Abstract

The paper extends the Lanchester model of advertising competition to a setup in which the rate at which a firm attracts customers from its competitors depends not only on the firm’s own advertising effort, but also on the efforts of its rivals. Doing so enables us to use attraction rate specifications borrowed from the economic theory of contests. Exploiting the fact that the sum of attraction rates equals one, we show that the differential equations that define the evolution of market shares in the Lanchester model can be considerably simplified. This makes the optimization problems of the firms considerably easier to analyze. Finallly, to illustrate how the above extensions work, three alternative specifications of attraction rates are studied: the Tullock ratio formulation, a linear transformation of the Tullock ratio, and a specification that incorporates an exogenous bias.

Similar content being viewed by others

Notes

Armstrong and Green [1] noted that empirical evidence suggests that objectives that incorporate targets for terminal market share tend to reduce the overall profitability of a firm. Apart from this it is not an easy task to assess the worth of a unit of market share at the horizon date.

If a firm is financed by equity only, one can interpret \(V^{i}\) as the worth of the firm at time t and when the vector of market shares is X.

An explicit solution of the second equation in (10) cannot be found as long as the attraction rate \(g_{i}\) is unspecified.

For a theoretical approach to this issue, see [5].

Commenting on the Hirschleifer CSF, Beviá and Corchón [6] argued that any advantage, measured by the difference between effort rates, should be scaled to the size of the conflict. This seems to be a valid argument in many contests.

A recent paper devoted to CSFs based on differences is Cubel and Sanchez-Pages [12].

A generalization to three or more contestants is not straightforward ([6], Sect. 4).

The conditions are sufficient but not necessary.

References

Armstrong JS, Green KC (2007) Competitor-oriented objectives: the myth of market share. Int J Bus 12:115–134

Baik KH (1998) Difference-form contest success functions and effort levels in contests. Eur J Polit Econ 14:685–701

Bass FM, Krishnamoorthy A, Prasad A, Sethi SP (2005a) Advertising competition with market expansion for finite horizon firms. J Ind Manag Optim 1:1–19

Bass FM, Krishnamoorthy A, Prasad A, Sethi SP (2005b) Generic and brand advertising strategies in a dynamic duopoly. Mark Sci 24:556–568

Bell DE, Keeney RL, Little JDC (1975) A market share theorem. J Mark Res 12:136–141

Beviá C, Corchón LC (2015) Relative difference contest success function. Theory Decis 78:377–398

Case JH (1979) Economics and the competitive process. New York University Press, New York

Cass D (1965) Optimum growth in an aggregative model of capital accumulation. Rev Econ Stud 32:233–240

Chintagunta PK, Vilcassim NJ (1992) An empirical investigation of advertising strategies in a dynamic duopoly. Manag Sci 38:1230–1244

Chintagunta PK, Vilcassim NJ (1994) Marketing investment decisions in a dynamic duopoly: a model and empirical analysis. Int J Res Mark 11:287–306

Corchón LC (2007) The theory of contests: a survey. Rev Econ Des 11:69–100

Cubel M, Sanchez-Pages S (2016) An axiomatization of difference-form contest success functions. J Econ Behav Organ 131:92–105

Dearden JA, Lilien GL (2001) Advertising co-opetition: who pays? Who gains? In: Baye MR, Nelson JP (eds) Advances in applied microeconomics, vol 10. JAI Press, Amsterdam, pp 203–219

Dockner E, Feichtinger G, Jørgensen S (1985) Tractable classes of nonzero-sum open-loop Nash differential games: theory and examples. J Optim Theory Appl 45:179–197

Dockner E, Jørgensen S, Van Long N, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge, UK

Drugov M, Ryvkin D (2017) Biased contests for symmetric players. Games Econ Behav 103:116–144

Erickson GM (1985) A model of advertising competition. J Mark Res 22:297–304

Erickson GM (1991) Dynamic models of advertising competition: open- and closed-loop extensions. Kluwer, Boston

Erickson GM (1993) Offensive and defensive marketing: closed-loop duopoly strategies. Mark Lett 4:285–295

Erickson GM (1995) Differential game models of advertising competition. Eur J Oper Res 83:431–438

Espinosa MP, Mariel P (2001) A model of optimal advertising expenditures in a dynamic duopoly. Atl Econ J 29:135–161

Friedman L (1958) Game-theory models in the allocation of advertising expenditures. Oper Res 6:699–709

Fruchter G, Kalish S (1998) Dynamic promotional budgeting and media allocation. Eur J Oper Res 111:15–27

Hirschleifer J (1989) Conflict and rent-seeking success functions: ratio versus difference models of relative success. Public Choice 63:101–112

Holt CA (2007) Markets, games & strategic behavior. Addison-Wesley, Boston

Huang J, Leng M, Liang L (2012) Recent developments in dynamic advertising research. Eur J Oper Res 220:591–609

Jarrar R, Martín-Herrán G, Zaccour G (2004) Markov perfect equilibrium advertising strategies of a Lanchester duopoly model: a technical note. Manag Sci 50:995–1000

Jørgensen S, Sigué SP (2015) Defensive, offensive, and generic advertising in a Lanchester model with market growth. Dyn Games Appl 5:523–539

Jørgensen S, Sigué SP (2016) A dynamic advertising game with market growth. In: Dawid H, Doerner K, Feichtinger G, Kort PM, Seidl A (eds) Dynamic perspectives on managerial decision making: essays in honor of Richard F. Hartl. Springer, Berlin, pp 77–91

Kimball GE (1957) Some industrial applications of military operations research methods. Oper Res 5:201–204

Konrad KA (2009) Strategy and dynamics in contests. Oxford University Press, Oxford

Kotler P (1984) Marketing management: analysis, planning, and control. Prentice-Hall, Englewood Cliffs

Krishnamurthy S (2000) Enlarging the pie versus increasing one’s slice: an analysis of the relationship between generic and brand advertising. Mark Lett 11:37–48

Lanchester FW (1916) Aircraft in warfare: the dawn of the fourth arm. Constable, London

Little JDC (1979) Aggregate advertising models: the state of the art. Oper Res 27:629–667

Martín-Herrán G, McQuitty S, Sigué SP (2012) Offensive versus defensive marketing: what is the optimal spending decision? Int J Res Mark 29:210–219

Nerlove M, Arrow KJ (1962) Optimal advertising policy under dynamic conditions. Economica 29:129–42

Schmalensee R (1976) Model of promotional competition in an oligopoly. Rev Econ Stud 43:493–507

Szidarovsky F, Okuguchi K (1997) On the existence and uniqueness of pure Nash equilibrium in rent-seeking games. Games Econ Behav 18:135–140

Tullock G (1980) Efficient rent seeking. In: Buchanan JM, Tollison RD, Tullock G (eds) Toward a theory of rent-seeking society. Texas A&M University Press, College Station, pp 97–112

Vojnović M (2015) Contest theory: incentive mechanisms and ranking methods. Cambridge University Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

Engelbert J. Dockner: deceased (1958–2017).

This paper was handled by Editor-in-Chief Georges Zaccour. The second author wishes to thank two anonymous reviewers for their helpful comments. All remaining errors are the responsibility of the second author.

Appendix: Proofs

Appendix: Proofs

Proof of Lemma 1

Market share dynamics are \(\dot{X}_{i}(t) =g_{i}(a(t))-X_{i}(t) \) which implies \(\sum _{i=1}^{N} \dot{X}_{i}(t) =1-\sum _{i=1}^{N}X_{i}(t) \). Defining \(Y(t)\triangleq \sum _{i=1}^{N}X_{i}(t) ,\) the dynamics can be written as \(\dot{Y}(t)=1-Y(t)\). This differential equation has the particular solution \(Y(t) =1\Leftrightarrow \sum _{i=1}^{N}X_{i}(t) =1\). We conclude that \(X_{i}(t) \le 1\). Integrating the market share dynamics yields \( X_{i}(t)=x_{i0}e^{-t}+e^{-t}\int _{0}^{t}g_{i}(a(t))e^{t}dt\) and hence \( X_{i}(t)\ge 0\) for all t. \(\square \)

Proof of Proposition 1

The HJB equation for firm i is

Collecting coefficients of \(X_{i}^{1}\) and \(X_{i}^{0}\) readily shows that value function parameters \(\alpha _{i}(t)\) and \(\gamma _{i}(t)\) must satisfy

which completes the proof. \(\square \)

Proof of Proposition 2

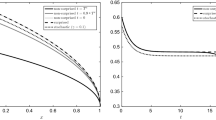

The equations in [18] have the following solution, valid for \(t\in [t,T):\)

Inserting from (11), advertising rates can be expressed as

from which the equilibrium attraction rates follow. The market shares in (20) are found by integration. \(\square \)

Proof of Proposition 3

The optimal profits of the firms can be rewritten as

and, given the two assumptions of the proposition, the result of the proposition follows. \(\square \)

Proof of Proposition 4

Noting that the attraction rates are

in which the second term on the right-hand side is the attraction rate valid for the unbiased case. Inserting the above attraction rates into the market share dynamics and integrating yields the equilibrium market shares. \(\square \)

Proof of Propositions 5, 6, and 7

The calculations essentially proceed in the same way as in Sects. 6.1 and 6.2 and it seems safe to omit the details. \(\square \)

Rights and permissions

About this article

Cite this article

Dockner, E.J., Jørgensen, S. Strategic Rivalry for Market Share: A Contest Theory Approach to Dynamic Advertising Competition. Dyn Games Appl 8, 468–489 (2018). https://doi.org/10.1007/s13235-018-0242-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-018-0242-1