Abstract

In this paper, we document the determinants of portfolio investments to Gulf Cooperation Council (GCC) economies by bringing up the role played by market forces, cultural affinities, and institutional quality. We classify the GCC economies as host to 35 countries as per the Coordinated Portfolio Investment Surveys (CPIS) of the IMF for the period 2001–2006. Using the CPIS data and data from various other reliable sources and appropriate panel data analysis techniques, we find a number of interesting results: 1) the relatively higher quality of institutional set up in GCC in comparison to other countries; 2) the relative volume of expatriates across source countries in GCC soil; and 3) bilateral factors such as trade linkages between GCC and source countries, all statistically and significantly explain portfolio investments to the GCC region. Additionally, we uncover the existence of a portfolio “GCC bias”. That is, GCC investors exhibit a strong preference towards their own markets when allocating their cross border financial asset holdings.

Similar content being viewed by others

Notes

It is expected that by 2020, GCC countries could rival rising economies such as Brazil, China, and India if their plan to enter a monetary union by 2010 and issue a common currency goes smoothly. Bley and Chen (2006), Guetat and Serranito (2007), and Alkulaib et al. (2008) have already associated the strong economic growth of the GCC countries to the ongoing economic and financial integration of the region with the rest of the world.

When we changed the order of the countries, the equation will be as follows;

$$ log(\theta_{j^*h})=(\alpha-1)log(1-\eta_{j^*h})+\alpha log(\varpi_{j^*h})-log\left(\sum\limits^{j^*=N,j \neq j^*}_{j=1}\left[(1-\eta_{jh})^{\alpha-1}\varpi^{\alpha}_{j^*i}\right]\right)+logY_{j^*}. $$(11)the very last two terms will be the fixed effect of the foreign country pair. In the empirical model, the constant effects for both host (home) and source (foreign) country have been used accordingly.

We use bilateral factors which are available for the GCC markets.

Short-term securities are defined as securities with maturity of less than a year.

The sources and explanations about these variables are incorporated in Table 1.

We included the fixed effects in accordance with the Hausman test. It is a test of testing if the random effects are consistent and efficient. (H 0: that random effects is consistent and efficient, versus H 1: that random effects would be inconsistent.) We found that Chi-square value is large enough to (55.13) to reject the null hypothesis.

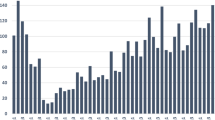

The volume of foreign asset inflows as well as the number of investors with stakes in GCC markets are quite limited in 2001, however, both the number and the volume have increased gradually in the years after.

Contiguous dummy (takes 1 if the both source and host country share borders, 0 elsewhere,) and similar country dummy (takes 1 if the countries are politically and culturally similar) The details of the new instruments are also listed in Table 1.

Due to data restrictions, we have only Bahrain and Kuwait listed as both source and host countries. Although the other GCC member countries do possess external assets, e.g., the UAE’s Abu Dhabi Investment Authority (ADIA), Qatar Investment Authority have external assets around 875 billion USD, the geographic distribution of those assets has not been published.

The regional bias contends that investors tend to hold a large share of their assets portfolio within their geographical boundaries even when they have the opportunities to spread their investments equally in various markets. These patterns are consistently observed lately, despite the overall increase in the volume of international assets holdings that takes place due to financial market integration and economic booms that have occurred in other parts of the world. Lane and Milesi-Ferretti (2005), Lane (2006) and Maela (2008) have also found portfolio Euro bias bias in their studies.

The GCC bias is again present, providing convincing evidence that when GCC investors make the decision to diversify their portfolio, they—at least the two members, Bahrain and Kuwait,—primarily choose other GCC countries to allocate their wealth.

References

Alfaro L, Kalemli-Ozcan S, Volosovych V (2005) Why doesn’t capital flow from rich to poor countries? An empirical investigation. Rev Econ Stat 90:347–368

Alkulaib YA, Najand M, Mashayekh A (2008) Dynamic linkages among equity markets in the Middle East and North African countries. J Multinatl Financ Manag 19:43–53

Baele L, Ferrando A, Hördahl P, Krylova E, Monnet C (2004) Measuring financial integration in the Euro area. Occasional paper no 14. European Central Bank

Balli F, Louis RJ, Osman M (2009) International portfolio inflows to GCC markets: are there any general patterns? Review of Middle East Economics and Finance 5(2):article 3

Bley J, Chen KH (2006) Gulf Cooperation Council (GCC) stock markets: the dawn of a new era. Glob Financ J 17:75–91

Chinn M, Hiro I (2008) A new measure of financial openness. Journal of Comparative Policy Analysis 10:307–320

Chow KV, Denning KC (1992) The symmetry and stability of word equity markets: getting to the issue on international portfolio diversification. J Multinatl Financ Manag 2:35–58

Fasano U, Iqbal Z (2003) GCC countries: from oil dependence to diversification. International Monetary Fund, Washington, DC

French K, Poterba J (1991) International diversification and international equity markets. Am Econ Rev 81:222–226

Grubel HL (1968) Internationally diversified portfolios: welfare gains and capital flows. Am Econ Rev 58:1299–1314

Guetat I, Serranito F (2007) Income convergence within the MENA countries: a panel unit root approach. Q Rev Econ Finance 46:685–706

Habib M, Zurawicki L (2002) Corruption and foreign direct investment. J Int Bus Stud 33

Hourani A, Khoury PS, Wilson MC (2004) The modern Middle East: a reader. I.B. Tauris, London

Husted BW (1999) Wealth, culture, and corruption. J Int Bus Stud 30(2):339–359

Lagoarde-Segot T, Lucey BM (2007) International portfolio diversification: is there a role for the Middle East and North Africa? J Multinatl Financ Manag 17:401–416

Lane P (2006) Global bond portfolios and EMU. International Journal of Central Banking 2:1–23. Also ECB working paper no. 553

Lane P, Milesi-Ferretti GM (2005) The international equity holdings of Euro area investors. The Institute for International Integration Studies Discussion Paper Series IISDP: 104

Lane P, Milesi-Ferretti GM (2008) International investment patterns. IMF working paper no. 134. Rev Econ Stat 90(3):538–549.

Lewis K (1996) What explain the apparent lack of international consumption risk sharing? J Polit Econ 104:267–297

Lewis K (1999) Trying to explain home bias in equities and consumption. J Econ Lit 37:571–608

Maela G (2008) EMU effects on stock markets: from home bias to Euro bias. International Research Journal of Finance and Economics 15:136–158

Mina W (2007) The location determinants of FDI in the GCC countries. J Multinatl Financ Manag 17:336–348

Mody A, Murshid AP (2005) Growing up with capital flows. J Int Econ 65:249–266

Obstfeld M, Rogoff K (2001) The six major puzzles in international macroeconomics: is there a common cause? Center for International and Development Economics Research (CIDER) working papers C:00–112, University of California at Berkeley

Sadik AT, Bolbol AA (2001) Capital flows, FDI and technology spillovers: evidence from Arab countries. World Dev 29:2111–2125

Seligson MA (2007) The impact of corruption on regime legitimacy: a comparative study of four Latin American countries. J Polit 64(2):408-433

Sørensen BE, Wu YT, Yosha O, Zhu Y (2007) Home bias and international risk sharing: twin puzzles separated at birth. J Int Money Financ 26:587–613

Svensson J (2005) Eight questions about corruption. J Econ Perspect 19(3):19–42

World Bank (2005) Global economic prospects 2005: regionalism and development. World Bank, Washington, DC

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Balli, F., Louis, R.J. & Osman, M. The patterns of cross-border portfolio investments in the GCC region: do institutional quality and the number of expatriates play a role?. J Econ Finan 35, 434–455 (2011). https://doi.org/10.1007/s12197-009-9111-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-009-9111-5