Abstract

The transfer of polluting industries from developed to developing countries and the often-detrimental effects this has on meeting sustainable development goals is well documented, but an analysis of the underlying reasons for this transfer has not been widely examined in the literature. This study seeks to analyse the complexity of Foreign Direct Investment in developed countries and its environmental impacts, by measuring inward and outward investment. A Panel Quantile Regression was undertaken for 14 European Union countries between 1995 and 2018. The results show that, whether countries are recipients or sources of high levels of FDI, the drivers of inward and outward investment are the same, and that sustainable development and renewable energy are both drivers of FDI. The paper also finds that outward Foreign Direct Investment is not driven by environmental regulation, and the regulatory quality of the European Union countries improves its foreign investment balance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

When assessing the potential benefits of investing abroad, investors are not always looking for something that is scarce in their own country. On the contrary, many in developed European economies are searching for countries with less of something they have in abundance; environmental regulations. This is often the prime motivation for Foreign Direct Investment (FDI) that transfers polluting industries to other countries. According to the World Investment Report 2022 published by the United Nations Conference on Trade and Development (UNCTAD), FDI flows into Europe (and developed countries in general) were at historically low levels in 2021. In particular, FDI to the European Union (EU) declined by 73% between 2019 and 2020. Could Europe’s stricter environmental regulations be driving investment away? They could be one explanation for a drop in inward FDI (IFDI) to the EU, which, according to Eurostat, fell from 98.6% of Gross Domestic Product (GDP) in 2018 to 96.7% in 2021.

While developed countries are frequently preferred for their higher institutional standards, such as rule of law, property rights, and regulatory efficiency, developing countries have abundant labour (Dellis et al., 2020) and frequently, lower environmental standards, which represent a comparative advantage for polluting industries. According to Eurostat, outward FDI (OFDI) from EU countries also fell slightly from 116.1% in 2018 to 114.6% in 2021, mainly due to the decline in OFDI from countries such as the Netherlands, Germany, Ireland and the United Kingdom (UNCTAD, 2022). The off-shoring of polluting production to circumvent local emission controls, known as carbon leakage, implies a reduction in the industrial capacity of the developed countries from which they originated. The resulting deindustrialisation has become a serious concern for developed countries whose governments are now taking steps to attract investment back through new tax incentives (especially for the manufacturing sector) (UNCTAD, 2022). EU countries also hope to attract back FDI through their focus on sustainable development and transitioning to cleaner energy systems. This expectation is not unreasonable as, according to UNCTAD (2022), over 60% of climate-change-related investment, particularly for renewable energy and energy-efficiency projects, has been directed towards developed countries.

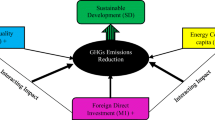

Most studies on the FDI-Environment nexus have focused on developing countries, given that they are frequently the recipients of FDI to fund polluting activities. This research is important, but overlooks the equally significant but complex influence of FDI in developed countries, which are simultaneously the sources and the recipients of investment. A fuller understanding of the complex patterns of causality involved could inform decision making and, specifically, shed light on the reasons behind the transfer of industries to developing from developed countries, which is causing environmental damage in the former and deindustrialisation in the latter. To enhance understanding of this complex subject, this paper takes an innovative approach that features five major lines of research: (i) examining the determinants of both inward and outward foreign investment (IFDI and OFDI) and the balance between them; (ii) analysing the environmental impact of foreign investment in developed countries; (iii) assessing the potential of Sustainable Development (SD) and Renewable Energy Consumption (RES) for attracting environmentally-friendly FDI to reverse the current trajectory of deindustrialisation in EU countries; (iv) measuring SD through the Comparable Genuine Progress Indicator (CGPI), a recently-developed indicator that, to the best of our knowledge, has not previously been used in studies on FDI and sustainability; and (v) evaluating the countries’ heterogeneity using a Panel Quantile Regression (PQR), as country-specific characteristic must always be considered by policymakers.

This led to the formulation of the central research question: (i) What determines foreign investment flows and their environmental impact in developed countries? Thus, a PQR was conducted using a panel of 14 EU countries for a period from 1995 to 2018. Although the EU countries chosen had similar environmental and regulatory standards, when they were evaluated using PQR, considerable heterogeneity was revealed, and it was found that the determinants of FDI (even those indicated by the literature) vary substantially between countries/quantiles. In fact, the determinants for countries in the higher quantiles (countries receiving high levels of FDI) differ from those in the lower quantiles (countries receiving low levels of FDI). The study also found that the same determinants attract IFDI to high-recipient countries and foster OFDI in high-source countries. Environmental policies only attract foreign investment to low-recipient countries, and do not encourage OFDI. The regulatory standards of a country are a key factor in determining its foreign investment balance, especially for inward flows. Lastly, it was found that FDI is strongly attracted by SD and RES, suggesting that a renewed commitment to them could bring in further investment and boost economic development.

This paper is structured as follows. “Literature Review” contains a literature review about the main determinants of FDI, the FDI-environment nexus, and sustainability. “Data and Methodology” describes the data, the components used in the CGPI calculation, and the method. In “Result”, presents the results and robustness checks. The implications of these results are discussed in “Discussion”, and the conclusions are presented in “Conclusions and Policy Implications”.

Literature Review

Foreign Direct Investment

Foreign Direct Investment comes about when a company in one country establishes commercial operations in another country through the creation of a new subsidiary, the acquisition of a foreign company, or through forming a joint venture. Briefly, as recently suggested by Aust et al. (2020), FDI could be described as capital flows from an entity in one country to an entity in another country. Narula (2012) considers per capita Gross Domestic Product (GDP), social and political stability, rule of law, and transparency to be attractive factors for FDI. This view is shared by Shahbaz et al. (2018) who consider financial development an attractive factor for FDI, as it is related to a country’s overall level of development and economic stability. Narula (2012) also maintains that the size of a country’s domestic market, the availability of skilled labour, and the cost of wages all influence decisions on FDI, which can also be attracted by investment-friendly regulations and tax incentives. Dellis et al. (2020) conclude that, for a developed country seeking inward investment, its income, the size and potential of its market, and its trade openness are all crucial, whereas, for developing countries pursuing investment, labour costs are of greater importance.

Besides their direct relevance in attracting FDI, these determinants also influence the target country’s decisions. Briefly, the attractiveness of countries depends on the value of their capabilities (Sadeghi et al., 2020). In the case of advanced economies, as Wang and Kafouros (2009) noted, their technological progress and stock of human capital (also termed knowledge stock by Sadeghi et al., 2020) enhances their attractiveness to FDI. These determinants are interrelated, as the benefits of technological FDI depend on the capability of skilled workers to receive, perform, and adopt advanced technologies (Fagbemi & Osinubi, 2020). Some studies have focused on the role of human capital and the productive capabilities of host countries. Melane-Lavado et al. (2018) consider that a scarcity of qualified workers makes a country less likely to attract FDI. However, countries with the same level of human capital may have differing levels of attraction to FDI (Sadeghi et al., 2020), as the providers of FDI may also be looking for fiscal benefits or economic stability.

Despite their qualified workers, developed countries have been losing their prominence as investment destinations (Dellis et al., 2020). Beyond a mere manifestation that the determinants of FDI have been changing over time, the waning appeal of developed countries as a destination for foreign investment could be the result of their stricter environmental regulations, introduced to meet SD goals. The next subsection discusses the environmental consequences of FDI in more depth. As Fagbemi and Osinubi (2020) noted, when sustainability enters the equation, human capital exerts significant leverage in attaining SD goals, and attracting FDI. The higher capacity of workforces in some countries to learn and absorb new knowledge and technologies, means they can make better use of FDI to quickly adopt and implement new technologies (Marques & Caetano, 2020). Notwithstanding the various theories on the drivers of FDI, as described by Dellis et al. (2020), at the end of the day, firms invest in countries because they expect higher profitability from lower production costs and/or increased returns.

The Foreign Direct Investment and Environment Nexus

Foreign Direct Investment can be a vehicle for creating long-lasting relationships between countries, although its effects may be positive or negative. In fact, FDI can have a positive outcome for both source and recipient countries. The source countries providing the investment, seek to exploit perceived advantages, such as natural resources or an abundance of cheap labour, while the recipient countries prospect to benefit from an inflow of valuable external and private capital (Aust et al., 2020), which boosts their economic growth (De Pascale et al., 2020; Muhammad & Khan, 2019; Yin et al., 2021). Given these economic advantages, countries aim to attract as much FDI as possible. However, the potential negative impact of FDI, particularly to the environment of recipient countries, should also be considered by policymakers. Thus, quite rightly, many studies have focused on the effects of FDI on environmental quality in recipient countries.

The studies on the FDI-Environment nexus have broadly considered two main hypotheses, the Pollution Halo and the Pollution Haven hypotheses. The Pollution Halo hypothesis (PHlH) maintains that FDI has a positive effect on the environment. Some literature (e.g. Singhania & Saini, 2021; Yilanci et al., 2020) maintains that FDI reduces pollution, mainly due to the transference of improved and eco-friendly technologies that generally consume less energy. In contrast, the Pollution Haven Hypothesis (PHH) argues that FDI increases pollution. It posits that countries with stricter environmental regulations tend to transfer their polluting industries to countries with lower environmental standards to avoid the cost of meeting these standards at home (e.g. De Pascale et al., 2020; Singhania & Saini, 2021; Yin et al., 2021). From this, it can be inferred that the lure of potential investment may be encouraging developing countries to accept polluting industries and widen international discrepancies in environmental regulation.

Besides discrepancies in environmental standards, the aims of source countries and the characteristics of recipient countries may also influence the impact of FDI on the environment. According to Hao et al. (2020), investors seeking to attribute FDI fall into three main categories: resource-seeking, market-seeking, and technology-seeking. Countries that are abundant in resources (natural or human) become attractive to resource-seeking FDI, countries with market potential will attract market-seeking FDI, and technology-seeking FDI will be drawn to technologically advanced markets where there is easier access to new technology and knowledge. For instance, technology-seeking FDI tends not to be invested in countries with lower levels of human capital, as their reduced capacity to adopt new technology increases the costs of adjustment and delays the returns on the FDI (Marques & Caetano, 2020).

One more category should be added to this list of FDI-seeking categories: low regulation-seeking FDI. This is the kind FDI that certain countries use to finance the transfer of their polluting industries to countries with lower environmental standards. This is not an endogenous characteristic, but a consequence of policy decisions, as countries seeking more FDI may choose to relax their environmental standards to obtain a comparative advantage in pollution-intensive industries (Shahbaz et al., 2015; Singhania & Saini, 2021). However, climate change is a worldwide concern, and this transfer of polluting industries merely relocates global emissions rather than reducing them. To prevent this undesirable phenomenon of carbon leakage, it is essential to properly understand the mechanisms and drivers involved.

In the literature, this nexus has generally been analysed using groups of countries, such as MENA (Shahbaz et al., 2019), BRICS (Yilanci et al., 2020), groups of developed and developing countries (Sarkodie & Strezov, 2019; Singhania & Saini, 2021), OECD countries (De Pascale et al., 2020), or African countries (Aust et al., 2020). However, geographic proximity and similarities in income levels and environmental standards, do not necessarily mean that policies in one county of the group will have the same impact in another, and the potential heterogeneity of countries should always be taken into account. This could be a major reason for the current lack of consensus on the FDI-environment nexus in the literature, and led us, in this study, to specifically address the issue of heterogeneity by using Panel Quantile Analysis.

Sustainable Development

The indicator generally used to measure the income level of a country is Gross Domestic Product, which categorises countries into low-income and high-income. The ubiquity of this categorisation has led countries to focus on increasing their GDP because, in addition to being used by scholars, it is often used as a reference in international agreements. However, the narrow pursuit of growth as measured by GDP may be incompatible with the goals of sustainable development (SD), and may even negatively affect human wellbeing (Menegaki & Tugcu, 2018). The generally-accepted definition of SD is that the needs of the present generations are met without compromising the ability of future generations to meet their own needs. Thus, for many, GDP is an inadequate measure of sustainable development (dos Gaspar et al., 2017; Marques et al., 2016; Menegaki & Tugcu, 2018), as it ignores income inequality, household work, environmental degradation, and the depletion of natural resources, among others. Pais et al. (2019) consider there was a disparity between GDP and SD, and have developed the threshold hypothesis to explain it, which posits that there is a point at which the costs of GDP growth outweigh its benefits. In fact, the authors also conclude that the richest countries do not always have the highest levels of SD.

The development of the private sector is considered by Sachs (2012) to be crucial for achieving SD goals. As a major source of private capital, FDI could help increase sustainability, particularly if applied using the concept of “Sustainable Investment” introduced by Aust et al. (2020). However, the effectiveness of this type of investment is influenced by the regulatory standards of the recipient countries. The stability such regulations generally bring, can help these countries achieve economic, social, and environmental sustainability (Aust et al., 2020). As less developed countries have fewer resources for mitigating climate change (Zaidi & Saidi, 2018), countries with higher income levels should cooperate with them to effectively achieve global sustainability (Gusmão Caiado et al., 2018). However, as recent literature indicates, FDI is currently funding the transfer of polluting industries, and this represents a major obstacle to SD worldwide (Sarkodie & Adams, 2020).

Measuring SD is far from easy. Some authors use a single indicator to measure SD, such as the Human Development Indicator (Apinran et al., 2018), or the Ecological Footprint (Doytch, 2020). However, these indicators do not consider the three pillars of sustainability: the economic, social, and environmental and, for some time, academics have sought to devise a sustainability index that combines all three dimensions (Aust et al., 2020; Dartey-Baah, 2014). Frugoli et al. (2015) makes a comparison of 10 different indicators, while Kwatra et al. (2020) presents a critical overview of the evolution of the most commonly used indicators of SD.

Of these SD indicators containing the three dimensions, the Genuine Progress Indicator (GPI) and the Index of Sustainable Economic Development (ISEW) are the most common. These indicators are calculated using different methodologies so, as Lawn (2005) and Bleys and Whitby (2015) state, the way such indices are calculated needs to be standardised. To overcome this shortcoming, Pais et al. (2019) introduced the CGPI index, which minimizes the assumption made by the availability of data and enables the comparison of different countries.

In short, as indicated by Melane-Lavado et al. (2018) there is a lack of academic studies on the relationship between FDI and sustainability, particularly research using indicators that consider the three pillars of SD. Consequently, this study addresses this gap in the literature by making a novel use of the CGPI index as an indicator of SD and to analyse how FDI and SD interact. Moreover, it investigates how SD influences IFDI and OFDI with particular focus on the transfer of polluting industries and its adverse effect on meeting SD goals.

Data and Methodology

Data

The aim of this study is to better understand the complexity of FDI in developed countries and to analyse the environmental impact of FDI in them. In light of this, a set of 14 EU countries were analysed, namely: Austria, the Czech Republic, Estonia, Finland, France, Hungary, Ireland, Italy, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, and the United Kingdom. These countries were chosen for three main reasons: (i) the high environmental standards imposed by their shared policy guidance as EU member states, (ii) the availability of data, especially that needed to calculate the CGPI (see Appendix Table 7), and (iii) the recent trend of deindustrialisation in these countries. Two periods were analysed: 1995-2018 and 1998-2018. The first period was used to examine the impact on CO2 emissions of FDI and some other determinants, and only considered 12 of the 14 countries, as there was insufficient data on the number of patents in Ireland and Italy. The second period was used in the analysis of IFDI, OFDI and foreign investment balance, and covered a shorter time period so that data on advanced education could be included. Thus, the specific EU states and time spans analysed were primarily chosen due to the availability of data. Table 1 presents the descriptions and sources of the variables analysed in this study.

Although it is essential to understand how FDI can be leveraged to help meet SD goals (Fagbemi & Osinubi, 2020), it is also important to investigate how SD can attract FDI. As mentioned above, the index used by this study to represent SD was the CGPI. To better understand the complex interactions of FDI in developed countries the impacts of key determinants of both inward and outward FDI were analysed. These determinants were chosen taking into account those commonly used in the literature research, and the high-environmental standards of EU countries.

The ratio of IFDI to OFDI was analysed to understand the effects of the various determinants on the foreign investment balance of countries. It was also used to analyse the impact of FDI on CO2 emissions (as a proxy for pollution). The foreign investment balance of countries was considered to be the ratio between IFDI and OFDI, and was primarily used to represent the capacity of these countries to both attract foreign investment and to invest in another country. The higher this ratio, the greater the amount of IFDI, compared to OFDI. The relationship between this ratio and CO2 emissions was also used to illustrate the environmental effect of attracting FDI to these countries. The countries in the study are all developed, so it was expected that this FDI would be technology-seeking and, thus, more environmentally friendly. As the interest in proving or disproving the PHH in this paper was primarily related to the transfer of polluting industries to developing countries, it would have been appropriate to analyse the FDI specifically applied to the industrial sector. However, as commonly in the literature (e.g. Shahbaz et al., 2019), information on FDI is available as aggregated variables to allow a comparison between countries, and there is insufficient data on FDI by sector.

An important factor in attracting FDI to a country is its capacity for absorbing new knowledge and technology, as this enables it to transfer technology more successfully and reduces the costs of adjustment (Adom et al., 2019). Thus, investment in education is crucial (Sultana & Turkina, 2020), and a country with skilled manpower is more likely to receive FDI. To represent the influence of human capital in this analysis, an indicator of the level of advanced education among a country’s labour force (LEDU) was used as a proxy.

Innovation is another magnet for FDI so, following the example of Burhan et al. (2017), the number of patents registered by the residents of a country was used as a proxy for this (LPAT), and its relationship with CO2 emissions was analysed to evaluate the extent to which countries have used innovation to reduce pollution. Another important component in reducing pollution and promoting sustainability is the adoption of renewables, so the study also used a proxy of Renewable Energy Consumption (RES), to analyse their role in attracting FDI.

Al-mulali et al. (2015) found that financial development is crucial for reducing CO2 emissions, and the International Monetary Fund uses the Financial Development Index to indicate the level of development of a country’s financial institutions and markets. Shahbaz et al. (2018) consider that countries with higher levels of this indicator tend to attract FDI, so it was also used as a variable in this study. Increased domestic investment is another variable that can enhance a country’s capabilities and, as Sadeghi et al. (2020) state, makes it more likely to attract FDI, so Gross Fixed Capital Formation was used in the study as a proxy for domestic investment. A more open economy makes commercial transactions and the flow of investments, such as FDI, easier (Teixeira et al., 2017). Bearing this in mind, trade openness was included in the analysis because, as Dellis et al. (2020) suggest, it is crucial to attracting FDI in developed countries.

Climate action targets and SD goals require a proper regulatory framework, and much literature on the FDI-Environment nexus has discussed the discrepancies in environmental regulation among countries. Thus, a central focus of this study was the influence of regulatory frameworks on FDI decisions. (Narula, 2012) states that the regulatory standards of countries affect the level of FDI it attracts, and can also determine the effect of FDI on the environment, further supporting the PHH. Therefore, the number of environmental policies enacted in a country was used in this study as a proxy for environmental regulation (Neves et al., 2020) and the regulatory quality measures whether governance is rigorous or permissive in these countries (Kaufmann et al., 2011).

Comparable Genuine Progress Indicator

Some countries have adopted a strategy of relaxing environmental standards to attract FDI, even though it may compromise achieving their SD goals. Thus, we analysed how both environmental regulation and SD affect the attractiveness of a country to FDI, using as a proxy for SD the CGPI proposed by Pais et al. (2019).

Equation (1) presents the general equation for the CGPI, and Appendix Table 7 summarises the descriptions, sources, and signs of the variables used. The employment variable was calculated by subtracting unemployment from the total labour force. Following the example of Posner and Costanza (2011), missing data for the GINI index and road infrastructure investments in some countries was estimated by using trends from the known data.

Preliminary Analysis

The characteristics of the data were analysed by conducting a series of preliminary tests. First, the descriptive statistics of the data were analysed, and are presented in the Appendix Table 8. The data was subjected to the correlation matrix and Variance Inflation Factor (VIF) tests to check for collinearity and multicollinearity respectively (see Appendix Tables 9 and 10). Neither collinearity nor multicollinearity were found. We also checked for cross-sectional dependence (CD) by using the Pesaran (2004) CD test, and, consequently, both the first- (Maddala & Wu, 1999) and second-generation (Pesaran, 2007) unit root tests. The results of these tests are not included in this paper to save space, but are available upon request.

Method

Panel Quantile Analysis

Even among countries with similar features, such as those with comparable income levels, it is always worth considering the heterogeneity of the data, mainly when analysing the relationships between FDI, financial development, energy consumption, and carbon emissions (Sultana & Turkina, 2020). Thus, the slope homogeneity test proposed by Pesaran and Yamagata (2008) was carried out, under the null hypothesis that the slope coefficients are homogeneous. The results indicated the presence of heterogeneity.

Heterogeneity is a potential concern in panel data analysis, and is commonly addressed by using heterogeneous estimators. But these do not allow observations within heterogeneity to be made at a specific moment. However, this issue can be overcome by using a PQR model. Quantile regressions allow scrutiny of the various effects that explanatory variables may have in the conditional distribution of dependent variables (Afonso et al., 2019). Furthermore, Quantile Regressions are robust in the presence of singular events, commonly known as outliers (Ike et al., 2020). By using this method, it was expected to reveal the idiosyncrasies of countries with nominally similar standards and, thereby, highlight the importance of tailoring policies to their specific needs.

The Breusch-Pagan Lagrange Multiplier (LM) test proposed by Breusch and Pagan (1980), was conducted to reveal any panel effects, under the null hypothesis that the variance across entities is zero. The Hausman test was also carried out to determine which estimator was most suitable, with the null hypothesis of random effects being more appropriate. Furthermore, the presence of time-fixed effects was also assessed using the test of overall significance. The null hypothesis under this test is that the coefficients for all years are jointly equal to 0. The results indicated that there were fixed panel effects.

The presence of heteroskedasticity, contemporaneous correlation, and autocorrelation were assessed through the Modified Wald, Pesaran, and Wooldridge tests, respectively. Bearing this in mind, a panel regression with fixed effects augmented with the Driscoll and Kraay (1998) estimator was used as a benchmark for the Quantile via Moments estimator, as used by Ike et al. (2020). To conduct a PQR, it is necessary to check the normality of the series, and accordingly, the Shapiro-Wilk and Skewness-kurtosis tests were performed, and revealed that the null hypothesis of normality was rejected (see Appendix Table 11).

As stated by Ike et al. (2020), some of the principal benefit of employing the Method of Moments Quantile regression with fixed effects is that it can identify conditional heterogeneity, and also allows individual effects to impact the distribution. This methodology is particularly useful when the explanatory variables under analysis may be endogenous (Ike et al., 2020).

According to Machado and Santos Silva (2019), the conditional distribution for a panel is as specified in Eq. (2):

It is assumed that \(P\left\{{\delta }_{i}+{Z}_{it}{\prime}\gamma >0\right\}=1\). The parameters (\({\propto }_{i}\),\({\delta }_{i}\)), i=1, …, n, identify the individual i fixed effects and Z is a k-vector of identified differentiable transformations of the components of X with element l given by Eq. (3). \({X}_{it}\) is independently and identically distributed (i.i.d) for any fixed i and independent across t. \({U}_{it}\) is i.i.d. across individuals (i) and time (t), and statistically independent of \({X}_{it}\) to verify the moment conditions imposed by Machado and Santos Silva (2019) of \(E\left(U\right)=0\wedge E\left(\left|U\right|\right)=1\).

Equation (2) implies the conditional quantile given by equation (4):

According to Ike et al. (2020), from Eq. (4), \({Q}_{y}\left(\tau |{X}_{it}\right)\) denotes the quantile distribution of the dependent variable, which is conditional on the location of independent variable \({X}_{it}\). The indicative of quantile-\(\tau\) fixed effect for individual i is represented by \({\propto }_{i}\left(\tau \right)\equiv {\propto }_{i}+{\delta }_{i}q(\tau )\), where \(q(\tau )\) denotes the \(\tau\)-th sample quantile, and is estimated as following:

where \({R}_{it}\) means the residuals, and \({\rho }_{t}\left(A\right)=\left(\tau -1\right)AI\left\{A\le 0\right\}+TAI\{A>0\}\) is the check function (Ike et al., 2020). For further detail, please see Machado and Santos Silva (2019).

Results

Inward and Outward FDI, and Foreign Investment Balance

Due to the presence of fixed panel effects, heteroskedasticity, contemporaneous correlation and first-order autocorrelation, the Driscoll-Kraay estimator was employed for fixed panel effects and was used as a benchmark model (FE-DK). Before analysing the results, it is important to explain the quantiles. The 10th - 25th quantiles represent the lower quantiles of the distribution of the dependent variable under analysis. The 50th quantile represents the middle of the distribution and the 75th - 95th quantiles, the higher quantiles in the distribution. Thus, in the IFDI model, lower quantiles represent low-recipient countries, and higher quantiles represent high-recipient countries. This general principle is applicable to all models, following the same logic. Table 2 summarises the results for the IFDI model.

From Table 2, it is possible to conclude that the FE-DK and PQR analyses produce similar results regarding the effect of the variables on IFDI. Although there are some differences in the levels of significance across quantiles in the Quantile Regression analysis of the determinants of IFDI, the level of heterogeneity is relatively low, as the impacts are unchanged.

The results of the FE-DK model indicate that RES, trade openness, SD, environmental regulation, regulatory quality, and advanced education are all drivers of FDI. However, the results of the Quantile Regression provide a fuller picture by showing that only RES, trade openness, and SD are drivers of FDI in every quantile. The inability of FE-DK to reflect these varying results demonstrates that PQR is a more effective tool for analysing the drivers of FDI, which differ depending on whether countries are high or low recipients. Consequently, the subsequent analysis in this paper will focus on the results of the Quantile Regressions. In short, the results from the PQR indicate that environmental regulation and advanced education attract FDI in low- to middle-recipient countries, financial development is not statistically significant, and gross fixed capital formation reduces a country’s attractiveness to FDI.

Turning to outward foreign investment, Table 3 illustrates the results regarding the determinants of OFDI.

The results in Table 3 reveal that only SD (represented by LGCPI) is statistically significant at a 1% level in stimulating OFDI in all quantiles. Renewable Energy Consumption (LRES) increases its statistical significance until the middle of the distribution, and then its significance reduces in high-source countries. Advanced education (LEDU) significantly increases OFDI, particularly in low to middle-quantiles, but loses the statistical significance in countries that are major sources of FDI. Financial development (LFD) seems to increase OFDI more effectively than it increases IFDI, but appears to have no statistical significance in high-source countries. Neither regulatory quality nor environmental regulation were shown to be statistically significant for OFDI, and this will be further discussed in the next subsection.

Table 4 displays the results of analysing the influence of the same determinants on the balance of inward and outward FDI in the countries studied, measured by the ratio of IFDI to OFDI.

When examined together with those in Tables 1 and 2, the results in Table 4 provide rich grounds for discussion, as they indicate that, although certain variables may not have a direct impact on IFDI and OFDI, they can still influence the interaction between them. A determinant that increases the foreign investment balance can be considered a driver of IFDI, whereas a determinant that reduces it can be considered to increase the capacity of that country to invest abroad. By using a PQR to analyse this ratio, we were able to look simultaneously at countries that were major sources and countries that were major recipients of FDI, and determine the relationships between the capacities of countries to attract FDI and to invest abroad. In this analysis countries in the 10th to 25th quantiles were considered high-investors, and from 75th to 90th quantiles, high-recipients.

In the middle of the distribution, RES seems to reduce the foreign investment balance, but only at 10% statistical significance. Financial development increases OFDI and reduces the balance. Trade openness, SD, and advanced education appears to drive both IFDI and OFDI, but they seem to increase OFDI even more, resulting in a lower ratio of inward to outward foreign investment. Regulatory quality is also effective in increasing the foreign investment balance, but does not appear to have a direct effect on increasing or reducing IFDI or OFDI.

FDI and the Environment

Several studies have proved that different economic sectors produce differing levels of emissions. The European Environment AgencyFootnote 1 points that, after the energy supply sector, the industrial and transport sectors are the most significant emitters of greenhouse gases (GHG). As renewable energy generally encourages both IFDI and OFDI, this study examines the effectiveness of renewable energy in the industrial (LRESI) and transport sectors (LREST) in reducing pollution.

Once again taking our cue from the literature, some of the same variables employed to examine FDI flows were reused in this analysis of pollution, such as trade openness, gross fixed capital formation, SD, and environmental regulation. The number of patents registered was used as a proxy to examine the relationship between innovation and pollution-reduction. Lower quantiles represent countries with low emissions and higher quantiles represent countries with high emissions.

The results in Table 5 show that RES by the industrial and transport sectors, reduces pollution in all quantiles, whereas gross fixed capital formation (LGFCF) and patents increases it. In high-emissions countries, environmental regulation (POL) is effective in reducing pollution but, unexpectedly, SD (indicated by LCGPI) increases it. A higher balance of inward to outward foreign investment reduces pollution in all quantiles, except those of the highest emitting countries.

Given that SD might attract FDI that reduces pollution and consequently produces further SD, there was a suspicion of endogeneity in the data, a suspicion confirmed by the results of the Sargan test. Although the Quantile Via Moments method developed by Machado and Santos Silva (2019) is robust in the presence of endogeneity, the Panel Autoregressive Distributed Lag (PARDL) model with the Driscoll and Kraay (1998) (DK) estimator was run to check the robustness of the findings. This model was chosen as it can cope with endogeneity and supports I(0) and I(1) variables. The DK estimator can deal with heteroskedasticity, contemporaneous correlation, and first-order autocorrelation. The outcomes of these tests and the PARDL model are not presented to preserve space but are available upon request to the authors. Overall, the findings corroborated the results of the PQR. However, they showed that environmental policies, which were shown to be a driver of IFDI by the PQR, reduce IFDI in the short run. Nonetheless, their impact in the PARDL model is only statistically significant at 10% level and insignificant in the long run, which is consistent with the fact that it takes time for environmental regulation to have a meaningful impact.

Discussion

The main goal of this study was to analyse the effect of certain determinants (based on the literature) on both IFDI and OFDI, and on the ratio between them. It is generally accepted that policies aiming to increase income (and attract FDI) must take into account the goals of SD. Therefore, this paper analysed the role of SD and RES in attracting FDI in developed countries, and explored the environmental impact of the balance of inward and outward foreign investment in these countries. The results provide empirical evidence about the drivers of FDI, and reveal that many of the determinants that attract IFDI also foster OFDI in high-recipient and high-source countries, as can be seen in Table 6. This finding reveals the complexity of the chain of causality involved in FDI and highlights the need to properly examine the balance of foreign investment in developed countries and the effect of various determinants on it. The fuller understanding such as analysis brings, will make it easier to identify the globally beneficial drivers of FDI and avoid those that are harmful to sustainable growth.

Table 6 summarises the results and, while showing that most of the determinants that attract FDI also encourage OFDI, it also underlines that the determinants of FDI vary across the different quantiles of the distribution. This highlights the advantage of this innovative use of PQR, which contributes to the literature by producing more precise and robust results in the analysis of FDI determinants.

As to the results themselves, they shed light on the role played by all the determinants considered. Developed countries generally have higher environmental standards, which often encourage the adoption of green energy generation. It is widely accepted in the literature that RES reduces pollution in countries, irrespective of their existing emissions levels, even in energy-intensive sectors such as industry and transport (Yin et al., 2021). Our study also found that RES increases both IFDI and OFDI. One reason for this may be that the lower marginal costs of renewable energy production often result in lower electricity prices, as noted by Blazquez et al. (2018). These reduced production costs create a new competitive scenario that may attract new companies and foreign investment to these markets and countries. These lower marginal costs also allow firms to save more capital to invest in foreign projects. Trade openness stimulates such transactions, as it simplifies the commercial exchange of goods and services (imports and exports). Teixeira et al. (2017) find that, as an economy becomes more open, commercial transactions become more straightforward, and capital/investment flows more freely, making the countries more attractive to FDI.

One unexpected finding of this study was that gross fixed capital formation increases pollution. This may be an effect of scale, in other words, more capital in the production process results in higher energy consumption that, in turn, increases pollution, as found by Sapkota and Bastola (2017). Gross fixed capital formation was also found to reduce both IFDI and OFDI. As Stupnikova and Sukhadolets (2019) stated, the accumulation of fixed capital in the acquisition of new assets means that added value is invested rather than consumed, and the opportunity cost of this investment tends to lower consumption. Consequently, more spending on capital goods leaves less capital available for consumer goods and other types of investment. Thus, the higher domestic investment implied by increased gross fixed capital formation may both lower demand for inward foreign investment and reduce the capital available for outward foreign investment.

The results also show that SD plays a crucial role in attracting FDI and, looking at the components used to calculate SD suggests two potential explanations for this role. SD may increase a country’s attractiveness to FDI due to the reduced environmental costs associated with it, or due to factors arising from the development in engenders, such as increased private consumption and/or public non-defensive and rehabilitative expenditure. Thus, the higher regulatory standards, political stability and private consumption seen in countries with higher levels of SD, along with the associated lower environmental costs, mean that these countries tend to attract more IFDI. Increased SD in these countries also fosters more OFDI, because the higher private consumption it generates increases their capacity to invest abroad.

Another finding was that registering more patents tends to increase pollution, suggesting that these patents have focused more on increasing economic growth than mitigating pollution. All the countries under analysis, independent of their level of emissions, are becoming more developed, but this development has often been detrimental to the environment. This result was also unexpected, considering the higher levels of environmental awareness in these countries.

The study’s findings confirm those of Yin et al. (2021) who found that advanced education raises IFDI, suggesting that the human capital is a vital driver of FDI in general. However, this effect is only found in low- to middle-recipient countries. The positive effect of increased IFDI suggests that the foreign investment flowing into these countries is primarily technological. Regarding the impact on OFDI, although advanced education was not shown to be statistically significant in most high-source countries, it may be stimulating OFDI, because the higher wages associated with advanced education prompt some firms to employ OFDI to exploit lower labour costs abroad. This generally only happens in industries whose production processes are relatively easy and standardised and do not require highly specialised or qualified workers, but these processes are often polluting.

The results regarding environmental regulation suggest that stricter environmental standards attract environmentally friendly FDI in low- to middle-recipient countries, and confirm the conclusions of Dong et al. (2020) that environmental regulations play an important relevant role in investment decisions. Although environmental regulations were not found to be statistically significant in encouraging OFDI, the study revealed their importance in increasing a country’s overall balance of foreign investment. This suggests that the strictness of environmental regulations in source countries does not directly encourage OFDI. It also shows that the environmental standards of recipient countries have a significant influence on investment decisions, particularly if foreign investors are seeking to take advantage of lower environmental standards. In short, the transfer of polluting industries to third countries appears to be more determined by lower environmental regulations in host countries than by stricter environmental regulations in source countries. The unsurprising finding that environmental regulation reduces pollution in developed countries, underlines the importance of introducing stringent mandatory environmental regulations to reduce pollution in countries with high-emission levels.

Although environmental regulations attract clean FDI and reduce pollution, policymakers should be careful not to make these regulations unduly harsh, as this could inhibit productivity, as noted by Shen et al. (2020). Furthermore, overly strict environmental regulations may exacerbate the discrepancy in environmental regulation between countries, and encourage the transfer of polluting industries. A higher level of regulatory quality in a country tends to improve the foreign investment balance in low- to high-recipient countries (excluding those that receive the very highest levels of FDI), suggesting that, although regulatory quality does not directly impact IFDI or OFDI, it does affect the dynamics between them. From this, it might be deduced that FDI transactions and their target countries are indirectly determined by the regulatory quality of the respective countries.

Regarding the balance between inward and outward foreign investment, financial development appears to have a role in decreasing this ratio by increasing OFDI, primarily in the lower quantiles, but less statistically significantly in the higher quantiles. As Shahbaz et al. (2018) suggested, financial development is crucial for the overall development and economic stability of a country, so that higher financial development tends to increase its investment capacity. In summary, environmental regulation and regulatory quality tend to increase the ratio of inward to outward foreign investment in a country, whereas advanced education and financial development tend to reduce this balance. A higher foreign investment balance significantly reduces emissions in low to middle-emissions countries, but it is not statistically significant in countries with the highest emissions, suggesting that, on balance, FDI is environmentally friendly. In countries with high-emissions, RES and environmental regulation tend to reduce pollution.

Thus, the quantile analysis reveals a hitherto unobserved heterogeneity, particularly between the lower and upper quantiles. Among these differences, it was found that RES, trade openness, SD, and environmental regulations attract IFDI in low-recipient countries, while the drivers of IFDI in high-recipient countries are RES, trade openness, and SD. OFDI is encouraged by RES, trade openness, SD, advanced education and financial development in low-source countries, but is prompted by RES, trade openness, and SD in high-source countries. Given this, it is remarkable that the determinants of inward and outward FDI are the same in high-recipient and high-source countries, although the reasons for each may differ. The high levels of inward investment in major recipients of FDI could be inducing still further investment, whereas the outward investment may be more the result of favourable conditions and the influence of firms on each other.

Conclusions and Policy Implications

To better understand the complexity of foreign investment flows, this study examined the determinants of IFDI, OFDI, and the foreign investment balance (the ratio of IFDI to OFDI) for a group of 14 EU countries from 1995 to 2018. The study also analysed the impact of foreign investment balances to ascertain whether the presence of this type of investment in developed countries is environmentally friendly. Developed countries have made conspicuous efforts to reduce their direct environmental impact, but this has often entailed carbon leakage and deindustrialisation whose global benefits are questionable. Therefore, this study empirically assessed the role of SD and RES as determinants in attracting foreign investment and to evaluate their potential effectiveness in sustainably reversing the deindustrialisation of developed countries.

The main findings of the study are that the determinants of IFDI also foster OFDI, particularly in countries that are the source and recipient of high levels of FDI. Surprisingly, the determinants that attract FDI to countries receiving low levels of FDI differ from that those that receive high levels. These findings highlight the heterogeneity of FDI determinants and the importance of considering the specific characteristics of a country when defining policies.

The study also revealed that a commitment to SD is more likely to attract environmentally friendly FDI, because SD is a driver of IFDI. As a result of the political stability, environmental protection and lower environmental costs it promotes, greater sustainability also fosters outward FDI in all the EU countries studied. As a central pillar of sustainability, RES thus creates a “win-win” effect by both attracting FDI and reducing pollution. It was found that environmental regulation also has an important role in attracting IFDI and reducing pollution. This might suggest that inward investment to developed countries is primarily environmentally friendly. This was confirmed by the finding that a higher ratio of inward to outward foreign investment tends to reduce pollution, thus supporting the Pollution Halo Hypothesis. However, greater environmental regulation was not found to encourage OFDI. This suggests that the transfer of polluting industries to other countries is driven by the laxer environmental standards in some recipient countries, rather than the environmental stringency of source countries. Moreover, regulatory quality appears to be more important for improving the balance of foreign investment than merely increasing IFDI or OFDI. This suggests that, in choosing the destination of outward investment, the regulatory quality of the potential recipient country is significant.

Another strong inference that can be drawn from this study is that RES capacity should be increased, particularly in countries with high-emissions. This could be done through measures such as fiscal incentives to adopt bi-hourly energy pricing that, in peak hours, reduce household consumption, leave more renewable energy available for industry. These same countries would also benefit from investment in the development of environmentally-friendly technologies for both industrial and domestic users. For example, passive and/or smart houses equipped with interconnected devices, appliances and sensors would make it easier to control energy consumption. In parallel, increasing market competition could reduce prices and encourage consumer investment in energy saving options.

Developed countries should continue to maintain high environmental standards, as these attract environmentally-friendly FDI. Developing countries, on the other hand, should avoid the temptation of relaxing environmental regulation to attract polluting industries from other countries, and should seek to improve the quality of their regulatory frameworks and stamp out corruption in their implementation. All these aspects should be considered by those in and out of the country making decisions on policy and foreign investment. Greater regulatory quality and control of corruption in developing countries could attract more FDI that could promote sustainable development and enhance political stability.

Global warming is a transnational problem and developed countries should realise that they can help mitigate it by transferring technology and knowledge to developing countries, where it will have a substantial positive environmental impact. The dependence of developing countries on foreign investment became particularly apparent during the recent pandemic. This underlines the importance of developed countries sharing technical innovation and making judicious use of FDI, to promote sustainable development. Improving the quality of environmental regulations and reducing regulatory discrepancies worldwide is an essential step in this process. Thus, by conducting an innovative analysis of a group of developed European countries this paper sheds light on the complexity of FDI in both its global interconnectedness and the local specificity of its determinants, and highlights the need to take both into account when devising policies to promote sustainable growth.

Data Availability

The data that support the findings of this study are available from the corresponding author upon request.

Abbreviations

- BRICS:

-

Brazil, Russia, India, China, and South Africa

- CD:

-

Cross-sectional Dependence

- CGPI:

-

Comparable Genuine Progress Indicator

- CO2 :

-

Carbon Dioxide

- EU:

-

European Union

- FDI:

-

Foreign Direct Investment

- FE-DK:

-

Fixed effects panel data with Driscoll and Kraay estimator

- GDP:

-

Gross Domestic Product

- GHG:

-

Greenhouse gas

- KTOE:

-

Kilo tonnes of oil equivalent

- LM:

-

Lagrange Multiplier

- MENA:

-

Middle East and North Africa

- OECD:

-

Organisation for Economic Co-operation and Development

- PHH:

-

Pollution Haven Hypothesis

- PHlH:

-

Pollution Halo Hypothesis

- PQR:

-

Panel Quantile Regression

- RES:

-

Renewable Energy Consumption

- SD:

-

Sustainable Development

- USD:

-

United States Dollars

References

Adom, P. K., Opoku, E. E. O., & Yan, I. K. M. (2019). Energy demand–FDI nexus in Africa: Do FDIs induce dichotomous paths? Energy Economics, 81, 928–941. https://doi.org/10.1016/j.eneco.2019.05.030

Afonso, T. L., Marques, A. C., & Fuinhas, J. A. (2019). Energy–growth nexus and economic development: a quantile regression for panel data. The Extended Energy-Growth Nexus, 1–25. https://doi.org/10.1016/b978-0-12-815719-0.00001-2

Al-mulali, U., Tang, C. F., & Ozturk, I. (2015). Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environmental Science and Pollution Research, 22(19), 14891–14900. https://doi.org/10.1007/s11356-015-4726-x

Apinran, M. O., Taşpınar, N., & Gökmenoğlu, K. K. (2018). Impact of Foreign Direct Investment on Human Development Index in Nigeria. Business and Economics Research Journal, 9(1), 1–13. https://doi.org/10.20409/berj.2018.90

Aust, V., Morais, A. I., & Pinto, I. (2020). How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. Journal of Cleaner Production, 245. https://doi.org/10.1016/j.jclepro.2019.118823

Blazquez, J., Fuentes-Bracamontes, R., Bollino, C. A., & Nezamuddin, N. (2018). The renewable energy policy Paradox. Renewable and Sustainable Energy Reviews, 82(September 2016), 1–5. https://doi.org/10.1016/j.rser.2017.09.002

Bleys, B., & Whitby, A. (2015). Barriers and opportunities for alternative measures of economic welfare. Ecological Economics, 117, 162–172. https://doi.org/10.1016/j.ecolecon.2015.06.021

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. The Review of Economic Studies. https://doi.org/10.2307/2297111

Burhan, M., Singh, A. K., & Jain, S. K. (2017). Patents as proxy for measuring innovations: A case of changing patent filing behavior in Indian public funded research organizations. Technological Forecasting and Social Change, 123, 181–190. https://doi.org/10.1016/j.techfore.2016.04.002

Dartey-Baah, K. (2014). Effective leadership and sustainable development in Africa: is there “really” a link? Journal of Global Responsibility. https://doi.org/10.1108/jgr-03-2014-0014

De Pascale, G., Sardaro, R., Faccilongo, N., & Contò, F. (2020). What is the influence of FDI and international people flows on environment and growth in OECD countries? A panel study. Environmental Impact Assessment Review, 84(June), 106434. https://doi.org/10.1016/j.eiar.2020.106434

Dellis, K., Sondermann, D., & Vansteenkiste, I. (2020). Drivers of genuine FDI inflows in advanced economies. Quarterly Review of Economics and Finance, xxxx. https://doi.org/10.1016/j.qref.2020.09.004

Dong, Y., Tian, J., & Ye, J. (2020). Environmental regulation and foreign direct investment: Evidence from China’s outward FDI. Finance Research Letters, April, 101611. https://doi.org/10.1016/j.frl.2020.101611

Doytch, N. (2020). The impact of Foreign Direct Investment on the Ecological Footprints of Nations. Environmental and Sustainability Indicators, Iii, 124658. https://doi.org/10.1016/j.indic.2020.100085

Driscoll, J. C., & Kraay, A. C. (1998). Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Review of Economics and Statistics, 80(4), 549–560. https://doi.org/10.1162/003465398557825

Fagbemi, F., & Osinubi, T. (2020). Leveraging foreign direct investment for sustainability: An approach to sustainable human development in Nigeria. Resources, Environment and Sustainability, 100005. https://doi.org/10.1016/j.resenv.2020.100005

Frugoli, P. A., Almeida, C. M. V. B., Agostinho, F., Giannetti, B. F., & Huisingh, D. (2015). Can measures of well-being and progress help societies to achieve sustainable development? Journal of Cleaner Production, 90, 370–380. https://doi.org/10.1016/j.jclepro.2014.11.076

dos Gaspar, J., & S., Marques, A. C., & Fuinhas, J. A. (2017). The traditional energy-growth nexus: A comparison between sustainable development and economic growth approaches. Ecological Indicators, 75, 286–296. https://doi.org/10.1016/j.ecolind.2016.12.048

Gusmão Caiado, R. G., Leal Filho, W., Quelhas, O. L. G., de Mattos, Luiz, Nascimento, D., & Ávila, L. V. (2018). A literature-based review on potentials and constraints in the implementation of the sustainable development goals. In Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2018.07.102

Hao, Y., Guo, Y., Guo, Y., Wu, H., & Ren, S. (2020). Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Structural Change and Economic Dynamics, 52, 109–119. https://doi.org/10.1016/j.strueco.2019.08.012

Ike, G. N., Usman, O., & Sarkodie, S. A. (2020). Testing the role of oil production in the environmental Kuznets curve of oil producing countries: New insights from Method of Moments Quantile Regression. Science of the Total Environment, 711, 135208. https://doi.org/10.1016/j.scitotenv.2019.135208

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law, 3(2), 220–246. https://doi.org/10.1017/S1876404511200046

Kwatra, S., Kumar, A., & Sharma, P. (2020). A critical review of studies related to construction and computation of Sustainable Development Indices. Ecological Indicators, 112(January), 106061. https://doi.org/10.1016/j.ecolind.2019.106061

Lawn, P. A. (2005). An assessment of the valuation methods used to calculate the Index of Sustainable Economic Welfare (ISEW), Genuine Progress Indicator (GPI), and Sustainable Net Benefit Index (SNBI). In Environment, Development and Sustainability. https://doi.org/10.1007/s10668-005-7312-4

Machado, J. A. F., & Santos Silva, J. M. C. (2019). Quantiles via moments. Journal of Econometrics, 213(1), 145–173. https://doi.org/10.1016/j.jeconom.2019.04.009

Maddala, G. S., & Wu, S. (1999). A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxford Bulletin of Economics and Statistics, 61(S1), 631–652. https://doi.org/10.1111/1468-0084.0610S1631

Marques, A. C., & Caetano, R. (2020). The impact of foreign direct investment on emission reduction targets : Evidence from high- and middle-income countries. Structural Change and Economic Dynamics, 55, 107–118. https://doi.org/10.1016/j.strueco.2020.08.005

Marques, A. C., Fuinhas, J. A., & Gaspar, J. D. S. (2016). On the Nexus of Energy Use - Economic Development: A Panel Approach. Energy Procedia, 106, 225–234. https://doi.org/10.1016/j.egypro.2016.12.118

Melane-Lavado, A., Álvarez-Herranz, A., & González-González, I. (2018). Foreign direct investment as a way to guide the innovative process towards sustainability. Journal of Cleaner Production, 172, 3578–3590. https://doi.org/10.1016/j.jclepro.2017.03.131

Menegaki, A. N., & Tugcu, C. T. (2018). Two versions of the Index of Sustainable Economic Welfare (ISEW) in the energy-growth nexus for selected Asian countries. Sustainable Production and Consumption, 14(January), 21–35. https://doi.org/10.1016/j.spc.2017.12.005

Muhammad, B., & Khan, S. (2019). Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Reports, 5, 1305–1315. https://doi.org/10.1016/j.egyr.2019.09.004

Narula, K. (2012). ‘Sustainable Investing’ via the FDI Route for Sustainable Development. Procedia - Social and Behavioral Sciences, 37, 15–30. https://doi.org/10.1016/j.sbspro.2012.03.271

Neves, S. A., Marques, A. C., & Patrício, M. (2020). Determinants of CO2 emissions in European Union countries: Does environmental regulation reduce environmental pollution? Economic Analysis and Policy, 68, 114–125. https://doi.org/10.1016/j.eap.2020.09.005

Pais, D. F., Afonso, T. L., Marques, A. C., & Fuinhas, J. A. (2019). Are economic growth and sustainable development converging? Evidence from the comparable genuine progress indicator for organisation for economic co-operation and development countries. International Journal of Energy Economics and Policy, 9(4), 202–213. https://doi.org/10.32479/ijeep.7678

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. University of Cambridge, Faculty of Economics, Cambridge Working Papers in Economics No. 0435, 1229, 41.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22(2), 265–312. https://doi.org/10.1002/jae.951

Pesaran, M. H., & Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal of Econometrics, 142(1), 50–93. https://doi.org/10.1016/j.jeconom.2007.05.010

Posner, S. M., & Costanza, R. (2011). A summary of ISEW and GPI studies at multiple scales and new estimates for Baltimore City, Baltimore County, and the State of Maryland. Ecological Economics, 70(11), 1972–1980. https://doi.org/10.1016/j.ecolecon.2011.05.004

Sachs, J. D. (2012). From millennium development goals to sustainable development goals. In The Lancet. https://doi.org/10.1016/S0140-6736(12)60685-0

Sadeghi, P., Shahrestani, H., Kiani, K. H., & Torabi, T. (2020). Economic complexity, human capital, and FDI attraction: A cross country analysis. International Economics, 164(September), 168–182. https://doi.org/10.1016/j.inteco.2020.08.005

Sapkota, P., & Bastola, U. (2017). Foreign direct investment, income, and environmental pollution in developing countries: Panel data analysis of Latin America. Energy Economics, 64, 206–212. https://doi.org/10.1016/j.eneco.2017.04.001

Sarkodie, S. A., & Adams, S. (2020). Electricity access and income inequality in South Africa: Evidence from Bayesian and NARDL analyses. Energy Strategy Reviews, 29, 100480. https://doi.org/10.1016/j.esr.2020.100480

Sarkodie, S. A., & Strezov, V. (2019). Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Science of the Total Environment, 646, 862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Shahbaz, M., Balsalobre-Lorente, D., & Sinha, A. (2019). Foreign direct Investment–CO 2 emissions nexus in Middle East and North African countries: Importance of biomass energy consumption. Journal of Cleaner Production, 217, 603–614. https://doi.org/10.1016/j.jclepro.2019.01.282

Shahbaz, M., Nasir, M. A., & Roubaud, D. (2018). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Economics, 74, 843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shahbaz, M., Nasreen, S., Abbas, F., & Anis, O. (2015). Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Economics, 51, 275–287. https://doi.org/10.1016/j.eneco.2015.06.014

Shen, C., Li, S., Wang, X., & Liao, Z. (2020). The effect of environmental policy tools on regional green innovation: Evidence from China. Journal of Cleaner Production, 254, 120122. https://doi.org/10.1016/j.jclepro.2020.120122

Singhania, M., & Saini, N. (2021). Demystifying pollution haven hypothesis: Role of FDI. Journal of Business Research, 123(October 2020), 516–528. https://doi.org/10.1016/j.jbusres.2020.10.007

Stupnikova, E., & Sukhadolets, T. (2019). Construction sector role in gross fixed capital formation: Empirical data from Russia. Economies, 7(2). https://doi.org/10.3390/economies7020042

Sultana, N., & Turkina, E. (2020). Foreign direct investment, technological advancement, and absorptive capacity: A network analysis. International Business Review, 29(2), 101668. https://doi.org/10.1016/j.ibusrev.2020.101668

Teixeira, A. A. C., Forte, R., & Assunção, S. (2017). Do countries’ endowments of non-renewable energy resources matter for FDI attraction? A panel data analysis of 125 countries over the period 1995–2012. International Economics, 150(December 2016), 57–71. https://doi.org/10.1016/j.inteco.2016.12.002

United Nations Conference on Trade and Development. (2022). World Investment Report. July.

Wang, C., & Kafouros, M. I. (2009). What factors determine innovation performance in emerging economies? Evidence from China. International Business Review. https://doi.org/10.1016/j.ibusrev.2009.07.009

Yilanci, V., Bozoklu, S., & Gorus, M. S. (2020). Are BRICS countries pollution havens? Evidence from a bootstrap ARDL bounds testing approach with a Fourier function. Sustainable Cities and Society, 55(January), 102035. https://doi.org/10.1016/j.scs.2020.102035

Yin, Y., Xiong, X., & Hussain, J. (2021). The role of physical and human capital in FDI-pollution-growth nexus in countries with different income groups: A simultaneity modeling analysis. Environmental Impact Assessment Review, 91(August), 106664. https://doi.org/10.1016/j.eiar.2021.106664

Zaidi, S., & Saidi, K. (2018). Environmental pollution, health expenditure and economic growth in the Sub-Saharan Africa countries: Panel ARDL approach. Sustainable Cities and Society, 41(July 2017), 833–840. https://doi.org/10.1016/j.scs.2018.04.034

Acknowledgments

The authors would like to gratefully acknowledge the financial support of the NECE-UBI – Research Unit in Business Science and Economics, Portugal, Project no. UIDB/04630/2020; and of the Santander Universities through “Scholarship BID/UBI-Santander Universities/2020”.

Funding

Open access funding provided by FCT|FCCN (b-on). Fundação para a Ciência e a Tecnologia, UIDB/04630/2020, António Marques, Banco Santander, Scholarship BID/UBI-Santander Universities/2020, Rafaela Vital Caetano.

Author information

Authors and Affiliations

Contributions

Rafaela Vital Caetano: conceptualization; data curation; formal analysis; funding acquisition; investigation; methodology; software; visualization; roles/writing-original draft. António Cardoso Marques: formal analysis; funding acquisition; project administration; resources; supervision; validation; visualization; writing-review & editing. Tiago Lopes Afonso: formal analysis; funding acquisition; supervision; validation; visualization; writing-review & editing.

Corresponding author

Ethics declarations

Competing Interests

The authors declare that there is no financial or personal conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caetano, R.V., Marques, A.C. & Afonso, T.L. Can Sustainable Development Induce Foreign Direct Investment? Analysis of the Complex Inward and Outward Flows of Investment in European Union Countries. J Knowl Econ (2023). https://doi.org/10.1007/s13132-023-01473-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-023-01473-9