Abstract

We calculate reserves regarding expected policyholder behavior. The behavior is modeled to occur incidentally similarly to insurance risk. The focus is on multi-state modelling of insurance risk and behavioral risk in terms of free policy risk and surrender risk. We discuss valuation techniques in the cases where behavior is modeled to occur independently or dependently of insurance risk, respectively. Ordinary differential equations make it easier to work with dependence between insurance risk and behavior risk. We analyze the effects of the underlying behavioral assumptions for two contracts. For a “new” contract with low technical interest rate relative to the market interest rate, we obtain the lowest reserve by counting in dependence. For an “old” contract with high technical interest rate relative to the market interest rate, the picture is more blurred, depending on assumptions on reactivation (recovery) and independence.

Similar content being viewed by others

References

Bacinello AR (2003) Fair valuation of a guaranteed life insurance participating contract embedding a surrender option. J Risk Insur 70(3):461–487

Buchardt K, Møller T (2013) Life insurance cash flows with policyholder behaviour, Preprint (submitted), available at http://www.math.ku.dk/buchardt/

Buchardt K, Møller T, Schmidt KB (2013) Cash flows and policyholder behaviour in the semi-Markov life insurance setup, to appear in Scand Actuar J

Eling M, Kiesenbauer D (2013) What policy features determine life insurance lapse? An analysis of the German market. J Risk Insur. doi:10.1111/j.1539-6975.2012.01504.x

De Giovanni D (2010) Lapse rate modeling: a rational expectation approach. Scand Actuar J 2010(1):56–67

Grosen A, Jørgensen PL (2000) Fair valuation of life insurance liabilities: the impact of interest rate guarantees, surrender options, and bonus policies. Insur Math Econ 26(1):37–57

Kim C (2005) Modeling surrender and lapse rates with economic variables. North American Actuar J 9(4):56–70

Kuo W, Tsai C, Chen W-K (2003) An empirical study on the lapse rate: the cointegration approach. J Risk Insur 70(3):489–508

Loisel S, Milhaud X (2011) From deterministic to stochastic surrender risk models: impact of correlation crises on economic capital. Eur J Oper Res 214(2):348–357

Milhaud X (2013) Exogenous and endogenous risk factors management to predict surrender behaviours. ASTIN Bull 43(3):373–398

Siu TK (2005) Fair valuation of participating policies with surrender options and regime switching. Math Econ 37(2005):533–552

Steffensen M (2000) A no arbitrage approach to Thiele’s differential equation. Insur Math Econ 27:201–214

Steffensen M (2002) Intervention options in life insurance. Insur Math Econ 31:71–85

Tsai C, Kuo W, Chen W-K (2002) Early surrender and the distribution of policy reserves. Insur Math Econ 31:429–445

Valdez EA (2001) Bivariate analysis of survivorship and persistency. Insur Math Econ 29:357–373

Acknowledgments

Work supported by the Danish Advanced Technology Foundation (Højteknologifonden) (017-2010-3).

Author information

Authors and Affiliations

Corresponding author

Appendix: A The Danish FSA yield curve used in the market basis

Appendix: A The Danish FSA yield curve used in the market basis

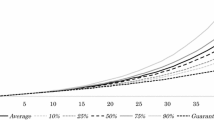

In Fig. 9 we plot the (discretely compounded) yield curve, \(R\), published on 2013-04-08 by the Danish FSA, from which we extracted the equivalent continuous forward rate used in the market basis. We also plot the technical interest rates used in the two contracts considered in Sect. 6.2, here discretely compounded (\(R^* = e^{r^*} - 1\)).

Rights and permissions

About this article

Cite this article

Henriksen, L.F.B., Nielsen, J.W., Steffensen, M. et al. Markov chain modeling of policyholder behavior in life insurance and pension. Eur. Actuar. J. 4, 1–29 (2014). https://doi.org/10.1007/s13385-014-0091-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-014-0091-2