Abstract

Price uncertainty is one of the major uncertainties in the life of mine (LOM) planning process which can have a decisive effect on the overall profitability. Today’s mine planning software tools provide block-sequencing optimisation for a given static price assumption that is then used as a basis of managerial decision-making process. This paper proposes a complementary approach to this by introducing a simulation-based decision-making tool that, with the help of simulation, seeks for the optimal mine plan when a managerially estimated price development with minimum and maximum boundaries is used as a data input for the given period. To demonstrate the approach, a realistic gold mine case study is presented with five alternative and technically feasible mine plans calculated in a static optimiser from a commercial mine planning software package. These mine planning scenarios are then subjected to price uncertainty in simulation with and without a price trend assumption to highlight the effect of price on the mine’s expected performance. Based on the results, we derive and demonstrate a simulation-based system that automates the matching of optimal mine plan with the managerial insight of long-term price development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Metal mining investments are long-term, irreversible investments with high costs of development. The economic feasibility of these investments is largely dependent on the metal prices (see discussion, e.g. Humphreys 2010). In this paper, we propose a simulation-based decision-making system which considers the long-term price uncertainty while selecting the initial mine plan. This method addresses the gap identified by, e.g. Martinez 2010 that most of the current valuation methods and mine planning optimisation techniques are not integrated in the investment decision-making process.

We focus the quantitative investment analysis where, according to the surveys of the mining industry, valuation methods revolve around discounted cash flow (DCF) metrics such as net present value (NPV), internal rate of return and payback period (see Bhappu and Guzman 1995; Moyen et al. 1996). Even though a vast scientific literature on more advanced valuation methodology, reviewed, e.g. by Savolainen (2016), has been published since the publication of the above-mentioned papers, it seems that the DCF-based screening analysis remains the de facto threshold that any project should pass before any further detail analysis (Humphreys 1996a; Smith 2002). The key issue with the resulting numbers of the DCF- analysis is that they are static in a sense that they take one price vector as an input of calculation that should represent the expected average of all the possible price scenarios and this averaged price vector is never realized in the volatile metal markets. Supplementing the analysis with alternative price scenarios or random simulation provides additional managerial insights but are practically inhibited by the inability to alter the mine plan as well to match the selected scenario. Automating this matching process between the optimal mine plan for the managerially estimated market price development is in the core of this paper.

Strategic and long-term production planning have significant impacts on valuation and profitability of mining operations. The pit optimisation process is constrained with geometrical criteria such as slope/s, access, and smallest mining unit (SMU), plus economical parameters such as metal price, capital and operational costs, foreign exchange rate and discount rate. Another important concept related to mine planning is the cut-off grade (COG), which in mine planning means the minimum metal content of the block that is considered as ore. The blocks with a grade below this threshold are considered as waste. Today, the process of mine planning is done using dedicated software tools, which gives a set of alternative block sequences, with the different COGs using the above-mentioned metal price assumption from which the rational investor can choose the one that maximizes the overall cash flow (CF). In other words, if the price assumption would change, then also the optimal sequence within the given set of block sequences could change. In an operational level, mining companies do implement short to medium term optimisation by changing the implemented block sequence as the price fluctuates. However, the major decisions are often made in the start of the mining operations as the order of block extraction is irreversible. In other words, the mine planning selection problem is path-dependent which means that past decisions have an effect on today’s possibilities and the range of possible future actions.

According to Espí and De La Torre (2013), there are two major ways to estimate future price development in projects: using either long-term price average price or aggregated expert estimate available from consultant reports or in-house experts. As discussed by Smith 2002, in a single scenario approach, there is an evident incentive for the project proponents to bias price (or any other input variable) forecasts in a direction of a positive investment decision. A supporting evidence consisting of 250 feasibility studies of mining investments, provided by Espí and De La Torre 2013, show that the most conservative price estimates were observed to be used in the projects with the highest margins in large companies operating in low-risk countries. These existing works indicate that this process of setting the price is not isolated from organizational politics which further motivates our effort of using managerial price estimates side-by-side with the statistical simulation in this paper.

In the investment literature, a commonly used technique to estimate future metal prices is the use of stochastic differential equations (SDEs) and especially its simplest form: geometric Brownian motion (GBM). The main criticism regarding modelling of the metals market concerns GBM’s property of attaining unrealistically high values in the long run in many of the scenarios simulated.

In this paper, we take the existing capabilities of block sequencing software and combine it with the statistical modelling of metal prices to build a managerial decision-making system for mine plan selection. To motivate and highlight the need of such system, an illustrative gold mine case example is used. This case example is dealt with using in two phases; first a set of alternative mine plans is derived from the mine planning software, and second the expected range economic returns for each mine plan are modelled Monte Carlo random simulation (MCS) using different statistical price SDE models. We are not only interested in the initial price assumption, as is the usual case, but also the effects of price volatility and trend. We show that including volatility and drift into the analysis give additional considerations of risks and robustness into mine plan selection which is often seen as a simple economic value maximization exercise in the managerial setting. Finally, the structure of the managerial decision-making system is presented which automates the uncertainty simulation process to match the optimal mine plan with the managerially estimated price.

This rest of the paper is structured as follows. The next section contains a literature study on the strategic mine planning and investment decision-making. The “Methods and materials” section provides a methodology and case study descriptions. The “Results on project valuation” section reports simulation results which we use to demonstrate the mine plan decision-making system introduced in the “Simulation-based recommendation system for mine production scenario selection” section. The paper closes with conclusions and discussion.

Literature study

The possibility to alter the sequence and timing of ore extraction is already a widely studied real option (RO) problem in the metal mining-related literature (see, e.g. Newman, Rubio, Caro, Weintraub, & Eurek, 2010; Savolainen, 2016, for reviews). In mining, the RO framework deals with the uncertainties and flexibilities of operations, which can both add (economic) value and decrease risks; see, e.g. Davis, 1996; 1998; Dimitrakopoulos & Abdel Sabour, 2007.

The ability to forecast future market is a topic of constant interest both for the practitioners and academia addressed by, e.g. Evatt et al. (2012); M A Haque et al. (2014a, b); Shafiee, Topal and Nehring (2009); and Thompson and Barr (2014). An ex-post study of Auger and Guzmán (2010) on 51 realized copper mine investments show that less than a half of them were optimally timed/sized considering the observed price development. In the academic investment literature setting, the price of metals is usually assumed as a random variable that can be modelled with stochastic differential equations (SDEs)—and most commonly the random walk process also known as the geometric Brownian motion (GBM). In reality, the price of metal will likely correlate with the average cost of production when looking at very long time series (see, e.g. De Lamare Bastian-Pinto, Brandao, Rafael, & De Magalhaes Ozorio, 2013; McDonald & Siegel, 1985; Slade, 2001; J. E. Smith & McCardle, 1999). Furthermore, there is an existing, statistical evidence (see discussion in Roberts, 2009; Rossen, 2015; Watkins & McAleer, 2004) that the metal prices do not follow a random walk, but the market movements correlate with macroeconomics and other responses of the overall market. Another points related to price volatility, discussed in Dixit (2004), are the changes in overall production capacities when old facilities close and new ones open depending on the current prices. In this vein, more advanced SDE-models—such as mean reversion (MR)—which inhibit prices to rocket or plummet way above/below long-term average production costs are often preferred in academic, but practically oriented, studies (see discussion, e.g. in Savolainen, 2016). These insights support the idea of using managerial insights, when making the future price predictions accounting industry dynamics. According to Bunn and Wright (1991), in these type of situations with no implicit information on the future, managerially estimated models might perform relatively accurate.

According to Monkhouse and Yeates (2007), existing industry practices do not take into account the price uncertainty in the mine planning, and therefore, mine plans will change if the geological and price uncertainties are considered. Grobler et al. (2011) considered an optimum mining strategy under price uncertainties. They found that, on the contrary to the general perception, maximizing capacity is a financially viable option only up to a certain point after which further capacity increase becomes too costly or risky. From the practitioners’ point of view, one of the key methods to deal with the (negative) effects of metal price is by mine planning including production phase design and detailed block sequencing (see, e.g. Asad & Dimitrakopoulos, 2012). Haque et al. (2014a, b) constructed a numerical simulation for a hypothetical gold mine using real option valuation (ROV) under metal price uncertainty. They ran the model with 15 years of price data concluding that project value could be higher when the price volatility is either below or at average.

Abdel Sabour and Dimitrakopoluos (2011) rank alternative mine designs using NPV/ROV-based rank indicators using Monte Carlo simulation (MCS)–based approach. They assume that the ability to revise pit limits is the source of real option value. Abdel Sabour (2002) provide an analytical solution to estimate the optimal mine production scale indicating that the high production rates should be preferred when the price is high. Also, it is concluded that the optimum production scale is inversely related to the expected trend in mineral price. Asad and Dimitrakopoulos (2012) study the phase design of an open pit using uncertain, price- and cost-dependent, values in the block-sequencing design. In their study, the design algorithm leads to a substantially increased pit size (~ 40%) compared to a conventional optimisation.

Defining an optimal cut-off grade is addressed by several authors, e.g. Asad and Dimitrakopoulos (2013) and Azimi, Osanloo and Esfahanipour (2013). Thompson and Barr (2014) suggest that, when using stochastic prices, the resulting cut-off grades are lower than those of attained from the static price-based analyses. They continue that high cut-off grades should be preferred if a decrease of metal price is anticipated. The actual realization of the ore grades is a major uncertainty in metal mining projects, which can be reduced by additional exploration investments. Dowd (2003) provides a detailed discussion on the ore grade uncertainty in metal mining projects highlighting that the grade and tonnage are functions of location, where the access to specific blocks is allowed only at specific points of time. Elkington and Gould (2011) applied a RO valuation framework to test the notions of operational flexibilities such as varying cut-off grade with and without stockpiling and their impacts on optimisation of the mining projects strategies, such as the size of processing plant and profitability of projects.

In this paper, we assume that the cut-off grade in the investment analysis is fixed for the alternative mine plans studied. This excludes operational cut-off grade optimization which is another topic of study from the problem setting that might be of importance during the actual operation as realized price data are available together with the technical details of the mine. Despite the promising academic results of RO in the context of mining, the simple, management-friendly NPV calculation is still the preferred tool when a company wants to make a reality check on a project’s profitability (see discussion, e.g. Humphreys, 1996a, 1996b). Cortazar et al. (2001) developed a RO model to evaluate exploration investment concluding that a large portion of a project’s value depends on the development and operational real options available to project managers. Moyen et al. (1996) noted that practically relevant RO applications in mining concern mostly the high-cost mines that operate close to their break-even profitability, whereas methods without RO flexibility may be good enough for the project with large economic margins.

Methods and materials

Metal price modelling based on historical data

In the global markets, metals are exchanged constantly, and a solid datasets of past prices have been accumulated allowing an ex-post statistical analysis that may (or may not) be used as a vague indicator for the future. For the purposes of this research, monthly gold price data (uninflated) were acquired from IndexMundi (2019). Assuming that the uncertainty of price is of parametric type (see discussion, e.g. in Langlois, 1984), we can say that the historical data serves as a basis to forecast the future. Hence, price mean value, \(\overline{p }\)(Eq. 1), and annualized volatility, σp (Eq. 2), were fitted on the historical monthly price data as:

where pi represents the individual monthly observations. The estimated drift rate, i.e. trend, dp was calculated by fitting a first-order polynomial (= straight line) with the least-squares minimization (LSM) for the selected range of price data. The resulting equation is of form of a straight line:

where y is the linear trend or function of x which is the variable of time and kp indicates the rate of change per unit of time (month in here) and finally b is the initial value for the trend. We convert the monthly value into yearly change by multiplying it with 12 months (per year) and dividing with the average price of the timeframe in question:

We note that the above provided equations are simplifications of reality: looking back into historical price data does not tell whether the observed trend is produced by the random movements in the markets and, if not, does the trend-creating market drivers continue to exist in the future. In our opinion, assuming the existence of trends or not may be justified by starting from different views on market mechanics; therefore, both options are adopted in this paper without a further philosophical discussion beyond this point. The results of above-described fitting of prices are illustrated in Fig. 1 (see Appendix for numerical values). We can see that, in the short to medium term, the volatility and drift rate are highly dependent on the selected timeframe.

Left: Nominal gold price from February 1999 to February 2019 from IndexMundi (2019) (US $) with two illustrative linear trends (1st-order polynomial fitting using LSM). Right: Fitted gold price parameters as a function month used in the analysis

Optimal mine plan selection with simulation

Net present value (NPV) estimates the value of future cash flows based in today’s money: the more distant the cash flows are, the more uncertain they are which is considered by a discount factor. The NPV can be written as:

where Rt is the revenue in month t (dependent on price, p), Ct is the cost including taxes for month t, dft is the discount factor in month t and I0 is the initial investment at t = 0. A simple NPV model was constructed in MATLAB in order to operate with price vectors easily. The model takes the price vector as an input allowing to flexibly run Monte Carlo random simulation (MCS). In our study, we run the MCS for each scenario using a set of 1000 price realizations for each price parametrisation. This approach also allows a performance comparison of each of the alternative mine scenarios for each of the given vectors: here, we simply give a ranking numbers 1–5 to indicate the relative highest NPV among scenarios (see Fig. 2).

The price parameters are derived from historical data and used to simulate possible future price scenarios, which are tested in a random simulation for five alternative mine plans. The process can be summarized as follows:

-

1.

Creating “n” alternative and technically feasible mine scenarios using mine planning software, based on the same pit designs but with different mill throughputs, and processing plant scales and capital expenditures are also varied.

-

2.

Running a sensitivity analysis of price uncertainty for each of the scenarios in the NPV simulation to evaluate the relative goodness of the alternative scenarios. The following price parameters are varied in the sensitivity analysis: starting price, volatility and annual return

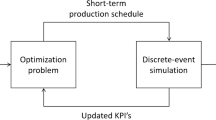

Once we have shown how the relative ranking of mine planning scenarios is dependent on the price uncertainty, we propose a conceptual information system that automatically takes a managerially estimated price vector (with uncertainty range included) and matches it with the best fitting mine plan.

Ideally, a randomized price trend analysis described above using the NPV calculation should be conducted on the available mine planning scenarios before deciding the operation’s scope and design that is to a large amount fixed after the decision. To enable this type of analysis, we propose the following, simulation-based methodology:

-

1.

Input managerial price estimate to the simulation system with three values: best estimate, low limit and high limit.

-

2.

Calculate volatility parameter of the price based on the best estimate (Eq. 3).

-

3.

Run random price simulation in a loop while screening out the scenarios that go above or below the given limits at any point of time in the simulated timeframe. Repeat until a desired amount of random price realizations (e.g. 1000) within the given limits is reached.

-

4.

Use the set of random price realizations attained in (3) to run MCS for the NPV-calculation.

-

5.

Recommend extraction sequence based on the relative ranking of plans.

Case description

An open pit gold mine is considered in this paper. A 3D geological block model is used (see Fig. 3), with a maximum block model size of 15 m (width) * 15 m (length) * 10 m (height). The inputs are based on common industry assumptions and best industrial practices for open pit design are applied. The overall slope angle of the pit is assumed to be 45°. The price of gold assumed at AU $ 1600 with the foreign exchange rate of AU $1.00 = US $ 0.75 and a discount rate of 5% applied in the NPV calculation.

Ultimate pit limits

In the first phase, the block model is used to generate the ultimate pit shell and subsequently the production schedules based on varying criteria. General mine planning (GMP) software is used to arrive at the ultimate pit and nested shells, as well as for production scheduling with different scenarios. The pit optimisation is run using Deswik Pit Optimisation Tool (pseudoflow algorithm) commodity price and generated positive value (revenue – costs) for each nested shell. Screenshots of the pit optimisation outputs are visible in Fig. 3.

The output of the process is a series of nested shells with varying revenue factors for the static metal price (1600 AU $/oz equivalent to 1143 US $/oz) used in process. The software applies a constant multiplier or a constant step to a defined range of revenue factors (RF), for example, between RF = 0.5 and RF = 1.5 with a defined step (for example, 0.1, introduced by user); 11 nested shells from RV = 0.5, 0.6 to 1.5 are expected. If there is no positive CF returned for a RF, then no shell is constructed for that specific price point. The different revenue factors are in fact a direct indication of varying the price of commodity at the time of exercise and the impact on the optimisation process. Hence, a lower revenue factors shells are less sensitive to the initial price assumption, while the higher RF shells are more sensitive. The mine planner decides which of the generated pit shells is selected as the ultimate pit. In practice, the ultimate pit shell is generally close to the revenue factor (RF) 1 shell which represents the exact predicted commodity price at the time of the exercise (i.e. 1600 AU $/oz equivalent to 1143 US $/oz with no factorisations), although this is a point for further discussion beyond this paper. In this example, we also follow this convention and select the pit shell RF = 1 as the ultimate pit shell since it produces the highest undiscounted revenue. For the purposes of production scheduling, two smaller pit shells with the RF = 0.5 and RF = 0.6 pit shells are selected as the “starter pit” (stage1/pit1) and next cut-back (stage2/pit2).

In real life mining, the selected shell(s) in conjunction with the geological block model are used to design an open pit mine and its infrastructures with respect to a series of known constraints. Then, the mining blocks for pit and cut-backs are created and used as inputs for the scheduling software. In this project, the selected shells have been used to generate the mining blocks.

Mine production schedule

Production scheduling for this project is done using Hexagon’s “MinePlan Scheduling Optimiser” (MPSO). MPSO uses mixed integer linear optimiser engines (i.e., CPLEX or LINDO) to maximise the schedule’s NPV for a series of given physical and non-physical constraints such as production targets, economics and practical precedencies. The basic inputs include mining blocks or panels with quantities (i.e. volume, tonnes, etc.) and qualities (density, grade, etc.) which are incorporated or calculated based on the geological block model data which also used in the pit optimisation process. Key assumptions for mine production scheduling include the gold price, tax and discount rate, initial capital investments and sustain expenditure, average mining and processing cost and annual targets. For the purpose of this research, a total of five different mine planning scenarios are generated and tabulated in Table 1. A total of 561 million tonnes (Mt) of material is mined in all scenarios during the LOM with an average Au grade of 2.64 g/t. Assumptions of 90% metallurgical recovery from processing plant, 30% tax rate and 5% discount rate have been used for all cases.

The results in Table 1 show operational physicals and expenditure (OPEX) as an average per year for the life of the mine for each scenario. Sustaining capital expenditure (CAPEX) accounts for the life of the mine; however, it is spent in different sums in different years for each scenario. The NPV is calculated based on fixed price of 1600 AU $/oz and 5% discount rate.

Results on project valuation

Fixed price assumption

The first simulation is the “industry standard”, where the feasibility of scenarios is evaluated against long-term mean price only (see discussion, e.g. Moyen et al., 1996). In other words, we are not considering the expected volatility and drift. Experiences of Espí and De La Torre (2013) suggest that periods of 3, 5 or 10 years are commonly applied when the companies sketch out their NPV calculations. We extend our price range to cover the full range of 1–240 months data and then the NPV for each mine planning scenarios calculated at each point. The results are plotted in Fig. 4 left, and a sensitivity analysis against the price assumption is shown on the right-hand side. These figures depict the case as a clear and predictable decision that one should proceed with the largest 8.0 Mt/a mine plan to arrive at the maximum NPV.

NPVs of different mine plans using flat, long-term mean price assumption without uncertainty. Left: Project value (M $ AU; dotted lines) as a function of data length (months) taken into account when calculating the historical average price (US $/oz; dashed line). Right: Sensitivity analysis of the observed mean price range (from 1235 to 1895 US $/oz)

Uncertain price assumption

As for the initial analysis with price uncertainty, we assume that there are no trends in the price data (drift = 0%/year), which allows us to depict gold price development using only the starting price and volatility parameters. In the context of real option analysis, we are interested in the statistical outcome. Therefore, for each of the five mine plans, we simulate the NPV calculation using 1000 alternative price scenarios applying the current price (1847 AU $/oz in February 2019) with 3% and 9% volatilities. These volatility figures represent the extremes between choosing short-term (3%) or long-term (9%) gold price development when deciding the “reference point” for the future (see Appendix Table for numbers). The histograms of NPVs illustrated in Fig. 5 shows 3% (left) and 9% (right) volatility assumptions with 1847 AU $ as the starting price (last available historical data point). The Y axis displays the simulation numbers and the X axis showing the NPV. As it is expected, the mean NPV for each mine planning scenario with different volatility is almost unchanged. However, the distribution of NPV for the higher volatility price is vastly dispersed in comparison to the lower volatility price distribution. Additionally, in the high volatility scenario, the shapes of the histograms are weighted towards the positive outcomes. This is because the price changes are calculated on the percentual basis of the last price observation, which means that high price values lead to higher changes in terms of absolute values.

We can observe from Fig. 5 that with the 3% and 9% volatility assumptions, the distribution of histograms is approximately similar for all the scenarios within the 3% and 9% scenarios. Based on this additional information provided, we should still proceed with the 8.0 Mt plan as it has the higher NPVs, and the distributions show no drastic differences for any of the tested scenarios. It may be argued that the mean value for other volatility rates, for example, 0%, can generate the same NPVs. However, it is noted that the mean values alone do not explain the probability to arrive to that result, meaning that upside or downside potentials are hidden away.

Uncertain price with a trend assumption

The simulation model using 9% volatility assumption was re-run with negative and positive trend of 4%/year included (Fig. 6). The results of two illustrative MCS runs show that the selection of mine plan depends on the expected price trend, where 8.0 Mt dominates the decreasing price scenario, but interestingly the lower production scenarios such as 4.0 Mt should be chosen in the case of increasing prices. It suggests that in upward trending price environment, a lower production rate, but in a downward trending, a higher production rate generate higher NPVs. This is an important finding that shows the drift has significant implications on selection of production scenarios. Figure 6 shows the NPVs using 9.0% volatility (20-year historical value), 1847 AU $ as the starting price and decreasing/increasing trend assumptions. Trend on left (-4%/year) and right (+ 4%/year). The Y axis displays the simulation numbers, and the X axis shows the NPV.

The histograms presented in Fig. 6 do not contain the information on which of the mine plans would best suit each given price vector. As discussed earlier, within this research, we are especially interested to investigate the relative performance of the mine plans under some given price assumptions, and for this purpose, a ranking of 1–5 is implemented next. To further illustrate the problem of selecting the best fitting planning scenario, we run a sensitivity analysis using combinations of starting price [1250, 1900] and volatility [0, 50%]. A comparison of the relative attractiveness of large (8.0Mt or 7.5Mt) mine planning scenarios and small (4.0Mt or 5.0Mt) scenarios is provided in Fig. 7.

Based on Fig. 7, the large plans (8.0 Mt or 7.5Mt) (left) clearly dominate the simulation space. The implication of the graphical presentation above is to proceed with “full scale” when the (expected) volatility is low (0 to 5%/year) and even more so when the starting price is also high. Interestingly, the smaller scenarios are most attractive (relative) when prices are low and volatility is high (15 to 25%/year).. We note that volatilities above 10% were not observed in the historical price data of gold (see Appendix Table), but they are not uncommon for other metals such as base metals (e.g. Nickel).

The analysis suggests larger production rate scenarios to be the most attractive candidates, but there are still probable price outcomes where scenarios performances decrease compared to lower production rate scenarios. For the purpose of illustration, displaying out these specific price developments, we plot the rank one price vectors for each scenario in a separate sheet shown in Fig. 8. The key insight given is that regardless of the parameters, we will arrive at the (approximately) same shape in the set of vectors that suits the best for each alternative mine plan (see Appendix). Four-year historical data were used for the left diagrams with starting price of 1731 AU $/oz and volatility of 5.54% and positive return rate of 2.57%, whereas 10-year historical data were used for left diagrams with starting price of 1831 AU $/oz, volatility of 7.07% and negative return rate of 0.31%. The Y axis displays the NPV and the X axis showing the number of years for the LOM.

Price vectors extracted from simulation results (total 1000 vectors) allocated to each plan ranked as number one (n). Parameters used on the left diagrams are from four years of history data with starting price 1731 AU $/oz, volatility 5.54% and positive return rate of 2.57%. On the right, diagrams account for 10-year history data with the start price of 1831AU $/oz, volatility of 7.07% and negative return rate of − 0.31%

The results (visualized in Figs. 7 and 8) illustrate that building maximum capacity might not be the optimal solution in the case of low-price level but upward trending prices. On the other hand, the intuitive decision to reduce the size of investment plans in the case of decreasing prices can also result in a sub-optimal extraction sequence design.

As a summary, the above analysis presented variety of methods that can be adopted when deciding the mine plan. Within this paper, there is no solid philosophical basis to say that any choice, except the fixed price assumption, would be superior compared to the others. Therefore, the decision boils down the managerial insight which is discussed next.

Simulation-based recommendation system for mine production scenario selection

The basic idea of the mine plan decision-making system was described in the “Optimal mine plan selection with simulation” section. Shortly, three vectors of price estimates are needed out of which two serve as the min- and max-scenarios for each year. The volatility parameter is fitted within the min–max limits by iterating Eq. 3. Once, the volatility is estimated as such that it stays within the limits, a Monte Carlo Random simulation is run for the given mine plans. In the final phase, the system outputs the relative ranking of plans based on the mean NPV. If needed other performance indicators may be added as well—such as the standard deviation of results, minimum NPV and maximum NPV—in order to better account for the riskiness of decision alternatives.

The above-described recommendation system is demonstrated with the illustrative gold mine using 1 yearly-based managerial price estimate with min–max -limits depicted in Fig. 9. The estimate is deliberately made such that it has a limited downside and high upside potential, which can be thought as a typical expert estimate, when one is “selling” a project to the investors (see discussion, e.g. (L. D. Smith, 2002)).

The average yearly drift is calculated based on the best estimate giving a value of 4.39% per year. Calculated yearly volatility equals 2.48%, which seems unrealistically low. To better estimate the volatility factor, an iteration with volatilities of 2, 4, 6 and 8% is performed. Based on the graphical analysis in Fig. 10, the value of 6% is selected as its random simulation gives the most realistic looking fit while still including the negative scenarios. Using low volatility leads to better fit of random simulations within the specified min–max boundaries (bold red) but leaves out the extreme scenarios indicated by the single-point estimate.

The desired price vectors, inside managerially estimated boundaries, are simulated and input into the simulation model. The recommendation system gives the highest mean rank (1.53) for the 4.0 Mt plan, which is an expected result based on the earlier simulation results. The second highest rank (2.01) is given to 5.0 Mt plan followed by the 6.0 Mt (2.83), 8.0 Mt (3.62) and 7.5 Mt (5.00). We highlight that the recommendation system presented here is of conceptual type, and its results are direction giving and dependent on the discount rate (i.e. estimated risk) given to the project. To verify the “statistically most correct” fit of the managerial estimate versus random simulation, a numerical approach should be adopted instead the graphical one. However, we believe that the approach itself, where managerial insight is automatically combined with available mine plans and statistical simulation for decision-making, does provide a useful application for the industry practitioners and could be elaborated more in the academic setting. The method is most applicable to any large investments, where some historical data on the output prices is available.

Conclusions

In this paper, we proposed a managerial decision-making model for mine plan selection which takes the advantage of modern simulation tools combined with the managerial knowledge on the metal markets. The need of a such tool was motivated by showing how accounting for price uncertainty can affect the initial mine planning decision that has been traditionally made based on single-point, price estimate. A gold mine example was used and in this specific case the simulation statistics of results did favour fast extraction of the orebody in the majority of cases and especially in the case of high prices (see also Abdel Sabour, 2002) as the default policy. However, some indication was given that decision should be considered in case of starting the mining operation in a market environment with low price and high volatility. Therefore, it is proposed that the final decision on the initial mine plan should be left to the managerial judgement supported by the envisioned decision-making tool for economically optimal results.

The decision support tool was shown to be able to automatically match the managerially estimated price development with the most suitable technical mine plan available which is a valuable addition per se in the mine investment planning. Thus, the results have practical relevance to both the experts of mine planning and management executives of mining companies. As a practical implication to the industry in a wider perspective, adopting the above-described decision support tools in companies could promote more diverse policies when choosing the initial mine plan for new projects which are still very much built using the maximum possible capacity to achieve economies of scale and short investment payback.

The limitations of this include the use of fixed discount rate which may not fully reflect the risk of many of the on-going projects. We note that using a higher discount rate, such as the “industrial standard” of 10%, would steer the results towards the “as big as possible” mine planning scenario which is the industry’s default policy. A sensitivity analysis of the results should be performed to inspect this issue further. The future research could expand the simulation modelling to assess the impact of enhancement options on the mine planning scenarios. Furthermore, the number of uncertainties could be considered more realistically as this paper focused only on market prices. In addition, a more detailed simulation model, running on a level of quarterly/monthly mine scheduling, could be applied to study if forecasting the price movements would be of economic benefit on an operational level. As the final caveat, this study restricted on the quantitative, financial analysis only while ignoring the qualitative aspects of the mining—such as land use, legislation and environmental issues—that nowadays play an ever-increasing role in the mining investment context.

Data availability

Data and models presented are available from authors upon request.

References

Abdel Sabour S (2002) Mine size optimization using marginal analysis. Resour Policy 28(3–4):145–151

Abdel Sabour, S., and R. Dimitrakopoluos. 2011. “Incorporating geological and market uncertainties and operational flexibility into open pit mine design.” J Min Sci 47(2): 191–201. http://www.researchgate.net/publication/226247998_Incorporating_geological_and_market_uncertainties_and_operational_flexibility_into_open_pit_mine_design/file/72e7e52c866ac94fc4.pdf (September 4, 2014).

Asad, Mohammad Waqar Ali, and R Dimitrakopoulos. 2012. “Implementing a parametric maximum flow algorithm for optimal open pit mine design under uncertain supply and demand.” 64(2): 185–97. https://doi.org/10.1057/jors.2012.26%5Cnpapers2://publication/doi/10.1057/jors.2012.26.

Asad, Mohammad Waqar Ali, and Roussos Dimitrakopoulos. 2013. “A heuristic approach to stochastic cutoff grade optimization for open pit mining complexes with multiple processing streams.” Resourc Policy 38(4): 591–97. http://www.sciencedirect.com/science/article/pii/S0301420713000792.

Auger, Felipe, and Juan Ignacio Guzmán. 2010. “How rational are investment decisions in the copper industry?” Resourc Policy 35(4): 292–300. http://linkinghub.elsevier.com/retrieve/pii/S0301420710000292 (November 4, 2014).

Azimi, Yousuf, Morteza Osanloo, and Akbar Esfahanipour. 2013. “An uncertainty based multi-criteria ranking system for open pit mining cut-off grade strategy selection.” Resourc Policy 38(2): 212–23. http://www.sciencedirect.com/science/article/pii/S0301420713000056 (August 15, 2014).

Bhappu, Ross R., and Jaime. Guzman. 1995. “Mineral investment decision making: a study of mining company practices.” Eng Min J July: 36–38.

Bunn D, Wright G (1991) Interaction of judgmental and statistical forecasting methods: issues & analysis. Manag Sci 37(5):501–518

Cortazar, Gonzalo, Eduardo S. Schwartz, and Jaime Casassus. 2001. “Optimal exploration investments under price and geological-technical uncertainty: a real options model.” R and D Management 31(2): 181–89. http://doi.wiley.com/https://doi.org/10.1111/1467-9310.00208.

Davis GA (1998) One project, two discount rates. Min Eng 50(4):70–74

Davis, Graham A. 1996. “Option premiums in mineral asset pricing: are they important?” Land Econ 72(2): 167–86. http://www.jstor.org/stable/https://doi.org/10.2307/3146964.

RG Dimitrakopoulos SA Abdel Sabour 2007 Evaluating mine plans under uncertainty: can the real options make a difference? Resour Policy 32 3 116 125

Dixit, Avinash K. 2004. “Investment and Hysteresis.” In Real Options and Investment under Uncertainty, eds. Eduardo S. Schwartz and Lenos Trigeorgis. The MIT Press, 153–78.

Dowd, Peter. 1994. “Risk assessment in reserve estimation and open-pit planning.” Trans Inst Min Metal (January): 148–54.

Espí JA, De La Torre L (2013) Factors influencing metal price selection in mining feasibility studies. Min Eng 65(8):45–51

Evatt GW, Soltan MO, Johnson PV (2012) Mineral Reserves under Price Uncertainty. Resour Policy 37(3):340–345

Grobler, F., T. Elkington, and Jean-Michel Rendu. 2011. “Robust decision making – application to mine planning under price uncertainty.” Appl Comp Oper Res Mineral Ind (September): 371–80.

Haque MA, Topal E, Lilford E (2014a) A numerical study for a mining project using real options valuation under commodity price uncertainty. Resour Policy 39(1):115–123

Haque, Md. Aminul, Erkan Topal, and Eric Lilford. 2014. “A numerical study for a mining project using real options valuation under commodity price uncertainty.” Resources Policy 39: 115–23. http://www.sciencedirect.com/science/article/pii/S0301420713001220 (September 5, 2014).

Humphreys D (1996a) Comment. New approaches to valuation: a mining company perspective. Resour Policy 22:75–77

Humphreys D (2010) The great metals boom: a retrospective. Resour Policy 35(1):1–13. https://doi.org/10.1016/j.resourpol.2009.07.002

IndexMundi. 2019. “Gold Monthly Price - US Dollars per Troy Ounce.” https://www.indexmundi.com/commodities/?commodity=gold&months=300 (April 9, 2019).

Langlois, R. N. 1984. “Internal organization in a dynamic context: some theoretical considerations.” In Communication and Information Economics: New Perspectives, eds. M. Jussawalla and H. Ebenfield. Amsterdam: North-Holland, 23–49. http://web.uconn.edu/ciom/Internal.pdf (December 30, 2014).

Martinez, Luis. 2010. “Strategic project evaluation for open pit mining ventures using real options and allied econometric techniques.”

PHL Monkhouse GA Yeates 2007 Beyond naïve optimisationOrebody Modelling and Strategic Mine Planning - Spectrum Series 14 3 8

Moyen N, Slade M, Uppal R (1996) Valuing risk and flexibility a comparison of methods. Resour Policy 22:63–74

Newman, Alexandra M. et al. 2010. “A review of operations research in mine planning.” Interfaces 40(3): 222–45. http://pubsonline.informs.org/doi/abs/https://doi.org/10.1287/inte.1090.0492.

Savolainen J (2016) Real options in metal mining project valuation : review of literature. Resour Policy 50:49–65. https://doi.org/10.1016/j.resourpol.2016.08.007

Shafiee, S, E Topal, and M Nehring. 2009. “Adjusted real option valuation to maximise mining project value – a case study using century mine.” Proj Eval Confer 21 22

Smith LD (2002) Discounted cash flow analysis methodology and discount rates. CIM Bull 95(1062):101–108

Elkington T, Gould J (2011) Optimisation with options. Min Technol 120(4):233–240

Thompson, Matt, and Drew Barr. 2014. “Cut-off grade: a real options analysis.” Resources Policy 42: 83–92. http://linkinghub.elsevier.com/retrieve/pii/S0301420714000701 (December 17, 2014).

Acknowledgements

The authors would like to thank Tarrant Elkington (General Manager, Snowden Group), for his constructive comments throughout the preparation of this paper. We also extend our acknowledgements for the academic use of software by MathWorks, Hexagon Mining and Deswik Software.

Funding

Open Access funding provided by LUT University (previously Lappeenranta University of Technology (LUT)). This research acknowledges the funding from Liikesivistysrahasto (decision nr. 16–9133) and the funding from Strategic Research Council (SRC) at the Academy of Finland-Manufacturing 4.0—project decision no. 335990.

Author information

Authors and Affiliations

Contributions

Conceptualization, J.S. and R.R.; methodology, J.S and R.R..; formal analysis, J.S.; writing—original draft preparation, J.S., R.R. and R.D.; writing—review and editing, J.S., R.R. and R.D.; supervision, R.D.; project administration, R.D. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

Authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Table

Figure

Mean values with 10% and 90% percentiles of the simulated 1000 price vectors allocated to each plan ranked as number one (n). Parameters used on the left diagrams are from 4 years of history data with starting price 1731 AU $/oz, volatility 5.54% and positive return rate of 2.57%. On the right, diagrams account for 10-year history data with the start price of 1831AU $/oz, volatility of 7.07% and negative return rate of − 0.31%

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Savolainen, J., Rakhsha, R. & Durham, R. Simulation-based decision-making system for optimal mine production plan selection. Miner Econ 35, 267–281 (2022). https://doi.org/10.1007/s13563-021-00297-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-021-00297-w