Abstract

Gas lift technology increases oil production rate by injection of compressed gas into the lower section of tubing through the casing–tubing annulus and an orifice installed on the tubing string. To achieve optimum recovery, operation must begin at the optimum time, in addition to inject optimum gas rate. In this work, we develop a new approach to consider the time factor in the gas lift optimization process. A piecewise cubic Hermite function is used to model the gas lift performance. The optimization procedure for gas allocation to several wells is achieved using the Genetic algorithm approach. The developed model was used to study the effect of gas lift initiation time on the reservoir life and net present value. Our calculations showed that the initiation time has a noticeable influence on the optimization procedure and should be considered a major factor for gas allocation problems in real fields.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The most similar artificial lift method to the natural flow process is gas lift. In a well under the gas lift, the injected free gas, which is lighter than the displaced oil, reduces the density of the flowing fluid leading to an increase in the drawdown pressure and oil production.

If a sufficient amount of gas is available, gas is injected to all wells at its optimum value to achieve maximum oil production. However, because of the limited available gas in most circumstances, it is impossible to reach the maximum oil production for each well. Therefore, we have to distribute the available gas between wells. This approach is called gas allocation optimization which increases the oil production and decreases the gas compression cost. Nishikiori et al. (1989, 1995), Buitrago et al. (1996), Alarcon et al. (2002), and Ray and Sarker (2007) proposed different methods for solving this problem. The optimization approaches are based on the gas lift performance curve (GLPC) for all of the wells in the field

Gutierrez et al. (2007) went a step further and optimized gas lift operation in an integrated model. They considered the process and injection model in addition to the reservoir and well gathering system.

For all of the mentioned approaches, gas lift operation starts at a specific time for all wells. The initiation time of the gas lift operation was never considered a constraint. In this paper, we present a new approach to generate an appropriate model to couple time effect, GLPC, and economic considerations to optimize the gas allocation for a system of wells and answer the question regarding to the best time for gas lift initiation.

Mathematical model

The liquid production rate for each well during gas lift is a nonlinear function of the gas injection rate, calculated as follows:

However, there is no explicit function for determining the production level for all wells. Thus, we have to collect production data for a number of discrete points of oil production at different injection gas rate values to generate an approximate function. Recently, the use of piecewise linear function (Kosmidis et al. 2005; Ray and Sarker 2007) or quadratic function (Camponogara and Nakashima 2006a, b) has become frequent. However, these approaches overestimate or underestimate the correct value of the production rate. Therefore, to find a more accurate interpolator, we tested other functions like polynomial, cubic Spline function and piecewise cubic Hermite function. As shown in Fig. 1, our calculations illustrated that polynomial and cubic Spline functions have the tendency to vibrate around the available points. This tendency is a problem, even if the point interval in the x axis is great. To reduce this problem, the piecewise cubic Hermite interpolation is presented in this article and, as shown in Fig. 1, it is the best estimator to enable continuity in GLPC.

Hermite interpolation is an extension of the basic polynomial interpolation that not only matches discrete information at a set of points, but also matches the rate of change at those points.

If S is a discrete data set of distinct points defined as follows:

then there exists a unique polynomial of degree 2n + 1 or less that interpolates the data by matching the position of each point and the slope at each point; that is,

is called the piecewise Hermite, interpolating to the data set S.

We used piecewise cubic Hermite interpolation function, in other words, we considered n = 1.

The total oil production from a network of n wells, which is the sum of each well production, is a function of gas injection rate to the wells and can be shown as follows:

where q0 is the oil production rate (STB/d) and qg is the gas injection rate (MSCF/d). Hence, the goal of the gas allocation optimization is to maximize the oil production. This problem can be written as:

By the following constraints:

It is worth mentioning that some of the wells are naturally producing and some are almost dead at the initiation of the gas lift. For the dead wells, generally, a minimum amount of the injected gas is needed to restart the flow which is equal to qgmin in our model. Usually, if the gas injection exceeds a maximum level, the oil production declines due to the frictional pressure loss in the tubing. We consider this limit an upper limit for the gas allocated to each well during the optimization.

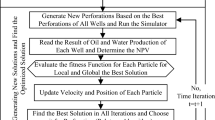

Optimizer machine

The response to the gas injection is different for wells in a reservoir. Some of the wells noticeably respond to this operation which is equal to a significant improvement in the production rate. On the other hand, there are also some wells which do not respond very well to the gas injection. To allocate most of the available gas to wells in the first category, a pre-processing procedure was applied. Hence, for each well, slope variation of the GLPC was analyzed. If there is no significant slope change in the GLPC due to the gas injection, the well does not respond effectively and is considered a “bad well”. For better allocation of the available gas, we attempted to not distribute gas to these “bad” wells.

After the initial screening of the wells, a genetic algorithm approach was applied to optimize the gas allocation problem. In any genetic algorithm approach, two functions are initially established which are “objective function” and “fitness function”. We consider our objective function as the total oil production and the fitness function as the revenue of the gas lift operation as:

Different models were completed to achieve the best parameters for the algorithm. In the optimized approach, the population size was selected to be equal to 100 and the generation amount to be 40.

To avoid fast convergence, we decided to use crossover and mutation rate dynamically as

The roulette wheel is regularly used as a reproduction operator in the genetic algorithm problems; however, because of its randomness characteristic, this sometimes does not work. Hence, in this study, we utilized “tournament selection” as the reproduction operator.

In the next step, the crossover operator must be selected. To achieve better genetic exchange between two parent chromosomes, we decided to use two operators but not at a same time. This means that we applied “un-uniform crossover” until the specific generation and after that we used the crossover according to the fitness operator for faster coverage and more accurate results. The “uniform mutation” is used as a mutation operator to avoid overly fast convergence problems.

To obtain more produced oil, we had to apply the maximum available gas amount (ideally the entire amount of gas). To overcome this constraint, we used a novel method instead of ordinary methods like penalty method, etc. Thus, we generated and added another operator to this algorithm. This operator was applied after the initial population generation and each time the crossover and the mutation operators were applied to populations. Through this operator, which we called the correction operator, it is aimed to have all of the gas to allocate among wells not more and not less (exact same as the gas limit). The correction operator calculates the summation of these values at all chromosomes (possible answer) and according to the difference of the sum and the gas limit, the difference is added to or subtracted from each gen (gas rate in each well) according to its ratio in the summation.

Model results

Our proposed model can detect weak wells to allocate more gas to other wells. Also, besides the correction operator, we utilized dynamic rate and operators in the genetic algorithm to empower this heuristic search.

There are two typical fields in the literature that we used to verify our approach. These two problems were first proposed by Buitrago et al. (1996). For convenience, we will call their method the Buitrago et al. model. The first case was a small study with six wells under the gas lift operation. Then, a more complicated problem was solved and optimized. Both systems are also compared to the work of Ray and Sarker (2007), which used another genetic algorithm approach to optimize the gas allocation problem. Similarly, for convenience we will call their method the Ray et al. model. In our examples, we assume oil and gas prices to be 87$/STB and 3.5$/MSCF, respectively.

Case 1: six-well problem

The problem is to maximize the total oil produced from six wells using gas lift. Figure 2 shows the total oil production computed by our gas allocation approach and that of other models. The total amount of available gas was assumed to be equal to 4,600 MSCF.

Under the natural flow, this field could produce up to 1,009.4 bbl/d of oil. Gas lift operation under our proposed injection rate could increase the daily oil rate by around 263.98 %. Also, profits of 0.28 and 1.25 % in production rate are gained compared to the models reported by Ray et al. and Buitrago et al., respectively, illustrating development of the optimization procedure. The gas rate to be injected into each of the six wells and their corresponding amount of oil produced is mentioned in Table 1.

Case 2: fifty-six-well problem

To examine the quality of our model for larger problems, we studied the gas allocation to a large field with 56 wells. Figure 3 shows our results for oil production compared to other available models, indicating a noticeable improvement in the production. In this problem, the available gas was 22,500 (MSCF) which was distributed among 56 wells, as shown in Table 2. The production rate for this field was 13,202 bbl/d under the natural flow conditions. By applying the gas lift operation under our proposed conditions, the production rate increase by 69.88 %.

Profits of 1.79 and 2.93 % in the total production rate were achieved compared to the Ray et al. and Buitrago et al. models, respectively. Hence, our model showed better performance in the large field optimization.

Time optimization

To this point, we had prepared an optimizer model, which was able to optimize a gas allocation problem properly in the gas lift operation. As mentioned, the main objective of this paper was to consider the initiation time of the gas lift operation in the optimized procedure. Hence, we assumed an oil reservoir with five vertical wells, each of which had a specific well head pressure, MD, and perforation interval. Different initiation times were considered for the wells and the GLPC for each case was modeled. The gas allocation problem was optimized by our model to achieve the highest cumulative oil production for the system for each initiation time. We assumed that 3,400 Mscf gas was available on each day.

To evaluate an E&P project properly, we had to consider economical viewpoints. Discounting is a method used to quantify time effects, as it is economically attractive to receive payments as early as possible, i.e., until they have been received they cannot be used by the receiver to make a return on their investment and therefore gradually lose value.

The annual cash flow F k in year k can be expressed as

where R is the revenues, E is the expenses, p0 is the oil price, N is the annual production, O is the OPEX, C is the CAPEX, rR is the royalty rate, and TR is the tax rate; also, Ibt is the taxable income (or income before tax) defined as:

where D is the depreciation function and K the number of years over which the CAPEX can be depreciated. In this article, we used straight line depreciation, in which the CAPEX was divided into equal parts over a period of K years.

The value of S to be paid or received in year n should therefore be reduced to a discounted value Sdisc as follows:

where S is the sum of money paid or received in year n in $, Rdisc is the discount rate in % per year, and n is the number of years since the investment.

The discounted cumulative cash surplus of a project is often referred to as the net present value (NPV) at a particular discount rate.

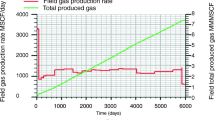

Figure 4 shows the typical production rate difference between natural flow and the gas lifted operation in our field. In this specific case, the production rate and corresponding NPV calculated until year 2 considering the well under natural flow, and from this point until the fifth year considering the well, are subject to the gas lift operation.

Table 3 expresses the values selected for the necessary parameters in Eqs. 11–13. The economic performance of the project can be calculated for different initiation times of the gas lift, as shown in Fig. 5.

Each curve in this figure showed the oil production NPV at the first four and half years of the production for different discount rates. For example, for a discount rate of 15 %, which is a rough estimation of the usual discount rate in the oil and gas industries, if gas lift operation starts in month 6, the NPV is around $278 million. However, by delaying the operation for another 6 months, the NPV of the field increases to around $290 million. Also, it is noticeable that even delaying the start of the gas lift operation to the middle of the third year does not reduce the benefit of the project compared to the case in which the injection is started from the first year. Hence, this approach for modeling shows that it is critical to define the best time for initiation of the gas lift operation and delaying it may lead to additional benefits.

As indicated in Fig. 5, for any of the selected discount rates, the end of the first year is the optimum point for injection initiation. In other words, to have the best recovery factor for the current field, it is best to allow the field to flow naturally for 1 year before initiation of the gas lift operation.

Conclusions

In this paper, a new approach was presented regarding the effect of the gas lift initiation time on the optimization process. A procedure was developed to select the best initiation time for the gas lift to reach to the highest profit for a reservoir which was producing naturally and was under depletion. The proposed optimizer algorithm was compared with previous models and its accuracy has been confirmed. By integrating the proposed algorithm with the economic model and calculating the related NPV of different initiation times, the optimum time for starting the gas lift operation was found. We applied our approach for a large field under gas lift and, for usual oil and gas discount rates, the benefit of $12 million was achieved by delaying the operation by only 6 months.

References

Alarcon G, Torres C, Gomez L (2002) Global optimization of gas allocation to a group of wells in artificial lift using nonlinear constrained programming. J Energy Resour Technol 124:262–268

Buitrago S, Rodriguez E, Espin D (1996) Global optimization techniques in gas allocation for continuous flow gas lift systems. SPE gas technology conference, Calgary, Canada, pp 375–383, SPE #35616

Camponogara E, Nakashima P (2006a) Solving a gas-lift production of oil wells: piecewise linear formulation and computational analysis. IIE Trans 38:173–182

Camponogara E, Nakashima P (2006b) Optimizing gas lift optimization problem using dynamic programming. Eur J Oper Res 174:1220–1246

Gutierrez F, Hallquist A, Shippen M, Rashid K (2007) New approach to gas lift optimization using an integrated asset model. IPTC, Dubai, U.A.E., IPTC#11594

Kosmidis V, Perkins J, Pistikopoulos E (2005) A mixed integer optimization formulation for the well scheduling problem on petroleum fields. Comput Chem Eng 29:1523–1541

Nishikiori N, Redner R A, Doty D R, Schmidt Z (1989) An improved method for gas lift allocation optimization. In: Proceedings of SPE annual technical conference and exhibition, San Antonio, Texas, SPE #19711

Nishikiori N, Redner RA, Doty DR, Schmidt Z (1995) An improved method for gas lift allocation optimization. ASME J Energy Resour Technol 117:87–92

Ray T, Sarker R (2007) Genetic algorithm for solving a gas lift optimization problem. J Pet Sci Eng 59:84–96

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Ghassemzadeh, S., Pourafshary, P. Development of an intelligent economic model to optimize the initiation time of gas lift operation. J Petrol Explor Prod Technol 5, 315–320 (2015). https://doi.org/10.1007/s13202-014-0140-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13202-014-0140-z