Abstract

Dated measurements of lead pollution in deep Greenland ice have become a useful proxy to monitor historical events because interruptions in lead-silver production result in fluctuations in lead emissions. However, the application of the lead emission record has not perhaps received the attention it deserves because of the difficulty in connecting macroscale events, such as wars and plagues, to their economic repercussions. For instance, although debasement of silver coinage with copper has been proposed as a reasonable response to interruptions in silver production, reductions in fineness of the silver denarius, the backbone of Roman coinage from the late third century BC, are not always coincident with decreases in lead deposited in Greenland. We propose that extensive recycling of silver that is evident in the numismatic record can better explain drops in lead emissions and, thereby, the responses to major historical events, such as warfare in the silver-producing areas of the Iberian Peninsula and southern France during the middle and late Roman Republic.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During the Second Punic War (218–201 BC), the silver denarius was introduced as a replacement of Rome’s early currency silver systems (Crawford 1987, 43–51), and this became the backbone of Roman coinage for nearly 450 years (Elliot 2020, 68–85). The silver used for the Republican denarius was of a good standard of purity (often over 95% silver) and seems to have been maintained over time (Crawford 1974, 569).

The application of lead emissions based on dated measurements of lead pollution in deep Greenland ice has become a useful proxy for historical events, including imperial expansion, wars, and major plagues (McConnell et al. 2018). For example, increases in lead pollution around 500 BC (Fig. 1) have been shown to be consistent with a transition from extracting silver from lead-poor ‘dry’ silver ores to the massive exploitation of lead ore deposits for their trace amounts of intrinsic silver at Laurion in Greece (Wood 2023). Here, the focus is placed on the downturn in lead emissions evident during late second- to mid–first-century BC (shaded ellipse in Fig. 1). This decline in lead emissions has been attributed to major interruptions in lead-silver production, coinciding with warfare during the middle and late Roman Republic in the silver-producing areas of the Iberian Peninsula and southern France (McConnell et al 2018). In effect, because lead ores were often exploited for their low amounts of silver and lead is used to refine silver in the cupellation process, recurring wars and periods of stability and instability instigating peaks and troughs in lead-silver production resulted in fluctuations in the lead pollution deposited in Greenland ice.

Estimated lead emission data (thousands of tonnes/year) derived from ice cores in Greenland (adapted from McConnell et al. 2018). Approximate chronologies for relevant events are signposted. The shaded ellipse represents the main period under investigation

The main proxy used to relate lead emission data to silver coinage (and, thereby, ancient economies) has been the silver concentrations of the coins themselves. Periods of debasement—that is, the introduction of copper to silver—have been shown to exhibit similar trends to those of the lead emission data (McConnell et al. 2018). To some extent, however, this parameter is problematic because silver coinage is abundant throughout the Roman Republic—the period when silver denarius became the main currency. In effect, it is difficult to reconcile the amount of silver coinage in circulation with the decreases observed in the lead emissions by considering solely the changes in the concentrations of silver used in Republican coin production, especially when it is considered that silver concentrations in denarii and its fractions rarely dip below 95% (Fig. 2a).

Here, we consider another factor to explain historical fluctuations in lead-silver production: the melting down of silver objects and coins to produce new coinage. We propose that massive amounts of recycling, probably brought on by warfare and political instability during the Roman Republic, contribute significantly to the decreases observed in the lead pollution deposited in Greenland ice.

Compositions of Roman Republican silver coinage

The dataset for the Roman Republican and early Imperial Roman coinage in this article is from the ERC-funded Rome and the Coinages of the Mediterranean 200 BCE—64 CE (RACOM) project. Each coin in the dataset is recorded with a reference number (e.g. W216), a denomination (e.g. denarius), and—if known—the name of the magistrate under whom the coin was minted, the location of the mint, the date of the coin, and a reference number according to the 1974 Crawford catalogue (e.g. RRC 182/1) for Republican coins and the RIC for the coins of Augustus (e.g. RIC I Augustus 264).

The aim of the sampling procedure was to have comprehensive coverage, with multiple specimens of each ‘Crawford’ type, where possible. This was constrained by (a) the comprehensiveness of museum collections that we could access and (b) whether the coins were suitable for sampling (shape of flan, thickness, brittleness). These constraints were circumvented by approaching several institutions (Ashmolean Museum, Oxford; Firestone Library, Princeton; Münzkabinett Winterthur; Yale University Art Gallery). Coins were also sampled from hoards in Romania (Poroschia, Seica Mica, Breaza, Zatreni, Poiana).

The elemental composition of each coin was determined using microwave plasma atomic emission spectroscopy (MP-AES). Samples for elemental analysis were taken using steel twist drills (with the turnings being collected after discarding the first millimetre or so to avoid using the altered surface material). Ten milligrams of the drillings were then weighed into a glass vial, one for each coin, and digested in a 10% aqua regia solution. The aqua regia is needed to dissolve the gold and tin in the alloy, but the silver in the sample is converted to insoluble silver chloride and so cannot be measured. The solution was then measured for arsenic, gold, bismuth, cobalt, chromium, copper, iron, manganese, nickel, lead, antimony, tin and zinc. Silver and copper were measured separately using a scanning electron microscope with energy dispersive spectrometry (SEM–EDS). The remaining aqua regia solutions were also used for lead isotope analysis.

The solutions were measured on an Agilent 4200 microwave plasma atomic emission spectrometer (MP-AES) in the Department of Archaeology, Classics and Egyptology at The University of Liverpool. Calibration standards were prepared from commercial standard solutions that were matrix matched to the samples, and a certified standard reference material for archaeological silver alloys (AGA3, MBH analytical) was run alongside the samples to monitor accuracy. Instrumental precision was better than 1% for all elements above the limit of detection (Tables 1 and 2).

For the purposes of this investigation, Fe, Ni, Mn, Co, and Cr were removed from the subsequent analyses to reduce any influence of possible contamination from the sampling procedure (Wood and Liu 2023). This left 9 elemental components: As, Au, Bi, Cu, Pb, Sb, Sn, Zn, and Ag. The data used in the current article can be found in the Supplementary Material.

In total, 1050 coins were analysed to determine their chemical compositions. This included 84 coins from hoards of Roman denarii found in Romania. Six of the coins recovered were identified as ancient copies and were removed from the subsequent analyses. An undated coin (R55) from this assemblage was also removed. A further two coins were removed from the dataset: W220 produced negative values in some of the trace element measurements; Y2192 was a forgery and not made from silver but comprised mainly lead and tin.

Table 3 presents a list of the 1041 coins used in the following analyses delineated by their attribution to mints (in alphabetical order). Some mints are more certain than others: Rome/Italy, Lugdunum (Lyon), Emerita (Merida), and Cyrenaica are relatively certain. The dataset includes some non-Roman issues whose mint is certain: Iberian denarii from Arekorata and Kese. Coins attributed to Caesaraugusta (Zaragoza) and Colonia Patricia (Cordoba) are probably from Spain or Gaul, whereas Samos and Peloponnesus are presumably Eastern. Those classified as ‘uncertain’ also suggest Eastern mints. Some coins are only designated according to the names to which they are associated (e.g. mint with Sulla). Nearly 80% of the coins were minted at Rome, and the majority of other mints emerged after the middle of the first century BC.

Figure 2 plots the silver and copper concentrations of 1041 Roman silver coins from the Republican period and the reign of Augustus: denarius (940); denarius serratus (63); quinarius (36); sestertius (2). (Note: In the Supplementary Material, three denarii are recorded as aureus because of they were identified from their gold prototype). The plot highlights the dips in the fineness of the silver used to mint coins, particularly coins centred around 88 BC and 45 BC (Fig. 2a). The dates of the Republican coins in the article follow Crawford RRC (1974).

These dips in the silver concentrations of coins are predominantly associated with elevated concentrations of copper (Fig. 2b) and appear concurrent with the Social War (91–87 BC) and return of Caesar from Gaul (49 BC), the Civil War (49–45 BC), and its immediate aftermath. There also appears to be smaller dips in the silver concentration of coins in the dataset, again associated with elevated concentrations of copper (as often found in quinarii).

These changes in silver concentration could suggest that the silver supply was interrupted and that currency reform was required. However, cursory inspections of the plots of lead emissions (Fig. 1) and the plots of silver and copper concentrations in coinage (Fig. 2) show that this is probably not the whole story. First, the decline in lead emissions in the first half of the first century BC does not reflect the relatively constant silver concentrations in Republican coinage either side of the Social War (91–87 BC). Similarly, there appears to be an increase in lead emissions in the second half of the first century BC (at the time of the Civil War that followed Caesars’s return from Gaul in 49 BC) around the same time as a decrease in the fineness of the silver used to make Republican coinage.

These discrepancies raise the question as to whether changes in the production of Roman silver coinage caused by historical events can be identified from the lead concentrations in Greenland ice. This, however, is not the issue under investigation in this article. In fact, we agree that since the atmospheric model of McConnell et al. (2018) attributes the bulk of lead pollution measured in Greenland to European emissions, and that the main European silver production centres were under Roman control by the mid-second century BC (after the Punic wars (264–146 BC) and the defeat of the Carthaginians), this would suggest that any interruptions in lead-silver production should be reflected in the lead emission record. In effect, the Roman state moved very swiftly to exploit metal resources in newly conquered or acquired territories, such as those in the south-west of the Iberian Peninsula (Willies 1997; Domergue 1983, 1990; Hirt 2010, 260–269), with much of the silver minted into denarii at Rome being extracted from either argentiferous lead deposits or jarosite ores that required the addition of lead as a collector, with both being refined using lead.

Although we agree that lead emissions have sufficient resolution to investigate historical events that interrupted lead-silver mining, we question whether the variation in silver concentrations in Roman coinage necessarily reflects these events. In other words, this article questions the proxy that is used to relate lead pollution in Greenland to the economic changes brought on by major historical events.

Recycling and mixing

Figure 3 plots the Au/Ag ratio (expressed as Au/Ag × 100), which is a useful parameter as the gold present in the silver is unlikely to be affected by processing, such as smelting and refining, because gold is almost entirely inert; that is, it survives from ore to object (Gale et al. 1980; Meyers 2003, 271–88; Wood et al. 2021; for a practical application, see Wood et al. 2019).

The gold to silver ratio in the Republican coinage plotted as Au/Ag × 100. Note six coins Au/Ag × 100 > 1.7 from after 20 BC are not plotted due to scale. The blue shaded area delineates a cluster of coins with low Au/Ag levels (that is Au/Ag × 100 < 0.1) between 120 and 100 BC. The red shaded area delineates a cluster of coins with Au/Ag × 100 centred around 0.4 between 49 and 39 BC

The higher values of the Au/Ag ratio (Au/Ag × 100 > 0.1) for most of the dataset suggest the availability of a geological source of silver with relatively high levels of gold to make Roman Republican silver coinage. This could implicate jarosite ores, such as those found in south-west Iberia (Rothenberg and Blanco-Freijeiro 1981; Salkield 1982; 1987), rather than argentiferous lead ores that have Au/Ag ratios generally around one or two orders of magnitude lower (Gale et al. 1980; Wood et al. 2021; Wood 2023). For example, the ores of Riotinto have gold levels that range from 0.3 to 16Au% (Gale et al. 1980: Table 1). Furthermore, ‘Orientalising’ (eighth–sixth centuries BC) silver objects from Iberia have gold concentrations that range between trace levels and 6.4%Au (Montero-Ruiz et al. 2008; Wood et al. 2019), and a piece of silver recovered from the probable Roman production site of Las Arenillas (site RT103: also known as Cerro del Moro, a prominent steep hill next to the small mining town of Nerva, about 3 km from the main slag heaps of the Riotinto mine – Craddock et al. 1987) was found to have 1.37% gold in the silver (Wood 2019: table 8.3; Wood and Montero-Ruiz 2019). Over 100 Roman Imperial coins minted in the west Mediterranean have Au/Ag × 100 values centred around ≈ 0.5 (Wood et al. 2023).

A cluster of coins with low Au/Ag levels (that is Au/Ag × 100 < 0.1) is found to lie between 120 and 100 BC (blue shaded region in Fig. 3). The low Au/Ag × 100 values in the cluster suggest that a silver source with low concentrations of gold became available to the Romans to make coinage. Another cluster can be observed lying between 49 and 39 BC, centred around Au/Ag × 100 ≈ 0.4. This cluster suggests the introduction of another silver source and is consistent, at least chronologically, with silver deriving from Gaul that was introduced into Roman coinage after Caesar’s return from Gaul in 49 BC and used to finance the Civil Wars (49–45 BC).

With several sources of silver contributing to the production of Republican Roman coinage, each with different chemical signatures, the issue of mixing and recycling becomes potentially significant (Wood 2022). It is proposed here that decreases in lead emissions around the same time as silver coinage becomes the major currency of the Roman Republic (Fig. 1) are more indicative of recycling of existing silver (including coins) rather than any reductions in the amounts of argentiferous lead processed due to the debasement of coinage (Fig. 2).

Modelling recycling and mixing

Recycling is now examined through the Au/Ag × 100 vs. chronology plot in Fig. 3. Higher values of the Au/Ag ratio (Au/Ag × 100 > 0.1) are apparent in the coins lying between 164 BC and around 140 BC. Between 140 and 120 BC, coins emerge with lower Au/Ag ratios (i.e. Au/Ag × 100 < 0.1). These values indicate that more than one silver supply was used to make Republican coinage. This low-gold silver supply becomes particularly apparent between 120 and 100 BC (delineated by the blue shaded region in Fig. 3). In effect, the variation in the Au/Ag ratios suggests a mixing of sources; that is, coins with intermediate Au/Ag ratios could be mixtures of low-gold silver with high-gold silver to make silver ingots that were subsequently used for coinage and/or silver coinage with high levels of gold (coins with Au/Ag × 100 > 0.1) might have been recalled, mixed, and melted down with silver that had concentrations of gold in the hundredths of a percent to mint new coinage.

The mixing scenario perhaps gains some traction because of the convergence of Au/Ag values in Fig. 3: that is, there is an increasing number of coins with intermediate Au/Ag ratios after 100 BC. Figure 4 suggests possible mixing mechanisms (Hunt 2004; Perreault 2019): a mixture of silver coins with similar gold concentrations melted down together would retain the same mean value, even if there were differences in the variance of each batch (Fig. 4a). In fact, a stable mean but changing variance would result in a time-averaged distribution in which the central values are overrepresented. However, if silver coins with different concentrations of gold were melted down in the same melting pot, a distribution would emerge that is wider and flatter, with a mean concentration of gold in the silver that lies somewhere between the individual components that make up the mixture (Fig. 4b). These mechanisms (Fig. 4a and b) are not mutually exclusive.

Mixing increases variance: a) a stable mean and fluctuating variance (i.e. the mean of the mixture remains constant); b) a fluctuating mean and stable variance (i.e. the means of the individual groups converge in the mixture) resulting in a wider, flatter and converging to a uniform distribution, compared to the individual components. Adapted from Perreault 2019, fig. 3.12

The mechanism in Fig. 4b is supported by examining histograms of the Au/Ag ratio (Figs. 5 and 6). Prior to the cluster (before 120 BC), the majority of coins have higher levels of gold (Au/Ag × 100 > 0.1) than the coins in the cluster (Au/Ag × 100 < 0.1) that emerges around 120 BC; that is, only 23 out of the 162 coins minted between 164 and 120 BC are from a low-gold silver supply (Fig. 5a). The Au/Ag ratio between 120 and 110 BC (Fig. 5b) shows that silver with low concentrations of gold dominates the distribution (43 out of 65 coins have Au/Ag × 100 < 0.1), including four out of the five coins minted at Narbo in 118 BC.

Histogram of the Au/Ag × 100 values of Republican silver coins a) prior to the emergence of the cluster in 120 BC; b) between 120 and 110 BC. Bin widths were determined from the Freedman–Diaconis (1981) rule (bin width = 2 IQR(x)/∛n, where IQR is the interquartile range of the data and n is the number of observations in the sample x)

Histograms of Au/Ag × 100 in Republican silver coinage delineated into 10-year periods after the emergence of the low-gold cluster (120–100 BC) delineated by the blue box in Fig. 3. To maintain the same scale, coins with Au/Ag values over 1.75 are not plotted in the last two plots. Bin widths were determined from the Freedman–Diaconis (1981) rule (bin width = 2 IQR(x)/∛n, where IQR is the interquartile range of the data and n is the number of observations in the sample x)

Building up the histogram in 10-year increments from the cluster (Fig. 6) shows that variation in the Au/Ag values increases, with the histogram converging to an almost uniform distribution. This wider and flatter distribution, which appears to extend until around 50 BC, indicates many recycling events (that is, the mixing of silver with various gold concentrations). In effect, the low-gold silver supply in the cluster was potentially mixed with silver that was already available (such as the higher Au/Ag silver that was available to make coins before 120 BC in Fig. 5). Some of of these mixing events were potentially associated with debasement of silver with copper (c. 90–85 BC) (Fig. 2).

After 50 BC, the distribution changes, with a peak (centred around Au/Ag × 100 ≈ 0.4) perhaps suggesting the introduction of a new silver supply producing a cluster of coins between 49 and 39 BC with a low range (Au/Ag × 100 ≈ 0.34 − 0.5)—possibly associated with Caesar’s return from Gaul in 49 BC. This new supply, which also appears to have undergone debasement (perhaps prior to its arrival at one of the Roman mints) (Fig. 2), appears to dominate the distribution and is possibly a component of further recycling of coinage into Imperial times.

Figure 7a plots the time-averaged variance of the Au/Ag × 100 for the entire dataset, that is, the variance among observations at yearly time-steps. Of the 178 time-steps (164 BC–AD 13), 131 time-steps had sufficient numbers of coins to calculate variance values. Figure 7b plots the time-averaged variance for coins that have been attributed to the mint at Rome (112 time-steps had sufficient coins to calculate the variance). The large increase in the variance into Imperial times (after c. 25 BC) in Fig. 7a is consistent with increases in the numbers of mints in operation, such as mints associated with regions other than Rome in Italy and mints in Spain (e.g. Colonia Patricia) and Gaul (e.g. Lugdunum). It should be also noted, however, that fluctuations in the time-averaged variance prior to the Imperial period are evident over the time-frames in both plots (Fig. 7a and b); that is, fluctuations are due to differences in the silver supplies used for Republican coinage generally, even though a few coins were produced at mints other than Rome.

Changes in the variance of Au/Ag × 100 in a time-averaged assemblage of coinage from 178 time-steps (164 BC to AD 13): a) for the entire dataset (131 time-steps had sufficient numbers of coins to calculate the variance); b) for coinage attributed to the mint at Rome (112 time-steps had sufficient numbers of coins to calculate the variance)

The cluster of coins with low Au/Ag values that emerges in Fig. 3 around 120 BC is particularly useful, as it appears to result in an increase in the time-averaged variance (Fig. 7). Its composition suggests that, in some cases, the silver supply was used directly to mint coins but that it also became a component of a mixture used to make coinage after 120 BC. This may have taken the form of direct mixing of silver supplies to make ingots for coinage or from the melting down and re-minting of these low Au/Ag silver coins with silver with higher Au/Ag values. Either way, it is likely that this low Au/Ag silver entered the silver reservoir for Republican coinage, thereby allowing investigation of the mixing hypothesis mentioned above.

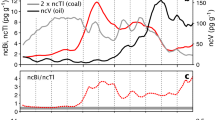

Figure 8a and b plots the time-averaged variance in the Au/Ag × 100 among all coins minted from 120 BC and their mean values, respectively, alongside the lead emissions over the same time period (Fig. 8c). For reasons of scale, two points with high variance and mean values at the beginning of the Imperial period in Fig. 7 have not been plotted.

a) Changes in the variance of Au/Ag × 100 in a time-averaged assemblage of coinage from the cluster (Au/Ag × 100 < 0.1) at 120 BC for the entire dataset. Periods of variance inflation (until c. 100 BC) potentially reflect the overall dispersion of the mean over the time period due to mixing and recycling (dashed line from Eq. 1). b) Changes in the time-averaged mean of Au/Ag × 100 after 120 BC; c) Pb lead emissions in Greenland ice between 120 BC and 13 AD (see Fig. 1: data from McConnell et al. 2018). Arrows on the three plots show the approximate midpoints of the dips and peaks in silver and copper concentrations, respectively, that reflect potential periods of debasement (Fig. 2).

The initial increase in the variance in Fig. 8a (until around 100 BC) supports the mechanism shown in Fig. 4b; that is, different batches of silver with different mean values were mixed together to form a mixture with a flatter, broader distribution.

The dashed line in Fig. 8a is based on a mixing mechanism from Hunt (2004) and assumes that the Au/Ag value of each batch of silver that contributes to the mixture is distributed normally and that the mean of each batch is different (Fig. 4b). For a constant variance, the value of any single measurement of the Au/Ag can be expressed as the mean of the context from which it is drawn, plus some deviation from the mean (Hunt 2004). For a mixed system, the value of an observation is the sum drawn from the population of the means and the population of deviations from the group mean. This model further assumes that the distribution of the Au/Ag values at a time t depends on its distribution at the preceding time step, t-1 (that is, there is temporal autocorrelation due to each component contributing to the mixture) and that the expected variance inflation, E[Vm], in the mixed system can be expressed as

where μStep and δStep are measures of the mean and variance, respectively, of a random distribution (that is, the mean of the Au/Ag distribution is assumed to shift every time step by an incremental amount drawn from this random distribution) (see Hunt 2004 for full derivation). Equation 1 represents the initial inflation of variance reasonably well (dashed line in Fig. 8a) by setting both μStep and δStep to 0.06.

The increase in the time-averaged mean between 120 and 100 BC supports the view that the low Au/Ag silver supply was mixed with silver with higher Au/Ag values, thereby increasing the Au/Ag of the silver mixture. The sudden decrease in the variance after 100 BC suggests a change of mechanism, from silver deriving from more than one supply being mixed together (Fig. 4b) to silver deriving from one supply (the coincident drop in the time-averaged mean suggests that low-gold silver was still available and became the dominant supply).

Increases in the variance (and mean) after the drop at c. 100 BC until 88 BC suggest another series of mixing events, resulting in a mixture with a mean Au/Ag × 100 value of approximately 0.5. Furthermore, the variance of the Au/Ag values in coinage increases around the same time as increases in copper concentrations (and concomitant decreases in the silver concentrations) are observed in Republican coinage (Fig. 2; the first arrow in Fig. 8 is centred around 88 BC). This suggests that debasement was conducted at the same time as silver supplies with different compositional signatures were mixed together. This coincidence suggests that mixing silver supplies and copper debasement were processes that were connected, probably at the mint. Assuming that silver from the mixture (that is, the silver mixture produced between approximately 100 and 88 BC) was one component of the new mixture, the lower time-averaged mean in the Au/Ag values after the mixing event around 88 BC (Au/Ag × 100 ≈ 0.3) would suggest that the silver added had lower Au/Ag values, perhaps deriving from the same supply as the silver in the cluster (Au/Ag × 100 < 0.1; 120–100 BC). A further increase in variance occurs at around 60 BC, again suggesting the mixing of silver supplies.

The introduction of new silver to make Republican coinage in about 49 BC appears to have dominated the Republican silver supply, as there is very little change in the time-averaged variance; that is, if this silver was mixed with existing supplies, there was either not enough silver in the reservoir to increase the variance or the new silver derived from a supply with a similar compositional signature. The first option is more likely because of the emergence of the peak in the histograms in Fig. 6 at around Au/Ag × 100 ≈ 0.4 (and the slight increase in the time-averaged mean in Fig. 8b). This new silver supply has elevated copper concentrations which could suggest that this silver already contained copper or that copper was added almost immediately at the Roman mint after this silver was acquired (Fig. 2).

The transition from Republican to Imperial Roman coinage exhibits large increases in the time-averaged variance and mean values. Coins lying in time-steps for 11 BC and 9 BC (not plotted in Fig. 8 for reasons of scale) have time-averaged variances of 1.32 and 0.6, respectively (see Fig. 7), with both having time-averaged mean values of over 2.2. These high values indicate that another silver supply with high Au/Ag × 100 values was potentially added to existing Republican supplies of silver at the beginning of the Imperial period.

In effect, the initial increase in the variance and mean values in Fig. 8a and b (between 120 and 100 BC) suggest that silver with different Au/Ag values contributes to a mixture that was used to mint Republican coinage. This increase is coincident with the initial decrease in lead emissions as recorded in the pollution records in Greenland ice (Fig. 8c). This correlation could suggest that a silver supply with high Au/Ag × 100 values was mixed with the low Au/Ag × 100 silver supply from the cluster and that existing stocks of silver were mixed together that resulted in a decrease in lead emissions until 100 BC—that is, the decrease in emissions supports that production from lead-silver ores had been interrupted and that mixtures of recycled silver were the main silver supplies of coinage.

After 100 BC, lead emissions start to increase which may suggest that lead-silver production resumed around the same time as copper was added (the peak centred around 88 BC in Fig. 2 and the arrow in Fig. 8). A peak in the variance at 60 BC is coincident with increases in lead emissions, suggesting that the mixture produced contained a component that had been extracted and refined around this time. The introduction of new silver with Au/Ag × 100 ≈ 0.4 (Fig. 6) is not associated with a large increase in variance which suggests that it dominated the silver supply. Furthermore, its introduction is around the time that lead emissions decrease which could suggest that this silver was used to make coinage without further processing. This could suggest the acquisition of silver from booty. Furthermore, the elevated levels of copper, which would not necessarily increase lead emissions, were either already present in the silver when it entered the Republican silver supply or added almost immediately after it was acquired by the Roman mint. The increase in emissions at the beginning of the Imperial period is consistent with silver sources with very high Au/Ag values being exploited in south-west Iberia.

Discussion

It is clear that the decreases in lead emissions noted during late second- to mid–first-century BC are not consistent with the denarii becoming the main currency of the Roman Republic. Although fluctuations in the fineness of silver coinage have been proposed to explain changes in the lead pollution record, we suggest that recycling of silver is a more tenable explanation. The cluster of coins with low gold concentrations that appear in the numismatic record around 120 BC allows investigation of recycling, as this silver was not only used to mint coins but also appears to have become a component of the silver mixture used to mint late Republican coinage. That mixing of metals occurred during the Roman Republic is not in question: copper was added to coinage, probably deliberately, following currency reform, often in times of crisis (Butcher and Ponting 2015). By the same rationale, silver from different supplies was mixed together, probably as a consequence of shortages and issues with supply chains.

A cluster of coins with low gold-to-silver ratios that emerges around 120 BC is extremely fortuitous, as it provides a potential end-member for any subsequent mixing of silver, making its analytical signature potentially significant in assessing a silver supply of Republican Roman coinage; that is, the cluster at 120 BC provides a starting point to observe variance inflation due to mixing. Although the provenance of this low Au/Ag silver supply is not the topic of this paper, its compositional signature suggests that the coins in this cluster were made from silver that was from a different supply to the silver used previously to mint the majority of Republican coins (which have higher Au/Ag × 100 values) and that this batch of silver was acquired relatively suddenly (around 120 BC). This not only suggests the acquisition of existing silver (perhaps from booty) which was subsequently melted down to make coins with low Au/Ag values, but that it also provided a component to the Republican silver reservoir used to make coinage after 120 BC. In effect, the silver used to make coinage in the cluster appears to have been mixed with silver that was used previously to make coinage (probably silver deriving from the higher Au/Ag silver sources of south-west Iberia) that resulted in a mixed silver supply that was used throughout the first half of the first century BC.

Around 50 BC, the histograms change (Fig. 5) from a relatively broad flat distribution centred around Au/Ag × 100 ≈ 0.25 to being dominated by a peak centred at approximately 0.4, suggesting the introduction of a new silver supply with higher concentrations of gold, potentially related to Caesar’s return from Gaul. This new supply is reflected in the increase in the mean and a decrease in lead emissions which could suggest that the silver acquired between 49 and 39 BC (delineated by the red cluster in Fig. 3) was used without further processing. Increasing variance after 25 BC suggests that new sources of silver were exploited and added to the silver reservoir, resulting in an increase in lead emissions. High Au/Ag values suggest that a silver source with very high gold concentrations was exploited to mint early Imperial coinage. This source was potentially exploited in the West Mediterranean to mint Imperial coinage throughout the first century AD (Wood et al. 2023).

Concluding remarks

What we have attempted to demonstrate in this article is that by examining distributions, time-averaged variances, and means of the Au/Ag ratio, mixing of silver supplies appears prevalent in Republican coinage. Furthermore, since mixing can occur with decreases in lead emissions, this could suggest that the silver used for coinage was not always extracted directly from silver deposits but was recycled from existing supplies of silver. For the mixing events between 120 and 100 BC, this could suggest that silver objects, perhaps acquired as booty, were melted down or that existing coinage was recycled to produce new coinage. Silver for coins minted between 100 and 50 BC appears to derive from this mixture, with additions from sources with similar compositional signatures being added to this reservoir of silver. Some of this silver appears to have been debased with copper during the mixing process around the time of the Social War (91–87 BC). For the influx of silver that occurred around 49 BC, the decrease in lead emissions at this time suggests that much of the silver was used without further processing with lead. This, again, could suggest the acquisition of silver as booty and/or coinage (probably from Gaul) that was subsequently melted down and debased with copper (assuming that it had not already been debased when it was acquired) to make coins for the Roman Republic and to also become a component of the silver reservoir, along with a supply of high Au/Ag silver, into Imperial times.

There was a crisis in the Roman Republic regarding the acquisition of silver during the late second- to mid–first-century BC. However, this crisis does not appear to have affected the production of silver coinage. Essentially, although debasement of coinage requires less silver, the melting down of existing silver to mint new coinage appears to better reflect the decline in the lead emissions that are evident during late second- to mid–first-century BC rather than the fluctuations in the fineness of silver coinage. The reasons for recycling, however, were probably the same as those proposed previously by McConnell et al. (2018) to explain the fluctuations in lead emissions; that is, warfare during the middle and late Roman Republic in the silver-producing areas of the Iberian Peninsula and southern France resulted in major interruptions in lead-silver production.

References

Butcher K, Ponting M (2015) The metallurgy of Roman silver coinage: from the reform of Nero to the reform of Trajan. Cambridge University Press

Craddock PT, Freestone IC, Hunt Ortiz M (1987) Recovery of silver from speiss at Rio Tinto (SW Spain). IAMS Newsletter. https://www.ucl.ac.uk/archaeo-metallurgical-studies/sites/archaeo-metallurgical-studies/files/iams_10-11_1987_craddock_freestone_ortiz.pdf. Accessed 10 Jan 2023

Crawford M (1974) Roman Republican coinage, 2 vols. Cambridge

Crawford M (1987) Sicily, in Burnett A, Crawford M (Eds.) The coinage of the Roman world in the late Republic (pp. 43–51). British Archaeological Reports International Series 326. Oxford

Domergue C (1983) La mine antique d’Aljustrel (Portugal) et les tables de bronze de Vipasca. Conimbriga 22:5–193

Domergue C (1990) Les mines de la péninsule ibérique dans l'antiquité romaine. École Française de Rome, Rome, p 696. Publications de l'École française de Rome, 127-1. https://www.persee.fr/doc/efr_0000-0000_1990_ths_127_1. Accessed 8 Sept 2023

Elliot CP (2020) The role of money in the economies of ancient Greece and Rome. In Battilossi S et al (Eds.) Handbook of the history of money and currency. Springer https://doi.org/10.1007/978-981-13-0596-2_46

Freedman D, Diaconis P (1981) On the histogram as a density estimator: L2 theory. Z Wahrscheinlichkeitstheorie Verw Gebiete 57:453–476

Gale NH, Gentner W, Wagner GA (1980) Mineralogical and Geographical silver sources of archaic Greek coinage. In Metcalf DM, Oddy WA (Eds.) Metallurgy in Numismatics I. The Royal Numismatics Society

Hirt AM (2010) Imperial mines and quarries in the Roman world: organizational aspects 27 BC – AD 235. Oxford Classical Monographs, Oxford

Hunt G (2004) Phenotypic variation in fossil samples: modeling the consequences of time-averaging. Paleobiology 30:426–443

McConnell JR, Wilson AI, Stohl A, Arienzo MM, Chellman NJ, Eckhardt S, Thompson EM, Pollard AM, Steffensen JP (2018) Lead pollution recorded in Greenland ice indicates European emissions tracked plagues, wars, and imperial expansion during antiquity. PNAS 115:5726–5731

Meyers P (2003) Production, distribution, and control of silver: information provided by elemental composition of ancient silver objects. In L. van Zelst (Ed.) Patterns and process: a festschrift in honor of Dr Edward V. Sayre, Washington, DC

Montero-Ruiz I, Gener M, Hunt M, Renzi M, Rovira S (2008) Caracterización analítica de la producción metalúrgica protohistórica de plata en Cataluña. Revista d’arqueologia de Ponent 18:292–316. https://raco.cat/index.php/RAP/article/view/251824. Accessed 8 Sept 2023

Perreault C (2019) The quality of the archaeological record. University of Chicago Press, Chicago

Rothenberg B, Blanco-Freijeiro A (1981) Studies in ancient mining and metallurgy in South-West Spain: explorations and excavations in the Province of Huelva. The Institute of Archaeo-Metallurgical Studies

Salkield LU (1987) A technical history of the Rio Tinto Mines: some notes on exploitation from pre-Phoenician times to the 1950s. The Institute of Mining and Metallurgy, London

Salkield LU (1982) The Roman and Pre-Roman slags at Rio Tinto Spain. In T.A. Wertime and S.F. Wertime (Eds.) Early pyrotechnology: the evolution of the first fire-using industries, Washington D.C

Willies L (1997) Roman mining at Rio Tinto, Huelva, Spain. Bull Peak District Mines Hist Soc 13:1–29

Wood JR (2019) The transmission of silver and silver extraction technology across the Mediterranean in Late Prehistory: an archaeological science approach to investigating the westward expansion of the Phoenicians. PhD Thesis, UCL (University College London). https://discovery.ucl.ac.uk/id/eprint/10070018/. Accessed 8 Sept 2023

Wood JR (2022) Approaches to interrogate the erased histories of recycled archaeological objects. Archaeometry 64:187–205. https://doi.org/10.1111/arcm.12756

Wood JR (2023) Other ways to examine the finances behind the birth of Classical Greece. Archaeometry 65:570–586. https://doi.org/10.1111/arcm.12839

Wood JR, Liu Y (2023) A multivariate approach to investigate metallurgical technology: the case of the Chinese ritual bronzes. J Archaeol Method Theory 30:707–756. https://doi.org/10.1007/s10816-022-09572-8

Wood JR, Montero-Ruiz I (2019) Semi-refined silver for the silversmiths of the Iron Age Mediterranean: a mechanism for the elusiveness of Iberian silver. Trab Prehist 76:272–285. https://doi.org/10.3989/tp.2019.12237

Wood JR, Montero-Ruiz I, Martinón-Torres M (2019) From Iberia to the southern Levant: the movement of silver across the Mediterranean in the Early Iron Age. J World Prehist 32:1–31. https://doi.org/10.1007/s10963-018-09128-3

Wood JR, Hsu Y-T, Bell C (2021) Sending Laurion back to the future: Bronze Age silver and source of confusion. Internet Archaeol 56. https://doi.org/10.11141/ia.56.9

Wood JR, Ponting M, Butcher K (2023) Mints not mines: a macroscale investigation of Roman silver coinage. Internet Archaeology. (in press)

Funding

This project has received funding from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme (grant agreement no. 835180).

Author information

Authors and Affiliations

Contributions

Coins were selected, sampled and measured by M.P and K.B. Compositional data were analysed by J.W. The main text was written by J.W. and edited by J.W, M.P. and K.B. All authors reviewed the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wood, J.R., Ponting, M. & Butcher, K. Crisis? What crisis? Recycling of silver for Roman Republican coinage. Archaeol Anthropol Sci 15, 147 (2023). https://doi.org/10.1007/s12520-023-01854-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12520-023-01854-w