Abstract

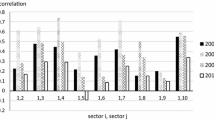

We show that nonlinearity in the relation between the equity premium and the slope of the term structure has two dimensions, namely asymmetry between positively and negatively sloped term structures, and regime switching. Asymmetry is uncovered only if volatility regime switching is allowed in equity premium dynamics. Predictive power for the equity premium arises only from the positively sloped term structure, and only in periods of low volatility of the equity premium.

Similar content being viewed by others

Notes

Unit root tests are available upon request.

The usual LR test is problematic because it does not have the standard asymptotic distribution. The problem comes from the fact that under the null, some parameters are not identified.

These authors found that recessions are associated with increases in stock market volatility.

References

Boudoukh J, Richardson M, Whitelaw RF (1997) Nonlinearities in the relation between the equity risk premium and the term structure. Manage Sci 43(3):371–385

Campbell JY (1987) Stock returns and term structure. J Financ Econ 18:373–389. doi:10.1016/0304-405X(87)90045-6

Chen S-S (2007) Does monetary policy have asymmetric effects on stock returns? J Money Credit Bank 39:667–688. doi:10.1111/j.0022-2879.2007.00040.x

Clare A, Thomas S, Wickens M (1994) Is the gilt-equity yield ratio useful for predicting UK stock returns? Econ J 104:303–315. doi:10.2307/2234751

Davies RB (1987) Hypothesis testing when the nuisance parameter is present only under the alternative. Biometrika 74:33–43

Dimson E, Marsh P, Staunton M (2003). Global Investment Returns Yearbook, ABNAMRO

Estrella A, Hardouvelis G (1991) The term structure as predictor of real economic activity. J Finance 46:555–576. doi:10.2307/2328836

Fama EF, French KR (1989) Business conditions and expected returns on bonds and stocks. J Financ Econ 25:23–49. doi:10.1016/0304-405X(89)90095-0

Fraser P (1995) UK stock and government bond returns: Predictability and the term structure,. Appl Financ Econ 5:61–67. doi:10.1080/758529173

Guidolin M, Timmermann A (2005) Economic implications of bull and bear regimes in UK stock and bond returns. Econ J 115:111–143. doi:10.1111/j.1468-0297.2004.00962.x

Harvey C (1988) The real term structure and consumption. J Financ Econ 22:305–334. doi:10.1016/0304-405X(88)90073-6

Hamilton J, Lin G (1996) Stock market volatility and the business cycle. J Appl Econ (Sep-Oct):573–593. doi:10.1002/(SICI)1099-1255(199609)11:5<573::AID-JAE413>3.0.CO;2-T

Meenagh D, Minford P, Peel D (2007) Simulating stock returns under switching regimes. Econ Lett 94:235–239. doi:10.1016/j.econlet.2006.06.036

Shah M, Wadhwani S 1990, The effect of the term spread, dividend yield and real activity on stock returns: Evidence from 15 countries, LSE Financial Markets Discussion Paper

White H (1980) A heteroscedasticity-consistent covariance matrix and a direct test for heteroscedasticity. Econometrica 48:817–838. doi:10.2307/1912934

Whitelaw R (2000) Stock market risk and return: An equilibrium approach. Rev Financ Stud 13(3):521–547. doi:10.1093/rfs/13.3.521

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kanas, A. A note on the relation between the equity risk premium and the term structure. J Econ Finance 34, 89–95 (2010). https://doi.org/10.1007/s12197-008-9069-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-008-9069-8