Abstract

The aim of this paper is to examine the impact of dependencies between climate transition and physical risks on the default probability and profitability of a non-life insurer focusing on the scenario of a delayed and sudden transition. Toward this end, we suggest a simplified modeling approach for scenario analyses for climate risks affecting assets and liabilities, taking into account potential nonlinear dependence structures. Our results show that dependencies on the liability side and between assets and liabilities in the context of physical-transition scenarios can have a significant impact, particularly on the default risk of a non-life insurer. We additionally analyze the mitigating effects of stop loss reinsurance and risk-adjusted pricing, which—if implementable—seem to be an effective risk management measure against physical climate risks in particular.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate risks represent one of the most significant and unpredictable emerging risks in current times, and can be categorized in transition risks and physical risks (see [17, 20]). Physical climate risks arise either directly from the consequences of extreme weather events, or indirectly through, for example, the breakdown of supply chains. In the case of a non-life insurer, these risks relate in particular to liabilities [21]. Transition risks refer to market and credit risk of assets in carbon-intensive sectors due to the transition to a low-carbon economy, as a result of far-reaching policy decisions to rapidly reduce carbon emissions, which may also result in regulatory and legal risks, as well as due to potential changes in technology as well as customer demand [11, 20]. While transition risks may also have an impact on liabilities, e.g., in the form of climate litigation risks in specialized insurance policies such as Directors’ and Officers’ liability, the primary influence of transition risks is typically on assets [6]. In this context, Golnaraghi [29] and the German supervisory authority BaFin [11] emphasize the significance of considering the interdependence between climate transition and physical risks, which consequently extends to interdependence between assets and liabilities to be taken into account within an asset-liability management. Given their diverse and interlinked nature, EIOPA [20] also highlights the need for a comprehensive assessment of both physical and transition risks in a climate stress test. The short-term nature of possible shock scenarios with regard to physical climate risks and transition risks is pointed out in EIOPA [20], and Campiglio et al. [12] point out the significant economic costs of accumuluation effects resulting from a sudden transition after a climate-related natural disaster.

Since 2022, EIOPA requires European insurers to include climate scenario analyses within their ORSA process, which in a first step may be qualititative, but are generally expected to be quantitative in a second step the following year [21]. In this context, the aim of this paper is to conduct a climate risk scenario analysis with focus on the impact of climate risk-induced tail dependencies between claim frequency and severity as well as between assets (climate transition risks) and liabilities (physical climate risks) in an asset-liability management setting. The analysis is based on NGFS [37] scenarios and is intended to examine how climate transition and physical risks can accumulate on the balance sheet and potentially impact a non-life insurer’s profitability and default risk [20, 37].

Toward this end, we first model the impact of physical climate risks on liabilities, which may be subject to more frequent and more severe natural disasters. While dependence structures within a collective risk model have already been well studied (see, e.g., [1,2,3, 10]), including the context of natural catastrophe risk [9], we use a different approach in the present setting by assuming an upper tail dependence between the frequency and severity of claims. We then model the impact of climate risks on assets, which may result from a sudden and disorderly transition to a low-carbon economy through a sharp increase of carbon prices, for instance, following the scenario described by EIOPA [21]. Last, we consider the scenario of a physical-transition disaster scenario (too little, too late) of a delayed and then sudden transition, as reflected by a negative climate-induced correlation between assets and liabilities [11]. This scenario is modeled using tail dependence, whereby a major increase in physical risks (visible on the liability side) results in an abrupt transition of the economy, leading to higher transition risks on the asset side. We finally examine the impact of reinsurance and risk-adjusted pricing in this setting, and the extent to which reinsurance may help mitigate climate-related impacts. The present work is therefore also related to the literature on asset-liability as well as risk- and value-oriented management under Solvency II, e.g., Eckert and Gatzert [15] and Eling et al. [16]. The effect of these types of climate risk scenarios on a non-life insurer’s default probabability and expected surplus are then studied using Monte-Carlo simulation with scenario and sensitivity analyses.

Our findings show that considerations of tail dependencies in climate risk scenarios can disproportionately affect the solvency situation of a non-life insurer as well as its profiability. While effects resulting from physical climate risks seem to be managable by risk-adjusted pricing and adequate reinsurance (if available), a simultaneous impact of physical and transition risks has a major impact on a non-life insurer’s default risk depending on the respective asset allocation, investments in high-carbon segments in particular, despite risk management measures.

The remainder of this paper is structured as follows. Section 2 describes the model framework for a non-life insurer, numerical results are presented in Sects. 3 and 4 concludes.

2 Model framework

Designing appropriate climate change scenarios for the purpose of assessing the vulnerability and resilience of insurers is crucial in a climate stress test [20] within an asset-liability management. In particular, both the joint and separate consideration of physical and transition risks is essential. Therefore, we use the four basic scenarios described in the NGFS [37] and also applied by EIOPA [20].

In the baseline scenario, it is assumed that a well-orderly transition to a carbon–neutral economy takes place and climate goals are achieved, i.e., the baseline scenario involves neither additional physical nor transition risks. However, regardless of the respective paths and greenhouse gas emissions, a global warming of 1.5 °C—along with the resulting physical climate risks—are expected by 2050 [32]. The impact of physical climate risks then depends on whether the targets of the Paris Climate Agreement are met. If not, this will have an considerably adverse impact on the liabilities, which is also referred to as the hot house world scenario (see Sect. 2.1). While we follow the EIOPA [20] in this scenario, we note that there are concerns that especially physical climate risks may be significantly underestimated in such commonly used climate models due to the influence of climate tipping points, involuntary mass migration, and the associated uncertainty in the hot house world scenario ([31], p. 6). Therefore, our approach should only represent the impact in this scenario in a conceptual manner. The impact of transition risks depends on whether the transition to a low-carbon economy is orderly or disorderly and sudden, with regulatory actions adversely affecting assets (see Sect. 2.2). In case physical risks force a (delayed) disorderly sudden transition (too little, too late), there will be a simultaneous impact on both assets and liabilities, and additionally a climate-induced dependence between assets and liabilities is considered (see Sect. 2.3).

2.1 Liabilities

In non-life insurance, a central risk in this context is the occurrence of a high number of claims resulting from catastrophic events, requiring simultaneous handling. This can also lead to operational and liquidity constraints, as well as solvency issues. Therefore, due to the increasing climate-related catastrophic losses, physical climate risks pose a significant threat to the liabilities of non-life insurers (see, e.g., [19]). These losses are primarily driven by more frequent and more severe natural disaster events such as heatwaves, wildfires, storms, and floods [20, 33] and are expected to impact all property-related lines of businesses [22]. For example, Knutson and Tuleya [34] observe a positive correlation between CO2 concentration and hurricane intensity as well as precipitation. With respect to floods, Kreienkamp et al. [35] find that the probability of a heavy rain event such as the one which triggered the severe flood in Germany in 2021 (region Ahr/Erft) could increase by 20–40% even in a 2 °C scenario. The risk modeling agency RMS further notes that average annual losses resulting from floods for European insurers could increase by 26–80% by mid-century [5]. Any variations in the expected probability and intensity of such events are expected to affect all property-related lines of business [22]. As a result, assumptions regarding the distribution of claims should increasingly take into account heavy-tailed properties [30] and a higher volatility [23].

In the collective risk model, the total amount of claims up to time t is described as a stochastic sum

where \({N}_{t}\) denotes the frequency of claims up to time t and \({X}_{i}\) denotes the severity of the i-th claim, whereby \(\{{X}_{i}{\}}_{i\in {\mathbb{N}}}\) are assumed to be i.i.d. (see, e.g., [8]). Let {\({W}_{i}{\}}_{i\in {\mathbb{N}}}\) be the claim inter-arrival times, i.e., \({W}_{i}\) is the time between the (i–1)-th and i-th claim. The initial model assumes independence between claim severity \(\{{X}_{i}{\}}_{i\in {\mathbb{N}}}\) and claim inter-arrival time {\({W}_{i}{\}}_{i\in {\mathbb{N}}}\), which translates into independence between claim frequency and severity. Integrating natural disaster risks into this claim model is carried out in Biard et al. [9], for instance, focusing particularly on earthquakes and flood damage. For this purpose, dependencies between each claim severity and the previous (or more generally the past) claim inter-arrival time are applied and investigated. Using a different approach, in Albrecher and Boxma [2] the inter-arrival time between two claims depends on the prevoiusly occurred claim severity. Albrecher and Teugels [3] further consider a copula-based dependence structure between the inter-arrival time and the successive claim severity, and similar approaches are presented in Boudreault et al. [10], Meng et al. [36] or Ambagaspitiya [4], whereby dependence itself is always assumed between the inter-arrival time and the claim severity.

In this paper, we take a different and simplified approach by directly assuming a dependence between claim severity and frequency, without an indirect route via interdependent inter-arrival times of claims. In order to meet the requirements for a claims distribution with higher expected value and more volatility, our approach assumes that, as a result of more and increasingly intense natural catastrophe events, both the number of claims ([26], p.41) and their severityFootnote 1 will increase considerably, which we translate into an upper tail dependence between claim frequency and severity.Footnote 2

To define a dependence structure between the random variables \(\{{X}_{i}{\}}_{i\in {\mathbb{N}}}\) and \(\{{N}_{t}{\}}_{t\in {\mathbb{R}}^{+}}\), the stochastic sum in Eq. (1) needs to be rewritten and simplified. For this purpose, we first focus on the one-year total claims amount \({S}_{1}\) and replace the stochastic claim severities with 52 i.i.d. random variables \(\{{X}_{w}{\}}_{w\in \{1,..,52\}}\), which denote the average claim severity in week w.Footnote 3 The total amount of claims is then given by

where \({N}_{w}\) is the frequency of claims in week \(w\). To model catastrophic loss events under climate risks, we assume an upper tail dependence between \({N}_{w}\) and \({X}_{w}\), meaning that if a high number of claims occurs in week w, then the claim severity of those claims is also likely to be high and vice versa. The dependence structure between the frequency of claims within one week \({N}_{w}\) and the claim severity \({X}_{w}\) in week \(w\) is described by a copula \({C}^{FS}\), which is fixed for all weeks \(w\in \{\)1,…, 52} and is assumed to have upper tail dependence, e.g., a Gumbel or rotated Clayton copula. The bivariate Clayton copula based on Clayton [14] is thereby defined as

For the dependence structures implemented in this paper, a 180° rotated Clayton copula is used:

Furthermore, we assume that the frequency of claims \({N}_{w}\) is Poisson distributed and that the average severity of claims \({X}_{w}\) follows by approximation a normal distribution due to the central limit theorem.

The effect of the strength of dependence of the copula \({C}_{\theta }^{FS}\) is illustrated in Fig. 1, where the probability density functions for the total claims amount \({S}_{1}\) from Eq. (2) are displayed based on the rotated Clayton copula \({C}_{\theta }^{FS}\) defined in Eq. (4) for different strengths of dependence expressed by Kendall’s tau \({\rho }_{\tau }\). It can be seen that with an increasing strength of dependence \({\rho }_{\tau }\), the upper tail of the total claims distribution becomes increasingly heavy, see Fig. 1.

Since such climate risk driven upper tail dependencies should have a stronger impact on the tails of the total claims distribution, we also consider the relevance of a stop-loss reinsurance (solely to gain insight, without focusing on optimization or other reinsurance types; see, e.g., [41], for such an analysis). If the annual total amount of claims \({S}_{1}\) exceeds the priority P, the difference to P is covered by the reinsurer. The reinsurance payout \({X}^{SL}\) can thus be expressed by

For pricing, we use the expected value principle with proportional loadings \(\delta\) for the primary insurer and \({\delta }^{SL}\) for the reinsurer, resulting in annual premiums

We note at this point that the reinsurance market may be heavily impacted by the occurrence of large catastrophic events and historically exhibited cycles of hard markets (high prices, limited capacity) and soft markets (low prices, sufficient capacity) [38]. As a result, the affordability and availability of suitable reinsurance products are becoming increasingly challenging due to the growing number of natural disasters [39].

As a central component of physical climate risk, which may lead to shifts and heavy tails in the total claims distribution, underwriting risk is considered as a key aspect affecting a non-life insurer’s liabilities [20]. Underwriting risk refers to the risk that an insurer will suffer losses due to inadequate pricing or underestimation of the risk associated with a particular policy. According to EIOPA [19], the possibility to re-price risks due to short-term contracts may have commercial and social limits in the medium- and long-term perspective. For example, Tesselaar et al. [39] show that annual re-pricing in the context of climate change may not be sustainable in European flood insurance markets. An increase in premiums and changes in contractual conditions (e.g., higher deductibles and exclusions) may also have adverse consequences for the insurance industry in terms of reputational risk, making insurability and affordability challenging from a societal perspective [22]. Moreover, an insurer may not be able to re-price the contract annually due to customer relationships, despite the possibility from a purely contractual point of view [19].

To account for the potential underwriting risk associated with arising nonlinear dependencies and thus increasing total claims amounts, we consider two scenarios: one in which the insurer adjusts its premium calculation to take into account the heavier tails and higher expected value in Eq. (6), and one in which it does not. Not taking into account dependencies results in underwriting losses as premiums are calculated based on the total claims distribution according to Eq. (2) without dependencies, i.e.

Furthermore, we assume that the reinsurer as the main carrier of natural catastrophe risks always takes into account climate risk (i.e., in our case the upper tail dependence between claim frequency and severity), leading to the reinsurance premium defined in Eq. (6).

2.2 Assets

The impact of transition risks on assets is mainly determined by market risks and credit risks [20]. Market risks result from a potential impairment of financial assets due to the transition to a low-carbon economy, e.g., stranded assets and a drop of market values in carbon-intensive industry sectors. Credit risks occur in case of a deterioration of counterparties’ creditworthiness, as companies that do not adequately account for transition risks may suffer losses. Both types of risk can have a negative impact on an insurers’ asset value in the sense of an equity price or yield shock [20]. In order to model and assess climate risks on the asset side, we consider the adverse environmental scenario described in EIOPA [24] as the basis, where transition risks in particular play a dominant role. In this scenario, a sudden disorderly transition to a carbon–neutral economy through an increase in carbon prices leads to increasing short- and long-term interest rates and to sharply declining equity prices that depend on the industrial sector. The calibration will be based on the quantitative results of this scenario for Institutions for Occupational Retirement Provisions (IORPs) as described in EIOPA [25]. Considering that non-life insurers tend to be relatively less exposed to market risk than life insurers and IORPs in terms of solvency capital requirements [18], the impact of a sudden transition on IORPs assets can be interpreted as an upper bound for non-life insurers.

With respect to assets, the initial asset value \({A}_{0}\) is composed of initial equity \({U}_{0}\) and premium income \(p\) minus the reinsurance premium \(\Pi\), which is invested at the capital market and earns a stochastic one-period return \({r}_{1}\) (see, e.g., [16], or [15], for such a model). With the one-year asset value being.

the insurer’s surplus \({U}_{1}\) is then determined by

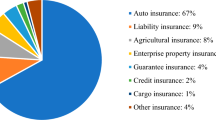

Based on the asset classes government bonds, coporate bonds, equity, property, and others, EIOPA [20] further classifies assets in equity and corporate bonds into high-carbon “brown” investments and “green” investments, with the shock factor in the transition shock scenario being substantially higher for brown investments than for others. In our context, brown assets include investments in the industrial sectors “mining and quarrying, manufacturing petroleum, manufactoring mineral and non-metal, electricity and transport” [25], p. 18), which suffer the five highest relative shocks in the 2022 IORP stress test by EIOPA [25], and thus coincide with relevant sectors according Battiston et al. [7]. As shown in EIOPA ([25], pp. 19–20), the transition shock has similar effects on government bonds, non-brown corporate bonds and non-brown equities due to increasing interest rates and higher default rates. Overall, the drop in these non-brown asset classes was approximately 12% in one year, while the average decline for brown investments (in the five brown industries) ranges from about 21% for bonds to about 27% for equity. In what follows, we distinguish between “brown” investments and “others”. Depending on the individual asset allocation of the insurer, the annual rate of return is determined by

where \({q}^{BI}\) and \({r}_{1}^{BI}\) denote the proportion and return of brown investments (in equity and corporate bonds) and \({r}_{1}^{Other}\) denotes the return rate for the remaining assets. For simplicity, we follow EIOPA ([23], p. 61) and for the non-transition scenarios assume that \({r}_{1}^{BI}\) and \({r}_{1}^{Other}\) are normally distributed with the same parameters \(\mu_{r}\) and \(\sigma_{r}{\prime}\), which are independent of the carbon-sensitivity of the asset class and thus equal for both subportfolios. To take into account the impact of climate risks and exposure to transition risks in the transition scenarios, we consider shock factors \({c}^{BI}\) and \({c}^{Other}\) that negatively affect the expected value of the respective returns as follows

Although also the standard deviation may be affected by a transition scenario, we here focus on the affected expected returns. Both stochastic return rates are further assumed to be correlated with a correlation coefficient \(\rho ({r}_{1}^{BI},{r}_{1}^{Other})\). To exclude diversification effects in the sensitivity analysis stemming from the correlation between brown and other assets, we fix the volatility of the total portfolio \({\sigma }_{r}\) and scale the standard deviation of the brown and other subportfolios \(\sigma_{r}{\prime}\) by.

2.3 Nonlinear climate-risk induced dependencies

In addition to the simultaneaous impact of climate risks on assets and liabilities of a non-life insurer, we consider the following situation in the context of scenario analyses. As described before, if necessary actions to meet climate goals are not implemented in time by policymakers, there is a possibility that a sharp increase in physical risks requires a delayed and abrupt transition of the economy. This in turn would lead to higher transition risks on the asset side, in addition to higher physical risks, as also described by BaFin [11] for instance (too little, too late scenario, see [20, 37]). Based on these considerations, we postulate a nonlinear dependence structure between the rate of return of brown investments \({r}_{1}^{BI}\) and the total claims amount \({S}_{1}\). This implies that high claims, which may be caused by higher physical climate risks, are likely to come with lower returns for assets that are highly exposed to transition risks, brown assets in particular. In this environment, a dependence between physical climate risks, which mainly affect liabilities, and transition risks affecting assets, translates into a dependence between assets and liabilities. The dependence structure between the return rate for brown investments \({r}_{1}^{BI}\) and the total claims amount \({S}_{1}\) is represented with a copula \({C}^{AL}\). We define a 90° counterclockwise rotated Clayton copula as defined in Eq. (3) as the dependence structure by

Random numbers from both copulas applied are shown in Fig. 2 to illustrate the causal relationship expressed by dependence structure.

2.4 Default probability and expected surplus

In order to examine the effects of short-term shocks on the solvency situation, we consider the one-year default probability DP as the probability that the surplus at time 1 becomes negative, i.e., assets are not sufficient to cover the total claims, by

As a metric for the impact on the balance sheet [21]. For evaluating the effect of physical and transition risks on profitability, EIOPA [21] further suggests investigating the overall impact on the firm’s profit [20, 21]. We thus consider the expected surplus

where \({U}_{1}\) is defined according Eq. (9).

3 Numerical analyses

Our numerical analysis involves estimating input parameters and conducting scenario and sensitivity analyses. In scenario analyses, we aggregate physical and transition risks, while sensitivity analyses will be performed to study the behavior of key figures under varying degrees of dependencies and proportions of brown investments. In addition, the influence of mitigating effects through reinsurance and risk-adjusted premiums is examined.

3.1 Input parameters

The input parameters listed in Table 1 were chosen for illustration purposes and were subject to robustness tests. The distribution parameters for the liability model, namely the expected values of claim severity and frequency (in thousands) and the standard deviation of the average weekly claim severity, are based on the claim frequencies and inflation-adjusted insurance claims of all German non-life insurers in the period from 2010 to 2021 [27]. The initial expected asset return \({\mu }_{r}\) and volatility \({\sigma }_{r}\) of the overall portfolio are illustratively chosen considering the capital market line in Eckert and Gatzert [15] as an upper bound, and \({\sigma }_{r}{\prime}\) is derived as described in Sect. 2, resulting in 10.17%. Both the transition shock factors \({c}^{BI}\) and \({c}^{Other}\) and the proportion of brown assets \({q}^{BI}\) are averaged and rounded values following the quantitative results of the climate stress test by EIOPA ([25], pp.16–20) for IORPs. The proportion of brown assets of 3.4% is also similar to the value estimated in Weyzig et al. [40] of 4.4% and is subject to sensitivity analyses in Sect. 3.3. The strengths of dependencies are defined based on \({\rho }_{\tau }\) = 0.3 for \({C}_{\theta }^{AL}\) and \({\rho }_{\tau }\) = 0.6 for \({C}_{\theta }^{FS}\) and are subject to sensitivity analyses in Sect. 3.3 as well. The initial equity is calibrated to achieve a one-year default probability of 0.5%, as required as a minimum by Solvency II. To obtain results, a Monte Carlo simulation is run with 10 million scenarios with the same random numbers for comparability.

3.2 The impact of climate risks

As described in Sect. 2, our scenario analyses are based on the four basic scenarios according to NGFS [37] that focus on the impact of physical and/or transition risks. The orderly transition scenario serves as the baseline setting without any (additional) climate risk exposure and is calibrated to result in a one-year default probability of no more than 0.5% by adjusting the initial equity capital respectively (see Table 1). The disorderly transition scenario involves a sudden transition that causes a shock to normally distributed asset returns [according to Eq. (11)]. In contrast, the hot house world scenario does not include an asset shock, but results in an upper tail dependence between claim frequency and severity to reflect physical climate risks [Eqs. (2) and (4)] (we once again point out the potential underestimation of climate risks in this scenario due to nonlinear tipping points as described in Sect. 2). The too little, too late scenario represents a simultaneous impact of physical and transition risks on assets and liabilities, where we also consider tail dependencies between assets and liabilities (too little, too late + tail). Table 2 shows the effect of climate risk scenarios on the expected surplus (14) and default probability (13) of the non-life insurer for a short-term perspective of one year, as well as the potential mitigating effects of including a stop-loss reinsurance contract (+ SL) and risk-adjusted pricing (+ adj.) [see Eqs. (5), (6), and (7)].

As can be seen from Table 2, the impact of the scenarios is more pronounced for the default probability than the expected surplus. In the disorderly transition scenario, we first study the impact of a transition shock to the insurer’s assets, which results in a 48% decrease in the expected surplus and a significant increase in the default probability from 0.5% to more than 7.3%. This can be explained by the fact that in such a transition scenario, not only (the small portion of) brown investments, but also “other” investments suffer from such a shock (here by 12.4% in line with [25], with a 24.1% decline in case of brown assets). Adding a stop-loss reinsurance contract still reduces the default proability, but only by about 7% in relative terms as compared to about 25% in the baseline scenario without the transition shock.

We next consider the effect of the hot house world scenario, where only physical climate risks are modeled by assuming an upper-tail dependence between the weekly claim frequency and severity. In this case, the default probability also considerably increases to 0.8%, but still much less severe than in the previous pure disorderly transition scenario, while the expected surplus is reduced by 4.7%. Adding reinsurance (SL) in this situation helps to considerably reduce the default probability to 0.52% and to improve the expected surplus as well. If the insurer is additionally able to adjust its pricing adequately by taking into account physical climate risk through higher premiums (adj), one can observe a strong positive effect on both default risk and expected surplus (also compared to the baseline scenario), especially when combining risk-adjusted pricing with reinsurance.

The third scenario too little, too late combines both transition and physical climate risks on the asset and liability side. While the impact on the expected surplus is given by adding both individual effects of physical (hot house world) and transition (disorderly transition) risks, the combined impact on the probability of default is greater than the sum of the individual effects, resulting in a default probability of 9.58%. Adding tail dependence between assets and liabilities (too little, too late + tail) in the last scenario further increases the default probability to 11.9% due to the even stronger emphasis on tail events, while the expected surplus remains almost unaffected. In all scenarios, the mitigating effect of stop-loss reinsurance as well as risk-adjusted pricing can be seen, highlighting the importance of these measures in the context of climate-related disaster scenarios.

3.3 Sensitivity analysis

To investigate the robustness of the results presented previously, we vary the strength of dependence of both copulas, \({C}_{\theta }^{FS}\) for the dependent claims model and \({C}_{\theta }^{AL}\) for the climate risk-induced dependence between assets and liabilities, transforming copula parameter \(\theta\) to Kendall’s tau \({\rho }_{\tau }\) with \({\rho }_{\tau }=\theta /(\theta +2)\). Figure 3 first shows the impact of the strength of dependence between brown assets and total claims amount for the too little, too late + tail scenario with physical and transition climate risks regarding assets and liabilities and tail dependence between brown assets and total claims. As before and as expected, the default probability is monotonically increasing for an increasing strength of dependence between brown assets and liabilities, but decreasing in slope and thus concave. This effect of increasing default probabilities cannot be effectively eliminated by mitigating instruments, which only help to lower the level of the default probability.

Figure 4 next focuses on the hot house world scenario with only physical climate risks for the liability side. As can be seen, an increasing strength of dependence between frequency and severity of claims implies a considerable increase in the default probability, which, however, can almost be eliminated by a combination of stop-loss reinsurance and risk-adjusted pricing (hot house world + adj + SL scenario), which is in contrast to Fig. 3.

Additionally, the left graph in Fig. 5 shows that the sensitivity to Kendall’s tau between claim frequency and severity is stronger in scenarios with transition risks (too little, too late) as compared to the hot house world scenario that only takes into account physical climate risks. The difference in the impact between premium adjustment and reinsurance becomes even more apparent in the too little, too late + tail scenario considered in the right graph of Fig. 5 (right). Although both instruments result in similar default probabilities for \({\rho }_{\tau }=\) 0.4, the default probability curves considerably diverge for smaller \({\rho }_{\tau }\), implying a stronger mitigating effect of adjusted pricing in the present setting. In the sensitivity curves presented in Figs. 4 and 5, risk adjusted-pricing tends to reduce the slope of the curve and stop-loss reinsurance rather reduces the intercept.

Finally, we consider the sensitivity of default probability to the fraction of brown investments in the asset portfolio and the strength of dependence between the return rate of brown and other assets. Figure 6 shows that the sensitivity to the share of brown assets appears to be linear and positive. Furthermore, the mitigating effects result in a parallel shift of the sensitivity curves, but without a reduction in the slope, even with the addition of both stop-loss reinsurance and risk-adjusted pricing (right graph in Fig. 6), as the shock in this scenario stems from the asset side.

Figure 7 clearly shows that the probability of default in the too little, too late + tail scenario reacts very sensitively to the correlation between brown assets and other assets. This can be attributed to the fact that the dependence between claims and brown assets extends to a dependence between the overall portfolio as the correlation increases.

4 Summary

In this article, we examine the impact of climate risks on the asset and liability side of a non-life insurer using scenario analysis in an asset-liability management context, with a special focus on potential accumulation effects on the balance sheet and measured based on the default probability and expected surplus. We take into account climate transition and physical risks using tail dependencies based on copulas. To model physical risks, which impact liabilities primarily through more frequent and more severe natural catastrophe events, we assume an upper tail dependence between claim severity and frequency distributions to address the heavier tail of the claims distribution. In the next step, we model the impact of transition risks that negatively affect asset returns in the context of a disorderly transition to a carbon–neutral economy, where investments in carbon-intensive equity and bonds (brown investments) would be affected more severely, but all other assets are affected as well. Last, beyond the pure accumulation of both transition and physical risk effects, we consider the effect of nonlinear dependencies between the brown asset return rate and the annual claims amount. This is based on a disaster scenario, where a sharp increase in physical risks (e.g., strongly accumulating natural disasters) causes an abrupt transition of the economy and thus leads to increased transition risks also on the asset side. Finally, we study the effect of a stop-loss reinsurance contract and risk-adjusted pricing by the primary insurer by raising premiums (in the scenarios with physical risk) as potential risk transfer instruments in order to gain first insight into potential mitigating effects of climate risks.

Our scenario analyses show that especially transition risks on the asset side are of high relevance for non-life insurers, as not only brown assets, but also other assets are affected by market value losses due to increases of commodity and energy prices and interest rates, for instance. Considering only physical risks through higher total claims also results in a considerable increase in default risk, but these appear to be manageable through a risk-adjusted pricing as well as reinsurance contracts (if the latter are available). One key result is that an occurrence of both physical and transition climate risks in the too little, too late scenario (with or without tail dependence between assets and liabilities) can result in a significant increase in the default probability through severe accumulation effects. A sensitivity analysis further showed that the default probability is strongly impacted by the strength of the dependence between assets and liabilities as well as by the proportion of brown investments and their correlation to remaining assets. This sensitivity of default probabilities can be reduced significantly by means of reinsurance (if available and affordable) and risk-adjusted pricing at least with respect to physical risks, but the proportion of brown assets in the portfolio remains a relevant risk driver. Overall, climate risks can thus have a severe accumulation effect on a non-life insurer’s balance sheet, potentially resulting in a considerably higher default probabilities, which should be mitigated by taking appropriate actions (e.g., reinsurance, shifting assets, risk-adjusted pricing).

As the present study intends to shed first insight on the accumulation effects of climate risks for non-life insurers for a one-year period, future work should take into account a multi-year perspective, study different types of (optimal) reinsurance strategies as well as pricing approaches and address the level of detail of the company-specific asset and liability structure.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Notes

For example, in 2020, the German the non-life insurance industry faced claims with an average severity of 2358€ [27]. In 2021, the flood event “Bernd” caused about 213,000 (additional) claims for non-life insurers with an average claim severity of 39,900€ [28]. Overall, this resulted in an average claim severity of 2872€ in 2021, which was therefore 21.8% higher than in the previous year.

Note that this assumption represents one possible way of how climate risks may materialize in the context of claims, and that it is intended as a type of scenario analysis for the liability side, while our focus will be laid on interactions between assets and liabilities as laid out later.

The period of one week is selected because climate-related natural disasters can be assigned to a particular week in the majority of cases (~ 77%), see CRED [13].

References

Albrecher H, Boxma OJ, Ivanovs J (2014) On simple ruin expressions in dependent Sparre Andersen risk models. J Appl Probab 51:293–296

Albrecher H, Boxma OJ (2004) A ruin model with dependence between claim sizes and claim intervals. Insur Math Econ 35(2):245–254

Albrecher H, Teugels J (2006) Exponential behavior in the presence of dependence in risk theory. J Appl Probab 43(1):257–273

Ambagaspitiya R (2009) Ultimate ruin probability in the Sparre Andersen model with dependent claim sizes and claim occurrence times. Insur Math Econ 44(3):464–472

Babovic F, Castéran A, Jewson S, Lederer T, Sassi M, Seyedi J (2021) Modeling future European flood risk. RMS White Paper. Retrieved from https://www.rms.com/offer/europe-flood-whitepaper. access 22 Apr 2023

Bank of England (2022) Results of the 2021 climate biennial exploratory scenario (CBES). Retrieved from https://www.bankofengland.co.uk/stress-testing/2022/results-of-the-2021-climate-biennial-exploratory-scenario. Access 07 Jul 2023

Battiston S, Mandel A, Monasterolo I, Schütze F, Visentin G (2017) A climate stress-test of the financial system. Nat Clim Chang 7:283–288

Beard RE, Pentikainen T, Pesonen E (1977) Risk theory: the stochastic basis of insurance, 2nd edn. Chapman and Hall

Biard R, Lefèvre C, Loisel S, Nagaraja H (2011) Asymptotic finite-time ruin probabilities for a class of path-dependent heavy-tailed claim amounts using Poisson spacings. Appl Stoch Model Bus Ind 27(5):503–518

Boudreault M, Cossette H, Landriault D, Marceau E (2006) On a risk model with dependence between interclaim arrivals and claim sizes. Scand Actuar J 5:265–285

Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) (2019) Merkblatt zum Umgang mit Nachhaltigkeitsrisiken. Retrieved from https://www.bafin.de/SharedDocs/Downloads/DE/Merkblatt/dl_mb_Nachhaltigkeitsrisiken.html. Access 30 Jan 2023

Campiglio E, Daumas L, Monnin P, von Jagov A (2023) Climate-related risks in financial assets. J Econ Surv 37(3):950–992

Centre for Research on the Epidemiology of Disasters (CRED) (2023) Emergency Events Database (EM-DAT). Retrieved from https://public.emdat.be/data. Access 22 Feb 2023

Clayton D (1978) A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence. Biometrica 65:141–151

Eckert J, Gatzert N (2018) Risk and value-based management for non-life insurers under solvency constraints. Eur J Oper Res 266:761–774

Eling M, Gatzert N, Schmeiser H (2009) Minimum standards for investment performance: a new perspective on non-life insurer solvency. Insur Math Econ 45:113–122

European Central Bank (2021) Climate-related risk and financial stability. ECB/ESRB Project Team on climate risk monitoring

European Insurance and Occupational Pensions Authority (EIOPA) (2011): EIOPA Report on the fifth Quantitative Impact Study (QIS5) for Solvency II. EIOPA-TFQIS5-11/001

European Insurance and Occupational Pensions Authority (EIOPA) (2021) Report on Non-Life Underwriting and Pricing in Light of Climate Change. EIOPA-BoS-21/25

European Insurance and Occupational Pensions Authority (EIOPA) (2022): Methodological principles of insurance stress testing—climate change component. EIOPA-BOS-21/579

European Insurance and Occupational Pensions Authority (EIOPA) (2022) Application Guidance on Running Climate Change Materiality Assessment and using Climate Change Scenarios in the ORSA. EIOPA-BoS-22/329

European Insurance and Occupational Pensions Authority (EIOPA) (2022) European Insurers’ Exposure to Physical Climate Change Risk. EIOPA-22/278

European Insurance and Occupational Pensions Authority (EIOPA) (2022) Prudential Treatment of Sustainability Risks. Discussion Paper. EIOPA-BoS-22-527

European Insurance and Occupational Pensions Authority (EIOPA) (2022) 2022 IORP Stress Test. EIOPA-22-310.

European Insurance and Occupational Pensions Authority (EIOPA) (2022) Report on 2022 IORP Climate Stress Test. EIOPA-BoS-22/551

Gesamtverband der Deutschen Versicherungswirtschaft (GDV) (2022) Schadenverhütung in der Sachversicherung 2021/2022. GDV-Report. Retrieved from https://www.gdv.de/resource/blob/85592/28bec9dcf795772a30cbf683c6712f4f/schadenverhuetung-in-der-sachversicherung-2021-2022-data.pdf. Access 05 May 2023

Gesamtverband der Deutschen Versicherungswirtschaft (GDV) (2022) Zahlen und Daten zur Schaden- und Unfallversicherung 2021. Retrieved from https://www.gdv.de/gdv/medien/zahlen-und-daten/beitraege-leistungen-vertragszahlen-der-einzelnen-versicherungsparten. Access 30 Jan 2023.

Gesamtverband der Deutschen Versicherungswirtschaft (GDV) (2022): Zahlen und Fakten–Flutkatastrophe “Bernd” 13–18.Juli 2021. Retrieved from https://www.gdv.de/resource/blob/85468/5d36e1c4913dbd0214cea9f0f78ff932/zahlen-und-fakten-data.pdf. Access 22 Feb 2023

Golnaraghi M (2021) Climate change risk assessment for the insurance industry. Retrieved from https://www.genevaassociation.org/sites/default/files/research-topics-document-type/pdf_public/climate_risk_web_final_250221.pdf. access 10 Nov 2021

Hu L, Yang Y (2009) A Bayesian monte carlo markov chain method for loss models and risk measure assessments. Rev Pac Basin Financ Mark Policies 12(3):529–543

Institute and Faculty of Actuaries (IFoA) (2023): The Emperor’s New Climate Scenarios—Limitations and assumptions of commonly used climate-change scenarios in financial services. Retrieved from https://actuaries.org.uk/media/qeydewmk/the-emperor-s-new-climate-scenarios.pdf. Access 12 Jul 2023

International Actuarial Association (IAA) and Intergovernmental Panel on Climate Change Working Group I (IPCC WGI) (2022) Climate science: a summary for actuaries. Retrieved from https://www.actuaries.org/IAA/Documents/Publications/Papers/Climate_Science_Summary_Actuaries.pdf. Access 04 Jul 2023

Intergovernmental Panel on Climate Change (IPCC) (2012) Managing the risks of extreme events and disasters to advance climate change adaption. Cambridge University Press

Knutson TR, Tuleya RE (2004) Impact of CO2-induced warming on simulated hurricane intensity and precipitation: sensitivity to the choice of climate model and convective parameterization. J Climate 17(18):3477–3495

Kreienkamp F et al. (2021) Rapid attribution of heavy rainfall events leading to the severe flooding in Western Europe during July 2021. Scientific Report - World Weather Attribution. Retrieved from https://www.worldweatherattribution.org/wp-content/uploads/Scientific-report-Western-Europe-floods2021-attribution.pdf. Access 21 Apr 2023

Meng Q, Zhang X, Guo J (2008) On a risk model with dependence between claim sizes and claim intervals. Statist Probab Lett 78(13):1727–1734

Network for Greening the Financial System (NGFS) (2019) A call for action: climate change as a source of financial risk. Retrieved from https://www.ngfs.net/sites/default/files/medias/documents/ngfs_first_comprehensive_report_-_17042019_0.pdf. access 30 Jan 2023

OECD (2018) The contribution of reinsurance markets to managing catastrophe risk. Retrieved from www.oecd.org/finance/the-contribution-of-reinsurance-markets-to-managing-catastrophe-risk.pdf. Access 19 Jul 2023

Tesselaar M, Botzen W, Aerts J (2020) Impacts of climate change and remote natural catastrophes on EU flood insurance markets: an analysis of soft and hard reinsurance markets for flood coverage. Atmosphere 11:146

Weyzig, F., Kuepper, B., van Gelder, J. W., van Tilburg, R. (2014): The Price of Doing Too Little Too Late. Green European Foundation - Green New Deal Series, 11.

Zanotto A, Clemente GP (2022) An optimal reinsurance simulation model for non-life insurance in the solvency II framework. Eur Actuar J 12:89–123

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gatzert, N., Özdil, O. The impact of dependencies between climate risks on the asset and liability side of non-life insurers. Eur. Actuar. J. 14, 1–19 (2024). https://doi.org/10.1007/s13385-023-00364-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-023-00364-2

Keywords

- Non-life insurance

- Collective risk model

- Climate risks

- Nonlinear dependencies

- Asset-liability management