Abstract

Throughout his career, Ngo Van Long made substantial contributions to applied economic theory. With nearly 200 articles and 8 books to his credit, his contributions span the fields of international trade, industrial organization, public finance, natural resources, and environmental economics. This paper contributes to the significant literature which developed after Long (J Econ Theory 10:42–53, 1975), an early contribution to exhaustible resource theory published in the year Long received his PhD. He deduced the optimal extraction path of an exhaustible resource when there is a risk the resource will be nationalized at an unknown time. After surveying the related literature, we deduce the implications of Long’s dynamics when the random event would raise rather than lower the competitive price of the asset. We illustrate with 3 applications: an investment project which a court might allow to commence; land with regulatory restrictions preventing development which might be rezoned for an income-generating use; and a futures contract on a currency which might be revalued before the contract expires.

Source jstor

Source “weekly monetary report” International Monetary Market, 15 October, 1976.

Similar content being viewed by others

Notes

Long’s formulation is quite general. His hazard function may vary over time, his optimizer may assign positive probability to nationalization never occurring, and the optimization problem can be applied to either a central planner or a monopolist. While in each of these applications, the implied price path may be inferred, the inference is left to the reader. Long’s main finding is that nationalization risk initially induces more rapid and more rapidly descending extraction than would occur in the absence of this risk and exhaustion would occur sooner (unless nationalization actually occurs). See his Fig. 1. In our paper, we examine the special case of Long’s general formulation that has received the most attention: a constant hazard rate and the price path in competitive equilibrium prior to nationalization.

Difficult econometric challenges arise when large price jumps are anticipated to occur only rarely. For, then the resulting time series of prices appears to contradict conventional rational expectations predictions. These difficult issues were first investigated by Rogoff [24, 25] and later by Krasker [16]. See Lewis [19] for a more recent survey of how these econometric problems have been addressed.

Some but not all of the relevant literature published after Long’s article cites his article. We review the literature containing Long’s idea, whether or not he is cited.

Vernon Smith and Tjalling Koopmans were in the first group; Wilson and Smith were in the second group; and Robert Solow and Joseph Stiglitz were in both groups.

The most recent, comprehensive survey of contributions to the Hotelling literature is Gerard Gaudet’s Presidential Address to the Canadian Economics Association [8]. While his survey is 16 years old, it nonetheless covers most contributions to the exhaustible resource literature since publications in the last decade and a half have slowed to a trickle (see Fig. 1).

Long’s article was, therefore, well ahead of Dasgupta and Stiglitz’s presentation at the Stanford Conference of their working paper on the effect on the oil price of anticipating the invention of a low-cost backstop at an unknown time, which was presented at the Stanford Conference. Their revision eventually became [4] and [30].

According to Johany [13] and the references therein, “Once the host countries became the ones who decide how much to produce and how much to charge for each barrel of oil, the role of the companies was essentially reduced to that of contractors. That amounted to a de facto nationalization of the crude oil deposits.”

For example, Merrill and Orlando note that the conventional wisdom “that uncertainty reduces investment” is turned on its head when resource suppliers expect that they will be unable to profit from future extraction [23].

The international finance literature on the peso problem tends to cite Salant–Henderson [26] but not Long [21]. One reason for this is that gold has always interested international finance specialists and nationalization risk has not. In addition, the first version of the Salant–Henderson gold paper appeared in 1974, prior to the publication of Long [21]; therefore, their working paper on gold did not cite Long [21]. The published version [26] does cite Long [21]. In between 1974 and 1978, however, MIT students like Rogoff [24] were completing their own research on the peso problem. As Paul Krugman [17] recalled in his New York Times blog: “Back in 1975–76 a lot of us were Rudi Dornbusch students, working on exchange rates. We were alerted to the peso issue by stuff coming from Steve Salant at the Fed; this was the same time that the Salant–Henderson model of gold markets was being drafted, and expectations—including expectations of possible sudden large price changes due to events such as gold auctions and devaluations—were very much on our minds.” Hence, even though Long [21] was published three years before the publication of Salant–Henderson [26], the international finance students at MIT, who initiated study of the peso problem, cite Salant–Henderson [26], not Long[21].

Long [21] in fact has a time-varying hazard rate, but virtually all of the subsequent literature reviewed has a constant hazard rate; in principle, the hazard rate could also depend on the control and state variables.

Despite claims in the title and introduction that their analysis concerns the “short-medium term,” the upper limit of the integrals in later sections is infinity.

Given that no jump has occurred through period t, the probability that it occurs in the remaining \(T-t\) periods is thus \(1-(1-\alpha )^{T-t},\) which is increasing in \(\alpha \) and T and decreasing in t. Intuitively, the fewer periods that remain or the smaller the hazard rate, the lower the probability that a price jump will occur in the remaining time.

It is straightforward to show that if the price sequence is strictly increasing (respectively, decreasing), each successive price difference is larger (smaller). Recursion (1) can be rewritten as \(p_{t+1}-p_{t}=p_{t}\left( \frac{1+r}{1-\alpha }\right) -\frac{\alpha f}{1-\alpha }.\) Similarly \(p_{t+2}-p_{t+1}=p_{t+1}\left( \frac{1+r}{1-\alpha }\right) -\frac{\alpha f}{1-\alpha }.\) It follows that the second difference is larger than the first if and only if \(p_{t+1}>p_{t}.\) Thus, the increments increase if the price sequence is increasing—the discrete-time analog of convexity.

More generally, since the two strategies must yield equal payoffs whether initiated at \(t=1\) or at any subsequent \(t,\; p_{t}(1+r)^{T-t}=p_{T}(1-\alpha )^{T-t}+\sum _{x=t+1}^{T}\alpha (1-\alpha )^{x-(t+1)}[f(1+r)^{T-x}] \text{ for } t=1,\ldots ,T.\) This can be shown to be equivalent to \(p_{t}=\frac{p_{T}}{m^{T-t}}+\hat{p}(1-\frac{1}{m^{T-t}}),\) for \(t=1,\ldots ,T.\) This generalization of (2) uniquely defines the price of the asset at any \(t=1,\ldots T.\)

There is one case we have not considered. We include it for completeness despite our inability to find any illustrative application. Recall that \(\hat{p}=f\frac{\alpha }{\alpha +r}<f,\) whenever \(r>0.\) So if a downward price jump is anticipated initially, \(p_{1}>f>\hat{p}\) and the price sequence must continually increase, insuring that the downward jump is also anticipated in every subsequent period. If, on the other hand, \(p_{1}<\hat{p}<f\), then an upward price jump is anticipated initially and the price sequence must decrease continually, insuring that an upward jump in price is anticipated in any subsequent period. This leaves unexamined the case where \(p_{1} \in (\hat{p},f].\) In that case, an upward price jump is anticipated initially, and yet, the price sequence strictly increases. One can therefore imagine a case where \(p_{1}>\hat{p}\) but \(p_{T} \in (\hat{p},f]\). Then there would be a strictly increasing sequence of prices even though in each period the price would jump up to f if the anticipated favorable event occurred. As is easily verified, the price in anticipation of the upward jump would then always rise slower than the rate of interest. This case arises in the continuous-time counterpart as well and occurs because the positive interest rate imparts a slight bias toward an increasing price even if the anticipated jump is upward.

Denote the continuous-time counterparts to the discrete-time interest rate and hazard rate as \(\tilde{r}\) and \(\tilde{\alpha }\), respectively. These are sometimes referred to as the “force” of interest and hazard: \(\tilde{r}=ln(1+r)\) and \(\tilde{\alpha }=-ln(1-\alpha ).\) Denote \(\tilde{p}=\frac{\tilde{\alpha }f}{\tilde{\alpha }+\tilde{r}}.\) Any holder of the asset at time t can (1) sell it and bank the proceeds; alternatively, he can (2) wait until the random event occurs and then sell the asset and bank the proceeds. (If the event never occurs, he can sell the asset for the terminal price, \(p_{T}.)\) Both strategies should have the same payoff in equilibrium if agents are identical and risk neutral. Using strategy (1), the agent’s bank balance at T will be the left-hand side of the following equation, whereas if he uses strategy (2), his bank balance at T will be the right-hand side of the equation:

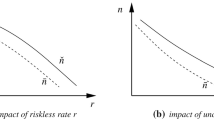

$$\begin{aligned} p(t)e^{\tilde{r}(T-t)}=p_{T}e^{-\tilde{\alpha } (T-t)}+\int _{x=t}^{x=T}\tilde{\alpha }e^{-\tilde{\alpha }(x-t)} fe^{\tilde{r}(T-x)}dx. \end{aligned}$$Solving the definite integral and simplifying, we obtain \(p(t)=(p_{T}-\tilde{p})e^{-(\tilde{\alpha }+\tilde{r})(T-t)}+\tilde{p}.\) Note that this satisfies the terminal condition since if \(t= T, p(T)=p_{T}\) setting \(t=0\) generates the counterpart to (2). If, instead, we differentiate with respect to t and simplify, we obtain the counterpart to (1): \(\dot{p}(t)=(\tilde{\alpha }+\tilde{r})p(t)-\tilde{\alpha }f.\) As in the discrete-time case, the price is stationary if \(p(0)=\tilde{p}\) but rises if p(0) is above this fixed point and falls if p(0) is below it. Differentiating again, we conclude that \(\ddot{p}=(\tilde{\alpha }+\tilde{r})\dot{p}(t).\) Thus, if the price path is increasing (respectively, decreasing), it is strictly convex (respectively, strictly concave).

More generally, the hazard function could be a step function with descending steps. The height of each step and the length of time it prevails would be specified exogenously. As long as this step function for the hazard rate is foreseen, Eq. (2) could be used recursively to construct the price path in anticipation of the jump to f at an unknown time.

Such as Houston, Texas.

See [6].

See [9].

Alternatively, one can check that this solution satisfies the difference equation (1) and the endpoint condition at \(t=T\).

References

Bahel E (2011) Optimal management of strategic reserves of nonrenewable natural resources. J Environ Econ Manag 61(3):267–280

Chaton C, Cretin A, Villeneuve B (2009) Storage and security of supply in the medium run. Resour Energy Econ 31(1):24–38

Dasgupta P, Heal GM (1979) Economic theory and exhaustible resources. J. Nisbet and Cambridge University Press, Cambridge

Dasgupta P, Stiglitz J (1981) Resource depletion under technological uncertainty. Econometrica 49(1):85–104. https://doi.org/10.2307/1911128

Fountain H (2023, January 31) E.P.A. blocks long-disputed mine project in Alaska. New York Times. https://www.nytimes.com/2023/01/31/climate/pebble-mine-epa-decision.html

Freemark Y (2020) Upzoning Chicago: impacts of a zoning reform on property values and housing construction. Urban Aff Rev 56(3):758–789. https://doi.org/10.1177/1078087418824672

Fromm G, Stiglitz J, Solow R (1975) Conference on econometrics and mathematical economics: workshop on energy-related general research in micro-economics [Conference Presentation]. In: 1975 conference on natural resources, sponsored by the National Bureau of Economic Research, Palo Alto, CA

Gaudet G (2007) Natural resource economics under the rule of Hotelling. Can J Econ 40:1033–59. https://doi.org/10.1111/j.1365-2966.2007.00441.x

Graber H (2022, January 31) Can you force the suburbs to build apartments? Massachusetts is trying. Slate. https://slate.com/business/2022/01/massachusetts-zoning-apartments-housing-transit.html

Hicks J (1939) Value and capital. Oxford University Press, Oxford

Hillman AL, Long NV (1983) Pricing and depletion of an exhaustible resource when there is anticipation of trade disruption. Q J Econ 98(2):215–233. https://doi.org/10.2307/1885622

Hotelling H (1931) The economics of exhaustible resources. J Polit Econ 39:137–175. https://doi.org/10.1086/254195

Johany Ali D (1979) OPEC and the price of oil: cartelization or alteration of property rights. J Energy Dev 5(1):72–80

Kemp MC, Long NV (1980) Resource extraction under conditions of common access. In: Kemp MC, Long NV (eds) Exhaustible resources, optimality, and trade. North-Holland, Amsterdam, pp 127–135

Keynes JM (1930) Treatise on money, vol 2. Macmillan, London

Krasker WS (1980) The peso problem in testing the efficiency of forward exchange markets. J Monet Econ 6:269–276

Krugman P (2008, July 15) Trivial intellectual history blogging. New York Times. https://archive.nytimes.com/krugman.blogs.nytimes.com/2008/07/15/trivial-intellectual-history-blogging/?searchResultPosition=1

Leroy SF (1982) Expectations models of asset prices: a survey of theory. J Finance 37(1):185–217. https://doi.org/10.2307/2327125

Lewis KK (2008) Peso problem. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95121-5_2504-1

Lo C (2020, December 3) The end of the road for Alaska’s Pebble Mine project. https://www.mining-technology.com/features/pebble-mine-alaska/

Long NV (1975) Resource extraction under the uncertainty about possible nationalization. J Econ Theory 10:42–53. https://doi.org/10.1016/0022-0531(75)90060-5

Long NV, Sinn HW (1985) Surprise price shifts, tax changes and the supply behaviour of resource extracting firms. Aust Econ Pap 24:278–289. https://doi.org/10.1111/j.1467-8454.1985.tb00116.x

Merrill RK, Orlando AW (2020) Oil at risk: political violence and accelerated carbon extraction in the Middle East and North Africa. Energy Econ 92(C):104935

Rogoff K (1977) Rational expectations in the foreign exchange market revisited. Massachusetts Institute of Technology. Unpublished manuscript

Rogoff K (1980) Tests of the martingale model for foreign exchange futures markets. In: Essays on expectations and exchange rate volatility. Ph.D. dissertation, Massachusetts Institute of Technology

Salant S, Henderson D (1978) Market anticipations of government policies and the price of gold. J Polit Econ 86(4):627–648. https://doi.org/10.1086/260702

Samuelson PA (1965) Proof that properly anticipated prices fluctuate randomly. Ind Manag Rev 6:41–63

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15:360–394. https://doi.org/10.1007/s10797-008-9082-z

Solow RM (1974) The economics of resources or the resources of economics. Am Econ Rev 64(2):1–14

Stiglitz JE, Dasgupta P (1981) Market structure and resource extraction under uncertainty. Scand J Econ 83(2):318–333. https://doi.org/10.2307/3439903

Author information

Authors and Affiliations

Contributions

JK (CUNY) did the first draft of the literature survey. He also provided the vacant land example and the references. SS (University of Michigan) did the first draft of the model section and provided the other two examples. Both authors reviewed and revised the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the topical collection “Dynamic Games in Economics in Memory of Ngo Van Long” edited by Hassan Benchekroun and Gerhard Sorger.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Salant, S., Keller, J. How Much is a Nonearning Asset with No Current Capital Gains Worth?. Dyn Games Appl 14, 7–19 (2024). https://doi.org/10.1007/s13235-023-00536-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-023-00536-5