Abstract

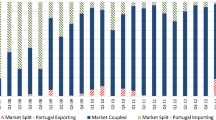

This paper examines price and volatility interrelationships in five European, day-ahead, wholesale spot electricity markets. These include the French, German, Belgian and Dutch electricity markets, forming the Central-Western European (CWE) region, as well as the Nord Pool Spot electricity market, a pool market for the Nordic region. For this purpose, a novel VAR model with dummy variables was developed to model the conditional mean price, while the CCC-MGARCH model and a DCC-MGARCH model were used to model volatility. The results suggest that evidence of market integration, as measured by cross-mean spillovers and conditional correlation, do exist in the electricity markets under examination. Nevertheless, they also indicate that the CWE electricity markets are stronger integrated, while, on the other hand, weaker integration is observed between them and the Nordic electricity market. We attribute these findings to the fact that physical interconnection capacity is not sufficient for the electricity markets to become fully integrated.

Similar content being viewed by others

Notes

Although the EPEX Spot Power Exchange also covers the electricity market of Austria and Switzerland, these two electricity markets do not participate in the market integration mechanism and thus, they are not included in the analysis. On the other hand, the NPS is a pool electricity market, with one common system price for the entire Nordic region (Denmark, Norway, Sweden, Finland, and the Baltic states). This common system price is then adjusted internally to several local market nodes, at which the national electricity markets of the region are divided. The market coupling between the CWE and the Nordic region takes place at the level of this common system price. Thus, this common system price is included in our analysis [34].

A feedback relationship between two price series exists when the dependence coefficient \(\varphi _{ij}^k\), which denotes the linear price dependence between markets i and j, for lag k, is \(\varphi _{ij}^k \ne 0\), while at the same time \(\varphi _{ji}^k \ne 0\) [43, p. 349].

A feedback relationship between two price series i and j exists when the dependence coefficient \(\varphi _{ij}^ \ne 0\), while at the same time \(\varphi _{ji}^ \ne 0\). A unidirectional relationship exists when the dependence coefficient \(\varphi _{ij}^ \ne 0\), but at the same time \(\varphi _{ji}^ =0\) [43, p. 349]. Building on this concept we could consider that a feedback relationship between two price series does not exists when one of \(\varphi _{ij}^k \) or \(\varphi _{ji}^k \) is non-significant. In this case, a unidirectional relationship should be considered.

References

Agency for the Cooperation of Energy Regulators—ACER (2012), http://www.acer.europa.eu. Accessed Dec 2012

Bauwens, L., Laurent, S., Rombouts, J.: Multivariate GARCH models: a survey. J. Appl. Econ. 21, 79–109 (2006)

Bollerslev, T.: Generalized autoregressive conditional heteroscedasticity. J. Econ. 31(3), 307–327 (1986)

Bollerslev, T.: Modeling the coherence in short-run nominal exchange rates: a multivariate generalized arch model. Rev. Econ. Stat. 72(3), 498–505 (1990)

Bunn, W.D., Gianfreda, A.: Integration and shock transmissions across European electricity forward markets. Energy Econ. 32(2), 278–291 (2010)

Bystrom, H.N.E.: The hedging performance of electricity futures on the Nordic power exchange. Appl. Econ. 35(1), 1–11 (2003)

Chan, K.F., Gray, P.: Using extreme value theory to measure value-at-risk for daily spot electricity prices. Int. J. Forecast. 22(2), 283–300 (2006)

Chevalier, J.: Time-varying correlations in oil, gas and CO2 prices: an application using BEKK, CCC and DCC-MGARCH models. Appl. Econ. 44(32), 4257–4274 (2012)

De Vany, A.S., Walls, W.D.: Cointegration analysis of spot electricity prices: insights on transmission efficiency in the western US. Energy Econ. 21(3), 435–448 (1999)

Engle, R.F.: Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4), 987–1008 (1982)

Engle, R.F., Kroner, K.F.: Multivariate simultaneous generalized ARCH. Econ. Theory 11(1), 122–150 (1995)

Engle R. F., Sheppard, K.: Theoretical and empirical properties of dynamic conditional correlation multivariate GARCH, Working Paper, National Bureau of Economic Research (NBER), Working Paper 8554 (2001)

Engle, R.F.: Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroscedasticity. J. Bus. Econ. Stat. 20(3), 339–350 (2002)

EPEX Spot Power Exchange. Market Coupling Documentation (2012), http://www.epexspot.com/. en/market-coupling. Accessed Dec 2012

European Market Coupling Company—EMCC (2012), http://www.marketcoupling.com. Accessed Dec 2012

Escribano, A., Pena, J., Villaplana, P.: Modeling electricity prices: international evidence. Oxf. Bull. Econ. Stat. 73(5) (2011)

Gonzalo, J., Pitarakis, J.: Lag length estimation in large dimensional systems. J. Time Ser. Anal. 23(4), 401–423 (2002)

Hadsell, L., Marathe, A., Shawky, A.: Estimating the volatility of wholesale electricity spot prices in the US. Energy J. 25(4), 23–40 (2004)

Higgs, H.: Modeling price and volatility inter-relationships in the Australian wholesale spot electricity markets. Energy Econ. 31, 748–756 (2009)

Higgs, H., Worthington, C.: Systematic features of high frequency volatility in Australian electricity markets: intraday patterns, information arrival and calendar effects. Energy J. 26(4), 1–19 (2005)

Higgs, H., Worthington, C.: Stochastic price modeling of high volatility, mean-reverting, spike-prone commodities: the Australian wholesale spot electricity market. Energy Econ. 30, 3172–3185 (2008)

Huisman, R., Mahieu, R.: Regime jumps in electricity prices. Energy Econ. 25, 425–434 (2003)

Huisman, R., Kilic, M.: A history of European electricity day-ahead prices. Appl. Econ. 45(18), 2683–2693 (2013)

Haldrup, N., Nielsen, M.O.: A regime switching long memory model for electricity prices. J. Econ. 135(1–2), 349–376 (2006)

Kalantzis, G.F., Milonas, T.N.: Analyzing the impact of futures trading on spot price volatility: evidence from the spot electricity market in France and Germany. Energy Econ. 36, 454–463 (2013)

Karolyi, G.: A multivariate GARCH model of international transmissions of stock returns and volatility: the case of the United States and Canada. J. Bus. Econ. Stat. 13(1), 11–25 (1995)

Knittel, R., Roberts, R.: An empirical examination of restructured electricity prices. Energy Econ. 27(5), 791–817 (2005)

Koopman, J., Ooms, M., Carnero, A.: Periodic reg-ARFIMA-GARCH models for daily electricity spot prices. J. Am. Stat. Assoc. 102(477), 16–27 (2007)

Ku, Hsu Y., Wang, J.J.: Estimating portfolio value at risk-via-dynamic conditional correlation MGARCH model: an empirical study on foreign exchange rates. Appl. Econ. Lett. 15(7), 533–538 (2008)

Li, Y., Flynn, P.: Deregulated power prices: comparison of diurnal patterns. Energy Policy 32, 657–672 (2004a)

Li, Y., Flynn, P.: Deregulated power prices: comparison of volatility. Energy Policy 32, 1591–1601 (2004b)

Lindstrom, E., Regland, F.: Modeling extreme dependence between European electricity markets. Energy Econ. 34(4), 899–904 (2012)

Mount, T., Ning, Y., Cai, X.: Predicting price spikes in electricity markets using a regime-switching model with time-varying parameters. Energy Econ. 28(1), 62–80 (2006)

Nord Pool Spot Power Exchange—NPS. The Power Market. (2012), http://www.nordpoolspot.com/How-does-it-work/. Accessed Dec 2012

Robinson, T.: Electricity pool series: a case study in non-linear time series modeling. Appl. Econ. 32(5), 527–532 (2000)

Robinson, T., Baniak, A.: The volatility or prices in the English and welsh electricity pool. Appl. Econ. 34(12), 1487–1495 (2002)

Robinson, T.: The convergence of electricity prices in Europe. Appl. Econ. Lett. 14, 473–476 (2007)

Rubin, O., Babcock, B.: A novel approach for modeling deregulated electricity markets. Energy Policy 39(5), 2711–2721 (2011)

Solibakke, P.: Efficient estimated mean and volatility characteristics for the nordic spot electricity power market. Int. J. Bus. 7(2), 17–35 (2002)

Squicciarini G., Cervigni G., Perekhodtsev D., Poletti, C.: The Integration of the European Electricity markets at a turning point: from the regional model to the third legislative package, Robert Schuman Centre for Advanced Studies—Florence School of Regulation, Working Paper RSCAS 2010/56 (2010)

Tashpulatov, Sh: Estimating the volatility of electricity prices: the case of the England and wales wholesale electricity market. Energy Policy 60, 81–90 (2013)

Thomas, S., Ramiah, V., Mitchell, H., Heaney, R.: Seasonal factors and outlier effects in rate of return on electricity spot prices in Australia’s national electricity market. Appl. Econ. 43(3), 355–369 (2011)

Tsay, R.: Analysis of financial time series, 2nd edn. Wiley, New York (2005)

Tsay, R.: Multivariate volatility models. IMS Lect. Notes Monogr. Ser. 52, 210–222 (2006)

Tse, Y., Tsui, A.: A multivariate autoregressive conditional heteroscedasticity model with time-varying correlations. J. Bus. Econ. Stat. 20(3), 351–362 (2002)

Worthington, A., Spratley, A., Higgs, H.: Transmission of prices and volatility Australian electricity spot markets: a multivariate GARCH analysis. Energy Econ. 27(2), 337–350 (2005)

Zachmann, G.: Electricity wholesale market prices in Europe: convergence? Energy Econ. 30, 1659–1671 (2008)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sotiriadis, M.S., Tsotsos, R. & Kosmidou, K. Price and volatility interrelationships in the wholesale spot electricity markets of the Central-Western European and Nordic region: a multivariate GARCH approach. Energy Syst 7, 5–32 (2016). https://doi.org/10.1007/s12667-014-0137-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-014-0137-1