Abstract

This research carries out a comparative analysis of the Internal Market Orientation (IMO) to a sample of small and medium enterprise companies, which has been divided into nine groups based on their business sectors. Applying the statistical technique of structural equations, the coefficients of four IMO inputs in each business sector are obtained. Next, the PROMETHEE multicriteria technique is applied to obtain a composite indicator of the IMO implementation of each business sector. The value of the composite indicator together with the GAIA plane allow to distinguish the differences of the IMO profiles, their strengths and their weaknesses. The results show the divergences in the IMO inputs according to the sector, which is evidence that the business sector is a predictor of the IMO implementation of a company.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Internal Market Orientation (IMO) is an employee-centred paradigm in the firm’s management, which was developed from the concept of internal marketing (Lings 2004). It groups the set of management activities that an organization uses, first, to determine the needs and demands of its employees, second, to create value for the company’s personnel and, finally, to facilitate and maintain the performance of the employees and the organization, so that the objectives set by the marketing strategy are achieved (Boukis et al. 2017). The scientific work carried out so far distinguishes two main streams of IMO research. One stream of researcher focuses on the IMO antecedents and examines the elements that constitute IMO (Gounaris 2006). Simultaneously, another stream of research encompasses the measurement of the effects of IMO on organizational performance (Ruizalba et al. 2014; Powers et al., 2020).

There is consensus in the scientific literature on the factors generating IMO. In this vein, Ruizalba et al. (2014) and Kazakov et al. (2020) establish that factors such as Internal Communication (INT.COM), Training (TRAI), Management Concern (MC) and Work Family Balance (WFB) constitute inputs or factors that generate IMO, and that the results of this orientation, outputs, can be measured through the Job Satisfaction (JS) and the Employee Commitment (EC). The research carried out so far focuses on the approach of a construct and the obtaining of results from a sample, which corresponds to companies that have a common business sector characteristic including, for instance, family businesses (Cabrera-Suárez et al. 2011), hotels (Ieong and Lam 2016), and banking (Park and Tran 2018). However, there is no research in the literature that performs a comparative analysis of the IMO between sectors.

On the other hand, in general, companies follow characteristic behavioural patterns of the sector to which they belong in aspects such as organization, working conditions, training, etc. (Chatman and Jehn 1994; Johns, 2006). In fact, both companies and trade union organizations tend to group themselves by sector. Therefore, it is reasonable to inquire as to whether each sector has its own characteristics and is different from the rest, in the adoption, implementation and results of the IMO. Understanding the industry specifics in pursuant to IMO is significant for academia and managers, because it facilitates the development of IMO adoption strategies (Gounaris 2006). However, nothing has been published in the literature. performing a comparative analysis of the IMO between sectors. A priori, it is logical to think that certain IMO inputs may be closely conditioned by the activity of each sector. Thus, for example, in the Restaurant and Catering sector, it is possible that WFB is more complicated than in other sectors. Still, there are no works that corroborate or refute this idea. Until now, the literature has not analysed, in a comparative way, the IMO profile of each sector, the characteristic strengths and weaknesses of each one.

In this work, we will quantify the IMO inputs of a wide sample of Small and Medium Enterprises (SMEs) companies belonging to different business sectors. The companies will be categorized according to their respective sectors, and within each sector, the inputs for Internal Market Orientation (IMO) will be quantified, based on the calculation of factor loadings performed in Kazakov et al. (2020). Next, the four inputs are considered as simple indicators, measuring different IMO aspects, and a composite indicator is constructed, using a discrete multicriteria technique. Discrete multicriteria analysis is used to study and characterise a set of alternatives (in our case, business sectors) based on a set of conflicting criteria (in our case, the criteria are the inputs IMO). These techniques are usually applied to obtain composite indicators, but their usefulness can go further, since they also address ordering, classification, description and design problems (Ishizaka and Nemery 2013; Doumpos and Zopounidis, 2002). Specifically, we apply the Preference Ranking Organization Method for Enrichment of Evaluations (PROMETHEE) (Brans 1982; Brans and Mareschal 1994), a multicriteria method based on the comparison of alternatives (sectors) in pairs, and which provides both an ordering or ranking of sectors and a characterization, based on their strengths and weaknesses. In other words, both a ranking and a characterization of each sector are obtained. In addition, the method provides the GAIA map, a graphic tool that allows visualizing in two dimensions the evaluation of the IMO inputs of each sector.

This current study presents a novel approach to quantify IMO contributions across various business sectors. To do this, we start from a large sample of small and medium-sized companies that are grouped according to the sector of business activity. Based on a SEM estimate, four IMO inputs are obtained: internal communication, training, management concern and work family balance. These inputs are used as simple indicators to build a composite indicator that quantifies the IMO level of each sector objectively and globally, applying discrete multi-criteria analysis techniques. In this sense, the reported research not only further validates the previously determined link between the antecedents and consequences of OMI obtained in Kazakov et al. (2020), but also reveals results of comparative analyzes of IMO contributions, which yield sectoral classifications and characterizations, and shows the specific strengths and weaknesses of each sector. The results of this research can be of interest to companies, business associations, workers’ organizations, unions and governments. Based on a sectorial evaluation, all these actors can propose and adopt measures to improve specific aspects of some sector, legislative modifications that promote business growth based on the reality of the sector, aid that promotes improvements in competitiveness differentiated, based on specific needs, etc.

The paper is divided into the following sections: Sect. 2 examines the scientific literature related to IMO and build a theoretical rationale for our approach to measuring IMO effects by ranking firms. Section 3 depicts the research methodology based on PROMETHEE multicriteria ranking method. Then, section four exhibits the findings of the study. The theoretical and business implications are discussed in Sect. 5. Section 6 presents conclusions, noted limitations, and suggest future research lines in the scoped field of study.

2 Literature review

2.1 Internal market orientation measurement

One of the great challenges that companies face is the development of favourable relationships with the different agents with which they interact, since these relationships result in the good health of the company. One of the most important groups involved in the company is that of the employees. When this group is satisfied and committed to their company, they will work in the direction that it sets in order to achieve their objectives. This fact explains the importance that the analysis of internal marketing, or “inward” marketing, has gained in recent years, both at a scientific level and in business practice. Through the IMO, the company is able to know in depth the needs of its workers in the performance of their work, and will be able to satisfy them, which will result in the internal well-being of the organization (Lings and Greenly, 2005).

That marked the point of market orientation universe bifurcation to its external and internal domains (Kazakov 2019). Gounaris (2006; 2008) and Ruizalba et al. (2014) presented three organisational behaviour structural elements as IMO antecedents: the management concern, the internal communications between employees of the organization and the management response, which, in turn, is made up of two elements: work-family balance and training.

Prior studies have determined the positive outcomes of IMO implementation, whereas according to the findings of the noted research, firms demonstrated strengthening their positions on the market thanks to the application of IMO strategies (Zebal 2018; Yu et al. 2019; Powers et al., 2020). Until recently, the scientific literature has focused on the conceptualization of the “adjustable” antecedents of IMO and the methods of its implementation to facilitate the implementation of IMO in the organization (Gounaris 2006; Herhausen et al. 2018). In addition, the IMO analyses focus on a specific type of company, such as the work by Ruizalba et al. (2014), who examined IMO implementation consequences in the hospitality context.

Two questions arise naturally that have not yet been addressed in the scientific literature. The first of these is related to the homogeneity of IMO between companies; specifically, we question whether factors such as the business sector, the size of the company (number of employees, capital), the type of capital (public or private), targeted customer types, etc., could have any influence in the IMO implementation in the company. In this work, we specifically consider if the business sector is a key element impacting the outcomes of IMO application. It is to be expected that some IMO inputs, such as work family balance, will be more difficult to favour in certain sectors (hospitality, transport, etc.), but reliable studies are needed to confirm this. In fact, Jaworski and Kohli (2017), point out that market orientation concept does not necessarily work the same way operationally for all types of businesses (Jaworski and Kohli, 2017, p. 11) and encouraged researchers for more effort in examination of market orientation typologies and ranking approaches. The second question is the assessment of IMO trying to provide a holistic measure, which includes the multidimensional nature of this concept.

2.2 Composite indicator and multicriteria analysis

Discrete Multicriteria Decision Analysis (MCDA) is a branch of Operations Research that addresses the evaluation of a set of units, based on several conflicting criteria. This conflict arises from the fact that generally, the unit that is best in one criterion is not the best in others. Multicriteria techniques are used in the processes of choosing the best possible unit, the classification of units, their grouping and characterization, etc. (Ishizaka and Nemery 2013). Since the beginning of MCDA, in the 1970s, until now, the number of scientific works in this field has been constantly growing, both theoretically and applied, and this is logical since MCDA is a very useful tool to achieve a better and greater knowledge of any multidimensional phenomenon (Cinelli et al. 2020, Basilio et al. 2022).

An area in which the application of discrete multicriteria techniques has been further developed is the construction of composite or synthetic indicators. A composite indicator is a mathematical tool that allows a simple comparison of complex phenomena from a simple indicator aggregation process (El Gibari et al. 2018). In the works of Greco et al. (2019) and El Gibari et al. (2019), exhaustive bibliographic reviews are carried out regarding composite indicators, the techniques through which they are constructed and their application in all types of scientific disciplines. On the other hand, at the economic, social and political level, the construction of composite indicators also proliferates. The globally recognised indicators include Global Competitiveness Index, published each year by the World Economic Forum, and the Business Confidence Index, published by the OECD. Additionally, several researchers suggested an MCDA method that integrates structural equation modelling (SEM) and fuzzy additive ratio assessment (ARAS) (Baki 2022).

The problem we are dealing with is, therefore, the following: we start with a sample of companies, grouped by economic activity sectors. For each sector we estimate the values of the parameters of the inputs and outputs IMO. Focusing on the inputs, we will have a vector of the IMO inputs of that sector, a multidimensional measurement of the IMO of the sector, which we can synthesize in a global assessment and that will allow us to characterize each sector based on its IMO inputs, establish its strengths and weaknesses, etc.

3 Methodology

3.1 PROMETHEE method

Discrete multicriteria decision analysis focus on multidimensional problems in which researchers choose, sort, rank or evaluate, a set of alternatives (business sectors in the present study). The mathematical formulation of the discrete multicriteria problem is:

where A = {a1, a2, …, am} is a finite set of m possible actions or alternatives (business sectors) which are evaluated through n criteria, f1, f2, …, fn, in our case the four IMO inputs. We suppose, without loss of generality, that all the criteria are to be maximised.

In general, problem (1) is an ill-posed mathematical problem, because there exist no alternative optimising all the criteria at the same time. PROMETHEE is a family of discrete multicriteria methods, developed by Brans (1982), Brans et al. (1986), which has a wide application in different areas: management, logistic, finance, tourism and is also subjected in operations research (Kunsch et al., 2019; Vavatsikos et al. 2022).

PROMETHEE is based on the pair-wise comparison of the alternatives on each criterion and requires that the decision maker provide two types of information before solving the problem: (a) the inter-criteria and (b) the intra-criteria information; (a) The inter-criteria information is a weight, \({w}_{j}>0, j = 1, ?, n,\)which represent the importance of each criterion, (in the sense of that the higher the weight, the more important is the criterion); (b) The intra-criterion information is a preference function, Pj(a, b), for each criterion which transform the difference in the valuation of each pair of alternatives, fj(a) - fj(b), into a value between 0 and 1: Pj: AxA→[0, 1], which indicates the preference of action a over action b. Brans and Vincke (1985) proposed six basic forms for the preference function, and, before solving the problem, it is necessary to choose a preference function for each criterion, and the parameters linked to it. So, if the decision maker chooses the Gaussian preference function (Fig. 1), he/she has to choose a parameter (sj) that defines the inflection point of the preference function. As can be seen in Fig. 1, the Gaussian function is an increasing function, with an inflection point at s. The function is convex (concave) when the difference between the evaluations of the alternatives is less (greater) than sj. This implies that if the difference between two alternatives is less (greater) than the value sj, the value of the preference grows less (more) than proportionally.

Based on these values, the preference index of one alternative over another, π (a, b), is calculated, as the weighted sum of the preferences of each criterion as depicted by function (2).

From these preference indices, for each alternative we can obtain the positive and the negative flow, given by functions (3) and (4):

which represents the strength and the weakness of each alternative in comparison with all the other actions. The difference between positive and negative flow is net flow, as given by function (5):

which measures how good an alternative is to the rest and gives a complete ranking of the alternatives, in which all the alternatives are comparable.

Net flows are the basis for the GAIA (Geometrical Analysis for Interactive Aid) plane, (Brans and Mareschal 1994). It is a visual complement of the PROMETHEE II method that represents in the plane the criteria and the actions. By using main component analysis, the GAIA plane collects all the relevant information. In the GAIA plane, both the criteria and the alternatives are represented, through axes and points, respectively. The proximity of each axis (criterion) with respect to the rest, indicates the degree of similarity with respect to the rest. If two axes (criteria) point in opposite directions (forming an angle of 180 degrees), it means that these criteria are in total conflict. The length of the axis indicates the degree of discrimination of that criterion in the ranking finally obtained (that is, if its influence on the final result is high or low). The position of each alternative (point) with respect to the axes and with respect to the rest of the alternatives also indicates the degree of attainment with the axis or with the alternative considered: if an alternative is in the direction of an axis, then it is good in the criteria that axis represents. Therefore, this plan gives a holistic view of the problem that arises and is a very useful tool in ranking analysis.

It is important to note that the fact that several dimensions are transferred to the plane, means that some of the information can be lost in the process. Therefore, next to the GAIA plane, a parameter (delta) is always presented, which measures the part of the original information that is reflected in the plane, considering that a delta of 70% or more is accepted.

3.2 Data Collection

3.2.1 Variables and questionnaire

In this study, we opted for a survey method to collect the data that was essential for the computation of multicriteria indicators under the PROMETHEE technique. In this phase of the research, we utilised a questionnaire adopted from Ruizalba et al. (2014) as a solitary tool for a selected data collection approach. This original questionnaire, however, was appended with supplementary questions that were necessary to retrieve additional variables, namely job satisfaction, employee commitment, and business performance metrics. These dependent variables were vital to compute and rank organisations based on the consequences of IMO implementation. A variable and relevant survey form question pertinent to job satisfaction were based on the method proposed by Hartline and Ferrell (1996). The data required for employee commitment measurement was collected with the help of an approach suggested by Rusbult et al. (1988).

3.2.2 Sampling method

The present study advances the outcomes and uses data from Kazakov et al. (2020). In that and this research, SMEs were selected as research setting for our study because they are an essential contributor to national economies and social wellbeing (Karetsos et al. 2011). A blended technique that amalgamated probability and non-probability sampling methods was used to obtain empirical data. The first stage of sampling implied general population or universe determination by the browsing through publicly available database, which keeps a record of almost 120,000 unique small and medium businesses in one East European country. At the second stage of the sampling procedure, we applied a quota sampling pertinent to probability class of methods. As we opted for companies and not employees as a general population unit in this study, this stage of sampling implied a randomised selection of a quota containing 2000 SMEs from the database. The third stage of the procedure entailed a convenience method that belongs to a non-probability class of sampling methods. Convenience sampling implies building a sample from potential general population units who are willing to cooperate with researchers and are going to participate in the study (Hultsch et al. 2002). This method receives preference in social studies because of its versatility and affordability (Brewis 2014).

A response which contained a consent to participate in the survey was received from 615 companies. The perspective participants were supplied with a link leading to a webpage with an online questionnaire that was specially developed for the electronic survey. Upon the link distribution to survey participants, it had been available for two weeks before the survey was closed. After the survey close and filled in questionnaire forms inspection, 423 of them were accepted as eligible for dataset building and consequent data analysis. As Menon et al. (1996) pointed out, the threshold of acceptable response rate in the convenience sampling should not fall short of 15%. This study complies with this requirement, as the resulted response rate reached nearly 21%.

3.2.3 Initial data analysis

Table 1 shows the distribution of the companies in the sample, including indication of the business sector to which they belong. The design of this study required the computation of factor scores for independent and dependent variables. Following this direction, we had, at first, applied SEM CFA to build and validate a nomological model in accord with Ruizalba et al. (2014) (Fig. 2) reporting the results of the model estimation in Kazakov et al. (2020). Then, we applied a weighted sum scores technique (DiStefano et al. 2019) by using measured variable scores (\({\sigma }_{{\lambda }_{ik}}\)) to compute structural latent factor scores (Fi), where k = 1, …, 32, represents the 32 variables measured in the SEM CFA model and i corresponds to the business sector, i = 1, …, 9. This technique was accomplished by taking a standardised score (µik) of each of 32 measured variables, multiplying it by the same variable factor loadings normalised to 1 (e.g., weights) that corresponded with a given factor and summing up the results, according to Eqs. 6 and 7.

IMO framework (adopted from Ruizalba et al. 2014)

The computed scores were pertinent to the first-order factors that included work-family balance and training. Factor score values were also retrieved for the second-order constructs that encompassed management concern and internal communications, as well as for output factors relevant to job satisfaction and commitment.

When performing the analysis, the sample was divided according to the type of company, considering the industry classification. The results of these scores are in Table 2. As we can see, in the Table 2 the best group of companies in all inputs is IT Services. Moreover, Cleaning Services is the worst sector in almost in all inputs except Work Family Balance. For this input the worst sector is Transportation. But, beyond these two evidences, it is impossible to rank the other groups of companies without constructing a composite indicator. The model estimation through running SEM procedure using covariance-based method was completed with reporting the results in Kazakov et al. (2020).

In this paper, we will perform this classification through a composite indicator, using the four IMO inputs. For the aggregation of these four inputs, we apply the PROMETHEE multicriteria method. The two outputs, job satisfaction and employee engagement, are linear combinations of the four inputs and do not provide additional information on the measurement of OMI. Therefore, following Greco et al. (2019), and to avoid “double counting”, we have not used the two outputs in the construction of the composite IMO indicator.

Once the composite indicator was obtained, we performed an analysis of the results with the complement of the GAIA plane. The combination of both instruments will allow us to obtain not only an order of the business sectors based on the composite value.

In addition, we will analyse the relative position of each sector, and know the influence of each input. It is, therefore, an analysis that goes beyond a simple ranking, since it serves as a diagnostic tool for the business sectors and determining the importance of each input.

4 Results and discussion

4.1 Results

As noted in Sect. 3.1, the application of the PROMETHEE method requires that the decision maker provide two kinds of information: the inter-criteria information, through the weights, and intra-criteria information, through the choice of the preference functions. To set the weights we have followed the recommendation of Brans and Mareschal (1994), and we have initially set all the weights equal (0.25). Next we have analyzed the discrimination power of the weights through the GAIA plane and we have carried out a stability analysis of the weights.

Intra-criteria information consists of choosing a preference function for each criterion and the parameter linked to it. This preference function transforms the difference between the values of two alternatives into a value between 0 and 1. Of the six functions proposed by the authors (Brans et al. 1986), we have chosen the Gaussian preference function. One of the characteristics of this function is that it computes any difference between criteria. The parameter s is the inflection point of the preference function and has been set equal to the value of the standard deviation of the criterion. This choice has been made based on the fact that the preference function evaluates the differences between the values of two alternatives in the same criterion, and the standard deviation is an average value of the deviations of the alternatives with respect to the mean.

The complete ranking, the positive, negative and net flows, using the PROMETHEE method are showed in Table 3, where the groups of companies have been ordered, from the best to the worst in the ranking PROMETHEE. As we have seen in Sect. 3.1 net flow is a value between − 1 and 1 that is calculated as the difference between the positive and negative flows, which means that the higher the value the better the category of companies is.

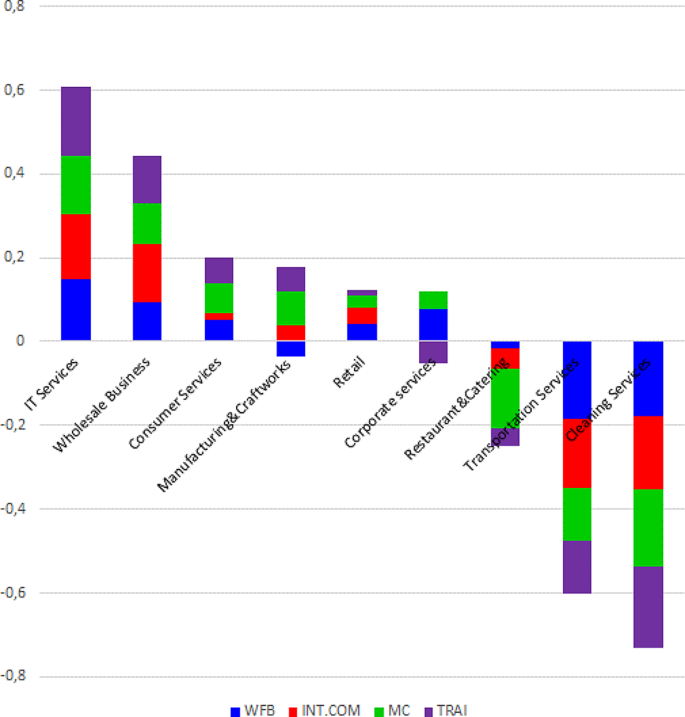

As we can see, the first business sector is IT services, which leads this ranking with a net flow of 0.61, followed by Wholesale Business and Consumer Services. The three next sectors are Manufacturing & Craftworks, Retail and Corporate Services. The last three sectors in the ranking are Restaurant & Catering, Transportation Services and Cleaning Services, all of them with negative net flows.

Source: Own elaboration.

The stacked bar chart (Fig. 3) graphically shows the net flow disaggregated by inputs, that is, the contribution (strength or weakness) of each input to the position of each sector. The chart shows that the first three sectors (IT services, Wholesale services and Consumer services), as well as the fifth in the ranking (Retail) do not present weaknesses. Manufacturing and Corporate Services present weaknesses in only one criterion (Work Family Balance, the first, and Training, the second). The three categories at the end of the ranking (Restaurants and Catering, Transportation and Cleaning Services) show weaknesses in the four IMO inputs.

The GAIA plane (Fig. 4) shows relevant information about the influence of each input and the relative situation of each sector in each input. The quality of the GAIA plane (delta parameter) is 96%, which means that 96% of the information of the multicriteria inputs is shown on the map. In this plane, the sectors are collected through dots and the four inputs through axes. There is an additional axis, the decision stick, D, in black. This axis is the projection on the GAIA plane of the weight vector, and its size indicates the discrimination power of the weights in the ranking obtained.

Regarding the inputs (represented by axis), the length of each line indicates the discriminating power of the input it represents. In our analysis, the input that most influences the classification is Work Family Balance (WFB). The rest of the inputs have more or less the same degree of influence on the results.

As can be seen, the lines point in different directions. This means that, for the analysed data set, each input includes an IMO aspect that is different from the rest, although there is a relationship between them. Specifically, the proximity between the input lines is indicative of the level of correlation between inputs. When two lines are very close, the correlation between the inputs they represent is high. In our case, this occurs with the Training (TRAI) and Management Concern (MC) inputs. In addition, the lines of these two inputs form an angle of about 90 degrees with respect to the Work Family Balance input, which is indicative that Management Concern and Training are independent Work Family Balance inputs and, in the analysed data, measure different IMO aspects. The Internal Communication line is located between Work Family Balance and Training and Management Concern, which indicates that there is a certain degree of correlation of this input with the rest.

The location of the sectors in the GAIA plane and the strengths and weaknesses shown in Fig. 3, allows us to know in more detail the characteristics of each sector. In our case, we observe that:

-

IT services and Wholesale Business, the two leading sectors in the ranking, which show strengths in all inputs, are located in the direction of the decision stick.

-

Consumer Services also has strengths in all inputs, but these are greater in Management Concern and Training, so its position in the plane is closer to the axes of these two inputs.

-

The other sector with strengths in all inputs is Retail, fifth in the ranking. Its greatest strengths are in Work Family Balance and Internal Communication, something that is displayed quite clearly in the GAIA plane.

-

Manufacturing & Craftworks, fourth sector of the ranking, has good results in Internal Communication, Training and, especially in Management Concern, being weak in Work Family Balance, something that is also deduced from its position in the GAIA plane, close to the input in which It has greater strength and away from the input in which it is weak. The behaviour of Corporate Services (sixth in the ranking) is just the opposite of Manufacturing & Craftworks: it is strong in Work Family Balance and weak in Training.

-

The remaining three sectors have weaknesses in all inputs and, therefore, are located in the opposite direction to those of the input axes. In the case of Restaurant and Catering, the greatest weakness is in Management Concern, and the lowest in Work Family Balance, so that its location on the plane is close to this input and away from the Management Concern axis. Transportation Services and Cleaning Services have weaknesses in all inputs, the first being a little better in Training and Management Concern.

Finally, note that the GAIA plane shows that the influence of the weights on the ranking is apparently low, since the decision stick (D) is small, compared to the length of the rest of the axes. However, we have performed a sensitivity analysis of the weights using the Visual PROMETHEE software ((http://www.prometheegaia.net/software.html)) and have obtained the following sensitivity intervals: Work Family Balance, w1 ∈ [0.1929, 0.2941], Internal Communication w2∈ [ 0, 0.5246], Management Concern w3∈[ 0.1715, 0.6378] and Training: w4∈ [0.1614, 0.9104]. For values outside these ranges we have made changes in the weights and we have observed that there are exchanges of positions between the three intermediate sectors of the ranking: Manufacturing & Craftworks, Retail and Corporate Services, but the rest of the positions are maintained. Therefore, we can affirm that the ranking is stable in the face of changes in weights.

4.2 Discussion

Our study advances the outcomes of the prior research asserting the general positive IMO effects on employee job satisfaction and commitment (Ruizalba et al. 2014; Yu et al. 2019; Kazakov et al. 2020) by comparative measurement of the IMO levels in SMEs from different economic sectors through a composite indicator. The results obtained show that, in the analysed sample, the economic sector is a key element in the IMO implementation of companies. Such a finding echoes the proposition of Jaworski and Kohli (2017) who anticipated variable effects of market orientation implementation in different business sectors. According to our findings, the cleaning services industry denotes the lowest-ranked business sector, as companies in this sector exhibited weak scores in all IMO outputs except internal communication. This result is in line with other previous results, which indicate characteristics of this sector, such as the nature of the workforce, remuneration and the quality of human capital in this industry (Akinbode and Uwem 2013).

Other companies that traditionally have a high percentage of low-skilled labour, for example, restaurants, catering and transport, are also located in the lower positions of the ranking. In this line, cleaning services and other industries may be the target of future research that may examine the applicability of IMO in such an environment that would lead to employee job satisfaction and loyalty, thus reducing company costs sustained for the staff (Ružić 2015; Tomic et al. 2018). On the contrary, companies that belong to the IT industry use experienced human resources that have value in the labour market. Therefore, IT companies are inclined to need more human resource management (SamGnanakkan 2010); therefore, they may be more prone to IMO implementation than organisations operating in different sectors examined under this study. Finally, the completed study and especially the multicriteria ranking methodology applied in it have confirmed the viability and relevance of the PROMETHEE method (Brans 1982) and GAIA plane visualisation (Brans and Mareschal 1994) application in IMO-themed studies. This research outcome aligns with prior studies utilising the PROMETHEE method in operations research (Vavatsikos et al. 2022).

5 Conclusions

When a company designs an IMO strategy, it makes an effort to increase the degree of involvement and satisfaction of its employees, in order to improve performance, which will benefit both the company and the employees themselves. IMO actions are not something new in the business world (Sergey, there is a scientific quote here explaining some IMO action in the past, do you know of any???), but their analysis and measurement is. The existing literature shows a consensus on the inputs that generate IMO, and there have been studies that have measured IMO inputs and outputs. However, IMO measurement using a composite indicator has not been considered so far. This is the first contribution of this work: to construct a composite indicator that measures, in a comparative way, the IMO level of a group of companies, based on their inputs. To do so, we have used a combination of two quantitative techniques: structural equations and multi-criteria analysis, and with this we have managed to assign a numerical value to the IMO, a business aspect which, due to its complexity and multidimensional nature, is difficult to evaluate.

Our proposal for a composite indicator has been applied to a group of small and medium-sized enterprises, belonging to different business sectors. Following Kazakov et al. (2022), four IMO inputs have been considered: management concern, internal communication, work-family balance, and training, and, for each business sector, these inputs have been calculated using structural equations. Each of them measures a specific aspect of the IMO of the sector, and individual analysis of them can give an idea of the IMO position of each sector. But aggregating them allows all these aspects to be considered simultaneously. This multidimensional nature of the IMO makes multicriteria techniques appropriate for evaluating this important focus of any company. In this work, we propose the use of the PROMETHEE multicriteria method, together with the GAIA visualization tool. The results show that the implementation is clearly different between economic sectors, with which we can affirm that the industrial sector can explain the degree of implementation of IMO of the organization and, therefore, can be considered as a convincing predictor of market orientation. internal. In this sense, we understand that this work opens a debate on the predisposition of the company to adopt IMO depending on the affiliation of the industry.

The approach of the work invites, in addition, to consider other possible characteristics of the organizations as predictive elements of the adoption of IMO. These elements can be the size of the company, the legal regime of the company, the region in which it operates, the national or international nature, whether the company is public or private, etc. All these elements constitute future lines of research for the authors.

The combination of the application of structural equation techniques and multi-criteria analysis is relatively new. Baki (2022) also proposes the use of structural equations and the ARAS multi-criteria technique for the choice of a supplier. In this sense, we believe that this mix of techniques can give rise to novel studies, in which we wish to measure a complex and multidimensional aspect, such as IMO, by means of two quantitative techniques: (1) a statistical technique, which extracts the numerical values that interconnect different dimensions of a phenomenon from a sample of data, and (2) a multicriteria technique, which allows us to synthesise these complex realities in a composite indicator.

On the other hand, the results also present a series of practical implications for managers, business owners, governments, unions, professional organizations, etc. This type of quantitative and comparative analysis advances priorly popular and established techniques (El Gibari et al., 2018; Cinelli et al., 2020; Baki 2022). On top of that, the suggested technique constitutes a new and practical tool for assessing the internal marketing orientation of organizations and monitoring the progress of their strategic plans thus further develops dedicated studies in the marketing literature (Ruizalba et al. 2014; Herhausen et al. 2018; Zebal et al., 2018). It reveals the strengths and weaknesses of organizations in their relations with workers. It allows laying the foundations for designing internal marketing strategies that help improve the performance of employees and, by extension, of the organization itself.

Finally, it is important to point out that the combination of structural equations and discrete multicriteria analysis is a novel technique further developing an approach suggested by Baki (2022). The developed technique can be used in the evaluation of phenomena that are not directly observable but for which a quantitative evaluation and diagnosis is desired.

Data availability

The data that support the findings of this study are available from the corresponding author, Kazakov S. upon request.

References

Akinbode JO, Uwem L (2013) Human resource management practices in private cleaning service outsourcing organizations in Lagos State, Nigeria. Int J Basic Appl Sci 2:266–275

Baki R (2022) An Integrated Multi-criteria Structural equation Model for Green Supplier Selection. Int J Precis Eng Manuf -Green Tech 9:1063–1076. https://doi.org/10.1007/s40684-021-00415-7

Basílio MP, Pereira V, Costa HG et al (2022) A systematic review of the applications of Multi-criteria decision aid methods (1977–2022. Electronics 11(11):1720. https://doi.org/10.3390/electronics11111720

Boukis A, Gounaris S, Lings I (2017) Internal market orientation determinants of employee brand enactment. J Serv Mark 31:690–703. https://doi.org/10.1108/JSM-07-2016-0272

Brans JP (1982) L’ingénierie de la décision: L’élaboration d’instruments d’aide a la décision. Université Laval, Faculté des sciences de l’administration

Brans JP, Mareschal B (1994) The PROMCALC & GAIA decision support system for multicriteria decision aid. Decis Support Syst 297–310. https://doi.org/10.1016/0167-9236(94)90048-5

Brans JP, Vincke P (1985) A preference ranking Organisation Method: the PROMETHEE Method for multiple criteria Decision-Making). Manage Sci 31:647–656. https://doi.org/10.1287/mnsc.31.6.647

Brans JP, Vincke P, Mareschal B (1986) How to select and how to rank projects: the PROMETHEE method. Eur J Oper Res 24:228–238. https://doi.org/10.1016/0377-2217(86)90044-5

Brewis J (2014) The ethics of researching friends: on convenience sampling in qualitative management and organization studies. Br J Manag 25:849–862. https://doi.org/10.1111/1467-8551.12064

Cabrera-Suárez MK, Cruz Déniz-Déniz M, Martín-Santana JD (2011) Familiness and market orientation: a stakeholder approach. J Fam Bus Strateg 2:34–42. https://doi.org/10.1016/j.jfbs.2011.01.001

Chatman JA, Jehn KA (1994) Assessing the relationship between industry characteristics and organizational culture: how different can you be? Acad Manag J 37:522–553. https://doi.org/10.5465/256699

Cinelli M, Kadziński M, Gonzalez M, Słowiński R (2020) How to support the application of multiple criteria decision analysis? Let us start with a comprehensive taxonomy. Omega 96:102261. https://doi.org/10.1016/j.omega.2020.102261

DiStefano C, Zhu M, Mindrila D (2019) Understanding and using factor scores: considerations for the applied researcher. Pract Assess Res Eval 14:1–11

Doumpos M, Zopounidis C (2002) Multicriteria decision aid classification methods, vol 73. Springer Science & Business Media

El Gibari S, Gómez T, Ruiz F (2018) Evaluating university performance using reference point based composite indicators. J Informetr 12:1235–1250. https://doi.org/10.1016/j.joi.2018.10.003

El Gibari S, Gómez T, Ruiz F (2019) Building composite indicators using multicriteria methods: a review. J Bus Econ 89:1–24. https://doi.org/10.1007/s11573-018-0902-z

Gounaris SP (2006) Internal-market orientation and its measurement. J Bus Res 59:432–448. https://doi.org/10.1016/j.jbusres.2005.10.003

Gounaris S (2008) The notion of internal market orientation and employee job satisfaction: some preliminary evidence. J Serv Mark 22:68–90. https://doi.org/10.1108/08876040810851978

Greco S, Ishizaka A, Tasiou M, Torrisi G (2019) On the methodological framework of composite indices: a review of the issues of weighting, aggregation, and robustness. Soc Indic Res 141:61–94. https://doi.org/10.1007/s11205-017-1832-9

Hartline MD, Ferrell OC (1996) The management of customer-contact service employees: an empirical investigation. J Mark 60:52. https://doi.org/10.2307/1251901

Herhausen D, Luca LM, Weibel M (2018) The interplay between employee and firm customer orientation: substitution effect and the contingency role of performance-related rewards. Br J Manag 29:534–553. https://doi.org/10.1111/1467-8551.12230

Hultsch DF, MacDonald SW, Hunter MA et al (2002) Sampling and generalisability in developmental research: comparison of random and convenience samples of older adults. Int J Behav Dev 26:345–359. https://doi.org/10.1080/01650250143000247

Ieong CY, Lam D (2016) Role of Internal Marketing on employees’ Perceived Job performance in an Asian Integrated Resort. J Hosp Mark Manag 25. https://doi.org/10.1080/19368623.2015.1067664

Ishizaka A, Nemery P (2013) Multi-criteria decision analysis: methods and software. Wiley. https://doi.org/10.1002/9781118644898

Jaworski BJ, Kohli AK Conducting field-based, discovery-oriented research: lessons from our market orientation research experience. AMS Rev 7:4–12. https://doi.org/10.1007/s13162-017-0088-5

Johns G The essential impact of context on organizational behavior. Acad Manag Rev 31:386–408. https://doi.org/10.5465/amr.2006.20208687

Karetsos S, Manouselis N, Costopoulou C (2011) Modeling an e-government observatory for rural SMEs using UML with RUP. Oper Res Int J 11:59–57. https://doi.org/10.1007/s12351-009-0060-8

Kazakov SP (2019) Revisiting Internal Market Orientation in family firms. Eur J Fam Bus 9:5–20. https://doi.org/10.24310/ejfbejfb.v9i1.5468

Kazakov S, Ruiz-Alba JL, Muñoz MM (2020) The impact of information and communication technology and internal market orientation blending on organisational performance in small and medium enterprise. Eur J Manag Bus Econ 30:129–151. https://doi.org/10.1108/EJMBE-04-2020-0068

Kunsch PL, Brans JP (2019) Visualising multi-criteria weight elicitation by multiple stakeholders in complex decision systems. Oper Res Int J 19:955–971. https://doi.org/10.1007/s12351-018-00446-0

Lings IN (2004) Internal market orientation. J Bus Res 57:405–413. https://doi.org/10.1016/S0148-2963(02)00274-6

Lings IN, Greenley GE (2005) Measuring internal market orientation. J Serv Res 7:290–305. https://doi.org/10.1177/1094670504271154

Menon A, Bharadwaj SGH (1996) The quality and effectiveness of marketing strategy: effects of functional and dysfunctional conflict in intraorganizational relationships. J Acad Mark Sci 24:299–313. https://doi.org/10.1177/0092070396244002

MSC code 62F07 (Statistics, Parametric inference, Statistical ranking and selection procedures)

Park JH, Tran TBH (2018) Internal marketing, employee customer-oriented behaviors, and customer behavioral responses. Psychol Mark 35. https://doi.org/10.1002/mar.21095

Powers TL, Kennedy KN, Choi S Market orientation and performance: industrial supplier and customer perspectives. J Bus Ind Mark 35:1701–1714. https://doi.org/10.1108/JBIM-08-2019-0369

Ruizalba JL, Bermúdez-González G, Rodríguez-Molina MA, Blanca MJ (2014) Internal market orientation: an empirical research in hotel sector. Int J Hosp Manag 38:11–19. https://doi.org/10.1016/j.ijhm.2013.12.002

Rusbult CE, Farrell D, Rogers G, Mainous AG (1988) Impact of exchange variables on exit, voice, loyalty, and neglect: an integrative model of responses to declining job satisfaction. Acad Manag J 31:599–627. https://doi.org/10.2307/256461

Ružić MD (2015) Direct and indirect contribution of HRM practice to hotel company performance. Int J Hosp Manag 49:56–65. https://doi.org/10.1016/j.ijhm.2015.05.008

SamGnanakkan S (2010) Mediating role of organizational commitment on HR practices and turnover intention among ICT professionals. J Manag Res 10

Tomic I, Tesic Z, Kuzmanovic B, Tomic M (2018) An empirical study of employee loyalty, service quality, cost reduction and company performance. Econ Res istraživanja 31:827–846. https://doi.org/10.1080/1331677X.2018.1456346

Vavatsikos AP, Sotiropoulou KF, Tzingizis V (2022) GIS-assisted suitability analysis combining PROMETHEE II, analytic hierarchy process and inverse distance weighting. Oper Res Int J 22:5983–6006. https://doi.org/10.1007/s12351-022-00706-0

Yu Q, Yen DA, Barnes BR, Huang YA (2019) Enhancing firm performance through internal market orientation and employee organizational commitment. Int J Hum Resour Manag. https://doi.org/10.1080/09585192.2017.1380059

Zebal MA (2018) The impact of internal and external market orientation on the performance of non-conventional islamic financial institutions. J Islam Mark 9:132–151. https://doi.org/10.1108/JIMA-03-2016-0024

Funding

Funding for open access publishing: Universidad Málaga/CBUA

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical statement of the research involving human participants

This article uses surveying method with human participants and does not contain any interventional studies performed by any of the authors. Ethical approval is not required.

Informed consent

Survey participants were informed and understood that their participation was voluntary and that they were free to withdraw at any time, without giving a reason and without any costs to be sustained in that regard.

MSC code

62F07 (Statistics, Parametric inference, Statistical ranking and selection procedures).

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Muñoz, M.M., Kazakov, S. & Ruiz-Alba, J.L. Sectorial evaluation and characterization of internal marketing orientation through multicriteria analysis. Oper Res Int J 24, 24 (2024). https://doi.org/10.1007/s12351-024-00835-8

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12351-024-00835-8