Abstract

Many firms use social media (SM) to solicit online investments. In this study, we examine the interaction between SM attributes and online-investment attributes to determine how this interaction shapes users’ investment decisions. Specifically, we investigate initial coin offerings (ICOs) as an application domain of distributed ledger technology for peer-to-peer investment. We use signaling theory to develop a context-specific explanation for how the interplay of persuasion signals found in SM and technology-enforced lockups shapes individuals’ ICO investment decisions. To evaluate this interplay, we conducted a 2 × 2 factorial experiment with 473 participants. The results show that when an investment does not require a technology-enforced lockup, persuasion signals encourage investments in ICOs; however, when an investment requires a technology-enforced lockup, persuasion signals do not affect investments in ICOs. Furthermore, our analyses suggest that combining a technology-enforced lockup and persuasion signals reduces the ICO’s plausibility. This is the first study to investigate how the willingness to invest in ICOs is influenced by the relationship between technology-enforced lockups and persuasion signals. The findings have practical implications for individuals attempting to make sound decisions on ICO investments, policymakers regulating online investments, and firms seeking to attract investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Technological innovation, process disruption, and business transformation have impacted financial services (Gomber et al., 2018). Investment activities have shifted from offline to online environments, allowing entrepreneurs to generate funding and granting small investors easy access to investment opportunities. As a result, the market capitalization of the global crypto ecosystem reached 2.9 trillion USD in November 2021, attracting attention from individual investors, scholars, politicians, and companies (CoinMarketCap, 2022).

Nonetheless, many online-investment vehicles fail to realize their goals. Consider initial coin offerings (ICOs), of which only 25% reach their funding goals (Ernst & Young, 2017). An ICO is a token sold to investors to raise equity funding. Tokens represent digital assets on blockchain applications that are cryptographically secured (BaFin, 2019). Purchasing an ICO token gives investors a share in a company and/or endows them with the right to vote and receive profit distributions (Kranz et al., 2019). Most ICOs use blockchain technology to issue and trade tokens without centralized control (Fridgen et al., 2018; Momtaz, 2021; Rossi et al., 2019). As a result, ICOs are perceived as riskier than initial public offerings (IPOs), which conform to clearly defined financial rules and regulations (Park & Yang, 2018; U.S. SEC, 2019).

ICO investments often include technology-enforced lockups, which can create certainty for sellers but compound risks for buyers. A lockup is a period during which an investor must hold an investment before they have the option to sell it. Although lockups have been examined in prior research, especially in the finance literature, technology-enforced lockups have received insufficient scholarly attention (Field & Hanka, 2001; Keasler, 2001a). Technology-enforced lockups typically require the holding of investments for an indeterminate period, often until certain market and technology conditions are met. ICOs impose lockups to ensure the access to equity required to support taking a product to market. Typically, technology-enforced lockups embedded in tokens terminate when an ICO is listed on a cryptocurrency exchange platform. This form of exchange involves technology-enforced lockups because newly issued tokens are often not yet tradable on any exchange, such that the gap between the new token’s issuance and the listing on an exchange platform is technology-mediated and represents a lockup situation for the investor. Only when terms are met will the technology permit token holders to sell, trade, or buy more tokens.

Although lockups may create certainty for issuers, who know that investors cannot withdraw their money until defined goals are met, they can create risk and uncertainty for potential ICO buyers (Batiz-Benet et al., 2017; Kranz et al., 2019). Lockups create risk for two reasons: (1) during a technology-enforced lockup, ICO tokens cannot be resold to realize profits or prevent losses, and (2) the technology-enforced lockup of an ICO has an indeterminate duration and uncertain outcomes, and a buyer does not know when the terms of the lockup will be met (Aschauer et al., 2017; Kranz et al., 2019).

To resolve investors’ perceptions of risk, especially when they are aware of technology-enforced lockup situations, ICO issuers use social media (SM) campaigns to disseminate posts that make arguments in favor of the investment (Albrecht et al., 2020; Jin et al., 2020). To mitigate investors’ perceived risk of purchasing an ICO token, these SM posts include signals from other investors who are making money or who deliberately drop well-known public figures’ names. Using such signals, these posts direct attention away from the actual attributes of the investment and toward the potential for profits or other opportunities. Altogether, the evidence suggests that using SM to appeal to investors’ social, technological, and financial motives may loosen their purse strings and positively influence ICO-funding success (Amsden & Schweizer, 2018; Fisch et al., 2018).

To further the understanding of why people invest in ICOs, research needs to examine the effects of the interplay between the SM persuasion signals used to communicate investment opportunities and the design of online investments (i.e., technology-enforced lockups). Given the characteristics of technology-enforced lockups, we propose that lockups influence investors’ perceptions of risk, their perceptions of plausibility, and ultimately their intentions to invest. In particular the perceptions of plausibility provide interesting insights for this study, as the construct captures potential negative effects of persuasion signals and technology-enforced lockups, by measuring an investors’ focus on exaggerations and misplaced claims (Ramiller & Swanson, 2003). This study also aims to explain the effectiveness of SM persuasion signals designed to mitigate the negative effects of technology-enforced lockups on investors. Furthermore, we aim to provide insights into signaling theory to improve the understanding of boundary conditions and to highlight the negative ramifications of persuasion signals, beyond known implications. Examining this interplay is important because a better understanding of the tension between the design and marketing of online investments could shed light on how and why people form risk perceptions, develop suspicion in terms of reduced plausibility, and form intentions to purchase ICO tokens. Understanding the interplay among persuasion signals, technology-enforced lockups, plausibility, and risk perceptions such as investment intentions can inform the decisions of ICO issuers, investors, and regulators.

While the extant literature lacks a conclusive understanding of the effect of persuasion signals on ICO investment intentions, the practical need for insights into the effectiveness of persuasion signals and the mechanisms of lockups remains high. For this reason, ICO issuers would benefit from knowing whether persuasion signals and technology-enforced lockups shape investors’ willingness to purchase ICO tokens. For investors, it would be helpful to understand whether communication strategies can cause them to disregard important information about the design of ICO investments. Finally, knowledge of this interplay could help regulators frame rules about the information ICO issuers must share with investors and how that information must be shared. To understand the theoretical mechanisms and practical implications of the interplay between persuasion signals and ICO investment designs, we investigate the following research question: How does the interaction between technology-enforced lockups and persuasion signals impact ICO investment decisions?

Using signaling theory, we conducted an online experiment that manipulated the presence of technology-enforced lockups and persuasion signals. In contrast with our intuitions and the signaling literature, the results suggest that investment mechanism requirements — particularly technology-enforced lockups — influence the positive effect of persuasion signals on the investor’s intention to invest in an ICO. When viewed in isolation, persuasion signals positively affect ICO risk perceptions and investment intentions. However, when viewed in the presence of technology-enforced lockups, persuasion signals elicit lower ICO investment intentions and lower the ICO’s plausibility.

This study makes three contributions to the IS and financial investing literature. First, we demonstrate that because contextual factors like technology-enforced lockups reduce ICO investment intentions and ICO plausibility, they represent a serious boundary condition of the power of persuasion signals. Contrary to extant research, we offer preliminary insights into the negative effects of persuasion signals and how they reduce plausibility perceptions. Second, we clarify how persuasion signals encourage online financial investments, specifically in ICOs. Third, our study is the first to offer a nuanced explanation of how technology-enforced lockups influence the decisions of online investors; this explanation has practical implications for policymaking and secure and sound online investing.

Theoretical background

Online investments and initial coin offerings

Disintermediation can reduce the costs of online investing and increase investors’ asset liquidity, especially when comparing purchasing IPO shares to purchasing ICO tokens (Egelund-Müller et al., 2017; Kranz et al., 2019). Moreover, disintermediation allows amateur investors to participate in the early stages of start-up projects; formerly, robust regulations and high entry costs limited most such participation to “accredited investors” (Investor.gov, 2021).

However, the disintermediation of financial markets creates risk. ICOs are risky because they bypass the due-diligence processes and regulations associated with IPOs and the rigorous vetting and assurances promised by crowdfunding websites. The factors that increase the perceived risk of ICOs include the following (Table 1): (1) ICOs are largely unregulated and allow start-ups to raise high funding volumes with little effort; (2) in cryptocurrency transactions, no personal information is exchanged, ensuring anonymity; (3) investors rely on business ideas instead of liable enterprises; (4) ICOs are characterized by highly inconsistent presentations; (5) ICOs avoid the costs of compliance and intermediaries (Dürr et al., 2020); and most importantly, (6) ICO investments include technology-enforced lockups of undetermined length (Kranz et al., 2019). Such lockups constitute a nontransparent risk factor that ICO investors may perceive as unpredictable and noncontrollable. Given these risk factors, it is unsurprising that a 2018 study estimated that 78% of ICOs were fraudulent (Dowlat, 2018).

Despite these risks, investors continue to participate in ICOs. According to the crowdfunding literature (e.g. Hoegen et al., 2018), relevant antecedents of investment decisions include cognitive characteristics such as the way of thinking, heuristics used, and the need for cognition of the investor (Burtch et al., 2016; Choy & Schlagwein, 2016). Contextual factors that influence decision-making in the crowdfunding context include affordances, general features or functionalities of the crowdfunding platform and immediate surroundings, and mobile access (Burtch et al., 2015; Choy & Schlagwein, 2016). We rely on this general understanding of investment antecedents from the crowdfunding literature because crowdfunding and ICOs are conceptually related, and scholars view ICOs as an advancement of crowdfunding (Kranz et al., 2019; Rohr & Wright, 2019).

Examining the ICO-related literature, research shows that ICO investors (even experienced ICO investors) rely heavily on superficial signals, often omitting a careful analysis of firm characteristics and making investment decisions based on limited information. Such signals include technical white papers and high-quality source code (Fisch, 2019), as well as non-rational aspects such as a “CEO beauty premium,” general blockchain discourse, Twitter sentiment, and general emotionality (Albrecht et al., 2019, 2020; Colombo et al., 2022), which increase investors’ investment intentions and funding amounts even though they do not allow investors to assess the safety of the ICO investment. Furthermore, ICO investors are primarily motivated by ideological, technological, or financial motives (Zhao et al., 2021). Previous studies examining the heuristics used by investors to assess the trustworthiness of an ICO (Shrestha et al., 2021) and trust formation in cryptocurrencies such as bitcoin (Marella et al., 2020) show that ICOs from countries with stronger institutions positively influence investment intentions (i.e., they receive higher investment amounts). Moreover, when faced with fewer ICO regulations, investors use the country of origin as a proxy for the unobserved trustworthiness of the ICO. Taken together, the prior literature confirms that investors rely on more superficial cues in environments with limited information.

ICO issuers use such signals in the form of persuasion signals as advertising tactics to convince investors to fund ICO projects. Interestingly, Momtaz (2020, p. 2) found that “(…) the absence of institutions that verify endogenous signals may induce a moral hazard in signaling.” Consequently, a moral hazard problem arises for investors (Fisch et al., 2021; Momtaz, 2020), which is on the one hand induced by the technology-enforced lockup periods that cause investors to not fully trust the information provided by issuers. On the other hand, the use of persuasion signals based on less relevant information encourages investment intentions.

Taken together, these findings explain why investment activity in ICOs is high, despite the risks involved. Persuasion signals as cognitive stimuli fall into the category of superficial signals and are therefore expected to positively influence ICO investment decisions. Furthermore, Momtaz (2020) addressed the effect of signaling on investment intention, but to the best of our knowledge, no study has examined the interaction effects of persuasion signals and lockups as moral hazards, and their impact on the intention to invest, perceived plausibility, and risk perception among online investors. Therefore, it is important to develop a contextualized argument for how the interplay of rational but non-ratable factors (investment conditions embedded in technology-enforced lockups) and non-rational factors (SM persuasion signals) influence investment decisions.

Technology-enforced lockups

The concept of lockup is known for traditional stock investment, in which shares are sold to pre-underwriting shareholders who contractually agree not to sell their shares for a predefined period after the IPO (Field & Hanka, 2001). Traditional stock IPOs are issued through a trusted intermediary, that is, a regulated stock exchange. ICO issuers distribute their tokens directly to investors without intermediaries. Furthermore, intermediaries support trades of ICO tokens only when they expect enough activity to sustain their value. Moreover, while ICO lockups are technology-enforced, intermediaries may not support the exchange of tokens that do not adhere to common technological formats (e.g., ERC-20, ERC-223, or ERC-777 token formats). Only after the ICO tokens are standardized and listed on an exchange platform trading will be possible (Kranz et al., 2019).

Technology-enforced lockups, therefore, require ICO investors to keep their ICO tokens until funding goals are reached, standardized token formats are established, and project goals are realized, for exchange platforms to list the tokens (Kranz et al., 2019). Until the ICO tokens are listed on an exchange, investors commit resources to fund the business idea until the lockup terms are met. In other words, their financial resources will remain illiquid for an indeterminate period.

As Table 2 shows, the main difference between IPO lockups and the technology-enforced lockups of ICOs is investors’ certainty regarding when they can sell an ICO token because technology-bound specifics must mature before trading occurs (Aschauer et al., 2017; Rossi et al., 2019). On the other hand, IPO lockups require an investor to hold a share for a known, fixed number of calendar days, which makes risk more manageable (Garfinkle et al., 2002; Keasler, 2001a, 2001b).

There are substantial differences between the theoretical concept of lock-in periods from the business studies and IS literature and the theoretical concept of technology-enforced lockups. The most prominent difference is that lock-in periods are contractually determined, and both parties in the exchange are aware of the lock-in period’s conditions (Farrell & Klemperer, 2007). Furthermore, in lock-in periods, consumers may terminate contracts before they expire (Yang et al., 2020), which subjects the consumer to a financial penalty. In technology-enforced lockups, no such option exists. Finally, lock-in periods are subject to regulatory restrictions (Congress, 2013; CRTC, 2013; European Union, 2009); technology-enforced lockups are not.

Lockups affect the value of IPOs and ICOs in different ways. Underwriters of IPOs naturally prefer longer lockup periods because they allow the market to stabilize. In contrast, shareholders generally prefer shorter lockup periods, because shorter periods improve their ability to act and react to the market (Keasler, 2001a). Research on IPO lockup periods has revealed that regardless of the lockup period’s length, IPO stocks have statistically abnormal returns of − 1.5%, in addition to trading volumes that increase significantly (i.e., by 40–45%) after the unlock date (Field & Hanka, 2001; Garfinkle et al., 2002). In IPOs, contract-based lockups create value for investors by ensuring that they know when they can expect to realize a return by selling their shares.

It is important to note that if a token never gets listed on an exchange platform, it may never have real-world value, and an investor’s money may consequently remain perpetually locked up or be lost forever (Coinopsy, 2022). For risk-tolerant investors, an advantage of the lockup period’s indeterminacy is that tokens at the presale are commonly offered at a considerable discount, and successful early-stage investments have high-profit potential (Amsden & Schweizer, 2018; CNN Business, 2018). Such discounts are offered to overcome concerns about uncertainty and risk of less risk-tolerant investors that a token may never reach the maturity necessary to be listed on an exchange. To win over investors and mitigate their uncertainty and concerns about risk, ICO issuers often turn to SM. Specifically, they craft SM posts with persuasion signals designed to highlight the opportunities afforded by investing in ICOs.

Signaling theory and social media persuasion strategy

Signaling theory explains how two parties (buyer and seller) exchange information at the pre-contractual stage when a substantial amount of information remains hidden as is the case in ICOs (Wells et al., 2011). Therefore, sellers communicate signals to buyers “to convey information credibly about unobservable product quality” (Rao et al., 1999, p. 259). Signaling theory has been applied to contexts where individuals have limited information or where information about a product is asymmetric (Dawson et al., 2016; Kirmani & Rao, 2000). In such contexts, buyers use signals as heuristics to assess the quality and reduce product uncertainty.

Signaling has some overlap with nudging, which means that nudging could potentially provide a theoretical lens for this research as well. Rooted in the psychological literature, nudging is based on the assumption that humans are prone to bias in their decision-making due to bounded rationality (Simon, 1955). This means that human decision-making is based on externally induced heuristics that bias the outcome of human decisions (Tversky & Kahneman, 1974). While nudges have been successful in predicting results, existing studies on nudges have been conducted mainly in offline contexts (Schneider et al., 2017, 2020; Weinmann et al., 2016).

Despite the large literature base on nudging theory, we chose to focus on signaling because nudges and signaling are conceptually distinct: nudges typically involve mechanisms associated with the external perspective of the ICO issuer (often the external perspective of the seller in the existing literature), and they are the mechanisms that influence an investor’s decision (Schneider et al., 2020; Weinmann et al., 2016). By contrast, signaling takes the investor’s internal perspective (in the existing literature, often the buyer’s internal perspective) on the psychological mechanisms of the decision-making process. Appendix 6 summarizes the literature on nudging that has informed our study.

In this study, we do not only focus on an (exclusively) online context but also on the internal perspective of the investor. For this reason, our study uses signaling theory to explain the cause-effect relationships of ICO investment intentions and their implications for technology-enforced lockups.

We extend the concept of signaling in online markets by assessing the power of persuasion signals in the context of online decision-making, where individuals typically rely on cognitive shortcuts (heuristic signals) when sorting through a plethora of stimuli (Y. Chen et al., 2019; Cialdini, 2009; Kahneman, 2012).

For more than a decade, SM has been the preferred tool for attracting business contacts and investors (Kazienko et al., 2013; D. Lee et al., 2018). Consequently, ICO issuers use SM to attract attention in crowded online financial marketplaces. Evidence suggests that an effective SM strategy can make a company visible in competitive markets and facilitate the achievement of business goals (Albrecht et al., 2020; Manthiou et al., 2014).

For many ICO issuers, the value of their SM strategy cannot be overestimated, as the strategy involves more than just the marketing of online investments; it affects the issuers’ future receivables and ability to sustain business operations (Albrecht et al., 2020; Mai et al., 2018). In particular, existing research supports the fact that ICO investors rely on superficial cues, rather than on a careful analysis of facts (Marella et al., 2020; Shrestha et al., 2021; Zhao et al., 2021). Therefore, SM strategy is directly related to the pricing and legitimacy of investment offers such as ICOs (Chanson et al., 2018), as encouraging investment in SM is positively correlated with funding success (Amsden & Schweizer, 2018; Jin et al., 2020). This also leads to the moral hazard problem discussed above (Fisch et al., 2021; P. Momtaz, 2020).

Persuasion signals are embedded in posts, such as images of happy investors spending the proceeds from the sale of an ICO token or written endorsements from business leaders. Such persuasion signals direct investor’s attention to nonrational cues about the benefits of investment decisions that are positive or easy to digest (Ofir & Sadeh, 2019). Cialdini (1984) proposed that six types of signals (liking, reciprocity, social proof, consistency, authority, and scarcity) influence human decision-making in a broad variety of contexts — ranging from purchasing decisions and charitable donations to phobia remission and explaining suicide patterns (Cialdini, 2009). To determine which persuasion signals are most commonly used by ICO issuers in SM, we conducted a closet qualitative analysis (Sutton, 1997; details in Appendix 1). We found that ICO issuers frequently use social proof and authority as persuasion signals.

Next, we explain factors that influence the effectiveness of the signals. Existing research on social persuasion has yielded mixed results regarding the effectiveness of persuasion signals such as social proof and authority. In particular, the effectiveness and interaction effects of persuasion signals vary with contextual factors, which are discussed in the following sections.

Social proof refers to the behavior of unknown others that serves as evidence and reference for one’s own behavior (Cialdini, 1985). For example, the effects of social proof can be seen in stock price fluctuations that are based on the behavior of market participants rather than on new information (Graham, 1999; Scharfstein & Stein, 1990).

Existing research on the persuasion signal of social proof has examined its effects in a variety of contexts, including past sales and “word of mouth (WOM)” (Li & Wu, 2018), friends on a large online peer-to-peer lending site (Liu et al., 2015), phishing attacks (Goel et al., 2017; Wright et al., 2014), and online reviews (Moe & Schweidel, 2012). In general, social proof positively influences certain behavioral effects, such as the herding effect (Li & Wu, 2018) or the bandwagon effect, which encourages individuals to contribute to prior positive content and discourages them from contributing to prior negative content (Moe & Schweidel, 2012). These effects can even be reinforced by suggesting specific outcomes, for example, social outcomes of messages are perceived as less susceptible to those that promise materialistic outcomes (Wright et al., 2014). However, in the context of money lending, lenders were no more likely to follow a friend’s social-proof signal than a stranger’s. Only when the context of the study was disaggregated by type of friendship (offline vs. online) did an offline tie of the lender show a positive effect, while an online tie showed a negative effect on following with the bid (D. Liu et al., 2015). It should be noted that the lack of credibility of a content or message with social proof, as well as the lack of motivation to pursue certain outcomes, can lead to divergent outcomes (Goel et al., 2017). Nevertheless, social proof can lead to counterintuitive behaviors. For example, negative social proof (e.g., poor credit scores in microloan markets) can increase herding dynamics, while favorable signals of social proof (e.g., borrower characteristics, such as a friend’s endorsement) weaken herding effects (Zhang & Liu, 2012). Overall, the social proof is a strong indicator for individuals’ intentions and behaviors, but the results of existing research vary by context.

The signal of authority involves positive responses from individuals to those who possess fame, expertise, or other forms of notoriety (Bushman, 1984). For example, professors, doctors, celebrities, politicians, and industry leaders are able to credibly signal authority (Oinas-Kukkonen & Harjumaa, 2008).

Prior research has identified factors that define the effectiveness of authority signals in different contexts, such as social media (Djafarova & Rushworth, 2017), online used car markets (Dimoka et al., 2012), and software development (Moreno & Terwiesch, 2014). Typical signals of authority are celebrity status, third-party endorsements, and reputation. Authority positively affects a source’s credibility, social identification, and behavioral outcomes such as purchase intention (Djafarova & Rushworth, 2017) and bidding intention (Moreno & Terwiesch, 2014). For example, celebrity status on Instagram influences purchase behavior (Djafarova & Rushworth, 2017). Interestingly, non-traditional celebrities (bloggers, YouTube personalities, and “Instafamous” profile owners) are more credible and relatable than traditional celebrities and thus have a stronger influence on consumer decisions. In addition, authority signals such as third-party product endorsements also significantly reduce product uncertainty (Dimoka et al., 2012).

In summary, the existing literature has described a variety of contextual factors that determine the effectiveness of persuasion signals such as social proof and authority. In particular, celebrity status, third-party endorsements, and changes in reputation scores determine the success of authority signals and were therefore included in our study design.

To the best of our knowledge, no study has examined the interaction between persuasion signals and technology-enforced lockups. Therefore, to fill this gap in the IS literature, we incorporate insights from existing research into our theorizing and experimental design; these insights support our testing of the interaction effects of technology-enforced lockups and persuasion signals.

Hypotheses

Given that ICOs present both opportunities and risks, we argue that to reach investment decisions, investors weigh perceptions of opportunity against perceptions of risk, paired with plausibility perceptions. Investors in an ICO-backed early-stage venture commit resources in exchange for the opportunity to purchase substantially discounted tokens. In making ICO investment decisions, investors weigh the possibility of profit against the unknown length of the business project’s development phase, the uncertainty about ICO standards, and the lack of a trusted exchange. To tip the balance between opportunity and risk in favor of opportunity, firms offer early investors tokens at a significantly lower price than they predict the tokens will be worth when sold on open markets (Amsden & Schweizer, 2018; CNN Business, 2018).

Committing to an ICO with a technology-enforced lockup requires strong initial trust in the issuer’s ability to cope with substantial fraud risks (McKnight et al., 1998) or with the failure to raise sufficient capital. Risk is an important driver of decision-making when uncertainty and information asymmetry are present (Dimoka et al., 2012; D. Kim & Benbasat, 2009), such as when potential investors are uncertain about when an ICO will mature or lack a detailed understanding of a business venture’s viability. If the investment fails, investors lose the resources used to purchase tokens and are left with an otherwise worthless investment (Coinopsy, 2022). Evidence suggests that many ICO issuers have no intention of realizing their forecasted business achievements, leading to 84% of ICOs including no more than mere ideas (Ernst & Young, 2017); according to Dowlat (2018), 78% of ICOs could be fraudulent. We argue that despite the possibility of profits offered by ICO tokens and given the uncertainty about whether ICOs can generate profits, investors will be less likely to commit to purchasing ICOs with technology-enforced lockups. Thus, we hypothesize the following:

-

Hypothesis 1: An indeterminate, technology-enforced lockup will negatively affect the decision to make an ICO investment if no persuasion signals are present.

Signals help investors estimate the value of their investments, under situations of high levels of uncertainty regarding the investment’s outcome and the actual quality (Crawford & Sobel, 1982; Dimoka et al., 2012). Effective signals are visible, clear, credible, and differentially costly (signals that are more costly for bad sellers than for good sellers) (Rao & Monroe, 1989) and help buyers reduce information-search costs.

Using signaling theory, our study suggests that ICO issuers leverage SM to distribute persuasion signals about the opportunities of ICO tokens to mitigate potential investors’ concerns about the risks associated with technology-enforced lockups (Aggarwal et al., 2012; Kirmani & Rao, 2000). Because ICOs are a rather novel investment option, many investors lack the personal expertise or experience necessary to evaluate the risks of lockups. Potential investors will look for evidence of quality in the issuer’s SM posts, such as the timing of announcements (e.g., early- or late-round purchases) and whether the information has been acquired from observing the behavior of other people, from the opinions of trusted people (e.g., authority figures) or, more generally, from the information found in the moment itself (e.g., SM posts; Lee et al., 2015; Liu et al., 2015). Generally, the evidence suggests that persuasion signals can become powerful drivers of investors’ purchasing decisions (Wells et al., 2011).

Issuers use social proof and authority tactics to communicate signals to investors about the quality of ICOs. A potential investor may interpret signals of social proof as evidence that many others trust the ICO issuer and that they have acted based on positive incentives that outweigh existing disincentives. This logic is consistent with a study that found that social proof encouraged high-risk behavior in high-risk online situations, such as phishing (Wright et al., 2014). As mentioned above, an investor may similarly weigh suggestions from authority figures who possess expertise, fame, or other forms of notoriety (Bushman, 1984). For example, a potential investor may perceive signals from an ICO investment specialist (whose authority is evidenced by signals such as job title, job description, or references) as credible investment advice. In other words, this logic suggests that in ambiguous decision-making situations (such as purchasing ICO tokens from an unknown company), potential investors are more likely to invest in an ICO when presented with social proof or advice from an authority figure.

Theoretically, persuasion signals will trigger automated information processing that positively affects decisions to make investments (Djafarova & Rushworth, 2017; Moreno & Terwiesch, 2014), which leads to greater compliance with ICO issuers’ requests (Dawson et al., 2016). Thus, we hypothesize the following:

-

Hypothesis 2: Persuasion signals on social media will positively affect the decision to make an ICO investment if no technology-enforced lockup is present.

Extant research has demonstrated that token issuers seek to reduce perceived information asymmetry by signaling the qualities of their ICO to investors (Fisch, 2019; Giudici & Adhami, 2019). Persuasion signals focus on earning investor trust and putting to rest any concerns about cost, lockups, and other ICO qualities (Connelly et al., 2011; Sanders & Boivie, 2004).

Research on persuasion signals has confirmed risk-mitigating positive effects for many different investment types and online purchasing behavior (Agarwal et al., 2012; Dimoka et al., 2012; Li & Wu, 2018; D. Liu et al., 2015; Moreno & Terwiesch, 2014). For example, signals of herding on large online peer-to-peer lending sites stimulate lending behavior (Liu et al., 2015). In online service markets, numerical reputation scores and unstructured reputational information serve as quality signals that lead requesters to accept higher bids (Moreno & Terwiesch, 2014). Finally, extant research has revealed that electronic word of mouth helps ventures obtain higher funding amounts and better valuations (Aggarwal et al., 2012).

Building on the persuasion-signal literature, we evaluate whether social proof and authority serve to mitigate investors’ aversion to investing in ICOs, amplify their plausibility perceptions of ICOs, and reduce their risk perceptions of ICOs. We argue that even under high levels of risk, SM persuasion will motivate potential online investors to purchase ICO tokens. Moreover, we argue that by introducing persuasion signals, ICO issuers will be able to cloud potential investors’ fears about ICOs with lockups and encourage them to invest. Thus, we hypothesize the following:

-

Hypothesis 3: In the presence of a technology-enforced lockup, persuasion signals will positively affect the decision to make an ICO investment.

Method

We adopted a 2 × 2 factorial, between-subjects experimental design with a sample of 473 participants. The four experimental scenarios included two manipulations: a manipulation of the presence of technology-enforced lockups and a manipulation of persuasion signals. The lockup scenario informed participants of an ICO investment opportunity in which the tokens to be acquired could not be resold or traded. The no-lockup scenario informed participants that tokens were already listed on exchange platforms and could be sold or traded at any time. The manipulations of the persuasion signals were included in the screenshots of actual ICO SM posts (Appendix 4). We incorporated signals of social proof and authority in the picture, in the caption, in the liking, and the subscription numbers of the post. The posts were designed to emulate posts on Facebook.

Measurement

We operationalized ICO investment decisions via the following three constructs to gain a holistic understanding: the participant’s intention to invest (adapted from Sia et al., 2009), perceived plausibility (adapted from Ramiller & Swanson, 2003), and risk perceptions (adapted from Keil et al., 2000). Using more than one construct enabled us to offer an in-depth assessment of persuasion signals and the influence of technology-enforced lockups on investment decisions. The construct of perceived plausibility captured potential investors’ focus on exaggerations and misplaced claims (Ramiller & Swanson, 2003) and captured the potential negative effects of the persuasion signals on ICO investment decisions. Together with the construct of risk perceptions, the three constructs add depth to the theoretical composition of the cognitive process underlying investors’ investment decisions.

Our assessment of the validity and reliability of our measures (Appendix 3) detected no issues, and we retained all the items in the ensuing analysis.

Experimental procedure

At the beginning of the study, all the participants were introduced to the topic of the study and the idea of the fictional new product, called “IngredientScan,” to be financed via an ICO. We purposefully selected an unknown context to avoid associations with any existing (blockchain) business models that would evoke participants’ previous experiences or expectations.

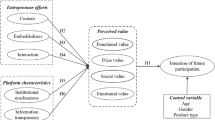

All the participants received the same information about the ICO of IngredientScan, such as technical details and profiles of the founding team. The IngredientScan page was designed to be as realistic as possible. Following the ICO profile page, we measured the dependent variables (intention to invest, perceived plausibility, risk perception) for the first time. Subsequently, the participants were randomly allocated to four experimental groups. After the manipulations were presented, we measured the dependent variables for the second time. Figure 1 depicts the flow of the experimental procedure.

In total, four manipulations were designed for the study. Manipulations 1 and 2, technology-enforced lockup and its neutral counterpart (no lockup), were modeled via a vignette, which included illustrations to aid understanding. The concept of a technology-enforced lockup was introduced to the participants in a way that they were told to make the upcoming investment decision under a scenario including either a technology-enforced lockup or no lockup. Directly afterward, the participants were confronted with manipulations 3 and 4, the SM posts including or not including the persuasion signals (depending on the scenario).

The manipulation of social proof and authority was designed to present all the relevant information in the text box and the caption of the related picture. The pictures of the posts themselves were consistent across all the experimental groups. To ensure that only the persuasion signals were manipulated, without other influences of diverse aspects coming from the picture, only the captions of the pictures were modified. Table 3 provides an overview of the 2 × 2 factorial experimental design with all the manipulations (details of the manipulations appear in Appendix 4).

Pretests and sampling

Regarding our sampling, we did not specifically focus on risk-seeking and experienced investors but on the general internet population. This decision was based on the extreme information uncertainty surrounding early-phase startups that raise funds through ICOs. Such uncertainty is associated with the absence of regulations that mandate a structured, transparent information disclosure, which makes the identification of successful ICOs difficult, even for experienced investors (Boreiko & Risteski, 2021). More importantly, even though rational learning theories posit that investors learn to improve their strategies through experience (Jiang & Verardo, 2018), the behavioral finance literature has described many psychological biases that can cause investors with substantial experience to invest less effectively than they would otherwise (Boreiko & Risteski, 2021). Moreover, consumers with little expertise in the intended product category tend to rely excessively on deceptive information cues rather than using them as one component of a thorough monitoring and decision-making process (Skitka et al., 2000; Tseng & Fogg, 1999; B. Xiao & Benbasat, 2011). Focusing only on experienced investors would have limited our insights into the effectiveness of heuristic cues like persuasion signals.

Furthermore, most of our participants belonged to the general US internet population. A crowd that Amazon Mechanical Turk resembles (Difallah et al., 2018; Ipeirotis, 2010). Because ICO investors require access to the internet, this approach seemed natural and reasonable for our context. Further, SM signaling (via Facebook) regards nearly everyone (81%) of the American adult population with a Facebook account (Wise, 2022), considering the rising importance of SM advertising for online investments. Moreover, the majority of ICO investors are occasional investors with little experience (Boreiko & Risteski, 2021; K. Kim & Viswanathan, 2018) and should thus be well represented in our sample. We acknowledge that risk-seeking and experienced investors may be less vulnerable to being lured into an investment without clearly understanding the risks. On the other hand, existing research has questioned whether investment experience leads to more effective ICO investment decisions (Boreiko & Risteski, 2021). Therefore, we decided to base our sample on a cross-section of the general US population without screening for previous investment experience.

We conducted our pretests in two stages. The sample for the pretests and the main study was limited to native English speakers. Thomas and Clifford (2017) demonstrated that online participants are as attentive as participants in a laboratory setting; accordingly, we collected our main data from two online research platforms: Prolific Academic and Amazon Mechanical Turk.

We received 548 responses. We screened the data to exclude the participants who did not finish the survey, did not respond to all the questions, or did not pass the attention checks. We opted for the listwise deletion of data because it is the most rigorous means of ensuring data quality (Allison, 2001). We also checked for excessive completion time, inconsistent responses, and implausible responses to open-ended questions. A total of 473 participants qualified for the final analysis (see Tables 4 and 5).

Results

Lockup without persuasion signals

To evaluate Hypothesis 1, we manipulated the technology-enforced-lockup scenario (lockup vs. no lockup) to determine whether it affected the dependent variables, that is, the subjects’ intention to invest in the ICO, the risk perception, and the perceived plausibility of the ICO. The persuasion signals were purposefully omitted to enable a comparison of the differences between the groups regarding the lockup scenario. The experimental groups (lockup and no lockup) were compared using a repeated measures analysis of variance (ANOVA). Specifically, we examined the relationship between each of the three dependent variables (intention to invest, risk perception, and plausibility), measured before and after the manipulation with a within-subjects factor (time) and a between-subjects factor (the experimental group: lockup vs. no lockup). Please find a detailed table with the statistical results in Appendix 5.

The results, based on comparisons between the two time points of measurement and between the experimental groups, revealed no significant differences (p > 0.1) for neither the dependent variable intention to invest in the ICO (F(1, 237) = 0.714, p = 0.399) nor the dependent variable perceived plausibility of the ICO (F(1, 237) = 0.104, p = 0.748) or the dependent variable of risk perception (F(1, 237) = 1.065, p = 0.303). In other words, no differences were observed in the outcome variables depending on whether a technology-enforced lockup was present or not. Thus, Hypothesis 1 was not supported.

Persuasion signals with no lockup

To evaluate Hypothesis 2, we presented a SM post with persuasion signals (no lockup) and compared the results against a post with neutral stimulus (i.e., no persuasion signals and no lockup). The results of the repeated measures ANOVA for the dependent variable intention to invest revealed a significant difference (p < 0.05) between the experimental groups and between the time points of measurement (intention to invest: F(1, 237) = 5.060, p = 0.025). Furthermore, the dependent variable of risk perception also revealed a significant difference (p < 0.1) between experimental groups and between the time points of measurement (F(1, 237) = 2.866, p = 0.092).

As Fig. 2 illustrates, in the no-lockup scenario without persuasion signals (dotted line), the participants’ intention to invest in the ICO decreased significantly between the time points of measurement (1 and 2). However, if they were exposed to the persuasion signals on the SM page (without lockup), their intention to invest in the ICO remained constant between the time points of measurement (continuous line). In combination with a significant decrease in risk perception between the time points of measurement, when persuasion signals (without lockup) were present, compared to no persuasion signals, Hypothesis 2 was partially supported.

In this scenario without lockup, the results of the repeated measures ANOVA for the dependent variable perceived plausibility revealed no significant differences (p > 0.1) between the experimental groups or between the time points of measurement (F(1, 237) = 0.279, p = 0.598).

Persuasion signals with lockup

To evaluate Hypothesis 3 (i.e., the interaction of lockup and persuasion signals), we introduced a technology-enforced-lockup scenario to the participants and analyzed it in combination with and without persuasion signals. The results were compared to the control condition (lockup + neutral, i.e., without persuasion signals) with a repeated measures ANOVA. The analysis revealed nonsignificant differences in the intention to invest in and the risk perception of the ICO (p > 0.1) between the experimental groups, measured before and after the manipulations (intention to invest: F(1, 232) = 1.778, p = 0.184/risk perception: F(1, 232) = 2.412, p = 0.122).

As Fig. 3 shows, the participants’ intention to invest in the ICO significantly decreased between the time points of measurement (1 and 2) for both the experimental group with and the experimental group without persuasion signals. Thus, Hypothesis 3 was not supported.

However, further analysis revealed that the perceived plausibility (Fig. 4) of the ICO in the investment scenario with a technology-enforced lockup significantly differed (p < 0.01) between the experimental groups and between the time points of measurement (F(1, 232) = 6.788, p = 0.010). The perceived plausibility of the ICO with a technology-enforced lockup decreased significantly (continuous line, Fig. 4) between the time points of measurement (1 and 2) when a SM post with persuasion signals was presented. A slight increase in perceived plausibility was observed (dotted line) between the repeated measures when participants were confronted with the neutral SM (i.e., no persuasion signals) manipulation.

These results suggested that the persuasion signals did not positively influence subjects to invest during a technology-enforced lockup but that the technology-enforced lockup exerted a negative effect on the perceived plausibility of the ICO.

Robustness checks (variance of the dependent variables over time)

We conducted t tests with dependent samples to determine whether the effects of persuasion signals during technology-enforced lockup scenarios were robust. We thereby contrasted the measures of the dependent variables and looked for differences between the measurement before and the measurement after the manipulation. The results of the tests are displayed in Table 6 and 7 and are further described in the following paragraphs.

When a technology-enforced lockup was absent, but persuasion signals were present, the intention to invest in the ICO and the perceived plausibility of the ICO remained constant between the measurement before and the measurement after the manipulation (Table 6). This finding was consistent with those of the repeated measures ANOVA; the persuasion signals strengthened the participants’ intention to invest.

The post hoc analysis also revealed that under the no-lockup scenario, the dependent variable of risk perception decreased significantly (p = 0.045) between the time points of measurement (Table 6). As inferred in Hypothesis 2, this result indicated that persuasion signals had risk-mitigating effects in the no-lockup scenario.

Further, the results revealed that in the presence of a technology-enforced lockup, the intention to invest in the ICO and the perceived plausibility of the ICO decreased significantly between the time points of measurement (intention to invest: p = 0.020; perceived plausibility: p = 0.001) (Table 7). This finding confirmed the repeated measures ANOVA; that is, the persuasion signals positively affected the subjects’ intention to invest in the ICO only when no lockup was present.

Thus, Hypothesis 2 was partially supported, and Hypothesis 3 was not supported. Interestingly, the results suggested that technology-enforced lockups represent a serious boundary condition of the effectiveness of persuasion signals.

Discussion

This study provides insights into the interplay between technology-enforced lockups (e.g., the structure of ICO investments) and SM strategy (e.g., the use of persuasion signals) influencing investment intentions and shaping how online investors view the plausibility and risk of an ICO. The results of testing hypothesis 1 suggest that a technology-enforced lockup is a contextual factor that does not have significant power on its own. Testing hypothesis 2 revealed that persuasion signals have a positive impact on investment intention, such that the intention to invest remains consistently high. In contrast, in the absence of persuasion signals, participants’ investment intentions diminish, an effect we attribute to impulse buying. Impulse-buying behavior describes participants with high initial investment intentions that are typically lost over time, in the absence of further intervention (i.e., persuasion signals) (Applebaum, 1951; Y. Liu et al., 2013; Stern, 1962). The results of testing hypothesis 3 indicate that persuasion signals negatively affect investment decisions, which is contrary to existing theory. We find that persuasion signals, combined with technology-enforced lockups, make online investors more resistant to the persuasion tactics of ICO issuers. Hypothesis 3 was not supported, but this finding is important because it suggests that the design of investment vehicles shapes whether investors make sound financial decisions online.

Our findings are important for several reasons. First, they suggest that perceived plausibility decreases when investors cannot cash out for an indefinite period of time, in combination with the ICO issuers trying to oversell their tokens through persuasive SM signals. If this is true, this logic explains why technology-enforced lockups alone have no significant effect but have a negative impact when combined with persuasion signals. Our results suggest that the use of persuasion signals in the context of technology-enforced lockups is ineffective in increasing investment intentions and appears to damage the perception of an ICO.

Our findings extend the theory on persuasion signals in SM. We introduce a new boundary condition (technology-enforced lockups) that limits (i.e., moderates) the effectiveness of persuasion signals in online financial markets. Specifically, we build on the work of Albrecht et al., (2019, 2020) and Li and Wu (2018), which suggest that contextual features can limit the effectiveness of persuasion signals. We explicitly extend this insight by identifying and testing a specific feature of the context as a boundary condition, namely technology-enforced lockups. Our results show that lockups negatively affect investment intentions and plausibility perceptions when combined with persuasion signals. To the best of our knowledge, our study is the first to present a theoretical account and empirical evidence of the effects of the technology-enforced-lockup construct. As technology-enforced lockups exist in other contexts (e.g., online crowd workers (Bruckner et al., 2020)), future studies could extend our work in such directions.

Discussing our findings in light of existing work, Li and Wu (2018), for example, found that persuasion signals in Facebook posts have a positive effect on sales numbers, and in particular, social proof was suggested to increase product awareness with greater efficiency than providing consumers with evidence of product quality. Our study confirms the findings of Li and Wu (2018) and extends them by examining high-stakes purchases (ICO investments) instead of low-stakes purchases (Groupon sales). In support of positive persuasion effects, Albrecht et al., (2019, 2020) investigated the influence of Twitter activity on the business success of ICOs. They found that positive language and a high and consistent level of interactivity with the community were positively associated with funding success.

Our study includes social proof from strangers. However, Liu et al. (2015) found that people are more likely to follow the “wisdom of the crowd” when the crowd includes both friends and strangers. Therefore, future work could examine whether the social proof provided by friends has a stronger influence on investment decisions than that provided by strangers. This effect is plausible, because online investors may feel a social obligation to support their friends, which may lead them to ignore the risk and uncertainty associated with technology-enforced lockups; this, in turn, could lead to a poor decision that negatively impacts economic value. Since anonymity and trust are key attributes of blockchain applications such as ICOs, focusing on the effects of persuasion signals from friends versus persuasion signals from strangers could shed light on why people make ICO investments.

In addition, our study extends the understanding of SM persuasion tactics. We extend Moreno and Terwiesch’s (2014) work on numerical and verbal persuasion signals in online service markets to the context of ICO investments. Together with the pretests of our study, their context shows that a combination of numerical and verbal signals has the strongest effects in terms of increased ICO investment intentions. Although we found that the terms of the investment opportunity (e.g., technology-enforced lockups) significantly reduce perceived plausibility, researchers need to better understand why the combination of formats shapes online investors’ financial decisions.

Our results have implications for other contexts in which persuasion signals are used to encourage investments. Consider Aggarwal et al. (2012) and Wei and Lu (2013), who found that electronic word of mouth (eWOM) and celebrity endorsements encourage online purchases and venture-capital funding. Aggarwal et al. (2012) found that the eWOM from popular bloggers helped ventures receive higher funding amounts and valuations. Because eWOM and celebrity endorsements are conceptually similar to persuasion signals of this study (social proof and authority), in unregulated online financial investment systems, eWOM/persuasion signals represent a powerful tool in the hands of cybercriminals seeking to defraud online investors of their money. To help solve this problem, our study suggests that regulators could address this issue by requiring that investment terms (such as technology-enforced lockups) be clearly communicated to potential investors. As our data show, such transparency would reduce perceptions of plausibility and thus promote sound investment decisions.

Our study also has implications for the context and literature on ICOs. For example, we describe the differences between ICOs, classical investments, and crowdfunding and explain how these differences influence investors’ perceptions (which is also a contribution to the crowdfunding literature as well) (Hoegen et al., 2018). In addition, we examine the influence of persuasion signals on online investors’ decision-making. We confirm positive effects, but more importantly, we find negative effects in the context of funding an ICO. We show in detail that combining persuasion signals with technology-enforced lockups negatively affects the perceived plausibility of ICOs, a limiting factor not previously considered in the signaling literature. Our study illustrates that individual effects of persuasion signals (social attribute) and joint effects, with technology-enforced lockups (technical attribute), play an important role in causal relationships affecting online financial investments. Although we develop these insights in the context of ICO success (or failure), they could be applied to more general online investment contexts that also include technology-enforced lockups.

Our study has implications for entrepreneurs, issuers of ICO investment offerings, investors, and regulators. First, we advise ICO issuers to consider the technical characteristics of their investments when attempting to attract investors through SM persuasion signals. Entrepreneurs may find that SM strategies (including persuasion signals) are less effective in attracting investment when technology-enforced lockups are an attribute of the offering. Instead of relying on persuasion signals, issuers might consider offering smart contracts to provide their investors with independent safeguards for a trustless investment.

Second, we urge inexperienced investors to look beyond the SM postings to evaluate how the technical features of an ICO investment shape risk. Because ICOs are not required to disclose technology-enforced lockups in their SM posts, it is important that potential investors have access to the additional information they need to understand how technology-enforced lockups affect investment risk. This implication is particularly important for inexperienced and risk-averse investors, as they are targeted by ICO issuers who seek to lure vulnerable people into investing without fully disclosing the risks involved. Our findings publicly highlight some of the most prominent pitfalls of ICOs and raise awareness of their risks for inexperienced online investors.

Third, our study identifies a lever that policymakers can use to regulate ICO investments. Regulators should pay attention to how persuasion signals are used on SM platforms to influence investors and how investment issuers report technical features. Because customers rely on simple heuristics when making ICO investment decisions based on SM, regulators should consider implementing mechanisms that “slow down” thinking and increase the transparency of ICO investment features (Kahneman, 2012). For example, regulations that require an ICO issuer’s SM communication to include clear information on how ICO investments include technology-enforced lockups. This transparency could help investors make better financial decisions. Such regulations would be consistent with evidence-based policymaking (Gomber et al., 2018). Given that even experienced investors can be strongly influenced by biases (Boreiko & Risteski, 2021), this recommendation is also important when considering experienced and risk-seeking investor profiles. Because investors who are unaware of ICO investment features such as technology-enforced lockups are at greater risk, policymakers should require ICO issuers to provide transparent information about the investment and intervene to regulate the markets to limit investor risk. The implementation of government-mandated, non-negotiable smart contracts is one possible solution for regulators to address this issue (Bruckner et al., 2022).

Limitations and future research

This study has several limitations. First, because we sought to examine how ICOs use strategies to attract new investors, we drew a cross-sectional sample of investors from an online panel. We acknowledge that a study involving experienced ICO investors might yield different results. Future research should thus investigate the effects of technology-enforced lockups and persuasion signals in SM with experienced investors.

In addition, because our sample consisted mainly of the US internet population, we focused on a population characterized by US values and culture. However, we argue that our findings are generalizable to populations that have the same Internet and SM access, common cultural traits and values, and a comparable disposition to seek risks. However, we are aware that studies involving participants with different cultural backgrounds may generate different results.

Second, because existing research has suggested that combining persuasion signals exerts a stronger influence on individuals than single persuasion signals (Li & Wu, 2018), our manipulations presented our participants with joint persuasion signals. However, future research should consider using single signals and additional sets of signals to extend insights on the rate of change that defines the strength of different social persuasion setups. We also encourage future research to investigate the interaction effects of persuasion tactics and various features of technology-enforced lockups in such settings.

Third, although our experimental design had internal validity and allowed us to assess causality more effectively than other ICO studies, which analyze secondary data (K. Chen, 2019; W. Chen et al., 2020; Fisch, 2019; Guske & Bendig, 2018), we acknowledge that there is a need for future research on how various design features of ICO investments limit the impact of persuasion signals on online investors. Studies could examine whether the power of persuasion tactics varies with issuer type, issuer location, or specific features of the investments included in, for example, Security Token Offerings, Initial Exchange Offerings, or Nonfungible Tokens.

Lastly, because technology-enforced lockups are only one example of risk and because persuasion signals are only one example of risk-mitigation effects for investment markets, future research could fruitfully explore other mechanisms, their effects, and the significance of boundary conditions — like, for example, the implications of nudging and its influence on potential investors despite technology-enforced lockups (Schneider et al., 2020; Weinmann et al., 2016).

Studies could also examine the implementation of nonnegotiable smart contracts (Beck et al., 2017, 2018), which have the potential to serve as regulatory mechanisms for lockup situations in digital contexts.

Conclusion

ICO issuers use SM persuasion signals to attract investors and solicit funding. Although we find that persuasion signals can influence investment decisions, our analysis reveals that characteristics of ICO investments, such as technology-enforced lockups, can limit their effectiveness. Specifically, we found that the interaction between persuasion signals and technology-enforced lockups reduces the perceived plausibility of ICO investments. This finding is important because it suggests that certain characteristics of ICO investments — in this case, the indeterminate nature of the technology-enforced lockup — can serve as boundary conditions for the use of persuasion signals.

In addition to highlighting actions ICO issuers can take to shape investment decisions, our findings have important implications for policymakers seeking to regulate disintermediated financial markets. Specifically, the findings suggest that, even while respecting the advantages of disintermediation in blockchain applications, regulators should require ICOs to disclose certain details of technology-enforced lockups and provide binding reports on the status of token listings. These forms of transparency could help investors make more rational investment decisions. This recommendation is particularly relevant to policymakers seeking to limit the fraud originating from ICO token-issuing entities.

References

Agarwal, R., Anand, J., Bercovitz, J., & Croson, R. (2012). Spillovers across organizational architectures: The role of prior resource allocation and communication in post-acquisition coordination outcomes. Strategic Management Journal, 33(6), 710–733. https://doi.org/10.1002/smj.1965

Aggarwal, R., Gopal, R., Gupta, A., & Singh, H. (2012). Putting money where the mouths are: The relation between venture financing and electronic word-of-mouth. Information Systems Research, 23(3), 976–992. https://doi.org/10.1287/isre.1110.0402

Albrecht, S., Lutz, B., & Neumann, D. (2020). The behavior of blockchain ventures on Twitter as a determinant for funding success. Electronic Markets, 30(2), 241–257. https://doi.org/10.1007/s12525-019-00371-w

Albrecht, S., Lutz, B., & Neumann, D. (2019). How sentiment impacts the success of blockchain startups – An Analysis of social media data and initial coin offerings. Proceedings of the 52nd Hawaii International Conference on System Sciences, 4545–4554.

Allison, P. D. (2001). Missing Data (Vol. 07). SAGE Publications.

Amsden, R., & Schweizer, D. (2018). Are blockchain crowdsales the new “gold rush”? success determinants of initial coin offerings. Proceedings of the Digital Innovation Festival Conference 2018, Lyon, France. https://doi.org/10.2139/ssrn.3163849

Angst, C. M., & Agarwal, R. (2009). Adoption of electronic health records in the presence of privacy concerns: The elaboration likelihood model and individual persuasion. MIS Quarterly, 33(2), 339. https://doi.org/10.2307/20650295

Applebaum, W. (1951). Studying customer behavior in retail stores. Journal of Marketing, 16(2), 172–178. https://doi.org/10.1177/002224295101600204

Aschauer, H., Schanzenbach, M., Schmidt, J.-M., & Ferreira Torres, C. (2017). Positionspapier: Blockchain. Münchner Kreis, 3–18.

BaFin. (2019). Second advisory letter on prospectus and authorisation requirements in connection with the issuance of crypto tokens. Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). https://www.bafin.de/SharedDocs/Downloads/EN/Merkblatt/WA/dl_wa_merkblatt_ICOs_en.html. Accessed 9 Dec 2021.

Batiz-Benet, J., Santori, M., & Clayburgh, J. (2017). The SAFT project. Protocol Labs and Cooley. https://saft-project.org

Beck, R., Avital, M., Rossi, M., & Thatcher, J. B. (2017). Blockchain technology in business and information systems research. Business & Information Systems Engineering, 59(6), 381–384. https://doi.org/10.1007/s12599-017-0505-1

Beck, R., Müller-Bloch, C., & King, J. L. (2018). Governance in the blockchain economy: A framework and research agenda. Journal of the Association for Information Systems, 19(10), 1020–1034. https://doi.org/10.17705/1jais.00518

Boreiko, D., & Risteski, D. (2021). Serial and large investors in initial coin offerings. Small Business Economics, 57(2), 1053–1071. https://doi.org/10.1007/s11187-020-00338-8

Bruckner, M. T., Frenzel, A., & Veit, D. (2020). Trust building and risk mitigation via smart contracts on amazon mechanical turk. Proceedings of the 26th Americas Conference on Information Systems (AMCIS).

Bruckner, M. T., Gillies, I. C., & Veit, D. J. (2022). The effect of smart contracts on online investment decisions: an experimental study in ICOs. Proceedings of the 17th International Conference on Wirtschaftsinformatik.

Burtch, G., Ghose, A., & Wattal, S. (2015). The hidden cost of accommodating crowdfunder privacy preferences: A randomized field experiment. Management Science, 61(5), 949–962. https://doi.org/10.1287/mnsc.2014.2069

Burtch, G., Ghose, A., & Wattal, S. (2016). Secret admirers: An empirical examination of information hiding and contribution dynamics in online crowdfunding. Information Systems Research, 27(3), 478–496. https://doi.org/10.1287/isre.2016.0642

Bushman, B. J. (1984). Perceived symbols of authority and their influence on compliance. Journal of Applied Social Psychology, 14(6), 501–508. https://doi.org/10.1111/j.1559-1816.1984.tb02255.x

CNN Business. (2018). What is an ICO? - YouTube. Youtube.Com. https://www.youtube.com/watch?v=WZwMt42CzH0. Accessed 2 Nov 2018.

Chanson, M., Gjoen, J., Risius, M., & Wortmann, F. (2018). Initial coin offerings (ICOs): The role of social media for organizational legitimacy and underpricing. Proceedings of the 39th International Conference on Information Systems, San Francisco, USA.

Chen, K. (2019). Information asymmetry in initial coin offerings (ICOs): Investigating the effects of multiple channel signals. Electronic Commerce Research and Applications, 36, 100858. https://doi.org/10.1016/j.elerap.2019.100858

Chen, Y., Deng, S., Kwak, D.-H., Elnoshokaty, A., & Wu, J. (2019). A multi-appeal model of persuasion for online petition success A linguistic cue-based approach. Journal of the Association for Information Systems, 20(2), 105–131. https://doi.org/10.17705/1jais.00530

Chen, W., Li, W., & Xie, K. (2020). Growing entrepreneurship with crypto tokens. Proceedings of the 41st International Conference on Information, Hyderabad, India.

Chod, J., & Lyandres, E. (2018). A theory of ICOs: Diversification, agency, and information asymmetry. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3159528

Choy, K., & Schlagwein, D. (2016). Crowdsourcing for a better world: On the relation between IT affordances and donor motivations in charitable crowdfunding. Information Technology & People, 29(1), 221–247. https://doi.org/10.1108/ITP-09-2014-0215

Cialdini, R. B. (1984). Principles of automatic influence. In J. Jacoby & C. S. Craig (Eds.), Personal selling: Theory, research, and practice. Heath.

Cialdini, R. B. (1985). Influence: Science and practice (5th ed.). Scott-Foresman.

Cialdini, R. B. (2009). Influence: Science and practice. Pearson Education.

Cohen, J. (1960). A Coefficient of agreement for nominal scales. Educational and Psychological Measurement, 20(1), 37–46.

CoinMarketCap. (2022). Global cryptocurrency market charts. CoinMarketCap. https://coinmarketcap.com/charts/

Coinopsy. (2022). ICO dead coins. Coinopsy 2022. https://www.coinopsy.com/dead-coins/ico/

Colombo, M. G., Fisch, C., Momtaz, P. P., & Vismara, S. (2022). The CEO beauty premium: Founder CEO attractiveness and firm valuation in initial coin offerings. Strategic Entrepreneurship Journal, 16, 491–521. https://doi.org/10.1002/sej.1417

Congress. (2013). Unlocking consumer choice and wireless competition act. 113th Congress. https://www.congress.gov/bill/113th-congress/house-bill/1123

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67. https://doi.org/10.1177/0149206310388419

Corbett, J. (2013). Designing and using carbon management systems to promote ecologically responsible behaviors. Journal of the Association for Information Systems, 14(7), 339–378. https://doi.org/10.17705/1jais.00338

Crawford, V. P., & Sobel, J. (1982). Strategic information transmission. Econometrica, 50(6), 1431–1451. https://doi.org/10.2307/1913390

CRTC. (2013). The wireless code. Canadian CRadio-Television and Telecommunications Commission. https://crtc.gc.ca/eng/archive/2013/2013–271.html. Accessed 6 Jul 2022.

Dawson, G., Watson, R., Boudreau, M.-C., & Pitt, L. (2016). A knowledge-centric examination of signaling and screening activities in the negotiation for information systems consulting services. Journal of the Association for Information Systems, 17(2), 77–106. https://doi.org/10.17705/1jais.00422

Dennis, A. R., Yuan, L. (IVY), Feng, X., Webb, E., & Hsieh, C. J. (2020). Digital nudging: Numeric and semantic priming in e-commerce. Journal of Management Information Systems, 37(1), 39–65.https://doi.org/10.1080/07421222.2019.1705505

Difallah, D., Filatova, E., & Ipeirotis, P. (2018). Demographics and dynamics of mechanical turk workers. Proceedings of the Eleventh ACM International Conference on Web Search and Data Mining, 135–143. https://doi.org/10.1145/3159652.3159661

Dimoka, A., Hong, Y., & Pavlou, P. A. (2012). On product uncertainty in online markets: Theory and evidence. MIS Quarterly, 36(2), 395–426. https://doi.org/10.2307/41703461

Djafarova, E., & Rushworth, C. (2017). Exploring the credibility of online celebrities’ Instagram profiles in influencing the purchase decisions of young female users. Computers in Human Behavior, 68(1), 1–25. https://doi.org/10.1016/j.chb.2016.11.009

Dowlat, S. (2018). Cryptoasset market coverage initiation: network creation (pp. 1–30). Satis Group.

Dürr, A., Griebel, M., Welsch, G., & Thiesse, F. (2020). Predicting fraudulent initial coin offerings using information extracted from whitepapers. Proceedings of the 28th European Conference on Information Systems. Initial Coin Offerings: Emerging Practices, Risk Factors, and Red Flags, A Virtual AIS Conference.

Durward, D., Blohm, I., & Leimeister, J. M. (2016). Crowd work. Business & Information Systems Engineering, 58(4), 281–286. https://doi.org/10.1007/s12599-016-0438-0

Egelund-Müller, B., Elsman, M., Henglein, F., & Ross, O. (2017). Automated execution of financial contracts on blockchains. Business & Information Systems Engineering, 59(6), 457–467. https://doi.org/10.1007/s12599-017-0507-z

Ernst & Young. (2017). EY research: Initial coin offerings (ICOs) (p. 44). Ernst & Young.

European Union. (2009). Regulatory framework for electronic communications. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=LEGISSUM%3Al24216a. Accessed 6 Jul 2022.

Farrell, J., & Klemperer, P. (2007). Coordination and lock-in: Competition with switching costs and network effects. Handbook of Industrial Organization, 3, 1967–2072. https://doi.org/10.1016/S1573-448X(06)03031-7

Field, L. C., & Hanka, G. (2001). The expiration of IPO share lockups. The Journal of Finance, 56(2), 471–500. https://doi.org/10.1111/0022-1082.00334

Fisch, C. (2019). Initial coin offerings (ICOs) To finance new ventures. Journal of Business Venturing, 34(1), 1–22. https://doi.org/10.1016/j.jbusvent.2018.09.007

Fisch, C., Masiak, C., Vismara, S., & Block, J. H. (2018). Motives to invest in initial coin offerings (ICOs). SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3287046

Fisch, C., Masiak, C., Vismara, S., & Block, J. (2021). Motives and profiles of ICO investors. Journal of Business Research, 125, 564–576. https://doi.org/10.1016/j.jbusres.2019.07.036

Fridgen, G., Regner, F., Schweizer, A., & Urbach, N. (2018). Don’t slip on the ICO - A taxonomy for a blockchain-enabled form of crowdfunding. Proceedings of the 26th European Conference on Information Systems (ECIS), Portsmouth, UK, 1–18. https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1082&context=ecis2018_rp

Garfinkle, N., Malkiel, B. G., & Bontas, C. (2002). Effect of underpricing and lock-up provisions in IPOs. The Journal of Portfolio Management, 28(3), 50–58. https://doi.org/10.3905/jpm.2002.319842

Giudici, G., & Adhami, S. (2019). The impact of governance signals on ICO fundraising success. Journal of Industrial and Business Economics, 46(2), 283–312. https://doi.org/10.1007/s40812-019-00118-w

Goel, S., Williams, K., & Dincelli, E. (2017). Got phished? Internet security and human vulnerability. Journal of the Association for Information Systems, 18(1), 22–44. https://doi.org/10.17705/1jais.00447

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the Fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. https://doi.org/10.1080/07421222.2018.1440766

Graham, J. R. (1999). Herding among investment newsletters: Theory and evidence. The Journal of Finance, 54(1), 237–268. https://doi.org/10.1111/0022-1082.00103

Guske, N., & Bendig, D. (2018). Cutting out the noise—Costly vs. costless signals in initial coin offerings. Proceedings of the 39th International Conference on Information Systems, San Francisco, CA

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate Data Analysis (7th ed.). Pearson.

Hashim, M. J., Kannan, K. N., & Wegener, D. T. (2018). Central role of moral obligations in determining intentions to engage in digital piracy. Journal of Management Information Systems, 35(3), 934–963. https://doi.org/10.1080/07421222.2018.1481670

Ho, S. Y., & Lim, K. H. (2018). Nudging moods to induce unplanned purchases in imperfect mobile personalization contexts. MIS Quarterly, 42(3), 757–778. https://doi.org/10.25300/MISQ/2018/14083

Hoegen, A., Steininger, D. M., & Veit, D. (2018). How do investors decide? An interdisciplinary review of decision-making in crowdfunding. Electronic Markets, 28(3), 339–365. https://doi.org/10.1007/s12525-017-0269-y

Investor.gov. (2021). Accredited investors – Updated investor bulletin. U.S. Securities and Exchange Commission. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/updated-3. Accessed 9 Feb 2022.

Ipeirotis, P. (2010). Demographics of Mechanical Turk. NYU Center for Digital Economy Research Report, CeDER-10–01, 1–14.

Jiang, H., & Verardo, M. (2018). Does herding behavior reveal skill? An analysis of mutual fund performance. The Journal of Finance, 73(5), 2229–2269. https://doi.org/10.1111/jofi.12699