Abstract

The prominence of emissions mitigating policies call for an understanding of their potential distributional impact. To assess this heterogeneity, we quantify and analyse the consumption emission intensity, defined as carbon emissions per unit of consumption, across households in Spain. With the exception of the poorest households, emission intensity decreases with income and peaks for households whose head is middle-aged (40 years old). Moreover, households whose main earner is less educated and male, and who live in smaller cities and rent their main residence, also emit more per unit of expenditure and thus, may be disproportionably impacted by emissions mitigating policies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Most economies face the challenge of curbing emissions in the next decades, if not now. Different climate mitigating policies have been proposed and implemented over the years. Following the example of Finland, 19 European countries have implemented a carbon tax policy, although the intensity and coverage of each policy differ remarkably.Footnote 1 The establishment of the EU Emissions Trading System, setting emission allowances for a subset of sectors, and the explicit intent of many countries to introduce or expand their emission mitigating policies are clear indicators of the relevance of measures that could increase the relative price of carbon emissions. In its Sixth Assessment Report (IPCC 2022), the Intergovernmental Panel for Climate Change (IPCC) states that The global coverage of mandatory policies—pricing and regulation—has increased, and sectoral coverage of mitigation policies has expanded. Emission trading and carbon taxes now cover over 20% of global CO\(_{2}\) emissions. Allowance prices as of 1 April 2021 ranged from just over USD1 to USD50, covering between 9% and 80% of a jurisdiction’s emissions. However, they also stress that there is incomplete global policy coverage of non-CO\(_{2}\) gases, CO\(_{2}\) from industrial processes, and emissions outside the energy sector. Few of the world’s carbon prices are at a level consistent with various estimates of the carbon price needed to limit warming to 2 °C or 1.5 °C. Therefore, more emission mitigating policies that eventually increase the relative price of carbon emission are needed. Such policies might face strong public opposition [(see for instance Cherry et al. (2012), Carattini et al. (2018), Leiserowitz et al. (2013) and Mildenberger et al. (2022)], and understanding how their incidence varies across groups of households could be crucial to a better design, implementation, and the scaling up of such policies, increasing the chance they are introduced successfully.

The effect of changes in relative prices due to emission mitigating policies across households depends on how much emission the consumption basket of each household creates or their consumption carbon emission intensity, defined as the emission per monetary unit of consumption.Footnote 2 First, consumption emission embeds the emissions incurred while producing the goods that are finally consumed and second, looking at intensity instead of total emission (or carbon footprint) allows us to compare households independent of size and absolute level of consumption, utilizing a measure of incidence to pinpoint the set of household most exposed to policies in relative terms. The purpose of this work is twofold. First, we evidence and analyse the heterogeneity of emission intensity from consumption across households using Spanish data. In particular, leveraging data on consumption expenditure of goods and services across households provided in the Spanish Household Budget Survey (Encuesta de Presupuestos Familiares, EPF henceforth), the emission and output by industry, and the production network described by the Input–Output tables from National Accounts, we measure the household-specific consumption emission intensity from 2006 to 2021 and analyse how it varies according to households’ known characteristics. Second, we investigate how emission intensity has varied in the last 15 years and whether the relationship between emission intensity and household characteristics is stable.

We find that, in general, emission intensity decreases with income and peaks for households whose head is middle-aged (around 40 years old). Moreover, we show that households whose main earner is relatively less educated and male emit more per unit of consumption expenditure. Finally, households, who rent their main residence, have more members and live in smaller cities also emit more per euro consumed. Emission intensities are heterogeneous across households, driven by different compositions of goods in consumers’ baskets, warranting the attention of policymakers and other stakeholders making decisions on how to implement emission mitigating policies. Although emission intensity has fallen significantly in the past decade, due to improvements in emission efficiency in production, the pattern of heterogeneity across households we highlight remained stable from 2006 to 2021.

Merging the emission and output by industry and the Input–Output tables, we generate a measure of emission intensity at the industry level, defined as the emission associated with producing one euro of gross output, taking into account the emission embedded in all inputs used in the production of the goods in each industry. The Spanish EPF collects information on household expenditure across different categories of goods. We then assign each category of consumption goods in the EPF (COICOP classification) to each industry and calculate the share of household consumption expenditure in each industry. Household-specific emission intensity is then obtained by combining emission intensity by industry with the share of household expenditure in each industry. Under the assumption that variation in expenditure shares across households reflects variation in emissions—rather than, say, changes in prices—we can assign an emission intensity per unit spent to each household.Footnote 3 The EPF survey also provides information on a set of characteristics for each household and its members. We analyse whether these characteristics are systematically correlated with higher or lower levels of household-specific emission intensity to get a better understanding of how a carbon policy that alters relative prices would impact each household and why.

Emission intensity is found to vary with the level of income. During 2006–2021, households at the lower to middle end of the income distribution (more precisely from the first decile upwards to the median) have a pattern of consumption whose emission content is greater for each euro spent than high-income households (above the 50th percentile of the distribution) and thus, would have higher carbon tax incidence. In particular, households whose income is at the bottom decile implicitly emit almost 5% more per thousand euros of consumption expenditure than households whose income is at the top decile.Footnote 4 The key driver of this result is that poorer households spend a greater share of their consumption on energy. Despite the recent growth in renewable energy, the energy sector as a whole is still the most emission intensive sector in the Spanish economy. We also observe that the relationship between income and emission intensity is not linear. For households whose income is higher than the 10th percentile, we uncover a monotonic negative relationship between income and emission per unit of consumption. In contrast, for households whose income is below the 10th percentile (which corresponds to less than 750 euros monthly—the base year 2015) emission intensity increases with income. That is so because although energy expenditure decreases with income, expenditure in transport increases sharply as income increases from such low levels, driving emission intensity up. Our core results are for CO\(_{2}\) emission. We also show these correlation patterns are unchanged when we use a more general measure of Greenhouse Gas (GHG) emissions.

Emission intensity also varies with age, peaking for households whose head is middle-aged. Households whose head is 40 years old emit almost 10% more per thousand euros of consumption expenditure than households whose head age is 70 years old. Confirming the results in Basso et al. (2022), the age and emission intensity relationship remains largely unchanged when cohort effects are controlled for. Moreover, we find emission intensity increases by almost 15% when we compare a household who lives in a large city (greater than 100,000 habitants) to a small city (smaller than 10,000 habitants) and that renters emit almost 10% more per thousand euros of consumption expenditure than home owners. Finally, we also find that households headed by a female, whose main occupation is managerial or white collar type of job, whose level of education is higher all emit less by unit of consumption, although the differences in these cases are smaller in magnitude (ranging from 2 to 4%).

The core of our analysis focuses on the heterogeneity in emission intensity coming from households’ different patterns of consumption, keeping industry emissions constant. Incorporating variation in industry emission allows us to study the evolution of average yearly emission intensity, disentangling the contribution of changes in the basket of goods and the contribution from changes in efficiency in production. We find that average emission intensity decreased by fifty per cent in the last fifteen years. The main underlying source of this fall has been improvements in production processes that have reduced the emission per monetary unit of output across most sectors in Spain and not due to changes in the composition of consumption baskets.

Crucially, the heterogeneity in emission intensity patterns across households identified in the baseline results is unchanged when we allow for time variation in industry emission.

This work relates to other studies that leverage household-level data to build measures of consumption carbon emission intensities, merging expenditure shares with emission, output, and production network linkages. Fremstad and Mark (2019); Levinson and O’Brien (2019) and Sager (2019) build measures for the US looking particularly at the link between income and emission. Basso et al. (2022) look at the link between demographics and age, employing both household-level data and US state and country-level data. In line with this literature, we analyse how emission intensity varies with income, age, and other household characteristics in Spain. Relative to the results for the US, we find that emission intensity is also negatively associated with income but to a lesser extent, while we also highlight that for the poorest (first decile) emission increases with income. We find that the relationship between age and emission intensity is hump-shaped in Spain as it is in the US, although it peaks at an earlier age in Spain (40 years old) than in the US (60 years old). Finally, we confirm that looking at a more general measure of total greenhouse emissions does not alter the correlation patterns identified between emissions and household characteristics. The main caveat to the conclusions from this literature is that introducing carbon taxes may induce households to alter their consumption baskets, and some households may have better conditions to do so than others. Complementing the results here with an analysis of household demand responses to price increases in energy and transport would improve the understanding of the overall impact of carbon taxes across different households.

The majority of the studies on emission across households in Spain that look at similar levels of consumption disaggregation as our analysis focus on total emission or the carbon footprint. López et al. (2016) use Household Budget Survey as well as input–output structure of the Spanish economy to analyse the inequality of carbon footprint. Tomás et al. (2020) use similar methodology with a focus on heterogeneity in carbon footprint based on the municipality size and urban-rural divide. Similarly, Mahía et al. (2022) calculate the excess carbon footprint of households in Spain. Unlike these studies, the focus of our paper is on carbon emission intensities (rather than carbon footprint, that measures total carbon emissions), which provide a better measure to analyse the incidence of any mitigating policies. Symons et al. (2002) also look at carbon emission intensities for households in Spain (as well as for France, Italy, Germany and the UK), but their analysis uses less disaggregated consumption data for the nineties and does not explore the full set of household characteristics as we do.

The rest of the paper proceeds as follows. Section 2 describes the data and the methodology of our empirical investigation. Sect.3, using our baseline model, assesses the association between household characteristics and emission intensity paying special attention to its relationship with income and age along with other factors, such as the location, size, gender, educational and occupational of (the head of) the household. Sect.4 looks at the evolution of emission intensity at the production side and its correlation with household characteristics. Section 5 concludes.

2 Data and methodology

We build a panel of emission intensity, real income, and known demographic characteristics across households in Spain, leveraging micro data from the Household Budget Survey (EPF) from 2006 to 2021, as well as sectoral data from the industry production and the input–output tables of the Annual Spanish National Accounts, from 2006 to 2019, and the industry-by-industry carbon emissions from the Environmental and Air Emission Accounts, from 2008 to 2020. All datasets are from the Spanish National Statistical Institute (INE by it’s Spanish abbreviation). See Appendix 1 for a detailed description. As in Levinson and O’Brien (2019), Sager (2019) and Basso et al. (2022), combining the input–output table and carbon emissions, we obtain the total emission in tons of CO\(_{2}\) of producing one euro of output for each industry k, denoted \(e_{k}\). That combines both direct and indirect, through the production network linkages, emission to produce a final good in each industry.Footnote 5 For the baseline estimations, we hold emission intensity by industry constant using data for 2008, focusing exclusively on the heterogeneity of consumption baskets. In Sect. 4, we allow emission by industry to change with time and decompose the source in the evolution of annual emission.

We use consumption data from 2006 to 2021. From 2006 to 2015, the EPF provided household-level expenditure at the 4-digit good category level based on the COICOP classification. From 2015 onwards, the EPF provides expenditure on good categories based on the ECOICOP classification. Assigning each EPF consumption category (COICOP or ECOICOP) to each industry (k), we calculate the share of consumption of household i (\(S_{i,k,t}\)) for each industry.Footnote 6 The emission intensity of consumption for household i living in Spain in the region (Comunidad Autonoma) s is then defined as

in tons of CO\(_{2}\) per thousand euros of consumption, and K denotes the set of industries (CNAE 2009, 2 digits).Footnote 7

Our focus is on emission intensity of consumption since it provides a measure of incidence of mitigating policies. We compare the average consumption emission intensity of households in our sample to the emission intensity of production of 1000 euros of value added; in this case instead of using consumption expenditure shares for each sector we use their share of value-added for each year. Consumption emission intensity is around 800 kilos of CO\(_{2}\) per 1000 euros of consumption while value-added emission intensity is around 600 kilos of CO\(_{2}\) per 1000 euros of value-added. The key difference is that the more emitting sectors account for a larger share of consumption relative to their share of value-added.Footnote 8 Details of the comparison between value-added and consumption emission intensity measures are shown in the Appendix 1.

Given that the EPF does not provide extensive data on quantity consumed (and those would necessarily be with different measures complicating aggregation), our measure of emission per sector relies on shares of expenditure. If shares of expenditure change across time, this could be due to changes in quantity or changes in prices. By assuming all changes in shares result in changes in emission intensity, we are implicitly assuming all changes in shares are due to quantity variation. In order to verify if that is biasing our measure of emission and, therefore our results, we also calculate changes in the relative prices of goods attributed to each sector. We start by first constructing the “sector-level” price index in the following way. We use the bridging matrix between COICOP and sectoral classifications for Spain from Cai and Vandyck (2020), which allows us to construct the weight of each COICOP item (at a two digit level) in every sector. Then, for each sector, we construct the price index as a weighted average of the price indices of the corresponding COICOP items using the weights constructed above. The relative price of a given sector is then the ratio of individual sector-level price index to the total price index. Then, we use this relative price measured, denoted \(\frac{\pi _{k,t}}{\pi _t}\) to calculate a relative price adjusted measure of emission intensity (\(e^{\pi }_{i,s,t}\))

Under the adjusted measured, we implicitly assume households fully adjust quantity consumed as relative prices changes and therefore, only the changes in expenditure over and above relative price changes affect emissions, the opposite end of the spectrum relative to our baseline measure of intensity (note that some households might not be able or willing to adjust quantities when relative prices move, thus by netting relative price changes the new measure may underestimate the responses in quantity due to price changes).

Finally, we also calculate emission intensity for a particular set of industries (for example, transport), in this case we only aggregate goods within the industries in question:

where \(K_1 \subset K.\)

Real income is defined as the household total income divided by the appropriate GDP deflator. The key household characteristics used are age, gender, education level, occupation, and type of contract of the household’s head (as an indication of the permanent level of income of the household). We also include other demographic characteristics of the households, family size, housing tenure status and city size to control for potentially different spending patterns. Appendix 1 provides the details of all the variables used.

3 Household characteristics and emission intensity

We start the analysis by investigating how the emission intensity of household’s consumption i during the period of 2006–2021, denoted \(e_{i,s,t}\), varies with a set of household characteristics after we control for time (\(\alpha _t\)) and region (\(\gamma _s\), s denotes the autonomous community each household resides in). The explanatory variables included are the age and age squaredFootnote 9 of the household’s head (\(\textrm{age}_{it}\) and \(\textrm{age}^2_{it}\)), total household real income (\(y_{it}\)) and \(\textbf{X}_{i,t}\), a set of dummy and index variables that include the sex, education, occupation, type of contract of the household head, whether the household rents or owns a house and whether the household lives in cities of different sizes (different scales from greater than 100,000 to less than 10,000 habitants). See Appendix 1 for a detailed description of the data.Footnote 10 Formally, the baseline econometric model is

Standard errors are clustered on both time and region (Comunidad Autonoma).

As in our baseline, we kept emission and production data constant, the key driver of heterogeneity is the consumption baskets of distinct households. We find that poorer households emit more for every thousand euros in expenditure and obtain a hump-shaped relationship between age and emission intensity, confirming the results in Basso et al. (2022) who use US data. Given the parameter estimates for \(\textrm{age}_{it}\) and \(\textrm{age}^2_{it}\), while keeping all other variables constant, emission intensity is at its maximum when the household head is around 40 years old. Moreover, emission intensity tends to be higher for households with more members and lower for households whose head is female and has completed a college degree. Households that live in larger cities and households whose head’s occupation is classified as managerial or white collar emit less for each unit of expenditure. Finally, emission intensity is higher for households whose main residence is rented. Results are displayed in the first column of Table 1.Footnote 11

The next four columns of Table 1 offer a similar analysis, decomposing emission intensity by sector. After accounting for the production network linkages across sectors, the highest emission intensity sectors at the household level can be grouped into three main areas Transport, defined as the sum of sectors 19, 49, 50 and 51 (Petroleum products (fuel) and Transport in Land, Water and Air, respectively), Energy, sector 35 and Food, sector 10–12 (Food, beverages and tobacco products).

First, we sum the emission intensity coming from consuming goods produced by these three groups of sectors, to obtain \(e_{i,s,t}^{\textrm{High}}\). These sectors combined account on average for more than 60% of household emission intensity. Results in the second column of Table 1 confirm the correlation pattern we observe at aggregate is very similar to the one observed for the high emitting sectors. This indicates that the driver of the heterogeneity of emission intensity across households is due to their expenditure on goods in these key sectors.

We then focus on each of these groups separately in the third, fourth and fifth columns of Table 1. As expected, we observe that emission intensity from Energy and Food expenditure decreases with income, driving the negative relationship we find at the aggregate level. However, this is not the case for Transport. The direction of the overall relationship between emission intensity and the size of the household, whether the head of the household is female or male or whether it lives in a small or large city seems to be related to their expenditure on Transport and to a lesser extent to expenditure on Food. Whereas households whose heads are college educated and whose occupation is managerial or white collar emit less by euros spent on Energy and Food, driving the conditional correlation on total emission intensity. Finally, renters’ overall emission intensity is higher due to their higher expenditure share on Energy and Food, although emission intensity on Transport is also slightly higher for this group of households.

Robustness

We run three main robustness exercises. First, we altered the measure of emission intensity to adjust for changes in relative prices. Results are displayed in Table 2. Results are largely unaffected, indicating the key driver of the results are the cross-section differences in household consumption patterns.

Second, we consider the stability of our results through time by dividing the sample into two periods, 2006–2013 and 2014–2021. The key qualitative conclusion is unchanged. Finally, our core results are for CO\(_{2}\) emission. Nonetheless, the estimation results are qualitatively unchanged when we use a more general measure of Greenhouse Gas (GHG) emissions, in tonnes of carbon dioxide equivalent, since CO\(_{2}\) accounts for a large share of greenhouse emissions (results for the last two robustness exercises are in Appendix 1)

3.1 Emission Intensity and Income

Next, we scrutinise further the relationship between income and emission intensity. We start by verifying whether the relationship between income and emission intensity present some degree of nonlinearity by regressing emission on age, age squared, and other characteristics \(\textbf{X}_{i,t}\), but instead of assuming an affine relationship between income and emission intensity we search for the best-fitting (deviance difference) fractional polynomial of dimension two, \(f(y_{it}) = \beta _{y,1} ((y_{it}+a)/b)^{Y_1} + \beta _{y,2} ((y_{it}+a)/b)^{Y_2}\), where a and b are the scaling factors and \(Y_1\) and \(Y_2 \in \{-2, -1, -0.5, 0, 0.5, 1, 2\}\), and if \(Y_1 = 0\), \(((y_{it}+a)/b)^{Y_1} = ln((y_{it}+a)/b)\) and if \(Y_1 = Y_2\), \(((y_{it}+a)/b)^{Y_2} = ln((y_{it}+a)/b)((y_{it}+a)/b)^{Y_2}\). The empirical model therefore is \(e_{i,s,t} = \beta _0 + \alpha _t + \gamma _s + \beta _a age_{it} + \beta _{a2} age^2_{it} + f(y_{it}) + \beta _x \textbf{X}_{i,t} + \epsilon _{i,s,t}\). We observe that \(\beta _0\), \(\beta _a\), \(\beta _{a2}\) and \(\beta _x\) are not significantly changed if instead of an affine structure for income we use this more flexible specification. We plot how the predicted value \(\hat{e}_{i,s,t} = \hat{\beta }_0 + \widehat{f(y_{it})}\) varies with \(y_{it}\), see Fig. 1a. The relationship between income and emission is positive for a household with income within the first decile, and negative for households whose income is greater than percentile 10 (or more than 755 euros per month).Footnote 12

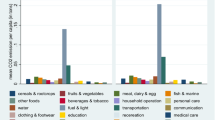

Emission Intensity and Real Income. Note: a depicts the fitted emission intensity level as a function of best-fitting fractional polynomial of dimension 2 on real income, its 95% confidence interval and the vertical lines depicting the level of income of percentiles 10 and 90 of the income distribution in euros, 2015 constant prices and b depicts the average emission intensity for the high emission sectors for households within different income groups from 2006 to 2021

To pinpoint the driver of the reversal of the relationship between income and emission intensity for the poorest households, we depict the emission intensity from Highest Emission sectors and within that the intensity for Transport, Energy and Food sectors for three income groups: one with households whose income is at the bottom decile and corresponds to less than 755 euros per month for 2015 constant prices, one with households whose income is between the bottom decile and the median and the third with the household whose income is higher than the median or more than 1,735 euros per month.Footnote 13. On the one hand, the emission intensity from Energy and Food decrease with income; the poorest spend a greater share of consumption on energy and food expenses. On the other hand, the emission intensity from Transport increases with income. The emission intensity from Transport is fairly small for the poorest decile and increases substantially for the next deciles (p10 to p50) who in fact emit roughly the same amount of kilos per 1000 euros in Transport as the richer households whose income is above the median. Thus, the positive relationship between income and emission intensity for the poorest households is due to the increase in Transport expenditure that offsets the drop in emission intensity from Energy and Food, while the negative relationship observed for households whose income is within the second to the tenth decile is largely due to the decreasing shares of expenditure in Energy and Food, as for these income groups Transport expenditure only mildly increases (see Fig. 1 (b)).

Finally, we re-estimate the baseline empirical model for each income group (Income < p10, p10 < Income < p50 and Income > p50) separately. Results are shown in Table 3 (Column 1 replicates the results for all households). Confirming the nonlinearity we uncover, an additional unit of income is related to more emission intensity for households whose income is in the first decile. In comparison, it is related to less emission intensity for households whose incomes are in all higher deciles. Finally, we do not observe statistically significant (at p<0.05) sign reversals in the relationship between the other household characteristics and emission intensity across the three income groups (Income < p10, p10 < Income < p50 and Income > p50), with the only exception being the parameter estimates for the dummies for Female headed households. We also observed that the effect of Renters become significantly stronger (see Table 3). In order to verify whether female and renters are driving the relationship between income and emission intensity, we re-estimate the model for female and male headed households (and renters and home owners) separately and find similar correlation patterns including the reversal of the relationship between income and emission intensity (thus, as it occurs in the model with all households, the relationship is negative for female headed households whose income is greater than the 10th percentile but positive for female headed households whose income is smaller than the 10th percentile). Results are displayed in Appendix. Also notable is the fact that the relationship between age and emission intensity (see Table 3) changes depending on the income level. The higher the household income, the less pronounced the hump-shaped profile of emission intensity is. Basso et al. (2022) find similar results for the US, using individual consumption data, but also at the aggregate level, exploring the link between demographic structure and emission intensity across US states.

3.2 Emission Intensity and Age

In the baseline model specification, we introduced age and age squared to capture the relationship between age and emission intensity. To verifying whether the relationship between age and emission intensity is indeed well represented by a quadratic function, we regress emission on income, and other characteristics \(\textbf{X}_{i,t}\), but instead of assuming an the quadratic relationship between age and emission intensity we search for the best-fitting (deviance difference) fractional polynomial of dimension two, similarly to the one we used for income. We observe that the parameter estimates of the other variables are not significantly changed when we use this more flexible specification. We plot how the predicted value \(\hat{e}_{i,s,t} = \hat{\beta }_0 + \widehat{f(age_{it})}\) varies with \(age_{it}\), see Fig. 2 (a). The relationship between age and emission is hump-shaped peaking at 40 years old confirming the results in the baseline regression.

Given that the relationship between emission intensity and the age of the head of the household peaks at 40 years old, to illustrate the link between age and emission intensity, we show the average emission intensity for Transport, Energy and Food sectors, for two age groups, the households whose heads are within 35 and 45 (so around the peak of the relationship between age and emission intensity) and the others. See Fig. 2 (a). The key component driving the higher emission intensity for household whose head is middle-aged is the expenditure on Transport. The emission intensity from Energy and Food consumption is slightly greater for households whose head is older than 45 and younger than 35.

Emission Intensity Across Age groups. Note: Figure adepicts the fitted emission intensity level as a function of best-fitting fractional polynomial of dimension 2 on age and its 95% confidence interval. Figures bdepicts the average emission intensity for the high emission sectors for households whose head’s age is within 35 and 45 and for the other households whose head’s age are greater than 45 or smaller than 35

To analyse the robustness of our results with regards to the relationship between age and emission intensity, we estimate an additional model where we exclude age, age squared and include instead four dummy variables, for households whose head has age below 25, from 26 to 40, from 40 to 55, and from 55 to 70 (the reference group, therefore, are the households whose head is above 70 years old). Furthermore, we add controls to capture cohort effects, including dummy variables for households whose head was born after 1977, between 1963 and 1976, between 1949 and 1962, and between 1935—1948 (the reference group therefore are the households whose head was born between 1918—1934) to verify whether the age relationship we uncover is, in fact, proxying for differences in the behaviour of different cohorts. Results are shown in Table 4. We confirm the hump-shaped relationship obtained under the baseline estimation and find that introducing cohort effects do not alter the qualitative implications of our results.

Identifying single-year cohorts and age effects when time fixed effects are used is problematic due to the collinearity of regressors (Age = Period–Year of birth). In the specification above, we make additional restrictions, assuming the age effects are the same for 15-year age groups, the cohort effects are the same for 14-year cohort groups given the limited time series dimension of our dataset.Footnote 14 The main drawback is that age and cohort effects are generally not robust to changing the additional restrictions imposed to correct for the collinearity problem (the restrictions could be grouping age or cohort effect, or orthogonalizing time fixed effects, see Lagakos et al. (2018)). Using a longer dataset for the US, Basso et al. (2022) estimate age, cohort, and time effects of emission intensity using the intrinsic estimator (Yang et al. (2008)), which identifies age and cohort effects that are invariant to the restriction imposed, and find a similar hump-shape relationship between emission intensity and age than the one obtained from a simple empirical model using age and age squared as regressors, suggesting that, as it is the case in their setting, it is unlikely cohort effects are driving our result.

3.3 Emission Intensity and Other Household Characteristics

We now look closely at the relationship between emission intensity and other key household characteristics. We look at household size, city size, whether the household is headed by a female and its housing tenure. To analyse the relationship between household and city size and emission intensity we regress emission on income, age and other characteristics \(\textbf{X}_{i,t}\) and search for the best-fitting (deviance difference) fractional polynomial of dimension two of household or city size, similarly to the one we used for income. We plot how the predicted value \(\hat{e}_{i,s,t} = \hat{\beta }_0 + \widehat{f(z_{it})}\) varies with \(z_{it} = \{\text {household size}, \text {city size} \}\), see Figs. 3 (a) and 4 (a). The relationship between household size and emission increases sharply as household size increase from 1 to 4 members, reaching a plateau for families greater than 7 members. As for city size, as we increase the city size index from 1 (large cities with more than 100,000 habitants) to 5 (small cities with less than 10,000 habitants) emission intensity increases almost linearly.

To uncover the main drivers of these relationships, we depict the emission intensity for Transport, Energy and Food sectors for households of different sizes and living at largest and smallest cities. Bigger households spend a smaller share of expenditure in energy reflecting some gain of scale, but these are not sufficient to compensate for the bigger share of expenditure in transport. As a result, bigger households emit more for each euro spent. Households leaving in smaller cities also spend more on transport, perhaps reflecting the need to rely on private instead of public transport. Thus, households in smaller cities tend to have higher emission intensities. Female headed households spend more on energy but significantly less on transport and thus, have lower emission intensity relative to male headed households, although conditionally on the other covariates the impact is small (only 15 Kg of CO\(_{2}\) per 1000 euros). Finally, renters spend relatively more on energy and food and therefore, emit roughly 63 Kg of CO\(_{2}\) per 1000 euros more than home owners (see Table 1).

Emission Intensity by Household Characteristics. Note: a depicts the fitted emission intensity level as a function of best-fitting fractional polynomial of dimension 2 on household size and its 95% confidence interval. b depicts the average emission intensity for the high emission sectors for households with one member and household with 4 or more members

Emission Intensity by Household Characteristics. Note: a depict the fitted emission intensity level as a function of best-fitting fractional polynomial of dimension 2 on city size and its 95% confidence interval. b depict the average emission intensity for the high emission sectors for households living in cities with more than 100,000 habitants and less the 10,000 habitants

Evolution of average emission intensity across households. Note: a depicts the evolution of consumption emission intensity from 2006 to 2021 under constant and varying industry emission. b depicts the evolution of consumption emission intensity from different goods with constant industry emission. c depicts the evolution of consumption emission intensity from different goods with varying industry emission

4 The evolution of emission intensity from consumption

So far, we have measured emission intensity keeping industry emissions fixed at their 2008 level (\(e_{k,2008}\)), thus concentrating on the heterogeneity coming from households’ different patterns of consumption. In this section, we calculate household emission intensity using time varying industry-level emission per 1000 euro of value-added (\(e_{k,t}\)), which implies that our measure of household emission intensity is given byFootnote 15

Where \(GDPDef_{t,\tau }\) is the GDP deflator for time t base year 2015, thus production emission is measured in kilos of CO\(_{2}\) per 1000 euros of 2015. Our interest is twofold. First, by depicting the evolution of average yearly emission intensity under first fixed and then time varying industry emissions, we can separate, from the aggregate movement in emission intensity, the contribution of changes in the basket of goods and the contribution from changes in efficiency in production. In other words, we can untangle whether households are switching towards greener consumption and or whether production processes are becoming greener in Spain. Second, we can verify whether the heterogeneity in household emission patterns is stable as industry emission varies. That is, are the efficiency gains in production affecting some households more than others? Both sets of questions are vital in terms of the policy implications of carbon taxes.

We start by looking at the yearly average emission intensity across households, both with constant industry emission (\(e_{i,s,t}\)) and with time-varying industry emissions (\(e^{tv}_{i,s,t}\)). Results are displayed in Fig. 6a, b and c. Constant industry emission numbers highlight the effect of changes in household consumption patterns only. From the period 2008 to 2021, households switched towards less greener goods; holding industry emissions constant, household total emission intensity increased during this period (see Fig. 6a). When we look at the decomposition of across household emission intensity with constant industrial emission by sectors (Transport, Energy and Other, denoting the emission of goods from the remaining sectors), we see that the increase in emission intensity is largely due to the increase in the share of households’ expenditure on energy from 2008 to 2012 (see Fig. 6b).Footnote 16 Comparing constant versus time-varying industry emissions numbers highlight the effect of the efficiency gain in production, measured as emission per monetary unit of value added, on household emission intensity.Footnote 17 When these efficiency gains are considered household total emission intensity falls by almost 50% in the last 15 years see Fig. 6a. These gains are particularly noticeable after 2012 during the time in which household consumption patterns have been fairly stable.Footnote 18 In Fig. 6c, we depict the evolution of yearly average of the household emission intensity by sectors under time-varying industrial emission. As it can be seen during the sample period, emission intensity has decreased for all sectors, transport, energy and others.

To verify whether the emission efficiency gains in production are not affecting some households more than others, altering the conditional correlations between household characteristics and emission intensity, we re-run regression (4) using \(e^{tv}_{i,s,t}\) as the dependent variable instead. Results are displayed in Table 5. The qualitative conclusions are unchanged, indicating that the sizable efficiency gains (steaming from less emitting production processes per value-added) seem to have impacted all households unconditionally to their demographic characteristics. As such changes in efficiency are by and large being captured by the time fixed effects when the time-varying emission intensity (\(e^{tv}_{i,s,t}\)) is used in the regressions.Footnote 19

5 Conclusion

This work offers an empirical investigation of emission intensity for Spanish households, covering the period 2006-2021. This is achieved by combining and elaborating household-level consumption data from the EPF with sectoral-level data on production from the input–output table of the Spanish National Accounts and the industry-by-industry carbon emissions database from the Environmental and Air Emission Accounts. Understanding the distributional picture of emission intensity and relating this to a set of household characteristics is very relevant for eminent climate crisis mitigation policies, including carbon taxes. Our analysis indicates a nonlinear relation between household real income and emission intensity. For households whose income is higher than the first decile, we uncover a monotonic negative relationship between income and emission per unit of consumption; emission intensity decreases with income. In contrast, for households whose income is below the first decile (which corresponds to less than 750 euros monthly) emission intensity increases with income. The underlying factor for this is the composition of households’ consumption expenditure and changes therein at different levels of income. In particular, within the lowest decile, although energy expenditure decreases with income, expenditure in transport increases sharply as income increases from very low levels, driving emission intensity up. Emission intensity also varies with age, peaking for households whose head is middle-aged. We also find that households headed by a female, whose main occupation is managerial or white collar type of job, whose level of education is higher all emit less by unit of consumption. Finally, households who rent their main residence, households living in smaller cities, and households with more members have higher consumption emission intensity.

Our baseline analysis focuses on the divergences in emission intensity coming exclusively from households’ different patterns of consumption, keeping industry emissions constant. Incorporating variation in industry emission allow us to highlight the evolution of average yearly emission intensity stemming from the production side and to investigate the contribution of production and consumption in total emission intensity. We find that the average emission intensity decreased by fifty per cent in the last fifteen years for Spain, with a sharp decrease from 2012 onwards. Before 2012, the share of expenditure on Energy increased. As the Energy sector, despite the recent growth in renewable energy, is the most emission intensive sector of the economy, that offset some of the gains in production emission efficiency. As consumption patterns stabilize from 2012 onwards, efficiency gains drove household emission intensity down. Furthermore, as the correlation patterns between emission intensity and household characteristics remain qualitatively similar, the gains in emission efficiency did not affect the heterogeneity in emission patterns across households identified in the baseline results.

The heterogeneous CO\(_{2}\) emission intensity by household should be an integral part of emissions mitigating policies that affect relative prices. For instance, a CO\(_{2}\) tax design should reflect on its regressive structure for low-income households and should be complemented with subsidy and/or other corrective measures. The same applies to differences across location and size of household as well as gender-related disparities. Finally, it is important to explore variations in consumption and production patterns frequently, and adjust policies accordingly when required. Understanding, anticipating and correcting distributional imbalances is also a key step in augmenting public support and implementing a successful climate mitigation strategy.

Notes

Finland was the first country to introduce a carbon tax in 1990, with latest additions being Austria (in 2022), Luxembourg and Netherlands (both in 2021). There is significant heterogeneity in the carbon tax rates, ranging from around 1 euro per ton of carbon emissions in Poland and Ukraine, to more than €100 per ton of carbon emissions in Sweden, Switzerland and Liechtenstein.

The elasticities of the price changes are of course also important to establish the final incidence of any policy that ultimately affect prices.

Although we do not fully isolate price effects, we show our results are robust to controlling for relative price changes.

In this paper, we focus on emission intensity, i.e. the total emission per 1000 euros spent. If we look instead at total emissions, as rich consume more overall, they also emit more, but at a decreasing rate for each unit of consumption increase. This is consistent with Starr et al. (2023).

If additional emissions—beyond production and distribution—result from the usage/consumption of the product or service in hand, these may not be included in our measure. For example, we do not include emissions coming from the international trade. According to WIOD, in 2021 in Spain those accounted for around 8% of total emissions.

Here, we focus on total expenditure rather than physical units consumed. The reason being that EPF provides data on physical units only on a subset of COICOP/ECOICOP categories and households. We match each COICOP item at the 4 digit level to a sector using the COICOP-CPA (Classification of Products by Activity) match. See details in the Appendix 1.

Emissions from consumption could also be calculated using the emissions generated from the entire life-cycle of products/goods (Life-cycle assessment, LCA). Castellani et al. (2019) show that for CO\(_{2}\) emissions both methodologies deliver similar results.

This difference is akin to potential gap that may emerge between GDP deflator and CPI inflation measures.

Controlling for age and age squared (to capture a potential hump shape profiles linked to lifecycle) is standard in the literature of consumption, nonetheless in Sect. 3.2 we look at a more flexible specification as well and find that indeed the quadratic function of age is a good approximation.

We included a more extensive list of controls available at the EPF, results were not changing significantly and thus, we select the more parsimonious econometric model.

Time and region fixed effects are displayed in Appendix 1.

We also run a regression model that allows the linear relationship between income and emission intensity to be different for households with income below and above 755 euros (10th percentile), further corroborating the nonlinearity between income and emission intensity (see the Appendix for details).

We compute the deciles for real income using the pooled sample for the whole time period avoiding the risk that the bottom decile is overrepresented by households that saw their income reduced during a sharp recession. Despite the real income growth observed during the sample period the households in the bottom decile are not significantly overrepresented in the years at the beginning of the sample period. The base year for the calculations is 2015. The cut-off for the groups are set given the nonlinear nature of the relationship observed in Fig. 1 (a).

We use 14 instead of 15 year cohort groups to ensure the oldest or the newest cohort groups are well represented at the start or at the end of the sample period.

Due to data availability, for 2006 and 2007, we use emissions data from 2008, and for 2021 we use emissions data from 2020.

Essentially the share of expenditure in Energy increases during this period and as we show in the Appendix B this is not due to changes in relative prices. Note that this does not necessarily imply the quantity of energy consumed increased but as overall expenditure becomes more concentrated on energy, the emission for a given 1000 euros of expenditure increases, which ceteris paribus imply households become more exposed to increases in the price of carbon in relative terms.

These gains in efficiency relate specifically to a measure of emission intensity per monetary unit of output. For a more general treatment of emission efficiency of production in Spain, see Serrano-Puente (2021).

From 2008 to 2012, households increased their share of expenditure on Energy offsetting the industry efficiency gains.

Fixed effects for the time varying model are displayed in the Appendix.

Available for download at https://www.ine.es/jaxiPx/Tabla.htm?tpx=50184 &L=1

Available for download at https://www.ine.es/jaxiT3/Tabla.htm?t=32450 &L=1.

The Input–Output tables of Spanish economy, that includes total requirements matrix, are available for download at https://www.ine.es/en/daco/daco42/cne15/cne_tio_16_en.xlsx.

Available for download at https://ine.es/daco/daco42/daco4213/correspondencias_ecoicop.xlsx.

Available at https://fred.stlouisfed.org/series/ESPGDPDEFQISMEI.

As we tend to attribute the consumption items to the sectors that are later in the production chain, that could also lead to a higher consumption emission intensity relative to value added.

References

Basso HS, Jaimes R, Rachedi O, Jaimes R, Rachedi O (2022) Demographics and emissions: the life cycle of consumption carbon intensity. Mimeo, New York

Cai M, Vandyck T (2020) Bridging between economy-wide activity and household-level consumption data: matrices for European countries. Data Brief 30:105395

Carattini S, Carvalho M, Fankhauser S (2018) Overcoming public resistance to carbon taxes. Wiley Interdiscip Rev Clim Change 9(5):e531

Castellani V, Beylot A, Sala S (2019) Environmental impacts of household consumption in Europe: comparing process-based LCA and environmentally extended input-output analysis. J Clean Prod 240:117966

Cherry TL, Kallbekken S, Kroll S (2012) The acceptability of efficiency-enhancing environmental taxes, subsidies and regulation: an experimental investigation. Environ Sci Policy 16:90–96

Fremstad A, Paul M (2019) The impact of a carbon tax on inequality. Ecol Econ 163(C):88–97

IPCC (2022) Climate change 2022: mitigation of climate change. Contribution of working group III to the sixth assessment report of the IPCC

Lagakos D, Moll B, Porzio T, Qian N, Schoellman T (2018) Life cycle wage growth across countries. J Polit Econ 126(2):797–849

Leiserowitz A, Maibach E, Roser-Renouf C, Feinberg G, Rosenthal S (2013) Public support for climate and energy policies in November 2013. Yale project on climate change communication

Levinson A, O’Brien J (2019) Environmental Engel curves: indirect emissions of common air pollutants. Rev Econ Stat 101(1):121–33

López LA, Arce G, Morenate M, Monsalve F (2016) Assessing the inequality of Spanish households through the carbon footprint: the 21st century great recession effect. J Ind Ecol 20(3):571–581

Ramón M, de Arce R (2022) Quantifying the excess carbon footprint and its main determinants of Spanish households. Energy Environ. https://doi.org/10.1177/0958305X221140582

Mildenberger M, Lachapelle E, Harrison K, Stadelmann-Steffen I (2022) Limited impacts of carbon tax rebate programmes on public support for carbon pricing. Nat Clim Change 12(2):141–147

Sager L (2019) Income inequality and carbon consumption: evidence from environmental Engel curves. Energy Econ 84(S1):104507

Serrano-Puente D (2021) Are we moving toward an energy-efficient low-carbon economy? An input-output LMDI decomposition of CO2 emissions for Spain and the EU28. SERIEs J Span Econ Assoc 12(2):151–229

Starr J, Nicolson C, Ash M, Markowitz EM, Moran D (2023) Assessing US consumers’ carbon footprints reveals outsized consumers’ carbon footprints reveals outsized impact of the top 1%. Ecol Econ 205:107698

Symons EJ, Speck S, Proops JLR (2002) The distributional effects of carbon and energy taxes: the cases of France, Spain, Italy. Germany and UK. Eur Environ 12(4):203–212

Tomás M, López LA, Monsalve F (2020) Carbon footprint, municipality size and rurality in Spain: inequality and carbon taxation. J Clean Prod 266:121798

Yang Y, Schulhofer-Wohl S, Fu WJ, Land KC (2008) The intrinsic estimator for age-period-cohort analysis: what it is and how to use it. Am J Sociol 113(6):1697–1736

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no relevant or material financial interests related to the research described in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We are grateful to the Editor Virginia Sánchez Marcos and two anonymous referees for their comments that greatly improved the paper. We also thank Olympia Bover, Laura Hospido, Carlos Thomas, Javier Valles and Ernesto Villanueva for comments. The replication material for the study is available at 10.5281/zenodo.8396489.The views expressed in this paper are those of the authors and do not necessarily represent the views of the Banco de España or the Eurosystem.

Appendices

A Data

In this section, we give more details on the data used in the analysis. All data are publically available from the Spanish National Statistical Institute, St. Louis FRED or Eurostat. Below we describe each step used to create the final dataset.

Calculating emission intensities on the sectoral level We start with describing how we construct the emission intensity coefficients on the sectoral level. First, we construct the direct emission coefficient for each sector by diving the total sectoral emissionsFootnote 20 by the total value added of that sector.Footnote 21 As our benchmark measure of emissions, we use the CO\(_{2}\) emission, while we also use the total GHG emissions in robustness analysis below. The coefficients are rescaled to represent the amount of emissions in kg per 100 euros of value added, for each sector. Those direct coefficients are calculated using each industry’s output, and do not include emissions associated with upstream inputs. As such, we calculate the total emission coefficients using the total requirements matrixFootnote 22 in the following way:

where c is the vector of direct coefficients, T is the (Leontieff) total requirements matrix, and \(\tilde{c}\) is the vector of total emission coefficients. As the emission data are not available for 2006 and 2007, to calculate the direct and total coefficients, we use the 2008 emission data for those years.

Merging sectoral and household consumption data Our household-level data are the 2006–2021 waves of the Household Budget Survey in Spain (Encuesta de Presupestos Familiares, EPF). We use the 4-digit household-level expenditures based on the COICOP (between 2006 and 2014) and eCOICOP (from 2015 onwards) classification. We use the correspondence between two classifications provided by the Spanish National Statistical Institute (Instituto Nacional de Estadistica, INE) to create harmonized expenditure categories for the whole period.Footnote 23 Unfortunately, emissions data is only available on the sectoral level (Statistical classification of products by activity, CPA). In order to create the link between two classifications, we use the correspondence tables provided by Eurostat.Footnote 24 In total, we match 302 household expenditure items available in the EPF to a total of 65 sectors for which we have emission intensity coefficients. All COICOP items found in the Household Budget Survey are assigned to a sector, while many COICOP items are matched to several sectors at the same time. When many sectors are feasible to be attached to a COICOP item, and there is not a direct, clear match, we do one of the two things. We either match to the sector that is later in the production chain. Otherwise, we match to the sector whose emissions are close to the average of all possible sectors that could be matched. Having created all 65 expenditure categories, we then assign each household an emission intensity coefficient (total and per each category) per 1000 euros of expenditure on that category.

Other household characteristics In the EPF, we define age as the age of the head of the household. Income is defined as total real household income. As the EPF reports nominal household income, we deflate household income by the GDP deflator available from FRED.Footnote 25 Household size is measured as the number of members in the household. Female indicates if the head of household is female. Variable College is an indicator variable that takes a value 1 if the head of household obtained a college degree. Variable Manager indicates if the occupation of the head of the household is classified as managerial or while collar. Fixed-term contract indicates if the head of the household works under a temporary contract. City size takes values of 1–5, 1 denoting cities with more than 100,000 habitants, 2 for cities with 50,000 to 100,000 habitants, 3 for cities with 20,000 to 50,000 habitants, 4 for cities with 10,000 to 20,000 habitants and 5 denoting cities with less than 10,000 habitants. Finally, Renter takes a value of 1 if the tenure status of the household is renters.

In Fig. 7, we plot the average consumption emission intensity of households (black dotted line) and that calculated directly of the value-added structure of the Spanish economy (that is, we calculate the weighted-average emission intensity of total production, keeping emission intensity constant in 2008 level, blue line). As the Figure demonstrates, the consumption shares are more skewed towards high emission sectors than value-added structure, resulting in slightly higher consumption versus value added emission intensities.Footnote 26 When we use time varying emission intensities (see Sect. 4 for details) both measures of emission intensity move closely together.

Consumption versus value-added emission intensity. Note: a depicts the average consumption emission intensity of households (black dotted line) and that calculated directly of the value-added structure of the Spanish economy (blue line) using industry emission from 2008 and (b) depicts the average consumption emission intensity of households (black dotted line) and that calculated directly of the value-added structure of the Spanish economy (blue line) using time varying industry emission from 2006 to 2021

B Additional results

In this appendix, we provide additional results as well as extra supporting material for benchmark analysis in the main text.

First, we plot the estimated time and region fixed effects used in the main regression. Those are displayed in Fig. 8.

Time and region fixed effects. Note: This figures plot the time and region fixed effects for the baseline regression. Region codes are: 01—Andalucía, 02—Aragón, 03—Asturias, Principado de, 04—Balears, Illes, 05—Canarias, 06—Cantabria, 07— Castilla y León, 08—Castilla-La Mancha, 09—Cataluña, 10—Comunitat Valenciana, 11— Extremadura, 12—Galicia, 13—Madrid, Comunidad de, 14—Murcia, Región de, 15—Navarra, Comunidad Foral de, 16—País Vasco, 17—Rioja, La, 18—Ceuta, 19—Melilla

Second, we report the results of the main baseline model for two sub-samples, 2006–2013 and 2014–2021. Those are reported in Table 6. The key qualitative conclusions are unchanged.

Then, we report the main results from Sect. 3 replacing the total CO\(_{2}\) emissions with total Greenhouse Gas emissions (expressed in tones of CO\(_{2}\) equivalent). Those are reported in Table 7.

Next, we report the estimation results assuming a more flexible relationship between income and emission intensity and one in which we allow the linear relationship between income and emission intensity to be different for household whose income is below the 10th percentile. Those are reported in Table 8

Next, we report regressions for different subgroups, female and male headed households and renters versus home owners. We find that the core relationships between emission, income, age and other household characteristics are stable across this groups. Those are reported in Table 9.

Next, we report the plot of the time and region fixed effects for the time varying industrial emissions model. Those are displayed in Fig. 9.

Finally, we report the evolution of emission intensity on Energy for constant industry emission and emission intensity adjusted for relative prices on Energy for constant industry. Relative prices are not driving the increase in emission during the recession of 2008–2013. Those are displayed in Fig. 10.

Time and region fixed effects. Note: These figures plot the time and region fixed effects for the baseline regression. Region codes are: 01— Andalucía, 02—Aragón, 03—Asturias, Principado de, 04—Balears, Illes, 05—Canarias, 06— Cantabria, 07—Castilla y León, 08— Castilla-La Mancha, 09—Cataluña, 10— Comunitat Valenciana, 11—Extremadura, 12— Galicia, 13—Madrid, Comunidad de, 14—Murcia, Región de, 15—Navarra, Comunidad Foral de, 16—País Vasco, 17—Rioja, La, 18—Ceuta, 19—Melilla

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Basso, H.S., Dimakou, O. & Pidkuyko, M. How consumption carbon emission intensity varies across Spanish households. SERIEs 15, 95–125 (2024). https://doi.org/10.1007/s13209-023-00292-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-023-00292-0