Abstract

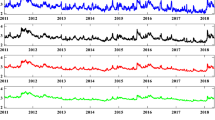

This study measures dynamic volatility spillovers and identifies the connectedness network across 11 Australian Securities Exchange (ASX) sector indices using the spillover index methodology of Diebold and Yilmaz (J Econ 182:119–134, 2014). Additionally, we visualize volatility connectedness relationships as links within a complex network to capture the propagation path of volatility connectedness across the 11 ASX sectors. Our results indicate that recent financial crises intensified the degree of volatility connectedness across the 11 ASX sectors, supporting the contagion hypothesis. Importantly, the financial sector is the main transmitter of volatility connectedness across the 11 ASX sector markets.

Similar content being viewed by others

Notes

Derived from World Federation of Exchanges (WFE) data. Accessed https://statistics.world-exchanges.org/, 30 December 2020. Figures are for Calendar 2019.

We use the open-source Gephi software to visualize network graphs (https://gephi.org).

References

Adrian T, Brunnermeier M (2008) CoVaR. Staff report 348. Federal Reserve Bank of New York

Awartani B, Maghyereh AI, Al Shiab M (2013) Directional spillovers from the U.S. and the Saudi market to equities in the Gulf cooperation council countries. J Int Financ Markets Inst Money 27:224–242

Balli F, Balli HO, Hong R (2016) Spillover effects on the sectoral returns for Australian and New Zealand equity markets. J Econ Financ 40:568–589

Barbi AQ, Prataviera GA (2019) Nonlinear dependencies on Brazilian equity network from mutual information minimum spanning trees. Physica A 523:876–885

Basu, S. Das, S. Michailidis, G. Purnanandam, A., 2017. A system-wide approach to measure connectivity in the financial sector (November 15, 2019). Available at SSRN: https://ssrn.com/abstract=2816137 or https://doi.org/10.2139/ssrn.2816137

Baumöhl E, Kočenda E, Lyócsa Š, Výrost T (2018) Networks of volatility spillovers among stock markets. Physica A 490:1555–1574

Billio M, Getmansky M, Lo AW, Pelizzon L (2012) Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J Financ Econ 104:535–559

Budd BQ (2018) The transmission of international stock market volatilities. J Econ Financ 42:155–173

Caporale GM, Pittis N, Spagnolo N (2006) Volatility transmission and financial crises. J Econ Financ 30(3):376–390

Cimini R (2015) Eurozone network “connectedness” after fiscal year 2008. Financ Res Lett 14:160–166

Demirer M, Diebold FX, Liu L, Yilmaz K (2018) Estimating global bank network connectedness. Appl Econometrics 33:1–15

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28:57–66

Diebold FX, Yilmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econ 182:119–134

Diebold FX, Yilmaz K (2016) Trans-Atlantic equity volatility connectedness: U.S. and European financial institutions, 2004-2014. Journal of Financial Econometrics 14(1):81–127

Etesami J, Habibnia A, Kiyavash N (2017) Econometric modeling of systemic risk: going beyond pairwise comparison and allowing for nonlinearity. SRC discussion paper (no. 66). Systemic Risk Centre, The London School of Economics and Political Science, London, UK

Fernández-Rodríguez F, Gómez-Puig M, Sosvilla-Rivero S (2016) Using connectedness analysis to assess financial stress transmission in EMU sovereign bond market volatility. J Int Financ Markets Inst Money 41:126–145

Garman MB, Klass MJ (1980) On the estimation of security price volatilities from historical data. J Bus 53(1):67–78

Gong C, Tang P, Wang Y (2019) Measuring the network connectedness of global stock markets. Physica A 535:122351

Greenwood-Nimmo M, Nguyen VH, Rafferty B (2016) Risk and return spillovers among the G10 currencies. J Financ Mark 31:43–62

Grieb T (2015) Mean and volatility transmission for commodity futures. J Econ Financ 39:100–118

Hué S, Lucotte Y, Tokpavi S (2019) Measuring network systemic risk contributions: a leave-one-out approach. J Econ Dyn Control 100:86–114

Jain P, Sehgal S (2018) An examination of return and volatility spillovers between mature equity markets. J Econ Financ 43:180–210

Kang SH, Lee JW (2019) The network connectedness of volatility spillovers across global futures markets. Physica A 526:120756

Kang SH, Mclver R, Yoon S-M (2017) Dynamic spillover effect among crude oil, precious metal, and agricultural commodity futures markets. Energy Econ 62:19–32

Kang SH, Yoon S-M (2019) Financial crises and dynamic spillovers among Chinese stock and commodity futures markets. Physica A 531:121776

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econ 74(1):119–147

Liu X, An H, Li H, Chen Z, Feng S, Wen S (2017) Features of spillover networks in international financial markets: evidence from the G20 countries. Physica A 479:265–278

Long W, Guan L, Shen J, Song L, Cui L (2017) A complex network for studying the transmission mechanisms in stock market. Physica A 484:345–357

Maghyereh AI, Awartani B, Bouri E (2016) The directional volatility connectedness between crude oil and equity markets: new evidence from implied volatility indexes. Energy Econ 57:78–93

Mclver RP, Kang SH (2020) Financial crises and dynamic of the spillovers between the U.S. and BRICS stock markets. Res Int Bus Finance 54:101276

Mensi W, Boubaker FZ, Al-Yahyaee KH, Kang SH (2018) Dynamic volatility spillovers and connectedness between global, regional, and GIPSI stock markets. Financ Res Lett 25:230–238

Mensi W, Hammoudeh S, Kang SH (2017) Risk spillovers and portfolio management between developed and BRICS stock markets. N Am J Econ Financ 41:133–155

Mensi W, Hammoudeh S, Nguyen DK, Kang SH (2016) Global financial crisis and spillover effects among the U.S. and BRICS stock markets. Int Rev Econ Financ 42:257–276

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Economics Letters 58(1):17–29

Qian X (2020) Gold market price spillover between COMEX, LBMA, and SGE. J Econ Financ 44:810–831

Qu Z, Perron P (2007) Estimating and testing structural changes in multivariate regressions. Econometrica 75(2):459–502

Shahzad SJH, Ferrer R, Ballester L, Umar Z (2017) Risk transmission between Islamic and conventional stock markets: a return and volatility spillover analysis. Int Rev Financ Anal 52:9–26

Shahzad SJH, Kayani GM, Raza SA, Shah N, Al-Yahyee KH (2018) Connectedness between US industry level credit markets and determinants. Physica A 491:874–886

Syriopoulos T, Makram B, Boubaker A (2015) Stock market volatility spillovers and portfolio hedging: BRICS and the financial crisis. Int Rev Financ Anal 39:7–18

Yoon S-M, Al Mamun M, Uddin GS, Kang SH (2019) Network connectedness and net spillover between financial and commodity markets. North Am J Econ Finance 48:801–818

Zhang D (2017) Oil shocks and stock markets revisited: measuring connectedness from a global perspective. Energy Econ 62:323–333

Acknowledgments

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2020S1A5B8103268).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• This study investigates volatility spillovers and the connectedness network across ASX sector markets.

• The spillover index of Diebold and Yilmaz (2014) is applied to measure the magnitude and direction of volatility connectedness.

• We visualize the propagation path of the volatility connectedness network.

• The financial sector is the main transmitter of volatility connectedness.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Choi, KH., McIver, R.P., Ferraro, S. et al. Dynamic volatility spillover and network connectedness across ASX sector markets. J Econ Finan 45, 677–691 (2021). https://doi.org/10.1007/s12197-021-09544-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-021-09544-w