Abstract

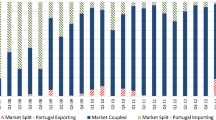

We study the convergence of day-ahead and balancing prices for the Italian power market. The zonal time-series of the prices are evaluated, seasonally adjusted and tested to assess their long-run properties. We focus on the dynamic behavior of the four continental price zones of Italy (North, Central-North, Central-South and South). Using a sample of data that spans the last decade and applying the fractional cointegration methodology, we show the existence of long-run relationships. This signals the existence of convergence between prices in each zone but zone Central-South, where prices are divergent. We also measure the average price difference, and analyse how it evolves over time. Price differences dynamically reduce for all zones except for Central-South. We comment the results and provide an interpretation for the differences across zones. We also discuss policy consequences for both Italian and other markets.

Similar content being viewed by others

Notes

In this paper we refer to the TSO as a general term, regardless of whether it is an Independent System Operator as in the USA or a proper Transmission System Operator as in Europe.

The European Commission [17] defines balancing services as “balancing energy or balancing capacity or both”, where the former is defined as “energy used by TSOs to perform balancing and provided by a balancing service provider” and the latter is “a volume of reserve capacity that a balancing service provider has agreed to hold and in respect to which the balancing service provider has agreed to submit bids for a corresponding volume of balancing energy to the TSO for the duration of the contract”.

From now onward, we shall refer to balancing service providers as power plants, for the sake of simplicity, even though sometimes these services can also be provided by load serving entities.

Please see below Sect. 3.1 for further details about the Italian market.

Note that the Italian dispatching service market does not include the whole set of ancillary services that are provided by power plants. In particular, emergency restoration services such as black start are not exchanged in the market but are regulated through a cost-based mechanism. For this reason, we shall not refer to the prices of the MSD as the ancillary service prices but we prefer to refer to it as the balancing prices. where the Italian TSO (Terna s.p.a.) acquires the following balancing services: FCR—Frequency Controlled Reserves; FRR—Frequency Restoration Reserves and RR—Replacement Reserves. The Italian MSD consists of a sequence of six auctions, each split in two parts, a phase of reserves procurement and a subsequent phase of activation of the reserves. The former is called ex-ante MSD; the latter Balancing Market (MB—Mercato del Bilanciamento in Italian). Note that the Italian terminology is in contrast with the European one, which defines balancing market as “the entirety of institutional, commercial and operational arrangements that establish market-based management of balancing” (see European Commission [17]), and not just the activation phase as for the Italian case. In this paper, we follow the European definition and refer to the whole MSD as the balancing market since that is the marketplace where the whole balancing services are procured.

The TSO states that the purchases of balancing services in the ex-ante MSD is done to relieve internal congestion also. This is due to the specific features of Italian market, which is characterized by relevant transmission capacity limits within zones. This is different from other markets, such as the German one, where congestion management services are remunerated on a regulated basis. It is not possible to assess how much of the services are purchased for congestion management purposes and how much for balancing needs. For this reason, we shall attribute the results of the MSD entirely to balancing services.

There is also a limited production of specific types of eligible RES or Load Serving Entities, called UVAC and UVAM. We do not consider them since they have been introduced only recently and their relevance is negligible at present.

See Cretì and Fontini [13, Ch.11] for introduction and more detailed explanations of balancing markets and the double-settlement systems.

The irregular patterns of MSD data, characterized by missing observations, instability in the seasonal patterns, presence of structural breaks in the mean as well as in the variance do not allow us to analyze the two zones of Sicily and Sardinia. The zones of the two islands Sardinia and Sicily are scarcely interconnected with the continent. Furthermore, their interconnection capacity has been changing throughout the sample period. Markets in the islands have their own peculiarities. In Sardinia there are no gas-fired power plants since there are no natural gas pipelines. This is a sharp difference compared with the rest of Italy, where natural gas fired plants are the majority of thermal power plants. In Sicily, balancing prices have been administratively set under a special regime from 2016 onward, due to the lack of sufficient thermal capacity in the MSD. Due to their peculiarities, we believe that there is no lack of generality from not having these two zones analyzed.

The structure of the \(\hbox {FVECM}_{d,b}\) model is very similar to that of the \(\hbox {FCVAR}_{d,b}\) model,

$$\begin{aligned} \Delta ^d X_t =\xi +\alpha \beta ^\prime \Delta ^{d-b}L_b X_t+\sum _{i=1}^k \Gamma _i \Delta ^d L_b^i X_t +\varepsilon _t \quad \varepsilon _t \sim iid (0,\Omega ), \end{aligned}$$as it only replaces the fractional lag operator, \(L_b^i\), with the standard lag operator, \(L^i\), in the short run dynamics.

The supplementary material also includes the correlogram of the FVECM residuals and of the error correction terms.

We thank an anonymous reviewer for pointing out this effect.

References

Arciniegas, I., Barrett, C., Marathe, A.: Assessing the efficiency of US electricity markets. Util. Policy 11(2), 75–86 (2003)

Asan, G., Tasaltin, K.: Market efficiency assessment under dual pricing rule for the Turkish wholesale electricity market. Energy Policy 107, 109–118 (2017)

Bernardi, M., Petrella, L.: Multiple seasonal cycles forecasting model: the Italian electricity demand. Stat. Methods Appl. 24(4), 671–695 (2015)

Bigerna, S., Bollino, C.A., Polinori, P.: Renewable energy and market power in the Italian electricity market. Energy J. 37(S2), 123–145 (2016)

Bollerslev, T., Osterrieder, D., Sizova, N., Tauchen, G.: Risk and return: long-run relations, fractional cointegration, and return predictability. J. Financ. Econ. 108(2), 409–424 (2013)

Boogert, A., Dupont, D.: On the effectiveness of the anti-gaming policy between the day-ahead and real-time electricity markets in the netherlands. Energy Econ. 27(5), 752–770 (2005)

Borenstein, S., Bushnell, J., Knittel, C.R., Wolfram, C.: Trading inefficiencies in California’s electricity markets. Technical report, National Bureau of Economic Research (2001)

Brijs, T., De Vos, K., De Jonghe, C., Belmans, R.: Statistical analysis of negative prices in European balancing markets. Renew. Energy 80, 53–60 (2015)

Caporin, M., Preś, J., Torro, H.: Model based Monte Carlo pricing of energy and temperature quanto options. Energy Econ. 34(5), 1700–1712 (2012)

Caporin, M., Ranaldo, A., Santucci de Magistris, P.: On the predictability of stock prices: a case for high and low prices. J. Bank. Financ. 37(12), 5132–5146 (2013)

Carlini, F., Santucci de Magistris, P.: On the identification of fractionally cointegrated VAR models with the F(d) condition. J. Bus. Econ. Stat, 37(1), 134–146 (2019a)

Carlini, F., Santucci de Magistris, P.: Resuscitating the co-fractional model of Granger (1986). Technical report, CREATES WP series (2019b)

Cretì, A., Fontini, F.: Economics of Electricity: Markets, Competition and Rules. Cambridge University Press, Cambridge (2019)

de Menezes, L.M., Houllier, M.A., Tamvakis, M.: Time-varying convergence in European electricity spot markets and their association with carbon and fuel prices. Energy Policy 88, 613–627 (2016)

Dolatabadi, S., Nielsen, M.Ø., Xu, K.: A fractionally cointegrated VAR analysis of price discovery in commodity futures markets. J. Futures Mark. 35(4), 339–356 (2015)

Engle, R.F., Granger, C.W.: Co-integration and error correction: representation, estimation, and testing. Econometrica 55, 251–276 (1987)

European Commission. Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing. Technical report (2017)

Fama, E.: Random walks in stock market prices. Financ. Anal. J. 21(5), 55–59 (1965)

Fernandes, C., Frías, P., Reneses, J.: Participation of intermittent renewable generators in balancing mechanisms: a closer look into the Spanish market design. Renew. Energy 89, 305–316 (2016)

Gelabert, L., Labandeira, X., Linares, P.: An ex-post analysis of the effect of renewables and cogeneration on Spanish electricity prices. Energy Econ. 33, S59–S65 (2011)

Gianfreda, A., Parisio, L., Pelagatti, M.: A review of balancing costs in Italy before and after RES introduction. Renew. Sustain. Energy Rev. 91, 549–563 (2018)

Gianfreda, A., Parisio, L., Pelagatti, M.: The RES-induced switching effect across fossil fuels: an analysis of day-ahead and balancing prices. Energy J. 40, 20 (2019)

Gianfreda, A., Parisio, L., Pelagatti, M., et al.: The impact of RES in the Italian day-ahead and balancing markets. Energy J. 37(Bollino–Madlener Special Issue), 1 (2016)

Granger, C.J.: Developments in the study of cointegrated economic variables. Oxford Bull. Econ. Stat. 48(3), 213–228 (1986)

Heim, S., Goetz, G.: Do pay-as-bid auctions favor collusion?, p. 35. Evidence from Germany’s market for reserve power, ZEW-Centre for European Economic Research Discussion Paper (2013)

Hirth, L., Ziegenhagen, I.: Balancing power and variable renewables: three links. Renew. Sustain. Energy Rev. 50, 1035–1051 (2015)

Janczura, J., Trück, S., Weron, R., Wolff, R.C.: Identifying spikes and seasonal components in electricity spot price data: a guide to robust modeling. Energy Econ. 38, 96–110 (2013)

Jha, A., Wolak, F.A.: Testing for market efficiency with transactions costs: an application to convergence bidding in wholesale electricity markets. Seminar, Yale University. Citeseer. Citeseer, In Industrial Org (2013)

Johansen, S.: A representation theory for a class of vector autoregressive models for fractional processes. Econom. Theory 24(3), 651–676 (2008)

Johansen, S., Nielsen, M.Ø.: Likelihood inference for a fractionally cointegrated vector autoregressive model. Econometrica 80(6), 2667–2732 (2012)

Longstaff, F.A., Wang, A.W.: Electricity forward prices: a high-frequency empirical analysis. J. Financ. 59(4), 1877–1900 (2004)

Mauritzen, J.: Dead battery? Wind power, the spot market, and hydropower interaction in the Nordic electricity market. Energy J. 20, 103–123 (2013)

Muesgens, F., Ockenfels, A., Peek, M.: Economics and design of balancing power markets in Germany. Int. J. Electr. Power Energy Syst. 55, 392–401 (2014)

Mulder, M., Scholtens, B.: The impact of renewable energy on electricity prices in the Netherlands. Renew. Energy 57, 94–100 (2013)

Müsgens, F., Ockenfels, A., Peek, M.: Economics and design of balancing power markets in Germany. Int. J. Electr. Power Energy Syst. 55, 392–401 (2014)

Newey, W.K., West, K.D.: A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3), 703–708 (1987)

Nielsen, M.Ø., Popiel, M.K.: A MATLAB program and user’s guide for the fractionally cointegrated VAR model. Technical report, Queen’s Economics Department Working Paper (2018)

Nowotarski, J., Weron, R.: On the importance of the long-term seasonal component in day-ahead electricity price forecasting. Energy Econ. 57, 228–235 (2016)

Ocker, F., Ehrhart, K.-M.: The “German Paradox” in the balancing power markets. Renew. Sustain. Energy Rev. 67, 892–898 (2017)

Ocker, F., Ehrhart, K.-M., Belica, M.: Harmonization of the European balancing power auction: a game-theoretical and empirical investigation. Energy Econ. 73C, 194–211 (2018a)

Ocker, F., Ehrhart, K.-M., Ott, M.: Bidding strategies in the Austrian and German secondary balancing power market. Wiley Interdiscip. Rev. Energy Environ. 7, 1–16 (2018b)

Robinson, P.M., Yajima, Y.: Determination of cointegrating rank in fractional systems. J. Econom. 106(2), 217–241 (2002)

Sapio, A.: The effects of renewables in space and time: a regime switching model of the Italian power price. Energy Policy 85, 487–499 (2015)

Shimotsu, K.: Exact local Whittle estimation of fractional integration with unknown mean and time trend. Econom. Theory 26(2), 501–540 (2010)

Shimotsu, K., Phillips, P.C.: Exact local Whittle estimation of fractional integration. Ann. Stat. 33(4), 1890–1933 (2005)

Sorknæs, P., Andersen, A.N., Tang, J., Strøm, S.: Market integration of wind power in electricity system balancing. Energy Strat. Rev. 1(3), 174–180 (2013)

Uniejewski, B., Weron, R., Ziel, F.: Variance stabilizing transformations for electricity spot price forecasting. IEEE Trans. Power Syst. 33(2), 2219–2229 (2018)

Weron, R.: Modeling and forecasting electricity loads and prices: a statistical approach, vol. 403. Wiley, Oxford (2007)

Woo, C.-K., Horowitz, I., Moore, J., Pacheco, A.: The impact of wind generation on the electricity spot-market price level and variance: the Texas experience. Energy Policy 39(7), 3939–3944 (2011)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank Cosimo Campidoglio and Marco Molini of Gestore Mercato Elettrico, for their help with data downloading and Mauro Bernardi for providing us with the code for the estimation of the cyclical patterns of electricity prices. A previous version, related to this work, titled “Price convergence within and between the Italian electricity day-ahead and dispatching services” was presented at MAF2018 International Conference on Mathematical and Statistical Methods for Actuarial Sciences and Finance in Madrid, University Carlos III. The authors are the only responsible for what is written here.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Caporin, M., Fontini, F. & Santucci de Magistris, P. The long-run relationship between the Italian day-ahead and balancing electricity prices. Energy Syst 13, 111–136 (2022). https://doi.org/10.1007/s12667-020-00392-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-020-00392-x