Abstract

In this paper, we devise a stochastic asset–liability management (ALM) model for a life insurance company and analyze its influence on the balance sheet within a low-interest rate environment. In particular, a flexible procedure for the generation of insurers’ compressed contract portfolios that respects the given biometric structure is presented, extending the existing literature on stochastic ALM modeling. The introduced balance sheet model is in line with the principles of double-entry bookkeeping as required in accounting. We further focus on the incorporation of new business, i.e. the addition of newly concluded contracts and thus of insured in each period. Efficient simulations are obtained by integrating new policies into existing cohorts according to contract-related criteria. We provide new results on the consistency of the balance sheet equations. In extensive simulation studies for different scenarios regarding the business form of today’s life insurers, we utilize these to analyze the long-term behavior and the stability of the components of the balance sheet for different asset–liability approaches. Finally, we investigate the robustness of two prominent investment strategies against crashes in the capital markets, which lead to extreme liquidity shocks and thus threaten the insurer’s financial health.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, several life insurers decided to sell parts of their insurance portfolios to run-off companies, i.e. to firms that are specialized in the processing of existing contracts without issuing new policies. Reasons for this may have been the ongoing period of low, and in some cases even negative, interest rates on the one side and simultaneous high obligations from existing contracts on the other side, making it difficult to obtain sufficient returns on the managed funds, see Kok et al. [14]. The sales attracted a lot of attention and were often viewed critically in public reporting as they highlighted the challenges today’s life insurers have to face. Against this background, a successful asset–liability management (ALM) seems to become more important. The application of stochastic simulations can support managerial decisions by illustrating the long-term effects of potential measures.

Essentially, ALM can be seen as the goal-driven coordination of assets and liabilities of the balance sheet, see Wagner [20]. The investments in the capital market need to be reconciled with the obligations induced by the insurance products such that claims can be met when they are due. An ALM model typically consists of several components (sub-models) to describe both the evolution of assets and liabilities and different external environments affecting the insurance business (e.g. capital market and policyholder behavior).

A lot of work has been already done within the wide-spread field of asset–liability management. In particular, stochastic ALM-modeling has become quite popular. Many papers focus on the valuation of insurance contracts, see e.g., Bauer et al. [1], Grosen and Jørgensen [10], Hieber et al. [11], or Zaglauer and Bauer [21] and the references therein. Conditions for fair prices are derived by calculating discounted expectations of the final benefit payments under a risk-neutral measure Q. For doing so, one typically needs strong simplifications. Examples are the consideration of single insurance contracts or one cohort of identical policies, the restriction to one lump-sum premium payment at the contract’s inception, and the negligence of surrender.

Further ALM models are introduced in, e.g., Bohnert and Gatzert [3], Bohnert et al [4], Burkhart et al. [5, 6], Fernández et al. [8], Gerstner et al. [9], Kling et al. [12, 13], and Kok et al. [14]. Most of them restrict to run-off companies. Exceptions are Kling et al. [12, 13], looking at a life insurer in a “steady state” where a constant fraction of the liabilities is paid out as benefit payments every year. However, they consider neither mortality nor surrender effects, justifying this by the assumption that new business roughly compensates for withdrawals and surrender would not influence the amount of assets and liabilities. This appears to be a rather strong assumption, as individual contract characteristics, biometric parameters, and policyholder behavior are not taken into account. Milhaud and Dutang [17] state that, nowadays, the lapse risk is one of the most important risk factors life insurers need to consider since surrendering and stopping premium payments can trigger unexpected cash flows and can thus strongly affect the life insurer’s asset–liability management. For example, Kubitza et al. [16] provide empirical evidence that rising interest rates can significantly raise surrender rates, potentially yielding to insurance runs in the most extreme case. Another exception is Burkhart et al. [5] who analyze the impact of new business on the liabilities within a risk-neutral setting. Their insurance portfolio consists of different cohorts of identical policies. However, it is rather homogeneous than heterogeneous as each cohort represents all contracts concluded within a specific year. Such a grouping scheme disregards the diverse nature of an insured collective.

Hieber et al. [11] emphasize the importance of the heterogeneity aspect within life insurance portfolios. Indeed, the assumption of a single contract or cohort structure neglects the fact that the joint management of different contracts leads to interactions between existing and newly signed policies, e.g., due to management rules, claims on the same bonus reserve, or individual surrender options. Gerstner et al. [9] present a quite general ALM model where a run-off company manages the processing of a heterogeneous insurance portfolio consisting of different cohorts, so-called model points. It is not shown how these are generated but the authors sketch possible grouping criteria. For their numerical investigations, they simulate the needed data for each of the 500 equal-sized cohorts.

Analytic solutions are no longer available in general if considering a heterogeneous insurance portfolio comprising complex payoff-structured contracts, not least because of the strong interactions between assets and liabilities. To cope with computationally intensive numerical methods, suitable approximation techniques are required. Krah et al. [15], e.g., use the least-squares Monte Carlo method for the calculation of the capital requirements under Solvency II. In the recommendations of the German Association of Actuaries DAV [7], an exemplary procedure for the compression of an insurance portfolio is presented, where first target figures are chosen and secondly a restricted minimization problem is solved.

Due to the complexity of bookkeeping, simplified approaches to handle the fundamental balance sheet equation are applied in the literature. They are often associated with the principles of single-entry bookkeeping. By defining the equity (sometimes also called the reserve or buffer account) residually by the difference between assets (left side of the balance sheet) and liabilities (remaining accounts on the right side), the balance sheet equation is automatically fulfilled. In comparison, we aim at providing an even balance sheet model without assuming that this relationship holds by default. Therefore, our approach is closely related to the double-entry bookkeeping system.

In this paper, we consider a life insurer that manages a large, heterogeneous insurance portfolio consisting of participating contracts. The holders of such policies are, in addition to the contractually guaranteed benefits, entitled to variable bonus payments which allow them to participate in the obtained surpluses. Bodie et al. [2] distinguish between defined contribution (DC) and defined benefit (DB) type of insurance products. In our case, the contracts represent hybrids of both types. Indeed, the benefit payments result from the accumulated contributions, but due to premium guarantees, interest rate promises, and entitlements to allocated surpluses, the policies are not fully funded. Early termination of the contracts is possible due to surrender options and mortality. For the latter, we use detailed life tables providing a realistic development of death probabilities. The insurance portfolio’s heterogeneity is reflected by different maturities and premiums of the policies and by a wide range of biometric parameters regarding the insured collective.

Starting with an initial insurance portfolio, our aim is the forward projection of a given balance sheet structure and the investigation of conditions for a long-term stability or stationarity. Here, we put emphasis on the making of the balance sheet. We do not assume that the sum of all liabilities automatically equals the sum of all assets in contrast to many models in the literature. Instead, we explicitly prove that the fundamental balance sheet equation is fulfilled at the end of every period. This is in line with the principles of double-entry bookkeeping as required in accounting.

The objective of long-term stability requires the inclusion of new business, i.e. the addition of newly concluded contracts and thus policyholders in each period. In particular, our model is not confined to run-off companies.

Furthermore, we propose an approach for the efficient simulation of a given large insurance portfolio by grouping the insured collective into cohorts according to biometric, contract-related criteria and to simulate only representative contracts. The procedure can be seen as an approximation of the real insurance portfolio by a fictive, less heterogeneous portfolio of the same size whereas the primal general structure is maintained. Our grouping scheme is flexible and universally applicable to any insurance portfolio. The initial number of cohorts and the number of policyholders within these depend on both the size and the heterogeneity of the given insured collective. We also show how to efficiently integrate new contracts into the existing insurance portfolio.

Regarding the legislation, we orient ourselves towards European and in particular to German law, e.g. by considering a lagged participation process for the surpluses, but we do not focus on the stringent adaption to all regulations or the incorporation of local accounting rules. We aim at a balance between tractability and taking into account relevant legal requirements in order to get meaningful simulation results on the long-term stability.

The modular framework enables the realization of alternative modeling approaches or the adaption to different insurance products. In this paper, we especially consider two prominent investment strategies and alternative patterns of new contract arrivals including a run-off scenario. We also expand the chosen capital market model by allowing for fixed and random crashes. This extension aims at obtaining insights on the robustness of the applied investment strategies and the stability of the life insurer’s balance sheet, as well as quantifying the risk of (extreme) liquidity shocks.

The remainder of this paper is organized as follows. Section 2 constitutes the main part of this paper. There, we describe the general framework of our ALM model and introduce its various, interacting parts with a strong focus on our grouping procedure for the generation of cohorts and the integration of new contracts. We close that section by proving that our model is reasonable in the sense that the fundamental balance sheet equation is fulfilled at all times (cf. Theorem 2.2). To illustrate our model, we perform several simulation studies in Sect. 3. The basis forms an exemplary parameter configuration (Table 2), while modifications are made subsequently to consider different scenarios regarding the insurer’s business form, the interest rate environment, and to allow for possible capital market crashes. Section 4 provides our conclusions.

2 The ALM model

The model consists of different, interacting parts presented in Fig. 1. The capital market is modeled by short rate and stock price processes and the insurer’s financial assets are presented in simplified form by stocks and bonds. On the counterpart, we have liabilities formed by the insurance contracts comprising existing and new business. The management model describes the insurance company’s decisions regarding the asset allocation and the declaration of the bonus payments and of the annual interest return. Each of these modules can be adjusted or extended further, without affecting the overall structure of our model.

2.1 General setting

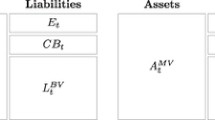

The simulation period \([0,{\mathcal {T}}]\) is discretized in \(K\) intervals, \(0=t_0<t_1<\cdots <t_K={\mathcal {T}}\), of equal length \(\varDelta t={\mathcal {T}}/K\). Inventory figures like previously signed contracts are linked to past times \(t_{-k}<0\). The balance sheet as displayed in Table 1 for time \(t_k\) forms the reference for the simulation of the asset–liability management.

The total capital \(C_{k}\) of the assets is allocated to bonds of different times to maturity, stocks, and a cash position with market values \(C^b_{k}\), \(C^s_{k}\), and \(C^c_{k}\), respectively. On the opposite side of the balance sheet, the liabilities comprise the equity \(Q_{k}\), the free reserve \(F_{k}\), the actuarial reserve \(A^{}_{k}\) and the bonus reserve \(B^{}_{k}\) forming the technical reserve \(V^{}_{k} = A^{}_{k} + B^{}_{k}\), and the liabilities to banks \(L_{k}\). The actuarial reserve represents the obligations towards the policyholders arising from the guarantees embedded in the life insurance contracts. Surpluses credited to individual contracts are accounted for by the bonus reserve. Unappropriated and unallocated surpluses are registered in the free reserve and the equity is the stake kept by the shareholders. As the free reserve is not assigned to individual policies, it can be used to cover future losses under strict conditions. Finally, the insurance company can take loans which must be registered as liabilities to banks.

2.2 Capital market model

For life insurers, the two most important markets to invest in are the bond and the stock markets. To model the first one, we choose a (discretized version of the) Vasiček model. The short rate at time \(t_k\) follows the dynamics

where \(\Delta _kW_r{:}{=}W_r(t_k)-W_r(t_{k-1})\) for a Brownian motion \(W_r\) under the subjective probability measure P and with \(b={\tilde{b}}+\lambda \sigma _r\in {\mathbb {R}}\), \(a={\tilde{a}}>0\), and \(\sigma _r>0\). Here, \({\tilde{b}}\) and \({\tilde{a}}\) denote the short rate parameters under the risk-neutral measure Q defined by choosing a market price of risk for interest rates of the formFootnote 1\(\lambda (t_k)=\lambda \) with \(\lambda \in {\mathbb {R}}\). The corresponding price of the zero-coupon bond with maturity \(T\) is then given by

with

The stock prices follow a discretized geometric Brownian motion model,

with drift \(\mu _s\in {\mathbb {R}}\), volatility \(\sigma _s>0\), and \(W_s(t)=\rho W_r(t)+\sqrt{1-\rho ^2}Z(t)\) for a Brownian motion \(Z\) independent of \(W_r\). Thus, \(W_s(t)\) and \(W_r(t)\) have correlation \(\rho \). We simplify the insurer’s investments by considering a financial market consisting only of bonds and one stock. The latter could represent an index or the value of an entire portfolio. In Sect. 3.4, we expand our capital market model by allowing for crashes in the stock and bond markets. This approach covers the extension to corporate bond investments.

2.3 Management model

In the presented model, the management of the life insurance company decides about the asset allocation and the surplus participation process.

The asset allocation due to cash flows from the insurance business (premium payments, benefit payments, credit repayments) and price changes of the financial products (stocks, bonds) is adjusted for the next balance sheet at given time points \(t_{k-1}\). Throughout the interval \((t_{k-1}, t_k)\), the numbers \(\varphi ^s_{k}\) and \(\varphi ^b_{k}\) of stocks held and bonds with duration \(\tau \) purchased are kept constant. As indicated in Fig. 2, only single prices for bonds and stocks are quoted at each time point \(t_k\).

We denote by \(C^B_{k}\) the aggregated capital being bounded in the kept bonds with different times to maturity and by \(C^L_{k}\) the position of liquid funds. Both quantities are calculated at the beginning of each period depending on the previous balance sheet and the obtained premiums, see Sect. 2.5. The reallocation of assets depends on the chosen investment strategy. The new numbers of stocks held and bonds purchased are given by

where \(C^{s,tar}_{k}\) represents the management’s target for the stock position. In the simulation studies (Sect. 3) we apply two alternative investment strategies specifying \(C^{s,tar}_{k}\).

The management also decides on the use of financial surpluses. As insurance companies are obliged to run their businesses carefully, a number of protection features are incorporated in practice. For example prolonged life tables reduce the longevity risk for the insurance company or the investments at the financial market must be carried out cautiously. Normally, all this leads to the insurance company making surpluses which belong to the policyholders and are distributed to the collective. In the presented model, the collective surpluses are first accounted by the free reserve \(F_{k-1}\). They are later distributed to the individual policies and used depending on the type of insurance contract. This is done by declaring an annual interest rate

at the beginning of the year, i.e. at times \(t_{k-1}\) with \(k\equiv 1 \left( \text{mod} \, \frac{1}{\varDelta t} \right) \). Here, a guaranteed interest rate \({\widehat{i}}_G\) is taken into account, which might be a feature of the insurance contract.Footnote 2 The distribution ratio \(\omega \) is controlled by the management and weights the deviation between the reserve fund quota

and target value \(\gamma _{}\in [0, 1]\).

2.4 Liability model

The insurance company’s liabilities consist of commitments entered into by the conclusion of insurance contracts of different types. Beside structural characteristics, the policies heavily depend on biometric parameters of the insured.

2.4.1 The concept of model points and biometric parameters

To simplify the simulation of an insurance portfolio, the policies are grouped according to biometric characteristics, yielding so-called model points or cohorts, and are averaged within these model points to form representative contracts. The biometric dependencies of both the existing and new policies are characterized by the customer’s gender \(g^{}\), the signing age \({\underline{x}}^{}\), the current age \(x_{k}^{}\) at time \(t_k\), and the age \({\overline{x}}^{}\) at the contract’s expiry, with \({\underline{x}}^{}, x_{k}^{}, {\overline{x}}^{} \in {\mathbb {R}}^+ \). The insured collective is divided into \(M_{0}\) cohorts due to the three criteria

-

1.

gender \(g^{}\),

-

2.

integer current age \( \lfloor x_{0}^{}\rfloor \in {\mathbb {N}}\), where \(\lfloor x \rfloor = \text{max} \left\{ z\in {\mathbb {Z}} \left. \right| z \le x\right\} \), and

-

3.

integer exit age \( \lfloor {\overline{x}}^{}\rfloor \in {\mathbb {N}}\).

Note that the signing age \({\underline{x}}^{}\) is not a grouping criterion and policies within a model point can have different contract periods. The number \(M_{0}\) of generated cohorts depends on both the size and the heterogeneity of the initial insurance portfolio as illustrated in Fig. 3. Here, each insurance portfolio is simulated separately based on the distributional assumptions of the biometric parameters described in Sect. 3. The number of model points increases slower for large insurance portfolios and is bounded from above due to age limits. The dependence on the heterogeneity can be seen from the non-monotonic growth.

After the grouping, we assign numbers and select randomly a representative policyholder from each cohort \(m\in \left\{ 1,\dots ,M_{0} \right\} \) denoting the gender by \(g^{m}\), the current age by \(x_{0}^{m}\in {\mathbb {R}}^+\), and the exit age by \({\overline{x}}^{m}\in {\mathbb {R}}^+\). By this, we also take fractions of the year into account. The updated current age and the remaining contract period are described recursively, i.e. \(x_{k}^{m}=x_{k-1}^{m}+\varDelta t\) and \( d^{m}_{k}=d^{m}_{k-1}-1 \), with \(d^{m}_{0}= \left\lceil \frac{ {\overline{x}}^{m}-x_{0}^{m} }{\varDelta t} \right\rceil \in {\mathbb {N}}\), where \(\lceil x \rceil = \text{min} \left\{ z\in {\mathbb {Z}} \left. \right| z \ge x\right\} \).

The initial size of the insurance portfolio \(\delta ^{}_{0}\) can be written as \(\delta ^{}_{0}=\sum _{m=1}^{M_{0}} \delta ^{m}_{0},\) where \(\delta ^{m}_{0}\) denotes the number of policies in cohort \(m\) at time \(t_0\). According to the biometric distribution, the cohorts’ sizes differ, see Fig. 4.

On the right-hand side of Fig. 4, we show the distribution of male policyholdersFootnote 3 over the cohorts generated for an exemplary insurance portfolio of size \(M_{0}=500{,}000\). Here, the numbering of the cohorts reflects the corresponding age criteria in ascending order such that, for example, all 33-year-old, male policyholders with exit ages from 55 to 70 are located in cohorts 179 to 194 (blue excerpt). Note that the appearance of the shown distribution depends on the specific way of numbering the cohorts. On average, there are 383 policyholders per model point.

2.4.2 Termination of insurance contracts due to death or cancellation

Insurance contracts can be terminated for a number of reasons, most prominently death and cancellation. Death of policyholders is modeled using the cohort life tables for Germany provided by the Federal Office of Statistics.Footnote 4 The contained annual death probabilities \(q_x=q_x\left( x,g,y \right) \) depend on the age x, on the gender g, and on the year of birth y. Assuming a constant force of mortality throughout the year, death probabilities \(q_k^m\) for time period \(\left[ t_{k-1}, t_k\right] \) are given by

where \(x_{max} \) denotes the maximum age in the life tableFootnote 5 and \(y^m=\lfloor {\mathcal {Y}}-x_{0}^{m}\rfloor \) the representative’s year of birth with \({\mathcal {Y}}\) being the current calendar year. The extension to a stochastic mortality approach is straightforward and does not change the model’s overall structure.

To model the contract’s surrender option, one needs probabilities \(u_k^m\) of the insured terminating the contract in period \(k\). Different modeling approachesFootnote 6 can easily be adopted depending on the life insurer’s business form and the applied simulation method. Considering a single policy, it is reasonable to assume that the probability increases in the first periods of the contract time due to growing uncertainties. Since terminating a contract is linked with paying cancellation fees, the surrender probabilities can be expected to decrease after reaching a maximum around the run time’s midterm. We model the surrender probability using an exponential distribution with parameter \(\kappa \), namely

with \({\mathbbm {1}}_{\left\{ \right\} }\) being the indicator function. The reason for this is the averaging of contracts including newly signed ones to form the updated model point throughout the simulation. This balances the effects of individual contracts and makes it reasonable to assume the same surrender probability in each period.

2.4.3 The development of the cohorts

After describing the cohorts and their initial state at the beginning of the simulation, we now present the subsequent development. More specifically, recursive representations of the size of the insurance portfolio \(\delta ^{}_{k}\), the number of cohorts \(M_{k}\), and the number of policyholders in the individual cohorts \(\delta ^{m}_{k}\) are derived for all periods \(k=1,\dots ,K\). In Fig. 5, we illustrate the events related to a cohort \( m\in \left\{ 1,\dots ,M_{k} \right\} \) within the period \([t_{k-1}, t_{k}]\).

At the beginning of the \(k\)th-period, a random number of new customers \(\delta _{k}^{new}\) occurs. Their age structure is generated based on suitable distributions, cf. Sect. 3. At first, the collective of new customers is divided into \(M^{new}_{k}\) cohorts based on the established criteria. To avoid an increase in the number of cohorts, the new ones are merged with existing ones according to the gender, the rounded current age, and the rounded exit age. The number of additional customers in cohort \(m\in \left\{ 1,\dots ,M_{k-1} \right\} \) is denoted by \(\delta ^{new, m}_{k}\). Those cohorts who could not be merged augment the set of existing model points by \(M^{add}_{k}\).

At the end of the period \(k\), starting with the size of the cohort \(\delta ^{m}_{k-1}+\delta ^{new, m}_{k}\) and taking the survival probability \(1-q_k^m\), the surrender probability \(u_k^m\), and the remaining contract periods into account, the number of policyholders in model point \(m\) at time \(t_k\) which remain in the insurance collective is given by

For convenience, we thus assumed that decrements only occur at the end of each period and that only policyholders who survive the period for the surrender option are considered. Therefore, the number of deaths in model point \(m\) amounts to \(\delta ^{q,m}_{k}=q_k^m\cdot (\delta ^{m}_{k-1}+\delta ^{new, m}_{k})\) and the number of cancellations to \(\delta ^{u,m}_{k}=u_k^m\cdot (1-q_k^m) (\delta ^{m}_{k-1}+\delta ^{new, m}_{k})\).

Finally the new number of model points and the size of the collective are

Cohorts becoming empty, i.e. \(\delta ^{end,m}_{k}={\mathbbm {1}}_{\left\{ d^{m}_{k}=0\right\} } \delta ^{m}_{k-1}\), can be deleted during a simulation and the numeration of the cohorts could be adjusted.

2.4.4 Development of the policyholders’ accounts

As this paper aims at presenting the fundamental relations in simulating the asset-liability-management, we assume that only one type of contract exists, namely a classic endowment insurance. It is equipped with a guaranteed interest rate for the invested premiums, a surrender option, and death benefits. Moreover, we consider a lump-sum benefit payment and not a pension phase.

Due to the concept of model points, cash flows are associated with the representative contracts. The survival, death, and surrender benefit payments resulting from cohort \(m\) at time \(t_k\) are given by

with the contract value \(V^{m}_{k}\) and the surrender factor \( \vartheta \in [0, 1] \). The contained guaranteed and unpredictable bonus parts being related to the actuarial account \(A^{m}_{k}\) and the bonus account \( B^{m}_{k} \) are specified correspondingly.Footnote 7

The policyholders’ accounts for the classic endowment insurance are adjusted at the end of every period. The actuarial account includes all premium payments compounded with the guaranteed interest rate \({\widehat{i}}_G\). The bonus account covers the excess of compounding the total account with the declared interest rate surpassing the actuarial account. As the new business changes the size of the cohorts, the representative accounts must be adjusted according to the fraction \(\frac{\delta ^{m}_{k-1}}{\delta ^{m}_{k-1}+\delta ^{new, m}_{k}}\) and the weighted average \(P^{m}_{k}\) of previous and new premiums. Then the values of all actuarial and bonus accounts in model point \(m\in \left\{ 1,\dots ,M_{k} \right\} \) at times \(t_k\) with \(k\ge 1\) equal

and

Combining these two accounts yields the contract value

In the following section, the representative accounts are linked to the corresponding reserves.

2.5 Balance sheet model

After introducing the relevant components, we describe the modeling of the balance sheet. This comprises the development of the assets and the projection of the liabilities introduced in Table 1. It is shown how the life insurer finances the periodic obligations against the insured collective. As a main result, we prove that the fundamental balance sheet equation holds at all times.

2.5.1 Projection of the assets

The balance sheet summarizes the business performance at the end of each period meaning that the values of the capital positions for cash \(C^c_{k}\), stocks \(C^s_{k}\), and bonds \(C^b_{k}\) are calculated. The starting point is the previous balance sheet with the company’s total assets \(C_{k-1}=C^c_{k-1} + C^s_{k-1} +C^b_{k-1}\). The calculation steps within the \(k\)th-period \([t_{k-1}, t_k]\) follow a strict order due to the investment strategy and the rules of accounting. At the beginning of the period, these are

-

1.

calculation of the value of the tied up capital,

-

2.

computation of the liquid capital, and

-

3.

reallocation of the assets according to the chosen investment strategy.

Here, we assume that bonds are held until maturity and that maturity falls on a period’s end implying \(\frac{\tau }{\varDelta t}\in {\mathbb {N}}\). The tied up capital comprises previously purchased bonds having positive remaining residual terms, i.e.

New premiums, liquid assets, and the previous demand for credits \(L^+_{k-1}\) determine the liquid capital

which is needed for the investment decision. The premium \(P^{}_{k}\) is in fact aggregated over all cohorts, including the new ones. This leads to

The credits to enter newly amount to

All the available cash \(C^c_{k-1}\) is invested, so the insurance company just adds new stocks and bonds. At the end of the period, the following business steps occur:

-

1.

reevaluation of the assets,

-

2.

disbursements of the obligations and credits,

-

3.

calculation of the demand for credit, and

-

4.

preparation of the balance sheet.

The actual value of the assets is given by the prices \(s_{k}\) and \(p_{}\left( t_k,t_i + \tau \right) \) at time \(t_k\). The bonds have been purchased at times \(t_i\). Since some bonds expire at the end of the period, they contribute to the income while on the other hand we have disbursements \(D_{k}\) consisting of due obligations \({\mathcal {B}}_{k}\) and expiring credits \(L^-_{k}\), i.e.

The due obligations against the policyholders are benefit payments in case of survival, death, and surrender and can be calculated by

The guaranteed and the bonus part of these payments are denoted with a superscript G and B (as done in Proposition 2.1) and can be obtained analogously, e.g. by replacing \(E^{m}_{k}\) by \(E^{G,m}_{k}\).

It is possible that the payouts from expired bonds do not cover the disbursements \(D_{k}\). In that case we assume that the life insurer sells stocks first and then takes out a loan if necessary. Thus, the demand for credits can be written as

Note that we have \(L^+_{k}>0\) if the value of liquid assets is insufficient and a credit is needed to meet the due obligations against the policyholders. Finally, the new balance sheet positions are given by

forming the result \(C_{k} = C^b_{k} + C^s_{k} + C^c_{k}\). The changes in the liabilities to bank due to new credits \(L^{new}_{k}\) and expiring ones \(L^-_{k}\) will be accounted for at the start of each period and is part of the description of the liabilities.

2.5.2 Projection of the liabilities

Turning to the balance sheet’s liabilities, we first describe the evolution of the actuarial reserve \(A^{}_{k}\), the bonus reserve \(B^{}_{k}\), and the technical reserve \(V^{}_{k}=A^{}_{k}+B^{}_{k}\). Using the results of Sect. 2.4 regarding the cohort size \(\delta ^{m}_{k}\) and the respective policyholders’ accounts \(A^{m}_{k}\), \(B^{m}_{k}\), and \(V^{m}_{k}\), the reserves at time \(t_k\) are given by

The following proposition shows the relation to the previous balance sheet of time \(t_{k-1}\).

Proposition 2.1

(Recursive schemes of the reserves) Consider the endowment insurance with surrender factor \(\vartheta >0\). Then, it holds for all \(k=1,\dots ,K\):

-

(i)

\(A^{}_{k} = \left( 1+{\widehat{i}}_G\right) ^{\varDelta t} \left( A^{}_{k-1} + P^{}_{k} \right) - \left( E^{G}_{k}+T^{G}_{k} + \frac{1}{\vartheta }S^{G}_{k} \right) \),

-

(ii)

\(B^{}_{k} = \left( 1+{\widehat{i}}_{k} \right) ^{\varDelta t} B^{}_{k-1} + \left( \left( 1+{\widehat{i}}_{k} \right) ^{\varDelta t} - \left( 1+{\widehat{i}}_G\right) ^{\varDelta t} \right) \left( A^{}_{k-1} + P^{}_{k} \right) -\left( E^{B}_{k}+T^{B}_{k}+\frac{1}{\vartheta }S^{B}_{k} \right) \),

-

(iii)

\(V^{}_{k}=\left( 1+{\widehat{i}}_{k} \right) ^{\varDelta t} \left( V^{}_{k-1} + P^{}_{k} \right) -\left( E^{}_{k}+T^{}_{k}+\frac{1}{\vartheta }S^{}_{k} \right) \).

Here, superscript G and B denote the corresponding guaranteed and bonus part of the benefit payments from Eq. (2.10).

Proof

To prove the first statement (i), the representation of \(A^{}_{k}\) in (2.11), the definition (2.5), and the equation \({\mathbbm {1}}_{\left\{ d^{m}_{k}>0\right\} }={\mathbbm {1}}_{\left\{ d^{m}_{k}\ge 0\right\} }-{\mathbbm {1}}_{\left\{ d^{m}_{k}=0\right\} }\) are used, yielding

With analog equations to (2.6) and (2.10) for the guaranteed benefit payments,Footnote 8 the actuarial reserve can be written as

using additionally that it holds \({\mathbbm {1}}_{\left\{ d^{m}_{k}\ge 0\right\} } u_k^m= {\mathbbm {1}}_{\left\{ d^{m}_{k}> 0\right\} }u_k^m\) due to Eq. (2.4). Inserting the expression of Eq. (2.7), using Eqs. (2.9), (2.11) for \(A^{}_{k-1}\), and taking into account that \({\mathbbm {1}}_{\left\{ d^{m}_{k}\ge 0\right\} } = {\mathbbm {1}}_{\left\{ d^{m}_{k-1} > 0\right\} }\) leads to statement (i). To prove the second statement, we derive

in the same manner as above using the corresponding bonus part of the benefit payments. The same argument using Eq. (2.8) leads to statement (ii). For the last statement, adding equation (i) and (ii) yields

since \(E^{}_{k} = E^{G}_{k} + E^{B}_{k}\), \(T^{}_{k} = T^{G}_{k} + T^{B}_{k}\), and \(S^{}_{k} = S^{G}_{k} + S^{B}_{k}\). The definition of \(V^{}_{k}\) shows (iii). \(\square \)

We now derive the liabilities to banks \(L_{k}\). It is assumed that the management decides to raise credits with a fixed duration and variable interest rate. This can be interpreted as short-selling of bonds. As the new credits are registered at the start of the period due to the recharging of premiums, there are some bridging loans besides the long-term credits. To sum up, raising new credits and paying off expiring ones, i.e.

and the bridging loans \(L^+_{k}\) lead to the balance sheet position

The last two positions, the free reserve \(F_{k}\) and the equity \(Q_{k}\), depend on the generated surplus \(G_{k}\). This arises at time \(t_k\) from the investments in the financial market and in practice also from conservative estimates for interest rates, death probabilities, and expenses used for the calculation of premiums. In our model, the total surplus \(G_{k}\) is divided into an interest and a surrender component, i.e. \(G_{k} = G_{k}^i+G_{k}^s\). The interest surplus \(G_{k}^i\) is given by the difference between the total capital market return on the one side and the total interests deposited in the policyholders’ accounts and the credits on the other side, namely

with \(\Delta s_{k} = s_{k} -s_{k-1}\) and \(\varDelta p_{k, i}= p_{}\left( t_k,t_i +\tau \right) -p_{}\left( t_{k-1},t_i +\tau \right) \). The surrender surplus for the classic endowment insurance is given by

and is positive for the surrender factor \(\vartheta \in \left( 0,1\right] \). The surpluses are distributed between the insured collective and the shareholders. Due to legal requirements, most of a positive raw surplus belongs to the insured collective while shareholders participate to a small extent through dividend payments. Here, a fixed portion \(\alpha \) \(G_{k}\) is deposited in the free reserve \(F_{k}\) and the remaining amount is credited to the equity \(Q_{k}\). The parameter \(\alpha \in [0, 1]\) is referred to as participation rate.Footnote 9 In the case of a negative surplus, i.e. \(G_{k}<0\), one has to distinguish if the free reserve suffices or not. If so, i.e. \(\left| G_{k} \right| \le F_{k-1}\), the loss is covered by the free reserve. In the latter case, the shareholders absorb the remaining loss \(F_{k-1}+G_{k}\). In total,

By construction, surpluses are completely allocated every period, i.e. we have for all \(k=1,\dots ,K\)

Indeed, the latter equation will be needed to prove that the fundamental balance sheet equation is respected at any time, see Theorem 2.2.

2.5.3 Balance sheet equation

We now present the central theorem showing that the balance sheet equation is fulfilled at each point in time \(t_k=k\varDelta t\). That is, the business activities lead to equal sums of assets and liabilities as displayed in Table 1.

Theorem 2.2

(Verification of the model) Consider the endowment insurance with surrender factor \(\vartheta >0\) and suppose that the sum of all assets equals the sum of all liabilities at the start of the simulation, i.e. \(C_{0}=A^{}_{0}+B^{}_{0}+F_{0}+Q_{0} + L_{0}\). Then, the fundamental balance sheet equation is fulfilled at any time, i.e. it holds for all \(k=0,\ldots ,K\)

Proof

We prove the statement by induction on \(k\), starting with

and using the assumption that the equality

holds for all time steps up to \(k-1\). Inserting the induction hypothesis and using the relation in Eq. (2.12) leads to

which completes the proof. \(\square \)

3 Simulation studies

3.1 Preparations

In this section, we perform several simulation studies to investigate the long-term stability of a life insurer’s business. To this end, we consider a classic endowment insurance and, if not stated otherwise, consider a company providing new business.

However, a lot of the existing literature mainly focuses on run-off scenarios. Therefore, after the initialization and the parameter specification, we first compare in our ALM model the impact of the incorporation of new business with the corresponding run-off scenario. We then investigate stability by considering alternative patterns of new contract arrivals. It follows a comparison study of two possible investment strategies taking into account both the life insurer’s and the policyholders’ point of view. Here, we also look at robustness with respect to possible stock market crashes varying intensity and crash time. Finally, we perform a sensitivity analysis to study the influence of selected parameters.

3.1.1 Initialization

We start with the liability side of the balance sheet. The initial values of actuarial, bonus, and technical reserve, \(A^{}_{0}\), \(B^{}_{0}\), and \(V^{}_{0}\), are calculated according to the equations in (2.11). The initial values of the respective policyholders’ accounts, \(A^{m}_{0}\), \(B^{m}_{0}\), and \(V^{m}_{0}\), and the initial premium \(P^{m}_{0}\) are determined by the arithmetic means of the actual contracts belonging to one cohort. Equation (2.3) implies for given initial reserve rate \(\gamma _{0}\) the value of the free reserve \(F_{0}\). The amount of equity \(Q_{0}\) is determined by the initial fraction of own funds

Respecting the fundamental balance sheet equation at time \(t_{0}\) yields

where the initial values of the stock and cash position are specified by fractions of the total assets \(C_{0}=C^b_{0}+C^s_{0}+C^c_{0}\). Regarding the bond part \(C^b_{0}\), we assume a uniform allocation, i.e. the numbers of bonds purchased at past times \(t_{1-\frac{\tau }{\varDelta t}},\ldots , t_{-1}\) coincide with

The investment strategies we consider for asset allocation (cf. Sect. 2.3) are introduced and shortly motivated in the following.

CM strategy (constant mix) The insurance company strives to have a fixed share quota \(\pi ^{s,tar }\in [0, \pi ^{s,max }] \), with the maximum depending on regulatory requirements. The adapted stock purchase can be written as

This strategy has a simple structure and is often used in the corresponding literature, e.g. in Burkhart et al. [6], Fernández et al. [8], or Gerstner et al. [9].

CPPI strategy (constant proportion portfolio insurance) As the equities \(Q_{k-1}\) and the free reserve \(F_{k-1}\) provide a financial buffer for the insurance company, the share quota is linked to them by

using the constant multiplier \(m^{CPPI }\).Footnote 10 A CPPI strategy is also considered in Bohnert et al. [4].

If not stated otherwise, we apply the CM strategy and provide a comparison study with the CPPI strategy in Sects. 3.3 and 3.4.

3.1.2 Parameter specification

Table 2 specifies the parameters used for the numerical investigations in the following sections. Regarding the initial balance sheet, there is no liquidity gap at the beginning of the first period, i.e. \(L^+_{0}=L_{0}=0\), and the initial amount of cash equals the average excessive value of expiring bonds obtained by prior simulations. To use the beta distribution for the average number \(\Lambda _k\) of new customers per period \(k\) is motivated by the high flexibility of this distribution family. Alternative new business scenarios can be considered by choosing different shape parameters \(\alpha _k\) and \(\beta _k\), as we do in Sect. 3.2. The remaining two parameters represent the minimum and maximum amount of newly issued contracts per period. Their values are inspired from observations from annual business reports of a large German life insurer. The parameters within the capital market model represent a low interest rate environment. Possible stock market crashes are described in Sect. 3.3. Note that the initial number of model points \(M_{0}\), the sizes of the cohorts \(\delta ^{m}_{0}\), and the representatives’ characteristics (e.g. the premium size \(P^{m}_{k}\)) depend on the grouping scheme described in Sect. 2.4 and thus on the distribution of the actual biometric parameters.

3.1.3 Run-off vs. ongoing business with stationary new business

In this section, we compare a run-off scenario with an ongoing business where in addition new customers arrive in course of time. Among others, we analyze the effects of incorporating stationary new business on the development and structure of the future balance sheets. For the stationarity assumption, we choose \(\left( \alpha _k,\beta _k\right) =(1,1)\) yielding \(\Lambda _k\sim {\mathcal {U}}\left( 0.5\%\cdot \delta ^{}_{0},2.2\% \cdot \delta ^{}_{0} \right) \). We perform a Monte Carlo simulation consisting of \(N=10{,}000\) paths. With the objective of a good comparability of both settings, we start with the same balance sheet and insurance portfolio. Moreover, surrender probabilities are modeled homogeneously by Eq. (2.4).

Figure 6 displays the size of the insurance portfolio in course of time. In the run-off-case, it is falling monotonously and after 30 years, there only remains about 1% of the contracts. In the ongoing-business-case, it first decreases and then becomes stable. The development in both cases heavily depends on the distribution of the biometric parameters of the insured collective. The deterministic decrement results from our approach of modeling mortality and cancellation, whereas the random numbers of new customers induce uncertainty in the ongoing insurance business-case. This, and the independence from the random capital markets’ variations also explain the development of the actuarial reserve in Fig. 7.

In Fig. 7, we show the development of the (aggregated) balance sheet positions. The corresponding 5–95% quantiles are illustrated by colored areas. Only during the first years, the developments in both cases look similar. Then, the effect of including new business becomes clearly visible. While capital \(C_{k}\) and actuarial reserve \(A^{}_{k}\) continue to decrease in the run-off scenario, they become more and more stable in the case of an ongoing business. The bonus reserve \(B^{}_{k}\) is built up in the first years and then reduces (on the left) or becomes stable (on the right). Looking at the size of the quantile distance illustrated by the width of the colored areas, the uncertainty regarding own funds \( F_{k}+ Q_{k}\ \) increases in the case of an ongoing business, while it reduces from year 10 onwards in the other case. Demand for credits can only be observed in the long term in the case of a run-off. But even there, the median equals zero at all times.

In Fig. 8, we illustrate the expected structure of the balance sheet in the case of a run-off and an ongoing business with stationary new business. In particular, the graphs visualize the fulfillment of the fundamental balance sheet equation.

In Fig. 9, we see the annually declared interest rate \({\widehat{i}}_{k}\). On both sides, only the guaranteed rate \({\widehat{i}}_G=0.9 \%\) is paid in the worst-5% average case. Let us now focus on the run-off scenario for a moment. On average and in the best-5% average case, the interest rate increases in course of time, and especially fast after 22 years. This is caused by the stronger decrement of the technical reserve \(V^{}_{k}\) compared to the free reserve \(F_{k}\) yielding constantly increasing reserve rates \(\gamma _{k}\) and thus higher interest rates, cf. Eq. (2.2). After 33 years, when there are only less than 0.5% of the initial policyholders left, the interest rates get unrealistically large.Footnote 11 Note that in other studies sometimes an upper bound is put on the declared interest rate, e.g. 10% in Gerstner et al. [9], which we do not do here. Looking at the right-hand side, we see that here the declared interest rate becomes stable. Already after 6 years, there are no adjustments larger than 0.3 percentage points. In the medium and long term, the policyholders can expect 1.3% on average and 3.8% in the best-5% average case.

3.1.4 Ongoing business with alternative new business scenarios

Now we investigate for ongoing insurance business the effect of non-stationary contract arrivals. For this, we specify four alternative patterns of new contract arrivals and study the effects on the expected balance sheet structure. The case of a stationary new business is set as a benchmark (scenario 0). Scenario 1 and 2 correspond to a gradually expanding and decreasing new business. Positive and negative shocks on the expected future numbers of new customers are considered in the last two scenarios.

Table 3 displays the chosen shape parameters of the beta distribution for modeling the new contract arrivals. The corresponding new business scenarios and the resulting size of the insurance portfolios are illustrated in Fig. 10 where, e.g., the first row reflects the scenario of a stationary new business (NBS 0) and the last row reflects the scenario with a negative shock on the expected future number of new customers after 25 years (NBS 4).

The expected balance sheet structures within the considered scenarios are shown in Fig. 11. We can clearly see the dependence on the development of the future new business. However, one can also observe stability on average regarding the target of a constant stock portion according to the CM strategy and the amount of equity or the reserves. Even in the extreme scenarios 3 and 4, the bonus reserve, the free reserve, and the equity remain stable which is in line with the life insurer’s objectives of a smooth surplus participation and the preservation of enough own funds for future uncertainties.

3.1.5 Comparison of two investment strategies

In the following two sections, we compare the CPPI and the CM strategies in the case of an ongoing life office with stationary new business. They essentially differ in terms of the capital invested in stocks. In order to analyze the specific characteristics and behavior of these strategies, we first consider a single simulation path based on the same sequence of generated random numbers and perform a Monte Carlo study in the next section.

Figure 12 shows the path of the stock prices in this exemplary scenario and the resulting reached stock ratios over time. Before the investment, i.e. at the end of the previous period, they can be larger than the maximum or target value, since liquid funds needed for benefit payments are firstly taken from expired bonds. After the investment, however, this is not possible. Following the CPPI strategy, the amount of funds invested in stocks is implicitly linked to the actual stock prices via the free reserve and equity. They contain the generated surpluses depending partly on the past stock prices. This characteristic can be observed in Fig. 12: during the first years, the stock initially performed well and then decreased substantially. As a result, the stock ratio increased to over 30% and then dropped to zero around 3 years. At all times, increasing or decreasing stock ratios are traceable to corresponding variations of the stock prices. Note that the described dependence would be even more visible if we had no or a higher maximum stock ratio (here 35%). In the CM-case, we observe a completely different development. After the reallocation of assets, the stock ratio equals almost always the target value of 10%.

As we can see in Fig. 13, the differences between the two strategies are also reflected by the amounts of bought bonds and the value of stocks sold due to payment of benefits and repayment of credits. The CPPI strategy yields a volatile development for both positions. There are many points in time where no bonds are bought at all, while at others we see large purchases. As a result, the life insurer often needs to sell stocks, since the amount of expired bonds does not suffice. For example, after 6 years we observe the first large peak which is due to the fact that no bonds were bought at time \(t_k=3\). Instead, at this time the life insurer takes loans by short-selling bonds, here illustrated by a negative amount of bought bonds. The reason why no stocks were sold after 3 years (although no bonds were bought at time \(t_{0}\)) is that the stock ratio was 0, cf. Fig. 12. In the CM-case, the number of bought bonds is always positive and the development seems to be quite balanced over time. As a consequence, selling of stocks due to disbursements is less frequent. The periodic pattern in the value of bought bonds in both cases can be explained by the assumption that liquid funds are first invested in stocks for each strategy, while the remaining part is used to buy bonds having a fixed duration of \(\tau \) years (here \(\tau =3\)) and which are held until maturity. More generally, the investments are determined by a variety of factors, including the chosen strategy, the development of prices, but also the disbursements depending partly on the distribution of biometric parameters within the insurance portfolio.

3.1.6 Investment strategies within capital markets with crashes

In this section, we investigate the robustness of the considered investment strategies. We consider again an ongoing business with stationary new business. In contrast to the section before, we now allow for crashes in the stock and bond markets.Footnote 12 First, we assume a deterministic setting with a single crash either in the stock markets or in the bond markets. More specifically, the time of occurrence and the intensity of the crash are chosen in advance and then \(N=10{,}000\) realizations of the capital market are generated. This can be seen as a worst-case approach. Indeed, fixed crash sizes can be interpreted as stochastic crash sizes attaining an predefined upper bound. The life insurer has no knowledge about the time and the size of the fixed crash. Later, we expand our considerations to more general crash scenarios.

In the case of a stock market crash \(\left( t^{C },z^{ C }\right) ^{s}= \left( t^{ C , s}, z^{C , s}\right) \) the stock prices decrease instantly by a factor \(z^{ C , s}\) at time \(t^{C , s}\) (in years). Regarding bond market crashes one needs to take correlations between different bonds into account, in addition to the time and the size of crashes. Since we want to investigate robustness of the investment strategies and stability of the balance sheets even in extreme scenarios, we assume a perfect correlation implying that a bond market crash affects all held bonds to the same extent. At crash time \(t^{C , b}\) (in years), a fraction \(z^{ C , b}\) of all held bonds defaults completely.Footnote 13 Correspondingly, the number of held bonds with different times to maturity is decreased instantly. Therefore, the bond market crash \(\left( t^{C },z^{ C }\right) ^{b}= \left( t^{ C , b}, z^{C , b}\right) \) also leads to liquidity shocks in the following periods.

Figure 14 displays five realizations of the stock price process and its expected development illustrating a crash of size \(z^{ C , s}=0.4\) after 25 years.

Expected balance sheet positions in the case of a stock market crash \(\left( t^{C },z^{ C } \right) ^s=(25,0.4)^s\) (top) and in the case of a bond market crash \(\left( t^{C },z^{ C } \right) ^b=(25,0.1)^b\) (bottom). The right scale on the right-hand side is only for the liabilities to banks. Left: CM, right: CPPI

The averages of the development of the (aggregated) balance sheet positions for the two investment strategies in this scenario are shown in the first row of Fig. 15. The liabilities to banks equal zero in the CM case at all times, in contrast to the CPPI case where it increases. Especially after the stock market crash we observe larger values about \(10^8\). The actuarial reserve is not effected due to its independence from the capital markets’ variations while free reserve and equity suffer a lot. It is striking that the overall exposure seems to be higher using the CPPI strategy. Indeed, the equity was about 10% higher than in the CM case shortly before the crash but then decreased tremendously. In the end, we observe \(0.5\times 10^9\) and \(0.3\times 10^9\) in the CM and in the CPPI case, respectively. The second row of Fig. 15 shows the influence of a bond market crash of size \(z^{ C , b}=0.1\) after 25 years. Now the crash is also clearly visible in the CM case and the overall exposure seems to be of comparable size in both cases. At the end, the bonus reserve in the CPPI case is even three times larger than in the CM case.

The latter observations are also reflected in Fig. 16 visualizing the impact of the stock market crash (first row) and the impact of the bond market crash (second row) on the annual declared interest rate. In the first case and applying the CPPI strategy, it is approximately reduced by half while applying the CM strategy, it is adjusted by 1.2 percentage points (pp) in the best-5% average case and 0.4pp in the average case corresponding to a reduction of less than 30%. In the case of a bond market crash, the declared interest rate suffers more applying the CM strategy: in the best-5% average case, we observe a reduction of 2.5pp (over 60%) compared to 1.5pp (20%) if applying the CPPI strategy. However, in the average case the relative change is similar for both strategies.

Now we investigate the robustness of the strategies in more detail by considering varying crash scenarios \(\left( t^{C },z^{ C } \right) ^{\cdot }\) regarding the stock and bond markets and measuring their impact on the performance within the corresponding crash-free capital market. More specifically, on the basis of \(N=10{,}000\) simulated paths, we average over all simulations and all periods to get the average change per period as a number for illustration. We select different criteria reflecting both the life insurer’s and the policyholders’ point of view. In more detail, these are the own funds \(F_{k}+Q_{k}\), the liabilities to banks \(L_{k}\), the default probability PD, the declared interest rate \({\widehat{i}}_{k}\), and the benefit payments \({\mathcal {B}}_{k}\). The influence is measured in terms of absolute changes if non-positive values are possible, otherwise in terms of relative changes (in %) or in percentage points (pp). The results are shown in Table 4.

Clearly, the changes are larger for greater crash-intensities and since we averaged over all periods, they are smaller if the crash occurs at later time points. In the case of stock market crashes, applying the CM strategy there is no demand for credits in any considered scenario and the performance is always much less affected than that in the CPPI case. Regarding bond market crashes, the differences between the strategies are much smaller. Even more, the default probability and partly the own funds are now more affected applying the CM strategy. It is spiking that in the considered scenarios bond market crashes have a larger impact on the performance than stock market crashes. This is due to the fact that most funds are invested in bonds, see Fig. 12.

We complete this section by expanding our investigations to more general settings. In contrast to before, we consider random crash times and sizes regarding both the stock and bond markets. In particular, we now allow for several crashes within the considered time horizon but we do not assume that there always has to be a crash. The independent waiting times \(W_1,W_2,\ldots \) for the crashes are modeled by an exponential distribution with parameter \(\frac{1}{{\mathcal {T}}}\) such that the l-th crash time is given by \(t^C _l=\sum _{j=1}^{l}W_j\). This approach leads to an average amount of one crash within the considered time horizon \({\mathcal {T}}\), but also allows for crash-free scenarios and several crashes. The independent crash sizes \(z^C _l\) are modeled by a beta distribution with parameters 2 and 6. Hence, the expected value of the crash size is 0.25 as in the deterministic crash scenarios. As before, we perform several Monte Carlo simulations consisting each of \(N=10{,}000\) simulated paths and calculate the established criteria. We consider crashes only in stock markets, only in bonds markets, independent crashes in both markets, and coupled crashes in both markets where the crashes of independent sizes occur in both markets at the same (random) time. Table 5 summarizes the results.

Here, the observations made so far manifest themselves again. The CM strategy (with a target stock ratio of \(\pi ^{s,tar }=10\%\)) is more robust against possible stock market crashes and, to a smaller extent, for most criteria also against possible bond market crashes. In the CM case, the latter leads to much higher default probabilities compared to a crash-free scenario but they are still smaller than in the CPPI case. Furthermore, significant amounts of liabilities to banks are now also observed in the CM case. From the last two sections we can conclude that for the considered parameter set and scenarios, the CPPI strategy yields on average larger bonus reserves, free reserves, and declared interest rates. At the same time, it leads to a higher default probability and in most cases to a greater exposure against possible capital market crashes.

3.1.7 Sensitivity analysis

The capital market’s true parameters are, in general, not known but have to be estimated on the basis of historical data. However, estimations are always associated with a certain degree of uncertainty. In the following, we study this issue using the long-term mean \(\frac{b}{a}\) of the short rate process as a key parameter. We specify three different scenarios. In one case, it equals the guaranteed interest rate \({\widehat{i}}_G=0.9\%\). In the other cases, it is 0.4 percentage points above or below the guaranteed rate. If not stated otherwise, all other initial values remain the same, cf. Table 2. Here, we consider again a life insurer with stationary new business applying the CM strategy for investments. The corresponding probabilities and expectations are each estimated on the basis of \(N=10{,}000\) simulations. In the upper part of Fig. 17, we show the development of the default probabilities \(PD_k\), i.e. the probabilities of the events \(\left\{ Q_{j}<0 \, \text{for} \,\text{some} \, j\in \left\{ 0,\dots ,k \right\} \right\} \). Within the first years, they are (almost) zero for all scenarios due to the initial amount of own funds \(F_{0}+Q_{0}\). From year 5 onwards, we observe significant differences getting larger as time goes on. The default probability increases as the long-term mean decreases (slightly). This indicates a high sensitivity with respect to the long-term mean of the short rate, which is characteristic for life insurers writing long-term insurance business. It is also noticeable that the influence is non-symmetric. The probability of default is more affected by negative deviations than by positive ones.

An important objective could be to keep the default probability within a certain time horizon, say during the next 10 years, under a predefined threshold, say 5%. As illustrated in the lower part of Fig. 17, this can be achieved by increasing the initial fraction \(\psi _{0}\) of own funds.Footnote 14 Note that we ensured a non-negative value of initial equity. As expected, the probabilities decrease if the own funds increase, especially fast for smaller values of \(\psi _{0}\). Here, a default probability equal to the threshold of 5% requires initial fractions of approximately 9.9%, 11.3%, and 13.2% if the long-term mean is 1.3%, 0.9%, or 0.5%, respectively. The declared interest rates \({\widehat{i}}_{k}\) on average are displayed in the upper part of Fig. 18. During the first year, only the guaranteed rate \({\widehat{i}}_G=0.9\%\) is paid. Then, interest rates increase before they become stable. Significant differences between the three scenarios are observable from year 5 on. In contrast to the case of default probabilities, these do not increase steadily with time but remain approximately constant. In addition, now the positive deviations in the long-term mean have a (slightly) stronger influence. In the medium and long term, the average values are 1.2%, 1.5%, and 1.9% if \(\frac{b}{a}\) equals 0.5%, 0.9%, and 1.3%. A complementary benchmark, additionally to the declared interest rate, could be the probability that only the guaranteed interest rate \({\widehat{i}}_G\) will be paid as illustrated in the lower part of Fig. 18. The probabilities decrease during the first years and then become quite stable. As expected, larger values for the long-term mean result in lower probabilities that the declared interest rate equals the guaranteed rate. As before, the differences between the scenarios remain approximately constant over time.

4 Conclusion

We introduced a modular, stochastic asset–liability management model for life insurers which on the one hand allows us to describe the processing of a given, large, heterogeneous insurance portfolio, and on the other hand is capable of simulating an ongoing business. The model is consistent in the sense that it respects the fundamental balance sheet equation at the end of every period according to the principles of double-entry bookkeeping as required in accounting. At the same time, the framework is kept universal, such that the realization of alternative modeling approaches or the adaption to different insurance products are straightforward. Furthermore, we proposed an approach for the explicit generation of cohorts and the integration of new contracts which is necessary for efficient computations when considering large insurance portfolios. In extensive simulation studies reflecting the current situation of the capital markets, we illustrated the model’s performance and its high flexibility. The consideration of different new business scenarios and the incorporation of both stock and bond market crashes, gave insights on the stability of the insurance business and the robustness of possible investment strategies. In many cases we observed a certain stationarity and found that the asset allocation plays an important role in obtaining a smooth and robust surplus participation. This is in line with the idea of a healthy and solid insurance company writing long-term policies. At the same time, we saw that especially bond market crashes can cause extreme liquidity shocks and thus constitute a substantial risk. The impact of varying crash scenarios was investigated from both the life insurer’s and the policyholders’ point of view. Using a sensitivity analysis, we discussed the strong influence of single parameters on the performance. Keeping in mind that the simulation requires to model or estimate a lot of input parameters, this shows that one has to be careful with the interpretation of single observations. However, the application of such stochastic simulations can support managerial decisions by illustrating the long-term effects of potential measures, as for example the impact of specific investment strategies or interest rate fixings.

Notes

More generally, choosing \(\lambda (t_k)\) to be any affine transformation of \(r_{k}\) yields a representation of the short rate under Q with the same structure as (2.1). In Kok et al. [14], e.g., they follow a proportional approach. Maintaining the pace of the mean reversion motivates our choice, though.

In practice, existing insurance portfolios typically consist of contracts equipped with varying guaranteed interest rates. An extension to such a setting is possible.

The distribution of the female policyholders over the remaining cohorts is similar.

In our case, we have \(x_{max} =100\).

For example, Kubitza et al. [16] follow an interest rate-driven approach for the simulation of surrender rates, including macroeconomic control variables.

For example, the guaranteed and the bonus survival benefit payments are given by \(E^{G,m}_{k} = {\mathbbm {1}}_{\left\{ d^{m}_{k}=0\right\} } A^{m}_{k}\) and \( E^{B,m}_{k} = {\mathbbm {1}}_{\left\{ d^{m}_{k}=0\right\} } B^{m}_{k}\).

Under German legislation, a typical value would be \(\alpha \in [0.9,1]\) meaning that at least 90% of the risk surplus has to be credited to the policyholders’ accounts, see Wagner [20].

In practice, we typically have \(m^{CPPI }>1\).

After 48 years, when there are no longer any contracts in the insurance portfolio, we would observe interest rates of 27%, 26%, and 16% in the considered average cases.

Here, we assume that crashes are caused by exogenous factors. Alternatively, bond market crashes could be caused by (instantly) rising interest rates.

At this time point, this is equivalent to assume that the prices of all held bonds decrease instantly by the same factor \(z^{ C , b}\).

In practice, a typical drawback would be higher costs of equity.

References

Bauer D, Kiesel R, Kling A, Ruß J (2006) Risk-neutral valuation of participating life insurance contracts. Insur Math Econ 39(2):171–183

Bodie Z, Marcus AJ, Merton RC (1988) Defined benefit versus defined contribution pension plans: what are the real trade-offs? In: Pensions in the US economy. University of Chicago Press, pp 139–162

Bohnert A, Gatzert N (2012) Analyzing surplus appropriation schemes in participating life insurance from the insurer’s and the policyholder’s perspective. Insur Math Econ 50(1):64–78

Bohnert A, Gatzert N, Jørgensen PL (2015) On the management of life insurance company risk by strategic choice of product mix, investment strategy and surplus appropriation schemes. Insur Math Econ 60:83–97

Burkhart T, Reuß A, Zwiesler HJ (2015) Participating life insurance contracts under Solvency II: inheritance effects and allowance for a going concern reserve. Eur Actuar J 5(2):203–244

Burkhart T, Reuß A, Zwiesler HJ (2017) Allowance for surplus funds under Solvency II: adequate reflection of risk sharing between policyholders and shareholders in a risk-based solvency framework? Eur Actuar J 7(1):51–88

DAV (2019) Best estimate in der Lebensversicherung: Hinweis. https://aktuar.de/unsere-themen/fachgrundsaetze-oeffentlich/2019-06-27_DAV-Hinweis_Best_Estimate_Lebensversicherung.pdf

Fernández JL, Ferreiro-Ferreiro AM, García-Rodríguez JA, Vázquez C (2018) GPU parallel implementation for asset–liability management in insurance companies. J Comput Sci 24:232–254

Gerstner T, Griebel M, Holtz M, Goschnick R, Haep M (2008) A general asset-liability management model for the efficient simulation of portfolios of life insurance policies. Insur Math Econ 42(2):704–716

Grosen A, Jørgensen PL (2000) Fair valuation of life insurance liabilities: the impact of interest rate guarantees, surrender options, and bonus policies. Insur Math Econ 26(1):37–57

Hieber P, Natolski J, Werner R (2019) Fair valuation of Cliquet-style return guarantees in (homogeneous and) heterogeneous life insurance portfolios. Scand Actuar J 6:478–507

Kling A, Richter A, Ruß J (2007) The impact of surplus distribution on the risk exposure of with profit life insurance policies including interest rate guarantees. J Risk Insur 74(3):571–589

Kling A, Richter A, Ruß J (2007) The interaction of guarantees, surplus distribution, and asset allocation in with-profit life insurance policies. Insur Math Econ 40(1):164–178

Kok C, Pancaro C, Berdin E (2017) A stochastic forward-looking model to assess the profitability and solvency of European insurers. Tech. rep. European Central Bank, Frankfurt

Krah AS, Nikolić Z, Korn R (2020) Machine learning in least-squares Monte Carlo proxy modeling of life insurance companies. Risks 8(1):21

Kubitza C, Grochola N, Gründl H (2021) Life insurance convexity (preprint). https://doi.org/10.2139/ssrn.3710463

Milhaud X, Dutang C (2018) Lapse tables for lapse risk management in insurance: a competing risk approach. Eur Actuar J 8(1):97–126

Statistisches Bundesamt (2020) Kohortensterbetafeln für Deutschland. Ergebnisse aus den Modellrechnungen für Sterbetafeln nach Geburtsjahrgang. 1920–2020

Statistisches Bundesamt (2020) Kohortensterbetafeln für Deutschland. Methoden- und Ergebnisbericht zu den Modellrechnungen für Sterbetafeln der Geburtsjahrgänge 1920–2020

Wagner F (2017) Gabler Versicherungslexikon. Springer, Berlin

Zaglauer K, Bauer D (2008) Risk-neutral valuation of participating life insurance contracts in a stochastic interest rate environment. Insur Math Econ 43(1):29–40

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Diehl, M., Horsky, R., Reetz, S. et al. Long-term stability of a life insurer’s balance sheet. Eur. Actuar. J. 13, 147–182 (2023). https://doi.org/10.1007/s13385-022-00322-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-022-00322-4