Abstract

While energy consumption affects many different areas, it is also affected by many different factors. Therefore, policies aiming to reduce energy consumption gain a multidimensional feature. Income level and education play an important role in the success of these policies. Because as the income and education levels of individuals increase, the success rate of policies aiming to reduce energy consumption is higher. In this way, while energy consumption is reduced or used more efficiently, environmental problems are prevented. In this study, the effects of average schooling rate and income level on energy consumption in residences were investigated. For this purpose, the panel data analysis was used within the scope of the annual data of 19 OECD member countries for the 1990–2019 period. As a result of the analysis, a cointegration relationship was detected between the variables and long-term coefficients and error correction coefficient and short-term coefficients were obtained with the Augmented Mean Group (AMG) estimator. The findings show that the long-term average schooling rate has a negative effect on energy consumption in households, but income level has a positive effect on a panel basis. On the other hand, it was also found that the error correction mechanism works and that the income level has a positive effect on the energy consumption in the households in the short term, but the average schooling rate does not have a significant effect on the energy consumption in the households in the short term.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The term “household” refers to an economic unit that lives together in the same house or any part of the same house, whether they are related by blood or not, and does not separate income and expenses between individuals. Similar to other economic units, households also make various expenditures a large part of which consists of consumption expenditures. The most important factor determining consumption expenditures is the level of income (Tutar & Kuşçu, 2020). Energy resources, which have the characteristics of intermediate goods, are compulsory consumption goods included in the expenditure items for households for the continuation of economic activities. However, the economic conjuncture and the structure show the energy demand of the household as a determining factor to a large extent (Koç, 2021). Energy consumption, which comes to the forefront with its household consumption and social characteristics, has important economic characteristics with its contribution to economic growth. As well as the fact that energy consumption is effective on economic growth by creating an intermediate input to economic processes, economic growth is also a factor that affects the amount of energy consumption. The incomes of businesses and households at the micro level and the incomes of the countries at the macro level affect the energy consumption of these actors directly.

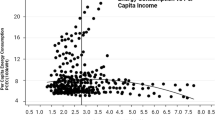

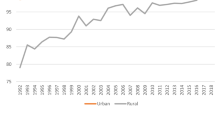

Households can purchase a variety of appliances with high energy consumption as they reach higher income levels in OECD member countries. This causes households to consume more energy in OECD countries. However, the economic development levels of countries or regions and the living standards of individuals affect the relationship between economic growth and energy consumption directly. Per capita energy consumption is relatively higher in developed countries, such as OECD countries, where households have higher living standards, but per capita energy consumption in these countries does not vary much in terms of quantity. Considering these effects, energy consumption gains the characteristic of a socio-economic concept (Ersoy, 2010). In OECD countries, information on sectoral energy consumption is given in Fig. 1 and Table 1.

When the information in Fig. 1 is investigated, it is seen that the highest energy consumption was recorded in the transportation, industry, and housing sectors, respectively, in the 1990–2019 period in all OECD countries. It is also seen that the energy consumption in the houses, which includes the energy consumption of the households, and the energy consumption used in the industry follow a parallel progression.

The information given in Table 1 shows that the energy consumption is close to 20% of the total energy consumption in the residential sector. The fact that the energy consumption share in the industrial sector is 23.4% shows that the amount of energy consumed in the housing sector is too large to be ignored. At this point, the housing sector comes to the forefront of reducing energy consumption, especially in energy-dependent countries, because it is easier to implement consumption-reducing practices such as efficient use of energy and energy savings in the housing sector compared to industry and transportation sectors in the short term.

Table 2 shows the distribution of total energy consumed in houses in OECD countries in the period 1990–2019 according to energy resources. When the information in the table is investigated, it is seen that the most consumed energy source in houses is natural gas, followed by electrical energy. Considering that some of this electrical energy is also obtained from natural gas, the natural gas source comes to the forefront in policies aimed at reducing energy consumption in residences.

The income levels of individuals, the climate characteristics of the place they live in, and the amount and type of energy resources owned by the country differ among countries, but all of them have effects on energy consumption in households. Also, the training individuals receive, avoiding unnecessary energy use, preferring energy efficiency/energy saving products, reducing energy consumption by being aware of environmental degradation, and raising awareness have all impacts on the energy consumption of households. In this respect, the effects of education level on energy consumption in residences become important.

In developed countries, increases in education levels contribute more to energy-saving policies (Zarnikau, 2003). Education is also among the main tools of the policies performed to prevent environmental degradation because of energy consumption, especially the consumption of fossil energy sources (Aytun, 2014).

The progress of the educational levels of the countries contributes to economic growth, and economic growth, in turn, contributes to the increase of the educational opportunities of the individuals by eliminating poverty. On the other hand, the increase in income levels in this economic growth process may require more energy consumption. For this reason, education, economic growth, and energy consumption are becoming closely related concepts, especially in developing countries (Inglesi-Lotz & Corral Morales, 2017). The fact that education affects economic growth and economic growth affects energy consumption, in turn, uses education as a means of economic growth and shows that it is effective on energy consumption (Ben Abdelkarim et al., 2014).

Especially with industrialization, household energy consumption has become widespread and has reached a significant level, and its share in total energy consumption is gradually increasing (Ding et al., 2017). In this respect, household energy consumption is an important issue for countries. Household energy consumption may also vary depending on the characteristics of family structures (Huebner, 2016). In this study, although income and education level factors that are thought to be effective in household energy consumption were examined, the number of household members, the ages of the individuals, whether the place of residence is rural or urban, household ownership, and the use of technologies such as internet in households factors also affect household energy consumption. These factors show that household energy consumption has not only economic features but also social and cultural features.

Energy consumption is affected by different factors in economic and social terms, and it is both a macroeconomic and microeconomic variable that also affects many other factors. Based on an economic and social perspective, energy consumption is affected by various factors as a macroeconomic and microeconomic variable that also affects many other factors. Some of these factors that affect energy consumption are the size of the residential area in square meters, the number of rooms, having a garage, increase in the monthly income of the household, increase in the number of people living in the household, presence of a second house of the household, and having internet connection. Also, it is already known that the presence of electronic devices such as mobile phones, computers, game consoles, deep freezers, washing machines, dishwashers, and LCD televisions in the household has an increasing effect on the electricity consumption of households. One of the most important factors affecting household energy consumption is technological devices, because, thanks to innovations, technological development is achieved and the technological equipment of houses also changes in this direction. The construction of houses and the electrical household appliances and equipment used are renewed with technological developments. In this way, energy efficiency in residences is increased and less energy is consumed. The fact that energy consumption is associated with many fields causes energy policies to be performed to reduce consumption to gain a multidimensional characteristic. However, one of the most important policies in this multivariate structure is education-based policies. Income levels play important roles in the success of these policies. Because as the income levels of individuals increase and the development levels of countries increase, the success rate of policies aiming to reduce energy consumption becomes higher.

In this respect, the factors that affect the energy consumption of the households in the houses were investigated in the present study. The average schooling rate was used in the present study as one of the explanatory variables in terms of representing the level of education and being one of the human development indicators. Income level, which is considered a determining factor in energy consumption, was also used as the other explanatory variable. In this context, the purpose of the present study was to examine the relationships between the average schooling rates and income levels, and energy consumption in houses. As well as the analysis of the relationship between income levels and energy consumption, which is widely used in the literature, it is expected that the study will contribute to the literature data in terms of considering energy consumption at the scale of the housing sector and including the effects of schooling.

To this end, firstly, the findings of empirical studies discussing the relationship between income levels and education indicators, and energy consumption were included in the present study. Then, the dataset and method used in the analysis were introduced, and the findings were presented and interpreted.

Literature Review

Household energy consumption is an important indicator in terms of determining the amount of energy consumption in the energy policies of countries and providing energy savings by using energy more efficiently. Because when the sectoral energy consumption amounts of OECD countries are investigated, it is seen that the energy consumption of the households ranks 3rd after the transportation and industry sectors, following a similar and parallel course to the industrial sector energy consumption. This shows that energy consumption is at significant levels in houses. For this reason, energy consumption in houses and income levels and education indicators that are closely associated with this subject are discussed by researchers with various methods and are the subject of different research. Examples of studies conducted on this subject are given below.

When the national literature was reviewed, Kar and Kınık (2008), who conducted a study on sectoral energy consumption and economic growth in Turkey with the data of the 1975–2005 period, used cointegration, error correction, and causality analysis. The findings obtained as a result of the Granger causality test showed that there are unidirectional causality relationships from total electricity consumption to economic growth, unidirectional from industrial sector electricity consumption to economic growth, and bidirectional causality relationships between household electricity consumption and economic growth. Aytaç (2010) investigated the causality relationship between energy and economic growth for the 1975–2006 period in Turkey with Granger causality and multivariate vector autoregression (VAR) models. As a result, it was concluded that there was unidirectional causality running from energy consumption to labor force and from economic growth to capital. Şahbaz and Yanar (2013), on the other hand, investigated the relationship between sectoral energy consumption and economic growth in Turkey with annual data for the 1970–2010 period and Toda-Yamamoto causality analysis. As a result of their study, although a one-way causality relationship was found from the economic growth to the energy consumption of the agricultural sector and the conversion sector, no causality relationship was detected between the energy consumption of the industrial sector and the energy consumption of the housing sector and economic growth. Özcan et al. (2013) analyzed the factors that affect the choice of energy consumption in households in Turkey with a multi-logit model. The findings show that household income, age of the household chief, working status, education of the household chief, being urban or rural, household type, and number of rooms affect household energy choice.

Gövdere and Can (2015) investigated the relationship between economic growth and energy consumption with the help of the Engle-Granger cointegration test and dynamic least squares method for the 1970–2014 period and reported that a 1% increase in energy consumption increases economic growth by 0.429% in the long run. They also found that a 1% increase in energy consumption increases economic growth by 0.599% in the short term. As a result, it was reported that the effect of energy consumption on economic growth was more. Arı et al. (2016) investigated the variables that affect the electricity consumption of households in Turkey with an ordered logit model. It was found in the findings that the types and quantities of electrically powered products, household size, income, housing type, and characteristics were important factors in increasing the electricity consumption of households. Çağlar et al. (2017) investigated the effects of changes in the amount of energy consumption per capita in the Turkish economy for the 1960–2014 period on real national income per capita with Zivot and Andrews (1992) structural break unit root test, Gregory and Hansen (1996) structural break cointegration test, DOLS, FMOLS, and CCR methods. As a result, they determined a cointegration between energy consumption and national income. Usta and Berber (2017), who investigated the relationships between sectoral energy consumption and economic growth, used Toda-Yamamoto causality analysis by considering the 1970–2012 period. As a result of their analysis, although bidirectional causality relations were determined between the energy consumption of the transportation sector and the industrial sector and economic growth, no causal relationship was detected between the energy consumption of the agricultural sector and household sector and economic growth. Dineri and Çayır (2020) tested the impacts of energy consumption and human capital on economic growth for the EU-15 and Turkey with the AMG estimator under cross-sectional dependence. As a result of their analysis, they reported that the increase in energy consumption and capital stock increased economic growth. They also reported that the effect of the human capital variable on economic growth was positive, but no significant relationship was detected. Turna and Ceylan (2022) analyzed the effects of the changes in physical capital, human capital, and energy consumption factors on GDP in Turkey for the years 1965–2014 with the NARDL method. As a result, they reported an asymmetry relationship between physical capital and GDP in the long run and the short run. On the other hand, only a long-term asymmetry relationship was detected between energy consumption and GDP. When the relationship between human capital and GDP was investigated, no asymmetrical relationships were detected between the variables. Arı (2022) investigated the effects of income inequalities on energy consumption in Turkey between 1989 and 2018 with the Bayer and Hanck (2013) cointegration test. According to his findings, no long-term relationships were detected between income inequality and energy consumption. The study also investigated the causality relationship between the variables with the Hacker and Hatemi test (2010) and found no causality relationships between income inequality and energy consumption. Arif et al. (2023) discussed urban electricity consumption patterns on a household basis with a questionnaire approach. According to their results, lifestyle, income levels, and awareness of energy-saving concepts affected electricity consumption patterns. Their findings also showed that the number of family members had no significant effects on household energy use when compared to income. Also, geographical conditions such as green areas and land use were physical factors that affected energy consumption.

When the international literature on energy consumption and economic growth was reviewed, it was found that there are many studies conducted on this subject. Among these, Dumitrescu and Hurlin (2012) found a unidirectional causality relationship from economic growth to energy consumption and physical capital stock, and from human capital to economic growth, as a result of the panel Granger causality test. Tewathia (2014) used a multivariate regression model to determine the variables that affect the monthly and seasonal average electricity consumption of households living in Delhi, India. The results showed a direct relationship between the average electricity consumption of the household and their monthly income, the number of people in the household, the number of electrical devices, and the size of the household’s usage area, and an opposite relationship with the education level of the chief of the household. Fan et al. (2015) used a multivariate regression model for households and various sectors in China and reported a significant relationship between monthly electricity consumption and the real price of electricity, climate conditions, and holidays.

Bernard and Kenneth (2016) found a positive relationship between total energy consumption and economic growth in Nigeria. In the sector-based analysis, they also found that the amount of energy consumed in the industry and transportation sectors and residences had positive effects on economic growth. Fang and Chang (2016), on the other hand, in their study conducted on 16 Asia Pacific countries, concluded that energy consumption and physical capital are much more effective growth determinants for the region in general. In their study on the characteristics of urban household electrical energy consumption in Indonesia, Batih et al. (2016) found that amplifiers, television sets, refrigerators, and air conditioning units were the devices that had the highest potential for saving energy. Chang, Fang, and Hamori (2017) analyzed the relationship between energy consumption, human capital, and economic growth in ASEAN-5 countries. A long-term relationship was determined between 1965 and 2011 in the regression analysis and Johansen cointegration analysis. On the other hand, Ilesanmi and Tewari (2017) investigated the relationship between energy consumption, human capital investments, and economic growth in South Africa in the 1990–2015 period with error correction model. In the findings, they also determined that there is cointegration between the variables along with a bidirectional causality relationship between economic growth and energy consumption in the long run, and there was a one-way causality relationship between economic growth and energy consumption to social and economic infrastructure investments. Inglesi-Lotz and Corral Morales (2017) conducted a panel data analysis that covered 21 countries with 1980–2001 period data to investigate the relationship between secondary school enrollment levels to represent the energy consumption and education variable. They aimed to determine how the relations between these variables changed according to the development levels of the countries by choosing 10 of the developed countries and 11 of the developing countries in the study. As a result of their analysis, they found a significant long-term relationship between the cointegration test and energy consumption and education. Also, according to their findings, energy consumption increased with increasing education levels in developing countries, and energy consumption decreased with increasing education levels in developed countries. As a result of the causality test, it was found that there is a one-way causality relationship from the education variable to the energy consumption. Matthew et al. (2018) found that human capital development was not associated with economic growth in Nigeria for the 1981–2016 period, but electricity consumption was associated with economic growth.

Ballı, Sizege, and Manga (2018) investigated the relationship between energy consumption and economic growth for the Commonwealth of Independent States by using the 1992–2013 period data and found a two-way causality relationship between energy consumption and economic growth, and that when energy consumption increased, economic growth also increased. Chen and Fang (2018) investigated the relationship between economic growth, industrial energy consumption, and human capital in a study conducted on 210 cities in China between 2003 and 2012 and revealed that industrial energy consumption had a greater effect on economic growth than physical and human capital. It was determined that human capital supports economic growth more in the east of the country, and energy consumption contributed more to growth in the western and central regions of the country. They also found that the causality relationship in the three major regions of China was from economic growth to energy consumption. Regarding the period 1996–2013 in China, Dong and Hao (2018) examined income inequalities between rural areas and cities with a dynamic panel approach and reported that income inequalities reduced electricity consumption. Çalmaşur and Inan (2018) investigated the factors that affect household electricity consumption in Turkey and how these factors affect electricity consumption. In their study, they used the partial proportional betting model (PPOM) and calculated post-estimation marginal effects. As a result, they reported that monthly income, number of people living in the house, housing characteristics, and technological devices had significant effects on electricity consumption.

Fatima et al. (2019) investigated the relationship between renewable energy production, total energy use, human capital, and economic performance variables for the long and short term in Pakistan for the 1990–2016 period and reported a causal relationship between total energy use, renewable energy production, human capital, and economic growth. They also found that there was a causal relationship between human capital to renewable energy production, from renewable energy production and from human capital to total energy use. Yao et al. (2019) investigated the effects of human capital on energy consumption for the 1965–2014 period for OECD countries and reported that standard deviation reduces energy consumption by 15.36% and human capital created positive externalities for the environment. Bashir (2019) investigated the relationship between human capital, energy consumption, CO2 emissions, and economic growth variables in Indonesia and reported a direct causal relationship between human capital, energy consumption, and per capita income to CO2 emissions. Rahman and Velayutham (2020) investigated the relationship between energy consumption and renewable energy consumption and economic growth in five South Asian countries and found that both energy consumption indicators affected economic growth positively. The causality test results showed the existence of a causal relationship between economic growth to renewable energy consumption. Yılmaz and Cowley (2022) investigated the relationship between energy consumption and economic growth and found that GDP and trade openness affected electricity consumption positively in both the long and short run. Awaworyi Churchill et al. (2023) investigated the relationship between human capital and energy consumption in the UK and reported a negative relationship between total human capital and energy consumption in the long run. Uslu (2018) investigated the relationship between economic growth and energy consumption in 21 developing countries by using the 1990–2014 period data and found that there was a two-way causality and cointegration relationship between economic growth and energy consumption. They also found that when energy consumption increased by 1%, economic growth increased by 1.13%, and when economic growth increased by 1%, per capita energy consumption increased by 0.45% in these countries. Koç (2020) investigated the effects of sectoral energy consumption on economic growth between 2010 and 2016 in 132 countries by using panel data analysis. As a result of his analysis, a positive relationship was reported between energy use in transportation, industry, agriculture, and services sector and economic growth. In his study investigating the relationship between energy consumption and economic growth, Mete (2021) used the data of the G7 countries for the 1993–2018 period. It was determined in the study in which economic growth, energy consumption, greenhouse gas emissions, and trade openness values were included in the analysis that energy consumption, trade openness, greenhouse gas emissions, and economic growth were cointegrated according to the results of the cointegration analysis. Also, according to the analyses made for the estimation of the long-term relationship, it was found that the independent variables affected energy consumption in the long run. Finally, it was determined that trade openness was statistically insignificant, and the increase in greenhouse gas emissions and economic growth increased energy consumption. To find the factors affecting household energy consumption and investigate the relationship between these factors in China, Guo et al. (2023) integrated internet behaviors into the structural equation model, based on the data of the Chinese household energy consumption questionnaire. According to the findings of their study, increasing the frequency of internet use reduced the positive effects of income on household energy consumption to some extent.

Dataset

The average schooling rates, GDP, and total energy consumption data in residences were discussed in the present study, in which the effects of schooling rates and income levels on energy consumption in residences (households) were investigated. A panel data analysis was performed with the annual data of 19 OECD countriesFootnote 1 for the 1990–2019 period in the study. All variables were included in the analysis by taking their natural logarithms. The explanations and summary statistics of the variables are given in Table 3.

The average schooling rate makes up the education indicator, which is one of the three main components of the Human Development Index (i.e., education, health, and income). The average schooling rate calculated by the United Nations Development Program (UNDP) represents the average year in which individuals who are aged 25 and over receive education (UNDP, 2022). Housing sector energy consumption refers to the energy consumption of households other than the energy consumption in transportation (IEA, 2022). The income level variable consists of fixed prices and GDP in dollars.

A balanced panel dataset that consisted of 570 observations was examined in the study. The basic statistics of the dataset are given in Table 3. When this table information is evaluated, it is seen that the lowest value of the average schooling rate is 4.5 years, the highest value is 14.15 years, and the average is 10.68 years for the panel. When the income level data are evaluated, it is seen that the lowest value is approximately 106 billion dollars, the highest value is approximately 11 trillion dollars, and the average for the panel, in general, is approximately 2 trillion dollars. It was determined based on the basic statistics of total energy consumption in residences that the lowest value was 16.599 PJ, the highest value was 11,137.29 PJ, and the average for the overall panel was 1393.729 PJ.

Method and Analysis Results

In the present study, the relationships between the variables were investigated by using the panel data analysis method. The econometric model that was created with the average schooling rate (ASR) as a social factor to explain the total energy consumption in residences (TECR) and the GDP variables to express the income level as an economic factor is given below.

In Eq. 1, “i” represents cross-section units, “t” represents the time dimension, and “uit” refers to the error term.

Unit root tests should be used to examine the stationarity of the variables in panel data analysis, which also includes time series characteristics. However, to decide on the unit root test to be applied, cross-section dependency and homogeneity research should be done. The LM and CDLM tests were used in the present study to examine cross-sectional dependence, and the Swamy S test was used for homogeneity.

With the effect of especially globalization, foreign trade, etc., countries started to establish more relations with each other, and other countries became affected by a macroeconomic shock that occurred in one country. Considering this, deviant and inconsistent findings can be obtained as a result of the analyses made without first investigating whether there is a cross-sectional dependence (Menyah et al., 2014; Mercan, 2014). One of the tests that examine cross-sectional dependence is the Lagrange multiplier (LM) test which was developed by Breusch and Pagan (1980). This test is used when the cross-sectional dimension N is smaller than the time dimension T (Yerdelen Tatoğlu, 2018). Equation 2 shows the test statistics for this test.

In the equation above, “\(\widehat{\rho }\)” refers to the correlation between residues, “T” shows the time dimension, and “N” denotes the cross-section dimension. The null hypothesis of the test is “H0: There is no relationship between horizontal sections” (Pesaran, 2004; Güloğlu Ivrendi, 2010).

Another test that examines the cross-sectional dependence is the CDLM test. This test, which was created by Pesaran (2004), is an improved version of the LM test and is used when T is greater than N. The null hypothesis of this test is established as “H0: There is no relationship between horizontal sections” (Pesaran, 2004). The expression of the test is included in Eq. 3.

In previous studies that were conducted by using the panel data analysis method, if heterogeneous slope coefficients are assumed to be homogeneous and analyses are performed in this way, country-specific differences are also overlooked. For this reason, it is necessary to determine the homogeneity of slope parameters before unit root tests (Aytun & Akın, 2014). Also, if the heterogeneity is not taken into account in the model, results with deviations from the estimations can be obtained (Swamy, 1970). The information obtained from the homogeneity test also enables the determination of which cointegration and estimation methods will be used. The main hypothesis of the S test used to examine homogeneity is that the parameters are homogeneous. The test statistics of this test are included in Eq. 4 (Yerdelen Tatoğlu, 2017).

In the equation above, “\(\widehat{\beta }\) i” denotes the EKK estimators obtained from the regressions for the sections, “\(\overline{\beta }\)∗” refers to the weighted fixed effects estimator, and “\(\widehat{V}\) i” is the variance difference between the estimators.

Table 4 shows the results of the LM and CDLM cross-section dependency tests and Swamy S homogeneity tests, which are preferred because of the T (30) > N (19) in the dataset used.

When the information given in Table 4 is evaluated, it is seen that the probability values are less than 0.05. In this case, null hypotheses stating that there is no cross-sectional dependence and that the parameters are homogeneous are rejected, and it is decided that all variables contain cross-sectional dependence and are not homogeneous.

It was decided to apply the second-generation unit root tests because the dataset was T > N in the study and the variables included cross-sectional dependence. Also, considering the heterogeneity of the variables, a stationarity study was performed with the PANICCA panel unit root test, which is a second-generation test and also allows heterogeneity. The PANICCA unit root test that was developed by Reese and Westerlund (2016) is based on common factor modeling. According to the null hypothesis of the test, the series does not contain unit roots (Reese & Westerlund, 2016).

Before the unit root test was applied, a graphic analysis of the variables was made (the graphs of the variables are given in the Appendix). As a result of the graphic analysis, it was determined that the variables had a trendy structure. For this reason, especially the results of the trended models were taken into account in the unit root test results. The PANICCA panel unit root test is used in a balanced panel dataset. For this reason, the observation loss of the variables after the difference-taking process was taken into account, and the difference stability was investigated by providing a balanced panel dataset. Also, when the difference stationarity was examined, the differences were realized with models with stationarity constant because the trended structures of the variables were lost after the difference-taking process. The results of the panel unit root test are given in Table 5.

When the PANICCA panel unit root test results are interpreted, firstly, the stability of the residues is investigated, provided that the common factor is stationary. In light of this, when the stationarity results for the level values are investigated, it is seen that the common factor of the TECR variable is stationary in the fixed and trend models, but the residual stationarity cannot be achieved. For this reason, it is decided that the level value of the TECR variable is not stationary. It was determined that the common factor of the ASR variable was stationary in the fixed model; it was not stationary in the fixed and trended model and was not stationary in the level values of its residuals. It was also understood that the GDP variable is not stationary in terms of both common factor and residual stationarity in the level value. For this reason, the first differences of all 3 variables were taken and their stationarities were investigated again. According to the findings, it was determined that all variables were both common factors and residuals difference stationary. As a result, the study continued with cointegration analyses because all three variables were difference stationary and were stationary at the same level.

Before the cointegration analysis was performed, cross-sectional dependence and homogeneity tests of the model were performed to decide which cointegration test to use. The results are presented in Table 6.

For the model in which the cointegration relationship was investigated, the null hypotheses were rejected according to the cross-sectional dependence and homogeneity test results, and it was decided that there was heterogeneity and cross-sectional dependence. Based on these results, the analyses of Pedroni (1999, 2004), Westerlund (2007), and Gengenbach, Urbain, and Westerlund (2016) cointegration tests, which are the second-generation cointegration tests and take heterogeneity into account, continued.

The differences from the averages of the variables are taken (with the demeaning process) in the second-generation Pedroni cointegration test, thus making it resistant to cross-section dependence. Also, the null hypothesis of this test, which provides different results for homogeneous and heterogeneous panels, states that there is no cointegration relationship (Yerdelen Tatoğlu, 2017).

Westerlund’s (2007) panel cointegration test consists of 4 panel cointegration tests, which are based on the error correction model. Among these tests, Pt and Pa statistics show the cointegration relationship based on the panel, and the cointegration relationship based on units can be tested with the Gt and Ga statistics (Westerlund, 2007). It is recommended in this test, which can also be used under heterogeneity, to use bootstrap probability values and these resistive probability values in case of cross-sectional dependence (Chang, 2004).

Another test used to account for inter-unit correlation and heterogeneity is the Gengenbach, Urbain, and Westerlund (2016) (GUW) cointegration test. The significance of Y(t − 1) is investigated in this test, which is based on the error correction model. The null hypotheses for these tests used in the study indicate that there is no cointegration relationship. The results of the tests are given in Table 7.

When the results of the cointegration test used to investigate the long-term relationship between the variables were investigated, it was seen that the “t” statistical values according to the Pedroni panel cointegration test were greater than the 1.96 t table value at the 0.05 significance level for the group statistics. In this case, the null hypothesis is rejected and it is understood that there is a cointegration relationship. When the information of the Westerlund panel cointegration test results is evaluated, the Gt and Ga statistics results of the heterogeneity are investigated because of the bootstrap values of the cross-section dependence of the panel. The information shows that the null hypothesis was rejected because these probability values were less than 0.05 and there was a cointegration relationship. Based on the information on the GUW cointegration test results, it is shown that the null hypothesis was rejected because the probability value for Y(t − 1) was < 0.01 and there was a long-term relationship between the variables.

All panel cointegration test results show that there is a long-term relationship between the variables. In such a case, long- and short-term relationships can be investigated with panel error correction models. However, to decide which of the error correction models to use, which provides the opportunity to analyze the short-term and long-term relationships at the same time, it was decided to use the second-generation Augmented Mean Group (AMG) estimator, in line with the results of the cross-section dependence of this model and the determination of heterogeneity.

This AMG error correction model, which was developed by Bond and Eberhardt (2009) and Eberhardt and Teal (2010), takes into account the cross-section dependence and calculates by weighting the results of the panel and the coefficients for the units. This estimation method is applicable when there are problems stemming from error terms such as varying variance (Eberhardt and Bond, 2009). The equations of the AMG estimator are given below (Bond & Eberhardt, 2009, Eberhardt & Teal, 2010):

The AMG estimator is used in cases of cross-sectional dependence and heterogeneity. It is also preferred because it can calculate the individual coefficients of the countries in the panel as well as the cointegration coefficient of the panel. In addition, this test is preferred because it is a test that can be used if the cointegration degrees of the series are different (Eberhardt, 2012: 64).

After determining the long-term relationships between the variables with the cointegration test, the analysis of long-term and short-term coefficients was made with the AMG test. As well as the long-term coefficients, the error correction coefficient (ECTt−1), and short-term coefficients were obtained in the tests and are given in Table 8. When the table is investigated, it is seen that ASR had negative effects on TECR in the long term and GDP had a positive effect on the panel in general. Also, the fact that the error correction coefficient was negative (< 1 and significant) indicates that the error correction mechanism is working. This means that 96% of the imbalances occurring in the next period are in balance. In other words, when there is a deviation from the balance, the balance occurs again in an average of 1.04 years. When the short-term coefficients were investigated, it was concluded that ASR did not have significant effects on TECR, while GDP had a positive effect in the short term.

When the short-term and long-term coefficients of the countries were investigated, it was found that ASR had a significant and negative effect on TECR only in Austria. When the effects of GDP were investigated, it was found that they had positive and significant effects in Australia, Austria, Belgium, Canada, Japan, South Korea, Spain, and Turkey. According to the long-term coefficients according to countries, it was found that ASR had significant and negative effects on TECR in the Czech Republic, France, Germany, Sweden, and Turkey. It was also found that GDP had positive and significant effects on TECR in Australia, the Czech Republic, France, Germany, Spain, Switzerland, Turkey, England, and the USA.

Result and Investigation

In our present day, the energy factor is considered among the most basic inputs in the production process to realize economic and social development. Electrical energy is used as one of the energy factors to determine the development levels of countries and evaluate their consumption levels. Electrical energy has great importance in every aspect of daily life and reflects the production level of countries. On the other hand, investments in human capital, which will ensure growth in the realization of economic development, also have an importance. Education expenditures are at the forefront of human capital investments. The educational levels of people, avoiding unnecessary energy use, preferring energy-saving products, reducing energy consumption, and raising awareness all have impacts on the energy consumption of households. In this respect, the effects of educational levels on energy consumption in residences are considered important.

The increase in the education levels of countries contributes to economic growth, and the income levels of individuals increase in turn. The increase in income levels can cause an increased energy consumption. As mentioned above, education affects economic growth and economic growth affects energy consumption interchangeably, therefore, education uses economic growth as a tool and it can be seen that it has effects on energy consumption in this way.

In this respect, the factors that affect the energy consumption of the households were investigated in the present study. For this purpose, the average schooling rate and income level were determined as explanatory variables. Panel data analysis was performed in the study by using the 1990–2019 period data of 19 OECD member countries. Firstly, cross-section dependence and homogeneity tests were applied in the analysis, and then stationarity was investigated with the PANICCA panel unit root test, which is a second-generation unit root test. After the variables were determined as “difference stationery,” the analyses were continued with the second-generation cointegration tests Pedroni (1999, 2004), Westerlund (2007), and Gengenbach, Urbain, and Westerlund (2016). As a result of these tests, it was found that the variables act together in the long run. Finally, the long- and short-run coefficients were estimated by using the Extended Average Group (AMG) estimator.

It was determined that there is no significant effect of ASR on TECR in the short term on a panel basis, but GDP has a positive impact in this regard. Also, when these positive effects of GDP are investigated in more detail, it is seen that the short-term effect is higher than the long-term effect (0.44 > 0.34). On the other hand, it was also determined that the error correction mechanism also works, in other words, when deviations from the balance occur, the balance can occur again.

Some of the findings obtained as a result of the study are compatible with expectations. A positive relationship has been determined between income level and energy consumption in households. This situation is consistent with expectations. Because as individuals’ incomes increase, their consumption of energy products and many areas increases. However, the results obtained regarding the schooling rate are not compatible with expectations. As a result of the study, it was determined that there was a long-term positive relationship between schooling rate and energy consumption in households. However, expectations are that as individuals’ level of education increases, they will become more aware of energy consumption and reduce their energy consumption. The results obtained from this study are consistent with Cayla et al. (2011) and Guo et al. (2023) studies. These studies also found that increases in household income and education level increase energy consumption. On the other hand, Jakuˇcionyte-Skodien and Liobikiene (2023) revealed in their study that the education level and income level have a reducing effect on electricity consumption in households.

The positive effects of GDP on TECR in the short and long term mean that with the increase in household income, they increase the amount of energy used in houses. It is also understood that the increase in income is immediately reflected in the energy consumption in the houses and the energy consumption increases at a higher rate depending on the income increase in the short term. When the effects of ASR on TECR are investigated, the lack of a significant effect in the short term occurs because the outputs associated with schooling cannot be obtained in the short term, but the schooling activities are completed and the outputs can be obtained in the long term after a certain period. Because educational activities cover a certain process, the expected effects at the end of this process become more evident in the long term rather than the short term. For this reason, the effects of ASR on TECR become significant in the long run. Also, the negative determination of this effect in the long term shows that individuals reduce energy consumption in households in the presence of increased schooling rates. In this way, it is ensured that individuals become conscious of energy consumption and consume less energy in individual households with education. However, the results also show that the long-term effects of ASR on decreasing TECR are smaller than the effect of GDP on increasing TECR (0.24 < 0.44). In other words, it is seen that educational activities that are not effective in the short term are less effective than the income variable in the long term.

Conclusion and Policy Recommendations

All these findings show that the income factor is important in the energy consumption of individuals in households, but it is also understood that individuals can be conscious of energy consumption with educational activities. It is important to determine how energy consumption in houses increases when faced with income increase and to perform policies for these areas, especially in countries with foreign dependence on energy. Because in this way, it will become possible to reduce energy demand in energy consumption areas with high-income sensitivity and educational activities and energy-saving technologies in the identified areas. For this reason, the implementation of policies that harmonize the economic power and education levels of individuals with technological developments by policymakers will allow energy consumption to be reduced and used more efficiently, both individually at the micro level and the macro level for the country.

The long-term positive impact of both income level and schooling rate on household energy consumption has an important place in the policies to be implemented, as stated above. In addition, regions with high energy consumption should be determined by the state and the use of home appliances with high energy efficiency in households in these regions should be encouraged. On the other hand, it should be taken into consideration that women take a more active role in energy consumption in households. In addition, the number of individuals living in households, their age ranges, education levels, and gender status should also be taken into consideration in policies aimed at ensuring energy savings.

There were some limitations while carrying out this study. In the study, data for the period 1990–2019 was available, but the time dimension of the data set could not be expanded further. While examining the factors affecting household energy consumption, a research was conducted within the framework of individuals’ income levels and education levels. This study should be expanded by examining other factors that will affect household energy consumption. In addition, characteristics of the household such as size, gender status, and age ranges need to be considered in research. On the other hand, in this study, a research was conducted on the country group using panel data analysis. Carrying out this issue on a country-specific basis in other studies will contribute to the literature. In this way, more accurate policies can be produced by taking into account the specific situations of the countries.

Data Availability

The data can be available on request.

Notes

Australia, Austria, Belgium, Canada, Czech Republic, Denmark, France, Germany, Italy, Japan, South Korea, Mexico, Netherlands, Spain, Sweden, Switzerland Turkey, UK, USA.

References

Arı, A. (2022). The relationship between income inequality and energy consumption: Evidence from Turkey. Manisa Celal Bayar University Journal of Social Sciences, 20(2), 236–244. https://doi.org/10.18026/cbayarsos.1056051

Arı, E., Noyan, A., KaracaN, S., & Saraclı, S. (2016). Analysis of households’ electricity consumption with ordered logit models: Example of Turkey. International Journal of Humanities and Social Science Invention, 5(6), 73–84.

Arif, N., Emerita, M., & Shrestha, I. (2023). The socio-economic and geographic related factors affecting electricity consumption in urban households: A case study of Kota Tengah, Gorontalo. In Unima International Conference on Social Sciences and Humanities (UNICSSH 2022) (pp. 1239–1246). Atlantis Press.

Awaworyi Churchill, S., Inekwe, J., Ivanovski, K., & Smyth, R. (2023). Human capital and energy consumption: Six centuries of evidence from the United Kingdom. Energy Economics, Elsevier, 117(C). https://doi.org/10.1016/j.eneco.2022.106465

Aytaç, D. (2010). A forecast of the relation between energy and economic growth with a multivariate var approach. Maliye Dergisi, 0(158), 482–495.

Aytun, C. (2014). The nexus between carbon dioxide emissions, economic growth and education in emerging economies: A panel data analysis. The Journal of Academic Social Science Studies, 27, 349–362.

Ballı, E., Sizege, Ç., & Manga, M. (2018). Energy consumption and economic growth: The case of CIS countries. UİİİD-İJEAS 18. EYİ Özel Sayısı, 773–788.

Bashir, A., Thamrin, K. M. H., Farhan, M., Mukhlis, M., & Atiyatna, D. P. (2019). The causality between human capital, energy consumption, CO2 emissions and economic growth: Empirical evidence from İndonesia. International Journal of Energy Economies and Policy, 9(2), 98–104.

Batih, H., & Sorapipatana, C. (2016). Characteristics of urban households’ electrical energy consumption in Indonesia and its saving potentials. Renewable and Sustainable Energy Reviews, 57, 1160–1173.

Ben Abdelkarim, O., Ben Youssef, A., M’henni, H., & Rault, C. (2014). Testing the causality between electricity consumption, energy use and education in Africa. William Davidson İnstitute working paper no. 1084.

Bernard, O. A., & Kenneth, O. O. (2016). Sectoral consumption of non-renewable energy and economic growth in Nigeria. International Journal of Research in Management. Economics and Commerce, 6(7), 15–22.

Çağlar, A. E., Kubar, Y., & Korkmaz, A. (2017). Energy, as the dynamic of growth in Turkish economy. Akdeniz IIBF Journal, 36, 103–129.

Çalmaşur, G., & İnan, K. (2018). The factors affectıng household electrıcıty demand: An applıcatıon on Turkey. Journal of Erciyes University Faculty of Economics and Administrative Sciences, 52, 71–92. https://doi.org/10.18070/erciyesiibd.435627

Cayla, J. M., Maizi, N., & Marchand, C. (2011). The role of income in energy consumption behavior: Evidence from French households data. Energy Pol, 39(12), 7874–7883.

Chang, Y. (2004). Bootstrap unit root tests in panels with cross sectional dependency. Journal of Econometrics, 120(2), 263–293.

Chang, Y., Fang, Z., & Hamori, S. (2017). Volatility and causality in strategic commodities: Characteristics, myth and evidence. International Journal of Economics and Finance, 9(8), 162–178.

Chen, Y., & Fang, Z. (2018). Industrial electricity consumption, human capital investment and economic growth in Chinese cities. Economic Modelling, 169, 205–219.

Dineri, E., & Çayir, B. (2020). The effects of human capital and energy consumption on economic growth: An application on EU15 and Turkey. Gaziantep University Journal of Social Sciences, 19(4), 1686–1701. https://doi.org/10.21547/jss.699205

Ding, Q., et al. (2017). The relationships between household consumption activities and energy consumption in China—An input-output analysis from the lifestyle perspective. Applied Energy, 207, 520–532.

Dong, X., & Hao, Y. (2018). Would income inequality affect electricity consumption? Evidence from China. Energy, 142(C), 215–227. https://doi.org/10.1016/j.energy.2017.10.027

Eberhardt, M. (2012). Estimating panel time-series models with heterogeneous slopes. The Stata Journal, 12(1), 61–71.

Eberhardt, M., & Teal, F. (2010). Productivity analysis in global manufacturing production. Economic series working papers no. 515. University of Oxford.

Ersoy, A. Y. (2010). Energy consumption and economic growth. Uluslararasi Hakemli Sosyal Bilimler E-Dergisi, 20, 1–11.

Fan, J. L., Tang, B.-J., Yu, H., & Hou, Y.-B. (2015). Wei, Y-M: Impacts of socioeconomic factors on monthly electricity consumption of China’s sector. Natural Hazards, 75(2), 2039–2047.

Fang, Z., & Chang, Y. (2016). Energy, human capital and economic growth in Asia pacific countries - Evidence from a panel cointegration and causality analysis. Energy Economics, 56, 177–184.

Fatima, N., Li, Y., & Ahmad, M. (2019). Analyzing long-term empirical interactions between renewable energy generation, energy use, human capital, and economic performance in Pakistan. Energy, Sustainability and Society, 9(42), 2–14. https://doi.org/10.1186/s13705-019-0228-x

Gövdere, B., & Can, M. (2015). Energy consumption and economic growth: A cointegration analysis in Turkey. Uluslararası İktisadi Ve İdari Bilimler Dergisi, 1(2), 104–114.

Güloğlu, B., & İvrendi, M. (2010). Output fluctuations: Transitory or permanent? The case of Latin America. Applied Economics Letters, 17, 381–386.

Guo, J., Xu, Y., Qu, Y., Wang, Y., & Wu, X. (2023). Exploring factors affecting household energy consumption in the internet era: Empirical evidence from Chinese households. Energy Policy, 183, 1–11.

Huebner, G., Shipworth, D., Hamilton, I., Chalabi, Z., & Oreszczyn, T. (2016). Understanding electricity consumption: A comparative contribution of building factors, sociodemographics, appliances, behaviours and attitudes. Appl Energy, 177, 692–702. https://doi.org/10.1016/j.apenergy.2016.04.075

IEA (International Energy Agency). (2022). Data and statistics. https://www.iea.org/data-and-statistics/data-sets. Accessed 4 Apr 2023.

Ilesanmi, D. K., & Tewari, D. D. (2017). Energy consumption, human capital investment and economic growth in South Africa: A vector error correction model analysis. OPEC Energy Review.

Inglesi-Lotz, R., & Corral Morales, L. D. (2017). The effect of education on a country’s energy consumption: Evidence from developed and developing countries. Economic Research Southern Africa (ERSA) Working Paper, 678, 1–2.

Jakuˇcionyte-Skodien, M., & Liobikiene, G. (2023). Changes in energy consumption and CO2 emissions in the Lithuanian household sector caused by environmental awareness and climate change policy. Energy Policy, 180(2023), 113687. https://doi.org/10.1016/j.enpol.2023.113687

Kar, M., & Kinik, E. (2008). An econometric analysis of the relationship between the types of electricity consumption and economic growth in Turkey. Afyon Kocatepe University İ.İ.B.F. Journal, 10(2), 333–353

Koç, Ü. (2020). Sectoral energy consumption and economic growth. Third Sector Social Economic Review, 55(1), 508–521.

Koç, P. (2021). The analysis of the effect of GDP per capita and household size on energy consumption: A regional approach. Third Sector Social Economic Review, 56(4), 2498–2515.

Matthew, O., Osabohlen, R., Ejemeyovwl, J., & Fanlyl, F. F. (2018). Electricity consumption and human capital development in Nigeria: Exploring the implications for economic growth. International Journal of Energy Economics and Policy, 8(6), 8–15.

Menyah, K., Nazlioğlu, Ş, & Wolde-Rufael, Y. (2014). Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach. Economic Modelling, 37, 386–394.

Mercan, M. (2014). The testing Feldstein-Horioka hypothesis for EU-15 and Turkey: Structural break dynamic panel data analysis under cross section dependency. Ege Academic Review, 14(2), 231–245.

Mete, E. (2021). The relationship between energy consumption and economic growth: The case of G7 countries. Ataturk University Journal of Economics and Administrative Sciences, 35(4), 1481–1495. https://doi.org/10.16951/atauniiibd.938207

Özcan, K. M., Gülay, E., & Üçdoğruk, Ş. (2013). Economic and demographic determinants of household energy use in Turkey. Energy Policy, 60(C), 550–557.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. University of Cambridge working paper. 0435 Internet Address. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=572504. Accessed 10.09.2014

Rahman, M. M., & Velayutham, E. (2020). Renewable and non-renewable energy consumption-economic growth nexus: New evidence from South Asia. Renewable Energy, 147, 399–408.

Reese, S., & Westerlund, J. (2016). Panicca: Panic on cross-section averages. Journal of Applied Econometrics, 31(6), 961–981.

Şahbaz, A., & Yanar, R. (2013). An econometric analysis of relationship between total and sectoral energy consumption and economic growth in Turkey. Finans Politik & Ekonomik Yorumlar, 50(575), 31–44.

Swamy, P. A. V. B. (1970). Efficient inference in a random coefficient regression model. Econometrica, 38(2), 311. https://doi.org/10.2307/1913012

Tewathia, N. (2014). Determinants of the household electricity consumption: A case study of Delhi. International Journal of Energy Economics and Policy, 4(3), 337–348.

Turna, Y., & Ceylan, R. (2022). The relationship between economic growth and physical capital, human capital and energy consumption in Turkey: NARDL approach. Journal of Mehmet Akif Ersoy University Faculty of Economics and Administrative Sciences, 9(1), 223–242. https://doi.org/10.30798/makuiibf.860983

Tutar, E., & Kuşcu, A. (2020). Factors affectıng households consumptıon habıts: Bor applıcatıon. Journal of Social and Humanities Sciences Research, 7(53), 1205–1218.

UNDP (United Nations Development Program). (2022). Human development index (HDI). https://hdr.undp.org/data-center/human-development-index#/indicies/HDİ. Accessed 4 Apr 2023.

Uslu, H. (2018). Energy consumption and economic growth relationship: Panel data analysis on developing countries. International Journal of Social Humanities Sciences Research, 5(20), 729–744.

Usta, C., & Berber, M. (2017). Sectoral analysis of relationship between energy consumption and economic growth in Turkey. International Journal of Economic & Social Research, 13(1), 173–187.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748.

Yao, Y., Ivanovski, K., Inekwe, J., & Smyth, R. (2019). Human capital and energy consumption: Evidence from OECD countries. Energy Economics, 84, 1–39.

Yerdelen Tatoğlu, F. (2017). Panel Zaman Serileri Analizi. Beta Yayıncılık, İstanbul.

Yerdelen Tatoğlu, F. (2018). Panel Zaman Serileri Analizi Stata Uygulamalı (2. Baskı.). İstanbul: Beta Basım Yayın A.Ş.

Yilmaz, E., & PasinCowley, P. (2022). Econometric approach to the relationship of energy consumption and economic growth. Journal of Academic Researches and Studies, 14(26), 59–74. https://doi.org/10.20990/kilisiibfakademik.1037212

Zarnikau, J. (2003). Consumer demand for ‘green power’ and energy efficiency. Energy Policy, 31(15), 1661–1672.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, formal analysis, data curation, writing—original draft preparation, visualization: Kezban Ayran Cihan; validation, investigation, writing—review and editing, resources: Nurdan Değirmenci. All authors have read and agreed to the published version of the manuscript. We confirm that this manuscript has not been published elsewhere and is not under consideration by another journal. We have approved the manuscript and agree with its submission to Journal of the Knowledge Economy.

Corresponding author

Ethics declarations

Ethical Approval

We declare that we have no human participants, human data, or human tissues. Study data were obtained from secondary sources.

Consent for Publication

Not applicable.

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Cihan, K.A., Değirmenci, N. The Effects of Schooling Rates and Income Levels on Energy Consumption in Households: A Panel Data Analysis on OECD Countries. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-02057-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-02057-x