Abstract

The paper focuses on financial and axiological aspects of the new instrument in the digital economy, such as digital tokens (DTs). The purpose of the article is to examine the investment performance of certain types of DTs. We suggest a categorisation of DTs according to the types of assets that they represent and analyse them in terms of profitability, risk, and effectiveness. The investment performance of different types of DTs was compared with stock market indices and commodity prices. The empirical source of information is data from the coinpaprika platform from January 2018 to July 2022. It occurs that DTs demonstrate, on average, lower investment performance than traditional instruments. However, there is a wide group of the former that can be included in the portfolio as their investment performance is higher than the one represented by stock market assets. Our contribution comprises, first, the extension of existing research on tokenization and tokens to include the investment aspect. Second, we develop and apply the original proposal of DT classification, which takes into account the hitherto neglected aspect of worldview valuation of a given DT type by market participants. Finally, we assess the investment performance of DTs (both in terms of our proposed classification and in the context of stock market indices). We also specify recommendations for investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Digital tokens (DTs) now form the foundation for developing technological instruments within the framework of open and decentralised finance. They are categorised in two main ways. The first considers questions of the legal background for DTs when attempting to conceptualise definitions and classifications of tokens, enabling their incorporation into the legal systems of certain communities (Cumming et al., 2019; Demertzis & Wolff, 2018; Ferreira & Sandner, 2021; Hacker & Thomale, 2018; Houben & Snyers, 2018; Massad, 2019; Omarova, 2020). The second way involves creating breakdowns according to the digital record formats (Milunovich, 2021; Eyal, 2017; Tasca & Tessone, 2019). These two main categorisation methods (legal background and digital record formats) are relevant to our study as we propose an axiological classification of tokens, which is a manifestation of a new approach to perceive and investigate DTs. However, there are only a few studies that impose the views of an ordinary investor on DTs (Euler, 2018), when the key issue is to determine the investment performance of a given token type based on the belief that ‘you can make good money on it’. We aim to contribute to bridging the gap by undertaking research on how the investment potential of DTs can be assessed, taking into account the breakdown of tokens according to their functionality (the type of asset they represent).

The ongoing discussion around the economy, i.e. economics, often centres on new ways of defining value and valuation (Kallis, 2017). Within digital economy research, there is a noticeable lack of studies that do not reduce the concept of value solely to the pricing dimension. Even fewer scientific endeavours introduce a cultural, axiological approach. Notably, existing studies predominantly discuss specific types of DTs, e.g. personal tokens (Marchewka-Bartkowiak et al., 2022). Therefore, we aim to contribute to bridging the gap by the research that we present in this paper. Our study adopts a financial-axiological approach, as we are interested in the exchange valuation of DTs, which also incorporates the worldview valuation of a specific type of token. This is because we assume that when an investor decides to purchase a particular type of DT, they are simultaneously making sense of their actions by defining certain types of DTs as the ones worth investing in. However, in this paper, we do not only consider the material sense of value—we contemplate the value axiologically. That is, alongside profit, other motivations are considered, such as good deeds or even a good humour, as in the case of specific DTs designed for amusement (dog-coins).

The question of how to do pricing of cryptocurrencies and DTs is becoming increasingly important for investors attempting to diversify their portfolios. As noted by Nadler and Guo (2020), more research on the pricing of cryptocurrency tokens is warranted, investigating how the markets of this asset differ from the markets of the already established asset types. Our research problem focuses on whether the axiological type of DT (the value to which the token refers) is crucial for its stock market valuation. This consideration is crucial for determining whether it is worthwhile to invest in DTs and, if so, what type to invest in.

The purpose of this article is to explore the investment potential of specific DT types. We pose the following research question: Is there a relationship between the type of DT and its market valuation? The assumption here is that a person acquiring DTs for investment purposes is interested in information about the profit and the risks related to the undertaken operations (Cronqvist et al., 2015; McInish, 1982). The investment performance of a DT will, therefore, be indicated by a high return and low risk. As part of the study, we propose a self-developed classification of DTs according to the types of assets they represent. We create this classification based on a review of the functional tags available on the most common platforms aggregating data of cryptocurrency markets and exchanges (coinpaprika, coingecko). We consider the types of assets which DTs represent on the axiological ground; namely, each tag is related to a certain area of values. In our classification of DTs, these areas are categorised functionally and then generalised into main and subcategories. The axiological context is, therefore, relevant to our study as it provides a basis for finding an answer to the research question about the relationship between a particular type of DT (considered axiologically in this study) and its market valuation (examined by the traditional measures). With reference to the classification created, we carry out a study of specific types of DTs in terms of their profitability, risk, and effectiveness. This data allows us to estimate the investment performance of different DT types. To deepen our research, we compare the obtained results to stock market indices. Such a comparison makes it possible to give a clear answer to a potential investor regarding the investment attractiveness of tokens compared to other classic types of investments.

The empirical source for us is data from the coinpaprika platform, spanning from January 2018 to July 2022. The rationale for choosing the research period is that cryptocurrencies established themselves on the exchange at the beginning of 2018. Based on the listing of the DTs under study, we determined historical returns, enabling us to determine the profitability, risk, and investment effectiveness of the DTs (as measured by the Sharpe ratio). In terms of methodology, a similar approach was adopted in previous studies on energy tokens, which were considered potential financial instruments (Marchewka-Bartkowiak & Wiśniewski, 2022). Using such an approach, a ranking of the DTs was drawn up in terms of each measure. Additionally, the median investment performance measures across all DTs in a certain category were calculated. This provided an overview of which DT categories may be most attractive to investors.

Our contribution includes, firstly, supplementing previous research on tokenisation and DTs with an investment aspect. Secondly, the creation and application of a self-developed DT classification proposal that takes into account the hitherto overlooked aspect of the worldview valuation by market participants of a given DT type. Thirdly, assess the investment performance of DTs, both in relation to our proposed classification and in the context of stock market indices. We also provide recommendations for investors. To our knowledge, studies to date have not yet provided investment recommendations in the context of the performance of individual types of DTs, while this market is growing very rapidly, and investor interest is also increasing.

The article is structured as follows. In the ‘Literature Review’ section, we cite the most important findings on distributed ledger technologies (DLTs) and the tokenisation process, the DT types distinguished in the literature, and research on investment aspects of DTs, including the importance of the axiological aspect. In the next section, we identify the type and sources of data and the methods we used to analyse them. We then present the results of our research. In the final sections—‘Discussion’ and ‘Conclusions’—we address the previous discussion regarding the investment potential of DTs and present conclusions based on the findings. Furthermore, we provide the most important limitations of our research and a proposal of recommendations for investors who are interested in entering the cryptocurrency market.

Literature Review

The DTs and Tokenisation—Legally and from the Perspective of the Digital Record Formats

DTs are categorised as the next stage in the development of cryptoassets, a blockchain-based financial instrument (Oliveira et al., 2018; Treiblmaier & Beck, 2019). The creator(s) of bitcoin as a cryptocurrency, Nakamoto (2008, 2009), proposed a new way to establish trust for the transaction system. This trust is not to be guaranteed by the hitherto socially accepted social institutions (defined by us sociologically, i.e. as reasonably stable socio-cultural arrangements that—by regulating social interactions—satisfy specific needs of collectives and individuals; Giddens & Sutton, 2021), such as a bank or other financial institutions. The new warrant for trust is blockchain technology, chains of blocks of encrypted transactions, forming a distinct, distributed system whose decentralisation realises the ideas (transparency, peer-to-peer, immediacy) intended to underpin the axiological basis of Nakamoto’s proposed model of trust (Eyal, 2017). The social context for the emergence of the peer-to-peer model and the emergence of DLTs was the socio-economic crisis of 2007 (especially the housing aspect), which caused the traditional institutional model of trust to collapse (Aznar, 2020; Garcia-Teruel & Simón-Moreno, 2021). Blockchain technology emerged in 2008 and provided security and consistency that other technologies could not offer.

Researchers also draw attention to the ideological colouring of the crypto-ecosystem (Golumbia, 2016). Some studies show the societal roots of crypto assets, when trust and faith in the honest and transparent operation of state-regulated financial institutions are weakened or absent (Reijers & Coeckelbergh, 2018). In such cases, the lack of trust demotivates investors to invest in normal stocks, i.e. assets in the mainstream financial market.

Blockchain is a digital, immutable, shared, and synchronised database that operates in a distributed manner among different users (Chimienti et al., 2019). Each user (node) can modify the blockchain, which is cryptographically protected, so that the validation of each transaction in the database does not depend on a central authority but on the validation of the rest of the users (De Filippi & Wright, 2018). Blockchain transactions are based on smart contracts, i.e. sequences of computer codes, which allow a specific cryptocurrency (resource) to be quickly and securely transferred from one virtual wallet to another. For this purpose, parties create DTs or digital assets designed to represent a right. This phenomenon is called digital tokenisation. It allows the creation of different types of DTs (Milunovich, 2021).

Based on the types of protocols, three main types of DTs are distinguished (Milunovich, 2021; Eyal, 2017; Tasca & Tessone, 2019):

-

Fungible DTs, when using the ERC-20 protocol

-

Non-interchangeable DTs, thanks to the ERC-721 protocol (they contain in their metadata some specific information and characteristics that distinguish them from other tokens)

-

Non-transferable DTs, i.e. DTs that cannot be transferred because they are intended to represent titles or badges that can only belong to a specific person—these follow the ERC-1238 protocol.

DTs are often called coins (or altcoins). They are usually defined as a type of crypto-asset. It is most often assumed that DTs fall within the concept of cryptocurrency, although in some studies they are separated due to functionality (Marchewka-Bartkowiak & Nowak, 2020; Castrén et al., 2020). In the study, we adopt a broad definition, according to which DTs (or virtual tokens) are a digital record specific to the law, which can also be a representation of individual assets.

Tokenisation is the process of assigning rights when users of blockchain-based platforms create the so-called DTs or coloured coins, which represent rights to different types of assets. By transferring a DT, the parties aim to transfer the ownership or other property rights over the asset represented by the DT without the intervention of traditional intermediaries, such as real estate conveyancers, land registrars, or notaries specialising in real estate (Garcia-Teruel & Simón-Moreno, 2021).

In legal terms, it is pointed out that not all DTs pursue the same legal and economic goal (Edwards et al., 2019; Von der Leyen, 2019) and that they are usually created by initial coin offering, ICOs (Benedetti & Kostovetsky, 2021; Blemus & Guégan, 2019). In this sense, DT can be classified as follows:

-

Currency DTs, designed to work as a means of exchange and payment

-

Utility DTs, which entitle the holder to use the services offered by the issuer

-

Security DTs, representing shares or debts/liabilities in companies or in certain projects

-

Asset-backed DTs, designed to represent (ownership) rights to ‘real-world’ assets.

Selgin (2017), by introducing the concept of ‘synthetic commodity money’, anticipated the duality of financial instruments, based on the DLTs model of trust. The new type of money proposed by the researcher has, on the one hand, the properties of commodities—it is absolutely rare, unique, and unrepeatable, and, on the other hand, it has the basic property of money, namely, it is a carrier of value. Selgin (2015) did not equate his type of money with cryptocurrencies and pointed out that a trading system for synthetic commodity money need not to be based on blockchain technology. Nevertheless, in his proposal, he recognised the ontological duality of DTs, a duality that is particularly highlighted when writing about the tokenisation process. This is because the presence of DTs is related to the duality of their nature—DTs combine being a carrier of value with being a value.

The aforementioned property of DTs emerges especially within the framework of research on their legislative dimension (Allen & Lastra, 2019; Houben & Snyers, 2018; Zetzsche et al., 2021). The question of the type of rights that are present in a DT (combining being a value with being a carrier of value) has been related to the question of the link between smart contracts and their legal nature (Ferreira & Sandner, 2021; Raskin, 2017). Several studies have focused on taking the trouble to identify the legislative challenges of defining the tokenisation of property rights (Bullmann et al., 2019; Ishmaev, 2017; Savelyev, 2018; Yapicioglu & Leshinsky, 2020). Research of this type has been undertaken particularly in relation to how property rights to land are recorded (when DTs are intended to replace/modify/supplement existing land registries; Verheye, 2017; Vos et al., 2017) and in formulating proposals for the use of DTs as a new type of property registry (Konashevych, 2020). Attention has also been drawn to the important risk aspect of the tokenisation of private law (Savelyev, 2018) and to the related issue of creating rules for the transfer of property rights that would take into account the freedom of choice of citizens to select the corresponding technology on the basis of which they want to manage their property rights (Garcia-Teruel & Simón-Moreno, 2021).

The DTs and Tokenisation—Investment and the Axiological Aspects

The investment aspect of DTs, which is of interest to us, appears in studies on the use of blockchain for market needs (Garcia-Teruel & Simón-Moreno, 2021; Sapkota & Grobys, 2021; Fisch & Momtaz, 2020; Benedetti & Kostovetsky, 2021; OECD Blockchain Policy Series, 2020; Momtaz, 2019; Howell et al., 2018; Guo & Liang, 2016; Liao, 2021). In this context, tokenisation is explored based on findings from crowdfunding issues (Ahlers et al., 2015; Mollick, 2014; Vismara, 2016, 2018), paying attention to how DT issuers attempt to attract the attention of investors and encourage them to buy a given token (Garlick, 2018). Various proposals for reconstructing this process are used here—signalling theory (Fisch, 2019), fraud theory (Malinova & Park, 2018), or a perspective combining both approaches (Momtaz, 2021). Attention is paid to the notion of investment risk and how to estimate it, which become important in the investor’s decision-making process (Demertzis & Wolff, 2018; Hays & Kirilenko, 2019). Some studies are dedicated to specific types of DT, such as personal tokens, whose issuers want to attract investors in a specific way (based on personality traits) (Marchewka-Bartkowiak et al., 2022). Our study is part of this research stream, as we want to supplement it with the perspective of an investor’s view on which sub-market of DTs is worth investing in, i.e. which types of DTs (offering specific functionalities) are valued higher in the cryptocurrency market.

Axiology is the science of values, the philosophy of values (Fischer & Hartung, 2020). The Greek term axia means everything that has value, that is, it is precious, important, and good. Approaching any processes or phenomena in the axiological context means studying the values evoked within these processes/phenomena. Values are treated as the meaning-goal of actions taken by people (Schroeder, 2010). Certain types of beliefs, indicating values to be implemented, regulate people’s actions, motivating them to specific activities. Understanding the impact of technology on human values is extremely important and, therefore, systematically investigated into the axiological possibility space for future human (and post-human) civilisations (Danaher, 2021; Lundgren, 2023). Our research is to complement the existing tokenisation research with an axiological aspect understood as the process of giving value to the DT.

Axiological research on the link between culture and finance has primarily focused on a value such as trust. Financial contracts are economic exchanges based on two main variables—the feasibility of the contract and the mutual trust of the parties to that exchange. Financial systems differ according to the cultural regions in which they apply. In regions where amoral familism and personalised trust prevail, a development of alternative ways of financing occurs, such as those based on loans from parents, relatives, and friends, giving rise to a scarce development of financial markets (Guiso et al., 2006; Marini, 2016). The axiological determinants of financial market development are shown, inter alia, by the research of Guiso et al. (2004), who examined the differences in the financial development of different regions and provinces of Italy depending on the financial systems in these regions and the trust-building model respected by community members.

Studies dealing with cultural aspects of finance also draw attention to the so-called trust effect in stock markets. Individuals who trust less are generally less likely to invest in the stock market (Guiso et al., 2008), and the source of this attitude is not only the personality traits of the individual in question but also his or her beliefs, worldview (Dominitz & Manski, 2011). The individual’s subjective expectations of the stock market are treated here as an important determinant of investment decisions.

By including the axiological aspect (the beliefs that stand behind the decision to issue or purchase a particular type of DT) in our study, we contribute to a broader discussion concerning the functioning of socio-economic practice. It also focuses on the belief shifts taking place in relation to this issue in contemporary societies (Harrison & Huntington, 2000; Visser, 2010; Klamer, 2003). Previous thinking about the economy has been ideologised by the narrative of mainstream economics and the neoliberal doctrine that validates it, which has separated the economy from the rest of society in theoretical considerations (Zboroń, 2020).

New proposals to expand the beliefs and cultural ‘narrative’ regarding the consideration of values other than material (neoliberal profit) in business practice (including financial markets) focus primarily on the issue of linking business activity with concern for social well-being. On the ground of business ethics, the most important of these are the proposal of the five principles of CSR 2.0 (Visser, 2010) and the concept of CSV (creating shared value; Porter & Kramer, 2011). Visser (2010) proposes a new way of creating modern CSR programmes, based on five principles: (1) multilateral relations with stakeholders, (2) holistic scale of operation, (3) real commitment to solving emerging problems, (4) action identifying local and global needs, (5) action taking into account the circulation of resources and the zero-waste imperative. Porter and Kramer (2011) propose an alternative approach to business, which is to take actions that lead to the creation of shared value. Business goals are supposed to be linked to social goals. Both concepts draw attention to the values involved in responding to climate challenges—providing the thesis that any current study of any business practice should take this aspect into account.

The CSV concept also addresses the issue of examining the axiological attitudes of investors—each customer; investor (demand side) is not a passive recipient-target, but an autonomous subject revealing its needs and an active participant in value creation. Thus, he or she has a real influence on what is produced and how it is produced. We would, therefore, like to supplement the previous discussion of the worldview changes taking place in modern, technology-driven societies with questions of what type of beliefs are present in the DT sub-market.

Research has also shown that investors, in their decisions, are often conditioned by a fairly traditional worldview in the ‘spirit’ of mainstream economics, i.e. profit-oriented. Therefore, we hypothesise that the dominant in the DT sub-market will be those DTs that, in their functionality, are aimed at making a profit in ways that have been established so far (i.e. DTs of a business or technological-network nature).

Data and Methods

Data

The source of the data we used is one of the most popular platforms in the world, reporting the volumes of cryptocurrency exchanges—coinpaprika (coinpaprika.com). This exchange was created as a response to the problems faced by investors and shows the condition of digital assets, considering aspects such as low uptake, lack of trust, fraud, crime, lack of reliable information, lack of regulation, and artificial pumping of the value of some projects. It is integrated with most exchanges, so that not only the most up-to-date data is pulled, but also manipulation (intentional and unintentional) is detected. The methodology proposed by the creators of the exchange for collecting information about markets and exchanges has enabled the publication of additional indices that determine the quality of exchanges and projects (coinpaprika.com).

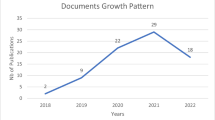

A total of 640 DTs were included in the study—their breakdown by functional type is indicated in the ‘Methods’ section. The data we analysed from the coinpaprika exchange is from the period January 2018 to July 2022. It is worth noting that listings for some DTs were not available for the entire period, as they were launched during the selected period—several of them only in 2021. However, even for these DTs, the number of observations was sufficient to make the calculations.

The rationale behind the choice of the time range of the data is that in December 2017, two Chicago US exchanges (CME and CBOE) introduced bitcoin futures into trading, thus ‘defining’ cryptocurrencies as something to be invested in. We are therefore starting from a year of cryptocurrencies becoming established on exchanges. Besides, assessments of the development of the cryptocurrency market refer to 2018 as the year of the test (Luczyk, 2019), when the cryptocurrency market becomes a legitimate sector of the capital market.

As already mentioned, 640 DTs were finally selected for the study. Initially, 3183 DTs, described with a total of 8091 tags, were used to perform the functional classification (Table 1). Unfortunately, not all the DTs had an acceptable number of observations, and most of them were characterised by low capitalisation. It was, therefore, decided to select a representative group, following the Pareto principle (80/20 rule) with regard to capitalisation. In the case of the studied DTs, the principle worked better than usual, as by selecting from each category the 20% of DTs with the highest capitalisation, the result was a group representing a minimum of 96% of the capitalisation for the functional type, and in some cases even above 99%.

In this study, we identify DTs as an alternative form of financial investment, and it was necessary to compare their investment performance to classic investment instruments—primarily equities, but also with commodities such as gold and crude oil. In particular, we compared the profitability, risk, and effectiveness of investing in DTs with the values of these measures achieved by the indices of the largest world stock exchanges (American: SPX, DJIA, Brazilian: BVP, British: FTM, German: DAX, French: CAC and Japanese: NKY) and by alternative commodity investments: gold price (XAU) and WTI-NYMEX crude oil price (CL.F)—hereafter referred to as indices. Data on the index values was taken from the local professional database (stooq.pl). The choice of stock exchange indices for comparisons resulted from the fact that investing in DTs seems to be similar to equity investments, with higher risk (volatility) than, for example, investments in debt instruments, e.g. bonds. In addition, capital investors often look for ways to diversify their portfolios, which is why they consider commodities as an alternative. We decided to compare investing in DTs with investments in gold and oil as frequently chosen commodities in scientific research (for example: Klein et al., 2018; Kyriazis, 2020).

For both DTs and indices, weekly listings were included in the analysis. The choice of such an interval was determined, among other things, by the need to standardise the frequency of data—in the case of indices, a week is, in principle, 5 days long, while in the case of DTs, data are available on each day of the week.

Methods

Generally, the investment performance is measured in two ways: rate of return and risk (Bain, 1996). The measurement can then be understood as the techniques that quantify how much return investor earned and what level of risk they accepted (Feibel, 2003). We attempted to apply classical investment measures, including profitability, risk, and effectiveness, to verify the classified DTs. Such an examination of DTs leads to an assessment of their investment performance from the perspective of portfolio analysis. By investment performance of a particular instrument, the authors understand its high expected returns and low risk (low volatility of returns)—according to the portfolio theory of Markowitz (1952). Investment efficiency, on the other hand, will be considered in terms of reward-to-variability, as the relationship between the above categories, according to the commonly used concept, formulated by Sharpe (1966, 1994). As stated in the introduction, a similar approach to assess the investment performance of DTs was adopted in the previous studies on energy tokens that were considered potential financial instruments (Marchewka-Bartkowiak & Wiśniewski, 2022).

In the axiological part of our study, we adopt a socio-regulatory cultural perspective (Coolen et al., 2002), according to which our actions, including investment ones, are guided by a specific type of belief. These beliefs determine what values we are to pursue. What is important is that a person does not necessarily have to be aware of what values guide him. Based on this concept, it is sufficient that the personal subject respects the values given, that is, acts according to these values.

Although in the literature, it is feasible to find a study of the risk of investing in DTs (initial coin offerings—ICOs) using the Value-at-Risk methodology (Kuryłek, 2020), in this study, the authors focused on classical risk measures such as standard deviation of returns, which, to the best of the authors’ knowledge, no one has done before.

Our analysis compared measures of investment performance (profitability, risk, and effectiveness), calculated from the weekly logarithmic returns of each DT over the time range indicated above. Based on this, a ranking of the DTs was made in terms of each measure. Additionally, for each category, the median of the investment performance measures was calculated for all DTs in the category. In this way, it was verified which categories of DTs may be most attractive to investors.

The value of individual investment performance measures was also calculated for individual market indices for the same time range. For the indices, the median of each investment performance measure was also estimated both for the whole sample and for each DT category separately. This allowed the investment performance of DTs to be verified against ‘traditional’ investment instruments.

Weekly logarithmic returns were used to assess the investment performance of the investment instruments analysed. The following measures of investment performance were determined for each DT and market index:

-

Profitability, described by the arithmetic mean return,

-

Risk, described by the standard deviation of returns,

-

Effectiveness, calculated using the Sharpe ratio (the quotient of the average return and the standard deviation of the returns—the value of the risk-free rate was omitted from the calculations of the Sharpe ratio due to the effectively zero interest rates occurring during the period analysed).

Results

Axiological Dimension of DTs: Classification of DTs According to Their Functional Profile

Since existing classifications of DTs by researchers have not considered the recognition of DTs according to their functional profile (functionality), we have created our own classification. This classification is based on a review of functional tags available on platforms collating data of cryptocurrency markets and exchanges (coinpaprika, coingecko). We view this classification as an expression of the worldview valuation of certain types of DTs, a valuation made by both DT issuers, investors, and the teams of platform developers aggregating DT data. We have identified two main categories of DTs: DT technological—autotelic tokens relating to technology and DT beyond-technological—relating to non-technological spheres. Within these, we have distinguished subcategories and detailed functional categories. Importantly, one DT can belong to several categories simultaneously. This is the case for those DTs that have more than one function. For example, the FIL-Filecoin token belongs to the data, software, and internet categories at the same time, as it is related to both data processing and applications used to provide services via the internet. Our own functional classification of DTs is presented in Table 1.

This summary shows that, quantitatively, payments and trading and investing DTs (PTI) are the most prevalent in the market, while communication DTs are the least frequent. Within technological DTs, tokens representing application functionalities are the most numerous, while in beyond-technological DTs, those that are FIN DT (business-oriented) are predominant. The axiological picture of the DT market seems to be quite traditional, associated with the beliefs established within the discourse of orthodox economics. This implies that investment practice is always motivated by financial gain, and investors are defined as narrowly conceived rational beings, directed only towards profit. However, it is noteworthy that the presence of DTs referring to non-economic valuations suggests slow changes in investor attitude. Not all investors adhere to neo-liberal beliefs about human nature and objective market mechanisms. When investing in atypical DTs (i.e. not traditionally associated with money), they refer to non-economic values such as environmental, social, or artistic considerations, adding meaning to their investment decisions. It is worth emphasising that the presented results should not be treated as data, statistics, or surveys that describe the attitudes, behaviours, and motivations of investors buying DTs. The highlighted DT types, according to their functional profile, indicate the presence of more DTs on the sub-market commonly associated with beliefs aligned with traditional investment methods on the DT market.

The classification not only organises investment DTs in terms of their functional profile, but also provides a starting point for further research into the relationship between DT types and their investment performance.

Investment Performance of DTs Based on Classification of DTs According to Their Functional Profile

As part of the analysis of the investment performance of DTs, a ranking of DTs was made based on profitability, effectiveness (tokens with the highest value of these indicators were assigned the rank = 1), as well as risk (tokens of the lowest risk were assigned the rank = 1). These results simultaneously reflect a record of the axiological attitudes adopted by DT purchasers. When investing in certain types of DTs, they validated them as ‘something worth investing in’, adhering (not necessarily consciously) to a certain set of beliefs that deem the purchase of a given DT worthwhile, whether for financial gain, environmental impact, or social connection. As noted earlier, we adopt a cultural perspective wherein awareness of the guiding value system is not deemed necessary for actions. The focus was on 50 DTs, with 25 from the top and 25 from the bottom of the ranking. Analysis of the top 25 and bottom 25 provides the most interesting findings. Table 2 presents the ranking of investment performance of these 50 DTs (top 25 and bottom 25).

The results show that the PTI DTs predominantly exhibit the highest profitability. In the top 25 concerning profitability, there are also 3 DTs related to cultural environment, 1 each of business and software types, along with 4 related to internet and services. Conversely, among the DTs with the lowest profitability, PTI DTs and internet and services DTs are also prominent. This is likely attributable to the fact that DTs of this type were the most numerous (285 and 108, respectively, constituting more than half of the research sample). Interestingly, the majority of business DTs, as well as all from natural environment, data, and interactions types, did not qualify for the top 25 nor bottom 25, indicating that their profitability remains at an average level.

The lowest risk is associated with investing in PTI DTs, with 24 DTs in this category leading the performance ranking in terms of risk. The riskiest DTs are observed in communication, natural environment, cultural environment, and business. Among the 25 DTs with the highest risk (bottom 25 in the ranking), there are as many as 23 of them.

The highest effectiveness (Sharpe ratio) is again characteristic for PTI DTs and internet and service types, with as many as 24 DTs in the top 25 ranking in terms of effectiveness. Among the least effective DTs (bottom 25 ranking, i.e. DTs with the lowest Sharpe ratio among those analysed), there are many PTI DTs, but also five internet and services DTs, two software DTs, and one cultural environment DT.

The analysis of the median profitability, risk, and effectiveness for the individual functional types leads to only partially similar conclusions compared to those formulated above (based on Table 2). In Table 3, we provide information on the median of the individual investment performance measures within the category.

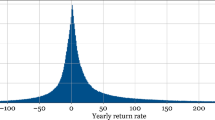

It is worth noting that the DTs with the highest investment performance (highest median profitability and effectiveness and lowest median risk) are coloured dark green, while the DTs weakest in this respect (lowest median profitability and effectiveness and highest median risk) are coloured dark red. The highest median profitability is observed for business, cultural environment, and interactions DTs (green-like colours in the column ‘Profitability’). The least attractive tokens in this respect are communication ones. The most attractive from a risk perspective (lowest risk, green-like colours in the column ‘Risk’) are PTI, software, and internet and services DTs. The riskiest is investing in natural environment DTs. Business, cultural environment, and interactions DTs have the highest effectiveness (green-like colours in the column ‘Effectiveness’). The least attractive in this respect are PTI and software DTs. Figure 1 allows for an examination of performance, considering both risk and profitability criteria.

A relatively good choice from the point of view of investment performance appears to be most of the PTI and internet and services DTs, which have relatively low risk and, in many cases, high profitability. At the opposite end of the spectrum are communication, natural environment, and cultural environment DTs, which have medium to high risk (especially the last two types) and relatively low profitability.

Analysis of DT Investment Performance as Compared to Indices

As part of the comparison of investment performance of DTs and indices, the latter were plotted on the ranking discussed above in terms of profitability, risk, and effectiveness. Figure 2 shows the individual measures, already discussed above, in terms of ranking—the green points represent the individual DTs, and the orange points represent the indices that were included in the analysis.

The higher the ranking (lower value on the X axis), the higher investment performance of a certain instrument.

Figure 2a allows us to conclude that around 150 DTs have higher profitability than any of the indices. On the other hand, the latter rank between 150 and 200 in terms of profitability, which means that around 450 DTs are less attractive than them. Similar conclusions can be drawn by comparing the ranking in terms of risk (Fig. 2b) and effectiveness (Fig. 2c)—here too, the indices did not receive ranks lower than 200. The exception is one index, which turned out to be so risky that it ranked 500. Yet, the indices are characterised by relatively low risk compared to the DTs. For most of them, a relatively low-risk measure allowed them to rank among the 150 instruments with the lowest risk. This means that most of the DTs are still less attractive in terms of the Sharpe ratio. It is also worth noting that the relatively risky index that ranked 500 is CL.F, linked to crude oil. The risk assessment for it is therefore biased due to the destabilisation of oil prices caused by the Russian invasion of Ukraine—the end of the time range of the study coincides with the war events.

The above analysis allows us to conclude that most DTs are characterised by lower investment performance than indices. Nevertheless, there are at least 100–200 (among the 640 tokens analysed) DTs that are characterised by a higher or similar investment performance to traditional instruments, which makes the former worth including in the investor’s investment portfolio. Given the conclusions of the analysis of the average investment performance measures for individual DTs, the observations made based on the comparison of the median of these measures for individual DT categories against indices are not surprising. Figure 3 shows median investment performance—DTs vs. indices.

The individual bars represent median measures across DTs in categories and across indices. Both median profitability (Chart 3a) and risk (Chart 3b) or effectiveness (Chart 3c) show that traditional instruments are, on average, more attractive for investors than DTs—the associated indices have the highest median profitability and effectiveness and the lowest median risk. This is because DTs are still outnumbered by those whose investment performance is at a relatively low level.

Discussion

The results of the research we carried out confirmed the hypothesis formulated (i.e. that the dominant in the DT sub-market will be those DTs that, in their functionality, are aimed at making a profit in ways that have been established so far). The DT sub-market is dominated by business-natured (PTI) or technology-network DTs. Thus, these are the DTs that axiologically encourage investors in a traditional way (in relation to the main value such as the profit). The considerations carried out at the beginning of this article have made it possible to draw up a new classification of DTs. The presented division of DTs according to their usefulness supplements the previously identified divisions made from the point of view of applied technological solutions and legal regulations. This approach provides a new perspective on DTs and their market. At the same time, it is a starting point for the research on links between the nature of a certain DT and its investment performance.

Our research confirms the existing categorisation of DTs as the next stage in the development of cryptoassets (Treiblmaier & Beck, 2019), when DTs become one means of portfolio diversification for investors. Our classification of DTs according to their functionality, on the other hand, demonstrates the validity of the definition of tokenisation as a process of assigning rights to different types of assets (Garcia-Teruel & Simón-Moreno, 2021), but at the same time highlights the—hitherto unrecognised—internal diversity of the existing DT classification in legal terms (Edwards et al., 2019; Von der Leyen, 2019).

Regarding the concept of ‘synthetic commodity money’ (Selgin, 2015, 2017) and the recognition of the ontological duality of DTs that can be made from it, the results of our study illustrate the investors’ perception of a DT as a carrier of value, which raises identifiable further research on the legislative dimension of DTs and the type of rights they represent.

Our further contribution to research on the investment aspect of DTs and the problematic use of blockchain for market needs (Garcia-Teruel & Simón-Moreno, 2021; Sapkota & Grobys, 2021; Fisch, 2019; Benedetti & Kostovetsky, 2021; OECD Blockchain Policy Series, 2020; Momtaz, 2019; Howell et al., 2018; Guo & Liang, 2016; Liao, 2021) and new funding models (Ahlers et al., 2015; Fisch, 2019; Garlick, 2018; Malinova & Park, 2018; Mollick, 2014; Momtaz, 2021; Vismara, 2016, 2018), is primarily to complement them with the perspective of the investor’s view. In our research, we mainly used the ‘traditional’ measures of investment performance (profitability, effectiveness, risk) and compared them with indices. In creating a classification of DTs according to their functionality, we also considered the axiological aspect, i.e. what type of beliefs on what is worth investing in are most commonly respected by investors. As can be seen from the overview, most investors’ decisions are motivated by beliefs formulated on the basis of the doctrine of economic orthodoxy.

Our research also addresses issues related to the problem of the creation, construction, and respected trust models in financial systems (Guiso et al., 2008; Marini, 2016). The compilation of the tags of each token type, from which we developed a classification of DTs according to their functionality profile, showed that investors have their own subjective expectations of each token type.

The proposed classification of DTs, which we treat as a visualisation of the respected beliefs that stand behind the decision to issue or purchase a particular type of DT, is a contribution to the discussion on the contemporary digital transformation and the role of non-economic values in business practice (Harrison & Huntington, 2000; Visser, 2010; Klamer, 2003). Our research shows that worldview transformations, integrating the economy into the rest of society and the humanistic values (the common good, the good of nature) respected by members of modern societies, are also slowly taking place in the DT sub-market.

Conclusions

Our research has shown the importance of considering the functionality of DTs, showcasing the potential of the DT classification we created. Information about the most prevalent type DT is extremely important for both investors and DT issuers.

The conducted research leads us to give an affirmative answer to the research question posed, indicating that there is a relationship between the type of DT and its market valuation. Moreover, the DT sub-market demonstrates internal diversity in terms of the DT types. Those with tags related to business-oriented spheres and those focused on communication technologies and networks dominate the market. This finding has significant implication for the literature, indicating that the current distinction between the two main DT categorisation methods (legal background and digital record formats) is crucial but not sufficient for a comprehensive typology of DTs. Importantly, extending the categorisation to include axiological dimensions allows to illustrate the complexity of this sub-market.

We also found that PTI DT is the ones with the highest profitability, indicating that both issuers and investors adhere to a relatively traditional approach to token valuation. The most numerous tokens offered are orientated towards profit, and such tokens also receive the highest valuation.

It is important to emphasise that the diversity of DT types, identified by tags, referring to particular axiological areas, reflects the on-going changes in economics. Specifically, the transition from mainstream economics to heterodox economics, as discussed in the field of economics, is also evident in the DT sub-market. New investment paths emerge as the ‘non-obvious’, niche, unusual tokens (e.g. environmentally friendly ones) are issued and appreciated by the investors.

In summary, this paper makes several key contributions. Firstly, it extends existing research on tokenisation and DTs by incorporating the investment aspect. Secondly, it introduces an original proposal of DT classification, considering the previously neglected aspect of worldview valuation by market participants of a given DT type. Thirdly, the paper provides an estimation of the investment performance of DTs, both within the proposed classification and in comparison to stock market indices. Additionally, the paper contributes to the broader discussion on the contemporary digital transformation and the significance of non-economic values in business practices. Lastly, the paper includes recommendations for investors.

The study acknowledges several limitations. Firstly, the research revealed that most investors perceive DTs as a store of value, prompting the need for further research into the legislative dimension of DTs and the type of rights they represent. Secondly, due to the challenges in gauging the level of trust among investors, our research is restricted to reconstructing axiological attitudes and beliefs in the DT sub-market. The encrypted nature of purchase processes makes it difficult to reach every investor and examine their intrinsic motivations for buying a given type of DT. Therefore, we cannot assess whether potential investors distinguishes between cryptocurrency and DTs or how cryptocurrency news influences DT investment decisions.

This study provides evidence that the DT sub-market is gradually ‘reacting’ to the contemporary changes in economic worldviews, permeating various sectors of the economy. The emerging image of the investor is becoming less homogeneous, directed towards orthodox economic values and the concept of homo oeconomicus. However, we must point out that our research is limited in this respect, as the axiological aspect is considered in the classification of DTs according to their functionality. Further research employing qualitative methodology, such as interviews with selected DT sub-market investors, would be necessary to delve deeper into the reconstruction of beliefs that accompany investors’ decisions to purchase a particular type of DT.

One of the most important implications from our study for investment practice and policy is to answer the following two questions: Is it worth investing in DTs, and can DTs be considered as an alternative in an investment portfolio? The research, based on information from 640 DTs, facilitated the identification and systemisation of their characteristics, forming the basis for classification. The classification according to usefulness reflects a worldview valuation of investors’ actions at the time of DT purchase decisions. Using classic measures for assessing investment performance, the study produced rankings for individual DTs and functional groups/categories based on median values for profitability, risk, and effectiveness. The results showed that the individual functional groups of DTs exhibit diverse average investment performance. PTI DTs, on average, displayed the highest profitability and lowest risk (this is also shown by the reward-to-risk ratios illustrated in Fig. 1). Conversely, the least attractive investment DTs are those associated with natural environment and communication. The observed regularity allows us to suggest that axiological foundations are of key importance for the valuation of DTs. The prevailing beliefs influencing investment decisions in DTs still align with neoliberal origins, favouring DTs aimed at increasing or maintaining value over those pursuing environment goals, for instance.

Investors interested in ‘unusual’ DTs may include those seeking new investment solutions aligned with values beyond profit. The first group of people who may want to invest in DTs other than PTI will be those interested in the monetization of their or other users’ social reach. In this case, an investment in this type of DT will not only be a capital investment, but also a way to build a brand and expand one’s social reach. The second group of investors will be pro-environmental advocates. Investing in DTs, whose tags refer to nature conservation or ecology, will, in this case, be an expression of support for ecological ideas. An interesting group of investors may also be people who are focused on fun, looking for new forms of entertainment, and treating investing itself as a form of play.

The identified patterns provide investment guidance for potential buyers. Investors considering tokens as an alternative form of capital investment, distinct from traditional investments in shares, currencies, or commodities, should focus on DTs tagged with labels such as investment, trade, and payments. According to this study, other types of DTs may not be regarded as efficient investment assets within the framework of traditional beliefs rooted in the discourse of economic orthodoxy. Purchasers of these DTs are likely guided by alternative investment rationales or beliefs, moving beyond the conventional profit-centric approach.

Data Availability

Not applicable.

References

Ahlers, G. K. C., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39, 955–980.

Allen, J. G., & Lastra, R. M. (2019). Towards a European governance framework for crypto-assets. SUERF The European Money and Finance Forum, Policy Note, Issue No 110. Accessed April 14, 2024, from https://www.suerf.org/wp-content/uploads/2023/12/f_ca91c5464e73d3066825362c3093a45f_7839_suerf.pdf

Aznar N. S. (2020). Naturaleza jurídica y regimen civil de los tokens en blockchain. La tokenización de bienes en blockchain: Cuestiones civiles y tributaries. Cizur Menor: Thomson Reuters Aranzadi. In: Garcia-Teruel, R.M., Simón-Moreno, H. (2021). The digital tokenization of property rights. A comparative perspective. Computer Law & Security Review 41. 105543. https://doi.org/10.1016/j.clsr.2021.105543

Bain, W. G. (1996). Investment performance measurement. Woodhead Publishing Ltd.

Benedetti, H., & Kostovetsky, L. (2021). Digital tulips? Returns to investors in initial coin offerings. Journal of Corporate Finance, 66, 101786. https://doi.org/10.2139/ssrn.3182169

Blemus, S., & Guégan, D. (2019). Initial Crypto-asset Offerings (ICOs), tokenization and corporate governance. Documents de travail du Centre d'Economie de la Sorbonne - 2019.04 (11.1), 1–2. Accessed April 14, 2024, from http://dx.doi.org/10.2139/ssrn.3350771

Bullmann, D., Klemm, J., & Pinna, A. (2019). In search for stability in crypto-assets: Are stablecoins the solution? European Central Bank. Occasional Paper Series, No 230. Accessed April 14, 2024, from https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op230~d57946be3b.en.pdf

Castrén, O., Kavonius, I. K., & Rancan, M. (2020). Digital currencies in financial networks, EBA Staff Papers Series, series No 8, June 2020, 1–50. Accessed April 14, 2024, from https://www.eba.europa.eu/sites/default/documents/files/document_library/887439/Digital%20currencies%20in%20financial%20networks.pdf

Chimienti, M. T., Kochanska, U., & Pinna, A. (2019). Understanding the crypto-asset phenomenon, its risks and measurement issues. ECB Economic Bulletin, 5. Accessed April 14, 2024, from https://www.ecb.europa.eu/pub/economic-bulletin/articles/2019/html/ecb.ebart201905_03~c83aeaa44c.en.html

Coolen, H., Boelhouwer, P., & Van Driel, K. (2002). Values and goals as determinants of intended tenure choice. Journal of Housing and the Built Environment, 17, 215–236. https://doi.org/10.1023/A:1020212400551

Cronqvist, H., Siegel, S., & Yu, F. (2015). Value versus growth investing: Why do different investors have different styles? Journal of Financial Economics, 117(2), 333–349. https://doi.org/10.1016/j.jfineco.2015.04.006

Cumming, D., Johan, S., & Pant, A. (2019). Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. Journal of Risk & Financial Management., 3, 126. https://doi.org/10.3390/jrfm12030126

Danaher, J. (2021). Axiological futurism: The systematic study of the future of values. Futures, 132, 102780. https://doi.org/10.1016/j.futures.2021.102780

De Filippi, P., & Wright, A. (2018). Blockchain and the law. The rule of code. Harvard University Press. https://doi.org/10.4159/9780674985933

Demertzis, M., & Wolff, G. B. (2018). The economic potential and risks of crypto assets: Is a regulatory framework needed? Policy Contribution. 27194, Bruegel. Accessed April 14, 2024, from https://www.bruegel.org/2018/09/the-economic-potential-and-risks-of-crypto-assets-is-a-regulatory-framework-needed/

Dominitz, J., & Manski, Ch. (2011). Measuring and interpreting expectations of equity returns. Journal of Applied Econometrics, 26(3), 352–370. https://doi.org/10.1002/jae.1225

Edwards, F. R., Hanley, K., Litan R. E., & Weil, R. L. (2019). Crypto assets require better regulation: Statement of the financial economists roundtable on crypto assets. Financial Analysts Journal, 75(2). https://doi.org/10.1080/0015198X.2019.1593766

Euler, T. (2018). The token classification framework: A multi-dimensional tool for understanding and classifying crypto tokens. Untitled INC, 18 January. Accessed April 14, 2024, from http://www.untitled-inc.com/the-token-classification-framework-a-multi-dimensional-tool-for-understanding-and-classifying-crypto-tokens/

Eyal, I. (2017). Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer, 50(9), 38–49. https://doi.org/10.1109/MC.2017.3571042

Feibel, B. J. (2003). Investment performance measurement. Wiley.

Ferreira, A., & Sandner, P. (2021). EU search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure. Computer Law & Security Review, 43. https://doi.org/10.1016/j.clsr.2021.105632

Fisch, C. (2019). Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing, 34(1), 1–22. https://doi.org/10.1016/j.jbusvent.2018.09.007

Fisch, C., & Momtaz, P. (2020). Institutional investors and post-ICO performance: An empirical analysis of investor returns in initial coin offerings (ICOs). Journal of Corporate Finance, 64, 101679. https://doi.org/10.1016/j.jcorpfin.2020.101679

Fischer, J., & Hartung, G. (Eds.). (2020). Nicolai Hartmanns dialoge, 1920–1950: Die “Cirkelprotokolle.” De Gruyter.

Garcia-Teruel, R. M., & Simón-Moreno, H. (2021). The digital tokenization of property rights. A comparative perspective. Computer Law & Security Review, 41, 105543. https://doi.org/10.1016/j.clsr.2021.105543

Garlick, R. (2018). Why Cryptoassets are Important. Medium, 12 September 2018. Accessed April 14, 2024, from https://medium.com/@rossgarlick/why-cryptoassets-are-important-to-me-a34e9ce9b313

Giddens, A., & Sutton, Ph. W. (2021). Sociology. Wiley.

Golumbia, D. (2016). The politics of bitcoin: Software as right-wing extremism. University of Minnesota Press.

Guiso, L., Sapienza, P., & Zingales, L. (2004). The role of social capital in financial development. American Economic Review, 94(3), 526–556. Accessed April 14, 2024, from https://www.jstor.org/stable/3592941

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, 20(2), 23–48. https://doi.org/10.1257/jep.20.2.23

Guiso, L., Sapienza, P., & Zingales, L. (2008). Trusting the stock market. Journal of Finance, 63(6), 2557–2600. https://doi.org/10.1111/j.1540-6261.2008.01408.x

Guo, Y., & Liang, C. (2016). Blockchain application and outlook in the banking industry. Financial Innovation, 2, 24. https://doi.org/10.1186/s40854-016-0034-9

Hacker, Ph., & Thomale, C. (2018). Crypto-securities regulation: ICOs, Token Sales and Cryptocurrencies under EU Financial Law. European Company and Financial Law Review, 15, 645–696. https://doi.org/10.2139/ssrn.3075820

Harrison, L. E., & Huntington, S. P. (Eds.). (2000). Culture matters. How values shape human progress. Basic Books. Accessed April 14, 2024, from https://ia902700.us.archive.org/19/items/CultureMattersHowValuesShapeHumanProgress/Culture%20Matters%20How%20Values%20Shape%20Human%20Progress.pdf

Hays, D., & Kirilenko, A. (2019). The use and adoption of crypto assets. Working paper of the Spanish Banking and Finance Institute. Accessed April 14, 2024, from https://s1.aebanca.es/wp-content/uploads/2019/10/the-use-and-adoption-of-crypto-assets.pdf

Houben, R., & Snyers, A. (2018). Cryptocurrencies and blockchain, legal context and implications for financial crime, money laundering and tax evasion. European Parliament, Policy Department for Economic, Scientific and Quality of Life Policies Directorate General for Internal Policies, PE 619.024. Accessed April 14, 2024, from https://www.europarl.europa.eu/cmsdata/150761/TAX3%20Study%20on%20cryptocurrencies%20and%20blockchain.pdf

Howell, S. T., Niessner, M., & Yermack, D. (2018). Initial coin offerings: Financing growth with cryptocurrency token sales. In Working Paper. National Bureau of Economic Research, 24774, 1–66. Accessed April 14, 2024, from http://www.nber.org/papers/w24774

Ishmaev, G. (2017). Blockchain technology as an institution of property. Metaphilosophy, 48(I5), 666–686. https://doi.org/10.1111/meta.12277

Kallis, G. (2017). Radical dematerialization and degrowth. Philosophical Transactions of the Royal Society A Mathematical, Physical and Engineering Sciences, 375(2095). https://doi.org/10.1098/rsta.2016.0383

Klamer, A. (2003). A pragmatic view on values in economics. Journal of Economic Methodology, 10(2). https://doi.org/10.1080/1350178032000071075

Klein, T., Thu, H. P., & Walther, T. (2018). Bitcoin is not the new gold – A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis, 59, 105–116. https://doi.org/10.1016/j.irfa.2018.07.010

Konashevych, O. (2020). General concept of real estate tokenization on blockchain the right to choose. European Property Law Journal, 9(1–2), 1–45. https://doi.org/10.1515/eplj-2020-0003

Kuryłek, Z. (2020). ICO tokens as an alternative financial instrument: A risk measurement. European Research Studies Journal, 23(4), 512–530. https://doi.org/10.35808/ersj/1697

Kyriazis, N. A. (2020). Is bitcoin similar to gold? An integrated overview of empirical findings. Journal of Risk and Financial Management, 13(5), 88. https://doi.org/10.3390/jrfm13050088

Liao, R. (2021). China’s national blockchain network embraces global developers. Techcrunch, 4 February 2021. Accessed April 14, 2024, from https://techcrunch.com/2021/02/03/bsn-china-national-blockchain

Luczyk, P. (2019). Sytuacja na rynku kryptowalut w 2018 roku (The situation on the cryptocurrency market in 2018). Zeszyty Studenckie “Nasze Studia”, (9), 325–334. Accessed April 14, 2024, from https://czasopisma.bg.ug.edu.pl/index.php/naszestudia/article/view/3425

Lundgren, B. (2023). Two notes on axiological futurism: The importance of disagreement and methodological implications for value theory. Futures, 147, 103120. https://doi.org/10.1016/j.futures.2023.103120

Malinova, K., & Park, A. (2018). Tokenomics: When tokens beat equity. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3286825

Marchewka-Bartkowiak K., & Nowak K. (2020). Get tokenized... The specificity of personal tokens in the context of tokenization and axiological categorization. In Proceedings of the 3rd International Conference on Economics and Social Sciences (pp. 823–831). Sciendo. https://doi.org/10.2478/9788366675162-081

Marchewka-Bartkowiak, K., & Wiśniewski, M. (2022). Energy tokens as digital instruments of financial investment. Economics and Business Review, 8(3), 109–125. https://doi.org/10.18559/ebr.2022.3.6

Marchewka-Bartkowiak, K., Nowak, K., & Litwiński, M. (2022). Digital valuation of personality using personal tokens. Electronic Markets. https://doi.org/10.1007/s12525-022-00562-y

Marini, A. (2016). Cultural beliefs, values and economics: A survey. MPRA, 69747. Accessed April 14, 2024, from https://mpra.ub.uni-muenchen.de/69747

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.2307/2975974

Massad, T. G. (2019). It’s time to strengthen the regulation of crypto-assets. Economic Studies at Brookings. Accessed April 14, 2024, from https://www.brookings.edu/wp-content/uploads/2019/03/Timothy-Massad-Its-Time-to-Strengthen-the-Regulation-of-Crypto-Assets.pdf

McInish, Th. H. (1982). Individual investors and risk-taking. Journal of Economic Psychology, 2(2), 125–136. https://doi.org/10.1016/0167-4870(82)90030-7

Milunovich, G. (2021). Assessing the connectedness between proof of work and proof of stake/other digital coins. Economics Letters, 110243, https://doi.org/10.1016/j.econlet.2021.110243

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business VenturIng, 29(1), 1–16. https://doi.org/10.1016/j.jbusvent.2013.06.005

Momtaz, P. P. (2019). Token sales and initial coin offerings: Introduction. The Journal of Alternative Investment, 21(4), 7–12. https://doi.org/10.3905/jai.2019.21.4.007

Momtaz, P. P. (2021). Entrepreneurial finance and moral hazard: Evidence from token offerings. Journal of Business Venturing, 36. https://doi.org/10.1016/j.jbusvent.2020.106001

Nadler, Ph., & Guo, Y. (2020). The fair value of a token: How do markets price cryptocurrencies? Research in International Business and Finance, 52, 101108. https://doi.org/10.1016/j.ribaf.2019.101108

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Accessed April 14, 2024, from https://bitcoin.org/bitcoin.pdf

Nakamoto, S. (2009). Bitcoin open source implementation of P2P currency, P2P Foundation. Accessed April 14, 2024, from https://satoshi.nakamotoinstitute.org/posts/p2pfoundation/1/

OECD Blockchain Policy Series. (2020). The Organisation for Economic Co-operation and Development, ‘The tokenisation of assets and potential implications for financial markets’. Accessed April 14, 2024, from https://web-archive.oecd.org/2020-01-17/542779-The-Tokenisation-of-Assets-and-Potential-Implications-for-Financial-Markets.pdf

Oliveira, L., Zavolokina, L., Bauer, I., & Schwabe, G. (2018). To token or not to token: Tools for understanding blockchain tokens. In: International Conference of Information Systems, ICIS, San Francisco, USA, 12 December 2018 – 16 December. https://doi.org/10.5167/uzh-157908r5https://doi.org/10.5167/uzh-157908

Omarova, S. T. (2020).Technology v. technocracy: Fintech as a regulatory challenge. Journal of Financial Regulation, 6(75), 105. Accessed April 14, 2024, from http://ssrn.com/abstract=3545468

Porter, M. E., & Kramer, M. R. (2011). Creating shared value. Harvard Business Review, 89, 62–77.

Raskin, M. (2017). The law and legality of smart contracts. Georgetown Law Technology Review, 304, 1–37. https://doi.org/10.2139/ssrn.2842258

Reijers, W., & Coeckelbergh, M. (2018). The blockchain as a narrative technology: Investigating the social ontology and normative configurations of cryptocurrencies. Philosophy and Technology, 31(1), 103–130. https://doi.org/10.1007/s13347-016-0239-x

Sapkota, N., & Grobys, K. (2021). Asset market equilibria in cryptocurrency markets: Evidence from a study of privacy and non-privacy coins. Journal of International Financial Markets, Institutions and Money, 74. https://doi.org/10.1016/j.intfin.2021.101402

Savelyev, A. (2018). Some risks of tokenization and blockchainizaition of private law. Computer Law and Security Review, 34(4), 863–869. https://doi.org/10.1016/j.clsr.2018.05.010

Schroeder, M. (2010). Value and the right kind of reason. Oxford Studies in Metaethics, 5, 25–55. Accessed April 14, 2024, from https://philpapers.org/archive/SCHVAT-2.pdf

Selgin, G. (2015). Synthetic commodity money. Journal of Financial Stability, 17, 92–99. https://doi.org/10.1016/j.jfs.2014.07.002

Selgin G. (2017). Money free and unfree, Washington: Cato Institute. Accessed April 14, 2024, from https://riosmauricio.com/wp-content/uploads/2020/08/Money-Free-and-Unfree.pdf

Sharpe, W. F. (1966). Mutual funds performance. The Journal of Business, 39(1), 119–138. https://doi.org/10.1086/294846

Sharpe, W. F. (1994). The sharpe ratio. The Journal of Portfolio Management, 21(1), 49–58. https://doi.org/10.3905/jpm.1994.409501

Tasca, P., & Tessone, C. (2019). A taxonomy of blockchain technologies: Principles of identification and classification. Ledger, 4. https://doi.org/10.5195/ledger.2019.140

Treiblmaier, H., & Beck, R. (2019). Business transformation through blockchain: Volume II. Palgrave Macmillan.

Verheye, B. (2017). Real estate publicity in a blockchain world: A critical assessment. European Property Law Journal, 6(3), 441–476. Accessed April 14, 2024, from https://doi.org/10.1515/eplj-2017-0020

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46, 579–590. https://doi.org/10.1007/s11187-016-9710-4

Vismara, S. (2018). Signaling to overcome inefficiencies in crowdfunding markets. In: The economics of crowdfunding (pp. 29–56). https://doi.org/10.1007/978-3-319-66119-3_3

Visser, W. (2010). The age of responsibility: CSR 2.0 and the new DNA of business. Journal of Business Systems, Governance and Ethics, 5(3), 7–22. https://doi.org/10.15209/jbsge.v5i3.185

Von der Leyen, U. (2019). A union that strives for more. My agenda for Europe. Political Guidelines for the Next European Commission 2019–2024. Accessed April 14, 2024, from https://ec.europa.eu/commission/sites/beta-political/files/political-guidelines-next-commission_en.pdf

Vos, J., Lemmen, C., & Beentjes, B. (2017). Blockchain-based land administration: Feasible, illusory or a panacea? Proceedings of the 2017 World Bank Conference on Land and Poverty. Accessed April 14, 2024, from https://ris.utwente.nl/ws/portalfiles/portal/287081518/lemmen_blo.pdf

Yapicioglu, B., & Leshinsky, R. (2020). Blockchain as a tool for land rights: Ownership of land in Cyprus. Journal of Property Planning and Environmental Law, 12(2), 171–182. https://doi.org/10.1108/JPPEL-02-2020-0010

Zboroń, H. (2020). Economic success or social well-being. In K. Bachnik, M. Kaźmierczak, M. Rojek-Nowosielska, M. Stefańska, & J. Szumniak-Samolej (Eds.), CSR in contemporary Poland: Institutional perspectives and stakeholder experiences (pp. 3–13). Palgrave Macmillan.

Zetzsche, D. A., Buckley, R. P., & Arner, D. W. (2021). Regulating Libra. Oxford Journal of Legal Studies, 41(1), 80–113. https://doi.org/10.1093/ojls/gqaa036

Funding

This work was supported by the Regional Initiative for Excellence programme of the Minister of Science and Higher Education of Poland, years 2019–2023 under Grant no. 004/RID/2018/19.

Author information

Authors and Affiliations

Contributions

All author(s) read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nowak, K.A., Wiśniewski, M. & Litwiński, M. Is It Worth Investing in Tokens? Investment Performance of Digital Tokens in Financial and Axiological Contexts. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01962-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01962-5