Abstract

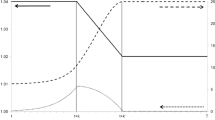

Market agents suffering through unanticipated boom-bust cycles would find extremely useful analytical techniques capable of serving as an early warning system. Unobserved components models and cointegration analysis are valuable in this respect. The stylized facts from unobserved components models alone do not suffice, but coupled with results from the Johansen cointegration test provided early evidence of the housing bubble and of its denouement. The paper uses real-time data vintages and shows that by 1998 the relationship between the smoothed growth rates of house prices and of per capita income was in uncharted territory. Moreover, the actual growth rates are cointegrated. This is important, as it establishes that any disequilibrium between the two becomes less tenable as its magnitude increases. By 2003, the disequilibrium was spectacular, yet it grew for another 4 years. In effect, we did not have to wait until 2008; the gruesome ending was predictable ex ante. Ironically, the greatest financial delusion of all occurred in an age that revered rationality, market efficiency, and the financial enlightenment of the TBTF actors. The empirical findings of this paper are a major problem for the rational expectations hypothesis and the remnants of the EMH.

Similar content being viewed by others

Notes

The Case-Shiller index, unlike the HPI, is not national in coverage; it omits 13 states and has incomplete coverage for 29 other states (Leventis, 2007).

The HPI began publication on January 1975, by the Office of Federal Housing Enterprise Oversight (OFHEO)—an agency that operated within the Department of Housing and Urban Development. On July 2008, the Housing and Economic Recovery Act combined OFHEO and the Federal Housing Finance Board into the new Federal Housing Finance Agency.

Eventually, even the final version suffers the inevitable benchmark or methodological revisions.

STMs have been used to model the behavior of exchange rates (Harvey et al. 1992); forecast consumer expenditures (Harvey and Todd, 1983); model inflation and the output gap (Kuttner 1994; Domenech and Gomez 2006; and Harvey 2008). Other examples include modeling inflation persistence (Stock and Watson 2007, and Dossche and Everaert 2005); productivity growth (Peláez 2004, and Crespo 2008); business cycles (Clark 1987), earnings per share (Peláez 2007); permanent income (Huang et al. 2008); the U.S. regional housing market (Fadiga and Wang 2009); modeling the core unemployment rate, (Harvey and Chung 2000); and testing for deterministic trends (Nyblom and Harvey 2005).

Dlog(HPI) is the first-difference of the natural logarithm of HPI. Clearly, this section does not use the smoothed growth rates.

If r = n, we have a contradiction of the assumption that the variables are I(1).

The Schwarz Criterion and the Hannan-Quinn Criterion reached their minima for a lag length of three quarters. The finding of cointegration is robust to an unrestricted constant and to the exclusion of any intervention variables as well.

The P-value is the probability of obtaining the given value of the test statistic under the null.

References

Bailey M, Muth R, Nourse H (1963) A regression method for real estate price index construction. Am Stat Assoc J 58:933–942

Baxter M, King R (1999) Measuring business cycles: approximate band-pass filters for economic time series. Rev Econ Stat 81:575–593

Bhargava A (1986) On the theory of testing for unit roots in observed time series. Rev Econ Stud 53:369–384

Blanchard O, Fisher S (1989) Lectures in macroeconomics. MIT Press, Cambridge

Borio C, Lowe P (2002) Assessing the risk of banking crises. BIS Quarterly Review December 43 –54

Calhoun C (1996) OFHEO house price indexes: HPI technical description. Office of Federal Housing Enterprise Oversight, Washington

Case K, Shiller R (1989) The efficiency of the market for single-family homes. Am Econ Rev 79:125–137

Clark P (1987) The cyclical component of U.S. economic activity. Q J Econ 102:797–814

Cochrane J (1991) A critique of the application of unit root tests. J Econ Dyn Control 15:275–284

Cogley T, Nason J (1995) Effects of the Hodrick-Prescott filter on trend and difference stationary time series: implications for business cycle research. J Econ Dyn Control 19:253–278

Crespo R (2008) Total factor productivity: an unobserved components approach. Appl Econ 40:2085–2097

Dickey D, Fuller W (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Diebold F, Rudebusch G (1991) On the power of the Dickey-Fuller test against fractional alternatives. Econ Lett 35:155–160

Dodd C (2007) Opening statement–hearing on Mortgage market turmoil: causes and consequences. U.S. Senate Committee on Banking, Housing, and Urban Affairs

Domenech R, Gomez V (2006) Estimating potential output, core inflation and the NAIRU. J Bus Econ Stat 24:354–365

Dossche M, Everaert G (2005) Measuring inflation persistence —a structural time series approach. Working Paper Series: 495, European Central Bank

Elliott J, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica 64:816–836

Fadiga M, Wang Y (2009) A multivariate unobserved component analysis of US housing market. J Econ Finance 33:13–26

Fama E (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49:283–306

Harvey A (1989) Forecasting, structural time series models and the Kalman Filter. Cambridge University Press, New York

Harvey A (1997) Trends, cycles and autoregressions. Econ J 107:192–201

Harvey A, Chung C (2000) Estimating the underlying change in unemployment in the UK. J R Stat Soc 163:303–339

Harvey A, Jaeger J (1993) Detrending, stylized facts and the business cycle. J Appl Econ 8:231–247

Harvey A, Ruiz E, Sentana E (1992) Unobserved component time series models with ARCH disturbances. J Econom 52:129–157

Hassler U, Wolters J (1994) On the power of unit root tests against fractional alternatives. Econ Lett 45:1–6

Hodrick R, Prescott E (1980) Postwar U.S. business cycles: An empirical investigation. Discussion Paper No. 451, Carnegie-Mellon University

Huang Y, Huang C, Kuan C (2008) Reexamining the permanent income hypothesis with uncertainty in permanent and transitory innovation states. J Macroecon 30:1816–1836

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in gaussian vector autoregressive models. Econometrica 59(6):1551–1580

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210

Juselius K (2008) The cointegrated VAR model: methodology and applications. Oxford University Press, New York

Kindleberger CP, Aliber RZ (2005) Manias, panics, and crashes: a history of financial crises, 5th edn. Wiley, Hoboken

Koopman SJ, Harvey AC, Doornik JA, Shephard N (2007) Structural time series analyser, modeller and predictor STAMP 8. Timberlake Consultants Ltd, London

Kuttner K (1994) Estimating potential output as a latent variable. J Bus Econ Stat 12:361–368

Lee D, Schmidt P (1996) On the power of the KPSS test of stationarity against fractionally integrated alternatives. J Econom 73:285–302

Leventis A (2007) A note on the differences between the OFHEO and S&P/Case-Shiller house price indexes. Office of Federal Housing Enterprise Oversight, July 25, 2007

Maddala GS, Kim I-M (2000) Unit roots, cointegration, and structural change. Cambridge University Press, Cambridge

Nelson CR, Plosser CI (1982) Trends and random walks in macroeconomic time series. J Monet Econ 10:139–162

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69(6):1519–1554

Nyblom J, Harvey A (2005) Testing for deterministic linear trends in time series. In: Harvey A, Proietti T (eds) Readings in unobserved components models. Oxford University Press, New York

OFHEO (2008) Revisiting the differences between the OFHEO and S&P Case-Shiller house price indexes: new explanations. Office of Federal Housing Enterprise Oversight

Perron P, Ng S (1996) Useful modifications to some unit root tests with dependent errors and their local asymptotic properties. Rev Econ Stud 63(3):435–463

Peláez R (2004) Dating the productivity slowdown with a structural time series model. Q Rev Econ Finance 44(2):253–264

Peláez R (2007) Earnings per share: stylized facts and new paradigms. J Behav Finance 8:198–208

Phillips PCB, Perron P (1988) Testing for a unit root in a time series regression. Biometrika 75:335–346

Reinhart C, Rogoff KS (2009) This time is different: eight centuries of financial folly. Princeton University Press, Princeton

Samuelson PA (1998) Summing up on business cycles: opening address. In: Fuhrer JC, Schuh S (eds) Beyond shocks: what causes business cycles? Boston: Federal Reserve Bank of Boston, Conference Series # 42, pp 33 –36

Shiller R (2000) Irrational exuberance. Princeton University Press, Princeton

Shiller R (2003) From efficient markets theory to behavioral finance. J Econ Perspect 17:83–104

Stock J, Watson M (2007) Why has U.S. inflation become harder to forecast? J Money, Credit Bank 39(Supplement F):3–33

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Peláez, R.F. The housing bubble in real-time: the end of innocence. J Econ Finan 36, 211–225 (2012). https://doi.org/10.1007/s12197-010-9165-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-010-9165-4