Abstract

We studied the unstable tax policy effects on the welfare and growth in the emerging economies. This is in a more general approach than those of Turnovsky (Dynamic macroeconomic analysis, pp 155–211, 2003) and Hopenhayn and Maniagurria (Rev Econ Stud 63:611–625, 1996), neglecting the emergent economy structure, and only taking the tax policy at random, not establishing endogenous stochastic adjustments. Through our elaborate stochastic growth model in continuous time and simulations for small open emerging economies that imitates foreign technology, the findings are as follows: (1) the higher the initial productivity in the technology adoption sector, the weaker the tax variation needed to offset the effects of a rise in international interest and inflation rates. (2) A high volatility of international prices has a contraction effect on the foreign capital inflows, deprives the domestic agents of foreign technology and reduces the opportunities to invest in imitation. (3) The expected negative tax volatility effect on investment stops from a threshold where the income effect starts to prevailing over the substitution effect. (4) The resulting welfare cost from an unstable tax policy suggests a need for stabilisation or compensation transfers measures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Macroeconomic volatility and its political implications continue to attract the interest of the applied literature (Burnside and Tabova 2009; Fernández-Villaverde et al. 2009; Diebold and Yilmaz 2008). Stochastic models have two main advantages compared to those of deterministic standard growth. First, thanks to the generalisation of the solutions they offer, the identification of the accumulation dynamics becomes possible without being limited to a comparison between different stationary states (Joshi 1998). Second, they allow to examine in a more systematic way the current issues such as welfare under a different monetary systems, the PPP in the presence of rigidities, the link between the macroeconomic volatility and international trade (Obsfeld and Rogoff 1999).

However, the examination of the effect of the fiscal policy on welfare in the stochastic continuous-time context has been scarcely carried out in the available applied literature on developing countries. Few studies have been carried out in a discrete-time stochastic context, on one hand, and have only considered uncertainty taxation as Aizenman and Marion (1993) and Mendoza et al. (1997) or the productivity shock on the other hand as Hopenhayn and Maniagurria (1996). Although their method allows isolating the tax effects on welfare, it does not seem to be convenient for conveying the overall macroeconomic interactions occurring as a result of the endogenous stochastic adjustments. It would be possible to do this through stochastic processes generating evolution for all macroeconomic variables as shown in this paper.

The aim of this paper was to examine the dynamic effects of the tax policy in the framework of a small open economy. We have shown that the nature and scope of these effects depend on the risk aversion degree of the representative agent and a “fluctuations threshold” that we endogenously determine. We also showed that the representative portfolio structure is continually modified in response to the several random shocks. For this purpose, we highlight the corresponding adjustment mechanisms.

This paper is organised as follows: the second section is devoted to the elaboration of an endogenous growth stochastic model for a small open economy. Here, a description of a stochastic environment of an emergent economy will be provided along with the equilibrium conditions in the stationary state. The third section, illustrating the analytical scope of the introduction of stochastic context in endogenous growth models, shows the effects of the variability of tax policy on welfare. Some simulations will be run, and some economic policy recommendations will be put forward.

2 An endogenous growth stochastic model for an emergent economy

Referring to the theory of endogenous growth allowing for the non-diminishing returns (Lucas 1988; Romer 1986; Mulligan and Sala-I-Martin 1993), and their continuous-time stochastic models adopted for the study of structural changes in the paths of growth in an uncertain environment (Obsfeld and Rogoff 1999),Footnote 1 we consider an emerging small open economy. Following Turnovsky (2003), we first describe the macroeconomic environment and its representative activities. Because of several sources of fluctuations, this emerging macroeconomic environment is characterised by some particular stylised facts, i.e. the procyclical real wages and the countercyclical variation in government expenditures.Footnote 2 We analyse then the conditions of the stationary state equilibrium.

2.1 Economic environment’s description

The central element of the economic environment of a small open economy is that the domestic agents imitate foreign technology incorporated into the imported capital goods. This economy is supposed to be subjected to two primary exogenous random shocks. The first is that of productivity caused by changes in the technologies incorporated in the imported goods. The second shock is that of the terms of trade caused by the changes in the relative price of tradable. Note that the uncertainty of fiscal policy arises from the lack of its credibility.Footnote 3 Furthermore, as in Turnovsky (2003), there are two types of financial assets: the non-tradable assets and the tradable assets. The former are emitted by the public sector and the latter are because of external debt flows, and the expectations made by the agents are instantaneous and rational. The hypotheses of rational expectations are fully justified not only by the pioneering works of Sargent and Wallace (1975) but also by the particular model integrating them (Blanchard 1985). Empirical literature shows that there are many transmission channels of these shocks such as the trade volume, the interest rate (Chaouachi et al. 2013), the foreign investment and the sentiment of investors (Chebbi et al. 2013).

2.1.1 The private sector

The AK-type production function (Rebelo 1991) considered here is generated by a Brownian stochastic process such that,

where A is the equivalent of investment in human capital necessary to the imitation of the foreign technology incorporated into the imported capital goods. It shows the skills in the knowledge of adopting the foreign technology. The financing of A is assumed to be proportional to the output of the private sector; a the equivalent of the total factor productivity in the productive private sector; dy the stochastic component of the output. It is a random variable independent overtime and normally distributed, a null means and of variance \(\sigma_{y}^{2} {\text{d}}t\). It captures the above-mentioned productivity shock.

The external debt flows are assumed not to exceed a limit such that their share in the national tradable assets, A, is equal to, \(\bar{d}\)

This is the debt–capital ratio that is often held as an indebtedness condition.Footnote 4

Let, W the overall wealth measured in real output units,

where B the non-tradable domestic assets; P the price of the non-tradable domestic securities measured in terms of domestic output; B * foreign assets; P * the price of foreign securities measured in terms of domestic output; A the domestic skills stock devoted to the adoption of foreign technology, measured in terms of domestic output and the only investment form considered in this model.

The returns from these various assets are supposed to follow the Wiener process. We thus keep the following relations depicting the return rates:

The return of non-tradable securities, \({\text{d}}R_{B}\), is assumed to follow a Brownian motion. Its deterministic component is \(r_{B}\). It constitutes a fixed yield per period. The stochastic component of \({\text{d}}R_{B}\) is \({\text{d}}U_{B}\) such that:

-

The foreign security (or bond) is assumed to generate a fixed yield per period, \(r_{{B^{*} }}\), and follows the following Brownian stochastic motion:

$${\text{d}}R_{{B^{*} }} = r_{{B^{*} }} {\text{d}}t + {\text{d}}U_{{B^{*} }}$$(5)with, \({\text{d}}U_{{B^{ *} }}\): its stochastic component.

-

The yield rate in the adoption of the technology sector is such that:

$${\text{d}}R_{A} = \frac{{{\text{d}}Y}}{A} = r_{A} {\text{d}}t + {\text{d}}a$$(6)where \({\text{d}}R_{B}\), \({\text{d}}R_{{B^{*} }}\) and \({\text{d}}R_{A}\): the respective random yield rates of the domestic non-tradable securities, B, of the foreign tradable securities, \(B^{*}\), and of investment in the adoption of technology, A.

Note that each stochastic component of each yield rate is a random variable normally and independently distributed. Their averages are null, and their respective variances are as follows: \(\sigma_{{ B^{*} }}^{2} {\text{d}}t\), \(\sigma_{ B}^{2} {\text{d}}t\) and \(\sigma_{a}^{2} {\text{d}}t\). The evolution of the price of the domestic non-tradable securities measured in domestic output units is described by the following Brownian motion:

where \(\pi^{*}\) the (average) growth rate of the international price of the securities, and \({\text{d}}p^{*}\) its stochastic component. The latter is exogenous and reflects also the random shock in international prices. dp and \({\text{d}}p^{*}\) are two random variables normally and independently distributed of null means and of respective variances \(\sigma_{p}^{2} {\text{d}}t\) and \(\sigma_{{p^{*} }}^{2} {\text{d}}t\).

Note that \({\text{d}}p^{*}\) could also reflect the random shocks of the terms of trade. Its variance, \(\sigma_{{p^{*} }}^{2} {\text{d}}t\), is considered as being exogenous in this small open economy model. The random components, \({\text{d}}p^{*}\) and dy, are assumed to be independent.

The rate of return on various assets can be calculated by means of Ito’s lemma. The stochastic evolution of the rate of return on non-tradable asset is determined as followsFootnote 5:

In Eq. (8), the expected return rate of a non-tradable assets, r B , is \(r_{B} = \left( {\frac{1}{P} + \pi } \right)\). This is the price of the coupon measured in terms of output units, (1/P), plus the capital gain, π. The tradable securities \(B^{*}\) generate a real average yield equal to the international interest rate, i *, plus \(\pi^{*}\):

2.1.2 The government

The government is represented in this model by the policy measures it is implementing. The economic policy is reflected by the choice of public expenditures, G, the taxation on the income of the domestic producers, T, and the loans, B, from the economy. We assume that the direct tax is different depending on whether the income component is deterministic or random.Footnote 6 We assume that the taxation is applied but on the imported capital goods’ sector so as to focus the analysis on the domestic fiscal policy. The introduction of other forms of direct and indirect taxation makes the representation more complicated without yet having any particular qualitative effect on the conditions of equilibrium at the stationary state examined in the specific case of this paper.

The taxes are then generated by the following stochastic process:

where dh ≡ Adv the stochastic component of the evolution of taxes. The tax applied on the stochastic part of the income is proportional to it at the rate \(\tau^{\prime }\). It is an instrument of macroeconomic regulation; τ the tax rate applied on the deterministic component, aA, of the income.

This choice of the representation of the tax policy reflects the possibility that the perception of this difference (between \(\tau^{\prime }\) and τ) by the agent may influence its decisions and, thus, the inter-temporal allocation of its resources (Turnovsky 1999, 2000). dv is a random variable independently distributed of null mean and of variance \(\sigma_{v}^{2} {\text{d}}t\).

The stochastic behaviour of public expenditures is justified by the government’s unpredicted expenditures throughout the fiscal year. The unforeseen nature of the expenditure is not only because of the uncertainty of some sources of financing, possibly flawed aspect of the predictions and the budget projections, but also to external shocks (that is, terms of trade shocks) that would have an effect on macroeconomic stability constraining the decision-maker to revise its budget plans during the year.Footnote 7 Graham (1992), justifying the necessarily stochastic aspect of public expenditures, puts forward the argument of the risk of profitability engendered by the public project and its effects on the potential improvement criterion of welfare. Public spending, dG, evolves in proportion to income. They are supposed to be generated by the Brownian process as follows:

where g the share of the public expenditures in the income. gaAdz the stochastic component of public expenditures. dv and dz two random variables independent one from the other and overtime, normally distributed and having means and variances, respectively, null and \(\sigma_{v}^{2} {\text{d}}t\) and \(\sigma_{z}^{2} {\text{d}}t\).

The external shocks will, thus, lead the decision-maker to a partial review of the annual plan of public expenditures. This presentation (Eq. 11) differs from that held by Benavie et al. (1996), Turnovsky (1995, 1996) who assign a different rate of public expenditures to each component of the stochastic process, dG. However, our key concern is not exclusively related to the study of the effect of the government expenditure policy.

2.2 Macroeconomic equilibrium

2.2.1 The private agent

The representative agent maximises the expected utility function, u, over an infinite horizon given the inter-temporal stochastic constraint of wealth, dW:

where \(u( C) = e^{ - \rho t} \frac{{C^{1 - \theta } }}{1 - \theta }\) the utility function having the traditional concavity features. ρ a discount parameter; θ the usual risk aversion rate; and θ −1 is the inter-temporal elasticity of substitution; \({\text{d}}W = {\text{d}}\left( {P^{*} B^{*} } \right) + {\text{d}}\left( {PB} \right) + {\text{d}}A - C{\text{d}}t - {\text{d}}T\) the inter-temporal stochastic constraint of wealth.

When using the stochastic equations of the several assets rates of returns (Eqs. 8, 9 and 10), the inter-temporal constraint becomes as follows:

where \(\eta_{B*} = \frac{{P^{*} B^{*} }}{W}\) the share of the foreign tradable assets in the wealth, W; \(\eta_{A} = \frac{A}{W}\) the share of the real asset in the wealth, W; \(\eta_{B} = \frac{PB}{W}\) the share of the domestic non-tradable assets in the wealth, W; and \({\text{d}}w \equiv \eta_{{B^{*} }} {\text{d}}p^{*} + r_{B} {\text{d}}p + \eta_{A} {\text{d}}a - \tau \eta_{A} {\text{d}}v\) the stochastic component of the inter-temporal constraint of wealth. Its mean is null and its variance is \(\sigma_{w}^{2} = E\left( {\frac{{{\text{d}}w^{2} }}{{{\text{d}}t}}} \right)\), which gives us the following expressionFootnote 8:

The representative agent equilibrium is then to choose the optimal shares in its portfolio, η (.), and its optimal inter-temporal consumption plan. It is then a matter of the solving of the optimisation program (12–13), whose solution demonstrated in “Appendix 2” is obtained as follows:

where, \(\varPhi \equiv r_{{B^{*}}}^{*} \eta^{*} + r_{B} \eta_{B} + \left( {1 - \tau } \right)r_{A} \eta_{A}\) is a weighted rate of returns average. It will be considered as the aggregate average rate of return.Footnote 9

Following Turnovsky (2000), Eq. (16) reflects the evolution overtime of the wealth–consumption ratio, C/W, in terms of the preference and technological parameters. For an adverse risk agent, the higher the wealth variance is, the lower the consumption–wealth ratio will be. Furthermore, and at the same time, a higher wealth variance corresponds to a higher risk which is likely to stimulate consumption at the expense of savings. A positive income effect is thus deduced. We can, then, provide a synthesis of these various effects through computing the overall differential of Expression (16). In fact, \({\text{d}}\left( {C/W} \right) = \left( {1/2} \right){\text{d}}\sigma_{w}^{2} - \left( {1/2} \right)\theta {\text{d}}\sigma_{w}^{2} - \left( {1/\theta } \right){\text{d}}\varPhi + {\text{d}}\varPhi\). The first two terms on the right side of this differential are, respectively, the substitution effect and the income effect of an increase in the wealth variance, \({\text{d}}\sigma_{w}^{2}\). The second two terms are, respectively, the substitution effect and the income effect of a rise in the expected average yield rate, Φ.

It should be noted that the expected average rate of return, Φ, acts on the evolution of the consumption–wealth ratio, C/W. For an agent having a risk aversion, θ > 0, it leads to two effects of opposite directions: a positive income effect of the measurement dΦ and a negative effect of a measurement of \(\left( {1/\theta } \right){\text{d}}\varPhi\) (the substitution effect).

Thus, on the basis of the first-order conditions, we can determine the relations between the differentials of the real yield rates of the assets and the risk premium that is associated with them (Eqs. 17, 18). If the agent is neutral with respect to risk, θ = 0, all the net rate of return will be equal to each other, because in this model, there are neither rigidities nor adjustment costs. In this case, we will see the results of the model in a deterministic context. It is one of the generalisation aspects provided by the current model compared to its deterministic version.

2.2.2 The government

The government is expected to implement fiscal policy. It issues non-negotiable securities under the constraint of a balanced budget, that is to say,

The government finances the public deficit,\(({\text{d}}G - {\text{d}}T)\) through issuing non-tradable securities d(PB), net of interests, \(\left( {PB} \right){\text{d}}R_{B}\). Let us divide the two sides of Eq. (19) by W and replace each of the variables by its expression, we obtain the equation of the budget constraint as follows:

As illustrated by Eq. (20), to get a balanced budget, the government resorts to the budgetary and financial tools. Its objective depends, of course, on the agents’ income that it is influenced by the portfolio allocation, η j, for j = A, B, the productivity, a, and the yield of government securities, r B .

2.2.3 The balance of payments

In the particular case of this model, when there is a trade deficit, the economy would be indebted towards the outside world. External debt is represented by a variety of foreign securities, \({\text{d}}(P^{*} B^{*} )\), accompanied by the interests, \({\text{d}}(P^{*} B^{*} ){\text{d}}R_{{B^{*} }}\). We thus have a “balance of payments” constraint obtained as follows:

This gives,

where \(\omega \equiv \eta_{A} /(\eta_{A} + \eta_{B} )\) is the share of the domestic tradable assets in all domestic assets held by the agent in its portfolio. Equation (22) is the dynamic stochastic equation of accumulation. It is important in so far that it will be used to determine the growth rate of the economy at the stationary state.

2.3 The stationary state

The stationary state is defined as usual by a situation in which all the control variables as well as those of the state evolve at the same rate. The growth rate of the economy at the stationary state is then as follows:

where Ψ refers to the deterministic component of the growth rate of the economy at the stationary state. The stochastic component of the growth rate is obviously that of the wealth constraint (Eq. 14). The endogenous variables of the model have thus to be found while meeting condition (23). In the first stage, we determine the endogenous random components of the various stochastic motions of the model, that is to say, dp, dw and dv as well as their respective motions. In the second stage, we find out their deterministic components.

2.3.1 Determination of the endogenous stochastic components

The determination of the endogenous stochastic components is shown in “Appendix 3”.

For the prices: dp

The prices’ random component, dp, is thus a weighted average of the three random exogenous shocks to which the economy is subjected, namely the random productivity shocks, dy, the public expenditures one, dz, and the terms of trade shocks, dp *, which are all exogenous in the context of this small open economy.

For the taxes: dv

The relationship (25) comes from endogenous adjustments. Indeed, the condition of a balanced budget that results in the (deterministic) tax rate must adjust to the (deterministic) rate of public spending since \(\eta_{A} \left( {g - \tau } \right) = 0\).Footnote 10 In other words, when government expenditures increase by 1 % as consequences to external shocks, should the tax rate also increase by 1 % to maintain fiscal balance. Furthermore, for the same condition, dv must adjust to \({\text{d}}v = \left( {\frac{a}{{\tau^{{\prime }} }}} \right){\text{d}}z\), as shown by Eq. (25). This means that the stochastic component of public spending is also ampler than the stochastic component is high and the tax rate is low. The variable tax is then a stabilising tool of fiscal volatility. It should be remarked that if the tax policy had been uniformly applied to the deterministic and stochastic component of the income (that is, τ = τ′), dv would have adjusted to \({\text{d}}z/\tau^{\prime }\). The endogenous adjustments are then the multiplication function of the random shock of the public expenditures, dz.

For the wealth: dw

The stochastic component of the growth rate at the stationary state (Eq. 25) is a weighted average of the exogenous stochastic components of the model, namely those of the international prices, dp *, those of the national output, dy, and those of the public expenditures, dz, which are, respectively, the primary sources of fluctuations in the small open economies. In fact, given their small sizes, technological backwardness, low competitiveness and the narrowness of their fiscal space, they are more influenced by foreign demand and the terms of exchange. During recessions in major countries, for example, the EU, supplementary finance laws were often decided in small open economies in response to the random shocks thus weakening their macroeconomics.

Finally, once we have determined the second-order moments of these random components, we obtain the share, ω * of the tradable domestic assets out of all the domestic tradable assets held by the agent in its portfolio, as followsFootnote 11:

Equation (27) shows that the share, ω *, of the capital to be intended for the adoption of foreign technology, A out of all the tradable assets is made up of two parts. The first is the difference between the domestic return rate (net of tax) and the expected international one, i *. This differential is positively linked to the share, ω *. Intuitively, the higher the difference, the higher the foreign capital inflows will be. These foreign capital inflows can be other than those of the debt such as foreign direct investments (FDIs). Analytically, the current model allows to explicitly integrate such inflows of capital and to show their positive effect on economic growth. Indeed, η A increases with ω * which increases with the difference between the foreign and the domestic capital rates of returns. In this way, FDI will increase domestic investment because they are both complementary. Foreign capital inflows generate technological externalities that will enable the local productive sector to benefit and thus improve productivity. The difference between the foreign and domestic capital rates of return is probably going to polarise more productive resources and to accelerate the investment in the imitation sector.

Furthermore, it is clear that foreign inflation reduces the difference in real rates of return, reduces the flow of foreign capital and thus limits the share of domestic capital in the aggregate portfolio. We can then suggest a policy indexing the tax rate, τ, to the differential of the rates of return. Thus, the present model brings out the following corollary:

Corollary

For a given difference between the rates of return on domestic and foreign assets, an indexation of the tax in the tradable sector on the foreign inflation prevents the decline in the share of domestic capital in the aggregate portfolio.

This tax policy would also be suggested to avoid the negative effects of a rise in the international interest rate on the foreign capital inflows into the national economy. For the given variances, \(\sigma_{y}^{2} , \sigma_{{p^{*}}}^{2}\), and a tax rate on the stochastic component of income, τ′, we have:

Thus, to maintain the share of assets A in the portfolio constant, whether the interest rate and inflation increase, would require the following condition,

The higher initial productivity (that is high a) in the technology adoption sector is, the weaker the fiscal variation, dτ, needed to offset the effects of a rise in the international interest and inflation rates should be. This is pointed out by the present model.

The second component in Eq. (27), \(2\sigma_{{p^{*}}}^{2} /\theta \left[ {a^{2} \left( {1 - \tau^{\prime} } \right)\sigma_{w}^{2} + 2\sigma_{{p^{*}}}^{2} } \right] ,\) captures the effects of the prices’ volatility, \(\sigma_{{p^{*} }}^{2}\), and of the productivity shock, \(\sigma_{y}^{2}\), on the share, \(\omega^{*}\), of the capital to be intended for the adoption of foreign technology. In fact, \({\text{d}}\omega^{*} /{\text{d}}\sigma_{{p^{*} }}^{*} < 0\) and \({\text{d}}\omega^{*} /{\text{d}}\sigma_{y}^{*} < 0\). Thus, a high volatility of international prices has a contraction effect on the foreign capital inflows, deprives the domestic agents of foreign technology and reduces the opportunities to invest in (A), therefore, the decline in \(\omega^{*}\).

Equation (28) makes it also possible the isolation of the negative effect of the tax policy (τ and τ′) on A and thus on the portfolio allocation held by the agent. This is overlooked in the Benavie et al. (1996) and Turnovsky (1995) papers.

2.3.2 The endogenous deterministic components of consumption, optimal shares of the portfolio and the growth rate

The stationary state growth rate of the economy Ψ is determined by Eq. (23). It follows that on the basis of the dynamic equation of the balance of payments (Eq. 22), we have,

Thus,

The determination of the deterministic components at the stationary state is equivalent to determining the optimal shares in the portfolio, η j, the share of consumption in the wealth, C/W, the expected growth rate, Ψ, and the aggregate yield rate, Φ.

Thus, we have a simple linear system of six equations with six unknowns, as shown in “Appendix 5” where the solution is obtained as follows:

where \(h \equiv (1 + \bar{d}\omega )\).

We thus establish the growth rate of the economy at the stationary state Ψ given by Eq. (34′). This growth rate is increased by the rate of the weighted average yield rate of all the assets, Φ. On the other hand, it is decreasing by the preference parameters ρ and θ. These results proved the standard endogenous growth models (Lucas 1988). The economic growth rate is also decreasing with the share of consumption in the wealth, C/W. Moreover, the wealth variance is negatively correlated with growth. Previously, we have shown this relationship by the risk to the agent with respect to his future wealth, which is probable to lead to stimulation of the current consumption and thus the weakening of stationary state growth because of the low rate of accumulation. For the effect of taxation policy, it is discussed below.

3 The tax policy effects on the welfare in a stochastic framework

When formulating their expectations, the agents take into account the variability of tax policy in their investment, consumption and portfolio allocation decisions. We will examine this issue using the model elaborated above. It allows an extension to the work of Hopenhayn and Maniagurria (1996), inspired from Aizenman and Marion (1993), and studying the effects of investment taxation variability on growth and welfare. This extension is as follows:

-

The random productivity shocks and the relative prices simultaneously take into consideration, whereas they were overlooked in the work of Hopenhayn and Maniagurria (1996).

-

The stochastic aspect of production, of accumulation, and of the economic policy is introduced, while in the work of these two authors, only the tax policy is stochastic.

-

The adoption of a more general value function. One adopted by these authors is analytically limited, because it leads to a monotonically decreasing relationship between taxation and welfare with no possible threshold effects.

A fiscal policy scheme is defined by the way it is implemented (monotonous or variable). Let z t be a random variable taking the “zero” value if the tax policy is implemented in a monotonous manner and “one” if otherwise. Let δ be the occurrence rate of the tax scheme change. The expected duration of the scheme is then 1/δ. We assume that the agents expect the implementation of the policy before taking decisions.

A modified version of Eq. (10) allows us to describe the evolution overtime of the taxes. It is then,

First, we have to study the case where the fiscal policy is applied in the same way it is originally designed, that is, the deterministic and stochastic tax rates, τ and τ′ are known in advance by the agents. In a second step, we introduce the expected variability, δ, of the tax policy. Comparisons between both cases will be made.

3.1 Effect of the deterministic taxation on welfare

We determine the value of welfare on the basis of the value function \(V\left( . \right),\) and we simulate the effects of a change in the level of deterministic taxation on welfare, for given levels of stochastic taxation rates. Using the Bellman equation, shown in “Appendix 2”, we have:

By substituting (C/W) by its equilibrium value [Eq. (48) in Appendix 2], and taking into account that \(V\left( {X\left( W \right),t} \right) = e^{ - \rho t} \kappa W^{ - \theta - 1}\), then, the taxation effect on welfare would be captured by that applied on the value function. By replacing Φ and \([\kappa \left( {1 - \theta } \right)]^{ - \theta - 1}\) by their respective values of the stationary state, in Eq. (35), and by standardising wealth to unity, we obtain the Bellman equation as follows:

It is clear that according to Eq. (37), the only value indicator is κ. To simulate the tax policy, the standard calibrated values usually used in the literature of the real business cycles, namely ρ = 0.02; θ = 2; and a = 0.16 are chosen. The international real interest rate \(r^{*}\) and the real interest rate on government securities, r B , are, respectively, fixed at 4 and 5 %. The stochastic parameters of the model are respective standard deviations of the productivity shock, σ y , of the public expenditures, σ z , and of the terms of trade, σ p . The respective chosen values are of 0.2; 0.02; and 0.6. Note that the value of σ y is taken from estimates made by Gali (1994) on 61 developing countries, whereas those of σ z and \(\sigma_{{p^{*} }}\) are from Gavin and Hausmann (1995) on the basis of estimates made on 60 developing countries. Several of Turnovsky and Chattopadhyay (2003) works accept these parameters for other similar cases. An estimation of the required parameters for a particular case would be more suitable.

The results are given for each stochastic taxation value, τ′, and according to various deterministic taxation values, τ (Tables 1, 2, 3).

When we examine these four tables horizontally, we notice, as expected, that the deterministic taxation rate, τ, affects negatively welfare as it becomes higher. Taxation reduces the available income in the sector of technology imitation and thus savings. Consequently, the investment decreases. This acts negatively on welfare in this particular framework. This particular result is also obtained by Easterly and Rebelo (1994) in an empirical study on a sample of countries and by Sialm (2006) showing that stochastic taxation affects returns of both risky and safe assets.

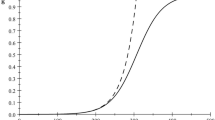

With regard to the effect of the stochastic income taxation, τ′ on welfare, the obtained results are important in so far that they highlight a threshold effect. By examining vertically the four tables together, we notice that for each tax rate of a deterministic income τ, welfare increases as taxation on the stochastic income, only τ′ is higher at a 40 % threshold (Table 4). This result is because of the expectations of the agents having a risk aversion who prefer to direct their resources towards the non-random income activity so long as the deterministic taxation, τ, has not gone beyond 40 %. Beyond this threshold, revenues and therefore the welfare are negatively affected by the stochastic tax. This effect is obtained when the taxation rate of the deterministic component exceeds the above-mentioned threshold. At this threshold, an additive effect of the two taxes is brought out. It is in this case that we find only the result of Hopenhayn and Maniagurria (1996) who take for random only the tax measure, thus overlooking the expected effects on the wealth variation, \(\sigma_{w}^{2}.\) According to Smith (1996), the effect of the tax variability may be positive or negative on savings therefore welfare, depending upon whether economic agents are averse to inter-temporal substitution. However, this relationship is monotonous, and the analysis did not show a limit to this effect because of the linear relationships used by the author in the assessment of the tax variability effects.

3.2 Tax policy variability’s effect on welfare

The fiscal policy’s variability is shown by the occurrence rate, δ. The higher this rate is, the more variable the tax policy will be. We refer to the approach of Lucas (1987) to use the “offsetting variation” in welfare following a tax policy. This involves comparing the welfare between a situation where tax policy is monotone, \(\rho \kappa (z\_t = 0),\) and where it is variable, \(\rho \kappa (z\_t = 1)\). To do so, we add to the value function a welfare differential capturing the effect of the shift from a monotonous tax scheme, \(z_{t} = 0\), to a variable tax one, \(z_{t} = 1\). These two situations are rendered by,

The offsetting variation in welfare because of the change in the tax scheme is accounted for in Eqs. (38) and (39) by \(\delta \left[ {\kappa \left( {z_{t} = 0} \right) - \kappa \left( {z_{t} = 1} \right)} \right].\)

From the Bellman equation taken up successively in the case of the schemes \(\left( {z_{t} = 0} \right)\) and \(\left( {z_{t} = 1} \right)\), the values corresponding to each, \(\kappa \left( {z_{t} = 0} \right)\) and \(\kappa \left( {z_{t} = 1} \right)\), are thus the solution of a simple system of two Eqs. (38) and (39) whose solution is given as follows:

where κ (0) the welfare index corresponding to the scheme not initially subjected to taxation; κ (1) the welfare index corresponding to the scheme subjected to taxation;

For the same values of preference and technological parameters previously retained, the results of the simulations on the tax policy and its variability effect on welfare are obtained for various values of δ and several values of τ. We define \(\bar{\kappa }\), as a simple average of κ(0) and κ(1) capturing a measurement of long-term welfare.Footnote 12 This average is that of the subsequent utility with equal probabilities, which corresponds to a stable distribution. We show through the simulationsFootnote 13 that the distinction between the low-frequency and the high-frequency changes in the fiscal system is critical to the analysis of the results.

Table 5 is devoted to the results about low variability of the fiscal policy, that is to say, for long-anticipated periods (that is for values of 1/δ) which are high: [δ \(\prec\) 1]: δ = 0.12 and δ = 0.5). Table 6 recaps the results of the high variability in tax policy, in other words, for short periods (that is, for values of 1/δ) which are low: [\(\delta \ge 1\)]: \(\delta = 1; \delta = 1.2\); and \(\delta = 5\)).

In the last two Tables 5 and 6, for all levels of variability variety, the lowest welfare corresponds as expected to the most restrictive tax policy. The category of low-frequency system (Table 5) shows a variability of greater magnitude in the taxation policy. In this case, the obtained results show that the higher the expected variability, the higher the negative effect on welfare is. When it is expected to be considerably altered, a reluctance to invest characterises the behaviour of the representative agent, and a substitution effect prevails over the income effect. However, beginning from a 30 % tax rate, the trend is seen to be inversed. This is interpreted, as far as an agent having a risk aversion is concerned, by an income effect prevailing over the substitution effect, as illustrated in the interpretation of Eq. (16). We will see that this is because of the low-frequency system category.

The second category concerns the high-frequency tax system (Table 6). What we have here is then a tax policy with low extent variability, τ. Only if the tax rate is weak (10 %) that we find a negative effect of tax variability on welfare. Although the levels of welfare corresponding to the tax rates which are higher than 10 % are lower than those obtained in the case of low frequencies, we notice a slight improvement in welfare in proportion with variability. This result is a priori surprising. However, a high frequency does not necessarily mean big amplitude. Indeed, for the same time interval, dt, the more the variable τ oscillates the less high its amplitude will be. In this case, consumption as well as welfare would tend to be smooth when the frequency of the fiscal policy is high.

The threshold effect is outlined for the case of low-frequency variability. This effect was impossible to get in the Hopenhayn and Maniagurria (1996) model which does not integrate the endogenous stochastic adjustments developed above.

The results of the following table (Table 7) also show that the faster the change of the system is made, the higher the cost in welfare \(C\kappa \left( \tau \right) = [\kappa \left( {z_{t} = 1} \right) - \kappa \left( {z_{t} = 0} \right)],\) will rise albeit at a decreasing pace (Table 8).

Thus, we deduce from this the importance of the measures that would stabilise the pace of change in the implementation of the tax policy to avoid the resulting deterioration of welfare. Otherwise, it would be advisable to offset the cost in welfare incurred by the agent during the implementation of an unstable tax policy.

4 Conclusion

Through a more generalised stochastic growth model than that of Turnovsky (2002, 2003), we elaborate for an emerging open economy that imitates foreign technology, some economic policy recommendations have also been made. For a given difference between the rate of return on domestic and foreign assets, an indexation of the tax in the tradable sector on the foreign inflation prevents the decline in the share of domestic capital in the portfolio, which would stimulate economic growth. This measure is also proposed to help avoid the negative effects of a rise in the international interest rate on foreign capital inflows into the national economy, given the foreign inflation rate.

Regarding the study of the variability in the tax policy effects on welfare, it is carried out through a generalisation of the results of Hopenhayn and Maniagurria’s (1996) (HM) model. The numerical simulation of the model yielded a threshold effect of fiscal policy on welfare. This threshold has not been obtained by (HM): for each deterministic tax rate, welfare rises in proportion with the rise in the stochastic component of the tax policy up to a 40 % threshold. This effect becomes negative when the deterministic component of the tax policy exceeds the above-mentioned threshold. Indeed, the agents having a risk aversion prefer to direct their resources towards an activity generating a guaranteed income so long as the deterministic taxation has not exceeded 40 %. At this threshold, we start having an additive and negative effect of these two taxes (deterministic and stochastic) on welfare. Only in this case, we get the particular result of Hopenhayn and Maniagurria (1996). In their model, the tax policy is only considered random, while the effects of the variance of wealth (behind the comparative effects of substitution and income) are neglected.

Furthermore, an important distinction we do between a high-frequency tax system and a low-frequency one. This distinction enabled us to conclude that for the low-frequency system, the expected variability affects negatively the welfare. For an agent having a risk aversion when the future income for investment is expected to be considerably altered because it is uncertain, then investment goes down, and income and thus welfare. This effect stops being verified from a 30 % taxation level. The reversal of the trends at this threshold is because of the risk aversion behaviour explaining that the income effect starts prevailing over the substitution effect at this threshold.

For the high-frequency tax systems category, for the same time interval, the more the taxation rate oscillates the less high its amplitude will be. In this case, consumption as well as the welfare tends to become smooth compared with the first category of weak frequencies. A learning mechanism is established in the case of the high-frequency regime when the agent with risk aversion makes its expectations.

The resulting cost in welfare from the implementation of an unstable tax policy would suggest a need for the implementation of stabilisation measures, or failing that, measures of compensation transfers.

Finally, because the assumption of rational expectations is critical in obtaining the results, it is first necessary to verify in future empirical work on the real economies with specific calibrated parameters.

Notes

See Agénor et al. (2000) for more extensive description.

Ito’s Lemma can be read as follows: Let n Ito’s one-dimensional process, S i , each given by \({\text{d}}S_{i} = \mu_{i} {\text{d}}t + \sigma_{i} {\text{d}}Z_{i}\) \(i = 1 , \ldots ,n.\) Let’s assume \(y = u\left( {t, S_{1} , S_{2} , \ldots , S_{n} } \right):[0, T] \times R\), has continuous partial derivatives \(u_{t} , u_{{S_{i} j}} , i, j \le n\). Thus, the process \(u\left( {t, S_{1} , S_{2} , \ldots , S_{n} } \right)\) is also an Ito’s process given by: \({\text{d}}y = u_{t} {\text{d}}t + \mathop \sum \limits_{i} u_{{S_{i} }} {\text{d}}S_{i} + \frac{1}{2}\mathop \sum \limits_{i} \mathop \sum \limits_{j} u_{{S_{i} S_{j} }} {\text{d}}S_{i} {\text{d}}S_{j}\).

We assume that the taxation is applied but on the imported capital goods’ sector so as to focus the analysis on the domestic fiscal policy. The introduction of other forms of direct and indirect taxation makes the representation more complicated without yet having any particular qualitative effect on the conditions of equilibrium at the stationary state examined in the specific case of this paper.

The case of Tunisia in 2013 is an example. The strong unexpected depreciation of the Dinar and the high price volatility of fuel added to the unexpected public expenses have significantly reduced the fiscal space and imposed restrictive regulatory measures as well as a complementary finance law passed by the end of the fiscal year.

See proof in “Appendix 1”.

See proof in “Appendix 3”.

See proof in “Appendix 4”.

See the simulation results of the effects of the tax policy κ(0) and κ(1) for each tax level, τ, in the overall simulation results in the “Appendix 6”.

The simulations are carried out using programming on Gauss95.

CAPM: Capital Asset Pricing Model. See a synthesis in Ingersoll (1987).

References

Agénor P, McDermott C, Prasad E (2000) Macroeconomic fluctuations in developing countries: some stylised facts. World Bank Econo Rev 14:251–285

Aizenman J, Marion N (1993) Policy uncertainty, persistence and growth. Rev Int Econ 1:145–163

Benavie A, Grinols E, Turnovsky SJ (1996) Adjustment costs and investment in a stochastic endogenous growth model. J Monet Econ 38:77–100

Benveniste L, Scheinkman J (1979) Duality theory for dynamic optimization models of economics: the continuous time case. J Econ Theory 27(1):1–19

Blanchard OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93(2):223–247

Burnside C, Tabova A (2009) Risk, volatility, and the global cross-section of growth rates. NBER Working Paper No. 15225. (August)

Calvo G, Mendoza E (1994) Trade reforms of uncertain duration and real uncertainty: a first approximation. Staff Pap Int Monet Funds 41(4):555–586

Chaouachi S, Chebbi A, Knani R (2013) Regimes Markov models with endogenous transition probabilities: modeling fluctuations in Tunisia. J Econ Int Financ 5(6):239–247

Chebbi A, Louafi R, Hedhli A (2013) Financial fluctuations in the Tunisian repressed market context: a Markov-switching–GARCH approach. Macroecon Financ Emerg Mark Econ. doi:10.1080/17520843.2013.781048

Cohen D (1995) Large external debt and (slow) domestic growth. A theoretical analysis. J Econ Dyn Control 19:1141–1163

Diebold FX, Yilmaz K (2008) Macroeconomic volatility and stock market volatility, worldwide. NBER Working Paper No. 14269 (August)

Easterly W, Rebelo S (1994) Fiscal policy and economic growth: an empirical investigation. NBER Working Paper No. 4499 (May)

Fernández-Villaverde J, Guerrón-Quintana PA, Rubio-Ramírez J, Uribe M (2009) Risk matters: the real effects of volatility shocks. NBER Working Paper No. 14875 (April)

Gali J (1994) Government size and macroeconomic stability. Eur Econ Rev 38:117–132

Gavin M, Hausmann R (1995) Overcoming volatility in Latin America. Inter-American Development Bank, Washington

Graham DA (1992) Public expenditure under uncertainty: the net-benefit criteria. Am Econ Rev 82(4):822–846

Hopenhayn H, Maniagurria ME (1996) Policy variability and economic growth. Rev Econ Stud 63:611–625

Ingersoll JE Jr (1987) Theory of financial decision making. Rowman and Littlefield, Lanham

Joshi S (1998) A framework to analyze comparative dynamics in a continuous time stochastic growth model. Econ Modelling 15:125–134

Lucas RE Jr (1987) Models of business cycles. Basic Blackwell, New York

Lucas RE Jr (1988) On the mechanics of economic development. J Monet Econ 22:3–42

Mendoza E (1995) Terms of trade, the real exchange rate and economic fluctuations. Int Econ Rev 36:101–137

Mendoza E (1996) Terms of trade, uncertainty and economic growth. J Dev Econ 54:323–356

Mendoza EG, Milesi-Ferretti GM, Aseac P (1997) On the ineffectiveness of tax policy in altering long-run growth: Harberger’s superneutrality conjecture. J Public Econ 66(1):99–126

Merton RC (1971) Optimum consumption and portfolio rules in a continuous-time case. J Econ Theory 3:337–413

Merton RC (1973) An intertemporal capital asset pricing model. Econometrica 41:867–888

Merton RC (1975) An asymptotic theory of growth under uncertainty. Rev Econ Study 2:375–393

Mulligan CB, Sala-I-Martin X (1993) Transitional dynamics in two-sector models of endogenous growth. Q J Econ 108(3):739–773

Obsfeld M, Rogoff K (1999) New direction for stochastic open economy models. National Bureau of Economic Research. Working Paper No. 7313 (August)

Rebelo S (1991) Long run-policy and long run-growth. J Polit Econ 99:500–521

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Sargent JT (1987) Dynamic macroeconomic theory. Harvard University Press, Cambridge

Sargent JT, Wallace N (1975) Rational expectations, the optimal monetary instrument, and the optimal money supply rule. J Polit Econ 83(2):241–254

Sialm C (2006) Stochastic taxation and asset pricing in dynamic general equilibrium. J Econ Dyn Control 30:511–540

Smith WT (1996) Taxes, uncertainty, and long-term growth. Eur Econ Rev 40(8):1647–1664

Turnovsky SJ (1995) Methods of macroeconomic dynamics. MIT Press, Cambridge, MA

Turnovsky SJ (1996) Fiscal policy, adjustment costs, and endogenous growth. Oxf Econ Pap 48:361–381

Turnovsky SJ (1999) Productive governments expenditure in a stochastically growing economy. Macroecon Dyn 3:544–570

Turnovsky SJ (2000) Methods of macroeconomic dynamics, 2nd edn. MIT Press, Cambridge, MA

Turnovsky SJ (2002) Growth in an open economy: some recent developments. In: Dombrecht M, Smets J (eds) How to promote economic growth in the euro area? Edward Elgar, Cheltenham, UK, pp 9–56

Turnovsky SJ (2003) Taxes and welfare in a stochastically growing economy. In: Altug S, Chadha J, Nolan C (eds) Dynamic macroeconomic analysis. Cambridge University Press, Cambridge, pp 155–211

Turnovsky SJ, Chattopadhyay P (2003) Volatility and growth in developing economies: some numerical results and empirical evidence. J Int Econ 59:276–295

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 Calculation of stochastic movements in asset prices and applications of Itô lemma

All assets in this model are measured in terms of domestic output.

-

Determination of the return rate, \({\text{d}}R_{B}\), of the non-tradable government securities:

The return on the title is based on the initial value, B, of the title. By definition, the evolution of the value of government bonds, B, is as follows: \({\text{d}}B / B \equiv i{\text{d}}t\) it is the evolution of the nominal value during the period dt. With \(i = 1/P_{B}\) that reports a single unit of assets measured in terms of real output.

Apply Ito’s lemma to determine the evolution of return, \({\text{d}}R_{B}\), as

Since \(\frac{{{\text{d}}P_{B} }}{{P_{B} }} = \pi_{B} {\text{d}}t + U_{{P_{B} }}\).

Then,

According Itô’s conditions, we obtain,

Equation (42) is simply Eq. (3) of the text. Thus, the expected rate of return of non-tradable shares is none other than the price of the coupon, \(\frac{1}{{P_{B} }}\), plus capital gain, \(\pi_{B}\).

-

Determination of the expressions of interest rate, \(R_{{B^{*} }}\), of the foreign debt

We have, \({\text{d}}R_{{B^{*} }} = r_{{B^{*} }} {\text{d}}t + {\text{d}}U_{{B^{*} }}\). For definitions, such as \(\frac{{{\text{d}}B^{*} }}{{B^{*} }} = i^{*} {\text{d}}t\), and \(R_{{B^{*} }} = P^{*} B^{*}\), with, \(\frac{{{\text{d}}P^{*} }}{{P^{*} }} = \pi^{*} {\text{d}}t + {\text{d}}P^{*}\).

The Itô’s development gives,

This allows us to have an expression similar to that obtained for calculating the return on government securities. Equation (43) is simply Eq. (9) in the text.

1.2 Determination of the expression of the variance of wealth

By definition \(\sigma_{w}^{2} = E\left( {\frac{{{\text{d}}W^{2} }}{{{\text{d}}t}}} \right)\). On the other hand, \({\text{d}}w = \eta_{{B^{*} }}^{*} {\text{d}}p^{*} + \eta_{B} {\text{d}}p + \eta_{A} {\text{d}}a - \tau^{\prime } \eta_{A} {\text{d}}v\).

Variance of wealth is obtained by calculating var(dw) as,

Just calculate the covariance between the terms of dw, two by two, to get a simpler form of the variance (44)

Equation (44) is simply Eq. (15) of the text. \(\sigma_{w}^{2} = \eta_{A} \text{cov} \left( {{\text{d}}w, {\text{d}}y - \tau^{\prime} ,{\text{d}}v} \right) - \eta_{{B^{*} }}^{*} \text{cov} \left( {{\text{d}}w, {\text{d}}p} \right) + \text{cov} ({\text{d}}w, {\text{d}}p_{B} )\).

Appendix 2

Resolution of the stochastic optimisation program (12–14)

The equilibrium of the representative agent is to choose the optimal shares of its portfolio and its optimal inter-temporal consumption plan. The first stage is to establish the stochastic Bellman equation as,

Such that V(W, t) is the value function. \(L_{w} (.)\) is the differential generator function

This amounts to:

With,

The Lagrange function, L, corresponding to the optimisation program is as follows:

With: v the usual Lagrange multiplier.

The first-order conditions are as follows: \(\partial L/ \partial C = \partial L / \partial \eta_{A} = \partial L / \partial \eta_{B} = \partial L/\partial \eta_{{B^{*} }} = \partial L/ \partial v = 0\)

According to the temporal separability of the value function (Benveniste and Scheinkman 1979), we can define X(W, t) as: \(V (W, t) \equiv V(X, W, t) \equiv e^{ - \rho t} X(W,t).\) The derivatives of first and second order of the function value, V(W, t) are then determined by those of X(W, t). On the other hand, u(C) is a hyperbolic utility function class with a constant risk aversion which allows the conversion to the following general form (Sargent 1987): \(u\left( C \right) = \kappa W^{1 - \theta }\) where κ a real constant to determine after. Note that,

And,

The Bellman stochastic equation (42) becomes as follows:

After taking into account the constraint \(\eta_{A} + \eta_{B} + \eta_{{B^{*} }} = 1\), the necessary conditions are as follows,

The transversality condition is, \(\mathop {\lim }\nolimits_{t \to \infty } E\left( {e^{ - \rho t} W^{\theta } } \right) = 0\).

By replacing (C/W) by \(\left( {1 - \theta } \right)\kappa^{ - 1/\theta }\) and resolve the system defined by the first-order conditions, we obtain:

Using the bi-symmetric property of the covariance, we can transform these equations as follows,

These two equations are, respectively, those (17) and (18) in the text.

Appendix 3: The determination of the endogenous stochastic components

-

for le prices: dp

Since \(\eta_{i} /\eta_{j}\) is constant and independent of the utility for \(i \ne j\) and \(i,j = A, B, B^{*}\), in the equilibrium, all investors hold shares determined by the market. The returns of different assets correspond to those of CAPM model type.Footnote 14

Then, \(\frac{{\eta_{B} }}{{\eta_{{B^{*} + \eta_{A} }} }} = \frac{PB}{{P^{*} B^{*} + A}}\) remains constant. Then,

By the Ito Lemma, we have,

where,

Equating the terms between them and the stochastic terms of the deterministic equations (57) together, we get the expression of stochastic component of the evolution of the price as follows,

Equation (56) is that (24) in the text

-

for le tax: dv

From the budget constraint of the state (20) and Eq. (56), we have:

Equating the terms between them and the stochastic terms of the deterministic equations (57) together, we get:

Equation (58) is simply Eq. (25) of the text.

-

for the wealth: dw

Substituting dp and dv by their respective values of Eqs. (56) and (58) in the expression of w, we obtain

Equation (59) is simply Eq. (26) of the text.

Appendix 4: Determination of the second-order moments

The second-order moments are obtained by a simple calculation of the variances of stochastic endogenous components (56, 58, 59) such that the exogenous random shocks are independent. It then comes:

Given the first-order conditions and equations (56, 58, 59), the second-order moments are obtained as follows:

And,

Remplace the expressions of the second-order moments in the first-order conditions to obtain:

Since \(a = r_{A}\) and \((i^{*} + \pi^{*} ) = r^{*} ,\) then replacing them in the equations of differential rates of return (net of tax) and solving for \(\omega\), we find the value of \(\omega^{*}\) at the steady state:

This is just Eq. (27) of the text.

Appendix 5

The simultaneous equations system in the deterministic components:

It is therefore a system of six equations with six unknowns determined as follows:

And,

Appendix 6: Program on Gauss95 to simulate the effect of tax policy on welfare

-

new;

-

library pgraph;

graphset;

output file = p.out reset;

n = 10;

tauprime = 0.0;

a1 = 0.02;

a2 = 2;

a4 = 0.04;

a5 = 0.05;

a6 = 0.06;

a7 = 0.2;

a = 0.16;

a8 = 0.2;

a9 = 0.2;

d = 0.24;

g = 0.2;

tau = zeros(n,1);

a3 = zeros(n,1);

h = zeros(n,1);

phi = zeros(n,1);

x = zeros(n,1);

y = zeros(n,1);

k = zeros(n,1);

xsi = zeros(n,1);

j = 1;

do while j lt n;

tau[j + 1] = tau[j] + 0.1;

j = j+1;

endo;

j = 1;

do while j le n;

a3[j] = ((1-tau[j])*a -a5 +2*a2*a8)/a2*(a*(1-tauprime)*a9 + 2*a8);

H[j] = (a1-0.5*a2*(1-a2)*a7)/a2 -((1-a2)/a2)*

((1-a3[j])*a4/(1 + d*a3[j])

+ d*a3[j]*a5/(1 + d*a3[j]) +(1-tau[j])*a3[j]*a6/(1 + d*a3[j]));

xsi[j] = d*a3[j]*a5/(1 + d*a3[j]) + a*(1-g)*a3[j]^2/(1 + d*a3[j]) +

(a4*(1-a3[j])^2)/(1 + d*a3[j])- ((1 + d*a3[j])/a3[j])*h[j];

j = j + 1;

endo;

tau ~ xsi;

xlabel(“tau”);

ylabel(“welfare”);

title (“Welfare tax policy effect”);

x = seqa(0,0.1,n);

y = k;

@xy(x,y);

@

end;

-

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Chebbi, A. Stochastic growth, taxation policy and welfare cost in an open emerging economy. Int Rev Econ 62, 57–84 (2015). https://doi.org/10.1007/s12232-014-0216-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-014-0216-6

Keywords

- Stochastic endogenous growth

- Brownian process

- Emerging economy

- Unstable tax policy threshold

- Welfare

- Simulations