Abstract

This research investigates the impact of R&D and innovation (R&D&I) subsidies on the innovative inputs and outputs of Polish manufacturing companies. We combine unique survey data that incorporates a representative sample of Polish manufacturing companies with data on the state aid from the State Aid Data Sharing System (SUDOP). Our results confirm the positive role of R&D&I subsidies on the likelihood of applying for a patent, filing for intellectual property protection for utility models, industrial designs, trademark registrations, and the introduction of process innovations, consistent with the existing literature. However, the results also indicate an insignificant impact of the intervention on firms’ R&D expenditures and product innovations. The extension of the analysis with the moderating effects of internal factors that affect the firms’ innovative behavior indicates that the R&D&I subsidies for exporters lead to the crowding-out effect and for non-exporters generate additional R&D expenditures and increase the propensity for R&D cooperation. Furthermore, R&D&I support for enterprises with foreign ownership reduces their propensity for patent applications and product innovations. In contrast, for beneficiaries with a predominance of domestic capital, it positively impacts many output variables.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The importance of research, development, and innovation (R&D&I) for medium- and long-term economic growth and development indicated in the endogenous growth models (Romer, 1986, 1990); Aghion & Howitt, 1992; Grossman & Helpman, 1994) has been a significant stimulus to increase the EU R&D&I spending in the last decade. Such targeting of EU activities can be perceived as an incentive to switch to an innovation-based strategy in Central and Eastern European Countries (CEECs) that joined the EU in the early twenty-first century. The investment-based regime adopted by these countries at the beginning of the democratic changes contributed to relatively high growth rates and the approaching the world’s technological frontier (Aghion et al., 2011). However, there is a concern about whether the shift from an investment- to an innovation-based strategy contributes to catching up with leading economies (Acemoglu et al., 2006). The sources of the apprehension in this regard are the specific conditions in CEECs affecting firms’ access, absorption, and creation of new technologies (Veugelers & Schweiger, 2016; Radosevic, 2017; Klímová et al., 2020; Odei et al., 2021).

In the case of Poland, factors that shaped innovation development in the last 30 years were linked to the transformation process characterized by decreasing R&D employment levels, low R&D expenditure, low and decreasing share of enterprises in R&D expenditures, and a relatively small number of patent applications. Furthermore, the new ownership structure of enterprises resulting from privatization was not favorable to developing R&D activity in Poland. It has led to a specialization in the lower end of the global value chain (Sulmicki, 2011; Radosevic, 2017). Despite EU actions shaping Poland’s innovation policy, no significant positive changes were seen in this area during the pre-accession period or the initial period of the EU membership (Sulmicki, 2011). This phenomenon is explained by the nature of the growth of CEECs, which is based on the interaction between domestic R&D and more advanced technology from imported equipment and inputs (Radosevic, 2017). The CEE countries differ from highly developed EU countries in the minor importance of R&D for economic growth and different institutional, innovative, and competitive environments. Therefore, the question is raised whether a particular emphasis on R&D&I under EU funds in the 2014–2020 financial perspective could bring the expected results in a country such as Poland. This paper addresses this question by analyzing the effects of R&D&I subsidies on Polish manufacturing firms’ innovative input and output.

There is reach literature on the impact of R&D subsidies on firms’ innovative input and output in highly developed countries, as illustrated by surveys of the empirical studies (David et al., 2000; Becker, 2015; Petrin, 2018) and meta-analysis (García-Quevedo, 2004; Dimos & Pugh, 2016). However, analogous research on developing and post-transition countries seem to be scarce. Therefore, the paper’s primary goal is to contribute to the limited empirical literature on the effectiveness of R&D and innovation subsidies for private sector R&D&I projects in a country with an advanced level of systemic transformation using firm-level data from the manufacturing sector in Poland. The first contribution is determining the effects of the R&D&I subsidies on firms’ innovative inputs and outputs by using the primary data from the manufacturing sector in Poland. Our second contribution is the extension of the analysis allowing for moderating effects of internal factors distinguishing Polish manufacturing firms and influencing their innovative behavior, namely size, exporter/non-exporter status, and foreign/domestic ownership.

In the case of Poland, firm-level R&D and innovation data are not available as all data provided by the Polish statistical office are aggregated. However, the analysis of the impact of R&D&I support on both the additionality of inputs (R&D expenditures and likelihood of R&D&I cooperation) and of outputs (patent, utility model applications, industrial designs, trademark applications, product and process innovations) was possible thanks to the access to a unique database created based on a survey conducted in 2018 on a random sample of 1049 manufacturing firms in Poland. Furthermore, additional information from the State Aid Data Sharing System (SUDOP) of the Polish Office of Competition and Consumer Protection on other state aid measures received by interviewed companies and sectoral concentration data from InfoCredit supplement the survey data. Thus, our study differs from the only study known to us on the effects of government support for private innovation in Poland (Szczygielski et al., 2016) in terms of the scope of outcome variables, the analyzed period of the support, and the quantitative methodological strategy.

Our interest in the manufacturing sector is justified by its significant importance in the Polish economy.Footnote 1Industrialization in Poland began in the nineteenth century and continued even in the socialist era, following the Soviet pattern. The systemic transformation that started in 1989 led to intense industrialization combined with deep restructuring, contributing significantly to economic growth. Foreign investors, who made investments based on the size of the Polish market, export orientation to the EU countries, and relatively low labor costs, made a significant contribution to the industrialization process. As a result, foreign-owned companies account for about 40-55% of manufacturing value-added in Poland. Strong export orientation is another feature of Polish manufacturing, evidenced by a 60% export share in the value-added created by manufacturing. Despite close ties with Western Europe, the sector differs considerably from manufacturing in Western Europe. The economic efficiency of Polish manufacturing is still lower than in southern Europe. It primarily results from basing industrialization on labor-intensive technologies and a small number of high-performing enterprises (Bukowski & Śniegocki, 2017). Therefore, Polish enterprises’ efficient use of the R&D&I support may constitute an opportunity to accelerate the convergence of European manufacturing in volume and efficiency.

Our study evaluates the intervention impact using Propensity Score Matching (PSM). Firstly, we investigate the factors determining receiving public R&D&I support. Secondly, we utilize the PSM method to achieve two “balanced” groups of companies — treated (e.g., firms that received R&D&I state aid) and non-treated ones (e.g., firms that did not receive aid). As a result, we obtain the most similar units in terms of the propensity scores — the function taking into account the characteristics of each unit (company). Finally, the units are matched in their calculated values of propensity scores.

Our results confirm the positive impact of R&D&I subsidies on the likelihood of applying for a patent, filing for intellectual property protection for utility models and industrial design, trademark registration, and the introduction of process innovations in general. The deepening of the analysis indicates moderating impact of firms’ characteristics, namely size, exporter/non-exporter status, and foreign/domestic ownership, on the effect of R&D&I subsidies. The diverse response to treatment could lead to substantial changes in the R&D&I policy recommendations in an economy with advanced systemic transformation like Poland to target potential state aid to selected groups of companies more precisely.

The paper is organized as follows. The “Public R&D&I Support — Theoretical and Empirical Approach” section introduces the theoretical and empirical foundation of the research. The other part presents the scope and amount of R&D&I support enterprises could use during the period under investigation. The “Data and Methodology” section is devoted to the methodology and description of the dataset. The “Results of the Analysis” section presents the results of the study. The “Discussion of the Results” and “Conclusion” sections are dedicated to the discussion and conclusions.

Public R&D&I Support — Theoretical and Empirical Approach

The literature indicates a wide range of market failures justifying public intervention supporting private R&D. Thus, Nelson (1959), Arrow (1962), Romer (1986), Bloom et al. (2019), and Antonelli (2020) emphasize the importance of positive external effects of R&D and incomplete appropriability of knowledge. Bloom et al. (2019) and other authors (Martin & Scott, 2000; Carboni, 2011) also point to market failures in real and financial markets that lead to a less than optimal level of research due to insufficient returns justify the private investment.

Although the market failure approach is a widely recognized rationale for public intervention supporting private R&D, it does not provide specific guidelines for policy design (Metcalfe & Georghiou, 1998). According to Metcalfe and Georghiou (1998), appropriate innovation policy depends on the situation specifics — the behavior of individuals and entities beyond the control of the innovation firm; therefore, it should be considered a trial-and-error experiment. Hence, considerable emphasis must be given to policy trials’ evaluation.

The vital issue for evaluation is the additionality of support measures. Well-targeted public support should induce an additional socially desirable activity that would not have occurred without intervention. According to Antonelli (2020), a vital additionality requirement of R&D public support increases the flow of R&D activities and the rates of accumulation of the stock of quasi-public knowledge. However, there is ongoing debate regarding how public R&D support should crowd out or accelerate the privately financed research of individuals (Martin, 2016).

Innovation policy typically distinguishes three types of additionality: input, output, and behavioral (Georghiou, 2002). For input additionality, the subject of interest is the impact of public support on the firm’s R&D expenditure. The assumption of the intervention on R&D input is to encourage the company, through the intervention, to expend additional resources on the targeted activity. This goal may not be achieved when the company’s R&D expenditure is equal to the R&D&I support, or the support is allocated to another area of its activity. In the case of the output additionality evaluation, the output size resulting from the intervention is of interest. Both intermediate achievements (e.g., patents, prototypes, new partnerships) and innovative outcomes (e.g., new and improved products, processes, or services) are considered outputs of innovative projects. In contrast, behavioral additionality occurs when an intervention leads to permanent or persistent changes in firm behavior (e.g., improvements in managerial practices) (Georghiou, 2002).

It should also be noted that the instrument used can shape, to a certain extent, the expected effects of public support. For example, in the case of public support for private R&D, two instruments are often applied: tax incentives and direct subsidies. In theory, tax incentives reduce marginal costs and, therefore, may generate crowding-out effects as they mainly affect the composition of R&D (Hall & Van Reenen, 2000). In turn, the subsidies increase the marginal rate of return on investment. Therefore, the additionality effect should be expected due to the usual process of selecting projects subject to support. Nevertheless, an increase in inelastic R&D input prices, lobbying, and the desire of public authorities to ensure the success of public support (picking the winners) are the potential sources of the crowding-out effects (Hall & Van Reenen, 2000; Chudnovsky et al., 2006).

As Edler and Fagerberg (2017) noted, existing evaluation studies on R&D&I support show mixed outcomes determined by differences in the context (i.e., depending on the countries and time of intervention). The feature of enterprises’ innovative activity in catching-up countries is the orientation on imitation, adoption, and improvement of existing technologies. Therefore, companies from these countries rarely conduct formal R&D activities leading to patents and radically new products and processes. Thus, the characteristic of firms’ innovative activity in catching-up countries may determine the selection of appropriate support areas and innovative outcomes and non-fiscal instruments due to financial constraints (Chudnovsky et al., 2006).

Existing empirical literature on evaluating R&D subsidies focuses primarily on developed countries, as illustrated by surveys of the empirical evidence (David et al., 2000; Becker, 2015; Petrin, 2018) and meta-analysis (García-Quevedo, 2004; Dimos & Pugh, 2016). The majority of studies concern the impact of the support on input additionality, and most of them indicate additive effects of R&D subsidies on private funding of R&D (Czarnitzki & Fier, 2002; Duguet, 2004; Carboni, 2011; Czarnitzki & Hussinger, 2004; Czarnitzki & Kraft, 2006; Clausen, 2009).

In the case of firm-level analyses on output additionality, the most commonly used measure is the number of patents or patent applications (Petrin, 2018). An example is the Bronzini and Piselli (2016) research on the effect of the R&D subsidy program implemented in an Italian region of Emilia-Romagna. The study results indicate a positive impact of the program on the number of patent applications of subsidized firms, with a significantly more significant effect for smaller firms than for larger ones. Czarnitzki and Hussinger’s study (2004) also implies that both the purely privately financed R&D and stimulated by the subsidy’ additional R&D expenditure show a positive impact on the patenting behavior of firms. Furthermore, Herrera and Sanchez-Gonzalez’s (2013) research indicates that R&D subsidies granted to small Spanish firms increase sales of products new to the firm. In contrast, public R&D support of large Spanish firms improves the sales of products new to the market. Finally, Kim et al.’s (2021) research reveals a positive impact of government financial support on firm collaboration and firms’ innovation output.

The body of literature on the issue of transition economies and catching-up countries is somewhat limited. Most of them indicate a positive impact of public R&D support on innovation input in the form of R&D intensity or R&D expenditure (Czarnitzki & Licht, 2006; Alecke et al., 2011; Özҫelik & Taymaz, 2008; Radas et al., 2015; Mardones & Zapata, 2018; Petelski et al., 2020). However, the results of some studies also revealed the mixed impact of public policy efforts on input additionality in various forms (Berrutti & Bianchi, 2019; Chudnovsky et al., 2006; Orlic et al., 2019; Petelski et al., 2020). The outcomes of the analysis by Chudnovsky et al. (2006) indicate a significant effect of the subsidy on total innovation expenditure intensity but not on privately funded spending. Berrutti and Bianchi (2019) identified the acquisition of embodied knowledge as the only form of input additionality obtained by Uruguayan firms due to R&D public support. The study results by Petelski et al. (2020) indicate a positive impact of R&D support in Argentina on the intensity of the technological effort of the beneficiary manufacturing firms but a lack of the policy’s positive impact on the intensity of R&D employment. The research outcomes conducted by Radas et al. (2015) imply that R&D subsidies increase R&D employment in Croatian SMEs. However, Orlic et al. (2019) study results show no additional treatment effect of R&D subsidies on SMEs’ innovative input (internal or external R&D) in six Western Balkan countries.

The research results so far also indicate the varied impact of public R&D support on the innovative output of enterprises in catching-up countries. For example, a study carried out by Czarnitzki and Licht (2006) implies that innovation output (patent applications) additionality is more noticeable in Western Germany than in Eastern Germany. Another study on the effectiveness of R&D subsidies in Eastern Germany shows that additionality in the innovation output (patent applications) holds for the R&D activity of SMEs and especially for microbusinesses (Alecke et al., 2011). Analysis of the impact of R&D public support on other forms of innovative output brings mixed results. The results of the estimation of the subsidies’ effect on innovation outcomes of Argentinian firms by Chudnovsky et al. (2006) indicate the insignificant effect of the support on sales of new or significantly improved products. In turn, research carried out by Radas et al. (2015) shows a positive effect of public R&D support on the percentage of sales from innovation and no definite effect on the number of innovations in Croatian SMEs. Subsidies also make Croatian firms more prone to collaborate with research institutions. However, a study conducted by Mardones and Zapata (2018) for Chilean firms indicates a positive effect of public support on the probability of having a formal R&D unit and an insignificant effect of the support on product, service, process, logistics, marketing, and organizational innovations. Moreover, in the case of SMEs from the six Western Balkan countries, an insignificant impact of R&D subsidies on innovation output (product and process innovations, radical innovation, incremental innovation, innovative sales) was observed. The intervention in this group of countries had a positive effect only on the cooperation activity of SMEs (Orlic et al., 2019).

The only known study concerning the efficiency of government support for private innovation in Poland, compared to Turkey, implies mixed results of R&D support (Szczygielski et al., 2016). The comparative analysis of the effects of government innovation aid in both countries is based on data from the 2008 and 2010 Community Innovation Survey (CIS). The results obtained indicate that government R&D support contributed to better innovation outcomes by firms in Poland and Turkey. However, in Poland, the coefficient for EU support was negative in the case of process innovations and product innovations that are new to the firm and statistically insignificant for product innovations that are new to the market. According to the authors, this unexpected outcome might be linked to the support scope- the EU supports concentration on new machinery and equipment investments.

The review of research on the impact of R&D subsidies on firms’ innovation input and output presented above indicates that in countries in transition and catching-up economies, the effects of the intervention are more heterogeneous than in the case of developed countries. However, a more substantial impact of R&D support on innovation input can be observed than innovation output. The company size and ownership, past innovation support, regional issues, and nature of R&D support programs are perceived as factors differentiating the strength of the intervention effects.

In line with theoretical context and empirical findings, our paper aims to evaluate the impact of support on the innovative inputs and outputs of Polish manufacturing firms. The only known study in this area concerning Poland (Szczygielski et al., 2016) did not include the analysis of the impact of the intervention on the input additionality; therefore, our first outcome variable is R&D expenditure. The literature on the subject essentially indicates the positive impact of R&D subsidies on this variable, and we also expect to obtain such a result. Hence, and taking into account the continuous nature of this variable, the first hypothesis (H1) addresses the following:

-

Hypothesis 1 (H1): Receipt of R&D&I subsidy boosts firms’ additional R&D expenditures

In the period we analyzed, firms in Poland could benefit from public support for a wide range of innovative activities; therefore, we extend our analysis to include the intervention’s impact on the other outcome variable. One of them is a binary variable — R&D cooperation. Since empirical studies indicate a positive impact of subsidies on R&D cooperation (Radas et al., 2015), in the second hypothesis (H2), we assume:

-

Hypothesis 2 (H2): Receipt of R&D&I subsidy positively influences firms’ propensity to R&D cooperation

We also assume a positive impact of the intervention on firms’ innovative performance in the third hypothesis (H3). This concept covers a group of five variables labeled as innovative output. The first is the patent application variable, a common research subject on output additionality in developed and catching-up countries. Moreover, due to the small number of patents held by firms or individuals in Poland (EBRD, 2014), our study also examines the impact of public R&D&I support on IP-related activities, such as utility model applications and industrial designs, and trademark applications. The last two outcome variables — introduction of product innovations and process innovations — concern technological upgrading, which are essential drivers of the catching-up process with the technological frontiers for CEECs (Radosevic, 2017). Therefore, our third hypothesis is as follows:

-

Hypothesis 3 (H3): Receipt of R&D&I subsidy positively influences firms’ innovative performance indicators

To deepen the analysis in the national context, we extend the analysis of outcomes with the moderating role of internal factors influencing firms’ innovative behavior by distinguishing the following enterprises: SMEs and non-SMEs, exporters and non-exporters, and foreign capital and domestic capital companies.

Public R&D&I Support in Poland

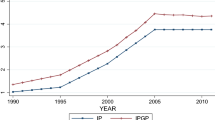

Our research focuses on R&D&I subsidies in Poland between 2014 and 2017. At that time, there was a shift in EU funding from capital investment to R&D, as companies began to see the possibilities of the EU’s R&D&I support under the 2014 and 2020 financial perspective. The significant impact of the EU on the priorities of innovation policy in Poland and its substantial financial support has resulted in a sizable increase in R&D state aid in the years 2014–2017 (Fig 1).

State aid spending in millions of EUR in Poland, at current prices. Source: State Aid Scoreboard, Country fiche Poland 2018, European Commission, DG Competition, https://ec.europa.eu/competition/state_aid/scoreboard/index_en.html

However, to fully reflect the range and scale of the increase in R&D&I public support of Polish enterprises, the above data should be supplemented by information on the possibilities of firms’ financial support for their activities on R&D and innovation, presented in Table 1. In the context of the data presented in Fig 1, it should be noted that not all areas of enterprise R&D&I support listed in Table 1 and are qualified as R&D state aid. For some programs, support under one project may be divided into three categories of state aid: R&D, regional investment, and de minimis state aid.

The information in Table 1 shows a broad spectrum of innovation support activities from EU funds. They include two groups of interventions (Metcalfe & Georghiou, 1998). The first one induces enterprises to exploit their existing innovation possibility frontiers by lowering the cost of R&D (via grants and subsidies). The second group aims to enhance capabilities at innovation (such as closer connection with the science base, general R&D initiatives, collaborative initiatives, and funding for research infrastructure for the science sector). The subject of our research is the first group that encompasses an extensive range of options to support the R&D and innovation activity of enterprises. In the EU financial perspective 2014–2020, the enterprises occupied a key position among the beneficiaries, provided that the support is used to innovate and introduce new products and services. Moreover, the multi-dimensional support of enterprises’ innovative activities can be assessed positively in the context of the intense focus on production processes rather than research innovation in catching-up economies (Radosevic, 2017).

It should be noted that compared to the programs implemented under the EU financial perspective 2007–2013, the amount of EU co-funding has decreased from 80 % to 50% on average (Chybowska et al., 2018). Therefore, the need for greater involvement of enterprises’ funds may lead to support for projects with a greater chance of commercial success. Thus, it may eliminate more risky innovative projects and smaller enterprises, which usually face financial constraints around R&D funding.

Another feature of the R&D&I public support of Polish enterprises under the EU financial perspective 2014–2020 was its multi-level nature. Actions could be carried out at local/regional, national, and supranational levels. However, the multi-level nature of the support could be a source of problems in the coordination of activities and lead to their overlapping in determining the impact’s strength. In turn, the aforementioned multi-dimensional nature of the support could affect the degree of complexity of the impact (Lewandowska et al., 2018). Therefore, we undertake the evaluation of the support system for innovative activities of Polish enterprises to determine whether the unique opportunity has been used.

Data and Methodology

Data

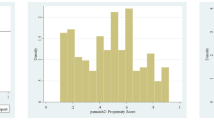

For our research, we use three data sources. The basic one is survey data obtained within the framework of the Research Project, “Intensity of competitive rivalry and innovative behavior of enterprises.” Initially, our goal was to obtain data from 1200 manufacturing enterprises domiciled in Poland in 2018. Therefore, the first step in constructing the database was drawing 2750 manufacturing firms from the InfoCredit database (the source of the Orbis data on Polish enterprises). The sample was representative of the InfoCredit database along with sector (2 digit industry sector), size (measured by employment), and regional (the location of the headquarters at NUTS 2 level of voivodships) dimensions. In addition, it considered the actual distribution of Polish manufacturing firms among specific sectors and according to their size (e.g., distributions of respondents’ answers were juxtaposed with the data on manufacturing from Statistics Poland, see Figs. 3 and 4 in Appendix). The access to the InfoCredit database also enabled us to calculate sectoral concentration ratios (e.g., HHI).

In the next step, we obtained survey data from 1049 manufacturing firms through contact with managers of enterprises and using various methods (due to the low effectiveness of the CAWI approach). The survey was a substantially augmented version of the CIS questionnaire, containing detailed information on the innovation and innovation activity of manufacturing companies from 2015 to 2017. One of the survey results’ features is the detailed data on the sources of public support for firms’ innovative activity, R&D expenditures and collaboration, patent and utility models’ applications, other innovations (industrial designs and trademarks), and product and process innovations. Finally, we supplemented the survey data with additional information from the State Aid Data Sharing System (SUDOP) of the Polish Office of Competition and Consumer Protection on other state aid measures received in the past by interviewed companies. The data obtained from SUDOP on the state aid received by the firms also enabled us to cross-validate the survey data on the treatment variable. While the data on the dependent variables (data on innovations, patents, etc.) were validated using the control questions included in the questionnaire. Overall, we obtained completed and consistent data on 1049 manufacturing firms domiciled in Poland in 2018.

A treatment variable included in the model would be a dummy indicator state_aid_agg equal to 1 if a company received any public R&D&I support from the local/regional, national, or EU level from 2015 to 2017 and zero otherwise. In addition, several covariates are included as the control variables to check for firms’ heterogeneity. In line with many scholars (see Busom and Fernández-Ribas (2008), Czarnitzki and Fier (2002), Radas et al. (2015), Czarnitzki and Hussinger (2004), Czarnitzki and Licht (2006), Galende and de la Fuente (2003), Herrera and Sanchez-Gonzalez (2013)), we consider the following firms’ characteristics affecting their innovative behavior. The age of the specific company (the log of a firm age) and its size (a dummy variable indicates whether the firm is SME or not) are common indicators of experience, knowledge, and ability to access the resources required to undertake R&D&I activity. While the export (a dummy variable indicates whether the firm is an exporter or not) and the foreign capital (a dummy variable implies whether the firm has a foreign investor or not) variables represent the firm’s internationalization strategy. The strategy is linked to the development of firms’ technological capacities and has also been an essential factor in the development of Polish manufacturing. Another variable representing the firm strategy is the variable Capital_group (a dummy variable specifying whether the firm is a part of a larger capital group or not), indicating formal and financial control over the firm.

On the one hand, such dependencies may discourage firms from undertaking innovative activities (Galende & de la Fuente, 2003). On the other hand, they may increase the propensity to apply for and receive public support (Szczygielski et al., 2016). A variable aid_past (a dummy variable that indicates whether the firm has received any state aid in 2005–2014 or not) indicates whether the reputation gained through the public support received in the past increases the chance of receiving the support now (so-called “Matthew effect” (Merton, 1968, Antonelli & Crespi, 2013). Moreover, we include four dummy sector variables according to NACE Rev. 2 that implies whether the firm belongs to a low-tech (nace_lt), a medium-low-tech (nace_mlt), a medium-high-tech (nace_mht), or a high-tech manufacturing sector (nace_ht). The last control variable is the HHI concentration index (a continuous variable measured at a two-digit industry level corresponding to the NACE classification). The market structure is traditionally regarded as an essential determinant of firms’ innovation activity.

We estimated seven cross-section models following the aims and formulated hypotheses in the paper. Dependent variables refer to the firm’s innovative input and output. We consider one continuous variable for R&D expenditures (ln_expend_cum) and 6 dummy variables: an innovative cooperation (cooperation: 1 = if the company reported having innovative cooperation in 2015–2017; 0 = if the company has not), patent applications (ip_patent_app: 1 = if the company has applied for patent; 0 = if the company has not applied), utility model applications (ip_utilitymodel_app: 1 = if the company has applied for utility model; 0 = if the company has not applied), industrial designs and trademark applications (ip_other_innov_reg: 1 = if the company has registered industrial design or trademark; 0 = if the company has not registered), introducing product innovations in general (product_innovation: 1= if the company has introduced a product innovation in the period 2015–2017; 0 = if the company has not) and process innovations (process_innovation: 1 = if the company has introduced a process innovation in the period 2015–2017; 0 = if the company has not). Table 2 provides descriptive statistics for the variables, and their description is presented in the Appendix (Table 9).

Methodology

The methods of estimation of public R&D&I support affecting private R&D cover numerous types of empirical models, using, e.g., cross-section ordinary least squares (OLS) (Shrieves, 1978; Higgins & Link, 1981), two-stage least squares (2SLS) and three-stage least square (3SLS) models (Leyden & Link, 1991), instrumental variables (Heckman et al., 2006) and panel data analysis with fixed effects (Howe & McFetridge, 1976; Lichtenberg, 1987; Holemans & Sleuwaegen, 1988; Levy, 1990; Busom, 1999). In most cases, private and public R&D complementarity has been proved. However, an approach based on OLS estimation has been heavily criticized for ignoring endogeneity problems, selection bias in the model construction, and the estimation phase (David et al., 2000; Klette et al., 2000; Heckman, 2001; Cerulli, 2010).

To tackle potential endogeneity problems, using cross-section data in estimating results (Holland, 1986), we use non-linear regression and sufficient matching techniques (following Guo et al., 2006).

Firstly, we utilize probabilistic regression. The probit regression is a widely known and favorable method for analyzing binary outcomes regarding non-normal data distribution (e.g., the inverse standard normal distribution of the probability is modeled as a linear combination of predictors). It enables us to calculate the probability of receiving public support for R&D by firms and examine the relationship between receiving support and individual characteristics of firms. As a result, we obtain the values of so-called propensity scores for every company.

In the second step, we use the Propensity Score Matching algorithm to capture the innovation policy effects (David et al., 2000). Propensity Score Matching (from now on: PSM) enables estimation of the effects of public R&D&I support on innovative inputs and outputs of a company and matching the units (treated – companies receiving support; non-treated – companies without support) with the most similar characteristics — in terms of calculated propensity scores. Matching can be established in numerous ways: nearest neighbor matching (nn), radius matching, kernel matching, mahalanobis matching, Etc. (Cerulli, 2015). The most common method is Nearest Neighbor Matching with a 1-1 assignment, and thus it is implied here. As a result of the counterfactual analysis, the net effect of the public intervention on treated units is obtained and is called the average treatment effect on the treated (ATET).

Given the knowledge of X (as the vector of observable control variables), the function of ATET(X) can be defined as:

where Y1i and Y0i are the values of outcomes when company i received (1) and not received (0) subsidy, D is the treatment status, respectively, and finally, ATET(X) is the net treatment effect calculated within the treated units measured as the average of the difference in values of outcome variable for treatment status D equal to 1.

The propensity score matching is based on two conditions. Firstly, it relies on the conditional independence assumption (CIA), which means that the process of selecting variables (characteristics in vector X) refers to observable characteristics only. Moreover, all variables influencing assignment to the treatment and the outcome Y variable also need to be observable by the researcher (Caliendo & Kopeinig, 2008). In practice, the first condition is infeasible to test. The second requirement refers to a common support. It assumes that every unit has a positive probability of being assigned to treatment:

Fulfilling these two requirements is essential to assessing the Average Treatment Effects on the Treated (Rosenbaum & Rubin, 1983). However, the matching results are often ambiguous and significantly different in terms of types of the data and applied matching technique (Almus & Czarnitzki, 2003; Duguet, 2004; Czarnitzki et al., 2011; Radas et al., 2015).

Thus, regarding the approach used in the study, we conduct a robustness check of our results. Our motivation is to include all the potential exogenous variables that could affect the outcomes and have unbiased results simultaneously. Furthermore, the literature states that the selection and inclusion of several estimators in one study can affirm the robustness of the results as there is no clear information as to which estimator is the first-best option among others (Stuart, 2010; Guo & Fraser, 2010). Thus, we utilize the inverse probability weighting (IPW) estimator to check whether our estimates yield similar results.

Results of the Analysis

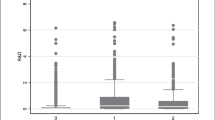

Figure 2 presents the distributions of propensity scores before and after the matching procedure using probit regression. The distribution on the left-hand side shows a significant difference in propensity scores between treated and non-treated units. After the matching procedure (the distribution on the right-hand side), the distance in propensity scores between selected units has been minimized because of pairing treated and non-treated ones with the most similar characteristics efficiently. In other words, the matching procedure is balanced, and the reduction of bias is up to 99%. Thus, the analysis of the treatment effects can be examined.

The results of the first step of PSM are presented in Table 3. It includes an analysis of factors influencing the propensity to receive treatment. The main drivers determining receiving R&D&I support are as follows: being an exporter and having a foreign investor. Also, operating in medium-high technology sectors increases the likelihood of obtaining R&D&I support compared to enterprises operating in high-tech sectors. However, if a company is SME, that fact significantly reduces the probability of receiving treatment. The variables indicated as factors increasing the likelihood of receiving support may also imply the possibility of crowding-out effects caused by supporting enterprises with strong incentives to undertake innovative activities, i.e., large firms, exporters, and foreign investors.

Table 4 shows the results of Nearest Neighbor (NN) Matching. The mean difference for dependent variables is ATET (or ATT) – average treatment effect on treated units. An interesting insight can be noted by focusing on the impact of treatment on R&D expenditures. The effect of treatment on R&D spending of R&D&I support beneficiaries (ATET) is unnoticeable and statistically insignificant. Thus, the H1 hypothesis cannot be entirely acceptable and should be rejected. Whereas, while considering the influence of R&D&I support on the probability of a willingness to collaborate innovatively, one major conclusion is viable. Beneficiaries are more likely to be involved in R&D cooperation because of receiving treatment (at the p<0.10). Thus, due to the low statistical significance level of the result, the H2 hypothesis cannot be proved and accepted.

Regarding the innovative output as a propensity to a patent application, receiving treatment is positive for subsidized companies. The results for utility model applications and other innovations (incl. registered industrial designs and trademarks) are very similar for R&D&I support beneficiaries (ATET). Subsidized firms are more likely to apply for patents and utility models and are more likely to register industrial designs and trademarks.

However, the impact of receiving treatment on innovative outcomes defined as introducing product and process innovations is highly ambiguous. According to the results, receiving an R&D&I subsidy positively affects the likelihood of introducing process innovations. However, the effect of the support on implementing product innovations is not apparent. The impact of the treatment on product innovations of subsidized firms is statistically insignificant. Thus, receiving R&D&I subsidies encourages entrepreneurs to implement only process innovations. Overall, because of the ambiguity of the results for innovative output, the H3 hypothesis cannot be entirely accepted.

Robustness Check — Inverse Probability Weights

Before conducting further analysis, we decided to prepare a robustness check of estimated results. As nearest neighbor matching is a commonly used estimator in the literature devoted to R&D&I program evaluation (Herrera & Nieto, 2008; Orlic et al., 2019), the results should be interpreted with caution before the study is supplemented with other analytical approaches to check for the robustness of results. Hence, we chose the Inverse Probability Weights (from now on: IPW; or inverse probability of treatment weighting – IPTW), a powerful approach to estimate treatment effects in program evaluation econometrics (Cerulli, 2014). Reweighting on the propensity scores (based on the IPW) relies on the assumption that the specifications of propensity scores are correctly estimated, which is validated by the inclusion of significant covariates in the probit/logit model. Moreover, the IPW estimator can be inconsistent if a function of explanatory variables does not sufficiently explain the probability of being treated (Cerulli, 2014).

The comparison of results of ATET, including two estimators (nearest neighbor matching and inverse probability weights), is shown in Table 5. The average treatment effects on treated units are primarily consistent across estimators. However, considering the R&D&I inputs, the results of reweighting are not robust with NN matching only for R&D&I cooperation (in terms of statistical significance). Hence, the H2 hypothesis should be rejected. Overall, the results for inputs show no additional effects of R&D&I subsidies on them. However, concerning R&D outputs, the results across estimators are relatively consistent. Additional effects are revealed for intellectual property rights (e.g., patent, utility model applications) and process innovations. The result for product innovation is in line with previous NN matching, however, with more substantial statistical significance (p<0.01), yet indicating decreasing propensity to introduce product innovation while receiving the public R&D&I support.

Overall, we conclude that our outcomes are consistent across various estimators regarding the obtained results for NN matching and inverse probability weights. However, we take a step forward in our analysis using nearest neighbor matching and prepare analysis in a deeper, national context due to the heterogeneity of firms included in the study.

Analysis of moderating effects of firms’ characteristics in terms of ATET

The identification of factors that increases the probability of receiving R&D&I support presented in Table 2, as well as the conclusions from the literature review on possible crowding-out due to selection failure, prompted us to investigate the moderating effects of internal factors that affect the firms’ innovative behavior. Among the existing research on the effectiveness of R&D support, there are examples of such an analysis in which the moderating factor is, e.g., the firms’ size (Herrera & Sanchez-Gonzalez, 2013), age (Schneider & Veugelers, 2010), ownership (Wang et al., 2020), location (Czarnitzki & Licht, 2006), and industry’s technology intensity (Albors-Garrigos & Barrera, 2011). Therefore, we split the sample into SME and large firms (Table 6 presents the ATET results), exporters and non-exporters (ATET results in Table 7), and foreign capital and domestic firms (see Table 8) for our moderating models.

Results differ significantly for each of these categories. To analyze the moderating effect of firm size, we distinguished two groups of enterprises: SMEs and non-SMEs. There is the following rationale for expecting a different impact of the intervention on these two groups of enterprises. On the one hand, large enterprises are perceived as major actors in technological change and future growth. On the other hand, SMEs are seen today as a source of change leading to technological differentiation stimulating growth and development (De Jong & Vermeulen, 2006; Orlic et al., 2019). Focusing attention on SMEs is also related to their dominance in the Polish economy regarding their number and employment share. Another justification is the visible emphasis of the public R&D&I support in Poland on SMEs and the possible limitation of the effects of intervention in this group, which were mentioned earlier. The ATET estimation results indicate that the R&D&I support does not generate additional R&D expenditure for this group of enterprises. It is, therefore, possible that the recipient firms would incur similar R&D expenditures also in the absence of intervention.

On the other hand, the positive effects of the intervention are evident in the case of the likelihood of R&D cooperation, patent and utility model applications, and process innovation. Except for the utility model applications, the intervention has a more significant impact on SMEs than on large enterprises for all these variables. Only in the case of product innovations is a decrease in the propensity to introduce them by the supported SMEs. Generally, however, the ATET results obtained for SMEs are similar to the ATET results for all the enterprises covered by the study, which might be explained by the significant share of SMEs among the support beneficiaries in our sample (see Table 4).

The firms’ internationalization through export is the second moderating factor. It allows us to distinguish two groups of enterprises: exporters and non-exporters. The moderating role of export is related to its contribution to Polish economic growth, the export orientation of Polish manufacturing, and exporters’ stronger incentive to innovate due to competitive pressure on foreign markets, and thus a greater propensity to apply for public R&D&I support (Orlic et al., 2019; Busom & Fernández-Ribas, 2008). The division of enterprises subject to the intervention into exporters and non-exporters resulted in statistically significant differences in ATET for the R&D expenditure variable (see Table 7). The different direction of the impact of the R&D&I support in the case of exporters and non-exporters is particularly noticeable. In the former case, a clear crowding-out is observed, and in the latter case, the additionality of R&D expenditures. Also, statistically significant ATET for other variables shows some difference in the intervention’s effects favoring non-exporting enterprises.

The last moderating factor of the analysis is firms’ ownership, which is the source of differences among firms in the innovation goals, inputs, and methods (Wang et al., 2020). The primary rationale behind such a division of our sample is better management and innovation capabilities, higher skills, and the technological advantage of foreign-owned firms that increase the probability of obtaining public support (Stojčić et al., 2020). Another justification is the significant share of foreign enterprises in the firms’ ownership in Polish manufacturing, often due to the privatization and the low interest of foreign firms in conducting R&D activity in Poland. The results we have obtained seem to confirm selection failure (see Table 8). All statistically significant ATET results for enterprises with foreign capital are negative, which means that the R&D&I support reduces their propensity for patent and utility model applications and product innovation. On the other hand, the result of R&D&I supporting enterprises with national ownership is a higher willingness to cooperate, a higher likelihood of applying for patents and utility models, and the introduction of process innovation.

Discussion on the Results

The paper’s primary focus is to answer whether increasing stimulation of Polish manufacturing firms’ innovative activities via R&D&I subsidies achieves the intended outcomes. Due to the multi-dimensional nature of R&D activities covered by the support, our attention has been devoted to various innovative input and output measures at the firm level.

Both for the innovative inputs and innovative outputs, matching estimators only partially confirmed the adopted hypotheses. In the case of the R&D expenditures variable, the support has no impact on the R&D expenditures of beneficiaries. Although these results are somewhat surprising and differ from those obtained for Eastern Germany (Czarnitzki & Licht, 2006), Turkey (Özҫelik & Taymaz, 2008), Croatia (Radas et al., 2015), and Argentina (Chudnovsky et al., 2006), they are similar to those obtained by Orlic et al. (2019) for the Western Balkan countries. This phenomenon may be explained by the low importance of R&D among drivers of innovations in CEECs (Radosevic, 2017), typical for efficiency-driven economies, based on the absorption of foreign technologies and the creation of efficient markets (Orlic et al., 2019). The result may also be linked to the necessity to co-finance the supported activities by enterprises, which reduces their willingness to undertake R&D activities with high uncertainty of success.

In the case of the second variable representing R&D input, one can notice the positive impact of the intervention on firms’ cooperation at a low significance level obtained by PSM and no significant impact in the case of the IPW estimator. The findings are in line with results from Berrutti and Bianchi (2019) and Kim et al. (2021) but different from Radas et al. (2015) and Orlic et al. (2019). The results are somewhat puzzling due to the frequent linking of support under various programs in Poland with the involvement of beneficiaries in cooperative activities. The explanation for such ambiguous results may be that the variable we use covers the broadly understood cooperation. Furthermore, the literature shows that the public policy additionality effect differs depending on the partner (more significant for public-private partnerships than for cooperation with other businesses) (Orlic et al., 2019; Busom & Fernández-Ribas, 2008).

The impact of public R&D&I support on innovative outputs varies depending on the analyzed outcome variable. As in the Czarnitzki and Licht (2006) study, the intervention increases beneficiaries’ likelihood of patent application. Furthermore, the results of our study indicate that R&D&I support increases the likelihood of applying for utility models and industrial design and trademark registration. Thus, we can conclude that public R&D&I support beneficiaries are more likely to register new concepts enriching a level of knowledge. Moreover, public support also accelerates process innovations. This fact indicates that public R&D&I support enables firms to achieve numerous new ideas for production processes and can be a crucial driver for improving existing technology.

However, the effect of R&D state aid on product innovations (both at the firm level and market level) and other innovations is highly ambiguous. The treatment effect for product innovations indicates a possibility for the occurrence of the crowding-out effect of the intervention. Nevertheless, this result should be interpreted with caution. As Czarnitzki and Licht (2006) noted, new products are usually introduced with some delay, usually after completing a given project. Therefore, the intervention effects for this variable appear later than for the variable representing patent or utility model applications. The results obtained may also indicate a risk aversion for firms in catching-up economies since they avoid introducing new products and developing new routines (Stojčić et al., 2020).

Interesting results are obtained from the ATET analysis considering the moderating effects of internal factors that affect the firms’ innovative behavior. The impact of the intervention on SMEs is similar to the results obtained for all enterprises that received R&D&I support. Moreover, a statistically significant ATET is obtained for the R&D expenditure variable for exporters and non-exporters. The results indicate that the support of exporters leads to the crowding-out effect. In the case of non-exporters, it generates additional R&D expenditures and increases the propensity for R&D cooperation. The moderating effect of ownership shows the positive impact of the intervention on many analyzed variables (R&D cooperation, patent, utility model applications, process innovation) for beneficiaries with a predominance of domestic capital. In contrast, R&D&I support for enterprises with foreign ownership reduces their propensity for patent applications and product innovations. These results may indicate public authorities’ desire to ensure public support’s success by backing enterprises with strong incentives to undertake innovative activities (picking the winners), leading, however, to the crowding-out effects.

Conclusions

This article is devoted to evaluating public support for firms’ R&D&I in a country with an advanced level of systemic transformation. Its main objective is to determine whether the public support for innovative activities of enterprises in Poland, intensified under the last EU financial perspective, induces an additional treatment effect concerning innovation inputs and outputs in manufacturing companies in Poland. We used unique survey data to conduct the study that incorporates a representative sample of Polish manufacturing firms with data on state aid from the State Aid Data Sharing System (SUDOP) and sectoral concentration data from InfoCredit. Applying different matching estimators to identify the causal effect of public R&D&I subsidies, we prove positive treatment effects in numerous outcome variables covered by previous studies concerning catching-up economies. The additional effect of R&D&I subsidies is noticeable in the case of process innovations and various forms of intellectual property protection. These results can be interpreted in the context of the risk aversion of companies from CEECs indicated in the literature (Hashi & Stojčić, 2013).

Furthermore, the impact of the intervention is significant on process innovations and insignificant on product innovations. Therefore, it may indicate actions taken to improve effectiveness through process innovations (a decrease in unit costs and/or an increase in the quality of production processes) without extending the range of products. At the same time, the positive impact of the R&D&I subsidies on various forms of intellectual property protection may imply the reduction of financial constraints limiting firms’ propensity to use these forms of protection.

The analysis results provide additional knowledge on the impact of R&D&I support on the moderating role of firms’ size, export orientation, and foreign ownership. It enriches the current state of the art in the context of the state aid efficiency and the area of the resource dependence theory and the stakeholder theory. Regarding the efficiency of R&D&I support, one can obtain the “Matthew effect” (Merton, 1968; Antonelli & Crespi, 2013) — the phenomenon defined as deepening existing differences between companies in terms of receiving R&D&I support. However, our results (i.e., the insignificant coefficient for aid_past) pointed out the absence of the “Matthew effect,” suggesting the existence of a proper selection of beneficiaries in this dimension. It means that the beneficiaries of public R&D&I support did not get a disproportionately greater chance of receiving the support, thanks to the reputation gained through the public support received in the past.

On the other hand, the estimated results for distinguished categories indicate a potential better targeting of the support’s beneficiaries. The results imply the significant positive impact of the intervention on the innovative activities of SMEs and non-exporters, and companies with a predominance of domestic ownership. On the other hand, the crowding-out effect of the R&D&I subsidies observed in the case of large firms, exporters, and firms with a predominance of foreign ownership may also indicate activities in the interest of shareholders rather than stakeholders.

Policy implications

The basic concept of evaluating and justifying public support for enterprises is additionality. In the case of supporting firms’ innovative activity, the presence of additionality indicates innovative input and output that would not exist without public support. Therefore, one can assume that a wide range of R&D&I public support in Polish manufacturing firms should generate additional effects in all areas of firms’ innovative activity. However, the results of our study show that the intervention is not effective in such critical dimensions as R&D expenditures, cooperation, and product innovations. The cause of this phenomenon may be both the specificity of the R&D activity of Polish manufacturing firms and the strategy of picking the winners applied by granting support authorities. Considering the moderating factors in the conducted analyses makes it possible to indicate a better support direction. Our study implies that R&D and innovation subsidies are a crucial stimulus for technological change for non-exporters, firms with the prevalence of domestic capital, and SMEs in Poland. Targeting the support to the groups of enterprises facing lower innovative and financial capabilities may be a source of strengthening their position in their markets and accelerating their development thanks to better access to financial resources for R&D&I activity and their efficient use. Directing state aid to these specific enterprises and introducing measures to eliminate bottlenecks, e.g., education, should enable Poland to move to a higher stage of innovation development in the coming years. This process should be backed by sufficient institutional infrastructure, broader availability of financial instruments, and a continuous upward trend in R&D spending. These activities could lead to higher levels of cooperation with other enterprises in the EU countries, upgrading to a value-added position within EU value chains, and developing Poland as an outright knowledge-driven economy.

Limitations of the study

The results of the study point out the directions for further research. Firstly, one should deepen the research on the selection of beneficiaries. Secondly, available cross-section data does not allow us to use other counterfactual methods to estimate innovative outputs (especially product innovations). Therefore, the study could be enriched with program evaluation targeted at specific inputs and outputs, which is essential for the design and implementation of innovation policy.

Data Availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

In 2017, manufacturing generated almost 17% of the value-added and 38% of revenues and incurred 51.7% of outlays on tangible fixed assets of non-financial enterprises in Poland. Enterprises from this sector accounted for 10.2% of Poland’s total number of non-financial enterprises. Moreover, nearly one-third of those working in the non-financial sector in 2017 were employed in manufacturing, the sector with the highest gross financial result per employee in large-sized enterprises (Statistics Poland, 2018a). Manufacturing is also characterized by a higher share of innovative enterprises (18.5%) compared to services (10.4%) (Statistics Poland, 2018b).

References

Acemoglu, D., Aghion, P., & Zilibotti, F. (2006). Distance to frontier, selection, and economic growth. Journal of the European Economic Association, 4(1), 37–74. https://doi.org/10.1162/jeea.2006.4.1.37

Aghion, P., Harmgart, H., & Weisshaar, N. (2011). Fostering growth in CEE countries: a country-tailored approach to growth policy. In S. Radosevic & A. Kaderabkova (Eds.), Challenges for European innovation policy: Cohesion and excellence from a Schumpeterian perspective (pp. 47–76). Edward Elgar Publishing.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351. https://doi.org/10.2307/2951599

Albors-Garrigos, J., & Barrera, R. R. (2011). Impact of public funding on a firm’s innovation performance. Analysis of internal and external moderating factors. International Journal of Innovation Management, 15(6), 1297–1322. https://doi.org/10.1142/S136391961100374X

Alecke, B., Mitze, T., Reinkowski, J., & Untiedt, G. (2011). Does firm size make a difference? Analysing the effectiveness of R&D subsidies in East Germany. German Economic Review, 13(2), 174–195. https://doi.org/10.1111/j.1468-0475.2011.00546.x

Almus, M., & Czarnitzki, D. (2003). The effects of public R&D subsidies on firms’ innovation activities: the case of Eastern Germany. Journal of Business and Economic Statistics, 21(2), 226–236. https://doi.org/10.1198/073500103288618918

Antonelli, C. (2020). Knowledge exhaustibility public support to business R&D and the additionality constraint. Journal of Technology Transfer, 45(3), 649–663. https://doi.org/10.1007/s10961-019-09727-y

Antonelli, C., & Crespi, F. (2013). The “Matthew effect” in R&D public subsidies: The Italian evidence. Technological Forecasting and Social Change, 80(8), 1523–1534. https://doi.org/10.1016/j.techfore.2013.03.008

Arrow, K. J. (1962). The economic implications of learning by doing. Review of Economic Studies, 29(2), 155–173. https://doi.org/10.2307/2295952

Becker, B. (2015). Public R&D policies and private R&D investment : A survey of the empirical evidence. Journal of Economic Surveys, 29(5), 917–942. https://doi.org/10.1111/joes.12074

Berrutti, F., & Bianchi, C. (2019). Effects of public funding on firm innovation: transforming or reinforcing a weak innovation pattern? Economics of Innovation and New Technology, 29(5), 522–539. https://doi.org/10.1080/10438599.2019.1636452

Bloom, N., van Reenen, J., & Williams, H. (2019). A Toolkit of Policies to Promote Innovation. Journal of Economic Perspectives, 33(3), 163–184. https://doi.org/10.1257/jep.33.3.163

Breznitz, D., & Ornston, D. (2017). EU financing and innovation in Poland. EBRD Working Papers, 198. https://doi.org/10.2139/ssrn.3119663

Bronzini, R., & Piselli, P. (2016). The impact of R&D subsidies on firm innovation. Research Policy, 45(2), 442–457. https://doi.org/10.1016/j.respol.2015.10.008

Bukowski, M., & Śniegocki, A. (2017). Manufacturing in Central and Eastern Europe. In R. Veugelers (Ed.), Remaking Europe: The New Manufacturing as an Engine for Growth (26). Bruegel Blueprint Series Retrieved 05 January, 2022, from https://www.bruegel.org/wp-content/uploads/2017/09/Remaking_Europe_blueprint.pdf

Busom, I. (1999). An empirical evaluation of the effects of R&D subsidies. Economics of Innovation and New Technology, 9(2), 111–148. https://doi.org/10.1080/10438590000000006

Busom, I., & Fernández-Ribas, A. (2008). The impact of firm participation in R&D programmes on R&D partnerships. Research Policy, 37(2), 240–257. https://doi.org/10.1016/j.respol.2007.11.002

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of Economic Surveys, 22(1), 31–72. https://doi.org/10.1111/j.1467-6419.2007.00527.x

Carboni, O. A. (2011). R&D subsidies and private R&D expenditures: evidence from Italian manufacturing data. International Review of Applied Economics, 25(4), 419–439. https://doi.org/10.1080/02692171.2010.529427

Cerulli, G. (2010). Modelling and measuring the effect of public subsidies on business R&D : A critical review of the econometric literature. The Economic Record, 86(274), 421–449. https://doi.org/10.1111/j.1475-4932.2009.00615.x

Cerulli, G. (2014). IVTREATREG: A new Stata routine for estimating binary treatment models with heterogeneous response to treatment and unobservable selection. The Stata Journal, 14(3), 453–480 10.1177%2F1536867X1401400301.

Cerulli, G. (2015). Econometric evaluation of socio-economic programs. Theory and applications. In Advanced Studies in Theoretical and Applied Econometrics (Vol. 49). Springer. https://doi.org/10.1007/978-3-662-46405-2

Chudnovsky, D., López, A., Rossi, M., & Ubfal, D. (2006). Evaluating the program of public funding of private innovation activities. In An econometric study of FONTAR in Argentina (Vol. 2829). IDB Publications (Working Papers), Inter-American Development Bank Retrieved 22 April, 2021, from https://publications.iadb.org/publications/english/document/Evaluating-a-Program-of-Public-Funding-of-Private-Innovation-Activities-An-Econometric-Study-of-FONTAR-in-Argentina.pdf

Chybowska, D., Chybowski, L., & Souchkov, V. (2018). R&D In Poland: Is the country close to a knowledge - driven economy? Management Systems in Production Engineering, 26(2), 99–105. https://doi.org/10.1515/mspe-2018-0016

Clausen, H. T. (2009). Do subsidies have positive impacts on R&D and innovation activities at the firm level? Structural Change and Economic Dynamics, 20(4), 239–253. https://doi.org/10.1016/j.strueco.2009.09.004

Czarnitzki, D., & Fier, A. (2002). Do innovation subsidies crowd out private investment? Evidence from the German service sector. Applied Economics Quarterly (Konjunkturpolitik), 48(02-04), 1–25.

Czarnitzki, D., Hanel, P., & Rosa, J. M. (2011). Evaluating the impact of R&D tax credits on innovation: A micro econometric study on Canadian firms. Research Policy, 40(2), 217–229. https://doi.org/10.1016/j.respol.2010.09.017

Czarnitzki, D., & Hussinger, K. (2004). The link between R&D subsidies, R&D spending and technological performance. ZEW Discussion Papers, 04-56. https://doi.org/10.2139/ssrn.575362

Czarnitzki, D., & Kraft, K. (2006). R&D and firm performance in a transition economy. Kyklos, 59(4), 481–496. https://doi.org/10.1111/j.1467-6435.2006.00346.x

Czarnitzki, D., & Licht, G. (2006). Additionality of public R&D grants in a transition economy: The case of Eastern Germany. Economics of Transition, 14(1), 101–131. https://doi.org/10.1111/j.1468-0351.2006.00236.x

David, P. A., Hall, B. H., & Toole, A. A. (2000). Is public R&D a complement or substitute for private R&D? A review of the econometric evidence. Research Policy, 29, 497–529. https://doi.org/10.1016/S0048-7333(99)00087-6

De Jong, J. P., & Vermeulen, P. A. (2006). Determinants of product innovation in small firms: a comparison across industries. International Small Business Journal, 24(6), 587–609. https://doi.org/10.1177/0266242606069268

Dimos, C., & Pugh, G. (2016). The effectiveness of R&D subsidies: A meta-regression analysis of the evaluation literature. Research Policy, 45(4), 797–815. https://doi.org/10.1016/j.respol.2016.01.002

Duguet, E. (2004). Are R&D subsidies a substitute or a complement to privately funded R&D? An econometric analysis at the firm level. Revue d’Economie Politique, 114(2), 245–274. https://doi.org/10.3917/redp.142.0245

EBRD. (2014). Transition Report 2014. Innovation in Transition. EBRD Retrieved February 10, 2022, from http://www.ebrd.com/downloads/research/transition/tr14.pdf

Edler, J., & Fagerberg, J. (2017). Innovation policy: What, why, and how. Oxford Review of Economic Policy, 33(1), 2–23. https://doi.org/10.1093/oxrep/grx001

Galende, J., & de la Fuente, J. M. (2003). Internal factors determining a firm’s innovative behaviour. Research Policy, 32, 715–736. https://doi.org/10.1016/S0048-7333(02)00082-3

García-Quevedo, J. (2004). Do public subsidies complement business R&D? A meta-analysis of the econometric evidence. Kyklos, 57(1), 87–102. https://doi.org/10.1111/j.0023-5962.2004.00244.x

Georghiou, L. (2002). Impact and additionality of innovation policy. In Six Countries Programme on Innovation Policy and Sustainable Development (Vol. 40, pp. 57–65).

Grossman, G. M., & Helpman, E. (1994). Endogenous innovation in the theory of growth. Journal of Economic Perspectives, 8(1), 23–44. https://doi.org/10.1257/jep.8.1.23

Guo, S., Barth, R. P., & Gibbons, C. (2006). Propensity score matching strategies for evaluating substance abuse services for child welfare clients. School Children and Youth Services Review, 28(4), 357–383. https://doi.org/10.1016/j.childyouth.2005.04.012

Guo, S., & Fraser, M. W. (2010). Propensity score analysis: Statistical methods and applications. Sage.

Hall, B., & Van Reenen, J. (2000). How effective are fiscal incentives for R&D? A review of evidence. Research Policy, 29(4-5), 449–469. https://doi.org/10.1016/S0048-7333(99)00085-2

Hashi, I., & Stojčić, N. (2013). The impact of innovation activities on firm performance using a multi-stage model: Evidence from the Community Innovation Survey 4. Research Policy, 42, 353–366. https://doi.org/10.1016/j.respol.2012.09.011

Heckman, J. J. (2001). MicroData, heterogeneity, and the evaluation of public policy: Nobel lecture. Journal of Political Economy, 109(4), 673–748. https://doi.org/10.1086/322086

Heckman, J. J., Urzua, S., & Vytlacil, E. (2006). Understanding instrumental variables in models with essential heterogeneity. The Review of Economics and Statistics, 88(3), 389–432. https://doi.org/10.1162/rest.88.3.389

Herrera, L., & Nieto, M. (2008). The National Innovation Policy Effect According to Firm Location. Technovation, 28(8), 540–550. https://doi.org/10.1016/j.technovation.2008.02.009

Herrera, L., & Sanchez-Gonzalez, G. (2013). Firm size and innovation policy. International Small Business Journal, 31(2), 137–155. https://doi.org/10.1177/0266242611405553

Higgins, R. S., & Link, A. N. (1981). Federal support of technological growth in industry: some evidence of crowding out. IEEE Transactions on Engineering Management, 28, 86–88. https://doi.org/10.1109/TEM.1981.6447450

Holemans, B., & Sleuwaegen, L. (1988). Innovation expenditures and the role of government in Belgium. Research Policy, 17(6), 375–379. https://doi.org/10.1016/0048-7333(88)90035-2

Holland, P. W. (1986). Statistics and causal inference. Journal of the American Statistical Association, 81(396), 945–960. https://doi.org/10.2307/2289064

Howe, J. D., & McFetridge, D. G. (1976). The determinants of R&D expenditures. Canadian Journal of Economics, 9(1), 57–71. https://doi.org/10.2307/134415

Kim, K., Choi, S., & Lee, S. (2021). The effect of a financial support on firm innovation collaboration and output: Does policy work on the diverse nature of firm innovation? Journal of the Knowledge Economy, 12, 645–675. https://doi.org/10.1007/s13132-020-00667-9

Klette, T. J., Møen, J., & Griliches, Z. (2000). Do subsidies to commercial R&D reduce market failures? Microeconometric evaluation studies. Research Policy, 29(4-5), 471–495. https://doi.org/10.1016/S0048-7333(99)00086-4

Klímová, V., Žítek, V., & Králová, M. (2020). How public R&D support affects research activity of enterprises: evidence from the Czech Republic. Journal of the Knowledge Economy, 11, 888–907. https://doi.org/10.1007/s13132-019-0580-2

Levy, D. M. (1990). Estimating the impact of government R&D. Economic Letters, 32(2), 169–173. https://doi.org/10.1016/0165-1765(90)90072-9

Lewandowska, M. S., Rószkiewicz, M., & Weresa, M. A. (2018). Additionality from public support to R&D and innovation in the European Union. In M. A. Weresa (Ed.), Strengthening the knowledge base for innovation in the European Union. PWN Retrieved 22 April, 2021, from http://kolegia.sgh.waw.pl/en/KGS/structure/IGS-KGS/publications/Documents/Book.pdf

Leyden, D. P., & Link, A. N. (1991). Why are government and private R&D complements? Applied Economics, 23(10), 1673–1681. https://doi.org/10.1080/00036849100000132

Lichtenberg, F. R. (1987). The effect of government funding on private industrial research and development: a re-assessment. The Journal of Industrial Economics, 36(1), 97–104. https://doi.org/10.2307/2098599

Mardones, C., & Zapata, A. (2018). Impact of public support on the innovation probability in Chilean firms. Economics of Innovation and New Technology, 28(6), 569–589. https://doi.org/10.1080/10438599.2018.1546548

Martin, B. R. (2016). R&D policy instruments – A critical review of what we do and don’t know. Industry and Innovation, 23(2), 157–176. https://doi.org/10.1080/13662716.2016.1146125

Martin, S., & Scott, J. (2000). The nature of innovation market failure and the design of public support for private innovation. Research Policy, 29(4-5), 437–447. https://doi.org/10.1016/S0048-7333(99)00084-0

Merton, R. (1968). The matthew effect in science: The reward and communication systems of science are considered. Science, 159(3810), 56–63. https://doi.org/10.1126/science.159.3810.56

Metcalfe, J. S., & Georghiou, L. (1998). Equilibrium and evolutionary foundations of technology policy. STI Review - Special Issue on New Rationale and Approaches in Technology and Innovation Policy, 22. https://doi.org/10.1787/sti_rev-v1998-1-en

Nelson, R. R. (1959). The simple economics of basic scientific research. Journal of Political Economy, 67(3), 297–306. https://doi.org/10.1086/258177

Odei, S. A., Stejskal, J., & Prokop, V. (2021). Revisiting the factors driving firms’ innovation performances: the case of visegrad countries. Journal of the Knowledge Economy, 12, 1331–1344. https://doi.org/10.1007/s13132-020-00669-7

Orlic, E., Radicic, D., & Balavac, M. (2019). R&D and innovation policy in the Western Balkans: Are there additionality effects? Science and Public Policy, 46(6), 876–894. https://doi.org/10.1093/scipol/scz036

Özҫelik, E., & Taymaz, E. (2008). R&D support programs in developing countries: The Turkish experience. Research Policy, 37(2), 258–275. https://doi.org/10.1016/j.respol.2007.11.001

Petelski, N., Milesi, D., & Verre, V. (2020). Public support to innovation: Impact on technological efforts in Argentine manufacturing firms. Economics of Innovation and New Technology, 29(1), 66–88. https://doi.org/10.1080/10438599.2019.1585672

Petrin, T. (2018). A literature review on the impact and effectiveness of government support for R&D and innovation. Retrieved 22 April, 2021, from http://www.isigrowth.eu/wp-content/uploads/2018/02/working_paper_2018_05.pdf

Radas, S., Anic, D., Tafro, A., & Wagner, V. (2015). The effects of public support schemes on small and medium enterprises. Technovation, 38(1), 15–30. https://doi.org/10.1016/j.technovation.2014.08.002

Radosevic, S. (2017). Upgrading technology in Central and Eastern European economies. IZA World of Labor, 338. https://doi.org/10.15185/izawol.338

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037. https://doi.org/10.1086/261420

Romer, P. M. (1990). Endogenous Technological Change. Journal of Political Economy, 98(5), 71–102. https://doi.org/10.1086/261725

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55. https://doi.org/10.2307/2335942

Schneider, C., & Veugelers, R. (2010). On young highly innovative companies: Why they matter and how (not) to policy support them. Industrial and Corporate Change, 19(4), 969–1007. https://doi.org/10.1093/icc/dtp052

Shrieves, R. E. (1978). Market structure and innovation: A new perspective. The Journal of Industrial Economics, 26(4), 329–347. https://doi.org/10.2307/2098078

Statistics Poland. (2018a). Activity of non-financial enterprises in 2017. Statistics Poland Retrieved 05 January, 2022, from https://stat.gov.pl/files/gfx/portalinformacyjny/pl/defaultaktualnosci/5502/2/14/1/dzialalnosc_przedsiebiorstw_niefinansowych_2017.pdf

Statistics Poland. (2018b). Innovative activity of enterprises in the years 2015-2017. Statistics Poland Retrieved 05 January, 2022, from https://stat.gov.pl/obszary-tematyczne/nauka-i-technika-spoleczenstwo-informacyjne/nauka-i-technika/dzialalnosc-innowacyjna-przedsiebiorstw-w-latach-2015-2017,2,16.html

Stojčić, N., Srhoj, S., & Coad, A. (2020). Innovation procurement as capability-building: Evaluating innovation policies in eight Central and Eastern European countries. European Economic Review, 121, 103330. https://doi.org/10.1016/j.euroecorev.2019.103330

Stuart, E. A. (2010). Matching methods for causal inference: A review and a look forward. Statistical Science, 25(1), 1–21. https://doi.org/10.1214/09-STS313

Sulmicki, J. (2011). R&D Disappearance in the period of Economic Transformation in Poland. Retrieved 22 April, 2021, from https://finquarterly.com/archives/?number=27&id=150

Szczygielski, K., Grabowski, W., Pamukcu, M. T., & Tandogan, V. S. (2016). Does government support for private innovation matter? Firm-level evidence from two catching-up countries. Research Policy, 46(1), 219–237. https://doi.org/10.1016/j.respol.2016.10.009

Veugelers, R., & Schweiger, H. (2016). Innovation policies in transition countries: One size fits all? Economic Change and Restructuring, 49(2), 241–267. https://doi.org/10.1007/s10644-015-9167-5

Wang, S., Zhao, S., Shao, D., & Liu, H. (2020). Impact of government subsidies on manufacturing innovation in China: The moderating role of political connections and investor attention. Sustainability, 12(18), 7740. https://doi.org/10.3390/su12187740

Code Availability

Not applicable.

Funding

This work was supported by the National Science Centre Poland under the project “Intensity of competitive rivalry and innovative behavior of enterprises” [UMO-2017/25/B/HS4/00162].

Author information

Authors and Affiliations

Contributions