Abstract

Using data for all exporters, we show that it is a small group of firms that dominate exports in Spain. For example, in 2015 the top 200 firms were responsible for half of Spanish exports. This concentration has not changed substantially over the 1997–2015 period. The dominance of a few firms, a phenomenon denoted as granularity, also defines the specialization of Spanish exports. If top exporters disappeared, Spain would lose its revealed comparative advantage in 60% of industries, which account for 45% of all Spanish exports. Finally, granularity explains around one-third of the growth in Spanish exports.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Exports are dominated by only a few firms. For example, the top 1% of exporters in Spain accounted for 72% of exports in 2015. As stated by Gabaix (2011), these large firms, also known as superstars, are the incompressible grains of economic activity. If only a few firms account for most of the exports, they are likely to play an important role in shaping the countries’ export specialization and dynamics. In this paper, we use Spanish firm-level export data to investigate this pivotal role.

We first show that exports are highly concentrated by firm, and this concentration has not changed substantially over the 1997–2015 period. We also document heterogeneity in export concentration across products. Second, superstars contribute substantially to trade specialization in many industries. If we removed the top 10 firms in each industry, Spain would lose its revealed comparative advantage in 60% of industries, which account for 45% of total exports. This result suggests that superstars, along with country-level fundamentals, play a very important role in determining Spain’s trade pattern. Finally, we show that superstars can explain around one-third of the variation in aggregate exports in Spain.

This paper is related to the recent empirical literature analyzing the granularity of exports. In particular, it is related to the work by Freund and Pierola (2015), who analyze the export concentration in 32 developing countries, investigating whether the countries’ trade patterns are defined by superstars.Footnote 1 Our research adds to the literature analyzing the weight and role of top exporters in Spain, a major world exporter. Our analysis is relevant, since there are few studies that analyze the concentration of exports with a sample that includes all exporters. In addition to this, our analysis allows us to compare the role of top exporters when defining export specialization in developing countries, along with their role in developed countries. We also add to the literature showing that export concentration is stable over time and documenting that export flows, where a flow is defined as a particular 8-digit product shipped to a particular destination, are also concentrated by firm. We also report heterogeneity in export granularity across products, especially in more disaggregated classifications. Finally, we add to the literature measuring the idiosyncratic contribution of top firms to the variation of exports.

In a broader sense, our research also relates to the literature that has introduced granularity into trade models (Eaton et al. 2012; Bernard et al. 2016), and to the literature that has applied these models to estimate the role of fundamental and granular forces in shaping the comparative advantage (Gaubert and Itskhoki 2016). Our research provides empirical support for this class of models. Finally, our paper is also related to the literature that has investigated how granularity might affect important economic phenomena, such as aggregate volatility (Gabaix 2011; Giovanni and Levchenko 2012; Giovanni et al. 2014), welfare (Giovanni and Levchenko 2013), and trade balance (Canals et al. 2007). We add to this literature investigating the idiosyncratic contribution of superstars to the variation of exports.

The rest of the paper is split into four different sections. Section 2 describes the concentration of exports by firm. Section 3 analyzes whether superstars define the specialization of Spanish exports. Section 4 investigates the contribution of top firms to the growth in Spanish exports. Section 5 presents the main conclusions of the paper.

2 The concentration of exports

2.1 Database

To calculate the concentration of Spanish exports, we have used the export transactions database, which is elaborated by the Customs and Excise Department of the Spanish Tax Agency. For each transaction, we know the firm’s identification code, the product according to the 8-digit Combined Nomenclature (CN) classificationFootnote 2, the destination of the export transaction, the free-on-board (FOB) value in euros of the transaction, and the exported quantity (in weight metric and/or units).Footnote 3 Every year, new CN8 codes are added to the classification and some CN codes are dropped. Since some sections of the paper compare data for different years, we use the Van Beveren et al. (2012) algorithm to create a consistent product classification over the period of analysis.Footnote 4 Using this database, we first analyze, how export concentration varies by the number of top firms. Second, we study whether concentration also occurs in export flows, where a flow is defined as a particular 8-digit product shipped to a particular destination. Finally, we analyze how sensitive concentration is to different product classifications.

2.2 Concentration of exports by firm

We begin by analyzing the concentration of exports by firm. Table 1 presents the concentration of exports for the top firm, and the top 5, top 50, top 200 and top 1000 firms over the 1997–2015 period. We use absolute numbers to identify top firms, rather than percentages (e.g. top 1% of exporters), because the number of exporters increases with the GDP (Fernandes et al. 2015).

In 2015, the top Spanish firm accounted for 3% of all exports. This firm exported 3725 times more than the average exporter, and almost 2 million times more than the median exporter. If we remove all the very small export operations (\(<6000\) euros)Footnote 5, the top Spanish firm exported 939 times more than the average exporter, and 10,354 times more than the median exporter.

The top 5 firms represented 10% of all exports, the top 50 accounted for almost one-third of all exports, the top 200 performed almost half of all exports, and the top 1000 were responsible for two-thirds of all exports. These figures suggest that the concentration of exports by firm is very high in Spain. If we removed the top 1000 firms, which only represented 0.7% of all exporting firms in 2015, 67% of all exports would vanish. Table 1 also shows that over the 1997–2015 period, there has been a moderate reduction in the concentration of exports by the top 5 firms. In contrast, the concentration of exports is similar for the top firm and the top 50 firms, and increases slightly for the top 200 and top 1000 firms.

Export concentration by firm is higher for goods than for services. Minondo (2013) shows that on average, over the 2001–2007 period, the top 1% of firms account for 49% of service exports, the top 5% of firms for 71% of service exports, and the top 10% of firms for 80% of service exports. For goods, the figures for the same period are 63, 85 and 93% for the top 1, 5 and 10%, respectively.

We want to compare the concentration of exports by firm with the concentration of total sales and employment. For that purpose, we combined the information from two databases: AEAT-Customs, which provides export sales data, and the Bureau Van Dick SABI database, which provides total sales and employment data. The latter database provides detailed financial and accounting records of Spanish firms that deposited their accounts in the Business Register. Unfortunately, we cannot match the AEAT-Customs and SABI databases, because we lack a common firm identifier. Hence, results should be interpreted with caution. Since the AEAT-Customs database only includes goods exports, to maximize comparability, we have selected exporters operating in the goods sectors (agriculture, industry, wholesale and retail) only from SABI. Table 2 presents the data for 2013, the last year available in SABI. Export concentration is similar to sales concentration (which includes sales in domestic and foreign markets), but higher than employment concentration. For example, whereas the top firm exported 3% of all Spanish exports, the firm with the largest number of employees only accounted for 1% of employment. Regarding the top 1000 firms, they made up more than two-thirds of exports, whereas they accounted for less than half of employment.Footnote 6

Concentration of exports by firm is not a particular characteristic of the Spanish economy. Table 3 compares the concentration of exports by firm in Spain with other countries. Since Spanish data is based on the universe of exporters, we only compared Spain with countries where the export concentration by firm was also calculated using data for all exporters. First, we compared Spain with the sample of 32 developing countries over the 2004–2008 period analyzed in Freund and Pierola (2015). They reported that the top exporter accounted for 14% of total exports, and the top 5 exporters for around 33% of total exports. The figures for Spain are 3 and 10%, respectively. These figures show that export concentration was much larger in developing countries than in Spain. The next rows present data for three European countries in 2003: Belgium, France and Norway, as calculated by Mayer and Ottaviano (2008).Footnote 7 They provide data for the top 1, 5 and 10% of exporters. To facilitate comparisons, we also calculated these percentages for Spain. The top 1% of firms held 72% of all exports in Spain, 48% in Belgium, 68% in France and 53% in Norway. The top 5% of exporters accounted for 92% of total exports in Spain, 73% in Belgium, 88% in France and 81% in Norway. Finally, the top 10% of exporters held 97% of total exports in Spain, 84% in Belgium, 94% in France and 91% in Norway. These figures point to the fact that the concentration of exports in Spain was similar to that found in a large developed country, such as France. This conclusion is confirmed in the last row, which presents US data for 2000, as calculated by Bernard et al. (2009). They reported that the top 1% of firms account for 81% of US exports, the top 5% of firms for 93% of total exports and the top 10% of firms for 96% of total exports. To sum up, the concentration of exports by firm in Spain is much lower than in developing countries, and similar to that found in other large developed countries.Footnote 8

Figure 1 presents the distribution of exports from the top 1000 firms in 2015. We rank the top exporting firm as first in the ranking. The figure shows that exports drop dramatically as we descend in the ranking. Using the methodology proposed by Gabaix and Ibragimov (2011), we tested whether a Pareto distribution fits the distribution of exports in the top 1000 Spanish firms. The regression concludes that 99.5% of the differences in the (log) rank of firms is explained by the (log) exports. This result confirms that a Pareto distribution fits the distribution of exports in the top 1000 exporters very well.Footnote 9

To finish this first set of analyses, we investigated the differences between the top 1000 firms and the rest of exporters. As shown in Table 4, superstars export more products to more destinations than ordinary firms. In particular, the median superstar exports to 30 different destinations, whereas the median ordinary firm only exports to one destination. However, there are superstars that only export to one destination, and there are a few ordinary firms that export to many destinations. Among the superstars, the maximum number of destinations is 141.

Differences between superstars and ordinary exporters are also salient regarding products. Among the superstars, the median firm exported 21 products in 2015, whereas the median ordinary firm exported only one. As before, we observe large differences among firms in each group. Among superstars, there are firms that export up to 1946 products and firms that export only one product. Among ordinary firms, while most firms export only one product, there is a firm that exports up to 1420 different products.

2.3 Zooming in on concentration

The Customs database provides the export value by firm, product and destination. This allows us to zoom in on the concentration of exports. In particular, we want to analyze how the concentration of exports differs when we zoom in from exports by firm to exports by firm-destination, exports by firm-product and exports by firm-destination-product. We denote these combinations as export flows. Figure 2 presents the results of the zoom-in exercises. As a benchmark, we have represented the accumulated percentage of exports up to the top 1000 firms (solid black line). This line reproduces the figures presented in Table 1 for 2015.

The top firm-product dyad represents 1.1% of all Spanish exports, the top firm-destination dyad includes 1.0% of all exports, and the top firm-destination-product triad accounts for 0.7% of all exports. This compares to the 3% of all Spanish exports made by the top Spanish firm. Although the zoom-in process reduces the concentration of exports, it is remarkable that the top firm-destination-product triad still represents almost 1% of all Spanish exports.Footnote 10

As shown in Fig. 2, the absolute difference in concentration between firms and our zoom-in categories widens as we increase the number of firms that are included in the set of top firms. However, the concentration of exports in the firm-product dyads, firm-destination dyads and firm-destination-product triads remains high. For example, the top 1000 firm-product dyads represent more than 51% of Spanish exports, compared to 67% for the top 1000 firms. For the firm-destination dyad, the figure is 43% and for the firm-destination-product triad it is 33%. These results suggest that exports are not only concentrated by firms, but also by destinations and products within each firm. Figure 4 shows the concentration of exports by the different categories using data for 1997. The results do not change.

2.4 Concentration across product classifications

In this subsection, we analyze whether the concentration of exports by firm is homogeneous across products. We have performed the analysis for three different product classifications. First, we used the 8-digit CN classification, consistent throughout time, which includes 7650 products. Second, we aggregated exports at the Harmonized System 2-digit level, which includes 96 products, denoted as chapters.Footnote 11 Finally, we aggregated exports at the section level, which constitutes the first level of disaggregation of the Harmonized System classification, and includes 21 categories. The latter two classifications are also used in the next section, where we analyze the influence of top firms in Spanish export specialization. To perform these analyses, we use data for the year 2015, and calculate the share of the top five firms in each product’s total exports.Footnote 12

Figure 3 presents the histograms for the three different product disaggregations. In the CN classification, panel (a), the top five firms account for almost 100% of exports in the majority of products. In particular, in the median product, the share of the top five firms in total exports is 91%. In panel (b), we define products at the chapter level. Since products are much more aggregated in this classification, the share of the top five firms in total exports is reduced significantly. In the median chapter, the share of the top five firms is 38%. We also observe a larger heterogeneity across chapters. For example, the share of chapters where the top five firms account for between 10 and 20% of exports is similar to the share of chapters where the top five firms account for between 40 and 50% of exports. The concentration is even lower for sections (panel (c)), where the top five firms account for 25% of exports in the median section.

3 Do superstars determine the specialization of Spanish exports?

Following the methods of Freund and Pierola (2015), we analyzed how Spain’s revealed comparative advantage would change if we removed superstar firms. To do so, we calculated Balassa’s revealed comparative advantage index for industry k (\(RCAb_{k}\)), where RCA stands for the revealed comparative advantage and the lower case b stands for Balassa, which is defined as follows

where \(x_{esp,k}\) and \(x_{world,k}\) are Spanish and world exports of product k, respectively; and \(X_{esp}\) and \(X_{world}\) are total Spanish and world exports, respectively.

We calculated the Balassa index for each of the 96 HS 2-digit chapters in 2015. We selected this classification to ensure a large enough number of firms per category.Footnote 13 To test the robustness of our results, we replicated the analysis using 1997 data. First, we calculated the Balassa index with all Spanish firms. Then, for each chapter, we re-calculated the index, excluding the chapter-specific superstar firms. We used the United Nations’ Comtrade database to calculate world export aggregates.Footnote 14

Table 5 shows the results of the calculations. First, we present the RCAb index for all chapters. The chapter with the highest RCAb index is cork and articles made from cork (HS2 code 45). Spain also has high RCAb indexes in the chapters related to food and the food industry, such as edible vegetables, edible fruit, vegetables, fruit and food preparations, and beverages. Spain also shows a high RCAb in the ceramic industry, railways and automobiles, pharmaceutical products, apparel and footwear, and iron and steel products. Note that automobiles is the chapter that accounts for the largest share in exports (18.44%) and pharmaceuticals is the fifth largest (4.19%).

The column RCAb All includes all exporters and identifies the chapters with a clear RCAb (\(\ge 1.1\)) and with a borderline RCAb (\(0.9<RCA_{b}<1.1\)). The chapters left in blank have a RCAb \(\le 0.9\). There are 40 chapters, out of 96, in which Spain has a clear RCAb; 4 chapters have a borderline RCAb and 52 chapters do not have RCAb. The next column, RCAb no Top 1, identifies whether the chapter would lose its RCAb if the top firm was removed from the market. The number of chapters with a clear RCAb drops to 29. However, 7 chapters move to a borderline RCAb, and only 4 chapters clearly lose their RCAb.Footnote 15 Hence, only 10% of the chapters (4 over 40) clearly lose their RCAb when we remove the top firm. However, the influence of the top firms on RCAb increases as we widen the set of superstar firms. When we exclude the top 5 firms, the number of chapters where Spain commands a clear RCAb drops from 40 to 17, with five of these industries moving to the bordeline RCAb situation. When we enhance the set of superstars to the top 10 firms, the number of industries with RCAb drops from 40 to 13, with three of these industries moving to the borderline situation. Hence, the top 5 firms determine the RCAb in 35% of the chapters (14 chapters clearly losing their RCAb out of 40 chapters), and the top 10 firms in 60% of the chapters (24 chapters losing their RCAb out of 40 chapters). The chapters in which Spain loses RCAb when the top 10 firms are removed account for 45% of all Spanish exports, and 67% of exports in the chapters in which Spain has a clear RCAb.Footnote 16

Table 8 in the “Appendix” presents the results based on the 1997 data. Spain had 36 chapters with a clear revealed comparative advantage, 8 industries with a borderline revealed comparative advantage and 52 industries without a revealed comparative advantage. When we remove the top exporter, the top 5 exporters and the top 10 exporters, Spain loses a clear revealed comparative advantage in 4, 10 and 20 industries, respectively. Hence, the top exporter determines revealed comparative advantage in 11% of industries, the top 5 exporters in 31% of industries and the 10 exporters in 55% of industries. These results are similar to those found for 2015.

The results presented in Table 5 suggest that superstars have a large influence on export specialization. However, we should qualify this statement, since we do not know how the remaining firms would behave if the superstars disappeared. Using a different methodology, Gaubert and Itskhoki (2016) analyze the contribution of granular (superstars-based) comparative advantage and fundamental (country-based) comparative advantage to differences in the share of exports across French industries. They find that granular comparative advantage explains 30% of the differences, and fundamental comparative advantage explains 70% of the differences. The contribution of granular comparative advantage is similar to the contribution of the top 5 firms to the RCAb in Spain.Footnote 17

As a robustness exercise, we calculated the regression-based revealed comparative advantage index (RCAr) proposed by Costinot et al. (2012), where the lower case r stands for regression-based. There are two main differences between the comparative advantage index proposed by Costinot et al. (2012) and Balassa’s revealed comparative advantage index. First, the comparative advantage measured proposed by Costinot et al. (2012) is derived from a Ricardian model of trade, which allows for heterogeneity across firms. In contrast, Balassa’s revealed comparative advantage index is not grounded on theory. Second, Costinot et al. (2012) estimate pairwise comparisons of productivity across countries and industries, which capture the essence of Ricardian comparative advantage. Moreover, they are able to control for the effect that trade costs might have on exports. In contrast, Balassa’s revealed comparative advantage index compares the share of an industry in a country’s exports relative to the share of that industry in world exports, and does not control for trade costs.

We have estimated the following regression equation

where \(x_{ijk}\) is industry k exports from country i to country j; and \(\delta _{ij}\), \(\delta _{ik}\) and \(\delta _{jk}\) are exporter-importer, exporter-product and importer-product fixed effects.

As explained by Costinot et al. (2012), the estimated exporter-product fixed effects are theoretically consistent estimates of the productivity of exporter i in product k. It is important to note that, due to the properties of the linear regression, all the estimated exporter-product productivities are defined relative to a numeraire good and a numeraire exporter. Hence, exporter-product fixed effects capture the productivity of exporter i in product k relative to the productivity of a numeraire exporter \(i^\prime \) in a numeraire product \(k^\prime \).Footnote 18 It is important to note that \(\delta _{ik}\) are estimates of revealed measures of relative productivity, because it is only possible to estimate the relative productivity of exporter i in product k if exporter i exports product k.Footnote 19

The limitation of the regression procedure is that computational capacity runs into difficulties if the number of fixed effects is high. To reduce this number, we group HS 2-digit chapters into the 21 HS sections. Next, we restrict the sample to the top 40 exporter countries in the world, which account for 77% of world exports. Once we have estimated country-industry fixed effects, following the method used by Freund and Pierola (2015), we estimated RCAr using

where \(X_{esp,k}\) is the exponent of the fixed effect of Spain in industry k (\(X_{esp,k}=e^{\delta _{ik}}\)). This variable captures Spanish exports in industry k relative to the numeraire country and product; \(mean(X_{esp,k})\) is the average relative export across industries in Spain. In the denominator, for each country, we divided relative exports in industry k by the average relative exports in the rest of industries and, then we took the average of this ratio over all countries.

Table 6 presents the results of the analysis with the RCAr index for 2015. For comparison, we also present the results obtained with the RCAb index. As before, we consider that Spain has a clear RCA in industry k if RCAr is \(\ge 1.1\), a bordeline RCAr if \(0.9<RCA<1.1\), and clearly no RCA if RCAr\(\le 0.9\). According to the regression-based methodology, Spain has a clear comparative advantage in 8 sections out of 20.Footnote 20 In line with Table 5, Spain has a RCAr in vegetables, fats and oils, foodstuff and beverages, leather, textile and garments, footwear, stone and cement (which includes ceramics), and transport equipment. When we remove the top firm, the number of sections with a clear RCAr drops to 3. When we remove the top 5 firms the number of sections with a clear RCAr drops to 2; and when we remove the top 10 firms the number of sections with a clear RCAr remains at 2. The sections that keep their RCAr once the top 10 firms are removed are fats and oils, and stone and cement. When we remove the top 10 firms, three sections shift from a clear RCAr to a bordeline situation: vegetables, foodstuffs and beverages, and footwear; and three sections clearly lose their RCAr: leather, textiles and garments, and transport equipment. According to these figures, when we remove the top 10 firms, Spain loses a clear RCAr in 38% (3 out of 8) of sections. These sections represent 29% of all Spanish exports, and 63% of exports in which Spain has a clear RCAr.

The last four columns present the results when RCA is computed with the Balassa index. When all firms are included, Spain has a RCAb in 11 sections over 21. When we remove the top 10 firms, Spain keeps a clear RCAb in 5 of these 11 sections; one moves to the bordeline range, and 5 clearly lose their RCAb. According to the Balassa index, Spain would lose a clear RCAb in 45% of the sections (5 out of 11). This figure is higher than the one obtained with the regression-based calculations. However, it is lower than the percentage we obtained when the analysis was performed at the chapter level (Table 5). Since there are more exporters per industry at the section level than at the chapter level, the removal of the top 10 firms has a lower impact on the former than on the later. The sections losing RCAb when the top 10 firms are removed represent 48% of all Spanish exports, and 76% of exports in sections where Spain has a clear RCAb.Footnote 21

Freund and Pierola (2015) analyze how countries’ revealed comparative advantage would change if top firms disappeared, using a sample of 32 developing countries. They find that developing countries would lose their revealed comparative advantage in 6% of industries if the top exporter disappeared and in 16% of industries if the top 5 exporters disappeared. The figures for Spain are 9 and 18%, respectively. Despite the lower concentration of exports in the top firms in Spain than in developing countries, the effect of granularity on the revealed comparative advantage is greater in the former than in the latter.

4 Granularity and the dynamics of exports

In this section, we analyze whether superstars shape the dynamics of Spanish exports. To do this, we follow the methodology proposed by Gabaix (2011).Footnote 22 The change in exports of firm f selling product k in market d can be separated into three components: a firm-specific, or idiosyncratic, component; a product component; and a destination component. It is the first component which captures the contribution of superstars to the variation in aggregate exports. To separate the idiosyncratic component, first we calculated the growth in exports for a specific firm, product and destination

where \(x_{f,k,d,t}\) are exports by firm f of product k in destination d at time t. Note that (4) can only compute export transactions at the firm, product and destination level that happen in year \(t{-}1\) and year t. Hence, it only captures the intensive margin of trade. This is a reasonable compromise, given that the intensive margin explains around 77% of the year-by-year variation in exports in Spain (de Lucio et al. 2011). Then, we calculated the average of the growth rates of all firms for product k and market d

where \(N_{k,d,t-1}\) is the total number of exporters of k to destination d at year \(t{-}1\). Note that \(g_{k,d,t}\) aggregates the product-level and destination-level growth components.

Then we identified the idiosyncratic component, \(ic_{f,k,d,t}\), as the difference between the firm growth rate and the average growth rate

Finally, we calculated the granular residual as the sum of the idiosyncratic components of top firms, weighted by the share of each superstar in the total exports of product k in market d at time \(t-1\)

where \(s_{f,k,d,t-1}\) is the share of firm f in total exports of product k to destination d at year \(t-1\), and \(S_{k,d,t-1}\) is the set of superstar firms in product k and market d at time \(t{-}1\) .

To measure the contribution of superstar firms to the changes in aggregate exports, we regressed the change in aggregate exports by product and destination on the granular residual. Following the technique used by Gabaix (2011), in addition to the contemporary granular residual, we added granular residual 1-year and 2-years lagged values to control for dynamic interdependencies. The regression equation is defined as follows

where \(\alpha \) is a constant and \(r_{k,d,t-1}\) and \(r_{k,d,t-2}\) are granular residual 1 and 2 year lags, respectively. We defined products at the HS 2-digit disaggregation and restricted the sample to those product and destination combinations that have at least 10 exporters operating in year \(t{-}1\) and year t.Footnote 23 We analyzed the contribution of the top firm and the contribution of the top 5 firms to the variation of exports.

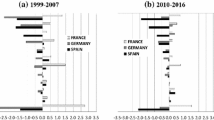

Table 7 presents the results of the regression analyses. The granular residual coefficients for the top firm and the top 5 firms are positive and highly statistically significant. These coefficients indicate that superstars influence the variation in exports. In particular, according to the adjusted R-square statistic in column (1), the top firm explains 29% of the variation in exports; according to column (4), the top 5 firms explain 33% of the variation. The coefficient for the contemporary granular residual remains positive and statistically significant, once we control for lagged values.

For output growth, Gabaix (2011) found that the top 100 firms in the US explained around one-third of the variations over the 1951–2008 period. Wagner (2012) found that the top 10 firms explained between 36 and 45% of the variation of manufacturing sales in Germany between 2007 and 2008. These results are in the range of the contribution we have estimated for Spain.Footnote 24

5 Conclusion

There is a great heterogeneity among firms in relation to exports. In Spain, the top 200 firms accounted for half, and the top 1000 firms for two-thirds, of Spanish merchandise exports in 2015. The granular nature of exports is remarkable, even when we zoom in to analyze export operations at the firm, destination and product level.

Granularity contributes substantially to export specialization in many industries. If the top 10 firms were removed, Spain would lose its revealed comparative advantage in 60% of 2-digit HS chapters, which account for 45% of all Spanish exports in 2015. This suggests that superstars, along with country-level fundamentals, play a very important role in determining countries’ trade patterns. Finally, we show that superstars can explain around one-third of the growth in Spanish exports.

These results suggest that large differences across exporters should be a key ingredient considered in international trade models. The dominance of a few firms might also qualify previous predictions concerning the effects of trade liberalization on firms entry and exit, aggregate productivity and welfare. In particular, as pointed out by Freund and Pierola (2015), small policy changes might have large effects if they alter the behavior of superstar firms.

Notes

An example of an 8-digit product is CN 87120030 Bicycles with ball bearings.

Due to their special geographical situation and fiscal status, we remove the Spanish firms registered in the two autonomous cities located in Africa (Ceuta and Melilla).

We have a consistent classification of 7650 products categories over the 1997–2015 period.

Up to this value, European Union (EU) exporters do not have to certify that the product meets the EU’s rules of origin http://madb.europa.eu/madb/rulesoforigin_preferential.htm.

Bernard et al. (2009) also documented a higher granularity in exports than in employment for the US.

These authors also present data for other European countries, but based on samples that do not include all exporters.

The regression yields a Pareto parameter equal to 1.1.

It is interesting to note that the top firm-destination-product triad in 2015 did not belong to the top exporter.

There is no Chapter 77, and we do not have data on Chapters 99 and 98.

We also performed the analyses using 1997 data. The results are not altered (Fig. 5 in the “Appendix”).

All chapters have at least 48 firms exporting more than 18,000 euros.

Available at http://comtrade.un.org/db/.

These are explosives; rubber; articles of apparel and clothing; and zinc.

As a robustness check, we also transformed the RCAb variable into a revealed symmetric comparative advantage (RSCA) variable (Laursen 2015). The RSCA is defined as (RCAb-1)/(RCAb+1) and has a \([-1,1]\) range. Using a RSCA \(\ge 0.1\) threshold to determine a clear RCAb, we obtain very similar results.

The methodology used by Gaubert and Itskhoki (2016) methodology relies on the distribution of sales per firm in the domestic and foreign markets. We cannot apply their methodology, since we do not have information about domestic sales per firm.

Following the methodology used by Freund and Pierola (2015), we selected a section with a low granularity level, and where Spain does not have RCAb, as the numeraire industry: machinery. We selected the USA as the numeraire country.

We could use the exporter-importer fixed effects to calculate \((\delta _{ik}-\delta _{ik^\prime })-(\delta _{i^\prime k}-\delta _{i^\prime k^\prime })\). This expression captures the Ricardian comparative advantage, since it compares the productivity of exporter i in product k relative to product \(k^\prime \) with the same ratio for exporter \(i^\prime \).

Note that we cannot calculate the RCAr in machinery, since it is the numeraire section.

To minimize the impact of outliers, we winsorized growth rates to the 5% and 95% percentiles.

Giovanni et al. (2014) analyzed the contribution of the firm-specific component to the volatility of exports for all firms, not only superstars. They found that the contribution of this component is much larger than the contribution of the sector and destination component. In contrast, Canals et al. (2007) found that idiosyncratic shocks only explain 15% of total variation in aggregate exports in Japan.

References

Bernard AB, Jensen JB, Redding SJ, Schott PK (2016) Global firms. NBER Working Paper No. 22727, National Bureau of Economic Research

Bernard AB, Jensen JB, Schott PK (2009) Importers, exporters and multinationals: a portrait of firms in the US that trade goods. In: Dunne T, Jense J, Roberts M (eds) Producer dynamics: new evidence from micro data. University of Chicago Press, Chicago, pp 513–552

Canals C, Gabaix X, Vilarrubia JM, Weinstein DE (2007) Trade patterns, trade balances and idiosyncratic shocks. Banco de España Research Paper No. WP-0721

Costinot A, Donaldson D, Komunjer I (2012) What goods do countries trade? A quantitative exploration of Ricardo’s ideas. Rev Econ Stud 79(2):581–608

de Lucio J, Mínguez R, Minondo A, Requena F (2011) The extensive and intensive margins of Spanish trade. Int Rev Appl Econ 25(5):615–631

Di Giovanni J, Levchenko AA (2012) Country size, international trade, and aggregate fluctuations in granular economies. J Polit Econ 120(6):1083–1132

Di Giovanni J, Levchenko AA (2013) Firm entry, trade, and welfare in Zipf’s world. J Int Econ 89(2):283–296

Di Giovanni J, Levchenko AA, Mejean I (2014) Firms, destinations, and aggregate fluctuations. Econometrica 82(4):1303–1340

Eaton J, Kortum SS, Sotelo S (2012) International trade: Linking micro and macro. NBER Working Paper No. 17864, National Bureau of Economic Research

Fernandes AM, Freund C, Pierola D, Cebeci T (2015) Exporter behavior, country size and stage of development. Policy Research Working Paper WPS7452. The World Bank

Freund C, Pierola MD (2015) Export superstars. Rev Econ Stat 97(5):1023–1032

Gabaix X (2011) The granular origins of aggregate fluctuations. Econometrica 79(3):733–772

Gabaix X, Ibragimov R (2011) Rank- 1/2: a simple way to improve the OLS estimation of tail exponents. J Bus Econ Stat 29(1):24–39

Gaubert C, Itskhoki O (2016) Granular comparative advantage. Available at http://www.princeton.edu/~itskhoki/papers/GranularCA.pdf

Laursen K (2015) Revealed comparative advantage and the alternatives as measures of international specialization. Eurasian Bus Rev 5(1):99–115

Marin D, Schymic J, Tscheke J (2015) Europe’s export superstars - it’s the organisation. Bruegel Working Paper 2015/05

Mayer T, Ottaviano GI (2008) The happy few: the internationalisation of European firms. Intereconomics 43(3):135–148

Minondo A (2013) Trading firms in the Spanish service sector. Revista de Economía Aplicada 21(63):5–28

Van Beveren I, Bernard AB, Vandenbussche H (2012) Concording EU trade and production data over time. NBER Working Paper No. 18604, National Bureau of Economic Research

Wagner J (2012) The German manufacturing sector is a granular economy. Appl Econ Lett 19(17):1663–1665

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Francisco Olarte for preparing the SABI data used in the empirical analyses and Jordi Paniagua for his valuable suggestions and comments. We would also like to thank the Customs and Excise Department of the Spanish Revenue Agency (AEAT) for providing essential information for this paper. We gratefully acknowledge financial support from the Spanish Ministry of Economy and Competitiveness (MINECO ECO2015-68057-R and ECO2016-79650-P, co-financed with FEDER), the Basque Government Department of Education, Language Policy and Culture (IT885-16), and the Generalitat Valenciana (Prometeo II-2014-053).

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

de Lucio, J., Mínguez, R., Minondo, A. et al. The granularity of Spanish exports. SERIEs 8, 225–259 (2017). https://doi.org/10.1007/s13209-017-0157-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-017-0157-x