Abstract

We analyze the interaction between a monopolistic seller and a continuum of identical customers of a single product when some of them can form a buyer group and the seller can implement a key account management (KAM) program to deal with these customers, leaving those that purchase on an independent basis to be served through posted prices. We find that the creation of the coalition of buyers and the seller’s response of utilizing a KAM program are related decisions that explain each other. Selling through a KAM program eliminates the inherent instability that would otherwise plague the formation of any buyer group. At the same time, a KAM program allows the seller to charge higher prices to customers that purchase on an individual basis and to build a more efficient relationship with grouped customers; thus, its profits increase.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In many industries, there is a tendency to configure purchasing groups as a means to achieve greater bargaining power vis-a-vis suppliers. This practice is widely used and the examples in specific economic sectors are numerous. In the USA, for instance, cable television operators create alliances to acquire programs from content providers (Chipty and Snyder 1999), purchasing groups bring together small drugstores and hospitals to acquire pharmaceutical products (Ellison and Snyder 2010), and auto parts companies group together, like Aftermarket Auto Parts Alliance, which represents some 50 auto parts distributors. Likewise, a number of examples of buyer groups can be found in the grocery, pharmaceutical retailing, and tobacco processing sectors in most European countries (Caprice and Rey 2015). As result of this practice, buyer groups have become the dominant purchasers of inputs in these and other industries. For instance, a survey by Burns and Lee (2008) reports that in the US healthcare products market, around 80% of hospitals participate in buyer groups and route 50% or more of their pharmaceutical spending through group purchasing organizations. Even more, according to the Healthcare Supply Chain Association (HSCA), “nearly every hospital in the U.S. (approximately 96–98%) chooses to use group purchasing organization contracts for their purchasing functions”.Footnote 1

The emergence of large buyers in the form of buyer groups usually leads to a segmented market, with such buyer groups receiving better deals from their seller than smaller buyers that purchase on an individual basis. Sometimes, it is the buyers’ initiative that leads the way. This happens, for example, with the Centers for Medicare and Medicaid Services in USA when implementing competitive bidding processes for durable medical equipment and similar items (Newman et al. 2017).Footnote 2 Frequently, however, it is the suppliers who react to particular buyers, dealing with them in a more personalized and bilateral fashion than with small and independent buyers. Indeed, sellers develop key account management (KAM) programs for top sales executives, often creating a separate sales force or even a separate corporate division (Jonhston and Marshall 2003). Such business strategies are traditionally justified in terms of the importance of retaining major customers in the face of competition by offering them personalized and preferential treatment (Capon 2001; Jonhston and Marshall 2003). According to the jargon of the marketing literature, “KAM programs are designed to manage strategic accounts intensively and in a coordinated manner and to increase the value derived from the relationships” (Marcos-Cuevas et al. 2014, p. 1216). Thus, the utilization of a KAM program as a selling method can be understood as a reaction to changes in the purchasing behavior of customers (Ivens and Pardo 2007).

The goal of this paper is to examine the interaction between a (monopolistic) seller that exerts market power and a continuum of identical price-taking customers in the following scenario. A subset of buyers can create a coalition (buyer group) and the seller has the possibility of dealing with such a coalition separately from customers that, remaining outside the coalition, purchase the good on an individual basis (independent customers). We particularly investigate the customers’ rationale for creating the buyer group, as well as the rationale that leads the seller to react using a KAM program as a selling strategy to segment a market configured by customers in a buyer group and by the remaining independent customers. In this context, we show that market segmentation explains the formation of the buyer group and vice versa. The creation of a buyer group allows its prospective members to gain leverage against the seller, but if there is no market segmentation, the seller treats all customers either inside or outside the buyer group equally; consequently, independent customers profit more from the formation of the group than its founders, as they have an incentive to freeride. This would have the result of leading the buyer group to unravel.

However, it is also true that, whenever there is a buyer group, the seller wishes to segment the market and deal with customers in the group separately from independent customers (Ivens and Pardo 2007). If there is no market segmentation, the buyer group can obtain leverage against the seller by restricting its demand as a whole. Market segmentation therefore has two main advantages for the seller: first, the seller can charge higher prices to customers that purchase on an individual basis; second, a more efficient relationship between the two strategic players (the seller and the buyer group) emerges from the utilization of KAM as a business strategy.

Interestingly, the fact that the seller reacts to the formation of a buyer group with a KAM approach encourages the actual creation of such a group. This article adds to the literature by describing a rationale for the emergence of a buyer group and the relationship with the implementation of a KAM program as selling method. We find that both decisions are closely linked, not only in the rather obvious sense of the seller creating a KAM program in response to the emergence of a buyer group, but also in the opposite sense of the group emerging and surviving because its prospective participants anticipate being treated separately from customers that remain outside the group. In this context, we point out that, without market segmentation, buyers face the standard free-rider problem of collective action (Olson 1965; Hardin 1971). In fact, a body of literature initiated by Bloch (1996) has considered the stability problem in the process of cartel formation and has analyzed how this can prevent the formation of a coalition (see Bloch 2005, for a sound review of this topic).Footnote 3 However, we also show that if customers expect the seller to react to the formation of a buyer group with a KAM strategy as the selling method, then the free-rider problem no longer holds. The seller, nonetheless, faces a commitment problem in this context. Ex-post, once a buyer group emerges, the seller’s profits increase when the consumers grouped receive preferential KAM treatment and the market becomes segmented. However, ex-ante, the seller’s profits would be greater if the utilization of a KAM program could be saved, since the buyer group would not arise in such a case.

To explore why a subset of customers might want to group and why the seller might react with a KAM strategy, we consider an industry with a monopolistic seller of a single product and a continuum of homogeneous buyers. In this set-up, we assume the seller has minimal marketing tools consisting of a supply-function rule.Footnote 4 We also assume that independent customers behave as price-takers, taking the industry price as given, since they are sufficiently small to have a negligible impact on such price. We then analyze both the incentive to create a group through the strategic impact of its members’ demand on the market price, and the seller’s strategic reaction of offering bilateral contracts—the KAM strategy—to the customers grouped rather than a supply-function rule as occurs with independent buyers.Footnote 5

The impact of bilateral deals and contracts on market competition has long been addressed by one strand of research within the industrial organization literature. For potential entrants into an industry, for instance, it has been argued that contracts between incumbent firms and buyers can act as an entry barrier (Innes and Sexton 1994; Segal and Whinston 2000). Beyond this, our findings suggest that, even in the absence of potential entrants, the utilization of bilateral contracts in transactions between the seller and its larger customers play a strategic role for both of them.

In their comparison of the relative merits of different sales modalities in a range of circumstances, a number of studies are of particular relevance to our research. First, when demand is uncertain, competing sellers are better off announcing supply functions rather than posting prices or quantities (Klemperer and Meyer 1989). Second, with asymmetric information and heterogeneous customers, an auction is more profitable for the seller than a posted price (Wang 1993). Third, under asymmetric information, bilateral bargaining is preferable for the seller to posted-price selling in a dynamic context (Wang 1995). Finally, Ausubel et al. (2014) pointed out that large buyers in multi-unit auctions are incentivized to reduce demand and shade bids differently across units, resulting in inefficiencies in both uniform-price and pay-as-bid auctions—with the latter often outperforming the former in terms of efficiency and expected revenues.

The remainder of the paper is laid out as follows. Section 2 describes the industry model used, namely, one consisting of a monopolist selling a homogeneous good to a continuum of buyers of equal size. Section 3 analyzes industry performance when all customers purchase the good on an individual basis and the seller submits a supply schedule. Section 4 examines the market outcome when some customers decide to form a coalition (a buyer group) and thus act strategically by submitting an aggregate demand function, whereas the seller continues to submit a supply-function rule as the only selling method with all customers, either inside or outside the group. In this context, we show that the customers not grouped profit more from the existence of the buyer group than the customers within the group, with the result that the group is destabilized. Section 5 analyzes the market outcome when the seller can offer different deals to customers in the group and outside the group; in this case, the seller’s profit increases with market segmentation, independent customers find they are worse off than grouped customers and the coalition then becomes stable. Section 6 concludes the paper.

2 The model

Consider an industry consisting of a monopolist that sells a homogeneous good to a continuum of n identical price-taking customers. A subset of these customers may create a buyer group, whereas the remaining customers continue to purchase the good on an independent basis. The seller is aware both of the fact that some buyers can group in a coalition and of the size of the coalition. Let \( 0 \le k \le n \) be the cardinal of customers that have decided to create the buyer group; thus, its relative size, \( s \equiv \frac{k}{n} \), can vary from 0 (in which case the seller may act as a pure monopoly) to 1 (when the industry is a bilateral monopoly). Bearing in mind the expected demand function,Footnote 6 it is assumed (until Sect. 5) that selling strategy consists of attending all customers through the linear supply function

where p denotes the product unitary price, and parameter \( \theta \), \( \theta > 0 \), measures the slope of the supply function chosen by the seller. In Sect. 5 we will assume that the seller can segment the market and, in addition to the linear supply function to deal with independent customers as reflected in Eq. (1), can also offer personalized treatment in the form of a KAM program to customers within the buyer group.

Each individual customer i (whether or not a member of the coalition) is assumed to have the quasi-linear utility function \( U\left( {q_{i} } \right) = \left( {1 - \frac{{q_{i} }}{2}} \right)q_{i} + w \), where \( q_{i} \) denotes the quantity consumed of the good, and \( w \) stands for the numeraire. The consumer surplus therefore amounts to

where p denotes the price of the good. On the other hand, the seller’s production costs are assumed to be

where \( \lambda \) is a strictly positive parameter measuring the convexity of the cost function.Footnote 7

Customers outside the buyer group are price-takers provided they are sufficiently small to have no impact on market outcomes. They therefore demand the quantity of product that maximizes their consumer surplus, as given in Eq. (2). In contrast, a buyer group of relative size s announces an aggregate demand for its members that takes into account the impact of this demand on market price. Thus, the coalition of buyers strategically chooses the slope of the per-member demand function. If there is a unique market-clearing price, the seller’s production is given by its supply function at this equilibrium price, and buyers obtain the quantity of product given by their demand schedule at that market-clearing price.

3 Market equilibrium when all buyers are price-takers

If all buyers purchase the good on an independent basis, the maximization of their consumer surplus, as reflected in Eq. (2), yields the individual demand \( D_{i} (p) = 1 - p \) for each one. Hence, the seller faces the market demand given by

and seeks to maximize its profit, that is,

The seller’s optimal price is that which satisfies the first-order condition

which for the demand and cost functions we consider, can be particularized as

where parameter \( z \) is defined as \( z \equiv \lambda n \), that is, as the product of the convexity of the seller’s cost function and the market size. Instead of setting the optimal posted price \( p^{m} = \frac{1 + z}{2 + z} \), where the superscript m denotes a pure-monopoly scenario, the seller can obtain the same profits by setting a supply function as in Eq. (1) that clears the market at the optimal monopoly price \( p^{m} \). Taking Eq. (7) into account, the market-clearing condition \( S\left( p \right) = D\left( p \right) \) yields the seller’s optimal supply function

which has slope \( \theta^{m} = \frac{n}{1 + z} \). All equilibrium values are straightforwardly obtained and can be summarized in Lemma 1.

Lemma 1

When all buyers purchase the good on an independent basis, the following holds:

-

(i)

Each buyer i consumes the quantity \( q_{i}^{m} = \frac{1}{2 + z} \) at the unitary price \( p^{m} = \frac{1 + z}{2 + z} \) and obtains the consumer surplus \( CS_{i}^{m} = \frac{1}{{2\left( {2 + z} \right)^{2} }} \).

-

(ii)

The seller’s profit amounts to \( \pi^{m} = \frac{n}{{2\left( {2 + z} \right)}} \).

The equilibrium described in Lemma 1 will be taken as a benchmark in two alternative scenarios. First, when a subset of customers can form a buyer group and the price of the good is the same for all customers inside or outside the coalition (Sect. 4). Second, when the seller deals with the buyer group members through a KAM program rather than through posted prices as done with customers outside the group (Sect. 5).

4 Market equilibrium when some customers decide to create a buyer group

Consider now the situation in which a subset of k customers, \( 0 \le k \le n \), decide to form a buyer group to purchase the good, while \( n - k \) customers remain as independent buyers outside the group. As in Sect. 3, each buyer has the demand function \( D_{i} (p) = 1 - p \), and the seller has the supply function \( S(p) = \theta p \). But this time there is a buyer group that, jointly, has the aggregate demand function \( D_{BG} \left( p \right) = k\alpha \left( {1 - p} \right) \), where the subscript BG refers to the buyer group. The equilibrium price in this context is thus determined by the market-clearing condition

which, for the demand and supply functions we consider, becomes \( \left[ {n - k\left( {1 - \alpha } \right)} \right]\left( {1 - p} \right) = \theta p \), or equivalently, \( n\left[ {1 - s\left( {1 - \alpha } \right)} \right]\left( {1 - p} \right) = \theta p \). Hence, the market-clearing price is given by \( p= \frac{{n - k\left( {1 - \alpha } \right)}}{{\theta + n - k\left( {1 - \alpha } \right)}} = \frac{{n\left[ {1 - s\left( {1 - \alpha } \right)} \right]}}{{\theta + n\left[ {1 - s\left( {1 - \alpha } \right)} \right]}} \).

The coalition of buyers and the seller simultaneously choose the slopes of their demand and supply functions, respectively. Therefore, parameter \( \alpha \), the slope of the per-member demand function, is chosen strategically to maximize the consumer surplus of customers within the coalition, taking into account both the expected (non-strategic) behavior of independent buyers and the seller’s expected (strategic) behavior. In this context, the manipulation of the coalition comes from the fact that its members may collectively restrict the demand they make. This is reflected in the fact that \( \alpha < 1 \). The seller, in turn, when deciding on the quantity of product to place on the market, anticipates the monopsonistic behavior of the buyer group and adapts its supply-function schedule \( S(p) \) accordingly.

Below we look for the optimal slope of buyer group demand for any given slope of the supply function, \( \alpha = \varPsi_{BG} (\theta ) \), and the optimal slope of the seller’s supply for any given slope of the buyer group demand, \( \theta = \varPsi_{S} (\alpha ) \), where subscript S refers to the seller. We then look for the slope profiles that constitute a Nash equilibrium in slopes.

The residual supply faced by the buyer group at any price p, \( RS(p) = S(p) - (n - k)D_{i} (p) \), is given by \( RS(p) = (\theta + n - k)p - (n - k) \). Thus, the price that maximizes the consumer surplus of each customer within the buyer group is that which solves the problem

The corresponding first-order condition is given by

and yields the optimal price \( p^{*} = \frac{{n\left( {\theta + n} \right) - k^{2} }}{{\left( {\theta + n + k} \right)\left( {\theta + n - k} \right)}} = \frac{{\frac{\theta }{n} + 1 - s^{2} }}{{\frac{\theta }{n}\left( {\frac{\theta }{n} + 2} \right) + 1 - s^{2} }} \). In order to maximize the consumer surplus of its members, the buyer group must choose an aggregate demand function that clears the market at price \( p^{*} \). This yields the aggregate demand function

If the seller is expected to follow the supply function given by Eq. (1), and if the demand of independent buyers is \( D_{i} (p) = 1 - p \), then the best response of the buyer group as a whole is to set the aggregate demand function stated in Eq. (12), for which the optimal slope of the demand function of each one of its members amounts to

It can be observed from Eq. (13) that \( 0 < \varPsi_{BG} (\theta ) < 1 \), that is, for a given market price, the buyer group demands a smaller per-member quantity than each independent customer. As a consequence, independent customers freeride the buyer group and obtain a larger consumer surplus than buyer group members themselves.

In the presence of a buyer group, the demand the seller faces at any price p is given by

and, in order to choose the optimal linear supply function, the seller seeks to maximize profits by selecting a point in the residual demand and choosing a supply function that equals demand at the optimal price, as in Eq. (8). The optimal price is then \( p^{*} = \tfrac{1 + \lambda (n - k + k\alpha )}{2 + \lambda (n - k + k\alpha )} = \tfrac{1 + z(1 - s + s\alpha )}{2 + z(1 - s + s\alpha )} \), and the linear supply function that leads to this price has the slope

From Eqs. (13) and (15) it follows that \( \varPsi^{\prime}_{BG} (\theta ) > 0 \) and \( \varPsi^{\prime}_{S} (\alpha ) > 0 \), that is, the buyer group’s behavior in choosing \( \alpha \) and the seller’s behavior in setting \( \theta \) are actions that behave as strategic complements (Bulow et al. 1985), as illustrated in Fig. 1.

The solution to Eqs. (13) and (15) yields the following proposition:

Proposition 1

When some buyers can group together, the equilibrium is unique and is as follows:

-

(i)

The buyers within the group choose \( \alpha^{*} = \tfrac{{\sqrt {1 - s^{2} } \sqrt {4(1 + z) + z^{2} (1 - s^{2} )} + z(1 - s^{2} ) - 2(1 + z)(1 - s)}}{2s(1 + z)} \) as the slope of their demand, whereas the seller chooses \( \theta^{*} = n\tfrac{{\sqrt {1 - s^{2} } \sqrt {4(1 + z) + z^{2} (1 - s^{2} )} - z(1 - s^{2} )}}{2(1 + z)} \) as the slope of its supply.

-

(ii)

The larger the buyer group, the flatter its demand function and the flatter the seller’s supply function.

Proof

See “Appendix A”.

Compared to Lemma 1, part (i) of Proposition 1 shows that the buyer group withdraws demand from the market, \( \alpha_{{}}^{*} < 1 \), and that the seller reacts to the existence of a buyer group by setting a flatter supply function than if all customers purchased on an independent basis, \( \theta_{{}}^{*} < \theta^{\text{m}} \). The intuition regarding this result is as follows: the existence of a coalition of buyers reduces aggregate demand and the seller reacts by increasing price sensitivity to any increase in supply. Part (ii) of the proposition indicates that both these behaviors are exacerbated as coalition size increases.

Given the equilibrium behavior reflected in Lemma 1 and Proposition 1, it can immediately be concluded that the quantity produced and consumed decreases in k, the number of customers that decide to form the buyer group. Less evident is what happens with the market price in relation to the buyer group size, although tedious algebraic manipulation shows that

which allows us to conclude that \( p^{*} < p^{m} \) and that \( \frac{{\partial p^{*} }}{\partial s} < 0 \). Hence, the equilibrium market price is low whenever there is a buyer group, and decreases further as the group’s size increases. Figure 2, which illustrates market equilibrium with and without a buyer group, depicts aggregate demand and supply functions when there is a buyer group and independent customers acting individually (broken lines) and when all customers purchase the good on an independent basis (solid lines).

The consumer surplus of customers inside and outside the buyer group can now be compared. From their respective consumption levels in equilibrium, \( q_{BG}^{*} = \alpha^{*} (1 - p^{*} ) \) and \( q_{i}^{\text{m}} = 1 - p^{ * } \), the consumer surplus for buyer group members amounts to

and for independent buyers amounts to

From Eqs. (17) and (18) it follows that, whenever a coalition of buyers withdraws demand from the market, independent buyers are better off than members of the group. In Lemma 2 below we summarize, in the presence of a buyer group of size s, the consumer surplus of each group member, \( CS_{BG} \), the consumer surplus of independent buyers, \( CS_{i} \), and the seller’s profit, \( \pi_{S} \).

Lemma 2

Given parameter z, if a buyer group of size s exists, then, in equilibrium, the consumer surplus of buyers within the group, the consumer surplus of buyers outside the group, and the seller’s profits are, respectively, \( CS_{BG} (s) = \tfrac{{1 - s^{2} }}{{[4(1 + z) + z^{2} (1 - s^{2} )](1 - s^{2} ) + [2 + z(1 - s^{2} )]\sqrt {1 - s^{2} } \sqrt {4(1 + z) + z^{2} (1 - s^{2} )} }} \), \( CS_{i} (s) = \frac{1}{8}\left( {1 - z\sqrt {\tfrac{{1 - s^{2} }}{{4(1 + z) + z^{2} (1 - s^{2} )}}} } \right)^{2} \), and \( \pi_{S} (s) = \frac{n}{2}\sqrt {\tfrac{{1 - s^{2} }}{{4(1 + z) + z^{2} (1 - s^{2} )}}} \).

Proof

See “Appendix A”.

In Proposition 2 below we compare the results in Lemma 1 regarding consumer surplus and the seller’s profits when all buyers purchase the good on an individual basis with the results obtained in Lemma 2 regarding payoffs of participants in the game when a coalition of buyers of size s exists.

Proposition 2

When some customers decide to create a buyer group, the following holds:

-

(i)

If \( z > 1 \), they are better off than when the buyer group does not exist, \( CS_{BG} (s) > CS_{i}^{\text{m}} \), whenever its size is below \( \bar{s} \), where \( 0 < \bar{s} < 1 \). Furthermore, the buyer group size that maximizes per-member consumer surplus is \( s^{*} = \left[ {\tfrac{{z^{2} + z + 2 - 2\sqrt {2z(1 + z)} }}{z(z - 1)}} \right]^{1/2} \) and satisfies \( \frac{{\partial s^{*} }}{\partial z} > 0 \). Contrariwise, if \( z < 1 \), then no buyer group is profitable for its prospective members, \( CS_{BG} (s) < CS_{i}^{\text{m}} \) for all \( s \in (0,\,1) \).

-

(ii)

Customers within the buyer group are always worse off than those not in the group, \( CS_{BG} (s) < CS_{i} (s) \).

-

(iii)

Seller’s profit is lower than when all customers purchase the good on an independent basis, \( \pi_{S} (s) < \pi^{\text{m}} \), and decreases as the size of the buyer group increases, \( \frac{{\partial \pi_{S} (s)}}{\partial s} < 0 \).

Proof

See “Appendix A”.

According to part (i) of Proposition 2, some buyer groups of size \( s > 0 \), in which their members collectively restrict their demand, achieve a larger consumer surplus than when all customers purchase on an individual basis. But part (ii) of the proposition states that independent buyers (i.e., those that do not participate in the buyer group) benefit from the existence of the group, and crucially, that they always end up better off than members of the group. Finally, part (iii) ensures that the existence of the buyer group decreases the seller’s profit, \( \pi_{S} < \pi^{\text{m}} \).

Part (i) of Proposition 2 also states that there exists a buyer group of size \( s^{*} \) that maximizes the consumer surplus of its members. Figure 3 shows that this “optimal” size of the group goes from 0 to 1 as parameter \( \lambda \) increases, and only approaches 1 as \( z \to \infty \). Intuitively, when the seller’s production costs increase quickly, total production becomes smaller and it becomes crucial for customers to create a buyer group as a means to obtain a beneficial market price. Therefore, the buyer group maximizing the consumer surplus of its members never incorporates all the customers, since the seller can react by setting a flatter supply function as the size of the group increases. In addition, the buyer group size that maximizes the per-member consumer surplus, \( s^{*} \), increases as the seller’s cost function becomes more convex (a larger λ), and/or as more buyers exist in the market (a larger n).

Part (iii) of Proposition 2 is the consequence of the seller being unable to offset the profit reduction resulting from the buyer group withholding demand. If a buyer group emerges, this opens the door to the seller for dealing with buyers other than through posted prices; namely, through a KAM program for those within the group: the seller can try to eliminate the ability of the buyer group to affect prices by segmenting the market. This is the possibility we will examine in Sect. 5 below.

Figure 4 below illustrates how the welfare of both members and non-members of the buyer group evolves with the size of the group, for a given value of parameter z, for which the formation of the group will increase the consumer surpluses of both members and non-members with respect to the scenario in which no group emerged, \( s^{*} = 0 \), as depicted in Sect. 3.

Proposition 2 characterizes, for a given size of the buyer group, payoffs of customers inside and outside the group. We can then consider whether a buyer group can emerge. To do this, we interpret the appearance of a buyer group as the formation of a coalition of buyers and we examine the stability of that coalition. Our definition of coalition stability is as follows:

Definition 1

(Stability of the buyer group) A coalition of buyers S (a buyer group with s members) is stable if, and only if,

-

(a)

Every sub-coalition \( S^{\prime} \) of buyer group \( S \) with \( s^{\prime} \) members, where \( S^{\prime} \subset S \) and thus \( s^{\prime} < s, \) gives its members a lower surplus than the one they would obtain in coalition S, \( CS_{BG} \left( {s^{\prime}} \right) \le CS_{BG} \left( s \right) \).

-

(b)

Every coalition \( S^{\prime\prime} \) that contains coalition S (that is, \( S^{\prime\prime} \supset S \) and thus \( s^{\prime\prime} > s \)) gives its members a lower surplus than the one they would obtain in coalition S, \( CS_{BG} \left( {s^{\prime\prime}} \right) \le CS_{BG} \left( s \right) \).

-

(c)

In the presence of coalition S, the customers that purchase the good on an individual basis are worse-off than the customers belonging to S, \( CS_{i} \left( s \right) \le CS_{BG} \left( s \right) \).

According to condition (a) of our definition of coalition stability, for a buyer group to be stable it must not be profitable for any subset of members to exit the group and create a smaller buyer group. Condition (b) implies that the buyer group has closed membership, meaning that its members can block the entry of additional members if group enlargement reduces their consumer surplus.Footnote 8 Moreover, we do not consider the possibility of side payments among customers. Hence, according to Proposition 2, there is a unique coalition of size s* that satisfies both conditions (a) and (b) in our definition of stability.

Finally, condition (c) in our definition of stability requires that customers remaining in the buyer group be better off than if they left it to buy the good individually. However, Proposition 2 also states that, for any size s of the buyer group, customers that remain outside the group are better off than those within the group. Therefore, there is no buyer group satisfying condition (c), and the following result can be established.

Proposition 3

If the seller deals with customers within the buyer group in the same way as with customers not in the group, then every buyer group of size s > 0 is unstable and, as a consequence, no buyer group emerges.

Propositions 2 and 3 illustrate a number of well-known results from the literature regarding collective action. Since, for any given size of the buyer group, customers are better off outside than inside the group, opting out is a dominant strategy. Therefore, any buyer group that may emerge would be unstable, because all prospective participants would prefer to freeride.

In the upcoming section, we will see how, when the seller can use a KAM program to deal with the buyer group, the consumer surplus of non-members changes and, as a consequence, the coalition instability result stated in Proposition 3 must be re-examined.

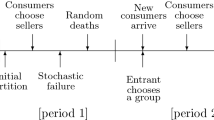

5 Market equilibrium when the seller can use a key account management strategy to deal with the buyer group

We now discuss the market outcome when, rather than a supply-schedule rule as discussed in Sect. 4, the seller can implement a KAM program to deal with customers within the buyer group. The interaction between the seller and customers now has the following sequence of moves. First, some customers decide to form a buyer group of a given size. Next, the seller offers a KAM deal—modeled as a personalized or bilateral contract—to the customers in the buyer group. If an agreement between the seller and the buyer group is reached, then the seller uses a supply function (as in Sects. 3 and 4) to deal with customers remaining outside the group, who will purchase the good on an independent basis. Contrariwise, in the absence of an agreement between the seller and the coalition of buyers, the seller establishes the relationship considered in Sect. 4 with all customers. This timing is aimed at reflecting the fact that the introduction of a KAM strategy is the supplier’s reaction to the emergence of strategically important customers in the form of a buyer group (Ivens and Pardo 2007).

To make the analysis tractable, we make two additional assumptions. First, the bilateral deal between the seller and the coalition of buyers is restricted to a linear price, \( p_{BG} \). Second, the seller holds all the bargaining power in negotiations with the coalition of buyers, so it can make a take-it-or-leave-it offer to them. This implies that the proposed linear price \( p_{BG} \) is that which leads the coalition members to receive their reservation value; namely, the consumer surplus achieved in the supply–demand function scenario reflected in Lemma 2 of Sect. 4. Finally, note that implementation of a KAM strategy with independent customers is not useful, because these buyers are price-takers and, thus, a separate linear price does not increase seller’s profits.

In theory, direct dealing with customers in the coalition through a KAM strategy accrues two potential benefits to the seller. First, the relationship between the seller and the group becomes more efficient, since the incentive to withhold demand disappears, and, as a result, the seller can potentially extract more surplus from the coalition members. Second, since the KAM program prevents coalition demand from being mixed with independent buyers’ demand, the effect of buyer-group market power on transactions between the seller and independent customers vanishes. Hence, the bilateral agreement harms the independent customers, who experience a price increase.

Turning to the analysis of this set-up, we first look at the behavior of the seller when a buyer group of size s already exists and the seller can implement a KAM strategy. The seller offers a linear price \( p_{BG} \) to the customers within the group, which leads to \( n\,s(1 - p_{BG} ) \) as the aggregate demand of the coalition. When setting a supply function for the independent customers, the seller seeks, for the equilibrium price \( p_{i} \), the demand function of independent customers that maximizes profits. The seller therefore chooses a pair of prices, \(p_{BG}\, \text{and}\, p_{i}\), that solves the problem

where the first restriction is the participation constraint that corresponds to the coalition customers, and the second one is a feasibility constraint.

It is useful to analyze, first, the case in which the participation constraint of the coalition affects the seller’s problem as defined in Eq. (19). Given z, the value \( \bar{s} \) defined in Proposition 2 is the buyer group size that satisfies

The condition reflected in Eq. (20) allows us to define a coalition of size s, \( s \in (\bar{s},\,1] \), for which it holds that \( CS_{BG} (0) > CS_{BG} (s) \). In other words, if the members of the group reject the seller’s offer and the interaction is as defined in Sect. 4, then a coalition of size greater than \( \bar{s} \) would be worse off than if all customers acted on an independent basis. In the interval \( (\bar{s},\,1] \), price \( p_{BG} = p^{\text{m}} \) is feasible (the participation constraint for the coalition is not binding), and, for independent buyers, the seller can set a supply function that leads to the price \( p_{i} = p^{\text{m}} \). Therefore, through a KAM program and in the interval \( (\bar{s},\,1] \), the seller can achieve the profits obtained by a monopolist facing non-strategic customers as described in Sect. 3. In contrast, in the interval \( s \in (0,\bar{s}] \), the participation constraint for the coalition is binding.

Lemma 3 characterizes the pair of prices \( (p_{BG} ,p_{i} ) \) that solves the problem defined in Eq. (19).

Lemma 3

If \( z > 1 \) and \( s \in (0,\bar{s}] \), then prices paid by the customers in the buyer group, \( p_{BG} \), and prices paid by customers not in the group, \( p_{i} \), are such that \( p_{BG} < p^{\text{m}} < p_{i} \). Thus, \( CS_{BG} > CS_{i}^{\text{m}} > CS_{i} \).

Proof

See “Appendix A”.

Lemma 3 reflects the striking result that, for a buyer group of size below \( \bar{s} \), the implementation of a KAM strategy by the seller leads it to squeeze customers that remain outside the group. Figure 5 shows how buyer group membership affects, for different sizes of the group, the consumer surplus attained by both its members and non-members in the presence of a KAM program implement by the seller.

Given the market size \( n \), as the size of the buyer group increases and as lower prices are offered to its members (thus increasing their level of consumption), the seller must restrict supply to independent customers in order to contain its production costs.Footnote 9 When the group reaches a size equal to or greater than \( \bar{s} \), however, the participation constraint of its members is no longer binding and the implementation of a KAM strategy leads to the same price level as that of a market in which all customers are price-taking agents.

5.1 Buyer group stability revisited

In Sect. 4 we showed that a coalition of customers is intrinsically unstable in the absence of a KAM program offered by the seller to coalition members. Indeed, a coalition is beneficial for its members only provided it does not exceed a maximum size, and it is, in any case unstable, since non-members profit more from the existence of the coalition than its members do. Our Lemma 3, however, suggests that if the good is sold through a KAM program to the customers of the buyer group, then customers not grouped are squeezed out. Hence, if the prospective members of the group anticipate tough treatment by the seller as independent buyers, they may have a strong incentive to join the group.

Thus, considering the case of customers forming a buyer group when they expect to be better off than if they acted independently, and also that group membership may be prevented whenever an additional entrant reduces the per-capita consumer surplus of its members, the following result holds.

Proposition 4

If \( z > 1 \) and the seller utilizes a KAM program to deal with the buyer group, then a buyer group of size s * emerges and becomes the only stable coalition of buyers.

It is easy to see that the buyer group of size \( s^{*} \) is the only coalition that satisfies all the conditions in our definition of stability. First, such a coalition is the only one that satisfies conditions (a) and (b) of the definition, since any coalition smaller than \( s^{*} \) leads to a lower consumer surplus; moreover, to incorporate additional members to a coalition of size \( s^{*} \) would reduce the consumer surplus of its existing members. Second, condition (c) of the definition of stability is also satisfied, since the members of an \( s^{*} \)-sized coalition have a higher consumer surplus than independent buyers.Footnote 10 In “Appendix B”, we show that a buyer group larger than \( s^{*} \) can only emerge with the co-occurrence of two conditions: first, if the only members that must be guaranteed a consumer surplus \( CS_{BG} \left( {s^{*} } \right) \) are those that already belong to the buyer group,Footnote 11 and second, if entrants are allowed to compensate former members of the buyer group by means of side payments.

A buyer group would not be created if its members did not expect personalized treatment from the seller. Thus, different treatment from independent customers solves the freerider problem that would otherwise plague the group. Likewise, the group is also stabilized by making the consumer surplus of its members greater than that of non-members (and no smaller than that of group members in the absence of a KAM deal). Furthermore, although ex-post it is in the seller’s interest to implement a KAM deal with the buyer group, this never allows the seller to achieve profits as large as when a supply-function schedule is applied to all buyers in the absence of a group. Hence, no buyer group will emerge if the seller can commit to never resort to a KAM program and serves all customers on equal terms, as in Sect. 4. The formation of a buyer group thus depends on the pressure placed on the seller to implement a KAM deal for customers in the buyer group.

6 Concluding remarks

We have examined the impact of the existence of a buyer group on the efficiency of a market served by a monopolistic seller that faces a continuum of identical consumers and deals with group members differently from non-members. In this context, we find a new rationale for utilizing a KAM strategy to deal with such (large) customers that differs from the traditional wisdom that KAM is used to court large clients by offering them better terms than small, independent clients. To that end, we model a market with a given number of identical customers, some of whom decide to form a buyer group (a coalition) to aggregate orders, behave strategically, and confront their aggregate demand with the seller’s supply-function schedule. The reaction of the seller, which is to price-discriminate and so segment the market by implementing a KAM strategy, is also considered.

In this set-up, the performance of three market configurations is analyzed. First, in the benchmark case, no buyer group emerges and the seller, by setting a supply-function schedule, achieves the best outcome. Second, in the buyer-group case, only a single buyer group emerges but no market segmentation holds, so the seller uses a posted pricing mechanism with every customer, either inside or outside the group. This entails a typical coalition situation with positive externalities for buyers not in the coalition, with the group investing in a kind of public good that benefits outsiders at zero cost. This buyer group, however, consequently suffers from stability problems. At the same time, in dealing with grouped and independent customers through a supply-function schedule, the seller faces reduced demand as well as reduced profits when group members are charged the same price as non-members. It is therefore in the seller’s interest to deal with the buyer group members using a KAM strategy (direct negotiation) rather than through supply-function pricing, and to deal with independent customers in accordance with a posted price.

The last case examined in the paper is that defined by the presence of both a buyer group and the utilization of a KAM program, where the seller improves on the buyer group case by segmenting the market. This market segmentation between customers dealt with under a KAM program and customers dealt with anonymously allows the seller to mitigate the negative impact of the buyer group on transactions between the seller and the customers that purchase on an independent basis. By preventing customers in the buyer group from purchasing the good in competition with independent customers, the seller can exploit the latter more efficiently. Bilateral bargaining with the buyer group thus enables the seller to partially make up for the negative impact of the group on profits by increasing the surplus obtained from independent customers. As a result, the consumer surplus of customers not grouped is lower than it would be in the absence of the buyer group, and is also lower than that of the customers in the group. Thus, the buyer group therefore empowers its members to negotiate better terms with the seller than non-members and joining the group is therefore advantageous.

To sum up, as strategic players both the seller and the buyer group members can achieve a win–win situation by exploiting the (non-strategic) customers outside the group. In addition, the utilization of a KAM strategy undoes the freeriding logic underlying the buyer group case and, thus, the lack of group stability. A buyer group, although initially unstable because of the threat of freeriders, thus can acquire stability when the seller resorts to price discrimination. Since the seller is better off without a buyer group, that is, when all transactions take place according to a supply- and demand-function schedule, a buyer group would never emerge if the seller could avoid utilizing a KAM strategy. The formation of a buyer group thus depends on pressure on the seller to reach a KAM deal with customers in the buyer group. This highlights the main contribution of the paper; namely, putting a buyer group and a seller’s KAM program together to demonstrate that both mechanisms reinforce each other.

We have restricted the analysis to the case of linear prices and no side payments among buyers (although the impact of such payments is discussed in “Appendix B”). Furthermore, we only examine the incentives to create a single coalition of buyers. Undoubtedly, an interesting avenue for future research is to consider more general contracts among players than those considered in the current paper, and examine the final endogenous organization of customers that emerges when more than one buyer group can be constituted.

A second issue of interest for future research is to understand what happens if customers were retailers of the good rather than end-users as in the current model. The interpretation of our findings suggests that, in a three-tiered situation of a seller and a number of retailers and end-users, the retailers remaining outside the retailer group would pay higher wholesale prices for the good than the retailers within the group, and would, accordingly, re-sell the good to their final customers at higher retail prices. We can thus conjecture that the frequently observed inefficiency of small independent retailers, as compared to large retailers, could be explained as the result of diseconomies of scale in purchasing rather than in producing the good.

Notes

See A Primer on Group Purchasing Organizations: Questions and Answers (p. 2). Retrieved from www.hiscionline.org/Files/gpo_primer.pdf.

See also the very interesting comments to their results in a letter to Health Affairs by Jack Bernard in 2017, “Competitive Bidding in Medicare”, Health Affairs 36, p. 1854.

In the selling procedure considered in Sect. 4, that is, before we consider the emergence of a KAM deal, the strategic decision by buyers as to whether to create a buyer group is similar to that of firms in an oligopoly deciding whether to merge or form a cartel in order to collude. Salant et al. (1983) were the first to note that, in a Cournot oligopolistic setting, a cartel is unprofitable unless a large number of firms enter it; moreover, outsiders obtain larger profits than insiders, rendering the cartel to be unstable.

A posted price is not optimal when demand is uncertain and when it cannot be responded to with an instantaneous adjustment of prices (Klemperer and Meyer 1989). Moreover, the supply-function rule may represent the decision rule imposed by top management on lower-level management, as would be realistic in a firm with different levels of sales management and in which top managers transmit rules of behavior that are useful under different contingencies but cannot ensure immediate feedback about the actual state of demand (Basu 1993, p. 142).

We assume that implementation of a KAM program is costless and implies the creation of a special sales force not obliged to follow general pricing guidelines but allowed to deal with the buyer group.

As stated in the Introduction, we follow Klemperer and Meyer (1989) in using a supply function to represent the seller’s pricing policy.

The assumption of a strictly convex cost function is crucial for our results to hold. With constant marginal costs, there would be no interaction in the seller’s objective function when there is a segmented market in Sect. 5 and, therefore, the creation of a buyer group would not yield any strategic effect.

Contrariwise, open membership would imply that insiders must admit new members in the buyer group even if their consumer surplus decreased as new entrants join the group.

For some parameter values, independent customers are not served at all.

Recall that closed membership is considered in our definition of stability. If we claim open membership instead of closed membership, whereby an existing buyer group cannot block the entry of additional members even if their individual payoffs are reduced, then condition (b) of the definition of coalition stability must be modified as follows: a coalition S of size s is stable against a larger coalition \( S^{\prime\prime} \) of size \( s^{\prime\prime} \) that includes S, \( S^{\prime\prime} \supset S \), if \( CS_{i} \left( {s{\prime \prime }} \right) > CS_{BG} \left( {s{\prime \prime }} \right) \)—in other words, if independent buyers do not want to enter the coalition. In this case, only a buyer group of size \( \bar{s} \) is a stable coalition.

That is, in the final buyer group of size s that holds we discard the creation of any sub-coalition \( \hat{S} \subset S \) that does not include “old members” in S that are already insiders when independent buyers request entry to the group.

Recall that customers that remain outside the buyer group can benefit from its enlargement (see Fig. 5).

We thus modify condition (a) in our definition of coalition stability in Sect. 3.

References

Ausubel LM, Cramton P, Rostek M, Pycia M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 0:1–35

Basu K (1993) Lectures in industrial organization theory. Blackwell, Oxford

Bloch F (1996) Sequential formation of coalitions in games with externalities and fixed payoff division. Games Econ Behav 14:90–123

Bloch F (2005) Group and net formation in industrial organization: a survey. In: Demange G, Wooders M (eds) Group formation in economics: networks, clubs, and coalitions. Cambridge University Press, Cambridge, pp 335–353

Bulow JI, Geanakoplos JD, Klemperer PD (1985) Multimarket oligopoly: strategic substitutes and complements. J Polit Econ 93:488–511

Burns LR, Lee JA (2008) Hospital purchasing alliances: utilization, services, and performance. Health Care Manag Rev 33:203–215

Capon N (2001) Key account management and planning. The Free Press, New York

Caprice S, Rey P (2015) Buyer power from joint listing decision. Econ J 125:1677–1704

Chipty T, Snyder CM (1999) The role of firm size in bilateral bargaining: a study of the cable television industry. Rev Econ Stat 81:326–340

Ellison SF, Snyder CM (2010) Countervailing power in wholesale pharmaceuticals. J Ind Econ 58:32–53

Hardin R (1971) Collective action as an agreeable n-prisoners’ dilemma. Behav Sci 16:472–481

Innes R, Sexton RJ (1994) Strategic buyers and exclusionary contracts. Am Econ Rev 84:566–584

Ivens BS, Pardo C (2007) Are key account relationships different? Empirical results on supplier strategies and customer reactions. Ind Mark Manag 36:470–482

Jonhston MW, Marshall GW (2003) Churchill/Ford/Walkers’s sales force management. McGraw-Hill/Irwin, New York

Klemperer PD, Meyer M (1989) Supply function equilibria in oligopoly under uncertainty. Econometrica 57:1243–1277

Marcos-Cuevas J, Nätti S, Palo T, Ryals LJ (2014) Implementing key account management: intraorganizational practices and associated dilemmas. Ind Mark Manag 43:1216–1224

Newman D, Barrette E, McGraves-Lloyd K (2017) Medicare competitive bidding program realized price savings for durable medical equipment purchases. Health Aff 36:1367–1375

Olson M Jr (1965) The logic of collective action. Harvard University Press, Cambridge

Salant SW, Switzer S, Reynolds R (1983) Losses from horizontal merger: the effects of an exogenous change in industrial structure on Cournot-Nash equilibrium. Q J Econ 98:185–199

Segal IR, Whinston MD (2000) Naked exclusion: comment. Am Econ Rev 90:296–309

Wang R (1993) Auctions versus posted-price selling. Am Econ Rev 83:838–851

Wang R (1995) Bargaining versus posted-price selling. Eur Econ Rev 39:1747–1764

Acknowledgements

The authors wish to thank L. Méndez and two anonymous referees for their useful comments and suggestions. Financial aid from the Xunta de Galicia (Consolidación e Estruturación—2016 GPC GI-2060), and from the Spanish Ministry of Education and Science (Grant ECO2013-48496-C4-1-R) is acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proofs

Proof of Proposition 1

(i) The fact that \( \varPsi_{BG} (0) = 1 - \frac{k}{n} \) is strictly positive whenever \( k < 1 \) means that any equilibrium must fulfill the condition \( \alpha > 1 - \frac{k}{n} > 0 \). Consider the two functions \( \theta = \varPsi_{BG}^{ - 1} (\alpha ) \) and \( \theta \ge 0 \). Any equilibrium consists of a value for \( \alpha \) in the interval \( \left[ {1 - \tfrac{k}{n},\,\;1} \right] \) for which it holds that \( \varPsi_{S} (\alpha ) = \varPsi_{BG}^{ - 1} (\alpha ) \). On one hand, note that at the corner, that is, whenever \( \alpha = 1 - \tfrac{k}{n} \), it follows that \( \varPsi_{S} (1 - \tfrac{k}{n}) > \varPsi_{BG}^{ - 1} (1 - \tfrac{k}{n}) \). On the other hand, for \( \alpha = 1 \), it holds that \( \varPsi_{S} (1) = \tfrac{n}{1 + z} \) and \( \varPsi_{BG}^{ - 1} (1) \to \infty \). Since both the \( \varPsi_{BG}^{ - 1} \) and \( \varPsi_{S} \) functions are continuous functions, they must cross somewhere in the interval \( \left[ {1 - \tfrac{k}{n},\,\;1} \right] \). Hence, there must be at least one equilibrium point. However, the fact that

allows us to conclude that the functions cross just once and do not cross again. Therefore, the equilibrium is unique and is provided by the values \( \alpha_{{}}^{*} \) and \( \theta_{{}}^{*} \) obtained from solving Eqs. (13) and (15).

(ii) It immediately follows that \( \frac{{\partial \alpha^{*} }}{\partial s} < 0 \) and \( \frac{{\partial \theta^{*} }}{\partial s} < 0 \). □

Proof of Lemma 2

From Proposition 1, we obtain the equilibrium values for the demand and supply slopes \( \alpha^{*} \) and \( \theta^{*} \), respectively, as well as the equilibrium price \( p^{*} \) stated in Eq. (16). Inserting these values into Eqs. (17) and (18), we can derive the values for the consumer surplus of buyer group members and non-members, respectively. Finally, by replacing the equilibrium price in Eq. (5), the seller’s profit \( \pi_{S} (s) \) is derived. □

Proof of Proposition 2

If we define \( x = 1 - s^{2} \), the consumer surplus obtained by each customer within the buyer group can be rewritten as

from which it holds

Since the denominator of Eq. (A3) is always positive, the sign of the derivative is defined by the sign of the numerator. The numerator is decreasing in x, and, moreover, if \( x = 0 \), it is reduced to \( 4(1 + z) \), which is always positive, whereas if \( x = 1 \), the numerator becomes \( 2(2 + z)(1 + z))(1 - z) \), which is positive whenever \( z < 1 \). We can thus state that:

-

When \( z < 1 \), \( \tfrac{{\partial CS_{BG} (x)}}{\partial x} \) is always positive in the interval \( x \in [0,1] \) and the consumer surplus of customers within the buyer group is maximized at \( x^{*} = 1 \). Taking into account that \( s = \sqrt {1 - x} \), we conclude that \( s^{*} = 0 \).

-

When \( z > 1 \), \( \tfrac{{\partial CS_{BG} (x)}}{\partial x} = 0 \) at \( x^{*} = \tfrac{2}{z(z - 1)}[\sqrt {2z(1 + z)} - (1 + z)] \in (0,1) \), and \( \tfrac{{\partial CS_{BG} (x)}}{\partial x} > 0 \) if, and only if, \( x < x^{*} \). Taking into account, again, that \( s = \sqrt {1 - x} \), it follows that the consumer surplus of customers within the buyer group is maximized at \( s^{*} = \left[ {\tfrac{{z^{2} + z + 2 - \sqrt {2z(1 + z)} }}{z(z - 1)}} \right]^{1/2} \). Furthermore, since \( CS_{BG} (x = 0) = 0 \), then \( CS_{BG} (x^{*} ) > CS_{BG} (x = 1) > 0 \) and \( \tfrac{{\partial CS_{BG} (x)}}{\partial x} > 0 \) along \( x \in (0,x^{*} ) \). By continuity, there is a value \( \bar{x} \in (0,x^{*} ) \) such that \( CS_{BG} (x) > CS_{BG} (x = 1) \) if, and only if, \( x \in (\bar{x},1) \). □

Proof of Lemma 3

If \( CS_{BG} (s) < CS_{i}^{\text{m}} \), the optimal price pm is that which solves the first-order condition of the problem stated in Eq. (19), and the participation constraint is not binding, \( \frac{{(1 - p^{\text{m}} )^{2} }}{2}\; > CS_{BG} (s) \). On the contrary, if \( CS_{BG} (s) > CS_{i}^{\text{m}} \), then the participation constraint is binding, and prices \( p_{BG} \) and \( p_{i} \) that solve Eq. (19) are, respectively,

and

On further inspection, it is evident that whenever \( CS_{BG} (s) > CS_{i}^{\text{m}} \), it holds that \( p_{BG} < p^{\text{m}} < p_{i} \), where \( p^{\text{m}} = \frac{1 + z}{2 + z} \) according to Lemma 1. □

Appendix B: Side payments among customers

In this appendix we briefly discuss which buyer group can emerge when side transfers among customers are feasible and the coalitions that can be formed are restricted to those that always include the members of the initial buyer group when new customers ask for entry.

To that end, let us first determine which buyer group maximizes the aggregate consumer surplus that we define as

Figure 6 depicts how the aggregate consumer surplus evolves as the size of the buyer group varies from 0 to 1 when parameter z takes value z = 2.

If we compare the size of the buyer group that maximizes the consumer surplus of all customers, \( s^{{{\text{Agg}}CS}} (z) \), with the size that maximizes the per-member consumer surplus, \( s^{*} (z) \), it follows that \( s^{{{\text{Agg}}CS}} (z) > s^{*} (z) \), for every z, as is depicted in Fig. 7.

Since aggregate consumer surplus is larger at \( s^{{{\text{Agg}}CS}} (z) \), an increase in the size of the buyer group from \( s^{*} (z) \) to \( s^{{{\text{Agg}}CS}} (z) \), coupled with side payments among customers, can lead to a Pareto improvement among buyers. For its implementation, the members of the existing group must receive a transfer \( t \) satisfying the condition

the independent customers that enter the buyer group must pay a fee \( f \) that satisfies

and the customers remaining outside the buyer group must pay a fee \( f_{i} \) such thatFootnote 12

Therefore, the transfer and fees must satisfy the budget constraint

This set-up has two possibly unappealing features. First, the customers that purchase on an independent basis pay a fee (a tax) even if they do not enter the buyer group. Second, we do not take into account the incentives of buyers to participate in such an arrangement.

Consider the following alternative set-up: there already exists a buyer group S of size s, and we look at the creation of a buyer group of larger size than s. We rule out side payments from customers that remain outside the new buyer group; that is, there is only monetary compensation between new members of the coalition and members of the initial buyer group S. We also give the following preferential treatment to members of the initial buyer group S: the only sub-coalitions \( S^{\prime} \) that can be created are those whose members belong to the initial buyer group, \( S^{\prime} \subset S \); in other words, new members cannot participate in these sub-coalitions.Footnote 13

Under these circumstances, it is immediate that whenever the size of the initial buyer group is smaller than \( s^{*} \), its members are willing to admit new participants to increase size to \( s^{*} \), outsiders want to enter, and no side payments are needed since both insiders and outsiders are better off. Therefore, a buyer group smaller than \( s^{*} \) is not stable.

Consider now an initial buyer group S of size \( s^{*} \). If we want to move from this coalition to a larger one of size \( s \), \( s > s^{*} \), then independent customers will be willing to enter the enlarged coalition if the participation constraint holds, that is

For the customers promoting the buyer group of size \( s^{*} \) to accept its enlargement, they must receive a side payment that compensates them for the reduction in their consumer surplus

that is, they must receive a payment satisfying

Finally, side payments must satisfy the budget constraint

The participation constraint (B6) can be thus rewritten in terms of transfer t as

In Fig. 8 we depict, when parameter z adopts the value \( z = 2 \), the sizes of the buyer group that satisfy both participation constraints expressed in terms of t, (B8) and (B10).

The largest size of the buyer group that satisfies both participation constraints, \( s^{L} \), is higher than \( s^{*} \), as depicted in Fig. 9 for different values of parameter z.

Let us now assume than members of the original buyer group of size s* can set the terms of entry for any additional member. In an enlarged buyer group of size \( s \), \( s > s^{*} \), the new members can be charged a fee payment \( f = CS_{BG} \left( s \right) - CS_{i} \left( s \right) \). Chosen as the final size of the buyer group is the size that maximizes the final payoff of members, taking into account that each member in the original buyer group can receive a transfer \( t = \frac{{s - s^{*} }}{{s^{*} }}f \). Formally, the customers that founded the initial buyer group solve the problem

Figure 10 depicts how \( CS_{BG} \left( s \right) + t \) evolves as the size s of the final buyer group varies from \( s^{*} \) to \( s^{L} \) (the size of the buyer group that satisfies \( CS_{BG} \left( {s^{L} } \right) - CS_{i} \left( {s^{L} } \right) = 0 \)) when parameter z takes the value \( z = 2 \); it also shows that the buyers who created the initial coalition are willing to incorporate \( \tilde{s} - s^{*} \) additional members.

Summing up, a larger buyer group can emerge.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Antelo, M., Bru, L. On the stability of buyer groups under key account management. SERIEs 9, 189–214 (2018). https://doi.org/10.1007/s13209-018-0175-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-018-0175-3