Abstract

Many OECD countries have addressed the issue of increased longevity by mainly increasing the retirement age. However, this kind of reforms may lead to substantial transfers from those with shorter lifespans to those that will live longer than the average, as they do not necessarily take into account the socio-economic differences in mortality. The contribution of our paper is therefore twofold. Firstly, we illustrate how both a Defined Benefit and a Notional Defined Contribution pay-as-you-go scheme can put the lower social economic classes at a disadvantage, when compared to the actuarially fair pensions. In contrast to that, higher classes experience a gain. This is due to the fact that mortality rates per socio-economic class are not considered by either scheme. Consequently, we propose a model that determines the parameters for each scheme and class which would render the pensions fairer even when no socio-economic mortality differences are considered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, we address the issue of actuarial fairness of pension schemes, given that socio-economic differences in mortality do exist and their impact is non-negligible. Besides discussing this matter through an example, we aim at providing an easy-to-implement solution, allowing policy-makers to not only improve the actuarial fairness of their pension schemes, but also to assess the extent to which pensions should differ depending on the socio-economic class.

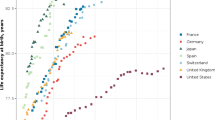

Increased longevity has been a well known and well documented phenomenon in recent years, with significant impact on pension schemes around the world. For example, Oeppen and Vaupel [33] note that the world life expectancy has roughly doubled in the course of 20 years, which has impacted the social needs of societies, among which pensions are included. OECD [30] estimates that on average, taking into account future mortality improvements leads to higher life expectancies for both men and women than when period life tables are used (2 years more for men and 2.5 years more for women at age 65, based on 2010 data). Hence the choice of mortality table becomes fundamental for pension funds and life insurance companies, with potential estimated shortfalls in reserves due to the use of period tables instead of generational ones going up to 20%. Bisetti and Favero [6] project mortality for Italy and find that the longevity risk for the Italian pension system over the years could rise from 0.06% of the GDP in 2012 to 4.35% in 2050. Määttänen et al. [24] also discussed the impact of increased longevity on five European countries and conclude that the cost, which is estimated as positive, would have to be paid either by the currently retired or the future generation. Moreover, they remark that the Finnish earnings-related pension system is not yet completely capable to sustain the ageing population. Lastly, Kisser et al. [20] estimate, based on US panel data, that each additional year of life expectancy would increase the liabilities of US public and private pension funds by 3%.

With many pension schemes forming the first pension pillar still financed on a pay-as-you-go basis (the contributions perceived during one period are used to pay benefits during that same period), the burden of the increased life expectancy is far from getting any lighter (as also pointed out by Stevens [42]). Indeed, in order to address this issue, many countries have proceeded to reforming their first pillars. OECD [31] notes that almost all OECD countries have taken steps towards changing their systems, the most common reform measure being the increase in the minimum or legal retirement age. However, we must point out that such a measure does not account for the heterogeneity in mortality induced by socio-economic class. The relationship between socio-economic class and mortality has already been documented in the literature. For instance, Villegas and Haberman [46] find significant differences in mortality between the most deprived and the least deprived individuals in England. Similarly, Nelissen [28] finds 4.5 years of difference in life expectancy between individuals in the lowest social class and those in the higher social class, remarking that this impacts not only earnings, but also pension contributions and benefits. Shkolnikov et al. [39] look into socio-economic mortality for German men, based on survey data and find that those belonging to a higher class, defined through occupation, can live more than two years longer than men in the lower class. Using a micro-level lifetime dataset from a Dutch pension fund, Van Berkum et al. [43] show that one of the most relevant risk factors explaining longevity gap between the participants within a fund is the salary, while Chetty et al. [14] find that, in the United States, life expectancy rises with the income. Olshansky et al. [34] also remark there is a difference in longevity in the US in function of the level of education, as well as race. On a similar note, Meara et al. [26] observe that the gains in life expectancy have not occurred evenly for all socio-economic groups, defined in the paper by level of education, with highly educated individuals having more important improvements in life expectancy. Consequently, as lower socio-economic classes have a lower life expectancy than the higher classes, with inequalities still expected to rise (as also remarked by Ayuso et al. [3]), increasing the retirement age would lead to individuals of lower classes spending even less time in retirement, as also pointed out by Sanzenbacher et al. [38]. Hence transfers are taking place towards those with a higher than average life expectancy, pointing out towards an unfair system, as also stated by Nelissen [28], Barnay [4] or Mazzaferro et al. [25]. A similar conclusion was also reached by Brown [12], who found that when annuities are the same for all individuals, redistributions appear from the less wealthy to those that are in a better financial state.

Moreover, we must note that, besides not considering the socio-economic differences in mortality when increasing the retirement age, pension schemes do not take into account such differences when calculating the benefits. In particular, our paper deals with two pay-as-you-go systems: a Defined Benefit (DB) and a Notional Defined Contribution (NDC) scheme. If in a DB scheme, the benefits are fixed based on the average salary and the contribution period of an individual, with the contribution rates deriving from the benefitsFootnote 1, in NDC schemes, each person has a notional account in which contributions are accumulated at a notional interest rate. At the retirement age, based on the mortality assumptions, the value accumulated into the accounts is transformed into a pension amount paid annually. Hence the benefits depend on the notional rate awarded, as well as on the mortality assumptionsFootnote 2. However, in practice, contribution rates are equal for all individuals in both DB and NDC systems, therefore not considering the socio-economic differences. Moreover, mortality by socio-economic class is not considered in determining the benefits under the NDC systems, which generally make use of unisex mortality tables. To illustrate this point, we use projected salaries and mortality by level of educationFootnote 3 to calculate and compare the DB or NDC pensions with the actuarially fair pensions (in other words, what each individual should receive given their contributions and their class-specific mortality). Our numerical example shows that, under the parametrisation considered, neither one of the two schemes is fair. In fact, higher socio-economic classes seem to gain with respect to the actuarially fair pension, while lower classes would receive less than what is actuarially fair. A similar conclusion was reached by Caselli et al. [13] and Mazzaferro et al. [25]. In other words, at a given retirement age, there exists a gap between what the individual should receive in order to maintain actuarial fairness and what is actually received.

It is important to note here that one of the key objectives of social security pension schemes, is the redistribution of income from the more wealthy to those with lower incomes in order to ensure a subsistence level for all individuals, and thus, social security schemes do not and can not aim actuarial fairness. However, by not considering the socio-economic mortality differences in the calculation of the pension benefits, the schemes disadvantage those in lower socio-economic classes, defined here in terms of the level of education, while higher socio-economic classes are gaining with respect to the actuarially fair framework. Transfers go then in the reverse order than intended by social security schemes. Therefore, aiming at fairer pensions appears to be the first step in order to ensure the subsistence level for all individuals, as lower socio-economic classes will see their pension amount increasing, while higher classes will see it decreasing. Naturally, this might not be sufficient to guarantee the subsistence level to all, but it goes in the right direction. Therefore, the identified gap existing between what the individual should receive in order to maintain actuarial fairness and what is actually received, should and can be filled by adjusting the parameters of the pension schemes, as it will be shown in this paper.

Even if many studies have focused on the link between the retirement age and the socio-economic class, defined among others in function of the level of education, (see, for example, Sanzenbacher et al. [38], Munnell et al. [27], Rutledge et al. [37], Venti and Wise [44] or Stenberg and Westerlund [41]), not enough has been said on what could be done to improve the fairness of the systems when the retirement age is fixed. In particular, the following studies are closer linked to this idea and therefore to our paper. Belloni and Maccheroni [5] perform an analysis of the actuarial fairness of the Italian system, considering white- and blue-collar occupational differences and find that white-collar employees have a higher present value ratioFootnote 4. Moreover, they remark that the Italian system is still unfair, even after the transition from the DB to the NDC scheme. However, the only suggested measure for improving the situation is the use of projected mortality, instead of the static mortality used by the Italian system, in the calculations of the NDC pension benefits. Bravo et al. [10] also note the importance of considering heterogeneity in mortality, based on socio-economic factors, in the calculations of pension benefits, listing different possible interventions to mitigate its effect, including offering different accrual and accumulation rates to each socio-economic group, without going into more technical details on these two possibilities. Holzmann et al. [17] define actuarial fairness in terms of a tax/subsidy rate for the NDC system and suggest different ways to introduce contribution rates dependent on the life expectancy of each socio-economic group. Lastly, though not specifically aiming at improving the fairness of the pension systems, Kuivalainen et al. [22] note that socio-economic differences surpass gender differences, in terms of pension income in Finland, while Kudrna et al. [21] propose introducing a means-tested pension in order to tip the scale towards those belonging to lower socio-economic classes.

Our paper contributes to the existing literature by offering, for the first time to the best of our knowledge, a tractable method that allows the systems to achieve greater actuarial fairness at a given retirement age, when the socio-economic differences in mortality are not considered by the pension schemes. This is done by adjusting the system parameters, namely the interest rate, accrual rate and notional rate, by socio-economic class, in order to compensate for the use of general mortality in the benefit calculations. The previously mentioned gap between the fair pension and the actual benefit is thus filled. Additionally to illustrating how such a process would occur based on our data by level of education, we aim at providing straightforward formulas for defining these parameters according to the socio-economic class and to the amount of data on socio-economic mortality rates available. Approximations to this formulas are also provided, in order to offer policy-makers an intuitive framework serving a double purpose. Determining such class-specific parameters will firstly allow those making decisions with respect to the pension systems to understand the importance of socio-economic mortality, by easily quantifying the extent to which pensions should differ across socio-economic class in a fairer system. Furthermore, our framework can be implemented in practice, allowing for fairer pensions even when class-specific mortality rates are not considered by the pension schemes.

The remainder of this paper is structured as follows: we define the DB and NDC pensions in Sect. 2. In Sect. 3, we assess the actuarial fairness of the DB and NDC schemes, based on our data by level of education and a defined set of parameters. We consequently illustrate, in the same section, the steps to take in order to adjust the parameters by class, along with the resulting values based on our data. We generalise our framework by providing mathematical expressions for the class-specific rates, dependant on the detail of the available data in Sect. 4. Lastly, we provide further avenues for our analysis in Sect. 5 and summarise our conclusions in Sect. 6.

2 The pension schemes

In this paper, we consider two pension schemes commonly used in practice, namely a Defined Benefit (DB) and a Notional Defined Contribution (NDC) scheme. Since we are interested in the social security systems (in other words, the first pillar in the three pillar pension system proposed by the World Bank [48]), these pension schemes have a pay-as-you-go (PAYG) financingFootnote 5. The pensions, defined hereafter, though considering the salaries per socio-economic class, do not take into account the mortality by social class. Hence, the relationship between contribution paid and benefits received might not correspond to the definition of an actuarially fair scheme. Indeed, in order to be actuarially fair, a pension scheme has to ensure, by definition, a present value ratio of one, so in other words that the present value at the moment of entry into the system of all contributions paid equals the present value at the same moment in time of all future benefits received, given salaries and mortality levels by socio-economic class, to account for heterogeneity. We refer to the pension satisfying this requirement as the theoretical pension.Footnote 6 Although PAYG systems do not strive for actuarial fairness, a sustainable PAYG scheme will also be fair if the actuarial fairness is evaluated using an interest rate that is equal to the growth rate of the wage bill. Hence, the theoretical pension defined as specified above corresponds to the amount that ensures both the sustainability of the scheme and its fairness, but only if the interest rate is given by the growth rate of the wage bill. Consequently, utilising a different interest rate does not fulfil the above mentioned requirements for the PAYG systems and would thus not aid in establishing the fairness of the schemes as defined in this paper, since the sustainability of the systems cannot be guaranteed. Therefore, in order to asses the fairness of the DB and NDC schemes, we will need to compare the pensions given by each type of scheme to the theoretical pension.

As previously stated, the remainder of this section is dedicated to defining the DB and NDC pensions. For this, we allow Z socio-economic classes to coexist in the system. Individuals belong to the same class from the age of entry into the system, namely \(x_0^i\), where i designates the class, until death. Retirement is taken at age \(x_r^i\) and the maximum lifespan is \(\omega\). Moreover, there is no unemployment or disabilityFootnote 7. During their working years, individuals pay contributions as a percentage \(\pi\) of their salaries. To ease notation, the gender is not indicated in the given formulas through an index. However, the formulas are valid for both men and women and the subsequent analysis is split by both gender and socio-economic class.

2.1 The Defined Benefit (DB) scheme

For the Defined Benefit (DB) scheme, we define the retirement benefit for an individual of socio-economic class i, retiring at age \(x_r^i\) at time t as \(P^{i,DB}_{x_r^i,t}\) in Eq. (1). Commonly, public DB pension schemes take into account the average wage over the last n working years, which we denote as \({\overline{W}}_{t}^{\,i}\). The pension is also a function of the accrual rate per year of affiliation, \(AR^i\). In order to keep our formulas as general as possible, we consider that the accrual rate differs across the socio-economic classes. Moreover, if the individuals retire early, so before the legal retirement age \(x_{legal}\) (hence \(x_r^i < x_{legal}\)), a penalty of \(b_{x_r^i}\%\) is applied. Similarly, if retirement is postponed (\(x_r^i > x_{legal}\)), a bonus of \(b_{x_r^i}\%\) is awarded. We also note that the coefficients of penalty and bonus are dependent on the age at which the retirement is taken, but not on the class. In other words, postponing retirement for one year implies a different bonus percentage than postponing it for two years. These factors should be calculated actuarially, such that the equivalence between the present value of contributions and that of benefits is ensured. Finally, we note that for the purpose of this paper, the DB pension is described as a function of the accrual rate \(AR^i\).

Moreover, \({\overline{W}}_{t}^{\,i}\) is given by Eq. (2) below, where \(W_{x,t+x-x_r^i}^i\) is the salary of a person of age x at time \(t+x-x_r^i\), belonging to class i, given that the retirement age \(x_r^i\) is reached at time tFootnote 8.

Though the contribution rate in the DB scheme should ensue from the level of the pension and the mortality assumptions, that is not the case in typical social security systems. In practice, a constant contribution across time and social classes is used. This is why we adopt the same condition for the contribution rate. Hence \(\pi\) is a fixed percentage for all classes and genders, as well as across time and age. Nevertheless, Sect. 5.3 discusses the case when the contribution rate is different for each socio-economic class.

2.2 The Notional Defined Contribution (NDC) scheme

As pointed out by the World Bank [49], the Notional Defined Contribution scheme mimics the mechanisms of a classical (funded) Defined Contribution scheme. If in a Defined Contribution scheme, each person has an individual account in which contributions are accumulated at a given interest rate, the process is similar in the NDC scheme. A notional account is created for every member in which contributions are accumulated at a notional rate \(nr^i\) (once again, for generalisation purposes, we allow the notional rate to depend on the class). However, these accounts, as well as the accumulation, are only virtual, since we are still in a PAYG setting. Moreover, the notional interest rate is based on a macroeconomic index that will ensure the sustainability of the system, such as the growth rate of GDP. It is not, therefore, an actual return on the financial market. In a NDC scheme, at the time of retirement, the present value of future pensions of a specific cohort should be, by definition, equal to the accumulated value of that cohort’s savings accountFootnote 9. The pension amount is thus given by Eq. (3) below, where \(L_{x,t}^{unisex}\) is the number of people of age x alive at time t (given unisex mortality rates). In this case, the pension is calculated using unisex mortality, thus there is no difference made between classes or genders. Lastly, similarly to the DB pension, to ease the comprehension of the remainder of this paper, the NDC pension is defined as a function of the notional rate.

Equation (4) provides the general definition for an annuity factor \(\ddot{a}_{x_r,t}^{i,\beta }(r)\) as a function of a given interest rate r, thus following Bowers et al. [9]. Once again, i designates the class, while \(\beta\) is the indexation rate. Furthermore, \(p_{x,t}^i\) is the class-specific survival rate, while \({}_kp_{x,t}^{i}\) is the probability that a person of age x at time t survives another k years. Hence, \(\ddot{a}_{x_r^i,t}^{unisex,\beta }(nr^i)\), used in Eq. (3), follows the same definition, but uses the unisex mortality and the notional rate \(nr^i\) instead.

3 Assessing and improving the fairness of the pension schemes: a numerical example

In this section, we asses the fairness of both a DB and a NDC scheme for a given set of parameters. Subsequently, we optimise the parameters of each scheme in order to improve their fairness. As stated, this is a numerical example meant to illustrate how the actuarial fairness of a pension scheme can be improved in order to account for the mortality differences between socio-economic classes, given a set of original parameters, such as the contribution rates and the legal retirement age, among others.

3.1 The French data

A first natural step in our example is, of course, assessing the fairness of a DB and a NDC pension scheme, when socio-economic differences are considered. For this, we use the data in function of the degree of educationFootnote 10 provided by the French Office of Statistics. Table 1 summarises the categories for this classification, to which we attribute a category label. Hence D1 refers to the class with the highest level of education, namely people having an university degree, while D5 represents the class with no formal education. The French Office of StatisticsFootnote 11 offers historical data on both salaries and mortality for these classes, which we use to project values for these two variables for the period 2016–2116Footnote 12. The details regarding the data and the projections for salaries can be found in Section A, while Section B contains the details regarding the mortality data and projections. This classification suits our purpose, given that both salaries and mortality are provided for the same classes. In addition, the historical data regarding the class-specific mortality allows us to project the mortality rates per class used for the remainder of this example.

Moreover, we define in the same table, the entry ages \(x_0^i\) for each class. Individuals with a higher level of education will enter the labour market later than the ones with lower degrees. Hence, people in category D5 enter as early as 15, while those with an university diploma will enter much later, at age 21. The entry age for the lowest class corresponds to the first age for which data is available, given the assumption that people with no formal education will start working at the earliest time possible. For the rest of the classes, we generally follow the description of the French educational system provided by Hörner et al. [18]. They note that the certificates for professional competence and studies are awarded at age 17, while those doing the Baccalaureate exam finish at 18. Once the school studies are completed, a Bachelor diploma requires another three years of studies, hence the entry age of 21 for the class D1. The only deviation from this description that we allow here is related to those having a National Diploma. Though Hörner et al. [18] place the age of obtaining this diploma at 15, we decided to put it to 16 to allow a difference between the class D4 and D5.

3.2 Assessing the fairness of the pension schemes

As already indicated in the first paragraph of Sect. 2, the two pension schemes described in Sects. 2.1 and 2.2 do not necessarily ensure actuarial fairness. In fact, the differences in life expectancy across socio-economic groups affect the actuarial fairness of the system, that is, the relationship between the contributions paid and the retirement benefits received. By definition, under an actuarially fair scheme, the present value at the moment of entry into the system of all contributions paid should equal the present value at the same moment of all future benefits received. Hence, we denote by \(P^{i,th}_{x_r^i,t}\), defined in Eq. (5), the theoretical pension, that is the amount implied by an actuarially fair system for an individual from socio-economic class i and retiring at age \(x_r^i\) at time t. As before, \(W_{x,t}^{i}\) is the salary of a person of age x at time t, belonging to class i, while r is the interest rate. Furthermore, \({}_{x-x_0^i}p_{x_0^i,t-x_r^i+x_0^i}^{i}\) is the probability of an individual from class i, aged \(x_0^i\) at time \(t-x_r^i+x_0^i\) (the time of entry in the system, where t corresponds to the time when retirement occurs) to survive to age x. As stated before, the interest rate r used here, should correspond to the growth rate of the wage bill (so \(1+r=(1+g)(1+d)\), with g the growth rate of salaries and d the growth rate of the population).

Please note that the pension \(P^{i,th}_{x_r^i,t}\) does not depend on the pension scheme studied, but that it solely depends on the life expectancy of the individual, their wages and the assumptions with regards to the interest rate r and contribution rate \(\pi\). In practice, the pension actually paid will depend on the design of the public pension scheme. We can therefore compare the theoretical pension \(P_{x_r^i,t}^{i,th} (r)\) to the one paid under the two different pension schemes considered here, namely the DB and the NDC scheme.

Consequently, in order to determine the fairness of each of the scheme, for each class, we use Eq. (6) below, in which the difference in pension capitals at time t is denoted by \(PV_{x_{ref},t}^{i,u}(x_r^i)\). In the previously mentioned equation, we compare the pension capital associated with a fair pension (\(P^{i,th}_{_{x_r^i,t+x_r^i-x_{ref}}}\)) and the pension capital based on the (actual) amount received (\(P^{i,u}_{x_r^i,t+x_r^i-x_{ref}}\), with u={DB, NDC} and i the class). The pension capital is calculated as the present value, at the fixed age \(x_{ref}\), of future pension payments, given the retirement age \(x_r^i\ge x_{ref}\) reached at time \(t+x_r^i-x_{ref}\). Furthermore, as before, r is the interest rate and \({}_{x_r^i-x_{ref}}p_{x_{ref},t}^i\) the class-specific probability that a person of age \(x_{ref}\) at time t survives until age \(x_r^i\). The annuity factor \(\ddot{a}_{x_r^i,t}^{i,\beta }(r)\) is given by Eq. (4). Consequently, a value of \(PV_{x_{ref},t}^{i,u}(x_r^i)\) equal to zero means the pension received is actuarially fair, while a positive value indicates that the pension is more than fair and thus, the individuals are gaining. Conversely, a negative value means the pension is less than fair and the individuals incur losses.

In order to proceed with our numerical illustration, we start by fixing the contribution rate \(\pi =14.3\%\). This rate ensures the equality between the present value of the contributions and the present value of DB benefits (as defined in Sect. 2.1) for an average individual that enters the market at age \(x_0=17\), retires at the legal retirement age, faces unisex mortality and has average earnings (hence no class distinction is made), given an accrual rate AR of 1%. An interest rate \(r=1.8\%\)Footnote 13 is used to determine the theoretical pensions for each class, as well as the value of the annuity in Eq. (6).

For simplification purposes, the indexation rate \(\beta\) is set to zeroFootnote 14. Hereafter, we assess, in turns, the actuarial fairness of a DB and a NDC scheme, for retirement ages going from 50 to 75. Therefore, the reference age \(x_{ref}\) is the minimum retirement age considered here, namely 50.

3.2.1 The Defined Benefit scheme

Assessing the fairness of the DB scheme described in Sect. 2.1, process done according to Eq. (6), starts by setting the legal retirement age \(x_{legal}\) to 65 for both men and women, for all classes, value that aligns with the policy of many OECD countries (see OECD [32]). The accrual rate chosen is \(AR=1\%\)Footnote 15, which is applied to the average salary \({\overline{W}}\) calculated over the entire career for all the socio-economic classes. The bonus and penalty values \(b_{x_r}\) are, just as for the contribution rate, calculated based on the average individual in the system, entering at age \(x_0=17\), given an interest rate \(r=1.8\%\). They are therefore actuarially fair for the average individual, but not for each socio-economic class. The determined values ensure the equivalence between the present value of contributions and that of benefits and are given in Table 2. Hence, for example, if an individual retires at age 50, a penalty of 35.6002% is applied, while postponing the retirement to age 75 implies a bonus of 53.8640%. Since the legal retirement age is set to 65, there is no coefficient applied to this age. Given that these values are calculated based on an average person’s experience, they are applied without distinction to all classes considered here and to both genders, as it is also done in practice. We calculate the value of PV, as given by Eq. (6), for retirement ages \(x_r^i\) between 50 and 75. The results are displayed in Fig. 1, which shows the difference in pension capitals, discounted to age \(x_{ref}=50\), given a retirement age between 50 and 75.

The results displayed in Fig. 1 allow us to observe that such a DB scheme as the one set up here favours greatly individuals with a higher education, while the lower classes either suffer losses or do not gain as much. Though the advantage is more striking for highly educated men than for women of the same class, namely D1, the observation holds for both gendersFootnote 16. For men in class D1, postponing the retirement time translates into a higher gain with respect to the theoretical pension. In other words, the DB pension increases quicker than the theoretical pension, making it more attractive to retire late. Moreover, we notice that the penalty coefficients are insufficient for this class, since even when retirement is taken at age 50, thus 15 years before the legal retirement age, the difference in pension capitals is still positive. However, for men of lower education the situation is almost inverted. If class D2 is close to a zero difference for the interval proposed here, we note that for the remaining classes the DB pension is always smaller than the actuarially fair pension. The losses increase the more retirement is postponed, noting that these categories are at a disadvantage. The bonus of retiring later than the legal age is not enough to catch up with the increase in the theoretical pension due to the accumulation of the contributions paid and the fewer years spent in retirement. Hence those living longer are favoured by the lack of mortality consideration. The same can be said in the case of women, since we observe right from the start that all classes gain with respect to the theoretical pension. For them, the DB pension is much more generous than the actuarially fair (or theoretical) framework, even at the minimum retirement age considered. What is more, postponing the retirement age increases the gain, meaning that the increase in the DB pension surpasses the increase in the theoretical pension. Lastly, we remark that the reason for which women always gain with respect to the theoretical pension lies also in the calculation of the contribution rate, which uses unisex mortality. Due to the fact that female mortality is lower than the unisex one, the contribution rate is lower than it should be for women, leading to lower theoretical pensions. Hence the difference in pension capitals remains positive, with the DB pension being more generous than the theoretical framework.

3.2.2 The Notional Defined Contribution scheme

To study the fairness of the NDC scheme, described in Sect. 2.2, we keep the above mentioned contribution rate \(\pi =14.3\%\), the interest rate \(r=1.8\%\) and the indexation rate \(\beta =0\%\). We also set the notional rate of return, which we keep constant throughout time and across classes, to 1.8%. This notional rate satisfies the same relationship as the interest rate r, namely \(1+nr=(1+g)(1+d)\), with \(g=1.4\%\) the growth rate of salaries calculated from our data and \(d=0.4\%\) the growth rate of the population for the year 2016 in France. In Fig. 2 we see, as for the DB scheme, that women gain with respect to the theoretical pension and this gain increases the more the retirement is postponed. This is, in fact, not surprising, since the NDC pension is calculated based on the unisex mortality, while the theoretical pension uses the corresponding class-specific female mortality, which is lower than the unisex one. However, for men the situation is reversed, with all the categories losing with respect to the actuarially fair framework. Thus, for men, the notional interest rate used to accumulate the retirement capital is not enough to compensate for the increased longevity inferred by the use of the unisex mortality, compared to the class-specific one. Even more, the difference in pension capitals decreases the more the retirement is postponed, suggesting that the cost of one year of life less spent in retirement is higher in the NDC scheme than in the actuarially fair framework. This is of more consequence to men in class D5, for whom postponing retirement to higher ages implies a higher loss than for the other classes. Lastly, it is important to note that those with the highest level of education are better off than those in the other classes. Indeed, men in class D1 lose the least (though the difference with respect to class D2 is minimal), while women in the same class gain the most, when compared to the theoretical framework.

3.3 Improving the fairness of the pension schemes

As discussed above, for a given set of parameters, we find that neither the DB, nor the NDC scheme is fair, benefiting more the upper socio-economic classes and disadvantaging the lower classes. This is not the purpose of a social security system, which is meant to help those who really need it, namely the lower socio-economic classes. Hence, the mortality by socio-economic class should be considered in the design of the different schemes, as well as in the calculation of the actuarially fair pensions. However, in practice, the mortality rates by social class are not often used or even known. In order to improve the fairness of the system and thus compensate for the lack of use of the class-specific mortality rates, we suggest adapting the parameters that drive the pensions, namely the interest rate for the theoretical pensions, the accrual rate for the DB pensions and the notional rate for the NDC pension. Therefore, our process is done in steps, starting with the theoretical pension and so, with the interest rate, followed by the accrual rate and the notional rate for the DB and NDC schemes respectively. When socio-economic mortality differences are not considered in the calculations of actuarially fair (or theoretical) pensions, the interest rate awarded to each class should be adapted to ensure that the fair pension remains at the same level, regardless of the use of class-specific survival rates. Formally, we search for the \(r^i\), so the interest rate for each class i that solves Eq. (7).

In other words, we fix the interest rate \(r^{fixed}\) and calculate the theoretical pensions when the class-specific mortality rates are used. Hence \(P_{x_r^i,t}^{i,th}\left( r^{fixed}\right)\) is known for each class and gender. Consequently we look for the interest rate for each class that solves our equation, given that \(P_{x_r^i,t}^{th}\left( r^i \right)\) utilises general mortality (so no class difference) ratesFootnote 17. Taking into account our numerical illustration provided until now, we set \(r^{fixed}\) to \(1.8\%\), while the contribution rate remains \(\pi =14.3\%\). The entry ages into the system are those given in Table 1, while the retirement age is fixed at 65 for all classes and both genders, so \(x_r^i=65, \forall i\). The resulting interest rates for individuals retiring in 2066 are displayed in Table 3. Consequently, those belonging to class D1 reaching the age of 65 in 2066 have entered the system in 2022, while those from classes D2 to D5 have entered in 2019, 2018, 2017 and 2016 respectively.

We note that the class-specific interest rates given in Table 3 are unique solutions to Eq. (7). Hence, the level of the interest rate for each class is not influenced by the type of system adopted, but is dependent on the value of \(r^{fixed}\). Given our projections for the salaries and mortality for each class, we find that, in general the interest rates offered to lower social classes should be higher than those awarded to those with a higher education. This holds for both men and women, though the differences are slightly larger for men. Therefore, for individuals with a higher education and thus with higher survival probabilities, the use of the general mortality instead of the class specific one implies lower interest rates. If men belonging to class D1 only need an interest rate of 1.547%, we would have to offer a rate of 1.9487% to those of class D5. Similarly, women of class D1 require an interest rate of 1.7585%, while for class D5 a value of 1.8214% is found. This is normal, since for lower classes, the general mortality is lower than the class-specific one, inferring lower pensions if the 1.8% interest rate would have been used. Hence, to ensure the equality a higher interest rate should be awarded. The inverse holds for higher classes. Finally, it is important to note that, in general, the gap between the rates given to the classes is smaller for women due their closer mortality and salary profiles, observation that is also visible in Figs. 1b and 2b.

After determining the class-specific interest rates, we search for the accrual rate and the notional rate that would render the DB and the NDC pension, respectively, actuarially fair. In other words, we look for the rates that ensure the equality between the two types of pensions and the theoretical pension, respectively. Formally, this is given in Eqs. (8) and (9) below.

The solutions to these two equations are given in Table 3, alongside the values for the class-specific interest rates. We observe a similar situation for the accrual and notional rate for each class as for the interest rates. Both rates are higher for individuals with a lower education and hence lower salaries. We find that individuals with an university degree require an accrual rate of 0.907% in the case of men, while for women this value is 0.8443%. On the other hand, for those with no formal education, the accrual rate is 1.1872% for men and 0.9028% for women. We notice then that the spread between the lowest and highest class is more important for men than for women. Hence, as before, the differences are more visible for men than for women. The situation is not much different when we look at the notional rate. The highest socio-economic class should receive a notional rate of 1.9033%, in the case of men and 1.4198% in the case of women, while the lowest class is awarded a rate of 2.2319% for men and 1.5127% for women. One other remark to be made here is that the notional rate awarded to men is generally higher than the interest rate for the same gender, while for women the situation is reversed. This is due to the use of the unisex mortality rates for determining the NDC pensions. The unisex mortality is higher than the female mortality and lower than the male one. Thus, in order to preserve the equality between the actuarially fair pension and the NDC pension for the two genders, men should receive a higher notional rate to compensate for the inferred longer lifespan, while women can be awarded a lower interest rate, since the unisex mortality rates are favourable for them. Similarly, the accrual rates for women are lower than for men, since unisex mortality is utilised to determine the contribution rate used to compute the theoretical pensions, this being coupled, of course, with the higher salaries earned by men. Moreover, we must note here that in the case of the DB scheme, the effects of salaries and entry ages in the system are mixed with the effects of the socio-economic mortality rates, since the contribution rates are based on the average individual and they affect only the theoretical pension. A different contribution rate for each class, based on their corresponding salaries and entry ages would allow us to separate the two effects. Such a solution, though not necessarily possible in practice, is discussed in Sect. 5.3.

Lastly, we can compare the obtained rates and the consequent pensions with the initial parameters and the pensions the individuals would have received (so in the case when \(r=1.8\%\), \(AR=1\%\) and \(nr=1.8\%\)). We see that the accrual and notional rates for women in Table 3 are lower than the initial parameters. This is due to the fact that the systems were more generous for women (see Figs. 1b and 2b). Given that the DB and NDC pensions are increasing in the accrual and notional rates respectively, the lower rates for women mean that their pensions will decrease in order to meet the fair pensions. However, because the obtained rates are higher for lower classes, the pensions are not impacted to the same extend. For instance, decreasing the accrual rate from 1% to 0.8443% for class D1 induces a decrease in the DB pensions of 15.57%, while for the class D5 passing to a rate of 0.9171% implies a difference of only 8.29%. For the NDC pensions, the new notional rate for the women in class D1 results in a decrease of 12.5%, while for the class D5 the corresponding percentage is 10.5%. The situation is slightly different for men. Since men with higher education were advantaged by the DB scheme, while those in lower classes were loosing with respect to the fair pensions (see Fig. 1a), the accrual rates for the upper classes decrease with respect to the initial parameters, while for lower classes they increase. Hence men in class D1 receive an accrual rate of 0.907% instead of 1%. At the other end, those in class D5 should get an accrual rate of 1.1872% instead of the initial 1%. Thus the DB pension of those in class D1 will decrease by 9.3%, while that of the individuals belonging to class D5 will increase by 18.7%. In the NDC scheme, men of all classes are at a disadvantage when compared to the theoretical framework (see Fig. 2a). Hence men in class D1 receive a notional rate of 1.9033%, while those in class D5 are awarded a notional rate of 2.2319%, instead of the original 1.8%. Hence the increase of the pension for men in class D1 is of only 3.17%, while the increase for class D5 is of 17.8%. As stated before, the rates given in Table 3, through their impact on the pensions, will close the gap between the fair pension and that actually received, in order to compensate for not using socio-economic mortality rates in the pension calculations, thus reducing the transfers from the lower classes to the higher ones.

3.4 Extending the framework to include pension adequacy

We consider pension adequacy in terms of a minimum pension \(P_{min}\), which is defined as a percentage \(RR_{target}\) of the mean salary in the system at time t, as given by Eq. (10) below.

As one of the goals of the social security system is to ensure a subsistence level for all individuals, it is only natural that such a target minimum pension is fixed within the system, at the legal retirement age. Depending on the chosen percentage \(RR_{target}\), and thus on the level of the minimum pension, the interest rates, accrual rates and notional rates of those classes not reaching the intended target should be further adapted in order to allow these individuals to achieve the minimum required. To accomplish this, we look for the interest rates, accrual rates and notional rates that satisfy the equalities in Eq. (11). The adapted rates will thus depend on the chosen target level \(P_{min,t}\) and implicitly on \(RR_{target}\).

In Switzerland, the subsistence level is defined as 40% of the mean salary in the system. Since the first pillar in France proposes a minimum pension of 37.5% of the average salary of the individual’s careerFootnote 18, we decided, for illustration purposes, to keep the minimum standard to 40% of the average salary in the systemFootnote 19. We start by calculating the minimum pension at the legal retirement age \(x_{legal}=65\), at time \(t=2066\) and we display in Table 4 the pensions calculated using the parameters from Table 3, expressed in percentage of the target minimum pension, of course at age 65.

We see that the pensions for women are lower than those of men, because of their lower income and higher longevity. Indeed, we see that at the legal retirement age of 65, the pension for men with the highest level of education is more than 150% of the minimum, while women in the same class receive only 77% of the minimum pension. However, as expected, individuals with higher education benefit from higher pensions, and this regardless of the gender. If men in class D1 receive 169% of the minimum pension, those in class D4 only get 76% of the target pension. Similarly, women with an university degree reach 77% of the minimum pension, while the corresponding percentage for those in class D4 is 45%.

Given the percentages displayed in Table 4, we will need to adjust the awarded rates for women belonging to all classes, as well as for men belonging to class D2, D4 and D5. The new rates yielded by Eq. (11) in this case are given in Table 5. We see, when comparing to the results in Table 3, that the rates to be awarded to these groups have to be increased in order to allow them to reach the intended level of 40% for the average salary in the system. Thus, for example, women in class D1 should receive an interest rate of 2.4807% instead of 1.7585% and so the accrual rate would pass from 0.8443% to 1.0972%, while the notional rate becomes 2.1646%, instead of 1.4198%. Similarly, the interest, accrual and notional rate for the class D5 are now 3.3872%, 1.7189% and 3.1233%, instead of 1.8214%, 0.9171% and 1.5127% respectively. The slightly lower rates awarded in this case to class D3, compared to the other classes, can be anticipated from the percentage of the minimum pension that they receive, since this class is the closest to the minimum level among the four groups given here, given the data on salaries used for the projections. Men in class D2 will receive an interest, accrual and notional rate of 1.8537%, 1.0898% and 2.1585% respectively after the adjustment, as opposed to the respective original 1.662%, 1.0206% and 1.9724%. For the men in class D5 the rates pass from 1.9487%, 1.1872% and 2.2319% to 2.0547%, 1.2348% and 2.3351% for the interest rate, accrual rate and notional rate respectively. Of course, we remark once again that these results are meant to be just an illustration and thus, will depend on the minimum pension chosen and the data regarding the mortality and salaries for each class.

4 Determining formally the class-specific rates

In this section, we provide easy-to-implement formulas for adjusting the parameters of the pension schemes (as illustrated by the previous section), in order to compensate for the absence of mortality by socio-economic class in the benefit calculations. Our framework allows policy-makers to render the pension system fairer, in a simple way, and to fully quantify the importance of considering socio-economic heterogeneity in mortality through the observed differences in pensions that will arise after the parameters are adjusted.

4.1 The general framework

As mentioned in Sect. 3, class-specific mortality might not be used in the determination of the pensions. In fact, mortality rates by socio-economic class might not be available or complete enough to yield reliable projections. This should however not impede the process of adapting the parameters of the pensions schemes as described in Sect. 3 in order to improve the fairness of the system. In this sense, it is possible to express the class-specific rates mathematically, if the relationship between the mortality of the general population and the one of the class is known and this for each gender (either detailed data are available for one or a few years, or assumptions can be provided by expert opinions or by looking at the mortality experience of neighbouring countries). Hence, let us assume that the following relationship is known:

In Eq. (12) \(p_{x,t}^i\) is the probability of a person of age x at time t, belonging to class i to survive to age \(x+1\), \(p_{x,t}\) is the general survival probability of a person also aged x at time t (hence no class distinction considered) and \(M_{x,t}^i\) is an age-specific, time-specific and class-specific factor defining the relationship between the class and the general population. We note here that the gender is not specified, to ease notation, as the mathematical expressions will be identical for both genders. Given Eq. (12), we can also express \({}_kp_{x,t}^i\), the class-specific probability for a person aged x at time t to survive to age \(x+k\), in function of \({}_kp_{x,t}\) (the same probability, but without the class distinction) as below:

In order to simplify the formulas, we drop the index i from the entry and retirement age. Hence from here onwards we refer to the entry age as \(x_0\) and to the retirement age as \(x_r\). However, this does not change the generalisation aspect of this section. The formulas work the same, even if these ages would be class-specific.

As in Sect. 3.3, we would like to ensure the fairness of the system by allowing a different interest rate per class \(r^i\) that would satisfy Eq. (7), in order to compensate for the use of the general mortality, instead of a class specific one. Consequently, we follow the process described in Sect. 3 by fixing the interest rate \(r^{fixed}\) that should be used to calculate the class-specific theoretical pension \(P_{x_r^i,t}^{i,th}\) and solving Eq. (7) for the interest rate by class \(r^i\). We can then show (the proof can be found in Section C) that Eq. (7) holds for:

From Eq. (14) above, we can deduce that, should the factor \(M_{x,t-x_r+x}^i\) be larger than one, so in other words, should the survival probability of the class i be larger than the general gender specific survival rate, then the interest rate to be awarded, \(r_{x,t-x_r+x}^i\), will be smaller than \(r^{fixed}\). Hence those with higher than average survival rates will receive lower interest rates. Conversely, should \(M_{x,t-x_r+x}^i\) be smaller than one, the interest rate awarded will be larger than \(r^{fixed}\). Ergo, those with lower survival probabilities will receive higher rates.

Using Eq. (8), we can easily express now the accrual rate for each class as a function of the theoretical pension as defined in Eq. (C.2.2), given the vector of interest rates \(r^i_{vec}=\{r_{x_0,t-x_r+x_0}^i,r_{x_0+1,t-x_r+x_0+1}^i\,...,r_{\omega ,t-x_r+\omega }^i\}\) found through Eq. 14:

Lastly, we want to determine a formula for the notional rate of return for each class. For this, we first assume a similar relationship between the gender specific survival rate \(p_{x,t}\) and the unisex rate \(p_{x,t}^{unisex}\) as in Eq. (12), therefore we have:

Hence we find the following relationship between the interest rates and the notional rates (see Section D for details):

Similarly to the case described in Eq. (14), should the factor \(M_{x,t-x_r+x}\) be larger than one, so should the general gender-specific survival probability be larger than the corresponding unisex rate, then the notional rate awarded to class i, \(nr_{x,t-x_r+x}^i\), will be smaller than the interest rate given to the same class \(r^{i}_{x,t-x_r+x}\). Hence those that are favoured by the use of the unisex survival probabilities should receive lower notional rates. On the opposite side, should \(M_{x,t-x_r+x}\) be lower than one, the notional rates will be larger than the respective interest rates.

4.2 A simplification

In many situations, the relationship between the survival rates by age and time, governed by \(M_{x,t-x_r+x}^{i}\) and \(M_{x,t-x_r+x}\), might not be known in such details, so by age and time. However, it might be possible to estimate average factors that would be kept constant through time and across ages or make an assumption as simple as Eqs. (18) and (19), allowing pensions to still be adapted to increase fairness to all socio-economic classes.

With these two factors constant, the interest rates will no longer be time and age dependent, but will remain class specific. We can thus simplify the above expressions for the class-specific rates, obtaining:

Consequently we obtain:

To illustrate this, we estimate the two constant factors for the French data used in Sect. 3 by averaging across ages and across time. The values obtained are given in Table 6. As expected, the values for \(z\%\) are the same for every class, since this factor defines the ratio between the gender specific survival rate, when no class distinction is made, and the unisex survival rates. Moreover, this rate is higher for women, due to the fact that unisex mortality is higher than the female mortality. With regards to \(y^i\%\), we note that the rate decreases with the class, with the higher classes having a survival rate superior than the general one. The differences appear smaller for women than for men, congruent with our observations from Sect. 3.

We then calculate the interest rates, accrual rates and notional rates according to Eqs. (20), (21) and (22) respectively. The results in this case are displayed in Table 7. We see that though the rates are different than the ones in Table 3, the values are in general not far from the initial ones. For instance, the difference between the interest rates \(r^i\) given in Table 3 and in Table 7 is of only 0.0384% for men in class D5, while the respective differences for the accrual and notional rate are, in this same case, 0.017% and 0.7353%. Moreover, they allow us to draw the same conclusions as in Sect. 3.3. For women in the same class, the differences between the interest rates, accrual rates and notional rates from the two tables are 0.0778%, 0.0288% and 0.5369% respectively. The lower classes require higher rates, with the spread between the newly obtained parameters being larger for men than for women. In conclusion, though not perfect, the approximation would allow providing fairer pensions, in function of the socio-economic class.

5 Further analysis

5.1 No gender distinction

In the European Union, differentiating between men and women is not legally allowedFootnote 20. Hence the solution proposed in Sect. 3.3, where the interest rates, accrual rates and notional rates were adjusted for each class and gender in order to improve the actuarial fairness of the schemes, might not be possible to apply. Hence, we perform a similar analysis as done above, when no gender differences are considered. Consequently, salaries and mortality are distinct for each socio-economic class, but do not take gender into account. In setting up the salaries for each class for our numerical illustration, while disregarding gender, we assume a ratio of 51–49% between women and men (in other words, the salaries for each class are composed of 51% of the salaries for women and 49% of those for men of the same class). Hence, the average salaries in the system are calculated, followed by the contribution rate and the bonus and penalty coefficients applied in the DB scheme. Consequently, the new contribution rate is 14.6%. The accrual rate is set at 1%, while the interest and notional rates are both 1.8%, as done in Sect. 3.2.

We then proceed to calculating the differences in pension capitals for the DB and the NDC scheme, as given in Eq. (6). As in Sect. 3.2, the retirement ages considered are those from 50 to 75, with the legal retirement age being 65 and the reference age \(x_{ref}\) being set to 50. The results are displayed in Fig. 3. Firstly, we observe, as expected, that individuals with the highest level of education are the most advantaged by either one of the schemes, with their gain increasing with age. In the case of the DB scheme, we observe that the lower classes experience a loss with respect to the actuarially fair pension, though not significant. Moreover, higher retirement ages imply an even bigger loss. The situation is slightly reversed for those in class D2 and D3, who experience a gain that increases with age. Lastly, we note that the differences between classes D2 to D5 are not big, while those with the highest level of education receive a distinct advantage from the two schemes. The situation is similar for the NDC scheme, although the gain of class D1 is less significant. Moreover, those in class D2 and D3 see their gain increase when retirement is postponed, while those in class D4 will go from suffering a loss to experiencing a small gain the more retirement is pushed. However, those without any diploma will lose with respect to the theoretical framework and their disadvantage increases with the retirement age.

Subsequently, we applied the methodology described in Sect. 3.3 to adjust the parameters in order to allow the system to achieve actuarial fairness. As previously stated, we consider \(r^{fixed}=1.8\%\) and we set the retirement age to 65. The results stemming from Eqs. (7), (8) and (9) in this case are given in Table 8. Of note here is that \(P^{i,th}_{x_r,t}\left( r^{fixed}\right)\) is calculated based on class-specific survival rate and class-specific salaries, without a gender distinction. It then follows that for \(P^{th}_{x_r,t}(r^{i})\) we will use class-specific salaries, but unisex mortality rates. As expected, the observations to be made here are similar to those from Sect. 3.3. The awarded rates are lower for those in higher classes and higher for those in lower classes, to compensate for the not considering class-specific mortality rates in the calculation of the pensions. Hence those in class D1 will receive an interest rate of \(1.6560\%\), an accrual rate of \(0.8889\%\) and a notional rate of \(1.6560\%\), while for those in class D5 the interest, accrual and notional rates are \(1.8848\%\), \(1.0704\%\) and \(1.8848\%\) respectively. Moreover, we note that the interest rates \(r^i\) and the notional rates \(nr^i\) have the same values, since, when no gender distinction is made, the two pensions are equivalent. Lastly, we can compare the newly obtained rates with our initial parameters (\(r=1.8\%\), \(AR=1\%\) and \(nr=1.8\%\)). As expected, we see that only those in class D5 will receive an interest rate and a notional rate above the initial value of 1.8%, but that the adjusted rates are close to the initial parameters, indicating that only this class was facing a loss with respect to the theoretical pension, in 2066. The accrual rates for classes D1 to D3 are slightly lower than the initial 1%, since the individuals belonging to these classes were favoured by the DB scheme, while those in the remaining classes are awarded rates above 1% to compensate for their losses with respect to the actuarially fair pension.

As in Sect. 3.4, we are also interested in making sure that the pensions reach adequacy. In other words, individuals should receive at least the minimum pension, defined in our numerical example as 40% of the average salary in the system. Given the rates presented in Table 8, we start by computing the corresponding pensions as percentages of the minimum pension and we display the results in Table 9. In this case, when no gender distinction is applied, only those in class D1 reach the intended pension target. The remaining classes are below the threshold for pension adequacy, with class D2 reaching only 75% of the minimum pension and class D4 obtaining 62% of the same reference amount. Lastly, we note that the lower pensions for classes D2 to D5 are also due to the fact that the salaries in this case are based on a slightly higher proportion of female wages than male.

Given the results displayed in Table 8, the interest, accrual and notional rates for classes D2 to D5 should be adjusted to ensure that the pensions are adequate. In other words, we repeat the process explained in Sect. 3.4 and given by Eq. 11. The corresponding rates can be found in Table 10. The individuals belonging to class D2 should thus receive an interest, accrual and notional rate of \(2.5255\%\), 1.2875% and 2.5260% respectively. For class D4 the corresponding values are 3.0567%, 1.6900% and 3.0572%. As explained, the new rates will allow the pensions for these classes to reach the minimum target pension. These results are in line with our previous observations, given in Sect. 3.

5.2 Adjusting the parameters at retirement

In the analysis provided until now, we have considered socio-economic differences from the beginning of the working career. However, this might be difficult to implement in practice. Thus, a possible alternative that would be easier to put in practice for the policy makers consists of considering the differences in mortality based on socio-economic class only for the retirement phase. This section analyses this option in more depth. In other words, for the following analysis, all individuals are considered equal with respect to their mortality during the active life and the class-specific rates should only be applied from the retirement age onward.

Though the definition of the DB and NDC pensions does not change, our methodology for determining the class-specific rates needs to be reviewed. Moreover, in this section we add to the analysis the case of no gender distinction, as to keep in mind the limitations described in Sect. 5.1 above.

Let us begin with how the notional rate in a NDC scheme can be adjusted at the retirement age. As previously explained, in such a scheme the individuals accumulate a notional capital, which is then transformed into an annuity using unisex mortality rates. Since we are interested in considering socio-economic differences in mortality starting from the retirement time, we must differentiate between the active phase and the retirement phase for each socio-economic class. During the active phase, all classes will receive the same notional rate, while the notional rate awarded at retirement will be distinct for each class and will allow us to compensate for the use of unisex mortality rates instead of class-specific mortality rates. Hence the NDC pension at the legal retirement age \(x_{legal}\) can be rewritten as in Eq. (23), with \(nr^{act}\) the notional rate awarded during the active life to all individuals, regardless of class. For simplification purposes, the formula assumes the notional rate during the active phase is constant for the duration. However, the methodology presented here can take into account a notional rate changing yearly. Our numerical illustration will account for both possibilities.

We also redefine the theoretical pension at the legal retirement age \(x_{legal}\) as given in Eq. (25), where \(AccCap^i\) is the capital accumulated under the NDC scheme by an individual belonging to class i and \(r_{ret}\) is the interest rate at the moment of retirement (the rate for which the equation \((1+r)=(1+d)\cdot (1+g)\) holds, at the time of the retirement). Since the mortality differences are considered only at retirement, it is only logical that the accumulated capital should be the same for the NDC and the theoretical pension.

Subsequently, we look for the notional rate \(nr^i\) that solves Eq. (26). As already explained, our goal is to determine the class-specific notional rates \(nr^i\) that will allow us to compensate for not using the mortality rates by socio-economic class in the calculation of the NDC pension.

If we develop Eq. (26) as done in Sect. 4, using Eqs. (12) and (16), we obtain a the same formula as given in Eq. (17), with \(x\ge x_{legal}\) and \(r_{ret}\) taking the place of \(r^{fixed}\).

To illustrate this part of our paper, we start by assuming a constant notional rate of 1.8% for the active life, as well as an interest rate at retirement of 1.8%. This corresponds to the parameters used in Sect. 3. Hence the contribution rate stays at the level of 14.3%. The legal retirement age is considered 65, while the indexation stays zero. The solutions of Eq. (26) are given in Table 11. Because the accumulated capital is the same for the NDC and the theoretical pension, the contribution rate impacts both pensions in the same way and thus has no effect on the results stemming from Eq. (26). We observe that the notional rates for men of all classes are higher than 1.8%, while the rates awarded to women are lower than the interest rate at retirement. This is in line with our previous analysis and the values displayed in Fig. 2 and is due to the use of unisex mortality rates for the NDC pension. Moreover, we see once more that the rates for lower classes are higher than those for higher classes, allowing us to compensate for the use of unisex mortality rates in the calculation of the NDC pension. Hence men in class D1 are awarded a rate of 2.0415%, while those in class D5 receive 2.7528% starting at the retirement age. For women in class D1 the notional rate in this case is 0.96%, while for those with no education the corresponding value is 1.1059%. When no gender distinction is made, the notional rates are lower than the interest rate at retirement for all classes, except for class D5. Those with the highest level of education receive a notional rate of 1.5214%, while the individuals with no education are awarded a rate of 1.9550%. As for men and women, the rates for the higher classes are below those for the lower classes. The results are once again in line with the values displayed in Fig. 3b. To further our analysis, we also take into account that at retirement, the interest rate might suffer a shock, even if the notional rate during the active period is 1.8%. If the interest rate at retirement is 1.5% and not 1.8%, the values for the class-specific notional rates are recalculated and are given in Table 11, alongside the results discussed above. The conclusions in this case are the same as those for the previous case, when the interest rate at retirement is 1.8%. We note that men receive higher rates than women, with the value of the interest rate at retirement of 1.5% being lower than the notional rates for men and higher than the notional rates for women. This is once more due to the use of unisex mortality rates in the calculation of the NDC pension. Moreover, individuals in higher class receive lower notional rates than those in lower classes. Hence the notional rates for class D1 are 1.7459% for men and 0.6502% for women. For those in class D5, the notional rates are 2.4598% and 0.7982% for men and women respectively. A similar conclusion can be drawn when no gender distinction is made, with the notional rate for class D1 being 1.2191% and the corresponding value for class D5 reaching a level of 1.6551%.

As an additional step, we allow the notional rate during the active life to differ each year. In order to accomplish this, we fix the growth rate of salaries to 1.4% and we fit an ARIMA(1,1,2) modelFootnote 21 to the historical growth rate of the French population. Subsequently, we project the values of \(d_t\) by simulating 100 paths for the growth rate of populationFootnote 22. We then determine the notional rate for each year using the relationship \(1+nr^{act}_t=(1+g)\cdot (1+d_t)\). At the retirement age, the interest rate \(r_{ret}\) corresponds to the notional rate of that specific year. Given the different simulations, the notional rates for each class and gender, as well as those with no gender distinction are determined according to Eq. (26). Figures 4, 5 and 6 show the simulations for the notional rates during the active phase in black, as well as the results for the class-specific rates for men, women and when no gender distinction is made respectively, for two chosen simulations. The interest rate at retirement is 2.34% in the first depicted simulation and 2.71% in the second. Our previous observations hold in this case as well. We observe that men will receive a notional rate higher than the interest rate (in black in the plots), with men with the lowest level of education having a higher notional rate than the rest. For women, the notional rates are lower than the interest rate at retirement, but once again women with the lowest education receive the highest notional rates. Moreover, as before, we observe that the differences are more significant for men than for women. When no distinction for gender is made, only those in class D5 will receive a rate higher than the interest rate at retirement, with the remaining classes situated below the level. This is expected, since the values for salaries and class-specific mortality in this case are based on a gender distribution of 51% for women and 49% for men.

We are now interested in adjusting the accrual rate at the retirement age in a DB scheme. As expected, since there is no capital accumulation in this type of scheme, a similar reasoning as that described for the NDC scheme and given in Eqs. (25) and (26) does not apply. We describe the process of adjusting the accrual rate at retirement in the remainder of this section. As previously explained, for an accrual rate fixed by the system, to which we will refer here as \(AR_{sys}\), the contribution rate is calculated, based on the salary and mortality of the average individual. Hence the system assumes that the present value of benefits to be paid depends on the unisex mortality rates. However, in reality, the class-specific mortality rates will drive the present value at retirement of the benefits. Hence we are looking for the accrual rate for each class that will allow the two present values specified above to be equal. This is given in Eq. (27), with \(P^{i,DB}_{x_{legal},t}(AR_{sys})\cdot \ddot{a}_{x_{legal},t}^{unisex,\beta }\) the amount that the system assumes the individual will receive and \(AR^i_{ret}\) the accrual rate that will allow the present value of what is actually paid to the individual to equate the value presumed by the system.

Developing Eq. (27), we obtain the accrual rate for each class as given in Eq. (28).

In our numerical illustration, we keep the accrual rate set by the system to 1% (hence \(AR_{sys}=1\%\)) and the indexation rate to 0. The interest rate used to calculate the values of the annuities is kept at 1.8%. The resulting accrual rates for each class are given in Table 12, for men, women and when no gender distinction is made. The observations to be made here are in line with our previous analysis on the notional rates. When the mortality differentials are only accounted for starting at retirement, men will receive higher rates than the fixed 1%, while the accrual rate for women is lower. For the case when no gender distinction is made, only those with no education receive a rate higher than 1%. However, the main conclusion still stands. Individuals in lower classes are awarded higher accrual rates than those in higher classes. Therefore, men in class D1 receive an accrual rate of 1.0314%, while those in class D5 are awarded a rate of 1.1263%. The corresponding rates for women are 0.8942% for class D1 and 0.9122% for class D5. When no gender distinction is made, the accrual rate for those with the higher education is 0.9643%, while for those with no education the rate awarded is 1.0201%. Lastly, we note here that a change in the interest rate used for calculating the annuities will not lead to significant changes in the results, since the rate impacts both annuities.

Furthermore, we must remark here on the principal disadvantage of such an approach, namely considering the socio-economic differences only once the individuals reach retirement. Although this option might be easier to implement from the point of view of the policy makers, it will still slightly disadvantage those in lower socio-economic classes, as it does not account for their higher mortality during the active life. Hence the notional rates and accrual rate will not completely compensate for the lower life expectancy of those belonging to lower socio-economic classes. For instance, in the NDC scheme, since the accumulation phase does not consider the higher mortality for those groups, the survival dividends taken into account are lower than they should be. Moreover, for the DB scheme the accrual rate for those of lower classes are lower than the ones provided in Table 3, suggesting an insufficient compensation for the socio-economic differences. Still comparing between the two tables, we observe that the differences between the accrual rates given to each class are smaller when the socio-economic distinctions are only considered at retirement. This holds for both genders. Similarly, for the NDC scheme, as the active phase is identical between all the individuals, the differences between the classes are smaller in this case than when socio-economic differences are taken into account for the entire duration of the working life.

5.3 Different contribution rates

As previously explained, the choice of the contribution rates do not impact the values of the notional rates to be awarded, since both the NDC and the theoretical pension are affected by the contribution rates in the same way. However, the DB pension does not depend on the contribution rate, while the theoretical pension is impacted by it, hence a different contribution rate will lead to different accrual rates than those displayed in Tables 3 and 10. Since the contribution rate of 14.3% is fixed based on unisex mortality, average salaries and an entry age in the system of 17, the effects of the class-specific mortality on the accrual rates of Tables 3 and 10 are mixed with the effects of the class-specific salaries and entry ages. To remedy this situation and isolate the effect of the mortality by socio-economic class, the evolution of salaries for each class and gender, as well as the corresponding entry ages should be considered in the calculation of the contribution rates. The resulting values, using class-specific salaries and entry ages, but unisex mortality rates, are given in Table 13. As expected, the contribution rates for higher classes are higher, indifferent of gender, since they enter the system later and since their earning are higher. Moreover, women should pay a lower contribution rate than men to reflect their lower salaries.

Given the contribution rates given in Table 13, we recalculate the accrual rates to be awarded to each class. The corresponding values are given in Table 14. We observe that the accrual rates for those in lower classes are higher than for those with the highest level of education. Hence men in class D5 should receive an accrual rate of 1.1778%, while women in the same class should be awarded a rate of 0.8952% and when no gender distinction is considered the accrual rate is 1.0329% for the same class. For class D1 the accrual rates are 1.0191%, 0.8734% and 0.9472% for men, women and when no gender distinction is made, respectively. However, in this case the differences between classes are reduced in the case of men and the values overall are approaching those in Table 12. Moreover, we see that the rates for men are higher than the fixed accrual rate of 1%, while those for women are lower than the same fixed rate. When no gender distinction is made, only those with no education receive an accrual rate higher than 1%. As expected the differences between the classes are smaller in this case, when compared to the results in Table 3, since the distinction in contribution rates accounts for a part of the socio-economic gap. However, we note that setting the contribution rates differently for each socio-economic class to reflect the corresponding differences in salaries and entry ages does not completely explain and eliminate the discrepancies between the classes. This points towards the significant impact of the socio-economic mortality rates. Hence compensating for the lack of use of class-specific mortality rates remains an important task, in order to improve the fairness of the system and lower the disadvantage for the lower socio-economic classes.

We summarise the different scenarios considered in this paper in Table 15, along with the key findings for each case.

6 Conclusions

In this paper, we focus on the actuarial fairness of the Defined Benefit and the Notional Defined Contribution pension scheme, when mortality rates differ by socio-economic class. We show, through a numerical example based on data by level of education from the French Office of Statistics, that these schemes can indeed be unfair. This is due to the fact that neither the DB, nor the NDC scheme incorporates mortality rates by socio-economic class. We find that not only do the DB and NDC pensions differ from the actuarially fair pension, but they also tend to advantage those with higher education. In reverse, individuals belonging to lower classes lose with respect to the actuarially fair pensions. We can thus conclude that socio-economic differences in mortality have a significant impact on the fairness of the retirement systems, be they the DB or NDC type. Therefore, mortality by socio-economic class should be included in the pension calculations. However, this is rarely done in practice. One reason for this could be the scarcity of data. Another possible explanation lies in the additional complexity introduced when considering the socio-economic mortality rates, since a new variable is added to the systems. An alternative is therefore required in order to help improve the fairness of the systems. Hence, we propose a simple methodology that allows each system to adapt its parameters, namely the interest rates, the accrual rates and the notional rates of return, for each socio-economic class. Our numerical example allows us to see that the rates should be higher for lower socio-economic groups, while individuals with higher education would receive lower rates. Subsequently, we looked beyond the fairness of each system and included pension adequacy in our framework. Hence, in order to allow all individuals to attain a given minimum pension level, the parameters for each system would need to be adapted again, for those not reaching the target value. In our example, we fix the minimum desired pension to 40% of the average salary in the system at the moment of retirement. Therefore, the class-specific rates need to be increased only for those not reaching the intended level.