Abstract

Risk transfers represent a preferred method for removing pension liabilities from corporate balance sheet. We examine the role of institutional shareholders on firm’s decision to offload pension liabilities to professional risk managers. We find that the likelihood of pension risk transfers is higher for firms with higher level of institutional ownership and independent institutional owners. Firms with higher concentration of institutional ownership adopting a passive investment strategy are less likely to complete pension risk transfers. We also document the plan and sponsor-level factors affecting firms’ decision to undertake pension risk transfers.

Similar content being viewed by others

Notes

We obtain the number of lump sums from Form 5500, Schedule R, line 3 and active and TV counts from Form 5500, Schedule Sb. The median lump sum percentage is obtained by looking at the plan’s lump sum percentage in each of the available 5500 filings.

When variables are highly persistent, both Fama-MacBeth and OLS yield biased standard errors (Petersen 2009).

To obtain unbiased estimates, the clustered standard errors are adjusted by (N-1)/ (N-P) × G/(G-1), where N is the sample size, P is the number of independent variables, and G is the number of clusters.

“Companies with newly flush pensions see chance to unload the risk” The Wall Street Journal, 2018.

References

Aghion P, Van Reenen J, Zingales L (2013) Innovation and institutional ownership. Am Econ Rev 103:277–304

Agnes Cheng CS, He Huang H, Li Y, Lobo G (2010) Institutional monitoring through shareholder litigation. J Financ Econ 95(3):356–383

Agrawal A, Mandelker G (1990) Large shareholders and the monitoring of managers: the case of anti-takeover charter amendments. J Financ Quant Anal 25:143–161

Almazan A, Hartzell J, Starks L (2005) Active institutional shareholders and cost of monitoring: evidence from executive compensation. Financ Manag 34:5–34

Amir E, Guan Y, Oswald D (2010) The effect of pension accounting on corporate pension asset allocation. Rev Acc Stud 15:345–366

An H, Huang Z, Zhang T (2013) What determines corporate pension fund risk taking strategy? J Bank Financ 37:597–613

Andriosopoulos D, Yang S (2015) The impact of institutional investors on mergers and acquisitions in the United Kingdom. J Bank Financ 50:547–561

Antia M, Kim I, Pantzalis C (2013) Political geography and corporate political strategy. J Corp Finan 22:361–374

Bartram SM (2018) In good times and in bad: Defined-benefit pensions and corporate financial policy. J Corp Finan 48:331–351

Beaudoin C, Chandar N, Werner E (2010) Are potential effects of SFAS 158 associated with firms' decisions to freeze their defined benefit pension plans? Rev Acc Finance 9(4):424–451

Brickley J, Lease R, Smith C Jr (1988) Ownership structure and voting on antitakeover amendments. J Financ Econ 20:267–291

Burns N, Kedia S, Lipson M (2010) Institutional ownership and monitoring: evidence from financial misreporting. J Corp Finan 16:443–455

Bushee B (1998) The influence of institutional investors on myopic R&D investment behavior. Account Rev 73:305–333

Bushee B (2001) Do Institutional Investors Prefers Near-Term Earnings over Long-Run Value? Contemp Account Res 18:207–246

Bushee B, Noe CF (2000) Corporate disclosure practices, institutional investors, and stock return volatility. J Account Res 38:171–202

Cameron AC, Miller DL (2011) Robust inference with clustered data. In: UllAh A, Giles DE (eds) Handbook of empirical economics and finance. CRC Press, pp 1–28

Chen X, Harford J, Li K (2007) Monitoring: which institutions matter? J Financ Econ 86:279–305

Chen L-W, Johnson SA, Lin J-C, Liu Y-J (2009) Information, sophistication, and foreign versus domestic investors’ performance. J Bank Financ 33(9):1636–1651

Choy H, Lin J, Officer MS (2014) Does freezing a defined benefit pension plan affect firm risk? J Account Econ 57(1):1–21

Connelly B, Tihanyi L, Certo S, Hitt M (2010) Marching to the beat of different drummers: the influence of institutional owners on competitive actions. Acad Manag J 53:723–742

Cornett MM, Marcus AJ, Saunders A, Tehranian H (2007) The impact of institutional ownership on corporate operating performance. J Bank Financ 31(6):1771–1794

Dvorak T (2005) Do domestic investors have an information advantage? Evidence from Indonesia. J Financ 60(2):817–839

Eaton TV, Nofsinger JR, Varma A (2014) Institutional investor ownership and corporate pension transparency. Financ Manag 43(3):603–630

Geddes TJ, Howard BB, Conforti AGSteinmetz AR (2014) Pension risk transfer: evaluating impact and barriers for de-risking strategies. Deloitte Consulting LLP. Sponsored by the Society of Actuaries, Research report

Gillan S, Starks L (2000) Corporate governance proposals and shareholder activism: the role of institutional investors. J Financ Econ 57:275–305

Hartzell J, Starks L (2003) Institutional investors and executive compensation. J Financ 58:2351–2374

Heckman JJ (1981) Heterogeneity and state dependence. Stud Labor Markets:91–139

Jin L, Merton RC, Bodie Z (2006) Do a firm’s equity returns reflect the risk of its pension plan? J Financ Econ 81:1–26

Johnson S, La Porta R, Lopez-de-Silanes F, Shleifer A (2000) Tunneling. Am Econ Rev 90:22–27

Kim K, Nofsinger JR (2005) Institutional herding, business groups, and economic regimes: evidence from Japan. J Bus 78:213–242

Krupa T, Utke S (2020) Whose Taxes Matter? The Effects of Institutional Ownership on Dividend Payout Policy Around Tax Rate Changes Working Paper. Available at SSRN: https://ssrn.com/abstract=3271931 or https://doi.org/10.2139/ssrn.3271931. Accessed 1 Apr 2020

Lin Y, MacMinn RD, Tian R (2015) De-risking defined benefit plans. Insur: Math Econ 63:52–65

Metlife (2019) 2019 Pension Risk Transfer Poll https://www.metlife.com/content/dam/metlifecom/us/homepage/institutionalRetirement/insights/PensionRisk/2019-PRT-Poll-Report-exp2-2020.pdf. Accessed 1 Apr 2020

Mohan N, Zhang T (2012) An analysis of risk-taking behavior for public defined-benefit pension plans. J Bank Financ 40:403–419

Parrino R, Sias R, Starks L (2003) Voting with their feet: institutional ownership changes around forced CEO turnover. J Financ Econ 68:3–46

Petersen MA (2009) Estimating standard errors in finance panel data sets: comparing approaches. Rev Financ Stud 22:435–480

Phan H, Hegde S (2013) Pension contributions and firm performance: evidence from frozen defined benefit plans. Financ Manag 42(2):373–411

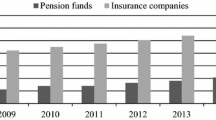

Ranade N, Saavedra A, Rhodes T (2015) Risk Transfer Study Plan Years 2009–2013. Pension benefit guaranty corporation https://www.metlife.com/content/dam/metlifecom/us/homepage/institutionalRetirement/insights/PensionRisk/2019-PRT-Poll-Report-exp2-2020.pdf. Accessed 23 Apr 2019

Rauh JD (2006) Investment and financing constraints: evidence from the funding of corporate pension plans. J Financ 61:33–71

Rauh JD, Stefanescu I, Zeldes SP (2020) Cost saving and the freezing of corporate pension plans. J Public Econ 188:104211

Shivdasani A, Stefanescu I (2010) How do pensions affect corporate capital structure decisions? Rev Financ Stud 23:1287–1323

Shleifer A, Vishny R (1997) A survey of corporate governance. J Financ 52:737–783

Silverstein B (2019) Defined Benefit Pension De-Risking and Corporate Investment Policy Available at SSRN: https://ssrn.com/abstract=3463389 or https://doi.org/10.2139/ssrn.3463389. Accessed 17 Nov 2019

Thompson SB (2011) Simple formulas for standard errors that cluster by both firm and time. J Financ Econ 99:1–10

Treynor J (1977) The principles of corporate pension finance. J Financ 32(2):627–638

Vafeas N, Vlittis A (2018) Independent directors and defined benefit pension plan freezes. J Corp Finan 50:505–518

Yu K (2014) Excess of the PBO over the ABO and hard pension freezes. Rev Quant Finan Acc 46:1–28

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

McCarthy, M., Pana, E. & Weinberger, A. The role of institutional investors in pension risk transfers. J Econ Finan 45, 451–468 (2021). https://doi.org/10.1007/s12197-020-09537-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-020-09537-1