Abstract

The key scientific problem to be solved in this paper is the optimal development and utilization model and the economic evaluation model of China's land-phase shale oil and gas resources, and the purpose of the research is to promote the large-scale commercial development and utilization of China's shale oil and gas resources, and to safeguard China's oil and gas energy security and the sustainable development of the economy. The article proposes to adopt the small surface element volume method (oil content rate method) to evaluate the pure shale oil resources, adopt the Cobb–Douglas production function model as the optimization model to measure the boundary production capacity of shale oil and gas, construct the optimal development and utilization model for shale oil and gas resources considering the five first-level safeguard indexes, namely, science and technology (A), capital (K), talents (L), reserves (S) and ecological environment (E), and establish the basic constraint model for the optimal development and utilization of shale oil and gas resources. The basic constraint model, as well as the evaluation model of economic coefficients for the development and utilization of shale oil and gas resources were established. The pure shale oil resources are mainly calculated based on the movable oil content of shale. In the paper, the S1 of normal pyrolysis (300 °C) is regarded as movable oil, and the sum of S1 and evaporated hydrocarbon (light hydrocarbon) loss is the movable oil content of shale. The integrated geological-physical exploration-engineering comprehensive evaluation of China’s land-phase shale oil-rich and high-yielding “sweet spot” is an important prerequisite for the realization of shale oil and gas resources to build production scale and effective development, and the least-squares method is used to estimate the average production function, the distance to the maximum value of the residuals, and the boundary capacity production function. The average production function and residual maximum distance are estimated by the least squares method, and the production function of the boundary capacity is derived, and the quotient of the boundary capacity and the actual capacity is calculated to get the capacity utilization rate, which can be used to analyze the potential of future shale oil and gas growth. The development of shale oil and gas resources in a target block requires comprehensive consideration of the first-level guarantee indicators such as science and technology (A), capital (K), talents (L), reserves (S) and ecological environment (E), as well as more than 10 s-level indicators and a number of third-level indicators, in order to ensure that the oil companies maximize their profits by organizing the development and production. The economic coefficient can be expressed as the ratio of economically recoverable resources to geological reserves. The larger the economic coefficient for the development and utilization of shale oil and gas resources is, the better the economy of the area is, and the larger the proportion of shale oil and gas resources that can be exploited. There is little special literature on the optimal development and utilization model of shale oil and gas resources and energy security among many research results at home and abroad. The evaluation of pure shale oil using the small surface element volume method (oil content rate method) and the construction of the boundary capacity calculation model, the optimal development of the basic constraints model and the economic evaluation model that we have determined, although they can not yet fully cover all the links and factors related to the development and utilization of shale oil and gas resources, are not yet fully covered by our research work. However, our research work has given the model more geological and economic theoretical connotations, and provided an economic basis and technical reference for the large-scale and commercial development and utilization of shale oil and gas resources as an effective alternative to oil imports.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy is the foundation for the development of social productivity in any country on a global scale. It is an important source of a country’s economic development and an important factor in improving a country’s comprehensive national power. Today the world is facing unprecedented turbulence since the end of the Cold War, and the ongoing political and military crisis in Europe has accelerated the change of the world's geopolitical map, which has a profound impact on the global supply and demand of energy resources and trade patterns. With the continuous fermentation of the Russian-Ukrainian political and geopolitical conflict, as well as the U.S. and Western countries have continued to impose all kinds of sanctions on Russia, the international energy market has been violently impacted, oil and natural gas energy supply has been blocked, oil and gas supply has become a major core issue of high concern to the global energy security, and the world began to re-examine the importance of oil and gas and other fossil energy sources.

The Russian–Ukrainian political geopolitical conflict and the global heat wave have brought a brutal double blow to the global energy market, and energy security has become an urgent problem to be solved at present. With the prolongation of the Russian-Ukrainian conflict and the growth of global energy demand, the contradiction between high energy prices, inflation and other issues has increased. At present, the most capable of curbing the rise in oil prices is shale oil and gas. Shale oil, shale gas and other unconventional oil and gas resources development and utilization and energy security issues have been related to the sustainable use of human resources and energy and sustainable economic and social development. In view of the current global energy market and energy pattern reshaping in the context of the intertwining of the great powers game, as well as the increasing depletion of conventional oil and gas resources worldwide, the development and utilization of shale oil, shale gas and other non-conventional oil and gas resources will be an effective way to solve the energy crisis and sustainable development problems faced by mankind at present. In the past two or three decades, with the increasing global voice for clean and efficient development of unconventional energy, shale oil, shale gas and coalbed methane, as a new type of unconventional alternateve energy, have entered the historical stage and become a hot stream of research in the field of unconventional energy all over the world (Kunzig 2009; Andrews 2013; An et al.2010; Mauter et al. 2014; Estrada 2016; UNCTAD 2018; EIA 2016; EIA 2019; Wu et al. 2020). The United States is the first country in the world to realize the industrialization and commercial development of shale oil, and has reversed thedecline in oil production since the 1970s (Wu et al. 2020; EIA 2017; Arredondo-Ramírez et al. 2016). Especially since 2008, American oil companies have used horizontal drilling, hydraulic fracturing and other technologies accumulated of shale gas in the shale oil field, which has promoted the industrialization of shale oil. It has achieved commercial mass production and reshaped the world oil market. China's current conventional oil and gas resources growth space has been quite limited, production capacity basically maintained at about 200 million tons, the new oil reserves deterioration in quality, low recovery rate, low yield of a single well, stable production period is short; oil and gas resources to increase the reserves on the production will mainly rely on shale oil, shale gas, coal bed methane and other non-conventional oil and gas resources (Jia et al. 2012; Kang 2016; Zhang et al. 2022; Zhang et al. 2023; Jin et al. 2021; Yin et al. 2022). According to the U.S. Energy Information Administration (EIA 2023) enumeration statistics and world shale oil and gas reserves data, China's shale oil technology recoverable resources of 4.393 billion tons, second only to Russia and the United States, accounting for about 6% of the world. Large-scale development and utilization of shale oil and gas is a new energy revolution in China, and its development and utilization is of great strategic significance for optimizing energy structure, ensuring energy security, improving energy use efficiency, promoting energy conservation and emission reduction, and promoting economic and social development. How to realize the optimal development and rational use of shale oil and shale gas resources in China, and maximize its substitution effect and economic value for conventional oil and gas resources, so as to guarantee China's future energy security, has increasingly become a hot spot for theoretical research in economics and other related natural sciences.

The current global energy pattern and the strategic significance of the development and utilization of shale oil and gas resources

Under the interweaving background of the great power game, the global energy market and energy pattern

Energy resources are the source of power and the material basis for supporting economic and social development, and are an important part of national security. As relatively high-quality, low-carbon and important fossil energy sources, oil and natural gas account for nearly 60% of global energy consumption, and have always been the focus of attention of countries' energy security. Since the outbreak and escalation of the Russia-Ukraine conflict in 2022, under the interweaving of multiple factors such as geopolitics, energy crisis and trade protectionism, the energy structure and industrial chain pattern in Europe will face reshaping and have a more far-reaching impact on the global economy. Affected by the chain reaction of the Russia-Ukraine conflict, the European Union, which is highly dependent on energy imports, may once again face the challenge of the energy crisis. Russia is the world's second-largest oil producer and the world's second-largest natural gas producer after the United States (BP 2021), and it is the largest natural gas supplier to Europe, with natural gas sold to Europe accounting for nearly half of Europe's natural gas imports. After the Russia-Ukraine conflict, the global energy market has been profoundly restructured, and the supply and demand pattern of fossil energy has been reconfigured. In the short term, the energy crisis has caused the structure of the EU's energy import sources to be changing. The EU previously formed with Russia's stable supply and demand is broken, it is through increased energy imports from Norway, the United States and other countries to meet demand. In the long term, the energy crisis has prompted the EU to invest more in renewable energy infrastructure, energy efficiency, industrial transformation to reduce fossil fuel consumption, methane production and other areas to increase the speed of its energy transition. The report World Energy Outlook 2022 (IEA 2022), published by the International Energy Agency (IEA: International Energy Agency), opens with the statement that the global energy crisis triggered by the geopolitical conflict between Russia and Ukraine has never been more widespread and complex.

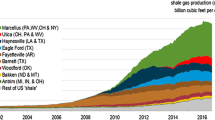

In recent years, with the discovery and development of conventional and unconventional oil and gas resources, in terms of oil and gas supply and demand patterns and circumstances which is illustrated (Fig. 1), the CIS, the Middle East and Africa region output of oil and gas production in the case of self-marketing, there is a surplus (oil–gas production index PI is much higher than 100%), as a net export area; oil and gas production and demand in Latin America and North America such as the United States, Canada, Mexico, Brazil and other countries have basically formed a balanced and slightly surplus situation, while Europe and the Asia–Pacific region (including China) oil and gas supply and demand gap is large (oil–gas production index PI is far less than 100%), need to import a lot of oil and gas energy to meet demand. The suppliers of oil and gas resources in Russia, the Middle East and Africa constitute the "four circles and two systems" trade pattern of global oil and gas resources (Fig. 1, Wang 2023). The "four circles" refer to the Russia Europe trade circle, the Middle East Asia Pacific (including China) trade circle, the Americas trade circle, and the Africa South Europe South Pacific trade circle. The "two systems" refers to the integrated system of oil and gas supply and demand in the Americas trade circle (III), and the separate system of oil and gas supply and demand in the remaining three circles. Although there is some overlap between the trading circles, the volume of trade is relatively small. Neighboring oil and gas supply and demand markets, complete transportation facilities, smooth transportation corridors and economic prices are the basis for the formation of a stable trade pattern in the "four circles and two systems". The Americas Trade Circle, which integrates supply and demand, is relatively stable in the existing oil and gas supply and demand system, while the other three trade circles, which are separated from supply and demand, are susceptible to the influence of external factors and show obvious vulnerability.

Taking the Russia Europe trade circle as an example, since the Russia-Ukraine conflict, the EU has successively restricted the purchase, price and transportation of Russian oil and gas, and sought oil and gas supplies from Russia from the Middle East, the United States and Africa, which has begun to change the existing global energy resource supply and trade pattern; Especially with the destruction of the Nord Stream 1 and Nord Stream 2 natural gas pipelines passing through the Baltic Sea, more than one tenth of global oil and a quarter of natural gas supply are facing disruptions, putting European countries with great energy demand for Russia in a passive energy supply situation in the short term. Oil and gas exports are shifting eastward and southward, and finding new markets in Asia has become a foregone conclusion. The United States and the Organization of the Petroleum Exporting Countries (OPEC) have formed a bipolar pattern, becoming the main source of new global production.

World energy outlook

The World Energy Outlook 2023, a report released by the International Energy Agency (IEA 2023) on October 24, 2023, states that by 2030, the world's energy system will undergo significant changes.

The energy world remains fragile, but there are effective ways to improve energy security and address emissions

In the first half of 2023, rising oil supply, coupled with slowing demand in developed economies, has seen benchmark crude oil prices fall back to pre-conflict levels in Russia and Ukraine, and refined petroleum product prices have retreated from historically high levels, easing countries' energy security. However, energy markets, geopolitics and the global economy remain unstable, and the risk of further disruption is always present. More than a year after the Russian-Ukrainian conflict, fighting continues in Ukraine, while there is also a risk of prolonged conflict in the Middle East. The macroeconomic situation is not encouraging, with stubborn inflation, rising borrowing costs and elevated debt levels. Today, global average surface temperatures are already about 1.2 °C above pre-industrial levels, triggering heat waves and other extreme weather events, while greenhouse gas emissions have yet to peak. The energy sector is also a major contributor to the polluted air that more than 90% of the world's population is forced to breathe. In some countries, positive trends towards improved access to electricity and cleaner cooking have slowed or even reversed.

Against this complex backdrop, the emergence of a new clean energy economy led by solar photovoltaics (PV) and electric vehicles (EVs) offers hope for the future.In 2023, renewable energy capacity will exceed 500 gigawatts, a new record. More than $1 billion per day is being spent on solar deployment. Production capacity for key components of clean energy systems, including solar photovoltaic modules and batteries for electric vehicles, is also expanding rapidly. It is because of this momentum that the International Energy Agency recently concluded in its updated "Net Zero Roadmap" that the pathway to limiting global warming to 1.5 degrees Celsius is very difficult, but remains open.

Expected to see all fossil fuels reach their peak by 2030

One legacy of the global energy crisis may be the beginning of the end of the fossil fuel era. The share of coal, oil and gas in global energy supply, which has been stuck at around 80 per cent for decades, is starting to go downhill, reaching 73 per cent in the Energy Supply Standard by 2030. This is an important shift. However, if demand for these fossil fuels remains high, as it has for coal in recent years, and as STEPS (The Stated Policies Scenario, an outlook based on the most recent policy environment, including energy, climate, and related industrial policies) has projected for oil and natural gas, it will be far from sufficient to meet global climate goals. Policies to support clean energy are working as the projected pace of change accelerates in key global markets. In the EU in 2030, heat pump installations in STEPS will reach two-thirds of the level required in the NZE (Net Zero Emissions by 2050) scenario, compared to one-third projected two years before World Economic Outlook 2021 (WEO-2021). In China, new installations of solar photovoltaic (PV) and offshore wind are expected to triple by 2030 compared to the forecasts in WEO-2021. The outlook for nuclear power has also improved in key markets, with countries such as Japan, South Korea and the United States supporting the extension of the life of existing nuclear reactors, and several others supporting the construction of new nuclear reactors.

While demand for fossil fuels has been strong in recent years, there are signs that the direction is changing. The deployment of low-emission alternatives has been accompanied by a slowdown in the addition of fossil fuel-using assets to the energy system. In the power sector, global additions of coal- and gas-fired power plants have been at least halved from earlier peaks. In many countries in Europe and the United States, sales of residential gas-fired boilers have been on a downward trend and have now been replaced by sales of heat pumps.

China is changing the energy world

China plays a pivotal role in shaping global energy trends. This influence is evolving as China's economic growth slows, its structure adjusts, and its use of clean energy grows. Over the past decade, China has accounted for nearly two-thirds of the growth in global oil use, nearly one-third of the growth in natural gas use, and has been a dominant player in the coal market. China is also a clean energy powerhouse, with wind and solar power accounting for roughly half of the world's new electricity generation in 2022, and electric vehicle sales set to exceed half of the global total. If economic growth slows further, China's fossil fuel demand will have more room to decline. According to our forecasts, China's GDP will grow at an average annual rate of just under 4% through 2030. This will cause China's total energy demand to peak in the middle of this decade, while a strong expansion of clean energy sources will bring down total fossil fuel demand and emissions. If China's near-term growth slows by another percentage point, the reduction in coal demand in 2030 would be almost equal to the current consumption of all of Europe. Oil imports would fall by 5 per cent and liquefied natural gas imports by more than 20 per cent, which would have a major impact on the global balance.

New investment dynamics are taking shape

The end of the era of fossil fuel growth does not mean the end of fossil fuel investment, but it weakens any case for increased spending. Until this year, meeting the projected demand for STEPS meant increasing oil and gas investment over the decade, but a stronger clean energy outlook and declining demand for fossil fuels means this is no longer the case. However, current investment in oil and gas is almost twice the level required under the NZE (Net Zero Emissions by 2050) scenario for 2030, suggesting that the long-term use of fossil fuels will make the goal of limiting global warming to 1.5 °C unattainable.

Simply cutting spending on oil and gas will not put the world on track for the NZE (Net Zero Emissions by 2050) scenario; the key to an orderly transition lies in scaling up investment in all aspects of the clean energy system. The development of clean energy systems and their impact on emissions can be enhanced by policies that ease the exit of inefficient, polluting assets or limit the entry of new assets into the system. However, it is imperative to accelerate the pace of new clean energy projects, especially in many emerging and developing economies outside of China, where investment in the energy transition would need to increase more than fivefold by 2030 to reach the levels called for in the NZE (Net Zero Emissions by 2050) scenario. New efforts, including stronger international support, will be critical to address barriers such as high capital costs, limited fiscal space for government support, and a challenging business environment.

Meeting development needs in a sustainable manner is the key to accelerating development

The global peak in demand for the three fossil fuels masks important differences between economies at different stages of development. The drivers of growth in demand for energy services remain very strong in most emerging and developing economies. India is the largest source of STEPS energy demand growth, outpacing Southeast Asia and Africa. Finding and financing low-emission ways to meet the growing energy demand in these economies will be an important determinant of the ultimate rate of decline in global fossil fuel use.

Clean electrification, efficiency improvements and a shift to low- and zero-carbon fuels are key levers for emerging and developing economies to achieve national energy and climate goals. Achieving these goals, including net-zero targets, on schedule will have wide-ranging implications for future development paths. In India, this means that by 2030, Indian industry will produce 30% less carbon dioxide (CO2) per dollar of value-added than it does today, and passenger cars will emit 25% less CO2 per kilometer driven on average. In Indonesia, the share of electricity generated from renewable sources will double to more than 35% by 2030. In Brazil, by the end of the decade, biofuels will meet 40 per cent of road transportation fuel needs, up from 25 per cent today. In sub-Saharan Africa, meeting diversified national energy and climate targets means that 85 per cent of new power plants will be powered by renewable energy by 2030.

Sufficient global production capacity brings huge development space for solar photovoltaic industry

According to the STEPS program, renewable energy will account for 80% of new generating capacity by 2030, with solar PV alone accounting for more than half. Utilizing 70% of the projected solar PV manufacturing capacity would bring deployment to the levels projected in the NZE scenario; effectively integrated, this would further reduce fossil fuel use, starting with coal. In a sensitivity case, we explore how STEPS projections would change if more than 800 gigawatts of solar PV were added globally per year by 2030. This has a particularly pronounced impact on China, where coal-fired generation will be reduced by a further 20% by 2030 compared to the STEPS forecast. Without assuming any additional retirements, the average annual capacity factor for coal-fired plants would fall from over 50 percent today to about 30 percent in 2030. The consequences would extend well beyond China: in this scenario, the average annual deployment of new solar PV in Latin America, Africa, Southeast Asia, and the Middle East exceeds 70 gigawatts per year by 2030. Even with modest cuts, fossil-fueled generation in these regions would be reduced by about a quarter in 2030 compared to STEPS. Solar PV alone will not put the world on track to meet its climate goals, but it will light the way forward more than any other clean technology.

The new round of liquefied natural gas export projects will reshape the natural gas market

An unprecedented surge in new liquefied natural gas (LNG) projects starting in 2025 will change the balance of the market and concerns about gas supplies. In recent years, the gas market has been dominated by security concerns and price spikes following Russian supply cuts to Europe. In the near term, the balance of the market remains precarious, but the situation will change from the middle of this decade onwards. Projects for which construction has started or final investment decisions have been made will add up to 250 bcm of liquefaction capacity per year by 2030, almost half of current global LNG supply. Published schedules show particularly large increases between 2025 and 2027. More than half of the new projects are located in the United States and Qatar.

China’s energy demand and dual carbon goals

As the world's second largest economy after the United States, China is also one of the world's larger oil and gas importers and an important oil and gas consumer market, with its dependence on oil rising from 56.9% in 2012 to 72% in 2021, and its dependence on natural gas rising from 28.9% in 2012 to 46% in 2021. in 2022, China's dependence on crude oil will fall by 0.8 percentage points year-on-year, while its dependence on natural gas will fall by 5.5 percentage points year-on-year. 0.8 percentage points, natural gas dependence on foreign countries decreased by 5.5 percentage points year-on-year; oil and gas dependence on foreign countries for the first time synchronized decline in this signal, although the release of the domestic oil and gas production continued to grow, a small decline in demand; but in the current situation of the world's century-old changes accelerating the evolution of the situation, the importance of the security of oil and gas supply more and more apparent, coupled with China's crude oil production capacity to further expand the production of the space is not much. Energy security supply situation is not optimistic, the unprecedented energy crisis in Europe to China's energy security has also sounded the alarm.

In the past five years, China's dependence on crude oil has exceeded 70% (Fig. 2a), and its dependence on natural gas has exceeded 40% (Fig. 2b). The deepening of the "coal to gas" policy has accelerated China's energy structure adjustment, and the gap between natural gas supply and demand has continued to expand. In 2018, China surpassed Japan as the world's largest importer of natural gas for the first time. In 2022, China's crude oil imports will be 508 million tons, down 1.0% year-on-year, and the external dependence will be reduced to 71.2% (Fig. 2a); under the condition of continuous and substantial growth of natural gas imports for many years, the import volume of natural gas in 2022 will be 152.99 billion cubic meters, down 10.4% year-on-year, and the external dependence will be reduced to 40.2% (Fig. 2b). The rapid rebound of China's oil and gas consumption since 2021 and the vigorous promotion of "coal to gas" under China's haze control policy have led to a high growth rate of natural gas demand until 2030, which will make China's oil external dependence remain at a high level for a period of time. In particular, the interaction between climate change and energy transition will make global coal, natural gas and oil prices show high and sharp fluctuations before renewable energy truly becomes the dominant energy. The high external dependence of oil and natural gas and the large fluctuation of oil and gas prices are the obvious and prominent problems in China's current energy security risks. Under the background of energy transformation and global carbon reduction, China's macro energy consumption policy has gradually formed as the country continues to move towards the dual carbon goals of “2030 and 2060” Coal control.

The Paris Agreement on Climate Change represents the general direction of the global green and low-carbon transition, and is the minimum action needed to protect the Earth's homeland. On September 22, 2020, China formally proposed at the 75th session of the United Nations General Assembly to achieve the goal of carbon peaking in 2030 and carbon neutrality in 2060, referred to as the "dual-carbon" strategic goal. The "dual-carbon" strategic goal. To realize the "dual-carbon" goal, the first step is to save energy and improve efficiency, to deeply adjust the industrial structure, to satisfy the reasonable demand for energy with scientific supply, and to integrate the current and long-term security of energy. China's dual-carbon goal is not contradictory to shale oil and gas exploration and development, which takes green and low-carbon development as an important development strategy. The construction of a land-phase shale oil net-zero emission first demonstration area clearly demonstrates the demonstration goals of clean energy use, net-zero emission, and green production. Specific implementation includes three aspects: first, carbon dioxide is injected into the formation to replenish the energy of the reservoir and increase the production of shale oil and gas wells, so that greenhouse gases can be turned into treasures; second, research on the reuse and harmless treatment of fracturing return fluid is carried out to achieve the clean and clean discharge and recycling of discharged water, which realizes the reuse of water resources as well as green production; third, drilling rigs and other construction equipment are gradually realizing the replacement of oil drive by electric drive, and electric drive has been launched to replace oil drive. Thirdly, drilling rigs and other construction equipment are gradually replacing oil drive with electric drive, and the demonstration of electric drive and natural gas drive fracturing equipment schemes and accelerated tests have been initiated, which will make the production and construction process more decarbonized in the future, and achieve the goal of energy saving and emission reduction.

The strategic significance of global distribution and development of shale oil and gas resources

At present, international energy supply and demand contradictions are prominent, energy security affects the development of national economy and social stability, countries around the world through various channels to solve their own energy problems, in which shale oil and gas resources exploration and development of the world's attention. Today's rising energy demand and huge resource pressure, the growth of oil and natural gas prices, the continuous improvement of development technology and people's dependence on oil and natural gas, making shale oil and gas has become an important field and target of oil and natural gas industrialized exploration.

Global distribution and development status of shale oil and gas resources

Global distribution and development status of shale oil resources

Although unconventional oil and gas resources such as shale oil, shale gas, and coalbed methane belong to non renewable natural resources along with traditional fossil fuels, they are widely distributed, have multiple layers, and have large reserves worldwide, making them a promising alternative energy source for conventional oil and gas development and utilization. Shale oil and gas are mainly distributed in the Asia Pacific, North America, South America, and Africa regions worldwide (Fig. 3, Fang et al. 2019). According to data from the US Energy Information Agency (EIA) and Advanced Resources International (ARI), as of the end of 2017, the total global shale oil geological resources (Risked Oil In Place) were 93.6835 billion tons, with technically recoverable resources of 61.847 billion tons, of which more than 20% were distributed in North America.

From a regional perspective, global shale oil is mainly distributed in North America and Eurasia, North America shale oil technically recoverable resources accounted for 30% of the world, followed by Eastern Europe, including Russia, technically recoverable resources accounted for 19% of the global ratio; Asia–Pacific region recoverable resources accounted for 18% of the world (Fig. 3). From the distribution of countries, shale oil resources are distributed in many regions of the world, but the distribution is not uniform, mainly in the United States, Russia, China, Argentina and other countries (Fig. 4a). The United States has the largest amount of shale oil resources, with technically recoverable resources amounting to 15.375 billion tons, and the reason for the higher proportion of shale oil resources is mainly due to the higher degree of exploration, which is much higher than that of other countries in the world. With the rise of shale oil development. The technically recoverable resources of other countries will have a significant rise. At present, shale oil and gas resources have been proved in more than 170 sets of shale formations in 104 basins among 46 countries in the world, of which China ranks third in the world (Fig. 4a, Fang et al. 2019), with technically recoverable resources of 4.393 billion tons, accounting for about 6% of the world.

At present, only North America has achieved large-scale commercial development of shale oil globally (Fig. 4b), and Canada’s shale oil production is also increasing (Fig. 4b). Other countries such as China, Russia, Argentina, etc. (Fig. 4b) are still in the early stages of shale oil development and have not yet achieved large-scale commercial development and utilization.

The United States is one of the countries with earlier research on shale oil and gas in the world. Currently, the United States has discovered abundant shale oil and gas resources, possesses world leading exploration and development technologies, and has achieved large-scale commercial development of shale oil. Shale oil development in the United States began in the Williston Basin in the 1950s, but production has always been low; Around 2005, significant breakthroughs were made in shale oil development in the United States, and around 2009, it entered a period of rapid growth. According to data from the US Energy Information Agency (EIA 2023), the total shale oil production in the United States is expected to decrease by approximately 18,000 barrels per day to 939,900 barrels per day in August 2023 (an increase of 5900 barrels per day in July) (Fig. 4b). The United States, relying on shale oil production, surpassed Saudi Arabia to become the world's largest oil producing country in 2017. Shale oil production directly transformed the United States from a net importer of oil to an exporter of oil.

Canada ranks 13th with 1.206 billion tons of technically recoverable shale oil resources, or about 2% of the world's total (Advanced resources international 2015). Due to the spillover effects of the shale oil revolution in the United States, Canada began commercial development of shale oil earlier (Liu 2018). In 2005, driven by high oil prices and a revolution in shale development technology at the time, Canada launched commercial development of shale oil in the Bakun area bordering the United States, with a daily production of 144,100 barrels. As technology matured, Canada's shale oil production reached its peak of 437,300 barrels per day by 2014. With the decline in international oil prices, the number of new wells drilled in Canada has decreased, and by 2018, shale oil production has fallen back to 344,700 barrels per day (Fig. 4b).

The Russian Ministry of Energy formulated a development plan to join the global shale revolution in 2012, and the daily shale oil production reached a peak of 119,800 barrels in 2013 (Fig. 4b). At present, large-scale commercial exploitation of shale oil in Russia has not been carried out, and only experimental exploitation has been carried out in the Barynov Formation; As of 2016, there were 146 vertical wells and 36 horizontal wells in operation in the Bazenov Abala Formation in West Siberia, with an average daily production of 79.38 barrels per day for vertical wells and 55.13 barrels per day for horizontal wells. The shale oil resources in Russia have enormous potential, and relevant institutions in Russia are optimistic about achieving commercial shale oil extraction in the future. The Russian Ministry of Natural Resources predicts that by 2030, Russia can produce 617.4 million barrels of shale oil per year (Liang et al. 2019). The Russian Academy of Sciences predicts that by 2040, the shale oil extracted from the Barrenov Formation alone can reach 1.029 billion barrels.

China is rich in shale oil resources, but the research on shale oil started relatively late. Since 2015, with the advancement of the basic research work of the shale oil national "973" project and further support from major national oil and gas projects, a consensus has gradually formed in the industry that shale oil is the most realistic oil resource replacement field in China's future, enhancing the understanding of oil companies in strengthening the strategic positioning of shale oil exploration and development, Significant progress has been made in exploring key technologies for shale oil exploration and beneficial development. In 2022, China's total shale oil and gas production reached 3.12 million tons and 24 billion cubic meters, respectively, an increase of 2.8 times and 2.2 times compared to 2018. The average daily shale oil production has reached 62,800 barrels (Fig. 4b).

Argentina's shale oil resources are rich in technically recoverable resources of 3683 million tons, ranking fourth in the world (Fig. 4a). Among them, the Neucken Basin is the most promising shale oil enrichment area in Argentina, considered the most likely basin to achieve large-scale shale oil extraction outside of North America, and has not yet undergone large-scale commercial extraction. According to data from the Argentine Ministry of Energy, in July 2018, Argentina's shale oil production was 52,900 barrels (Fig. 4b), accounting for 10.91% of the country's oil production.

Global distribution and development status of shale gas resources

Global shale gas resources are mainly distributed in North America, Central Asia and China, the Middle East and North Africa, Latin America, the former Soviet Union and other regions (Fig. 5). China, Argentina, Algeria, the United States, Canada, Mexico, Australia, and South Africa all have shale gas technology recoverable resources exceeding 300 × 1012 ft3. From a resource perspective, based on current exploration results, China's shale gas reserves rank first in the world (Fig. 5), with a resource volume of 1115.2 × 1012 ft3, followed by Argentina and Algeria, with the United States ranking fourth (Fig. 5).

Although the United States only ranks fourth in shale gas resources, it is still the United States that conducted shale gas research earlier, successfully drilling the world's first shale gas well as early as 1821. Since the 1970s, the US government has strongly supported shale gas development, effectively promoting its development. In 2000, the annual shale gas production in the United States was 122 × 108 m3; In 2005, there were over 40,000 shale gas wells in the United States (OGJ online 2010); In 2007, the annual production of the Newark East shale gas field alone reached 217 × 108 m3; In 2009, shale gas production in the United States approached 1000 × 108 m3, exceeding the annual production of conventional natural gas in China (Ambrose et al. 2008). The breakthrough in shale gas extraction technology has increased natural gas reserves in the United States by nearly 40%, therefore shale gas plays a crucial role in the United States and has become one of the important energy supplies.

Canada is another important country for developing shale gas resources, with approximately 15.6 × 1012 to 24.4 × 1012 in the western region. With a shale gas reserve of 1012 m3, shale gas has become an important alternative energy source in Canada, and commercial development of shale gas has been achieved, but it is still in its early stages. China has officially started exploring and developing shale gas resources, following the United States and Canada. However, research on shale gas reservoirs in China is relatively lacking, and shale gas exploration and development technology is not yet mature. Compared with conventional natural gas and coalbed methane, shale gas is still in its early stages. At present, Europe is gradually carrying out shale gas exploration, such as the UK, France, Germany, Austria, Poland, Hungary, and Sweden.

The strategic significance of shale oil and gas resource development and utilization

The United States is the first country in the world to achieve shale oil and gas industrialization and commercial development (BP 2019; EIA 2019), known as the "shale oil and gas revolution", which brought the United States back to its position as the world's largest oil and gas producer; Not only has it achieved energy self-sufficiency, but it has also continuously enhanced its discourse power on the global oil and gas supply side. While increasing the self-sufficiency rate of oil and gas consumption and achieving net oil and gas exports, it has reshaped the global oil and gas supply and demand and geopolitical landscape, laying the resource foundation for the United States to move towards energy hegemony. The shale revolution in the United States has brought renewed prosperity to the oil, gas, and petrochemical industries in the United States and even the world, changing the economic viability of difficult to utilize resources (off balance sheet resources), expanding the cake of available oil and gas resources, bringing about a revolution in oil and gas development concepts and engineering technologies, putting an end to the theories of oil depletion and peak value, and promoting the emergence of a "second spring" in the American oil and gas industry. At the same time, it will also pose new and severe challenges to traditional oil producing countries in the Middle East, natural gas exporting countries such as Russia, as well as liquefied natural gas (LNG) resource producing countries such as Qatar and Australia, and also bring a shock to the world's oil, gas, and petrochemical industries. The success of the shale revolution in the United States not only led to the true independence of American energy (Fang et al. 2019; Liang et al. 2019), but also led the global wave of shale oil exploration and development. Currently, Russia and Canada which Canadian Association of Petroleum Producers, have also achieved commercial development of shale oil (NEB 2011).

The mid-twentieth century will be an energy era dominated by oil and natural gas. However, with the development of the oil and natural gas industry, China's exploration and development of oil and natural gas have entered the mid-term stage. The oil and natural gas resources that are large in scale, large in reserves, high in resource abundance, easy to explore, and easy to exploit are becoming fewer and fewer. This has forced people to gradually shift the focus of exploration and development to those that were not previously valued Oil and natural gas resources with relatively poor development efficiency and high exploration and development technology requirements. Unconventional natural gas resources such as shale oil, shale gas, tight sandstone gas, and coalbed gas have become the primary resource successors.

Worldwide, shale oil and shale gas, as unconventional natural gas resources, have gradually become the main growth points of oil and natural gas production. In recent years, with the rapid development of China's petroleum and natural gas industries, shale oil and shale gas have also experienced varying degrees of development. Accurately analyzing the key factors of China's shale oil and shale gas development, accurately grasping the development path of China's shale oil and shale gas, is crucial for the orderly development and utilization of China's petroleum and natural gas, and is of great significance for the sustained and stable improvement of China's energy structure and sustainable development.

China has a wide range of basic conditions for the development of shale oil and shale gas, as well as good organic geochemical indicators of shale; The southern regions of China and the eastern shale gas producing regions of the United States (such as Appalachia) have many geological comparability, rich organic matter, high maturity, and favorable geological conditions for shale gas development, making them important areas for oil and gas exploration and development in southern China. China is a major energy consuming country, and the demand for natural gas is increasing day by day. Since the construction of the first line of the "West East Gas Pipeline", China's downstream gas infrastructure has been continuously expanding, and the people are becoming increasingly dependent on natural gas. Domestic production is unable to meet the requirements of demand growth, and in recent years, there have been multiple instances of "gas shortages". According to industry experts, the proportion of China's net natural gas imports will expand from 20% in 2010 to 30–40% from 2015 to 2020. Compared with domestic natural gas, currently imported natural gas—whether it is pipeline gas or LNG—has significantly higher prices, and the public's ability to bear gas prices is very limited. Natural gas is an important defense line for national energy security, but the serious shortage of natural gas energy in China has become a bottleneck for the sustainable development of the Chinese economy. Therefore, shale oil and shale gas are important unconventional oil and gas resource types that are highly valued and have extensive exploration significance in China.

Development and utilization potential and existing problems of shale oil and gas resources in China

Development and utilization potential of shale oil and gas resources in China

Shale oil and gas is one of the important development directions of petrochemical energy in the future. The shale revolution in the United States has been successful and has a wide impact on the world. China is also ushering in a new stage of extensive development of shale oil and gas, becoming the third country with commercial development of shale oil and gas after the United States and Canada. At present, the world's unprecedented changes have accelerated the evolution. For China, shale oil and gas are important strategic resources. Accelerating the exploration and development of shale oil and realizing the largescale and commercial development and utilization of shale oil and gas are not only the inevitable choice under China's existing oil and gas resource endowment, but also the "pillar" of energy supply. It is one of the realistic ways to ensure national energy security.

The potential of shale oil and gas resources in China is similar to that in the United States, and the reserves are large. The technology recoverable resources of shale oil are 4.393 billion tons (Fig. 4a), accounting for about 6.0% of the world. The technology recoverable resources of shale gas are 1115.2 trillion cubic feet (31.57 trillion cubic meters), accounting for 14.7% of the world's total. If these oil and gas can be mined on a large scale, there is no need to worry about the depletion of oil and gas resources for a long time to come. China's shale oil and gas resources (Zhang et al. 2022, 2023; Jin et al. 2021; Yin et al. 2022) are mainly distributed in Songliao Basin, Bohai Bay Basin, Ordos Basin, Sichuan Basin, Junggar Basin, Qaidam Basin and other large oil and gas basins, as well as Santanghu Basin, Subei Basin, Jianghan Basin, Nanxiang Basin and other small oil and gas basins (Fig. 6a). From the perspective of the geological age of shale development, it is mainly distributed in more than ten sets of strata of Permian Lucaogou Formation (P2l), Triassic Yan 'an Chang 7 member (T3yc7), the Jurassic Ziliujing Formation (J1z), the Liangshan Formation (J1l) and the Shaximiao Formation (J2s), Qingshankou Formation of Cretaceous (K1q) and the Quantou Formation (K2qn), Paleogene Funing Formation (E1f), the Xingouzui Formation (E2x) and the Kongdian group second section (E2k2), the third section of Shahejie Formation (E2s3) and the fourth section of the Shahejie Formation (E2s4), and the Neogene upper Ganchaigou Formation (N1s) and other more than 10 sets of layers (Fig. 6b). Looking back at the changes in shale oil and gas production in China in the past five years, the total oil and gas production of oil shale in 2022 reached 3.12 million tons (Fig. 7a) and 24 billion cubic meters (Fig. 7b), respectively, which were 2.8 times and 2.2 times higher than those in 2018 (Fig. 7a) and 10.9 billion cubic meters (Fig. 7b), respectively. In particular, from 2020 to 2022, 72% of China's new oil production will be shale oil, and 30% of the new natural gas production will be shale gas. In 2022, shale oil and gas will run out of the acceleration of high quality development, become the main force of stable production and production increase of crude oil and natural gas, and help China realize the leap-forward development from conventional oil and gas to unconventional oil and gas. In the future, if we can achieve technological progress, reduce costs and improve efficiency, shale oil and gas resources will become a breakthrough and new hope for China's oil and gas resources to achieve self-sufficiency.

The problems in the development and utilization of shale oil and gas resources in China

China has abundant shale oil and gas reserves, and vigorously developing shale oil and gas resources in the future will help resolve the high dependence on external energy. However, due to the late start of shale oil and gas exploration and development in China, it faces many challenges such as technology, cost, and geography. Currently, it is not possible to carry out large-scale extraction of shale oil and gas, nor can it be regarded as a major unconventional energy source that regulates the country's energy structure like the United States.

From the perspective of geological characteristics of shale oil and gas

Shale oil in the United States is mainly distributed in geologically stable foreland or cratonic basins, with marine shale oil as the main component. The rock texture is stable, and the density and viscosity of shale oil are relatively low, with good fluidity. The burial depth is almost always around 1000–2000, making it relatively shallow and easy to extract. The cost is relatively low. The shale oil in China is mainly terrestrial in nature, consisting of semi deep lacustrine to deep lacustrine sediments with a wide distribution range, relatively new age, high organic matter abundance, large thickness, deep burial, low maturity, and mainly oil generation characteristics. In addition, the organic rich shale in terrestrial has high clay mineral content, low matrix permeability, significant changes in debris content and compressibility; Therefore, large-scale effective exploration and development face significant challenges such as unclear resource scale, unclear enrichment patterns, and difficulties in predicting the distribution of available resources.

From the perspective of geographical environment in the distribution area of shale resources

China's shale resources are mainly distributed in terrain areas such as low mountains and hills, seabed, and mountains. Some of these areas have inconvenient transportation and high difficulty in mining; Some are located in densely populated areas, resulting in a reduction in effective mining area and higher mining costs; Also located in the northwest region, the infrastructure is backward, which limits the development of shale oil and gas. From the perspective of the Songliao Basin, the area is facing numerous geological and scientific problems, and large-scale mining has not yet been achieved.

From the perspective of mining technology

Shale gas and shale oil have the characteristics of tight reservoirs and poor permeability. They need to be extracted from the rock layers through horizontal well drilling, hydraulic fracturing, and thermal processing (distillation). This is a process that requires very high technical content. The shale oil reservoirs in China are mainly composed of organic rich shale in terrestrial lake basins, which require high enrichment conditions. Key technologies for shale oil and gas development in China, such as horizontal well staged fracturing, mainly introduce foreign technologies, tools, materials, and supporting equipment. However, it should be noted that China's shale oil resources are mainly terrestrial, which means that fracturing technology in North America is not fully applicable.. Although breakthroughs have been made in some aspects in recent years, they are still in the field testing stage and have not yet formed effective and mature key technologies, which have constrained the rapid development of shale oil and gas. For example, what is the optimal fracturing program? What is the optimal wellbore structure? What is the optimal completion level? What is the optimal length for primary well completion? How many clusters of perforations should each level have? What is the optimal distance between adjacent shower hole segments? What is the best fracturing fluid? How much proppant is best injected into each stage? How much liquid is best injected into each stage?

In terms of development mode, mature foreign technologies such as shale in-situ heating and upgrading technology, nano zinc dioxide oil recovery technology, nitrogen oil recovery technology, etc. are borrowed. The low-cost industrial extraction of shale oil will have a milestone impact on the petroleum industry.

From the perspective of mining cost

Shale oil and shale gas are two types of energy that require higher extraction technology, thus increasing the cost of extraction. The high difficulty and cost require oil prices to remain above $30 per barrel in order for shale oil to reach profit points and avoid losses. The shale oil and gas industry in the United States relies on improving hydraulic fracturing, optimizing completion design, and using multi well platform drilling to improve drilling efficiency and single well production, resulting in a significant reduction in shale oil and gas extraction costs. Currently, China's resource distribution is complex, technology is backward, and extraction costs are high. The extraction cost of shale oil and shale gas is between 50 and 80 US dollars per barrel, while the extraction cost in the United States is between 30 and 50 US dollars per barrel, This indicates that our extraction costs are higher than foreign prices, and the abundant shale oil and gas reserves underground are currently difficult to convert into high economic resource advantages. From the development of shale gas in China, independently developed fracturing trucks and bridge plugs have been successfully applied in Fuling, greatly reducing production costs. For example, the completion cost of shale gas in Fuling, Chongqing has been reduced from hundreds of millions of yuan in the early stage to 80 million to 60 million yuan, and Sinopec's goal should be below 50 million yuan. However, the complex geological structures in other areas, as well as the drilling and completion of terrestrial shale gas, have not yet fully broken through, and the production of continental shale gas is still relatively low.

From the perspective of green environmental protection

Due to the fact that shale oil and shale gas resources are clean energy, the mutual constraints between development and utilization, as well as environmental and resource protection, will put forward higher requirements for environmental protection and ecological governance. Against the background of China's "dual carbon" goals (achieving carbon peak by 2030 and carbon neutrality by 2060), shale oil and gas exploration and development will regard green and low-carbon development as an important development strategy. In recent years, the development and utilization of shale oil and shale gas have led to an increasing number of regional ecological problems during the extraction process, directly affecting the development of local resources such as water, soil, and ecological geological environment. At present, China is in the trial stage of developing shale oil and shale gas, with an incomplete regulatory and standard system, a lack of strong regulatory mechanisms, and a lack of clear environmental access systems, which pose risks to the local ecological environment. It is necessary to propose solutions during the extraction process to ultimately achieve green and sustainable development of shale gas.

From the perspective of policy support

Compared with the development and utilization of conventional oil and gas resources, the long-term and stable policy support and financial subsidies for the development and utilization of unconventional oil and gas resources in China, such as shale oil and gas, are not enough. Given the broad development and utilization prospects of shale oil and gas resources, the country should introduce relevant supporting policies to encourage and support shale oil development, paving the way for the "dual wheel drive" of the scale and efficiency of the shale oil and gas resource industry to promote the healthy and green development of the shale oil industry.

The optimal development model and economic evaluation of shale oil and gas resources

The connotation of optimal development and economic evaluation of shale oil and gas resources

Shale oil and gas production capacity construction is a booster to support the stable growth of oil and gas production in the future. It is a key measure and important guarantee to realize the sustainable development of oil and gas field enterprises. It seeks the optimal development path of shale oil and gas. Petroleum enterprises organize production according to the principle of profit maximization, and strive to make every ton of oil and gas produced effective.

The connotation of optimal development of shale oil and gas resources is that the optimal exploitation of shale oil and gas resources is greatly influenced by geological understanding (theory), exploration and development degree, mining technology, ecological environment, fluctuation of resource demand and economic environment. Its connotation can be interpreted as taking the maximization of proven reserves, recovery rate and the optimal comprehensive benefit of exploration and development of reservoir life cycle as the goal. Under the guidance of "double carbon" goal and environmental protection, the comprehensive reservoir information and data are used to guide the optimization of accurate well layout, efficient drilling and fracturing design, so as to realize the coordination of geological science, reservoir research, drilling and completion engineering and ecological environment. It greatly improves the drilling efficiency and single well production of oil wells, reduces the comprehensive cost of shale oil and gas, and greatly improves the intensive and efficient development of shale oil and gas and long-term economic benefits.

The connotation of economic evaluation of shale oil and gas resources is to evaluate the economic value of shale oil and gas resources and the economic benefits of development and utilization according to the conditions of shale oil and gas resources, the level of exploration and development technology, oil and gas prices, the economic environment, the government's oil policy and the ecological environment of the resource area (Li et al. 2018a, b). At the national level, shale oil and gas resources refer to the resources that can be proved under the existing technical conditions, and the resource evaluation results basically do not consider the economy; at the level of oil companies, shale oil and gas resources refer to the resources that can be proved under the existing technical and economic conditions. Economic interests must be considered. It is necessary to combine the current status of domestic shale oil and gas exploration and development and the existing economic and efficient development technology to carry out economic analysis of shale oil and gas resources. Eliminate some shale oil and gas resources that cannot be used or have no economic value by current technology. The results of the assessment are the basis for reserve trading or block transfer pricing, and also an important basis for national oil and gas resource management.

The optimal development model of shale oil and gas resources

Small bin volume method is proposed to evaluate pure shale oil and gas resour-ces

Modica proposed a PhiK model for calculating the porosity of shale organic matter, and then evaluated the shale oil resources according to the porosity (Modica 2012). Chen proposed an improved method for calculating the porosity of shale organic matter, and evaluated the shale oil resources according to the porosity volume (Chen 2016). Yang evaluated the resource potential of shale oil in Chang 7 Member of Yanchang Formation in Ansai area of Ordos Basin by analyzing shale porosity and using volumetric method (Yang et al. 2019). Chen proposed a method to evaluate the resource potential and mobility of shale oil (Chen et al. 2019). Taking the Upper Devonian Duvernay Formation shale in the Western Canada Basin as an example, the in-situ amount and movable oil amount of shale oil were evaluated. Lie proposed a method for calculating the total oil content of shale in situ, analyzed the characteristics of shale movable oil in the Shahejie Formation of the Bohai Bay Basin, and evaluated the potential of shale oil resources (Li et al. 2018a, b, 2019a).

In view of the strong heterogeneity of continental shale in China, combined with the current situation of shale oil exploration, a small bin volume method (oil content method) is proposed to evaluate pure shale oil resources. It is expected to provide reference for resource evaluation, exploration planning and potential economic benefits of continental shale oil in China.

In order to reduce the influence of heterogeneity, the evaluation method of pure shale oil resources adopts the small panel volume method, and the calculation formula is:

In the formula:\(Q_{Shale}\)-pure shale oil resources, 108 t; Si-the area of the ith small faceted shale, km2; Hi-the thickness of the shale in the ith facet, m; \(N_i\)-the movable oil content of shale in the ith small facet, mg/g; \(\rho_{rock}\)-Shale density, t/m3.

At present, there are still great differences in the calculation of shale movable oil content. Jarvie proposed the judgment method of S1/TOC, and believed that S1/TOC = 100 mg/g is the threshold of movable oil (Jarvie 2012). Michael et al. believed that almost all pyrolysis S1 is movable oil (Michael et al. 2013). Many scholars confirmed that S1 was released before 300 °C by improving the test method of rock pyrolysis, while the movable hydrocarbon was released before 200 °C (Sarmiento 2019; Li et al. 2019; Li et al. 2020; Guo et al. 2020; Jiang et al. 2016). In this paper, the S1 of normal pyrolysis (300 °C) is regarded as movable oil, and the sum of S1 and evaporation hydrocarbon (light hydrocarbon) loss is the original S1, that is, the calculation formula of shale movable oil content of the ith small facet can be expressed as follows:

In the formula: S1i-the free hydrocarbon content of the normal pyrolysis of the i small faceted shale, mg/g;\(c\)-Light hydrocarbon recovery coefficient (> 1).

The accurate evaluation of shale oil resources lays a resource foundation for the optimal development of shale oil and gas resources.

Construction of geological-geophysical-engineering integrated development technology model

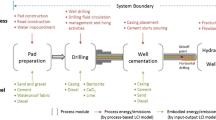

The formation conditions of continental shale oil in China are different from those of conventional reservoirs, so it is generally not necessary to evaluate the trap and transport conditions. The formation conditions of continental shale oil are usually evaluated according to the distribution characteristics of shale reservoir, hydrocarbon generation conditions, storage conditions, preservation conditions, brittle mineral content, fracture development degree, oil content and so on (Fig. 8a).

The comprehensive geological evaluation of the rich and high-yield "sweet spot" of continental shale oil in China is an important prerequisite for its effective exploration and development. In recent years of shale oil geological research and exploration practice, a series of geological comprehensive evaluation techniques for continental shale oil in China has been initially formed. It mainly includes 8 key technologies, such as geological multiparameter comprehensive evaluation, petrological analysis, well logging reservoir evaluation, logging reservoir evaluation, seismic reservoir prediction, resource evaluation, favorable target optimization evaluation, and horizontal well optimization design (Fig. 8b).

If there is no guidance of geological-geophysical-engineering integration method, shale oil and gas resources cannot achieve optimal development, and the single well production of shale oil and gas will be very low or the production will decline rapidly, even no production. Geological-geophysical-engineering integration technology is to use drilling, logging, geophysical exploration and production data for shale oil and gas reservoir evaluation and engineering design. Its main characteristics are as follows: (1) Combining reservoir research with engineering design to carry out integrated engineering design and exploration and development, so as to improve single well production, reduce well construction cost, shorten well construction period and speed up exploration and development; (2) Combining the "post" evaluation with the "pre" design, comprehensively evaluate the production data of existing wells, sum up experience, improve the design of new wells, and continuously optimize the development plan of oil and gas reservoirs; (3) Combining the analysis of key wells with the comprehensive study of blocks, that is, the combination of points and surfaces, and the optimization of engineering design and overall deployment from local to global. Schlumberger designed the integrated workflow of geophysical exploration-geology engineering (Fig. 8c, Pankaj et al. 2018). The selection of unconventional high-quality reservoirs, well location deployment, fracturing design and production optimization have achieved seamless connection. The key steps include the establishment of reservoir geological model, mechanical model considering geomechanics and reservoir characteristics, fracturing simulation, micro-seismic monitoring data correction fracture model, reservoir grid model and production simulation, which improves the overall development efficiency of shale oil blocks.

On the basis of fully understanding the geological development characteristics of continental shale oil in China, this paper focuses on the innovation of oil and gas differential enrichment mechanism, geological-geophysical-engineering integration, application of big data and artificial intelligence technology, and enhanced oil recovery technology in different types of continental shale strata, and forms the evaluation methods and technologies of continental shale oil development, including the understanding of enrichment law, litho-facies evaluation, reservoir characterization, mobility evaluation, compressibility evaluation, productivity evaluation and integrated “sweet spot” analysis technology of geological modeling and numerical simulation, so as to realize the optimal development and scale production of continental shale oil and gas resources in China.

Optimization model of shale oil and gas boundary productivity calculation

Oil and gas production capacity is the production factors such as capital, labor, management and technology invested by oil companies. The amount of oil and natural gas produced is divided into boundary capacity and actual capacity. Oil and gas boundary capacity, also known as potential capacity or full employment capacity, refers to the maximum output that oil companies can obtain by investing in production factors (Liu 2022). The actual production capacity of oil and gas refers to the actual output of oil companies invested in production factors. Usually, the actual capacity is less than the boundary capacity. For example, the measured boundary productivity of shale oil and gas in the target block is taken as the estimated value of the actual productivity, the deviation between the actual productivity and the potential productivity of shale oil and gas is measured, and the variation law of shale oil and gas productivity is analyzed to analyze the future growth potential of shale oil and gas in the target block.

There are many methods to calculate the boundary capacity (Liu 2022), such as production function method, statistical analysis method, peak method and cost function method. In this paper, the Cobb–Douglas production function model proposed by American mathematician Cobb and economist Douglas, which is simple and easy to calculate, is given to calculate the boundary productivity of shale oil and gas. In the exploration and development of shale oil and gas resources, it is difficult to distinguish and strip the labor and capital used in oil and gas fields, oil fields and gas fields. Therefore, shale oil and shale gas are treated with oil equivalent units to synthesize shale oil and gas productivity indicators, and boundary productivity calculation and comparison are carried out. Firstly, the average production function and the maximum residual distance are estimated by the least square method, and the boundary capacity production function is obtained. The basic form of shale oil and gas production function is:

In the formula: Q-shale oil and gas production; a-shale oil and gas development technology level; K-the amount of capital invested in shale oil and gas development; L-the amount of labor invested in shale oil and gas development; α and β represent the capacity contribution rate of K and L respectively, which are determined by economic statistics. \(e^{ - u}\) represents the inefficiency of production. The logarithm of both sides of Eq. (3) is taken to obtain Eq. (4):

According to the definition of boundary capacity, u = 0, the boundary \(Y^*\) production function is:

Let lna = δ, E (u) = ε (residual), then (4) is converted to:

Since E (u-ε) = 0, the average production function of oil and gas can be obtained by using the OLS (ordinary least squares) pair (6):

The boundary capacity fitted by the boundary production function is higher than the actual capacity, and the residual ε formula is:

Substituting the residual \(\hat{\varepsilon }\) derived from Eq. (6) into Eq. (5), the δ is obtained. Therefore, the boundary capacity function is:

Data selection and optimal model construction: In view of the availability of data, for example, the comprehensive productivity, capital and labor data of shale oil and gas since the drilling of shale oil and gas in a basin can be selected. Suppose that Q (t) is only related to K (t) and L (t):

The fitting error between Q (t) and K (t) + L (t) data is calculated by Matlab, and the model is solved by the number of fitting error. The boundary productivity of shale oil and gas in the target block is obtained, and the productivity utilization rate is obtained by calculating the quotient of boundary productivity and actual productivity.

Basic constraint model for optimal development of shale oil and gas resources

The shale oil and gas exploration and development activities of oil companies are aimed at maximizing profits under the protection of national energy security. Under the given shale oil and gas production, the minimum cost of development and utilization is pursued. Shale oil and gas resources have potential economic value. Only by exploring and developing them under appropriate technical and economic conditions can their economic value be realized. The exploration and development of shale oil and gas resources is a complex input–output process, and the technical and economic conditions of exploration and development resources are the state of various factors that affect the economy of this process (Liu 2022). The development of shale oil and gas resources in a target block needs to comprehensively consider the first-level guarantee indicators such as science and technology (A), capital (K), talent (L), reserves (S) and ecological environment (E) listed (Table 1), as well as more than 10 s-level indicators and several third-level indicators.

By introducing the above five first-level indicators or variables into Eq. (3), the formula becomes Eq. (11):

The constraint condition (1) describes that there are enough technically proven recoverable reserves for shale oil and gas in the target area, and there are continuous new discoveries to ensure the sustainability of mining; constraint condition (2) describes the effective protection of the ecological environment by taking various measures in the exploration and development of shale oil and gas in the target area. When the above conditions are met, oil companies organize development and production according to the principle of profit maximization:

In Eqs. (12) and (13), π is the profit, \(T_t\) is the shale oil and gas resource tax in period t, \(TC_t\) is the total cost in period t, and \(P_t\) is the oil and gas price in period t. The value range of t is determined by the exploration and development process and planning of the target block, such as from 2023 to 20,230.

In the formula: \(H_t \left( {Q_t } \right)\) is the minimum cost of oil and gas exploitation in the t period, and r is the interest rate.

In the formula: \(C_{At}\) represents the cost of science and technology in the t period, including investment in basic geological theory research of shale oil and gas, investment in technology research and development, and investment in horizontal well fracturing engineering equipment. \(FC_t\) is the conventional fixed cost in period t, \(C_t = r_t K_t (Q_t )\), K is obtained by the established production cost minimization equation. \(VC_t\) is the variable cost of t period, \(VC_t = \omega_t L_t (Q_t )\), K is obtained by the established production cost minimization equation. \(C_{Et}\) is the ecological environment protection cost of the target block in the t period, \(C_{Et}\) = mud discharge tax + sewage discharge tax + carbon tax + other ecological environment protection compensatory input. \(C_{\theta t}\) is the exploration cost of shale oil and gas in period t.

Economic evaluation model of shale oil and gas resources

Calculation of economically recoverable shale oil reserves

Taking into account the positive logic of "how much technically recoverable resources", "how much economically recoverable resources", and "how much remaining resources", shale oil and gas resources are divided into technically recoverable reserves, economically recoverable reserves, and remaining economically recoverable reserves based on the dual factors of "technically recoverable" and "economically recoverable" (Hu et al. 2022; National Land and Resources Standardization Technology Committee 2020). Evaluate the development and utilization benefits of available economically recoverable reserves and remaining economically recoverable reserves.

Economic recoverable reserves refer to the economically valuable reserves that can be extracted under certain conditions. The economic recoverable reserves of an oilfield reflect the degree of reserve utilization, analyze the economic effects of oilfield development, and study the basis for adjusting and tapping potential measures. Economic recoverable reserves are an important basis for formulating oilfield development plans, scientifically deploying oil and gas production, and making comprehensive adjustments. The general steps for evaluating economically recoverable reserves are as follows:

-

1.

Determine the reservoir type, development method, and current development stage of the block.

-

2.

Predict development indicators such as oil production, number of wells opened, and economic parameters such as investment and cost. There are roughly three types of decreasing patterns in a block: there are obvious decreasing patterns in the production process of the block, and Arps decreasing is directly used for production prediction; Due to thein vestment of new wells, there is no obvious decline pattern in the block, and it is necessary to refer to the decline pattern of old wells to determine the decline rate; Some newly developed units, which have only been in development for a few years, exhibit a decreasing trend similar to adjacent similar blocks due to their increasing production.

-

3.

Calculate economic evaluation indicators such as economic recoverable reserves and economic exploitation period.

-

4.

Reasonably analyze the calculation results.

The calculation method for economically recoverable reserves is to first use the decline method to calculate the annual production forecast during the decline stage of the oilfield, and then based on the cash flow situation, intercept the maximum cumulative net cash flow to determine the economically recoverable reserves and economic recovery rate.

Decline method

Based on the variation curve of monthly oil production (104t) over time in a certain shale oil and gas field, such as Qingcheng Shale Oil Field, calculate the monthly production decline rate. Then, use this decline rate to predict the later production decline law, and determine the economically recoverable reserves based on the economic limit production. If December 2022 is the starting point for the decline of shale oil production in the Qingcheng Shale Oil Field, and when calculating the economically recoverable reserves, this time is the starting point for selecting the decline law.

Using the cash flow method to intercept the maximum cumulative net cash flow for cumulative oil recovery