Abstract

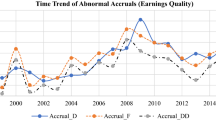

Previous research shows that foreign (domestic) banks rely more on ‘hard’ (‘soft’) information in their lending decisions and such approaches may give a motivation for the local firms to improve their credit scores by, for example, overstating earnings. The paper develops a theoretical model and empirically tests the model using actual data from Korea. The model predicts that local firms tend to overstate earnings when they increase the loan relations with foreign banks and the proportion of local firms with earnings management increases as the recoverability of foreign banks decreases (increases) in the higher (lower) level of recoverability. The results of the empirical test are consistent with the predictions by the model. We also discuss the implications of the study and an extension for the future study.

Similar content being viewed by others

Notes

The change is shown as a movement from point A\( \left(\widehat{x}\left( FN, FE\right)\right) \) to point B\( \left(\widehat{\widehat{x}}\left( FN, FE\right)\right) \) which denotes a new marginal firm indifferent between FN and FE in Figure 1.

It can be considered as the foreign bank sells its loan to the firms without earnings management at a full loan price and a discounted price of \( \left(1-\alpha \right)\beta {\tilde{r}}_F \) to the firms with earnings management.

The change is shown as a movement from point C\( \left(\widehat{x}\left( FE, DN\right)\right) \) to point D\( \left(\widehat{\widehat{x}}\left( FE, DN\right)\right) \) which denotes a new marginal firm indifferent between FE and DN in Figure 1.

The change is shown as a movement from point A\( \left(\widehat{x}\left( FN, FE\right)\right) \) to point B\( \left(\widehat{\widehat{x}}\left( FN, FE\right)\right) \) which denotes a new marginal firm indifferent between FN and FE in Figure 4.

The change is shown as a movement from point C\( \left(\widehat{x}\left( FE, DN\right)\right) \) to point D\( \left(\widehat{\widehat{x}}\left( FE, DN\right)\right) \) which denotes a new marginal firm indifferent between FE and DN in Figure 4.

Korea has adopted IFRS since 2012 and we use firm data before the IFRS adoption for the study.

There has been many studies on the firm-bank relationship in Korea after the Asian financial crisis. For example, Sohn and Choi (2011) have investigated the impact of pre-existing relationship on the lending decisions by Korean banks after merger.

References

Adusei M (2015) The impact of bank size and funding risk on bank stability. Cogent Economics and Finance 3:1–19

Agarwal S, Hauswald R (2010) Distance and private information in lending. Rev Financ Stud 23:2757–2788

Aharony J, Lin C, Loeb MP (1993) Initial public offerings, accounting choices, and Earnings management. Contemp Account Res 10:61–81

Ahn S, Choi W (2009) The role of bank monitoring in corporate governance: evidence from borrowers’ earnings management behavior. J Bank Financ 33:425–434

Anderson CW, Makhija AK (1999) Deregulation, disintermediation, and agency costs of debt: evidence from Japan. J Financ Econ 51(2):309–339

Asthana SC, Raman KK, Xu H (2015) U.S.-listed foreign companies’ choice of a U.S.-based versus home country-based big N principal auditor and the effect on audit fees and earnings quality. Account Horiz 29:631–666

Bae KH, Kang JK, Lim CW (2002) The value of durable bank relationships evidence from Korean banking shocks. J Financ Econ 64:181–214

Beck, T., A. Demirgüç-Kunt., and M. S. M. Peria. 2010. Foreign banks and small and medium enterprises: Are they really estranged? VOX, Research-based policy analysis and commentary form leading economists, http://www.voxeu.org/article/

Becker C, DeFond M, Jiambalvo J, Subramanyam K (1998) The effect of audit quality on earnings management. Contemp Account Res 15:1–24

Behn B, Choi JH, Kang T (2008) Audit quality and properties of analyst earnings forecasts. Account Rev 83(2):327–359

Berger AN, Klapper LF, Udell GF (2001) The ability of banks to lend informationally opaque small business. J Bank Financ 25:2127–2167

Berger AN, Klapper LF, Peria MSM, Zaidi R (2008) Bank ownership type and banking relationship. J Financ Intermed 17:37–62

Bhattacharya S, Chiesa G (1995) Proprietary information, financial intermediation, and Research Incentives. J Financ Intermed 4:328–357

Billett MT, Flannery MJ, Garfinkel JA (1995) The effect of lender identity on a borrowing Firm's equity return. J Financ 50(2):699–718

Broecker T (1990) Credit-worthiness tests and interbank competition. Econometrica: Journal of the Econometric Society 58:429–452

Burnett BM, Cripe BM, Martin GW, McAllister BP (2012) Audit quality and the trade-off between accretive stock repurchases and accrual-based earnings management. Account Rev 87:1861–1884

Byers SS, Fraser DR, Shockley RL (1998) Lender identity and borrower returns: the evidence from foreign Bank loans to U.S Corporations. Global Finance Journal 9(1):81–94

Chan KH, Jiang EJ, Mo PLL (2017) The effects of using bank auditors on audit quality and the agency cost of bank loans. Account Horiz 31(4):133–153

Chiappori PA, Perez-Castrillo D, Verdier T (1995) Spatial competition in the banking system: localization, cross subsidies, and the regulation of deposit rates. Eur Econ Rev 39:889–918

Choi W (2007) Bank relationships and the value relevance of the income statement: evidence from income-statement conservatism. J Bus Financ Acc 34(7&8):1051–1072

Cole RA, Goldberg LG, White LJ (2004) Cookie cutter vs. character: the micro structure of small business lending by large and small banks. J Financ Quant Anal 39:227–251

Danos P, Holt DL, Imhoff EA Jr (1989) The use of accounting information in Bank lending decisions. Acc Organ Soc 14(3):235–246

Dechow PM, Sloan RG, Sweeney AP (1995) Detecting earnings management. Account Rev 70:193–225

DeFond M, Jiambalvo J (1994) Debt covenant violation and manipulation of accrual. J Account Econ 17:145–176

Diamond D (1991) Monitoring and reputation: the choice between bank loans and privately placed debt. J Polit Econ 99:689–721

Djankov S, Jindra J, Klapper LF (2005) Corporate valuation and the resolution of bank insolvency in East Asia. J Bank Financ 29:2095–2118

Dyreng SD, Vashishtha R, Weber J (2017) Direct evidence on the informational properties of earnings in loan contracts. J Account Res 55(2):371–406

Fama EF (1985) What’s different about banks? J Monet Econ 15:29–36

Fama EF, French KR (1995) Size and book-to-market factors in earnings and returns. J Financ 50:131–155

Fok, R. C., W., Y. Chang, and W. Lee. 2004. Bank relationships and their effects on firm performance around the Asian financial crisis. Financ Manag, 33: 89–112

Franks, J., A. de Servigny, and S. Davydenko. 2004. A comparative analysis of the recovery process and recovery rates for private companies in the UK, France and Germany. Standard and Poor’s Report

Gormley TA (2010) The impact of foreign Bank entry in emerging markets: evidence from India. J Financ Intermed 19:26–51

Hadlock CJ, James CM (2002) Do banks provide financial slack? J Financ 57(3):1383–1419

Hauswald R, Marquez R (2006) Competition and strategic information acquisition in credit markets. Rev Financ Stud 19(3):967–1000

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Huang J, Huang C, You C (2015) Bank relationship and the likelihood of filing for reorganization. Int Rev Econ Financ 35:278–291

Khurana IK, Raman KK (2004) Litigation risk and the financial reporting credibility of big 4 versus non-big 4 audits: evidence from Anglo-American countries. Account Rev 79(2):473–495

Kothari S, Leone AJ, Wasley CE (2005) Performance matched discretionary accrual measure. J Account Econ 39:163–197

Lehner M, Schnitzer M (2008) Entry of foreign banks and their impact on host countries. J Comp Econ 36(3):430–452

Mian A (2006) Distance constraints: the limits of foreign lending in poor countries. J Financ 61:1465–1505

Pong CKM, Kita T (2006) Influence of banks on company auditor choice: the case of Japan. Int J Audit 10(2):87–98

Pontines V, Siregar RY (2014) How should we bank with foreigners? An empirical assessment of lending behavior of international banks to six east Asian economies. Int Rev Econ Financ 29:552–568

Rajan RG (1992) Insiders and outsiders: the choice between informed and Arm's-length debt. J Financ 47(4):1367–1400

Riodan MH (1993) Competition and Bank performance: a theoretical perspective. In: Mayer C, Vives X (eds) Capital markets and financial intermediation. Cambridge University Press, Cambridge, UK

Sharpe SA (1990) Asymmetric information, bank lending, and implicit contracts: a stylized model of customer relationships. J Financ 45(4):1069–1087

Sohn W, Choi H (2011) Banks’ lending decisions after loan acquisitions: do banks favour pre-existing relationships? Appl Econ 43:1099–1112

Stiglitz JE (1993) The role of the state in financial markets. In Proceedings of the World Bank Annual Conference on Development Economics 7:19–52

Xue M, Cheng W (2013) National culture, market condition and market share of foreign bank. Econ Model 33:991–997

Acknowledgements

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2018S1A5A2A01037704).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lee, S., Bae, S.H. & Seol, I. Loan relation with foreign banks and information asymmetry: evidence from earnings management by local firms in Korea. J Econ Finan 43, 344–366 (2019). https://doi.org/10.1007/s12197-018-9465-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-018-9465-7