Abstract

Business model innovation is a process that allows firms to build and maintain competitive advantages. However, it imposes major challenges to managers who rely on incomplete cognitive representations while attempting to understand the environmental dynamics that determine a business model’s prospective performance. System Dynamics is a computational approach potentially useful in enhancing managerial understanding and decision-making during business model innovation, yet its effects lack sound empirical evidence. This study of five cases inside BMW assesses the usefulness of System Dynamics along the different phases of business model innovation processes. In order to develop a nuanced understanding we triangulate insights from the multiple-case study approach with results from a Q-Sort exercise. Our emergent theory highlights that System Dynamics enables managers to develop more accurate cognitive representations about their business models. Unexpectedly, we find that this process leads to a cognition gap apparent in the communication with managers not involved in the modelling process. We observe two strategies to overcome this gap. A second key insight is that System Dynamics has a tendency to consolidate mental models by different managers that need to be managed cautiously. We develop a set of 11 propositions that represents the core of our theoretical insights.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Business model innovation (BMI) is a valuable mean to create and maintain superior firm performance (Aspara et al. 2010; Cucculelli and Bettinelli 2015; Desyllas and Sako 2013; Kim and Min 2015). For instance, changing its business model from selling tools, spare parts, and maintenance services directly to a fleet management model, is widely considered as the main driver of Hilti’s competitive success over recent years (Casadesus-Masanell et al. 2017a). Not surprisingly, the majority of top managers prioritizes or engages actively in BMI (IBM 2006; Matzler et al. 2013).

However, BMI is complex and poses a variety of challenges for decision makers (Chesbrough 2010; Lucas and Goh 2009; Teece 2010; Tripsas and Gavetti 2000). Uncertainty concerning the viability of a new business model and the dynamics arising from complex interactions between its components cause significant difficulties to successful innovation. BMI in established firms requires additional considerations as a potential business models may create or hinder synergistic effects within a portfolio of multiple business models (Aversa et al. 2017; Rumble and Mangematin 2015; Sabatier et al. 2010). Even if not, the innovation of an established business model is most often facing significant inertia originating from existing resources or past success (Chesbrough and Rosenbloom 2002; Leonard-Barton 1992; Tripsas and Gavetti 2000). For instance, the introduction of Hilti’s fleet management model was not an obvious success story but required its top management to reflect on the potential consequences across a diverse set of issues ranging from the financing of assets previously part of its customers’ balance sheets, to a necessary restructuring of its sales force (Casadesus-Masanell et al. 2017b). Whilst Hilti has been able to successfully innovate its business model, scholars have provided rich insight on firms whose top managers failed to evaluate the complex and dynamic consequences triggered by (potential) changes (cfr. Chesbrough and Rosenbloom 2002; Lucas and Goh 2009).

Theory on managerial cognition assumes managers to spend their time absorbing, processing, and disseminating information about their environment. It offers valuable insights why they face cognitive challenges when exposed to contexts characterized by high levels of complexity and dynamics (McCall and Kaplan 1985; Prahalad and Bettis 1986; Simon 1957; Walsh 1995; Weick 1979). The central argument is that the cognitive limitations of the human brain only allow for simplified representations of reality (Gavetti 2012; Gavetti and Levinthal 2000; Martignoni et al. 2016; Nadkarni and Barr 2008) and poorly understood dynamic behaviour (Forrester 1961; Sterman 2000; Stern and Deimler 2006) causing misjudgements in decision-making. When innovating business models, managers rely on simplified cognitive models (Baden-Fuller and Morgan 2010), and hardly grasp the entirety of interactions between different business model components that give rise to complex dynamic behaviour (Demil and Lecocq 2010). Their cognitive representations are incomplete and the decisions regarding their innovation are bounded rational.

One research stream receiving increasing managerial and academic attention focuses on the modelling and simulation of business models to counteract cognitive limitations and improve managerial decision-making in the context of BMI (cfr. Aversa et al. 2015; Baden-Fuller and Haefliger 2013; Chesbrough 2010; Gambardella and McGahan 2010; Rumble and Mangematin 2015). One established approach to enhance understanding and facilitate effective decision-making in the face of complexity represents System Dynamics (SD) (Forrester 1961, 2007; Sterman 2000) and hence, scholars have referred to SD as a promising tool for managerial support during BMI (Markides 2015; Massa and Tucci 2014).

The corresponding studies indicate that SD may be useful during BMI because it can enhance managers when communicating, creatively designing, and evaluating new business models (cfr. Cosenz 2017; Onggo et al. 2006), or assessing strategic options for the optimization of existing ones (cfr. Groesser and Jovy 2016). Research further indicates a positive relation between the use of SD and managerial cognition in BMI (cfr. Abdelkafi and Täuscher 2016; Barabba et al. 2002).

Yet, although these studies provide valuable insights, important issues remain. First, the empirical support and generalizability for the highlighted benefits of SD for decision-making in BMI is limited. The few existing publications majorly rely on the study of single cases. Although single case studies enable rich descriptions of the phenomenon of interest (Siggelkow 2007) the case variety inherent to multiple-case studies enable the development of more robust and generalizable theories (Eisenhardt and Graebner 2007). Further, the mentioned studies focus nearly exclusively on business models of entrepreneurial firms. Investigations into the usefulness of SD on BMI in corporate contexts remain an exception (cfr. Barabba et al. 2002; Moellers et al. 2017). Cosenz (2017) and Groesser and Jovy (2016) concur on this, and explicitly call for empirical research examining the usefulness of simulation approaches for BMI. Second, so far there is limited understanding of the constraints SD imposes when used to support managers in understanding and making decisions during BMI. This is surprising given the vital discussions in the broader SD community (cfr. Featherston and Doolan 2012; Royston et al. 1999).

Taken together, these issues suggest that despite the relevance of simulation of business models for managerial support, scholars lack differentiated understanding of the usefulness of SD during BMI. We address this gap by asking: How does System Dynamics support managers’ understanding and decision-making along the different phases of BMI processes?

Given the theoretical and empirical limits of the existing research we rely on an inductive multiple-case study approach (Eisenhardt 1989; Yin 2014) which we complement with a Q-Sort exercise (Stephenson 1953). Our setting comprises a sample of five contextually diverse projects inside BMW.

Theoretical background

Business model innovation

A business model is most commonly considered as a structured and analytical model that defines the logic “by which the enterprise delivers value to customers, entices customers to pay for value, and converts those payments to profit” (Teece 2010, p.172). As an attribute of the real firm (Massa et al. 2017) a business model defines a distinct and holistic configuration of interrelated components (Baden-Fuller and Haefliger 2013; Baden-Fuller and Mangematin 2013; Baden-Fuller and Morgan 2010; Klang et al. 2014; Rumble and Mangematin 2015). These components represent the firm’s value proposition, the addressed market segment, the value chain, the value capture mechanisms, as well as their internal linkages but also the connections to the external environment (Al-Debei and Avison 2010; Ali-Vehmas and Casey 2012; Foss and Saebi 2017; Saebi et al. 2016). Those linkages impose feedback and circular causality to the business model (Casadesus-Masanell and Ricart 2010; Sterman 2000) and cause non-trivial dynamic behaviour (Afuah and Tucci 2003; Cavalcante et al. 2011; Demil and Lecocq 2010).

Foss and Saebi (2017) define BMI as “designed, novel, and nontrivial changes to the key elements of a firm’s BM and/or the architecture linking these elements” (p.201). There exist two complementary, but distinct conceptualizations of BMI. First, it may refer to an outcome, i.e. an innovative business model. Contributions in this field comprise contextually-embedded case studies that relate to specific sectors (e.g., Abdelkafi et al. 2013; Hwang and Christensen 2008; Karimi and Walter 2016; Kastalli et al. 2013; Souto 2015), technologies (e.g., Richter 2013; Tapscott and Tapscott 2016), or socio-economic environments (e.g., Gebauer et al. 2017). Further, this line of research analyses the performance implications of BMI (e.g., Fang et al. 2008; Suarez et al. 2013; Visnjic et al. 2016).

Second, BMI refers to the (re)configuration process of existing business models (Amit and Zott 2012; Berends et al. 2016). Throughout this paper, we refer to this second notion of BMI. Scholars concerned with BMI as a process distinguish between two basic modes for innovation, i.e. experimental search and cognitive search (Gavetti and Levinthal 2000). For experimental search, new business models originate from experiments through which new configurations of business model components are explored (McGrath 2010). These actions and their real consequences are the source of experience and guide the subsequent identification of new combinations (Holland et al. 1986; Levitt and March 1988) in a trial-and-error fashion (Mezger 2014; Sosna et al. 2010). For cognitive search, managers instead rely on mental representations to identify new business models and assess their attractiveness according to established performance dimensions (Aspara et al. 2011; Casadesus-Masanell and Ricart 2010; Doz and Kosonen 2010; Furnari 2015; Martins et al. 2015; Porac et al. 1989). These representations are conceptual structures held by individuals that contain a simplified understanding of their environmental reality (Lakoff 1987). Cognitive search therefore allows to assess multiple configurations ‘off-line’ but the judgement of attractiveness underlies errors in those representations or processing of their inherent dynamics (Gavetti and Levinthal 2000; Lippman and McCall 1976). Berends and colleagues (Berends et al. 2016) find that during BMI firms combine both modes with varying emphasis. For instance, when relying on leaping, firms start with a focus on an cognition-centred mode before shifting to experimental search.

In line with cognition-centred modes of innovation, Frankenberger and colleagues (Frankenberger et al. 2013) describe four archetypical phases BMI entails, namely initiation, ideation, integration, and implementation: The first phase of the iterative process, named initiation, refers to managers’ attempts to gain understanding of the environmental developments and the corresponding identification of needs to innovate. The ideation is a creativity-centred phase aiming to generate ideas for potential business model reconfigurations responding to the observed developments. Whilst the ideation is concerned with opening up the solution space of potential business model configurations, the integration focuses on elaborating the new business model along all components and embedding it into the organizational context of the focal firm. Finally, the implementation of the business model is introduced to the market most dominantly through a series of experiments.

System dynamics in the context of BMI

Formal conceptual business model representations play a central role in mediating between operational reality and cognitive representations during BMI. These refer to tangible objects through which managers explicate and materialize their understanding relying on written, pictorial, mathematical, or symbolic forms (Demil and Lecocq 2015; Massa et al. 2017; Zoric 2011). The tangible property of conceptual representations enable their circulation between various individuals. By using conceptual representations managers can consequently enhance and guide communication, understanding, and coordination within their firm when engaging in BMI (Doganova and Eyquem-Renault 2009; Stigliani and Ravasi 2012).

Computational modelling has received increased attention sought to produce conceptual representations that allow managers to understand the consequences of changes in their business models (e.g., Akkermans et al. 2004; Bouwman et al. 2008; Gordijn and Akkermans 2003). Previous studies relying on cognition-centred BMI include stochastic modelling (Euchner and Ganguly 2014) and quantitative scenario analysis (Pagani 2009; Zoric 2011), amongst others. More recently, scholars have called for research to connect System Dynamics and BMI to accommodate for the dynamic interdependencies inside business models (de Reuver et al. 2013; Kaplan 2012). SD is a computer-aided approach to enhance analysis and decision-making in complex systems (Forrester 2007). It relies on formal modelling to develop a simplified and consistent representation of the business model (Aversa et al. 2015; Sterman 2000). Through quantification and computational simulations of a system’s elements and interrelations of the latter (Forrester 1961; Schwaninger 2006) this approach facilitates the consideration of feedback loops and dynamic behaviour (Sterman 2000). SD attempts to mitigate potential decision errors by providing users with means of learning about complex systems and the potential consequences of their actions. Such ‘virtual worlds’ or ‘simulation games’ allow them to explore the potential consequences of alternative business model configurations (Aversa et al. 2015; Forrester 1961; Sterman 2000).

SD has been applied to various domains including strategic decision-making (Gary et al. 2009; Graham et al. 1992; Lyneis 1999), innovation processes (Galanakis 2006), and more recently BMI. For instance, Abdelkafi and Täuscher (2016) applied SD to develop a conceptual business model for sustainability. They found cognitive processes of entrepreneurs and within established organizations to be important factors in the design and evaluation of a “sustainable” business model. Cosenz (2017) extended those insights through single-case study applying SD in combination with the Business Model Canvas (Osterwalder and Pigneur 2010). He concluded that SD might be a valuable support tool for entrepreneurs experimenting with different configurations of the business model while keeping the costs of experimentation low. In particular, he considered SD to enhance the design and performance assessment for decision-making on new business models but also the communication with external stakeholders. The latter aspect may originate from the ability to study how interactions of different stakeholders influence market supply and demand as shown by Onggo and colleagues (Onggo et al. 2006) based on a hypothetical business model for component-based simulation software. In the course of a single case study, Groesser and Jovy (2016) gained similar insights, referring to “simulation-based prototyping of strategic initiatives” (p. 80) as a creative and iterative process to analyse those effects on the current business model and to optimize it. These findings are in line with Köpp and Schwaninger (2014). Based on the study of Groupon’s business model they applied SD to demonstrate its ability for “dynamic optimization, calibration and redesign of business models” (p.3) to support entrepreneurs in the early phases of business model design. The authors conclude that the modelling process enhances understanding of the underlying business model logic allowing for possible redesigns through model modification. Collectively, these studies indicate that SD may support managers in cognition-centred BMI processes.

A few authors also indicate limitations in the usefulness of SD. For instance, SD models of business models tend to quickly become complex leading potential users to feel overwhelmed (Groesser and Jovy 2016; Groesser and Schwaninger 2012). In addition, for high levels of uncertainty regarding certain variables or cause-and-effect relationships, the model behaviour may be difficult to track, validate or falsify (Cosenz 2017). However, empirical evidence on the usefulness of SD for managerial support during corporate BMI remains scarce.

Methodology

This study addresses the research question ‘How does System Dynamics support managers’ understanding and decision-making along the different phases of business model innovation processes?´ Given the limited current understanding of this phenomenon, we opted for an inductive multiple case study approach (Eisenhardt 1989; Yin 2014) of 5 embedded cases inside BMW. Each case corresponds to one BMI project in which managers heavily relied on SD for understanding and decision support.

We initiated our research through a pre-study in which we reviewed archival records of each project’s documentation. For complementary means, we conducted three in-depth interviews with managers heavily exposed to SD in their projects to identify initial theoretical constructs relating to the relevance of SD in corporate BMI processes. In the course of the main study, we conducted additional 18 interviews to further corroborate and elaborate our initial findings. For analytical support, we triangulated our insights from these interviews with those of a Q-Methodology (Jick 1979; Stephenson 1936, 1953). The Q-Methodology is a quantitative analysis technique. It is centred around the forced ordering of ‘heterogeneous items’ that are subsequently analysed using an inverted factor analysis (Stephenson 1936). This process allows “to find qualitative ‘order’ even in domains where variability and disparity seem initially to have prevailed” (Watts and Stenner 2005, p.73) and can alleviate social desirability bias (O’Reilly III et al. 1991). In the course of our study, the Q-Methodology was used to sort statements concerning the usefulness of SD in the context of the BMI projects our informants were involved in. This allowed us to understand differences in individual perspectives in sum facilitating more nuanced theoretical constructs. Overall, the triangulation of data sources and research methodologies allows to create novel theoretical perspectives of high internal validity (Gibbert and Ruigrok 2010; Gibbert et al. 2008; Jick 1979).

Setting

The setting is BMW, a multinational automotive company with more than 133′000 employees. BMW provides an attractive research context for three main reasons: First, BMW has begun to leverage SD for BMI in multiple projects (cfr. Moellers et al. 2017). Second, BMW provided us with access to a vast array of internal documents and informants. Notably, we were able to make direct and continuous observations about the development of two cases, including various internal discussions. This richness of data allows for an accurate assessment of the underlying phenomenon. Third, the long stability of the automotive manufacturing business model and the looming change the industry is confronted with – summarized under variations of the acronym CASE (connected car, autonomous driving, shared mobility, electrification) - constitutes an attractive setting to study BMI in an established firm.

BMW pursues a cognitive-centred approach to BMI, which is exemplified by their paradigm “Fail in Virtuality to profit in Reality!” often found in internal presentations on the topic. Within BMW, the use of SD for BMI is referred to as ‘Business (Model) Simulation’ (BMS). BMS is an internally applied method that leverages SD to support the design and evaluation of business models. It is divided into an iterative set of six distinct phases, i.e. Sensing, Analysis, Transfer, Aggregation, Simulation, and Decision. Sensing comprises an assessment of the usefulness of SD for a specific business model decision. Analysis aims to establish a common understanding of the business model between the modelling team and the other managers. Transfer refers to the translation of semantic descriptions into a model of cause-effect relationships. Aggregation refines and substantiates the modelled relationships to allow for testing of new business model configurations, which is part of the Simulation phase. The final Decision phase aims to transform the deep understanding gained about the business model into simple and precise decision recommendations in respect to the specific context of each manager. For a detailed description of the method we refer to Moellers and colleagues (Moellers et al. 2017). BMW operates a dedicated unit for the implementation of BMS.

Grounding our analysis on a specific application method, BMS, eliminates variance from several variables that affect the usefulness of SD, e.g., the model development process, the model usage and the integration of different managers into the modelling process. Hence, it increases the reliability of our analysis.

Data sampling and collection

This study relies on data from five BMI projects. We majorly collected and analysed the following types of data: (1) transcripts from semi-structured interviews; (2) archival data including SD models, causal-loop-diagrams, brainstorming maps, interim and final presentations, project management artefacts; (3) observations from meetings, work periods, and internal discussions; (4) an indicative survey answered by 59 senior executives of BMW Financial Services; (5) e-mails, phone calls, and follow-up discussions with informants.

We began our sampling through a review of all past and current BMI projects utilizing SD. This process revealed a potential set of seven cases. By analysing archival records and preliminary interviews, we generated brief write-ups of each case containing project metadata (project dates, motivation, involved parties, outcomes) and a case chronology. We found that two cases were similar in setup and context and focused on the case for which more data was available. Additionally, we excluded one case for confidentiality reasons, leading to a final set of five BMI projects. Each of these cases involves different sets of managers (mainly teams from different departments) and project timelines. This high degree of contextual heterogeneity across the cases enhanced the potential to recognize clear pattern of the central constructs (Eisenhardt and Graebner 2007).

Our main data body consists of interviews with 21 different informants. We selected the informants based on their involvement and decision-making power in the project. In order to enhance the openness and truthfulness they were granted anonymity. We ensured that we interviewed all involved parties at least once for each project as well as the respective decision-makers. We conducted the main interviews for this study between May and July 2017 in person and with an average duration of 60 min. We chose German as the interview language to avoid language barriers that might prevent deeper reflection and understanding. Four types of informants provided complementary viewpoints on the same events:

-

1)

modellers, who are trained in SD and lead the modelling process;

-

2)

input providers, who commonly work on issues closely related to the BMI project and provide subject-specific inputs;

-

3)

decision makers, who bear the strategic and financial responsibility for the project in their respective department;

-

4)

project owners, who are operationally in charge of the project – typically the project owner(s) comprise one or more employees of the decision maker.

The interviews were semi-structured and consisted of five main segments: (i) background information on the informant, (ii) project setup, involved parties, and primary goals, as well as questions regarding the informant’s contributions to the project; (iii) chronology of the major events and work phases; (iv) direct questions related to insights derived from the application of SD and its perceived usefulness in the project context; (v) the Q-Sort, with follow-up questions about particular sort choices.

During the interviews, we consistently followed an event-based approach in line with the ‘courtroom style’ advocated by Eisenhardt (1989) to reduce the impact of recall bias (Huber 1985; Miller et al. 1997). We let the informant identify key events in the project’s chronology and challenged the informant’s statements only when inconsistent with our previously developed case write-ups. Table 1 provides an overview of the five cases and the informants including their respective roles, corresponding units, and details of the Q-Sort exercise that we discuss in the subsequent section. Figure 1 outlines the project development of the Regulation case along the different BMI phases. Collectively, our sample largely represents the firm’s experience with SD for BMI.

Data analysis

We transcribed all interviews aiming for the generation of a rich base of textual data. We then employed a two-stage within-case coding process to distil our data into higher order codes (Gioia et al. 2012): First, we relied on open coding to ‘open up’ the text-based sources (Flick 2009). In order to stay close to the data and avoid a premature introduction of theoretical ideas, we aligned with Charmaz’ (2014) suggestion of a line-by-line coding, leading to code formulations very close to the source (1773 codes in total). We then performed axial coding by aggregating these first order concepts into code groups, which we labelled by second order themes (Flick 2009; Gioia et al. 2012). In order to increase construct validity, we triangulated our interview data with archival records and case histories throughout this stage. This allowed us to harmonize different accounts of the same case. Following Eisenhardt (1989), we subsequently performed a cross-case analysis based on the generated hierarchical code structure.

Before turning to the findings the next section provides details relating to the derivation of statements and evaluation of responses of the complementary Q-Methodology.

Derivation of Q-methodology statements

At the core of the Q-Methodology lies a set of multifaceted items on the phenomenon of interest. In the context of our study, we relied on the Q-Methodology as a complementary analytical approach to analyse the established or emerging theoretical constructs. We formulated these constructs as hypothetical statements and presented them as a Q-sort exercise to 12 of our informants.

We relied on two sources for the generation of statements: First, we searched the BMI literature for concepts that have been associated with managerial understanding and decision-making and generated one statement for each identified concept. For instance, scholars have found that the capability of managers to initiate BMI strongly depends on their ability to interpret external developments as threats or opportunities and further that perceived threats and opportunities have different effects in initiating BMI (Gilbert 2005; Osiyevskyy and Dewald 2015; Saebi et al. 2016). In this case, we formulated two statements relating to the concepts of both threat and opportunity:

1. “In this project, Business Simulation helped me to recognize and assess external threats to BMW”

2. “In this project, Business Simulation helped me to recognize and assess opportunities to BMW”

Second, we used the interview data from the first phase to identify relevant cognitive mechanisms that were not covered by the previous statements. We subsequently refined this set through discussions among the researchers and informants. In total, this process yielded a set of 16 statements, which is consistent with prior literature (Cross 2005). Table 2 lists the 16 statements and provides foundational literature references where applicable. It further lists the z-scores for each factor correspondingly to the Q-Sort statements. We briefly discuss their development in the following section.

Evaluation of Q-Methodology responses

The Q-Methodology ‘inverts’ the axes of the Q-Sorts and thus undertakes a factor analysis of the individual respondents as dependent variables and the questions as samples (Stephenson 1936). This produces groups of respondents who tend to rank the same statements similarly. Our analysis of the 16 responses followed a two-step approach in line with established Q-Methodology practices (cfr. Watts and Stenner 2005). In a first step, we reduced the data dimensionality using a principal components analysis. We rotated the factors using the standard varimax rotation method to maximize the variance of factor loadings. For the selection of the major factors to be included, we imposed two standard Q-Methodology requirements (cfr. Watts and Stenner 2005): a) eigenvalues for each factor are greater than 1.00; b) features at least two significant loadings. The factor loadings and flagging for each Q-sort respondent are displayed in Table 1Footnote 1. Subsequently, to identify those statements that distinguish the different vectors, we calculated the difference in the normalized factor score (z-score) for each statement (Table 2).

Overall, our insights from the various data sources of the multiple case study and the results of the Q-methodology served as the foundation for a set of 11 propositions that collectively provide a testable entry to our emergent theory. Our inference from empirical data to theoretical explanation is based on inductive reasoning (Ketokivi and Mantere 2010). We sought to bridge the unavoidable logical gap of inductive reasoning, i.e. a set of empirical data can be used to formulate different theoretical explanations, each coherent with the data (Goodman 1954; Maher 1998), by means of inter-researcher reasoning (Eisenhardt and Graebner 2007).

Findings

Our research seeks to assess how SD supports managers along the BMI process. The qualitative analysis of five cases substantiated the idea that these effects depend on the model properties, the model development process, and the way the insights are presented. The importance of each of these aspects varies depending on the respective phase of the BMI process. The analysis of factor loadings from the Q-Sort further indicated that informants’ perception of the usefulness of SD in a BMI context vary, even within the same case and between managers of the same role. Correspondingly, the four respondent groups – each represented by one of the factors (f1–4) – do not reveal a distinct character (in terms of role, unit, or case). For instance, project owners are represented in each factor but each factor comprises respondents of other roles.

In the following, we present our findings structured along the four BMI phases (Frankenberger et al. 2013). Thereby, our main focus lies on the insights generated from primary interview data, observations and archival records of the cases. We complement these by results from the Q-Sort analysis.

Initiation

In the context of the initiation the informants reported increased predictability of the impact of external developments on the existing business model based on insights from the SD model. We observed this in the Regulation and Insurance cases, in which managers were able to better understand the consequences of changes in the regulative environment or a proposed business model change from a collaboration partner. In both cases, the cross-functional approach and the extensive amounts of collected data facilitated the detailed identification of change drivers. Furthermore, the SD model enhanced the interpretation of the ‘general direction of outcomes’ (16 quotations) in the Insurance case. Similarly, in the regulation case enabled managers to quantify the impact of climate regulation on BMW’s business model in the long-term planning horizon (5 quotations). In this context, one manager stated:

We know the dynamic trajectories of the volume-models and the individual units and you do rough estimations. When you see [redacted: country-specific regulatory changes] you simply know, ‘this is going to be extremely expensive’ and the System Dynamics method was ideal to better understand and quantify this ‘extremely expensive’. - #9: Project Owner

Related to the same case another interviewee further highlighted how SD facilitated attention among top management for strategic issues:

To us [the anticipated financial impact on the business model] seemed somehow obvious, however in regards to the fines, the level of the peak in 2020 was quite a surprise […] and when you suddenly start talking about these amounts, then people start listening. […] of course BMW knows this somehow. Somewhere some people know that this exists […] But it is about the creation of this connection between the headquarter and the market. - #8: Modeller

Such a long-term horizon of the quantified forecasts was highly unusual in the context of the Regulation case that is characterized by a short-term sales orientation (8 quotations). In return, project members were able to raise attention among decision makers for possible solutions. Specifically, the project team could argue that investments for activities that reduce (potential) fines would best match the level of these avoided fines. In sum, the detailed forecasts proved crucial for the approval of two related BMI projects.

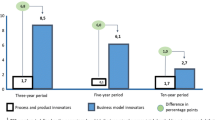

The Q-Sort results provide complementary findings. Interestingly, f1 (−1.78, −1.49) and f4 (2.26, 1.12) assign high but contrary scores to the statements that relate to the recognition and assessment of opportunities.Footnote 2 The identified environmental developments related to the Regulation and Mobility case where rather perceived as threats, whereas the Insurance and Mobility case this assessment was neutral to positive. Under this consideration the results indicate that managers felt supported to gain a clear understanding of the impact of the identified developments, whereas the SD model did not change or reveal opposite perceptions. Respondents of f2 put the most significant scores on the statement “In this project, Business Simulation helped me to understand the longer-term dynamics of BMW’s existing business model.” (2.17) Considering their affiliation with either the Market, or the Business Simulation unit, the SD model provides them with a holistic understanding of how the individual parts of the business model collectively drive performance along the parameters of interest.

-

Proposition 1. Quantifiable results from system dynamics models are useful in guiding attention of decision makers towards relevant environmental developments.

-

Proposition 2. System dynamics models provide holistic business understanding for domain experts.

Ideation

In the context of the ideation, our cases showed only limited effectiveness in applying SD for the generation of new business model ideas. Our thematic coding supports this finding on a more granular level: In contrast to 11 quotations relating to the code ‘No new operational ideas generated through BMS’, only two quotations related to the code ‘New BM idea.’Footnote 3 The Q-Sort analysis majorly supports these findings. The groups of respondents consistently put negative loadings on the statement “In this project, Business Simulation helped me to understand how a business model from a different context/industry could be applied to BMW.” Similarly, respondents reported difficulties to “leverage [their] professional experience at BMW to generate new BM ideas” and to “combine multiple components of existing business models in a novel way.” The loadings for these two statements are, however, lower. Surprisingly, one group of informants (f3) put very high scores (1.97) on the latter statement. This group entails two input providers and one project owner.

In an attempt to consolidate these findings, we interpret that SD is not well suited for the generation of innovative business model ideas. The standardized notation built on systems of cause-and-effect relationships hinders creative cognition. However, when the innovation heavily relies on the reuse/reconfiguration of components or mechanisms that are well understood, since they are based on existing business models. In these cases managers may perceive that their professional experience is useful, but they cannot leverage it themselves. However, when the underlying cause-and-effect relationships of knowledge domains, such as business model components well are understood some managers might be able to translate this domain knowledge into new component combinations using SD.

-

Proposition 3. System Dynamics models are of limited use in generating new business model ideas that rely on creative cognition.

-

Proposition 4. If the underlying cause-and-effect relationships of business model components are well understood, this knowledge can be used for new component combinations.

Integration

During the integration our informants reported that the SD model facilitated the elaboration of business model ideas and the creation of shared understanding among managers. In the following both aspects are outlined separately. Across all cases the interviewees attributed a more holistic elaboration of the business model to the application of SD modelling (18 quotations). This effect can be divided into support in ‘identifying own knowledge gaps’ and ‘understanding the business model as a whole.’ First, the SD modelling process allowed managers to identify knowledge gaps for instance, by highlighting business model elements that require a more distinguished understanding such as motives for customer behaviour (Sharing case). Second, the SD model itself allowed managers to understand the business model holistically by providing those involved in its development with the perception to capture the real-life complexity (‘capturing complex relationships in a business model’, 12 quotations; ‘BMS encourages realistic modelling’, 9 quotations; ‘including circular relations in the business model, 3 quotations). For instance, in the Regulation case, managers modelled parameter variations for multiple model elements and ran simulations to analyse their effects over time.

Essentially, the development of the SD model demands managers to form explicit and precise definitions about the existence of business model elements and their interrelationships and to reflect critically on the development of certain model parameters by running simulations. These mechanisms guide them towards deeper levels of understanding, which outsiders may lack of (‘information gap between modellers and non-modellers’, 3 quotations). In summary, we posit

-

Proposition 5. System Dynamics modelling processes induce deep reflection and a fine-grained understanding of the complex relationships in new business models.

Throughout all cases, we found evidence that the application of SD had a consensus-forming effect/created shared understanding among those managers directly involved model development. We observed three properties to facilitate this effect: First, the development of a holistic model integrating a diverse set of managers and units consolidates different understanding by enforcing a consistent terminology. For instance, in the Insurance case there originally existed different mental models, and even abbreviations for the same business model:

Regarding the claims, it was already a revelation in terms of wording: When we [as Aftersales] talk about «claims», then my primary focus is the claimed parts, because we are assessed based on revenue on parts … ‘What is actually the KPI of an insurance?’ They are assessed based on CR, the Combined Ratio, which we internally refer to as Cost of Retail. Already the wording is different between Financial Services and Sales. You really need to realize what you and the others talk about. - #14: Project Owner

Second, the SD model facilitates the consolidation of mind-sets between managers by providing a neutral frame that can be highly effective at “de-politicizing” otherwise divisive topics:

I think [using SD] is meaningful, once I approach cross-departmental issues, because […] I can de-emotionalize those using such a tool. - #13: Project Owner

Overall [applying SD] was very, very constructive, and the political discussions fade into the background or disappeared completely. - #12: Modeller

Third, the SD model creates shared understanding through the explicit integration and quantification of causal relationships. Whereas it is traditionally difficult to track the consideration of certain business model elements in decision-making processes, SD allows managers to transparently ensure that all relevant ones are taken appropriately into account. Thereby, discussions tend to favour global maxima in the use of conflicting assets, such as financial resources within the business model. Surprisingly, the z-scores from the Q-Sort exercise reveal consistently negative factor loading on the statement ‘BMS helped me to identify areas of conflict between BMW’s current business model and potential configurations of BMW’s future business model’. We interpret this result to originate from the definition of the model boundaries. In order to manage the complexity of the SD model, elements from adjacent business models inside BMW are only taken into account if they are immediately affected by the new model. This in return allows managers to resolve potential asset conflicts across departments within the modelled system.

-

Proposition 6. System Dynamics facilitates shared understanding (especially on divisive issues and conflicting assets) within the model boundaries by providing a neutral and consistent frame for discussion.

However, the integration of a diverse set of managers into the modelling process can also foster a type of ‘least common denominator’-consensus, leading to a simulation model largely consisting of simple, often linear relations among variables. We observed this in the Sharing project: Originating from different mental models the informants reported that they perceived the SD model to differ markedly from the “true” logic of the underlying business model. Our triangulation with archival records revealed that shared consensus was only created between a set of variables in linear relation to customer satisfaction, which was used as a proxy for demand and represents the dominant business case logic inside BMW. While the process of building the simulation model helped the Sharing project members to understand each other’s mental model, the final SD model did not represent real consensus of the business model logic.

-

Proposition 7. When managers’ mental models are highly diverse, system dynamics models tend to reflect the dominant logic without creating a new shared understanding.

Evidence from the Regulation and Sharing cases suggests that the modelling process that determines the access and utilization of data moderates the extent to which the SD model creates new shared understanding. For instance, in the evolution of the Sharing case, single elements that reflected an integral part of a non-dominant mental model in the business model logic, such the importance of a ‘word-of-mouth effect,’ were eventually excluded from the simulation model due to a lack of underlying data. Eventually, this reduced the simulation model back to set of established financial variables and their relationships for which data was more readily available.

In contrast, a systematic data gathering process from internal and external sources characterized the Regulation case. Consequently, the single code with the most related quotations was ‘utilize expert input/feedback’ (12x). The resulting simulation model differed significantly from the market organization’s dominant logic. Still, decision makers judged its results credible, largely because data was readily available or obtainable by the Regulation project team and the managers had confirmed the high data quality. The focus on acquiring and using data outside of immediate reach in the course of the modelling process (e.g., data located in another organizational unit within BMW) contributed much to the overall credibility and revelatory potential of the simulation. One decision maker states:

It is quite uncommon in the context of sales to disassemble a project on such a level of detail before reassembling it again. Hence, I think it is worth sharing that there was definitely admiration for this system. - #10: Decision Maker

We summarize:

-

Proposition 8. The data handling (determined in the modelling process) moderates the extent of shared understanding created by the system dynamics model.

In contrast to the consensus created among managers involved in the modelling process, multiple informants reported that “outsiders” sometimes perceive the simulation model as ‘black boxes’ (13 quotations) and start to mistrust the simulation results. Essentially, the inherent model complexity inhibits the effective communication of insights to non-modellers. For instance, one informant in the Sharing case stated:

Everybody looks at the front end and presses a button. Then something happens and you start thinking ‘hm, somehow this relationship looks odd’. But in this moment you can barely grasp if a careless mistake slipped in somewhere, if a relationship is actually non-existent or not appropriately represented… - #4: Project Owner

Informants across all cases attributed three factors to the failed communication. First, informants perceived a ‘liability of newness’ that applied to the use of SD simulations for decision support per se. This applied especially to managers from the controlling department who are regularly confronted with business case calculations. One interviewee shared:

Some people did not fully understand why we try to develop a simulation model and the added value of this approach, if it is meaningful or why we can’t just do it in Excel. People confront us quite often with such questions and it is difficult to provide a concise explanation. Especially, if people have never used a simulation software, it is difficult to say ‘You know there are tables and you can adjust graphs manually’ … that is not tangible and people do not understand it they haven’t tried it themselves.” - #5: Modeller

Second, informants reported difficulties to convert the simulation model into a simple narrative for presentation purposes. This, however, was reported as crucial due to the decision-making setting, which involves a large audience and short time slots to pitch innovation initiatives (cfr. Bartel and Garud 2009). One interviewee concludes:

[A] presentation using the business model simulation is quite complex for a larger audience and rather leads to questions than results - #2: Input Provider

Third, the multitude of mathematically specified relations in the model seems to be difficult also for informants to reconstruct when facing questions on model details by decisions-makers.

The corresponding results from the Q-Sort consistently confirmed the impression that SD models help to make sense of the real-life complexity inherent to any business model. All informants ranked the statement ‘BMS helped me to grasp the complexity of a business model’ (statement #10) high (0.84/1.32/1.26/0.77). Interestingly, when asked about the usefulness of SD for the communication of the business model to outsiders (statement #11) only one group of informants put significantly positive z-scores on this statement (f1, 1.59), whereas another group in contrast used highly negative scores (f3, −1.97).

We interpret this result as follows: When confronted with a SD model managers understand the complexity of the real business model. However, only those who have the possibility to thoroughly analyse the underlying dynamics gain deeper levels of understanding. Others remain ‘outsiders’: they feel overwhelmed by the level of complexity and unable to closely follow the line of reasoning.

-

Proposition 9. The use of System Dynamics models in business model innovation projects complicates the communication of insights to non-modellers, especially to larger audiences.

Elaborating on means to improve communication when relying on insights from SD, the informants frequently referred to ‘translation’ of the insights suiting the decision-making context as a critical component (14 quotations relating to this code group in total). How can the insights created from the simulation model be ‘translated’ for the audience in presentation contexts? We identified two distinct mechanisms: First, by integrating conventional metrics in the SD model and exclusively focusing on these when communicating to decision-makers. Among others, we observed how this approach enhanced the communication in the Mobility case. Here, initial discussions concerning the value of on-demand mobility and its implications for BMW remained abstract and did not sufficiently take the insights from the SD model into account. Eventually, managers integrated a metric that is long-established within the manufacturing division of BMW: production costs per unit. In spite of a minor and trivial mathematical operation to transfer to this metric, this step significantly improved the discussions with managers from other units.

Second, multiple informants from the Sharing case highlighted a complexity reduction in visual interfaces as a valuable approach to suit the underlying model to the communication context with non-modelling managers. By hiding visual tools to define key settings of the simulation (e.g., sliders), managers can reduce the perceived complexity of the model. For presentations to larger audiences managers may even refrain from presenting the simulation at all and communicate only static key scenarios. For instance, in their communication to decision-makers in the Regulation case managers began their presentation by outlining the functioning of SD in general terms. They continued to highlight the activities to ensure and exhaustiveness and rigor in the gathering and aggregation of the used data. This included to elaborate on the data’s origin that had been gathered from internal market experts. The combination of a sophisticated, theoretically appealing methodology and rigorous execution created credibility for the method. For the actual presentation of results to the decision-makers, the managers did not leverage the SD model. Instead, they focused on the resulting insights relying on established terms and the formulation of concise core statements such as ‘potential regulatory fine payments.’ This indeed proved to change the mind-set of the decision-makers who became aware of the acuity of impeding regulatory changes.

-

Proposition 10. The communication of insights from the system dynamics model to managers not involved in the modelling can be improved through the integration of established metrics and terms and complexity reduction in visual interfaces.

Implementation

In the context of the implementation we observed the notion of ‘risk’ as a dominant issue across the majority of interviews. This heavily guided the ways by which managers utilized SD throughout this phase. Here, our cases revealed two distinct modes: First, instead of engaging directly in experimentation, managers leveraged model simulations for quasi-experiments, through which they intended to test broadly, efficiently, and at low risk levels. Q-Sort respondents consistently assigned positive scores to the statement “BMS helps me to test and compare different possible configurations of a business model.” One interviewee elaborates on this issue:

Of course, you could say ‘let’s do it as a startup’ or you can order it from a startup or invest in one through BMW ventures, or alternatively you say: ‘I have this group that can simulate systems, that just costs me man power, IT and brain.’ And thereby I can already start testing. […] It’s faster and cheaper. And you get more variants. Within the firm I cannot say: ‘It didn’t work out, so let’s try it a different way.’ I have my targets, my KPIs, my revenue objectives, my profit objectives, this needs to have some kind of flow. You can always conduct some minor tests, but not too many. - #16: Decision Maker

Second, managers made use of the SD model to identify the most critical levers for subsequent testing. Hence, SD was leveraged as preparatory means for experimentation. By testing various scenarios, it enabled managers to develop suggestions for concrete steps of subsequent action.

However, the results from the Q-Sort reveal that the usefulness of SD for such subsequent operationalization is rather limited. The informants consistently put relatively neutral factor loadings on the statement ‘BMS helped me to formulate concrete actions for implementing a business model’ (0.47/−0.12/−0.12/−0.01). This may explain why in some cases the simulation results were only used as a preparatory means to steer mutual agreement on a series of actions. For instance, one interviewee stated:

We came up with very concrete suggestions for action, but developed it again in a workshop […] So we prepared [the workshop] a bit, but jointly formulated [concrete actions]. - #8: Modeller

In sum, we interpret that whilst individual managers attribute great value to SD models in partly replacing or preparing experimentation-related actions, others do not. Yet though, they may agree on the same set of actions when confronted with them through conventional means.

-

Proposition 11. System Dynamics models accommodate managerial risk aversion by providing an efficient mean for (pre-)experimentation guiding subsequent steps of action.

Figure 2 provides an overview of the SD model used for the Regulation case.

Discussion and conclusion

We add to theories of system dynamics and managerial cognition. Prior theory suggests that SD has positive effects on managers’ perceived ability to understand and make decisions in BMI. But empirical evidence is limited and does not sufficiently differentiate between the different activities within the same BMI process. Addressing this gap, we explored how managers at BMW used SD throughout their BMI processes to support their understanding and decision-making across five contextually different cases. We condensed our insights into a set of eleven propositions thereby “bridging the often wide gulf between qualitative and quantitative researchers” (Gioia et al. 2012, p.25) to facilitate future theory testing.

Prior research has emphasized the difficulties for managers to cope with dynamic behaviour of systems imposed by the cognitive limitations of the human brain (Cyert and March 1963; Weick 1979). When reconfiguring their business models these lead managers to make decisions based on incomplete, lower dimensional cognitive representations of relevant interdependencies within the firm and to its external environment (Gavetti and Levinthal 2000; Tripsas and Gavetti 2000). Consolidating our findings, we conclude that SD modelling enables corporate managers to reflect deeply about a business model’s component architecture and consequently to develop higher dimensional cognitive representations. SD-based simulations enhance their processing capabilities and allow them to better quantify the impact of environmental changes. This is particularly valuable when initiating BMI because managers can better anticipate the existing business model’s prospective performance and raise decision makers attention. Along the BMI process the SD model integrates the input from various managers into a single, fine-granular model containing mathematical descriptions of cause-and-effect relationships. SD thereby allows individuals to overcome cognitive limitations by leveraging the intelligence from multiple managers and computational simulation. Such combinations of computational processing and human cognition capabilities have been demonstrated to facilitate valuable solutions in the context of business model validation (Dellermann et al. 2018).

However, our findings also highlight that this integrative property needs to be handled with caution. When elaborating on potential business model configurations the SD models guide managers towards new shared understanding. Yet, if the individual mental models are highly diverse and supportive data for new representations may be out of immediate reach, the shared understanding tends to reflect and enforce the conventional business model logic. A mitigating strategy is the purposeful gathering of data reflecting alternative configurations.

Additionally, SD may impose what we would call a cognition gap among managers. This gap refers to the challenges arising from different levels of dimensionality in the cognitive models between managers that are involved and those not involved in the modelling process. During the modelling process managers gain thorough understanding of fine-grained dynamics inherent to the business model, for instance by varying the graphs of individual relationships and observing the consequences on other parts of the model in simulations. Among those being involved in this kind of practice the SD model provides a neutral frame in which different mental models become transparent and can be openly discussed. This is what our informants referred to when they described SD as tool to de-emotionalize and facilitate constructive discussions. ‘Outsiders’ however, that hold lower dimensional cognitive representations grasp the underlying complexity of the models, yet they feel overwhelmed by it and perceive them as ‘black boxes’. Such varying levels of dimensionality impede constructive discussions. Due to the sheer amount of variables, their value ranges and relations, modelling managers may fail to recall every model property in the moment of discussion when confronted with requests on a specific detail leading non-modelling managers in extreme cases to generally suspect the model of holding faulty assumptions.

We observed different strategies aiming to overcome the cognition gap. First, an integration of conventional metrics into the SD model aims at building a connection between the dominant cognitive representations and the simulation model. Second, a simplification in visual interfaces reduces the perceived complexity and is achieved by simplifying the visible architecture of elements and by focusing on a selection of static scenarios.

Notwithstanding these insights, there are some limitations that apply to our research. First, our findings derive from a specific application of System Dynamics, BMS. The BMS method represents a distinct approach used by BMW to leverage SD during BMI. Any transfer from BMS to SD is to be taken carefully. Nevertheless, since our approach aligns closely with the best practices in SD modelling formulated by Martinez-Moyano and Richardson (2013) we expect that our insights and corresponding propositions on the usefulness of SD in the context of corporate BMI possess external validity. Second, BMW’s BMI processes and culture are also distinct and may limit the transferability into other corporate contexts, for instance with lower levels of risk aversion. Third, our cases relate to a cognition-centred approach for BMI. As outlined before, this approach differs significantly from experimental modes of search often associated with innovation of the entrepreneurial firm (Blank 2013; Sarasvathy 2001). Therefore, we are not able to draw conclusions about the usefulness of SD to support experimental search in general. However, considering that BMW deploys significant resources (in terms of time, human and financial resources), we assume that SD is better suited for corporate environments.

Despite these limitations, we conclude that our study is amongst the first empirical inquiries into the application of SD for BMI in a corporate environment. It provides a differentiated understanding of the benefits and challenges when managers leverage it as a tool to support their understanding and decision-making along the different phases of the innovation process. We invite further research to build on our insights to extend and test theory in this domain.

Notes

Complementary parts of the Q-Sort analysis can be found in the Appendix.

f1 (project owner: Insurance, project owner: Sharing); f4 (project owner: Mobility, decision maker: Regulation)

Both quotations relate to an idea for a business model innovation in the context of the Insurance case. This new idea, however, quickly proved to be unviable after minimal investigation.

References

Abdelkafi, N., & Täuscher, K. (2016). Business models for sustainability from a system dynamics perspective. Organization & Environment, 29(1), 74–96.

Abdelkafi, N., Makhotin, S., & Posselt, T. (2013). Business model innovations for electric mobility — what can be learned from existing business model patterns? International Journal of Innovation Management, 17(1), 1–41.

Afuah, A., & Tucci, C. L. (2003). Internet business models & strategies: Text and cases (2nd ed.). New York: McGraw-Hill.

Akkermans, H., Baida, Z., Gordijn, J., Peña, N., Altuna, A., & Laresgoiti, I. (2004). Value webs: using ontologies to bundle real-world services. IEEE Intelligent Systems, 19(4), 57–66.

Al-Debei, M. M., & Avison, D. (2010). Developing a unified framework of the business model concept. European Journal of Information Systems, 19(3), 359–376.

Ali-Vehmas, T., & Casey, T. R. (2012). Evolution of wireless access provisioning: a systems thinking approach. Competition and Regulation in Network Industries, 13(4), 333–361.

Amit, R., & Zott, C. (2012). Creating value through business model innovation. MIT Sloan Management Review, 53(3), 40–50.

Andries, P., Debackere, K., & van Looy, B. (2013). Simulatenous experimentation as a learning stratgy: business model development under uncertainty. Strategic Entrepreneurship Journal, 7(1), 27–47.

Aspara, J., Hietanen, J., & Tikkanen, H. (2010). Business model innovation vs replication: financial performance implications of strategic emphases. Journal of Strategic Marketing, 18(1), 39–56.

Aspara, J., Lamber, J.-A., Laukia, A., & Tikkanen, H. (2011). Strategic management of business model transformation: lessons from Nokia. Management Decision, 49(4), 622–647.

Aversa, P., Haefliger, S., Rossi, A., & Baden-Fuller, C. (2015). From business model to business modelling: modularity and manipulation. Advances in Strategic Management, 33, 151–185.

Aversa, P., Haefliger, S., & Reza, D. G. (2017). Building a winning business model portfolio. MIT Sloan Management Review, 58(4), 47–54.

Baden-Fuller, C., & Haefliger, S. (2013). Business models and technological innovation. Long Range Planning, 46(6), 419–426.

Baden-Fuller, C., & Mangematin, V. (2013). Business models: a challenging agenda. Strategic Organization, 11(4), 418–427.

Baden-Fuller, C., & Morgan, M. S. (2010). Business models as models. Long Range Planning, 43(2–3), 156–171.

Barabba, V., Huber, C., Cooke, F., Pudar, N., Smith, J., Paich, M., … Cooke, F. (2002). A multimethod approach for creating new business models: the general motors OnStar project. Interfaces, 31(1), 20–34.

Bartel, C. A., & Garud, R. (2009). The role of narratives in sustaining organizational innovation. Organization Science, 20(1), 107–117.

Berends, H., Smits, A., Reymen, I., & Podoynitsyna, K. (2016). Learning while (re)configuring: business model innovation processes in established firms. Strategic Organization, 14(3), 181–219.

Bingham, C. B., & Eisenhardt, K. M. (2011). Rational heuristics: the “simple rules” that strategists learn from process experience. Strategic Management Journal, 32(13), 1437–1464.

Blank, S. (2013). Why the lean start-up changes everything. Harvard Business Review, 91(5), 63–72.

Bouwman, H., de Vos, H., & Haaker, T. (2008). Mobile service innovation and business models. Berlin Heidelberg: Springer-Verlag.

Casadesus-Masanell, R., & Ricart, J. E. (2010). From strategy to business models and onto tactics. Long Range Planning, 43, 195–215.

Casadesus-Masanell, R., Gassmann, O., & Sauer, R. (2017a). Hilti (A): Fleet management? Harvard Business School Press (pp. 1–19).

Casadesus-Masanell, R., Gassmann, O., & Sauer, R. (2017b). Hilti Fleet management (B): Towards a new business model. Harvard Business School Press (pp. 1–9).

Cavalcante, S., Kesting, P., & Ulhøi, J. (2011). Business model dynamics and innovation: (re)establishing the missing linkages. Management Decision, 49(8), 1327–1342.

Charmaz, K. (2014). Constructing grounded theory: A practical guide through qualitative analysis (2nd ed.). Thousand Oaks: Sage Publication.

Chesbrough, H. (2010). Business model innovation: opportunities and barriers. Long Range Planning, 43(2–3), 354–363.

Chesbrough, H., & Rosenbloom, R. S. (2002). The role of the business model in capturing value from innovation: evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555.

Cosenz, F. (2017). Supporting start-up business model design through system dynamics modelling. Management Decision, 55(1), 57–80.

Cross, R. M. (2005). Exploring attitudes: the case for Q methodology. Health Education Research, 20(2), 206–213.

Cucculelli, M., & Bettinelli, C. (2015). Business models, intangibles and firm performance: evidence on corporate entrepreneurship from Italian manufacturing SMEs. Small Business Economics, 45(2), 329–350.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. Englewood Cliffs: Prentice-Hall.

de Reuver, M., Bouwman, H., & MacInnes, I. (2009). Business models dynamics for start-ups and innovating e-businesses. International Journal of Electronic Business, 7(3), 269–286.

de Reuver, M., Bouwman, H., & Haaker, T. (2013). Business model roadmapping: a practical approach to come from an existing to a desired business model. International Journal of Innovation Management, 17(1), (134006-)1–18.

Dellermann, D., Lipusch, N., Ebel, P., & Leimeister, J. M. (2018). Design principles for a hybrid intelligence decision support system for business model validation. Electronic Markets. https://doi.org/10.1007/s12525-018-0309-2

Demil, B., & Lecocq, X. (2010). Business model evolution: in search of dynamic consistency. Long Range Planning, 43(2–3), 227–246.

Demil, B., & Lecocq, X. (2015). Crafting an innovative business model in an established company: the role of artifacts. Advances in Strategic Management, 33, 31–58.

Desyllas, P., & Sako, M. (2013). Profiting from business model innovation: evidence from Pay-As-You-Drive auto insurance. Research Policy, 42(1), 101–116.

Doganova, L., & Eyquem-Renault, M. (2009). What do business models do?. Innovation devices in technology entrepreneurship. Research Policy, 38(10), 1559–1570.

Doz, Y. L., & Kosonen, M. (2010). Embedding strategic agility: a leadership agenda for accelerating business model renewal. Long Range Planning, 43(2–3), 370–382.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532–550.

Eisenhardt, K. M., & Graebner, M. E. (2007). Theory building from cases: opportunities and challenges. Academy of Management Journal, 50, 25–32.

Euchner, J., & Ganguly, A. (2014). Business model innovation in practice. Research-Technology Management, 57(6), 33–39.

Fang, E. (. E.)., Palmatier, R. W., & Steenkamp, J.-B. E. (2008). Effect of service transition strategies on firm value. Journal of Marketing, 72(5), 1–14.

Featherston, C. R., & Doolan, M. (2012). A critical review of the criticisms of system dynamics. In The 30th International Conference of the System Dynamics Society (pp. 1–13).

Flick, U. (2009). An introduction to qualitative research (4th ed.). Thousand Oaks: Sage Publication.

Forrester, J. W. (1961). Industrial dynamics. Cambridge: MIT Press.

Forrester, J. W. (2007). System dynamics—The next fifty years. System Dynamics Review, 23(2/3), 359–370.

Foss, N. J., & Saebi, T. (2017). Fifteen years of research on business model innovation: how far have we come, and where should we go? Journal of Management, 43(1), 200–227.

França, C. L., Broman, G., Robèrt, K. H., Basile, G., & Trygg, L. (2017). An approach to business model innovation and design for strategic sustainable development. Journal of Cleaner Production, 140, 155–166.

Frankenberger, K., Weiblen, T., Csik, M., & Gassmann, O. (2013). The 4I-framework of business model innovation: a structured view on process phases and challenges. International Journal of Product Development, 18(3/4), 249–273.

Furnari, S. (2015). A cognitive mapping approach to business models: representing causal structures and mechanisms. Advances in Strategic Management, 33, 1–40.

Galanakis, K. (2006). Innovation process. Make sense using systems thinking. Technovation, 26(11), 1222–1232.

Gambardella, A., & McGahan, A. M. (2010). Business-model innovation: general purpose technologies and their implications for industry structure. Long Range Planning, 43(2–3), 262–271.

Gary, M. S., Kunc, M., Morecroft, D. W., & Gary, M. S. (2009). System dynamics and strategy. System Dynamics Review, 24(4), 407–429.

Gassmann, O., Frankenberger, K., & Csik, M. (2014). The business model navigator: 55 models that will revolutionize your business. Harlow Pearson, UK: FT Press.

Gavetti, G. (2012). PERSPECTIVE — toward a behavioral theory of strategy toward a behavioral theory of strategy. Organization Science, 21(1), 267–285.

Gavetti, G., & Levinthal, D. (2000). Looking forward and looking backward: cognitive and experiential search. Administrative Science Quarterly, 45(1), 113–137.

Gebauer, H., Haldimann, M., & Saul, C. J. (2017). Business model innovations for overcoming barriers in the base-of-the-pyramid market. Industry and Innovation, 24(5), 543–568.

Gentner, D. (1983). Structure-mapping: a theoretical framework for analogy. Cognitive Science, 7, 155–170.

Gibbert, M., & Ruigrok, W. (2010). The “what” and “how” of case study rigor: three strategies based on published work. Organizational Research Methods, 13(4), 710–737.

Gibbert, M., Ruigrok, W., & Wicki, B. (2008). What passes as a rigorous case study? Strategic Management Journal, 29(13), 1465–1474.

Gilbert, C. G. (2005). Unbundling the structure of inertia: resource versus routine rigidity. Academy of Management Journal, 48(5), 741–763.

Gioia, D. A., Corley, K. G., & Hamilton, A. L. (2012). Seeking qualitative rigor in inductive research: notes on the Gioia methodology. Organizational Research Methods, 16(1), 15–31.

Goodman, N. (1954). Fact, fiction, and forecast. Cambridge: Harvard University Press.

Gordijn, J., & Akkermans, J. M. (2003). Value-based requirements engineering: exploring innovative e-commerce ideas. Requirements Engineering, 8(2), 114–134.

Graham, A. K., Morecroft, J. D. W., Senge, P. M., & Sterman, J. D. (1992). Model-supported case studies for management education. European Journal of Operational Research, 59(1), 151–166.

Groesser, S. N., & Jovy, N. (2016). Business model analysis using computational modeling a strategy tool for exploration and decision-making. Journal of Management Control, 27(1), 61–88.

Groesser, S. N., & Schwaninger, M. (2012). Contributions to model validation: hierarchy, process, and cessation. System Dynamics Review, 8(2), 157–181.

Holland, J. H., Holyoak, K. J., Nisbett, R. E., & Thagard, P. (1986). Induction: Processes of inference, learning, and discovery. Cambridge: MIT Press.

Huber, G. P. (1985). Temporal stability and response-order biases in participant descriptions of organizational decisions. Academy of Management Journal, 28(4), 943–950.

Hwang, J., & Christensen, C. M. (2008). Disruptive innovation in health care delivery: a framework for business-model innovation. Health Affairs, 27(5), 1329–1335.

IBM. (2006). Expanding the Innovation Horizon: The Global CEO Study 2006, 1–61.

Jick, T. D. (1979). Mixing qualitative and quantitative methods: triangulation in action. Administrative Science Quarterly, 24(4), 602–611.

Kaplan, S. (2012). The business model innovation factory: How to stay relevant when the world is changing. Hoboken: Wiley.

Karimi, J., & Walter, Z. (2016). Corporate entrepreneurship, disruptive business model innovation adoption, and its performance: the case of the newspaper industry. Long Range Planning, 49(3), 342–360.

Kastalli, I. V., Van Looy, B., & Neely, A. (2013). Steering manufacturing firms towards service business model innovation. California Management Review, 56(1), 100–123.

Ketokivi, M., & Mantere, S. (2010). Two strategies for inductive reasoning in organizational research. Academy of Management Review, 35(2), 315–333.

Kim, S. K., & Min, S. (2015). Business model innovation performance: when does adding a new business model benefit an incumbent? Strategic Entrepreneurship Journal, 9, 34–57.

Klang, D., Wallnöfer, M., & Hacklin, F. (2014). The business model paradox: a systematic review and exploration of antecedents. International Journal of Management Reviews, 16(4), 454–478.

Köpp, S., & Schwaninger, M. (2014). Scrutinizing the Sustainability of Business Models: System Dynamics for Robust Strategies, 1–55.

Lakoff, G. (1987). Women, fire and dangerous things: What categories reveal about the mind. Chicago: University of Chicago Press.

Leonard-Barton, D. (1992). Core capabilities and Core rigidities: a paradox in managing new product development. Strategic Management Journal, 13, 111–125.

Levitt, B., & March, J. G. (1988). Organizational learning. Annual Review of Sociology, 14, 319–340.

Lippman, S. A., & McCall, J. J. (1976). The economics of job search: a survey. Economic Inquiry, 14, 155–189.

Loock, M., & Hacklin, F. (2015). Business modeling as configuring heuristics. Business Models and Modelling, 33, 1–19.

Lucas, H. C., & Goh, J. M. (2009). Disruptive technology: how Kodak missed the digital photography revolution. Journal of Strategic Information Systems, 18(1), 46–55.

Lyneis, J. M. (1999). System dynamics for business strategy: a phased approach. System Dynamics Review, 15(1), 37–71.

Maher, P. (1998). Inductive inference. In E. Craig (Ed.), Routledge encyclopedia of philosophy (pp. 755–759). London: Routledge.

Markides, C. C. (2015). Research on business models: challenges and opportunities. Advances in Strategic Management, 33, 1–16.

Martignoni, D., Menon, A., & Siggelkow, N. (2016). Consequences of misspecified mental models: contrasting effects and the role of cognitive fit. Strategic Management Journal, 37(13), 2545–2568.

Martinez-Moyano, I. J., & Richardson, G. P. (2013). Best practices in system dynamics modeling. System Dynamics Review, 29(2), 102–123.

Martins, L. L., Rindova, V. P., & Greenbaum, B. E. (2015). Unlocking the hidden value of concepts: a cognitive approach to business model innovation. Strategic Entrepreneurship Journal, 9(1), 99–117.

Massa, L., & Tucci, C. L. (2014). Business model innovation. In M. Dodgson, D. M. Gann, & N. Phillips (Eds.), The Oxford handbook of innovation management (pp. 420–441). Oxford, UK: Oxford University Press.

Massa, L., Tucci, C., & Afuah, A. (2017). A critical assessment of business model research. Academy of Management Annals, 11(1), 73–104.

Matzler, K., Bailom, F., von den Eichen, S. F., & Kohler, T. (2013). Business model innovation: coffee triumphs for Nespresso. Journal of Business Strategy, 34(2), 30–37.

McCall, M. W., & Kaplan, R. E. (1985). Whatever it takes: Decision makers at work. Upper Saddle River: Prentice Hall.

McGrath, R. G. (2010). Business models: a discovery driven approach. Long Range Planning, 43(2–3), 247–261.

Mezger, F. (2014). Toward a capability-based conceptualization of business model innovation: insights from an explorative study. R&D Management, 44(5), 429–449.

Miller, C. C., Cardinal, L. B., & Glick, W. H. (1997). Retrospective reports in organizational research: a reexamination of recent evidence. Academy of Management Journal, 40(1), 189–204.

Moellers, T., Bansemir, B., Pretzl, M., & Gassmann, O. (2017). Design and evaluation of a system dynamics based business model evaluation method. DESRIST 2017. Lecture Notes in Computer Science, 10243, 125–144.

Nadkarni, S., & Barr, P. S. (2008). Envirnonmental context, managerial cognition, and strategic action: an integrated view. Strategic Management Journal, 29, 1395–1427.

O’Reilly, C. A., III, Chatman, J., & Caldwell, D. F. (1991). People and organizational culture: a profile comparison approach to assessing person-organization fit. Academy of Management Journal, 34(3), 487–516.

Onggo, S., Soopramanien, D., & Pidd, M. (2006). A dynamic business model for component-based simulation software. In Proceedings of the 2006 Winter Simulation Conference (pp. 954–959).

Osiyevskyy, O., & Dewald, J. (2015). Explorative versus exploitative business model change: the cognitive antecedents of firm-level responses to disruptive innovation. Strategic Entrepreneurship Journal, 9, 58–78.

Osterwalder, A., & Pigneur, Y. (2010). Business model generation: A handbook for visionaries, game changers, and challengers. Hoboken: Wiley.

Pagani, M. (2009). Roadmapping 3G mobile TV: strategic thinking and scenario planning through repeated cross-impact handling. Technological Forecasting and Social Change, 76(3), 382–395.

Petrovic, O., Kittl, C., & Teksten, R. D. (2001). Developing Business Models for Ebusiness. SSRN Electronic Journal, 1–6.

Porac, J. F., Thomas, H., & Baden-Fuller, C. (1989). Competitive groups as cognitive communities: the case of Scottish knitwear manufacturers. Journal of Management Studies, 26(4), 397–416.

Prahalad, C. K., & Bettis, R. A. (1986). The dominant logic: a new linkage between diversity and performance. Strategic Management Journal, 7(6), 485–501.