ICI indicated for NSCLC and small cell lung cancer, had errors in its reimbursement data, preventing its use in the analysis for this study. It has been on the market since 2017 and is effective for lung cancers, which are difficult to treat, so it may have a significant impact on spending and utilization.

5 Conclusions

The results of this study show that utilization, spending, and prices of ICIs have increased dramatically over the past decade. There is no doubt that these trends will only continue to increase as cancer incidence and drug prices rise. The description of trends over time for the spending and utilization of ICIs in the Medicaid population may help healthcare providers, payers, and policymakers who are interested in underlying causes and patterns of drug prices for ICIs in identifying a potential cost driver in Medicaid programs and providing evidence for discussions on cost containment in a time where drug pricing is at the center of health policy debates.

References

CDC. An update on cancer deaths in the United States. 2022. https://www.cdc.gov/cancer/dcpc/research/update-on-cancer-deaths/index.htm. Accessed 15 Nov 2022.

Global Burden of Disease CC. Cancer incidence, mortality, years of life lost, years lived with disability, and disability-adjusted life years for 29 cancer groups from 2010 to 2019: a systematic analysis for the Global Burden of Disease Study 2019. JAMA Oncol. 2022;8(3):420–44. https://doi.org/10.1001/jamaoncol.2021.6987.

Siegel RL, Miller KD, Fuchs HE, Jemal A. Cancer statistics, 2022. CA Cancer J Clin. 2022;72(1):7–33. https://doi.org/10.3322/caac.21708.

Soni A. Trends in use and expenditures for cancer treatment among adults 18 and older, US civilian noninstitutionalized population, 2001 and 2011. Rockville (MD): Statistical Brief (Medical Expenditure Panel Survey); 2001.

Mariotto AB, Enewold L, Zhao J, Zeruto CA, Yabroff KR. Medical care costs associated with cancer survivorship in the United States. Cancer Epidemiol Biomarkers Prev. 2020;29(7):1304–12. https://doi.org/10.1158/1055-9965.EPI-19-1534.

Prasad V, De Jesús K, Mailankody S. The high price of anticancer drugs: origins, implications, barriers, solutions. Nat Rev Clin Oncol. 2017;14(6):381–90. https://doi.org/10.1038/nrclinonc.2017.31.

Vaddepally RK, Kharel P, Pandey R, Garje R, Chandra AB. Review of indications of FDA-approved immune checkpoint inhibitors per NCCN guidelines with the level of evidence. Cancers (Basel). 2020;12(3):738. https://doi.org/10.3390/cancers12030738.

Leighl NB, Nirmalakumar S, Ezeife DA, Gyawali B. An arm and a leg: the rising cost of cancer drugs and impact on access. Am Soc Clin Oncol Educ Book. 2021;41(41):1–12. https://doi.org/10.1200/EDBK_100028.

The Commonwealth Fund. What is Medicaid’s value? 2019 [updated December 13, 2019]. https://www.commonwealthfund.org/publications/explainer/2019/dec/medicaids-value. Accessed 15 Oct 2022.

Ermer T, Walters SL, Canavan ME, Salazar MC, Li AX, Doonan M, et al. Understanding the implications of Medicaid expansion for cancer care in the US: a review. JAMA Oncol. 2022;8(1):139–48. https://doi.org/10.1001/jamaoncol.2021.4323.

Siegel DA, Li J, Henley SJ, Wilson RJ, Lunsford NB, Tai E, et al. Geographic variation in pediatric cancer incidence: United States, 2003–2014. MMWR Morb Mortal Wkly Rep. 2018;67(25):707–13. https://doi.org/10.15585/mmwr.mm6725a2.

Medicaid.gov. State drug utilization data. 2022 [updated February 7, 2022]. https://www.medicaid.gov/medicaid/prescription-drugs/state-drug-utilization-data/index.html. Accessed 16 Oct 2022.

Guo JJ, Kelton CML, Pasquale MK, Zimmerman J, Patel A, Heaton PC, et al. Price and market-share competition of anti-ulcer gastric medications in the Ohio Medicaid market. Int J Pharm Med. 2004;18(5):271–82. https://doi.org/10.2165/00124363-200418050-00002.

Federal Reserve Bank of St. Louis Federal Reserve Economic Data. Consumer Price Index for all urban consumers: medical care in US city average. https://fred.stlouisfed.org/series/CPIMEDSL. Accessed 31 Oct 2022.

Urquhart L. Top companies and drugs by sales in 2021. Nat Rev Drug Discov. 2022;21(4):251. https://doi.org/10.1038/d41573-022-00047-9.

Urquhart L. Top companies and drugs by sales in 2020. Nat Rev Drug Discov. 2021;20(4):253. https://doi.org/10.1038/d41573-021-00050-6.

Urquhart L. Top companies and drugs by sales in 2019. Nat Rev Drug Discov. 2020;19(4):228. https://doi.org/10.1038/d41573-020-00047-7.

Urquhart L. Top drugs and companies by sales in 2018. Nat Rev Drug Discov. 2019. https://doi.org/10.1038/d41573-019-00049-0.

National Cancer Institute. What is cancer? 2021 [updated 2021]. https://www.cancer.gov/about-cancer/understanding/what-is-cancer#:~:text=There%20are%20more%20than%20100,cancer%20starts%20in%20the%20brain. Accessed 16 Oct 2022.

Topalian SL, Hodi FS, Brahmer JR, Gettinger SN, Smith DC, McDermott DF, et al. Safety, activity, and immune correlates of anti-PD-1 antibody in cancer. N Engl J Med. 2022;366(26):2443–54. https://doi.org/10.1056/NEJMoa1200690.

Haslam A, Prasad V. Estimation of the percentage of US patients with cancer who are eligible for and respond to checkpoint inhibitor immunotherapy drugs. JAMA Netw Open. 2019;2(5):e192535. https://doi.org/10.1001/jamanetworkopen.2019.2535.

National Cancer Institute. FDA approves first immunotherapy treatment for lung cancer. 2015. https://www.cancer.gov/news-events/cancer-currents-blog/2015/fda-opdivo. Accessed 30 Oct 2022.

Center for Drug Evaluation and Research. Pembrolizumab (Keytruda) checkpoint inhibitor. 2019. https://www.fda.gov/drugs/resources-information-approved-drugs/pembrolizumab-keytruda-checkpoint-inhibitor. Accessed 29 Nov 2022.

Slater H. Bristol Myers Squibb withdraws nivolumab indication for treatment of SCLC. 2021. https://www.cancernetwork.com/view/bristol-myers-squibb-withdraws-nivolumab-indication-for-treatment-of-sclc. Accessed 20 Nov 2022.

The ASCO Post. Pembrolizumab’s indication in small cell lung cancer is withdrawn. 2021. https://ascopost.com/news/march-2021/pembrolizumabs-indication-in-small-cell-lung-cancer-is-withdrawn/. Accessed 2 Dec 2022.

Vokinger KN, Hwang TJ, Carl DL, Laube Y, Ludwig W-D, Naci H, et al. Price changes and within-class competition of cancer drugs in the USA and Europe: a comparative analysis. Lancet Oncol. 2022;23(4):514–20. https://doi.org/10.1016/S1470-2045(22)00073-0.

Robert C, Schachter J, Long GV, Arance A, Grob JJ, Mortier L, et al. Pembrolizumab versus ipilimumab in advanced melanoma. N Engl J Med. 2015;372(26):2521–32. https://doi.org/10.1056/NEJMoa1503093.

Weber J, Mandala M, Del Vecchio M, Gogas HJ, Arance AM, Cowey CL, et al. Adjuvant nivolumab versus ipilimumab in resected stage III or IV melanoma. N Engl J Med. 2017;377(19):1824–35. https://doi.org/10.1056/NEJMoa1709030.

Sheng IY, Ornstein MC. Ipilimumab and nivolumab as first-line treatment of patients with renal cell carcinoma: the evidence to date. Cancer Manag Res. 2020;12:4871–81. https://doi.org/10.2147/cmar.S202017.

Postow MA, Chesney J, Pavlick AC, Robert C, Grossmann K, McDermott D, et al. Nivolumab and ipilimumab versus ipilimumab in untreated melanoma. N Engl J Med. 2015;372(21):2006–17. https://doi.org/10.1056/NEJMoa1414428.

Kooshkaki O, Derakhshani A, Hosseinkhani N, Torabi M, Safaei S, Brunetti O, et al. Combination of ipilimumab and nivolumab in cancers: from clinical practice to ongoing clinical trials. Int J Mol Sci. 2020;21(12):4427. https://doi.org/10.3390/ijms21124427.

Wang J, Chmielowski B, Pellissier J, Xu R, Stevinson K, Liu FX. Cost-effectiveness of pembrolizumab versus ipilimumab in ipilimumab-naïve patients with advanced melanoma in the United States. J Manag Care Spec Pharm. 2017;23(2):184–94. https://doi.org/10.18553/jmcp.2017.23.2.184.

Baghdadi R. Health policy brief: Medicaid best price. Health Aff. 2017. https://doi.org/10.1377/hpb2017.8.

Rudowitz R, Hinton E, Diaz M, Guth M, Tian M. Medicaid enrollment and spending growth: FY 2019 and 2020. KFF; 2019. https://www.kff.org/medicaid/issue-brief/medicaid-enrollment-spending-growth-fy-2019-2020/. Accessed 5 Dec 2022.

Garfield R, Dolan R, Williams E. Costs and savings under federal policy approaches to address Medicaid prescription drug spending. KFF; 2021. https://www.kff.org/medicaid/issue-brief/costs-and-savings-under-federal-policy-approaches-to-address-medicaid-prescription-drug-spending/. Accessed 2 Dec 2022.

Garfield R, Dolan R, Williams E. Costs and savings under federal policy approaches to address Medicaid prescription drug spending. KFF; 2021. https://www.kff.org/medicaid/issue-brief/costs-and-savings-under-federal-policy-approaches-to-address-medicaid-prescription-drug-spending/. Accessed 6 Dec 2022.

Sorenson C, Chalkidou K. Reflections on the evolution of health technology assessment in Europe. Health Econ Policy Law. 2012;7(1):25–45. https://doi.org/10.1017/s1744133111000296.

Blumen H, Fitch K, Polkus V. Comparison of treatment costs for breast cancer, by tumor stage and type of service. Am Health Drug Benefits. 2016;9(1):23–32.

Mapes D. New cancer drugs lead to life-threatening financial choices. Fred Hutch Cancer Center; 2020. https://www.fredhutch.org/en/news/center-news/2020/12/new-cancer-drugs-financial-toxicity-TKI.html. Accessed 6 Dec 2022.

Wu D, Duan C, Wu F, Chen L, Chen S. Which treatment is preferred for advanced non-small-cell lung cancer with wild-type epidermal growth factor receptor in second-line therapy? A meta-analysis comparing immune checkpoint inhibitor, tyrosine kinase inhibitor and chemotherapy. Oncotarget. 2017;8(39):66491–503. https://doi.org/10.18632/oncotarget.20281.

Busse A, Lüftner D. What does the pipeline promise about upcoming biosimilar antibodies in oncology? Breast Care (Basel). 2019;14(1):10–6. https://doi.org/10.1159/000496834.

Pfizer reports fourth-quarter and full-year 2021 results. 2021 February 8. 2022. https://s28.q4cdn.com/781576035/files/doc_financials/2021/q4/Q4-2021-PFE-Earnings-Release.pdf. Accessed 6 Dec 2022.

What science can do: AstraZeneca annual report and Form 20-F information 2018. 2018. https://www.astrazeneca.com/content/dam/az/Investor_Relations/annual-report-2018/PDF/AstraZeneca_AR_2018.pdf. Accessed 6 Dec 2022.

Annual report pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934. Securities and Exchange Commission; 2018. https://www.sec.gov/Archives/edgar/data/872589/000153217619000009/regn-123118x10k.htm. Accessed 6 Dec 2022.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Conflicts of interest

Young Eun Shin, Arun Kumar, and Jeff Jianfei Guo have no conflicts of interest that are directly relevant to the content of this article.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Availability of data and material

The authors confirm that the data supporting the findings of this study are available within the article.

Code availability

Not applicable.

Authors’ contributions

The authors confirm contribution to the paper as follows: study conception and design: YES and JG; data collection: JG; analysis and interpretation of results: YES. All authors contributed to the draft manuscript preparation. All authors reviewed the results and approved the final version of the manuscript.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Shin, Y. ., Kumar, A. & Guo, J.J. Spending, Utilization, and Price Trends for Immune Checkpoint Inhibitors in US Medicaid Programs: An Empirical Analysis from 2011 to 2021. Clin Drug Investig 43, 289–298 (2023). https://doi.org/10.1007/s40261-023-01254-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40261-023-01254-x