Abstract

Innovation is a general measure of the success of a company and shows a positive relationship with several key factors such as collaboration with universities and technology centers or belonging to medium- and high-tech sectors. While many studies have found that gender diversity in company management teams has a positive influence on companies’ economic success, few have focused on the impact that the inclusion of women in the board of directors has on product, process, and organizational innovation. This paper builds on previous knowledge about the determinants of innovations and shows that greater gender management team diversity, compared to male-only teams, positively affects the achievement of said innovations. However, these results change when we incorporate the size of the companies as a moderating variable. In this case, we identify a turning point corresponding to firm size in the impact of gender diversity on product and process innovations, but not for innovations in organizational methods, where the impact is positive and significant for both SMEs and large enterprises. Collaboration with universities and technological centers is an important determinant of innovation for both SMEs and large enterprises.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

Introduction

Previous literature on vertical segregation argues that women and men may differ in terms of personal characteristics such as risk aversion, level of trust, or ethical values, which leads them to make different decisions. However, there is no agreement regarding these inherent differences and their impact on the level of innovation in firms. Many such studies claim that, on average, men tend to have more confidence in themselves than women (Barber and Odean, 2001; Lundeberg et al., 1994). On the other hand, there is no consensus on risk attitudes: Jianakoplos and Bernasek (1998) and Croson and Gneezy (2009) show that women are more risk-averse than men, while Adams and Funk (2012) find the opposite. Using a sample of the 125 non-financial companies listed on the Madrid Stock Exchange from 2005 to 2009, Reguera-Alvarado et al. (2017) find a positive relationship between the number of women on the board of directors and the firm’s financial results; and Adams and Ferreira (2009) report a positive relationship between the impact of gender diversity on boards of directors and company results.

One of the most recurrent questions in research on vertical occupational segregation is whether gender differences could affect corporate results and whether companies could benefit from an increase in the number of female directors; that is, whether it is important to have more women in these teams. Previous studies show that the representation of women on firms’ corporate boards depends on firm characteristics. Sector or size could be significant factors explaining female representation on corporate boards. Empirical evidence suggests that women are not uniformly represented across industrial sectors (Bertrand and Hallock, 2001). Traditionally, women have been more prevalent in service-oriented sectors like health, social services, and trade than in manufacturing industries. In these sectors, there is a greater pool of women from which firms could find candidates to integrate into their corporate boards. The limited number of executive positions held by women in industrial sectors makes it difficult to incorporate internal female candidates. There is a demand-side and a supply-side determinant of the increase in female participation in firms’ higher-level management. From the supply point of view, there has been an increase in qualified women that could access boardroom positions. On the demand side, many countries have made strong recommendations about greater female board representation, while others have established binding gender quotas (Matsa and Miller, 2013).

The literature on this topic is abundant but somewhat fragmented. Previous research has analyzed the influence of gender diversity on firms’ performance, but no studies to date have attempted to simultaneously test the impact of gender diversity versus gender homogeneity (the latter measured as male-only management teams) on product and process innovation and innovation in organizational methods. The differences between them become more pronounced when we introduce company size as a moderating variable. Another important contribution of this study is that it shows the impact that collaboration with universities and technological centers (UTC) has on innovation. We find a positive influence of UTC on all three types of innovation, regardless of the size of the companies. Drawing on the Survey of Business Strategies (ESEE, 2016), we provide empirical evidence for manufacturing companies in the Spanish industrial sector.

In terms of the theoretical underpinnings, we rely on the Upper Echelon Theory (UET), based on the work of Hambrick and Mason (1984) and Hambrick (2007), to explore how the demographic characteristics of managers and directors influence their actions in the companies they lead. Gender is a demographic variable that runs deeper than other variables such as age, training, profession, or tenure of members of the management team, since its effects originate in managers’ socio-cognitive base (e.g., Krishnan and Park, 2005; Torchia et al., 2011; Ruiz-Jiménez and Fuentes-Fuentes, 2016). The UET posits that an organization's strategic methods and outcomes are a function of the managerial characteristics of top-level managers. In this sense, strategic choices are more the result of behavioral features than they are mechanical calculations aimed at economic optimization. As such, strategic choices are multifaceted and reflect the idiosyncrasies of decision-makers. Given that managers' cognitive base, values, and perception are not observable, the UET points to certain measurable managerial characteristics as potentially appropriate substitutes.

The rest of the paper is organized as follows: Section Theoretical Framework and Hypothesis Testing introduces the theoretical framework, Section Data, Variables, and Methodology describes the data, methodology, and variables used in the estimation; Section The Data details the empirical results, and Section The Variables present the concluding remarks and implications for policies and business strategies.

Theoretical Framework and Hypothesis Testing

Our theoretical framework is based on previous research related to the UET, which argues that demographic characteristics of managers, such as gender, can proxy for models of knowledge and decision-making, and the literature on gender diversity in business, which states that women have different management styles than men. Drawing on this framework, we analyze how more gender diverse management teams in manufacturing companies in the Spanish industrial sector positively influence the relationship between management skills and innovation. The more gender diverse the composition of these teams, the better the company will be able to generate procedures and organizational routines that enhance the impact of management teams on innovation performance. The central assumption of the UET is that managers’ experiences, values, and personalities influence their appraisals of the situations they face and therefore their decisions (Hambrick, 2007). In this sense, the demographic characteristics of the managers can be used as proxies for their knowledge models; therefore, the strategic behavior of companies reflects the shared leadership of their management team, and their collective knowledge, skills, and interactions (Ruiz-Jiménez and Fuentes-Fuentes, 2016).

A diverse leadership team can give an organization multiple benefits, and gender diversity constitutes an important measure of that diversity. Previous studies show that gender diversity in the management team provides different types of skills, knowledge, and ideas that generate benefits for the organization (e.g., Krishnan and Park, 2005; Torchia et al., 2011; Ruiz-Jiménez and Fuentes-Fuentes, 2016).

The differences in corporations’ management teams have prompted a multitude of scientific studies attempting to explain the predominance of men in the highest managerial positions. The negative effects of gender segregation have generated abundant research from different areas of specialization. Women have a harder time than men when aspiring to managerial positions due to self-image, discriminatory stereotypes, or lack of networking opportunities in corporate management circles. In addition, the size of the company and the masculine corporate culture may prevent the election of women to governance bodies (Brieger et al., 2019). A more wide-ranging review of segregation research from an economic, sociological, and psychological standpoint can be found in Reskin and Bielby (2005), Terjesen et al. (2009) and Longarela (2017).

Blau (1970), Adams and Ferreira (2008), and Agrawal and Knoeber (2001) find a positive relationship between the size of the company and the representation of female directors on the boards. These studies argue that large companies may be more sensitive to external or social pressures to increase the proportion of women. In other cases, they are subject to the quota regulation implemented by some countries. Another reason for the positive relationship between size and the percentage of female board members is that large companies often have training programs to help ensure the upward mobility of their employees, and women could benefit from this.

In addition, Minguez-Vera, and Martin (2011) analyze the importance of female directors in Spanish small and medium-sized enterprises (SMEs). While more studies focus on large companies, they argue that SMEs (fewer than 250 employees) are the predominant business type in developed countries and account for 70% of employment, with this percentage being even higher in Spain. Using a sample of non-financial SMEs included in the SABI database between 1998 and 2003, they analyze the relationship between female representation on the board of directors and company performance, finding that gender diversity has a negative effect on company performance due to women’s greater risk aversion. Furthermore, they find that SMEs are more diverse because they are family businesses.

Another interesting issue is how institutions influence companies' decisions directly or indirectly. The company culture and the social context of the country where the economic activity takes place influence the diversity of the management teams. The institutional change needed to facilitate gender diversity on boards of directors is analyzed by Lucas-Pérez and Minguez-Vera (2015). Institutional changes could help ensure that key stakeholders put pressure on companies to improve their corporate performance, in order to achieve greater social legitimacy (García-Sánchez et al., 2020). European Union institutions' efforts to ensure greater gender equality in the labor market are transmitted to the parliaments of Member States, which then enact legislation aimed at achieving these goals. Formal institutions, universities, technology centers, research centers, and so on, can help generate greater gender diversity in companies' management teams. Accordingly, the variable that measures the company's collaboration with these institutions, UTC, is included as one of the explanatory variables in our analysis. Moving away from the more traditional model of innovation where firms use internal R&D inputs to produce an output, the new innovation model is characterized by its openness. In the "open innovation" model, firms use both internal and external sources to acquire technologies and knowledge. This has become necessary in a context of greater technological complexity and a highly competitive environment where companies find it difficult to carry out innovation activities on their own (Trott and Hartmann 2009). One important source of external knowledge is collaboration with UTC. Collaboration between firms and universities and the important role that these agreements play in firms’ innovation has been widely studied (Baba et al., 2009; Lane and Lubatkin, 1998; Powell et al., 1996). Focusing on Spain, Abramovsky et al. (2007) find evidence to suggest that firms collaborate to overcome risks and financial constraints. Segarra-Blasco and Arauzo-Carod (2008), using a sample of Spanish firms with data from the Spanish version of the Community Innovation Survey (CIS-3), analyze the determinants of R&D cooperation between innovative firms and universities. Their results show that there is a close relationship between firms’ cooperation activities and the characteristics of both the industry and the firm. Specifically, they find a higher propensity to cooperate associated with firms from high-tech sectors, firms that perform both product and process innovation, larger firms, and firms that undertake internal R&D activities.

Considering this theoretical background, we now define the hypotheses to be tested with the econometric estimation introduced in the following sections.

Therefore, hypothesis 1, which refers to the UET in terms of gender diversity vs gender homogeneity (measured as male-only management teams), is formulated as follows:

-

Hypothesis 1: Compared to gender homogeneity, greater gender diversity fosters the achievement of process, product and organizational innovations.

Hypothesis 2 focuses on UCT and is based on the premise that external knowledge can help enrich company management teams and thus company decision-making, in accordance with the UET. The hypothesis is therefore formulated as follows:

-

Hypothesis 2: Firms that engage in collaboration with UTC produce more innovations that those that do not.

Hypothesis 3 centers on firm size. Previous research has explored differences between SMEs (Minguez-Vera and Martin, 2011) and large companies in relation to gender diversity and business success (Blau, 1970; Adams and Ferreira, 2008; Agrawal and Knoeber, 2001). The hypothesis is formulated as follows:

-

Hypothesis 3: Size moderates the impact of gender diversity/gender homogeneity on innovation.

By testing these three hypotheses, we seek to gain a better picture of the gender composition of management teams of Spanish manufacturing firms and its impact on companies’ strategic choices, measured as the achievement of process, product, and organizational innovation.

Data, Variables, and Methodology

The Data

We use data from the Survey on Business Strategies (Encuesta Sobre Estrategias Empresariales, ESEE) for 2016, which is the first year in which the number of managers in the company is broken down by gender. A characteristic of the ESEE is that the companies participating in the survey were selected according to a carefully stratified structure. The sample contains almost all Spanish manufacturing firms with more than 200 employees. Firms employing between 1 and 200 workers were picked according to a stratified random sample representative of the population of SMEs. Given the process used to select firms participating in the survey, it can be considered that both samples—of SMEs and large companies—allow the estimation of the distribution of any of the features of the population of manufacturing firms with information available from the dataset. The ESEE is produced by the Fundación SEPI with the support of the Spanish Ministry of Industry.

The high-quality microdata from this survey facilitates the analysis of firms' strategic choices regarding innovation, among other aspects. The mean firm size in the industrial sector is greater than the mean firm size in the Spanish economy as a whole. The firms included in the ESEE are grouped into 20 industrial sectors, which are listed in Table 1.

Our initial sample includes 1808 firms from the ESEE and refers to the year 2016, which was when the survey first included information on the management team (MT) broken down by gender. From the original sample, 137 firms were eliminated as they did not have an MT. The sample used for estimation contains 1671 observations, and the statistics of this data are presented in Table 2.

Table 2 presents the descriptive statistics for the variables used for estimation. From the full sample of 1671 companies, the proportion of women in the MT—we call this variable Gender Diversity (GD)—is 19%. The maximum number of women in the MT is 83, while in the case of men it is 318. The number of men is 3.8 times greater than that of women. Only 4.5% of MTs are made up exclusively of women, while the corresponding value for male-only MTs is 52.81%: in this case, more than 10 times higher than women. In this sample, 16% of companies have achieved product innovation; 39.74% process innovation, and 21.72% innovation in organizational methods. Of all the companies in the sample, 36.74% belong to medium- and high-tech sectors, and 24.24% collaborate with UTC.

Table 3 shows the descriptive statistics for the sample divided into two sizes. In these subsamples, 331 companies have more than 200 employees while there are 1,340 companies with 200 employees or less. Here, we use the Villamizar et al. (2017) classification to establish the cut-off between SMEs (200 employees or less) and large enterprises (LEs, with more than 200 employees) as it represents the reality of Spanish manufacturing companies better than the OECD classification (where SMEs are those 250 employees or less).

For LEs, GD is 16.4% while for SMEs it is 19.74%. In the case of LEs, a greater number of women in MTs is observed: on average 2.74 compared to 0.67 in SMEs. In relative terms, however, the percentage of women is higher in SMEs because while there are fewer women there are also fewer men. In this group, the maximum number of men is 23 compared to a maximum of 20 women in the MT. For companies with more than 200 employees, there are both more women and more men, but the number of men is 3.8 times greater than that of women. In the SMEs, we observe a greater proportion of male-only and female-only homogeneous teams: 58% and 5.5%, respectively. In the case of LEs, this percentage drops to 33% and 0.06%, respectively. A first glance at these descriptive statistics points to the fact that the gender composition of the MTs is conditioned by the size of the companies.

Size is also a relevant factor in the achievement of product, process, and organizational innovations. If we focus on the sectors, we observe that there are more companies that belong to medium- and high-tech sectors in the LE subsample than in the SME subsample. The greatest difference between the two groups is observed in collaboration with UTC, which is 56.5% for LEs compared to 16.27% for SMEs.

The Variables

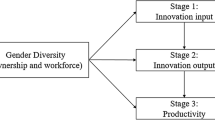

In this study, we focus on three types of innovations and their determinants in the Spanish industrial sector: namely, product innovation, process innovation, and organizational innovation. Product innovation refers to a new or improved product, equipment, or service that is successful in the market; process innovation is the adoption of a manufacturing process that improves the efficiency in the manufacture of a certain product; and organizational innovation encompasses the capacity to adapt the organization’s skills, knowledge, and abilities to take advantage of market opportunities before the competition.

Since the different innovations carried out by companies in the industrial sector have a direct impact on their survival and productivity, we take these three types of innovation as a reflection of their strategic behavior. Huergo and Jamandreu (2004), using data from the ESEE survey, find that companies that introduce process innovations achieve additional productivity growth, although this growth tends to slow over time. That said, if companies stop introducing process innovations, their productivity will be affected in the following years.

To obtain the empirical evidence that allows us to test the three hypotheses defined in the theoretical framework section, we estimate three Probit models that have the following dependent variables:

-

1.

Product Innovation, which takes the value 1 if the company has produced a product innovation in the period, and 0 otherwise.

-

2.

Process Innovation, which takes the value 1 if the company has produced a process innovation in the period, and 0 otherwise.

-

3.

Organizational Innovation, which takes the value 1 if the company has produced an innovation in an organizational method in the period, and 0 otherwise.

To explain these dependent variables, we have chosen a set of explanatory variables, which are described below.

Gender Diversity (GD)

is measured as the proportion of women in the firm’s MT; that is, the number of female executives divided by the total number of executives in the firm’s MT.

Gender Homogeneity (GH)

MTs made up only of men. This is a binary variable that takes the value 1 if the MT is male-only, and 0 otherwise.

Collaboration with Universities and Technology Centers

This is a binary variable that takes the value 1 if the firm collaborates with UTC, and 0 otherwise.

Medium- and High-Tech Sectors

These sectors are chemical and pharmaceuticals; plastic and rubber; fabricated metals; computer, electronic and optical; vehicles and accessories; other transport equipment; and other manufacturing products. It is a dummy variable that takes the value 1 if the business belongs to this group of sectors, and 0 otherwise.

Size

This is a binary variable that takes the value 1 if the firm has more than 200 employees, and 0 otherwise.

Moderating variables

Previous research reports empirical evidence about the interaction of variables that can modify the impact of gender diversity on business performance (Dwyer et al., 2003; Miller and del Carmen Triana, 2009).

The descriptive statistics in Table 3 show important differences in the composition of management teams between LEs and SMEs. Therefore, in the econometric analysis in the following section, we include size as a moderating variable of the impact of gender diversity in MTs on innovation. Accordingly, we include two variables capturing the crossed effect of GD by the size of the company and GH by the size of the company:

GD x S

This variable is the interaction of gender diversity and size. It is a dummy variable that takes the value of the percentage of women in the MT when the firm has more than 200 employees, and 0 otherwise.

GH x S

This variable is the interaction of gender homogeneity (male-only MTs) and size. It is a dummy variable that takes the value 1 if the MT is homogeneous in a firm with more than 200 employees, and 0 otherwise.

The Empirical Results

In this section, we analyze the impact that GD/GH has on MTs as reflected in the achievement of product, process, and organizational innovations. In this context, collaboration with UTC plays an important role not only in the sharing of knowledge but also because these institutions can act as a mirror of social and demographic reality.

To conduct the empirical analysis, we use a parametric binary choice model, the Probit model. Here, we take the three types of innovation as dependent variables, labeled for convenience I=0 (when the firm does not achieve innovation) and I=1 (when the firm does achieve innovation). Most binary choice models set up this way are based on an index function, β’X, where β is the vector of parameters to be estimated. The latent regression approach is specified:

The observed counterpart to I* is:

I=1 if and only if I*>0.

The random variable ε is the disturbance, and in the Probit model is assumed to have a normal distribution.

Table 4, 5 and 6 show the parameters obtained from the estimation of the non-linear econometric models (Probit) whose dependent variables are the three types of innovation mentioned above. Models 1 and 2 include GD as an independent variable, while models 3 and 4 analyze the impact of GH as an independent variable. Model 2 incorporates the interaction of GD with size to test whether size acts as a moderating variable of the impact of GD/GH on innovation.

The Chi-squared of the three estimations is significant (p<0.01), which indicates that the observed data of the sample fit the proposed theoretical or expected distribution.

GD is positive and significant in models 1 and 2, for the three types of innovation. These results indicate that greater GD promotes the implementation of strategic decisions in Spanish manufacturing companies and provides evidence supporting the hypothesis proposed by Hambrick and Mason (1984) and Hambrick (2007). The composition of companies’ MTs influences their performance through their strategic choices. Nishii et al. (2007), using data from 260 US organizations, find that companies that have adopted diversity initiatives outperform those that have not. Using gender diversity in the UET framework, find a partial correlation between greater diversity in MTs and company innovation. Campbell and Mínguez-Vera (2008) show that a higher proportion of women in MTs positively influences the value of the company, but not the other way around.

GH is negative and significant in models 3 and 4 for the three types of innovation. This result shows that the impact of male-only MTs is detrimental to performance in terms of process innovation, product innovation, and organizational innovation.

The collaboration of firms with UTC allows them to share knowledge, experiences, and skills. This collaboration can help these companies to develop a greater absorptive capacity to exploit both internal and external knowledge through interaction and learning, generating mutual benefits derived from the complementarities of said interaction. (Cohen and Levinthal, 1990; Van der Vegt and Janssen, 2003; Quintana García and Benavides-Velasco, 2008). In line with previous literature, we find a positive and significant impact on innovation for those firms that collaborate with UTC. The value of this coefficient is high and fairly similar for the different models, indicating that such collaboration positively conditions the achievement of product innovation, process innovation, and organizational innovation. The impact of the medium and high-tech sectors is positive and significant, indicating that the companies belonging to these economic sectors have achieved more product and process innovations than low-tech sector firms, Tables 4 and 5. On the contrary, in the case of innovation in organizational methods, Table 6, the coefficients of this variable are not significant for any of the four models. specified. Innovations in organizational methods fundamentally include innovations in the organization of work or external relations. Conversely, product innovations are characterized by innovations in components, features, and materials, while process innovations may be due to the use of new equipment, new software, or new techniques. Therefore, these last two types of innovation are more closely associated with medium- and high-tech sectors (Villamizar et al., 2017). Size is an important factor that conditions the performance of manufacturing firms. Using the ESEE survey, Diaz and Sanchez (2008) examine the technical efficiency of SMEs as a function of their characteristics and their flexibility in adapting to cyclical changes, finding that SMEs are more efficient. Van Aken et al. (2008) analyze the relationship between the degree of innovation (measured as innovation in products, processes, and administration systems) and performance among 1,091 Spanish manufacturing SMEs. Their results indicate that innovation has a positive effect on competitiveness for SMEs in low-tech and high-tech industries. Kearney et al. (2014) suggest that the management skills of small businesses promote the development of innovations because they encourage interaction and the use of resources, as well as the collaboration between workers and innovation. On the contrary, in our results, the size coefficient turns out to be positive and significant for the three types of innovation, indicating that larger companies achieve a higher level of product, process, and organizational innovations than SMEs.

To further explore the impact of GD on innovation performance, we include in the econometric estimation the interaction of size with both types of MT, those with GD (GD by size) and those with GH (GH by size). When we include size as a moderating variable, the impact on product and process innovations changes for both GD and GH, while for organizational innovation the coefficient of these interactions is not significant. For the whole sample, the impact of GD on these innovations is positive and significant. Therefore, our results corroborate the previous literature that reports that greater gender diversity in teams improves company results, but the introduction of the size variable moderates this result. We have a turning point in the impact of GD on product and process innovations. For companies with more than 200 employees, the interaction of these two variables yields a negative and significant coefficient. Therefore, for large companies (more than 200 employees), greater gender diversity has less of an impact on these innovations than for smaller companies (200 employees or less). This finding is consistent with the empirical results of previous studies such as that of Li and Chen (2018), showing that gender diversity on the board has a positive impact on company performance if and only if the value of company size is less than some critical value. They find that the size of the company can undermine the positive impact of GD on company performance. In our results, the critical value for firm size is more than 200 employees.

We find an interesting result with the interaction of size and GH (GH by size). When analyzing size as a moderating variable of gender homogenous MTs, we find that this interaction reverses the sign of the influence of GH on product and process innovations, giving rise to a positive and significant coefficient. But, as was the case with GD, this interaction is not significant for organizational innovation. This result indicates that although greater MT homogeneity is detrimental to these three types of innovation in the sample as a whole, in the case of large companies there is a turning point where we see a reverse in the result on product and process innovations.

Conclusions and Policy Implications

Gender Diversity vs Gender homogeneity

In this study, we have shown that greater GD in the MTs of manufacturing companies promotes strategic decisions that give rise to more product, process and organizational innovations, compared to companies with more homogeneous MTs. However, our results show differences between innovations that are more closely linked to technology (product and process innovations) and those concerning organizational methods. For the last type of innovation, MT diversity is a determining factor, while for the first two types of innovation there is a turning point, such that for large companies the impact is positive in the case of male-only teams.

The question about greater diversity or greater homogeneity in MTs does not have a clear answer. Arguments in favor of diversity in MTs hold that diversity in both gender and ethnicity allows the implementation of strategies that are less traditional and that better connect with social reality. MT diversity can allow a better understanding of the market where the company is going to be operating, if the diversity of the company reflects the diversity of potential buyers and suppliers (Korenkiewicz and Maenning, 2022). Basset and Jones (2005) showed that diversity in the workplace also has drawbacks that can affect company results. Heterogeneity or diversity in firms’ MTs could reflect the process of selecting candidates; it should be noted that the processes of selection of the boards of directors are underpinned by different norms and stereotypes that point to the best candidate as having typically masculine characteristics (Branson, 2007, Schein, 2007).

The presence of female directors in Spanish companies has increased significantly in recent years, in part thanks to the different regulations that promote gender diversity on boards of directors. In 2020, the percentage of companies that met the 30% recommendation established in the 2015 Code of Good Governance for Listed Companies was significantly higher among Ibex 35 companies than among companies in the rest of the continuous market. Currently, the new 2020 Code and the Quota Law share the same diversity goal: 40% of the underrepresented gender. The different regulations introduced in Spain on gender diversity in boards of directors have one thing in common: they are voluntary. Voluntary regulations, also known as soft regulations, do not entail penalties in the event of non-compliance. Other European countries have introduced hard regulations, including Norway (exclusion from the stock market), Italy (penalties), and France and Belgium (suspension of compensation of the directors and cessation of activities) (Martinez and Gómez, 2021). The growing presence of women in the political sphere in Spain since 2007 may also foster greater female presence in other spheres of society. Indeed, the importance of applying quotas is that it helps to raise the visibility of this presence and encourages younger women to aim for these positions of responsibility. In Spain, weak regulation still predominates when it comes to the application of quotas in the economic sphere. It remains to be seen whether the possible adoption of an EU directive on gender quotas in boards of directors, the mobilization of women entrepreneurs, or the increasing transfer and learning among Member States in the adoption of public policies will make Spain move towards a stronger regulatory approach to quotas in companies (Lombardo and Verge, 2016).

The need to maintain a reputation and compliance with quotas are factors that affect large companies more than small ones. Konrad et al. (2008), based on Kanter's (1977) theory of tokenism, suggest that a critical mass of women is necessary to achieve unambiguously positive outcomes in the companies where they participate in the MTs.

Collaboration with Universities and Technological Centers

The collaboration of UTC with industrial companies has generated much attention from academics and political leaders in charge of calls for research projects, both at the national and European levels. In 2002, the European Commission pointed out the need for an integrated innovation system to improve the exploitation of knowledge and basic research generated in Europe. Nevertheless, difficulties such as divergent goals among the participants can also hinder positive results (Galán-Muros and Plewa, 2016; Kivleniece and Quelin, 2012). It is widely-believed that organization and management issues are critical factors that can facilitate or inhibit relationships between companies and universities (Siegel et al., 2003). The literature also suggests that the work of universities rarely translates directly into new products and services (Pavitt 2001). Laursen and Salter (2004), using the UK Innovation Survey, find that only a limited number of companies use universities directly as a source of information or knowledge for innovative activities. Instead, Ferreira and Gonçalves (2021), using the information provided by 83 scientific papers, find evidence that academic research affects regional innovation through channels such as geographic proximity and networks. One reason is that in high-tech sectors, companies that invest heavily in R&D are often closely related to universities and research institutions.

Our results show a clear positive impact on firms’ achievement of product, process and organizational innovations stemming from collaboration with UTC. We have econometrically tested the interaction of this collaboration with GD and GH, finding no significant impact on the different innovations. Nor have we found a significant impact in the case of the interaction with size or with medium- and high-tech sectors.

In Spain, competitive research projects convened at the state or regional level include incentives for teams that include a woman in a leading role, as well as promoting quotas of a minimum of 40% of the least represented gender group in the field of research that is submitted for evaluation. However, meeting these quotas does not exempt the research teams from producing scientific articles of verifiable quality and impact, developed by international teams, etc. This makes such collaborations extremely worthwhile and also fosters the integration of women in the MTs of companies in the industrial sector, a sector that is much more male-dominated than other economic sectors.

In addition to the imposition of quotas, which helps raise the visibility of women in managerial positions, these women have to be in positions where relevant decisions are made. If they are not, then there is no true diversity in decision-making and the inclusion of women is done simply to avoid the reputational problems caused by not doing so. At the same time, it is necessary to encourage young women to embark on careers with a more technological orientation, where they account for a smaller share. Women are underrepresented in STEM (Science, Technology, Engineering and Mathematics) as well as in academia at all levels (Adams & Kirchmaier, 2016).

References

Abramovsky, L., Harrison, R., & Simpson, H. (2007). University research and the location of business R&D. Economic Journal, 117(519), 114–141.

Adams, R. B., & Funk, P. (2012). Beyond the glass ceiling: Does gender matter? Management Science, 58(2), 219–235.

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94, 291–309.

Adams, R. B., & Ferreira, D. (2008). Do directors perform for pay? Journal of Accounting and Economics, 46, 154–171.

Adams, R. B., & Kirchmaier, T. (2016). Women on boards in finance and STEM industries. American Economic Review: Papers & Proceedings, 106(5), 277–281. https://doi.org/10.1257/aer.p20161034

Agrawal, A., & Knoeber, C. R. (2001). Do some outside directors play a political role? Journal of Law and Economics., 44(1), 179–179.

Baba, Y., Shichijo, N., & Sedita, S. R. (2009). How Do Collaborations with Universities Affect Firms' Innovative Performance? The Role of ‘Pasteur Scientists’ in the Advanced Materials Field. Research Policy, 38(5), 756–764. https://doi.org/10.1016/j.respol.2009.01.006

Barber, B. M., & Odean, T. (2001). Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment. The Quarterly Journal of Economics, 116(1), 261–292.

Bassett-Jones, N. (2005). The paradox of diversity management, creativity and innovation. Creativity and Innovation Management, 14(2), 169–175. https://doi.org/10.1111/j.1467-8691.00337.x

Bertrand, M., & Hallock, K. F. (2001). Industrial and Labor Relations Review, 55(1), 3–21.

Blau, P. M. (1970). A formal theory of differentiation in organizations. American Sociological Review, 35(2), 201–218.

Branson, D. M. (2007). No Seat at the Table: How Corporate Governance and Law Keep Women Out of the Boardroom. Legal Studies Research Paper Series, 2007–2011.

Brieger, S. A., Francoeur, C., Welzel, C., & Ben-Amar, W. (2019). Empowering women: The role of emancipative forces in board gender diversity. Journal of Business Ethics, 155, 495–511. https://doi.org/10.1007/s10551-017-3489-3

Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83(3), 435–451.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective of learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

Díaz-Mayans, M. A., & Sánchez, R. (2008). Firm Size and Productivity in Spain: A Stochastic Frontier Analysis. Small Business Economics, 30(3), 315–323. https://doi.org/10.1007/s11187-007-9058-x

Dwyer, S., Richard, O. C., & Chadwick, K. (2003). Gender diversity in management and firm performance: The influence of growth orientation and organizational culture. Journal of Business Research, 56(12), 1009–1019.

ESEE. (2016). Encuesta Sobre Estrategias emprsariales, Fundación SEPI. https://www.fundacionsepi.es/investigacion/esee/spresentacion.asp

Freire, J. A. F., & Gonçalves, E. (2021). Cooperation in Innovative Efforts: a Systematic Literature Review. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-021-00837-3

Galán-Muros, V., & Plewa, C. (2016). What drives and inhibits university-business cooperation in Europe? A comprehensive assessment. R&D Management, 46(2), 369–382.

García-Sánchez, I. M., Oliveira, M. C., & Martínez-Ferrero, J. (2020). Female directors and gender issues reporting: The impact of stakeholder engagement at country level. Corporate Social Responsibility and Environmental Management, 27(1), 369–382. https://doi.org/10.1002/csr.1811

Hambrick, D. C., & Mason, P. A. (1984). Upper Echelons: The Organization as a Reflection of its Top Managers. Academy of Management Review, 9(2), 193–206.

Hambrick, D. C. (2007). Upper Echelons Theory: An Update. Academy of Management Review, 32(2), 334–343.

Huergo, E., & Jaumandreu, J. (2004). Firms’ Age, Process Innovation and Productivity Growth. Journal of Industrial Organization, 22(4), 541–559. https://doi.org/10.1016/j.ijindorg.2003.12.002

Jianakoplos, N. A., & Bernasek, A. (1998). Are women more risk-averse? Economic Inquiry, 36(4), 620–630.

Kanter, R. M. (1977). Men and women of the corporation. Basic Books.

Kearney, A., Harrington, D., & Kelliher, F. (2014). Exploiting managerial capability for innovation in a micro-firm context. European Journal of Training and Development, 38, 95–117. https://doi.org/10.1108/EJTD-11-2013-0122

Kivleniece, I., & Queen, B. V. (2012). Creating and capturing value in public–private ties: A private actor’s perspective. Academy of Management Review, 37, 272–299.

Korenkiewicz, D., & Maenning, W. (2022). Women on a corporate board of directors and consumer satisfaction. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-022-01012-3

Konrad, A. M., Kramer, V., & Erkut, S. (2008). Critical mass: the impact of three or more women on corporate boards. Organizational Dynamics, 37(2), 145–164.

Krishnan, H. A., & Park, D. (2005). A few good women on top management teams. Journal of Business Research., 58, 1712–1720. https://doi.org/10.1016/j.jbusres.2004.09.003

Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and inter-organizational learning. Strategic Management Journal, 19(5), 461–477. https://doi.org/10.1002/(SICI)1097-0266(199805)19:5<461::AID-SMJ953>3.0.CO;2-L

Laursen, K., & Salter, A. (2004). Searching high and low: What types of firms use universities as a source of innovation? Research Policy, 33(8), 1201–1215.

Li, H., & Chen, P. (2018). Board gender diversity and firm performance: The moderating role of firm size. Business Ethics: A European Review, 27, 294–308. https://doi.org/10.1111/beer.12188

Lombardo, E., & Verge, T. (2016). Cuotas de género en política y economía. Política y Gobierno, 24(2), 301–331.

Longarela, I. L. (2017). Explaining vertical gender segregation: a research agenda. Work, Employment, and Society, 31(5), 861–871.

Lucas-Pérez, M. E., & Mínguez-Vera, A. (2015). Women on the Board and Managers’ Pay: Evidence from Spain. Journal of Business Ethics, 129(2), 265–280.

Lundeberg, M. A., Fox, P. W., & Punccohar, J. (1994). Highly confident but wrong: Gender differences and similarities in confidence judgments. Journal of Educational Psychology, 86(1), 114–134.

Martínez, I., & Gómez, F. (2021). Hitos y retos de la diversidad de género en los consejos de administración en España. Cuadernos de Información Económica, 282, 77–83.

Matsa, D. A., & Miller, A. R. (2013). A Female Style in Corporate Leadership? Evidence from Quotas. American Economic Journal: Applied Economics, 5(3), 136–169. https://doi.org/10.1257/app.5.3.136

Miller, T., & del Carmen Triana, M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management Studies, 46(5), 755–786.

Mínguez-Vera, A., & Martin, A. (2011). Gender and management on Spanish SMEs: an empirical analysis. The International Journal of Human Resource Management, 22(14), 2852–2873. https://doi.org/10.1080/09585192.2011.599948

Nishii, L., Gotte, A., & Raver, J. (2007). Upper Echelon Theory: The Relationship Between Upper Echelon Diversity, the Adoption of Diversity Practices, and Organizational Performance. Cornell University ILR School.

Pavitt, K. L. R. (2001). Public policies to support basic research: What can the rest of the world learn from US theory and practice? (and what they should not learn). Industrial and Corporate Change, 10, 761–779.

Powell, W., Koput, K. W., & Smith-Doerr, L. (1996). Interorganizational Collaboration and the Locus of Innovation: Networks of Learning in Biotechnology. Administrative Science Quarterly, 41(1), 116–145.

Quintana-García, C., & Benavides-Velasco, C. A. (2008). Innovative competence, exploration, and exploitation: The influence of technological diversification. Research Policy, 37, 492–507.

Reguera-Alvarado, N., De Fuentes, P., & Laffarga, J. (2017). Does Board Gender Diversity Influence Financial Performance? Evidence from Spain. Journal of Business Ethics, 141, 337–350. https://doi.org/10.1007/s10551-015-2735-9

Reskin, B. F., & Bielby, D. D. (2005). A sociological perspective on gender and career outcomes. Journal of Economic Perspectives, 19, 71–86.

Ruiz-Jiménez, J. M., & Fuentes-Fuente, M. (2016). Management capabilities, innovation, and gender diversity in the top management team: An empirical analysis in technology-based SMEs. BRQ Business Research Quarterly, 19(2), 107–121. https://doi.org/10.1016/j.brq.2015.08.003

Segarra-Blasco, A., & Arauzo-Carod, J. M. (2008). Sources of innovation and industry–university interaction: Evidence from Spanish firms. Research Policy, 37(8), 1283–1295. https://doi.org/10.1016/j.respol.2008.05.003

Siegel, D., Waldman, D., & Link, A. (2003). Assessing the impact of organizational practices on the relative productivity of university technology transfer offices: An exploratory study. Research Policy, 32, 27–48.

Schein, V. E. (2007). Women in management: Reflections and projections. Women in Management Review, 22, 6–18. https://doi.org/10.1108/09649420710726193

Terjesen, S., Sealy, R., & Singh, V. (2009). Women directors on corporate boards: A review and research agenda. Corporate Governance: An International Review, 17(3), 320–337.

Torchia, M., Calabrò, A., & Huse, M. (2011). Women directors on corporate boards: from tokenism to critical mass. Journal of Business Ethics, 102, 299–317.

Trott, P., & Hartman, D. (2009). Why ‘Open Innovation’ is Old Wine in New Bottles. International Journal of Innovation Management, 13(04), 715–736. https://doi.org/10.1142/S1363919609002509

Van Auken, H., Madrid-Guijarro, A., & Garcia-Perez-de-Lema, D. (2008). Innovation and performance in Spanish manufacturing SMEs. International Journal of Entrepreneurship and Innovation Management., 8, 36–56. https://doi.org/10.1504/IJEIM.2008.018611

Van der Vegt, G., & Jansen, O. (2003). Joint impact of interdependence and group diversity on innovation. Journal of Management, 29(5), 729–751.

Villamizar, M. A., Cobo, A., & Rocha, R. (2017). Characterisation of the manufacturing sectors of high and medium-high technology compared with other industrial sectors. Journal of technology management & innovation, 12(1), 39–48.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work has been financed by the research projects: PROMETEO/2019/095 grant from the Program for the promotion of excellent scientific research, technological development, and innovation in the Valencian Community and from the Ministry of Science and Innovation - State Research Agency, through the research project ref. PID2019-110790RB-I00.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sánchez, R., Diaz, Á. & Urbano, A. Vertical segregation, innovation, and gender diversity in Spain’s industrial sector. J Knowl Econ 15, 4975–4996 (2024). https://doi.org/10.1007/s13132-023-01211-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-023-01211-1