Abstract

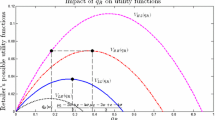

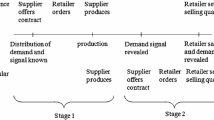

Consider the optimal selling problem of a supplier who sells the same product to two competing retailers under two types of uncertainty—the selling costs of retailers and external demand. The confidence level is used to characterize the risk caused by the two uncertainties and the profits of the participants in the supply chain channel. Our results demonstrate that higher risk levels correlate with lower belief-degree costs of the two retailers and higher belief-degree sizes of the market. For the vertically integrated channel, the supplier always supplies a larger quantity to the retailer with the low belief-degree cost than to the other retailer. Whereas, for the decentralized channel, the optimal selling decision of the supplier sometimes violates the volume ranking suggested by the quantities of the vertically integrated channel, i.e., when the belief-degree cost differences between the two retailers are not significant and the competitive intensity is high, the supplier supplies more units of the product to the retailer with the high belief-degree cost than to the other retailer. Furthermore, a decrease in the risk borne by the channel or an increase in the competitive intensity often reduces the quantities supplied to the retailers. However, in some cases, increased risk or intense competition increases the quantity supplied to the retailer with the low belief-degree cost or to the other retailer. Finally, we design a contract menu of two-part tariffs with quantity controls such that the optimal quantities supplied and retailer profits are the same for the relaxed and original models in the decentralized channel

Similar content being viewed by others

References

Adida E, Perakis G (2006) A robust optimization approach to dynamic pricing and inventory control with no backorders. Math Program Ser B 107(1–2):97–129

Adida E, Perakis G (2010) Dynamic pricing and inventory control: uncertainty and competition. Oper Res 58(2):289–302

Biswas I, Avittathur B, Chatterjee A (2016) Impact of structure, market share and information asymmetry on supply contracts for a single supplier multiple buyer network. Eur J Oper Res 253(3):593–601

Buzacott J, Yan H, Zhang H (2003) Risk analysis of inventory models with forecast updates. In: Supply Chain Decisions with Forecast Updates (draft version) (Chapter10)

Cachon G, Kök A (2010) Competing manufacturers in a retail supply chain: on contractual form and coordination. Manag Sci 56(3):571–589

Chen X, Ralescu D (2013) Liu process and uncertain calculus. J Uncertain Anal Appl 1(1):1–12

Chung W, Talluri S, Narasimhan R (2010) Flexibility or cost saving? Sourcing decisions with two suppliers. Decis Sci 41(3):623–650

Corbett C, Groote X (2000) A suppliers optimal quantity discount policy under asymmetric information. Manag Sci 46(3):444–450

Corbett C, Zhou D, Tang C (2004) Designing supply contracts: contract type and information asymmetry. Manag Sci 50(4):550–559

Ellsberg D (1961) Risk, ambiguity, and the savage axioms. Q J Econ 75(4):643–669

Gan X, Sethi S, Yan H (2005) Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Prod Oper Manag 14(1):80–89

Gao Y, Qin Z (2016) A chance constrained programming approach for uncertain p-hub center location problem. Comput Ind Eng 102:10–20

Gotoh J, Takano Y (2007) Newsvendor solutions via conditional value-at-risk minimization. Eur J Oper Res 179(1):80–96

Hendricks K, Singhal V (2005) Association between supply chain glitches and operating performance. Manag Sci 51(5):695–711

Kostamis D (2013) A note on optimal selling to asymmetric retailers. Prod Oper Manag 22(5):1118–1125

Lau H, Lau A (1999) Manufacturer’s pricing strategy and return policy for a single-period commodity. Eur J Oper Res 116(2):291–304

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2009a) Some research problems in uncertainty theory. J Uncertain Syst 3(1):3–10

Liu B (2009b) Theory and practice of uncertain programming, 2nd edn. Springer, Berlin

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu B (2013) Toward uncertain finance theory. J Uncertain Anal Appl 1(1):1–15

Liu B (2015) Uncertainty theory, 4th edn. Springer, Berlin

Liu Y, Ha M (2010) Expected value of function of uncertain variables. J Uncertain Syst 4(3):181–186

Liu Z, Zhao R, Liu X, Chen L (2016) Contract designing for a supply chain with uncertain information based on confidence level. Appl Soft Comput. doi:10.1016/j.asoc.2016.05.054

Markowitz H (1959) Portfolio selection: efficient diversification of investment. Wiley, New York

Marx L, Shaffer G (2004) Opportunism and menus of twopart tariffs. Int J Ind Org 22(10):1399–1414

McAfee R, Schwartz M (1994) Opportunism in multilateral vertical contracting: nondiscrimination, exclusivity, and uniformity. Am Econ Rev 84(1):210–230

McGuire TW, Staelin R (1983) An industry equilibrium analysis of downstream vertical integration. Mark Sci 2(2):161–191

Ouardighi El, Kim B (2010) Supply quality management with wholesale price and revenue-sharing contracts under horizontal competition. Eur J Oper Res 206(2):329–340

Qin Z, Gao Y (2017) Uncapacitated \(p\)-hub location problem with fixed costs and uncertain flows. Journal of Intelligent Manufacturing 28(3):705–716

Rey P, Verge T (2004) Bilateral control with vertical contracts. Bell J Econ 35(4):728–746

Rey P, Verge T (2008) Economics of vertical restraints. In: Buccirossi P (ed) Handbook of antitrust economics. The MIT, Cambridge, pp 353–390

Shen Y, Willems P (2012) Coordinating a channel with asymmetric cost information and the manufacturers optimality. Int J Prod Econ 135(1):125–135

Tsay A, Agrawal N (2000) Channel dynamics under price and service competition. Manuf Serv Oper Manag 2(4):372–391

Weng Z (1995) Channel coordination and quantity discount. Manag Sci 41(9):1509–1522

Wu J, Yue W, Yamamoto Y, Wang S (2006) Risk analysis of a pay to delay capacity reservation contract. Optim Methods Softw 21(4):635–651

Wu X, Zhao R, Tang W (2014a) Uncertain agency models with multi-dimensional incomplete information based on confidence level. Fuzzy Optim Decis Mak 13(2):231–258

Wu X, Zhao R, Tang W (2014b) Optimal contracts for the agency problem with multiple uncertain information. Knowl Based Syst 59(2):161–172

Yang K, Zhao R, Lan Y (2014) The impact of risk attitude in new product development under dual information asymmetry. Comput Ind Eng 76(3):122–137

Yao K (2013) Extreme values and integral of solution of uncertain differential equation. J Uncertain Anal Appl 1(1):1–21

Zhang P, Xiong Y, Xiong Z, Yan W (2014) Designing contracts for a closed-loop supply chain under information asymmetry. Oper Res Lett 42(2):150–155

Zhao X (2008) Coordinating a supply chain system with retailers under both price and inventory competition. Prod Oper Manag 17(5):532–542

Zhou C, Tang W, Zhao R (2014) An uncertain search model for recruitment problem with enterprise performance. J Intell Manuf. doi:10.1007/s10845-014-0997-1

Zhou C, Tang W, Zhao R (2015) Optimal consumer search with prospect utility in hybrid uncertain environment. J Uncertain Anal Appl 3(6):1–20

Acknowledgements

This work was supported by the National Natural Science Foundation of China under Grant No. 71471126 and Hubei Province Natural Science Foundation of Key Project under Grant No. 2015CFA144

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

Because the function \(\Pi _{i}(q_{l},q_{h}; \, x_{i},y)\) is strictly decreasing with \(x_{i}\) and is strictly increasing with y, \(M\big \{\Pi _{i}(q_{l},q_{h};\xi _{i},\eta )\geqslant \Pi _{0i}\big \}\geqslant \alpha\) is equivalent to

And \(\Pi _{mi}(q_{l},q_{h};\alpha )=\max \{\Pi _{0i}\}\), chain i’s maximum profit \(\Pi _{mi}(\cdot ,\cdot )\) under the confidence level \(\alpha\) is

By Eq. (8), Model (3) can be equivalently turned into the following one,

The proof of the theorem is completed.

Proof of Theorem 2

Since the objective function in Model (4) is concave about the order quantity \(q_{i}\), its first-order conditions are \(2q_{l}+2\theta q_{h}=s_{l}\) and \(2q_{h}+2\theta q_{l}=s_{h}.\) Solving the equation set, the conclusions in Theorem 2 can be obtained.

Proof of Proposition 1

By Theorem 2, we have

We can find that \(\displaystyle \frac{\partial q_{l}^{*}}{\partial \theta }<0\) if \(\displaystyle 0\leqslant \theta <\left( s_{l}-\sqrt{s_{l}^{2}-s_{h}^{2}}\right) /s_{h}\) and \(\displaystyle \frac{\partial q_{l}^{*}}{\partial \theta }>0\) if \(\displaystyle \left[ s_{l}-\sqrt{s_{l}^{2}-s_{h}^{2}}\right) /s_{h}<\theta <\left( s_{l}+\sqrt{s_{l}^{2}-s_{h}^{2}}\right) /s_{h}\). Similarly, the conclusion \(\displaystyle \frac{\partial q_{h}^{*}}{\partial \theta }\leqslant 0\) holds if \(\displaystyle 0 \leqslant \theta < s_{h}/s_{l}\). The proof of the proposition is completed.

Proof of Proposition 2

The proof is obvious and omitted here.

Proof of Corollary 1

Substituting \(s_{i}=\Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-c=(a_{2}-c)-\alpha (a_{2}-a_{1}+c_{i})\) and \(t_{i}=a_{2}-a_{1}+c_{i}\) into Theorem 2, we can derive the results of Corollary 1.

Proof of Corollary 2

By Corollary 1, we obtain

Therefore, when \(\displaystyle 0\leqslant \theta <t_{l}/t_{h}\), we have \(\displaystyle \frac{\partial q_{l}^{*}}{\partial \alpha }<0\). When \(\displaystyle t_{l}/t_{h}\leqslant \theta <\frac{b_{2}-c-\alpha t_{l}}{b_{2}-c-\alpha t_{h}}\), we have \(\displaystyle \frac{\partial q_{l}^{*}}{\partial \theta }\geqslant 0\). Similarly, the conclusion \(\displaystyle \frac{\partial q_{h}^{*}}{\partial \alpha }<0\) holds if \(\displaystyle 0 \leqslant \theta< \theta <\frac{b_{2}-c-\alpha t_{l}}{b_{2}-c-\alpha t_{h}}\). The proof of the corollary is completed.

Proof of Lemma 1

The proof is obvious and omitted here.

Proof of Theorem 3

The proof of the theorem is similar to that of Theorem 1.

Proof of Theorem 4

For the sake of brevity, we denote retailer i’s profit \(\pi _{i}(T_{i},q_{l},q_{h};\Phi ^{-1}(\alpha ),\Psi ^{-1}(1-\alpha ))\) as \(\pi _{i}\), Model (7) can be equivalently transformed into the following one,

By Eqs. \((IC_{l})\) and \((IC_{h})\), we have \((q_{l}-q_{h})\left[ (s_{l}-s_{h})+\theta (q_{l}-q_{h})\right] \leqslant 0\), and thus \(q_{l}\geqslant q_{h}\) or \(q_{l}\leqslant q_{h}-(s_{l}-s_{h})/\theta\) because \(s_{l}>s_{h}\). We first establish the following two lemmas and then use them to solve Model (10).

Lemma 2

When \(q_{l}\geqslant q_{h}\), we obatin \(\pi _{h}=0\) and \(\pi _{l}=(s_{l}-s_{h})q_{h}+\theta q_{h}(q_{l}-q_{h})\). The retailers’ optimal order quantities are as follows.

-

1.

If \(s_{l}/s_{h}\geqslant 2\), then \(q_{l}=s_{l}/2\) and \(q_{h}=0\).

-

2.

If \(\sqrt{10}-2\leqslant s_{l}/s_{h}<2\), then

-

(a)

If \(\displaystyle 0\leqslant \theta <\frac{4s_{h}-2s_{l}}{3s_{l}}\), then \(\displaystyle q_{l}=\frac{(2+\theta )s_{l}-6\theta s_{h}}{4-4\theta -9\theta ^{2}}\) and \(\displaystyle q_{h}=\frac{4s_{h}-(2+3\theta )s_{l}}{4-4\theta -9\theta ^{2}}\);

-

(b)

If \(\displaystyle \frac{(4s_{h}-2s_{l})}{3s_{l}}\leqslant \theta <1\), then \(q_{l}=s_{l}/2\) and \(q_{h}=0\).

-

(a)

-

3.

If \(1<s_{l}/s_{h}<\sqrt{10}-2\), then

-

(a)

If \(\displaystyle 0\leqslant \theta <\frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\), then \(\displaystyle q_{l}=\frac{(2+\theta )s_{l}-6\theta s_{h}}{4-4\theta -9\theta ^{2}}\) and \(\displaystyle q_{h}=\frac{4s_{h}-(2+3\theta )s_{l}}{4-4\theta -9\theta ^{2}}\);

-

(b)

If \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\leqslant \theta \leqslant \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\), then \(\displaystyle q_{l}=\frac{s_{h}}{2(1+\theta )}\) and \(\displaystyle q_{h}=\frac{s_{h}}{2(1+\theta )}\);

-

(c)

If \(\displaystyle \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}<\theta <1\), then \(q_{l}=s_{l}/2\) and \(q_{h}=0\).

-

(a)

Lemma 3

When \(q_{l}\leqslant q_{h}-(s_{l}-s_{h})/\theta\), we obtain \(\pi _{l}=\pi _{h}=0\). The retailers’ optimal order quantities are as follows.

-

1.

If \(s_{l}/s_{h}\geqslant 5/3\), then \(q_{l}=0\) and \(q_{h}=(s_{l}-s_{h})/\theta\).

-

2.

If \(1< s_{l}/s_{h}<5/3\), then

-

(a)

If \(\displaystyle 0<\theta \leqslant \frac{2(s_{l}-s_{h})}{3s_{h}-s_{l}}\), then \(q_{l}=0\) and \(q_{h}=(s_{l}-s_{h})/\theta\);

-

(b)

If \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-s_{l}}<\theta <1\), then \(\displaystyle q_{l}=\frac{(2+3\theta )s_{h}-(2+\theta )s_{l}}{4\theta +4\theta ^{2}}\) and \(\displaystyle q_{h}=\frac{(2+3\theta )s_{l}-(2+\theta )s_{h}}{4\theta +4\theta ^{2}}\).

-

(a)

Proof of Lemma 2

Since \(s_{l}>s_{h}\), \(q_{l}\geqslant q_{h}\geqslant 0\), we have \(\pi _{l}\geqslant \pi _{h}\) and constraint \((IR_{l})\) is unnecessary by the constraints \((IC_{l})\) and \((IR_{h})\). Therefore, constraint \((IR_{h})\) is binding at the optimal solution, i.e., \(\pi _{h}=0\). Note that contract \((IC_{l})\) and \((IC_{h})\), the value \(\pi _{l}\) for any values of \(q_{l}, q_{h}\) is bounded below only constraint \((IC_{l})\), not by constraint \((IC_{h})\). Thus, we first ignore constraint \((IC_{h})\) and show that the optimal solution satisfies \((IC_{h})\) at the end. According to the objective function, we obtain that constraint \((IC_{l})\) is binding at the optimal solution, i.e., \(\pi _{l}=(s_{l}-s_{h})q_{h}+\theta q_{h}(q_{l}-q_{h})\). In view of the two conclusions mentioned above, Model (10) is equivalent to the following one,

The multipliers \(\lambda _{1}\) and \(\lambda _{2}\) are assigned to the constrains in Model (11), respectively. The optimal quantities satisfy the following conditions,

and we consider the following three cases.

Case 1 If \(\lambda _{1}>0, \lambda _{2}>0\), then \(q_{l}=q_{h}=0\), \(\lambda _{1}=-s_{l}<0\) and \(\lambda _{2}=-2s_{h}<0\). Contradiction.

Case 2 If \(\lambda _{1}>0, \lambda _{2}=0\), then \(\displaystyle \lambda _{1}=\frac{(3\theta +2)s_{h}-(2\theta +2)s_{l}}{2(1+\theta )}\), and the retailer’s order quantities are

When \(2(s_{l}-s_{h})/(3s_{h}-s_{l})<\theta <1\) and \(s_{l}/s_{h}<5/4\), the multiplier \(\lambda _{1}>0\). So Eq. (13) is a candidate optimal solution if

Case 3 If \(\lambda _{1}=0, \lambda _{2}>0\), then \(\lambda _{2}=(2s_{l}-4a_{h}+3\theta s_{l})/2\) and the retailers’ order quantities are

The multiplier \(\lambda _{2}>0\) if

Therefore, Eq. (15) is a candidate optimal solution if condition (16) holds. When both (14) and (16) are violated, the optimal solution is

Comparing conditions (14) and (16), we have

-

1.

If \(s_{l}/s_{h}\geqslant 2\), Eq. (15) is the optimal solution.

-

2.

If \(\sqrt{10}-2\leqslant s_{l}/s_{h}<2\), then \(\displaystyle \frac{4s_{h}-2s_{l}}{3s_{l}}\leqslant \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\). Therefore, there are three subcases as follows.

-

(a)

When \(\displaystyle 0\leqslant \theta <\frac{4s_{h}-2s_{l}}{3s_{l}}\), Eq. (17) is the optimal solution.

-

(b)

When \(\displaystyle \frac{4s_{h}-2s_{l}}{3s_{l}}\leqslant \theta \leqslant \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\), Eq. (15) is the optimal solution.

-

(c)

When \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}<\theta <1\), Eq. (13) or Eq. (15) is the optimal solution. Comparing the corresponding objective function values, we obtain that Eq. (13) is the optimal solution if \(\displaystyle \theta <\frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\). Otherwise, Eq. (15) is the optimal solution. Since \(\displaystyle \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\leqslant \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\) when \(\sqrt{10}-2\leqslant s_{l}/s_{h}\), Eq. (15) is the optimal solution if \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}<\theta <1\).

-

(a)

-

3.

If \(s_{l}/s_{h}<\sqrt{10}-2\), then \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}< \frac{4s_{h}-2s_{l}}{3s_{l}}\). Therefore, there are three subcases as follows.

-

(a)

When \(\displaystyle 0\leqslant \theta <\frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\), Eq. (17) is the optimal solution;

-

(b)

When \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\leqslant \theta \leqslant \frac{4s_{h}-2s_{l}}{3s_{l}}\), Eq. (13) is the optimal solution;

-

(c)

When \(\displaystyle \frac{4s_{h}-2s_{l}}{3s_{l}}<\theta <1\), Eq. (13) or Eq. (15) is the optimal solution. Since \(\displaystyle \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}<\frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\) when \(1<s_{l}/s_{h}<\sqrt{10}-2\), Eq. (13) is the optimal solution if \(\displaystyle \frac{4s_{h}-2s_{l}}{3s_{l}}<\theta \leqslant \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\), and Eq. (15) is the optimal solution if \(\displaystyle \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}<\theta <1\). The proof of Lemma 2 is completed.

-

(a)

Proof of Lemma 3

The proof of this lemma is similar to that of Lemma 2.

According to Lemma 2 and Lemma 3, we obatin

-

1.

If \(s_{l}/s_{h}\geqslant 2\), then we need to compare the supplier’s profits corresponding to the first conclusions in Lemmas 2 and 3. The difference between them is \(\displaystyle \frac{s_{l}^{2}\theta ^{2}+4(s_{h}^{2}-s_{h}s_{l})\theta +4(s_{l}-s_{h})^{2}}{4\theta ^{2}}>0\). Therefore, the first conclusion of Theorem 4 holds.

-

2.

The difference between the supplier’s profits corresponding to cases (iia) or (iiia) in Lemma 2 and (iib) in Lemma 3 is

$$\begin{aligned}\displaystyle \frac{\left[ 4(s_{h}-s_{l})+\theta ^{2}(5s_{l}-3s_{h})\right] ^{2}}{8\theta ^{2}(1+\theta )[4-4\theta -9\theta ^{2}]}>0, \end{aligned}$$so Eq. (17) is the optimal solution if \(\displaystyle 0\leqslant \theta <min \left( \frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}},\frac{4s_{h}-2s_{l}}{3s_{l}}\right)\). Similarly, The difference between the supplier’s profits corresponding to case i), iib) or iiic) in Lemma 2 and case iib) in Lemma 3 is

$$\begin{aligned} \begin{array}{ll} \displaystyle f_1=\frac{2s_{l}^{2}\theta ^{3}+(s_{l}^{2}-s_{h}^{2}-2s_{l}s_{h})\theta ^{2}+4(s_{l}-s_{h})^{2}\theta +4(s_{l}-s_{h})^{2}}{8\theta ^{2}(1+\theta )}, \end{array} \end{aligned}$$(18)and \(\displaystyle \frac{\partial f_1}{\partial s_{l}}=\frac{2s_{l}\theta ^{3}+(s_{l}-s_{h})\theta ^{2}+4(s_{l}-s_{h})\theta +4(s_{l}-s_{h})}{4\theta ^{2}(1+\theta )}>0.\) Thus,

$$\begin{aligned}f_1\geqslant f_1|_{\frac{s_{l}}{s_{h}}=\sqrt{10}-2}=\frac{s_{h}^{2}\left[ (28-8\sqrt{10})\theta ^{3}+(17-6\sqrt{10})\theta ^{2}+(76-24\sqrt{10})\theta +76-24\sqrt{10}\right] }{8\theta (1+\theta )}>0. \end{aligned}$$Thus, the second conclusion of Theorem 4 holds.

-

3.

The difference between the supplier’s profits corresponding to case iiib) in Lemma 2 and case iib) in Lemma 3 is \(\displaystyle f_2=\frac{(s_{l}-s_{h})\left[ 4(s_{l}-s_{h})+4\theta (s_{l}-s_{h})-\theta ^{2}(s_{l}+3s_{h})\right] }{8\theta ^{2}(1+\theta )}\), which has only one positive root

$$\begin{aligned} \theta =\displaystyle \frac{2(s_{l}-s_{h})+2\sqrt{2(s_{l}^{2}-s_{h}^{2})}}{s_{l}+3s_{h}}. \end{aligned}$$Since \(\displaystyle f_2|_{\theta =\frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}}>0\) and \(f_2|_{\theta =\frac{2s_{l}^{2}-s_{h}^{2}}{s_{l}^{2}}}<0\), the conclusion corresponding to case iiib) in Theorem 4 holds. If \(\displaystyle \frac{2(s_{l}-s_{h})+2\sqrt{2(s_{l}^{2}-s_{h}^{2})}}{s_{l}+3s_{h}}\leqslant \theta \leqslant \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}\), the conclusion corresponding to case iiic) in Theorem 4 holds. If \(\displaystyle \frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}<\theta\), then thereexits \(\displaystyle \overline{\theta }(s_{l},s_{h})\in (\frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}},\frac{s_{h}}{s_{l}})\) such that \(f_1=0\) since \(\displaystyle \lim _{\theta \rightarrow 0^{+}}f_1>0\), \(\displaystyle f_1|_{\theta =\frac{2s_{h}^{2}-s_{l}^{2}}{s_{l}^{2}}}<0\) and \(\displaystyle f_1|_{\theta =\frac{s_{h}}{s_{l}}}>0\). Thus, the conclusions corresponding to cases iiib) and iiic) in Theorem 4 hold.

Proof of Proposition 3

The monotonicity of \(\widehat{q}_{l}\) about \(\theta\) is provedfrom the following three cases and that of \(\widehat{q}_{h}\) about \(\theta\) is similarly proved.

-

1.

When \(\widehat{q}_{l}> \widehat{q}_{h}>0\),we have \(\displaystyle \widehat{q}_{l}=\frac{(2+\theta )s_{l}-6\theta s_{h}}{4-4\theta -9\theta ^{2}}\), and thus,

$$\begin{aligned} \displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }=\frac{3\left[ (3s_{l}-18s_{h})\theta ^{2}+12s_{l}\theta +4s_{l}-8s_{h}\right] }{(4-4\theta -9\theta ^{2})^{2}}. \end{aligned}$$Let \(\Delta =s_{l}^{2}+4s_{l}s_{h}-6s_{h}^{2}\) and we obtain that\(\Delta>0\) if \(\sqrt{10}-2< s_{l}/s_{h}<2\) and\(\Delta <0\) if \(1<s_{l}/s_{h}<\sqrt{10}-2\). Particularly, \(\displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }\leqslant 0\) if \(\Delta =0\). Therefore, we have

-

(a)

If \(\sqrt{10}-2< s_{l}/s_{h}<2\), then Proof of Proposition 3. \(\displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }=0\) has two positive roots. The larger root is omitted since it does not satisfythe condition \(\displaystyle \theta \in \left( 0, \frac{4s_{h}-2s_{l}}{3s_{l}}\right)\). Since the smaller root is \(\displaystyle \theta '_{0}=\frac{6s_{l}-2\sqrt{6\Delta }}{18s_{h}-3s_{l}}<\frac{4s_{h}-2s_{l}}{3s_{l}}\) in this case, we have \(\displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }\leqslant 0\) if \(0\leqslant \theta \le \theta '_{0}\) and \(\displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }>0\) if \(\displaystyle \theta '_{0}<\theta <\frac{4s_{h}-2s_{l}}{3s_{l}}\).

-

(b)

If \(1<s_{l}/s_{h}<\sqrt{10}-2\), then \(\displaystyle \frac{\partial \widehat{q}_{l}}{\partial \theta }<0\).

-

(a)

-

2.

When \(\widehat{q}_{l} = \widehat{q}_{h}>0\), we have \(\displaystyle \widehat{q}_{i}=-\frac{s_{h}}{2(1+\theta ^{2})}<0\), and thus, \(q_{i}\) is decreasing in \(\theta\).

-

3.

When \(\widehat{q}_{h}> \widehat{q}_{l}>0\), the proof is similar to that of case 1). Summarizing the above conclusions,we can obtain Proposition 3.

Proof of Proposition 4

The proof of this proposition is similar to that of Proposition 3.

Proof of Proposition 5

From the proof of Theorem 4, we obtain \(T_{i}=(\Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-q_{i}-\theta q_{j})q_{i}-\pi _{i}\) and prove the proposition from the following three cases.

-

1.

When \(\widehat{q}_{h}>\widehat{q}_{l}>0\), we obtain \(\widehat{q}_{l}=\displaystyle \frac{(2+3\theta )s_{h}-(2+\theta )s_{l}}{4\theta +4\theta ^{2}}\), \(\widehat{q}_{h}=\displaystyle \frac{(2+3\theta )s_{l}-(2+\theta )s_{h}}{4\theta +4\theta ^{2}}\) into \(T_{i}\), and thus,

$$\begin{aligned} \begin{array}{ll} \displaystyle {T_{l}}-{T_{h}}=c(\widehat{q}_{l}-\widehat{q}_{h})-\frac{s_{l}^{2}-s_{h}^{2}}{4(1+\theta )}<0 \end{array} \end{aligned}$$and

$$\begin{aligned} \begin{array}{ll} \displaystyle \frac{T_{l}}{\widehat{q}_{l}}-\frac{T_{h}}{\widehat{q}_{h}}=(s_{l}-s_{h})+(1-\theta )(\widehat{q}_{h}-\widehat{q}_{l})>0. \end{array} \end{aligned}$$That is, \(T_{l}<T_h\) and \(T_{l}/\widehat{q}_{l}>T_{h}/\widehat{q}_{h}\) if \(\widehat{q}_{h}>\widehat{q}_{l}>0\).

-

2.

Similarly, when \(\widehat{q}_{l}>\widehat{q}_{h}>0\), we obtain \(T_{l}>T_{h}\) and \(T_{l}/\widehat{q}_{l}<T_{h}/\widehat{q}_{h}\). This completes the proof of the proposition.

Proof of Corollary 3

Substituting \(s_{i}=\Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-c=(a_{2}-c)-\alpha (a_{2}-a_{1}+c_{i})\) and \(t_{i}=a_{2}-a_{1}+c_{i}\) into Theorem 4, the corollary can be obtained.

Proof of Corollary 4

The proof of the corollary is similar to that of Corollary 2.

Proof of Theorem 5

First, we prove the existence of a menu of two-part tariffs that implements the supplier’s optimal selling mechanism. If retailer i selects tariff \(w_{i}q+k_{i}\), her optimal order quantityis given by the following optimization problem,

Its first-order condition is \(\overline{q}_i=(\Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-\theta q_{j}-w_{i})/2\). Further, \(|\frac{\partial \overline{q}_i}{\partial q_{j}}|=\theta /2<1\), i.e., retailer i’s best response is a contraction mapping guaranteeing the uniqueness of the equilibrium conditional on she choosing tariff \(w_{i}q+k_{i}\). For the optimal contract menu to be implemented, we must obtain \(\overline{q}_i=\widehat{q}_{i}\) and \(\pi _{mi}(w_{i},k_{i},\overline{q}_i,\overline{q}_j;\alpha )=\pi _{i}\), and thus, we have

We next show that retailer i choosing tariffs \(w_{i}q+k_{i}\) is an equilibrium by appropriate quantity control. Fixing retailer j’s selection of tariff \(w_{j}q+k_{j}\) and quantity \(\widehat{q}_{j}\), if retailer ichooses tariff \(w_{j}q+k_{j}\), her optimal order quantity is given by the following optimization problem,

Its first-order condition is \(\widetilde{q}_i=\left( \Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-\theta \widehat{q}_{j}-w_{j}\right) /2.\) Substituting \(w_{j}\) in (20) into expression above, we obtain

and retailer i’s optimal deviation profit becomes \(\pi _{mi}(w_{j},k_{j},\widetilde{q}_i,\widehat{q}_{j};\alpha )\). The quantity control of all kinds of situations are as follows

-

1.

When \(\widehat{q}_{h}>\widehat{q}_{l}>0\), substituting \(\displaystyle \widehat{q}_{l}=\frac{(2+3\theta )s_{h}-(2+\theta )s_{l}}{4\theta +4\theta ^{2}}\), \(\displaystyle \widehat{q}_{h}=\frac{(2+3\theta )s_{l}-(2+\theta )s_{h}}{4\theta +4\theta ^{2}}\) into deviation quantity and deviation profit, we have \(\pi _{i}- \pi _{mi}(w_{j},k_{j},\widetilde{q}_i,\widehat{q}_{j};\alpha )=0\). Thus, retailer i choosing tariff \(w_{i}q+k_{i}\) is an equilibrium and quantity control is not necessary.

-

2.

When \(\widehat{q}_{l}>\widehat{q}_{h}>0\), substituting \(\displaystyle \widehat{q}_{l}=\frac{(2+\theta )s_{l}-6\theta s_{h}}{4-4\theta -9\theta ^{2}}\), \(\displaystyle \widehat{q}_{h}=\frac{4s_{h}-(2+3\theta )s_{l}}{4-4\theta -9\theta ^{2}}\) into deviation quantity and deviation profit, we have

$$\begin{aligned}\widetilde{q}_{l}=\frac{(3s_{h}-5s_{l})\theta ^{2}-6\theta s_{l}+4s_{h}}{2(4-4\theta -9\theta ^{2})}, \end{aligned}$$$$\begin{aligned}\pi _{l}- \pi _{ml}(w_{h},k_{h},\widetilde{q}_{l},\widehat{q}_{h};\alpha ))=-\frac{\left[ (3s_{h}-5s_{l})\theta ^{2}+4(s_{l}-s_{h})\right] ^{2}}{4(4-4\theta -9\theta ^{2})^{2}}<0.\end{aligned}$$Thus, the retailer with a low belief-degree cost chooses tariff \(w_{h}q+k_{h}\) and quantity \(\widetilde{q}_{l}\). Note that

$$\begin{aligned}\pi _{ml}(w_{h},k_{h},q_l,\widehat{q}_{h};\alpha )\end{aligned}$$is a strictly concave function of \(q_l\) and \(\widetilde{q}_{l}-\widehat{q}_{h}=(s_{l}-s_{h}+\theta (\widehat{q}_{l}-\widehat{q}_{h}))/2>0\). If the supplier does not allow a retailerchoosing tariff \(w_{h}q+k_{h}\) to order more than \(\widehat{q}_{h}\), then the optimal order quantity of the retailer with a low belief-degree cost is \(\widehat{q}_{h}\), i.e., she choose the high-belief-degree-cost retailer’s contract such that \(\pi _{l}- \pi _{ml}(w_{h},k_{h},\widehat{q}_{h},\widehat{q}_{h};\alpha )=0\). Thus, the retailer with the low belief-degree cost does not need to choose retailer j’s contract. On the other hand,

$$\begin{aligned} \begin{array}{ll} \pi _{h}-\pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widetilde{q}_{h};\alpha )\\ \displaystyle =-\frac{\left[ (5s_{l}-3s_{h})\theta ^{2}-4(s_{l}-s_{h})\right] \left[ (5s_{l}-3s_{h})\theta ^{2}+(16s_{l}-24s_{h})\theta +12(s_{l}-s_{h})\right] }{4(4-4\theta -9\theta ^{2})^{2}}. \end{array} \end{aligned}$$(23) -

(a)

When \(\sqrt{10}-2\leqslant s_{l}/s_{h}<2\), we obtain \(\pi _{h}-\pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widetilde{q}_{h};\alpha )\geqslant 0\). Thus, the high-belief-degree-cost retailer does not have an incentive to choose tariff \(w_{l}q+k_{l}\).

-

(b)

When \(1<s_{l}/s_{h}<\sqrt{10}-2\), we have

-

If \(\displaystyle 0\leqslant \theta \leqslant \frac{(12s_{h}-8s_{l})-2\sqrt{s_{l}^{2}-24s_{l}s_{l}+27s_{h}^{2}}}{5s_{l}-3s_{h}}\), then \(\pi _{h}-\pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widetilde{q}_{h};\alpha )\geqslant 0\), and the high-degree-cost retailer does not have an incentive to choosing tariff \(w_{l}q+k_{l}\).

-

If \(\displaystyle \frac{(12s_{h}-8s_{l})-2\sqrt{s_{l}^{2}-24s_{l}s_{l}+27s_{h}^{2}}}{5s_{l}-3s_{h}}<\theta <\frac{2(s_{l}-s_{h})}{3s_{h}-2s_{l}}\), then \(\pi _{h}-\pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widetilde{q}_{h};\alpha )<0\). Thus, the high-degree-cost retailerchooses \(w_{l}q+k_{l}\) and quantity \(\widetilde{q}_{h}\). Note that \(\pi _{mh}(w_{l},k_{l},\widehat{q}_{l},q_h;\alpha )\) is a strictly concave function of \(q_h\) and \(\widetilde{q}_{h}-\widehat{q}_{l}=(s_{h}-s_{l}+\theta (\widehat{q}_{h}-\widehat{q}_{l}))/2<0.\) If the supplier does not allow the retailer choosing tariff \(w_{l}q+k_{l}\)to order less than \(\widehat{q}_{l}\), then the optimal order quantity of the retailer with the high belief-degree cost is \(\widehat{q}_{l}\), i.e., she chooses the low-belief-degree-cost retailer’s contract such that \(\pi _{h}- \pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widehat{q}_{l};\alpha )>0\). Thus, the retailer with the high belief-degree cost does not have an incentive to choose tariff \(w_{l}q+k_{l}\).

-

-

3.

When \(\widehat{q}_{l}=\widehat{q}_{h}>0\), substituting \(\widehat{q}_{l}=\displaystyle \frac{s_{h}}{2(1+\theta )}\), \(\widehat{q}_{h}=\displaystyle \frac{s_{h}}{2(1+\theta )}\) into deviation quantity and deviation profit, we have

$$\begin{aligned}\pi _{l}- \pi _{ml}(w_{h},k_{h},\widetilde{q}_{l},\widehat{q}_{h};\alpha )=-(s_{l}-s_{h})^{2}/4<0.\end{aligned}$$Thus, the retailer with a low belief-degree cost chooses \(w_{h}q+k_{h}\) and quantity \(\widetilde{q}_{l}\). Since \(\widetilde{q}_{l}-\widehat{q}_{h}=(s_{l}-s_{h})/2>0\), if the supplier does not allow the retailerchoosing tariff \(w_{h}q+k_{h}\) to order more than \(\widehat{q}_{h}\), then the optimal ordering quantity of the retailer with the low belief-degree cost is \(\widehat{q}_{h}\), i.e., she chooses the high-belief-degree-cost retailer’s contract such that \(\pi _{l}- \pi _{ml}(w_{h},k_{h},\widehat{q}_{h},\widehat{q}_{h};\alpha )=0\). Thus, the retailer with the low belief-degree cost does not have an incentive to choose tariff \(w_{h}q+k_{l}\). On the other hand,

$$\begin{aligned}\pi _{h}- \pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widetilde{q}_{h};\alpha )&=-(s_{l}-s_{h})^{2}/4<0,\\ \widetilde{q}_{h}-\widehat{q}_{l}&=(s_{h}-s_{l})/2<0,\\ \pi _{h}- \pi _{mh}(w_{l},k_{l},\widehat{q}_{l},\widehat{q}_{l};\alpha )&=0. \end{aligned}$$

If the supplier does not allow the retailer choosing tariff \(w_{l}q+k_{l}\)to order less than \(\widehat{q}_{l}\), the retailer with the high belief-degree cost does not need to choose retailer j’s contract. The proof of the theorem is completed.

Proof of Corollary 5

We will show that retailer i selecting tariff \(w_{j}q+k_{j}\) is not an equilibrium. If retailer i chooses tariff \(w_{j}q+k_{j}\), then her optimal order quantity is given by the following optimization problem,

Its first-order condition is \(q^{o}_i=(\Psi ^{-1}(1-\alpha )-\Phi _{i}^{-1}(\alpha )-\theta q_{j}-w_{j})/2\). Further, \(|\frac{\partial q^{o}_i}{\partial q_{j}}|=\theta /2<1\), i.e., retailer i’s best response is a contraction mapping guaranteeing the uniqueness of the equilibrium conditional on retailer i choosing tariff \(w_{j}q+k_{j}\). Substituting \(w_{j}\) in (20) into the expression \(q^{o}_i\), we obtain

-

1.

When \(\widehat{q}_{l}=\widehat{q}_{h}=\widehat{q}\), recalling that quantity restrictions apply and using the analysis similar to that mentioned above, we obtain that the unique responses will be \(q_{l}^{o}=q_{h}^{o}=\widehat{q}\). Using \(w_{i}\), \(k_{i}\) in (20) and \(\widehat{q}_{l}=\widehat{q}_{h}=s_{h}/[2(1+\theta )]=\widehat{q}\), we have \(w_{l}\widehat{q}+k_{l}=s_{h}\widehat{q}/2=w_{j}\widehat{q}+k_{j}\).

-

2.

When \(\widehat{q}_{l}>\widehat{q}_{h}>0\), the unique responses will be \(q_{l}^{o}\leqslant \widehat{q}_{h}\) and \(q_{h}^{o}\geqslant \widehat{q}_{l}\). As in the previous case, it is a straightforward argument that the unique best responses will be \(q_{l}^{o}=\widehat{q}_{h}\) and \(q_{h}^{o}=\widehat{q}_{l}\). For this to be an equilibrium, the retailer with the high belief-degree cost should not have an incentive to deviate to tariff \(w_{h}q+k_{h}\) and choose quantity \(\widehat{q}_{h}\). Her optimal deviation profit should be \(\pi _{mh}(w_{h},k_{h},\widehat{q}_{h},\widehat{q}_{h};\alpha )=(\Psi ^{-1}(1-\alpha )-\Phi ^{-1}_{h}-\widehat{q}_{h}-\theta \widehat{q}_{h})\widehat{q}_{h}-w_{h}\widehat{q}_{h}-t_{h}\). Using (20), we have\(\pi _{h}-\pi _{mh}(w_{h},k_{h},\widehat{q}_{h},\widehat{q}_{h};\alpha )=-(s_{l}-s_{h})(\widehat{q}_{l}-\widehat{q}_{h})<0\). Thus, the retailer with the high belief-degree cost has an incentive to deviate and choose tariff \(w_{h}q+k_{h}\), i.e., retailer i choosing tariff \(w_{j}q+k_{j}\) is not an equilibrium in this case.

-

3.

When \(\widehat{q}_{h}>\widehat{q}_{l}>0\), the retailers’ order quantities are given by (25). By using (20), the high-belief-degree-cost retailer’s profit in this case \(\displaystyle \pi _{mh}(w_{h},k_{h}, q_{l}^{o}, q_{h}^{o};\alpha )=\left( \widehat{q}_{l}-\frac{s_{l}-s_{h}}{2-\theta }\right) ^{2}-\widehat{q}_{l}^{2}<0\). Thus, the retailer with the high belief-degree cost is better off not transacting with the supplier. Therefore, retailer i choosing tariff \(w_{j}q+k_{j}\) cannot be an equilibrium in this case neither. The proof of the Corollary is completed.

Rights and permissions

About this article

Cite this article

Chen, H., Wang, X., Liu, Z. et al. Impact of risk levels on optimal selling to heterogeneous retailers under dual uncertainties. J Ambient Intell Human Comput 8, 727–745 (2017). https://doi.org/10.1007/s12652-017-0481-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-017-0481-9