Abstract

Objective

We aimed to assess whether the introduction of the first infliximab biosimilar was associated with changes in overall infliximab consumption (originator and biosimilars) and price changes to the originator infliximab.

Methods

An interrupted time series analysis using infliximab sales data from 2010 to 2020 from the IQVIA Multinational Integrated Data Analysis System for eight selected regions: Australia, Canada, Hong Kong, Korea, India, Japan, the UK, and the USA. Quarterly measures of infliximab consumption and list prices were respectively defined as the number of standard units (SU)/1000 inhabitants and as 2020 USA dollars (USD)/SU.

Results

Following the introduction of infliximab biosimilars, overall infliximab consumption increased in Australia [immediate change: 0.145 SU/1000 inhabitants (P = 0.014); long-term change: 0.022 SU/1000 inhabitants per quarter (P < 0.001)], Canada [immediate change 0.415 (P = 0.008)], the UK [long-term change 0.024 (P < 0.001)], and Hong Kong [immediate change: 0.042 (P < 0.001)]. The list price of originator infliximab also decreased following biosimilar introduction in Australia [immediate change: − 187.84 USD/SU (P < 0.001); long-term change − 6.46 USD/SU per quarter (P = 0.043)], Canada [immediate change: − 145.58 (P < 0.001)], the UK [immediate change: − 34.95 (P = 0.010); long-term change: − 4.77 (P < 0.001)], and Hong Kong [long-term change: − 4.065 (P = 0.046)]. Consumption and price changes were inconsistent in India, Japan, Korea, and the USA.

Conclusions

Introduction of the first infliximab biosimilar was not consistently associated with increased consumption across regions. Additional policy and healthcare system interventions to support biosimilar infliximab adoption are needed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Biosimilars have improved patient access to biologic therapy and reduced drug costs in many European countries but there is limited evidence of this effect in other geographic regions. |

Following the introduction of the infliximab biosimilar, increased consumption and decreased prices of the originator occurred only in some regions. The success observed in Europe has not been consistently replicated in more diverse markets and healthcare systems. |

Introducing biosimilars alone may not suffice to lower drug prices or improve access, particularly for private healthcare systems with reimbursement policies that favor high-cost originator biologics. |

The adoption of biosimilars needs to be part of a larger coordinated package of policy interventions designed to accommodate their adoption and achieve anticipated reductions in drug spending. |

1 Introduction

Biologics have revolutionized the treatment of autoimmune diseases and cancer [1, 2]. The high cost of biologics however remains a key barrier to accessing these treatments, particularly in low-income and middle-income countries [3]. Biosimilars represent a potential solution to this barrier as they are less costly, are highly similar to their reference product, and have a comparable clinical efficacy and safety profile [4, 5]. The success of generic medicines in reducing costs and improving access is also expected to be realised for biosimilars [6].

The introduction of biosimilars is linked to better accessibility and affordability of biologic medicines through reductions in drug costs [7] and greater potential for budget cost saving [8, 9]. In Europe, biosimilars were marketed at a 25–55% lower price compared with their reference biologic. Introducing biosimilars has increased biologic utilization by 16% to 263% and decreased the price of biologic originators by 27% to 50% [10]. The European market has at least two characteristics that influence the use of biosimilars: the European Union established the earliest regulations and approval system for biosimilar medicines in 2001, and has a supportive policy environment. This has resulted in both a high number of approved biosimilar products and a rate of biosimilar uptake in Europe that has outpaced other countries [11].

The success of the biosimilar market in Europe may not be reproducible in other regions as studies have identified multiple factors that influence biosimilar consumption (e.g., healthcare system, regulation, and pricing) [12,13,14]. For instance, the performance of biosimilars in the USA market appears to be far from satisfactory having achieved only 9% of predicted cost savings [12, 15]. Studies also report that the introduction of biosimilars resulted in lower utilization of overall biologics in Japan [14]. These descriptive studies have not adequately quantified the effects of biosimilar competition nor applied robust methods for causal inference after changes in medicine-related policy. They also omitted the initial consumption trend before biosimilar availability and were therefore unable to distinguish the long- and short-term effects associated with the introduction of biosimilars.

In this study, by using infliximab as a case study, we examined whether the introduction of biosimilars led to an increased overall utilization of infliximab and a reduction in the price of the originator infliximab among different countries both immediately at the time of biosimilar introduction and in the longer term. Infliximab is an essential medicine [16] and is a tumor necrosis factor inhibitor indicated for the treatment of inflammatory diseases such as rheumatoid arthritis, Crohn’s disease, ulcerative colitis, and psoriasis, and it was one of the first approved anti-tumor necrosis factor biologics and one of the first biosimilars to be used in rheumatology and gastroenterology. Infliximab and its biosimilars have considerable global sales and are widely available in diverse markets globally [17]. To inform clinicians, decision makers, and health policy analysts about the benefits of a biosimilar introduction, we used sales data to conduct an interrupted time series (ITS) analysis to quantitatively assess the effects of introducing infliximab biosimilars on the price of originator infliximab and consumption of overall infliximab products to a range of international markets in Asia Pacific (Australia, Hong Kong, Japan, Korea and India), North America (Canada and the USA), and Europe (the UK).

2 Methods

2.1 Data Source and Selected Geographical Regions

Infliximab sales data were obtained from the IQVIA-Multinational Integrated Data Analysis System (IQVIA-MIDAS); a global pharmaceutical drug database covering 95% of the global prescription drug market, [18] with coverage rates exceeding 80% in most countries [19, 20]. Sales data were reported as list prices at the manufacturer sales level and standardized internationally using a series of criteria defined by IQVIA (e.g., standardized pack volumes, product name, monetary units) to facilitate cross-country analyses. The validity and reliability of MIDAS have been widely evaluated as good quality and used in several studies [21,22,23,24].

Sales data are collected in terms of the number of pack units sold and are then multiplied by the price to produce the sales. Infliximab prices comprised three groups collected from different sources by MIDAS (Table 1 of the Electronic Supplementary Material [ESM]). Source prices were obtained at the manufacturer price level (manufacturer’s selling price or wholesaler’s purchase price: Hong Kong, India, and USA); trade price level (price paid by a retail or hospital pharmacy for products: Australia, Canada, and UK); and the National Health Insurance reimbursement price (official prices determined by a government funding agency: Korea and Japan). On-invoice discounts, rebates, bonus pack, and cash return were captured for certain channels as described in Table 1 of the ESM. All prices were further standardized to the manufacturer level by IQVIA to facilitate a cross-country comparison based on local conversion factors, which were derived from information provided by health authorities, the pharmaceutical industry, and wholesaler associations.

Our initial IQVIA-MIDAS dataset comprised quarterly infliximab sales from Quarter 1 2010 to Quarter 4 2020 in 18 regions. Sales were reported in USA dollars (USD) for each reporting quarter (i.e., not adjusted for inflation). Sales volumes were presented in standard units (SU). Standard units are determined by taking the number of counting units sold divided by the standard unit factor, which is the smallest common dose of a product form defined by IQVIA. For infliximab products in our data set, one SU represents one vial for parenteral infusion as dry vials/bottles (New Form Code = FQD), subcutaneous vials (FQE), or other vials (FQY).

2.2 Biosimilar Identification and Intervention

We identified infliximab biosimilars based on the international product name, sourced from the USA Food and Drug Administration, European Medicines Agency, and research articles. The intervention timepoint was the market entry of the first infliximab biosimilar, defined as the quarter when the first sales data were available in MIDAS. A full list of infliximab biosimilar brand names and the earliest available times are presented in Table 2 of the ESM.

2.3 Eligibility Criteria

To ensure adequate power of the ITS analysis, we restricted our analysis to regions with at least eight quarters of infliximab sales data pre- and post-intervention [25]. Additionally, to avoid extreme variations in sales as a result of extremely low consumption, we included only regions with an average annual infliximab consumption greater than 5000 SUs. After application of the eligibility criteria, eight regions were included for analysis: Hong Kong, India, Japan, Korea, Australia, Canada, the USA, and the UK.

2.4 Outcomes

Study outcomes of interest were changes in overall infliximab consumption (as measured by sales volume) and the price of the originator infliximab following the introduction of infliximab biosimilars. We computed infliximab list prices at the manufacturer sales level by dividing infliximab sales in USD by the number of infliximab SU sold each quarter and converted to 2020 USD based on the USA Consumer Price Index. Prices are therefore presented in 2020 equivalent USD/SU. We removed outlier records with infliximab SU prices lower than $1, which accounted for less than 0.001% of overall infliximab sales volumes in the eight regions. Infliximab sales were standardized for population as SU/1000 inhabitants of each country per year, using population data from the World Bank [26]. Next, we visualized the annual sales volumes of infliximab and its biosimilars to observe the trend in infliximab sales volumes and biosimilar uptake rate over time. To assess biosimilar price differences, we calculated the SU price of the infliximab biosimilar and originator, respectively. Additionally, we calculated the price difference between infliximab biosimilars and infliximab originators in the year the biosimilar was introduced, and in 2020, representing the pricing strategies at the market entry period and the market stable period.

2.5 Main Analysis

We performed an ITS analysis to assess the impact of the infliximab biosimilar introduction on the change of infliximab sales volumes and the price of the infliximab originator. Changes include short-term effects (level change at the first quarter following biosimilar introduction) and long-term effects (slope change following biosimilar introduction). An effect of the intervention on overall infliximab consumption requires (1) both level and slope changes to be statistically significant and in the same direction or (2) one level or slope change to be statistically significant and the other change insignificant. These same rules were applied to determine the effect on pricing of the originator infliximab. The Newey–West estimator was applied to account for the autocorrelation within the time series, allowing up to third-order autoregressive terms [27]. A quarterly effect was included in the model to adjust for any periodic seasonality. Additional details of the statistical model selection are included in the ESM.

2.6 Supplementary Analysis

To validate the biosimilar’s effect on the originator price as identified from the MIDAS data for the USA, we replicated the ITS analyses on the infliximab originator price using USA Medicaid outpatient prescription data, extracted from the publicly available Medicaid State Drug Utilization Data managed by the Centers for Medicare and Medicaid Services. All 50 states and the District of Columbia reported the Medicaid beneficiaries. Quarterly reimbursements per prescription or per unit were calculated as a proxy for the price. All analyses were conducted with R version 4.1.1 (R Core Team, Vienna, Austria), and results were independently cross-checked by two authors (KP and XT).

3 Results

3.1 Overall Infliximab Consumption

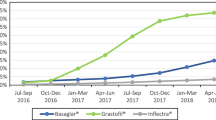

From Quarter 1 2010 to Quarter 4 2020, infliximab utilization and the penetration rate increased in general, while the size of the increase varied across regions (Fig. 1). The highest increase in infliximab consumption, calculated by dividing Quarter 4 2020 sales with Quarter 1 2010 sales, was observed for Korea (7.60 times), followed by India (2.45 times), and Australia (2.34 times). Infliximab consumption in Hong Kong increased only by 0.15 times. By 2020, the UK had the greatest biosimilar uptake rate (95.3%), and the USA had the lowest biosimilar uptake rate (15.8%).

Prior to the introduction of biosimilar infliximab, the trend in overall infliximab consumption was increasing in Australia, Canada, India, Japan, Korea, the UK, and the USA (Fig. 2; Table 1, all P < 0.001), but not in Hong Kong (P = 0.421). At baseline (Quarter 1 2010), the USA had the highest consumption of infliximab (4.63 SU/1000 inhabitants), while India had the lowest (0.0005 SU/1000 inhabitants). Canada had the most rapid increase in infliximab consumption of 0.14 SU/1000 inhabitants per quarter. The level of overall infliximab consumption increased immediately upon the biosimilar introduction in Australia (P = 0.014), Canada (P = 0.008), Hong Kong (P < 0.001), and Korea (P = 0.007). No change was observed for India (P = 0.758), Japan (P = 0.568), the UK (P = 0.118), and the USA (P = 0.638). After the introduction of biosimilars, there was an accelerated uptake of infliximab in Australia (P < 0.001), the UK (P < 0.001), and USA (P = 0.016); with no significant change in the consumption rate in India (P = 0.120), Korea (P = 0.506), Canada (P = 0.143), and Hong Kong (P = 0.105). Conversely, the consumption rate in Japan declined after the introduction of the infliximab biosimilar (P < 0.001).

Trend in overall infliximab (INF) quarterly consumption before and after first biosimilar INF introduction. The Y axis shows the consumption of INF standard units per 1000 inhabitants. Shaded area represents post biosimilar introduction period. Solid line is the actual consumption trend; dashed line simulates the counterfactual scenario if biosimilars were not introduced

3.2 Price of Infliximab Originator Product

In the latest year of data availability (2020), the unit price of infliximab originator ranged from $196 in Australia to $727 in Canada (Table 3 of the ESM); the unit price of the infliximab biosimilar ranged from $133 in Australia to $424 in the UK. In general, biosimilars were associated with a 19.2% (SD = 23.4%) price reduction compared with the originators when first introduced to the market. By 2020, the price reduction level had increased to 29.1% (SD = 12.4%). In regions such as Hong Kong and Canada, infliximab biosimilar prices were much lower than their originator (43–47% lower); while in Korea and the UK, there was only a marginal difference between biosimilar and originator prices (8–15% lower). Notably, infliximab biosimilars were 29% more expensive than the originator when first introduced in the USA.

Before biosimilars were introduced, originator infliximab prices presented a decreasing trend in Australia (P = 0.002), Canada (P < 0.001), India (P < 0.001), Japan (P < 0.001), and Korea (P < 0.001). A stable trend was observed in Hong Kong (P = 0.605) and the UK (P = 0.155), while in the USA there was an increasing trend in price where the originator infliximab price increased at a rate of 5.14 USD/SU per quarter [(P < 0.001), Fig. 3; Table 2]. Japan had the largest decreasing trend with a rate of 19.85 USD/SU per quarter (P < 0.001). The price of the originator infliximab decreased significantly immediately after the entry of infliximab biosimilar in Australia (P < 0.001), Canada (P < 0.001), Japan (P = 0.002), Korea (P < 0.001), and the UK (P = 0.010); increased in the USA (P < 0.001) and India (P = 0.009) but had no impact in Hong Kong (P = 0.861). After the introduction of biosimilars, the trend of the originator infliximab price further decreased in Australia (P = 0.043), Hong Kong (P = 0.046), UK (P < 0.001), and the USA (P < 0.001) but increased in India (P < 0.001), Japan (P = 0.018), and Korea (P < 0.001) and remained unchanged in Canada (P = 0.404). In summary, our results indicate that the introduction of the infliximab biosimilar was associated with increased overall infliximab consumption in Australia, Canada, Hong Kong, Korea, the UK, and USA, and reduced infliximab originator prices in Australia, Canada, the UK, and Hong Kong.

Originator and biosimilar infliximab (INF) prices before and after first biosimilar INF introduction. The Y axis is the unit price of originator INF per standard unit. Shaded area represents post biosimilar intervention period. Solid line is the actual price trend; dashed line simulates the counterfactual scenario if biosimilars were not introduced

3.3 USA Medicaid Price Data

Using the Medicaid reimbursement data (Table 4; Fig. 1 of the ESM), the price of the infliximab originator increased at 8.55 USD/SU per quarter (P < 0.001) before the biosimilar introduction and increased (P < 0.001) in the quarter when the biosimilar infliximab was first introduced, with the subsequent price slope decreased by 31.4 USD/quarter on average (P < 0.001). Despite varied effect sizes, trends in infliximab originator prices in MIDAS and Medicaid were highly consistent.

4 Discussion

Given the divergent long-term and immediate impacts of the infliximab biosimilar introduction of utilization and costs observed in different regions, we considered the differences in pricing strategy, reimbursement coverage, policy guidance, and competing products separately for India, Japan, and the USA. Additionally, we discuss the results for Australia, Canada, UK, Hong Kong, and Korea together as they had consistent changes in consumption and costs after the introduction of the infliximab biosimilar.

4.1 India

India currently does not have a mechanism for the reimbursement of biologics [28] and the high price of both the originator and biosimilar products might weaken the effect of biosimilar introduction, as cost is an important factor influencing the behavior of both the patient and prescriber [29]. A previous study reported that medicine costs could account for up to 70% of overall out-of-pocket health costs for people living in India [30]. The disease-related out-of-pocket health costs are associated with a greater risk of incurring catastrophic health expenditure [31]. Despite limited health insurance coverage, the list price of infliximab in India, the only lower-middle income economy in our study, remained relatively high compared with other developed countries. Consequently, among the countries in our study, India has the lowest infliximab consumption per 1000 inhabitants. In India, biologics are not currently listed on the National List of Essential Medicines, thus the pricing of biologics are not regulated [32] and despite a less costly biosimilar, the price is still prohibitive for many individuals on low incomes while those on higher incomes can afford infliximab regardless of the lower price of the biosimilar. Unfavorable economic conditions and a less well-regulated pharmaceutical market has changed the dynamics of policy intervention [33], which likely explains why increased utilization and reduced originator prices have not been achieved in India.

4.2 Japan

In Japan, the trend in infliximab consumption dropped substantially after the introduction of the infliximab biosimilar and overturned the original increasing trend in the pre-intervention period. Previous market analysis in Europe reported a similar phenomenon that in 21% of cases, the introduction of lower priced biosimilars was actually associated with a reduction in the overall number of patients treated [13]. While the reason for such reductions remains unclear, it could be attributed to the increased usage of other competing biologic agents. It has been reported that prescribers and patients may prefer more user-friendly agents (e.g., golimumab, tocilizumab, adalimumab) that can be self-administered subcutaneously, compared with infliximab that has to be administered by an intravenous infusion [9]. Regarding pricing, biosimilars listed on the National Health Insurance programme are priced 30% lower than originators according to a price-link policy [14]. Despite the marked price reduction, no policies designed to encourage biosimilar substitution have been implemented and physicians remain cautious in using biosimilars. Conversely, the current drug co-payment scheme in Japan covers medication costs exceeding a fixed threshold to control the financial burden on the patient. Consequently, as the cost of the infliximab biosimilar and originator remained the same, the subsidy system was therefore believed to disincentivize the demand for biosimilars, resulting in a limited uptake rate of infliximab in Japan [34]. This could explain the dramatic drop in the originator price when the biosimilar infliximab was introduced followed by a flat trend.

4.3 USA

No national pricing or purchasing strategy currently exists to set drug prices in the USA [33]. Pharmacy benefit managers are third-party administrators responsible for deciding drug reimbursement and formulary inclusion for major commercial health plans, self-insured employer plans, Medicare Part D plans, the Federal Employees Health Benefits Program, and state government employee plans. Brand drug manufacturers pay rebates to pharmacy benefit managers to ensure their products are covered. How savings from rebates are used remains confidential. A 2019 study found only 14% of scenarios where a biosimilar was covered with priority to originators according to USA commercial health plans [35]. Manufacturers of listed originator drugs thus have limited incentive to reduce drug costs as there is limited competition from cheaper biosimilars [36]. In the absence of competition, brand drug manufacturers can set drug prices at will. According to the latest report to the White House, drug prices within the Medicare program increased more than twice the overall inflation rate in the past two decades [36]. Evidence comparing the use of the originator and biosimilar infliximab suggests that Medicare (one of the largest payers for infusion therapies) reimbursement policies in fact deter the use of biosimilars in an academic medical center, as opposed to a Veteran’s Affairs Medical Center [37]. Medicare cannot negotiate drug prices as opposed to the Veteran’s Affairs, which uses a centralized negotiating process and has a national formulary. This study showed that despite a lower average selling cost for the biosimilar infliximab, the potential institutional incentive under the Medicare Part B reimbursement policy was in fact greater for the originator. Moreover, Medicare Part B provides reimbursement at a rate of the average sales price plus a 4.3% add-on fee to cover administration costs for drugs (e.g., infliximab) that require a hospital-based injection, which potentially incentivize physicians to prescribe higher priced originators to gain higher add-on fees according to a report for Congress [38]. Consequently, limited biosimilars were prescribed and the manufacturers of originators were less likely to lower their prices. A two-quarter lag in the average selling price explains the higher price for the first 6 months after a biosimilar approval. This has been observed in Baker et al. [37] and is clear in both the MIDAS and Medicaid data. This could potentially explain the increasing originator price before the introduction of biosimilars and the uncommon biosimilar price, which was greater than its originator when first introduced (Fig. 3). Regarding the divergent price trend in the USA compared with all other regions, we additionally extracted USA Medicaid outpatient prescription data to verify the sales trends in MIDAS, which depicted almost identical price trends to the MIDAS data. Moreover, a recent study using Medicaid data incorporated rebates, which we failed to capture in MIDAS data, obtained similar decreasing infliximab originator price trends following a biosimilar introduction [39], thus supporting the robustness of our results.

4.4 Australia, Canada, UK, Hong Kong, and Korea

These five regions demonstrated similar consumption and price changes after the biosimilar infliximab introduction. In terms of pricing, all five regions have mature pricing strategies such as tendering and negotiations, pharmacoeconomic evaluation, and reference pricing to ensure that drug prices are not excessive [40, 41]. Manufacturers must bid for a listing in either public or private formularies to gain a greater market share, which incentivizes the originator manufacturer to lower prices to compete with biosimilar manufacturers. Korea is an outlier in this group of countries; although the originator price decreased significantly upon the biosimilar introduction, the subsequent decreasing trend was stable, which might be a result of the trivial price difference between the biosimilar and originator. A similar phenomenon was previously identified with the insulin biosimilar, where the small price difference between the biosimilar and originator led to a modest uptake rate of the insulin biosimilar and restricted the impact of the biosimilar introduction [42]. In terms of consumption, all five regions showed increased consumption after introducing the biosimilar infliximab, which aligns with the experience in central European countries and Denmark [10, 43].

4.5 Avoiding the Nocebo Effect

The nocebo effect refers to the negative outcome derived from patients’ negative expectations of treatment and not the drug’s pharmacological action [44]. Despite the similar efficacy and safety between biosimilars and the originator as demonstrated in clinical trials [4, 5], many healthcare professionals have concerns about switching from the originator to a biosimilar and remain resistant to prescribing biosimilars, even when made aware of the cost savings associated with biosimilar use [45]. Nocebo-reducing strategies are needed to enhance the benefits of biosimilars, including education on the risk versus benefits of biosimilars, and the adoption of a shared decision-making process with patients [44].

4.6 Limitations and Strengths

The results of this study have inherent limitations. First, we only accounted for the availability of the first infliximab biosimilar in our ITS analysis, while recent studies have revealed that the introduction of each successive biosimilar may also contribute to a further drop in the originator price [46, 47] and is directly applicable to Japan, UK, USA, Canada, Australia, and Korea where more than one infliximab biosimilar was subsequently introduced (Table 2 of the ESM). Second, we were unable to consider the impact of other newly introduced biologics with the same indications as infliximab (e.g., biosimilars of etanercept, adalimumab, rituximab, or newly developed sarilumab, upadacitinib) on the price and overall consumption of infliximab. Third, the long-term price can also be affected by other time-varying variables including market penetration rate and implementation of a national biosimilar policy and legislation. It should be emphasized that our study used infliximab as a case study, given its established use and long-term data after biosimilar introduction. Our findings may not be generalizable to other biologics. Finally, the list price of infliximab does not necessarily equate to the cost patients pay for the drug in clinical practice, given the complex nature of drug pricing in different healthcare systems. Future studies should focus on addressing the unmeasured confounding issue, and investigate how the national income level and healthcare system will react to the introduction of biosimilars.

To our knowledge, this is the first multi-country ITS analysis to quantitatively assess the effects of introducing biosimilars on the overall consumption and price of an originator biologic drug. This comprehensive study included eight diverse geographical regions, each with different healthcare systems, income levels, and market dynamics. The findings can enhance clinicians’ understanding about the use of infliximab and the trend towards a greater use of biosimilars. This evidence can also support clinicians in taking an active role in their health systems to facilitate greater competition amongst the available infliximab products and to choose the most cost-effective infliximab product within their local context. Our study allows clinicians and decision makers within the included regions to benchmark themselves to the other regions in terms of biosimilar adoption and could inform development of national policies to support demand side interventions to increase the use of infliximab biosimilars.

5 Conclusions

Following the introduction of infliximab biosimilars, we found increased overall infliximab consumption and reduced originator prices in Australia, Canada, Hong Kong, and the UK, but not in India, Japan, Korea, and the USA. The effects of biosimilar competition in increasing biologic drug utilization and reducing originator prices are multifactorial and therefore vary widely across regions. The adoption of biosimilars needs to be part of a larger coordinated package of policy interventions designed to accommodate their adoption and achieve anticipated reductions in spending.

References

Curtis JR, Singh JA. Use of biologics in rheumatoid arthritis: current and emerging paradigms of care. Clin Ther. 2011;33(6):679–707.

Schirrmacher V. From chemotherapy to biological therapy: a review of novel concepts to reduce the side effects of systemic cancer treatment. Int J Oncol. 2019;54(2):407–19.

Putrik P, Ramiro S, Kvien T.K, et al. Inequities in access to biologic and synthetic DMARDs across 46 European countries. Ann Rheum Dis. 2014;73(1):198–206.

Cohen HP, Blauvelt A, Rifkin RM, et al. Switching reference medicines to biosimilars: a systematic literature review of clinical outcomes. Drugs. 2018;78(4):463–78.

Komaki Y, Yamada A, Komaki F, et al. Efficacy, safety and pharmacokinetics of biosimilars of anti-tumor necrosis factor-α agents in rheumatic diseases; a systematic review and meta-analysis. J Autoimmun. 2017;79:4–16.

Dylst P, Simoens S. Does the market share of generic medicines influence the price level? A European analysis. Pharmacoeconomics. 2011;29(10):875–82.

Mulcahy AW, Hlavka JP, Case SR. Biosimilar cost savings in the United States: initial experience and future potential. Rand Health Q. 2018;7(4):3.

Dutta B, Huys I, Vulto AG, et al. Identifying key benefits in European off-patent biologics and biosimilar markets: it is not only about price! BioDrugs. 2020;34(2):159–70.

Aladul MI, Fitzpatrick RW, Chapman SR. Impact of infliximab and etanercept biosimilars on biological disease-modifying antirheumatic drugs utilisation and NHS budget in the UK. BioDrugs. 2017;31(6):533–4.

Kawalec P, Stawowczyk E, Tesar T, et al. Pricing and reimbursement of biosimilars in central and eastern European countries. Front Pharmacol. 2017;8:288.

Brill A, Robinson C. Lessons for the United States from Europe’s biosimilar experience. 2020. Available from: https://biosimilarscouncil.org/wp-content/uploads/2020/06/EuropeBiosimilars_June_2020.pdf. Accessed 15 Feb 2023.

Yazdany J. Failure to launch: biosimilar sales continue to fall flat in the United States. Arthritis Rheumatol. 2020;72(6):870–3.

IQVIA. The impact of biosimilar competition in Europe 2020. Available from: https://ec.europa.eu/health/sites/default/files/human-use/docs/biosimilar_competition_en.pdf. Accessed 8 Mar 2023.

Kim Y, Kwon HY, Godman B, et al. Uptake of biosimilar infliximab in the UK, France, Japan, and Korea: budget savings or market expansion across countries? Front Pharmacol. 2020;11:970.

Zhai MZ, Sarpatwari A, Kesselheim AS. Why are biosimilars not living up to their promise in the US? AMA J Ethics. 2019;21(8):E668–78.

World Health Organization. World Health Organization model list of essential medicines, 21st list. Geneva: World Health Organization; 2019.

Amgen. Biosimilar trends report. 2022. Available from: https://www.amgenoncology.com/assets/USA-CBU-80962.pdf. Accessed 15 Feb 2023.

IQVIA. MIDAS. Available from: https://www.iqvia.com/solutions/commercialization/brand-strategy-and-management/market-measurement/midas. Accessed 8 Oct 2021.

Blais JE, Wei Y, Yap KKW, et al. Trends in lipid-modifying agent use in 83 countries. Atherosclerosis. 2021;328:44–51.

Hsia Y, Sharland M, Jackson C, et al. Consumption of oral antibiotic formulations for young children according to the WHO Access, Watch, Reserve (AWaRe) antibiotic groups: an analysis of sales data from 70 middle-income and high-income countries. Lancet Infect Dis. 2019;19(1):67–75.

Jackson C, Hsia Y, Bielicki JA, et al. Estimating global trends in total and childhood antibiotic consumption, 2011–2015. BMJ Glob Health. 2019;4(1):e001241.

Tong X, Li X, Pratt NL, et al. Monoclonal antibodies and Fc-fusion protein biologic medicines: a multinational cross-sectional investigation of accessibility and affordability in Asia Pacific regions between 2010 and 2020. Lancet Reg Health West Pac. 2022;26:100506.

Brauer R, Alfageh B, Blais JE, et al. Psychotropic medicine consumption in 65 countries and regions, 2008–19: a longitudinal study. Lancet Psychiatry. 2021;8(12):1071–82.

Ju C, Wei L, Man KKC, et al. Global, regional, and national trends in opioid analgesic consumption from 2015 to 2019: a longitudinal study. Lancet Public Health. 2022;7(4):e335–46.

Penfold RB, Zhang F. Use of interrupted time series analysis in evaluating health care quality improvements. Acad Pediatr. 2013;13(6 Suppl.):S38-44.

World Bank. Population. 2021. Available from: https://data.worldbank.org/indicator/SP.POP.TOTL. Accessed 8 Mar 2023.

Newey WK, West KD. A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica. 1987;55(3):703–8.

PharmaBoardroom. Regulation, pricing and reimbursement overview. 2018. Available from: https://pharmaboardroom.com/legal-articles/regulation-pricing-and-reimbursement-india/. Accessed 5 Oct 2021.

Augustovski F, Beratarrechea A, Irazola V, et al. Patient preferences for biologic agents in rheumatoid arthritis: a discrete-choice experiment. Value Health. 2013;16(2):385–93.

Bose M, Dutta A. Health financing strategies to reduce out-of-pocket burden in India: a comparative study of three states. BMC Health Serv Res. 2018;18(1):830.

Kastor A, Mohanty SK. Disease-specific out-of-pocket and catastrophic health expenditure on hospitalization in India: do Indian households face distress health financing? PLoS ONE. 2018;13(5): e0196106.

National Pharmaceutical Pricing Authority. List of price controlled drugs (DPCO 1995). Available from: https://ipapharma.org/list-of-price-controlled-drugs-dpco-1995/. Accessed 21 Oct 2022.

Nguyen TA, Knight R, Roughead EE, et al. Policy options for pharmaceutical pricing and purchasing: issues for low- and middle-income countries. Health Policy Plan. 2015;30(2):267–80.

Matsumoto T, Tsuchiya T, Hirano T, et al. Changes in the penetration rate of biosimilar infliximab within Japan using a Japanese claims database. Clinicoecon Outcomes Res. 2021;13:145–53.

Chambers JD, Lai RC, Margaretos NM, et al. Coverage for biosimilars vs reference products among US commercial health plans. JAMA. 2020;323(19):1972–3.

US Department of Health and Human Services. Comprehensive plan for addressing high drug prices: a report in response to the executive order on competition in the American economy. Sep 9 2021. Available from: https://aspe.hhs.gov/reports/comprehensive-plan-addressing-high-drug-prices. Accessed 8 Mar 2023.

Baker JF, Leonard CE, Weisman MH, et al. Biosimilar uptake in academic and Veterans Health Administration settings: influence of institutional incentives. Arthritis Rheumatol. 2020;72(7):1067–71.

MedPAC. Report to the congress: Medicare and the health care delivery system. June 2021. Available from: https://www.medpac.gov/document/june-2021-report-to-the-congress-medicare-and-the-health-care-delivery-system/. Accessed 8 Mar 2023.

San-Juan-Rodriguez A, Gellad WF, Good CB, et al. Trends in list prices, net prices, and discounts for originator biologics facing biosimilar competition. JAMA Netw Open. 2019;2(12):e1917379.

Bonnett C, Stafinski T, Trindade E. Medicines pricing and reimbursement in Canada. Rev Bras Farm Hosp Serv Saúde. 2022;13(2):811.

Verghese NR, Barrenetxea J, Bhargava Y, et al. Government pharmaceutical pricing strategies in the Asia-Pacific region: an overview. J Mark Access Health Policy. 2019;7(1):1601060.

Godman B, Haque M, Leong T, et al. The current situation regarding long-acting insulin analogues including biosimilars among African, Asian, European, and South American countries; findings and implications for the future. Front Public Health. 2021;9:671961.

Jensen TB, Bartels D, Sædder EA, et al. The Danish model for the quick and safe implementation of infliximab and etanercept biosimilars. Eur J Clin Pharmacol. 2020;76(1):35–40.

Colloca L, Panaccione R, Murphy TK. The clinical implications of nocebo effects for biosimilar therapy. Front Pharmacol. 2019;10:1372.

Teeple A, Ellis LA, Huff L, et al. Physician attitudes about non-medical switching to biosimilars: results from an online physician survey in the United States. Curr Med Res Opin. 2019;5(4):611–7.

Barszczewska O, Piechota A. The impact of introducing successive biosimilars on changes in prices of adalimumab, infliximab, and trastuzumab-Polish experiences. Int J Environ Res Public Health. 2021;18(13):6952.

IQVIA. Biosimilars in the United States 2020–2024 competition, savings, and sustainability. 2020. Available from: https://www.iqvia.com/insights/the-iqvia-institute/reports/biosimilars-in-the-united-states-2020-2024. Accessed 8 Mar 2023.

Acknowledgements

We appreciate the assistance of Mr. Vincent KC Yan for interpretation of the IQVIA-MIDAS dataset. We also thank Ms. Lisa Lam for proofreading the manuscript.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Funding

This research was funded by NHMRC Project Grant (GNT1157506 and GNT1196900), Australian Government; RGC Early Career Scheme, University Grants Committee of Hong Kong (Reference number: 27603421), Enhanced Start-up Fund for new academic staff, LKS Faculty of Medicine, The University of Hong Kong; Internal Research Fund, Department of Medicine, School of Clinical Medicine, LKS Faculty of Medicine, and The University of Hong Kong.

Conflict of interest

XL received research grants from the Research Fund Secretariat of the Food and Health Bureau (HMRF, HKSAR), Research Grants Council Early Career Scheme (RGC/ECS, HKSAR), Janssen, and Pfizer; internal funding from The University of Hong Kong; a consultancy fee from Merck Sharp & Dohme and Pfizer, unrelated to this work. Nicole L. Pratt received research grants from the Australian Government. JJG reports payment of speaker fees from AbbVie, and Takeda. WKL received speaker fees from Abbvie, Ferring, Janssen, and Takeda. All outside the submitted work. CSL reports payment of speaker fees from AbbVie, Astra Zeneca, GSK, Janssen, Pfizer, and Roche. He has also participated on the Astra Zeneca Data Safety Advisory Board. All outside the submitted work. ICKW reports research funding outside the submitted work from Amgen, Bristol-Myers Squibb, Pfizer, Janssen, Bayer, GSK, Novartis, the Hong Kong RGC, and the Hong Kong Health and Medical Research Fund, National Institute for Health Research in England, European Commission, National Health, and Medical Research Council in Australia, and has also received speaker fees from Janssen and Medice in the previous 3 years. He is also an independent non-executive director of Jacobson Medical in Hong Kong. All other authors report no conflicts of interest.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Availability of data and material

The data that support the findings of this study are available from IQVIA Inc. Restrictions apply to the availability of these data, which were used under license for this study. Data are available with the permission of IQVIA Inc.

Code availability

The analytic code is available at https://github.com/kuanpeng420/IQVIA-MIDAS.git.

Author contributions

Study concept and design: XL, KP. Data acquisition: XL, NLP, ICKW, JJG. Data extractions, cleaning, and analysis: KP. Data validation and cross-check: XT, JB, FWTC, JBH, TS, MW. Data interpretation: all authors. Statistical support: MF. Drafting of the manuscript: KP, JB, XL. Critical revision of the manuscript of significant intellectual contribution: all authors. Funding acquisition: NLP, ICKW, XL. Study supervision: XL.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Peng, K., Blais, J.E., Pratt, N.L. et al. Impact of Introducing Infliximab Biosimilars on Total Infliximab Consumption and Originator Infliximab Prices in Eight Regions: An Interrupted Time-Series Analysis. BioDrugs 37, 409–420 (2023). https://doi.org/10.1007/s40259-023-00589-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40259-023-00589-3