Abstract

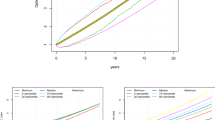

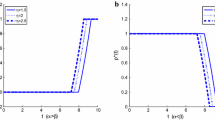

In this paper, we study a time consistent solution for a defined contribution pension plan under a mean-variance criterion with regime switching in a jump-diffusion setup, during the accumulation phase. We consider a market consisting of a risk-free asset and a geometric jump-diffusion risky asset process. Our solution allows the fund manager to incorporate a clause which allows for the distribution of a member’s premiums to his surviving dependents, should the member die before retirement. Applying the extended Hamilton-Jacobi-Bellman (HJB) equation, we derive the explicit time consistent equilibrium strategy and the value function. We then provide some numerical simulations to illustrate our results.

Similar content being viewed by others

References

Antolin, P., Pugh, C., Stewart, F.: Forms of benefit payment at retirement. OECD Working Papers on Insurance and Private Pensions, No. 26, OECD publishing, \(\copyright\) OECD. https://doi.org/10.1787/238013082545 (2008)

Azevedo, N., Pinheiro, D., Weber, G.W.: Dynamic programming for a Markov-switching jump-diffusion. J. Comput. Appl. Math. 267, 1–19 (2014)

Battocchio, P., Menoncin, F.: Optimal pension management in a stochastic framework. Insur. Math. Econ. 34(1), 79–95 (2004)

Bian, L., Li, Z., Yao, H.: Pre-commitment and equilibrium investment strategies for the DC pension plan with regime switching and a return of premiums clause. Insur. Math. Econ 81, 78–94 (2018)

Björk, T., Murgoci, A.: A general theory of Markovian time inconsistent Stochastic control problems. (2010) Available at SSRN: https://ssrn.com/abstract=1694759 or http://dx.doi.org/10.2139/ssrn.1694759

Björk, T., Murgoci, A., Zhou, X.Y.: Mean-variance portfolio optimization with state-dependent risk aversion. Math. Finance Int. J. Math. Stat. Financial Econ. 24(1), 1–24 (2014)

Chen, A., Delong, L.: Optimal investment for a defined-contribution pension scheme under a regime switching model. ASTIN Bull.: J. IAA 45(2), 397–419 (2015)

Chen, Z., Li, Z., Zeng, Y., Sun, J.: Asset allocation under loss aversion and minimum performance constraint in a DC pension plan with inflation risk. Insur. Math. Econ. 75, 137–150 (2017)

Chen, K., Chiu, M.C., Wong, H.Y.: Time-consistent mean-variance pairs-trading under regime-switching cointegration. SIAM J. Financial Math. 10(2), 632–665 (2019)

Chen, P., Yang, H., Yin, G.: Markowitzs mean-variance asset-liability management with regime switching: a continuous-time model. Insur. Math. Econ. 43(3), 456–465 (2008)

Czichowsky, C.: Time-consistent mean-variance portfolio selection in discrete and continuous time. Finance Stochastics 17(2), 227–271 (2013)

Devolder, P., Janssen, J., Manca, R.: Stochastic methods for pension funds. John Wiley & Sons, Hoboken (2013)

Di Giacinto, M., Federico, S., Gozzi, F.: Pension funds with a minimum guarantee: a stochastic control approach. Finance Stochastics 15(2), 297–342 (2011)

Emms, P.: Lifetime investment and consumption using a defined-contribution pension scheme. J. Econ. Dyn. Control 36(9), 1303–1321 (2012)

Federico, S.: A pension fund in the accumulation phase: a stochastic control approach. Banach Cent. Publ. Adv. Math. Finance 83, 61–83 (2008)

Guambe, C., Kufakunesu, R., Van Zyl, G., Beyers, C.: Optimal asset allocation for a DC plan with partial information under inflation and mortality risks. Commun. Stat. Theory Methods, 1–14 (2019)

He, L., Liang, Z.: Optimal investment strategy for the DC plan with the return of premiums clauses in a mean-variance framework. Insur. Math. Econ. 53(3), 643–649 (2013)

Hu, Y., Jin, H., Zhou, X.Y.: Time-inconsistent stochastic linear—quadratic control. SIAM J. Control Optim. 50(3), 1548–1572 (2012)

Hu, Y., Jin, H., Zhou, X.Y.: Time-inconsistent stochastic linear—quadratic control: characterization and uniqueness of equilibrium. SIAM J. Control Optim. 55(2), 1261–1279 (2017)

Li, D., Rong, X., Zhao, H.: Time-consistent investment strategy for DC pension plan with stochastic salary under CEV model. J. Syst. Sci. Complex. 29(2), 428–454 (2016)

Li, G., Chen, Z.P., Liu, J.: Optimal policy for a time consistent mean-variance model with regime switching. IMA J. Manage. Math. 27(2), 211–234 (2014)

Markowitz, H.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Norris, J. R.: Markov chains. Vol. No. 2. Cambridge University Press (1998)

Sun, Z., Guo, X.: Equilibrium for a time-inconsistent Stochastic linear-quadratic control system with jumps and its application to the mean-variance problem. J. Optim. Theory Appl. 181(2), 383–410 (2019)

Sun, J., Li, Z., Zeng, Y.: Precommitment and equilibrium investment strategies for defined contribution pension plans under a jump-diffusion model. Insur. Math. Econ. 67, 158–172 (2016)

Sun, J., Li, Y., Zhang, L.: Robust portfolio choice for a defined contribution pension plan with stochastic income and interest rate. Commun. Stat. Theory Methods 47(17), 4106–4130 (2018)

Wei, J., Wong, K.C., Yam, S.C.P., Yung, S.P.: Markowitzs mean-variance asset-liability management with regime switching: a time-consistent approach. Insur. Math. Econ. 53(1), 281–291 (2013)

Yan, T., Wong, H.Y.: Open-loop equilibrium strategy for mean-variance portfolio problem under stochastic volatility. Automatica 107, 211–223 (2019)

Acknowledgements

The first author would like to express a deep gratitude to the University of Pretoria ABSA Chair in Actuarial Science for financial support. We wish to extend our gratitude to the Editor and two anonymous reviewers, whose comments and suggestions have greatly improved this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of the Theorem 3.1.

To prove the theorem, we follow [5], Theorem 7.1. We divide the proof in two parts, first we show that for the equilibrium control \(\pi ^*\in {\mathcal {A}}\), the value function \(\Psi (t,x,\ell ,z,j)=\Phi (t,x,\ell ,z,j,\pi ^*)\) and \(\psi\) and \(\varphi\) have the following probabilistic representation:

In the second part, we prove that \(\pi ^*\in {\mathcal {A}}\) is indeed the equilibrium control strategy.

Let \(h(t,x,\ell ,z,j)\in {\mathcal {C}}^{1,2,2}([0,T]\times {\mathbb {R}}^2\times {\mathcal {S}})\), then by Itô’s formula ([2], Lemma A1),

where \({\mathcal {L}}h\) is given by (2.8). Since \(W,{\tilde{M}}\) and \({\tilde{N}}\) are martingales, under the integrability condition \(h\in L^2_T(X^{\pi ^*})\), we have that

is a martingale. Thus, for \(\Psi =h\), we have:

In order to show that \(\Psi (t,x,\ell ,z,j)=\Phi (t,x,\ell ,z,j,\pi ^*)\), we use the \(\Psi\)-equation (3.1) to obtain:

Then, from (3.2)–(3.2), The relation (4.1) becomes:

Similarly,

and

Then, using the above relations, the boundary conditions and (3.4), we can easily conclude that

In order to show that \(\pi ^*\) is indeed an equilibrium control strategy, we construct, for any \(\epsilon >0\) and \(\pi \in {\mathcal {A}}\), the control strategy \(\pi _{\epsilon }\) defined in Definition 2.2. For any \(s\in [t,t+\epsilon ]\) we have: (See Lemma 2.2, [5])

Moreover, for all \(\pi \in {\mathcal {A}}\) and (3.1), we have

Discretizing the above expression, we have

Hence

Therefore, from (4.2) and (4.3), we obtain

that is,

which completes the proof.

About this article

Cite this article

Guambe, C., Kufakunesu, R., van Zyl, G. et al. Time consistent mean-variance asset allocation for a DC plan with regime switching under a jump-diffusion model. Japan J. Indust. Appl. Math. 39, 119–143 (2022). https://doi.org/10.1007/s13160-021-00481-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-021-00481-z