Abstract

In this article, an imperfect vendor–buyer inventory system with stochastic demand, process quality control and learning in production is investigated. It is assumed that there are learning in production and investment for process quality improvement at the vendor’s end, and lot-size dependent lead-time at the buyer’s end. The lead-time for the first batch and those for the rest of the batches are different. Under n-shipment policy, the annual expected total cost of the system is derived. An algorithm is suggested to derive the optimal values of the number of shipments, the lot-size, the percentage of defective produced per batch and the safety stock factor so as to minimize the annual expected total cost of the system. The solution procedure is illustrated through numerical examples. The benefit of investment for reducing the defect rate is shown numerically. It is also observed that learning in production has significant effect on the annual expected total cost of the integrated system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The integrated vendor–buyer problem is inspired by the expanding focus on supply chain management, which has been proved to be an adequate means by which both the vendor and the buyer can be benefited simultaneously. In this context, a significant amount of literature can be found in Banerjee (1986), Goyal (1976, 1988), Ha and Kim (1997), Hill (1997, 1999), Pan and Yang (2002), Ouyang et al. (2006), Giri and Bardhan (2015), etc. and the references therein. In the vendor–buyer literature, the market demand is generally assumed to be deterministic and the shortages are not allowed in the buyer’s inventory. For instance, Otake et al. (1999) investigated an inventory model with investment in setup operations under return on investment maximization. Wee et al. (2009) studied multi-objective joint replenishment inventory models for deteriorating items under fuzzy environment. Ghasemy et al. (2014a) developed an enhanced joint pricing and lot-sizing problem with logit demand function. Ghasemy et al. (2014b) also studied pricing and lot-sizing decisions in the retail industry under fuzzy chance constraint approach. Using game theoretic approach, recently Noori-daryan et al. (2019) analyzed pricing, promised delivery lead time, supplier-selection, and ordering decisions of a multi-national supply chain under price and delivery lead time dependent demand.

Ben-Daya and Hariga (2004) were the first to extend an integrated vendor–buyer model with stochastic customer demand. Since then a lot of researchers have studied the integrated model with stochastic demand under various assumptions (Hsiao 2008b; Glock 2009, 2012). However, in most of these works, the production process is presumed to be perfect. Relaxing this perfect production assumption, Huang (2004) developed an optimal integrated inventory policy for defective items in a just-in-time manufacturing environment. Ouyang et al. (2006) also studied an integrated vendor–buyer inventory model for defective items. Hsiao (2008b) proved that an inventory system which is controlled by the reorder and shipping points is preferable compared to the system where only the reorder point acts as a control parameter. Glock (2009) developed a model with variable lead-time by extending Ben-Daya and Hariga (2004)’s model with an increase in the batch shipments by a fixed factor. Glock (2012) further extended the previous (Q, r) model by studying the alternative methods for reducing the lead-time. Taleizadeh and Noori-daryan (2016) developed pricing, inventory and production policies in a three-layer supply chain with rework process under a game theoretic approach. Taleizadeh et al. (2015) also studied pricing and ordering decisions in a three-layer supply chain with imperfect quality items under buyback of defective items. More studies on imperfect production process were contributed by Ben-Daya and Hariga (2000), Salameh and Jaber (2000), Ben-Daya and Hariga (2004), Lin (2012), Shu and Zhou (2013), to name a few. However, in these works, the quality of the production process was not taken to be a control parameter. But it is well established that making an investment in the production process, in terms of buying new equipment, regular machine maintenance and repair, worker training, etc. can help improving the production process quality (Porteus 1986). In an integrated scenario, since the production process is vendor-controlled, and the vendor has to pay warranty cost for defective items, it is beneficial for him/her to invest in order to reduce the number of defective items produced. For instance, Otake and Min (2001) and Li et al. (2008) studied inventory and investment in quality improvement under return on investment maximization.

In an integrated system with imperfect production process, it is very likely that the buyer performs some sort of inspection activity before selling the products to the customers. Neglecting this inspection/screening or assuming it to be non-negligible is not very practical. Keeping these issues in mind, Dey and Giri (2014) developed an integrated single-vendor single-buyer production inventory model with imperfect production process, finite screening time and vendor investment to improve process quality. This model was extended by Mukherjee et al. (2019) to include controllable backorder rate by means of backorder price discount. However, in both the above mentioned papers, the lead-time is assumed to be a constant. But, in reality, the lead-time is, more often than not, variable. A significant amount of works on variable lead time is available in the literature. Hosseini et al. (2013) adopted a multiple objective approach for joint ordering and pricing policy for an inventory system with stochastic lead-time. Ben-Daya and Hariga (2004) illustrated the benefits of a lot-size dependent lead time on the total expected costs. Glock (2012) showed how reducing the lead-time can affect the operational costs. With this view point, Mukherjee and Dey (2018) extended the model of Dey and Giri (2014) to include lot-size dependent lead-time. However, most of the papers mentioned above did not consider learning in production which is one of the most relevant issues of production-inventory systems in recent times.

Learning is an important human factor that has been proved to enhance the overall performance of a supply chain. In systems where workers are involved in repetitive type of production process, learning plays a very important role. Wright (1936) was among the early researchers who described the learning process with the help of a power curve. According to Wright’s learning curve, per unit production cost decreases by some fixed percentage when the production quantity doubles. Learning in production affects the optimal lot-sizes and dispatch time (Jaber and Boney 1999). Elmaghraby (1990) and Jaber and Boney (1996) addressed the forgetting phenomenon during non-production period. Glock and Jaber (2013) developed a mathematical model for imperfect production process where production and reproduction processes both are subject to learning and forgetting. Giri and Glock (2017) considered a closed-loop supply chain where production and inspection processes are subject to learning and forgetting. Recently, Dey and Giri (2018) presented a new approach to deal with learning in inspection for a single-vendor single-buyer integrated imperfect inventory model. However, the combined effects of vendor’s investment in terms of quality control, lot-size dependent lead-time and learning in production on the optimal decisions of an integrated vendor–buyer inventory model remains unexplored.

Keeping this point in mind, in this paper, an attempt is made to extend Dey and Giri (2014) and Mukherjee and Dey (2018)’s models further by taking into consideration lot-size dependent lead-time at the buyer’s end and learning in production at the vendor’s end. The safety stock factor is further assumed to be different for the first batch and the rest of the batches (Hsiao 2008a). The remainder of the paper is organized as follows. Notations and assumptions for developing the proposed model are given in the next section. Section 3 is devoted to model development from buyer’s and vendor’s perspectives as well as using integrated approach. The solution procedure of the model is outlined in Sect. 4. In Sect. 5, the model is illustrated through numerical examples. The paper is concluded with some remarks in Sect. 6.

Notations and assumptions

Notations

The following notations are used to develop the proposed model.

- Q:

Shipment size (decision variable)

- n:

Number of shipments (decision variable)

- y:

Percentage of defective items produced (decision variable)

- \(k_{1}\):

Safety stock factor for the first batch (decision variable)

- r:

Reorder point

- \(y_0\):

Original percentage of defective items produced

- D:

Expected demand rate for non-defective items(units/year)

- P:

Production rate, \(p = \frac{1}{P}\)

- A:

Buyer’s ordering cost per order

- F:

Transportation cost per delivery

- K:

Vendor’s setup cost

- L:

Lead-time

- \({h}_{v}\):

Vendor’s holding cost per item per year

- \({h}_{b1}\):

Buyer’s holding cost for defective items per item per year

- \({h}_{b2}\):

Vendor’s holding cost for non-defective items per item per year

- s:

Unit screening cost

- x:

Screening rate

- w:

Unit warranty cost for defective items

- \(\pi\):

Buyer’s shortage cost per item per year

- \(\eta\):

Fractional opportunity cost

- \(\delta\):

Percentage decrease in defective items per dollar increase in investment

- c:

Vendor’s production cost per unit per year

- l:

Learning exponent in the production process

- \(k_{2}\):

Safety stock factor for the \(j{\mathrm{th}}\) batch; \(j= 2,3,\ldots ,n\)

Assumptions

The proposed model is developed with the following assumptions:

The supply chain consists of a single vendor and a single buyer, and deals with a single product.

Demand is stochastic and normally distributed with mean D and standard deviation \(\sigma\).

The buyer follows the classical (Q, r) continuous review inventory policy.

An order of nQ (non-defective) items is placed by the buyer to the vendor. These items are then produced and transferred to the buyer in n equal-sized shipments by the vendor, n being a positive integer.

Lead-time L is not a constant; it depends on the lot-size Q as given below:

\(L=pQ+b\), where b denotes a fixed delay due to transportation, production time of other products scheduled during the lead-time on the same facility, etc. The mean and variance for lead time demand are \(D\sqrt{pQ+b}\) and \(\sigma ^2 \sqrt{pQ+b}\), respectively.

The re-order point r = expected demand during lead-time + safety stock (SS) i.e., \(r = D(pQ+b)+k\sigma \sqrt{pQ+b}\), where k is the safety stock factor.

Shortages at the buyer’s inventory are allowed and completely backlogged.

There is no overshooting of orders, i.e., there is no more than a single order outstanding in any cycle.

\(y_{0}~(0\le y_{0}\le 1)\) is the percentage of defective items produced in each batch of size Q.

The vendor’s production rate of non-defective items is greater than the mean demand rate i.e., \(P(1-y_{0})>D\).

Upon the arrival of each batch, the buyer inspects all the items. It is assumed that the screening process is non-destructive and error-free. The screening rate x is fixed and greater than the mean demand rate D.

The vendor incurs a warranty cost for each defective item produced.

The vendor invests money to improve the production process quality in terms of buying new equipment, improving machine maintenance and repair, worker training, etc. We consider the following logarithmic investment function I(y) (Porteus 1986):

$$\begin{aligned} I(y)=\frac{1}{\delta }\ln \left( \frac{y_{0}}{y}\right) \end{aligned}$$where \(\delta\) is the percentage decrease in y per dollar (or any other suitable currency) increase in investment and \(y_{0}\) is the original percentage of defective items produced prior to investment.

Model development

Buyer’s perspective

We assume that the vendor accepts an order of size nQ for non-defective items from the buyer. The vendor produces these nQ items all in one go so as to minimize the production costs, and then n batches of size Q are delivered each at regular intervals of \(Q(1-y_{0})/D\) units of time. Thus each ordering cycle is of length \(Q(1-y_{0})/D\) and the complete production cycle is of length \(nQ(1-y_{0})/D\).

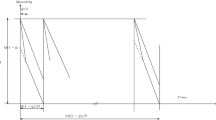

When the inventory of non-defective items reaches the re-order level r, the buyer requests the vendor for the next shipment. The vendor’s delivery reaches the buyer after a lead time L (see Fig. 1).

We assume the lead-time L as \(L(Q) = pQ+b\), where b denotes a fixed delay due to transportation, production time of other products scheduled during the lead-time on the same facility, etc. The fixed delay factor b can be decomposed into the waiting and set-up time \(T_{s}\) and the transportation time \(T_{b}\) (Hsiao 2008a). The production rate for non-defective items is assumed to be greater than the mean demand rate, and thus the vendor, having sufficient stock, can deliver the second batch at time \(t_{2} = t_{1} + \frac{Q}{D} - T_{b}\). Thus, the lead-time for the second batch is \(T_{b}\). Similarly, the lead-time for the jth batch is \(T_{b}\), for all \(j= 2,3,\ldots ,n\).

We assume that the demand during the lead time is normally distributed with mean DL(Q) and standard deviation \(\sigma \sqrt{L(Q)}\). In this case, the safety stock, S, is given by

\(k_{1}\) being the safety factor for the first batch.

The expected shortage during this first batch is \(b(s,L(Q))=\sigma \sqrt{pQ+b}\psi (k_{1})\), where \(\psi (k_{1})=\int _{k}^{\infty }(z-k_{1})\phi (z)dz\), \(\phi (z)\) being the standard normal density function.

For the jth batch, \(j=2,3,\ldots ,n\), the demand during lead time is normally distributed with mean \(DT_{b}\) and standard deviation \(\sigma \sqrt{T_{b}}\) and the safety stock, S, is given by

\(k_{2}\) being the safety factor for the \(j{{\mathrm{th}}}\) batch, \(j=2,3,\ldots ,n\).

The expected shortage during all other batches is given by \(b(sr,T_{b})=\sigma \sqrt{T_{b}}\psi (k_{2})\), where \(\psi (k_{2})=\int _{k}^{\infty }(z-k_{2})\phi (z)dz\)

From Eqs. (1) and (2), \(k_{2}\) can be expressed in terms of \(k_{1}\) as given below (Hsiao 2008a):

It is assumed that the safety factors \(k_{1}\) and \(k_{2}\) are related to the re-order point r. Since \(k_{2}\) is expressed in terms of \(k_{1}\), we consider \(k_{1}\) as a decision variable instead of r.

The defective items which are discovered gradually in each batch are kept in hold separately and then returned to the vendor on the arrival of the next batch. The buyer, thus, has holding costs for defective items and non-defective items. The buyer’s average inventory level for non-defective items (including those defective items which have not yet been detected before the end of the screening time Q / x) is given by

The average inventory level for defective items is

Therefore, the buyer’s annual expected total cost including the ordering cost, shipment cost, holding cost, shortage cost and screening cost is given by

Now, if the buyer follows a deterministic demand, places his order only when the inventory level falls to zero and receives the order instantaneously then \(k_{1}=k_{2}=0,L=0,\pi =0\). Also, if the buyer screens the items received as a single batch and rejects them as a single batch at the end of the screening process then we have \(h_{b1}=0\). Under these assumptions, the above expression for the annual expected total cost for the buyer modifies to

which is the same expression as given in Huang (2004).

If the production process is assumed to be perfect, i.e., \(y=0\), then the annual expected total cost for the buyer given in (6) reduces to

which is the same expression as given in Ben-Daya and Hariga (2004).

Vendor’s perspective

During the production process, the vendor produces Q items in the first instance and delivers those to the buyer. After that, the vendor delivers a quantity Q to the buyer every \(T=\frac{Q(1-y)}{D}\) units of time. This process continues till the vendor’s production run is completed after \(\frac{nQ}{P}\) units of time (Fig. 2).

By assumption, the vendor’s production rate for non-defective items is greater than the mean demand rate. Therefore, the vendor’s inventory level gradually increases as long as the production continues and when the production stops, the inventory level starts decreasing according to the demand rate. Then the vendor’s average inventory holding cost (see Fig. 3 for holding area) can be calculated as follows (Huang 2004):

The annual expected total cost incurred by the vendor is, thus, obtained as the sum of the setup cost, holding cost, warranty cost for the defective items and production cost (Huang 2004):

If the production process is perfect, i.e., \(y=0\), then (10) reduces to

which is the same expression as given in Ben-Daya and Hariga (2004).

The total cost given in Eq. (10) does not include any investment on part of the vendor to improve the process quality. We now assume that the vendor makes an investment to reduce the number of defective items produced. Assuming a logarithmic investment function of the form \(I(y)=\frac{1}{\delta }\ln \left( \frac{y_{0}}{y}\right)\), the expected annual total cost of the vendor can be obtained as

where \(\eta\) is the fractional opportunity cost. It may be noted here that this logarithmic function is convex in y.

Learning in production

Here we assume that \(Q_{p} = nQ\) units of items are produced in every cycle and the learning in the vendor’s production process follows the learning curve proposed by Wright (1936). In the following, we calculate the vendor’s average cost for the \(i{{\mathrm{th}}}\) cycle, \(i=1,2,3,\ldots\).

The production time for cycle i is given by

where l denotes learning exponent.

From (13), the production quantity in the \(i{{\mathrm{th}}}\) cycle can be written as

The average inventory of the product during the production process in the \(i{{\mathrm{th}}}\) cycle is given by

After the production starts in the \(i{{\mathrm{th}}}\) cycle, the time for the first dispatch is given by

Now, we calculate the vendor’s average inventory in the \(i{{\mathrm{th}}}\) cycle as follows:

From Fig. 4, we have

Thus, the vendor’s average inventory in the production period of the \(i{{\mathrm{th}}}\) cycle is determined from the three areas given above as

Thus, the vendor’s average inventory in the \(i{{\mathrm{th}}}\) cycle is

The vendor’s total cost in the \(i{{\mathrm{th}}}\) cycle is

On simplification, (21) reduces to

Integrated approach

The annual expected total cost of the integrated system is the sum of the vendor’s and the buyer’s annual expected total costs for the \(i{{\mathrm{th}}}\) production cycle, which is given by

Now, assuming the safety factor to be the same for all batches, \(j=1,2,\ldots ,n\), i.e., \(k_{1}=k_{2}=k\), and letting the lead-time to be zero and no investment on the part of the vendor, we get,

Further, assuming that the buyer does not hold the defective items, but rejects them in a batch at the end of the screening period, we get \(h_{b1}=0\). In this case, Eq. (24) reduces to

which is the same expression as given in Khan et al. (2014).

Again, neglecting the learning in production and the cost of production [putting \(l=0\) and \(c=0\) in Eq. (23)], we get

Now, if the safety factor is assumed to be the same for all the batches, Eq. (26) reduces to

Also, assuming the lead time to be constant instead of a variable quantity in the above equation, we get,

The cost function in Eq. (28) is the same as given by Dey and Giri (2014).

In the objective function given in Eq. (23), the control parameters are \(Q,y,k_{1}\) and n of which \(Q, y, k_1\) are positive real numbers (\(Q>0, 0\le y\le y_0,k_1>0\)) and n is a positive integer. It is not possible to show that the objective function is convex in all four decision variables. However, it can be verified numerically that, for given values of n, i (positive integer) and \(y~ (0\le y \le y_{0}\le 1)\), the cost function \(ETC_i\) is convex in Q and \(k_1\). One instance of 3D-graph of \(ETC_i\) is shown in Fig. 5. In the following section, we develop a solution procedure to derive the optimal values of \(Q,y,k_{1}\) and n such that the joint expected annual total cost \(ETC_i\) is minimized.

Solution procedure

To develop a solution algorithm for the proposed model, we assume that for fixed values of i, Q, \(k_{1}\) and y, \(ETC_i\) is convex with respect to real n. Further, we assume that, for fixed values of n, i and \(y~(0\le y \le y_{0}\le 1)\), \(ETC_i\) is convex in \(k_{1}\) and Q and for fixed values of n, i, Q, \(k_{1}\), the expected cost function \(ETC_i\) is convex in y.

If we consider the first production cycle (\(i=1\)), and there is no learning in production (\(l=0\)), then considering the safety factor to be equal for all batches (\(k_{1}=k_{2}=k\)), \(ETC_i\) can be shown to be convex in n(real), k and Q as given below:

where \(G(n)=\frac{A+B+nF}{n}\).

It is to be noted here that the sum of the first and third terms in Eq. (31) is much greater than the second term. Hence, the second derivative in (31) is effectively positive.

Hence, from Eqs. (30) and (31), \(ETC_i\) is seen to be convex in k and Q for fixed values of n and \(y~(0\le y \le y_{0}\le 1)\). Although y is bounded, it is not possible to prove conclusively that \(ETC_i\) is convex in y. So, in order to arrive at an optimal solution, the procedure suggested by Dey and Giri (2014) is followed here:

For fixed value of n, the first derivative of \(ETC_i\) w.r.t. k is set to zero. That is,

where \(F(\cdot )\) is the cumulative distribution function.

This gives

where \(\overline{F}(\cdot )=1-F(\cdot )\).

Next, taking the first derivatives of ETC with respect to Q and y and setting those equal to zero, we get

and

respectively. From Eqs. (29)–(35), we see that the control parameters \(Q, y, k_1,\) and n are dependent. So, we follow an iterative procedure and modify the algorithm proposed by Dey and Giri (2014) to obtain the optimal solution of the present problem.

Algorithm

- Step 1::

Set \(i = 1\) and \(ETC^{*}=\infty\).

- Step 2::

Set \(n=1\) and \(ETC_i^{*}=\infty\).

- Step 3::

Set \(y = y_{0}\), \(k_{1} = 0, k_{2}=0\), compute \(\psi (k_{1})\) and \(\psi (k_{2})\) and then compute \(Q = Q_{0}\) using the values of \(y_{0}, k_{1}, k_{2}, \psi (k)\) in equation (34).

- Step 4::

Compute \(k_{1}\) from (33) using \(Q_{0},y\) and \(\psi (k_{1})=\int _{k_{1}}^{\infty }(z-k_{1})\phi (z)dz\).

- Step 5::

Compute \(k_{2}\) using \(k_{1}\) and the relation \(k_{2}=k_{1}\sqrt{\frac{pQ+b}{T_b}}\).

- Step 6::

Compute y from (35) using the values of k and \(Q_{0}\) obtained in the previous step. If \(y\ge y_{0}\), then we set \(y=y_{0}\).

- Step 7::

Compute Q from (34) using the updated values of k and y. If \(|Q-Q_{0}|\le \epsilon\), then compute \(ETC_i(Q,k_1,y,n)\) and go to Step 8. Else, set \(Q_{0}=Q\) and go to Step 4.

- Step 8::

If \(ETC_i^{*}\ge ETC_i\), then set the followings \(ETC_i^{*}=ETC_i, Q^{*}=Q, y^{*}=y,k_{1}^{*}=k_{1}, n=n+1\) and go to Step 3. Else, put \(n^{*}=n-1\) and stop. The corresponding values of the control parameters for \(n^{*}=n-1\) give the optimal solution for the fixed value of i.

- Step 9::

If \(|ETC^* - ETC_i^*|>\epsilon\), set \(i=i+1\) and go to Step 2. Else, stop.

It is to be noted here that we only get a local optimum by adopting the solution procedure mentioned above. Since it is difficult to prove analytically that the objective function \(ETC_i\) is convex in all control parameters, we cannot claim that the solution obtained is a global optimum.

Now, we take the partial derivatives of ETC with respect to \(w, \delta , y_{0}\) and get

From Eq. (36), we can infer that the annual expected total cost \(ETC_i\) increases as the warranty cost increases. ETC also increases with an increase in the (original) percentage of defective items, i.e., with an increase in \(y_{0}\), as evident from (38). Equation (37) shows that \(ETC_i\) decreases as \(\delta\) increases, i.e., there is a reduction in the number of defective items with each dollar increase in investment. Thus, we can say that our effective total cost may decrease if we improve the process quality. To further showcase the effects of the process quality, the investment option and other model-parameters on the optimal decisions, numerical studies are carried out in the following section.

Numerical results and discussion

For numerical study, we consider the following data set:

\(D = 1000\), \(P = 3200\), \(A = 50\), \(F = 35\), \(K = 400\), \(L = 10/365\), \({h}_{v} = 4\), \({h}_{b1} = 6\), \({h}_{b2} = 10\), \(s = 0.25\), \(x = 175{,}200\), \(w = 20\), \(\pi = 100\), \(b = 0.01\), \(T_b=0.005\), \(c=100{,}000\), \(l=0.32\), \(\sigma = 5\), \(y = 0.22\), \(\eta = 0.2\), \(\delta = 0.0002\), in appropriate units.

For fixed values of \(Q,k_1\) and n, we find that the annual expected cost function \(ETC_i\) is convex in \(y~(0\le y \le y_{0})\), see Fig. 5a. For fixed values of \(Q,k_1\) and \(y~(0\le y \le y_{0})\), we find that the annual expected cost function \(ETC_i\) is convex in n, see Fig. 5b. Further, the convexity of \(ETC_i\) for given values of n and y is shown with the help of a 3D-graph of \(ETC_i\) in Fig. 6. From Figs. (5) and (6), we can see that \(ETC_i\) is convex w.r.t. y, n(real), Q and \(k_{1}\). Applying the algorithm developed in the previous section, the optimal solution of the model is obtained for consecutive 10 cycles. The results are shown in Table 1.

From Table 1, we see that, as the learning cycle increases, the expected total cost of the system decreases and also the investment made to improve the production process quality also decreases.

We now examine the sensitivity of the optimal results with respect to some important parameters of the model. Table 2 shows the effects of demand on the optimal results. For each value of D, we see that the expected total cost and the investment required to improve the production process quality of the system decrease as the number of cycles increases. It is further seen that an increased demand incurs a greater investment in terms of process quality control. Also, we can see that the smaller the value of D, the faster the learning curve becomes plateau.

Table 3 shows the effects of the warranty cost on the optimal result. We see that the percentage of defective items decreases with the increase in the amount of warranty. Table 4 shows that, with an increase in the original percentage of defective items present, y also increases. Also, with an increase in \(y_0\), the investment needed to improve the production process quality increases.

Table 5 shows that, as the production cost of the system decreases, the expected total cost of the system also decreases. Also it is seen that, a decrease in the value of c (vendor’s unit production cost) results in a faster plateauing of the learning curve. From Table 6, we see that the expected total cost and the investment required to improve the production process quality decrease as the learning exponent l increases. It is also seen that the average Q increases with l. All trends found in the results are intuitively correct and are similar to trends obtained in the existing literature.

Concluding remarks

This paper presents a single-vendor single-buyer integrated imperfect production-inventory model with learning in production and investment for process quality improvement. The lead-time is assumed to be lot-size dependent, and the safety stock factor is assumed to be different for the first batch and the rest of the batches. The annual expected total cost of the integrated system is derived and a simple iterative procedure is suggested to obtain the optimal values of the decision variables so as to minimize this cost. Numerical studies show that, as the cumulative number of production cycles increases, the expected annual total cost incurred by the integrated system decreases. It is also seen that the expected annual total cost and the investment required to improve the production process quality decrease, as the value of learning exponent increases. It is further observed that an increased demand rate requires an increased investment to minimize the expected annual cost incurred. There are ample scopes of future research based on the current work. The model studied here can be extended in terms of investment for controllable lead-time. Inspection errors can be introduced into the model as a possible extension. The proposed model can also be studied to include variable shipment size or multiple buyers.

References

Banerjee A (1986) A joint economic-lot-size model for purchaser and vendor. Decis Sci 17:292–311

Ben-Daya M, Hariga M (2000) Economic lot scheduling problem with imperfect production process. J Oper Res Soc 51:875–881

Ben-Daya M, Hariga M (2004) Integrated single vendor single buyer model with stochastic demand and variable lead-time. Int J Prod Econ 92:75–80

Dey O, Giri BC (2014) Optimal vendor investment for reducing defect rate in a vendor–buyer integrated system with imperfect production process. Int J Prod Econ 155:222–228

Dey O, Giri BC (2018) A new approach to deal with learning in inspection in an integrated vendor-buyer model with imperfect production process. Comput Ind Eng. https://doi.org/10.1016/j.cie.2018.12.028

Elmaghraby SE (1990) Economic manufacturing quantities under conditions of learning and forgetting (EMQ/LaF). Prod Plan Control 1(4):196–208

Ghasemy Yaghin R, Fatemi Ghomi SMT, Torabi SA (2014a) Enhanced joint pricing and lotsizing problem in a two-echelon supply chain with logit demand function. Int J Prod Res 52:4967–4983

Ghasemy Yaghin R, Fatemi Ghomi SMT, Torabi SA (2014b) Pricing and lot-sizing decisions in retail industry: a fuzzy chance constraint approach. In: Chakraverty S (ed) Mathematics of uncertainty modeling in the analysis of engineering and science problems. IGI Global, pp 268–289. https://doi.org/10.4018/978-1-4666-4991-0.ch013.

Giri BC, Bardhan S (2015) A vendor–buyer JELS model with stock-dependent demand and consigned inventory under buyer’s space constraint. Oper Res 15(1):79–93

Giri BC, Glock CH (2017) A closed-loop suply chain with stochastic product returns and worker experience under learning and forgetting. Int J Prod Res 55:6760–6778

Glock CH (2009) A comment: “Integrated single vendor-single buyer model with stochastic demand and variable lead time”. Int J Prod Econ 122:790–792

Glock CH (2012) Lead time reduction strategies in a single-vendor–single-buyer integrated inventory model with lot size-dependent lead times and stochastic demand. Int J Prod Econ 136:37–44

Glock CH, Jaber MY (2013) A multi-stage production-inventory model with learning and forgetting effects, rework and scrap. Comput Ind Eng 64(2):708–720

Goyal SK (1976) An integrated inventory model for a single supplier–single customer problem. Int J Prod Res 15:107–111

Goyal SK (1988) A joint economic-lot-size model for purchaser and vendor: a comment. Decis Sci 19:236–241

Ha D, Kim SL (1997) Implementation of JIT purchasing: an integrated approach. Prod Plan Control 8:152–157

Hill RM (1997) The single-vendor single-buyer integrated production-inventory model with a generalized policy. Eur J Oper Res 97:493–499

Hill RM (1999) The optimal production and shipment policy for the single-vendor single-buyer integrated production-inventory problem. Int J Prod Res 37:2463–2475

Hosseini Z, Ghasemy Yaghin R, Esmaeili M (2013) A multiple objective approach for joint ordering and pricing planning problem with stochastic lead times. J Ind Eng Int 9:29. https://doi.org/10.1186/2251-712X-9-29

Hsiao Y-C (2008a) A note on integrated single vendor single buyer model with stochastic demand and variable lead time. Int J Prod Econ 114:294–297

Hsiao Y-C (2008b) Integrated logistic and inventory model for a two-stage supply chain controlled by the reorder and shipping points with sharing information. Int J Prod Econ 115:229–235

Huang CK (2004) An optimal policy for a single-vendor single-buyer integrated production-inventory problem with process unreliability consideration. Int J Prod Econ 91:91–98

Jaber MY, Bonney M (1996) Production breaks and the learning curve: the forgetting phenomenon. Appl Math Model 20(2):162–169

Jaber MY, Bonney M (1999) The economic manufacture/order quantity (EMQ/EOQ) and the learning curve: past, present, and future. Int J Prod Econ 59(1–3):93–102

Jaber MY, Bonney M (2003) Lot sizing with learning and forgetting in set-ups and in product quality. Int J Prod Econ 83(1):95–111

Khan M, Jaber MY, Ahmed AR (2014) An integrated supply chain model with errors in quality inspections and learning in production. Omega 42(1):16–24

Lin HJ (2012) An integrated supply chain inventory model. Yugosl J Oper Res. https://doi.org/10.2298/YJOR110506019L

Li J, Min KJ, Otake T, Voorhis TM (2008) Inventory and investment in setup and quality operations under return on investment maximization. Eur J Oper Res 185:593–605

Mukherjee A, Dey O (2018) An integrated imperfect production-inventory model with lot-size-dependent lead-time and quality control. In: Kar S, Maulik U, Li X (eds) Operations research and optimization. FOTA 2016. Springer Proceedings in Mathematics and Statistics, vol 225. Springer, Singapore, pp 303–314

Mukherjee A, Dey O, Giri BC (2019) An integrated imperfect production–inventory model with optimal vendor investment and backorder price discount. In: Chandra P, Giri D, Li F, Kar S, Jana D (eds) Information technology and applied mathematics. Advances in intelligent systems and computing, vol 699. Springer, Singapore, pp 187–203

Noori-Daryan M, Taleizadeh AA, Jolai F (2019) Analyzing pricing, promised delivery lead time, supplier-selection, and ordering decisions of a multi-national supply chain under uncertain environment. Int J Prod Econ 209(2019):236–248

Otake T, Min KJ (2001) Inventory and investment in quality improvement under return on investment maximization. Comput Oper Res 28:113–124

Otake T, Min KJ, Chen C (1999) Inventory and investment in setup operations under return on investment maximization. Comput Oper Res 26:883–899

Ouyang LY, Wu KS, Ho CH (2006) Analysis of optimal vendor–buyer integrated inventory policy involving defective items. Int J Adv Manuf Technol 29:1232–1245

Pan JC-H, Yang JS (2002) A study of an integrated inventory with controllable lead time. Int J Prod Res 40:1263–1273

Porteus EL (1986) Optimal lot sizing, process quality improvement and setup cost reduction. Oper Res 36:137–144

Salameh MK, Jaber MY (2000) Economic production quantity model with for items with imperfect quality. Int J Prod Econ 64:59–64

Shu H, Zhou X (2013) An optimal policy for a single-vendor and a single-buyer integrated system with setup cost reduction and process-quality improvement. Int J Syst Sci. https://doi.org/10.1080/00207721.2013.786155

Taleizadeh AA, Noori-daryan M (2016) Pricing, inventory and production policies in a supply chain of pharmacological products with rework process: a game theoretic approach. Oper Res Int J 16:89–115

Taleizadeh AA, Noori-daryan M, Tavakkoli-Moghaddam R (2015) Pricing and ordering decisions in a supply chain with imperfect quality items and inspection under buyback of defective items. Int J Prod Res 53:4553–4582

Wee H, Lo C, Hsu P (2009) A multi-objective joint replenishment inventory model of deteriorated items in a fuzzy environment. Eur J Oper Res 197:620–631

Wright TP (1936) Factors affecting the cost of airplanes. J Aeronaut Sci 3(2):122–128

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Mukherjee, A., Dey, O. & Giri, B.C. An integrated vendor–buyer model with stochastic demand, lot-size dependent lead-time and learning in production. J Ind Eng Int 15 (Suppl 1), 165–178 (2019). https://doi.org/10.1007/s40092-019-00326-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40092-019-00326-y