Abstract

The forward premium anomaly refers to the fact that changes in spot exchange rates are negatively related to interest rate differentials between home and foreign countries, which is contrary to the predictions of the uncovered interest rate parity (UIRP). We propose a regression model of the interest rate differentials across countries (known as carry trade) adjusted for a time-varying exchange rate risk premium which can explain the anomaly and provide forecasts of exchange rate changes in accordance to the theory. The proposed model is based on estimates of the exchange rate risk premium implied by a simple and empirically attractive two-country affine term structure model with global and local factors. We also show that the forecasting power of the model compares favorably to the random walk model of exchange rates, considered as benchmark in the literature.

Similar content being viewed by others

Notes

Alternative theories include the following: peso problems due to missed regime shifts by investors (see Evans and Karen 1995), exchange rate stabilization monetary policy rules smoothing out exchange rate changes (see McCallum 1994), sticky prices yielding time-varying real exchange rate deviations from the PPP (purchasing power parity) (see, e.g., see Meese and Rogoff 1988, and more recently Boudoukh et al. 2016) and measurement errors combined with small magnitudes of interest rate differentials, see, e.g., Lothian and Wu (2011).

See Dai and Singleton (2002).

Note that the common factor structure of x1t and x2t across countries allows us to retrieve local factors \(x_{3t}^{(j)}\) based on the spreads of interest rates \(R_{t}^{(h)}(\tau )-R_{t}^{(f)}(\tau )\), for τ = {τ1,τ2}, by inverting the following relationships:

$$ \begin{array}{@{}rcl@{}} R_{t}^{(h)}(\tau_{1})-R_{t}^{(f)}(\tau_{1})&=&A^{(h)}(\tau_{1})-A^{(f)}(\tau_{1})+D_{3}^{(h)}(\tau_{1})x_{3t}^{(h)}-D_{3}^{(f)}(\tau_{1})x_{3t}^{(f)} \\ R_{t}^{(h)}(\tau_{2})-R_{t}^{(f)}(\tau_{2})&=&A^{(h)}(\tau_{2})-A^{(f)}(\tau_{2})+D_{3}^{(h)}(\tau_{2})x_{3t}^{(h)}-D_{3}^{(f)}(\tau_{2})x_{3t}^{(f)} \end{array} $$Then, given \(x_{3t}^{(h)}\) and \(x_{3t}^{(f)}\), we can retrieve x1t and x2t by also inverting (6), for τ1 and τ2.

For Germany, we have used the euro conversion rate of the Deutsche Mark (DM) (i.e., 1.95583) to participate in the EMS to calculate the series of the currency rate of this country with respect to USD after the introduction of Euro as the single currency in 1999. See also Diez de los Rios and Sentana (2011).

Note that Eurocurrency deposits are essentially zero-coupon bonds whose payoffs at maturity are the principal plus the interest payment. Eurocurrency deposit rates are used in many studies testing the predictions of the UIRP (see, e.g., Olmo and Pilbeam2011).

Note that ℘t(τ) constitutes a good proxy of the exchange rate risk premium implied by interest rate differential \(R_{t}^{(h)}(1)-R_{t}^{(f)}(1)\), for a small maturity τ and interval of time. This regression model corresponds to Eq. 9 - see Ahn (2004), and it is in the spirit of the regression models of Tzavalis (2003), and Argyropoulos and Tzavalis (2019) adjusting the term spread of interest rates for risk premium effects in order to forecast future changes in short-term interest rates or inflation rate changes, respectively.

This method has been suggested in the term structure of interest rates literature to capture the effects of the risk premium on the term spread in forecasting future short-term interest rates by Driffill et al. (1997).

Note that, for models M1 and M2, the DM test statistic is based on the forecast loss function \(d_{t+j}=\left (u_{t+j}^{(M1)}\right )^{2}-\left (u_{t+j}^{(M2)}\right )^{2}\). Given dt+j, DM is defined as \(DM=\left (\frac {1}{T-T_{0}}{\sum }_{j=T_{0}+1}^{T}d_{t+j}\right ) \hat {\sigma _{d}}^{1/2}\), where T0 is the initial, in-sample window of the sample and \(\hat {\sigma _{d}}\) is the long-run variance of dt+j, which can be consistently estimated based on Newey and West (1987) estimator.

References

Ahn D-H (2004) Common factors and local factors: implications for term structures and exchange rates. J Financ Quant Anal 39:69–102

Ang A, Chen JS (2010) Yield curve predictors of foreign exchange returns, AFA 2011 Denver Meetings Paper

Argyropoulos E, Tzavalis E (2015) Term spread regressions of the rational expectations hypothesis of the term structure allowing for risk premium effects. Studies in Nonlinear Dynamics & Econometrics 19:49–70

Argyropoulos E, Tzavalis E (2016) Forecasting economic activity based on the slope and curvature yield curve factors. North American Journal of Economics and Finance 36:293–211

Argyropoulos E, Tzavalis E (2019) The influence of real interest rates and risk premium effects on the ability of the nominal term structure to forecast inflation. Quarterly Review of Economics and Finance. forthcoming

Backus D, Foresi S, Telmer C (2001) Affine term structure models and the forward premium anomaly. J Financ 56:279–304

Baillie RT, Bollerslev T (2000) The forward premium anomaly is not as bad as you think. J Int Money Financ 19:471–488

Boudoukh J, Richardson M, Whitelaw RF (2016) New evidence on the forward premium puzzle. Journal of Financial and Quantitative Analysis 51:1063–1119

Chen Y-C, Tsang KP (2013) What does the yield curve tell us about exchange rate predictability? Review of Economics and Statistics 95(1):185–205

Coakley J, Fuertes AM, Wood A (2004) A new interpretation of the exchange rate - yield differential nexus. International Journal of Finance and Economics 9:201–218

Dai Q, Singleton KJ (2002) Expectations puzzles, time-varying risk premia and affine models of the term structure. J Financ Econ 63:415–441

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. Journal of Business and Economic Statistics 13:253–263

Diebold FX, Rudebusch GD, Aruoba SB (2006) The macroeconomy and the yield curve: a dynamic latent factor approach. J Econ 131:309–338

Diez de los Rios A (2011) Internationally affine term structure models. The Spanish Review of Financial Economics 9:31–34

Diez de los Rios A, Sentana E (2011) Testing uncovered interest parity: a continuous-time approach. Int Econ Rev 52:1215–1251

Driffill J, Psaradakis Z, Sola M (1997) A reconciliation of some paradoxical empirical results on the expectations model of the term structure. Oxford Bulletin of Economics and Statistics, Department of Economics, University of Oxford 59:29–42

Engel C (2014) Exchange rates and interest parity. In: Handbook of international economics 4, pp 453–522. Elsevier

Evans M, Karen L (1995) Do long-term swings in the dollar affect estimates of the risk premia? Rev Financ Stud 8:709–742

Fama E (1980) Forward and spot exchange rates. J Monet Econ 14:319–338

Hodrick RJ (1987) The empirical evidence on the efficiency of forward and futures foreign exchange markets. Harwood Academic Publishers, Chur

Inci AC, Lu B (2004) Exchange rates and interest rates: can term structure models explain currency movements? J Econ Dyn Control 28:1595–1624

Kim DH, Orphanides A (2012) Term structure estimation with survey data on interest rate forecasts. J Financ Quant Anal 47:241–272

Lothian JR, Wu L (2011) Uncovered interest-rate parity over the past two centuries. J Int Money Financ 30:448–473

Mark N (2001) International macroeconomics and finance. Blackwell Publishers, Malden

McCallum BT (1994) A reconsideration of the uncovered interest rate parity relationship. J Monet Econ 33(1):105–132

Meese R, Rogoff K (1988) What is real? The exchange rate interest differential relation over the modern floating rate period. J Financ 4:933–948

Newey WK, West KD (1987) A simple positive semi-definite heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Olmo J, Pilbeam K (2011) Uncovered interest parity and the efficiency of the foreign exchange market: a re-examination of the evidence. International Journal of Finance and Economics 16:189–204

Rossi B (2013) Exchange rate predictability. J Econ Lit 51 (1063):1119

Tzavalis E (2003) The term premium and the puzzles of the expectations hypothesis of the term structure. Econ Model 21:73–93

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank James Payne (the editor) and three anonymous referees for very helpful comments on an earlier version of the paper. We acknowledge financial support provided by the operational program “Human Resources Development, Education and Lifelong Learning” co-financed by the European Union (European Social Fund) and Greek national funds. Also, we would like to thank Thanasis Stengos and participants at the C.R.E.T.E. conference 2018, for useful comments on an earlier version of the paper. The views expressed in this paper are those of the author and do not necessarily reflect the views or policies of the IMF, its Executive Board, or IMF management.

Appendix

Appendix

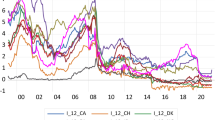

In this appendix, we present descriptive statistics, including correlation coefficients among interest rates \(R_{t}^{(j)}(\tau )\), for maturity intervals τ = {1, 3, 6, 12} months, and risk premium ℘t(τ) across all countries j (see Tables 5, 6 and 7). Figure 1 graphically presents the estimates of ℘t(τ).

Rights and permissions

About this article

Cite this article

Argyropoulos, E., Elias, N., Smyrnakis, D. et al. Can country-specific interest rate factors explain the forward premium anomaly?. J Econ Finan 45, 252–269 (2021). https://doi.org/10.1007/s12197-020-09509-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-020-09509-5

Keywords

- UIRP

- Two-country affine term structure model

- Forward premium anomaly

- Exchange rate forecasting

- Expectations hypothesis