Abstract

Disruptions in the minerals supply chain play a central role in defining the future stock of minerals; therefore, an in-depth analysis of the outcomes and variables affecting exploration is required. In comparative terms, the exploration of critical minerals and major minerals presents geological and technical differences; thus, exploration budgets for critical minerals should be expected to depart from those observed in other minerals. In this context, the main goal of this paper is to contrast how exploration budgets differ between critical and major minerals when considering a set of key variables. We take a multivariate statistical analysis approach based on firm-level budget exploration data to show four key findings: exploration budgets allocated for critical minerals remain consistently lower than major minerals even when controlling for other factors. Moreover, they present a higher sensitivity to fluctuations in commodity prices. Besides, the investment made by larger companies in critical minerals significantly lags behind those made by junior companies. Additionally, the focus of exploration activity for critical minerals predominantly lies in the earlier stages of the exploration process. We expect these initial results to be used as a step forward to facilitate the discussion about exploration policies and, consequently, the reliability of the supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

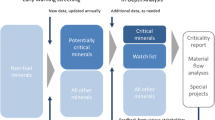

The material requirements of the energy transition present a unique opportunity to foster a new approach toward the interplay between mineral resources and society. Critical minerals are those that are likely to experience supply disruptions, lack reliable substitutes, and are part of key economic sectors (Schrijvers et al. 2020). Typical criticality assessments attempt to indicate the likelihood probability of supply disruption by considering factors such as limited production diversity and political risks. This view has become a common standard for a number of national and regional approaches (Graedel et al. 2015; European Commission 2020; Schulz et al. 2017). Nevertheless, most criticality assessments focus on short- to medium-term impacts (i.e., occurring in a timeframe of fewer than 20 years, explaining the widespread use of mineral production data, which might pose a challenge to the sustainability analysis of the entire supply chain (Henckens 2021; Henckens et al. 2016). Long-term criticality assessments require a thorough exploration of the availability of depletable resources, an ongoing subject of debate among researchers over an extended period (Tilton 2003; Skinner 1976; Tilton et al. 2018; Segura-Salazar and Tavares 2018). The relationship between exploration and geological scarcity is bidirectional, i.e., they influence each other. On the one hand, mineral exploration impacts the future stock of minerals as it guides the development of resources and reserves in the long term (Castillo and Eggert 2020, Michaux 2021; Mudd 2021; Henckens et al. 2014). On the other hand, exploration also depends on the geological potential of a country or region and its particular political and social institutions (Jara 2017; Castillo and Roa 2021). However, previous studies have not specifically focused on exploration budgets for critical minerals, nor have they effectively distinguished them from the exploration for major minerals.

Exploration techniques and geological knowledge that are typically effective for major minerals, since they are fairly well understood in their geological processes and the discovery of new deposits, may not always be directly applicable when searching for critical elements (González-Alvarez et al. 2021; Hu et al. 2020). Exploration targeting for critical minerals can be affected and differ from the procedures used with major minerals due to geological and economic conditions. Geologically, the classification of critical elements as by- or co-products significantly impacts their reportability, resulting in limited information disclosure. Consequently, our understanding of the geological processes involved in their formation and the restricted geographic locations of their deposits is limited (McNulty and Jowitt 2021; Mudd et al. 2017; Yuheng and Yan 2020; Munk et al. 2016). Therefore, current trends, policies, and strategies that are widely used for major minerals may not be entirely appropriate for critical minerals (Eggert 2023), particularly in situations where fundamental geological knowledge is lacking (Castillo and Roa 2021), and government intervention is necessary to encourage the initial stages of mineral development (Black 2018).

On the economic front, when it comes to critical minerals, there exists a significant lack of understanding regarding firms’ decision-making, primarily due to the complex and interdependent nature of their production (Jordan 2018). Additionally, critical minerals are more likely to experience higher price volatility, geopolitical concentration, or lower recycling rates (Redlinger and Eggert 2016; Nassar et al. 2015). Geological and economic differences across both sets of minerals are expected to affect exploration, with most differences pointing to lower incentives to explore critical minerals.

In this context, the primary objective is to examine the differences in exploration budgets for major and critical minerals. Specifically, we seek to understand how these budgets are influenced by factors such as price fluctuations, company type, and exploration stage. For the analysis, we take a multivariate statistical approach based on firm-level exploration data from a global exploration database (S&P Global 2021). This comprehensive global database includes non-ferrous exploration budgets at the firm level across 133 countries. It provides information about firm size, target element, destination countries, and exploration years from 2010 to 2020. Besides, this dataset is widely recognized as a reliable source of information on mineral exploration budgets and has been used in previous related studies. (Jara et al. 2008; Jara 2017; Vasquez Cordano and Priale Zevallos 2021; Castillo and Roa 2021).

The comparative analysis between major and critical minerals is based on the primary element targeted, as reported by each company. Critical minerals share similar structural geological conditions and are commonly included in critical materials lists in strategic analyses (European Commission 2020; Schrijvers et al. 2020). These critical minerals include silver (Ag), cobalt (Co), lithium (Li), molybdenum (Mo), Platinum Group Metals (PGM), and Rare Earth Elements (REEs), while gold (Au), copper (Cu), nickel (Ni), lead (Pb), and zinc (Zn) are classified as major mineralsFootnote 1. Our research shows statistically significant differences in exploration budgets made by companies when comparing critical and major minerals. The main findings reveal a consistent disparity in exploration budgets between critical minerals and major minerals, even after controlling for factors such as class and stage fixed effects, market size, and country fixed effects. Additionally, the budgets allocated for critical minerals exhibit a higher level of sensitivity to commodity prices. Junior companies largely dominate budgets in exploration for critical minerals while major and other companies allocate significantly lower investments. Moreover, the exploration for critical minerals primarily focuses on earlier stages of development. These differences indicate that exploration needs to be adjusted as a mitigation strategy to decrease the criticality of minerals because future resource development will not behave as expected from what has been historically seen in major minerals regarding resources and reserves.

The subsequent sections of the paper are structured as follows. The “Geology and exploration of critical minerals” section analyzes the crucial structural distinctions in the geological processes and exploration techniques employed for major and critical minerals, focusing on identifying the potential implications of these differences on exploration. The “Exploration budgets for critical minerals” section presents the methodological approach and data. The main outcomes derived from the econometric approach are presented in the “Econometric analysis and results” section. The “Discussion” section discusses the implications of our key findings, and the “Conclusions” section summarizes the conclusions.

Geology and exploration of critical minerals

Historically, mineral exploration has been focused on major minerals, such as those containing Cu, Ni, Au, or Fe, among others. As a result, a comprehensive understanding of the geological enrichment processes and the successful exploration of mineral deposits has been widely achieved. There is a consensus in the geological sciences regarding the formation of major deposit types such as porphyry Cu, VMS, magmatic massive sulfides, IOCG, sediment-hosted, and others. This consensus extends to their associated alteration facies and the predominant ore minerals that are typically encountered in these deposit types (Sillitoe 2010). Tailored exploration tools have been developed, supporting a more optimized exploration and discovery process (Mudd and Jowitt 2018).

In contrast, the exploration approaches for critical minerals involving elements such as Ag, Co, Li, Mo, PGM, and REE vary depending on their status as by- or co-products or main elements. Many critical minerals do not form main-product mineral deposits and are instead associated with base and precious metals, which implies that they could potentially be recovered as by- or co-products of main-product mineral deposits. The geological process responsible for the main product deposit — magmatic, sedimentary, hydrothermal, or magmatic-hydrothermal — will establish the critical mineral content.

As an example, copper is an important source of several by-product critical minerals such as Co, Bi, Mo, Te, Re, Se, and As (Graedel et al. 2013; Nassar et al. 2015; McNulty and Jowitt 2021). However, not all copper deposits have the same concentration of critical elements. To illustrate, rhenium (Re) is almost entirely contained in porphyry-Cu-Mo deposits, while cobalt (Co) is contained in Cu-Co sedimentary deposits as a co-product or in IOCG deposits as a by-product. The limited knowledge regarding the geological processes of critical minerals, combined with their restricted geographic occurrences and joint-production characteristics, further contributes to the insufficient understanding of their geological processes. This, in turn, affects exploration targeting and therefore demands adjustments to mitigate the criticality of these minerals (McNulty and Jowitt 2021; Mudd et al. 2017; Yuheng and Yan 2020; Munk et al. 2016).

When it comes to major minerals, exploration criteria are typically based solely on the main element, regardless of the presence or absence of minor co- or by-products. As per national instruments and industry codes, any co- or by-product that contributes less than 1% of the operation’s value is not reported (Jowitt et al. 2013; Mudd et al. 2017; McNulty and Jowitt 2021). Consequently, reserves and resources of co- or by-products under this 1% threshold are mostly undetermined and do not significantly impact exploration budgets. Nevertheless, recent efforts have been made to refine the geological understanding of critical minerals within the supply chain of major minerals, such as the analysis of antimony (Sb), bismuth (Bi), selenium (Se), and tellurium (Te) in copper anode slimes (McNulty et al. 2022). Additionally, it has been suggested that critical minerals found as co- or by-products could have an impact on exploration budgets. However, mineral deposits should be reported based on their geological processes rather than solely focusing on their grades and tonnages (Jowitt et al. 2013). By-product or co-product nature is a condition for several minerals. For instance, indium (In) and cadmium (Cd) are known to substitute into sphalerite (Scoullos et al. 2001; Werner et al. 2015), while cobalt (Co) can be associated with arsenopyrite, pyrrhotite, pyrite, and pentlandite (Donaldson and Beyersmann 2005). Germanium (Ge) is recovered from sphalerite and coal (Frenzel et al. 2017), PGM are often elevated in pentlandite and pyrrhotite (Mansur et al. 2021), and REE can be associated with apatite (Deng et al. 2017; Palma et al. 2019).

A more thorough understanding of geological processes in major minerals has led to a more targeted approach in exploration efforts, in contrast to the exploration of critical minerals which still requires deeper understanding. This trend is illustrated in Fig. 1, which depicts exploration and production data from 2011 to 2020 for three major minerals (Au, Cu, and Ni) and three critical minerals (Co, Li, and REE). The graph’s horizontal axis represents the Herfindahl-Hirschman concentration index, a commonly used metric to quantify the lack of supply diversity in criticality assessments (Schrijvers et al. 2020) for exploration budgets spanning from 2011 to 2020. The vertical axis displays the same index for production data, based on data from the US Geological Survey (2021). As expected, critical minerals exhibit a lower level of diversity in exploration and production. However, they tend to indicate a higher degree of geographic concentration in production, relative to exploration in comparison to major minerals, which appear closer to the diagonal or even to the right of it. This observation is consistent with the notion that improved geological knowledge results in more focused exploration budgets centered around expected deposit locations for major minerals. However, this is not the case for critical minerals. Despite being more concentrated in terms of production data, this fact has not led to the consolidation of exploration targets worldwide.

For example, the exploration of REE presents a different approach compared to other critical minerals. The geochemical characteristics of REEs make them very dispersed and not usually found in economically exploitable ore deposits (Balaram 2019). Currently, world reserves of REE are concentrated in countries such as China, Brazil, Vietnam, Russia, and India, with China holding one-third of the world’s REE reserves (Fortier et al. 2018; Balaram 2019). However, the exploration of most REE is predominantly limited to specific geographical areas where substantial REE deposits, primarily associated with carbonatites or their altered equivalents, have been identified (Yuheng and Yan 2020). Recent research describing the formation of regolith-hosted REE deposits (Sanematsu and Watanabe 2016; Li et al. 2017) has opened up new possibilities for REE exploration. The improved comprehension of geological processes has yielded successful discoveries in high-potential regions within the Chilean Coastal Range (Bustos et al. 2022), highlighting the potential for new REE deposits in diverse geological settings.

In the case of lithium, deposits consist of three main types: (1) pegmatites, (2) continental brines, and (3) hydrothermally altered clays, with brine and pegmatites being the main sources of lithium, with lithium frequently occupying the role of the primary or a significant co-product (Kavanagh et al. 2018). Brine Li-hosted deposits are more than an order of magnitude larger (1.45 Mt Li) than the average pegmatite deposit (0.11 Mt Li). However, lithium brine deposits are geographically limited to approximately eight locations in six countries (Chile, Bolivia, Argentina, USA, Jordan, and China) (Munk et al. 2016), suggesting the presence of specific conditions for their formation. Therefore, exploration opportunities are geographically constrained. In contrast, pegmatitic lithium deposits have a wider geographic distribution and count for a lesser percentage of the world’s lithium reserves (Kesler et al. 2012; Hao et al. 2017). Besides, pegmatitic deposits demonstrate a higher capacity for adapting their production in response to market changes (Kesler et al. 2012).

In summary, the geological attributes of critical minerals highlight distinct exploration characteristics compared to major minerals due to (1) the co- or by-product nature of the elements, (2) limited knowledge of the geological processes influencing their deposits, and (3) the constrained geographical distribution of critical element deposits.

Exploration budgets for critical minerals

Major minerals, which include those containing Au, Cu, Ni, Pb, and Zn, account for approximately 90% of global exploration budgets. Figure 2 illustrates the allocation of exploration budgets across various world regions at each stage of exploration. Despite the difference in the total amount allocated between major and critical minerals, the percentage of resources distributed across regions is similar, as depicted in Fig. 2(a) and (b)Footnote 2. However, Europe has a higher share of exploration for critical minerals compared to major minerals, primarily obtained from the Asia-Pacific region. Additional basic descriptive statistics can be found in Table 1 and Table 2.

Average share of exploration budgets by region in the period 2010–2020. (a) Major minerals include those containing gold (Au), copper (Cu), nickel (Ni), lead (Pb) and zinc (Zn). Panel (b) Minor and critical minerals consider those containing silver (Ag), cobalt (Co), lithium (Li), molybdenum (Mo), PGM, and REE. Source: based on S&P Global (2021)

Table 1 displays the average exploration budgets (in 2020 US$ million) for three exploration stages from 2010 to 2020. Grassroots exploration refers to early-stage exploration where little previous geological information is known. Late-stage & Feasibility exploration includes activities to decrease uncertainty after a discovery has already been made. Lastly, minesite exploration involves actions to improve the knowledge of a deposit in an ongoing mining operation. On average, firms tend to allocate fewer resources to the exploration of critical minerals at each stage. The difference is more pronounced for minesite exploration, where there is a substantial difference of around 3.0 US$ million, in contrast to an approximate difference of 0.6 US$ million for early-stage exploration.

To provide a more detailed geographic analysis, we divided the world into six macro-regions: Europe, Africa, Latin America and the Caribbean (LAC), Asia-Pacific, the USA and Canada, and the Middle East. Table 2 presents the regional differences in exploration budgets for critical minerals. Consistent with the geological review, certain regions exhibit a greater emphasis on receiving or promoting exploration for critical minerals compared to major minerals at different stages. This is evident by the lower values observed in the “Diff in means” column for each exploration stage. Despite the overall higher investment in major minerals across most regions (excluding the Middle East where it is not significant), regions such as the USA and Canada, Asia-Pacific and Europe attract a comparatively greater average investment in critical and minor minerals, particularly during earlier stages of exploration. Nevertheless, it is important to note that this data should not be considered conclusive, as there are other factors that need to be taken into account. These additional factors will be discussed in detail in the subsequent subsection, which outlines the econometric approach developed for this analysis (Fig. 3).

Average share of exploration budgets by group of minerals in the period 2010–2020. Each label indicates the main element being targeted. Others include niobium (Nb), tin (Sn), and tantalum (Ta). Source: based on S&P Global (2021)

Figure 4 displays the average exploration budgets at different development stages over the past decade. On average, exploration budgets for major minerals containing Au, Cu, Ni, Pb, and Zn surpass those allocated to critical minerals, including Ag, Co, Li, Mo, PGM, and REE. This is evident from the positive difference between the solid and dashed lines. The gap between the two groups is larger in minesite exploration. However, there is no clear common trend among the regions, as the gap between the two groups fluctuates over time. For instance, in 2014, the disparity between major and critical minerals narrowed, indicating an increase in exploration budgets specifically allocated to critical minerals in comparison to major minerals.

Exploration budgets for major and critical minerals, 2010–2020. (a) Shows average grassroots exploration budgets. (b) Shows average late-stage feasibility exploration budgets. (C) Shows average minesite exploration budgets. All values are in 2020 US$. Source: based on S&P Global (2021)

Econometric analysis and results

In the previous sections, we have discussed the structural differences between minor and critical minerals compared to major minerals. In this section, we will present empirical evidence to describe how exploration behavior, as reflected in exploration budgets, differs between these two main groups of minerals.

Model specification

The primary empirical approach employed in this study involves a multivariate statistical analysis. Specifically, we analyze how exploration budgets differ between major and critical minerals, considering a range of explanatory variables that account for firms’ investment allocation decisions. This approach is consistent with previous works that have analyzed firm-level exploration budgets (Castillo and Roa 2021; Castillo 2021) and is based on variables that are known to affect mineral exploration budgets (Jara 2017; Vasquez Cordano and Priale Zevallos 2021). The regression model is presented in Equation (1), where ln (yit) indicates the log of exploration budgets of firm i at year t.

CM is a dummy variable that takes the value of 1 for minor and critical minerals and 0 otherwise. The model further incorporates the dynamic effect of prices, including up to two lags, which means that the effect that prices up to 2 years have on exploration budgets is captured by the coefficient β2. Price information came from different sources as indicated by Table 3. Tit indicates the company type (i.e., junior, major, or other), Sit represents the exploration stage of the target (i.e., grassroots, late stage and feasibility, or minesite). Mktit consists of the market size of each mineral being targeted each year t. Market size is determined by the product of the average price during year t and the quantity of the mineral produced that year. Lastly, Xit includes other controls, such as region, company type, and exploration stage fixed effects. Interaction terms indicated by coefficients β3, β4 and β5 enable us to compare how exploration budgets between critical and major minerals differ when it comes to prices, company size, and stage of development. The approach also incorporates regional geographical differences. It is worth noting that the exploration process is not solely driven by rational factors, and there are additional unobservable elements that can influence decision-making. Such factors as the ability to attract investors, effective marketing and storytelling about deposits may impact exploration decisions but are not captured in our research (Olofsson, 2020).

Econometric results

The key findings regarding exploration patterns for critical minerals are outlined in Table 3. The econometric analysis yields four significant findings.

First and foremost, the coefficient of the dummy variable CM validates our hypothesis that firms investing in critical minerals allocate a lower portion of their exploration budget compared to those focusing on major minerals. This finding holds true, even after controlling for regional, firm size, and exploration stage effects. The coefficient exhibits a negative and statistically significant value, indicating that exploration budgets for critical minerals are approximately 18–19% lower than those allocated for major minerals. This result remains robust even after incorporating additional controls for market size and country-level fixed effects (Table 4).

Secondly, as anticipated, exploration budgets are positively affected by commodity prices. This is evident from the positive and statistically significant coefficient of ln(Pt) in all three models. Furthermore, the interaction between CM and ln(Pt) is also positive and statistically significant, indicating that exploration budgets for critical minerals show a higher degree of responsiveness to commodity prices than those for major minerals. The magnitude of the effect is substantial, with critical minerals exhibiting almost 30 to 60% greater sensitivity to price fluctuations than major minerals.

Third, our findings show that small and large firms differ in their exploration budgets for critical minerals surpassing the expectations based solely on their class (e.g., junior or major companies). The interaction between CM and a dummy variable representing large firms (CM x Major = 1) shows a negative and statistically significant coefficient. This suggests that large firms allocate a relatively lower portion of their exploration budget to critical minerals compared to small firms. Specifically, major companies allocate on average 25–29% less in exploration budgets compared to junior firms. Similarly, other firms invest approximately 15–16% less than junior firms, on average.

Fourth, the interaction between CM and the exploration stage reveals that exploration for critical minerals is mostly focused on earlier stages. While the budget difference between grassroots and late-stage exploration is not statistically significant, the budget for minesite exploration is about 25–26% lower than for grassroots exploration. This suggests that exploration for critical minerals is riskier and more speculative than for major minerals, and that firms tend to invest in early exploration stages to reduce risk.

Discussion

Our analysis differs from prior studies that use firm-level exploration by specifically examining the investment behavior of exploration companies in critical minerals. This particular focus on critical minerals has not been explored extensively in previous research, making our study a novel contribution to the field (Jara 2017; Castillo 2021; Castillo and Roa 2021; Vasquez Cordano and Priale Zevallos 2021). Our findings provide an initial characterization of the exploration surrounding critical minerals and shed light on the distinct variations in exploration budgets between major and critical minerals.

Basic descriptive statistics provide valuable insights into the exploration of critical minerals. Firstly, exploration budgets for critical minerals, on average, are significantly lower compared to those allocated for major minerals at the same stage of exploration. These discrepancies suggest that companies dedicate fewer resources to the exploration of critical minerals despite comparable geological uncertainty that should entail similar costs than major minerals. The econometric analysis corroborates this finding by showing that this difference in investment cannot be attributed to factors such as company type, market size, geographical location, stage of development, or commodity prices. Exploration techniques, such as drilling, mapping, and geochemistry, are generally similar across commodities, and hence the differences in exploration budget allocation should not be statistically significant. However, larger markets as those of major minerals receive more exploration funds, as indicated by the positive coefficient of the market size variable. Moreover, if certain minerals hold strategic or critical significance for governments, it is reasonable to anticipate that firms would allocate greater resources to mitigate potential disruptions in the supply chain. This consideration is likely to result in variations in exploration budgets for different minerals. The divergence between private decisions and state requirements can be indicative of diverse priorities. However, the reduced investment in critical minerals can also be attributed to firms’ hesitancy to allocate resources in minerals that exhibit fluctuating market conditions. Another significant factor explaining the difference in average exploration budgets between critical and major minerals is that a large proportion of the former are found as co- or by-products of the latter. Therefore, exploration investment already made for major mineral exploration can be utilized to potentially target critical minerals when found as co- or by-products, resulting in a lower overall investment.

Secondly, significant regional disparities exist in the distribution of resources allocated for critical minerals. Certain regions exhibit a clear indication of specialization in critical minerals, with a disproportionate allocation of financial resources to high-income countries. Exploration budgets for critical minerals in earlier stages are higher in the USA, Asia-Pacific and Europe compared to major minerals, as indicated in Table 2. This increased investment can be attributed to Europe’s proactive public policies that incentivize critical mineral exploration within the EU. These policies aim to secure a long-term supply for national and strategically important EU industries, demonstrating Europe’s commitment to ensuring self-sufficiency in critical minerals. Examples of these policies include the European Green Deal, the Industry Strategy for Europe, the EU Regulation on the establishment of a framework to facilitate sustainable investment, the Horizon 2020 research and innovation funding program, and the EU recovery plan for Europe. The cumulative effect of these policies influences investment in critical mineral exploration, leading to higher investment within the continent.

In regions like the USA and Canada, where the disparity in exploration budgets for different mineral sets is smaller compared to other regions, it suggests a growing emphasis on a “national security” perspective in exploring critical minerals. The allocation of more budget within these regions specifically for critical minerals highlights the objective of reducing political vulnerability in their supply chain. However, grassroots and late-stage exploration in Africa and Latin America are currently experiencing a lag. The investment climate in these regions is comparatively less dynamic, leading governments to develop policies that seek higher control over critical minerals. This situation increases challenges faced by firms to fully realize the mineral potential of these regions. Consequently, the likelihood of supply disruptions increases, posing additional risks to the global supply chain.

Thirdly, the participation of junior companies in the exploration of critical minerals brings attention to unique aspects associated with uncertainty and vulnerability in the development of future deposits. On the one hand, it underscores the higher level of uncertainty in geological information of critical minerals required to generate reliable exploration targets compared to major minerals and their relative lack of geological maturity. Major companies tend to invest in and develop lower-risk exploration targets with if compared to junior companies (Dougherty 2013). Therefore, if society allocates more resources through junior companies, exploring critical minerals is perceived as riskier than regular exploration, even after considering other important variables. Moreover, a higher reliance on junior companies creates higher variability in the allocation of funds to perform exploration activities. It is widely recognized that major companies have sufficient internal funds to support exploration activities, reducing their reliance on capital markets (Eggert 1987). The increased dependence of junior companies on capital markets can result in fluctuations in their ability to finance exploration projects.

Additionally, results of minesite exploration for critical minerals depict that exploration is not directed towards expanding current mines, which contrasts the trend observed in major minerals. Minesite exploration primarily involves large companies operating mines, and a lower comparative value indicates a lower level of maturity in attracting financially stable partners. This lower maturity poses challenges in the development of critical minerals, resulting in a higher reliance on junior companies and making it more challenging to establish a resilient supply chain.

Fourth, the impact of prices on exploration budgets differs between major minerals and critical minerals. Mineral economists often rely on prices to provide incentives to guide actions against scarcity and depletion (Tilton et al. 2018). In the context of exploration, a well-functioning market would indicate that long-term availability will be represented by changes in commodity prices, and firms would increase their effort to explore and discover deposits as prices rise. Our results show that exploration for critical minerals is more responsive to prices than exploration for major minerals. This finding raises questions about the direction of the effect, whether it should be positive or negative. Initially, it could be expected the effect to be no different than zero, as minerals are typically influenced by price incentive. However, due to the by-product nature of most critical minerals, there is an expectation of a negative relationship, as their exploration decisions are influenced not only by their own prices but also by the main product (Redlinger and Eggert 2016). Nevertheless, our result points out in the opposing direction. Two potential reasons may explain this. Firstly, several countries and consuming companies have implemented policies to develop and attract investment towards critical minerals, which shapes the behavior of mining companies, leading towards a heightened sensitivity to prices during the analyzed period. For example, concerns on the reliability of the supply chain prompt the mobilization of public funds to stimulate activity on critical minerals beyond sole market decisions; hence, exploration companies appear to be more responsive to prices for critical minerals compared to major minerals, owing to this underlying mechanism. Secondly, it is plausible that the markets for critical minerals undergo exponential growth during the period of analysis, leading to budget decisions that are based on speculative assessments of market development rather than a consistent approach to the potential long-term returns from discoveries.

The analysis presented above provides valuable insights, but it is important to note its limitations. To exemplify, considering geological variables and applying country fixed effects only partially addresses the potential variations in domestic politics that can evolve over time. To mitigate this, future research could incorporate a comprehensive set of national-level time fixed effects variables, even though it may potentially compromise statistical significance. Furthermore, investigating countries within specific regions sharing similar geological processes may shed light on the influence of the political environment on critical minerals exploration.

Another limitation of the analysis is the time period covered by the available data. Since data for critical minerals is not available before 2010, it is difficult to determine whether the observed changes in exploration budgets are part of a longer trend or a period of adjustment. To better understand these trends, a longer window of analysis may be necessary.

Lastly, any multivariate statistical analysis involves uncertainty about the causal effect of different variables on the outcome of interest. Although prices can be roughly considered as exogenous factors influencing company decisions, bias may arise if similar firms exhibit different behaviors based on their investment choices. Nevertheless, with the increasing availability of information on exploration techniques, we expect a convergence among exploration firms in their capacity to undertake exploration activities for critical minerals.

Conclusions

Mineral exploration plays a crucial role in establishing a sustainable and reliable supply chain of minerals for the energy transition. The scarcity of minerals cannot be accurately assessed without a proper understanding of undiscovered deposits. This is particularly essential for critical minerals, as their exploration strategies and geological understanding diverge from those employed for major minerals. Our study highlights significant differences in exploration budgets between critical and major minerals, particularly in terms of their response to market and geographical variables. These disparities could result in long-term vulnerabilities in critical mineral supply chains, potentially affecting the energy transition.

Our findings reveal that exploration companies allocate 18–19% less investment in critical minerals compared to major minerals, even when considering various explanatory factors. Furthermore, regional disparities show a disproportionate allocation of higher financial resources to high-income countries. While both major and critical minerals respond positively to commodity prices, the responsiveness of critical mineral exploration is about 30 to 60% more sensitive than major minerals. These initial results are expected to stimulate further research on the underlying reasons for these differences, potentially paving the way for broader policy considerations regarding critical minerals. This goes beyond the scope of substitution, extraction technologies, and international trade. For example, initiatives aimed at better understanding the geologic and geochemical processes related to critical minerals can play a pivotal role in optimizing the allocation of exploration budgets and mitigating long-term supply risks.

Notes

Uranium has not been included in the analysis due to its relative differences in the decision-making associated with military and government actions and the lack of price transparency and benchmarks.

References

Ali SH, Giurco D, Arndt N, Nickless E, Brown G, Demetriades A, Durrheim R, Enriquez MA, Kinnaird J, Littleboy A, Meinert LD, Oberhänsli R, Salem J, Schodde R, Schneider G, Vidal O, Yakovleva N (2017) Mineral supply for sustainable development requires resource governance. Nat 543(7645):367–372

Balaram V (2019) Rare earth elements: a review of applications, occurrence, exploration, analysis, recycling, and environmental impact. Geosci Front 10(4):1285–1303

Black M (2018) The global interior: mineral frontiers and American power. Harvard University Press), Cambridge

Bustos N, Marquardt C, Belmar A, Cordeiro P (2022) Regolith-hosted rare earth exploration in the Chilean coastal range of the Central Andes. J Geochem Explor 234:106934

Castillo E (2021) The impacts of profit-based royalties on early-stage mineral exploration. Res Policy 73:102231

Castillo E, Eggert R (2020) Reconciling diverging views on mineral depletion: a modified cumulative availability curve applied to copper resources. Resour Conserv Recycl 161:104896

Castillo E, Roa C (2021) Defining geological maturity: the effect of discoveries on early-stage mineral exploration. Res Policy 74:102378

Deng M, Xu C, Song W, Tang H, Liu Y, Zhang Q, Zhou Y, Feng M, Wei C (2017) REE mineralization in the Bayan Obo deposit, China: evidence from mineral paragenesis. Ore Geol Rev 91:100–109

Donaldson J, Beyersmann D (2005) Cobalt and cobalt compounds. In: Ullmann’s Encyclopedia of Industrial Chemistry, pp 433–435

Dougherty M (2013) The global gold mining industry: materiality, rent-seeking, junior firms and Canadian corporate citizenship. Compet Chang 17(4):339–354. https://doi.org/10.1179/1024529413Z.00000000042

Eggert R (1987) Metallic mineral exploration: an economic analysis. RFF Press

Eggert R (2023) Public policy toward critical materials: a false dichotomy, a messy middle ground, and seven guiding principles. In: Critical Minerals, the Climate Crisis and the Tech Imperium. Springer Nature Switzerland, Cham, pp 71–80. https://doi.org/10.1007/978-3-031-25577-9_4

European Commission (2020) Study on the EU’s list of critical raw materials. Technical report, European Commission

Fortier SM, Thomas CL, McCullough EA, Tolcin AC (2018) Global trends in mineral commodities for advanced technologies. Nat Resour Res 27(2):191–200

Frenzel M, Mikolajczak C, Reuter MA, Gutzmer J (2017) Quantifying the relative availability of high-tech by-product metals – the cases of gallium, germanium and indium. Res Policy 52:327–335

González-Álvarez I, Stoppa F, Yang XY, Porwal A (2021) Introduction to the special issue, insights on carbonatites and their mineral exploration approach: a challenge towards resourcing critical metals. Ore Geol Rev 133:104073

Graedel TE, Gunn G, Tercero Espinoza L (2013) Metal resources, use and criticality. In: Critical metals handbook. Wiley, pp 1–19

Graedel TE, Harper EM, Nassar NT, Nuss P, Reck BK (2015) Criticality of metals and metalloids. Proc Natl Acad Sci 112(14):4257–4262

Hao H, Liu Z, Zhao F, Geng Y, Sarkis J (2017) Material flow analysis of lithium in China. Res Policy 51(December 2016):100–106

Henckens M, Driessen P, Worrell E (2014) Metal scarcity and sustainability, analyzing the necessity to reduce the extraction of scarce metals. Resour Conserv Recycl 93:1–8

Henckens M, van Ierland E, Driessen P, Worrell E (2016) Mineral resources: geological scarcity, market price trends, and future generations. Res Policy 49:102–111

Henckens T (2021) Scarce mineral resources: extraction, consumption and limits of sustainability. Resour Conserv Recycl 169:105511

Hu R, Wen H, Ye L, Chen WT, Xia Y, Fan H, Huang Y, Zhu J, Fu S (2020) Metallogeny of critical metals in the southwestern Yangtze block. Chin Sci Bull 65(33):3700–3714

Jara JJ (2017) Determinants of country competitiveness in attracting mining investments: an empirical analysis. Res Policy 52:65–71

Jara JJ, Lagos G, Tilton JE (2008) Using exploration expenditures to assess the climate for mineral investment. Res Policy 33(4):179–187

Jordan B (2018) Economics literature on joint production of minerals: a survey. Res Policy 55:20–28

Jowitt SM, Mudd GM, Weng Z (2013) Hidden mineral deposits in Cu-dominated porphyry-skarn systems: how resource reporting can occlude important mineralization types within mining camps. Econ Geol 108(5):1185–1193

Kavanagh L, Keohane J, Garcia Cabellos G, Lloyd A, Cleary J (2018) Global lithium sources—industrial use and future in the electric vehicle industry: a review. Resour 7, 57(3)

Kesler SE, Gruber PW, Medina PA, Keoleian GA, Everson MP, Wallington TJ (2012) Global lithium resources: relative importance of pegmatite, brine and other deposits. Ore Geol Rev 48:55–69

Li YHM, Zhao WW, Zhou MF (2017) Nature of parent rocks, mineralization styles and ore genesis of regolith-hosted REE deposits in South China: an integrated genetic model. J Asian Earth Sci 148:65–95

Mansur ET, Barnes SJ, Duran CJ (2021) An overview of chalcophile element contents of pyrrhotite, pentlandite, chalcopyrite, and pyrite from magmatic Ni-Cu-PGE sulfide deposits. Miner Depos 56(1):179–204

McNulty BA, Jowitt SM (2021) Barriers to and uncertainties in understanding and quantifying global critical mineral and element supply. iScience 24(7):102809

McNulty BA, Jowitt SM, Belousov I (2022) The importance of geology in assessing by- and coproduct metal supply potential; a case study of antimony, bismuth, selenium, and tellurium within the copper production stream. Econ Geol 117(6):1367–1385

Michaux SP (2021) The mining of minerals and the limits to growth. Technical report, Geological Survey of Finland

Mudd GM (2021) Assessing the availability of global metals and minerals for the sustainable century: from aluminium to zirconium. Sustain 13(19):10855

Mudd GM, Jowitt SM (2018) Growing global copper resources, reserves and production: discovery is not the only control on supply. Econ Geol 113(6):1235–1267

Mudd GM, Jowitt SM, Werner TT (2017) The world’s by-product and critical metal resources part I: uncertainties, current reporting practices, implications and grounds for optimism. Ore Geol Rev 86:924–938

Munk LA, Hynek SA, Bradley DC, Boutt D, Labay K, Jochens H (2016) Lithium brines: a global perspective. In: Rare earth and critical elements in ore deposits

Nassar NT, Graedel TE, Harper EM (2015) By-product metals are technologically essential but have problematic supply. Sci Adv 1(3):e1400180

Palma G, Barra F, Reich M, Valencia V, Simon AC, Vervoort J, Leisen M, Romero R (2019) Magmatic and hydrothermal stages … ScienceDirect Halogens, trace element concentrations, and Sr-Nd isotopes in apatite from iron oxide-apatite ( IOA ) deposits in the Chilean iron belt : evidence for magmatic and hydrothermal stages of mineralization. Geochim Cosmochim Acta 246:515–540

Redlinger M, Eggert R (2016) Volatility of by-product metal and mineral prices. Res Policy 47:69–77

S&P Global (2021) Exploration budgets. Data retrieved from Corporate Exploration Strategies

Sanematsu K, Watanabe Y (2016) Characteristics and Genesis of Ion Adsorption-Type Rare Earth Element Deposits. In: Rare Earth and Critical Elements in Ore Deposits

Schrijvers D, Hool A, Blengini GA, Chen W-Q, Dewulf J, Eggert R, van Ellen L, Gauss R, Goddin J, Habib K, Hagelüken C, Hirohata A, Hofmann-Amtenbrink M, Kosmol J, Le Gleuher M, Grohol M, Ku A, Lee M-H, Liu G et al (2020) A review of methods and data to determine raw material criticality. Resour Conserv Recycl 155:104617

Schulz KJ, DeYoung JH Jr, Seal RR, Bradley DC (2017) Critical mineral resources of the United States—economic and environmental geology and prospects for future supply. Technical report, U.S, Geological Survey

Scoullos M, Vonkeman G, Thornton I, Makuch Z (2001) Mercury - cadmium - lead: handbook for sustainable heavy metals policy and regulation. Springer Science & Business Media, Berlin, Heidelberg

Segura-Salazar J, Tavares LM (2018) Sustainability in the minerals industry: seeking a consensus on its meaning. Sustain 10(5):1429

Sillitoe RH (2010) Porphyry copper systems. Econ Geol 105(1):3–41

Skinner BJ (1976) A second iron age ahead? Am Sci 64:258–269

Tilton JE (2003) Assessing the threat of mineral depletion. Miner Energy Raw Mater Rep 18(1):33–42

Tilton JE, Crowson PC, DeYoung JH, Eggert RG, Ericsson M, Guzman JI, Humphreys D, Lagos G, Maxwell P, Radetzki M, Singer DA, Wellmer F-W (2018) Public policy and future mineral supplies. Res Policy 57:55–60

U.S. Geological Survey (2021) Minerals yearbook. In: Technical report gold, cobalt, copper, lithium, nickel and rare earths. U.S. Department of the Interior

U.S. Geological Survey (2022) 2022 Final list of critical minerals. Technical report, U.S, Department of the Interior

Vasquez Cordano AL, Prialé Zevallos R (2021) Country competitiveness and investment allocation in the mining industry: a survey of the literature and new empirical evidence. Res Policy 73:102136

Werner TT, Mudd GM, Jowitt SM (2015) Indium: key issues in assessing mineral resources and long-term supply from recycling. Appl Earth Sci: Trans Inst Min Metall 124(4):213–226

World Bank (2017) The growing role of minerals and metals for a low carbon future. Technical Report

Yuheng J, Yan L (2020) Factors controlling the generation and diversity of giant carbonatite-related rare earth element deposits: insights from the Mianning–Dechang belt. Ore Geol Rev 121:103472

Acknowledgements

The authors thank the Chilean Copper Commission for providing the data supporting the analysis and two anonymous reviewers for their comments and observations. EC recognizes the support of VID-UCH to the project UI- 011/22. We also thank the attendants of the Critical Mineral stream at the 26th World Mining Congress in Brisbane, Australia. This research was part of the Cooperation Agreement between the Chilean Copper Commission and the University of Chile. All errors are our own.

Funding

Facultad de Ciencias Físicas y Matemáticas, Grant number VID-UCH UI- 011/22

Author information

Authors and Affiliations

Contributions

EC and IR contributed to the study conception and design. IR provided technical background. Material preparation, data collection and analysis were performed by CR and EC. The first draft of the manuscript was written by EC and IR and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Castillo, E., del Real, I. & Roa, C. Critical minerals versus major minerals: a comparative study of exploration budgets. Miner Econ (2023). https://doi.org/10.1007/s13563-023-00388-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13563-023-00388-w