Abstract

Under triopoly and Cournot competition, we study an infinite horizon Markov perfect equilibrium merger game in which in each period one of the firms (“the Buyer”) selects a bid price and then the two sellers accept or reject this offer with some probability. The possibility of a “war of attrition” equilibrium in which the seller who outlasts the other is then able to sell in the following period at a greater price, is a distinct feature of the model. Delayed monopolization is all the more likely when the discount factor is small and the ratio duopoly/ triopoly profits is important. Two other equilibria are shown to be possible: an unmerged and an immediate monopolization equilibrium. Each equilibrium is shown to correspond to a different set of parameter values. The two special cases of linear and constant price elastic demand functions are fully characterized.

Similar content being viewed by others

Data Availability

Not applicable.

Notes

Mergers in that case benefit more outsiders than insiders.

Two other, pure strategy, asymmetric, Nash equilibria exist in our game, in which one seller agrees to sell off immediately while the other does not.

The model here is parametrized by the value of the price elasticity of demand so that a large array of different situations may occur. Depending on the price elasticity and the discount factor the three equilibria may occur whereas the linear demand model allows only for unmerged or progressive monopolization equilibria.

Absolute values of profits do not matter for merger analysis.

As we will see later the discount factor depends negatively on the instantaneous rate of interest and of the length of the period.

For a survey see Fauli-Oller and Sandonis [6].

The intuition is that the positive direct effect of the merger (the internalization of the external effects between merging firms) is more than counterbalanced by the strategic effect (the increase of the output of outsiders).

See also Kamien and Zang [13] for further developments.

In the linear demand case, the total number of firms should not be \(\ge 5.\)

This differs substantially from KZ [13] where monopolization may only be delayed by one period and no war of attrition occurs (simply, as they themselves underline, for unknown reasons one seller accepts at sell at triopoly value while the other waits to sell at duopoly value).

Instantaneous profits should be distinguished from the discounted stream of instantaneous profits over a time interval of exogenous length \(\Delta \) which we refer to as “per period profits.” We show the relationship between these two concepts of profits at the end of this section.

In the case studied here (homogenous good and constant costs) monopolization could occur through acquisitions by several buyers since a merged firm is identical post-merger to non merged firms. Even a slight departure from these assumptions is sufficient to destroy this property and thus make the case of monopolization through acquisition by multiple buyers irrelevant.

Exactly as what happens in real estate transactions where would-be buyers make bids that are valid for a fixed period of time.

We assume for the sake of simplicity that an owner who is offered a price equal to her outside option prefers to sell off.

This is the buyer’s Bellman equation.

A continuous function may possibly have several maxima over a compact interval.

This is true in a static game where the Buyer plays first and then the sellers accept or reject the bid, like in the present model, as well as in the Kamien and Zang [12] static simultaneous model already described.

Notice that Assumption 1 excludes couples \(\left( a,b\right) \) such that \(ab<3\) and/or \(a<2\) (i.e., such that exogenous mergers to monopoly are unprofitable). This is not pictured to keep the figures readable.

Any \(B<\frac{\pi (3)}{r}\) is payoff equivalent to \(B=\frac{\pi (3)}{r}\) and corresponds to an unmerged equilibrium.

This follows from the discontinuity of the derivative of the buyer’s present value at \(\beta =1.\)

Indeed: \(F^{\prime }(\pi (2)-\pi (3))=\pi _{1}-3\pi _{2}+\pi _{3}\) for all \(\beta \in [0,1)\) but \(\underset{\{b\rightarrow \pi (2)-\pi (3),\beta \rightarrow 1\}}{LimF^{\prime }(\rho )}=\pi _{1}-4\pi _{2}+\pi _{3}.\)

This is true whenever condition (C\(_{0}\)) holds, which we shall see is always the case in a war of attrition equilibrium.

Using the Limit function of Mathematica.

This corresponds to its US long term average (see https://ycharts.com/indicators/us_real_interest_rate#:~:text=Basic%20Info,long%20term%20average%20of%203.69%25.)

For \(r=1,\) the critical value of \(\Delta \simeq 0.693.\)

Recall that we assumed \(\epsilon >1.\)

Which is the case when \(\beta \ge 0.0467376.\)

This is pictured in Fig. 9.

The profit function which is continuous in b over the compact interval \([0,\pi (2)-\pi (3)]\) always has a maximum over this interval. Since it cannot be at \(b=\pi (2)-\pi (3)\), it is either at \(b=0\) or at some \(b\in \left( 0,\pi (2)-\pi (3)\right) .\)

Notice that \(\beta ^{c}(\widehat{\epsilon } )\simeq 0.0467736.\)

In the latter case, this follows from the assumption, embodied in Condition (A), according to which it is better not to merge when this not strictly better.

That means that the benefits for the unmerged firm from a smaller number of competitors outweigh the loss from competing with more efficient rivals. In other words, the “holdup effect” still exists.

Of course \(\pi (1)\) is also greater than in the absence of cost savings.

Recall that this means that \(V_{A}^{\prime }(\frac{1}{16r},3)\le 0\).

It can be checked, using Mathematica that it is a local maximum (the SOC is negative for al \(\left( \beta ,\tau \right) \in \) \(\left[ 0,1\right] \times [\frac{1}{2}(3\sqrt{129}-32),1.25)\).

It is drawn using Mathematica We compute the interior maximum profit as a function of \(\beta \) and \(\tau \) and compare it to the profit at \(B=(2-\tau )^{2}/9r,\) i.e. \(\frac{\tau ^{2}}{4}-\frac{2}{9}(2-\tau )^{2}\) using the RegionPlot function.

Values of \(b<0\) are payoffs equivalent to \(b=0,\) and values of \(b>\pi (2)-\pi (3)\) give a profit smaller than \(\pi (2)-\pi (3).\)

Notice that from Assumption 1, \(\widetilde{\beta } <1.\)

We discard the case \(\beta =\widetilde{\beta }\) which occurs for a set of parameter values of measure zero.

An example is the linear demand case.

Using the ContourPlot function of Mathematica.

In addition to the green area.

References

Abreu D, Gul F (2000) Bargaining and reputation. Econometrica 68(1):85–117

Bishop DT, Cannings C (1978) A generalized war of attrition. J Theor Biol 70(1):85–124

Bulow J, Klemperer P (1999) The generalized war of attrition. Am Econ Rev 89(1):175–189

Davidson C, Mukherjee A (2007) Horizontal mergers with free entry. Int J Ind Organ 25(1):157–172

Fauli-Oller R (1997) On merger profitability in a Cournot setting. Econ Lett 54(1):75–79

Fauli-Oller R, Sandonís J (2018) Horizontal mergers in oligopoly. In: Handbook of game theory and industrial organization, volume II. Edward Elgar Publishing, pp 7–33

Fridolfsson SO, Stennek J (2001) Should Mergers be Controlled? SSRN 264348

Fridolfsson SO, Stennek J (2005) Hold-up of anti-competitive mergers. Int J Ind Organ 23(9–10):753–775

Fudenberg D, Tirole J (1986) A theory of exit in duopoly. Econometrica 54:943–960

Gowrisankaran G (1999) A dynamic model of endogenous horizontal mergers. RAND J Econ 30:56–83

Gowrisankaran G, Holmes TJ (2004) Mergers and the evolution of industry concentration: results from the dominant-firm model. RAND J Econ 35:561–582

Kamien MI, Zang I (1990) The limits of monopolization through acquisition. Q J Econ 105(2):465–499

Kamien MI, Zang I (1993) Monopolization by sequential acquisition. J Law Econ Organ 9:205

Kapur S (1995) Markov perfect equilibria in an N-player war of attrition. Econ Lett 47(2):149–154

Levin J (2004) Wars of attrition. Lecture Note

Motta M, Vasconcelos H (2005) Efficiency gains and myopic antitrust authority in a dynamic merger game. Int J Ind Organ 23(9–10):777–801

Nocke V (2000) Monopolisation and industry structure. Nuffield College, Oxford

Pesendorfer M (2005) Mergers under entry. RAND J Econ 36:661–679

Perry MK, Porter RH (1985) Oligopoly and the incentive for horizontal merger. Am Econ Rev 75(1):219–227

Salant SW, Switzer S, Reynolds RJ (1983) Losses from horizontal merger: the effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q J Econ 98(2):185–199

Smith JM (1974) The theory of games and the evolution of animal conflicts. J Theor Biol 47(1):209–221

Van Long N (2010) A survey of dynamic games in economics, vol 1. World Scientific, Singapore

Van Long N (2015) Dynamic games between firms and infinitely lived consumers: a review of the literature. Dyn Games Appl 5(4):467–492

Vasconcelos H (2006) Endogenous mergers in endogenous sunk cost industries. Int J Ind Organ 24(2):227–250

Acknowledgements

Didier Laussel gratefully acknowledges support by the French National Research Agency Grant ANR-17-EURE-0020, and by the Excellence Initiative of Aix-Marseille University - A*MIDEX.”

Funding

Didier Laussel gratefully acknowledges support by the French National Research Agency Grant ANR-17-EURE-0020, and by the Excellence Initiative of Aix-Marseille University - A*MIDEX.”

Author information

Authors and Affiliations

Contributions

I was alone to write the paper and draw the figures. No acknowledgement.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests

Ethical Approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank two anonymous referees for helpful comments and suggestions.

Appendix

Appendix

Let us define \(\rho =rB-\pi (3)\Leftrightarrow B=(b\rho +\pi (3))/r.\) Let us then substitute this value for B in \(V_{A}(B,3)\) as defined by Eq. (7). We only need to consider values of \(\rho \in [0,\pi (2)-\pi (3)]\).Footnote 37 One obtains a function \(F(\rho )=\frac{N(\rho )}{D(\rho )}\) where

This function has several useful properties:

(i) it has two asymptotes for \(\rho =-\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3])\) and for \(\rho =\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3])\) whenever \(\beta >0.\) Note that

Of course, the parts of the above function at the left and right of the asymptotes are irrelevant. We intend to analyze the properties of the function between the asymptotes. For that purpose the properties of \(F(\rho )\) outside this interval are informative.

(ii) \(F(\rho )\rightarrow +\infty \) as \(\mu \rightarrow -\infty \) and \(F(\rho )\rightarrow -\infty \) as \(\rho \rightarrow +\infty ;\)

(iii) Differentiating (13) wrt \(\rho ,\) we obtain \(F^{\prime }(\rho )=\frac{2}{D(\rho )^{2}}\left[ G(\rho )\right] \) where

The extrema of \(F(\rho )\) are the solutions of \(G(\rho )=0.\) There are at most four real solutions of this equation. The sum of the four roots, whether real or complex, equals zero.

Let us then define L \(=N(-\frac{1}{\sqrt{\beta }}(\pi (2)-\pi (3)))\) and \(R=N(\frac{1}{\sqrt{\beta }}(\pi (2)-\pi (3))\) and denote \(\widetilde{\beta }=\left[ \frac{\pi (1)-4\pi (2)+3\pi (3)}{2\left( \pi (1)-2\pi (2)\right) }\right] ^{2}\).Footnote 38

When \(\pi (1)-4\pi (2)+3\pi (3>0,\) it is easy to see that \(R<0\) for all \(\beta \in [|0,1)\) and that \(L>0\) iff \(\beta >\widetilde{\beta }\) (resp \(L<0\) if. \(\beta <\widetilde{\beta }\)). There are accordingly two cases.Footnote 39

Case (a) occurs when \(\beta >\widetilde{\beta }\) so that \(L>0\) and \(R<0\).

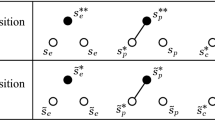

An example is pictured below.

In case (a) there is one (real) root \(<L\), one (real) root \(>R.\)

and either zero or two real roots in (L, R).

Case (b) occurs when \(\beta <\widetilde{\beta }\) so that L and R are both \(<0\) An example is pictured below.

In the limit case, when \(\beta =\widetilde{\beta }\), there is only one asymptote for \(\rho =\frac{2(\pi (1)-2\pi (2))(\pi (2)-\pi (3)}{\pi (1)-4\pi (2)+3\pi (3}>0.\) For all relevant purposes, this limit case resembles case (b).

When \(\pi (1)-4\pi (2)+3\pi (3<0\) Figs. 12–16 below illustrate the different cases,Footnote 40 it is easy to see that \(R<0\) for all \(\beta <1\) and \(L<0\) if \( \beta <\widetilde{\beta }\) (resp. \(L>0\) if \(\beta >\widetilde{\beta }\)).

Case (a) occurs (again) when \(\beta >\widetilde{\beta }.\) so that \(L>0\) and \(R<0\). It follows that case (a) always obtains when \(\beta >\widetilde{\beta }.\)

Case (c) occurs when \(\beta <\widetilde{\beta }\) so that R and L are both \(<0.\) An example is pictured below.

In the limit case, when \(\beta =\widetilde{\beta }\), there is only one asymptote for \(\rho =\frac{2(\pi (1)-2\pi (2))(\pi (2)-\pi (3)}{\pi (1)-4\pi (2)+3\pi (3}<0.\) For all relevant purposes, this limit case looks like case (c).

Finally, in the special case when \(\pi (1)-4\pi (2)+3\pi (3=0,\) we have \(\widetilde{\beta }=0\) and so case (a) obtains for all \(\beta >0.\)

Note that the condition \(\pi (1)-4\pi (2)+3\pi (3>0\) ( resp. \(<0\)) is the one that ensures that \(F(\rho )\) is convex (resp. concave) in \(\rho \) when \(\beta =0.\)

Whenever \(\beta >\widetilde{\beta }\), we obtain case (a). The local extrema of \(F(\rho )\) are the roots of a fourth order polynomial which has at most four real roots, so that there are at most four local extrema. There are obviously a local minimum in the interval \(\ \left( -\infty ,-\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3])\right) \) and a local maximum in the interval \(\left( \frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3]),+\infty \right) .\) There are either no extremum or a local maximum and then a local minimum in the interval \(\left( -\frac{1}{\sqrt{\beta }} (\pi [2]-\pi [3]),\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3])\right) .\) In case (b) \(F(\rho )\) is convex in the interval \(\left( -\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3]),\frac{1}{\sqrt{\beta }}(\pi [2]-\pi [3])\right) \) while in case (c) it is concave in this interval.

Proof of Lemma 2

(i) Suppose that Condition (\(\lnot \)B) holds then F’\((0)>0.\) Since under Condition (A)), \(F(\pi [2]-\pi [3])\le F(0),\) then a war of attrition (delayed monopolization) is the only possible equilibrium. (ii) Suppose then that Condition (B) holds. so that \(F^{\prime }(0)\le 0.\) For a war of attrition to be an equilibrium there should then be a minimum \(\rho _{0}\) and a maximum \(\rho _{1}>\rho _{0}\) of \(F(\rho )\) in \((0,\pi [2]-\pi [3]).\) That already makes two roots. Now consider the three possible cases:

In case (a) there would necessarily be in addition one root (a maximum) in [L, 0], one root (a minimum) in \(\left( \rho _{1},R\right) ,\) another root (a minimum) \(<L\) and one another (a maximum) \(>R\). Therefore, there would be six roots, two more than the maximum number.

In case (b) there would necessarily be in addition to \(\rho _{0}\) and \(\rho _{1},\) one root (a minimum) in \((\rho _{1},R)\) and there is one root (a maximum) greater than R, so that there would be four (real) roots greater than zero, which is impossible since the roots must sum to zero.

In case (c) notice first that \(G^{\prime }(0)<0\) for all \(\beta \in [0,\widetilde{\beta }].\) Indeed \(G^{\prime }(0)=\) \((-1+b)^{2} (ab(1-3\beta )+4b(-1+\beta )+3(1+\beta )\) is linear in \(\beta .\) For \(\beta =0\) one obtains \(G^{\prime }(0)=\) \((-1+b)^{2}(3-4b+ab)<0.\) For \(\beta =\widetilde{\beta },\) one obtains \(G^{\prime }(0)=(-1+b)^{2}\frac{(3-4b+ab)(ab-3)^{2}}{4b^{2}(a-2)^{2}b^{2}}<0.\) It follows that \(G^{\prime }(0)<0\) for all \(\beta \in [0,\widetilde{\beta }].\) Accordingly, if a war of attrition is an equilibrium there must be two strictly positive real values of \(\rho \in (0,\pi [2]-\pi [3]),\) namely two inflection points, such that \(G^{\prime \prime }(\rho )=0\) However, computing directly the two values of \(\rho \) such that \(G^{\prime \prime }(\rho )=0,\) we obtain

so that either (a) there is no corresponding real value or (b) one of them is negative, a contradiction in both cases.

We can conclude that when Condition (B) holds, an unmerged equilibrium is the only possible equilibrium. \(\blacksquare \)

Proof of Lemma 3

(i) When Condition \((\hbox {C}_{1})\) holds we have \(F^{\prime }(\pi [2]-\pi [3])<0\) so that, given that Condition (\(\lnot A)\) means that \(F(\pi [2]-\pi [3])>F(0),\) the only possible equilibrium is a war of attrition equilibrium.

(ii) When Condition (B) holds so that \(F^{\prime }(0)\le 0,\) the proof that one cannot obtain a war of attrition equilibrium is exactly the same in as point (ii) of the proof of Lemma 2. Given Condition (\(\lnot A),\) it can be concluded this time that immediate monopolization is the only possible equilibrium.

(iii) What we already proved is pictured in Fig. 17. The blue area corresponds to immediate monopolization and the green area corresponds to delayed monopolization (war of attrition). The white area in between where conditions (\(\lnot A\)), (\(\lnot B)\) and (\(\lnot C_{1}\)) hold is now under study.

When conditions (\(\lnot B\)) and (\(\lnot C_{1})\) both hold we have \(F^{\prime }(0)>0\) and \(F^{\prime }(\pi [2]-\pi [3])>0\) (see the corresponding area in Fig. 17). Then there are either zero or two real roots in the interval \(\left( 0,C\right) .\) In the latter case, the first is a maximum and a second is a minimum. In the former case, the only equilibrium is the immediate monopolization equilibrium. When there are two real roots \(\rho _{1}\) and \(\ \rho _{2},\) we need to compare \(F(\rho _{1})\) with \(F(\pi [2]-\pi [3]).\) This can only be done numericallyFootnote 41 in the space \(\left( b,a\right) \) for specific values of \(\beta .\)This yields in each case the locus \(a(b,\beta )\) along which \(F(\rho _{1})\) \(=F(\pi [2]-2\pi [3])\). This is pictured in red below for \(\beta =0.5.\) Below the locus, i.e., for all \(a\in (\frac{3b-1}{b},a(b,\beta )]\), \(\ F(\rho _{1})\ge F(\pi [2]-\pi [3]),\) a war of attrition equilibrium obtains.Footnote 42 Above we obtain an immediate monopolization equilibrium. Indeed since \(\rho _{1}<b-1\)

This is illustrated in Fig. 18. \(\blacksquare \)

Proof of Proposition 4

\(\widehat{\rho }\) is strictly positive iff \(\left( \pi [1]-\pi [2]-2\pi [3]\right) >0\) (Condition (\(\lnot \hbox {E}\))). It is strictly smaller than \(\pi [2]-\pi [3]\) iff \(\pi [1]-4\pi [2]+\pi [3]<0\) (Condition \(\hbox {C}_{0}\)). Iff condition (E) holds, then the global maximum occurs at \(\rho =0,\) corresponding to an unmerged equilibrium. Iff condition (\(\lnot C_{0}\)) holds, the global maximum occurs at \(\rho =\pi [2]-\pi [3],\) corresponding to an immediate monopolization equilibrium. Iff Conditions (\(\hbox {C}_{0}\)) and (E) hold the global maximum is an interior one at \(\rho =\widehat{\rho }.\) \(\blacksquare \)

Proof of Proposition 5

In the case when \(B\in \left[ 1/16r,1/9r\right] ,\) use Eq. (7) in which we set \(\pi (1)=1/4,\) \(\pi (2)=1/9\) and \(\pi (3)=1/16.\) Denote \(\rho =rB-\pi [3].\) Then the FOC wrt B obtains as

This equation has one (and only one) solution in the interval \(\left[ 1/16,1/9\right] \) iff \(\beta \ge 1/2\) which corresponds to a global maximum as is easily checked using Mathematica ManipulatePlot function. \(\blacksquare \)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Laussel, D. Sequential Mergers and Delayed Monopolization in Triopoly. Dyn Games Appl 14, 223–252 (2024). https://doi.org/10.1007/s13235-023-00526-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-023-00526-7