Abstract

While climate and energy policy targets require fundamental changes and expansions in the energy infrastructure, hydropower systems across Europe remain essential for low-carbon energy systems. With renewable fuel import prices being subject to large uncertainties, this work aims to substantiate the relationship between these fuel import prices and multireservoir hydropower systems in a climate-neutral energy system. To that end, three green hydrogen import price scenarios are combined with two aggregated modelling approaches for pan-European hydropower assets. Using the integrated energy system model SCOPE SD, the analysis shows that import prices for green hydrogen have a significant impact on European electricity generation (+ 595 GW\(_\text {el}\) and + 650 TWh\(_\text {el}\)/yr), domestic hydrogen production (+ 396 TWh\(_\text {th}\)/yr), and water values of European hydropower assets (+ 33 % of average value in Norway). The results further indicate that the different aggregation methods only have a minor impact, suggesting that the computationally more efficient approach with up to 90% reductions in solution time provides suitable approximations of hydropower generation and flexibility in future analyses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the European Green Deal, Europe aims to reduce its net greenhouse gas (GHG) emissions by at least 55% until 2030 and 100% until 2050 compared to the reference year 1990 [1]. Therefore, the European Commission has set several goals in its energy system integration strategy, including deep electrification of consumption based on renewable electricity and renewable and low-carbon fuels in existing and new application areas across the economic sectors [2].

Alongside large contributions of variable renewable power generation from wind and solar photovoltaics (solar PV), hydropower systems across Europe remain essential components of low-carbon electricity systems. With its ability to be dispatched, hydropower offers unique features and a backup production option, especially when capturing the flexibility potential of multireservoir systems. Another key technology to reach climate neutrality is green hydrogen, which can be produced domestically in Europe or imported from global fuel markets. It has been shown that hybrid power consumer technology combinations (e.g. dual-fuel boilers or hybrid heat pumps) and electrolysers may impact wholesale prices in future power markets, which are also affected by fuel imports [3]. Thus, future green hydrogen import prices could impact the use and operation of hydropower assets across Europe depending on individual hydropower characteristics and individual bidding zones’ attractiveness to invest in domestic electrolyser production.

In the current literature, two noteworthy streams concerning this study can be identified: On the one hand, there are many contributions addressing planning models for integrated energy systems, where hydropower usually only assumes a minor role despite its non-trivial contributions to flexibility. On the other hand, many studies are on modelling complex hydropower units at large system scales and their related aggregation methods. Nevertheless, the role of hydropower assets in climate-neutral energy system configurations and the repercussions of the system transformations on those hydropower assets require additional attention. Especially the impact of different renewable fuel import price scenarios on hydropower scheduling remains a knowledge gap.

Since there is still uncertainty about future renewable fuel import prices and quantities, this work aims to assess and substantiate the relationship between green hydrogen import prices and multireservoir hydropower systems across Europe in a climate-neutral energy system.

By using a pan-European capacity expansion planning model for integrated energy systems, this study investigates the influence of different green hydrogen and renewable fuel import prices on the use and scheduling of hydropower in long-term scenarios. As modelling hydropower is not straightforward in large-scale integrated energy system models, the study also quantifies the impacts of modelling hydropower with two different aggregation methods, i.e. equivalent and clustered-equivalent, based on the methodology presented in [4, 5].

The remainder of this article is organised as follows. Section 2 presents the current state of the literature on hydropower modelling and green hydrogen import prices. Section 3 introduces the conceptual approach built on the integrated energy system modelling and optimisation framework SCOPE Scenario Development (SCOPE SD), including the aggregated hydropower modelling approaches, which are necessary to reach the objective of this work. Afterwards, Sect. 4 describes the case study with its six different model runs and the chosen import prices for green hydrogen. The results are then shown, summarised, and discussed in Sect. 5, followed by Sect. 6, which draws relevant conclusions.

2 Previous work

Modelling complex hydropower units at large system scales is a challenge, especially in the context of analysing integrated energy systems and the transition processes to attain them. Such systems are strongly coupled in both time and space due to their large energy storage potential and cascaded topology. Planning models for integrated energy systems involve high-dimensional optimisation problems and incorporating detailed hydropower modelling approaches quickly becomes computationally intractable. Aggregation methods which develop auxiliary models with reduced complexity but still providing acceptable approximations to represent a very large number of reservoirs and plants can thus be instrumental in practice. To that end, many aggregated modelling approaches for multireservoir hydropower systems use equivalent model formulations, which are also known as “single- or multi-station equivalents” or “composite or one-dam representations” [4]. Early work of building equivalent representations of multireservoir hydropower systems goes back at least to [6]. More recently, various techniques have been presented using linear multi-scenario equivalent models [7], implementing a particle swarm optimisation-algorithm [8], using a probabilistic model for hydropower generation [9], as well as building multi-station equivalents based on a bi-level optimisation approach [10, 11].

In integrated energy system models focusing their analysis on coupled markets and infrastructure, i.e. in the electricity, building, industry, and transport sectors, hydropower usually only assumes a minor role. For example, the focus in [12] is on capacity factors of wind and solar PV and the associated costs for the overall energy system, while for hydropower, only the resulting larger storage demands due to an increased share of solar PV in certain simulations are addressed. The work in [13] stands out with its analysis of future operation of hydropower reservoirs in the European energy system. Also, a global analysis of the impact of climate change on hydropower is carried out in [14].

Analyses of the role of hydrogen in future European energy systems have emerged in large numbers in recent years. In most of these studies, there is agreement that hydrogen will be primarily used in the industry and transport sectors [15], that hydrogen production will predominantly occur in regions with cheaper electricity costs [16], and that a fully decarbonised European power system can benefit from hydrogen with regard to the achievement of strategic policy targets and in terms of overall system costs [17]. When determining hydrogen costs and prices, the focus can be on both domestic European production and imports from outside Europe. An example of the former analysis is [18] which investigates the time-resolved cost of hydrogen in a future climate-neutral electricity system that uses hydrogen in the industry and transport sectors. A key finding here is that flexibility in the hydrogen demand can reduce the production costs significantly. Analyses of the impact of different hydrogen prices on the energy system can be found in [19] and [20]. The former work calculates two price sensitivities for the European energy system with green hydrogen imports from outside Europe, namely 79 EUR\(_{2017}\)/MWh\(_\text {th}\) and 94 EUR\(_{2017}\)/MWh\(_\text {th}\). The latter calculates a cost optimised climate-neutral energy system in Germany with a varying hydrogen import price from 1.25 EUR/kg to 5 EUR/kg, which is the equivalent of a range from 37.5 EUR/MWh\(_\text {th}\) to 150 EUR/MWh\(_\text {th}\). Further country-specific analyses of the use of hydrogen in the respective energy systems can be found in [21] with its decarbonisation pathway for Norway and [22] which examines hydrogen in different scenarios in order to support the German hydrogen strategy development.

There are scattered articles in the literature on combining electrolysers for hydrogen production with hydropower plants. One of the first articles of this kind is [23], which proposes electrolysers to be located near the hydropower plant. Further examples are [24] describing a rather technical approach for cogeneration of green hydrogen in a cascade hydropower plant, [25] with its study on the prospect of hydropower to hydrogen in Nepal, and [26] assessing the feasibility of producing green hydrogen from solar, wind, and hydropower resources. Nevertheless, to the authors’ best knowledge, no existing literature addresses the impact of (hydrogen) import prices on hydropower scheduling and values, especially at a pan-European level.

While many studies focus on new sources of flexibility in integrated energy systems (e.g. temporal shifting in battery, thermal energy, or gas storage systems; or flexibility from fuel conversion by electrolysers or multi-fuel use of hybrid technology combinations to supply various end-use demands), the supply of low-carbon electricity and flexibility by multireservoir hydropower assets is less explored. From the literature, it can thus be concluded that little is known about the role and impact of hydropower assets in climate-neutral energy system configurations which are likely to be subject to future import prices for carbon-neutral gaseous and liquid fuels from global markets. These relationships are not as well studied, probably not least because of the necessary data and appropriate hydropower modelling approaches. To address the knowledge gap, this work focuses on the impact of different renewable fuel import price scenarios on the use of hydropower in the European energy system. The impact is quantified by hydropower-specific indicators describing the produced energy, storage level trajectories, and resulting water values. While the hydropower modelling approaches were developed and validated in previous work on a pan-European energy system with relevant cross-sectoral interactions, climate neutrality paradigms have increased the interactions in the systems, calling for a new application and assessment of those aggregation methods. Moreover, we use updated data sets, which have also been extended to more market areas.

3 Methodology

After outlining the conceptual approach for the underlying analysis in Sect. 3.1, Sect. 3.2 introduces the integrated energy system analysis framework SCOPE SD. Section 3.3 presents the data coverage of hydropower assets in Europe, the aggregation of which is implemented in Sect. 3.4 depending on the scenario.

3.1 Conceptual approach

To address the outlined objectives, this work analyses three hydrogen import price scenarios, i.e. low, medium, and high (see Sect. 4.2), in combination with two aggregation methods, i.e. equivalent (EQ) and clustered-equivalent (CLEQ) (see Sect. 3.4), for pan-European hydropower assets in a long-term, climate-neutral energy system scenario setting. To that end, the case study performs six individual model runs (see Sect. 4) with the pan-European cross-sectoral capacity expansion planning framework SCOPE SD. The results of the case study for the European energy system focus on the electricity production capacities and quantities, domestic generation by electrolysers as well as hydrogen imports from outside Europe. With regard to the individual hydropower systems in Europe, net hydropower production, reservoir filling levels, and water values are analysed.

3.2 SCOPE Scenario Development framework

The pan-European cross-sectoral capacity expansion planning framework SCOPE SD is a bottom-up techno-economic partial equilibrium model. Figure 1 illustrates the structure, components, and typical in- and output data of SCOPE SD (upper section) including the interactions of technology options (lower section) in the corresponding markets or policy instruments (middle section).

The modelling and optimisation framework develops coherent long-term low-carbon energy system scenarios for Europe for a given target scenario year in the future. By minimising the generation, storage, and cross-sectoral consumer technology investment and system operation cost, this large-scale linear programming (LP) approach has representations for the traditional power system as well as for all relevant bi- and multivalent technology combinations at the sectoral interfaces with the building, industry, and transport sectors.

Each market area, i.e. every country in Europe, is represented by one node. All units (generation, storage, and cross-sectoral demand technology options), their most important parameters (costs, potentials, and operational characteristics), and their relevant interactions between each other are modelled in hourly resolution. By explicitly modelling national and pan-European fuel markets, it is possible to distinguish between the use of fossil fuels, on the one hand, and synthetic renewables, on the other hand, which are either imported from outside Europe or produced domestically. In order to account for climate neutrality in future scenarios, national and international GHG emission budgets are implemented as a driving force behind investments in low-carbon technologies.

Recent mathematical formulations and applications of SCOPE SD can be found in [3, 19, 27,28,29]. The following parts provide formulations of the objective function and the key constraints of the underlying optimisation model. A detailed mathematical formulation of SCOPE SD’s sets and indices, decision variables, parameters, system-wide constraints, and technology constraints can be found in the appendix (see Appendix A).

The objective function of SCOPE SD minimises total costs for investment (INV) and system operation (SYSOP) decisions, including a broad range of power generation technologies, storage technologies, and cross-sectoral demand technologies from the industry, building, and transport sectors. The objective function of the LP is therefore written as

where (x, y, q, s, z) is the tuple of all decision variables and \(\mathcal {D}\) its polyhedral feasible set defined by all system-wide and technology-dependent unit constraints. The objective function components for investment decisions are defined as

where \(\Gamma\) is the superset of all power generation (GEN) technologies, \(\Theta\) is the superset of all power consumption (CON) technologies, and A is the set of all electricity storage system units (subtracted to avoid double counting). \(\overline{x}^\text {GEN}_\gamma\) and \(\overline{x}^\text {CON}_\theta\) are the capacity expansion variables representing investment decisions, for which the parameters \(C_\gamma ^\text {INV}\) and \(C_\theta ^\text {INV}\) capture the fixed operation costs and the corresponding specific annuitised investment costs.

The objective function components for system operation decisions in every considered time step \(t\in T\) are defined as

where \(C_\gamma ^\text {VP}\) and \(C_\theta ^\text {VP}\) are the variable production (VP) costs, for which \(x^\text {GEN}_{\gamma ,t}\) and \(x^\text {CON}_{\theta ,t}\) are the corresponding dispatch decision variables for electricity generation and consumption technologies, respectively. In order to avoid unrealistic cycling and ramping behaviour of generation and consumption units, load change (LC) costs \(C_\gamma ^\text {LC}\) and \(C_\theta ^\text {LC}\) are implemented to penalise the positive and negative dispatch deviations of generation \(x^{\text {LC},+/-}_{\gamma ,t}\) and consumption units \(x^{\text {LC},+/-}_{\theta ,t}\) between time steps. Costs for conventional boilers (CBs) \(C_{(.)}^\text {CB}\) are incurred for their corresponding fuel consumption decision \(y^\text {CB}_{(.),t}\) for hybrid boiler units (\(b\in B\)), hybrid heat pump units (\(h\in H\)), and multivalent combined heat and power (CHP) systems (\(g\in G^\text {CHP}\subseteq G\)). The latter incur additional costs \(C_g^\text {CHP}\) when the extraction condensing units are operated in cogeneration mode, for example when the CHP units supply heat \(q^\text {CHP}_{g,t}\). For renewable generators like wind turbines and solar PV (\(r \in R\)), curtailment (CU) costs (or benefits) \(C^\text {CU}_{r}\) can be imposed for CU decisions \(x^\text {CU}_{r,t}\). Internal combustion engines (ICEs) of (hybrid) vehicles also cause costs \(C_v^\text {ICE}\) for their fuel consumption \(y^\text {CON}_{v,t}\). The decision variables \(y_{m}^{\text {FI}}\) and \(y_{m}^{\text {RI}}\) represent fossil fuel import (FI) or renewable fuel import (RI) volumes from outside the considered system boundary for every fuel market \(m\in M^\text {FUEL}\). Each of them can be valued with exogenous import prices \(C_m^\text {FI}\) or \(C_m^\text {RI}\), respectively.

As already indicated, the system-wide constraints covering the clearing of wholesale electricity markets, heat market segments, cooling market segments, road transport market segments, GHG emission markets and fuel markets can be seen in Fig. 1 and in [28]. Given the relevance of hydrogen sourcing strategies in this case study, the clearing of a fuel market (m) is formulated as

where \(D_{m,t}\) is the exogenous fuel demand profile of fuel market m for every time step t. The fuel demand decision variables \(y_{g,t}\), \(y_{b,t}\), and \(y_{v,t}\) belong to the participating thermal power plants (g), hybrid boilers (b), and hybrid vehicles v, respectively. Domestic fuel productions, e.g. green hydrogen or synthetic natural fuels, are denoted as \(y_{l,t}^{\text {GEN}}\) for every time step t.

3.3 Detailed hydropower model and data

A critical aspect of the modelling approach is to represent hydropower assets across Europe. Given the heterogeneous orography across the European continent, hydropower systems exist in many different structural shapes and they are subject to very different natural inflow patterns, e.g. multireservoir systems with branched and parallel connections between turbine and pump units in alpine regions and long serial hydropower systems extending into multiple jurisdictions and participating in different markets at the same time.

The SCOPE SD framework uses the deterministic hydropower modelling approach developed in [4, 5]. Figure 2 shows its internal database containing hydropower plants and reservoir parameters of over 874 hydropower systems gathered from public data. Alongside plant- and reservoir-specific data (e.g. minimum and maximum capacity of turbines, minimum and maximum capacity of pumps, and the maximum usable volume of reservoirs), the database includes complex hydraulic connections and couplings as well as information on cross-border market participation.

Overview of explicitly covered and modelled hydropower systems across Europe (3657 hydro reservoirs and 2951 hydro plants in total), own illustration based on updated data sets developed in [4]

Public availability of reservoir inflow data is particularly challenging which is why the modelling approach employs a generic approach to generate natural inflow profiles of every single hydro reservoir in the considered market areas. The core idea is to infer natural inflows from past climatic and meteorological conditions, i.e. historical runoff data, in order to create reservoir-specific natural inflow profiles which are then adjusted to individual hydropower plant production data. For a more detailed description of the spatial and temporal interpolation based on the global atmospheric reanalysis ERA-Interim [30, 31], it is referred to [4, 5].

Figure 3 gives an overview of the detailed hydro reservoir model which features an operation planning tool for individual hydro plants and reservoirs based on the water domain. It allows for the modelling of multireservoir hydropower systems with parallel up- and downstream plant connections and hydraulic coupling.

While the detailed modelling approach can be used in the SCOPE SD modelling framework, it is important to mention that this modelling approach is computationally prohibitive when analysing the integrated energy system of Europe in high spatial and temporal resolution.

3.4 Aggregated hydropower modelling approaches

To overcome computational tractability issues, the model can derive two aggregated modelling approaches: equivalent (EQ) and clustered-equivalent (CLEQ). These approaches were first presented in [4, 5]. Figure 4 provides a schematic overview of the involved aggregation procedure from the detailed to the equivalent (EQ) to the clustered-equivalent (CLEQ) modelling approach based on the concept of an equivalent one-dam representation of each hydro system [32].

For different configurations of detailed hydropower systems, slightly different equivalent model types can be used to represent the hydropower system characteristics. Figure 5 summarises the different model types which differ due to available pumping capacity or the necessity to avoid overestimating the flexibility of pumped-hydro storage with a potential second synthetic reservoir.

Depending on the application, the EQ hydropower system model can already provide a sufficient reduction of complexity and computational burden. However, analysing the European power and energy system requires the representation of a large number of hydropower systems (recall Fig. 2) making further aggregation necessary. To that end, the core idea of the CLEQ hydropower system model is to harness the fact that the instances of the uniforming EQ model formulations can exhibit very similar characteristics. By clustering and merging these equivalent hydro units according to their coherent features, a further aggregation can be achieved [5]. The indicators describing the coherent features include the degree of regulation, storage-to-turbine design ratio, as well as inflow similarity patterns [4].

Note that the decision variables and parameters indicated in Fig. 5 correspond to the mathematical formulation of the SCOPE SD framework provided in Appendix A. More specifically, it is referred to Eqs. (15) and (18) describing the operational characteristics of the EQ and CLEQ hydropower model.

4 Case study description

To address the objectives of this work, the case study explores six different scenario variants. A detailed overview of the scenario variants including spatio-temporal structural and time series input data is given in Sect. 4.1. Section 4.2 explains how the import prices for green hydrogen and renewable fuels are determined.

The SCOPE SD model used for this case study is implemented in MATLAB®. The resulting large-scale LP instances have been solved with the Barrier (interior point) algorithm of IBM ILOG CPLEX® 12.9 on a medium-range HPCC node (Intel XEON E5-2698v3 16 Cores @ 2.30 GHz, 256 GB RAM).

4.1 Scenario overview

All scenario variants focus on the scenario year 2050 and assume that Europe becomes climate-neutral, implying that there are no net GHG emissions allowed in all considered energy-related sectors, i.e. power, transport, building, and industry. Note that this study only contains a pan-European GHG emission budget without any additional layer of country- or instrument-specific budgets. The term “Europe” refers to the current 27 Member States of the European Union without Malta and Cyprus but including Norway, Switzerland, and Great Britain (recall Fig. 1).

To consider meteorological effects and past climate conditions, the historical meteorological reference year 2012 is used to derive weather-dependent input data. The choice for this year is mainly that it features a two-week “Kalte Dunkelflaute” period (cold dark doldrums) and is, therefore, well-suited [33] to represent extreme weather conditions and their implication for design choices by the modelling framework.

Several data sources are used to determine the various energy demands in the end-use sectors. The final traditional electricity demand of every country in Europe is based on ENTSO-E data [34]. For the countries of Northern Europe, i.e. Denmark, Finland, Norway, Sweden, electricity consumption was aligned with a recent analysis from Statnett [35] in order to reflect developments of new consumers, e.g. data centres. Final energy demand developments of the European transport and heating sectors are based on the EU Reference Scenario 2016 [36].

The SCOPE SD framework employs a transport model for cross-border electricity flows. The net transfer capacities (NTCs) are based on the 2040 transmission grid scenario “GCA 2040” of the Ten-Year Network Development Plan (TYNDP) 2018 [37]. Although SCOPE SD is able to model endogenous transmission expansion planning, this option is not allowed in the model configuration of this case study.

For large thermal power plants, a distinction is made between existing or already planned plants and new to-be-built plants. In the former category, projections are made using specific lifetime assumptions for the existing and already planned thermal power plants from the PLATTS database [38]. Note that this only affects remaining nuclear production capacities in Finland (2.8 GW), France (1.75 GW), the Czech Republic (2.0 GW), Romania (0.7 GW), and Slovakia (0.88 GW). In addition, nuclear production capacities amounting to 3.5 GW are assumed in Sweden [39]. In the latter category, SCOPE SD can make investment decisions for open cycle gas turbines (OCGT) and combined cycle gas turbines (CCGT), both with or without possible cogeneration of heat and power. Note that all new to-be-built thermal power plants use hydrogen as their primary source of fuel. Solutions including Carbon Capture and Storage (CCS) technologies are not considered.

For renewable power generation, rooftop and utility-scale solar PV as well as onshore and offshore wind technology potentials are based on “satellite models”, which combine land-use data [40] with numerical weather prediction information based on the historical meteorological reference year. The European onshore wind capacities are scaled to the capacities of the “Distributed Energy 2050” scenario of the TYNDP 2022 [33], while the slightly more conservative “Distributed Energy 2040” scenario was used for the offshore wind capacities. In the countries of Northern Europe, i.e. Denmark, Finland, Norway, Sweden, solar PV capacities were adjusted to the values from the Nordic Grid Development Perspective 2021 [41]. It is important to note that the given capacities for offshore wind, one the one hand, are minimum values for the capacities, since the model would otherwise build less capacity endogenously due to the high costs for offshore wind. The given capacities for solar PV and onshore wind, on the other hand, are maximum values for the respective capacities, since SCOPE SD needs to consider the maximum potentials that come from its satellite models.

For the energy sources waste and biomass, the total amount of electricity produced is assumed for the scenario year and subtracted from the electricity demand of the respective country. This procedure is used because biomass plants in particular are very decentralised and not every single plant can be included in the model. The amount of energy is distributed evenly over all hours of the year.

As already discussed in Sect. 3.3, the generation stack of (multireservoir) hydropower systems across Europe is based on publicly accessible information that was gathered in an extensive database [4]. Note that hydropower expansion is not considered beyond currently existing and planned hydropower development projects in Europe. Table 1 gives an overview of the derived and modelled equivalent and clustered-equivalent hydropower systems across Europe.

Detailed information on the modelling and input data of heat generation technologies including heat pumps, thermal storage, district heating, and industrial heat generation can be found in [19, 28], which also features a detailed overview of the required time series data for renewable generation, end-use demands for electricity and heat, and passenger transport demands. Moreover, note that the conventional electricity load profiles in Europe from published ENTSO-E data [42] are adjusted by corrections of today’s heat-dependent electricity consumption.

The assumed investment costs of different technologies in these calculations are based on Fraunhofer IEE’s internal database, which is under continuous development in several research projects, and a current version can be found in [19]. Investment decisions incorporate different weighted average cost of capital ranging from 3 to 8% depending on the type of investor. All monetary values correspond to values of the year 2017.

As already mentioned in previous explanations, only green hydrogen is permitted in the model’s hydrogen sector. Following the classification of different types and origins of hydrogen in [5], green hydrogen is defined as a result of GHG-neutral production based on electrolysis powered entirely by renewable electricity from wind and solar PV.

In summary, six scenario variants combining different import prices (see Sect. 4.2) and two approaches for modelling hydropower system units (see Sect. 3.4) are investigated using the following naming convention:

-

Low import prices / equivalent hydropower units (LowEQ)

with low import prices for renewable fuels and equivalent hydropower units,

-

Low import prices / clustered-equivalent hydropower units (LowCLEQ)

with low import prices for renewable fuels and clustered-equivalent hydropower units,

-

Medium import prices / equivalent hydropower units (MedEQ)

with medium import prices for renewable fuels and equivalent hydropower units,

-

Medium import prices / clustered-equivalent hydropower units (MedCLEQ)

with medium import prices for renewable fuels and clustered-equivalent hydropower units,

-

High import prices / equivalent hydropower units (HighEQ)

with high import prices for renewable fuels and equivalent hydropower units,

-

High import prices / clustered-equivalent hydropower units (HighCLEQ)

with high import prices for renewable fuels and clustered-equivalent hydropower units.

4.2 Import prices for renewable gaseous and liquid fuels

The choice of the import price for green hydrogen from potential future global fuel markets can have a major impact on the results for the European energy system because the domestic hydrogen production volumes in Europe strongly depend on that import price, see e.g. [19].

Table 2 gives an overview of renewable fuel prices for the considered low, medium, and high import price scenario variants. The range of prices results from various possible causes. On the one hand, there are different production sites for green hydrogen depending on the exporting country, which differ in their production costs due to different site conditions for wind and solar PV. On the other hand, there are various options to transport the produced green hydrogen to Europe, i.e. by ship (rather expensive) or by pipeline (rather cheap).

The price assumptions for green hydrogen from non-European export countries are based on Fraunhofer IEE’s Power-to-X (PtX) atlas [43] which contains a broad assessment of global production and export sites. It can be further seen in Table 2 that not only the import prices for green hydrogen are varied, but also the import prices for renewable methane and renewable liquid fuels. Note that the price for green hydrogen from non-European export countries is subject to large uncertainty. Further information on the production potential of PtX fuels for all countries outside the European Economic Area and on the import options of these PtX products to Europe can be taken from [44].

As already mentioned in Sect. 3.2, SCOPE SD contains endogenous electrolyser investment decisions in every European market area to model domestic production of hydrogen. These electrolyser units do not have any additional flexibility restriction on their dispatch decisions and are assumed to have a general conversion efficiency of 0.71 MWh\(_\text {th}\)/MWh\(_\text {el}\). However, a limit on electrolyser consumption per country was imposed to avoid unrealistic electrolyser deployments in small jurisdictions. With this limit, the electricity consumption for domestic electrolysers must not exceed half of the respective country’s conventional electricity demand.

5 Case study results and discussion

The presentation of the case study findings begins with an assessment of the computational results in Sect. 5.1. In the next part of the case study analysis, key findings focus on the modelling results at the European energy system level in Sect. 5.2, to then take a closer look at the hydropower systems in Sect. 5.3. Afterwards, Sect. 5.4 discusses the results and points out relevant limitations of the study.

Note that the case study result data for the European energy system are available in an open-access repository at https://doi.org/10.5281/zenodo.7692180 [45] using the nomenclature from the “openENTRANCE” project [46].

5.1 Computational results

Table 3 gives an overview of the objective function values, the number of columns and rows of the optimisation problem instances, the computation times, and the so-called “ticks” (a measure of machine-independent computational effort by the solver CPLEX®) for each of the different scenario model runs. The figures in brackets indicate the relative reductions of the CLEQ modelling approach with respect to the corresponding EQ modelling approach.

The resulting objective function values and, therefore, the total costs of the considered energy system increase with higher hydrogen import prices. In contrast, clustering hydropower systems has a reducing but limited effect on the objective function values. The observed reductions are below 1% of the corresponding reference and result from pooling in clustered hydropower systems, which command greater flexibility of available aggregate storage capacity. More efficient use of storage leads to a more efficient energy system with less electricity needing to be generated.

The number of columns and rows of the corresponding optimisation problem instance is independent of the hydrogen import price since only the scalar price parameters change. That said, clustering hydropower systems substantially reduces the number of columns and rows as fewer individual plants require fewer columns and fewer constraints imply fewer rows.

In terms of computational efforts, the scenarios with CLEQ hydropower system models run considerably faster with up to 90% reductions in solution time than the scenarios with EQ hydropower system models, which is also confirmed by the obtained machine-independent CPLEX® tick metric. When considering the different import prices, there are notable differences between the model runs but there is no clear visible trend.

5.2 Climate-neutral energy system for Europe

The case study setup investigates two hydropower modelling approaches combined with three hydrogen import price scenarios. Since SCOPE SD captures both investment and operation decisions of several technologies and technology combinations across all sectors in an endogenous manner, the observed effects result from different investment decisions in the system configuration. These investment decisions affect renewable and thermal power generation, electricity and thermal storage, direct resistive heating, heat pumps, boilers, CHP units, electrolysers, and the operational decisions for every technology (combination) in the electricity, building, industry, and transport sectors. As a result, total energy and electricity consumption change depending on the hydrogen import price scenario and the hydropower modelling approach. Recall that all variants adopt a climate-neutral assumption for all model runs, implying that carbon dioxide emissions are zero from a net position perspective.

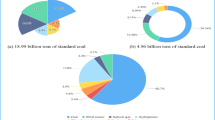

Given the case study setup, a key question is the origin of hydrogen or derived renewable fuels in the modelled market areas, i.e. the trade-off between importing green hydrogen from outside Europe and producing green hydrogen with domestic electrolysers. Figure 6a shows the annual hydrogen production and import balance for the considered energy system in Europe. For each scenario, the absolute figures in TWh\(_\text {th}\)/yr are given in Fig. 6a, while Fig. 6b indicates the absolute and relative changes. Note that the LowEQ scenario is considered as the reference scenario, which all other scenarios are compared against.

The results exhibit that the total amount of hydrogen used is highest when the import price is low, and vice versa, see Fig. 6a. Total import volumes of renewable fuels reduce with higher prices for imports. By contrast, the amount of hydrogen produced from domestic electrolyser operation in Europe increases as higher procurement prices on global markets render imports less attractive. As seen from the regional groups of market areas, this affects all regions of Europe but is most pronounced in the countries with access to good solar resources (see Fig. 6b). Moreover, the choice between clustered and non-clustered modelling of equivalent hydropower systems in Europe has little impact on the results, both in absolute and relative terms.

To substantiate the impacts on the European electricity system and markets, Fig. 7 shows the optimised (net) electricity generation balances in Europe. Again, for each scenario, the absolute figures in TWh\(_\text {el}\)/yr are given in Fig. 7a, while Fig. 7b indicates the absolute and relative changes in the various scenarios compared to LowEQ.

First, it can be seen that the amount of electricity produced in Europe increases when the price of importing renewable gaseous and liquid fuels is higher, see Fig. 7a. The main reason is that increased domestic hydrogen production via electrolyser capacities leads to increased demand for electricity. As expected for a climate-neutral setting, the electricity production primarily comes from renewable sources, including on- and offshore wind, solar PV, and hydropower. Furthermore, the figure shows that the increased expansion of renewable generation in the scenarios with higher import prices primarily affects solar PV installations since there are fewer technology potential and site restrictions for solar PV than for on- and offshore wind. Since there is no endogenous expansion of hydropower systems and due to the limitation of existing natural inflow volumes, an increase in electricity production from hydropower is only possible to a limited extent by better utilisation of storage capacities.

Thermal power plants only play a minor role in the cost-optimised integrated energy system. The endogenous thermal capacity expansions are, to a large extent, new CHP units for district heating and industrial applications. These thermal power plants are mainly required to maintain firm capacity during a few hours of the year when all other flexibility options are exhausted. Recall that due to the requirements of climate neutrality, all OCGT and CCGT units, as well as their CHP versions, are fired by green hydrogen. As a result, they are used even less when the import price for green hydrogen is relatively high (see Fig. 7b). The electricity produced from remaining nuclear power plants in Europe is assumed to be CO\(_\text {2}\)-neutral.

When comparing the modelling approaches for pan-European hydropower assets, the choice of EQ or CLEQ has small impacts on the results.

Besides the European electricity generation balance, it is also worth looking into the capacity expansion decisions for each scenario in Fig. 8. Again, for each scenario, the absolute figures in GW\(_\text {el}\) are given in Fig. 8a, while Fig. 8b indicates the absolute and relative changes in the various scenarios compared to LowEQ.

While the obtained capacity expansion results generally correspond to the electricity production figures from Fig. 7, there are some noteworthy aspects. For higher import prices, the most significant changes in installed capacity correspond to solar PV installations, while on- and offshore wind exhibit smaller build-outs in comparison. The remaining thermal generation stack shows a heterogeneous picture. While CCGT and industry CHP units exhibit reduced electricity outputs for high import prices in Fig. 7b, these reductions do not translate into decreased capacity deployments in Fig. 8b. The main reasons for this are that the underlying multivalent flexible CHP systems, see e.g. [29], are still essential to supply the heating demands and that the CCGT units remain competitive in some market areas to provide firm capacity. By contrast, OCGT units show only limited reductions in electricity output for high import prices but substantial relative changes in Fig. 8b. Similar to the previous observations, the choice of hydropower modelling approach has only marginal effects on the capacity expansion decisions.

5.3 Impacts on pan-European hydropower assets

The analysis focuses on several aspects to better understand the impacts of both the import price scenarios and the hydropower modelling approaches on pan-European hydropower assets. First, it illustrates the country-specific annual hydropower production and consumption balances. Second, a comparison of electricity consumption from hydropower pump units with battery storage and electrolyser units substantiates the role of flexibility provided by hydropower. Third, the analysis shows the obtained storage level trajectories and their changes throughout the modelled planning horizon. Finally, an analysis of aggregated water value trajectories throughout the considered year shows how the scenario variants impact the attractiveness of flexibility provided by pan-European hydropower assets.

Figure 9 shows the annual hydropower generation and consumption for the market areas across Europe that feature relevant hydropower systems and generation capacity.

Recalling the results from Fig. 7, the overall (net) hydropower production is stable across all considered scenarios, which the country-specific results in the figure above confirm. In market areas with substantial hydropower pumping capacity, i.e. Austria, Switzerland, Spain, Italy, and France, hydropower pumps’ electricity consumption decreases with increasing hydrogen import prices, thereby slightly increasing the net generation from hydropower. Only Portugal shows a slight decrease in net production due to increased pumping. Comparing the EQ with CLEQ modelling approaches, the results show that the stronger aggregation of the CLEQ can lead to more pronounced effects introduced by the hydrogen import prices.

To further investigate the role of hydropower pumping, Fig. 10 compares the annual electricity consumption from hydropower pump units with the consumption of battery storage and electrolyser units for those market areas across Europe that feature relevant hydropower systems and pump capacity.

When comparing hydropower pump units to flexible battery storage and electrolyser units, the results expose the dominant role of electrolysers in the resulting system configurations. With higher import prices for renewable fuels, there is a larger need and business case for domestic electrolysers producing hydrogen from local low-carbon electricity (recall Sect. 5.2). While the model cannot invest in additional but instead use the available hydropower pump capacity, hydropower pumps compete with flexible electrolysers and more efficient battery storage systems. In almost all market areas, annual pumping volumes decrease or remain at similar levels compared to the low import price scenarios. Pumping losses are avoided with the combined availability of electrolyser flexibility and high hydrogen demand in the system.

Figure 11 shows the optimised storage level trajectories for those market areas across Europe that feature relevant hydropower systems and generation capacity. Figure 12 contains the respective change in these storage level trajectories with respect to LowEQ. Note that the storage level trajectories are aggregate figures derived from the individual hydropower system model instances resulting from the EQ and CLEQ approaches and that the weekly means are derived from hourly dispatch decisions.

First, the resulting storage trajectories reflect the country-specific nature of the different (multireservoir) hydropower system stacks, i.e. the heterogeneous storage level trajectory throughout the considered planning horizon of a full year in hourly resolution and the active equivalent storage capacity. Norway and Sweden have by far the largest total equivalent storage capacity, followed by Spain, Italy, Switzerland, and France (recall Table 1). While many trajectories show the impact of a strong inflow period in the spring season, the storage operation depends on the composition of their national energy systems and their cross-border exchange possibilities. Second, for the most part, the influence of renewable fuel import prices and the aggregated modelling approach is limited. In countries with substantial conventional hydropower storage systems, e.g. Sweden and Spain, higher hydrogen import prices cause higher filling levels in the summer to the winter season (see Fig. 12). In countries with high relative shares of (pure) pumped-hydro storage systems, e.g. Germany and Great Britain, aggregate storage trajectories are more volatile and, therefore, more exposed to higher fuel prices and implied opportunity costs. The CLEQ approach correlates well with the EQ approach. However, more significant deviations between the two modelling approaches are visible for Spain, Italy, and Germany.

Figure 13 shows the observed water value trajectories inferred from the dual variable information of the storage continuity constraints. The water value trajectories are aggregate figures derived from the individual hydropower system model instances resulting from the EQ and CLEQ approaches. Moreover, the water value information is shown in weekly mean average figures for better readability and comparability.

In contrast to the storage level trajectories, the water value trajectories show larger differences among the considered renewable fuel import price scenarios and the aggregated modelling approaches. Except for Romania, higher import prices generally translate into higher water values. While hydropower storage reservoirs in the Nordics exhibit the lowest values in comparison, market areas in continental Europe feature the highest market-clearing prices, which also propagate through their hydropower storage reservoirs. Moreover, large reservoir volumes in the Nordics show different value levels for the import price scenario variants. However, they exhibit only limited time-dependent variations throughout the year, especially for the more aggregated CLEQ modelling approach. Market areas in continental Europe show more exposure to electricity prices in their water value trajectories. The modelling results show a drop in water values following the spring inflow season, which climb back to higher values during storage depletion in the remainder of the year.

As seen from the solid and dashed lines, the water value differences indicate a drawback of the CLEQ modelling approach. The more aggregated CLEQ modelling approach relaxes some of the local and temporal operational constraints of the EQ approach, allowing for better allocation and use of resources and storage capacities. However, while the CLEQ approach sometimes fails to match the EQ water value trajectories, the CLEQ approach still shows similar trends and differences between the investigated import price scenarios.

5.4 Summary and discussion of the results

The case study analysis and its results explore the impacts of different renewable fuel import prices and two aggregated modelling approaches on multireservoir hydropower systems across Europe in a climate-neutral scenario setting. The observed effects offer several insights, which are summarised below.

First, there are large computational savings of up to 90% with only limited effects on modelling accuracy (about 0.2% of the objective value) when using a clustered-equivalent (CLEQ) modelling approach for European hydropower systems. Second, the import prices for green hydrogen and renewable fuels have a notable impact on European electricity generation capacities (+ 595 GW\(_\text {el}\)) and electricity generation volumes (+ 650 TWh\(_\text {el}\)/yr). Third, with domestic electrolyser production ranging from 458 to 854 TWh\(_\text {th}\)/yr and hydrogen import volumes ranging from 939 to 289 TWh\(_\text {th}\)/yr, import prices for renewable gaseous and liquid fuels are sensitive parameters with a strong impact on the design and operation of an integrated European energy system in the future. Fourth, the results focusing on hydropower suggest only minor impacts on future storage level trajectories. In contrast, the resulting water values are subject to larger variations caused by both the import price scenario and the modelling approach. For instance, the largest aggregated hydropower storage capacity located in Norway exhibits an increase of 33% in its average water value. In other words, a higher import price for green hydrogen, acting as an opportunity cost in the system, typically increases the water value throughout the considered year. The water values are also more sensitive to the less aggregated modelling approaches as they can better represent the local constraints for using the hydro resources and the flexibility offered to the markets. As a last insight, hydropower aggregation impacts are more prominent than import price variations for some market areas, indicating improvement potential for the modelling approach, e.g. with an increased number of clustered systems per market area.

The SCOPE SD framework makes simplifying assumptions to be able to take a holistic perspective of integrated energy systems. As already outlined in [28], SCOPE SD is always based on specific assumptions regarding the representation of technologies, markets, and policies. Furthermore, all actors in the different sectors behave under perfect competition with total transparency, perfect market efficiency, and rational behaviour, whereas market power exertion effects are not part of the SCOPE SD framework. Concerning the participants in the various sectors, it should be mentioned that SCOPE SD does not address sequential and strategic decisions that market equilibrium models typically capture. Moreover, for computational tractability, the model does not account for market splitting procedures implemented in some market areas, e.g. Norway or Italy, which impact on the obtained results for individual market areas.

Furthermore, there are several uncertainties in determining renewable fuel import prices. Recalling Sect. 4.2, these include but are not limited to the site conditions, exporting countries, or transport options influencing future fuel (export) prices. Moreover, the SCOPE SD framework considers the import of renewable fuels from a market perspective, i.e. without any restrictions in the hydrogen transmission network and storage infrastructure in Europe. Explicitly modelling hydrogen infrastructure and storage potentially impacts (seasonal) hydropower operations across Europe as hydrogen storage assets could act as competitors of hydropower systems in Europe. A first step in this direction could be to couple SCOPE SD to the IMAGINE modelling framework for hydrogen and methane gas markets and infrastructure [47].

Another limitation is that the hydropower modelling comparison needs to look at the detailed model. However, the previous results in [4] indicate that equivalent model formulations can be used to approximate the effects at an acceptable level while still incorporating the multi-fold interactions in an integrated energy system.

6 Conclusion

The presented analysis uses the pan-European cross-sectoral capacity expansion planning framework SCOPE SD to gain insights into Europe’s future climate-neutral energy system with a particular focus on hydropower. It substantiates the relationship between three green hydrogen and renewable fuel import price scenarios and two aggregated modelling approaches for multireservoir hydropower systems across Europe. The results demonstrate that import prices for green hydrogen significantly impact the sector-wide demand for hydrogen, domestic hydrogen production, hydrogen import volumes, European electricity generation capacities and production volumes, and water values of European hydropower assets. Moreover, the results show considerable computational savings with limited effects on modelling accuracy, rendering the clustered-equivalent approach a fair and efficient trade-off for future analyses at the European level.

On a general note, the obtained results expose strong influences by multi-fuel flexibility and the interactions that are endogenous decisions in the integrated energy system model. For short- to long-term hydropower planning frameworks developed as power-sector-focused tools, it is important to incorporate those effects as they will influence the observed clearing prices and operational decisions in the modelling frameworks.

Data availability

The case study result data for the European energy system are available in the open-access repository “Zenodo” at https://doi.org/10.5281/zenodo.7692180.

References

European Commission: A European Green Deal—Striving to be the first climate-neutral continent (2021). https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

European Commission: Energy and the Green Deal (2021). https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/energy-and-green-deal_en

Böttger, D., Härtel, P.: On wholesale electricity prices and market values in a carbon-neutral energy system. Energy Econ. 106, 105709 (2022). https://doi.org/10.1016/j.eneco.2021.105709

Härtel, P., Korpås, M.: Aggregation Methods for Modelling Hydropower and Its Implications for a Highly Decarbonised Energy System in Europe. Energies 10(11), 1841 (2017). https://doi.org/10.3390/en10111841

Härtel, P.: Offshore Grids in Low-Carbon Energy Systems: Long-Term Transmission Expansion Planning in Energy Systems with Cross-Sectoral Integration using Decomposition Algorithms and Aggregation Methods for Large-Scale Optimisation Problems. PhD thesis, University of Kassel (2021). https://publica.fraunhofer.de/handle/publica/283522

Arvanitidits, N.V., Rosing, J.: Composite Representation of a Multireservoir Hydroelectric Power System. IEEE Trans. Power Appar. Syst. PAS–89(2), 319–326 (1970). https://doi.org/10.1109/TPAS.1970.292595

Blom, E., Söder, L., Risberg, D.: Performance of multi-scenario equivalent hydropower models. Electr. Power Syst. Res. 187, 106486 (2020). https://doi.org/10.1016/j.epsr.2020.106486

Blom, E., Söder, L.: Computation of Multi-Scenario Hydropower Equivalents Using Particle Swarm Optimization. In: 2020 IEEE International Conference on Environment and Electrical Engineering and 2020 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I &CPS Europe), pp. 1–6 (2020). https://doi.org/10.1109/EEEIC/ICPSEurope49358.2020.9160649

Gallego-Castillo, C., Victoria, M.: Improving Energy Transition Analysis Tool through Hydropower Statistical Modelling. Energies 14(1), 98 (2021). https://doi.org/10.3390/en14010098

Blom, E., Söder, L.: Accurate model reduction of large hydropower systems with associated adaptive inflow. Renew. Energy 200, 1059–1067 (2022). https://doi.org/10.1016/j.renene.2022.09.060

Blom, E., Söder, L.: Comparison of Different Computational Methods and Formulations for Hydropower Equivalents. In: 2022 IEEE 7th International Energy Conference (ENERGYCON), pp. 1–6 (2022). https://doi.org/10.1109/ENERGYCON53164.2022.9830320

Schlott, M., Kies, A., Brown, T., Schramm, S., Greiner, M.: The impact of climate change on a cost-optimal highly renewable European electricity network. Appl. Energy 230, 1645–1659 (2018). https://doi.org/10.1016/j.apenergy.2018.09.084

Gøtske, E.K., Victoria, M.: Future operation of hydropower in Europe under high renewable penetration and climate change. iScience 24(9), 102999 (2021). https://doi.org/10.1016/j.isci.2021.102999

Wasti, A., Ray, P., Wi, S., Folch, C., Ubierna, M., Karki, P.: Climate change and the hydropower sector: A global review. WIREs Clim. Change (2022). https://doi.org/10.1002/wcc.757

Seck, G.S., Hache, E., Sabathier, J., Guedes, F., Reigstad, G.A., Straus, J., Wolfgang, O., Ouassou, J.A., Askeland, M., Hjorth, I., Skjelbred, H.I., Andersson, L.E., Douguet, S., Villavicencio, M., Trüby, J., Brauer, J., Cabot, C.: Hydrogen and the decarbonization of the energy system in Europe in 2050: A detailed model-based analysis. Renew. Sustain. Energy Rev. 167, 112779 (2022). https://doi.org/10.1016/j.rser.2022.112779

Caglayan, D.G., Heinrichs, H.U., Robinius, M., Stolten, D.: Robust design of a future 100% renewable European energy supply system with hydrogen infrastructure. Int. J. Hydrogen Energy 46(57), 29376–29390 (2021). https://doi.org/10.1016/j.ijhydene.2020.12.197

Sasanpour, S., Cao, K.-K., Gils, H.C., Jochem, P.: Strategic policy targets and the contribution of hydrogen in a 100% renewable European power system. Energy Rep. 7, 4595–4608 (2021). https://doi.org/10.1016/j.egyr.2021.07.005

Öberg, S., Odenberger, M., Johnsson, F.: The cost dynamics of hydrogen supply in future energy systems—A techno-economic study. Appl. Energy 328, 120233 (2022). https://doi.org/10.1016/j.apenergy.2022.120233

Frischmuth, F., Härtel, P.: Hydrogen sourcing strategies and cross-sectoral flexibility trade-offs in net-neutral energy scenarios for Europe. Energy 238, 121598 (2022). https://doi.org/10.1016/j.energy.2021.121598

Peterssen, F., Schlemminger, M., Lohr, C., Niepelt, R., Bensmann, A., Hanke-Rauschenbach, R., Brendel, R.: Hydrogen supply scenarios for a climate neutral energy system in Germany. Int. J. Hydrogen Energy 47(28), 13515–13523 (2022). https://doi.org/10.1016/j.ijhydene.2022.02.098

Espegren, K., Damman, S., Pisciella, P., Graabak, I., Tomasgard, A.: The role of hydrogen in the transition from a petroleum economy to a low-carbon society. Int. J. Hydrogen Energy 46(45), 23125–23138 (2021). https://doi.org/10.1016/j.ijhydene.2021.04.143

Lux, B., Deac, G., Kiefer, C.P., Kleinschmitt, C., Bernath, C., Franke, K., Pfluger, B., Willemsen, S., Sensfuß, F.: The role of hydrogen in a greenhouse gas-neutral energy supply system in Germany. Energy Convers. Manage. 270, 116188 (2022). https://doi.org/10.1016/j.enconman.2022.116188

Tarnay, D.: Hydrogen production at hydro-power plants. Int. J. Hydrogen Energy 10(9), 577–584 (1985). https://doi.org/10.1016/0360-3199(85)90032-1

Jovan, D.J., Dolanc, G., Pregelj, B.: Cogeneration of green hydrogen in a cascade hydropower plant. Energy Convers. Manag. X 10, 100081 (2021). https://doi.org/10.1016/j.ecmx.2021.100081

Zhou, A., Zhou, W., Manandhar, P.: A Study on the Prospect of Hydropower to Hydrogen in Nepal. Asian Dev. Bank (2020). https://doi.org/10.22617/WPS200218-2

Kakoulaki, G., Kougias, I., Taylor, N., Dolci, F., Moya, J., Jäger-Waldau, A.: Green Hydrogen in Europe—A regional assessment: Substituting existing production with electrolysis powered by renewables. Energy Convers. Manage. 228, 113649 (2021). https://doi.org/10.1016/j.enconman.2020.113649

Böttger, D., Jentsch, M., Trost, T., Gerhardt, N., von Bonin, M., Eschmann, J.: Cost-Optimal Market Share of Electric Mobility Within the Energy System in a Decarbonisation Scenario. In: 2018 15th International Conference on the European Energy Market (EEM), pp. 1–5 (2018). https://doi.org/10.1109/EEM.2018.8469846

Härtel, P., Ghosh, D.: Modelling Heat Pump Systems in Low-Carbon Energy Systems With Significant Cross-Sectoral Integration. IEEE Trans. Power Syst. 37(4), 3259–3273 (2020). https://doi.org/10.1109/TPWRS.2020.3023474

Härtel, P., Korpås, M.: Demystifying market clearing and price-setting effects in low-carbon energy systems. Energy Econ. 93, 105051 (2021). https://doi.org/10.1016/j.eneco.2020.105051

Dee, D.P., Uppala, S.M., Simmons, A.J., Berrisford, P., Poli, P., Kobayashi, S., Andrae, U., Balmaseda, M.A., Balsamo, G., Bauer, P., Bechtold, P., Beljaars, A.C.M., van de Berg, L., Bidlot, J., Bormann, N., Delsol, C., Dragani, R., Fuentes, M., Geer, A.J., Haimberger, L., Healy, S.B., Hersbach, H., Hólm, E.V., Isaksen, L., Kållberg, P., Köhler, M., Matricardi, M., McNally, A.P., Monge-Sanz, B.M., Morcrette, J.-J., Park, B.-K., Peubey, C., de Rosnay, P., Tavolato, C., Thépaut, J.-N., Vitart, F.: The ERA-Interim reanalysis: configuration and performance of the data assimilation system. Q. J. R. Meteorol. Soc. 137(656), 553–597 (2011). https://doi.org/10.1002/qj.828

ECMWF: ERA Interim, Daily, Reading, United Kingdom (2015). https://confluence.ecmwf.int/display/DAC/Decommissioning+of+ECMWF+Public+Datasets+Service

Turgeon, A.: Optimal operation of multireservoir power systems with stochastic inflows. Water Resour. Res. 16(2), 275–283 (1980). https://doi.org/10.1029/WR016i002p00275

ENTSO-E and ENTSOG: TYNDP 2022 Scenario Building Guidelines (2021). https://www.entsog.eu/sites/default/files/2021-10/entsos_TYNDP_2022_Scenario_Building_Guidelines_211007_1.pdf

ENTSO-E and ENTSOG: TYNDP 2020 Scenario Report (2020). https://2020.entsos-tyndp-scenarios.eu/

Statnett: Langsiktig markedsanalyse—Norden og Europa 2020-2050 (2020). https://www.statnett.no/globalassets/for-aktorer-i-kraftsystemet/planer-og-analyser/lma/langsiktig-markedsanalyse-norden-og-europa-2020-50_revidert.pdf

European Commission: EU Reference Scenario 2016—Energy, transport and GHG emissions: trends to 2050 (2016). https://op.europa.eu/en/publication-detail/-/publication/aed45f8e-63e3-47fb-9440-a0a14370f243

ENTSO-E: TYNDP 2018 Scenario Report (2018). https://tyndp.entsoe.eu/tyndp2018/scenario-report/

S&P Global Market Intelligence: World Electric Power Plants Database (2016). https://www.spglobal.com/marketintelligence/en/campaigns/energy

NVE: Langsiktig kraftmarkedsanalyse 2020–2040 (2020). https://www.nve.no/energi/analyser-og-statistikk/langsiktig-kraftmarkedsanalyse/

European Environment Agency: CORINE Land Cover (2018). https://www.eea.europa.eu/publications/COR0-landcover

Energinet, Fingrid, Statnett, Svenska Kraftnät: Nordic Grid Development Perspective 2021 (2021). https://www.statnett.no/globalassets/for-aktorer-i-kraftsystemet/planer-og-analyser/nordic-grid-development-perspective-2021.pdf

ENTSO-E: Transparency Platform (2019). https://transparency.entsoe.eu/

Fraunhofer IEE: Global PtX Atlas (2021). https://maps.iee.fraunhofer.de/ptx-atlas/

Pfennig, M., Böttger, D., Häckner, B., Geiger, D., Zink, C., Bisevic, A., Jansen, L.: Global GIS-based potential analysis and cost assessment of Power-to-X fuels in 2050. Appl. Energy (2022). https://doi.org/10.48550/arXiv.2208.14887

Schmitz, R., Naversen, C.Ø., Härtel, P.: Case study result data set for Energy Systems (submitted) article: “Influence of hydrogen import prices on hydropower systems in climate-neutral Europe”. Zenodo (2023). https://doi.org/10.5281/zenodo.7692180

openENTRANCE H2020 project: Open Modelling Platform (2023). https://openentrance.eu/open-modelling-platform/open-modelling-platform-read-more/

Frischmuth, F., Schmitz, R., Härtel, P.: IMAGINE—Market-based multi-period planning of European hydrogen and natural gas infrastructure. In: 2022 18th International Conference on the European Energy Market (EEM), pp. 1–11 (2022). https://doi.org/10.1109/EEM54602.2022.9921154

Acknowledgements

The presented work has been performed as part of the project “HydroConnect—Impacts of connecting Norwegian hydropower to continental Europe and the UK”, which partly receives funding from The Research Council of Norway under funding reference number 320794. We thank the staff of Fraunhofer CINES for sharing their thoughts on future import prices of green hydrogen and renewable fuels.

Funding

Open Access funding enabled and organized by Projekt DEAL. The authors have no relevant financial or non-financial interests to disclose. All authors certify that they have no affiliations with or involvement in any organisation or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript. The authors have no financial or proprietary interests in any material discussed in this article.

Author information

Authors and Affiliations

Contributions

RS: Project administration, Conceptualisation, Data curation, Methodology, Formal analysis, Software, Validation, Visualisation, Writing—original draft, Writing—review and editing; CØN: Funding acquisition, Data curation, Writing—review and editing; PH: Funding acquisition, Conceptualisation, Data curation, Methodology, Formal analysis, Software, Validation, Visualisation, Writing—original draft, Writing—review and editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Model formulation of SCOPE SD

Appendix A: Model formulation of SCOPE SD

Based on the model formulation in [19], the following sections provide a concise nomenclature and formulation of the modelling and optimisation framework SCOPE SD.

1.1 Sets and indices

The sets and indices of SCOPE SD are defined as follows:

- \(t\in T\)::

-

Index and set of time periods,

- \(i\in I\)::

-

Index and set of nodes (countries),

- \(j\in J\)i::

-

Index and set of nodes connected to node i,

- \(m\in M^\text {EL}\)::

-

Index and set of electricity markets,

- \(m\in M^\text {HEAT}\)::

-

Index and set of heat markets,

- \(m\in M^\text {COOL}\)::

-

Index and set of cooling markets,

- \(m\in M^\text {FUEL}\)::

-

Index and set of fuel markets (e.g. hydrogen),

- \(m\in M^\text {ROAD}\)::

-

Index and set of road transport markets,

- \(m\in M^\text {GHG}\)::

-

Index and set of GHG emission markets,

- \(g\in G\)::

-

Index and set of conventional generation units,

- \(g\in G^\text {CHP}\)::

-

Index and set of CHP system units \(\left( G^\text {CHP} \subseteq G\right)\),

- \(r\in R\)::

-

Index and set of (variable) renewable generation units,

- \(u\in U\)::

-

Index and set of (equivalent) hydropower system units,

- \(a\in A\)::

-

Index and set of stationary (battery) storage system units,

- \(h\in H\)::

-

Index and set of heat pump system units,

- \(b\in B\)::

-

Index and set of (hybrid) boiler system units,

- \(v\in V\)::

-

Index and set of electric vehicle units,

- \(o\in O\)::

-

Index and set of cooling system units,

- \(l\in L\)::

-

Index and set of power-to-fuel (e.g. hydrogen, liquid) units,

- \(\gamma \in \Gamma\)::

-

Index and set of power producing units, i.e. \(\Gamma = G \cup R \cup U \cup A\),

- \(\theta \in \Theta\)::

-

Index and set of power consuming units i.e. \(\Theta = G^\text {CHP} \cup H \cup U \cup A \cup B \cup V \cup O \cup L\),

- \((\cdot )_i\)::

-

Index and subset of \((\cdot )\) belonging to node i (e.g. \(G_i, \Gamma _i, \Theta _i\)),

- \((\cdot )_m\)::

-

Index and subset of \((\cdot )\) belonging to market m (e.g. \(H_m, \Gamma _m, \Theta _m\)).

1.2 Decision variables

The continuous non-negative decision variables of SCOPE SD are defined as follows:

- \(x^\text {GEN}_{(\cdot ),t}\)::

-

Power generation for unit \((\cdot )\) (e.g. g) and time period t (MW\(_\text {el}\)),

- \(\overline{x}^\text {GEN}_{(\cdot )}\)::

-

Power generation capacity for unit \((\cdot )\) (e.g. g) (MW\(_\text {el}\)),

- \(x^\text {CON}_{(\cdot ),t}\)::

-

Power consumption for unit \((\cdot )\) (e.g. h) and time period t (MW\(_\text {el}\)),

- \(\overline{x}^\text {CON}_{(\cdot )}\)::

-

Power consumption capacity for unit \((\cdot )\) (e.g. h) (MW\(_\text {el}\)),

- \(x^{\text {LC}+/-}_{(\cdot ),t}\)::

-

Positive/negative load change for unit \((\cdot )\) (e.g. g) and time period t (MW\(_\text {el}\)),

- \(x^\text {CU}_{r,t}\)::

-

Power curtailment for renewable generation unit r and time period t (MW\(_\text {el}\)),

- \(x^\text {GEN,T}_{u,t}\)::

-

Turbine generation for unit u and time period t (MW\(_\text {el}\)),

- \(x^\text {GEN,PT}_{u,t}\)::

-

Pumped-turbine generation for unit u and time period t (MW\(_\text {el}\)),

- \(x^\text {S}_{u,t}\)::

-

Conventional reservoir storage level for unit u and time period t (MWh\(_\text {el}\)),

- \(x^\text {S,P}_{u,t}\)::

-

Pumped reservoir storage level for unit u and time period t (MWh\(_\text {el}\)),

- \(x^\text {SP}_{u,t}\)::

-

Conventional reservoir spillage for unit u and time period t (MW\(_\text {el}\)),

- \(x^\text {SP,P}_{u,t}\)::

-

Pumped reservoir spillage for unit u and time period t (MW\(_\text {el}\)),

- \(x^{\text {CON,HP}}_{h,t}\)::

-

Heat pump power consumption for heat pump system unit h and time period t (MW\(_\text {el}\)),

- \(x^{\text {CON,BU}}_{h,t}\)::

-

Backup power consumption for heat pump system unit h and time period t (MW\(_\text {el}\)),

- \(x^\text {S}_{a,t}\)::

-

Electricity storage level for unit a and time period t (MWh\(_\text {el}\)),

- \(x^\text {IN}_{a,t}\)::

-

Electricity storage input for unit a and time period t (MW\(_\text {el}\)),

- \(x^\text {OUT}_{a,t}\)::

-

Electricity storage output for unit a and time period t (MW\(_\text {el}\)),

- \(y_{l,t}^{\text {GEN}}\)::

-

Fuel generation for unit l and time period t (MW\(_\text {th}\)),

- \(y_{l,t}^{\text {CON}}\)::

-

Fuel consumption for unit l and time period t (MW\(_\text {th}\)),

- \(y^\text {CON}_{(\cdot ),t}\)::

-

(Total) fuel consumption for unit \((\cdot )\) (e.g. g) and time period t (MW\(_\text {th}\)),

- \(y^\text {CB}_{(\cdot ),t}\)::

-

Condensing boiler fuel consumption for unit g, b and time period t (MW\(_\text {th}),\)

- \(\phi _{(\cdot )}\)::

-

Market share for unit \((\cdot )\) (e.g. h) (1),

- \(q^\text {CHP}_{g,t}\)::

-

CHP heat generation for unit g and time period t (MW\(_\text {th}\)),

- \(q^\text {S}_{(\cdot ),t}\)::

-

Thermal storage level for unit g, o and time period t (MWh\(_\text {th}\)),

- \(q^\text {IN}_{(\cdot ),t}\)::

-

Thermal storage input for unit g, o and time period t (MW\(_\text {th}\)),

- \(q^\text {OUT}_{(\cdot ),t}\)::

-

Thermal storage output for unit g, o and time period t (MW\(_\text {th}\)),

- \(y_{m}^{\text {FI}}\)::

-

Fossil fuel procurement/import for fuel market m (MWh\(_\text {th}\)),

- \(y_{m}^{\text {RI}}\)::

-

Renewable fuel procurement/import for fuel market m (MWh\(_\text {th}\)),

- \(z_{v,t}^{\text {ICE}}\)::

-

Distance driven by internal combustion engine of vehicle unit v (km/h),

- \(z_{v,t}^{\text {EL}}\)::

-

Distance driven by electric drive of vehicle unit v (km/h).

1.3 Parameters

The input parameters of SCOPE SD are defined as follows:

- \(AV_{(\cdot ),t}\)::

-

Availability for unit \((\cdot )\) and time period t (% of installed capacity),

- \(C_{(\cdot )}^\text {INV}\)::

-

Investment (annuitised) and fixed operation cost for unit \((\cdot )\) (EUR/MW\(_\text {el/th}/a\)),

- \(C_{(\cdot )}^\text {VP}\)::

-

Variable production cost for unit \((\cdot )\) (EUR/MWh\(_\text {el}\)),

- \(C_{(\cdot )}^\text {LC}\)::

-

Load change cost for unit \((\cdot )\) (EUR/MW\(_\text {el}\)),

- \(C_{r}^\text {CU}\)::

-

Curtailment cost for unit r (EUR/MWh\(_\text {el}\)),

- \(C_{(\cdot )}^\text {CB}\)::

-

Variable boiler production cost for unit b, g, h (EUR/MWh\(_\text {th}\)),

- \(C_{v}^\text {ICE}\)::

-

Variable internal combustion engine cost for vehicle unit v (EUR/MWh\(_\text {th}),\)

- \(COP_{h,t}\)::

-

Coefficient of performance for heat pump unit h and time period t (e.g. MWh\(_\text {th}\)/MWh\(_\text {el}\)),

- \(D_{m,t}\)::

-

Demand for market type m and time period t (e.g. MWh\(_\text {el}\)/h, MWh\(_\text {th}\)/h),

- \(EC_{v}\)::

-

Distance-specific electricity consumption of vehicle unit v (MWh\(_\text {el}\)/km),

- \(E_{(\cdot )}\)::

-

Fuel-specific GHG emission factor of unit \((\cdot )\) (kgCO\(_\text {2}\)-eq./MWh\(_\text {th}\)),

- \(\overline{E}_{m}\)::

-

Emission budget of GHG emission market m (kgCO\(_\text {2}\)-eq./a),

- \(FC_{v}\)::

-

Distance-specific fuel consumption of vehicle unit v (MWh\(_\text {th}\)/km),

- \(FS_{v}\)::

-

Flexible charging share for vehicle unit v (1),

- \(NV_m\)::

-

Market size of road market segment \(m\in M^\text {ROAD}\) (No. of vehicles),

- \(PF_{l}\)::

-

Power-to-fuel conversion factor for unit l (MWh\(_\text {th}\)/MWh\(_\text {el}\)),

- \(PH_{g}\)::

-

Power-to-heat ratio (backpressure limit) factor for unit \(g \in G^\text {CHP}\) (MWh\(_\text {el}\)/MWh\(_\text {th}\)),

- \(PL_{g}\)::

-

Power loss factor for unit \(g \in G^\text {CHP}\) (MWh\(_\text {el}\)/MWh\(_\text {th}\)),

- \(ST_{(\cdot ),t}\)::

-

Solar thermal contribution factor of unit \((\cdot )\) (1),

- \(TL_{i,j}\)::

-

Linear power transmission loss factor for power exchange between nodes i and j (1),

- \(\underline{X}^\text {GEN}_{(\cdot ),t}\)::

-

Min. power generation limit for unit \((\cdot )\) (e.g. g) and time period t (MW\(_\text {el}\)),

- \(\underline{X}^\text {CON}_{(\cdot ),t}\)::

-

Min. power consumption limit for unit \((\cdot )\) (e.g. h) and time period t (MW\(_\text {el}\)),

- \(\overline{X}^\text {GEN}_{(\cdot )}\)::

-

Power generation capacity potential for unit \((\cdot )\) (e.g. g) (MW\(_\text {el}\)),

- \(\overline{X}^\text {CON}_{(\cdot )}\)::

-

Power consumption capacity potential for unit \((\cdot )\) (e.g. h) (MW\(_\text {el}\)),

- \(X^\text {N}_{u,t}\)::

-

Equivalent natural energy inflow into main reservoir for unit u and time period t (MW\(_\text {el}\)),

- \(X^\text {N,P}_{u,t}\)::

-

Equivalent natural energy inflow into pumped reservoir for unit u and time period t (MW\(_\text {el}\)),

- \(\overline{X}^\text {GEN,T}_{u,t}\)::

-

Max. turbine generation for unit u and time period t (MW\(_\text {el}\)),

- \(\overline{X}^\text {GEN,PT}_{u,t}\)::

-

Max. pumped-turbine generation for unit u and time period t (MW\(_\text {el}\)),

- \(\overline{X}^{\text {S}}_{u,t}\)::

-

Max. conventional reservoir storage level for unit u and time period t (MWh\(_\text {el}\)),

- \(\overline{X}^{\text {S,P}}_{u,t}\)::

-

Max. pumped reservoir storage level for unit u and time period t (MWh\(_\text {el}),\)

- \(\underline{X}^{\text {S}}_{v,t}\)::

-

Min. state-of-charge profile of vehicle unit v and time period t (MWh\(_\text {el}\)),

- \(\overline{X}^{\text {S}}_{v,t}\)::

-

Max. state-of-charge profile of vehicle unit v and time period t (MWh\(_\text {el}\)),

- \(X_{v,t}^\text {CON,IC}\)::

-

Inflexible (fixed) charging profile of vehicle unit v and time period t (MWh\(_\text {el}\)/h),

- \(\overline{X}_{v,t}^\text {CON,FC}\)::

-

Max. flexible charging profile of vehicle unit v and time period t (MWh\(_\text {el}\)/h),

- \(\overline{Z}^{\text {EL}}_{v,t}\)::

-

Max. distance driven by electric drive of vehicle unit v and time period t (km/h),

- \(\chi _{(\cdot )}\)::

-

Linear heating network transmission loss factor for unit \((\cdot )\) (1),

- \(\lambda _{(\cdot )}^\text {S}\)::

-

Linear thermal or electricity storage loss factor for unit \((\cdot )\) (e.g. g, a) (1),

- \(\Lambda _{(\cdot )}^\text {S}\)::

-

Linear thermal or electricity storage self-discharge factor for unit \((\cdot )\) (e.g. g, a) (1),

- \(\eta ^\text {CON}_{(\cdot )}\)::

-

Condensing boiler efficiency for unit g, b (1),

- \(\eta ^\text {CB}_{(\cdot )}\)::

-

Condensing boiler efficiency for unit g, b, h (1),

- \(\eta ^\text {CH}_{v}\)::

-

Charging efficiency for vehicle unit v (1),

- \(\eta ^\text {CON}_{(\cdot )}\)::

-

Electric heating/cooling efficiency for unit g, b, h, o (MWh\(_\text {th}\)/MWh\(_\text {el}\)),

- \(\eta ^\text {IN}_{(\cdot )}\)::

-

Storage input efficiency for unit \((\cdot )\) (e.g. g, a) (1),

- \(\eta ^\text {OUT}_{(\cdot )}\)::

-

Storage output efficiency for unit \((\cdot )\) (e.g. g, a) (1),

- \(\eta ^\text {P}_u\)::

-

Pump efficiency factor for unit u (1),

- \(\underline{\Phi }_{(\cdot )}\)::

-