Abstract

In recent years, cost-benefit analysis (CBA) has played an important role in disaster risk reduction (DRR) investment decisions, and now increasing attention is being paid to its application in developing countries. This article discusses government investment choices in DRR against typhoon disasters in Shenzhen, China. While the existing literature mainly focuses on disaster mitigation measures such as structural retrofitting, this study proposes a holistic framework of DRR investments in which structural (windproof retrofitting) and financial (insurance premium subsidies and post-disaster relief) are all taken into account. In particular, intermeasure spillover effects are measured and used in CBA. The results show that insurance premium subsidies yield the highest benefit-cost ratio and should be prioritized in investment. Windproof retrofitting comes in second place in terms of the benefit-cost ratio and can be considered when there is a sufficient budget. These results further confirm the need of a holistic review of government DRR investments to derive policy recommendations, while challenges remain in relation to the probabilistic modeling capacity to support CBA.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, the increasing frequency and intensity of extreme weather and climate events (IPCC 2012), together with the concentration of social assets in risk-prone regions under ad hoc and inappropriate land use planning (UNISDR 2015a), have contributed to rising human and economic costs from natural disasters. Because no single stakeholder or instrument can handle the problem of natural disaster risk alone, integrated safety nets with close partnerships among the public sector, the private sector, international financial institutions, and nongovernmental organizations are called for (Linnerooth-Bayer and Mechler 2007). As one of the critical components in the safety net, governments are indispensable in disaster risk reduction (DRR) through their roles in providing infrastructure and public services (Shi, P.J.2012), and because of their semi-neutral risk preferences (Arrow and Lind 1970; Gollier 2004; Mechler and Hochrainer-Stigler 2014) and advantageous position in allocating resources compared with the private sector. In addition, their sovereign credit power enables governments, particularly those with larger territory and financial resilience, to spread risks spatially and smooth shocks over longer time periods (Ye et al. 2013). The critical question for governments is how public funding can be applied most efficiently to reduce disaster risks.

In the literature, cost-benefit analysis (CBA) has been employed extensively in analyzing the cost-effectiveness of DRR investments. Studies have mainly focused on structural mitigation measures, particularly earthquake retrofitting, and mostly for developed countries (Nuti and Vanzi 2003; Jonkman et al. 2004; Padgett et al. 2010; Li 2012; Liel and Deierlein 2013). The literature suggests that the benefits of hazard mitigation should be measured in terms of losses avoided, that is, those losses that would have occurred had the measures not been put into place (World Bank 2014). Those benefits generally include reducing direct property damage and fatalities, and sometimes indirect impacts such as reducing business interruptions (Rose et al. 2007). As a typical financial appraisal, CBA converts all benefits and costs into monetary units, and uses the net present value, benefit-cost ratio (B/C), or internal rate of return (Kull et al. 2013) to indicate the cost-effectiveness of the DRR measures under discussion. Many of the analyses in developed countries and international community-supported projects in less-developed countries have provided convincing evidence of the value of investing in proactive risk management using mitigation and ex ante financing instruments (Mechler 2005; Rose et al. 2007; Wethli 2013).

There are two recent trends in the CBA of DRR investments. First, research focus has gradually turned to the needs of developing countries (Mechler 2005; Kull et al. 2013; Michel-Kerjan et al. 2013). These countries still tend to spend much more on coping (for example, emergency response, relief, and reconstruction) than on preparations to reduce vulnerability and exposure to future losses (World Bank/United Nations 2010). The governments of these countries may be convinced to prioritize preparations when strong evidence from CBA is provided. Second, probabilistic risk models are playing an increasingly important role in estimating benefits and costs. The costs of preparing for risks are immediate and must be incurred predominantly up front while the benefits, even if substantial, tend to accrue over time, are less visible, and are therefore more uncertain (World Bank 2014). The nature of uncertain future losses (and therefore the benefits of DRR investments) requires that CBA has to be probabilistic, and evaluations rely heavily on a set of “what if” scenarios (Rose et al. 2007; Michel-Kerjan et al. 2013). In response, quantitative catastrophe risk models that provide probabilistic risk metrics results and loss exceedance probability curves play critical roles.

A government’s DRR investment options are not limited to mitigation or prevention measures. Cost-benefit analysis should shift its emphasis from infrastructure-based options to soft resilience options (Mechler 2016). Decisions on the use of limited public funds for DRR essentially relate to the costs and benefits of various DRR instruments and their interactions (Freeman et al. 2003). For instance, governments need to find a balance between disaster mitigation/prevention that truly diminishes risk (by reducing either the probability or the loss amount) and risk financing that enables risk sharing among stakeholders (Kobayashi and Yokomatsu 2000; Mechler et al. 2010). Then, the question arises as to which specific structural mitigation measures should be used, an issue that has been explored extensively in many of the case studies mentioned above. With regard to risk financing, there is also the question of how much ex ante financing should be arranged, and how much should be left for ex post funding through diversion of resources from other projects and funds from international donors (Mahul and Eugene 2006; see also IIASA’s CATSIM model in Hochrainer-Stigler et al. 2015). Because government investment differs substantially by economy, institution, and social norms, a holistic framework must be developed that pays particular attention to the interactions among DRR measures.

The purpose of this article is to analyze the optimal choices of government investment in DRR when structural and nonstructural (financial) measures are all taken into account, and show the importance of considering the interaction and spillover effects between structural and financial measures. Shenzhen, a typical typhoon-prone and economically developed city on the southeast coast of China, was used for the case study. Government investment in windproof retrofitting, premium subsidies for typhoon damage insurance, and post-typhoon relief were used as the major DRR measures in the analysis. A typhoon risk model with stochastic typhoon events was employed to derive quantitative risk metrics and calculate the cost-effectiveness of various investments. Section 2 introduces the present structure of Chinese government investments in DRR by department, and depicts the trade-offs and synergies between different DRR measures. Section 3 provides the CBA for Shenzhen using a typhoon risk model. Section 4 concludes with a discussion of the results.

2 Chinese Government Investments in DRR

There are several key areas of substantial government investment in DRR. These investments can be grouped according to the time horizon of disasters, by preparing versus coping stages (World Bank 2014), or by preparedness, emergency response, recovery, and reconstruction stages (Carter 2008). Alternatively, investments can be grouped by government departments. In China, four key government functions are involved in DRR spending: providing disaster prevention, encouraging risk transfer, providing emergency management, and providing post-disaster relief (Shi 2005) (Fig. 1).

2.1 Providing Mitigation/Prevention

In the Chinese context, prevention in relation to DRR refers to structural mitigation measures that lower the physical vulnerability of buildings and reduce direct property damage and loss of life. Prevention includes investment in retrofitting existing buildings and providing prevention infrastructure such as dams or dikes. The provision of prevention measures is carried out by many government departments in China, including those responsible for urban and rural planning, agriculture and forestry, water resources, land resources, and oceans and meteorology. The related annual expenditure is substantial. According to incomplete statistics, from 2010 to 2013, Chinese central government expenditure in these areas increased from RMB 376.7 to 640.7 billion YuanFootnote 1 (Wu 2015).

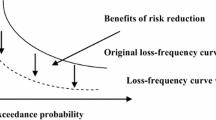

The benefits of investing in prevention include the direct damage avoided, lives saved, and reduced indirect impacts (Liel and Deierlein 2013). The extent of damage avoided can be measured by the difference in loss exceedance curves, with/without the prevention investment, using probabilistic risk models (Michel-Kerjan et al. 2013), converted into present values discounted for a given time horizon (prevention measures can function for decades). A prevention approach is particularly cost-effective against frequent but small-scale events (Mechler et al. 2010), while for well-reinforced buildings/regions, the benefits are less likely to outweigh the costs.

2.2 Encouraging Disaster Insurance

The Chinese government has been trying to cultivate the disaster insurance market through intervention. During the period 2007–2013, the government spent RMB 44.8 billion Yuan in subsidizing agricultural insurance, providing up to 80 % of the total premiums paid by farmers (Wang et al. 2011). The annual expenditure on crop insurance subsidies is currently 0.15 % of the annual expenditure for all levels of government. The initiative of the Chinese government, as suggested in some of the literature (Coble and Barnett 2012), plays a critical role in maintaining a reasonable insurance participation level (Liu et al. 2013). The Chinese government is likely to use a similar strategy to provide government subsidies for insurance premiums in other natural disaster insurance lines, although it remains controversial whether the government subsidies provide the right incentive for individuals’ disaster risk management (Goodwin and Smith 2013). Recent signs of this trend include the catastrophe insurance program launched in Shenzhen in 2014 (China Insurance Regulatory Commission 2014).

As suggested by the theory of insurance demand, the direct effect of government subsidies is to allow cheaper out-of-pocket premiums to encourage voluntary participation (Coble and Barnett 2012). Consequently, more direct losses can be insured. The benefit of premium subsidies is their effect in promoting insurance coverage, together with their effect on income transfer. The effect of premium subsidies has a diminishing margin, while the cost is marginally increasing (Glauber 2004). Other risk transfer instruments, such as reserve funds, contingent debt, and catastrophe bonds, are less likely to enter mainstream practice in China and are not discussed in our model.

2.3 Emergency Management

Since the 2008 snowstorm disaster in southern China, the Chinese government has increasingly emphasized the role of emergency management, that is, the initial response and coping during the emergency stage of a disaster. Emergency response plans have been developed for all levels of Chinese government. Once a state of emergency has been declared, according to those plans, the government shall mobilize all possible resources to reduce the direct damage caused by the disaster and the indirect impacts due to damage to physical assets and disrupted socioeconomic life. Emergency management in China is quite costly. After the 2008 Wenchuan Earthquake, the Chinese central government spent RMB 19.1 billion Yuan during the first month, while the five affected provincial governments spent a total of RMB 18.5 billion Yuan.

The evaluation of the benefits of emergency management is not as straightforward as that of other investment lines. Similar to the case of prevention, the benefits are equivalent to the extra losses should the emergency actions not be put into practice, while most of the present risk models are incapable of incorporating a response module.

2.4 Post-Disaster Relief

Post-disaster relief is one of the most conventional forms of government support for people affected by disasters all around the world. According to the Natural Disaster Relief Regulation (State Council of the People’s Republic of China 2009), the Chinese central government is responsible for providing a daily allowance to disaster-affected people for up to 3 months once any level of natural disaster emergency response is announced by the National Disaster Reduction Committee of China. There are also funds for collapsed buildings (RMB 10,000 Yuan/household) and damaged buildings (RMB 1000 Yuan/household). Specific relief criteria vary by hazard and region. The Chinese central government spent an average of RMB 11.5 billion Yuan in disaster relief, around 0.2 % of total expenditure each year during 1980–2010 (Ministry of Civil Affairs of China 2012). Of this expenditure, 55 % were used for daily allowances during emergency periods, 24 % for collapsed and damaged buildings, and the rest was used for recovery of people’s livelihoods.

Disaster relief can be regarded as a special type of loss transfer. As long as the government provides aid to affected people, part of their loss is borne by the government. The benefit from the point of view of the affected people is purely the aid provided by the government, which equals the cost to the government of providing that aid, assuming that there are no transaction costs.

2.5 Trade-offs and Synergy Among Fiscal Expenditure Lines

All the fiscal expenditure lines mentioned above comprise the total investment budget, and their effects are not independent. It is important to take possible mutual benefits into account in the development of an optimal strategy (Fig. 1). For instance, investment in prevention measures can reduce the probability of events, as well as losses over different return periods. The reduced risk can immediately reduce premium rates, and achieve similar benefits to providing premium subsidies (Kleindorfer and Kunreuther 1999). Better reinforced buildings will also reduce government inputs during a state of emergency. The amount of relief required following a disaster will be smaller, as the direct losses are likely to be smaller. Therefore, when applying CBA, the spillover effects must be taken into account in a holistic perspective.

3 Case Study of DRR Investment for Shenzhen Typhoon Disaster

In order to show the trade-offs and synergies between different DRR measures, a case study was carried out in Shenzhen City regarding typhoon disaster risk reduction. Using a typhoon risk model, cost-effectiveness of various investment scenarios was calculated based on quantitative risk metrics. Policy recommendations were then derived according to the CBA results.

3.1 Typhoon Disasters in Shenzhen

The city of Shenzhen lies on the southeast coast of China, between longitudes 113°46′ and 114°37′E and latitudes 22°27′ and 22°52′N, and comprises a total area of 1952.84 km2 (Fig. 2). Shenzhen was one of the first special economic regions in China, and has experienced rapid population (mainly migrants) and economic growth since the late 1970s. Today it is regarded as one of the megacities of China, together with Beijing, Shanghai, and Guangzhou.

Shenzhen has a tropical monsoon climate, and typhoons are one of the most frequent and severe forms of natural disaster. On average, Shenzhen experiences four or five typhoons each year (Shi 2003, 2011). During the period 2000–2007, losses as a result of typhoon disasters accounted for one-third of all losses caused by hydrometeorological disasters in Shenzhen (Wu and Li 2009).

3.2 Quantitative Typhoon Risk Assessment

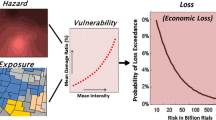

State-of-the-art typhoon risk modeling was employed in quantitative risk assessment, which involved three critical components: typhoon hazard as stochastically simulated typhoon wind speed, exposure of buildings in Shenzhen city, and quantitative vulnerability (loss) functions of building damage caused by different wind speeds.

3.2.1 The Typhoon Hazard Model

The parametric typhoon hazard model developed by Beijing Normal University (BNU) (Lin and Fang 2013; Li et al. 2014; Shi and Fang 2015) was employed in this study. This includes two important submodules. The typhoon track module contains both historical typhoon tracks in the northwest Pacific (China Meteorological Administration best-track dataset) and a set of stochastic typhoon event tracks generated from historical data using the Monte Carlo simulation approach (Shi, X.W. 2012) (Fig. 2). The stochastic typhoon event set contains 33,012 events in 1000 years of repetition. These datasets provide critical parameters for every 6-h interval, including the location of the typhoon center, central minimum pressure, maximum wind speed, and the radius of the maximum wind speed.

The typhoon wind field module generates typhoon-lifetime maximum 5-s gust wind speed for each 1-km grid based on a parametric wind field model (Vickery, Skerjl, and Twisdale 2000; Vickery et al. 2000; Lin 2014). The parametric model calculates the gradient wind field based on the input parameters mentioned above, and then converts wind speed to that at a height of 10 m after taking into account the roughness of the land surface.

3.2.2 Exposure

Exposure data for buildings in Shenzhen were provided by the Shenzhen City Real Estate Assessment and Development Center. Because detailed spatial distribution data for structure type and occupation information were not available for public use, statistical data for six districts of Shenzhen were obtained. For each district, building area (m2) by subcategory was derived based on cross-tables of construction (steel, reinforced concrete, composite masonry,Footnote 2 brick-wood, and miscellaneous), occupation (industrial, residential, commercial, public, and other), and number of stories (2, 5, and 10). The cross-table results are shown in Table 1.

Economic losses caused by typhoon damage to buildings essentially includes structure loss and inventory loss. In risk modeling, replacement cost is generally used for structure loss. As the specific replacement costs for Shenzhen city are not available for public use, a synthesis of official replacement costs from several large cities in China including Suzhou, Hangzhou, Wuhan, Changsha, and Beijing were used. For each subcategory of buildings, the highest replacement cost from all five cities was selected. This yields the hypothetical replacement cost valuation table for the present study (Table 2). Because data for value of contents of buildings were not available loss of inventory was not taken into account in the model.

3.2.3 Vulnerability: Hazards U.S.-MultiHazard Hurricane Loss Function

Loss functions from the Hazards U.S.-MultiHazard (HAZUS MH) hurricane model were used in this study to provide a quantitative description of building vulnerability to typhoons due to the unavailability of such critical information in China. The loss function generally uses logistic-type curves to determine the hurricane peak gust wind speed-to-building loss ratio. In the HAZUS MH hurricane model, buildings are divided into subcategories by construction, occupation, roof shape, material, structure, and window design (HAZUS MH 2.1 User Manual/Technical Manual). The HAZUS building categories are based on U.S. standards, so a perfect correlation between these and the types of buildings in Shenzhen is not possible. As a compromise, we use the loss functions for masonry, masonry-engineered, concrete, steel, and wood in the HAZUS manual for construction types of brick-wood, composite masonry, reinforced concrete, steel, and miscellaneous in Shenzhen, assuming that the buildings share similar occupation types and numbers of stories.

3.2.4 Probabilistic Risk Assessment Results for Typhoon-Induced Building Damage and Losses

Maximum gust wind speeds (hereafter “wind speed”) for each 1-km grid and each of the events in the stochastic typhoon set were then generated by the BNU typhoon hazard model. Given the lack of data for the spatial distribution of hazard intensity in relation to exposure, the median wind speed of all grids within each of the districts of Shenzhen was taken as the final input representing hazard intensity. Simulated maximum gust wind speeds were brought into loss functions of specific building types to derive event loss records, including physical damage (m2), and associated economic losses (RMB Yuan) measured with replacement costs. Event damages and losses where aggregated on an annual basis to derive the annual aggregate loss of the simulated 1000 years. Loss exceedance probability (%) and return period losses of damage ratio (physical damage/total area exposed), building damage (m2), and economic losses (RMB Yuan) are then derived (Fig. 3).

Figure 3 shows the annual building damage ratio, damage, and economic losses of the exceedance probability 0.1–10 % (return periods of 1/1000a–1/10a, respectively). Figure 3a, building damage ratio, reflects the comprehensive vulnerability of construction types to wind damage. At all return periods, Misc. building exhibits the highest damage ratio, brick-wood comes second, while reinforced concrete building is the least vulnerable. Figure 3b takes both vulnerability and exposure into account. Composite masonry building, although its vulnerability is moderate among all construction types, shows the largest area damaged because this is the major construction type in Shenzhen. Annual damage to brick-wood building was smaller than composite masonry building due to its limited exposure, although it is much less wind-resistant than composite masonry building. Misc. building damage was too small even to be observed in the figure for the same reason. Figure 3c, building economic losses, shows the economic losses measured with the replacement costs of each construction type, with a similar pattern to building damage due to the large difference in exposure.

3.3 Cost-Benefit Analysis of DRR Investment

Three major DRR measures were considered in our CBA: wind-proof retrofitting, premium subsidy to typhoon insurance, and post-disaster relief. Emergency response was not taken into account due to the lack of capability in modeling indirect impacts of delayed response. The government is assumed to be the funder of these DRR measures. Therefore, the CBA was from the viewpoint of the government.

3.3.1 Effects of Structure Retrofitting Measures

To accommodate the inherent “what if” feature of the analysis, three different scenarios of building retrofitting were considered in the simulation (Table 3). These scenarios were designed by simply upgrading construction types of higher vulnerability to those of lower vulnerability. For instance, compared to the status quo (the “benchmark” scenario), scenario I simply assumes that all buildings with a construction type of “miscellaneous” or “brick-wood” were retrofitted or upgraded so that their vulnerability decreased to that of “composite masonry,” while the occupation and number of stories remained unchanged. Scenario II provides for extra retrofitting based on scenario I by upgrading all original composite masonry structures to reinforced concrete ones. Scenario III assumes that all miscellaneous, brick-wood, and composite masonry buildings are retrofitted so that they are as resistant as reinforced concrete buildings.

The various scenarios are a simple switch of construction types. However, this guarantees the use of existing loss functions to determine building losses based on wind speed inputs. While the basic scenarios here are adequate for an illustrative case, they are flexible, and can be expanded to accommodate more realistic and complicated possibilities once a better description of the type of exposure becomes available.

When measuring the costs of retrofitting, only the direct cost was considered. Two retrofitting cost scenarios were considered. Cost scenario A assumed that the cost of changing one construction type to another is exactly the difference in replacement costs. This setting of the replacement cost parameter is exceptional in common CBA but it did provide the worst-case scenario of retrofitting cost (the most expensive case). Cost scenario B assumed retrofitting cost to be 30 % of the difference in replacement costs. It is more realistic than A according to various results (Liu et al. 2015), although still a rough approximation due to the lack of local experiment data. All of these costs are supposed to be borne by the government. As a result, retrofitting also has an income transfer effect besides its benefit in reducing wind damages and losses.

The typhoon risk model was run using all three retrofitting scenarios and two cost scenarios. Changes in exposure as well as corresponding loss functions yielded completely different building losses, despite an identical stochastic typhoon event set. The aggregate physical damages and economic losses for all scenarios are summarized in Tables 4 and 5, respectively.

The simulation results confirm the role of retrofitting (Table 4). As the overall vulnerability of buildings decreases by switching from scenario I through to scenario III, the annual average aggregate physical damage (AAD) measured by area (m2) decreases. Annual average damage ratio also drops. As the majority of buildings in Shenzhen are composite masonry and reinforced concrete, the changes in AAD and the damage ratio (AAD/AE, AE is total area exposed) are slight for scenario I. They become large in scenarios II and III, when upgraded composite masonry buildings are involved. The largest decline in AAD is 200,500 m2 (from the benchmark to scenario III) and the loss ratio changes by nearly 0.02 %, which is still modest due to the already high wind resistance of the composite masonry buildings.

The results in terms of building losses as measured by replacement costs are somewhat surprising. When cost scenario A was assumed, assessed AALs (million Yuan) indicate that upgrading construction types creates even higher risk, while the loss rate (AAL/AE) confirms lower relative loss risk. The difference shows the two inherent forces that determine the final losses, the change in exposure and the change in vulnerability. Therefore, in this case, the impact of increased exposure induced by upgrading construction type outweighed the effect of reduced overall vulnerability. Consequently, both slight increases in the absolute value of AAL and modest decreases in the AAD ratio are observed. By contrast, retrofitting yields positive effects when cost scenario B was assumed.

The effect of retrofitting on saving lives has been considered and estimated in the literature. In this study, a rigorous quantitative estimation was not possible due to the limited modeling capacity of our typhoon risk model. Instead, a coarse estimation was carried out. Historical data show that the annual average death toll (including missing persons) in Shenzhen is 3.125 (25 deaths/missing persons during the period 2000–2007). In several cases, consideration of the monetary value of lives saved adds substantially to the benefits of retrofitting (Michel-Kerjan et al. 2013). After considering a variety of suggested ranges of values of statistical life (VSLs) presented in the literature (Viscusi and Aldy 2003; Liel and Deierlein 2013), we used the VSLs of USD 75,000 and 6 million employed in Michel-Kerjan et al. (2013) as the lower and upper bounds, respectively. If an optimistic assumption is used whereby retrofitting can reduce fatalities by 50 %, the estimated monetary effects of lives saved would be approximately RMB 0.72 million Yuan/year and RMB 58 million Yuan/year, respectively. However, even using the upper bound, the effect still does not outweigh the increased economic losses in scenarios I-A, II-A, and III-A.

Given the simulation results, it is difficult to determine whether retrofitting is cost-effective. While the reduced AAD and damage ratios can bring benefits in other areas such as lower insurance premiums, the final decision depends on what spillover effects are provided in relation to other DRR measures.

3.3.2 Effects of Insurance Premium Subsidy

The effects of government subsidies for insurance premiums essentially depend on the response of the public to this form of intervention. Generally, premium subsidies will encourage more people to participate in an insurance program, and therefore more insurance coverage and protection is provided by the private sector (Glauber 2004). More insurance coverage purchased means that more losses can be indemnified by insurance (the “insured loss”), and therefore more risks are transferred. Therefore, the expected value of the extra insured loss can be used as a measure of the effect achieved.

In order to measure the effects of premium subsidies, it is necessary to understand insurance demand in response to subsidy rate as well as insurance coverage and premium rate changes. In insurance demand analysis, the literature uses participation probability to quantify insurance demand as an alternative to a “take-it-or-leave-it” question (dichotomous “yes/no” decision) (Sherrick et al. 2004; Hu et al. 2009). The probability that a person purchase a specific insurance product in such a context can be defined as \( \Pr \left( {par} \right) = \exp {\varvec{\upbeta}}^{\prime}{\mathbf{x}}/\left( {1 + \exp {\varvec{\upbeta}}^{\prime}{\mathbf{x}}} \right) \), in which \( {\mathbf{x}} \) is a vector of factors affecting insurance choice and \( {\varvec{\upbeta}} \) is a vector of associated coefficients describing the marginal effects. \( {\mathbf{x}} \) could be either sociodemographic variables or insurance product attributes. In the present case, we are interested in how participation probability will change in response to three elements: premium changes induced by premium subsidies provided by the government, coverage changes due to retrofitting, and premium rate changes due to retrofitting. Retrofitting buildings will lead to smaller premium rates as the actuarially fair premium rate is exactly the AAD ratio (Table 4). Therefore, insurance product attributes \( {\mathbf{x}}\,{ = }\,\left\{ {C,\sigma ,\pi } \right\} \) are considered, in which \( C \) is insurance coverage, assumed to be the replacement cost for each type of building, \( \sigma \) is government subsidy rate, and \( \pi \) is the actuarially fair premium rate (equivalent of the AAD ratio in Table 4). We can rearrange the equation using \( {\mathbf{x}}\,{ = }\,\left\{ {C,\sigma ,p} \right\} \), in which \( p = C \cdot \pi \cdot \left( {1 - \sigma } \right) \) is the total out-of-pocket premium paid by the policyholder.

Estimating coefficients in the logit probability when \( {\mathbf{x}} \) are insurance attributes involves choice experiment analysis. While the estimation of these coefficients requires a soundly designed and well-implemented survey of insurance purchasers, this is not feasible in Shenzhen because of the complete lack of typhoon insurance. As a result, coefficients estimated from an existing choice experiment analysis, although applied in other regions and to other insurance products in China, were employed (Liu et al. 2013). The coefficient vector is \( \beta_{C} = 0.003,\beta_{\sigma } = 0.008,\beta_{p} = - 0.050 \). In this subsidy scheme, the participation probability \( \Pr \left( {C,\sigma ,p} \right) \) will increase if a higher insurance coverage \( C \) or a higher subsidy rate \( \sigma \) is provided, or if premiums \( p \) fall. The cost of the government subsidy is the aggregate subsidy expenditure, which is the total area insured \( AE \cdot \Pr \left( {C,\sigma ,p} \right) \) multiplied by the subsidy per unit of area \( p \cdot \sigma \). The expected value of the extra insured losses can be measured with the increase in total area insured times per unit area coverage:

in which subscript c denotes different construction types, subscript s denotes different prevention scenarios listed in the first column of Table 5, and s = 0 denotes the benchmark scenario. The difference between the expected losses covered by insurance measures the influence of lower out-of-pocket premiums paid by policyholders, which is a joint effect of premium subsidies and retrofitting. The contribution of premium subsidies given any prevention scenario is \( {\text{E}}\Delta IL\left( {\sigma |C,\pi } \right) \). The contribution of retrofitting is related to scenario-specific insurance coverage measured as replacement costs (retrofitting costs included) and scenario-specific fair premium rates, \( {\text{E}}\Delta IL\left( {C,\pi |\sigma } \right) \).

Given all the values of C (insurance coverage, replacement costs in Table 2 and value exposed in Table 5) and π (premium rates, that is, the damage rates shown in Table 4, no risk loading and transaction costs are considered) associated with each construction type c under different scenarios s, the extra expected insured loss \( {\text{E}}\Delta IL \) can be derived. Figure 4 shows the results. Figure 4a depicts the overall extra expected insured losses in response to premium subsidy rate by scenario and Fig. 4b depicts the ratio of effect (extra expected insurance loss) to total subsidy cost in response to premium subsidy costs. As premium subsidy involves income transfer effect, adding 1 to the effect-cost ratio will lead to the measure of overall benefit-cost ratio.

The simulated results confirm the positive effect of premium subsidies in providing extra insurance coverage, and consequently more losses will be insured. The results of scenarios of I-A and I-B are extremely close to the benchmark case, as both scenarios induce very limited change in both exposure and premium rates (Table 5). For each retrofitting scenario (I, II, and III), the pair of curves of the A and B cost scenarios are parallel to each other, as each pair shares identical \( \pi \). The vertical difference between each pair of the curves (for example, II-A vs. II-B) are of total exposure change induced by coverage increase, or in other words, the net difference between retrofitting costs assumed in scenarios A and B. All curves show diminishing margins against subsidy rate. Also, the overall-slope for the benchmark case is the largest while that of scenario III is the smallest, indicating higher subsidy effects at higher premium rates.

The ratios of extra expected insured loss to total subsidy cost in Fig. 4b can be used as a measure of the cost-effectiveness of subsidies, although not taking the income transfer effect of subsidies into account. All the ratios are convex curves, indicating positive margins along decreasing curves in response to increasing subsidy rate. The ratios also show diminishing margin against premium rates. The ratios for the benchmark case, and scenarios I-A and I-B that have larger premium rates lie at the top part of the figure, while ratios for scenario III-A lie at the bottom.

Sudden jumps can be observed on the effect-cost ratio curves at the subsidy rate of 100 %, when the insurance premium is completely paid by the government and policyholders receive insurance service for free. The reason for the jump is rooted in the diminishing power of the subsidy in attracting participation. When the subsidy rate is substantially high, every percent increase in participation probability or every Yuan increase in extra insured loss will cost considerably. It would even be more cost-effective to just let all households be insured by providing “free” insurance. Consequently, there is a certain range of subsidy rate being dominated under each scenario in terms of cost-effectiveness. For instance, in the benchmark case, the ratio for 100 % subsidy is 0.21. Any subsidy rate larger than 80 % (the corresponding ratio is 0.21) and smaller than 100 % should not be considered from the viewpoint of CBA.

3.3.3 Effect of Disaster Relief

According to the Natural Disaster Relief Regulation (State Council of the People’s Republic of China 2009), the government is responsible for providing RMB 10,000 Yuan/household for collapsed buildings. A household is defined as comprising 100 m2 housing on average, therefore this equates to RMB 100 Yuan/m2 for repairs and reconstruction. The effect of disaster relief is to transfer a part of the loss to the government. Consequently, the effect as measured in monetary terms will be identical to the government’s costs.

Windproof retrofitting measures will, as noted in the discussion on premium subsidies, have a spillover effect on relief. As retrofitting measures reduce the level of physical damage to buildings, annual average relief costs can be reduced accordingly. The estimated spillover effect can be derived using the AAD reduced by retrofitting times per unit area relief cost. Therefore, spillover effects for scenarios I, II, and III, irrespective of cost scenario, are RMB 0.50, 15.97, and 17.55 million Yuan, respectively.

3.3.4 Overall Cost-Benefit Analyses and Government Choices

The optimal decision for the government depends on a comparison of the costs and benefits of the three different input approaches indicated above. A summary of the CBA for three different types of government investment in DRR is shown in Table 6.

The cost of investment in windproof retrofitting is one-off, but it can provide benefits for decades, while assumptions about the valid time horizon of retrofitting measures can influence benefit estimation (Liel and Deierlein 2013; Michel-Kerjan et al. 2013). Therefore, the overall benefit of the retrofitting strategy is the sum of AAL reduced under each scenario (first column in Table 6), plus the spillover effects of extra expected insured loss increased and relief cost reduced (second column in Table 6), aggregated at present values for a given time horizon. The discount rate for present value calculations is the benchmark interest rate announced by the People’s Bank of China in 2015, which is approximately 5 %. We considered a 25-year time horizon for discounting, which is exactly half of the time horizon for land use rights for commercial buildings in China. Other time horizons were also applied, but they did not change the pattern of the results due to the small annual benefits. As all the costs were assumed to be borne by the government, the retrofitting strategy involves an income transfer. In order to make the results comparable to the case of government relief, a baseline B/C of 1 is applied.

For the case of premium subsidy, B/Cs at the smallest subsidy rate (1 %) and B/Cs at the subsidy rate of 100 % are both reported. As the B/Cs “jump up” at the rate of 100 %, the critical subsidy rates that exactly yield identical B/Cs to the case of 100 % subsidy rate are also derived and reported. As premium subsidies also induce an income transfer effect, a baseline B/C of 1 is applied, similar to the results of retrofitting. The benefit in terms of disaster relief in the context of the present study is purely the loss transfer to the government, which equals government expenditure.

From a financial viewpoint, only the measures with B/Cs larger than 1 are cost-effective and worthy of investment. In this regard, the summary of benefits confirmed the importance of considering the spillover effects of the retrofitting investment. If 100 % of the difference in replacement cost was used (cost scenario A), retrofitting is barely cost-effective. Nevertheless, the spillover effects are almost large enough even to outweigh the negative impacts under cost scenario A. The overall B/Cs for scenarios II-A and III-A are smaller but quite close to the B/C baseline of 1. Then, adding the benefits in terms of lives saved will guarantee the cost-effectiveness of retrofitting, even in the case of expensive cost scenario A. If the roughly estimated annual benefits in terms of lives saved (RMB 0.72–58 million Yuan/year) are used, they are equivalent to benefits of RMB 11.1–858 million Yuan over a 25-year time period, similar to the magnitude of the direct effects in scenario III-B. Taking the values into account will allow the B/Cs of all scenarios be larger than 1. However, the size of benefits cannot lead to a boost in the overall B/Cs as in some studies (for example, Michel-Kerjan et al. 2013). As the largest share of construction type in Shenzhen is composite masonry, which is substantially windproof, the retrofitting costs will be significantly higher compared with the benefits if the income transfer effect is not taken into account, similar to the findings in other CBAs of earthquake retrofitting projects (for example, Liel and Deierlein 2013). Consequently, the B/Cs of retrofitting are always smaller than those of the insurance premium subsidy in this study.

The B/Cs for premium subsidies are cost-effective in all cases, ranging from 1.09 to 1.41. B/Cs across scenarios indicate that subsidies are more cost-effective when premiums are higher, which echoes the pattern as in Fig. 4. Therefore, the effects and B/Cs could be even larger in real cases than the results reported here—in real cases, the actual gross premium rates will include catastrophic loadings and administrative costs, which could lead to premium rates 50 % more than the actuarially fair one.

To translate the quantitative results into policy recommendation, the measure with the highest B/C should be given priority. Therefore, in the case of Shenzhen, government investment in premium subsidies should be prioritized irrespective of scenarios according to our CBA results, as long as the B/Cs of premium subsidies are all larger than those of retrofitting measures. The choice of the government essentially depends on its budget:

-

(1)

With limited budget, the government should first spend in subsidizing insurance premium, and use funding to gradually increase subsidy rate up to 80 %. No funds should be spent in retrofitting at the beginning.

-

(2)

If there is still sufficient funding after fulfilling step (1), the government could choose either to keep subsidy rate at 80 %, or to provide 100 % subsidy immediately, as subsidy rate interval (0.8, 1) in the benchmark scenario was dominated in terms of cost-effectiveness. The reason has been explained in Sect. 3.3.2 (see also in Table 6). As both 80 % and 100 % subsidy rates provide identical B/Cs in the benchmark case, the final choice depends on reasons other than the financial perspective. One hundred percent premium subsidy means that the government will pay the whole insurance premium and all exposure will be insured. It would be a good choice if merely considered from the measure of total risk transferred. It would also incur much less transaction costs than the case of 80 % subsidy as the premium collection process would be much simpler. However, from an economic point of view, full insurance subsidy is likely to leave the insured unaware of insurance protection.

-

(3)

If the government still has a sufficient budget after fulfilling the need in subsidizing insurance premiums, then retrofitting can be considered. It may first consider retrofitting the buildings of the most vulnerable construction type, for example, the miscellaneous and brick-wood buildings; then retrofitting composite masonry, which will involve substantial costs, can be considered.

-

(4)

Last but not the least, when all the ex-ante measures come into practice, the government can consider adding funds in post-disaster relief measures, which is considered as a pure loss transfer to the government.

4 Conclusion

The United Nations Sendai Framework for Disaster Risk Reduction 2015–2030 (UNISDR 2015b) proposes investment in disaster prevention and reduction, both public and private, and through structural and nonstructural measures. To achieve this, it is important to measure the cost-effectiveness of measures and promote “the integration of disaster risk reduction considerations and measures in financial and fiscal instruments” (UNISDR 2015b, p. 20). In light of this priority, this study applies CBA to evaluate and compare government investments in both structural (windproof retrofitting) and nonstructural (insurance premium subsidies and disaster relief) approaches. With the support of quantitative risk modeling, special attention has been paid to the spillover effects of structural investments, which have rarely been discussed in previous studies.

Our results provide several important observations. First, spillover effects are critically important when measuring the overall effectiveness of windproof retrofitting measures. Because Shenzhen is a region of low vulnerability to typhoon disaster, the direct benefit of retrofitting could be outweighed by its costs in high-cost scenarios if its spillover effects to premium subsidy and disaster relief are not taken into account. In low cost scenarios, the spillover effects are as large as direct effects of retrofitting in reduced AAL. This result confirms our focus on the intermeasure spillover effects in a holistic risk management framework. Second, our analysis suggests that insurance premium subsidies should be prioritized for typhoon risk reduction in Shenzhen. In the case of sufficient funds, the Shenzhen government can consider retrofitting the most vulnerable construction types. Disaster relief in our discussion is purely loss transfer from the affected population to the government and therefore should be considered last. Therefore, structural measures are not always the best first choice in DRR investments.

The research needs to be expanded in several important aspects before the results and policy recommendations can be applied in Shenzhen. First, improving the capacity of the typhoon risk model will enable more detailed discussion of benefits and costs. For instance, developing finer-scale distribution of exposure (construction type and value) can enable a spatially explicit discussion of retrofitting measures. Experiments for calibrating damage function changes in response to more specific retrofitting measures will also lead to more realistic results than the present one. It will also be critical to incorporate the benefits of reduced indirect impacts due to successful emergency coping such as emergency relocation of people and rapid post-disaster relief. Second, the CBAs in the present study, as in the existing literature, were inherently performed from a financial perspective and within a framework of partial equilibrium. The costs of government investments are all direct monetary costs, while the opportunity costs, which should be valued within a general equilibrium framework, should be taken into account in further studies.

Notes

1 USD = RMB 6.5 Yuan (approximately).

In China, the composite masonry construction type generally refers to reinforced masonry bearing walls with precast concrete diaphragms or to concrete frames with unreinforced masonry infill walls.

References

Arrow, K.J., and R.C. Lind. 1970. Uncertainty and the evaluation of public investment decisions. American Economic Review 60(3): 364–378.

Carter, W.N. 2008. Disaster management: A disaster manager’s handbook. Manila, Philippines: Asian Development Bank.

China Insurance Regulatory Commission. 2014. Initiative of Chinese catastrophe insurance institutional design with the promotion of the China insurance regulatory commission. http://www.circ.gov.cn/web/site0/tab5207/info3900215.htm. Accessed 3 Nov 2015 (in Chinese).

Coble, K.H., and B.J. Barnett. 2012. Why do we subsidize crop insurance? American Journal of Agricultural Economics 95(2): 498–504.

Freeman, P.K., L.A. Martin, R. Mechler, G. Pflug, and K. Warner. 2003. Disaster risk management: National systems for the comprehensive management of disaster risk and financial strategies for natural disaster reconstruction. Research report for the Inter-American Development Bank. http://pure.iiasa.ac.at/6980/. Accessed 3 Nov 2015.

Glauber, J.W. 2004. Crop insurance reconsidered. American Journal of Agricultural Economics 86(5): 1179–1195.

Gollier, C. 2004. The economics of risk and time. Cambridge, MA: MIT Press.

Goodwin, B.K., and V.H. Smith. 2013. What harm is done by subsidizing crop insurance? American Journal of Agricultural Economics 95(2): 489–497.

Hochrainer-Stigler, S., R. Mechler, and J. Mochizuki. 2015. A risk management tool for tackling country-wide contingent disasters: A case study on Madagascar. Environmental Modelling & Software 72: 44–55.

Hu, W.Y., T. Woods, and S. Bastin. 2009. Consumer acceptance and willingness to pay for blueberry products with nonconventional attributes. Canadian Journal of Agricultural Economics 41(1): 47–60.

IPCC (Intergovernmental Panel on Climate Change). 2012. Managing the risks of extreme events and disasters to advance climate change adaptation. A special report of Working Groups I and II of the Intergovernmental Panel on Climate Change, ed. C.B. Field, V. Barros, T.F. Stocker, D.H. Qin, D.J. Dokken, K.L. Ebi, M.D. Mastrandrea, K.J. Mach, G.-K. Plattner, S.K. Allen, M. Tignor, and P.M. Midgley. Cambridge: Cambridge University Press.

Jonkman, S.N., M. Brinkhuis-Jak, and M. Kok. 2004. Cost benefit analysis and flood damage mitigation in the Netherlands. Heron 49(1): 95–111.

Kleindorfer, P.R., and H. Kunreuther. 1999. The complementary roles of mitigation and insurance in managing catastrophic risks. Risk Analysis 19(4): 727–738.

Kobayashi, K., and M. Yokomatsu. 2000. Economic valuation of catastrophe risks: Beyond expected losses paradigms. Paper presented at the Second EuroConference on Global Change and Catastrophe Risk Management: Earthquake Risks in Europe, Laxenburg, Austria, 6–9 July 2000.

Kull, D., R. Mechler, and S. Hochrainer-Stigler. 2013. Probabilistic cost-benefit analysis of disaster risk management in a development context. Disasters 37(3): 374–400.

Li, Y. 2012. Assessment of damage risks to residential buildings and cost-benefit of mitigation strategies considering hurricane and earthquake hazards. Journal of Performance of Constructed Facilities 26(1): 7–16.

Li, X.Y., W.H. Fang, and W. Lin. 2014. Comparison of interpolation methods for tropical cyclone tracks and their intensity over the northwestern pacific basin. Journal of Beijing Normal University (Natural Science) 50(2): 111–116 (in Chinese).

Liel, A.B., and G.G. Deierlein. 2013. Cost-benefit evaluation of seismic risk mitigation alternatives for older concrete frame buildings. Earthquake Spectra 29(4): 1391–1411.

Lin, W. 2014. Typhoon wind hazard analysis of Hainan Island. Master’s thesis, Beijing Normal University, Beijing, China (in Chinese).

Lin, W., and W.H. Fang. 2013. Regional characteristics of the Holland B parameter in the typhoon wind field model for the Northwest Pacific. Tropical Geography 33(2): 124–132 (in Chinese).

Linnerooth-Bayer, J., and R. Mechler. 2007. Disaster safety nets for developing countries: Extending public-private partnerships. Environmental Hazards 7(1): 54–61.

Liu, K., M. Wang, and Y. Wang. 2015. Seismic retrofitting of rural rammed earth buildings using externally bonded fibers. Construction and Building Materials 100: 91–101.

Liu, Y.B., T. Ye, M. Wang, and W.Y. Hu. 2013. Agricultural producers’ willingness-to-pay for paddy rice insurance in Hunan Province, China: A stated choice experiment analysis. Paper presented at the Association of American Geographers Annual Meeting, 9–13 April 2013, Los Angeles, CA, USA.

Mahul, O., and G. Eugene. 2006. The macro financing of natural hazards in developing countries. World Bank Policy Research Working Paper No. 4075, Washington, DC: World Bank.

Mechler, R. 2005. Cost-benefit analysis of natural disaster risk management in developing countries. Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ). http://maail1.mekonginfo.org/assets/midocs/0003131-environment-cost-benefit-analysis-of-natural-disaster-risk-management-in-developing-countries-manual.pdf. Accessed 30 May 2016.

Mechler, R. 2016. Reviewing estimates of the economic efficiency of disaster risk management: Opportunities and limitations of using risk-based cost-benefit analysis. Natural Hazards 81(3): 2121–2147.

Mechler, R., and S. Hochrainer-Stigler. 2014. Revisiting Arrow-Lind: Managing sovereign disaster risk. Journal of Natural Resources Policy Research 6(1): 93–100.

Mechler, R., S. Hochrainer, G. Pflug, A. Lotsch, and K. Williges. 2010. Assessing the financial vulnerability to climate-related natural hazards. Background paper to the 2010 world development report. World Bank Policy Research Working Paper No. 5232. Washington, DC: World Bank.

Michel-Kerjan, E., S. Hochrainer-Stigler, H. Kunreuther, J. Linnerooth-Bayer, R. Mechler, R. Muir-Wood, N. Ranger, P. Vaziri, and M. Young. 2013. Catastrophe risk models for evaluating disaster risk reduction investments in developing countries. Risk Analysis 33(6): 984–999.

Ministry of Civil Affairs of China. 2012. Statistical yearbook of civil affairs of China (1986–2011). Beijing: China Statistics Press (in Chinese).

Nuti, C., and I. Vanzi. 2003. To retrofit or not to retrofit? Engineering Structures 25(6): 701–711.

Padgett, J.E., K. Dennemann, and J. Ghosh. 2010. Risk-based seismic life-cycle cost-benefit (LCC-B) analysis for bridge retrofit assessment. Structural Safety 32(3): 165–173.

Rose, A., K. Porter, N. Dash, J. Bouabid, C. Huyck, J. Whitehead, D. Shaw, R. Equchi, et al. 2007. Benefit-cost analysis of FEMA hazard mitigation grants. Natural Hazards Review 8(4): 97–111.

Sherrick, B.J., P.J. Barry, P.N. Ellinger, and G.D. Schnitkey. 2004. Factors influencing farmers’ crop insurance decisions. American Journal of Agricultural Economics 86(1): 103–114.

Shi, P.J. 2005. Theory and practice of disaster systems research in a fourth time. Journal of Natural Disasters 14(6): 1–7 (in Chinese).

Shi, P.J. 2012. On the role of government in integrated disaster risk governance – Based on practices in China. International Journal of Disaster Risk Science 3(3): 139–146.

Shi, P.J. (eds.). 2003. The atlas of natural disaster systems of China. Beijing: Science Press (in Chinese).

Shi, P.J. (eds.). 2011. Atlas of natural disaster risk of China. Beijing: Science Press (in Chinese).

Shi, X.W. 2012. Spatiotemporal characteristics and stochastic modeling of tropical cyclone tracks and their intensity in the NWP Basin. Master’s thesis, Beijing Normal University, Beijing, China (in Chinese).

Shi, X.W., and W.H. Fang. 2015. Spatiotemporal characteristics of tropical cyclones in the NWP Basin between 1949 and 2010. Journal of Beijing Normal University (Natural Science) 51(3): 287–292 (in Chinese).

State Council of the People’s Republic of China. 2009. Regulation for natural disaster relief. Beijing: State Council of the People’s Republic of China (in Chinese).

UNISDR (United Nations International Strategy for Disaster Reduction). 2015a. Making development sustainable: The future of disaster risk management. Global Assessment Report on Disaster Risk Reduction (GAR). Geneva: UNISDR.

UNISDR (United Nations International Strategy for Disaster Reduction). 2015b. Sendai framework for disaster risk reduction 2015-2030. Geneva: UNISDR.

Vickery, P.J., P.F. Skerjl, and L.A. Twisdale. 2000. Simulation of hurricane risk in the United States using empirical track model. Journal of Structural Engineering 126(10): 1222–1237.

Vickery, P.J., P.F. Skerjl, A.C. Steckley, and L.A. Twisdale. 2000. Hurricane wind field model for use in hurricane simulations. Journal of Structural Engineering 126(10): 1203–1221.

Viscusi, W.K., and J.E Aldy. 2003. The value of a statistical life: A critical review of market estimates throughout the world. Journal of Risk and Uncertainty 27(1): 5–76.

Wang, M., P.J. Shi, T. Ye, M. Liu, and M.Q. Zhou. 2011. Agriculture insurance in China: History, experience, and lessons learned. International Journal of Disaster Risk Science 2(2): 10–22.

Wethli, K. 2013. Benefit-cost analysis for risk management: Summary of selected examples. Document prepared for the world development report 2014. http://siteresources.worldbank.org/EXTNWDR2013/Resources/8258024-1352909193861/8936935-1356011448215/8986901-1380568255405/WDR15_bp_BenefitCost_Analysis_for_Risk_Management_Wethli.pdf. Accessed 30 May 2016.

World Bank. 2014. World development report 2014 – Managing risk for development. Washington, DC: World Bank. doi:10.1596/978-0-8213-9903-3.

World Bank/United Nations. 2010. Natural hazards, unnatural disasters: The economics of effective prevention. Washington, DC: World Bank.

Wu, B.X. 2015. Study on the optimization of government financial expenditure in integrated disaster risk governance. Doctoral thesis, Beijing Normal University, Beijing, China (in Chinese).

Wu, Y.L., and H. Li. 2009. Meteorological disaster and its risk assessment in Shenzhen City since 2000. Guangdong Meteorology 31(3): 43–45 (in Chinese).

Ye, T., M. Yokomatsu, P.J. Shi, and N. Okada. 2013. Government intervention into the disaster insurance market: Issues and alternatives in Japan and China. In Local, regional and international level cooperation in disaster risk management, ed. S.R. Sensarma and A. Sarkar 162–191. Concept Publisher: New Delhi.

Acknowledgments

Financial support from the China 973 Project under grant 2012CB955404 and the State Key Laboratory of Earth Surface Processes and Resource Ecology of China Project under Grant 2015-ZY-17 are highly appreciated.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ye, T., Wang, Y., Wu, B. et al. Government Investment in Disaster Risk Reduction Based on a Probabilistic Risk Model: A Case Study of Typhoon Disasters in Shenzhen, China. Int J Disaster Risk Sci 7, 123–137 (2016). https://doi.org/10.1007/s13753-016-0092-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13753-016-0092-7