Abstract

Starting from August 2007, the FED intervened by injecting liquidity in the inter-banking market and reducing interest rates. Day after day, the financial markets register negative trends and rallies. This is not due to events which are particularly related to the market itself. This appeared in the days when there were government interventions, when everybody expected a positive sign in the financial market but a negative sign occurred. Sometimes, this is due to the intensity of actions taken by the governments. The markets always expect appropriate interventions (in terms of intensity). Looking at these market reactions (in unexpected signs) after each government action, we can suppose that policy makers underestimate the intensity of this crisis. The capacity of making enforcement on the system should avoid underlining the side of governance rules which will never be precise. Being able to count on an active control of the market dealers, broadly speaking is a way of giving active confidence to individual/institutional agents who decide the allocations of saving in the financial market. There is no such confidence at the moment, if one focuses only on the definitions of new rules. If one starts from existing rules and does continuous monitoring so that they are applied adequately at crucial moments, then one could reduce the possibility of facing new exceeding volatilities of banking securities in the stock market. This work is focused on understanding how governance as well as central banks’ policy impact on the crisis, as well as possible future scenarios.

Similar content being viewed by others

Notes

Federal Open Market Committee (FOMC) is the committee of the Federal Reserve System that is in charge to decide the interest rate of the US market on a 6-week basis.

It is well known that in a monopoly, the monopolist cannot use both price and quantity to define the total revenue. Here, in this extraordinary historical moment, the Central Bank (the monopolist in printing money) uses both monetary aggregates and interest rate to help the market to find the right direction to exit the crises.

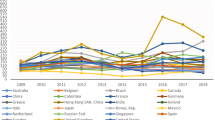

Here one point should be mentioned about the work of American Central Bank. If looking at the trend of the US interest rates, we can notice that it has been reduced to face this period of crisis. We have to ask whether (i) the interest rates were kept high for too long or it should not have been reduced in advance with respect to the market; (ii) the interest rates were kept low for too long or it should not have been raised in advance with respect to the market; this second aspect has a direct impact on the system associated credit risk. In 2003 and 2004 (see Fig. 1), a particular agent who had a credit score to borrow at 1% (adjustable) for a medium/long-term period might not have a credit score to borrow at 5.25% when the interest rates went up. This increase was not in the nominal interest rate but in the individual credit risk that was transformed into systematic risk from the demand side. This error was made in the pre-bubble period, and we hope that the same mistake will not be made also in the post-crisis period. From the supply side, the banking system is allowed to renegotiate (according to the contract) previous loans. The crisis started to appear in 2007 was not a coincidence. Two years earlier, a large number of loans with non-sustainable interest rates were renegotiated to a higher interest rate with respect to the initial rate of 1%.

References

Acharya VV, Richardson M (2009) Restoring financial stability. Wiley, New Jersey

Bagella M, Ciciretti R (2005) News Terroristiche e Mercati Finanziari. In: Goisis G, Parravicini P (eds) Politica monetaria, debito, inflazione: la fase attuale. LED, Milano, pp 9–16

Bagella M, Becchetti L, Ciciretti R (2007a) Market vs analysts’ reaction: the effect of aggregate and firm specific news. Appl Financ Econ 17(4):299–312

Bagella M, Becchetti L, Ciciretti R, Trenta U (2007b) I Mercati Finanziari Hanno un’Anima? Governance ed Eventi. Bancaria Editrice, Rome

Bagella M, Ciciretti R, Paesani P (2008) Monetary policy and stock market risk perception in the US. In: Fuchs EJ, Braun F (eds) Emerging topics in banking and finance. Nova Science, pp 187–200

Bank of England (2007) Financial stability report, October

Barsky RB, De Long JB (1990) Bull and bear markets in the twentieth century. J Econ Hist 50(2):265–281

Oldani C (2008) Governing global derivatives. AshGate Publs, London

Acknowledgments

The authors would give special thanks to Ugo Trenta and Mirko Iori for their help in collecting inter-banking market data.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bagella, M., Ciciretti, R. Financial markets and the post-crisis scenario. Int Rev Econ 56, 215–225 (2009). https://doi.org/10.1007/s12232-009-0072-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-009-0072-y