Abstract

I study an indefinitely repeated game where players can differ in size and investigate the implications for cooperative-looking behavior. A common approach to modeling such behavior is to appeal to trigger strategies, where deviation from the desired level of cooperation triggers a punishment phase. An alternative approach arises if players condition their actions on a stock of social goodwill, which is developed when players collectively choose more cooperative actions than the one-shot Nash (Benchekroun and Long in J Econ Behav Organ 67(1):239–252, 2008). Using data from two-person experimental games, I analyze an empirical model that combines these two approaches. I find nuanced support for each approach. For the social goodwill model, there is statistically important support in symmetric games and for larger players in asymmetric games, but not for smaller players.

Similar content being viewed by others

Availability of Data and Materials

Upon request.

Notes

A particularly dramatic illustration of this tension occurred in East Texas in the early days of the Great Depression. This situation was complicated by the tension between larger firms, often referred to as majors and smaller firms, often called independents. Libecap and Wiggins [33] show that small producers consistently pumped more than their relative share, measured by acreage or wells in place, and most frequently opposed negotiated efforts to restrict output levels.

In an environment where agents negotiate changes in emissions, asymmetries could make successful negotiation very difficult in the absence of side payments. Incorporating side payments can potentially address this complication, as a number of the papers I discuss below note. That said, I show below that the most cooperative agreement in an asymmetric environment is likely to push the ‘large’ player to indifference between accepting and declining the terms of the agreement, while the ‘small’ player strictly prefers acceptance. In such a regime side payments would need to be paid by the small player to the large player, which seems counter-intuitive (and contrary to the framing of international agreements such as the Clean Development Mechanism).

This earlier paper provides an econometric analysis of paired behavior to compare outcomes in symmetric and asymmetric structures, and finds that outcomes are not significantly different from a Nash equilibrium in the asymmetric treatment. That result left open the question as to whether each individual’s behavior conformed to the Nash equilibrium. My focus in the present paper is on individual player behavior.

Extending such political economy based analyses to a dynamic setting is non-trivial; for an example of such an extension, see [44].

Referring to the action following a deviation as a “repentance” action might suggest that playing in a selfish way is somehow sinful. An alternative approach would be to model behavior as embodying “other-regarding preferences” or “ethical choices”. For a survey of such an approach see [38].

Qualitatively similar results emerge in an indefinitely repeated game with unknown endpoint, if \(\delta \) is interpreted as the probability the game will continue one more period.

This characterization of average historical contributions can be rewritten as \(Q^a(\tau ) = \left( \frac{\tau - 1}{:}{\tau } \right) Q^a(\tau -1) + \frac{Q^N - Q(\tau )}{\tau }\), which gives a similar flavor to the discrete time characterization for S(t) above. In particular, were \(Q^N - Q(\tau ) = 0\) for multiple consecutive periods \(Q^a(\tau )\) would decline toward zero over time.

This value is reached asymptotically, implying steady state is not reached in finite time. Were an alternative version employed, under which the average past choice is calculated on the basis of a finite number K of past observations, then steady state could be reached in finite time.

Here I am substituting \(\gamma _{1}: = \mu _{1,a} + \nu _{1,a}, \gamma _{2} = \mu _{2,a} + \nu _{1,a}, \gamma _{3} = \mu _{4,a} + \nu _{2,a}\), and \(\gamma _{4} = \mu _{3,a} + \nu _{2,a}\).

I include the experimental instructions that were given to subjects, which includes an example payoff table, in the Appendix.

Relying on all data from an unbalanced panel can generate inconsistent estimates if there is some unobserved explanation for the differing sample periods for different units [55]. Testing for the presence of such an effect can be very difficult, and so I take the conservative approach of using just the first 35 periods in the initial pass through the data. I subsequently analyze the problem using the full data set, for comparison purposes.

See [21] for details. Dynamic stability requires that all of the \(\mu , \nu \) and \(\gamma \) parameters be less than one in magnitude—which they are here. This is a substantive concern, for dynamic stability allows one to interpret the choices derived here as equilibrium choices.

I note that the constant term in this regressions corresponds to the average value of the fixed effects as reported by STATA, the software package I used to obtain the estimates.

I thank an anonymous referee for suggesting this issue.

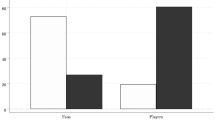

Moreover, the departures were roughly similar in magnitude, with large types choosing about 11% below their Nash equilibrium while small types choosing about 7% above their Nash equilibrium—explaining that while the pair’s choice might be close to the combined Nash equilibrium (as found in [41]) the pattern of play departs from a Nash equilibrium in that each type of player’s choice departed from their respective Nash equilibrium value.

See [40] for discussion. One potential explanation for the experimental outcome I describe in the present paper is that small sellers are less patient, i.e.they use a smaller discount factor. While the experimental design that underlies the data I analyze in the current paper is unable to shed light on the role of the discount factor, earlier work does investigate the role f the discount factor [42]. Incorporating such an adjustment to the underlying theoretical framework seems fairly straightforward; I leave such an extension for future research to come to grips with this issue.

References

Abreu D (1986) Extremal equilibria of oligopolistic supergames. J Econ Theory 39:191–225

Adams W, Mueller H (1982) The steel industry. In: Adams W (ed) The structure of American industry. Macmillan Press, New York, NY

Ansink E, Weikard H-P, Withagen C (2019) International Environmental Agreements With Support. J Environ Econ Manag 97:241–252. https://doi.org/10.1016/j.jeem.2018.02.001

Asheim GB, Froyn CB, Hovi J, Menz FC (2006) Regional versus global cooperation for climate control. J Environ Econ Manag 51(1):93–109

Asheim GB, Holtsmark B (2009) Renegotiation-proof climate agreements with full participation: conditions for pareto-efficiency. Environ Resour Econ 43(4):519–533

Axelrod R (1984) The evolution of cooperation. Basic Books, New York, NY

Bae H (1987) A price-setting supergame between two heterogeneous firms. Eur Econ Rev 31:1159–1171

Barrett S (1994) Self-enforcing international environmental agreements. Oxf Econ Pap 46:878–894

Barrett S (1999) A theory of full international cooperation. J Theor Polit 11(4):519–541

Barrett S (2001) International cooperation for sale. Eur Econ Rev 45:1835–1850

Benchekroun H, Long NV (2002) Transboundary fishery: a differential game model. Economica 69(274):207–221

Benchekroun H, Long NV (2008) The build-up of cooperative behavior among non-cooperative selfish agents. J Econ Behav Organ 67(1):239–252

Benchekroun H, Long NV (2012) Collaborative environmental management: a review of the literature. Int Game Theory Rev 14(04):1240002

Breton M, Sbragia L, Zaccour G (2010) A dynamic model for international environmental agreements. Environ Resour Econ 45(1):25–48

Carraro C, Siniscalco D (1993) Strategies for the international protection of the environment. J Public Econ 52:309–328

Colombo L, Labrecciosa P, Long NV (2022) A dynamic analysis of international environmental agreements under partial cooperation. Eur Econ Rev 143:104036

de Zeeuw A (2008) International dynamic effects on the stability of international environmental agreements. J Environ Econ Manag 55:163–174

Dockner EJ, Long NV (1993) International pollution control: cooperative versus non-cooperative strategies. J Environ Econ Manag 25:13–29

Finus M, Caparrós A (2015) Game theory and international environmental cooperation: essential readings. Edward Elgar, London

Finus M, Rundshagen B (1998) Renegotiation-proof equilibria in a global emission game when players are impatient. Environ Resour Econ 12(3):275–306

Fomby TB, Hill RC, Johnson SR (1988) Advanced econometric methods, 2nd edn. Springer, New York

Friedman JW (1983) Oligopoly theory. Cambridge University Press, Cambridge

Froyn CB, Hovi J (2008) A climate agreement with full participation. Econ Lett 99(2):317–319

Fudenberg D, Maskin E (1986) The Folk theorem in repeated games with discounting and with incomplete information. Econometrica 54:533–54

Fudenberg D, Tirole J (1989) Noncooperative game theory, Handbook of Individual Organization, vol 1. North-Holland Press, Amsterdam

Fuentes-Albero C, Rubio SJ (2010) Can international environmental cooperation be bought? Eur J Oper Res 202:255–264

Harrington JE (1991) The determination of price and output quotas in a heterogeneous cartel. Int Econ Rev 32:767–92

Heitzig J, Lessmann K, Zou Y (2011) Self-enforcing strategies to deter free-riding in the climate change mitigation game and other repeated public good games. Proc Natl Acad Sci 108(38):15739–15744

Hoel M (1992) International environment conventions: the case of uniform reductions of emissions. Environ Resour Econ 2:413–436

Kamien MI, Zang I (1990) The limits of monopolization through acquisition. Q J Econ 105(2):465–499

Kolstad CD (2010) Equity, heterogeneity and international environmental agreements. B.E. J Econ Anal Policy 10, Article 3

Laussel D, de Montmarin M, Long N (2004) Dynamic Duopoly with congestion effects. Int J Ind Organ 22(5):655–677

Libecap GD, Wiggins SN (1984) Contractual responses to the common pool: prorationing of crude oil production. Am Econ Rev 74(1):87–98

Libecap GD, Wiggins SN (1985) The influence of private contractual failure on regulation: the case of oil field unitization. J Polit Econ 93:690–714

List JA, Mason CF (2001) Optimal institutional arrangements for transboundary pollutants in a second-best world: evidence from a differential game with asymmetric players. J Environ Econ Manag 42(3):277–296

Long NV (1992) Pollution control: a differential game approach. Ann Oper Res 37(1):283–296

Long NV (2012) Applications of dynamic games to global and transboundary environmental issues: a review of the literature. Strateg Behav Environ 2(1):1–59

Long NV (2016) The impacts of other-regarding preferences and ethical choice on environmental outcomes: a review of the literature. Strateg Behav Environ 6(1–2):1–35

Marrouch W, Chaudhuri AR (2016) International environmental agreements: Doomed to fail or destined to succeed? A review of the literature. Int Rev Environ Resour Econ 9(3–4):245–319

Mason CF (2022) Cooperation in dynamic games with asymmetric players: the role of social preferences. Dyn Games Appl 12(3):977–995. https://doi.org/10.1007/s13235-022-00435-1

Mason CF, Phillips OR, Nowell C (1992) Duopoly behavior in asymmetric markets: an experimental evaluation. Rev Econ Stat 74:662–70

Mason CF, Phillips OR (2002) In support of trigger strategies: experimental evidence from two-person noncooperative games. J Econ Manag Strat 11(4):685–716. https://doi.org/10.1111/j.1430-9134.2002.00685.x

Mason CF, Polasky S, Tarui N (2017) Cooperation on climate-change mitigation. Eur Econ Rev 99:43–55

Mason CF, Umanskaya VI, Barbier EB (2017) Trade, transboundary pollution, and foreign lobbying. Environ Resour Econ 70:223–248

McGinty M (2007) International environmental agreements among asymmetric nations. Oxf Econ Pap 59(1):45–62

Polasky S, Mason CF (1998) On the welfare effects of mergers: short run vs long run. Q Rev Econ Finance 38(1):1–24

Rubio SJ, Ulph A (2007) An infinite-horizon model of dynamic membership of international environmental agreements. J Environ Econ Manag 54:296–310

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q J Econ 98(2):185–199

Schmalensee R (1987) Competitive advantage and collusive optima. Int J Ind Organ 5:351–367

Segerstrom PS (1988) Demons and repentance. J Econ Theory 45:32–52

Shapiro L (1980) Decentralized dynamics in duopoly with pareto outcomes. Bell J Econ 11:730–744

Weaver JL (1986) Unitization of oil and gas fields in texas: a study of legislative, administrative, and judicial policies. Resources for the Future, Washington, D.C

Weikard H-P (2009) Cartel stability under an optimal sharing rule. Manch Sch 77(5):575–593

Weikard H-P, Dellink R, van Ierland E (2010) Renegotiations in the greenhouse. Environ Resour Econ 45(4):573–596

Wooldridge JM (2012) Introductory econometrics: a modern approach. South-Western Cengage Learning, Mason

Funding

None.

Author information

Authors and Affiliations

Contributions

C.M. executed the empirical analysis, wrote the main manuscript and reviewed the manuscript.

Corresponding author

Ethics declarations

Ethical Approval

Not applicable.

Conflict of Interest

None.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the topical collection “Dynamic Games in Economics in Memory of Ngo Van Long” edited by Hassan Benchekroun and Gerhard Sorger.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mason, C.F. Do Small Players Undermine Cooperation in Asymmetric Games?. Dyn Games Appl 14, 133–156 (2024). https://doi.org/10.1007/s13235-023-00532-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-023-00532-9