Abstract

After the initial surge in decentralized finance, widespread public adoption did not materialize. A predominant portion of the populace harbors distrust towards the crypto asset market. Conversely, banks, serving as intermediaries in financial management, enjoy heightened trust. The contemporary development within the banking sector indicates an inclination towards integrating into the crypto asset market. This integration results in new business models for banking institutions and emergent opportunities for their clientele. Prior research addresses perceptions surrounding cryptocurrencies. The present research augments this field by investigating the acceptance of crypto assets. Specifically, we conducted an empirical user study to analyze investing behaviors. By adapting the theoretical framework of the technology acceptance model to the unique characteristics of crypto assets, we highlight acceptance drivers. Notable variances in awareness of crypto assets affect investment decisions. The findings of this study contribute to social welfare by identifying impediments to sustainable investment practices. Additionally, these insights facilitate a more sophisticated comprehension of strategic alternatives available to banking institutions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Financial institutions are entering the crypto market (Singh, 2022). For investors, this development opens up a secure gateway for crypto investments (Auer et al., 2023b). Since 2018, American financial institutions have applied for spot bitcoin exchange-traded products (ETPs) (Gensler, 2024). The year 2024 marks a milestone; the SEC approved the listing and trading of ETP shares (Gensler, 2024). In the European market, new forms of ETPs reflect a development in a similar direction (Singh, 2022). In response, the EU introduced a regulatory foundation for markets in crypto assets (MiCA) (Maia & ao dos Santos, 2021; Ferreira & Sandner, 2021). These changes contradict the original philosophy of decentralized finance (DeFi). Distributed trust (Seidel, 2018) without pre-existing trusted intermediaries (Schär, 2021; Zetzsche et al., 2020). Enabled by blockchain technology, the vision was an open financial system (Chen & Bellavitis, 2020).

An observation of the DeFi market shows that the business models differ in their degree of decentralization (Katona, 2021). Against the ideology of DeFi, new intermediaries emerged after eliminating the existing ones (Langley & Leyshon, 2021). An example is financial technology (FinTech), where technology companies substituted financial institutions (Chen & Bellavitis, 2020; Piñeiro-Chousa et al., 2022). Despite this ambiguity, the total market value of crypto assets increased over the years (Gramlich et al., 2023). The observation raises the question of whether investors demand and support re-intermediation (Schwiderowski et al., 2023b). The notion of re-intermediation appeared as a complementary perspective on institutional intermediaries becoming obsolete through the decentralization of finance. Hence, it subsumes the possibilities for financial intermediaries to react to the decentralization of transactions (Feulner et al., 2022).

Previous studies examined individuals’ intention to adopt cryptocurrencies (Alqaryouti et al., 2020; Sagheer et al., 2022) or their awareness of the crypto market (Henry et al., 2018). The findings show that the main motivation for investing in crypto assets is a combination of technological curiosity (Presthus & O’Malley, 2017) and distrust in financial systems (Bohr & Bashir, 2014). However, a recent research stream on the role of trust in crypto investment decisions provided evidence that trust in institutions and blockchain technology is not interchangeable (Lockl & Stoetzer, 2021; Jalan et al., 2023). Furthermore, a recent empirical study has shown that an individual’s literacy level can predict crypto asset investment behavior (Pilatin & Önder Dilek, 2023). Yet, research still needs to explore the individual’s intention to invest in crypto assets under the boundary condition of financial institutions as re-intermediaries. This study contributes to this emerging research and investigates the following research questions:

RQ 1. Which factors influence individual’s crypto asset investment behavior under the boundary condition of re-intermediation?

RQ 2. How can financial institutions participate in the crypto ecosystem and strengthen the crypto asset acceptance?

By adapting the theoretical perspective of technology acceptance, we address our research questions. In doing so, we built a theoretical model by synthesizing user trust theory, the theory of planned behavior (TPB), and the technology acceptance model (TAM) to align with the nature of crypto asset investment and to comprehend an individual’s intention to invest. In this vein, we conducted a quantitative user study to provide empirical support for our theoretical model. Due to changing legislation, crypto asset trading varies by time and country (Auer et al., 2023b). To study the impact of re-intermediation, we focus on countries where the involvement of the banking industry is high across the population. Thus, we sampled our data from countries of the DACH region (Germany, Austria, and Switzerland).

This research makes a threefold contribution to the existing literature. Firstly, we introduce an exploratory model for the context of crypto asset investment. While previous studies have primarily concentrated either on cryptocurrency acceptance (Mendoza-Tello et al., 2019; Voskobojnikov et al., 2021a) or the role of trust in investment behavior (Lockl & Stoetzer, 2021), we explore both for emerging crypto asset classes, such as crypto tokens (Schwiderowski et al., 2023a). Secondly, most quantitative research on crypto assets focuses on countries with minimal financial institution involvement and low reputation levels among the population. Our empirical study analyzes the influencing factors of crypto asset investment, particularly in an environment where banks are significant in the digital age. Thirdly, by validating established hypotheses, we provide a more comprehensive understanding of the factors influencing investor acceptance of crypto assets and explain behavior toward investment decisions. Thereby, our contribution to electronic market research involves exploring the interplay between technology and market dynamics, leveraging blockchain perspectives and advancing from financial institutions’ pioneering integration efforts (Alt et al., 2024; Alt, 2020).

The structure remainder of the paper is as follows: Section “Research background” introduces the crypto asset investment ecosystem, technology acceptance in the financial industry, and related work pertinent to our research. Section “Research model and hypothesis development” details the development of our hypotheses and presentation of our theoretical research model. Section “Study design” describes our study design, the measurements, sampling strategy, and data collection. We present the findings from the quantitative analysis in Section “Results” and discuss them in Section “Discussion.” We conclude with Section “Conclusion” by summarizing our main findings.

Research background

Ecosystem for crypto assets investment

Change of banking: Developments initiated primarily in information technology and the emergence of FinTech significantly impact the investment ecosystem (Schwiderowski et al., 2023b; Piñeiro-Chousa et al., 2022). They lead to substantial alterations in the financial sector propelled by technical innovations, new regulations, or escalating customer demands (Yavas et al., 2004). Online and mobile banking has witnessed a surge in popularity in the past decade due to client requests and technological advancements (Luo et al., 2010; Riffai et al., 2012). This significant shift allows customers to conduct banking activities remotely, rather than visiting a bank physically, by utilizing mobile applications (Al-Somali et al., 2009; Lee, 2009). As digitization progresses and the financial sector undergoes transformation, new digital currencies are emerging (Minesso et al., 2022; Allen et al., 2022). Central banks, as intermediaries with considerable power and influence, are spearheading initiatives for central bank digital currencies (CBDC), including the digital Euro (Auer et al., 2023a; Allen et al., 2022). These CBDCs can utilize blockchain technology to enhance privacy, trust, and security (Tronnier et al., 2022; Bech & Garratt, 2017). With the advent of blockchain in recent years, a plethora of use cases occurred in the financial industry, encompassing areas such as trade finance, compliance, security, and customer service (Guo & Liang, 2016; Korpela et al., 2017; Garg et al., 2021). Moreover, the integration of blockchain technology in the financial industry facilitates distributed clearing mechanisms, credit information systems, and innovations in supply chain finance (Guo & Liang, 2016; Korpela et al., 2017; Dutta et al., 2020). By embracing blockchain integration in processes and structures at an organizational level, banks can enhance their resilience in the dynamic financial landscape (Mishra et al., 2023; Zei et al., 2024). Prior to the blockchain movement’s emergence, transferring small amounts was not profitable (Schär, 2021; Piñeiro-Chousa et al., 2022). Decentralized market transactions were hindered by high trading costs, such as exchanging money across different banks and countries, as well as lack of financial inclusion (Gramlich et al., 2023; Ferreira & Sandner, 2021).

Understanding crypto assets: In the context of crypto assets, the increasing relevance of crypto assets and other DeFi services links to their perceived advantages over traditional assets, including faster and cheaper transactions, greater accessibility, more credibility, and greater transparency (Schwiderowski et al., 2023b; Gramlich et al., 2023; Chen & Bellavitis, 2020). Crypto assets are based on blockchain as their underlying technology (Voskobojnikov et al., 2021a; Schär, 2021). They facilitate the creation and secure storage of digital representations of tangible or intangible objects within the DeFi environment (Schwiderowski et al., 2023a; Kreppmeier et al., 2023; Sockin & Xiong, 2023). The DeFi ecosystem (Piñeiro-Chousa et al., 2022; Schär, 2021) represents a decentralized financial system utilizing smart contracts to design financial services that aim for transparency and interoperability (Zetzsche et al., 2020). Assets pertinent to DeFi or blockchain include digital art, tickets, collectibles (physically existent but traded digitally), and digital exchange objects such as immaterial football cards, in-game items, and rights to real estate that are tradable digitally (Kreppmeier et al., 2023; Whitaker & Kräussl, 2020; Valeonti et al., 2021; Sockin & Xiong, 2023). Crypto assets can be distributed through mechanisms such as initial coin offerings, which individuals also use for investing in organizations, particularly startups (Howell et al., 2020; Bruckner et al., 2023). A distinction exists between crypto tokens with payment (e.g., cryptocurrencies), asset (e.g., tokenized shares), and utility functions (e.g., items that enable access to online games) (Schwiderowski et al., 2023a). Cryptocurrencies are extensively investigated as payment tokens due to their spendability and economic impact (Mendoza-Tello et al., 2019; Rehman et al., 2020). Furthermore, non-fungible tokens are digital assets tradable on blockchain technology, providing a proof-of-ownership (Chalmers et al., 2022; Valeonti et al., 2021). In addition, tokenization and token economy, which entail representing objects and their ownership using blockchain, are widely applied concepts in organizations’ digital supply chains with an emphasis on traceability (Pytel et al., 2023; Sunyaev et al., 2021; Dutta et al., 2020). Tokens representing ownership of assets enable the division of previously immobile or indivisible valuable objects into smaller digital sub-units, a process known as fractionalization (Whitaker & Kräussl, 2020; Kreppmeier et al., 2023). This concept of fractionalization also holds significance for providers or artists, as it allows for equity ownership and profit realization with each subsequent trade (Whitaker & Kräussl, 2020).

New intermediary: A plethora of new players is inundating the financial world currently, along with a diverse range of new investment products and environments (Voskobojnikov et al., 2021a; Gramlich et al., 2023). Historically, a limited number of influential entities dominated this field, leading to the lack of a central and unbiased authority (Chen & Bellavitis, 2020; Howell et al., 2020). Large financial institutions, especially banks, held a near-monopolistic stance. Presently, emerging business models enabled by new technology offer innovative value propositions to users (Chen & Bellavitis, 2020; Schwiderowski et al., 2023b). A shift in the investment opportunities available to private investors precipitates this evolution (Piñeiro-Chousa et al., 2022). In the contemporary landscape, customers have access to a variety of investment options. These include traditional avenues such as precious metals (e.g., gold), currencies (e.g., the US dollar), and investments (e.g., funds, stocks, and shares), alongside tangible assets like watches or cars, and crypto assets (Ferreira & Sandner, 2021; Wurgler, 2000; Gramlich et al., 2023). The integration of blockchain technology has revolutionized the approach by offering a digital and automated concept of security, anonymity, transparency, and data integrity. This concept obviates the need for a centralized, trusted intermediary in controlling market activities and transactions (Chalmers et al., 2022; Gramlich et al., 2023; Zetzsche et al., 2020). However, new entities, such as application providers, are now entering the ecosystem and diminishing the influence of established players (Chen & Bellavitis, 2020; Gramlich et al., 2023). A considerable body of literature on disintermediation also refers to “re-intermediation” to describe the structural transformations in the banking industry (Schwiderowski et al., 2023b).

In this context, the elimination of any intermediaries from the ecosystem in connection with the blockchain concept is rather an idealization that obscures the actual substitution. New players, such as technology companies, are replacing financial institutions (Chen & Bellavitis, 2020). Figure 1 illustrates the change in the financial market and involved intermediaries. This shift is partly due to intermediaries’ advantages, such as reducing transaction costs, consolidating existing offerings, and providing a more diverse range for users. Nevertheless, they are essential in forgoing connections between different segments of the ecosystem (Chen & Bellavitis, 2020).

According to Voskobojnikov et al. (2021a), there is an expectation of a further increase in the supply of crypto assets. It is also improbable that the number of intermediaries will remain at the current level. Identifying the causal barriers to acceptance must be addressed to make the technology more appealing to a broader audience is crucial. Failing to address these barriers could result in an increasingly complex and daunting ecosystem for users.

Technology acceptance in the financial industry

As digitization permeates daily life, the acceptance and adoption of emerging technologies is a significant field of research (Ajzen, 2020; Taherdoost, 2018). Technology acceptance, in contrast to rejection, refers to the positive decision by users to adopt an innovation or new technology. Especially in social and linguistic contexts, there is often a conflation of terms such as attitude, user suitability, and adoption (Müller-Böling & Müller, 1986). Numerous models in this field of information systems address this topic, each considering different determinants (Venkatesh et al., 2003). The technology acceptance model (TAM), proposed by Davis (1985), serves as a foundational framework in many research endeavors (Dinev & Hu, 2007; Featherman & Pavlou, 2003). By now, it is one of the most popular models focusing on the explanatory power regarding acceptance (Jockisch, 2010). Its origins trace back to the Theory of Reasoned Action (Fishbein & Ajzen, 1975), a psychological model that aims to predict the behavioral intention of an individual (Davis, 1985). Theory of reasoned action and its extension, the Theory of Planned Behavior (TPB), have undergone extensive scientific testing and application (Ajzen, 1991; Lee, 2009; Wu & Chen, 2005). Beyond individual perspectives, numerous research approaches also consider groups and organizations in the context of technology adoption (Venkatesh et al., 2016). The TAM2 and TAM3 models introduce new variables compared to the original approach (Venkatesh et al., 2000, 2016). Furthermore, the Unified Theory of Acceptance and Use of Technology (UTAUT) is a well-established model in this domain (Venkatesh et al., 2003). Additionally, there is a model by Taylor & Todd (1995) that merges the TAM with the Theory of Planned Behavior, termed Combined Technology Acceptance Model and Theory of Planned Behaviors.

Related work

Research in the domain of technology acceptance within information systems has been conducted in various sectors, including e-services (Featherman & Pavlou, 2003), social media (Hansen et al., 2018), intelligent systems (Wanner et al., 2022), and online environments (Kuen et al., 2023). The advent of online and mobile banking represented a globally significant shift in the digitization process, integrating finance and information systems (Sathye, 1999; Al-Somali et al., 2009; Mutahar et al., 2018; Riffai et al., 2012). Lee (2009) examined the impact of risk on the adoption of online banking. Luo et al. (2010) expanded this analysis by observing users’ behavior with a scope on trust and risk. In the context of cryptocurrency adoption, technology acceptance studies have been carried out in multiple countries, including Spain (Arias-Oliva et al., 2019), China (Shahzad et al., 2018), Turkey (Pilatin & Önder Dilek, 2023), Thailand (Namahoot & Rattanawiboonsom, 2022), and South Africa (Walton & Johnston, 2018). Additionally, researchers explored users’ perceived risk (Abramova & Böhme, 2016; Jariyapan et al., 2022) as well as financial literacy (Jariyapan et al., 2022). Albayati et al. (2020) and (Mendoza-Tello et al., 2019) investigate financial transactions involving cryptocurrencies in e-commerce. Notably, there was specific research on the adoption and technology acceptance of Bitcoin (Folkinshteyn & Lennon, 2016; Abramova & Böhme, 2016). However, research on the adoption and acceptance of crypto assets remains relatively limited. Pilatin & Önder Dilek (2023) examined technology acceptance using a leading model in Turkey. Additionally, Voskobojnikov et al. (2021a) investigated the adoption of cryptocurrencies and crypto assets with a focus on risk and trust.

To gain an overview, Fig. 2 illustrates the related work and structure of the literature in two matrices. The first one structures the literature on a thematic focus. The second one illuminates the existing acceptance research on the topic. We summarize from Fig. 2 that there needs to be more research on the thematic focus of crypto assets. In the following, we conceptualize our research model with positioning regarding trust, risk, and awareness.

Research model and hypothesis development

Our research centers on identifying the drivers influencing investment behavior in crypto assets and how banks can sustainably position themselves in the crypto market to enhance acceptance among the broad masses. To achieve a theoretical understanding, we will employ a technology acceptance model (Davis, 1989), which aptly suits the research needs and allows for expansion with concepts derived from literature.

We incorporate extensional theoretical frameworks and constructs, such as the theory of planned behavior and the theory of reasoned action. These frameworks, which are associated with cognitive approaches, address human behavior in certain situations (Ajzen, 1991; Wu & Chen, 2005; Taylor & Todd, 1995). The complementary elements are detailed in the hypotheses chapter.

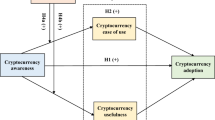

Our research model, named the crypto assets acceptance model, encompasses core components, the crypto assets extension, and moderators (as illustrated in Fig. 3). The constructs and hypotheses of the core components are primarily founded on technology acceptance research in information systems, particularly in the crypto field (Davis, 1989). The crypto assets extension enriches the model with new constructs, aiming to provide a comprehensive view. This includes focusing on users’ awareness, risk, trust, and behavioral control. The constructs and hypotheses from both the core and crypto extension derived from the literature are succinctly outlined.

Awareness (AW) of investing in crypto assets

The awareness of technology, including its provision as a service (Rogers & Shoemaker, 1971), is crucial in information systems research on technology acceptance behavior (Dinev & Hu, 2007). Given the limited research on the behavior in investing in new and innovative crypto assets, we use research on the technological transformation of finance and banking as a foundation. In contexts such as technology adoption in online banking or digital currencies, technology awareness is a fundamental component of many empirical studies, and its impact on the behavior is confirmed (Sathye, 1999; Al-Somali et al., 2009; Riffai et al., 2012). In detail, several studies demonstrate that awareness influences perceived risk (Mutahar et al., 2018), perceived usefulness (Al-Somali et al., 2009; Mutahar et al., 2018), perceived ease of use (Mutahar et al., 2018) or attitude toward using as well as behavioral intention (Sathye, 1999; Riffai et al., 2012; Dinev & Hu, 2007). In cryptocurrency technology adoption, the link between technology awareness in using crypto assets in Pakistan and perceived risk, ease of use, and usefulness was examined (Sagheer et al., 2022). Additional research explored the relationship between awareness and intention to use Bitcoin as a cryptocurrency in China (Shahzad et al., 2018).

We hypothesize that awareness of investing in crypto assets is critical to the perceived risk of potential private investors. In our crypto assets acceptance model, we assume a higher level of awareness and education of our people regarding the technology as well as the providing service when investing in crypto assets will decrease the perceived risk as individuals recognize risks with less loss (Mutahar et al., 2018). Furthermore, based on current research, we anticipate awareness positively impacting perceived behavioral control, usefulness, and ease of use when investing in crypto assets (Al-Somali et al., 2009; Sagheer et al., 2022; Mutahar et al., 2018). With increased awareness about the underlying technology and the service provided for investing in crypto assets, more potential private investors are likely to believe that their performance will be improved.

Hypothesis 1a. Awareness negatively influences the perceived risk of investing in crypto assets.

Hypothesis 1b. Awareness positively influences the perceived behavioral control of investing in crypto assets.

Hypothesis 1c. Awareness positively influences the perceived ease of use of investing in crypto assets.

Hypothesis 1d. Awareness positively influences the perceived usefulness of investing in crypto assets.

Perceived risk (PR) of investing in crypto assets

Bauer (1967) characterized perceived risk as a combination of uncertainty and the severity of outcome, examining consumer behavior and uncertainty concerning the consequences of product use. Additionally, Peter et al. (1976) conceptualized perceived risk as a type of subjective expected loss. With the evolution of consumer behavior and the advent of online services, perceived risk has expanded beyond just concerns about fraud or product quality. Perceived risk now encompasses potential losses when using an e-service to achieve a desired outcome (Featherman & Pavlou, 2003). In the domains of finance, banking, and technology, perceived risk includes dimensions such as social, financial, security, and time (Lee, 2009; Featherman & Pavlou, 2003).

In the specific area of mobile banking, a subset of finance and investing in crypto assets, perceived risk is a crucial component of technology acceptance models. Various studies have assessed the impact of perceived risk in mobile banking services for users, who are the same target group as potential private investors for our survey (Lee, 2019; Luo et al., 2010). Furthermore, financial research has explored the relationship between perceived risk and investment performance, noting a direct positive effect (Thai et al., 2017). Cuong & Jian (2014) conducted a study on the Vietnamese stock market, affirming the presence and influence of psychological factors, such as risk psychology, on individuals’ attitudes toward investing.

Research focusing on perceived risk in the context of crypto assets remains limited. An empirical study by Mendoza-Tello et al. (2019) investigates perceived risk in the acceptance of cryptocurrencies as monetary transactions in e-commerce. Further studies by Jariyapan et al. (2022), Arias-Oliva et al. (2019), Namahoot & Rattanawiboonsom (2022), and Abramova & Böhme (2016) examined the influence of perceived risk on behavior intention regarding cryptocurrency adoption. Risk mitigation in non-fungible token (Schwiderowski et al., 2023b) and regulation (Ferreira & Sandner, 2021) play significant roles in crypto assets research. Investing in crypto assets is similar to using online banking services, so we adapt social, financial, and security risks from the online banking sector. Emotional, financial, and security concerns are central to trusting technology and managing money and assets (Lee, 2009; Featherman & Pavlou, 2003; Voskobojnikov et al., 2021a). Regarding the behavior of investing in crypto assets, we argue that individuals with a higher expected loss (perceived risk) exhibit a lower perception of usefulness (Mutahar et al., 2018; Mendoza-Tello et al., 2019).

Hypothesis 2. Perceived risk negatively influences the perceived usefulness of investing in crypto assets.

Perceived trust (PT) of investing in crypto assets

The theory of trust perception examines various components: propensity for trust, institution-based trust, and beliefs in trust (Mayer et al., 1995). Trust is paramount in establishing and endorsing a specific system or technology, fostering a positive rapport among citizens (Pavlou & Fygenson, 2006). Additionally, trust is a foundational element in economic and social research, particularly in contexts characterized by uncertainty, authority delegation, and the potential for opportunistic behavior (Gefen et al., 2003; McKnight et al., 2002; Pavlou & Fygenson, 2006). Empirical studies on technology adoption (Wanner et al., 2022; Kuen et al., 2023; Hansen et al., 2018; Wu & Chen, 2005; Lee & Turban, 2001) frequently incorporate trust as a significant variable. In subsequent research focusing on technology adoption and acceptance in the financial sector, trust plays a vital role (Luo et al., 2010; Cheng et al., 2008).

In the realm of investment behavior, perceived trust is utilized in technology acceptance to comprehend investment behavior. These studies observe an effect on the attitude toward using as well as the intention to use crypto assets, particularly cryptocurrencies (Mendoza-Tello et al., 2019; Albayati et al., 2020; Voskobojnikov et al., 2021a). An empirical study could not confirm distrust of traditional banks as a driver for joining DeFi services (Lockl & Stoetzer, 2021). We identify research with detailed analysis of trust issues within the cryptocurrency ecosystem, encompassing aspects such as wallets, fraud detection, security, market factors, and stakeholder analysis (Rehman et al., 2020). As we investigate the acceptance of crypto asset investments, we hypothesize that the perceived trust of potential private investors affects their intention to invest in crypto assets.

Hypothesis 3. Perceived trust positively influences attitude toward investing in crypto assets.

Perceived behavioral control (PBC) of investing in crypto assets

Individual behavior, particularly the roles of individual organizational members and social systems, is elucidated and predicted via the theory of planned behavior, an extension of the theory of reasoned action (Fishbein & Ajzen, 1975; Ajzen, 1991). This behavior includes attitude, perceived behavioral control, and subjective norms. The attitude explains how an individual evaluates the behavior in question, either favorably or unfavorably. Additionally, perceived behavioral control refers to an individual’s perception of how easy or difficult it is to perform the behavior. According to Taylor & Todd (1995), perceived behavioral control encompasses external and internal behavioral constraints as well as resources and technology facilitating actions (Ajzen, 1991). Subjective norm signifies the perceived organizational or social pressure exerted on a person aiming to undertake a specific behavior (Ajzen, 1991; Lee, 2009; Wu & Chen, 2005).

In this study, we amalgamate the extended technology acceptance model with the theory of planned behavior in line with Hansen et al. (2018), incorporating perceived behavioral control and attitude. Behavioral control is a commonly employed construct in the acceptance of technology (Taylor & Todd, 1995; Venkatesh et al., 2003, 2000). Numerous studies in information systems and finance address the construct of perceived behavioral control (Hansen et al., 2018; Wu & Chen, 2005; Dinev & Hu, 2007). In the context of Internet banking, Lee (2009) defined perceived behavioral control as an individual’s perception of the ease or difficulty of performing the behavior in question and confirmed its effect on behavioral intention. Moreover, significant support exists for the positive influence of behavioral control and behavioral intention in integrating Bitcoin in South Africa (Walton & Johnston, 2018) and in Turkey (Pilatin & Önder Dilek, 2023). Consequently, we find that when investing in crypto assets, the individual’s perceived behavioral control impacts behavioral intention.

Hypothesis 4. Perceived behavioral control positively influences behavioral intention of investing in crypto assets.

Perceived ease of use (PEOU) of investing in crypto assets

As a core component in alignment with (Davis, 1989), perceived ease of use is the degree to which an individual believes that a particular system or technology would be effortless to use (Davis, 1989; Venkatesh et al., 2003). Studies in the financial field focusing on technology acceptance have explored the effect of the perceived ease of use and perceived usefulness (Lee, 2009; Featherman & Pavlou, 2003), the behavioral intention to use (Dinev & Hu, 2007) and the attitude (Lee, 2009; Al-Somali et al., 2009). Other examinations have verified the influence of perceived ease of use on the attitude towards using and perceived usefulness in adopting cryptocurrencies (Albayati et al., 2020; Folkinshteyn & Lennon, 2016; Mendoza-Tello et al., 2019; Shahzad et al., 2018). Ultimately, we conclude that the perceived ease of use when investing in crypto assets affects individuals’ perceived usefulness and attitude toward using.

Hypothesis 5a. Perceived ease of use positively influences perceived usefulness of investing in crypto assets.

Hypothesis 5b. Perceived ease of use positively influences attitude toward investing in crypto assets.

Perceived usefulness (PU) of investing in crypto assets

According to Davis (1989), the core component of perceived usefulness articulates the extent to which an individual believes that utilizing a specific system would be advantageous and augment their performance in activities. The correlation and effect between perceived usefulness and attitude toward using, as well as behavioral intention, are evidenced in numerous empirical studies on technology acceptance in information systems (Lee, 2009; Dinev & Hu, 2007; Davis, 1989). Additionally, research on blockchain or cryptocurrency adoption frequently incorporates perceived usefulness (Albayati et al., 2020; Namahoot & Rattanawiboonsom, 2022; Mendoza-Tello et al., 2019; Jariyapan et al., 2022). Schwiderowski et al. (2023b) examine the value creation in the non-fungible token market for collectors, platforms, and artists. We anticipate that the perceived usefulness of private investors when investing in crypto assets affects their behavioral intention and attitude toward using.

Hypothesis 6a. Perceived usefulness positively influences attitude toward investing in crypto assets.

Hypothesis 6b. Perceived usefulness positively influences behavioral intention of investing in crypto assets.

Attitude toward investing in crypto assets (ATT) and behavioral intention (BI) of investing in crypto assets

In amalgamating the technology acceptance model with the theory of planned behavior, attitude and behavioral intention emerge as pivotal factors (Ajzen, 1991; Davis, 1989; Taylor & Todd, 1995). Behavioral intention quantifies an individual’s commitment to enacting specific behaviors (Ajzen, 1991; Taylor & Todd, 1995). As elucidated by Taylor & Todd (1995), attitude constitutes an evaluative assessment and exerts a direct influence on behavioral intention. Further research extensively discusses the significance of attitude in technology acceptance research (Venkatesh et al., 2003). We follow Dinev & Hu (2007); Pavlou & Fygenson (2006); Lee (2009) incorporating in our crypto assets acceptance model the attitude towards investing in crypto assets and behavioral intention to invest in crypto assets. Moreover, we expect a positive impact of attitude on the behavioral intention to invest in crypto assets.

Hypothesis 7. Attitude toward using positively influences behavioral intention of investing in crypto assets.

Study design

To evaluate and investigate our research model and hypotheses, we conduct a study to gain insights into the private investor perspective on investing in crypto assets. For our study, we conceptualized and performed a qualitative cross-sectional analysis to explore the current barriers to adoption and the perspectives of retail investors on investing in crypto assets. To do this, we need to specify the target audience in our study. As we explore the current perspective of potential private investors in crypto assets, we require an audience with cultural similarities and a consolidated financial and banking system. In addition, we limit the countries to Austria, Germany, and Switzerland, the DACH region, as these countries have similar cultural behaviors and are a strong economic sub-environment in Europe (Müller, 2018). Furthermore, considering the future role of banks, we require an audience with a similar financial system and awareness and trust in the system. This region, where banks will face challenges with crypto assets in the future, is pivotal for analyzing barriers to accepting crypto assets from the perspective of potential private investors. Given the multilingual population in this region, speaking Italian, French, and German, we offer bilingual study in English and German to facilitate participation. Figure 4 provides a timeline of the conducted studies.

Preliminary work

In the first step of our study development, we conducted two preliminary studies (n = 155 students and their social environment) to identify important aspects and perspectives for investment in crypto assets. The first study comprises n = 72 and the second n = 83 participants. We communicated the pilot studies to undergraduate students via lectures and social media. Furthermore, we conducted a literature review to analyze preliminary work for the used constructs and measurements. The results of our preliminary studies and the findings of our literature review form an important foundation for the design of our study. We used this foundation and derived our first draft of the research model, the constructs, and measurements. Table 1 illustrates the used measurements: awareness, perceived behavioral control, perceived trust, perceived risk, perceived usefulness, perceived ease of use, attitude toward using, and behavioral intention to use. The table details the selection procedure of our measurement items and the resulting items for each reduction. We used various measurement items from the existing publications to provide a scientifically grounded basis for our model. The measurement items for awareness are primarily derived from Dinev & Hu (2007) and Al-Somali et al. (2009). Combining technology acceptance following Davis (1989) and Ajzen (1991) in our crypto assets acceptance model, we collected the items for recognizing perceived behavioral control from Taylor & Todd (1995), Lee (2009), and Venkatesh et al. (2000). Following the definition of trust by Mayer et al. (1995), we gather our questions for the survey from studies on technology acceptance in crypto and information system context (Cheng et al., 2008; Wanner et al., 2022; Lee & Turban, 2001). The measurement items for risk are from Featherman & Pavlou (2003). As the foundation of our model, we assemble the questions for usefulness, ease of use, attitude, and behavioral intention in accordance with Davis (1989).

Internal project team workshop

In this phase of research, we conducted a workshop within our team to evaluate the selected constructs and related measurement items. Within the heterogeneous team, we combined different knowledge bases in areas such as DeFi, business model development, and innovation management in order to scrutinize the previous findings and integrate new aspects and views. This process allowed us a thorough discussion of the previously selected items in more depth and the creation of a new, improved selection. We discussed the measurement items in detail. We assessed the suitability of each question for the study’s context, including whether any question overlapped. Following this, we refined the finalized ones to start the pretest with these measurement items, aiming to capture acceptance for investing in crypto assets as accurately as possible.

Pretest

After finalizing the crypto assets acceptance model as our research model and the survey, we conducted a pretest to evaluate the study design. In this pretest, we involved n = 50 participants for data collection with a balanced representation between men and women. We then evaluated the results and checked for potential errors within our study or in the translation between English and German. Therefore, we analyzed the differences between the answers of the different languages. Further, we examined tendencies toward neutral, overly positive, and overly negative responses to eliminate misleading questions or wording. We analyzed our participants’ crypto experience and the control question along with consistency, convergent, indicator reliability, and discriminant validation. We did not find any critical problems in any of our evaluation tests. For our pretest, we used prolific.uk with a country of residence filter (German, Austria, and Switzerland) and fluent languages (English and German) to address our target group and collect the data.

Main study

We started the data collection of our final main study with a total of n = 888 participants. Table 2 provides the participants’ demographics for the main study. Most participants in our survey are aged between 20 and 30 years and based in Germany. We also recognized an unequal distribution of gender among the attendees. We deployed our survey on prolific.uk as a data collection tool in July 2023. In doing so, we operated language fluency and country of residence filters to target our audience.

Our main study design is based on the elaborated crypto assets acceptance model with its constructs and measurement items. The participants begin our survey by selecting their preferred language. In addition, demographic questions about gender, age, and investment experience complete the first section of our survey design. Prolific.uk gives us more demographics about our participants, such as the residence. The second section briefly explains crypto asset investing to ensure a consistent understanding. Participants will then be asked to answer a few more questions about their demographics and interest in crypto assets. The subsequent section of our study design contains the measurement questions (see Fig. 1) related to the constructs in our crypto assets acceptance model. Finally, participants can give us personal feedback on our research and questionnaire.

We checked the collected data and the model in several quality performance analyses as the intention was to analyze direct and indirect effects using Structural Equation Modelling (SEM) (Zhao et al., 2010; Hair Jr et al., 2021). In the following, we briefly outline the procedure for the main study, as this is the most relevant for our paper. Before testing the structural model, we explored the measurement model to ensure the reliability and validity of the constructs and measurement items (indicators). Table 3 provides an overview of the reliability analysis of the constructs. We analyzed the relations between measures of constructs, items, and the designed constructs. By examining the measurement model, we checked for internal consistency, convergent (composite) reliability, convergence reliability (average variance extracted), and discriminant validity (cross-loadings; Fornell-Larcker criterion).

First, we approved the sampling adequacy of the data at hand to show that it is appropriate for the objective of structural equation modeling. We are able to reject the null hypothesis (p < 0,01) of the Bartlett’s test and the Kaiser-Meyer-Olkin test result shows a remarkable value (0.96). Second, we explored the measurement model in terms of the reliability and validity of constructs and indicators. At first, not all constructs achieved the desired threshold for Cronbach’s alpha and average variance extracted, whereas Dillon-Goldstein’s rho and eigenvalues were above the respective thresholds. Cronbach’s alpha was below the threshold for the construct perceived risk, and the average variance extracted was below the threshold for the construct awareness. Therefore, we analyzed the item loadings and communalities to identify items from the measurement model that are not explained well by the construct variable. Items AW3, AW4, AW5, AW7, AW9, PR2, and PU3 were thus excluded from the measurement model, resulting in an overall good reliability of all constructs. Finally, none of the constructs failed the Fornell-Larcker criterion. Tables 3 and 4 illustrate the final measurement model assessment. Besides checking the loadings (see Table 3) of the indicators with their latent constructs, we checked the cross-loadings and did not observe any.

With the results, we conducted a mediation analysis based on the direct and indirect effects observed to investigate the role of user’s awareness, perceived risks, perceived trust, and perceived behavioral control on their intention to invest in crypto assets. Theron, we follow the methodology presented by Zhao et al. (2010) and Hair Jr et al. (2021). In doing so, we derived the mediation effects by analyzing the direct and indirect effects within our research model presented in Fig. 5. Lastly, we investigate the moderating effects of gender, age, prior investment, and crypto asset experience on perceived behavioral control and awareness in our study. No significant findings were identified in this analysis.

Results

Assessment of the structural model

After evaluating the quality of the measurement model and items in the study, we inspected the structural component and estimation results of our crypto assets acceptance model. Figure 5 illustrates the estimated model results, where the direct effects are depicted as path coefficients in the proposed research model, and the observed indirect effects are delineated below.

With the results, we conducted a mediation analysis based on the direct and indirect effects observed to investigate the role of user’s awareness, perceived risks, perceived trust, and perceived behavioral control on their intention to invest in crypto assets. Theron, we follow the methodology presented by Zhao et al. (2010); Hair Jr et al. (2021). In doing so, we derived the mediation effects by analyzing the direct and indirect effects within our research model presented in Fig. 5.

To assess the overall quality of our structural model, we first examine the proportion of variance for the structural part. The coefficient of determination of our proposed research model demonstrates that 0.79 of variance in the endogenous latent construct can be accounted for by its predictors, i.e., its independent latent constructs. This finding confirms that the observed effect of behavioral intention to invest in crypto assets is substantial. Our proposed crypto assets acceptance model can explain a relatively high proportion of variation of intention to adopt investing in crypto assets. In the following sections, we will first examine the role of the core constructs as well as then thoroughly examine the exogenous and endogenous constructs of our Crypto Assets Extension.

Connecting the core constructs

The study explores the relationship between perceived ease of use, usefulness, and attitude on behavioral intention to invest in crypto assets. Accordingly, we postulate with H5, H6, and H7 a positive relation between ease of use and usefulness to attitude and a positive impact from usefulness on attitude to behavioral intention. Concerning the link between ease of use and usefulness, we can verify with our study that H5a has a significant positive effect of 0.304. Additionally, we observe a positive relationship between ease of use (0.169) and usefulness (0.354) to attitude. Furthermore, we can confirm H7 with the connection between attitude and behavioral intention (0.736). It indicates the most substantial impact in our research model, suggesting a strong positive effect of a user’s attitude regarding crypto asset investments on the intention to use it. Finally, we can support H5a, H5b, H6a, H6b, and H7. Table 5 depicts an overview of all effects.

Trust as antecedent of attitude towards investing in crypto assets

Perceived trust is paramount for investment decisions and an important predictor of adopting crypto assets. We obtain a highly significant effect of trust on attitude towards investing in crypto assets, with a magnitude of 0.445, making it a primary positive determinant of a user’s attitude towards crypto assets alongside usefulness (0.354) and ease of use (0.169). Further, we observe an indirect relation of trust to behavioral intention through attitude (0.323). In detail, a higher perceived trust influences the affection towards investing in crypto assets and affects our intention to use it directly and indirectly.

Awareness as key factor

We observe a highly significant connection between awareness and behavioral control (0.630), confirming H1b. With increased awareness, potential private investors anticipate more control or easier access when investing in crypto assets. We confirm a significant effect from awareness to perceived risk, ease of use, and usefulness. In detail, we observe a strong link between awareness and ease of use (0.720). Further, with a higher level of awareness of the benefits and risks, people perceive less risk (\(-\)0.371) when using crypto asset investments. Regarding our indirect effects, the link between awareness and usefulness is highly significant (0.620), supporting H1a, H1c, and H1d. Finally, we recognize the indirect impact of awareness on the behavioral intention to invest (0.422) as well as the attitude (0.344).

Perceived behavioral control as latent direct predictor of behavioral intention to use crypto assets

Further, we examine the role of perceived behavioral control as a predictor of intention to invest in or use crypto assets. We can confirm H4 since we observe an enormously significant effect of behavioral control on the behavioral intention to invest in crypto assets, with a magnitude of 0.213 (see Table 5). Concerning the coefficient of determination, behavioral control explains 40 percent of the variance of behavioral intention. This effect develops as anticipated since users’ perception of the ease or difficulty of realizing the behavior in question influences their investment. Thereby, it concerns the control beliefs about resources and opportunities available to the user over which they do not have deliberate control. We did not observe any indirect effects of behavioral control on other predictor constructs.

Perceived risk

The effect of the awareness of the underlying technology and its providing services and the perceived risk when investing in crypto assets is highly significant, with a negative impact of \(-\)0.371. An increased degree of awareness reduces the risk of potential private investors when using crypto asset investments. We investigate the possible influence between risk and usefulness, finding a non-significant influence with a magnitude of \(-\)0.022. Finally, we can validate H1a with our results, but there was no support for H2.

Discussion

Theoretical implications

Initially, we discuss briefly the main results of our study. Based on the findings, attitude predominantly influences the behavioral intention to invest in crypto assets, which aligns with research by Davis (1989), Pavlou & Fygenson (2006), Albayati et al. (2020), Pilatin & Önder Dilek (2023), and Walton & Johnston (2018). In addition, an elevated utility value when investing in crypto assets enhances the intention to invest, aligning to current studies on cryptocurrencies (Jariyapan et al., 2022; Shahzad et al., 2018; Mendoza-Tello et al., 2019) as well as information systems (Mutahar et al., 2018; Hansen et al., 2018; Lee, 2009; Al-Somali et al., 2009). Further, as behavioral control is associated with the probability of how easy or difficult the behavior performance appears, private investors are more likely to invest in crypto assets as they believe they have an adequate level of control, and the behavior implementation appears more accessible (Pilatin & Önder Dilek, 2023; Walton & Johnston, 2018). Lee (2009) and Wu & Chen (2005) corroborate similar findings in the field of technology adoption in finance, where behavioral control was one of the latent variables that explained the paramount variance of behavioral intention to use. Additionally, our observations align with the findings of Ajzen (1991); Dinev & Hu (2007); Pavlou & Fygenson (2006), which suggest that even if users strongly intend to behave in a certain way, they require the necessary resources and skills. The perceived trust of private investors notably affects the behavioral intention to invest in crypto assets. Our findings stand in line with studies (Shahzad et al., 2018; Namahoot & Rattanawiboonsom, 2022; Mendoza-Tello et al., 2019; Voskobojnikov et al., 2021a) on cryptocurrencies and assets, individuals’ trust and trustworthiness, beliefs or disposition affect an increased behavioral intention. Furthermore, the results of our study are consistent with the research findings on the digital Euro, as there is a relationship between hard and soft trust factors of the digital Euro (digital currency) and the willingness to use it (Tronnier et al., 2022). Moreover, we confirm that the degree of effort a private investor assumes when investing in crypto assets impacts the investing behavior (Davis, 1989; Lee, 2009; Riffai et al., 2012). In accordance with studies on the adoption of cryptocurrencies (Jariyapan et al., 2022; Abramova & Böhme, 2016; Mendoza-Tello et al., 2019), we confirm that if the investment in crypto assets requires a reasonable level of effort for the private investors, they are more likely to engage in such investments. Increasing awareness is essential for a heightened level of investment in crypto assets. Enhanced education about the underlying technology or financial literacy can facilitate an upsurge in investment (Dinev & Hu, 2007; Riffai et al., 2012; Shahzad et al., 2018; Arias-Oliva et al., 2019).

Secondly, we summarize and discuss the various impacts on the attitude towards investing in crypto assets. With this, trust significantly affects the attitude towards investing in crypto assets. Private investors’ attitudes might increase with trustworthy and credible websites for crypto asset investments (Hansen et al., 2018; Al-Somali et al., 2009; Albayati et al., 2020). In addition, an enhanced private investor usefulness is strengthening the attitude. These findings align with various studies on technology acceptance in the area of financial payment supported by information system technologies (Albayati et al., 2020; Pavlou & Fygenson, 2006; Lee, 2009; Dinev & Hu, 2007; Al-Somali et al., 2009). Furthermore, individuals perceived ease of use influences the attitude toward investing in crypto assets (Albayati et al., 2020; Pavlou & Fygenson, 2006; Lee, 2009; Al-Somali et al., 2009). Moreover, in accordance with previous empirical studies in crypto and finance, the individual’s perceived ease of use directly influences the usefulness positively (Albayati et al., 2020; Al-Somali et al., 2009). The non-significant effect of risk on usefulness is in accordance with Featherman & Pavlou (2003) but contrary to the study by Mendoza-Tello et al. (2019) where their results indicate an indirect negative effect on usefulness. At least, a more elevated level of awareness strengthens private investors’ attitudes toward investing in crypto assets.

Thirdly, we discuss the pivotal role of awareness when investing in crypto assets. Our results validate a negative relationship between awareness and the expected loss as perceived risk. Increased financial literacy, transparency, and targeted information about the employed technology and the processes enable private investors to understand that investment performance is intrinsically linked with risk, potentially leading to enhanced resistance to fraud and heightened security awareness (Mutahar et al., 2018; Sagheer et al., 2022). Consequently, they experience a lower expected loss as a risk. Additionally, awareness profoundly influences the perceived usefulness of investing in crypto assets with a stronger utility perceived by those more cognizant of the investment case and its benefits (Al-Somali et al., 2009; Mutahar et al., 2018; Sagheer et al., 2022). Our study further shows an effect on behavioral control, ease of use, and attitude, leading to the conclusion that awareness significantly influences the behavioral intention to invest in crypto assets for private investors (Mutahar et al., 2018; Sagheer et al., 2022; Dinev & Hu, 2007; Riffai et al., 2012; Sathye, 1999).

Finally, our study utilized the core components of a technology acceptance model (Davis, 1989) as its foundation. Further, we extended the core constructs with new measures for the perception of awareness, trust, and risk. Moreover, we incorporated the theory of planned behavior (Ajzen, 1991) when introducing the attitude towards investing in crypto assets as well the perceived behavioral control to our model (Hansen et al., 2018). As certain parts of our model, particularly constructs, have been tested in other models on the acceptance of cryptocurrencies or assets, we developed a novel and innovative model combining these perspectives in a single framework.

Practical implications

In addition to the theoretical implications, we receive the practical dimension of our research as a significant part of our contribution, with substantial implications. In our research paper, we investigated drivers influencing the behavior of investing in crypto assets for the broad mass (RQ1) and, furthermore, how financial institutions can participate in the crypto ecosystem and enhance crypto asset acceptance (RQ2). In doing so, our study revealed that private investors’ behavioral intention to invest in crypto assets is predominantly affected by their attitude, as well as their perceived trust and awareness. Therefore, stakeholders in DeFi must consider these factors if they wish to establish crypto asset investment broadly. As outlined in our crypto assets acceptance model, additional incentives for private investors are essential to address the correct perceptions.

Building upon this foundation, we aim to analyze how financial institutions can engage with the DeFi and crypto asset ecosystem, thereby fostering the acceptance of crypto assets (RQ2). As previously indicated, disintermediation is fundamental to blockchain technology (Zetzsche et al., 2020; Schär, 2021). With the rising popularity of DeFi and crypto assets, traditional intermediaries in the investment ecosystem have been displaced from the market (Chalmers et al., 2022; Piñeiro-Chousa et al., 2022). Concurrently, concerning the effect of re-intermediation, new players are entering the crypto market, replacing previously excluded intermediaries, for instance, crypto exchanges (Chen & Bellavitis, 2020; Langley & Leyshon, 2021). However, this has not significantly altered the situation, as many individuals still refrain from using it (Gramlich et al., 2023; Piñeiro-Chousa et al., 2022).

Previous research suggests that the reintroduction of traditional financial players is pivotal in the DeFi and crypto asset ecosystem (Chen & Bellavitis, 2020; Langley & Leyshon, 2021; Hawlitschek et al., 2018). When promoting DeFi and crypto assets, stakeholders of the DeFi ecosystem should highlight the advantages of DeFi and crypto assets (Gramlich et al., 2023; Lockl & Stoetzer, 2021) rather than focusing solely on the financial industry’s challenges in the traditional finance system. According to Lockl & Stoetzer (2021), there is no significant relationship between private investors’ distrust in traditional financial institutions and their investment in crypto assets or usage of DeFi services. Additionally, Hawlitschek et al. (2018); Gramlich et al. (2023) argue that blockchain networks, which are trust-free systems, necessitate integration into an institutional setting to address trust issues.

This section presents starting points for financial institutions to engage with the crypto asset market to strengthen crypto asset acceptance among a broad mass of potential private investors. We derived the roles from our elaborated crypto assets acceptance model and results from our conducted study. We supplemented it with the current state of literature for conceptualizing and designing these roles. We have identified four roles financial institutions can play in value creation, which we subdivide into service and product depending on the output focus for value creation (Bowman & Ambrosini, 2000; Schwiderowski et al., 2023b). By also considering the intention of customer contact, in direct or indirect form, the roles of crypto asset guide, crypto asset verifier, crypto asset platform provider, and crypto asset creator emerge, enabling financial institutions to act as intermediaries in the DeFi ecosystem. Figure 6 illustrates the four different roles financial institutions can adopt to join the crypto market.

Firstly, financial institutions have the opportunity to position themselves as crypto asset guides. This position entails elaborating and directly providing services for users with economic education or financial literacy concepts (Litterscheidt & Streich, 2020; Willis, 2011). In the current DeFi ecosystem, where many individuals may feel overwhelmed due to the abundance of information sources, this becomes particularly relevant (Rehman et al., 2020). Moreover, the content should be user-centered, designed to cater to various knowledge levels and incorporate common learning formats like interactive elements (Voskobojnikov et al., 2021b). While people often associate financial institutions with trustworthiness and security, their provision of education could significantly expand the user base (Gramlich et al., 2023; Litterscheidt & Streich, 2020). Financial education and financial behavior are well-established related, and Fernandes et al. (2014) recommend implementing targeted just-in-time financial education. In the realm of digital and crypto assets, financial education has an indirect effect on the outcome (Litterscheidt & Streich, 2020). Increasing user’s financial literacy by the financial institutions, we suggest a higher intention to invest in crypto assets, driven by enhanced user awareness and behavioral control as outlined in our crypto assets acceptance model (see Fig. 5). Additionally, suppose there is also guidance for novices as well as experts in design (e.g., UX, Usability) (Voskobojnikov et al., 2021b; Rehman et al., 2020; Zei et al., 2024). In that case, increased perceived usefulness and ease of use can lead to a heightened intention to invest in crypto assets.

Secondly, we apply the positioning of financial institutions as verifiers in the crypto asset market. This role entails offering services such as regulation checks and certification of crypto assets. We suggest the crypto asset creator engage financial institutions to scrutinize potential crypto assets, focusing on smart contract code quality and adherence to regulation or security standards (Conti et al., 2018; Ferreira & Sandner, 2021; Gramlich et al., 2023). Further, we detect that in alignment with our crypto assets acceptance model, managing trust and risk are crucial factors in this potential role as verifiers. Risk management is essential in the financial environment as preventing money laundry, scams, or terrorist financing is crucial (Rehman et al., 2020; Conti et al., 2018; Abramova & Böhme, 2016).

Thirdly, establishing a platform for crypto asset investments is vital for financial institutions entering the market. The current landscape describes an abundance of entry points for crypto asset investments, which can be overwhelming and confusing for individuals (Rehman et al., 2020; Zeiss et al., 2024). If financial institutions provided a platform featuring a curated selection of crypto assets from the market, it would enhance the accessibility for users (Gramlich et al., 2023; Lockl & Stoetzer, 2021). Furthermore, they could establish data and security standards for the crypto assets they offer, potentially making this investment route more trustworthy (Ferreira & Sandner, 2021; Conti et al., 2018; Valeonti et al., 2021). The increased accessibility and benefits for the broad masses could increase the ease of use and usefulness, ultimately strengthening the behavioral intention to invest in crypto assets.

Lastly, financial institutions could assume the creators of crypto assets themselves. Devising innovative financial products is one of the traditional players’ key activities and business models. Transferring these skills into the DeFi ecosystem, financial institutions could develop novel smart contracts and offer these as their own crypto assets in the market (Gramlich et al., 2023). Extending their product portfolio with new crypto assets could increase their relevance in the financial ecosystem (Whitaker & Kräussl, 2020; Kreppmeier et al., 2023; Schwiderowski et al., 2023b). By driving and establishing blockchain-based digital currencies (like CBDCs or digital Euro), banks can offer directly a payment option and gain market access for the broad mass of people as well as institutions or companies. In addition, financial institutes should concentrate on marketing activities that demonstrate the technological superiority of their DeFi solution (Lockl & Stoetzer, 2021).

Limitations and further research

This paper acknowledges limitations in various aspects. The objective of our study was to collect comprehensive, representative regional results in countries with a higher level of trust in the banking sector and to provide an overview of countries with comparable financial markets. In our study, it is evident that the participants from different countries are unevenly balanced, attributable to the near representation of the actual distribution of the population in the DACH region (see Table 2), as we depict within the scope of our study. Based on the year 2022, Germany has 84.08 million inhabitants, Austria has 9.04 million, and Switzerland has 8.77 million, mirroring similar ratios in participant allocation. However, to identify country-specific differences in the acceptance of crypto assets, we require in-depth studies in the individual countries. While our study identifies a trend for the DACH region, further research is necessary for other European areas not covered, considering differences to the DACH region, such as varying cultures, political structures, and economic situation. Given the study’s focus on the DACH region, the findings may not be generalizable on a global scale. Therefore, a promising avenue for future research could be to examine the effects of different cultures, economies, and regulatory environments on crypto asset adoption in diverse contexts, e.g., through a meta-analysis of existing findings. We also suggest not only relying on quantitative studies, but also conducting qualitative research on the cultural and legal environment in order to gain deeper insights into individual factors of crypto asset adoption.

Previous studies about crypto asset owners in several countries indicate that these owners are predominantly young males with a low level of education (Fujiki, 2021; Henry et al., 2018). Our results reflect that most participants are in the age between 20 and 30 years, aligning with this generation’s investment behavior in crypto assets (Bonaparte, 2022). Furthermore, investing in crypto assets correlates with an interest in information technologies (Fujiki, 2021; Henry et al., 2018), prevalent among the younger generation. Additionally, we use the Prolific platform for conducting our study, suggesting participant familiarity with technology, which also results in limitations.

The majority of study participants are male, a phenomenon explainable by gender differences in investment behavior, especially regarding crypto assets (Bonaparte, 2022), as well as a higher engagement in financial technologies, and statistically higher financial literacy among younger males (Bonaparte, 2022; Reiter-Gavish et al., 2022). Our study results show that n = 440 participants categorizing themselves as beginners in investment experience, n = 311 as advanced beginners, alongside categories of experienced users n = 129, experts n = 7, and others n = 1 indicating a large proportion of novices in blockchain. Although we recognize a preponderance of inexperienced participants, this aligns with our study’s intentions of investigating acceptance among the masses. The views of previous critics or hesitant investors are essential for the accentuation of the broad masses. However, we recommend more fundamental research comparing different investment experiences and their impact on crypto adoption. Based on our results, we assume different levels of risk for varying experience levels, which impact the acceptance.

The research model proposed follows the widely spread approach by Davis (1989), including the selected constructs and hypotheses, which are limitations. We also notice constraints about the roles derived from the literature and the results of our model, which could be empirically validated in subsequent work. Potential future research includes elaborating the requirements and platform design. A subsequent study could investigate and measure the impact of this platform on the intention to invest in crypto assets. We identify a need to extract standards and guidance for banks as verifiers and to empirically analyze the information requested by bank customers in advisory discussions on crypto assets. We consider investigating new crypto assets attractive to users and utilizing financial institutions’ expertise in creating these assets as an area for further research.

In addition to the influences of blockchain, other trends could lead to new developments in the financial sector. Therefore, our survey is a snapshot, and acceptance among the population may change with further technical progress. With the emergence of new technologies, financial institutions will continue to be affected by digitization and changing customer needs. The mass adoption of digital currencies, e.g., CBDCs such as the digital Euro, can also facilitate the adoption of crypto assets (Tronnier et al., 2022; Minesso et al., 2022; Allen et al., 2022). Furthermore, the current hype around generative artificial intelligence (genAI) is a strong impetus, which will be briefly illustrated as an example of impact technologies. Concerning our results and the analyzed roles, we see clear influences from genAI in financial education, support in programming within smart contracts and platforms, review of crypto providers, and effects on the preparation of documents and information around crypto assets. The first research papers focus on GenAI in education (Peres et al., 2023) or AI for a more trustworthy crypto ecosystem (Rehman et al., 2020). Due to the importance of trust and awareness (Banh & Strobel, 2023; Tomitza et al., 2023) in blockchain and genAI, we propose a combined approach and in-depth research concerning this topic. Since genAI output is not necessarily correct and bias is possible (Tomitza et al., 2023), the technology can impact acceptance. Many further research projects should advance the topic of acceptance of blockchain and crypto assets in the finance sector. Finally, re-intermediation (I and II) can also trigger effective and new changes that must be considered at the macro level (see Fig. 1). The influences on the financial sector and the DeFi concept should receive greater attention in research, making this work an initial push.

Conclusion

To conclude, our study underscores the influence of behavioral control, trust, awareness, ease of use, usefulness, and attitude on private investors’ intention to invest in crypto assets, aligning with existing literature in electronic markets and technology adaption within the financial sector. Grounded in the technology acceptance model, we built a theoretical model to empirically measure drivers affecting the behavioral intentions of private investors toward using crypto assets. We found that trust and awareness are pivotal in facilitating widespread adoption. Drawn from our empirical findings, we derived roles within the crypto asset market that foster sustainable acceptance. By emphasizing the role of financial institutions, we highlight their capacity to leverage their strengths efficiently, such as serving as crypto asset guides, verifiers, platform providers, and creators. The identification of these new roles not only sheds light on the evolving dynamics of financial institutions in the crypto market but also unveils novel avenues for future research. In doing so, our research contributes to the domain of electronic markets by adopting the values of blockchain market perspectives and building on the pioneering work of financial institutions in integrating electronic markets and networks.

Data Availability

The data that support the findings of this study are not openly available due to reasons of sensitivity and are available from the corresponding author upon reasonable request.

References

Abramova, S., & Böhme, R. (2016). Perceived benefit and risk as multidimensional determinants of bitcoin use: A quantitative exploratory study. International conference on information systems (pp. 1–20). https://doi.org/10.17705/4ICIS.00001

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50, 179–211. https://doi.org/10.1016/0749-5978(91)90020-T

Ajzen, I. (2020). The theory of planned behavior: Frequently asked questions. Human Behavior and Emerging Technologies, 2, 314–324. https://doi.org/10.1002/hbe2.195

Albayati, H., Kim, S. K., & Rho, J. J. (2020). Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technology in Society, 62, 101320. https://doi.org/10.1016/j.techsoc.2020.101320

Allen, F., Gu, X., & Jagtiani, J. (2022). Fintech, cryptocurrencies, and CBDC: Financial structural transformation in China. Journal of International Money and Finance, 124, 102625. https://doi.org/10.1016/j.jimonn.2022.102625

Alqaryouti, O., Siyam, N., Alkashri, Z., & Shaalan, K. (2020). Cryptocurrency usage impact on perceived benefits and users’ behaviour. M. Themistocleous & M. Papadaki (Eds.), Information systems (pp. 123–136). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-44322-1_10

Al-Somali, S. A., Gholami, R., & Clegg, B. (2009). An investigation into the acceptance of online banking in Saudi Arabia. Technovation, 29, 130–141. https://doi.org/10.1016/j.technovation.2008.07.004

Alt, R. (2020). Electronic markets on blockchain markets. Electronic Markets, 30(2), 181–188. https://doi.org/10.1007/s12525-020-00428-1

Alt, R., Fridgen, G., & Chang, Y. (2024). The future of fintech - Towards ubiquitous financial services. Electronic Markets, 34, 3. https://doi.org/10.1007/s12525-023-00687-8

Arias-Oliva, M., Pelegrín-Borondo, J., & Matías-Clavero, G. (2019). Variables influencing cryptocurrency use: A technology acceptance model in Spain. Frontiers in Psychology, 10, 1–14. https://doi.org/10.3389/fpsyg.2019.00475

Auer, R., Cornelli, G., & Frost, J. (2023). Rise of the central bank digital currencies. International Journal of Central Banking, 19, 185–214.

Auer, R., Farag, M., Lewrick, U., Orazem, L., Zoss, M. (2023). Banking in the shadow of bitcoin? The institutional adoption of cryptocurrencies. SSRN, 1–25. https://doi.org/10.2139/ssrn.4416784

Banh, L., & Strobel, G. (2023). Generative artificial intelligence. Electronic Markets, 33, 63. https://doi.org/10.1007/s12525-023-00680-1

Bauer, R. A. (1967). Consumer behavior as risk taking (pp. 13–21). Marketing: Critical perspectives on business and management.

Bech, M.L., & Garratt, R. (2017). Central bank cryptocurrencies. BIS Quarterly Review September, 1–16.

Bohr, J., & Bashir, M. (2014). Who uses bitcoin? An exploration of the bitcoin community. 2014 Twelfth annual international conference on privacy, security and trust (pp. 94–101). https://doi.org/10.1109/PST.2014.6890928

Bonaparte, Y. (2022). Time horizon and cryptocurrency ownership: Is crypto not speculative? Journal of International Financial Markets, Institutions and Money, 79, 1–23. https://doi.org/10.1016/j.intfin.2022.101609

Bowman, C., & Ambrosini, V. (2000). Value creation versus value capture: Towards a coherent definition of value in strategy. British Journal of Management, 11, 1–15. https://doi.org/10.1111/1467-8551.00147

Bruckner, M. T., Steininger, D. M., Thatcher, J. B., & Veit, D. J. (2023). The effect of lockup and persuasion on online investment decisions: An experimental study in ICOs. Electronic Markets, 33, 31, 1–25. https://doi.org/10.1007/s12525-023-00648-1

Chalmers, D., Fisch, C., Matthews, R., Quinn, W., & Recker, J. (2022). Beyond the bubble: Will NFTs and digital proof of ownership empower creative industry entrepreneurs? Journal of Business Venturing Insights, 17, 1–8. https://doi.org/10.1016/j.jbvi.2022.e00309

Chen, Y., & Bellavitis, C. (2020). Blockchain disruption and decentralized finance: The rise of decentralized business models. Journal of Business Venturing Insights, 13, 1–11. https://doi.org/10.1016/j.jbvi.2019.e00151

Cheng, D., Liu, G., Qian, C., & Song, Y.-F. (2008). Customer acceptance of internet banking: Integrating trust and quality with UTAUT model. 2008 IEEE international conference on service operations and logistics, and informatics (pp. 383–388). https://doi.org/10.1109/SOLI.2008.4686425

Conti, M., Kumar, E. S., Lal, C., & Ruj, S. (2018). A survey on security and privacy issues of bitcoin. IEEE Communications Surveys & Tutorials, 20, 3416–3452. https://doi.org/10.1109/COMST.2018.2842460

Cuong, P.K., & Jian, Z. (2014). Factors influencing individual investors’ behavior: An empirical study of the Vietnamese stock market. American Journal of Business and Management, 3, 77–94. https://doi.org/10.11634/216796061403527

Davis, F.D. (1985). A technology acceptance model for empirically testing new end-user information systems: Theory and results (Unpublished doctoral dissertation). Massachusetts Institute of Technology.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13, 319–340. https://doi.org/10.2307/249008

Dinev, T., & Hu, Q. (2007). The centrality of awareness in the formation of user behavioral intention toward protective information technologies. Journal of the Association for Information Systems, 8, 386–408. https://doi.org/10.17705/1jais.00133

Dutta, P., Choi, T.-M., Somani, S., & Butala, R. (2020). Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transportation Research Part E: Logistics and Transportation Review, 142, 1–33. https://doi.org/10.1016/j.tre.2020.102067

Featherman, M. S., & Pavlou, P. A. (2003). Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human-Computer Studies, 59, 451–474. https://doi.org/10.1016/S1071-5819(03)00111-3

Fernandes, D., Lynch, J. G., & Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60, 1861–1883. https://doi.org/10.1287/mnsc.2013.1849

Ferreira, A., & Sandner, P. (2021). EU search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure. Computer Law & Security Review, 43, 1–15. https://doi.org/10.1016/j.clsr.2021.105632

Feulner, S., Guggenberger, T., Stoetzer, J.-C., & Urbach, N. (2022). Shedding light on the blockchain disintermediation mystery: A review and future research agenda. ECIS 2022 research papers (pp. 1–21). https://aisel.aisnet.org/ecis2022_rp/13

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Philosophy & Rhetoric, 10(2), 130–132.

Folkinshteyn, D., & Lennon, M. (2016). Braving bitcoin: A technology acceptance model (TAM) analysis. Journal of Information Technology Case and Application Research, 18, 220–249. https://doi.org/10.1080/15228053.2016.1275242