Abstract

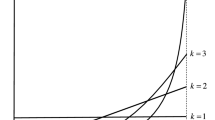

This paper studies a duopoly investment model with uncertainty. There are two alternative irreversible investments. The first firm to invest gets a monopoly benefit for a specified period of time. The second firm to invest gets information based on what happens with the first investor, as well as cost reduction benefits. We describe the payoff functions for both the leader and follower firm. Then, we present a stochastic control game where the firms can choose when to invest, and hence influence whether they become the leader or the follower. In order to solve this problem, we combine techniques from optimal stopping and game theory. For a specific choice of parametres, we show that no pure symmetric subgame perfect Nash equilibrium exists. However, an asymmetric equilibrium is characterized. In this equilibrium, two disjoint intervals of market demand level give rise to preemptive investment behavior of the firms, while the firms otherwise are more reluctant to be the first mover.

Similar content being viewed by others

References

d’Aspremont, C., Jacquemin, A.: Cooperative and non-cooperative R&D in duopoly with spillovers. Am. Econ. Rev. 78, 1133–1137 (1988)

Bessen, J., Maskin, M.: Sequential innovation, patents and imitation. Rand J. Econ. 40, 611–635 (2009)

Chevalier-Roignant, B., Trigeorgis, L.: Competitive Strategy: Options and Games. MIT Press, Cambridge (2011)

Décamps, J.P., Mariotti, T., Villeneuve, S.: Irreversible investment in alternative projects. Econ. Theory 28, 425–448 (2006)

Dixit, A., Pindyck, R.: Investment Under Uncertainty. Princeton University Press, Princeton (1994)

Femminis, G., Martini, G.: Irreversible investment and R&D spillovers in a dynamic duopoly. J. Econ. Dyn. Control 35, 1061–1090 (2011)

Fudenberg, D., Tirole, J.: Preemption and rent equalization in the adoption of new technology. Rev. Econ. Stud. 53, 383–401 (1985)

Hoppe, H.C.: Second-mover advantages in the strategic adoption of new technology under uncertainty. Int. J. Ind. Org. 18, 315–338 (2000)

Huisman, K.J.M., Kort, P.M.: Strategic technology adoption taking into account future technological improvements: a real options approach. Eur. J. Oper. Res. 159, 705–728 (2004)

Huisman, K.J.M., Kort, P.M., Thijssen, J.J.J.: The effects of information on strategic investment and welfare. Econ. Theory 28, 399–424 (2006)

Huisman, K.J.M., Kort, P.M., Thijssen, J.J.J.: Symmetric equilibrium strategies in game theoretic real option models. J. Math. Econ. 48, 219–225 (2012)

Jeanblanc, M.: Credit risk, Lecture notes, Lisbon. https://www.maths.univ-evry.fr/pages_perso/jeanblanc/conferences/lisbon.pdf. Accessed 4 Mar 2019

Jin, J., Troege, M.: R&D competition and endogenous spillovers. Manch. Sch. 74, 40–51 (2006)

Nishihara, M., Ohyama, A.: R&D competition in alternative technologies: a real options approach. J. Oper. Res. Jpn. 51, 55–80 (2007)

Øksendal, B.: Stochastic Differential Equations. Springer, Berlin (2007)

Reinganum, J.F.: On the diffusion of new technology: a game theoretic approach. Rev. Econ. Stud. 48(3), 395–405 (1981)

Reinganum, J.F.: The Timing of innovation: Research, Development, and Diffusion, Chapter 14, Handbook of Industrial Organization, vol. 1. Elsevier, Amsterdam (1989)

Sigman, K.: IEOR4700: Notes on Brownian motion, Columbia. http://www.columbia.edu/~ks20/FE-Notes/4700-07-Notes-BM.pdf (2006). Accessed 1 Nov 2018

Yap, Y.J., Luckraz, S., Tey, S.K.: Long-term research and development incentives in a dynamic Cournot duopoly. Econ. Model. 39, 8–18 (2014)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dahl, K.R., Stokkereit, E. A duopoly preemption game with two alternative stochastic investment choices. Afr. Mat. 30, 663–680 (2019). https://doi.org/10.1007/s13370-019-00674-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13370-019-00674-3