Abstract

Introduction

Rising obesity prevalence is a health priority for many governments because of its impact on population health and economic consequences. We sought to estimate the broader consequences of obesity in Canada by applying a government perspective framework that captures lost tax revenues and increased government spending on social benefit programs.

Methods

An age-specific prevalence-based model was built to quantify the fiscal burden of disease for government attributed to people living with obesity. The model was populated with age-specific wages, employment activity and government benefits received to estimate taxes and transfer costs. A targeted literature search was conducted to identify modifiers of employment status, wages and disability status attributed to people with obesity, and applied to employment and epidemiological projections which enabled us to estimate government costs and tax losses. Government tax revenue and costs attributed to obesity were projected over a 10-year period and discounted at 3%.

Results

The fiscal burden of obesity in Canada is estimated at CAD$22,974 million (2021). This figure consists of obesity-attributed revenue losses of CAD$9404 million from direct taxes due to decreased employment activity and CAD$2374 million from indirect tax revenue losses due to reduced consumption taxes. Healthcare costs are estimated at CAD$7881 million annually and disability costs of CAD$3686 million annually. This fiscal burden of disease distributed amongst taxpayers in 2021 is estimated to be CAD$752 per capita. We estimate for every 1% reduction in obesity prevalence, CAD$229.7 million net fiscal gains can be achieved annually.

Conclusions

Obesity is associated with substantial clinical and economic burden not only to the healthcare system but also to wider government budgets as demonstrated using fiscal analysis. Reductions in obesity prevalence are likely to have positive fiscal gains for government from reduced spending on public benefits and increased tax revenue attributed to employment changes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Why carry out this study? |

People living with obesity experience work activity reductions and often lower wages in addition to increased disability all of which can influence government tax revenue and costs |

We applied an established government perspective modelling framework to explore how living with obesity impacts on the government and how this can change following reductions in obesity prevalence |

What was learned from the study? |

A broad range of public economic costs fall onto governments as a result of people living with obesity |

We observe that tax revenue losses from people living with obesity are likely much greater than the direct healthcare costs attributed to treating obesity |

This would suggest that reducing obesity prevalence could have an even greater fiscal effect for governments than reduced healthcare costs owing to the potential income tax gains |

Introduction

Obesity is an important public health issue with increasing prevalence that affects several countries around the world [1]. In Canada, recent estimates of people living with obesity based on self-reported measures of height and weight suggest prevalence rates of 25.6%, with higher rates of increases observed in more severe obesity categories (class II and III) over the past three decades [2, 3]. As available prevalence data are based on self-reported measures, there is reason to believe these projections underestimate actual prevalence which could be up to 5% higher [4]. Increases in obesity prevalence have led to a significant rise in both direct (medical care) costs and indirect (impact on labour market outcomes) costs associated with obesity, which in turn, have a substantial impact on Canadian societal and public budgets. Estimates suggest direct medical costs attributed to obesity account for 2.2–12% of Canada’s total health expenditure, depending on study estimates and assumptions, making obesity one of the most costly chronic medical conditions to the healthcare system [5]. A study reporting the different costs associated with living with excess weight or obesity in Quebec found that the main cost driver was hospitalizations representing 44.8% of total costs [6]. The second largest cost component was associated with disability representing 21.7% of overall costs suggesting the impact of costs outside of the health service [6].

Many chronic health conditions can disrupt the work activity of individuals implying a broader range of economic effects that are likely to arise outside of the healthcare sector. In terms of indirect costs there are two primary means via which this chronic health condition may adversely affect labour market outcomes [7, 8]. Firstly, impact can be observed through decreased productivity stemming from health problems associated with obesity, which can lead to an increase in absenteeism/presenteeism [9]. Secondly, there is an increased probability exit from the workforce through early retirement or disability due to living with obesity and attributable comorbidities [1, 6]. The effects of these labour market influences attributed to living with obesity can negatively influence financial health because of reductions in earnings and lower household income and often decreased savings [10].

The economic effects of obesity are not isolated to individuals, households and industry, in which governments can also be financially impacted [11]. When individuals with chronic health conditions withdraw from the labour market as a result of work limitations, governments can lose tax revenue as economic activity is reduced, earnings decrease and consequently less tax revenue can be collected [12]. Furthermore, as individuals withdraw from work as a result of chronic health conditions, additional costs for government arise since the demand for disability payments and other social support programs increases [13]. In addition, reduced workforce participation rates result in fewer people of working age available to fund public benefits programs and this can place excess fiscal pressure on the remaining members of the workforce creating a need to increase taxes [14].

We have identified literature from several countries suggesting an important relationship between obesity and labour market outcomes [6, 15]. We sought to build a modelling framework on this established relationship and demonstrate how fiscal accounts at various levels of government can be impacted by obesity rates via changes in labour outcomes that can, in turn, influence tax revenues and transfer costs, and combine these effects to derive the net fiscal burden of obesity for government. We then will use this modelling framework to explore how varying changes in obesity prevalence could influence government accounts now and in the future.

Methods

A prevalence-based fiscal burden of disease (BoD) model was built in Microsoft Excel®, and a targeted literature review was conducted to inform model inputs (Supplementary Material Tables 1–3). The analysis produced by this study aimed to quantify both the fiscal BoD attributed to people living with obesity, and to assess incremental fiscal benefits for government from reducing obesity prevalence. The modelling framework used is similar to the methods used for cost-of-illness (CoI) studies; however, instead of estimating population attributable fractions (PAF) of obesity-related comorbidities, the present analysis estimated the amount of tax revenue loss, excess transfers costs and excess healthcare costs that can be attributed to obesity [12, 16].

The analysis consisted of estimating fiscal flows of the Canadian population on the basis of the current and projected prevalence of obesity. Current obesity prevalence estimates were used as the control group and were compared to the fiscal flows in a hypothetical population in which obesity did not exist. The difference between these two arms in terms of tax revenues, transfer costs and excess healthcare costs was considered as the total annual fiscal BoD of obesity i.e. the differing fiscal effects of obesity on the government. This analytic approach enabled us to explore how the current and varying prevalence of obesity could influence government fiscal accounts. The analyses were conducted for a single year (2021) and was projected for a decade (2021–2031) on the basis of epidemiological and demographic projections [17, 18].

The effects of obesity on government fiscal cash flows were based on previously published observational data showing the negative impact of obesity on labour force participation and on disability rates. To identify these effects a targeted literature search was conducted aimed at identifying relevant Canadian data. Details of the literature search strategy and inclusion/exclusion criteria are provided in the supplementary material. Prevalence data used were age- and gender-specific [19] and, for the purposes of this fiscal analysis, the Canadian adult population was split into two groups namely, “with obesity” and “without obesity”. The former group consisted of all individuals with body mass index (BMI) higher that than the obesity threshold (ΒΜΙ ≥ 30) [20] whereas the latter group included underweight, normal weight and overweight individuals (BMI < 30). Tax revenue loss from obesity-related morbidity was estimated through the reduction of labour force participation and/or the reduction of wages resulting from people living with obesity.

The analysis was developed using the most recently published evidence identified for Canada. The key labour market outcomes included in the fiscal analysis focused on wages, employment and disability status for individuals with obesity. Specifically, the analytic framework accounted for wage loss rates for people living with obesity reported by Larose et al. (2016) [6, 21], and increased disability attributed to living with obesity reported by Blouin et al. (2017) in Canada [6]. In addition to wage losses, the odds ratios of female workforce participation for people living with obesity from the study by Sari et al. (2018) were applied [1]. The extracted data used in the modelling is provided in the supplementary material.

Equations 1–11 illustrate the estimation methods for the fiscal BoD for current and varying obesity prevalence rates (Supplementary Material Table 4) [19]. The odds ratios (ORs) from the literature were combined with obesity prevalence and, in turn, labour force participation rates of the general population were calibrated to reflect discrete rates for those living with obesity and those without obesity [18, 19, 22,23,24,25]. Subsequently, age- and gender-specific annual gross earnings for those living with obesity and those individuals without obesity were estimated along with the corresponding annual tax revenues (Eqs. 1–3) (Supplementary Material Tables 5 and 6). To estimate annual tax revenues the tax wedge (the ratio of taxes paid by the average worker including labour costs for the employer) and the proportion of earnings that goes to indirect tax were applied to gross annual earnings [26]. Total and incremental tax revenues were estimated for the control and intervention groups (Eq. 3). Disability rates were converted into transfer costs by age group (Eqs. 4–5). To estimate disability resulting from obesity, disability rates of the general population were also calibrated for individuals with and without obesity and subsequently ORs of being disabled were applied to the calibrated disability rates of individuals without obesity [27]. Average disability transfer costs were, in turn, applied to disability rates to quantify the transfer-related cost by age group [28]. Excess disability costs attributed to living with obesity were subsequently quantified as the added disability costs of the control versus the intervention group. Furthermore, old-age pensions were estimated assuming an average retirement age of 65 years of age (Eq. 6) [29]. A recent cost of illness study by Alves et al. (2021) was used to estimate excess healthcare costs for male and female individuals living with diabetes [30] (Eq. 7). The number of annual deaths was estimated on the basis of the PAF and excess mortality rates reported by Alves et al. [30]. The results of the aforementioned study were used in combination with Canadian life table mortality to estimate the mortality burden of living with obesity [30, 31] (Eq. 8). Half-cycle correction was applied to the estimation of annual deaths attributable to obesity.

The fiscal BoD was estimated as the net fiscal effect which is the sum of tax revenue losses, excess disability transfers, healthcare costs and differences in pension costs for people living with and without obesity (Eqs. 9–11). It should be noted that this analysis did not include non-obesity-related healthcare costs. The framework also allowed for exploring the fiscal effects of incremental reductions in obesity prevalence to inform public economic gains for government (Eq. 11). Finally, gross earnings, tax revenues, disability transfers and healthcare costs were combined with the current and the projected age-pyramid of the Canadian adult population to estimate the fiscal BoD of obesity in Canada over 10 years (2021–2031) [18]. For the long-term analysis, a 2.25% increase of annual prevalence was modelled in addition to demographic projections [17, 18]. To produce present values for the future net fiscal BoD all costs were discounted at a 3% rate whereas, consistent with the methods of generational accounting, projected wages and transfers were inflated using 10-year geometric mean rates of wage growth and CPI of 2.5% and 1.5%, respectively [17] (Supplementary Material Table 7).

Equations

where t is year of analysis, i gender, j age group, DR disability rate, Dco annual disability pension, LP labour force participation rate, PE old-age pensions cost, Pco annual old-age pension, P prevalence, PR old-age pension rate, Y annual gross earnings, WP reduction in wages attributed to obesity, M mortality, Em excess mortality, S population.

Ethical Approval

Ethical approval was not required in relation to this modelling study. The model was constructed from previously published studies that have been cited in the text. No proprietary data, primary clinical data or individual data has been used in this research. No interventions requiring animals or humans are investigated in this study.

Results

The fiscal burden of obesity in Canada is estimated to be CAD$22,974 million annually for the year 2021. This figure consists of obesity-attributed tax revenue losses of CAD$9404 million from direct taxes attributed to decreased employment activity and CAD$2374 million loss from indirect tax revenue losses i.e. reduced consumption attributed to lower productivity and wages (Table 1). In terms of government impact, the main government cost was associated with healthcare costs estimated to be CAD$7881 million annually in 2021. This fiscal burden of disease distributed amongst taxpayers in 2021 is estimated to be CAD$752.18 per capita (Table 1).

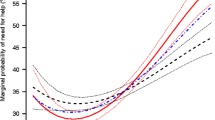

To illustrate the relationship between obesity prevalence and fiscal consequences for government, we vary obesity prevalence to demonstrate the net fiscal effect on the Canadian government in the year 2021 attributed to a reduction in prevalence (Fig. 1). It is estimated that for every percentage point reduction in obesity prevalence, CAD$229.7 million (CAD$22,974 × 1%), net fiscal gains can be achieved annually. Similarly, a 10% reduction in obesity would generate CAD$2297 million in savings within a single year which equates to CAD$75.22 savings per taxpayer per year.

The projected fiscal burden is estimated up to 10 years taking into consideration projections on obesity growth. The fiscal burden is expected to grow annually in line with government projections on obesity prevalence growth. The estimated difference in fiscal costs is expected to CAD$243,000 million with a discount rate of 3% (Fig. 2). Additionally, we ran a scenario with a 5% discount rate in which the fiscal cost was estimated to be CAD$221,653 million.

To test the sensitivity of the analysis to input parameters a one-way sensitivity analysis was performed. The analysis indicates that the findings are most sensitive to future tax rates in Canada, the impact of obesity on disability rates for male and female individuals, and future labour force participation rates and future earnings (Supplementary Material, Fig. 1S).

Discussion

Our analysis has applied a government perspective fiscal analysis for illustrating how public accounts are impacted in relation current obesity prevalence in Canada. As a result of the labour impacts associated with obesity, we estimate that government losses are CAD$9404 million annually from direct taxation on employment, and a further CAD$2374 million losses from indirect taxes attributed to reduced consumption taxes i.e. VAT. We also demonstrate changes in costs to government associated with disability support which increase by CAD$3686 million and excess healthcare costs of CAD$7881 million annually. It is worth noting that for a health condition as prevalent as obesity, healthcare costs are not the major cost for government in that tax revenue losses from wage losses, disability and inactivity are greater. We do estimate some reductions in pension costs for people with obesity as a result of early mortality. In total we estimate the impact on government money flows is to the detriment of CAD$22,974 million annually attributed to people living with obesity. The analysis described here is based on national data for Canada. As there is comparability amongst provinces in terms of taxation and social benefits, we believe these results are broadly applicable across the different Canadian provinces.

We have projected fiscal costs over a 10-year time horizon in our analysis to provide some idea of future costs. While it is possible to project fiscal burden for longer time horizons, we felt that 10 years is sufficient because of uncertainty regarding how obesity impacts on employment over the long term. The studies that define fiscal impacts associated with obesity used in our analysis were obtained from cross-sectional studies and therefore they provide data on a specific timepoint without knowledge about how the disease impacts employment and wages over time. In essence, we apply static assumptions about how obesity influences employment which could change over time, and extending the analysis would not provide any additional insights into the burden as future changes are uncertain.

The comparative results presented in Fig. 1 are intended to demonstrate the potential gains from reducing obesity prevalence in Canada. We demonstrate that reducing numbers of people living with obesity will bring more people into employment or prevent people from withdrawing in the future which will increase societal earnings and therefore positively influence tax revenue for government, increasing direct taxes by CAD$9404 million annually and increase indirect consumption taxes by CAD$2374 million annually. The hypothetical elimination of obesity would lead to annual savings from reduced spending on healthcare (CAD$7881 million) and on disability support (CAD$3686 million) shown as positive values. However, it should be noted that there can be negative fiscal consequences for government as a result of reduction in the prevalence of obesity. Firstly, governments collect taxes on cash benefit programs provided to people unable to work. As more people are working, there are less taxes collected on recipients of benefits (− CAD$277 million annually). However, these losses are more than offset by the increased taxes from employment increases. Similarly, in the absence of obesity, people will live longer, therefore increasing demand for state pensions in the future (− CAD$94 million).

The fiscal analysis described here incorporates a broader range of costs than those normally considered in burden of disease that focus only on direct healthcare costs [5]. The healthcare costs estimated in our analysis were CAD$7881 million annually related to obesity-attributable costs excluding costs of comorbidities. This estimate described in our analysis is comparable to that of the original study which the excess healthcare costs were obtained from [30]. We demonstrate that healthcare costs, often the focus of economic evaluations, represent approximately 50% of the overall costs to government. In Canada, like many other OECD countries, approximately 72% of healthcare spending is publicly funded through provincial and territorial government taxes [32]. Considering the large proportion of healthcare costs paid by government, in addition to all other costs that fall on different government programs, including lost taxes and disability attributed to obesity, we believe fiscal analysis when applied to evaluate medical technologies can be a valuable addition to complement cost-effectiveness analysis. Furthermore, our analysis does not include costs of treating comorbidities suggesting the total burden estimates provided here are conservative.

The analysis described here has focused on the current fiscal burden of obesity trends in adults. What is not described in our analysis is how rising obesity rates in children will influence government accounts in the future. Several studies have reported the growing concerns over prevalence of obesity in children and likely health costs [33]. Whilst health costs are of concern, what is more concerning is the likely impact that obesity may have on human capital accumulation, especially as relates to education in children which can have lasting fiscal effects from reduced earnings capacity linked to reduced education [33]. Furthermore, an association has been reported between children with obesity and a wide range of social and verbal skills which could influence a child’s fiscal life course, further influencing government costs [34]. Factoring in lower rates of education observed in some settings for children with obesity will have everlasting impact as this can influence future earnings and, in turn, lifetime taxes paid to governments. This might suggest the benefits of early management of obesity in children may offer important fiscal returns over their lifetime. As the impact of obesity in children is not captured in our analysis this would suggest that our model is an underestimate of the fiscal burden attributed to obesity.

The fiscal analysis reported here applies reported permanent employment transitions linked to obesity status. We have focused on permanent employment transitions as these represent more significant costs for government due to the need for disability payments and associated lost tax revenues. These include transitions from employment to early retirement and disability, but also includes death due to obesity as this removes a taxpayer from the labour market. As we have focused on permanent employment transitions, there are other economic losses that are more transient and subtle that can be attributed to absenteeism and presenteeism [9]. Recent estimates suggest that cost of absenteeism and presenteeism can be as high if not greater than direct costs [9]. While these costs are significant, they mostly fall onto employers; however, in the case of contract workers, who are only paid when they work, the impacts would directly impact individuals. While employers may shoulder many of the costs associated with absenteeism and presenteeism, there could be costs for government from lost productivity of workers which could impact firm profitability and therefore taxes on profit [35]. This suggests that our analysis has underestimated costs for government associated with short-term losses in productive output.

In an era of ageing populations, many governments are seeking to establish strategies that support active ageing and enable people to remain active in the work force for longer. Considering the relationship between health and wealth [36] and in particular how this may relate to enabling people to work into older ages to reduce strain on public pensions, policy researchers have stressed that economic gains can be achieved by maintaining a healthy work force as the working age population is declining [37]. In this context, it is important to explicitly recognise that every person that discontinues work prematurely because of poor health needs to be supported by others that remain in the workforce. Over the next two decades, the age-dependency ratio in Canada is expected to increase by 20%, thereby placing increasing stress on public systems and expecting more out of younger aged cohorts paying higher net taxes compared to previous generations [38]. Considering the size and magnitude of the burden associated with obesity, and the reported fiscal losses described here can inform policy-makers regarding potential economic gains from reducing the prevalence of obesity.

There are several limitations to the analysis described here that are worth considering. Firstly, in the analysis which varies prevalence, we estimate how changes in prevalence are likely to impact government in terms of net taxes. In the graphical representation of the results, we demonstrate a linear relationship between obesity prevalence and fiscal impact. This may not be the case as reducing obesity prevalence will likely require variable resource investment when considering mildly obese vs people living with severe obesity. As we do not know precisely how government policy may influence different types of obesity, we have assumed that a future policy intervention works universally to lower prevalence. This may be an overestimate as to how a future policy might work and its overall effectiveness. Another limitation may arise when combining data from different studies to project fiscal consequences in terms of wage losses, work activity and disability attributed to living with obesity. As we have combined data across a range of studies there is always the possibility of overestimating potential consequences attributed to obesity. Furthermore, our study only includes healthcare costs attributed to the treatment of obesity. The study does not estimate future non-obesity-related health costs in either the formerly obese population or the healthy population. The simplifying assumption is that formerly obese individuals would revert to the health population level of healthcare, which may not be the case as these individuals could carry a legacy of health burden attributed to their obese period. An additional limitation is that we have focused only on costs that impact government and have not included additional costs that might have been incurred by people with obesity.

It is possible to compare some of the results presented here with previous economic studies of obesity reported in Canada. Firstly, previous assessments of direct healthcare costs attributable to obesity in Canada in 2019 were estimated to be CAD$7800 million [30]. This figure is comparable to our estimates of obesity-related health costs of CAD$7881 million in fiscal year 2021. Furthermore, based on the numbers of obesity-attributable deaths estimated in our model, the obesity population attributable fraction is 9.1% of all deaths in Canada and 10.4% for the 18–65 years of age population. By comparison, premature deaths attributed to obesity estimated by Obesity Canada are one in ten (10%) in adults aged 20–64 [39]. Obesity-related deaths are an important consideration in fiscal models as premature death removes individuals from the workforce, therefore reducing tax revenues for government. The comparability of health costs and mortality provides reassurance that the fiscal estimates reported here are aligned with previously published findings.

Conclusions

The analysis described here highlights the broader impact associated with obesity that impacts on government tax revenue and public benefits programs. Namely, reductions in obesity prevalence are likely to have positive fiscal gains for government from reduced spending on public benefits and increased tax revenue attributed to employment changes. This fiscal modelling approach described here reflects a cross-sectorial budget impact associated with obesity and how changing obesity prevalence rates are likely to impact on government. We advocate this public economic approach should be used in conjunction with cost-effectiveness analysis for evaluating new medical technologies.

Data Availability

The data on which the analysis is based was derived from published materials. All material used has been referenced appropriately to enable readers to identify sources of information.

References

Sari N, Osman BA. The effect of body weight on employment among Canadian women: evidence from Canadian data. Can J Public Health. 2018;109(5–6):873–81.

Twells LK, Janssen I, Kuk JL. Canadian adult obesity clinical practice guidelines: epidemiology of adult obesity. CMAJ Open 2020;(1):E18-E26.

Statistics Canada. Health characteristics, annual estimates. Statistics Canada; Table 13-10-0096-01 Health characteristics, annual estimates 2020. https://doi.org/10.25318/1310009601-eng

Wharton S, Lau DC, Vallis M, et al. Obesity in adults: a clinical practice guideline. CMAJ. 2020;192(31):E875–91.

Tran BX, Nair AV, Kuhle S, Ohinmaa A, Veugelers PJ. Cost analyses of obesity in Canada: scope, quality, and implications. Cost Eff Resour Alloc. 2013;11(1):3.

Blouin C, Hamel D, Vandal N, et al. The economic consequences of obesity and overweight among adults in Quebec. Can J Public Health. 2017;107(6):e507–e513.

Caliendo M, Lee WS. Fat chance! Obesity and the transition from unemployment to employment. Econ Hum Biol. 2013;11(2):121–33.

Mosca I. Body mass index, waist circumference and employment: evidence from older Irish adults. Econ Hum Biol. 2013;11(4):522–33.

Goettler A, Grosse A, Sonntag D. Productivity loss due to overweight and obesity: a systematic review of indirect costs. BMJ Open. 2017;7(10):e014632.

Guariglia A, Monahan M, Pickering K, Roberts T. Financial health and obesity. Soc Sci Med. 2021;276:113665.

Runge CF. Economic consequences of the obese. Diabetes. 2007;56(11):2668–72.

Connolly MP, Kotsopoulos N, Postma MJ, Bhatt A. The fiscal consequences attributed to changes in morbidity and mortality linked to investments in health care: a government perspective analytic framework. Value Health. 2017;20(2):273–7.

Dixon JB, Browne JL, Lambert GW, et al. Severely obese people with diabetes experience impaired emotional well-being associated with socioeconomic disadvantage: results from diabetes MILES–Australia. Diabetes Res Clin Pract. 2013;101(2):131–40.

OECD. The heavy burden of obesity: the economics of prevention. OECD, Paris: OECD; 2019.

Kabiri M, Sexton Ward A, Ramasamy A, et al. Simulating the fiscal impact of anti-obesity medications as an obesity reduction strategy. Inquiry. 2021;58:0046958021990516.

Connolly M. The fiscal impact of investments in health care. Future Health Econ. 2016:181–91.

O'Neill M, Kornas K, Rosella L. The future burden of obesity in Canada: a modelling study. Can J Public Health. 2019;110(6):768–78.

Statistics Canada. Projected population, by projection scenario, age and sex 2021 [Table 17–0–0057–01 ]. https://www.canada.ca/en/revenue-agency/corporate/about-canada-revenue-agency-cra/individual-income-tax-return-statistics.html. Accessed 5 Mar 2023.

Statistics Canada. Overweight and obese adults, 2018. https://www150.statcan.gc.ca/n1/pub/82-625-x/2019001/article/00005-eng.htm. Accessed 5 Mar 2023.

Health Canada. It’s your health. In: Canada PHAo, editor. Ottawa: Her Majesty the Queen in Right of Canada; 2006.

Larose SL, Kpelitse KA, Campbell MK, Zaric GS, Sarma S. Does obesity influence labour market outcomes among working-age adults? Evidence from Canadian longitudinal data. Econ Hum Biol. 2016;20:26–41.

Statistics Canada. Labour force characteristics by sex and detailed age group, monthly, unadjusted for seasonality 2021. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410001701. Accessed 5 Mar 2023.

Statistics Canada. Income of individuals by age group, sex and income source, Canada, provinces and selected census metropolitan areas 2021. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901. Accessed 5 Mar 2023.

Statistics Canada. Average weekly wage rate 2021 [https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410006301. Accessed 5 Mar 2023.

Statistics Canada. Employee wages by industry, monthly, unadjusted for seasonality 2022 [Table 14–0–0063–01 ]. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410006301. Accessed 5 Mar 2023.

OECD. Taxing Wages, OECD https://doi.org/10.1787/047072cd-en (2020).

Morris S, Fawcett G, Brisebois L, Hughes J. Canadian survey of disability 2018. https://www150.statcan.gc.ca/n1/en/pub/89-654-x/89-654-x2018002-eng.pdf?st=XUy_Cs4u.

Government of Canada. Canada Pension Plan disability benefits 2021. https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-disability-benefit/eligibility.html.

Government of Canada. Canada pension plan - annual report 2018–2019. 2021. Contract No.: ISSN: 1494–4987. Accessed 5 Mar 2023.

Alves A, Larocque A, Matson P, Sheppard R, Risk & Regulatory Consulting. Obesity trends and the impact on morbidity and mortality costs. Society of Actuaries Research Institute; 2021.

Canadian Institute for Health Information. Who is paying for these services? https://www.cihi.ca/en/who-is-paying-for-these-services. Accessed 10 Nov 2023.

Spinelli A, Buoncristiano M, Kovacs VA et al. Prevalence of severe obesity among primary school children in 21 European countries. Obes Facts. 2019;12(2):244–58.

Spinelli A, Buoncristiano M, Kovacs VA, et al. Prevalence of severe obesity among primary school children in 21 European countries. Obes Facts. 2019;12(2):244–58.

Cawley J, Spiess CK. Obesity and skill attainment in early childhood. Econ Hum Biol. 2008;6(3):388–97.

Jensen JD. Can worksite nutritional interventions improve productivity and firm profitability? A literature review. Perspect Public Health. 2011;131(4):184–92.

World Health Organization. WHO guide to identifying the economic consequences of disease and injury. Geneva: World Health Organization; 2009. p. 2009.

Suhrcke M, McKee M, Sauto Arce R, Tsolova S, Mortensen J. The contribution of health to the economy in the European Union. European Communities, Luxembourg 2005. 2018.

Globerman S. Canada’s demographic crisis threatens incomes and living standards. Canada: The Hub; 2022.

Obesity Canada. Obesity in Canada. About obesity. 2020. https://obesitycanada.ca/obesity-in-canada/. Accessed 10 Nov 2023.

Acknowledgements

Medical Writing/Editorial Assistance

No medical writing support was provided in relation to this work.

Funding

The work described here was funded by Novo Nordisk. Fees from the sponsoring organization were also provided to cover the rapid publication charges for the journal.

Author information

Authors and Affiliations

Contributions

Both authors (Nikos Kotsopoulos and Mark Connolly) contributed to concept development, methodology, data identification, original and final draft writing. Mark Connolly conducted the literature search and funding acquisition. Nikos Kotsopoulos conducted the data analysis.

Corresponding author

Ethics declarations

Conflict of Interest

The work described here has been sponsored by Novo Nordisk. The authors Mark P. Connolly and Nikos Kotsopoulos received funding from the sponsoring organization for their contributions. The authors hold no financial interests in the sponsoring organisation. The authors retained full editorial control over the manuscript content and final published material. The study sponsors were given a chance to review the final manuscript; however, the authors retained full and final editorial control over published content. The authors report no other potential conflicts of interest in relation to this work.

Ethical Approval

Ethical approval was not required in relation to this modelling study. The model was constructed from previously published studies that have been cited in the text. No proprietary data, primary clinical data or individual data has been used in this research. No interventions requiring animals or humans are investigated in this study.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Kotsopoulos, N., Connolly, M.P. Assessing the Fiscal Burden of Obesity in Canada by Applying a Public Economic Framework. Adv Ther 41, 379–390 (2024). https://doi.org/10.1007/s12325-023-02718-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12325-023-02718-4