Abstract

This is a study on interest rate volatility, a crucial form of volatility which affects local and foreign investments in the real and financial sectors. Whether to prioritize interest rate stability to prevent distortions in the market mechanism or to prioritize other macroeconomic objectives while allowing interest rates to independently react to market forces is a key question for Nigeria’s apex monetary authority. Answering this question is the primary motivation for this research. This paper is an attempt to establish the effect of interest rate volatility on economic growth and further conclude on the suitability of the financial liberalization policy in Nigeria. To reach an evidence-based conclusion, the paper analyzes the relationship between interest rate volatility and economic growth in Nigeria for the period 1981–2020. The QARDL procedure was employed to establish the short-run and long-run quantile-specific impacts of interest rate volatility. As a final step, Granger causality tests are conducted to investigate the predictive powers of the variables. It is discovered from the econometric analysis that interest rate volatility adversely affects the economic performance of Nigeria in both the short run and long run. Consequently, full liberalization is not suitable for the economy. Moreover, we find that the short-run adverse growth effect of interest rate volatility is greater when the economy is already in a relatively weak state, whereas the long-run adverse growth effect is greater when the economy is already in a relatively strong position. The findings sufficiently prove that full interest rate liberalization is not Pareto efficient for Nigeria. Hence, greater supervision of the interest rate corridor system to reduce volatility in the rates and minimize chances of persistent upward or downward bias is advised. Study limitations and directions for further research are also provided.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Despite its status as Africa’s largest economy, Nigeria faces significant developmental challenges. A middle-income mixed economy with a growing market, Nigeria, is ranked the largest economy in Africa, the 27th largest economy in the world in terms of nominal GDP, and the 24th largest in purchasing power parity (Awe et al., 2023; Terwase et al., 2014). It is however an incontestable fact that the economy has grown weak over the decades in many respects. This is evident in the developmental challenges constantly being faced by the country. The 2022 multidimensional poverty index released by the National Bureau of Statistics reveals that about 63% of the populace live below the poverty line. It is thus an obvious reality that economic prosperity in Nigeria has been impeded by a myriad of factors. Particularly, the growing uncertainties of various forms plaguing the country is a cause for alarm.

For any developing economy on the right course, all influencers of national growth are topics of central discussion. Among multiple considerations of the various factors affecting the productivity and growth of any developing economy, the issue of the mechanism of interest rate, its variability, and trends through time has proven to deserve significant attention. Interest rate is the sum exacted on money given by a lender to a borrower and expressed as a proportion of the principal (Central Bank of Nigeria [CBN], 2016). This definition identifies it as the cost of borrowing from a lender. Another essential element in the definition is the recognition of the lender’s authority to charge a fee, also known as interest; for the creditor, the interest rate is the sum obtained for taking the risk to extend money to a borrower. Bergo (2003) describes it as compensation needed for placing capital at the disposal of others through savings. Interest rate can thus be seen from various perspectives. It can be seen as the cost of funds, the reward for savings, or the returns on investment of financial assets; whichever way, it is invariably an important economic price. As such, it is generally regarded as one factor that has a major impact on saving and investment within a country and, consequently, on economic growth. Typically, higher interest rates encourage savings as it leads to increased income. It however also raises the cost of capital, thus lowering a country’s rate of investment. Interest rate is therefore key to the transmission of monetary policy, and it is for this reason that it features in most financial and macroeconomic models (Das et al., 2014; Gil-Alana et al., 2017). Therefore, movements in interest rates, especially when unanticipated, are a major source of concern.

One common challenge plaguing Nigeria is the level of volatility often present in the financial system. Without a doubt, a robust financial system aids economic growth through the facilitation of savings and the channeling of funds from savers to investors. However, the challenges posed by the relatively high levels of instability in the system, especially with regard to sudden interest rate volatility, have the potential to adversely impact market efficiency (Istreffi & Mouabbi, 2017). Volatility creates inefficiencies in the financial system and consequently creates economic harm (Poterba, 2000). Di Giovanni and Levchenko (2006) emphasize that the adverse effects of volatility are even more pronounced in developing nations such as Nigeria when compared with developed nations.

As explained by Shunmugam and Hashim (2009), volatility in real interest rates impacts the entire economy either directly or indirectly. For instance, the statutory liquidity ratio portfolios and corporate bonds of financial institutions are directly susceptible to the risks posed by interest rate fluctuations. Institutional investors and mutual funds as well as the corporate sector are all also exposed to risks resulting from volatility in interest rates (Shunmugam & Hashim, 2009). Due to the strong interconnectivity between the financial sector, the corporate sector, and the overall economy, the adverse effects of interest rate volatility can quickly spread across the entire economy with dire consequences. Therefore, volatility in interest rate connotes a sense of uncertainty which adversely affects investment to the extent that investors lose confidence even in a currently low rate because of fear and expectations of a possible future rise which could pull down returns on investment. Istreffi and Mouabbi (2017) agree with this explanation that economies are adversely affected when uncertainty surrounds the future trajectory of interest rates, just as Donzwa et al. (2019) show that interest rate volatility spills over into other sectors of the economy.

For the aforementioned reasons, several researchers have advocated placing legal restrictions on interest rates to guard against market failures and information frictions that could be triggered by volatility (see Olasehinde-Williams & Özkan, 2022). On the other hand, it is also widely encouraged that interest rates should be left to the forces of demand and supply. It is claimed that the liberalization of the financial sector in this manner would improve economic growth (Ene et al., 2015; Mehran & Laurens, 1997). For instance, Ghironi and Ozhan (2020) present interest rate uncertainty as a useful tool for reducing ineffective capital inflows, as well as for modifying the structure of external accounts between marketable securities and foreign direct investment.

Thus, the best way of handling challenges triggered by sudden movements in interest rates has continued to generate debates in central bank policymaking (Olasehinde-Williams & Özkan, 2022). Nigeria’s apex bank, the CBN, through its monetary policy, power possesses significant influence on interest rates (Dabale & Jagero, 2013). Whether to prioritize interest rate stability to prevent distortions in the market mechanism or to prioritize other macroeconomic objectives while allowing interest rates to independently react to market forces is a key question for the CBN. Answering this question is the primary motivation for this paper.

Issues of interest rate volatility began to surface in Nigeria after the adoption of the liberalization policy in 1986. According to Kalejaiye et al. (2013), the application of the economic principle of liberalization began in the 1980s in Nigeria with the Structural Adjustment Program (SAP). At the commencement of this program, foreign trade and payment systems were liberalized, price controls and caps on interest rate were removed, and public sector enterprises were rationalized and restructured. All these efforts were aimed at increasing economic efficiency and placing the economy on a stable and durable growth path, especially in view of the problems encountered by Nigeria during the post-colonization era. However, economic growth has been epileptic, and there seems to be a relative insensitivity of the economy to the corrective liberalization policies. For instance, claims have been made that the interest rate liberalization policy in Nigeria has had no serious effect on the fund mobilization effort of commercial banks (Arikewuyo & Akingunola, 2019) or even on investment (Obinna, 2020).

A handful of studies have been carried out on interest rate volatility in Nigeria (see Dabale & Jagero, 2013; Ayopo et al., 2016; Omotunde & Nwokoma, 2016). Research has also been extensively done on Nigeria’s economic growth. However, so far, no study has attempted to merge these two critical issues. Considering the potential influence of interest rate volatility on overall productivity, findings about the growth effect of interest rate volatility provide policymakers with useful information. Overall, this paper augments the existing growth literature by determining the response of economic growth to interest rate volatility in a developing country such as Nigeria. The study further determines whether interest rate liberalization suits the Nigerian economy.

This paper contributes to existing literature in two unique ways. Firstly, it extends the empirical research on the interest rate-economic growth nexus by explicitly modeling interest rate volatility using the deviations of interest rate from trend components computed via the Hodrick–Prescott (HP) filter. Previous studies have mostly focused on inferring the growth effects of interest rate volatility indirectly from the growth impacts of interest rate. The ones that have actually estimated interest rate volatilities have done using ARCH/GARCH family models that are mainly useful for modeling volatility in high frequency data (see among others, Oseni & Nwosa, 2011; Bayracı & Ünal, 2014; Tian & Hamori, 2015). The method used in this study is better suited for modeling low-frequency data such as the annual data used in this study (see Grigoli & Mills, 2014). Secondly, this study takes into consideration the likelihood that various levels of interest rate volatility might not have similar effects on all levels of economic status, and the relationships might also vary from the short term to the long term. To this end, the novel Quantile Autoregressive Distributed Lag (QARDL) approach of Cho et al. (2015) is employed in modeling both short-run and long-run asymmetries between interest rate volatility and economic growth.

The remaining sections of this paper are organized as follows: the “Literature Review” section is the literature review, the “Data and Methodology” section describes the research methodology, the “Results” section reports the results, and the “Conclusion and Policy Recommendations” section concludes with a summary and policy recommendations.

Literature Review

Volatility in the macroeconomic space is generally caused by variability in fiscal and monetary policies (Shunmugam & Hashim, 2009). Volatility represents a measure of potential variations in economic variables captured through observed realizations over some historical period. It is thus commonly referred to as realized volatility and measured through standard deviations (Aizenman & Pinto, 2004; Lee et al., 2022). Thus, modeling volatility in macroeconomic variables involves establishing the deviations from equilibrium values in such variables (Aizenman & Pinto, 2004). Consequently, the effects of volatility in various economic variables have been examined this way in extant literature. Examples include the analysis of volatility in GDP growth rates and terms of trade by Acemoglu et al. (2003), the study on the investment-volatility dampening role of aid by Balcilar et al. (2022), the examination of the link between geopolitical threats and oil price volatility by Lee et al. (2021), the analysis of volatility in precious metals carried out by Khaskheli et al. (2022), and the study of volatility in house prices by Fan et al. (2022).

Specifically, interest rate volatility refers to the wide swings or changes in the rate of interest (Delebari & Didi, 2020). Volatility is usually experienced when liberalization policies are suspended. Interest rates may demonstrate “overshooting,” which arises from the upward drive compelled by inadequate fiscal and monetary policies; in this case, the perceived “volatility” is a normal dynamic adjustment in the marketplace (Glower, 1994). Studies have shown that interest rate volatility can affect the performance and monetary policy decisions of an economy through its effect on money demand (Githinji, 2015). Interest rate variations also influence consumer expenditure, household savings, and investment choices of enterprises (CBN, 2016). This causes fluctuations in the cost of borrowing and investment earnings. Rising interest rate volatility, especially when unanticipated, is also capable of lowering output (Evans, 1984; Friedman, 1982) and, as a consequence, raises unemployment (Dutkowsky, 1987). Naudé (1995) shows that the interest rate volatility that resulted from financial liberalization had a negative effect on the banking sectors of African countries. Patnaik and Shah (2004) report that interest rate volatility exposes banks to risks of equity capital loss. Olasehinde-Williams and Özkan (2022) find that uncertainties about interest rate generally aggravate investment volatility.

Studies linking interest rate and economic performance broadly fall into two categories (Olasehinde-Williams & Özkan, 2022). The first group of studies are those advocating the legal restriction of interest rates—financial repression. Financial repression is generally associated with the management of cross-border capital flows, a stronger relationship between the government and banks, interest rate caps, and relatively high reserve requirements (Reinhart, 2012). Arguments in support of restrictions of interest rates are mostly related to market failures and information frictions (see Stiglitz, 1989, 1993, 2000; Jafarov et al., 2019; Olasehinde-Williams & Özkan, 2022). Support for this position was widespread between the 1960s and 1980s; it has also regained prominence since the global economic crisis of the late 2000s (see Aloy et al., 2014; Reinhart & Sbrancia, 2015; Chari et al., 2020).

The second category comprises studies that support financial liberalization, which requires the government to play the role of an unbiased referee in order to ensure the smooth operation of the markets. Support for financial liberalization was kick-started by the theoretical arguments put forward by McKinnon (1973) and Shaw (1973). According to the authors, financial repression generates rates of return that are comparatively lower than what would be obtained in a competitive market, discouraging both savings and investment. They therefore consider financial liberalization a main stay for developing countries. Thornton (1991) further explains that the McKinnon-Shaw claim is that a repressed financial system interferes with development in the following ways: underdeveloped saving vehicles with negative or unstable returns, poor policies which discourage firms’ investments, and inefficient allocation of savings by the financial intermediaries. Ene et al. (2015) assert that liberalization of interest rate lays out an atmosphere for greater competitiveness in the mobilization of funds, an effective financial system and better performing organizations within the financial industry.

Many developing countries, Nigeria inclusive, have applied financial liberalization policies to strengthen the potency of monetary policy through greater reliance on market forces (Khan & Hassan, 1998). Succeeding the era of strict regulations and controls, liberalization featured in the Nigerian financial scene with the adoption of SAP in 1986. Ikhide (1998) reports that in 1987, all interest rate controls were eliminated; only the minimum rediscount rate was fixed to specify the preferred direction of the interest rate. In 1992, however, partial regulation was introduced, with financial institutions being compelled to keep a given level of spread between cost of funds and maximum lending rates. Controls were restored in 1994, but not without negative economic impacts. Hence, total liberalization was readopted in 1996 and has continued till date (Ene et al., 2015).

Data and Methodology

Model Specification

To observe the growth effect of interest rate volatility in the nation, a model is specified to capture the relationship that exists between the variables. Thus, gross domestic product (GDP) is the dependent variable, whereas interest rate volatility is the independent variable of interest. Taking a cue from theory and related research, exchange rate, inflation, investment, human capital, and population growth rate are included as control variables. Considering that these variables also influence economic growth, they are included as controls to overcome potential threats to valid inference. The functional relationship tested is given thus:

Here, gross domestic product (GDP) is shown as a function of interest rate volatility (ITRVOL), exchange rate (EXR), inflation (INF), investment (INV), human capital (HCAP), and population (POP).

Equation (1) is re-specified in an econometric form as follows:

where β0 = intercept; β1, β2, β3, β4, β5, β6 = coefficients of the regressors; \(\mu\) = error term of the regression; \({{\text{LGDP}}}_{t}\) = logarithmic form of GDP; \({{\text{ITRVOL}}}_{t}=\mathrm{interest rate volatility}\); \({{\text{LEXR}}}_{t}\)= logarithmic form of exchange rate; \({{\text{INF}}}_{t}\) = inflation rate; \({{\text{LINV}}}_{t}\) = logarithmic form of investment;\({{\text{HCAP}}}_{t}\) = human capital; and \({{\text{POP}}}_{t}\) = population. It is worthy of note that variables that are not originally measured in percentages appear in logarithmic form for ease of interpretation and to eliminate potential heteroscedasticity in the data series.

Estimation Techniques

This study captures location-based (quantile) asymmetries in both short-term and long-term links between interest rate volatility and GDP in Nigeria, employing the QARDL model proposed by Cho et al. (2015). In utilizing the QARDL approach, the study assesses the stability of relationships across quantiles, offering a more flexible econometric framework to investigate the connection between interest rate volatility and GDP (see Lahiani, 2018; Jiang et al., 2021; Nawaz et al., 2021; Sadiq et al., 2021; Wu et al., 2021). In comparison to linear ARDL models, the QARDL model holds the advantage of introducing potential asymmetries in how GDP reacts to changes in interest rate volatility across different quantiles.

According to Shahbaz et al. (2018), methodologically, the QARDL model outperforms linear models on several grounds. Firstly, it accommodates locational asymmetry, where parameters may depend on the location of the dependent variable (GDP) within its conditional distribution. Secondly, the QARDL model concurrently addresses the long-term relationship between interest rate volatility and GDP, and the associated short-term dynamics across various quantiles of the conditional distribution of GDP. Thirdly, the method is able to identify the existence of quantile-varying cointegration coefficients over the short term which conventional techniques often miss (Xiao, 2009). Fourthly, the QARDL model also accommodates variations in the cointegrating coefficient over the innovation quantile, induced by shocks. Finally, rather than exogeneously define nonlinearity via a set threshold as is the case in the Nonlinear Autoregressive Distributed Lag (NARDL) model (Shin et al., 2014), QARDL uses a data-driven process. These attributes make QARDL a superior choice for more accurately modeling the nonlinear and asymmetric linkages between interest rate volatility and GDP in Nigeria. The technique is thus used to obtain both the short-run and long-run relationships between the variables of interest. To begin with, a traditional ARDL model is specified, as shown in Eq. (3).

Note the following: \({\varepsilon }_{t}\) is the error term measured as \({{\text{LGDP}}}_{t}-E\left[{{\text{LGDP}}}_{t}/{F}_{t-1}\right]\). \({F}_{t-1}\) represents \(\delta\) which is the smallest field created via \(\left\{{{\text{ITRVOL}}}_{t}, {{\text{LEXR}}}_{t}, {{\text{INF}}}_{t}, {{\text{LINV}}}_{t},{{\text{LHCAP}}}_{t},{{\text{LPOP}}}_{t},{{\text{LGDP}}}_{t-1}, {{\text{ITRVOL}}}_{t=1}, {{\text{LEXR}}}_{t=1},{{\text{INF}}}_{t=1},{{\text{LINV}}}_{t=1}, {{\text{LHCAP}}}_{t=1},{{\text{LPOP}}}_{t=1}\dots \right\}\). \(p, { q}_{1\dots ..},\mathrm{ and }{q}_{6}\) represent the lag orders selected through the Schwartz Bayesian Criterion (SBC).

Following Cho et al. (2015), Eq. (3) is extended into the basic QARDL (p, q) model to accommodate variations across quantiles as shown in Eq. (4):

Here, \({\varepsilon }_{t}(\gamma )\) equals \({{\text{LGDP}}}_{t}-{Q}_{{{\text{LGDP}}}_{t}}\left[\gamma /{F}_{t-1}\right]\) and \({Q}_{{{\text{LGDP}}}_{t}}\left[\gamma /{F}_{t-1}\right]\) refers to the \({\gamma }_{{\text{th}}}\) quantile of \({{\text{LGDP}}}_{t}\) conditional on the information set \({F}_{t-1}\) (see Kim & White, 2003).

Equation (5) is then specified to analyze the QARDL.

The parameters in Eq. (5) capture the short-run effects of the relationship between GDP and the regressors. The long-run effects are obtained by reworking Eq. (5) as follows:

where \(X\) is the vector of regressors \(\left({\text{ITRVOL}},\mathrm{ LEXR},\mathrm{ INF},\mathrm{ LINV},\mathrm{ LHCAP},\mathrm{ LPOP}\right).\)

To avoid serial correlation of the error term (\({\varepsilon }_{t})\), QARDL is further simplified as follows:

Finally, a QARDL-ECM model, which was estimated, is specified thus:

As a final step in the empirical analysis, Granger causality testing is performed to determine whether interest rate volatility is a significant predictor of Nigeria’s economic growth. This technique relies on the assumption that the past can cause the future (Odhiambo, 2009). A variable Xt Granger causes another variable Yt, if the former contributes significantly to forecasting the latter. The technique involves the testing of the null hypothesis of no Granger causality from Xt to Yt and vice versa through the estimation of the following equations:

The null hypothesis that Xt does not Granger cause Yt is rejected if \({\alpha }_{12}\) exhibits joint significance. Similarly, the null hypothesis that Yt does not Granger cause Xt is rejected if \({\alpha }_{22}\) exhibits joint significance (Granger, 1969). It is worthy of mention that the first differences of all non-stationary sequences are used for Granger causality testing, as the procedure requires stationarity in the data series.

Nature and Sources of Data

Due to data availability, annual time series data for each variable, over the period 1981–2020, is utilized. The chosen time frame is relevant to the study in that it spans both the eras before and after liberalization in the Nigerian economy. Similarly, it is a period long enough to provide reliable results that reflect the actual nature of the relationship between the variables of interest in relation to the Nigerian economy. Time series data are collected over time and can identify trends in the variables concerned. This work utilizes data series that are freely downloadable from https://www.dataworldbank.org..

Data Description

Since GDP is a monetary measure of the market value of all the final goods and services produced in country within a given time period, it is often used as a single measure of a nation’s economic health. GDP is therefore often used as a measure of the dependent variable, economic growth (Abdulhakeem & Olasehinde-Williams, 2014; Balcilar et al., 2020; Coskuner & Olasehinde-Williams, 2017; Ntom Udemba et al., 2022). Interest rate volatility refers to variability in interest on loans and savings over time. It is the explanatory variable in the model whose impact on GDP the analysis seeks to estimate. Taking a cue from related research on volatility, its coefficient is expected to be negative, as increased volatility is most likely a deterrent to growth (β1 < 0) (see Ramey & Ramey, 1995; Aysan, 2007; Onwumere et al., 2012; Reyes-Heroles & Tenorio, 2017). Following Olasehinde-Williams (2021), volatility, as shown in Eq. (9), is constructed as the percentage change in the deviation of the absolute value of interest rate (xt) from its trend component calculated using the Hodrick–Prescott (HP) filter (τx,t).

where xt = interest rate at time t and τ = Hodrick-Prescott filter.

The exchange rate is an index which shows how valuable a currency is, relative to others. It has an impact on the GDP through its effect on international trade (importation and exportation); hence, it is included as one of the explanatory variables. Taking a cue from related research (see Chichi & Casmir, 2014; Ijirshar, 2019), its coefficient is expected to be positive (β2 > 0). Inflation is included as one of the controls, given the evident fact that it is one of the factors influencing Nigeria’s economic growth. The coefficient of this variable is expected to yield a negative sign (β3 < 0) (see Idris & Suleiman, 2019; Adaramola & Dada, 2020).

Investment refers to the process of acquiring an asset or an item with the understanding that it would help build future wealth. This variable is included as a control variable because its trend has an impact on GDP. Time series data on this variable is obtained as gross capital formation at constant prices. From economic theory, it is expected to positively influence GDP (β4 > 0) (see Jaiyeoba, 2015; Kalu & Mgbemena, 2015). Human capital is the economic value of labor’s skill, experience, and education, which increases productivity and efficiency in the process of production. Economic growth is expected to respond positively to an increased human capital (β5 > 0) (see Jaiyeoba, 2015; Ali et al., 2021). Population represents the number of residents within Nigeria, irrespective of legal status. It positively impacts GDP, provided the population also comes along with a skillful labor force; it could however exert a negative influence, if otherwise. Hence, the sign of its coefficient is indeterminate (β6 ≠ 0) (see Headey & Hodge, 2009).

Results

Descriptive Analysis

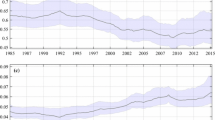

Figure 1 presents the area plots of variables over the time frame covered by the research. As shown, GDP has consistently risen over time, hence its upward trend. Short declines are however visible around 2009 and 2015. Interest rate volatility (ITRVOL) is captured by the non-stationary movements visible in the second graph. The rate at which the naira exchanges for the dollar (EXR) has increased over the years. This is shown in the third graph by the upward movement of exchange rate all through the period covered in this study. With its peak in the 1990s, as presented in the fourth graph, inflation shows a non-stationary trend over the sampled period. Also, as can be seen from the fifth graph, investment (INV) dropped at the beginning of the period under study but began to rise gradually afterwards and has shown a gradual and steady increase over time. As for human capital (HCAP), its movement has been somewhat unstable. The trend line reveals that it was relatively high around 1985 but dropped to about 80% in 1990 and has adopted a non-stationary movement ever since with a mean value of about 93%. Population growth rate (POP) has also fluctuated over time, though with not very sharp spikes as seen in other variables modeled in this study.

Table 1 presents the summary statistics of the variables. For the sample period, it reveals the average values of the variables (mean), spread from the average value (standard deviation), the lowest recorded values (minimum), and the highest recorded values (maximum). It can be inferred from the Jacque-Berra statistics that exchange rate and population growth are normally distributed. On the other hand, GDP, interest rate volatility, inflation, investment, and human capital are not normally distributed as their significant P-values lead to the rejection of the null of normality.

Table 2 presents the correlation matrix, a surface description of the relationship that exists among the variables employed in this study. The purpose of this is to confirm that the relationships among the regressors are not very high to the extent of posing a problem of multicollinearity in the model. Each variable is treated as random or stochastic, and there is no distinction between the dependent or independent variables (Fig. 2).

The correlation matrix suggests that GDP has statistically significant positive correlations with exchange rate, investment, and population growth rate. It however exhibits statistically significant negative relationships with interest rate volatility and inflation. The correlation between GDP and human capital is statistically insignificant. The degree of relationship among other variables is also explicitly revealed by the correlation matrix table. However, since the goal is to verify the absence of multicollinearity, the size of the correlation coefficients of the relationships among the regressors is observed. Following the rule of thumb that a correlation coefficient below 0.8 will not cause a multicollinearity issue, it is clearly seen that these variables can be safely used in the estimation since they all have coefficients less than 0.8.

Unit Root Testing

To avoid spurious regression results from non-stationary series, it is necessary to subject the variables to unit root testing. This research therefore conducts and reports the Phillip Perron (PP) unit root test results in Table 2. The outcomes reveal the presence of unit root in all the variables except interest rate volatility, inflation, and investment. This means that only these variables are stationary at level (I0). All other variables turn out to be stationary only after first differencing (I1). The unit root results hence necessitate the use of a technique capable of estimating relationships between these (I0) and (I1) variables.

Presentation of Regression Results

The fact that the unit root tests reveal a mix of stationary and non-stationary variables provides another reason to employ the QARDL. Because QARDL is a variant of the traditional ARDL technique, it is able to accommodate a mix of (I0) and (I1) variables. The short-run and long-run QARDL estimates of the effect of interest rate volatility alongside other regressors on economic growth in Nigeria are reported in Table 3.

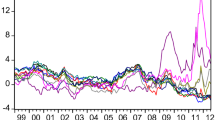

To begin with, the quantile estimates of the error correction term (ECM coefficient) start with an 8.2% speed of adjustment at a very low quantile (0.1), increase to 14.5% at mid-quantile (0.5), and further increase to 21.3% at a very high quantile (0.9). Overall, while the ECM coefficients vary across quantiles, they remain significantly negative all through. This indicates that there is a convergence of the model back to long-run equilibrium after a short-run disequilibrium and therefore confirms the presence of cointegration among the variables.

The quantile estimates of interest rate volatility remain strictly negative in both the short run and the long run, confirming that interest rate volatility adversely affects the economic growth of Nigeria in the short to long term. This negative impact occurs because interest rate volatility destabilizes investment decisions of businesses, savers, and borrowers alike. It makes forecast of return on financial assets and investment projects unreliable, hence reducing the growth prospects of the economy. It also distorts the performance of the stock market. This finding confirms the a priori expectation and is in line with the works of Ramey and Ramey (1995), Aysan (2007), and Reyes-Heroles and Tenorio (2017), who observe that countries with higher volatility tend to be characterized by weaker growth. This negative relationship may also be indirectly inferred from the finding of Onwumere et al. (2012) that interest rate volatility lowers saving and investment in Nigeria.

Moreover, in the short run, the negative impact of interest rate volatility on economic growth monotonically decreases from low to middle quantiles, beyond which it remains relatively stable with minor fluctuations. On the other hand, in the long run, the adverse effect of interest rate volatility gradually increases from lower quantiles to higher quantiles till a decline becomes visible beyond the 0.8 quantile. These outcomes suggest that the short-run adverse growth effect of interest rate volatility is greater when the economy is already in a relatively weak state. The long-run adverse growth effect is however greater when the economy is already in a relatively strong position.

Concerning the control variables, exchange rate displays a statistically significant negative short-term growth effect and statistically significant positive long-term growth effect. There is an escalation of the negative short-run effect between 0.1 and 0.2 quantiles, a decline in the negative short-run effect between 0.2 and 0.4 quantiles, and a stable negative short-run effect beyond the 0.4 quantile. In the long run, a gradual decline in the positive impact of exchange rate is noticeable between 0.1 and 0.7 quantiles, beyond which an increase is recorded and then a further decline. This is an indication that currency devaluation spurs growth in the long run, even though it may initially cause a depressing effect. The long-term positive impact occurs because a weaker currency boosts economic growth by incentivizing exports. Devaluation of a currency can encourage domestic investment and production; this in turn encourages net exports, thus improving economic growth (Idris & Suleiman, 2019). On one hand, currency devaluation makes a nation’s money cheaper, thus rendering the nation’s goods more competitive in the global market and consequently boosting exports. On the other hand, it makes foreign products relatively more expensive and therefore lowers imports. Overall, it leads to an increase in net exports which is a component of GDP. The short-run negative impact provides some support for the argument by structural economists that weaker currency adversely affects economic growth. They argue that the restrictive effect of currency devaluation on imported inputs distorts the production structure of developing nations such as Nigeria (Bird & Rajan, 2004; Karahan, 2020). This claim is however found by our study to be true only in the short run.

Inflation exhibits statistically significant negative short-run and long-run effects on economic growth. The quantile-specific short-run coefficients show that the negative growth effect declines in the lower quantiles and becomes relatively constant beyond the 0.3 quantile. In the long run however, the coefficients remain relatively stable from the lower to middle quantiles, beyond which a steady increase in the size of the negative impact becomes visible. This indicates that rising price levels of productive inputs as well as finished products reduce the incentive-to-produce, as well as the purchasing power of firms and households respectively. This finding is in consonance with the outcomes of the studies by Idris and Suleiman (2019) and Adaramola and Dada (2020).

Investment has a positive effect on economic growth both in the short run and the long run. This finding is in line with economic theory (see Jaiyeoba, 2015; Kalu & Mgbemena, 2015). The positive short-run effect is however statistically insignificant beyond the 0.7 quantile, whereas the positive long-run effect is significant across all quantiles in the long term. Also, the sizes of the long-run coefficients are consistently larger than those of the short-run. This indicates that the impact of investment on economic growth is majorly a long-term phenomenon. Moreover, while the short-run coefficients do not show a clear pattern, the long-run coefficients increase from lower to middle quantiles and then decline at very high quantiles. This suggests that investment becomes less effective beyond a threshold of economic status.

Human capital, on the other hand, only has a statistically significant positive long-run impact on economic growth, indicating that human capital development drives economic growth. This conclusion reached on the basis of our results confirms the claims of Jaiyeoba (2015) and Ali et al. (2021). In addition, the long-term positive effect of human capital, on the average, gradually increases from lower to higher quantiles.

Finally, the results reveal that population growth positively impacts Nigeria’s economic growth in both the short run and the long run. The long-run coefficients are also consistently bigger than the short-run coefficients, indicating that the economic growth effect of population growth is more important in the long term. This finding confirms that population growth is capable of driving expansions in labor, products, and consumption in a manner that stimulates economic growth. A similar conclusion is also reached by Zhizhi and Owuda (2019). In addition, the short-run quantile coefficients increase between the low (0.1) and mid (0.3) quantiles and then gradually decreases. The long-run quantile coefficients decline from lower quantiles to higher quantiles. Predominantly, these results suggest that population growth has a bigger effect when the economy is relatively weak (Figs. 3 and 4).

Table 4 contains the results of the Granger causality tests conducted as a means of further validating the authenticity of the estimated results. The causality test result shows that interest rate volatility Granger causes economic growth. This confirms the argument that investment volatility is a significant predictor of the economic growth of Nigeria. The test outcome further shows that other regressors asides investment and human capital also Granger cause economic growth in Nigeria over the period studied

Conclusion and Policy Recommendations

Concluding Remarks

This paper is an attempt to investigate the growth effect of interest rate volatility and further conclude on the suitability of liberalizing interest rates in Nigeria. To this end, empirical analyses of the link between interest rate volatility and the country’s GDP for the period 1981–2020 were carried out. The QARDL procedure was employed to establish the short-run and long-run quantile-specific impacts of interest rate volatility. As a final step, Granger causality tests were performed to investigate the predictive powers of the regressors. Based on the outcomes, it is concluded that interest rate volatility adversely affects the economic performance of Nigeria in both the short run and long run. Consequently, full liberalization is thus not suitable for the economy. Moreover, we find that the short-run adverse growth effect of interest rate volatility is greater when the economy is already in a relatively weak state, whereas the long-run adverse growth effect is greater when the economy is already in a relatively strong position.

Stronger regulation of the rates will lead to a stronger and more reliable economic system which can engender the growth of the Nigerian economy. Prioritization of interest rate stability will reduce the uncertainties caused by fluctuations in this rate and eliminate the detrimental impact of interest rate volatility on economic growth, as shown by this research. Not only will the internal fluctuations be minimized, the stability will also strengthen both local and foreign investors’ confidence in both real and financial sector investments.

This work has succeeded to a large extent in providing evidence-based research on how the growth of the Nigerian economy responds to interest rate volatility. Based on the results obtained and the realities faced by the economy, the following recommendations are made as policy directions to curb the current instability and encourage all-round growth and development. First, the study findings show that fully liberalizing the financial sector in a manner that permits interest rates to freely respond to market pressures is not Pareto efficient for Nigeria. Hence, it is advised that the CBN should prioritize greater supervision of the interest rate corridor system so as to reduce volatility in the rates and minimize chances of persistent upward or downward bias. Such supervision is needed, given the vulnerability and susceptibility of the economy to both internal and external shocks. In other words, the interest rate should not be left to the uncontrolled market forces but must be set by the monetary authority. This is because liberalizing interest rates makes it rise above binding ceilings sometimes; other times, it is forced down by increased pressure on margins or even reversing over time and not always in the same direction. To avoid these forms of wide swings, its movements must be closely monitored. Hence, the CBN must carefully watch all forms of interest rate movements which affect the economy.

Second, efforts to properly estimate the natural real interest rate should be prioritized by the CBN. Rates above it tends to depress economic growth, whereas rates below it tend to stimulate economic growth. As it is the interest rate that supports the economy at its optimum, wide unexpected deviations from it should be guarded against. Third, just like the natural real interest rate serves as a useful benchmark for achieving macroeconomic stability, the financial stability interest rate is also a useful benchmark for achieving financial stability. Thus, sudden unexpected deviations from the financial stability interest rate may induce instability in the financial system. The CBN is therefore also encouraged to pay close attention to this rate and introduce policies to guard against volatility in it. Overall, the CBN must carefully manage the interest rate. It must not be too high to discourage borrowing and not too low to discourage savings. As the economy expands and activities evolve, the rate can be revised and modified to suit the current economic situation.

There are some noteworthy study limitations. To begin with, the ARCH/GARCH family models are generally regarded as superior for modeling volatility. For instance, Hassani et al. (2020) demonstrate how these kinds of models are useful for modeling interest rate volatility. Unfortunately, the low frequency of the variables used for empirical analysis in this study makes the use of such models impracticable. It is therefore suggested that this topic be revisited for cases where higher frequency data is obtainable. Second, this work is centered on Nigeria alone. Therefore, the findings are not generalizable. Thus, as a direction for further research, panel studies of various country groupings may be conducted. This will help guide the direction of development policies toward financial stability in those specific country groupings. Also, a comparative study of the effect of interest rate volatility could be conducted between the regions of the world. This would be a global comparative analysis to further econometrically confirm how interest rate volatility impacts economic growth.

Data Availability

All data used for empirical analysis were sourced from the World Bank database available at http:dataworldbank.org.

References

Abdulhakeem, K. A., & Olasehinde-Williams, G. O. (2014). Governance and growth: Additional evidence from Africa. Political Science Review, 6(1), 108–129.

Acemoglu, D., Johnson, S., Robinson, J., & Thaicharoen, Y. (2003). Institutional causes, macroeconomic symptoms: Volatility, crises and growth. Journal of Monetary Economics, 50(1), 49–123.

Adaramola, A. O., & Dada, O. (2020). Impact of inflation on economic growth: Evidence from Nigeria. Investment Management and Financial Innovations, 17(2), 1–13.

Aizenman, J., & Pinto, B. (2004). Managing volatility and crises: A practitioner’s guide overview.

Ali, M., Raza, S. A. A., Puah, C. H., & Samdani, S. (2021). How financial development and economic growth influence human capital in low-income countries. International Journal of Social Economics, 48(10), 1393–1407.

Aloy, M., Dufrénot, G., & Péguin-Feissolle, A. (2014). Is financial repression a solution to reduce fiscal vulnerability? The example of France since the end of World War II. Applied Economics, 46(6), 629–637.

Arikewuyo, K. A., & Akingunola, R. O. (2019). Impact of interest rate deregulation on fund mobilisation of deposit money banks in Nigeria. Izvestiya Journal of Varna University of Economics, 63(2), 89–103.

Awe, O. O., Musa, A. P., & Sanusi, G. P. (2023). Revisiting economic diversification in Africa’s largest resource-rich nation: Empirical insights from unsupervised machine learning. Resources Policy, 82, 103540.

Ayopo, B. A., Isola, L. A., & Olukayode, S. R. (2016). Stock market response to economic growth and interest rate volatility: Evidence from Nigeria. International Journal of Economics and Financial Issues, 6(1), 354–360.

Aysan, A. F. (2007). The effects of volatility on growth and financial development through capital market imperfections. METU Studies in Development, 34(1), 1.

Balcilar, M., Olasehinde-Williams, G., & Tokar, B. (2022). The investment volatility-dampening role of foreign aid in poor sub-Saharan African countries. The Journal of International Trade & Economic Development, 31(5), 798–809.

Balcilar, M., Tokar, B., & Godwin, O. W. (2020). Examining the interactive growth effect of development aid and institutional quality in Sub-Saharan Africa. Journal of Development Effectiveness, 12(4), 361–376.

Bayracı, S., & Ünal, G. (2014). Stochastic interest rate volatility modeling with a continuous-time GARCH (1, 1) model. Journal of Computational and Applied Mathematics, 259, 464–473.

Bergo, J. (2003). The role of the interest rate in the economy. Central Bank of Norway BIS Review, 46, 1–9. https://www.bis.org/review/r031104f.pdf

Bird, G., & Rajan, R. S. (2004). Does devaluation lead to economic recovery or contraction? Theory and policy with reference to Thailand. Journal of International Development: THe Journal of the Development Studies Association, 16(2), 141–156.

Central Bank of Nigeria. (2016). Interest Rate (No. 3). CBN, Research Department. https://www.cbn.gov.ng/out/2017/rsd/cbn%20education%20in%20economics%20series%20no.%203%20interest%20rate.pdf

Chari, V. V., Dovis, A., & Kehoe, P. J. (2020). On the optimality of financial repression. Journal of Political Economy, 128(2), 710–739.

Chichi, O. A., & Casmir, O. C. (2014). Exchange rate and the economic growth in Nigeria. International Journal of Management Sciences, 2(2), 78–87.

Cho, J. S., Kim, T. H., & Shin, Y. (2015). Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics, 188(1), 281–300.

Coskuner, C., & Olasehinde-Williams, O. (2017). The impact of saving rates on economic growth in an open economy. International Journal of Economic Perspectives, 11(4).

Dabale, W. P., & Jagero, N. (2013). Causes of interest rate volatility and its economic implications in Nigeria. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(4), 27–32.

Das, S., Gupta, R., Kanda, P. T., Reid, M., Tipoy, C. K., & Zerihun, M. F. (2014). Real interest rate persistence in South Africa: Evidence and implications. Economic Change and Restructuring, 47, 41–62.

Delebari, O. R. O., & Didi, E. (2020). GARCH modeling of interest rate in Nigeria from 1997 to 2017. International Journal of Innovative Mathematics, Statistics & Energy Policies, 8(3), 53–68.

Donzwa, W., Gupta, R., & Wohar, M. E. (2019). Volatility spillovers between interest rates and equity markets of developed economies. Journal of Central Banking Theory and Practice, 8(3), 39–50.

Dutkowsky, D. H. (1987). Unanticipated money growth, interest rate volatility, and unemployment in the United States. The Review of Economics and Statistics, 144–148.

Ene, E. E., Atong, A. S., & Ene, J. C. (2015). Effect of interest rates deregulation on the performance of deposit money banks in Nigeria. International Journal of Managerial Studies and Research, 3(9), 164–176. https://www.arcjournals.org/pdfs/ijmsr/v3-i9/16.pdf

Evans, P. (1984). The effects on output of money growth and interest rate volatility in the United States. Journal of Political Economy, 92(2), 204–222.

Fan, T., Khaskheli, A., Raza, S. A., & Shah, N. (2022). The role of economic policy uncertainty in forecasting housing prices volatility in developed economies: Evidence from a GARCH-MIDAS approach. International Journal of Housing Markets and Analysis, (ahead-of-print).

Friedman, B. M. (1982). Federal Reserve policy, interest rate volatility, and the US capital raising mechanism. Journal of Money, Credit and Banking, 14(4), 721–745.

Ghironi, F., & Ozhan, K. (2020). Interest rate uncertainty as a policy tool. National Bureau of Economic Research Working Paper, 27084, 1–38. https://doi.org/10.3386/w27084

Gil-Alana, L. A., Cunado, J., & Gupta, R. (2017). Evidence of persistence in US short and long-term interest rates. Journal of Policy Modeling, 39(5), 775–789.

Di Giovanni, J., & Levchenko, A. A. (2006). Openness, volatility and the risk content of exports. In Conference The Growth and Welfare Effects of Macroeconomic Volatility by The World Bank, CEPR and CREI, Barcelona (pp. 17–18).

Githinji, A. N. (2015). The effect of interest rate volatility on money demand in Kenya. Faculty of Arts, Law, Social Sciences and Business Management, University of Nairobi, 1–34. http://hdl.handle.net/11295/93870

Glower, C. J. (1994). Interest rate deregulation: A brief survey of the policy issues and the Asian experience. Asian Development Bank. https://www.adb.org/sites/default/files/publication/28126/op009.pdf

Granger, C. W. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society, 424–438.

Grigoli, F., & Mills, Z. (2014). Institutions and public investment: An empirical analysis. Economics of Governance, 15, 131–153.

Hassani, H., Yeganegi, M. R., Cuñado, J., & Gupta, R. (2020). Forecasting interest rate volatility of the United Kingdom: Evidence from over 150 years of data. Journal of Applied Statistics, 47(6), 1128–1143.

Headey, D. D., & Hodge, A. (2009). The effect of population growth on economic growth: A meta-regression analysis of the macroeconomic literature. Population and Development Review, 35(2), 221–248.

Idris, T. S., & Suleiman, S. (2019). Effect of inflation on economic growth in Nigeria: 1980–2017. Maiduguri Journal of Arts and Social Sciences, 18(2), 33–48.

Ijirshar, V. U. (2019). Impact of trade openness on economic growth among ECOWAS countries: 1975–2017. CBN Journal of Applied Statistics (JAS), 10(1), 4.

Ikhide, S. I. (1998). Financial sector reforms and monetary policy in Nigeria. IDS Working Paper, 68, 2–46.

Istreffi, K., & Mouabbi, S. (2017). Interest rate uncertainty harms the economy. Banque de France. https://blocnotesdeleco.banque-france.fr/en/blog-entry/interest-rate-uncertainty-harms-economy

Jafarov, M. E., Maino, M. R., & Pani, M. M. (2019). Financial repression is knocking at the door, again. International Monetary Fund.

Jaiyeoba, S. V. (2015). Human capital investment and economic growth in Nigeria. African Research Review, 9(1), 30–46.

Jiang, C., Zhang, Y., Kamran, H. W., & Afshan, S. (2021). Understanding the dynamics of the resource curse and financial development in China? A novel evidence based on QARDL model. Resources Policy, 72, 102091.

Kalejaiye, P. O., Adebayo, K., & Lawal, O. (2013). Deregulation and privatization in Nigeria: The advantages and disadvantages so far. African Journal of Business Management, 7(25), 2403.

Kalu, C. U., & Mgbemena, O. O. (2015). Domestic private investment and economic growth in Nigeria: Issues and further consideration. International Journal of Academic Research in Business and Social Sciences, 5(2), 302–313.

Karahan, Ö. (2020). Influence of exchange rate on the economic growth in the Turkish economy. Financial Assets and Investing, 11(1), 21–34.

Khan, A. H., & Hasan, L. (1998). Financial liberalization, savings, and economic development in Pakistan. Economic Development and Cultural Change, 46(3), 581–597.

Khaskheli, A., Zhang, H., Raza, S. A., & Khan, K. A. (2022). Assessing the influence of news indicator on volatility of precious metals prices through GARCH-MIDAS model: A comparative study of pre and during COVID-19 period. Resources Policy, 79, 102951.

Kim, T. H., & White, H. (2003). Estimation, inference, and specification testing for possibly misspecified quantile regression. In Maximum likelihood estimation of misspecified models: twenty years later (pp. 107–132). Emerald Group Publishing Limited.

Lahiani, A. (2018). Revisiting the growth-carbon dioxide emissions nexus in Pakistan. Environmental Science and Pollution Research, 25, 35637–35645.

Lee, C. C., Olasehinde-Williams, G., & Akadiri, S. S. (2021). Are geopolitical threats powerful enough to predict global oil price volatility? Environmental Science and Pollution Research, 28, 28720–28731.

Lee, C. C., Olasehinde-Williams, G. O., & Olanipekun, I. O. (2022). GDP volatility implication of tourism volatility in South Africa: A time-varying approach. Tourism Economics, 28(2), 435–450.

McKinnon, R. I. (1973). Money and capital in economic development. Brookings Institution Press.

Mehran, H., & Laurens, B. (1997). Interest rates: An approach to liberalization. Finance and Development, 34, 33–37.

Naudé, W. (1995). Financial liberalisation and interest rate risk management in Sub-Saharan Africa. University of Oxford. WPS/96–12, Centre for the Study of African Economies.

Nawaz, M. A., Hussain, M. S., Kamran, H. W., Ehsanullah, S., Maheen, R., & Shair, F. (2021). Trilemma association of energy consumption, carbon emission, and economic growth of BRICS and OECD regions: Quantile regression estimation. Environmental Science and Pollution Research, 28, 16014–16028.

Ntom Udemba, E., Onyenegecha, I., & Olasehinde-Williams, G. (2022). Institutional transformation as an effective tool for reducing corruption and enhancing economic growth: A panel study of West African countries. Journal of Public Affairs, 22(2), e2389.

Obinna, O. (2020). Impact of interest rate deregulation on investment growth in Nigeria. International Journal of Economics and Financial Issues, 10(2), 170.

Odhiambo, N. M. (2009). Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energy Policy, 37(2), 617–622.

Olasehinde-Williams, G. (2021). Is US trade policy uncertainty powerful enough to predict global output volatility? The Journal of International Trade & Economic Development, 30(1), 138–154.

Olasehinde-Williams, G., & Özkan, O. (2022). Is interest rate uncertainty a predictor of investment volatility? Evidence from the wild bootstrap likelihood ratio approach. Journal of Economics and Finance, 46(3), 507–521.

Omotunde, R. A., & Nwokoma, N. I. (2016). Interest rate shocks and stock market volatility in Nigeria (1985–2014). West African Journal of Monetary and Economic Integration, 16, 44–72.

Onwumere, J. U. J., Okore, O. A., & Ibe, I. G. (2012). The impact of interest rate liberalization on savings and investment: Evidence from Nigeria. Research Journal of Finance and Accounting, 3(10), 130–136.

Oseni, I. O., & Nwosa, P. I. (2011). Stock market volatility and macroeconomic variables volatility in Nigeria: An exponential GARCH approach. Journal of Economics and Sustainable Development, 2(10), 28–42.

Patnaik, I., & Shah, A. (2004). Interest rate volatility and risk in Indian banking (Vol. 4). International Monetary Fund.

Poterba, J. M. (2000). Stock market wealth and consumption. Journal of Economic Perspectives, 14(2), 99–118.

Ramey, G., & Ramey, V. A. (1995). Cross-country evidence on the link between volatility and growth. The American Economic Review, 85(5), 1138–1151.

Reinhart, C. M. (2012). The return of financial repression. Peterson Institute for International Economics, Financial Stability Review, 16, 37–47.

Reinhart, C. M., & Sbrancia, M. B. (2015). The liquidation of government debt. Economic Policy, 30(82), 291–333.

Reyes-Heroles, R., & Tenorio, G. (2017). Interest rate volatility and sudden stops: An empirical investigation. International Finance Discussion Paper, (1209).

Sadiq, M., Hsu, C. C., Zhang, Y., & Chien, F. (2021). COVID-19 fear and volatility index movements: Empirical insights from ASEAN stock markets. Environmental Science and Pollution Research, 28, 67167–67184.

Shahbaz, M., Lahiani, A., Abosedra, S., & Hammoudeh, S. (2018). The role of globalization in energy consumption: A quantile cointegrating regression approach. Energy Economics, 71, 161–170.

Shaw, E. S. (1973). Financial deepening in economic development. Oxford University Press.

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. Festschrift in honor of Peter Schmidt: Econometric methods and applications, 281–314.

Shunmugam, V., & Hashim, D. A. (2009). Volatility in interest rates: Its impact and management. Macroeconomics and Finance in Emerging Market Economies, 2(2), 247–255.

Stiglitz, J. E. (1993). The role of the state in financial markets. The World Bank Economic Review, 7(suppl_1), 19–52.

Stiglitz, J. E. (1989). Financial markets and development. Oxford Review of Economic Policy, 5(4), 55–68.

Stiglitz, J. E. (2000). Capital market liberalization, economic growth, and instability. World Development, 28(6), 1075–1086.

Terwase, I. T., Abdul-Talib, A. N., & Zengeni, K. T. (2014). Nigeria, Africa’s largest economy: International business perspective. International Journal of Management Sciences, 3(7), 534–543.

Thornton, J. (1991). The financial repression paradigm: A survey of empirical research. Savings and Development, 15(1), 5–18.

Tian, S., & Hamori, S. (2015). Modeling interest rate volatility: A realized GARCH approach. Journal of Banking & Finance, 61, 158–171.

Wu, X., Sadiq, M., Chien, F., Ngo, Q. T., Nguyen, A. T., & Trinh, T. T. (2021). Testing role of green financing on climate change mitigation: Evidences from G7 and E7 countries. Environmental Science and Pollution Research, 28, 66736–66750.

Xiao, Z. (2009). Quantile cointegrating regression. Journal of Econometrics, 150(2), 248–260.

Zhizhi, M., & Owuda, R. L. (2019). The effects of population on economic growth in Nigeria. Available at SSRN 4146547.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Olasehinde-Williams, G., Omotosho, R. & Bekun, F.V. Interest Rate Volatility and Economic Growth in Nigeria: New Insight from the Quantile Autoregressive Distributed Lag (QARDL) Model. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01924-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01924-x