Abstract

Many studies on buyer–supplier-supplier triads demonstrate the value of the interactions between three business actors instead of two for identifying triadic collaboration strategies that can lead firms to improve their performance. However, there is little research to date that has explored which specific lean improvements the various types of buyer–supplier-supplier triads lead to. This paper fills this gap. We study an automotive supplier manufacturing company (the buyer) and its seven types of buyer–supplier-supplier triads emerging from the buyers’ attempt to implement zero-defect manufacturing (ZDM) in the production process of a crash management system. The case study shows how a buyer manages their first-tier suppliers through three types of closed buyer–supplier-supplier triads, where all three actors collaborate to work for the common goal of ZDM. The case also shows four additional types of open triads, where the buyer relies on the first-tier supplier to manage the second-tier supplier without directly interacting with the latter. The paper discusses what types of triads in the case study seem to be associated with the buyers’ efforts to achieve the following lean sub-goals of ZDM: full automation, production line flexibility, product flexibility, low cost, low defect rate, short cycle time, and minimum quality control. Finally, we also analyze the role of geographic proximity between the actors in open and closed buyer–supplier-supplier ZDM triads.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The idea of spreading lean thinking to the firm’s business network, e.g., developing lean supply chain, has been studied by many scholars (Liker & Choi, 2004; MacDuffie & Helper, 1997; Nightingale, 2005; Prajogo et al., 2016; dos Santos et al., 2020; Vitasek et al., 2005). For example, Bortolotti et al. (2016, p. 182) highlight the importance of expanding the scope of lean programs to supply networks and emphasize that “it requires the involved organizations to implement lean within each company and at the interfaces across-companies.”

There is an ongoing discussion regarding what lean management actually is—a strategy, a theory, or a philosophy? For Pär Åhlström, lean is a practice-based umbrella concept; for Pamela Danese, it is a socio-technical system and a scientific method; Peter Hines views lean as an evolutionary perspective; Torbjørn H. Netland calls lean a business phenomenon; Daryl Powell claims lean to be a meta-theory; Matthias Thürer views lean as striving for rationalization and institutionalization; and finally, Desirée H. van Dun suggests to view lean as a context or a collection of theories (Åhlström et al., 2021). Despite the ongoing debates around lean phenomenon, lean offers great amount of ideas, principles, practices, and managerial tools, such as Just-in-Time (Holl et al., 2010), Kanban (Sugimori et al., 1977), Heijunka (Coleman & Vaghefi, 1994), Gemba (Ohno, 1982), Jidoka (Bruun & Mefford, 2004), Kaizen (Mikvaa et al., 2016), and many others, that companies all over the world put into practice. In this paper, we want to narrow down our focus on one lean strategy called zero-defect manufacturing (Shingo, 1986).

Zero-defect manufacturing (ZDM) is a lean management strategy initially described in the 1960s by Shigeo Shingo of Japan (Shingo, 1986). It is an approach that focuses on developing systems that make defects nearly impossible or, if unavoidable, easy to detect and address.

So far, ZDM has been mostly viewed as something that organizations do internally (Halpin, 1996; Åhlström, 1998; Psarommatis et al., 2020a). In line with lean scholars (Netland & Powell, 2017; Powell & Coughlan, 2020) who suggest extending the research on lean to the firms business network, ZDM scholars also highlight the need to expanding the scope of ZDM research to the firms’ supply networks (Psarommatis et al., 2020b).

Be that as it may, ZDM requires reliable systems in place not only within the company, but also with firm’s business and supplier network. The number of defects in production may very well be associated with the firm’s partners since the manufacturing department strongly relies on suppliers of goods, logistics firms, and many other external actors.

An issue that has received less attention in the literature is how external actors are geographically located in relation to the focal firm and to each other in lean operations. Lean knowledge consists of both explicit (e.g., written manuals, documented procedures) and tacit knowledge (e.g., Kanban or lean practices embedded in production staff). The transfer of tacit knowledge is more demanding than the transfer of explicit knowledge, and it often requires close interactions and geographical proximity of partner firms and people (Herron & Hicks, 2008). Thus, we can assume that in some cases of lean production, it is sufficient to cooperate with remote partners, and in some other lean cases, it is necessary to cooperate with partners who are located nearby. We therefore expect that the strategic partners of the focal company are primarily located in the same industrial cluster with the focal company to enable the transfer of tacit knowledge required for production with zero defects.

This paper investigates the various types of interactions with external actors that are located in a cluster versus actors that are non-cluster located in ZDM processes in an automobile manufacturing case study. In order to better classify and systematically analyze how external actors inside and outside a cluster can affect ZDM, we employ the concept of triads, that according to the IMP school of thought is considered to be the minimum unit of network analysis (Laage-Hellman, 1989; Vedel et al., 2016). Netland and Powell (2017, p. 222) suggest that the lean supply chain research could focus on the “triadic buyer–supplier-supplier relationships and how such relationships promote knowledge-sharing and mutual learning among network members.” From our case study, we have theoretically deduced seven conceptually different types of triads, open and closed, with in-cluster and non-cluster located suppliers. Thus, the research question of this paper is: How can firms achieve their lean management goals of zero-defect manufacturing through the involvement of in-cluster and non-cluster located suppliers in different types of triads?

Theoretical Approach

Zero-defect Manufacturing

The study takes a starting point in the concept of zero-defect manufacturing (Halpin, 1996). Although Lean Philosophy is multifaceted and offers wide variety of tools for elimination of waste and continuous improvement (Kaizen), production firms often follow the strategy of zero-defect manufacturing (ZDM) in their lean management (LM) endeavors, where the main idea is to build the quality into the process; thus, redundant quality checks are considered to be a waste (Shingo, 1986). According to Halpin (1996), ZDM strategy is about doing things right the first time. Psarommatis et al. (2020a, p. 1) explain that ZDM “has the goal to decrease and mitigate failures within manufacturing processes to eliminate defective parts during production.” Achieving zero defects requires reliable systems in place. Zero-defect manufacturing aims for zero quality control (Shingo, 1986). The main idea of ZDM is to build the quality into the process; thus, redundant quality checks are considered to be a waste (Muda in Japanese) (Shingo, 1986).

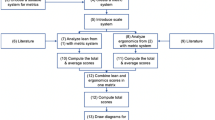

Åhlström (1998) proposed a certain sequence in implementation of lean production and states that management effort and resources need initially to be devoted to three parallel tasks: (1) installing a system for achieving zero defects as a basis for future improvements, (2) working on the elimination of waste through manufacturing cells manned by multifunctional teams, and (3) making sure the core LM principles are supported by vertical information systems and team leaders in the multifunctional teams (see Fig. 1).

Sequences in the implementation of lean production (Åhlström, 1998)

Thus, following Åhlström (1998), designing and building a multi-cell production line guided by the LM principles of ZDM—this is the manner in which the firms can lay a foundation for lean production and future improvements.

ZDM has been mostly viewed so far as something that organizations do internally (Halpin, 1996; Åhlström, 1998; Psarommatis et al., 2020a), and we have identified a gap in the literature where few have discussed ZDM in relation to external partners. For example, Psarommatis et al. (2020b) conducted a study about product quality improvement policies in Industry 4.0, in which the authors scrutinize characteristics, enabling factors, barriers, and evolution toward zero-defect manufacturing. Psarommatis et al. (2020a) and Lindström et al. (2020) studied how to set up internal processes to model an effective production system without defects. Psarommatis et al. (2020b, p. 8) discuss ZDM as a part of firm’s QMS (quality management system) and highlight that “linking QMS to the global supply chain” is important because “the manufacturing department strongly relies on suppliers, logistic department, marketing department.” The authors explain that firm’s ability to establish information flow between its internal quality management system and its global supply chain is a critical success factor for the firm’s QMS. Psarommatis et al. (2020b, p. 8) state that “QMS implementation will face some barriers which can be overcome by linking the actors of the supply chain to the QMS.” Bortolotti et al. (2016), Netland and Powell (2017), and Powell and Coughlan (2020) demonstrate the importance of expanding the scope of lean research to the firms’ supply networks. Psarommatis et al. (2020b), in particular, studied production system with zero defects and also emphasizes that more research is needed on the relationship between ZDM and firm’s global supply chain.

We agree with these authors, and we also think that it is important to discuss ZDM in relation to the firm’s business network. Indeed, from the lean perspective, the number of defects in production may very well depend on the work of the firm’s business partners, for example, on the quality of the delivered industrial robot to the production cell and robot’s setup made by the supplier-partner.

Explicit and Tacit Lean Management Knowledge

When firms jointly work on a complex multidisciplinary project, following LM strategy of ZDM, they exchange both explicit and tacit specific lean information on a daily basis. For example, Lindström et al., (2020, p. 14) explain that in order to model an effective ZDM system, a deep understanding of the full spectrum of knowledge about ZDM is required. According to Lindström et al., (2020, p. 14), this knowledge can be explicit such as “the data but also the domain knowledge, which may be formal (written/documented)” or tacit, the knowledge that is “embodied in production staff, development engineers, maintenance staff, etc.…without this, the system model will be less useful and less complete.”

Also Dyer and Hatch (2004) in their in-depth study of Toyota and its suppliers discuss the transfer of explicit and tacit lean knowledge. For example, Dyer and Hatch (2004, p. 58) “found that the company has developed an infrastructure and a variety of interorganizational processes that facilitate the transfer of both explicit and tacit knowledge within its supplier network.” The authors specify that these three main processes are “supplier associations, consulting groups and learning teams” (Dyer & Hatch, 2004, p. 58). Dyer and Hatch (2004, p. 58) explain that explicit knowledge “can be codified easily and transmitted without loss of integrity once the rules required for deciphering it are known…examples include facts, axiomatic propositions and symbols that provide information and so on” (Dyer & Hatch, 2004, p. 58). The transfer of explicit knowledge does not require close geographical location and intense interaction, because it is clearer and easier to transfer; therefore, the actors can be located remotely, while their location does not negatively affect the exchange of explicit lean knowledge.

Dyer and Hatch (2004, p. 60) explain further that “in contrast, tacit knowledge is ‘sticky’, complex and difficult to codify, and it often involves experiential learning.” Furthermore, Herron and Hicks (2008) state that a large portion of lean knowledge is tacit and requires close contact and intense interaction (e.g., Kanban) to be transferred. Therefore, we can assume that close location to strategic partners, especially in such a knowledge hub like an industrial cluster, can be considered to be important for lean tacit knowledge transfer. Geographical proximity of the firms in cluster has been considered an important factor for successful cooperation by the scholars of economy of geography (Boschma, 2005). The need for close personal contact for the transfer of tacit knowledge is also confirmed by Dyer and Hatch (2004, p. 61) when they explain that “although the supplier association facilitated the exchange of information that was primarily explicit, the personal visits of consultants were effective in transferring tacit knowledge of greater value.” Also, Dyer and Hatch (2004, p. 58) accentuate that “the really powerful type of knowledge is tacit because it is the primary source of innovative new products and creative ways of doing business.”

Thus, from the considerations above, we understand that for the successful creation of an effective ZDM system, the focal firm exchanges explicit and implicit ZDM knowledge with its network of business partners, and business partners, in turn, exchange explicit and implicit ZDM knowledge among themselves. Based on this, we find that an interesting issue with involving external actors is how close are these external actors to the focal firm and to each other. Thus, we suggest that it is interesting to look at how external actors, that are in-cluster located, versus actors, that are non-cluster located, affect ZDM. Moreover, for different types of knowledge, we need a different interaction, that is why it is interesting to look at both closed and open triads.

Location in Industrial Cluster

If we agree that we need to understand the role of the firm’s external partners on its lean management strategy of zero-defect manufacturing, then an interesting question arises whether these partners should be located in an industrial cluster in geographical proximity to the focal firm and to each other or outside of an industrial cluster.

Sölvell (2009) in his book on clusters explains that in order to facilitate regional economic growth, the European Union has promoted the design of more than 1000 cluster initiatives in Europe. In its turn, the Norwegian government launched the cluster development program Arena in 2002 and has since supported nearly 70 cluster projects (Technopolis, 2017). Examples of clusters of a global importance include Hollywood (feature films), Silicon Valley (computers, internet), and Detroit (automobile manufacturing) (Eklinder-Frick, 2016).

Porter (2000, p. 16) defines the cluster construct as “geographic concentration of interconnected companies, specialized suppliers, service providers, firms in related industries, and associated institutions (e.g., universities, standard agencies, trade associations) in a particular field that compete but also cooperate.” According to Porter (2000), companies that are co-located have competitive advantage and benefit from (1) a joint specialized labor market, (2) lower transport costs, and (3) a form of tacit industry knowledge.

IMP scholars, Håkansson et al., (2002, p. 7), discuss the Porterian view of “place as a creator of advantages for the individual company” and inquire whether “co-location” is a drawback or an advantage. Håkansson et al., (2002, p. 7) name the following advantages of co-location: (1) gaining knowledge diffusion, (2) exchange of experience, (3) shared infrastructure, and (4) innovation together. Furthermore, Håkansson and Snehota (2017, p. 129) highlight that “firms can take advantage of place-related features, such as 1) low-cost production, 2) access to raw materials or 3) scientific knowledge, in order to achieve value and benefits in various ways.”

Törnroos et al., (2017, p. 10) in their study about dimensions of space in business network research highlight that “space has been identified as an area in need of research” by IMP scholars like Håkansson et al. (2009), and “the concept of space and geography has remained unexplored and is not taken explicitly into account” within the IMP school of thought. Törnroos et al., (2017, p. 10) explain that it is important to fulfill this gap, because “the notion of space provides a core basis for e.g., resource heterogeneity, embeddedness and the overarching business network structure.”

As follows from Porter’s definition of a cluster, geographical proximity is one of the main dimensions that characterizes cluster. Boschma (2005) discusses five dimensions of proximity—(1) cognitive, (2) organizational, (3) institutional, (4) social, and (5) geographic. Boschma (2005, p. 71) argued in his study “that too much and too little proximity are both detrimental to learning and innovation.” Indeed, excessive geographic proximity creates spatial lock-in, thereby creating the opposite effect—limiting access to new knowledge and reducing the level of innovation (Boschma, 2005; Cantù, 2010; Holl et al., 2010; Johanson & Lundberg, 2007).

Despite the aforementioned concerns on excessive geographical proximity (Boschma, 2005), Oerlemans and Meeus (2005, p. 101) showed in their study that geographical proximity matters for firm performance, but as they say “in a limited and a specific way.” Their result supports the theoretical idea that firms that rely solely on regional knowledge bases do not gain sufficient knowledge and information to outperform other firms in their sector (Oerlemans & Meeus, 2005, p. 101). Oerlemans and Meeus (2005, p. 101) point out that it is only firms that have both intra- and interregional innovative ties with buyers and suppliers that tend to outperform other firms in the same sector as far as the percentage of innovative processes or products and relative growth of sales are concerned.

Several authors have argued that geographical proximity has a positive effect on a firm’s innovative and economic performance. Schmitt and Biesebroeck (2013) explain, that “the North American automotive industry was traditionally clustered around Detroit, and the importance of geographical proximity seemed indisputable” for a good cooperation with suppliers. At the same time, Bennett and Klug (2012) write that Toyota concentrated all their important suppliers in close geographical proximity to the assembly lines. Bennett and Klug (2012, p. 1283) concluded that “high integrated suppliers, based in proximity to the assemblers, enable simple, standardized, speedy and certain logistics processes according to reduced complexity of logistics operations.”

In the previous chapter, we highlighted that close location facilitates intense interaction that enables lean tacit knowledge transfer. Felzensztein et al. (2010) show that “co-location provides interaction opportunities and the sharing of experience necessary for inter-organizational collaboration (especially when tacitness is high)” and explains that “by facilitating repeated interactions and development of overlapping social and professional connections, concentrations of firms engaged in similar activities in a particular location create an environment that facilitates trust and the rapid and effective diffusion of ideas and collaborations.”

We would like to highlight that not only close location of business partners to each other in an industrial cluster matter, but also the long history of working together. Industrial clusters can be replenished with new firms. However, what matters, when external partners and the focal firm work together on building a multi-cell production line, is that they have common knowledge and understanding of each other’s needs, technologies, and cultures. This can be achieved fast when network actors have joint business legacy—they have already had a long history of working together and developed common business knowledge. Porter (2000, p. 254) includes this idea of commonalities between firms into his definition of a cluster, saying that cluster is “a geographically proximate group of inter-connected companies and associated institutions in a particular field, linked by commonalities and complementarities.”

Deep understanding of each other’s needs, technologies and cultures can certainly be achieved as well with the new partners. However, the process will take time, and it is not lean. According to the studies of the effects of co-location on marketing externalities, trust and linkages between firms established by a long history of working together are crucial in helping the diffusion of knowledge and cooperation (Felzensztein et al., 2018). Moreover, Treado (2010, p. 111), in his study of Pittsburgh steel technology cluster in the USA, claims that “when a closer look is taken at the development of the steel technology cluster, it becomes clear that the cluster’s success has depended on three main strengths of the Pittsburgh region: its location, its industrial legacy and its labour expertise.” By industrial legacy, Treado (2010) implies the knowledge about metallurgy and materials engineering accumulated over many years at the place of the industrial cluster. Furthermore, Treado (2010, p. 112) explains that “the steel technology cluster has benefited not only from the region’s reputation for understanding metallurgy and critical steel-making technology but also for its broader reputation as a centre for materials engineering.”

Knowing the importance of close location and legacy for lean tacit knowledge transfer, and realizing that automotive firms, in the recent decades, follow the trend of globally dispersed supply chains, we believe that we need to include in our analysis both in-cluster and non-cluster located firms, in order to understand the impact of both types on a firm’s lean performance. We adhere to the IMP school of thought that suggests the concept of triad as a minimum unit of network analysis (Laage-Hellman, 1989).

The Concept of “Triad”

Industrial marketing and purchasing (IMP) school of thought offers a useful and engaging approach to understanding business relationships of industrial organizations. First of all, the founders of the IMP school of thought declare that “No Business Is an Island” in their eponymous book (Håkansson & Snehota, 2017) and conceptualize business networks “as sets of connected relationships” (Anderson et al., 1994, p. 1). Two connected actors constitute one relationship; two connected relationships require at least three actors. The IMP scholars Holmen and Pedersen (2000, p. 5) refer to Cook and Emerson (1984) and “argue that a triad is the smallest unit of analysis which allows us to study connected relationships.”

Holmen and Pedersen (2000, p. 6) emphasize that it is important to distinguish that in the IMP school of thought, the concept of a triad is defined as “three actors and two or three relationships,” while the sociological conceptualization of Simmel (1950) implies “three actors and three relationships.”

Currently, there is no consensus in the literature on the definition of triads. In this paper, following Vedel et al. (2016), we call a constellation of three actors where one actor is connected to the other two “an open triad.” However, it is possible to find other definitions of an open triad (see Fig. 2). For example, Granovetter (1973) calls the structure where the buyer and two suppliers are not connected “the forbidden triad,” because he believes that the two suppliers always strive to be connected. Choi and Wu (2009) call an open triad—a triad with a structural hole, Ford and Håkansson (2013) call it “two dyads” or relationships between two pairs of actors, and finally Siltaloppi and Vargo (2017) refer to it as a brokerage.

In the same way, following Vedel et al. (2016), in this paper, we call a constellation of three actors where each of the three actors is connected to the other two “a closed triad.” However, other definitions of a closed triad also exist in the literature (see Fig. 2). For example, Holmen and Pedersen (2000) call it a unitary triad, Madhavan et al. (2004) a transitive triad, Ford and Håkansson (2013) call it “a triad” or relationships between all the actors, and finally Siltaloppi and Vargo (2017) refer to it as a coalition.

Triad, as a constellation of three individuals, has been found useful for better understanding relationships between people (Anderson & Gerbing, 1991; Heider, 1946, 1958; Katz & Kahn, 1966; Lott & Lott, 1966; Simmel, 1908, 1950; Weick, 1969) and for better understanding relational dynamics between organizations (Havila, 1996; Larson & Gammelgaard, 2001/2002; Havila et al., 2004; Madhavan et al., 2004; Dubois & Fredriksson, 2008; Choi & Wu, 2009; Wu et al., 2010; Hartmann & Herb, 2014, 2015; Vedel, 2016; Vedel et al., 2016; Siltaloppi & Vargo, 2017; Andersson et al., 2019).

IMP literature has a considerable amount of studies devoted to various types of triads with the buyer and two first-tier suppliers—buyer–supplier-supplier (BSS) triads (Aune et al., 2013; Håkansson et al., 1999), buyer–supplier-customer triads (Wynstra et al., 2015), and buyer–supplier-logistics service provider triads (Andersson et al., 2019; Bask, 2001). Mena et al. (2013) went further and focused on the multi-tier supply chain (MSC) studying buyer–supplier-supplier’s supplier triads in the agri-food industry. Mena et al. (2013, p. 73) suggest to “investigate MSCs in other industries, particularly industries with more complex and longer supply chains, such as automotive or electronics.” In this paper, we narrow down our focus and concentrate on the buyer–supplier-supplier and buyer–supplier-supplier’s supplier triads.

Wu et al. (2010) show in their multiple studies about BSS relationships that triads versus dyads allow for better understanding of relational dynamics between business partners (Choi & Hong, 2002; Choi & Kim, 2008; Choi & Wu, 2009). They rely on the arguments of Simmel (1950) and Weick (1969) that when a third actor is added to the equation of two, then the relationship between the two can be revealed from different angles.

IMP literature highlights the importance of network structure. For example, Håkansson et al. (1999) demonstrate the value of connections between suppliers in a BSS triad for learning. Dubois and Fredriksson (2008) show that a closed BSS triad contributes to efficiency and innovation for the buyer and two suppliers. As discussed above in the chapter about explicit and tacit lean knowledge, a different type of lean knowledge requires different interaction; that is why it is interesting to look at both closed and open triads. Moreover, IMP scholars, Holmen et al. (2007), argue that a supplier network cannot consist of only closely connected ties, as this is not always necessary, and often too costly, so the network is a kind of mixture of closed and open triads. Also, Kovalevskaya et al. (2021, p. 1940) suggest that “zooming into the effect of both open and closed triads on LM is an interesting direction for future research.”

Theoretical Framework

Thus, based on the discussion above, we have developed a theoretical framework of seven buyer–supplier-supplier triads with cluster and non-cluster located suppliers (Fig. 3). Our theoretical framework consists of three closed triads with a buyer and two first-tier suppliers and four open triads with a buyer, one first tier-supplier, and one second-tier supplier. The gray color indicates the in-cluster location of the actor, while the white color indicates that the actor is located outside of the industrial cluster.

These seven triads were deducted from our business case. Thus, given the literature review, it is the time to look more carefully to the cases, and the way to do this is through the triadic lens.

Method

The empirical data underlying this article consists of a single embedded case study (Bryman, 2012; Bryman & Bell, 2011; Dubois & Araujo, 2004; Dubois & Gadde, 2002, 2014, 2017; Eisenhardt, 1989; Yin, 2003, 2006, 2014), where the overall framing of the case is a buying company engaged in a construction of a new production line for bumper system in conjunction with its network of suppliers, specifically six first-tier and four second-tier suppliers. According to Yin (2014), case study research is suitable for studying descriptive or explanatory questions: i.e., what happened, how, and why. The case study methodology is best suited for inductive inquiries (Yin, 2003). As pointed out in the previous section, the link between ZDM and the firm’s business network remain underexplored. An exploratory research design is best suited when the underlying problem is unstructured (Ghauri & Grønhaug, 2005). The case study method is regarded advantageous when the phenomenon studied is complex, and difficult to separate from its environment (Yin, 2003), which is certainly the situation for ZDM phenomenon and overall for this study.

In this paper, a qualitative investigation of the relationships of the network of business partners involved in designing and building a new production line at BumperAlum (the buyer, our case company) has been carried out to understand how a firm can benefit from its network of business partners and from cluster localization to meet its LM goals of ZDM. We employ the “systematic combining” research approach to our case study, which is not a linear approach, but “a process where theoretical framework, empirical fieldwork and case analysis evolve simultaneously” (Dubois & Gadde, 2002)(p. 554). Semi-structured interviews (Bryman, 2012) were conducted with 14 respondents, all employed in the case company BumperAlum, 1 respondent who worked in BumperAlum in 2010–2012 as a Head of R&D, and with 14 respondents from 5 business partners (1 respondent from BumperMachining, 4 respondents from RobotsExpert, 2 respondents from RoboticsInnova, 1 respondent from AutomationProducer, and 6 respondents from ResearchOrg), all involved in designing and building the new production line in the period 2020–2021. Table 1 summarizes the information about the interviews, project meetings, and observations conducted for this research project.

Table 2 shows the distribution of collected data by triads.

The firms where the interviews were conducted are circled with the thick line in the triad figures in Table 2. The data about the firms which are not circled was collected via the interviews with other firms and by secondary data. The information about supplier S3 RobotsProducer was collected through secondary data and provided in the interviews by respondents from the supplier S1 RobotsExpert and the buyer BumperAlum. The information about supplier S6 TowingProducer was collected through secondary data and provided in the interviews by respondents from the sub-supplier Ss-D ResearchOrg and the buyer BumperAlum. The information about the sub-supplier Ss-A FeedersProducer was collected through secondary data and provided in the interviews by respondents from the supplier S1 RobotsExpert and the buyer BumperAlum. The information about the sub-supplier Ss-B was collected through secondary data and provided in the interviews by respondents from the supplier S2 RoboticsInnova and the buyer BumperAlum. The information about the sub-supplier Ss-C ElectricMotors was collected through secondary data and provided in the interviews by respondents from the buyer BumperAlum.

With some respondents, we had multiple interactions—follow-up interviews, exchange of documents via e-mail, etc. The duration of interviews ranged from 1 to 3 h. Interviews were recorded, transcribed, and analyzed. We have also had five full-day factory visits. During these visits, due to a lot of noise coming from the machines, we have written notes, instead of recording. Summing up, the number of respondents amounts to 28 people and interaction time to 156.5 h. The focus in the data collection was made on (1) actors individually (company background, location, role in the project), (2) their relationships, (3) their individual and joint work in designing and building the new production line, and (4) follow-up questions about 1–3. Data collected is used as a basis of a case description and input to the case analysis performed.

By employing the systematic combining research approach to our case study, we have been working on the theoretical framework, empirical fieldwork, and case analysis simultaneously. Throughout this process, we have theoretically deducted seven conceptually different triads—open and closed, consisting of a buyer, its first- and second-tier suppliers, which are in-cluster and non-cluster located.

Presentation of the Case Study

In the following, we will present the buyer, BumperAlum, and the network of its first- and second-tier suppliers involved in designing and building the new production line for crash management system. The description will focus on the lean requirements set by the buyer that suppliers had to comply with, on the role of the buyer and each supplier in the project and on the relationships between the buyer and the suppliers.

About the Case Study and the Companies Involved

The buyer in our case is BumperAlum, a Norwegian producer and supplier of crash management system (CMS) to large original equipment manufacturers (OEMs). Figure 4 shows the lightweight CMS that consists of (1) backplate, (2) crash box, (3) beam, and (4) towing system.

Lightweight CMS (Pero et al., 2020)

BumperAlum is located in one of the most advanced and productive industrial clusters in Norway. In 2017, BumperAlum together with one of its oldest and largest customers, GoodCars, decided to invest in a new CMS production line that would meet their lean management requirements of production with zero defects. For the implementation of this project, BumperAlum hired the group of local suppliers, which were located in the same industrial cluster in geographical proximity to BumperAlum, which designed the whole line, built most cells of the line, and coordinated the work between all the cells on the line. BumperAlum also worked in that project with non-cluster located suppliers, which built some other cells on the line, supplied robots, various machinery, and parts for the bumper system like the crash box, screws, and towing system (towing hook nut). There were also involved sub-suppliers into the project to supply certain machinery and equipment to the line, for example, feeders. Figure 5 shows the network of business partners involved in designing and building the new production line.

Table 3 shows an overview of actors involved in the project including the description of their role.

Figure 6 shows the outline of the new production line demonstrating that the line consists of five production cells.

RobotsExpert is a family company established in 1985, with 30 permanent employees, located in the Norwegian industrial cluster. RobotsExpert develops and produces flexible low-cost robot systems with the following characteristics: low investment, compact and movable, easy to set up, configure and use, human friendly—no safety fences, configuration instead of programming, multi operation, can be docked, and movable between different production units. RobotsExpert has already worked on other projects for BumperAlum in the past and proved itself as a reliable partner. RobotsExpert was hired by BumperAlum as the main supplier in that project, because it was responsible for the design of the whole line, building loading and assembly cells, and coordinating the work between all the cells on the line, also the cells built by other suppliers.

RoboticsInnova is an international company, established in 1990, nowadays employing 50 people, located in the Norwegian industrial cluster. RoboticsInnova delivers machines and robots that can work shifts unmanned with short cycle times. BumperAlum hired RoboticsInnova to supply cost-effective solutions such as robots that can see the details to be picked, custom-built drills, and welding jigs. RoboticsInnova has already worked on other projects for BumperAlum in the past and proved itself as a reliable partner. RoboticsInnova was responsible for building bending and sawing cells on the line.

RobotsProducer, established in 1978, is a pioneer in robotics, machine automation, and digital services, providing innovative solutions, employs more than 13,000 people in 57 countries, and has shipped more than 700,000 robot solutions. BumperAlum hired RobotsProducer to supply 18 industrial robots to the new production line. RobotsProducer has already worked on other projects for BumperAlum in the past and proved itself as a reliable partner.

BumperMachining is a daughter company of BumperAlum Group, established in 1976. Bumper Machining is a supplier to the automotive and glass industry all over the world, located in the USA. BumperMachining designs, develops, and builds manufacturing equipment as well as fully automated turnkey solutions for the production of chassis and body in components made of steel, aluminum, and carbon fiber products and their hybrids. BumperMachining also builds machining cells with milling robotics. BumperAlum hired BumperMachining to supply the Machining cell. BumperMachining has already worked on other projects for BumperAlum Group in the past and proved itself as a reliable partner.

AutomationProducer is a global company established in 1974 in Japan. AutomationProducer specializes in basic technologies, consisting of numerical controls, servos and lasers, robots, and the robomachines. For the new production line project, industrial robots were purchased via the BumperAlum Group from AutomationProducer and delivered directly to the BumperMachining, the supplier of the machining cell. There are four machining robots from AutomationProducer in the Machining Cell. AutomationProducer has already worked on other projects for BumperAlum Group in the past and proved itself as a reliable partner.

TowingProducer is a worldwide manufacturer and distributor of standard and custom tow hooks. TowingProducer was established in 1956 in the USA. TowingProducer sells tow hooks of a high quality at a competitive price. BumperAlum hired TowingProducer to supply towing hook nuts, which are fed to the assembly cell where robots assemble the bumper beam with the towing system, crash box, and backplate. TowingProducer has already worked on other projects for BumperAlum in the past and proved itself as a reliable partner.

FeedersProducer is located in France, established in 1955 with nowadays more than 400 employees. FeedersProducer has been developing and producing components for assembly automation in the areas of feeding, handling, and transport. As a leading specialist in work with small and micro parts, FeedersProducer offers a unique portfolio of innovative and high-quality feeding components which are the foundations of the high-end feeding systems. FeedersProducer is a second-tier supplier to BumperAlum. BumperAlum’s supplier RobotsExpert has a long-term agreement with FeedersProducer; therefore, FeedersProducer has already worked on other projects for RobotsExpert in the past and proved itself as a reliable partner. RobotsExpert purchased feeders for BumperAlum’s new production line from FeedersProducer which were installed at the assembly cell.

SuperTech, established in 1985, is located in the Norwegian industrial cluster. The company has a very modern park with computer numerical controlled (CNC) machining centers and extensive experience in CNC machining of various material qualities such as ordinary steel, stainless and acid-proof, and many others. SuperTech has milling machines, grinders, glassblowers, and a number of other auxiliary machines for complete machining and production. SuperTech is a second-tier supplier to BumperAlum. BumperAlum’s supplier RoboticsInnova has a long-term agreement with SuperTech; therefore, SuperTech has already worked on other projects for RoboticsInnova in the past and proved itself as a reliable partner. RoboticsInnova purchased various auxiliary machines for complete machining and production for BumperAlum’s new production line from SuperTech which were installed at the Bending and the Sawing cells.

ElectricMotors, established in 1976, is located in the USA. ElectricMotors markets, designs, manufactures, and provides service for industrial electric motors, generators, and mechanical power transmission products. These motors are commonly used in industrial robotics where precise motion and position control is required. The motors are expensive products and have complex construction and electronics involved. ElectricMotors is a second-tier supplier to BumperAlum. BumperAlum’s supplier RobotsProducer has a long-term agreement with ElectricMotors; therefore, ElectricMotors has proved itself as a reliable partner. RobotsProducer supplied 18 industrial robots to BumperAlum; all motors in these robots are produced by ElectricMotors.

ResearchOrg developed from the technology and industrial management unit of a large factory of Norwegian industrial cluster in 1950. Nowadays, it is owned by an independent Norwegian research organization that conducts contract research and development projects. ResearchOrg is a second-tier supplier to BumperAlum. BumperAlum’s supplier TowingProducer contracted ResearchOrg to perform metal material testing of their towing hook nuts, which TowingProducer supplies to BumperAlum.

About the Industrial Cluster of the Focal Company in the Case Study

The Norwegian industrial cluster is one of the leading industrial clusters in Norway. The Norwegian industrial cluster has existed long before any cluster development initiatives in Norway (Technopolis, 2017). This cluster has a rich technological legacy (Ringen, 2010; Treado, 2010), such as knowledge about aluminum production and automotive technologies.

It all started in the nineteenth century, when in 1873 the matchstick Factory was established in Norway (Ringen, 2010). During World War I, the Norwegian government acquired the factory and used it for production of ammunition. After the war, military production faced a downturn, and the factory faced the need to expand into other markets. One such market was the automotive industry, when in 1965 the factory signed the agreement with GoodCars (nowadays the biggest customer of our case company BumperAlum) to supply half a million aluminum bumper beams. Engineers started to experiment with the aluminum and in the 1980s developed an innovative air-break coupling system, which was accepted by GoodCars. This was a turning point, when the factory achieved a breakthrough, and since then the customer portfolio started to increase. The organizational change started in 1997; during that period, the factory grew into many units, which then were sold to various companies from all over the world. Today, in 2022, the Norwegian industrial cluster is one of the leading industrial clusters in Norway with more than 40 international companies, working mainly for automotive and defense industries.

Our case company, BumperAlum developed from the automotive unit of the factory. Since 2009 BumperAlum is owned by the International Corporation, BumperAlum Group, which offers lightweight solutions for the automotive industry and employs around 30,000 people at around 100 locations in around 30 countries, including Norway. Revenues of the BumperAlum Group in 2018 were 8 billion EUR. BumperAlum’s competence and technological knowledge on how to work with aluminum material root to the times in history when they belonged to the factory. Today, BumperAlum bids for contracts to large globally known OEMs.

BumperAlum competes on the international arena with other suppliers of car parts made both of aluminum and steel. It is tough to compete with those who produce steel parts because steel is much cheaper than aluminum. However, lighter suspension through the use of aluminum parts is a worldwide trend. A lighter car has solid advantages, such as improved dynamics, driverability and handling, lower fuel consumption, improved ride smoothness, and even reduced breaking distance. The body of the car and chassis make up over half the weight of the average vehicle; therefore, material can make a big difference in total weight, stiffness, and strength of the vehicle. Moreover, OEMs demand from suppliers of automotive parts high quality of the products, together with the lowest price and constant engineering improvement (Lodgaard et al., 2018), for example, lighter parts, because cars are becoming more and more compact at the same time as weight is being reduced to meet stricter CO2 requirements (Ringen, 2010).

In order to be competitive and to offer their customers a quality product at a competitive price, BumperAlum implements a lean management philosophy at their factories, where their main lean strategy is zero-defect manufacturing.

Table 4 presents 2 lean ZDM requirements that BumperAlum together with its customer GoodCars set for their suppliers that are involved in designing and building of the new CMS production line.

Criteria for the construction of a new line correspond to the Lean Philosophy of The BumperAlum Group and BumperAlum in Norway—zero-defect manufacturing that considers quality checks as waste and implies building the quality into the process. Project lasted 2.5 years and was a success—the new fully automated line was built. Comparing to the other lines, the new line is fully automated, flexible, and has a short cycle time and a low defect rate.

Analysis and Discussion

In this section, we present our findings from the systematic combining of theory on triads, location in industrial cluster, lean management strategy of zero-defect manufacturing, and the case study.

As discussed earlier, the IMP literature highlights the importance of network structure, identifying triads as a minimum unit of network analysis (Laage-Hellman, 1989). The IMP scholars identify the value of both closed buyer–supplier-supplier triads, calling them cohesive groups, that facilitate intense interaction and knowledge-transfer between the three actors (Håkansson et al., 1999; Vedel et al., 2016) which contributes for efficiency and innovation for the buyer and two suppliers (Dubois & Fredriksson, 2008) and the value of open buyer–supplier-supplier triads for innovation (Llopis & D'Este, 2022) and in general the value of triads being “the linkage between small and large world” (Håkansson & Gadde, 2019).

Even though open triads are called “forbidden” by Granovetter (1973), they are “permitted” in industrial networks (Holmen & Pedersen, 2000). Holmen and Pedersen (2000, p. 14) claim that “it may even be proposed that an important aspect of industrial networks is specifically that it allows for ‘forbidden triads,’ i.e., that two parties involved in a relationship can be connected to respective counterparts without these turning into cohesive groups; this may even be a reason for the existence of some actors.” For example, Vedel et al. (2016, p. 144) point out that an open triad, involving a supplier, an intermediary, and a buyer, can reflect a highly specialized and contingent set of relations. The intermediary can act either as a vehicle for cost-economizing or for the provision of specialized and valued services; and in both cases, there is little incentive for the two disconnected actors to invest in the development of a direct relationship; that is, there is no obvious driver of closure (Vedel et al., 2016, p. 144).

Although triads have been discussed extensively in the IMP literature, in this article, we want to specifically understand the value of closed and open triads for the firm reaching its lean management objectives. Since lean management is a broad subject itself, we narrow down our scope to one part of it called zero-defect manufacturing. We also bring into our analysis and discussion an element of the location of actors in a triad—in-cluster or non-cluster location. We consider the topic of actors’ location or “place” (Håkansson & Snehota, 2017; Håkansson et al., 2002), to be rather neglected in the IMP literature on triads (Törnroos et al., 2017); however, it is an important element when discussing a firm’s supply chain in the framework of lean management. For example, Bennett and Klug (2012) point out that Toyota concentrated its strategic suppliers in close geographical proximity to its assembly lines which facilitated reaching its just-in-time lean management objectives by decreasing transportation costs, alleviating decisions in inventory management and production planning.

Despite the acknowledged value of the firms’ location in industrial clusters (Porter, 2000), in recent decades, supply chains have increasingly transcended clusters, and even national borders, turning into global supply chains. Kalchschmidt et al. (2020, p. 3) points out that international sourcing and the extended commercial presence over the world bring many opportunities to the firms; however, the management of a globally dispersed supply chain becomes highly complex. Kalchschmidt et al. (2020, p. 3) highlights that “geographic dispersion significantly impacts the performance of an extended network as well as the decision-making authority and coordination within the firm” and that understanding the geography of supply chains has important implications at a managerial level, and it has remained a relatively unexplored topic in the literature (Kalchschmidt et al. 2020, p. 4).

In this article, we describe and analyze in detail seven types of buyer–supplier-supplier triads—three closed and four open. We analyze the interaction of the buyer and two suppliers in seven variations where the buyer is in-cluster located and suppliers are located inside and outside of the industrial cluster in geographical proximity or remoteness to the buyer and to each other. We attempt to understand which triadic configurations, open or closed, with in-cluster and non-cluster suppliers, lead to the firms achieving the buyer’s lean management goals of zero-defect manufacturing.

Three Closed Triads with In-cluster and Non-cluster Located Suppliers

We analyzed three closed triads, which are similar structurally, but different in their essence. Table 5 presents the traits of these triads. The detailed description of the three cases is presented in attachment in Figs. 7, 8, and 9.

Short About Each Case

In the closed triad 1 case, the buyer signed the contract with the local supplier S1 (RobotsExpert). S1 won the tender to be the main supplier to design and build a new crash management system (CMS) production line. S1 designed the full production line and built two production cells, loading and assembly, and also coordinated the work between all the cells on the line, such as making the software and building the stations between the cells. The buyer also signed the contract with the local supplier S2 (RoboticsInnova) to build two production cells—bending and sawing. S2 specializes in machines and robots that can work shifts unmanned with short cycle times. Both S1 and S2 delivered highly complex complementary products and built production cells that follow one after the other on the production line. Suppliers and the buyer cooperated (a) to coordinate the joint work of the cells on the line and (b) to solve the problem of aluminum chips which is especially acute in the sawing cell (built by S2), but aluminum chips can clog between the cells and disturb the work of the adjacent cells, like an assembly cell (built by S1). The three firms intensively worked together, systematically engaged in triadic interaction through the online and offline meetings, and found the solutions to both problems: (a) the firms jointly developed uninterrupted operation of electronic signals between the production cells, and (b) effective solutions to combat the spread of aluminum chips in the sawing cell and their further scattering to the adjacent production cells have been applied (air pressure to blow off large chips, brushes, covering the robot’s arm, etc.). In the case of closed triad 1, both suppliers delivered complementary highly complex products (design, manufacturing, and installation of production cells) which involved a lot of lean tacit knowledge and required intense interaction between the three actors in a triad. Location in geographical proximity of the three actors to each other in the Norwegian industrial cluster was critical in that case and facilitated intense interaction and lean tacit knowledge transfer. The relationships between three actors in this triad case are based on trust and commitment.

In the closed triad 2 case, the actors are the buyer, again in-cluster supplier S1 (RobotsExpert) and another non-cluster supplier S3 (RobotsProducer). In that case, S1 delivers a highly complex product (production cells), and S3 also delivers a complex product, but comparing to S1 in that case, the product of S3 is more standardized—industrial robots that are installed in the cells of S1. In that case, three companies have also intensively interacted to agree about technical specifications of the robots of S3 to fit the cells of S1 and to design the cells with robots in a way to shorten the cycle time on the production line. In that case, S3 is non-cluster located, but it is not critical, because the buyer has a long-term agreement with S3 and a long history of working together. S1 has also previously worked with S3 on other projects. The relationships between three actors in this triad case are based on trust and commitment.

In the closed triad 3 case, the actors are the buyer and two non-cluster located suppliers S4 (BumperMachining) and S5 (AutomationProducer). S4 delivers a highly complex product (machining cell), and S5 delivers a less complex and more standardized product, if compared to the product of S4, the industrial robots for the machining cell of S4. In that case, both suppliers are non-cluster located; however, the relationships are based on trust and commitment, because S4 has previously built a similar machining cell for the buyer’s daughter company in the USA, and S4 has successfully cooperated in that project with S5. In that case, three firms are engaged in intensive interaction both online and offline, and engineers of the three firms traveled from Norway to the USA and vice versa, jointly learnt from S4’s experiences and lessons learnt from S4 project of the machining cell built in the USA, and made improvements in the machining cell design for the buyer in Norway. One such improvement concerned solving the problem of aluminum chips in the machining cell.

Triadic Management Strategy

In all three triadic cases, the buyer plays the role of Tertius iungens “that is based on the Latin verb ‘iungo’ which means to join, unite, or connect,” by creating the new connection between previously disconnected actors (Obstfeld, 2005, p. 102). According to Siltaloppi and Vargo (2017), Tertius iungens is one of the four variants of brokerage type of triadic relationships that facilitates knowledge creation and innovation (the other three are Tertius Gaudens, Conduit, and Second-Hand Brokerage). Siltaloppi and Vargo (2017, p. 405) refer to Obstfeld (2005) and explain that “tertius iungens describes the creation of new ties in which knowledge creation depends on the nonsubstitutability (i.e., actors with complementary knowledge and skills) of the actors connected.”

In all three closed triads cases, the buyer has a cooperative relationship with each supplier, and the suppliers have a cooperative relationship with each other, corresponding to the Balanced State 1 triad with three “ + ” relationships described by Choi and Wu (2009). All three closed triad cases correspond to what Vedel et al. (2016, p. 143) call “a group-like structure” that “acts as an entity,” with high degree of internal cohesiveness, indicated by closure with strong ties.

The buyer’s commitment to each supplier encourages the suppliers in all three closed triad cases to combine and make adaptations of their heterogeneous and complementary resources for the benefit of the buyer’s business (Abrahamsen & Håkansson, 2015). In the case of closed triad 1, both suppliers combined resources and made resource adaptations—engineers worked together, exchanged technical information, made necessary adjustments to solve chips problems, and coordinate the safety configurations between the cells. Despite a certain control over suppliers, the buyer gave suppliers some freedom in designing the new production line which enabled them to approach the solution of the given task in a creative and innovative way. The task was complex and challenging for suppliers. Production engineer from S1 (RobotsExpert) says:

We have never made something as complex as this. Nobody new in the beginning how the line should look like. BumperAlum gave us a lot of freedom to be creative and we found it very motivating.

The management strategy in the closed triad 1 corresponds to what Dubois and Fredriksson (2008, p. 170) call a triadic sourcing strategy, when “the buyer actively creates interdependences between two suppliers” that contributes to efficiency and innovation for the three actors.

In closed triad 1 case, the buyer has a high level of trust to both suppliers, which is also fostered by location of all three actors in one industrial cluster. An engineer from S1 (RobotsExpert) says that there is a sub-culture in the Norwegian industrial cluster that firms work together and share knowledge like Norwegian champions share knowledge in their skiing team:

Now companies more and more see that sharing is the best way to develop. It is like in our Norwegian skiing team, the skiers share their knowledge within the team. And even if they're competing against each other, they are also gaining more out of this knowledge-sharing than if they would be keeping everything to themselves. This is what makes them champions.

This type of Norwegian approach to sport where the core of success is in knowledge-sharing and teamwork between the team members was recently described by Gjert Ingebrigtsen in his book “Gjert’s method” (Ingebrigtsen & Saugestad, 2021). Gjert Ingebrigtsen described how he coached his three sons, Henrik, Filip, and Jakob, who had many significant achievements in athletics. Jakob Ingebrigtsen competed in 1500 m at the 2020 Summer Olympics in Tokyo and won the gold medal and set the Olympic record with time 3:28.32. In 2018 Gjert Ingebrigtsen was awarded the title Norwegian sports coach. It is interesting that the engineers from RobotsExpert take as a reference point for their cooperation with local partners in the cluster the way Norwegian champions train, highlighting the importance of knowledge-sharing within the team for achieving their goals both in business and in sport.

In the case of closed triad 2, both suppliers S1 (RobotsExpert) and (S3) RobotsProducer combined resources and made resource adaptations—engineers worked together, exchanged technical information, and agreed about programming robots of S3 to fit the production cells of S1 and vice versa. In closed triad 2 case, a buyer has a long-term agreement with the supplier of robots, S3 (RobotsProducer), and achieves a better price for the robots than what the supplier of the cell, S1 (RobotsExpert), would achieve. Therefore, in this case, as Vedel et al. (2016) state, the buyer has more power over the suppliers. In the projects with the other buyers, the supplier of the cell S1 purchases directly from the supplier of robots S3 the needed robots for the cell and installs the cell at the buyer’s site. In the case of this project, the supplier of the cell S1 agrees that the buyer purchases the robots from the robots’ supplier S3 at a better price and the robots are delivered to the supplier of the cell S1. Despite this, two suppliers interact directly with each other since the robot supplier S3 supplies robots directly to the cell supplier S1 and all communication and discussion of technical specifications take place directly between them.

In closed triads 2 and 3 cases, the buyer’s strategy is the combination of intervention and delegation supply chain management strategies. The buyer manages its suppliers using an “intervention supply chain management strategy” (Johnsen, 2011) because the buyer achieves substantial cost advantages by purchasing robots directly from the second supplier, while in other projects, the second supplier is the sub-supplier of the first supplier. At the same time, the buyer encourages the suppliers to engage in direct communication and problem-solving, which corresponds to the “delegation supply chain management strategy” (Johnsen, 2011).

In-cluster and Non-cluster Location

In closed triad 1 case, the location of both suppliers and the buyer in an industrial cluster in geographical proximity to each other plays a crucial role, because two suppliers deliver highly complex products (complementing production cells following one after another). Location of the three actors in an industrial cluster facilitated knowledge exchange—transfer of both explicit and tacit lean knowledge. Nowadays the three firms are independent companies, but once there were different departments of a cluster-forming factory. Therefore, the three firms shared common history, common Norwegian culture, and technological legacy (Treado, 2010) on how to work with aluminum. The Norwegian cluster has a high employee rotation. During the project, we found out that some engineers at S1 (RobotsExpert) and S3 (RoboticsInnova) previously worked at the buyer; therefore, they were familiar with the buyer’s corporate culture and many technical details in the project. Moreover, the location in geographical proximity to each other in an industrial cluster facilitated frequent physical meetings and mutual factory visits, what is called in lean terms of Ohno (1982) “going to gemba” and is considered to be a very important lean management practice.

In closed triad 2 and 3 cases, the location of suppliers in the industrial cluster in geographical proximity to the buyer and to each other was critical, but less, especially because one supplier was building the cells (highly complex product), and the second supplier was supplying industrial robots or manufacturing machines for these cells, which are also highly complex products but are more standardized and can be delivered to the site. Design and building of the production cells are a more complex and creative process, that requires the close geographical location of the supplier to the buyer; therefore, in the closed triad 2 case, the supplier of the production cells S1 was in-cluster located, but the supplier of the robots S3 was non-cluster located. The engineers of the buyer and S1 had an intense interaction and frequent physical meetings and visited each other’s facilities. These visits were necessary, because before the production cells were built at the buyer’s plant, their prototypes were built and tested at the supplier’s site. For the buyer, the close location of the supplier of industrial robots S3 was not so critical; the most important was the excellent worldwide reputation of the supplier, high-quality robotics solutions, and long-term agreement.

In the closed triad 3 case, the fact that both suppliers are not located in the industrial cluster in geographical proximity to the buyer is compensated by the fact that both suppliers have already had experience in building the same machining cell for the buyer’s sister company in the USA. The buyer trusted these suppliers. In addition, the buyer, together with the suppliers, built on previous experience—“the lessons learnt in the USA,” corrected mistakes, and improved the new cell.

Zero-defect-manufacturing Goals Achieved in the Three Closed Triads

Table 5 shows that in closed triad 1, 2, and 3, the actors achieved the buyer’s lean management goals of zero-defect manufacturing.

Solving the aluminum chip problem (in sawing cell in closed triad 1 case and in machining cell in closed triad 3 case) and coordinating the work between the cells, such as electrical signals for safety (in closed triad 1 case) led to lowering the defect rate, which reduced the necessary number of quality controls, which all together lead to lowering the costs. In closed triad 2, case involvement of all three actors into discussion of technical specifications of the robots allowed to determine the most suitable technical characteristics of robots for a given production line and agree about how to program robots in order to minimize the number of defects, which led to minimum quality control. In closed triad 2 case, triadic interaction allowed achieving low-cost, fully automated high-quality robotics solutions.

In all three closed triad cases, the actors also managed to shorten the cycle time. This was possible by all three actors’ involvement in discussion of technical specifications of the production cells and robotic solutions.

Thanks to triadic cooperation in all three closed triad cases, robots can be reprogrammed quickly to a new bumper model (product flexibility), so that the new line can produce more product variation than other production lines of the buyer.

Finally, through triadic cooperation in all three closed triad cases, firms found solutions to fully automate their cells and in total the whole line.

Thanks to the triadic cooperation in closed triads 1 and 2, the line was designed in such a way that the buyer can have a lower initial investment in the beginning before the production has gone up. The line is flexible (production line flexibility), and robots can be added into it. For example, the assembly cell (built by S1) was initially built with eight robots, and then after 6 months, the number of robots was doubled. In closed triad 3 case, the product line flexibility box is not ticked in Table 5, because it is more difficult to make changes in the machining cell and increase the number of robots that drill holes in the bumper on the machining table.

Four Open Triads with In-cluster and Non-cluster Located Suppliers and Supplier’s Suppliers

We analyzed four open triads, which are similar structurally, but different in their essence. Table 6 presents the traits of these triads.

Mena et al. (2013) studied multi-tier supply chain (MSC) on the three agri-food cases of three-tier supply chains—beer, bread, and pork supply chains—consisting of the buyer, supplier, and supplier’s supplier. In their findings, the beer buyer–supplier-supplier’s supplier triad was open, the bread one closed, and the pork one transitional. Their research “suggests that competition for control combined with the importance of structural position is what determines power in an MSC… thus they begin to see why companies may try to jockey for better positioning within a supply chain… one way this can be carried out is by linking with other firms at tiers beyond their direct suppliers or customers” (Mena et al., 2013, p. 73). For example, in the transitional triad case, the buyer (retailer) was trying to establish the direct connection with the supplier’s supplier (pork breeder). For example, the authors propose that “a buyer who wants to influence key product characteristics needs to connect directly with its supplier’s supplier who works with undifferentiated resources” (Mena et al., 2013, p. 70). By undifferentiated resources, the authors mean, for example, natural resources, that only the supplier’s supplier has access to. In our case, this can be the production of metal from which the supplier’s parts are manufactured. For example, only the supplier’s supplier was handling the raw materials that are embedded in the final product, and the buyer had no control over the quality or sustainability of the production process of the supplier’s supplier. Therefore, Mena et al. (2013, p. 70) point out that “if the buyer want to influence the quality, environmental or social impact of the products and services they provide, they need to reach out to those key suppliers upstream that lie beyond their top-tier suppliers.”

Hingley (2005) discussed the problem of a “super middlemen” in agri-food business that has a lot of power of the sub-suppliers. Hingley (2005, p. 72) conceptualizes “super middlemen” as “the hub for both domestic and overseas products, they may or may not be primary producers themselves, but what they do is manage the flow and mix of supply.” In our case, there is a tender system that the buyer uses, that omits the problem of a “super middleman” in the automotive business.

Based on the discussion above, it is interesting to turn to our three-tier supply chain cases of the buyer–supplier-supplier’s supplier open triads and try to understand the interaction between three actors and management strategy in our cases of the buyer and two suppliers involved in the new CMS production line project. The detailed description of the four open triad cases is presented in attachment in Figs. 10, 11, 12, and 13.

Short About Each Case

In the open triad 1 case, the actors are the buyer, the supplier S2 (RoboticsInnova), and supplier’s supplier Ss-B (SuperTech). Suppliers’ products are complementary. In that case, S2 delivers highly complex products (production cells, bending, and sawing), and Ss-B delivers standardized, but complex products (auxiliary machines for bending and sawing cells). In that case, the buyer is not directly connected to the sub-supplier; however, the supplier had to agree with the buyer about the sub-supplier’s choice. All three actors are in-cluster located, and relationships are based on trust and commitment in both first and second tiers. The in-cluster location is critical, because Ss-B machines are integrated in the cells of S2. S2 and Ss-B cooperated to reduce the number of aluminum chips in the sawing cell, and also S2 relies on the Ss-B electronic computer system for documentation to manage their materials and production.

In the open triad 2 case, the actors are the buyer, the supplier S1 (RobotsExpert), and supplier’s supplier Ss-A (FeedersProducer). Suppliers’ products are complementary. In that case, S1 delivered highly complex products (production cells—loading and assembly), and Ss-A delivered standardized, but complex products (feeding technology to assembly cell). In that case, the buyer is not directly connected to the sub-supplier; however, the supplier had to agree with the buyer about the sub-supplier’s choice. S1 is in-cluster, and Ss-A is non-cluster located. The in-cluster location of S1 is critical to the buyer, because of the highly complex product S1 delivers—the production cells. S1 and the buyer have intense interaction and visit each other’s facilities frequently. The non-cluster location of Ss-A is not critical, because Ss-A is the world’s leader in feeding technology and supplies feeders directly to S1. S1 and Ss-A have a long history of working together. Feeders are placed outside of the assembly cell. Feeding technology is of a high quality with Poka-Yoke error prevention system. Relationships are based on trust and commitment in both first and second tiers.

In the open triad case 3, the actors are the buyer, the supplier S3 (RobotsProducer), and supplier’s supplier Ss-C (ElectricMotors). Suppliers’ products are complementary. In that case, S3 supplied standardized, but complex products (industrial robots to bending, loading, sawing, and assembly cells), and Ss-C supplied standardized, but complex products (electric engines for the robots). Both suppliers are non-cluster located. S3 has a long-term agreement with both the buyer and with Ss-C. Ss-C worked with S3 more than 30 years, supplying the high-quality electric engines with the long guarantee for the industrial robots of S3. Relationships are based on trust and commitment in both first and second tiers.

In the open triad 4 case, the actors are the buyer, the supplier S6 (TowingProducer), and the supplier’s supplier Ss-D (ResearchOrg). S6 delivered standardized, but complex product (towing hook nuts that are fed to the assembly cell), and Ss-D provided S6 with the complex service (quality checks of towing hook nut metal material). S6 is non-cluster, and Ss-D is in-cluster located. The in-cluster location of Ss-D is important in that case because Ss-D has worked with the buyer previously on the other projects and accumulated a large database on the metal material specifications and quality standards and requirements of the buyer. The buyer trusts highly reliable quality checks from Ss-D of towing hook nuts supplied by S6. There is a high level of trust between the actors in this triad, and there has also been in the past an employee rotation between the buyer and Ss-D.

Triadic Management Strategy

In all four open triad cases, the buyer has a cooperative relationship with the first tier supplier, and the first tier supplier has a cooperative relationship with the second tier supplier, corresponding to the Structural Hole State 1 triad with two “ + ” relationships described by Choi and Wu (2009).

In the open triad cases 1, 2 and 4, in the beginning of the project, the buyer performs the strategy of intervention and then delegation (Johnsen, 2011; Johnsen & Ford, 2005), thus leaving more freedom to suppliers. In intervention strategy, the buyer “specifies sub-suppliers either by nominating them or specifying components” (Johnsen, 2011, p. 703). The first-tier supplier has contractual obligations with the buyer. It is written in the contract that the buyer has the right to appoint a sub-supplier. These contractual obligations give the buyer leverage to control the first-tier supplier’s selection of the second-tier supplier. Buyer executes its power and nominates the second-tier supplier to the first-tier supplier, and this does not negatively impact the relationship between the first-tier supplier and the buyer. Because in a tough competitive environment, suppliers have to make a compromise; therefore, the first-tier supplier continues to collaborate with the buyer on the terms set by the buyer. In such a way, the buyer controls its supply chain, as also described by Mena et al. (2013), because the quality of crash management systems is critical. At the same time with intervention strategy in the open triad cases 1, 2, and 4, the buyer does not engage in direct communication with the sub-supplier, and the buyer leaves the first-tier supplier to engage in direct communication and problem-solving with the second-tier supplier, which corresponds to the “delegation supply chain management strategy” (Johnsen, 2011).

The open triad case 3 shows that the buyer uses only “delegation strategy” (Johnsen, 2011), and the buyer does not intervene by nominating the sub-supplier in that case, because the supplier S3 and sub-supplier Ss-C have a long-term agreement and sub-supplier Ss-C has been manufacturing and supplying electric engines for the industrial robots of S3 for more than 30 years.

Even though in the open triad 4 the sub-supplier Ss-D (ResearchOrg) had worked on many projects with the buyer, in that particular business case, Ss-D is not directly interacting with the buyer. Blankenburg and Johanson (1992, p. 15) refer to this type of triad in their study as an implicit triad: “It is conceivable that the supplier takes the impact of the connected relationship into consideration without explicitly referring to the connected actor in the interaction with the customer.”

In an open triad, two nodes (e.g., two suppliers) are not connected directly, except through a third node (e.g., the buyer) (Choi & Wu, 2009). Burt (1992) called an open triad “a structural hole” and stated that in such a triad, the structural hole between two disconnected nodes does not mean that the disconnected nodes are unaware of each other; it means that each of the two nodes focuses on its own activities such that it does not attend to the activities of the other. Our four open triad cases show that the buyer is aware of the second-tier supplier but focuses on its own activities and leaves the activity of managing the second-tier supplier to the first-tier supplier.

In-cluster and Non-cluster Location

In both open triad 1 and 2 cases, the first-tier suppliers supplied highly complex products, and both are located close to the buyer in the Norwegian industrial cluster.

In open triad 1 case, the buyer receives a turnkey solution from its first-tier supplier—readily built bending and sawing cells. These cells were initially built at the supplier’s test facilities. The buyer and the first-tier supplier had multiple meetings and mutual factory visits, the buyer visited the test facilities with the test cells at the first-tier supplier’s site, and after buyer’s approval, the first-tier supplier built these cells at the buyer’s actual production line. It is critical that the buyer and first-tier supplier are located in geographical proximity to each other, so they can exchange technical knowledge, go to gemba, and exchange lean tacit and explicit knowledge. In open triad 1 case, the sub-supplier of the auxiliary machines is also in-cluster located which is advantageous for all three actors. Since the subcontractor installs the equipment and various technological solutions in the cell built by the supplier, its presence in the industrial cluster with the buyer and the supplier is an advantage for both.

Open triad 1 case shows that it is important for a buyer to have a reliable supplier and for the supplier to have a reliable subcontractor in geographical proximity that can provide with the quality services and stick to agreed delivery times, which is essential for a firm that aims to reach its lean goals of ZDM.

In open triad 2 case, the location of the buyer and its first-tier supplier in geographical proximity to each other is critical, because the supplier is responsible for the design of the whole line (highly complex product) which requires frequent and intense physical interactions with the buyer in order to exchange technical information and lean explicit and tacit knowledge. In open triad 2 case, the sub-supplier is non-cluster located, which is not critical because he supplied the complex, but standardized product.