Abstract

The purpose of this paper is to develop a performance assessment modeling for managing transport enterprises and provide a framework that explains the conditions under which performance of enterprises optimized. In doing so, the multiples streams built upon the different stakeholders and shareholders as well as social actors play in the transport enterprise performance optimization. The novelty of this paper is the development of a computational modeling framework addressing the added value footprint by large transport operators providing mobility and accessibility to a regional economy. The analysis outputs promoting explanations towards operational efficiency and business productivity on one hand; and supporting decisions toward sustainable development, business intelligence and new investments on the other. The assessment methodology is based on "Fuzzy TOPSIS" modelling, where a series of key performance indicators have been introduced, providing results over time to assess business innovation and illustrate drivers of action towards sustainable development and business intelligence. Managerial implication of the paper is the development of a multi-objective assessment framework providing essential support for managing real business applications in transportation and support decisions towards resources optimization, adjustments in cooperate governance model and policies, assessment of new investments and short-term or/and long-term action plans.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Many researchers have illuminated on one hand the role of sustainable development in strategic management processes (2021; Dimitriou 2018a, b, 2020, 2021; Vogiatzis et al. 2020; Herzig and Moon 2013; Lin-Hi and Müller 2013), through which shareholders and managers optimize stakeholders support (Hillenbrand et al. 2013; Park et al. 2014) and attract the interest of institutional investors and analysts (Dimitriou et al. 2021; Dimitriou and Sartzetaki 2020a, b). On the other hand, there is broadly highlighted in literature that many enterprises play a key role in regional economic development and are a crucial generator of socioeconomic prosperity for countries and regions (Dimitriou et al. 2017; Dimitriou 2018). The contribution of these enterprise to business ecosystem, as well as the service on health, education, justice, security, communications, the environment and the functioning of the public sector is a priority and concern of the governmental authorities and decision makers, in order to support strategic decisions and investments towards efficient planning, management and economics (Dimitriou 2018; Agudel Latapí et al. 2019).

The novelty and purpose of this paper is to develop a performance assessment modeling for managing transport enterprises and provide a framework that explains the conditions under which performance of enterprises are optimized. In doing so, the multiples streams are built upon to develop a richer theoretical explanation of the different stakeholders and shareholders as well as social actors play in the enterprise management. By analyzing the related actors that originate and affect the enterprise contribution to ecosystem, decision makers and stakeholders would address in a coherent and integrated way the issue of enterprise strategic planning and managing towards regional development, considering all the external socioeconomic environment interactions with the enterprise.

The novelty and purpose of this paper is to develop a performance assessment modeling for managing transport enterprises and provide a framework that explains the conditions under which performance of enterprises are optimized. In doing so, the multiples streams are built upon the different stakeholders and shareholders as well as social actors play in the transport enterprise performance optimization.

The development of an integrated methodological framework that will support stakeholders for the decision-making process to manage an enterprise towards economic development is very crucial, leading to the need of a flexible methodological framework, to support decision makers and stakeholders. By analyzing the related actors that originate and affect the transport enterprise performance, decision makers and stakeholders should address in a coherent and integrated way the problem of enterprise strategic planning and managing towards economic development. The development of the performance assessment framework of the enterprise based on an integrated approach which while considering the external socioeconomic environment interaction with the enterprise, for all the stakeholders.

The paper aims to promote the performance optimization of a transport enterprise as a tool to decision makers, stakeholders in the field of investing in enterprise management towards economic development, addressing the development of the performance assessment framework based on a computational integrated composite index based on fuzzy TOPSIS (Technique for Order Preference by Similarity to Ideal Solution) framework. In this way, the "systemic" approach, on which the concept of the proposed modelling framework is based, will formulate a transparent and consistent framework to support decision makers to identify all the actors that originate and affect the performance assessment of a transport enterprise.

2 Background

Although enterprises, infrastructructure and organizations impact to economic development covers many different aspects of development, very often is limited to employment, income, productivity aspects, focusing only on economic growth (Dimitriou et al. 2017; Dimitriou 2018b).

In literature, extensive analysis on the projects and infrastructures’ economic impact and contribution in economic development has been undertaken (Dimitriou and Sartzetaki 2018; Mackie et al. 2014; Nelson John et al. 2010). Reviewing all the available tools, Cost Benefit Analysis (CBA) is used to measure and evaluate all non-momentary costs and benefits of the project investment (Dimitriou and Sartzetaki 2020a, b; Mackie et al. 2014; Kelly et al. 2015). In case alternatives for investments require different streams of benefits, then Life Cycle Cost Analysis (LCCA) may be utilized.

Economic Impact Analysis (EIA), focus on how transport infrastructures projects and enterprises affect economy, households and business ecosystem as a whole. Especially as regards, capital-intensive transport infrastructures, such as airports, the economic impact of such infrastructures on regions heavily depended on tourism is highlighted (Dimitriou and Sartzetaki 2018, 2021; Dimitriou 2021). EIA utilizes two different methods, the Input Output (IO) analysis and Computable General Equilibrium Models (CGE). Both methods employ four distinct categories of impacts, direct, indirect induced and catalytic (Miller and Blair 2009; Dimitriou et al. 2017; Tscharaktschiew and Hirte 2012).

Except than economic impact, much research has extensively analyzed the relationship between enterprises and sustainable development and Corporate Social Responsibility (CSR) and innovation, (Klewitz and Hansen 2014; Green et al. 2012). As highlighted by Agudel Latapí et al. (2019), CSR focus on the social actors and stakeholders’ expectations and contribute to the enterprise’s sustainable development agenda goals (Agudel Latapí et al. 2019). In addition, all the relevant stakeholders of enterprises, such as employees, and investors, expect enterprises to consider the broad social and environmental impact to ecosystem according to Poplawska et al. 2014. Furthermore, the enterprises relationship with CSR forces the achievement of Sustainable Development Goals (SDGs) (Human development Report, 2020).

The most recent composite indicator developed in order to incorporate all the sustainable and economic development issues is the Human Development Index (HDI). According to United Nations Development Programme (UNDP), HDI is a composite indicator that measures the human development, including education, health and income indicators. The goal of the cumulative index is the classification of countries according to the level of human development (Human Development Report, 2020).

Based on the gap of a composite index to address the need of an overall assessment of an enterprise contribution to regional business ecosystem, a composite index indicator is developed in this paper to assess the transport enterprise performance.

3 Methodology framework

The identification of different stakeholders builds on the understanding of an enterprise strategic position in regional business ecosystem. Development directions are the strategic options that an enterprise face considering the strategic capabilities and the expectations of stakeholders. Transport policy, planning and operation exist with a hierarchy of objectives functionally split into four directions-strategy, planning, competitiveness and innovation (Sartzetaki 2019).

Each dimension is based on principles that affect the strategic planning process as well as the management of an enterprise. Strategy and market development are based on regulation and protection, funding and capital leverage and socioeconomic impact. The Competitiveness dimension is forced by the regulatory framework, the Exposure to competition in the product market and the improvement in management performance and at last, the Innovation is driven by the Artificial Intelligence, new products and services and Intelligent Transport Systems development (Sartzetaki 2019).

For the four principal directions linked to enterprise performance and contribution in regional business ecosystem, thus the business resilience of the enterprise linked with social development and passengers service quality improvement, the operational efficiency that is linked with the economic growth and service quality improvement, the economic productivity improvement that that is linked with economic growth goals and infrastructure quality improvement and the social coherence and stability linked to social goals and infrastructure quality improvement, one perspective towards these directions are determined. For the service quality direction, the perspective is the innovation improvement, for the economic growth goals the contribution to economy, for the social goals’ direction, the human development perspective and for the infrastructure quality the infrastructure value added perspective as analytically depicted in Fig. 1.

3.1 Determination of transport enterprise perspectives’ indicators towards economic development

The next step is to develop an evaluation process based on a set of different indicators to assess the different indicators for each perspective of enterprise performance management. In literature there are many different key performance indicators analyzed, including tangible and intangible aspect (Marr, 2012; Kiel et al. 2014). In management performance evaluation expect than the variables concerning transport business and economy conditions, the demand supply social values have also to be taken into consideration. Based on the above analysis, after a comprehensive review, the indicators for the Human development perspective introduced are the Human Resource development, the social affect to local community, the climate change effect and the Human capital value added. Focusing on Human capital value added, as it focusses to the ‘’human’, thus the employees and are referred many times as ‘intangible assets’, and as anything intangible is difficult to measure, in order to understand the real financial impact from employees we use the Human Capital Value Added (HCVA). The indicators for the infrastructure added value perspective are the Added Value on Assets (AVA), the Return on Capital Employed (ROCE), the Return on Assets (ROA) and Capital employed to Revenues Ratio (CR). The indicators for the Contribution to Economy are the direct, indirect, induced and catalytic impact on economy. Finally, the indicators for the Business Intelligence perspective are the Safety and Security, the Service quality, the Connectivity or Accessibility improvement and the system availability. The Business Intelligence perspective aims to measure and improve passenger satisfaction, business performance, and transport enterprise service quality, in order to enhance the enterprise added value promote transport enterprise business intelligence excellence.

In Table 1 each indicator for each perspective is described outlining why the indicator is important and what is measures, how is formulated and how is calculated.

3.2 Indicators’ formulas calculation and adjustment

The A1-Human Development and A4-Business Intelligence qualititave indicators, are measured through an Operational Scorecard and are based on the key non-financial value drivers of the transport infrastructure linked to human development and service quality (Sartzetaki 2019).

Based on the average Score of the Operational Scorecard (ranging between 1–5, with 3 being “On-Target”) the ratio is calculated with values that range from 0.9 (Score = 1, “Poor”) and 1.1 (Score = 5, “Excellent”). If Score = 3 (i.e., “On Target”) the ratio value is 1. The target values for the year in question are based on an objective rule, i.e. “On Target” (score 3) was at least the average actual for the previous 5 years while Outstanding (score 5) was set higher than the best actual value for the previous last years.

For A3-Contribution to economy, the Input Output methodology in order to estimate how the change in demand the transport infrastructure in question year affects other sectors and the economy as a whole by developing the appropriate I-O multipliers and estimating the direct, indirect, induced and catalytic impacts (Dimitriou et al. 2017). For A2 Infrastructure quality the appropriate financial and asset value indicators are adjusted.

After the indicator values are computed, are then adjusted through min max calibration in the times series and transformed into indices between 0 and 1. Minimum and maximum values (goalposts) are set in order to transform the indicators into indices between 0 and 1. These goalposts act as the ‘natural zeroes’ and ‘aspirational goals’, respectively, from which component indicators are standardized (UNDP, 2014). The justification for placing the minimum and maximum values is either on historical evidence in a specific time series or the ‘’aspiration goals’’, depending on the indicator. Having defined the minimum and maximum values in time window, the sub-indices for each indicator are calculated as follows, based on the actual value observed in the reference year and the minimum and maximum values presented in question time series.

For values that are not exprsed by a single value, but range in between two values, equation is first applied to each of the two indicators, and then the arithmetic mean of the two resulting indices is taken. Thus, for indicators C13,C14,C15 are calculated as:

Since its indicator is a proxy for capabilities in the corresponding perspective, the transformation function from indicators that contain variables such as income to capabilities is likely to be concave (UNDP, 2014). Thus, for these variables such as income based on quantitative analysis the natural logarithm of the actual, minimum and maximum values is used.

3.3 Prioritization of indicators and composite index development

The modelling developed based on the formulation and evaluation of decision-making strategic analysis it in the context of enterprise contribution to ecosystem. In this way, the "systemic" approach, on which the concept of the proposed modelling framework is based, aims to formulate a transparent and consistent framework to support decision makers to identify all the indicators of the enterprise performance and to analyze the interactions between them.

Following the introduction of the indicators, the analysis process proceeds by assessing the priorities to identify those which of these indicators and perspectives are more in a position to pursue the socioeconomic and sustainable development goals of the enterprise towards economic development.

In order to prioritize the above sixteen criteria with various dimensions of benefits, Multicriteria Decision Analysis (MDCA) adopted in order to allow alternative analysis to be conducted (Yu and Li 2008; Zhuang and Yang 2010). The underlying concept of the MDCA involves the prioritization of the indicators based on the concept of the composite solution to choose the best alternative nearest to the positive ideal solution (optimal solution) and farthest from the negative ideal solution (inferior solution) (Behzadian et al. 2012). Analytically, based on the method Technique for Order Preference by Similarity to Ideal Solution (TOPSIS), the notion that the optimal perspective performance, or a point that represents it, should have a minimum distance from the positive-ideal and the maximum distance from the negative-ideal solutions in the geometric sense. Then the question of multi-criteria analysis for the m perspectives and n indicators criteria, is interpreted as a geometric system of m points in n-dimensional space.

We suppose that the decision group for enterprise performance assement and contribution to business ecosystem has S different actors. If the fuzzy rating and importance weight of the sth actor, about the ith enterprise perspective to ecosystem on jth indicator are:

The aggregated fuzzy ratings \(\overline{w}_{j}\) for the indicator C(j) are calculated by

such that:

The normalized fuzzy decision matrix is

where

As the normalized triangular fuzzy numbers belong to [0, 1], the weighted normalized fuzzy decision matrix ˜ F is computed by multiplying the weights ( ˜ wj) of indicators with the normalized fuzzy decision matrix ˜rig as:

were

The Fuzzy Ideal Solution Contribution to Economic Development (FISCED), thus the optimized contribution to ecosystem is defined as:

where \(\overline{u}_{j }^{*} = \left( {d,d,d } \right)\); such that \(d = \max_{i} \left\{ {d_{ij}^{\prime \prime } } \right\}\).

The distance \(D_{I}^{ + }\) of each weighted perspective indicator \(i = 1,2 \ldots \ldots .m\) from the FISCED is defined as the index of each indicator contribution to ecosystem and is computed as:

where \(i = 1,2 \ldots m\) and \(D_{ij} (\tilde{a},\tilde{b}),\) is the distance measurement between the two fuzzy numbers \(\tilde{a}\) and \(\tilde{b}\).

The indicator with highest closeness index value represents the perspective with the highest contribution to ecosystem and is closest to the FISCED. For each perspective, the total sub index defined as the sum of the \(D_{I}^{ + }\).

Finnaly the total aggregated index is defined as the geometric mean of each perspective index. The index defined as Development Infrastructure Management Index is the geometric mean of the FISCED indices and is defined as the nth root of the n perspectives A1, A2, A3, A4 and is computed as:

where n = number of enterprise perspectives contribution to ecosystem, A = enterprise perspective to ecosystem, i = \(D_{{A_{i} }}^{ + }\).

4 Numerical application

The proposed computational modelling developed, for the evaluation of a transport enterprise performance towards economic development, is the main airport in Greece. The modeling framework will be applied for a five-year time frame.

4.1 Case study key features

Greece is classified as an advanced high-income economy (World Bank, 2021), being the 51st largest in the world and the 54th largest in the world by purchasing power parity (World Bank, 2021), a founding member of the Organisation for Economic Co-operation and Development (OECD), and the 16th largest economy in the 27-member European Union in 2020 (Eurostat 2021). Greece’s primary industry involves tourism and shipping. Agriculture also plays an important role for the country’s economy. After a depression period from 2011 to 2016, Greece started to recover in GDP terms in 2017 and showed signs of total recovery prospects until 2023 (projections baseline, the year 2019) (IMF, 2020).

According to (Human Development Report, 2020), Greece’s HDI index ranking in comparison with other countries is in a high human development category, as for 2019 the index is 0.888. Its position was at 32 out of 189 countries. In addition, Greece’s HDI shows sign of increase, as in 2013 was 0.867, in 2017 was 0.87 and in 2019 0.88 (Human Development Report, 2020), From OECD, countries which are close to Greece in 2017 HDI rank and to some extent in population size are Belgium and Portugal, which have HDIs ranked 17 and 41, respectively. Between 1990 and 2017, Greece’s HDI value increased from 0.753 to 0.870, an increase of 15.5 percent. Between 1990 and 2017, Greece’s life expectancy at birth increased by 4.8 years, mean years of schooling increased by 2.9 years and expected years of schooling increased by 4.9 years. Greece’s GNI per capita increased by about 16.9 percent between 1990 and 2017 (UNDP, 2021).

The numerical application in the main airport in Greece, Athens International Airport (AIA). AIA was established in 1996 as a public private partnership under concession agreement framework for the Design, Financing, Construction, Maintenance, Operation, Management and Development of the airport. The airport enterprise is a privately managed company with the Greek State holding 55% of shares, while private shareholders collectively hold 45%.

AIAs as an enterprise, aims to create added value to all stakeholders, developing corporate strategy driven both from its aeronautical and non-aeronautical sectors. providing stakeholders an operating environment that meets increasing demands on service quality and safety.

4.2 Application results

Applying the methodology framework, in order to transform indices C1-C16 into a scale from 0 to 1, min max calibration was applied. The minimum and maximum values, for the min max calibration, set in order to transform the indicators into indices between 0 and 1, based on data driven in the specific five time series. Having defined the minimum and maximum values, the sub-indices were calculated as analytically presented in Table 2. The 5- year time frame starts from 2013 until 2017.

Then the aggregated fuzzy ratings x ̅_ij of perspectives (i) with respect to each indicator (j) are computed. The next step is the weighted normalized fuzzy decision matrix that is computed by multiplying the weights ( ˜ wj) of indicators with the normalized fuzzy decision matrix. Based on the algorithm developed the fuzzy weighted normalized matrix for year t is presented in Table 3.

Finally, the FISCED for each perspective calculated giving the fuzzy ideal contribution to ecosystem. The distance D_I^ + of each weighted perspective from the FISCED is defined as the index of each indicator and computed according to the algorithm developed. The indicator with highest closeness index value represents the perspective with the highest contribution to optimized contribution to ecosystem and is closest to the FISCED. The distance from FISCED for in time series t depicted in Table 4.

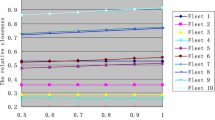

Finnaly the total aggregated index is calculated as the geometric mean of each perspective index. The DIMI index is the geometric mean of the FISCED indices and is defined as the nth root of the n perspectives A1, A2, A3, A4 according to algorithm developed. The results highlight the development of the DIMI in the five years’ time frame in Fig. 2.

Based on the ranking proposed by the United Nations for the HDI values, we define that when DIMI value is less than 0.5 a low-level contribution towards economic development is considered, when the DIMI value is between 0.5 and 0.8, then there is average development achievement towards economic development and at last, the enterprise DIMI value is greater than 0.8 corresponds to high contribution towards economic development. The case study results are at the greater level of contribution towards economic development with a growing trend in last five years.

The DIMI provides the full picture of transport enterprise contribution to ecosystem assessing regional economic development. Comparing the DIMI index with the HDI index, we investigate that the DIMI value stands remarkably close to the HDI and the perspective of Human development in many years stand exceeds it, shifting the focus of DIMI towards human development perspective. DIMI value is very close to HDI values at the amount of − 0.02 in t = 5, − 0.03 in t = 4, − 0.09 in t = 3, equal in t = 2, and − 0.05 in 2013 and the human development perspective is beyond the HDI at the amount of − 0.09 in t = 5, − 0.12 value in t = 4, − 0.05 in t = 3, − 0.06 in t = 2, − 0.09 in 2013 (Fig. 3).

This difference based on DIMI classification minus classification based on the HDI index shows the extent of transport enterprise towards human development. In case the difference of ranking the catchment area of the transport enterprise based on HDI from the ESE-based ranking shows a positive value, this means that the ranking according to the DIMI is better than corresponding HDI ranking, if the difference is negative value, then the opposite conclusion is derived.

5 Discussion and conclusions

This form of DIMI was developed in order to give an integrated picture of the transport enterprise performance towards economic development, combining four components of human, development, transport infrastructure value, income generated and service quality. The implementation of the proposed methodology and the modelling in the case study transport enterprise in this paper enabled the evaluation of the proposed methodology and the reliability of the results.

Based on the modelling framework and the index development over time we have identified which direction and perspectives are most advantageous from the others and that perspectives A2, A3 thus the perspectives incorporated with economic growth and economic performance, exceeding the DIMI over time.

Comparing the DIMI index with the HDI index, we investigate DIMI value stands remarkably close to the HDI and the perspective of Human development in many years stand exceeds it, shifting the focus of DIMI towards human development. This difference - based on DIMI classification minus classification based on the HDI index shows the extent of transport enterprise towards human development. The differentiation among the DIMI and HDI in terms of human development, is a challenge for decision makers to make the right decisions to improve the value of the Index towards the value of the Human Development Index (HDI) at the catchment area and at the same time reduce it the differences observed between DIMI and HDI.

The application of the methodology provided an opportunity to evaluate the proposed methodology of both its features in terms of completeness and usability as well as its and the reliability of its results. The use of the modelling that incorporates the proposed methodology is flexible, considering the specificities of the case study area as well as the characteristics of the transport enterprise. It provides an immediate and clear definition of all the parameters of the problem and an in-depth analysis of the interactions between the perspectives and the process of evaluating alternative development options and strategic proposals to promote effective and efficient transport enterprise performance towards economic development by decision-makers.

The basic advantages of the method include the easy handle data mining, the simple structure of the model and the possibility of updating it with new elements and new potential factors that could affect the enterprise perspectives and indicators in the future and its alignment with the needs of the decision maker every single year.

Further research could include, following the application of the proposed methodology in the specific transport enterprise, it could be further deployed in other enterprises either on the same country or similar enterprises to examine the potential of other enterprises competition and to draw conclusions on the potentialities and potential barriers for transport enterprises performance towards economic development. In addition, the impact of global financial conditions would be connected. As already analyzed above, the DIMI index evaluates the achievement of transport enterprise at a given time period.

The results of the computational modelling and modified fuzzy TOPSIS algorithm incorporated into the proposed methodology highlight that the transport enterprise responds to a high HDI values especially in the component of Human Development sub-Index. Based on the results, decision makers can focus and further improve this performance towards economic development and enables decision makers to distinguish between the weaknesses and the potential of the enterprises, in order to set action priorities in the management of an enterprise. The output of the paper based on the methodology and the computational modelling developed, addressed the "gap" identified for a holistic modeling framework to support transport enterprise performance assessment towards economic development, supporting enterprise management at a holistic level through a flexible and coherent, modeling, integrating all aspects of the question.

References

Agudel Latapí MA, Jóhannsdóttir L, Davídsdóttir B (2019) A literature review of the history and evolution of corporate social responsibility. Int J Corp Soc Respon 4(1):1–23

Athens International Airport (AIA) (2019), Annual and Sustainability Report https://www.aia.gr/el/company-and-business/the-company/Corporate-Publications/annual-report. Accessed July 2021

Behzadian M et al (2012) A state-of the-art survey of TOPSIS applications. Expert Syst Appl 39:13051–13069

Dimitriou DJ (2018a) Comparative evaluation of airports productivity towards tourism development. Cogent Bus Manage 5(1):1464378

Dimitriou D (2018b) Air transport economic footprint in remote tourist regions, pp 143–158. https://doi.org/10.5772/intechopen.71597

Dimitriou D (2020) Evaluation of corporate social responsibility performance in air transport enterprise. J Public Admin Govern 10(2):262–278

Dimitriou D (2021) The evolution in transport operator’s corporate structure: ownership and governance, pp 1–15. https://doi.org/10.5772/intechopen.96334

Dimitriou D, Sartzetaki M (2018) Assessing air transport socioeconomic footprint. Int J Transp Sci Technol 7(4):283–290

Dimitriou D, Sartzetaki M (2020a) Assessment framework to develop and manage regional intermodal transport network. J Res Transp Bus Manage 35:100455

Dimitriou DJ, Sartzetaki MF (2020b) Social dimensions of aviation on sustainable development. In: Walker T, Bergantino A, Sprung-Much N, Loiacono L (eds) Sustainable aviation. Palgrave Macmillan, Cham, pp 173–191

Dimitriou D, Sartzetaki M (2021a) National branding shifting to city branding: a new tendency for attracting investments and stimulating regional business ecosystems. In Pistikou V, Masouras A, Komodromos M (eds) Handbook of research on future policies and strategies for nation branding, pp 150–163. IGI Global. https://doi.org/10.4018/978-1-7998-7533-8.ch009

Dimitriou D, Zantanidis S (2021b) Key aspects of occupational health and safety towards efficiency and performance in air traffic management. In: Air traffic management and control. IntechOpen, pp 9–23. https://doi.org/10.5772/intechopen.101086

Dimitriou D, Mourmouris J, Sartzetaki M (2017) Quantification of the air transport industry socio-economic impact on regions heavily depended on tourism. Transp Res Procedia 25(2017):5242–5254. https://doi.org/10.1016/j.trpro.2018.02.051

Dimitriou DJ, Sartzetaki M, Kalenteridou I (2021) Dual-level evaluation framework for airport user satisfaction. Int J Oper Res Inf Syst 12:17–30

Eurostat (2021) Gross domestic product at market prices. Luxembourg: Eurostat. 30 July 2021. Retrieved October 2021

Green KW Jr, Zelbst PJ, Meacham J, Bhadauriab VS (2012) Green supply chain management practices: impact on performance. Supply Chain Manag 17(3):290–305

Herzig C, Moon J (2013) Discourses on corporate social ir/responsibility in the financial sector. J Bus Res 66(10):1870–1880

Hillenbrand C, Money K, Ghobadian A (2013) Unpacking the mechanism by which corporate responsibility impacts stakeholder relationships. Br J Manag 24(1):127–146

Human Development Report (2020) The next frontier: human development and the anthropocene (PDF). hdr.undp.org. United Nations Development Programme. 15 December 2020. pp. 343–346. ISBN 978–9–211–26442–5. Retrieved 15 December 2021.

IMF (2020) International Monetary Fund (2020), https://www.imf.org/external/datamapper/NGDPD@WEO/GRC?zoom=GRC&highlight=GRC

Kelly C, Laird J, Costantini S, Richards P, Carbajo J, Nellthorpa J (2015) Ex post appraisal: What lessons can be learnt from EU cohesion funded transport projects? Transp Policy 37:83–91

Kiel J, Smith RH, Ubbels B (2014) The impact of transport investments on competitiveness. Transp Res Proc 1:77–88

Klewitz J, Hansen EG (2014) Sustainability-oriented innovation of SMEs: a systematic review. J Clean Prod 65:57–75

Lin-Hi N, Müller K (2013) The CSR bottom line: preventing corporate social irresponsibility. J Bus Res 66(10):1928–1936

Mackie P, Worsley T, Eliasson J (2014) Transport appraisal revisited. Res Transp Econ 47:3–18

Miller RE, Blair PD (2009) Input-output analysis: foundations and extensions, 2nd Edn. Cambridge University Press, Cambridge, pp 10–29

Marr B (2012) Key Performance Indicators (KPI): the 75 measures every manager needs to know (Financial Times Series) 1st edn, pp 257–261

Nelson John D, Wright S, Brian M, Giorgio A, Aristotelis N (2010) Recent developments in flexible transport services. Res Transp Econ 29(1):243–248

Park J, Lee H, Kim C (2014) Corporate social responsibilities, consumer trust and corporate reputation: South Korean consumers’ perspectives. J Bus Res 67(3):295–302

Poplawska J, Labib A, Reed DM, Ishizaka A (2014) Stakeholder profile definition and salience measurement with fuzzy logic and visual analytics applied to corporate social responsibility case study. J Clean Prod 105:103–115

Sartzetaki M (2019) Value based management analysis framework towards transport enterprises resilience. Int J Econ Bus Manag Res 3(6):82–96

Tscharaktschiew S, Hirte G (2012) Should subsidies to urban passenger transport be increased? A spatial CGE analysis for a German metropolitan area. Trans Res Part A Policy Pract 46(2):285–309

Vogiatzis K, Dimitriou D, Gerolymatou G, Konstantinidis A (2020) Strategic noise mapping in Athens International Airport: a tool for balanced approach & health effects evaluation. Noise Mapping Int J 7(1):87–98

World Bank (2021) Gross domestic product 2020. Washington, D.C.: World Bank. 1 July 2021. Retrieved October 2021.

Yu J, Li Y-W (2008) Multilevel-fuzzy comprehensive evaluation method of airline's competitiveness, vol 8, pp 116–121

Zhuang Y, Yang J (2010) An improved ant colony optimization algorithm for solving a complex combinatorial optimization problem. Appl Soft Comput 10(2):653–660

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dimitriou, D., Sartzetaki, M. Performance assessment modeling for managing transport enterprises based on modified fuzzy TOPSIS analysis. Oper Res Int J 22, 6037–6053 (2022). https://doi.org/10.1007/s12351-022-00719-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-022-00719-9