Abstract

As shipping market players operate in a competitive and volatile business environment, their highly capital-intensive investment decisions to target value-generating projects are exposed to critical risks. Therefore, the paper investigates the efficiency of investment strategies based on the combination of technical trading rules and fundamental analysis in selling and purchasing ships in the container shipping market. Using historical datasets of second-hand vessel prices and time-charter rates from October 1996 to June 2021, long-run cointegrating implications and short-run causality spillover effects are examined for three groups of containerships, distinguished by their transportation capacity, viz. 725 TEUs, 1700 TEUs, and 3500 TEUs. In addition, the moving average trading rules are used to indicate the timing of investment or divestment decisions through the analysis period. The results for vessel prices and earnings for 3500 TEU containerships appeared to be more volatile compared to smaller ships (725 TEUs and 1700 TEUs), while time-charter earnings are seen to exert an impact on second-hand prices across all vessel types. Moreover, due to higher volatility, the trading strategies based on price-earning ratios significantly outperform the buy-and-hold strategies for the 3500 TEU and the 1700 TEU containerships. On the contrary, the decision to buy-and-hold smaller container ships (725 TEU) yields higher profits than the active sale and purchase strategy. The insights provided in this paper can be used by multiple stakeholders, such as liner operators, investors, lessors, and researchers.

Similar content being viewed by others

1 Introduction

As shipping market players operate in a competitive and volatile business environment, their highly capital-intensive investment decisions to target value-generating projects are exposed to critical risks. Moreover, new regulations imposed by the IMO towards the decarbonization, and the green energy transition, insert even more restrictions to the maritime investments and the owner’s operational decisions. Investment and trading strategies in the second-hand containership market have critical implications for shipping players due to market complexities, intense volatility dynamics, and multi-faceted risk exposures in the shipping industry. Several studies investigated the impact of key drivers on investment decisions and company profitability, by attempting to model a diverse set of critical factors, including new buildings, deliveries, order books, and scrapping rates (Strandenes, 1984; Tsolakis et al. 2003).

Volatile freight rates and their spillover effects have also been an important topic for maritime investors as part of their investment decisions, and much research has provided insightful findings in this area. Drobetz et al. (2012) examined the time-varying volatility in the dry bulk and the tanker market. By conducting appropriate tests in their model, these authors conclude with three main findings: firstly, the t-distribution was a more suitable measurement than the normal distribution. Secondly, macroeconomic factors should be included in the conditional variance rather than the conditional mean; and thirdly, there was a high asymmetric effect in the Tanker market, but that was not so evident for the bulk carries. In addition, Chen et al. (2010) investigate the interrelationships in the daily returns and volatilities between the Panamax and the Capesize vessel prices, and by using cointegration tests and the ECM-GARCH model, they identify the price relationship and the volatility spillover effects. The authors found dynamic changes across the different trading roots and times for both markets.

In the second-hand markets, several studies (Kavussanos, 1997; Merikas et al., 2008) have been focused on the pricing modeling and the econometric analysis for different vessel types and sizes. Alizadeh and Nomikos (2007) develop an empirical technical analysis framework, employing the second-hand bulk shipping market’s price-to-earnings (p/e) ratio to identify potential strategic investment opportunities. Following the cointegration relationship framework, the authors used the cointegration dynamics between (log) ship prices and (log) earnings, indicating potential long-run relationships between these series. They suggested that under efficient market conditions, the two spread series should be statistically equal and could be incorporated to shape strategic investment decisions. In the liner shipping market, empirical research has focused on pricing models, freight revenue drivers, and the differentiation between business segments. Moreover, much emphasis has been given to the development of vessel sizes, excess capacity, and cost reduction through the economies of scale (Lim 1998; Cullinane and Khanna 2000; Sys et al. 2008). Other parameters, such as the strategic actions based on the environmental aspects and regulations, have also been a part of the research topics. For example, Rau and Spinler (2016) developed a real option model for the oligopolistic container industry, taking into account the endogenous price function, the fuel-efficient investment, the timing and the second-hand prices, and they assessed the way those parameters can influence the optimal capacity in the industry.

The company’s revenues and the profitable strategies based on the freight rates have also been examined as part of the decision-making. Luo et al. (2009) applied a dynamic economic model in the container shipping industry to analyze the fluctuation of the freight rate between the demand for container transportation services and the capacity of the container fleet. They conclude that the demand is derived from the global trade, and the fleet capacity was mainly increased from the orders in the profitable market conditions.

Despite the extent of literature on the investors’ decision-making and their operational strategies, the topic of exploiting potentially profitable opportunities arising from vessel trading in the sales and purchase (second-hand) ship market has not adequately been researched. In addition, much attention has concerned the big container vessels rather than smaller ship types. Examining these issues precisely indicates the novelty of the present research.

Therefore, the paper examines the performance of negotiation strategies based on technical trading rules and fundamental analysis in the second-hand container shipping market, giving attention to the small and medium-sized container vessels. More specifically, the paper uses the historical data of second-hand vessel prices and time-charter rates from October 1996 to June 2021 for three container vessel sizes (725 TEU, 1700 TEU, and 3500 TEU). Following a similar approach to Alizadeh and Nomikos (2007), the present study tests the existence of a long-run cointegrating relationship and short-run causality between prices and earnings. This relationship is used as an indicator of investment or divestment timing decisions, utilizing the moving average trading rules. Finally, the snooping data technic is also applied to re-evaluate the factual series results.

The paper is structured as follows. In Sect. 2, the paper contains a literature review of the sales and purchase shipping market and provides an overview of the containership market and the fleet development for the analysis period. Section 3 represents the empirical results for the descriptive statistics and the cointegration tests for three different container vessels by their size (725 TEU, 1700 TEU, and 3500 TEU) traded on the second-hand shipping market. It also presents the moving average trading rules for those ships, while a bootstrap re-sampling technique is applied to re-evaluate the results from the original series. In Sect. 4, the paper provides a discussion, and it concludes.

2 Literature review

The maritime technology progress and the aged ships’ costs create different questions in investment decisions, especially for trading or scraping. In the trading markets, an owner sells a vessel, and another company buys it when he/she believes it can achieve profits. The scrapping market comes as the only buyer for aged ships between (s)20 and 30 years, where there is no other owner to buy them. Maritime cycles reinforce the whole process by driving the freight rates and the market sentiment upwards (when new ships are ordered) and downwards (when old ships are scrapped) (Stopford 2009).

2.1 The sales and purchase market

The sales and purchase market is one of the markets distinguished by Stopford (2009). It is a market where the participants are commonly shippers, shipowners, and investors who also trade in the other shipping market sectors. When a shipowner wants to sell a ship, he/she comes into the market with a ship for sale. On the other hand, a buyer wants to purchase a ship when it is suitable for the trades served or when (s)he is a new investor who wants to enter the market. The sales and purchase market is characterized as a market with high price volatility, where investors can achieve profits from the good timing of selling and purchasing activity known as “asset play.” In this market, the vessels’ prices are negotiated between the buyer and the seller, while the timing and the market conditions are the primary keys that influence the trading effectiveness. For example, when the ship is sold at the bottom of the shipping cycle, it is a great bargain from the buyer’s side (Stopford 2009).

The sale and purchase market has a tenuous role. On the one hand, it is a market that involves a transaction between a shipowner and an investor, who is usually another shipping company, and for this reason, this transaction does not affect the cash held in the industry. On the other hand, in the newbuilding market, cash flows out of the shipping market, as shipyards use them to pay for materials, profits, and labor. The shipping market cycle is driven by those cash flows. At the beginning of the cycle, freight rate rises, and the cash starts to insert into the market, allowing the owners to pay higher prices for second-hand ships. The cash flows allow the new investors to order new ships as their prices look more profitable. When the new ships are inserted into the market, the whole process goes in reverse as the freight rates press the cash inflows as investors pay for the new ships. In order to meet their obligations, weaker owners are forced to sell their ships in the second-hand market, creating the “asset play” in the market for the more prominent owners. One of the purposes of the maritime shipping cycle is to let out the inefficient companies and allow more efficient companies to enter the market (Stopford 2009).

Figure 1 compares the vessel’s sales activity for the tanker, the bulk carrier, and the container shipping industry from 1996 to 2021. It can be observed that different economic market conditions influence the vessel’s sales volume. For example, during the financial boom period 2002–2008, there was the highest activity in the sale volume of tankers and dry bulk ships, mainly caused by China’s economic development, which drove the freight rates to significant levels. However, the main reason for the high sales activity differed between the two segments.

Source: Clarkson’s Shipping Intelligence Network 2021

Vessel sale volume for the tanker, bulk carrier, and the container shipping industry.

For the tanker sector, 2002–2004 was a period when after the “ERIKA” (1999) and “PRESTIGE” (2002) spill incidents, the IMO approved the “IMO Regulation 13G” (UNCTAD 2004). The main guidelines of Regulation 13G were the phase-out of single tankers by 2010, the prohibition of heavy grade oil (HGO) transportation by single-hull tankers, and the contentment of the condition assessment scheme (CAS) for single hull tankers over the 15 years. New regulations compared to high freight rates for the tanker industry resulted in new building orders and high demolition till 2004. In the second-hand market, the main interest was the sales for conversion purposes into dry bulk, FPOs, and heavy-lift vessels (Clarksons Research 2004).

In the dry bulk industry, as the world economy continued growing mainly due to Asian production and the burst of oil imports in China, the freight rates and interest rates remained at high levels, despite the recession in 2005 due to the impact of hurricanes on the US Gulf (Clarksons research 2008). During 2007, both the new building and second-hand sale markets have been highly active, with the freight rates being the main driver in all sectors and shipowners’ earnings being over the long-term average. Moreover, in 2006, after an unexpected improvement in the demand for raw materials, mainly caused by Azerbaijan (its GDP was increased by 26%) and combined with the Olympic games conducted in China in 2008, shipowners were focused on second-hand dry bulk vessels, mainly due to extended delivery times for new buildings, and the high-order book for the containership and tanker vessels in previous years (UNCTAD 2008).

For the containership industry, the most imminent second-hand vessel sales were performed in 2020–2021 due to the supply chain disruption caused by COVID-19. The limitation in the availability of the container tonnage due to scrubber retrofitting, combined with the supply chain disruption (port congestions, the reduced level of services and reliability) from COVID-19, had a significant impact on the container trade volumes. By mid-April 2020, the SCFI had dropped by 19%, while from the start of 2020 till mid-June, the charter rates declined by 34% (Clarksons Research 2021). Through July and August 2020, there was a fast improvement in demand for box trade, and as a result, by September 2020, the freight rates returned to the same level as March of the same year. At the start of September, the SCFI index was 24% higher than at the start year, driven by record gains in Transpacific spot freight. One supportive factor in the container industry was the low bunker prices (50% decline), with liner company financial position in the second quarter to be the best quarterly margins since 2010. In 2021, as the world economy continues to grow (world GDP began to rebound in the second half of 2020, and it had returned to above pre-COVID levels by the second quarter of 2021), the containership market surged to record levels for both charter and freight market driven by rapid growth due to the trade volumes and the port congestions. In their efforts to maximize deployed capacity and a lack of ships available to charter, container-shipping owners considered the second-hand market very attractive. The number of containership sales up to 144% annually, driven by strong market conditions, with buyer demand firm (particularly from boxship operators amid a shortage of containership tonnage on the charter market). The impact was the high asset prices, with the containership secondhand price index being almost 125% above the end-2020 level, at the highest level in a decade, reflecting the demand for smaller container ships between 5 and 15 years old (Clarksons Research 2021).

As was indicated by the examples above, the second-hand prices and the sale volumes are impacted by freight rate level, age of the ship, inflation projections, and shipowners’ future expectations (Stopford 2009). First, it is important to mention that despite the maritime sector’s size and nature, the freight rates are the primary influence on the prices and the order book. For example, as it was shown in Fig. 1 above, although the tanker and the dry bulk sector, which are characterized by perfect competition, illustrate higher sale movements compared to the container shipping market, which is considered an oligopoly market (Sys and Vanelslander 2021), the sale volumes were influenced mainly by the freight rates and the market conditions. As the freight rates are growing, there is a demand for new capacity in the market, which is affected by other factors such as the shipyard’s capacity, the remaining uncompleted orders in other segments, and the availability of the existing capacity in the market. Secondly, the ship’s age is another critical factor due to the depreciation in the vessel’s value during its life. Thirdly, in the long term, ship prices are affected by inflation, while fourthly, operators future expectations influence second-hand prices, and they have an essential role, as they are the acceleration in the intensive market changes.

2.2 An overview of the container shipping market

Most general cargo is transported by containerized liner companies that provide fast, frequent, and reliable services. Containerization was successful in the time reduction, and it changed the way that liner companies operated for five reasons: First, because it inserts the “door-to-door” services and the logistics operations; second, the business combined into fewer companies, and as a result, the sector became the most concentrated in the shipping activity; third, new port terminals with fewer staff and ships were created; fourth, the core of the business services was through transport, and finally, the tramp ships with containerizable cargo disappeared.

One of the most critical decisions for a liner company is whether to charter or purchase a ship. At the beginning of 1990, most of the fleet was owned by the liner companies, which gradually was taken over by different operators, who managed to own almost half the fleet by 2007 (Stopford 2009). Regarding the fleet of ships in the liner services, there are six different types of ships: the containerships, which are the most modern vessels in this sector, the multi-purpose vessels, the tweendeckers, the general cargo liners, the ROs-Ros, and finally, there are the barge carrier ships.

Figure 2 shows the container fleet development, distinguished by the number of different container vessel sizes and their transportation capacity, through the period 1993–2022. In terms of vessel number, it can be noticed that feeder containerships remain the largest player in the market. Their number was grown from 1380 feeder ships in 1993, to 3306 container vessels in 2022, with a total capacity of 4240 thousand TEU. The number of intermediate container vessels was also grown (from 138 containerships in 1993, their number reached 1066 container vessels in 2022), remaining the second largest container segment in the market, with a total capacity of 4739 thousand TEU (2022). It should be mentioned that, after the economic boom (2004–2008), bigger container vessels were inserted into the market and Neo-Panamax vessels of 8000–12,000 TEU presented the major capacity in the whole container fleet. In 2022, there were 623 Neo-Panamax containerships with 5780 thousand TEU total capacity. Finally, a high transportation capacity is provided by Neo-Panamax (+ 12,000 TEUs) containerships, and Post-Panamax container vessels, despite their small number in the market. However, as there is not a second-hand market for the biggest container vessels, this research focuses on the feeder and the intermediate container ship sizes.

Source: Clarkson’s Shipping Intelligence Network 2021

Container fleet development.

Figure 3 shows the percentage for each container vessel in the global market in 2021. As it can be noticed, the feeder containerships between 100 and 1999 TEU represented 56% of the total container fleet, followed by the intermediated containerships of 3000–5999 TEU, with 20% participation in the sector. Finally, the rest 24% of the fleet are containers with a capacity of more than 6000 TEUs.

Source: own compilation based on Clarkson Research NV (2021)

Container fleet contribution in the global market in 2021.

Given the scope of the paper, Figs. 4 and 5 present in more detail the fleet development of the feeder and intermediate containerships. As can be observed in Fig. 4, from 1996 till 2008, there was a fast development in the feeder containership market, having 3280 vessels operating in 2009. However, from 2009 to 2017, there was a 10% reduction in the fleet, as many vessels were sold for scrapping. More specifically, the number of demolished containerships in those years was 934, driving the fleet to fall to 2932 ships in 2017. From 2018, the fleet tended to recover, and in the middle of 2021, the market had in operation 3036 feeder containerships. Finally, the average number of ships treaded in the second-hand market during the fleet reduction was 57 each year, while in 2018 and 2020, the number of the sold vessels was 88 and 100, respectively.

Source: own compilation based on Clarkson Research NV (2021)

Feeder containerships (100–2999 TEU) fleet development.

Intermediate containerships (Fig. 5) presented more smooth and more gradual development, reaching 1238 vessels in 2015 (309 new vessels were delivered in 2007–2010). However, from 2013, the old vessels started to be demolished, reducing the fleet, ending at 1066 intermediate containerships in 2021. Regarding the sale number, 88 ships were sold in 2017 and 106 in 2021, reaching the highest volumes in the whole period of this study.

Source: own compilation based on Clarkson Research NV (2021)

Intermediate containerships (3000–5999 TEU) fleet development.

3 Second-hand container shipping market

Given the purpose of the paper, three different ship types traded on the second-hand market are first evaluated. Next, the relationship between their prices and their revenues, as an indicator of the company’s profitability, is estimated. The container ship sizes were selected based on ship's contribution to the world market, as stated in Sect. 2. This also allows examining any differences in the alternative ship sizes.

3.1 Data description

For this study, monthly prices for 5-year-old ships are collected for three different container vessels (725 TEU, 1,700 TEU, and 3,500 TEU) from Clarkson’s Shipping Intelligence Network from October 1996 to June 2021. All prices are indicated in a million dollars and represent the average value of vessels traded in each category in any specific month (Table 1). Moreover, in the shipping sector, operating profits can be defined as time-charter rates (Alizadeh and Nomikos 2007).

For the study, time-charter rates are used as a deputy for earnings for two reasons. First, because time-charter rates represent the net earnings from chartering activities of the vessel and do not include voyage costs. Second, since time-charter rates are hired contracts for several consecutive periods, they are considered to contain information about the future earnings of the vessel during these periods (Kavussanos and Alizadeh 2002). As a result, it is proposed that earnings from time-charter rates may explain price changes better than current spot rates. Monthly time-charter rates for (725 TEU, 1700 TEU, and 3500 TEU) vessels were also obtained from Clarkson’s Shipping Intelligence Network for the same period.

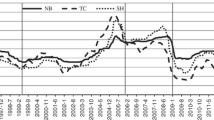

Figure 6 presents the time-charter earnings and the second-hand prices for the 725 TEU containerships from October 1996 to June 2021. The graph categorizes two main periods: from 1996, there is an upturn in the market, with a high pick for the time-charter rates in 2005, and, thereafter, is a market downturn until 2020. From 2021, the market tends to recover again. It can be noticed that, while the time-charter earnings are moving together with the second-hand prices during the period of this study, under different market conditions, they tend to fluctuate. For example, in the recovering years between 2002–2005 and 2012–2015, the spread between the prices and the earnings keen to narrow, while on the other hand, in the market’s downturns, for example, the years 1996–2004, 2005–2008, and 2015–2019, this spread keen to wide, which indicates the relationship between those series. Moreover, it can be observed that from 2004 to 2008, second-hand prices gained the highest values for the whole study period.

725 TEU containership, time-charter earnings, and second-hand prices. Source: own compilation based on Clarkson Research NV (2021)

Figure 7 describes the time-charter earnings and the second-hand prices for the 1700 TEU container vessel for the period 1996–2021. Similarly, with the graph of the 725 TEU container vessels, two main periods can be distinguished. From 1996, there was a recovery in the market, with the time-charter earnings reaching their peak in 2005, while from that year till 2020, there was market downturn. Moreover, both the prices and earnings present higher values, and they also fluctuate more than the 725 TEU containerships, while in the recovering years, the spread between those series, keen to narrow, and on the other hand, in the market’s downturns, this spread keen to wide, which also indicates the relationship between those series. In 2020, the market tended to recover, with the earnings adapting faster than the prices, representing the high volatility in this market.

1700 TEU containership, time-charter earnings, and second-hand prices. Source: own compilation based on Clarkson Research NV (2021)

In parallel, Fig. 8 shows the second-hand prices and the time-charter earnings for the 3500 TEU containerships. As it is indicated in the graph, under different market conditions, the series presents similar volatility and fluctuation as those of 1700 TEU container vessels. However, in 2021, the market’s upturn affects the time-charter rates even more, indicating that, as the vessel size is increased, higher volatility exists in the market.

3500 TEU containership, time-charter earnings, and second-hand prices. Source: own compilation based on Clarkson Research NV (2021)

In all three markets, 2005–2008 were the most productive period regarding the revenues. The second-hand prices also gained their highest values, indicating the eminent demand from the buyer’s perspective. The high rates can be interpreted by the fact that in 2001, China entered the WTO and had been developing its economy by creating serious infrastructures, and therefore, enormous quantities of goods were transported by the shipping service. Between 2002 and 2007, China’s steel production grew from 144 million tons a year to 468 million tons, adding capacity equivalent to that of Europe, Japan, and South Korea. Combined with the growth of oil imports and exports in 2003, this created a limited number of vessels. Tanker, container, and bulk carrier rates were driven to new highs, and despite some volatility, they stayed at these high levels for the following 4 years (Stopford 2009). Finally, due to disruption in the supply chain in the all markets caused by the COVID-19, in 2021, there was a spike in prices and the earnings for all three second-hand container vessel sizes.

3.2 Statistical analysis

The first step in the descriptive statistical analysis is evaluating and comparing the mean, median, and standard deviation of second-hand prices and operational earnings for the three vessel sizes. The results in Table 2 indicate that the mean levels of prices and the standard deviation for the 1700 TEU and 3500 TEU are higher than the containership of 725 TEU. That means prices for larger vessels fluctuate more than prices for smaller ships. Jarque and Bera Test (1980) describe the normality test and is distributed in 2nd-order as x2(2). Tests indicate significant departures from normality for time-charter earnings and second-hand prices in all vessels. Moreover, the autocorrelation test, proposed by Ljung and Box (1978), is performed using the Q statistics for 12th-order autocorrelations. Results from the test indicate that serial correlation is present in all price and profit series. Finally, ARCH test, which is the Engle (1982) test, for 2nd-order (2 lags) ARCH effect indicates the existence of autoregressive conditional heteroscedasticity in all series.

Table 3 describes the statistical analysis for logarithmic prices and logarithmic time charters for all types of vessels. Furthermore, Jarque and Bera Test (1980) indicate significant departures from normality for logarithmic time-charter earnings and second-hand prices in all vessels. The Ljung and Box (1978) Q statistics for 12th-order autocorrelations are all significant, indicating that serial correlation is present in all price and profit series. Finally, ARCH tests for 2nd-order (2 lags) ARCH effect indicate the existence of autoregressive conditional heteroscedasticity in all series.

Augmented Dickey–Fuller tests (ADF) for the unit root test (Dickey and Fuller 1979) are performed on the log-levels and log-differences of second-hand prices and time-charter rates for the three container ship sizes. Results from these tests indicate that log-levels of all price and earnings series are non-stationary (Table 4) for all the level degrees (1%, 5%, and 10%) compared to the t-statistic result.

On the contrary, the stationarity test is achieved in the first differences of logarithmic series for second-hand prices and the time-charter earnings for all the vessels, where the absolute t-statistic values are higher than the values for 1%, 5%, and 10% significance. This result also indicates that the variables are integrated of order one (Table 5).

3.3 Cointegration and causality

According to the econometric cointegration theory, two time series xt and yt are cointegrated if there is a parameter α such as:

with α to be a stationary process.

In other words, it can be considered that Yt (y1t,…,ynt) indicates an (n × 1) vector of I(1) time series. Yt is cointegrated if there is an (n × 1) vectors β = (β1,….βn) such as:

It is assumed that time series in Yt are cointegrated if there is a linear combination that is stationary in I(0). According to the economic theory, this linear combination is referred as a long-run equilibrium relationship, and the time series I(1) will be restored from any deviation from this equilibrium (Campbell and Perron, 1991).

In order to test the cointegration relationship for the time series of second-hand prices and time-charter earnings in the Dry Bulk shipping market, Alizadeh and Nomikos (2007) proposed the Johansen’s (1988) reduced rank cointegration technique by estimating the vector correction model (VECM) as follows:

The above vector Eqs. (3) were used as a cointegration relationship between the logarithmic earnings and logarithmic prices, and they were set up as a trading strategy, with the constant term in the error correction term θ0, to represent the long-run average term on the P/E ratio and the long-run equilibrium in the market. In their model, when the P/E ratio was greater than the long-run average term, ship prices were overvalued relative to the earnings or alternative, the earnings were lower than the vessel prices. Therefore, when the P/E ratio was lower than the long-run average, it could be considered that the vessels were undervalued regarding the potential profits, and as a result, in the following time period, the prices would be increased in order to restore the equilibrium in the market.

Finally, according to the Granger Representation Theorem, Granger (1969), if there is a cointegration between two time series, then at least one variable should Granger-cause the other. Alizadeh and Nomikos (2007) support that as ship prices are determined through the discounted present value of expected earnings, then the earnings should Granger-cause ship prices. Therefore, it can be considered that the (p/e) ratio contains information on future changes in ship prices, which can be used as an indicator for investment strategies.

Having identified that the time-charter earnings and the second-hand vessels prices, for the three containership sizes, are stationary in order one, or equivalent, in their first logarithmic differences, cointegration techniques are used next, to examine the existence of short-run and long-run relationship between these series.

The first step is to choose the number of lags in the vector error correction model (VECM). The lag length in the VECM model is chosen on the basis of the indications of the following criteria:

-

(1)

Schwarz Bayesian Information Criterion (SBIC)

-

(2)

FPE: Final prediction error

-

(3)

AIC: Akaike information criterion

-

(4)

HQ: Hannan-Quinn information criterion

Second, the Søren Johansen (1988) reduced rank cointegration method is used to establish the cointegration relationship between ship prices and earnings, using the Trace and Max-Eigen t-statistics for the tests. Thirdly, having identified the existence of the cointegration relationship between the second-hand prices and the time-charter earnings for the three vessel sizes, the VECM is performed, in order to test the causality between the prices and the earnings.

More specifically, the lag length for the container ships of 725 TEU was selected by AIC and FPE criteria, by 4 lags (q = 4), for container ships 1700 TEU, lags were 2 (q = 2) selected by all criteria, and finally, for container ship 3500 TEU, the selected lags were 2 (eq = 2) selected by AIC and FPE criteria.

Johansen (1988) reduced rank cointegration method is then used to establish the cointegration relationship between ship prices and earnings. This method involves assessing the rank of the long-run coefficients matrix, C, through the Max-Eigen and trace statistics, Johansen (1991). This method involves assessing the rank of the long-run coefficients matrix, C, through the Max-Eigen and trace statistics. The rank of C in turn determines the number of cointegrating relationships; for instance, if rank (C) = 1, then there is a single cointegrating vector describing the long-run equilibrium relationship between the variables. In this case, C can be factored as C = c H, where c and H are 2 × 1 vectors. Using this factor, the H represents the vector of cointegrating parameters, and c is the vector of error correction coefficients measuring the speed of convergence to the long-run steady state. The cointegration tests were performed with the assumption of no deterministic trend and with restricted constant.

Table 6 describes the results of the test. The Max-Eigen and trace statistics indicate the existence of one cointegrating vector between ship prices and time-charter for all vessels (acceptance of null hypothesis {at most one cointegration} with probability higher than 5% and reject the hypothesis of non-cointegration respectively). This means that log-prices and log time-charter earnings are united through a unique long-run relationship. In this sense, any deviation from this equilibrium is reinstated through the short-term adaption of these variables. In the same table, estimated cointegration vectors are also represented for the three ship sizes (1-θ1-θ0). These unrestricted cointegrating vectors are then used in the estimation of the VECM model.

In the cointegration vector model, residual diagnostics indicate that autocorrelation and heteroscedasticity are present in the residuals of all the regressions. Consequently, Newey and West (1987), correction for serial correlation and heteroscedasticity is applied to the standard errors of the regressions. Examination of the vector of error correction coefficients (Table 7) provides information for the equilibrium process for the three types of vessels.

For example, considering the 725 TEU container ships, the cointegrating vector is significant in both equations (Coint-Eqi = 1,2). More specifically, consider the results for the D(LOGCP), which indicates the logarithmic first deferent for second-hand prices, and the D(LOGTC), which is the logarithmic first deferent for second-hand prices. T-statistics are (− 0.008645) for the D(LOGCP) and (0.009687) for the D(LOGTC), indicating significance for 5% probability. Moreover, the signs of the speed of adjustment coefficient are compatible with the junction of TC earnings and ship prices to their long-run relationship (negative for ship prices and positive for TC earnings). For example, in response to a positive deviation from their long-run relationship at period t-1, i.e. pt-1-θ1pt-1-θο > 0, ship earnings in the next period will increase, and ship prices will decrease, resulting in the equilibrium achievement in the market.

The same statistical results are achieved by the other two containership sizes. In both markets, the cointegrating vector is significant in both equations (Coint-Eqi = 1,2), and the signs of the speed of adjustment coefficients are compatible with the junction of TC earnings and ship prices, to their long-run relationship. Finally, R-squared values indicate the significance in the VECM models, while the coefficients for the time-charter (D(LOGTC)) present better fits, and therefore, they can interpret the model more accurately.

Table 8 presents the statistical analysis for the causality test between the prices and the earnings for the three vessel sizes. The test which was performed was the Wald test. According to the Granger (1986) representation theorem, if two-time series are cointegrated, then causality must exist in at least one direction. In theory, it is expected that earnings to Granger-cause ship prices. Imposing the appropriate restrictions on the VECM model, the results for these variables were examined. The test is conducted for the long-run and short-run relationships between the prices and earnings. It can be considered that there is a long-run causality from earnings to prices (DCT − > DCP/prob. < 0.05 or 5%) for all the vessels, and there is causality from prices to earnings (DCP − > DCT/prob. < 0.05 or 5%) for the bigger vessels. Finally, there is a short-run causality from earnings to prices (DCT − > DCP) for all the vessels.

3.4 Trading rules and profitability

In order to set up trading strategies based on MA, two simple moving average–based rules were applied to exemplify the importance of the price-earnings relationship in determining ship prices, and therefore, market timing in the sale and purchase market for container ships. The strategy is based on two moving averages, one fast such as MA-1, and two slower ones, MA-6 and MA-12, illustrating the monthly average returns. The difference between the two constructed MA series is then used as an indicator for buy and sell timing decisions in the market.

A positive difference between the slow and the fast MA series signals a sell decision, while a negative difference signals a buy decision. For example, in container market for vessels 725 TEU (Fig. 9), from Οctober to 1996 till October 1999, the slower moving averages (MA-12, MA-6) were higher than the faster one (MA-1), illustrating a sell timing decision, as well as in the years 2008–2010 and 2011–2013. On the contrary, in the years June 2003 till October 2005, the faster moving average was higher than the slower ones, indicating a buy decision.

Source: own compilation based on Clarkson Research NV (2021)

Plot of moving average MA-12, MA-6 and moving average MA-1 of historical log-price–earnings ratio in 725 TEU second-hand container market.

Figures 10 and 11 show the moving average strategies for the 1700 TEU and 3500 TEU container vessels. The method and results follow the same tactics as the 725 TEU containers in Fig. 9. An interesting examination of the results is the similar patterns for the moving averages followed by all the container ship markets in the years under different economic conditions. For example, in the years of the economic crisis in 2008–2010, and the years 2011–2013 in all markets, the slower moving averages (MA-12, MA-6) were higher than the faster one (MA-1), illustrating a sell decision, while in years January 2003 till December 2008 the faster-moving average was higher than the slower ones, showing a buy decision.

Source: own compilation based on Clarkson Research NV (2021)

Plot of moving average MA-12, MA-6 and moving average MA-1 of historical log-price–earnings ratio in 1700 TEU second-hand container market.

Source: own compilation based on Clarkson Research NV (2021)

Plot of moving average MA-12, MA-6 and moving average MA-1 of historical log-price–earnings ratio in 3500 TEU second-hand container market.

The economic crisis of 2008 was determined as one of the most intense downturns for the shipping sector, especially for the containership market. During that time, as the world demand decreased significantly, the freight rates fell at nearly all times-lows. This impact was more evident during the period of the financial boom (2002–2007), the ship owners were driven to expand their fleet aggressively. Moreover, as the sector was considered profitable, many companies invested in new and bigger vessels. By the time of the vessel’s delivery, the supply had exceeded the demand, driving the market to overcapacity. Furthermore, in 2012, the reduction in the demand in Europe obliged the container liner operators to stop their contracts, as they could not pay for their chartered ships. Moreover, many small owners who could not afford their depths were forced out of the industry. This also led many banks to bankruptcy. Finally, due to the low cargo demand, the reduced freight rates, and the lower vessel speed dropped the time charter rates drastically. This decline was faster and more notable, as the exogenous market characteristics, such as the negative expectations from the economic perspective, created adverse phycological effects for the market players (Kalgora and Christian 2016).

Evaluating the performance of moving average strategies, the average returns (mean returns from log-p/e) were calculated for each strategy: MA-1, MA-6, and MA-12. Moreover, one alternative way was considered to calculate the decision of the buy and hold strategy. For this purpose, it was assumed that the ship was bought from its company from the beginning of the research (October 1996) and was kept during the entire analysis period. It was also adopted that the vessel is depreciated and gained a reduction in its value due to wear and tear each month. This is estimated as the average decline in the value between a 5-year-old and a 10-year-old vessel and is 0.2% per month for 725 TEU container vessel, 0.6% and 0.8% for 1700 TEU and 3500 TEU correspondingly. Finally, the operating profits are calculated for the entire month, and they are estimated on the assumption that the vessel will be on-hire 29 days per month or 348 days per year. The remaining 17 days per year represent time off-hire for repairs and maintenance.

The projected strategy is structured and performed in an entirely forward-looking way. In other words, investment decisions at any point in time are decided on the basis of information that is available to investors at that specific point in time. This way, a more realistic and precise representation is provided concerning the performance of the trading strategies.

Table 9 presents the mean returns, the standard deviations of returns, and the Sharpe ratios, which scale the mean returns by their standard deviations. It can be distinguished that both the (MA-6) and (MA-12) strategies outperform the buy and hold strategy, as indicated by the Sharpe ratios across 1700 TEU and 3500 TEU container markets. For instance, when (the MA-12) trading rule is applied, the Sharpe ratios for the 1700 TEU and 3500 TEU containers enlarged to 9.4183 and 7.2073, respectively, reflecting the joint effect of increase in mean returns and decrease in standard deviations of return in each market. It can also be noticed that the gain through such investment strategies and trading rules is greater in the markets for larger vessels due to higher volatility in these markets and better or more frequent trading opportunities arising due to such variation in prices. On the other hand, for the 725 TEU second-hand container market, the buy and hold strategy outperforms the trading strategies, as can be noticed from the mean returns and the sharp ratios.

The cumulative returns on the ‘‘buy and hold’’ and the (MA-12) trading rule investment strategy for the 725 TEU vessel are shown in Fig. 12. It can be observed that, while the “buy and hold” strategy outperforms the trading strategy, almost the whole period of the analysis, in profitable markets such as 2004–2008, the trading strategy yield higher profits for the owners due to higher earnings compared to the ship prices.

Source: own compilation based on Clarkson Research NV (2021)

Cumulative returns on buy and hold and MA trading strategy for 725 TEU second-hand container ships.

Figure 13 represents the cumulative returns for the 1700 TEU containerships. Compared to the 725 TEU container vessels, when the trading rule (MA-1) is used, the significance of cumulative returns increases compared to the “buy and hold” strategy. This evidence is clear from 2003, when the economic boom affected the containership market, and many owners and investors ordered new vessels. Moreover, it can be noticed that, due to higher volatility in the market, even during the period of the economic crisis, many investors could yield higher profits from the trading strategies than the buy and hold decision.

Source: own compilation based on Clarkson Research NV (2021)

Cumulative returns on buy and hold and MA trading strategy for 1700 TEU second-hand container ships.

Between the prices and the earnings, the high volatility is even more perceivable in the containers of 3500 TEUs (Fig. 14). Similar to the 1700 TEUs vessels, the trading decisions outperform the buy and hold strategy, and this comparison is more evident under the different market conditions, for example, in 2003–2008 and 2011–2015. In all three container shipping markets, it can be noticed that market booms (for example, 2005–2008) provide valuable opportunities for the “asset play” through the trading strategies, while this observation is more evident for the larger vessels due to higher price volatilities.

Source: own compilation based on Clarkson Research NV (2021)

Cumulative returns on buy and hold and MA trading strategy for 3500 TEU second-hand container ships.

3.5 Bootstrapping re-sampling

In the previous section, essential results were gained for the proposal of the trading strategies. However, a critical issue that supervenes when evaluating technical trading rules is that of data snooping. According to Sullivan et al. (1999) and White (2000), data snooping occurs when a dataset is used more than once for data selection and inference purposes. In other words, using the same set of data often to test strategic transactions may increase the likelihood of satisfactory results due solely to chance or the use of backward information rather than the superior ability of trading strategies.

The most commonly used method in the literature for evaluating the performance of trading strategies and testing for snooping data is the bootstrap, which was also suggested by Alizadeh and Nomikos (2007) for the dry bulk shipping market. The bootstrap, introduced by Efron (1979), is a re-sampling method that uses the empirical distribution of the statistic of interest rather than the theoretical distribution to conduct statistical inference.

The basic idea of bootstrapping is that the inclusion of a population from sample data can be modeled by re-sampling the sampling data and drawing conclusions about a sample of data that has been re-sampled. More typically, the bootstrap works by addressing the inclusion of true probability distribution J, given the original data, as a function of extracting its empirical distribution, considering the sampling data. The accuracy of the conclusions regarding the use of the data that has been sampled can be appreciated because, as it is known, if ∪ is a logical approach to J, then the quality of the conclusion for J can, in turn, be deduced.

However, the ordinary bootstrap method is only lawful in the case of iid observations. When ordinary bootstrap techniques are applied to serially dependent observations, as is the case with ship prices and earnings, the re-sampled series will not retain the original dataset’s statistical properties and yield inconsistent results and statistical inference. One method to overpass this phenomenon was introduced by Politis and Romano (1994). The method presented was the stationary bootstrap. This procedure is based on re-sampling blocks of random length, where the length of each block follows a geometric distribution, Sullivan et al. (1999). Therefore, to make a statistical estimation of the performance of the strategic trading, the stationary bootstrap technique is used to generate random paths that may be followed by ship prices and profits during the sampling period while maintaining the distributive properties of the initial series.

More specifically, having the logarithmic prices and time-charter, a random path for each sample, and a matrix of (297{number of original samples} *1000 {number of bootstraps} were recreated. Then, the moving average techniques were performed in each sample, and the means were received, as mentioned in the previous section.

Table 10 presents the mean returns, the standard deviations of returns, and the Sharpe ratios, which scale the mean returns by their standard deviations. The results are similar to the outcomes of the actual series data in the previews analysis. For instance, when (MA-6) trading rule is applied, the Sharpe ratios for containers 1700 TEU and 3500 TEU, increased to 9.19665 and 7.098149 respectively, reflecting the joint effect of increase in mean returns and decreased in standard deviations of return in these vessels, though for 725 TEU containers the mean returns are higher when the buy and hold strategy is applied.

The statistical analysis of the bootstrap techniques for each type of vessel, all the moving average bootstrapped techniques, and the buy and hold strategy are represented in Table 11. The empirical confidence intervals are constructed for 95% to test whether the p/e-based trading strategies provide significantly higher returns than the holding strategy. These are constructed as 2.5% and 97.5% percentiles. If the value of t-statistics is not defined between the confidence interval, then the simulations on “Moving average” and the “buy and hold” strategies are not significant at the 5% level. The results designate that both simulation strategies (MA and buy and hold strategy) are significant. Therefore, the results from the previous section about the strategic decisions can be accepted.

4 Discussion and conclusions

Investment and trading strategies have significant implications for maritime investors due to market complexities and the intense volatility dynamics in the market. Moreover, new regulations imposed by the IMO towards the decarbonization and the energy transition for green operations insert even more restrictions on the maritime investments and the owner’s operational decisions. In the maritime sector, empirical research has been focused on pricing models and freight revenue drivers, while much emphasis has been given on the scale increase in vessel sizes, the excess capacity, and the cost reduction through the economies of scale. Several studies (Alizadeh and Nomikos 2006, 2007) examined the profitability in the sales and purchase market for the Tanker and the Dry Bulk sector, and it was suggested that there are profitable opportunities for the second-hand vessels, through the trading strategies. However, in the containership market, research concerning the second-hand vessels is very scarce, while much emphasis has been given in the very large containerships, rather than the smaller vessels.

This paper differentiates from the previous literature and provides a novelty insight into the container sector for three main reasons. Firstly, it concerns the investment processes, where the literature is already very limited. Secondly, compared to other research, this paper focuses only on the small second-hand container vessels and their profitable opportunities through the “asset play.” As indicated, despite the oligopoly characteristics of the container sector, under different market conditions, the second-hand market is driven mainly by the freight rates, future expectations, and the vessel's age, and it can provide profitable opportunities to the investors. In addition, the main reason that only small ships were included in the scope of the analysis is that larger container ships were brought onto the market after the economic boom (2005–2008), and there is not yet a second-hand market for the very large ships (> 17,000 TEU). Thirdly, the period of the analysis in this paper (1996–2021) covers two critical timing periods for the maritime sector; the economic boom (2004–2007) and the economic crisis of 2008–2012. Therefore, this research also contributes to a complete understanding of the second-hand containership industry and its development through that period.

In order to evaluate the profitable opportunities in the sales and purchase market for second-hand container vessels, this research used a similar methodology developed by Alizadeh and Nomikos (2007). More specifically, this paper examined the historical data of the second-hand prices and the monthly time charter rates from October 1996 to June 2021 for the three containerships distinguished by their sizes: 725 TEUs, 1700 TEUs, and 3500 TEUs. In addition, using the cointegration technique, the long-run relationship and short-run causality between the second-hand prices and the time-charter earnings were examined. This relationship was used as an indicator for the investment or the divestment decisions, applying the moving average technique. Finally, the bootstrap resampling test was used in order to re-evaluate the results from the original time series.

Statistical results point out that second-hand prices for 3500 TEU container vessels fluctuate more than prices for 725 TEU and 1700 TEU containerships. In addition, cointegration tests indicated the relationship between the time charter earnings and the second-hand prices, which can be used as an indicator of the future price movements, and therefore as an index for the timing of the investments. The results of the moving average technique, as well as the annual cumulative returns, showed that the sale and purchase strategy yields higher profits than the buy and holding strategy for the 1700 TEU and the 3500 TEU container vessels, reflecting the joint effect of increase in mean returns and decrease in standard deviations of return in each market. It was also noticed that in the market upturns, for example, the years 2004–2008, the decision to purchase a vessel was considered more profitable, while in the market downturns (2008–2010), the selling decisions could yield higher profits. It was indicated that the gain through such investment strategies was greater in the markets for larger vessels due to higher volatility, and better or more frequent trading opportunities could arise due to such variation in prices. On the other hand, for the 725 TEU second-hand container market, the buy and hold strategy outperformed the trading strategy. However, during the economic booms, when the market was considered more profitable, trading decisions could yield higher profits than the passive buy-and-hold strategy. The bootstrap resampling technique indicated similar results for all three container vessel sizes. Generally, it is suggested that the market for smaller vessels is more efficient as there are more ship owners, and these vessels are more flexible in their operations. In the same perspective, larger ships could be more suitable for asset play, but the timing of the investments is crucial as the gains or losses are more eminent in these sectors (Alizadeh and Nomikos, 2007).

What can shipping market operators and investors learn from this empirical analysis? First, they can find profitable opportunities, including sales and purchases of vessel operations. As it was suggested in this research, the potential profits from the trading strategies in the second-hand container market are highly correlated to the large vessel of 1700 TEU and 3500 TEU due to the higher volatility in those markets. On the other hand, for smaller ships such as 725 TEU containerships, the buy and hold decision outperforms the trading strategy. Therefore, for investors operating with very small container vessels, the decision to keep the vessel is considered more profitable. However, this strategy was not evident during the market upturns, as the trading strategy outperformed the buy-and-hold decision. Secondly, a critical application in the decision-making concerns the timing of the investments. As indicated, under different market conditions (market booms or market downturns), decision-making has different effects (whether an investor has to buy or sell a vessel). This analysis showed that in market upturns, investors could achieve profits by purchasing a vessel and selling it when the market condition was declined. This observation was more evident for bigger vessels (1700 TEUs and 3500 TEUs) due to higher price volatilities.

From the academic perspective, it is indicated that the price to earnings (p/e) ratio contains essential information regarding investment timing and trading strategies in shipping markets while using the cointegration relationship, a strategy that measures the deviation of the p/e ratio from its long-run equilibrium may give signals for sale and purchase opportunities. However, as this paper concerns only three container vessel sizes (viz. 725 TEUs, 1700 TEUs, and 3500 TEUs), a future analysis could be applied on bigger containerships. Moreover, as time charter rates were used as revenue, future research can consider the spot rates. In addition, a similar methodology can be applied to other types of vessels (for example, the Ro-Ro’s or LNG’s), while it can also be implemented in other transportation modes, such as railways and the aviation industry. Finally, future research can be focused more extensively on the p/e relationship and the way the that those variables can be interpreted. Overall, this research can provide valuable information for investors’ profitable opportunities and future strategies.

References

Alizadeh AH, Nomikos NK (2006) Trading strategies in the market for tankers. Marit Policy Manage 33(2):119–140. Available at: https://doi.org/10.1080/03088830600612799

Alizadeh AH, Nomikos NK (2007) Investment timing and trading strategies in the sale and purchase market for ships. Transport Res Part B: Meth 41(1):126–143. Available at: https://doi.org/10.1016/j.trb.2006.04.002.

Campbell JY, Perron P (1991) Pitfalls and opportunities: what macroeconomists should know about unit roots. National Bureau of Economic Research (Technical Working Paper Series). Available at: https://doi.org/10.3386/t0100

Chen S, Meersman H, van de Voorde E (2010) Dynamic interrelationships in returns and volatilities between Capesize and Panamax markets. Marit Econ Logist 12(1):65–90. Available at: https://doi.org/10.1057/mel.2009.19

Clarksons Research (2004) The Clarkson, shipping review & outlook,. CLARKSON RESEARCH STUDIES. Available at: https://sin.clarksons.net/Download/Downloadfile?DownloadToken=88646ac6-c34a-43b0-b893-43939c61dcd4&friendlyFileName=Shipping%20Review%20and%20Outlook%20Autumn%202004.pdf.

Clarksons research (2008) Shipping review & outlook.

Clarksons Research (2021) Shipping intelligence network. http://www.clarksons.net

Cullinane K, Khanna M (2000) Economies of scale in large containerships: optimal size and geographical implications. J Transp Geogr 8(3):181–195. Available at: https://doi.org/10.1016/S0966-6923(00)00010-7

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431. Available at: https://doi.org/10.1080/01621459.1979.10482531.

Drobetz W, Richter T, Wambach M (2012) Dynamics of time-varying volatility in the dry bulk and tanker freight markets. Appl Financial Econ 22(16):1367–1384. Available at: https://doi.org/10.1080/09603107.2012.657349.

Efron B (1979) Bootstrap Methods: another look at the jackknife. Ann Stat 7(1):1–26

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4):987–1007. Available at: https://doi.org/10.2307/1912773.

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Granger CWJ (1986) Time series analysis, cointegration, and applications. Am Econ Rev 94(3):421–425

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6(3):255–259. Available at: https://doi.org/10.1016/0165-1765(80)90024-5

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in gaussian vector autoregressive models. Available at. https://doi.org/10.2307/2938278

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2):231–254. Available at: https://doi.org/10.1016/0165-1889(88)90041-3

Kalgora B, Christian TM (2016) The financial and economic crisis, its impacts on the shipping industry, lessons to learn: the container-ships market analysis. Open J Soc Sci 4(1):38–44. Available at: https://doi.org/10.4236/jss.2016.41005

Kavussanos MG, Alizadeh AH (2002) Efficient pricing of ships in the dry bulk sector of the shipping industry. Marit Policy Manag 29(3):303–330. Available at: https://doi.org/10.1080/03088830210132588

Kavussanos MG (1997) The dynamics of time-varying volatilities in different size second-hand ship prices of the dry-cargo sector. Appl Econ 29(4):433–443. Available at: https://doi.org/10.1080/000368497326930

LIM S.-M (1998) Economies of scale in container shipping. Marit Policy Manag 25(4):361–373. Available at: https://doi.org/10.1080/03088839800000059

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65(2):297–303. Available at: https://doi.org/10.1093/biomet/65.2.297

Luo M, Fan L, Liu L (2009) An econometric analysis for container shipping market. Marit Policy Manag 36(6):507–523. Available at: https://doi.org/10.1080/03088830903346061.

Merikas AG, Merika AA, Koutroubousis G (2008) Modelling the investment decision of the entrepreneur in the tanker sector: choosing between a second-hand vessel and a newly built one. Marit Policy Manag 35(5):433–447. Available at: https://doi.org/10.1080/03088830802352053

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703–708. Available at: https://doi.org/10.2307/1913610

Politis DN, Romano JP (1994) The stationary bootstrap. J Am Stat Assoc 89:1303–1314

Rau P, Spinler S (2016) Investment into container shipping capacity: a real options approach in oligopolistic competition. Transport Res E: Logist Transp Rev 93:130–147. Available at: https://doi.org/10.1016/j.tre.2016.05.012

Stopford M (2009) Maritime economics. London; New York: Routledge.

Strandenes SP (1984) Price determination in the time-charter and second-hand markets.’, Centre for Applied Research, Norwegian School of Economics and Business Administration [Preprint]

Sullivan R, Timmermann A, White H (1999) Data-snooping, technical trading rule performance, and the bootstrap. J Finance 54(5):1647–1691. Available at: https://doi.org/10.1111/0022-1082.00163

Sys C, Vanelslander T (2021) Introduction to maritime shipping. In: Vickerman R (ed) International encyclopedia of transportation. Elsevier, Oxford, pp 508–516

Sys C, et al. (2008) In search of the link between ship size and operations. Transp Plan Technol 31(4):435–463. Available at: https://doi.org/10.1080/03081060802335109

Tsolakis SD, Cridland C, Haralambides HE (2003) Econometric modelling of second-hand ship prices. Marit Econ Logist 5(4):347–377. Available at: https://doi.org/10.1057/palgrave.mel.9100086

UNCTAD (2004) Review of maritime transport 2004. Available at: https://unctad.org/system/files/official-document/rmt2004_en.pdf (Accessed: 18 July 2022)

UNCTAD (2008) Review of maritime transport, Geneva, p 200

White H (2000) A Reality check for data snooping. Econometrica 68(5):1097–1126. Available at: https://doi.org/10.1111/1468-0262.00152

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Georgoudakis, D., Syriopoulos, T. & Sys, C. Investment and trading strategies in the maritime sector: an application to the secondhand containership market. WMU J Marit Affairs 22, 59–89 (2023). https://doi.org/10.1007/s13437-022-00289-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13437-022-00289-9