Abstract

A new Monte Carlo method is presented to compute the prices of digital barrier options on stocks. The main idea of the new approach is to use an exceedance probability and uniformly distributed random numbers in order to efficiently estimate the first hitting time of barriers. It is numerically shown that the answer of this method is closer to the exact value and the first hitting time error of the modified Monte Carlo method decreases much faster than of the standard Monte Carlo methods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Derivative securities have witnessed incredible innovation over the past years. In particular, path-dependent options are successful, and most of them comprise barrier options to reduce the cost of hedging [4, 8, 22]. For these derivatives, exact valuation expressions are seldom available, thus one resorts to simulations multiple times. In this manuscript a new Monte Carlo method is proposed in order to efficiently compute the prices of digital barrier options based on an exceedance probability.

Binary options, a.k.a. digital options, are popular in the over-the-counter (OTC) markets for hedging and speculation. In addition, they are important to financial engineers as building blocks for constructing more complex derivatives products. A binary option is a type of option where the payoff is either some fixed amount of some asset or nothing at all. Therefore, binaries are considered to be one of the fastest growing simplified trading products out there, where the trader knows their exact exposure and potential gains at the time of placing a trade. The two main types of binary options are the cash-or-nothing and the asset-or-nothing options, the expiration values of the European asset-or-nothing and cash-or-nothing binary calls are shown in Fig. 1. The options are digital in nature because there are only two possible outcomes, they are also called all-or-nothing options and fixed return options (FROs), on the American Stock Exchange (ASE). Binary options are usually European-style options. In May 2008, ASE for the first time launched exchange trading European cash or nothing-digital options, which were soon followed in June 2008 by the Chicago Board Options Exchange. Binary contracts are available on a variety of underlying assets: stocks, commodities, currencies and indices. Since the binaries are popular options, much research work has been done on them. For example, Palan [20] has tested experimentally whether digital options can reduce price bubbles in a laboratory setting, and Appolloni et al. [1], proposed an efficient lattice procedure which permits to obtain European and American option prices under the Black and Scholes model for digital options with barrier features. Hyong-Chol et al. [10], have considered a special binary option called integral of i-th binary or nothing and then obtain the pricing formulae. In addition, Ballestra [3] considered the problem of pricing vanilla and digital options under the Black–Scholes model, and showed that, if the payoff functions are dealt with properly, then errors close to the machine precision are obtained in only some hundredths of a second.

Barrier options are similar to vanilla options except that the option is knocked out or in, if the underlying asset price hits the barrier price B, before expiration date. Since 1967, barrier options have been traded in the OTC market and nowadays are the most popular class of exotic options. A step further along the option evolution path is where we combine barrier and binary options to obtain binary barrier options and binary double barrier options. Accordingly, it is quite important to develop accurate and efficient methods to evaluate barrier digital option prices in financial derivative markets.

Most research done to date have focused on option pricing with various methods, for example, Mehrdoust [17] has proposed an efficient algorithm for pricing arithmetic Asian options based on the AV and the MCV procedures, and Jerbi et al. [13], have calculated the conditional expectation using the Malliavin approach and shown that with this formula, the American option under J-process can be performed using the Monte Carlo simulation. In addition, Zhang et al. [23], have presented the total least squares quasi-Monte Carlo approach for valuing American barrier options, and Jasra and Del Moral provided a review and development of sequential Monte Carlo (SMC) methods for option pricing [12], and in Kim et al. [15], have considered Heston’s stochastic volatility model and derive exact analytic expressions for the prices of fixed strike and floating-strike geometric Asian options with continuously sampled averages.

The Monte Carlo method is very popular and robust numerical method, since it is not only easily extended to multiple underlying assets but also is stochastic and amenable to coding. On the other hand, one of main drawbacks of the Monte Carlo method is slow convergence. The statistical error of the Monte Carlo method is of order \(O(\frac{1}{\sqrt{M}})\) with M simulations. In particular, for continuously monitored barrier options, the hitting time error is of order \(O(\frac{1}{\sqrt{N}})\) with N time steps, see [7], while the European vanilla options have no time discretization error. In this study, to efficiently reduce the hitting time error near the barrier price, inspired by [16], at each finite time step, we suggest the use of a uniformly distributed random variable and a conditional exceedance probability to correctly check whether the continuous underlying asset price hits the barrier or not. Numerical results show that the new Monte Carlo method converges much faster than the standard Monte Carlo method [18]. This idea of using exceedance probability for stopped diffusion is well known in the physics community [11, 16].

The outline of the paper is as follows: in “Digital options” section, we introduce digital options and their pricing formulas and we estimate it by using standard Monte Carlo. In “Modified Monte Carlo algorithm” section, we propose the new Monte Carlo method based on the idea of using uniformly distributed random variable and the conditional exceedance probability. In “Digital barrier options” section, we present numerical results for digital barrier options with one underlying assets and compare the accuracy and efficiency between the standard and the new Monte Carlo methods. In “Double-barrier digital options” section, we present numerical results for pricing double barrier digital options and see the efficiency of the new Monte Carlo method. Finally, we summarize our conclusions and give some direction for future work.

Digital options

The purpose of this section is to introduce two main types of digital options and express their pricing formula.

Cash-or-nothing options

The cash-or-nothing options pay an amount of cash x at expiration if the option is in-the-money. The payoff from a call is 0 if \(S_{\text {T}}\le K\) and x if \(S_{\text {T}}>K,\) and the payoff from a put is 0 if \(S_{\text {T}}\ge K\) and x if \(S_{\text {T}}<K,\) where \(S_{\text {T}}\) and K are stock price at maturity and strike price, respectively. Valuation of cash-or-nothing call and put options can be made using the formula described by Rubinstein and Reiner [21]:

with

where S is the price of the underlying asset, r is a risk-free interest rate, \(\sigma\) is a volatility, T is the exercise date and \(N(\cdot )\) denotes the cumulative function for the standard normal distribution. For example, the value of a cash-or-nothing put option with 9 months to expiration, futures price 100, strike price 80, cash payout 10, risk-free interest rate 6 % per year, and the volatility 35 % per year is \(p=10e^{-0.06\times 0.75}N(-0.5846)=2.6710.\) The simulation of standard Monte Carlo that conducted on Matlab for this example has the answer 2.23.

Asset-or-nothing options

At expiration, the asset-or-nothing call option pays 0 if \(S_{\text {T}}\le K\) and \(S_{\text {T}}\) if \(S_{\text {T}}>K.\) Similarly, a put option pays 0 if \(S_{\text {T}}\ge K\) and \(S_{\text {T}}\) if \(S_{\text {T}}<K.\) The option can be valued using the Cox and Rubinstein formula [6]:

where

Consider an asset-or-nothing put option with six months to expiration, \(S=70, K=65, r=7\,\%\) and \(\sigma =27\,\%.\) Valuation of this asset-or-nothing option is \(p=70e^{-0.07\times 0.5}N(-0.4836)=21.2461,\) whereas simulation of standard Monte Carlo by Matlab for this example has the answer 21.45.

Modified Monte Carlo algorithm

Let us assume that \((\Omega ,\mathcal {F},Q)\) is a probability space and the evolution of the underlying asset price follows the geometric Brownian motion with a constant expected rate of return \(r>0,\) and a constant volatility \(\sigma >0\) of the asset price, i.e.,

where \(W_{\text {t}}\) is the standard Brownian motion. Equations of the form (5) are powerful tools to description of many real-life phenomena with uncertainty, and there are some studies on the numerical solutions of them [5, 19]. From the Ito’s formula, the analytic solution of (5) satisfies

Using the Monte Carlo method, the expected value of the discounted terminal payoff is approximated under a risk-neutral measure Q, by a sample average of M simulations

where \(\Lambda (S_{\tau },\tau )\) is a discounted payoff function and \(\widetilde{\tau }\) is an approximation of the hitting time \(\tau.\) The global error can be split into the first hitting time error and statistical error,

From the central limit theorem, the statistical error \(\varepsilon _{\text {S}}\) in (8), has the following upper bound

where \(b_{\text {M}}\) is a sample standard deviation of the function values \(\Lambda (S_{\widetilde{\tau }},\widetilde{\tau }),\) and \(c_0\) is a positive constant related to confidence interval. For instance, \(c_0=1.96\) for \(95\,\%\) of confidence interval. On the other hand, the first hitting time error \(\varepsilon _{\text {T}}\) in (8), is approximated using an exceedance probability given the asset prices at each time step.

Let us first discretize the time interval [0, T] into N uniform subinterval \(0 = t_0 < t_1 <\cdots < t_N = T.\) Then compute \(S_{n+1} := S_{\text {t}_{n+1}}\) at each time step for \(n = 0,...,N-1\) by

where \(\Delta t_n\) and \(\Delta W_n\) denote the time increments \(\Delta t_n = t_{n+1}-t_n\) and the Wiener increments \(\Delta W_n = W_{\hbox{t}_{n+1}}-W_{\hbox{t}_n}\) for \(n = 0,\ldots ,N-1.\) Also, for the up-and-out barrier case, the approximation of the first hitting time \(\widetilde{\tau }\) can be defined by

with the given barrier price B. The idea is to use an exceedance probability at each time step. Let \(p_n\) denotes the probability that a diffusion process X exits of domain D at \(t\in [t_n, t_{n+1}]\) by given values \(X_n\) and \(X_{n+1}.\) In one dimensional half interval case, \(D=(-\infty , B)\) for a constant B, the probability \(p_n\) has a simple expression using the law of Brownian bridge, see [14]. So,

where \(\beta (x_1)\) is the diffusion part of \(X_n\) with \(x_1 < B\) and \(x_2 < B.\) For more general domain in higher dimension, the probability can be approximated by an asymptotic expansion in \(\Delta t_n\) [2]. For up-and-out barrier option, at each time interval \(t\in [t_n,t_{n+1}] ,\) we compute \(S_n\) and \(S_{n+1}\) by (10), though \(S_n\) and \(S_{n+1}\) do not hit the barrier, i.e., \(S_n < B\) and \(S_{n+1} < B,\) the continuous path \(S_{\text {t}},\) may hit the barrier at some time \(\tau \in [t_n,t_{n+1}] .\) To approximate this hitting event, we generate an uniformly distributed random variable \(u_{n}\) and compare with the exceedance probability \(p_n\) in (11). If \(p_n < u_n,\) then we accept that the continuous path \(S_{\text {t}}\) does not hit the barrier during this time interval \(t\in [t_n,t_{n+1}],\) since the exceedance probability is very small, i.e., the hitting event is rare to occur. On the other hand if \(p_n \ge u_n,\) then the probability that the continuous path \(S_{\text {t}}\) hits the barrier is high therefore we regard that \(S_\tau \ge B\) at \(\tau \in [t_n,t_{n+1}] .\) Therefore, we have the rebate R and start the next sample path, i.e., the value of the barrier option of this path is \(V (S_0, 0) = Re^{-r\tau },\) where R is a prescribed cash rebate. In this case, as an approximation of the first hitting time \(\tau,\) we may choose the midpoint \(\widetilde{\tau }=(t_n+t_{n+1})/2.\)

Digital barrier options

The digital barrier options can be divided into two main categories:

-

1.

Cash-or-nothing barrier options. These payout either a prespecified cash amount or nothing, depending on whether the asset price has hit the barrier or not.

-

2.

Asset-or-nothing barrier options. These payout the value of the asset or nothing, depending on whether the asset price has hit the barrier or not.

Rubinstein and Reiner present the set of formulas which can be used to price twenty eight different types of so-called binary barrier options [21].

Example 1

Consider a down-and-out cash-or-nothing put option with 6 months to expiration. The asset price is \(S=105,\) the strike price is \(K=102,\) the barrier is \(B=100,\) the cash payout is \(x=15,\) the risk-free interest rate is \(r=10\,\%\) per year, and the volatility is \(\sigma =20\,\%\) per year. Using below equations, the value of this barrier digital option is 0.0361.

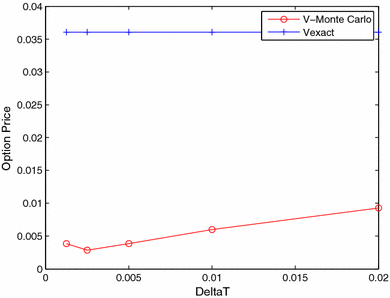

Simulation of the standard Monte Carlo for this example has the answer 0.42, and simulation of the new Monte Carlo, that conducted on Matlab with \(M=10,000,\) has the answer 0.0088. Figure 2 shows comparison between the exact value and the new Monte Carlo values for this example and Fig. 3 displays comparison between the standard MC and the improve MC errors.

The exact and new Monte Carlo values for Example 1

Comparison of approximation errors between the standard MC and the improve MC for Example 1

Double-barrier digital options

Hui has published closed-form formulas for the valuation of one-touch double-barrier binary options [9]. A knock-in one-touch double-barrier pays off a cash amount x at maturity if the asset price touches the lower L or upper U barriers before expiration. The option pays off zero if the barriers are not hit during the lifetime of the option. Similarly, a knock-out pays out a predefined cash amount x at maturity if the lower or upper barriers are not hit during the lifetime of the option. If the underlying asset price touches any of barriers during the option’s life, the option vanishes. Using the Fourier sine series, we can show that the risk natural value of double barrier cash or nothing knock-out is:

where

Example 2

Table 1 gives examples of values for knock-out double-barrier binary options for different choices of barriers and volatilities and the value of them simulation with \(M=10,000\) using the new Monte Carlo in Matlab. Also, Fig. 4 shows comparison between the exact value and the new Monte Carlo values on this example with \(~\sigma =0.1,\) and Fig. 5 displays comparison between the standard MC and the improve MC errors.

The exact value and the new MC values for Example 2 with \(\sigma =0.1\)

Comparison of approximation errors between the standard MC and the improve MC for Example 2 with \(\sigma =0.1\)

Conclusion

In this paper, we have proposed a new efficient Monte Carlo approach for estimate values of the digital barrier and double barrier options, to correctly compute the first hitting time of the barrier price by the underlying asset. The approximate error of the new method converges much faster than the standard Monte Carlo method. Future work will be devoted to extend this idea to more general diffusion problems, and theoretically study the rate of convergence of the approximate errors, and also pricing digital barrier options by other methods such as SMC and comparing results.

References

Appolloni, E., Ligori, A.: Efficient tree methods for pricing digital barrier options (2014). arxiv.org/pdf/1401.2900

Baldi, P.: Exact asymptotics for the probability of exit from a domain and applications to simulation. Ann. Probab. 23, 1644–1670 (1995)

Ballestra, L.V.: Repeated spatial extrapolation: an extraordinarily efficient approach for option pricing. J. Comput. Appl. Math. 256, 83–91 (2014)

Bingham, N., Kiesel, R.: Risk-Neutral Valuation: Pricing and Hedging of Financial Derivatives. Springer, New York (2004)

Cortes, J.C., Jodar, L., Villafuerte, L.: Numerical solution of random differential equations: a mean square approach. Math. Comput. Model. 45, 757–765 (2007)

Cox, J.C., Rubinstein, M.: Options Markets. Prentice Hall, New Jersey (1985)

Gobet, E.: Weak approximation of killed diffusion using Euler schemes. Stoch. Process. Appl. 87, 167–197 (2000)

Haug, E.G.: Option Pricing Formulas. McGraw-Hill Companies, New York (2007)

Hui, C.H.: One-touch double barrier binary option values. Appl. Financ. Econ. 6, 343–346 (1996)

Hyong-Chol, O., Dong-Hyok, K., Jong-Jun, J., Song-Hun, R.: Integrals of higher binary options and defaultable bonds with discrete default information. Electron. J. Math. Anal. Appl. 2, 190–214 (2014)

Jansons, K.M., Lythe, G.D.: Efficient numerical solution of stochastic differential equations using exponential time stepping. J. Stat. Phys. 100, 1097–1109 (2000)

Jasra, A., Del Moral, P.: Sequential Monte Carlo methods for option pricing. Stoch. Anal. Appl. 29, 292–316 (2011)

Jerbi, Y., Kharrat, M.: Conditional expectation determination based on the J-process using Malliavin calculus applied to pricing American options. J. Stat. Comput. Simul. 84, 2465–2473 (2014)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus. Springer, New York (1991)

Kim, B., Wee, I.S.: Pricing of geometric Asian options under Heston’s stochastic volatility model. Quant. Fin. 14, 1795-1809 (2014)

Mannella, R.: Absorbing boundaries and optimal stopping in a stochastic differential equation. Phys. Lett. A 254, 257–262 (1999)

Mehrdoust, F.: A new hybrid Monte Carlo simulation for Asian options pricing. J. Stat. Comput. Simul. 85, 507–516 (2015)

Moon, K.: Efficient Monte Carlo algorithm for pricing barrier options. Comm. Korean Math. Soc. 23, 285–294 (2008)

Nouri, K., Ranjbar, H.: Mean square convergence of the numerical solution of random differential equations. Mediter. J. Math. 12, 1123–1140 (2015)

Palan, S.: Digital options and efficiency in experimental asset markets. J. Econ. Behav. Organ. 75, 506–522 (2010)

Rubinstein, M., Reiner, E.: Unscrambling the binary code. Risk Mag. 4, 75–83 (1991)

Wilmott, P.: Derivatives: The Theory and Practice of Financial Engineering. Wiley, New York (1998)

Zhang, L., Zhang, W., Xu, W., Shi, X.: A modified least-squares simulation approach to value American barrier options. Comput. Econ. 44, 489–506 (2014)

Acknowledgments

The authors are grateful to the referees for their careful reading, insightful comments and helpful suggestions which have led to improvement of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Nouri, K., Abbasi, B., Omidi, F. et al. Digital barrier options pricing: an improved Monte Carlo algorithm. Math Sci 10, 65–70 (2016). https://doi.org/10.1007/s40096-016-0179-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40096-016-0179-8